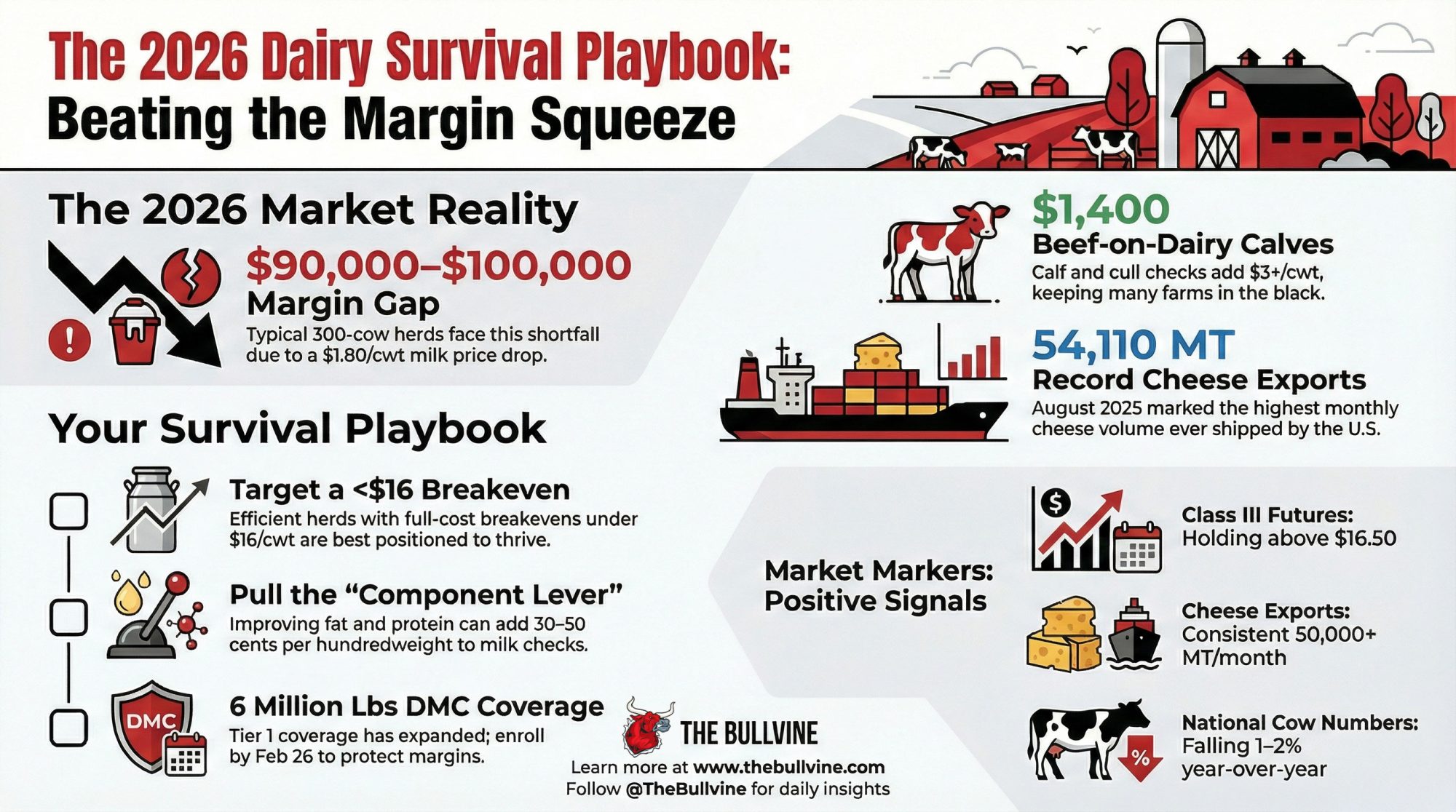

The Supreme Court struck down one set of tariffs and set a 150‑day clock. For a 500‑cow herd, the spread is $147,000. Where does your breakeven sit?

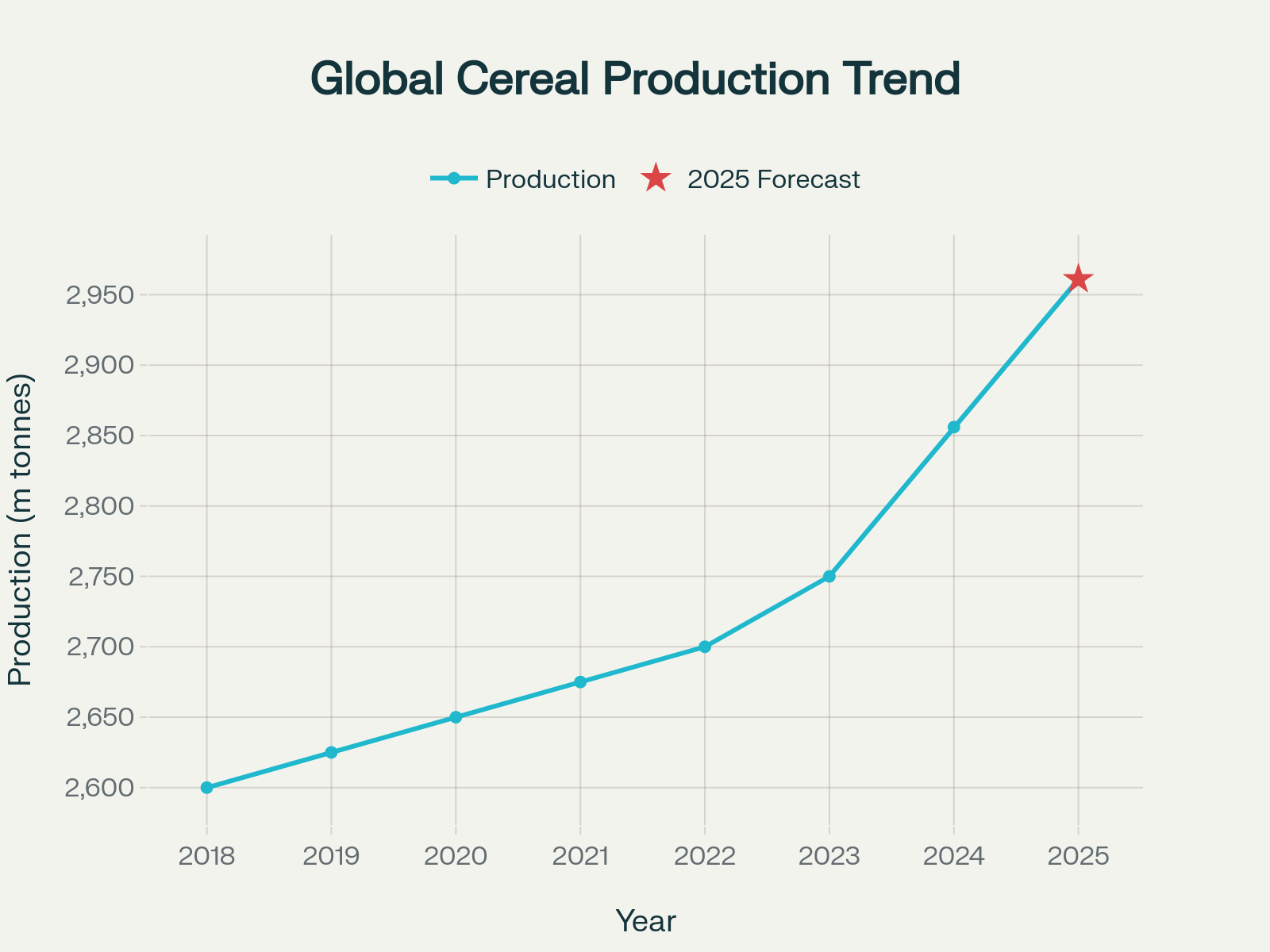

Executive Summary: The Supreme Court’s 6–3 ruling in Learning Resources, Inc. v. Trump killed all IEEPA-based tariffs and replaced them, for now, with a 15% Section 122 surcharge on a 150‑day clock that ends July 24. For a 500‑cow dairy shipping 117,500 cwt a year, Cornell economist Charles Nicholson’s model says the difference between tariffs gone, a 15% replacement that sticks, or continued uncertainty is about $147,000 in annual margin — enough to hire a person or cover six months of feed. At the same time, a new U.S.–Taiwan deal locks in zero dairy tariffs, while Canada’s ongoing obstruction of USMCA dairy TRQs now faces less U.S. leverage after the ruling, even as exporters still fight to use roughly 42% of the access they were promised. CBP has collected $133.5 billion in IEEPA tariffs through late 2025, and Penn Wharton estimates up to $175 billion could be refunded with interest, raising a blunt question: will processors keep that money, or pass any of it back down the chain? In the next 30 days, producers need to lock in or adjust 2026 Dairy Margin Coverage before the February 26 deadline; over the next 90–365 days, they should stress‑test breakevens against $18‑class futures, press co‑ops on export plans to Canada, Mexico, and Taiwan, and treat July 24 as a hard decision line for contracts and capital plans. Put simply, the Court didn’t eliminate tariff risk — it turned your milk check into a 150‑day countdown in which standing still is the most expensive option.

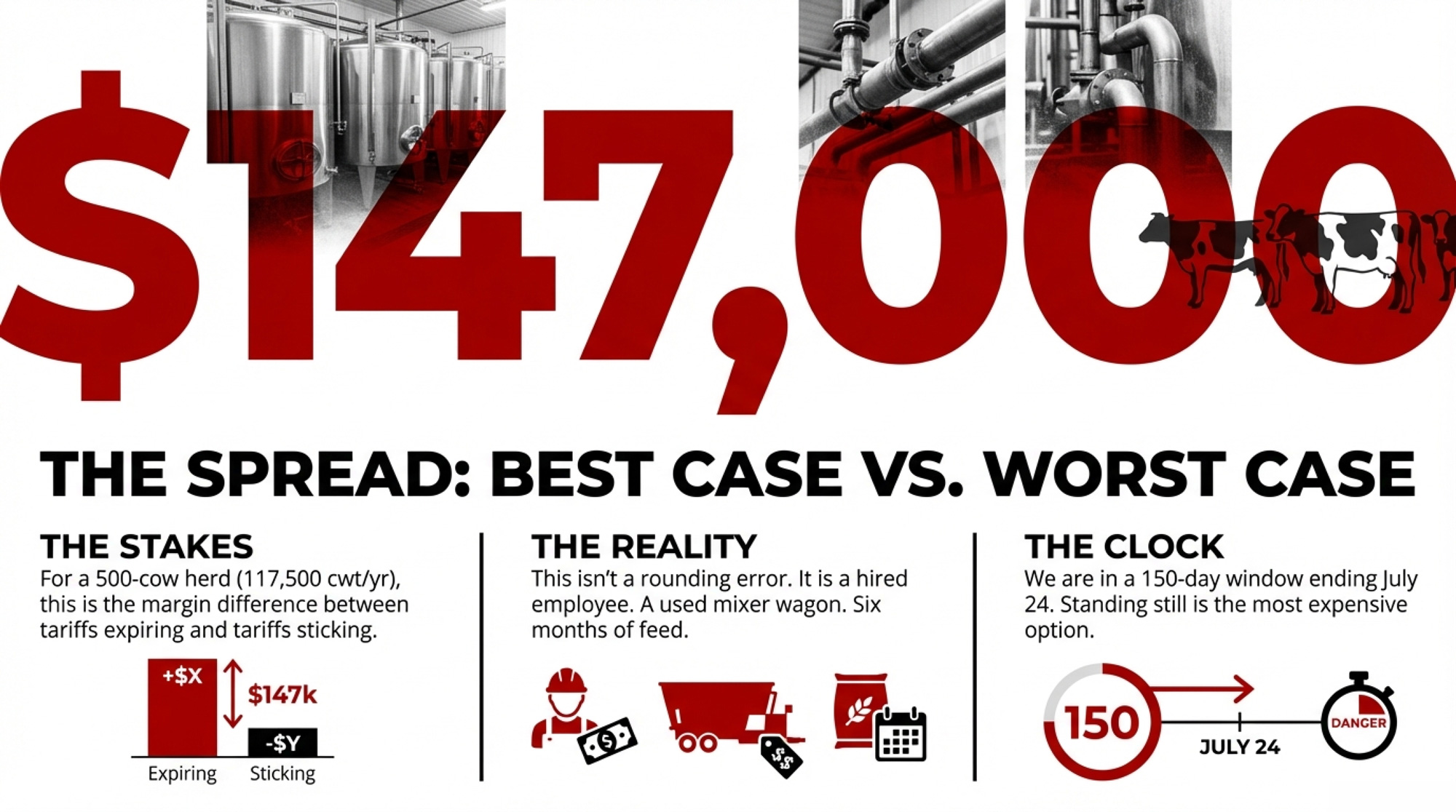

$147,000. That’s the gap between the best and worst scenarios facing a 500-cow dairy between now and July 24 — the day the replacement tariffs expire, or don’t. The Supreme Court’s 6-3 ruling on February 20 in Learning Resources, Inc. v. Trump didn’t end the tariff fight. It moved it to a different legal lane with a ticking clock.

Ted Vander Schaaf milks 1,250 Holsteins near Kuna, Idaho. He told the Senate last week that U.S. trade leverage was slipping — that countries were already gaming the system before the Court weighed in. Four days later, Chief Justice Roberts wrote the majority opinion, confirming what Vander Schaaf had seen in his bulk tank: the legal foundation of the tariff regime had never been solid.

Now every dairy producer in the country faces the same question Vander Schaaf does. Not whether the tariffs are gone—they’re not. Whether the replacement tariffs hold, and what your milk check looks like if they don’t.

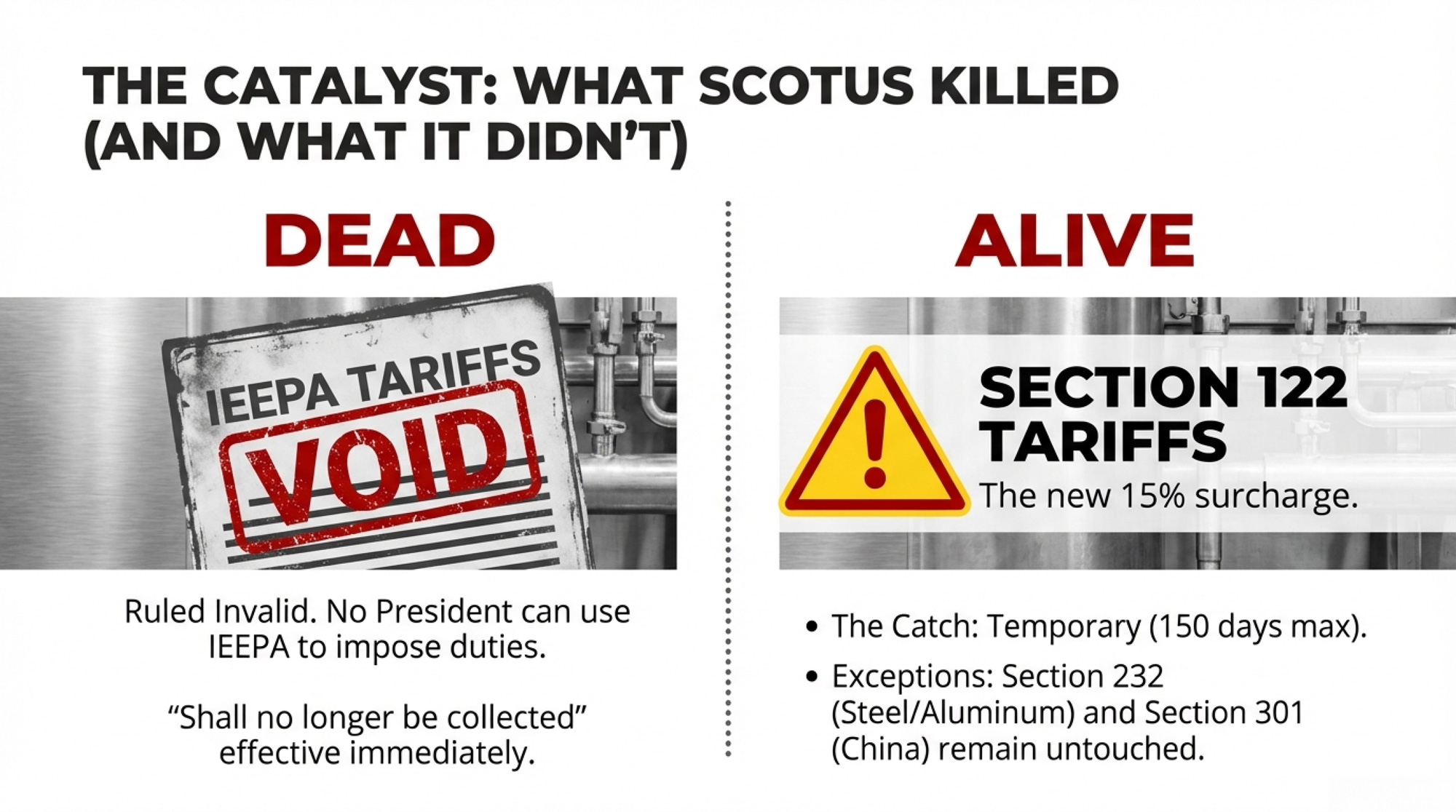

What the Court Killed — and What It Didn’t

The ruling was definitive on one point: IEEPA does not authorize tariffs. Period. Roberts, joined by Gorsuch, Barrett, Sotomayor, Kagan, and Jackson, wrote that the power to “regulate importation” as granted to the president in IEEPA does not embrace the power to impose tariffs. The statute contains no reference to tariffs or duties, and no president in IEEPA’s 49-year history had ever used it this way.

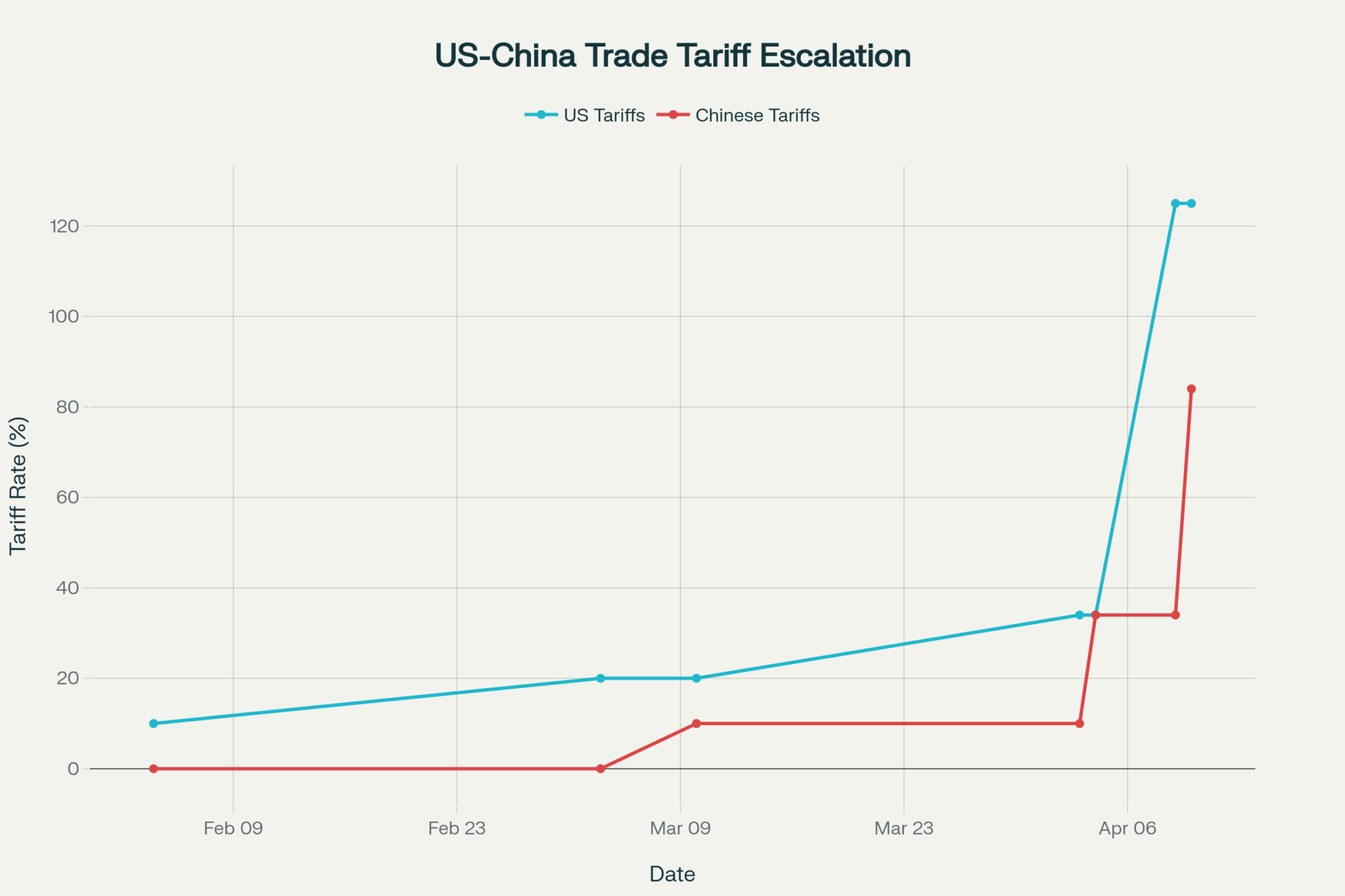

What’s gone: every IEEPA-based tariff. The country-by-country reciprocal rates — up to 34% on China, 25% on certain Canadian and Mexican goods, and the 10% baseline on everybody else. All invalidated. The administration issued an executive order the same day stating these tariffs “shall no longer be in effect and, as soon as practicable, shall no longer be collected.”

What’s still standing: Section 232 tariffs (national security — steel, aluminum), Section 301 tariffs (unfair trade practices — existing China tariffs on specific goods), and antidumping/countervailing duties. These operate under separate statutory authority and weren’t touched by the ruling.

[INTERNAL LINK: “The American Dairy Heist: Who Really Owns Your Milk Check” → Suggested anchor text: “the margin chain between your bulk tank and the shelf”]

And then there’s the replacement.

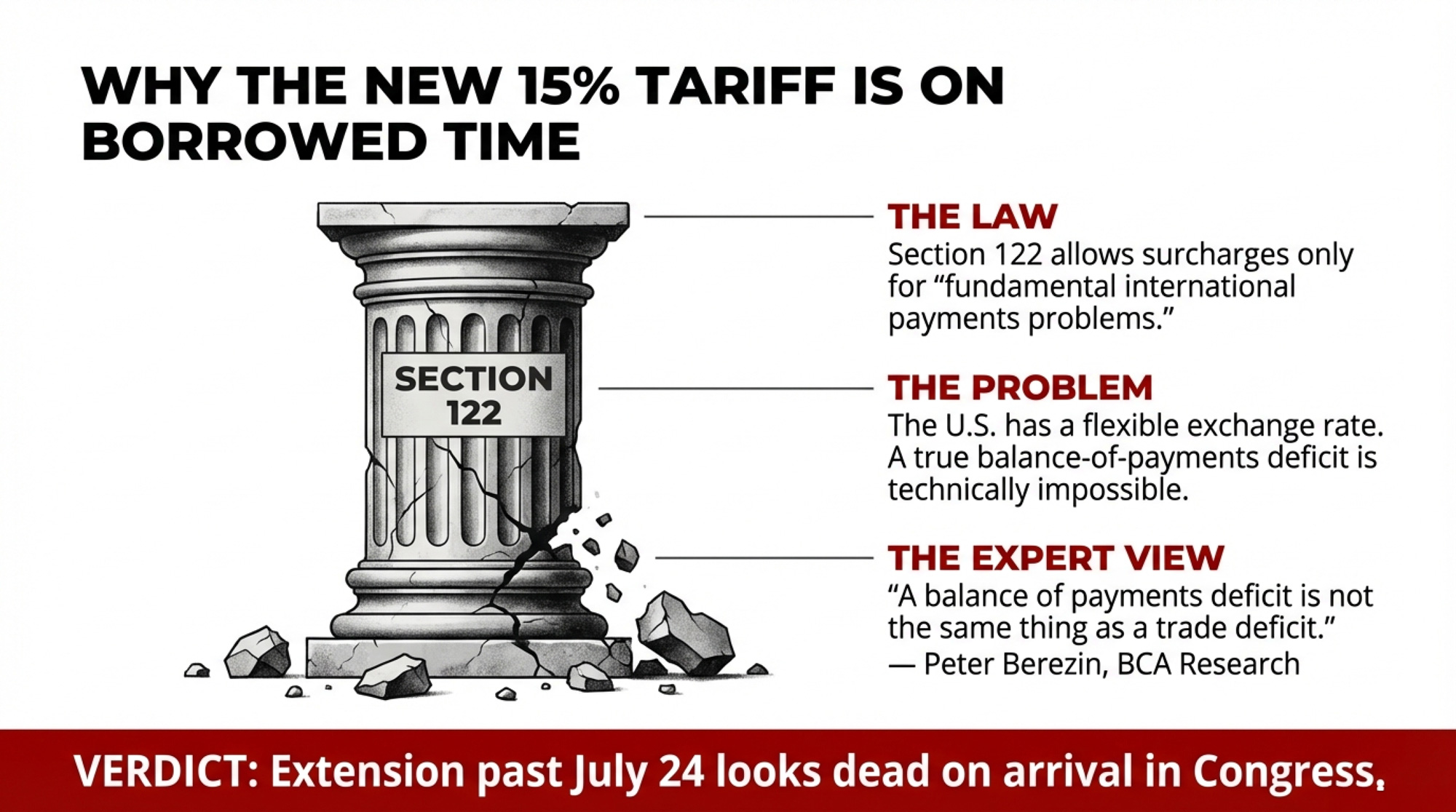

The 150-Day Clock: Why Section 122 Probably Won’t Survive

Within hours of the ruling, Trump announced a 10% tariff on imports from around the world under Section 122 of the Trade Act of 1974. A day later, he bumped it to 15% — the statutory maximum. Section 122 allows temporary import surcharges for up to 150 days to address “fundamental international payments problems.”

Here’s the problem: the U.S. doesn’t have one.

Peter Berezin, chief global strategist at BCA Research, put it bluntly on February 20: “A balance of payments deficit is not the same thing as a trade deficit. You cannot have a balance of payments deficit if you have a flexible exchange rate.” Bryan Riley, director of the National Taxpayers Union’s Free Trade Initiative, made the same argument: Section 122 was written for a fixed exchange-rate world that hasn’t existed since 1973. The statute has never been invoked. Not once in 52 years.

The Peterson Institute for International Economics laid out the technical case in a February 22 analysis. Under a floating exchange rate, potentially insufficient private financial inflows are remedied by currency depreciation, which puts domestic assets and exports “on sale” and precludes a balance-of-payments deficit before it starts. The U.S. has a large supply of attractive financial assets and faces no difficulty financing its current account deficits.

Even the administration’s own lawyers argued during the IEEPA case that Section 122 was no substitute for IEEPA because balance-of-payments deficits are “conceptually distinct” from trade deficits.

So the replacement tariff’s legal foundation is arguably weaker than the one the Court just demolished. And it expires on July 24, 2026 — 150 days from the February 24 effective date — unless Congress votes to extend it. Both the House and Senate have already passed bills disapproving of the IEEPA tariffs. Extension looks dead on arrival.

Rep. Mike Flood (R-NE) underscored the point: “The ruling underscores Congress’s responsibility and obligation to set tariff policy.”

What happens after July 24? The administration has signaled it will initiate Section 301 investigations against multiple trading partners and may accelerate pending Section 232 investigations. Those routes require investigations and findings of fact—a process that can take months, even on an expedited timeline. There will be a gap.

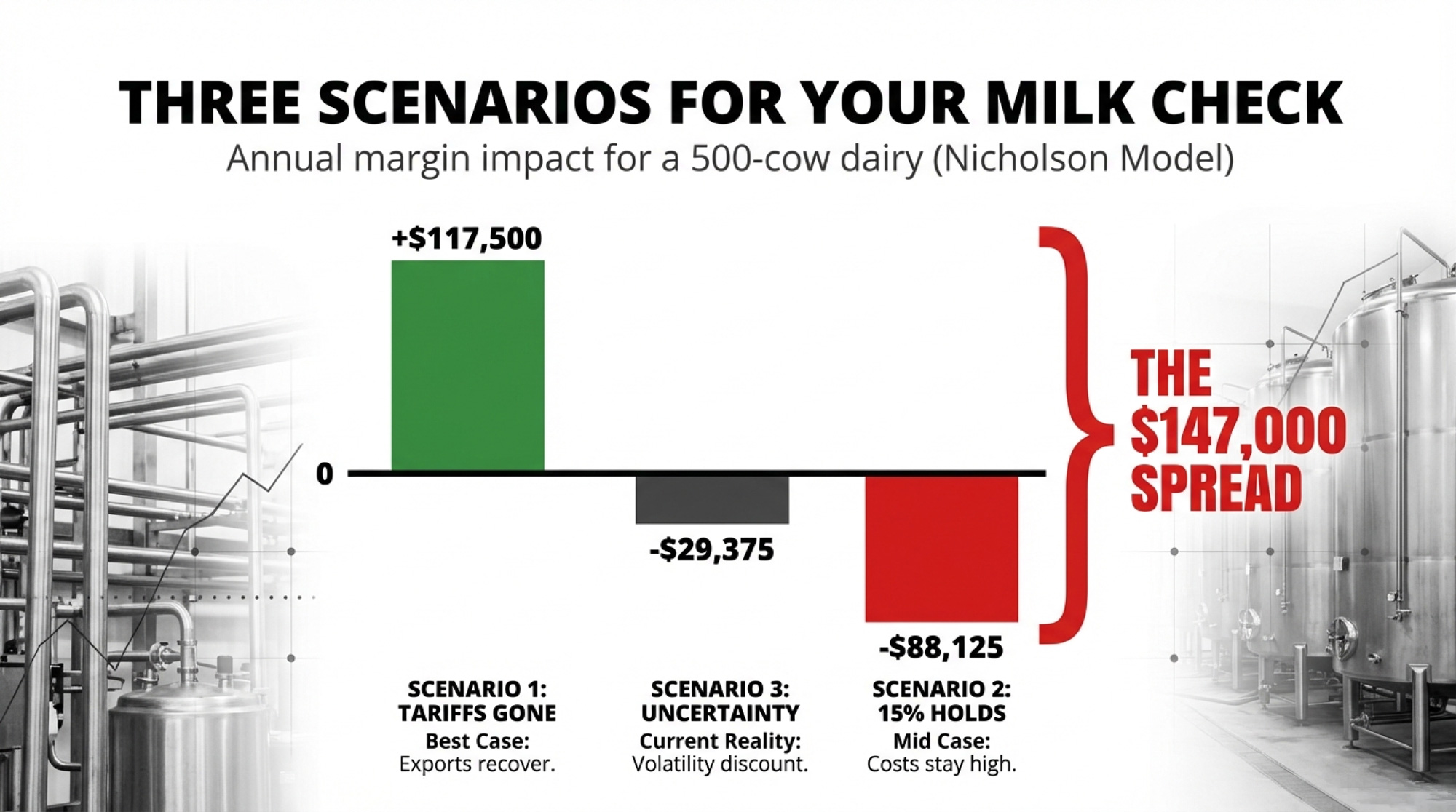

$147,000 Three Ways: What Your 500-Cow Dairy Looks Like Under Each Scenario

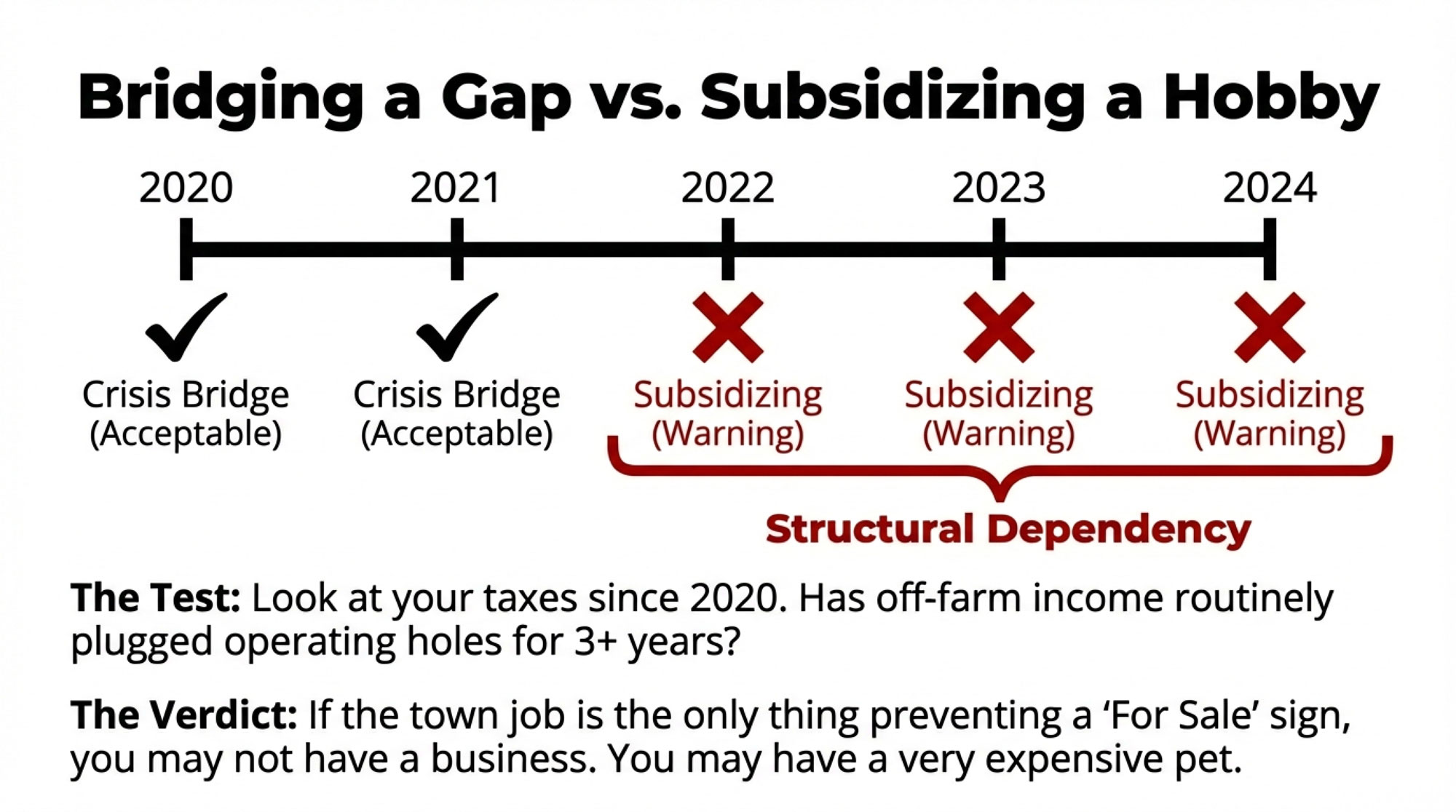

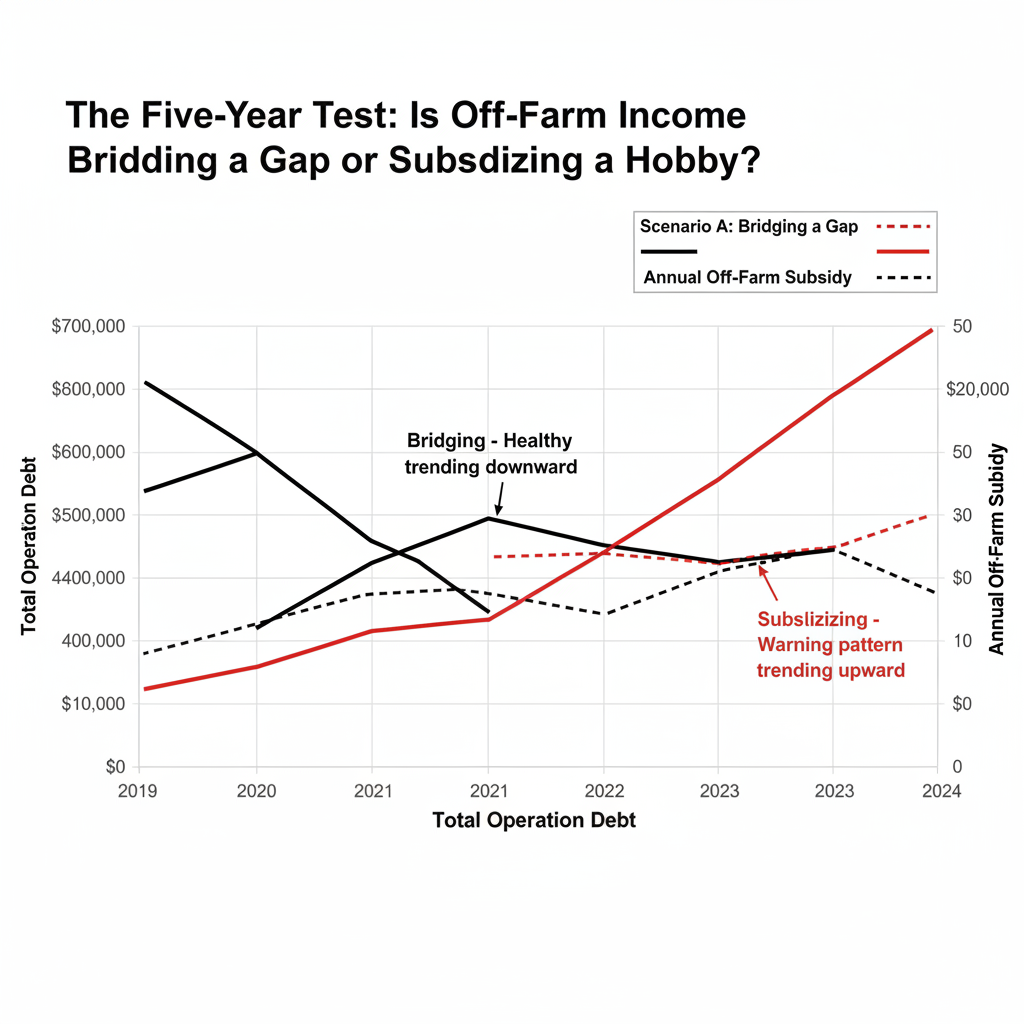

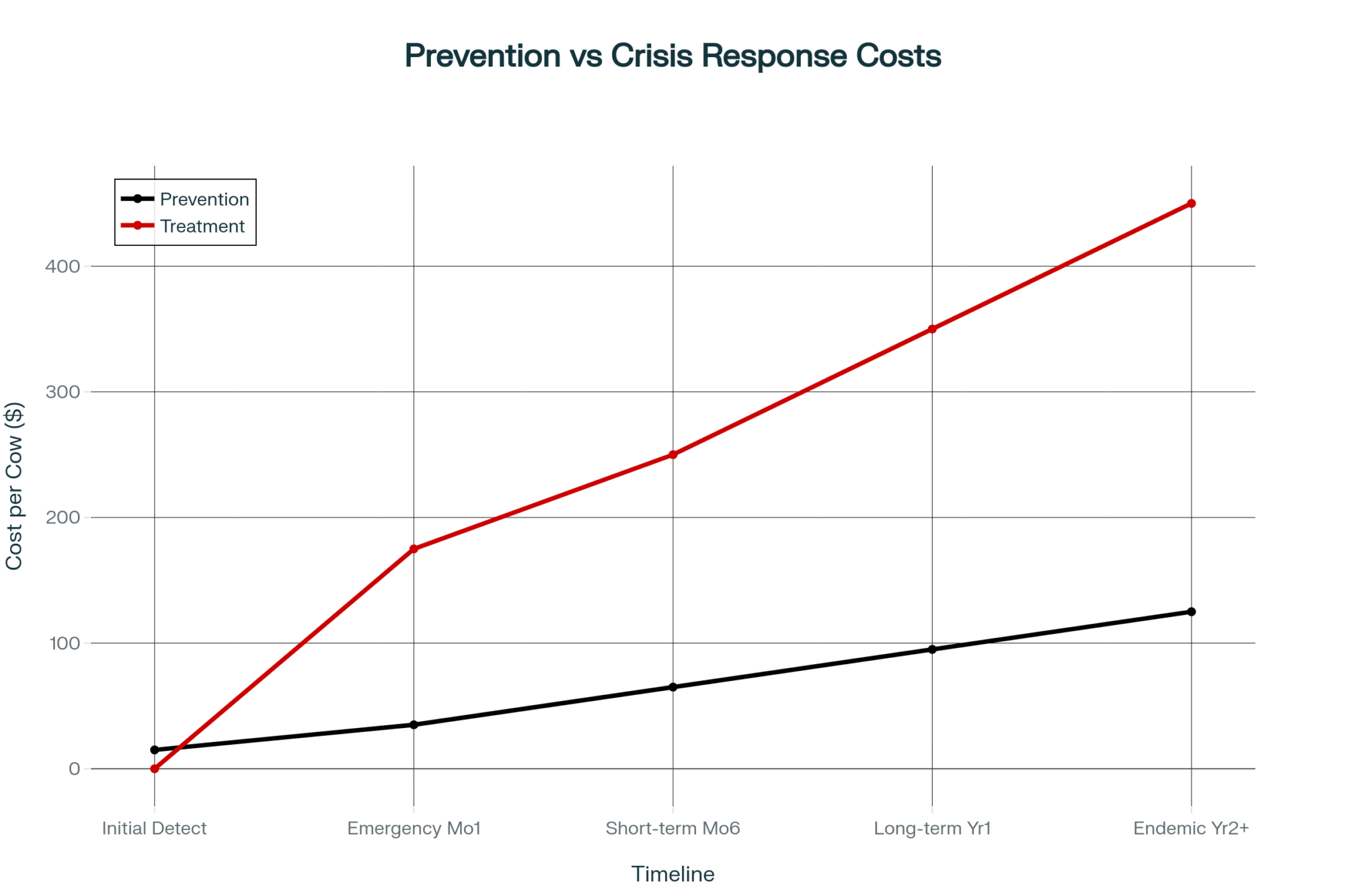

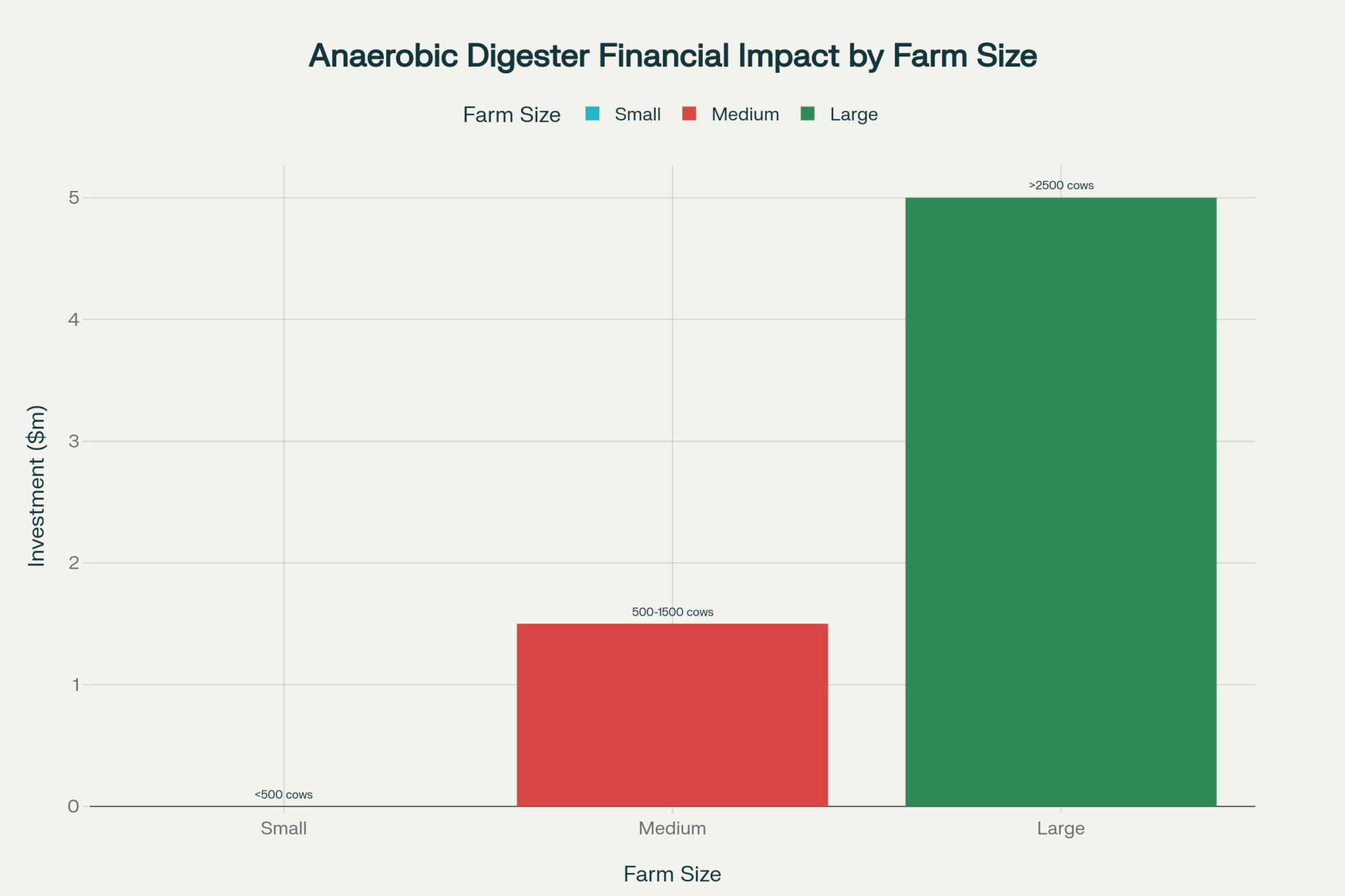

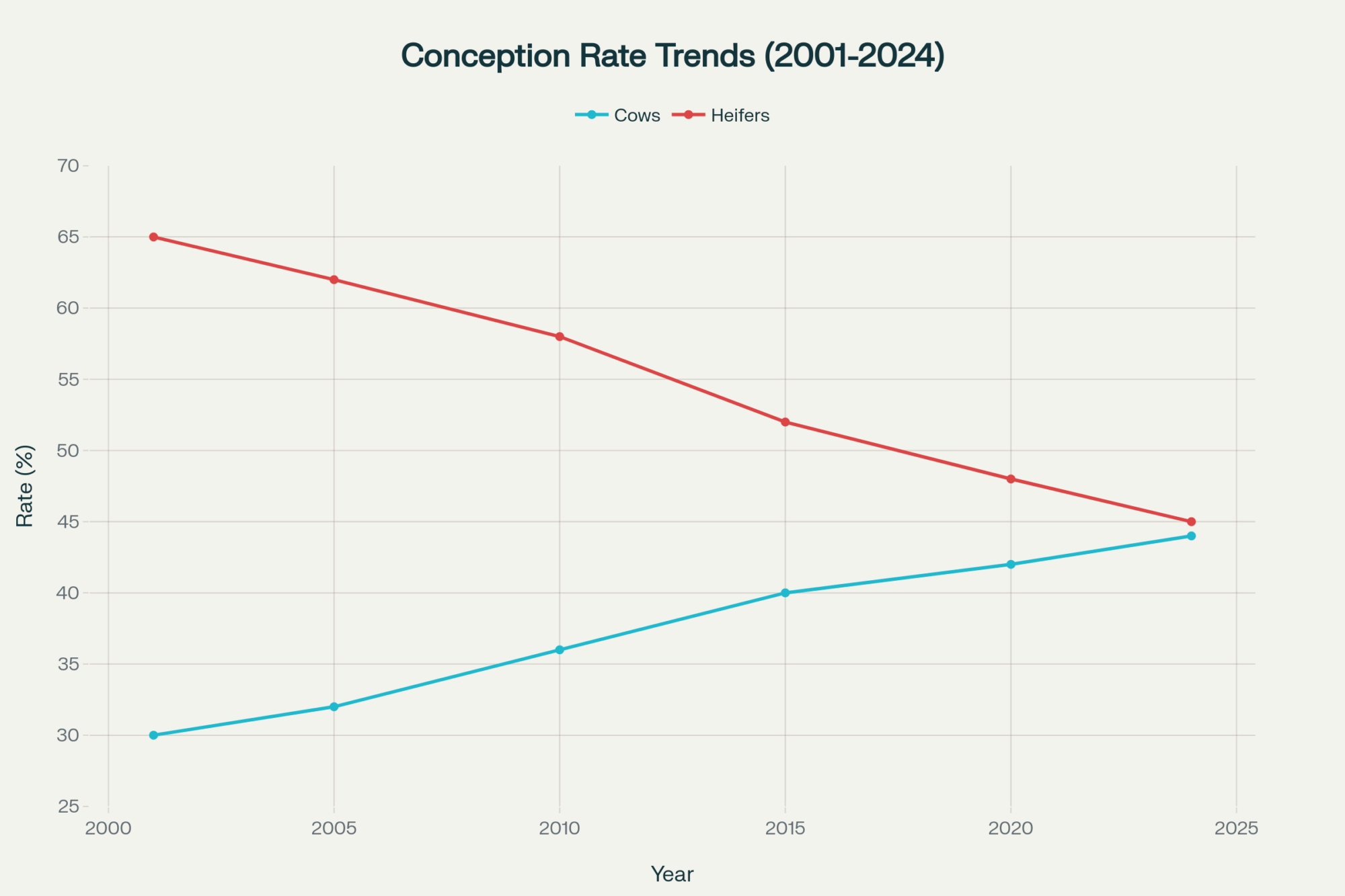

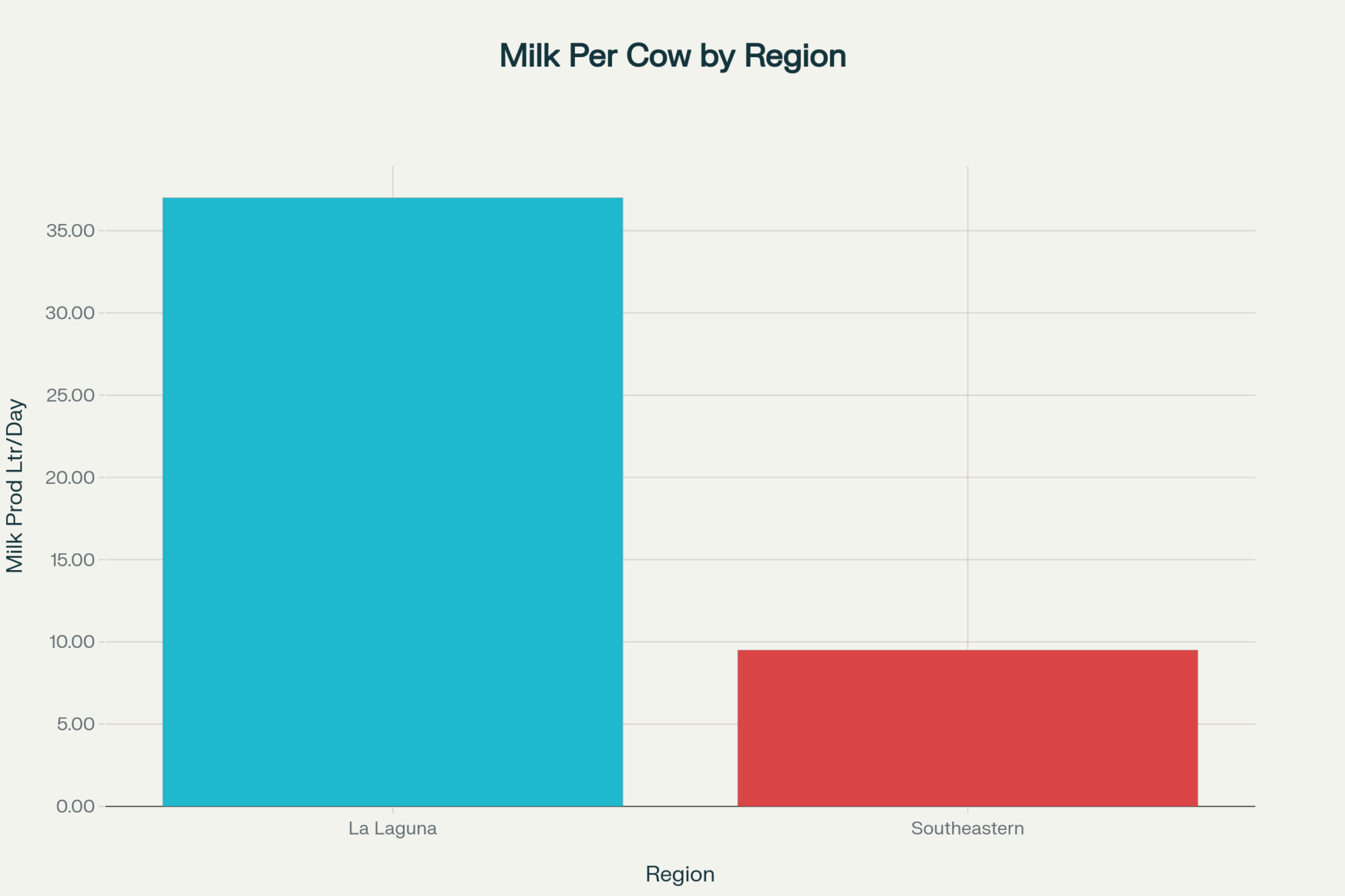

Cornell’s Charles Nicholson projected at the January 2025 Dyson Agricultural and Food Business Outlook conference that the combination of tariffs, deportations, and potential nutrition spending cuts could produce a $6 billion loss in U.S. dairy profits over four years. That’s a combined-policy number, not tariffs alone — but tariff-driven retaliation from Mexico, Canada, and China was the biggest single driver.

“If you pick a trade fight with our major export destinations — Mexico, Canada, and China — and they decide to retaliate, that has some substantive negative implications for dairy farms and processors,” Nicholson said.

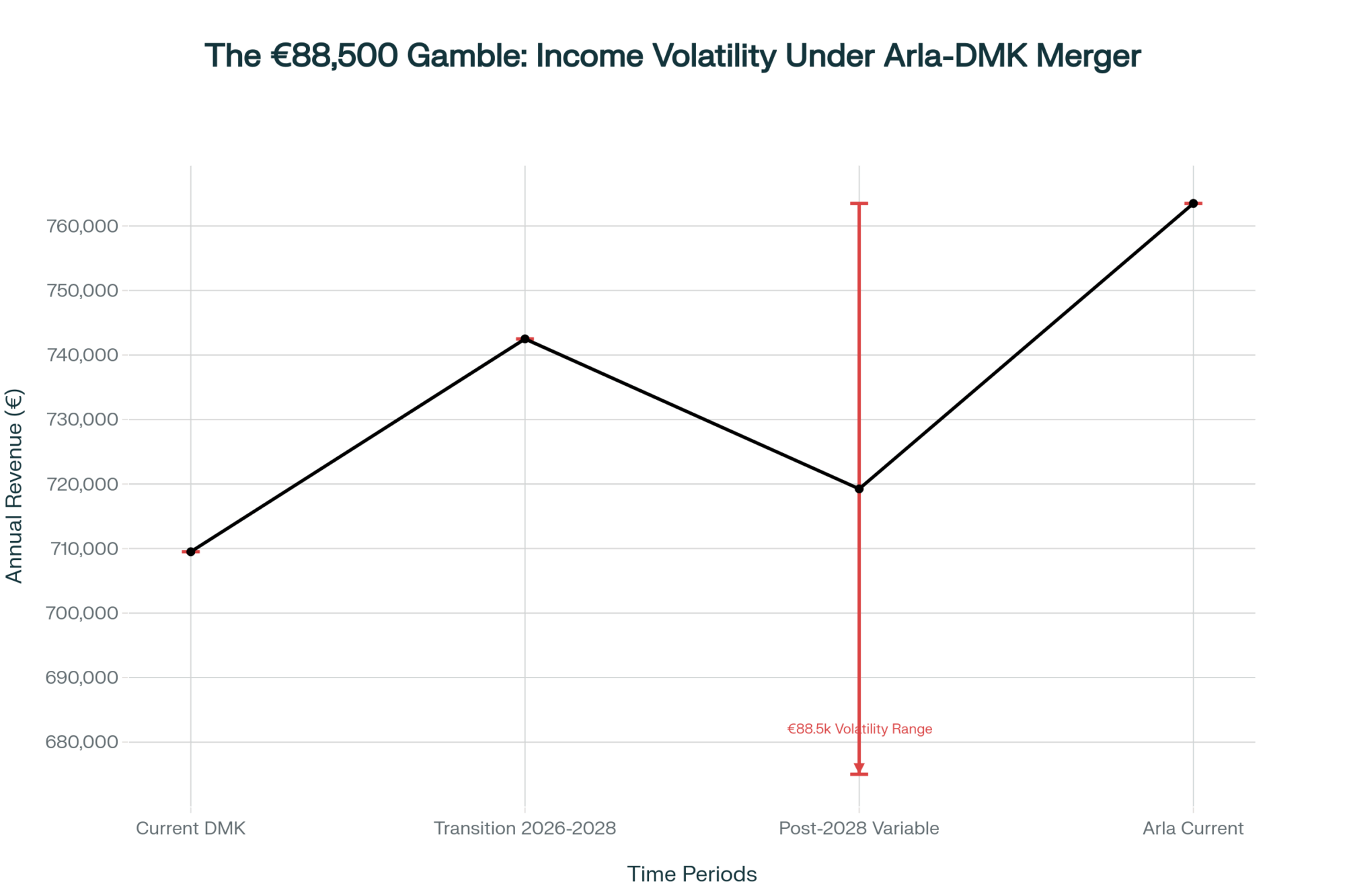

The SCOTUS ruling scrambled the assumptions underneath that projection. Here’s how the math lands on a 500-cow operation producing 235 cwt/cow/year — 117,500 cwt of annual production. Plug your own herd size, and you can scale these directly.

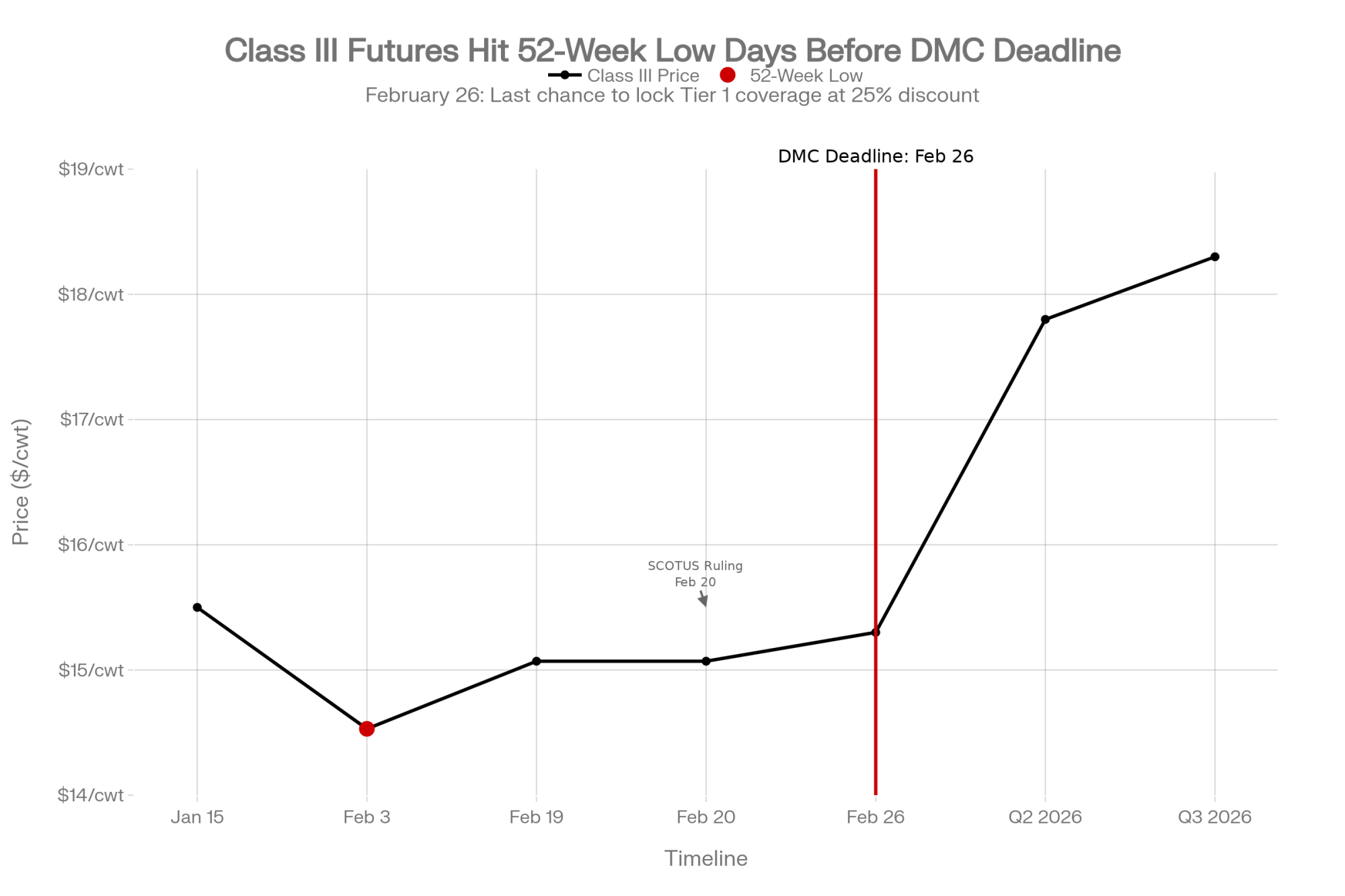

For context: Class III milk settled at $15.07/cwt on February 19 — the last trading day before the ruling. That’s up from a $14.53 low on February 3, but still well below the $17–18 range where Q2 and Q3 2026 futures are currently trading on the CME.

Scenario 1: Tariffs Effectively Gone (IEEPA dead, Section 122 expires, no replacement)

Retaliatory tariffs from Mexico, Canada, and China unwind. Export demand recovers. Class III and Class IV futures adjust upward as export-driven cheese and powder demand returns to the pre-tariff trajectory. Nicholson’s model suggests milk prices recover by 2027, with the 2025–26 damage partially absorbed.

Estimated price impact: +$0.75 to +$1.25/cwt above current baseline Your 500-cow math: 117,500 cwt × $1.00/cwt midpoint = +$117,500/year

This is the best case—and it’s not guaranteed. It depends on trading partners actually unwinding retaliatory measures, which Ian Sheldon at Ohio State warns is far from certain.

Scenario 2: 15% Replacement Holds (Section 122 survives legal challenge, transitions to 301/232)

The 15% across-the-board tariff stays through July 24. Retaliatory tariffs remain partially in place. Some trading partners renegotiate, others slow-walk. Class III price stays compressed. Input costs (equipment, parts, and some feed additives) remain elevated due to the 15% surcharge.

Estimated price impact: -$0.50 to -$1.00/cwt below pre-tariff baseline. Your 500-cow math: 117,500 cwt × -$0.75/cwt midpoint = -$88,125/year

Scenario 3: Uncertainty Persists (legal challenges, policy limbo, no clear signal)

Section 122 is challenged in court. Trading partners pause compliance with existing deals. Processors can’t price forward contracts. Futures volatility spikes. Co-ops hold back on premiums.

Estimated price impact: -$0.25 to -$0.50/cwt from uncertainty discount alone. Your 500-cow math: 117,500 cwt × -$0.25/cwt (conservative) = -$29,375/year in margin compression — before any tariff-driven price move lands

| Scenario | Legal Status | Milk Price Impact (per cwt) | Annual Margin Impact (500 cows, 117,500 cwt) | What That Buys |

| 1. Tariffs Gone | IEEPA dead, Section 122 expires, no replacement | +$1.00 | +$117,500 | Hired employee + equipment down payment |

| 2. 15% Replacement Holds | Section 122 survives or transitions to 301/232 | -$0.75 | -$88,125 | 6 months of feed costs vanish |

| 3. Uncertainty Limbo | Legal challenges, policy chaos, no clear signal | -$0.25 | -$29,375 | Used mixer wagon—gone |

| Spread (Best vs. Worst) | — | $1.75/cwt | $147,000 | The gap between survival and exit |

The spread between Scenario 1 and Scenario 2: roughly $147,000 per year on a 500-cow dairy. That’s not a rounding error. That’s a hired employee. A used mixer wagon. Six months of feed.

For Vander Schaaf’s 1,250-cow operation, multiply accordingly. The stakes scale linearly.

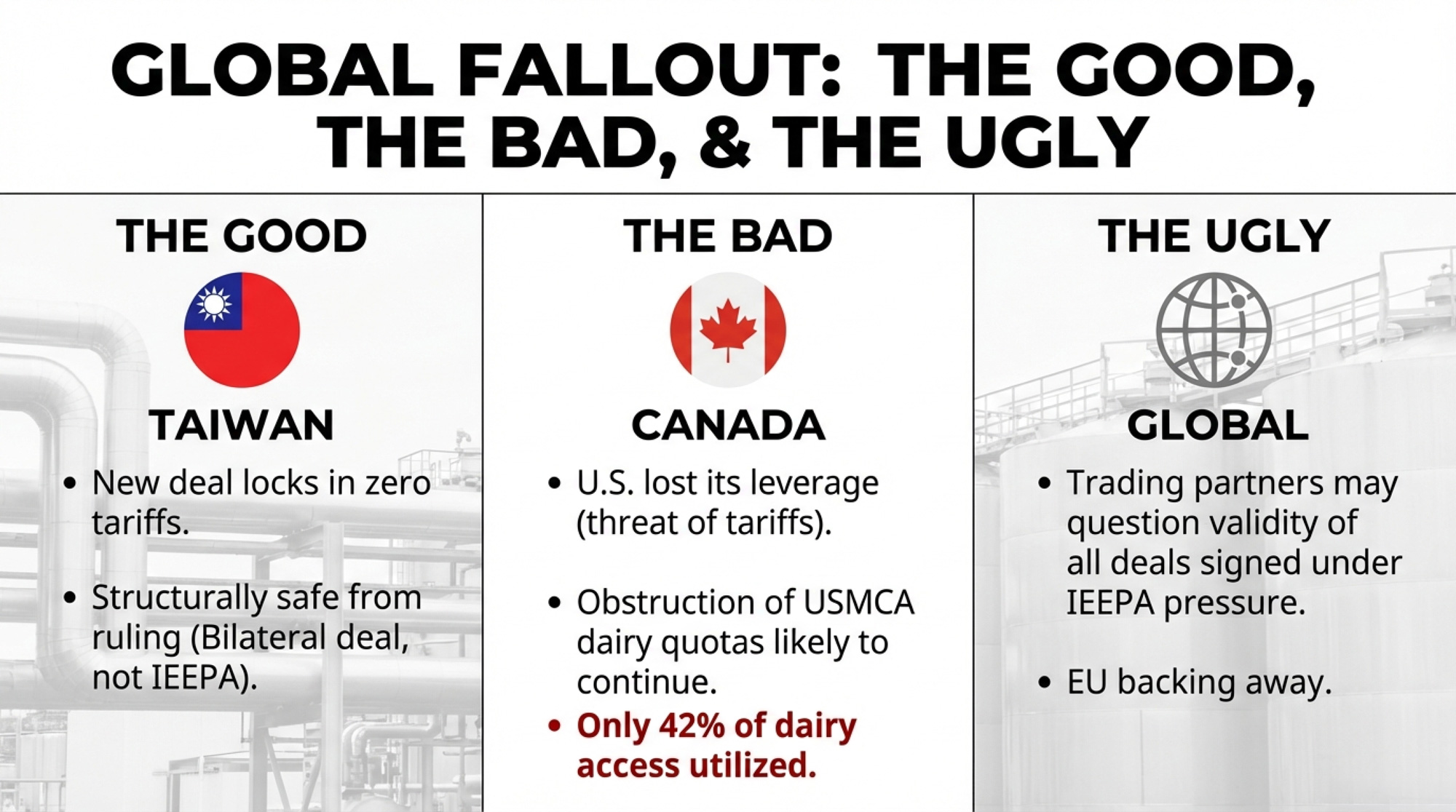

Is the Taiwan Deal Safe from the Ruling?

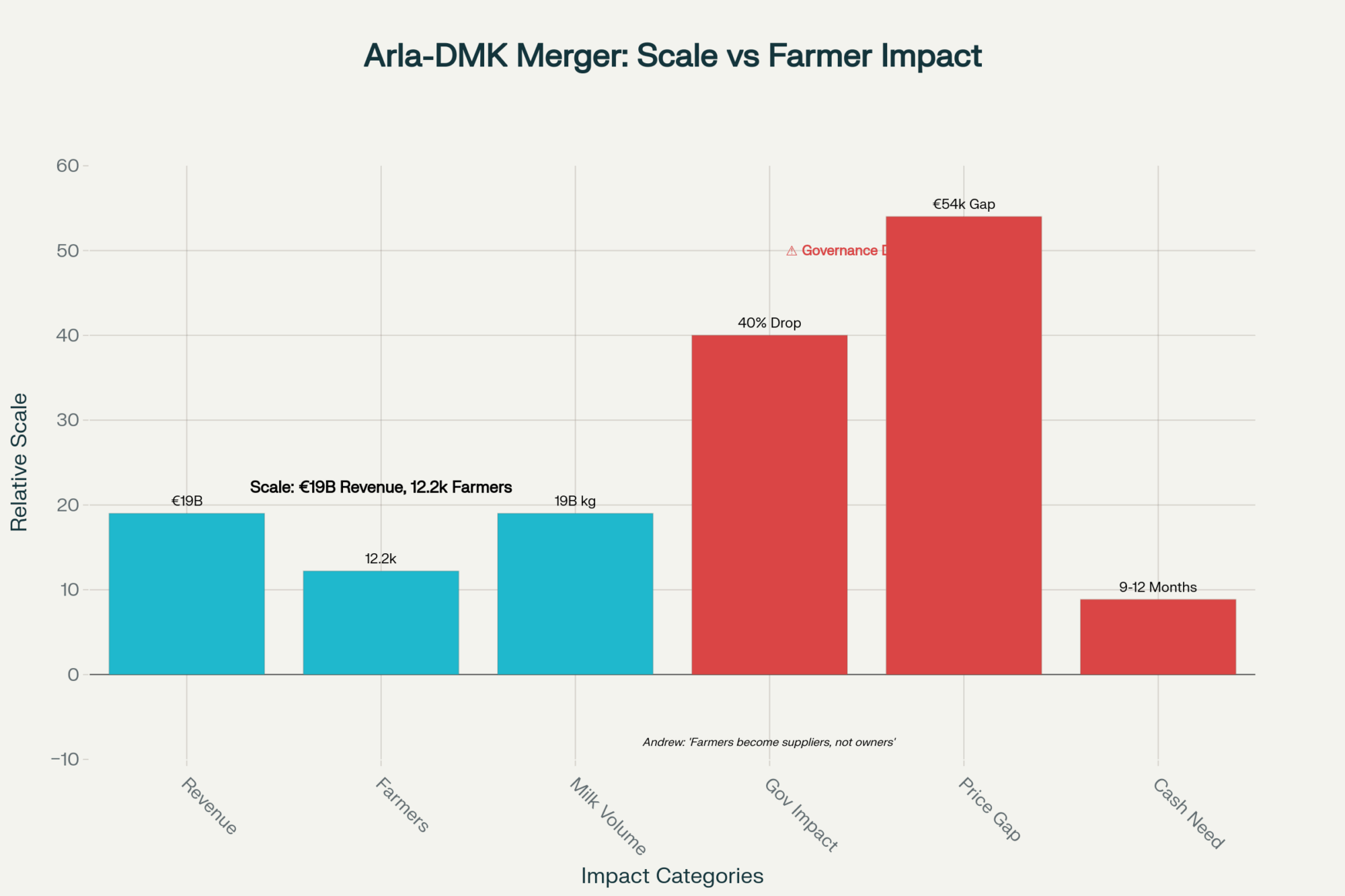

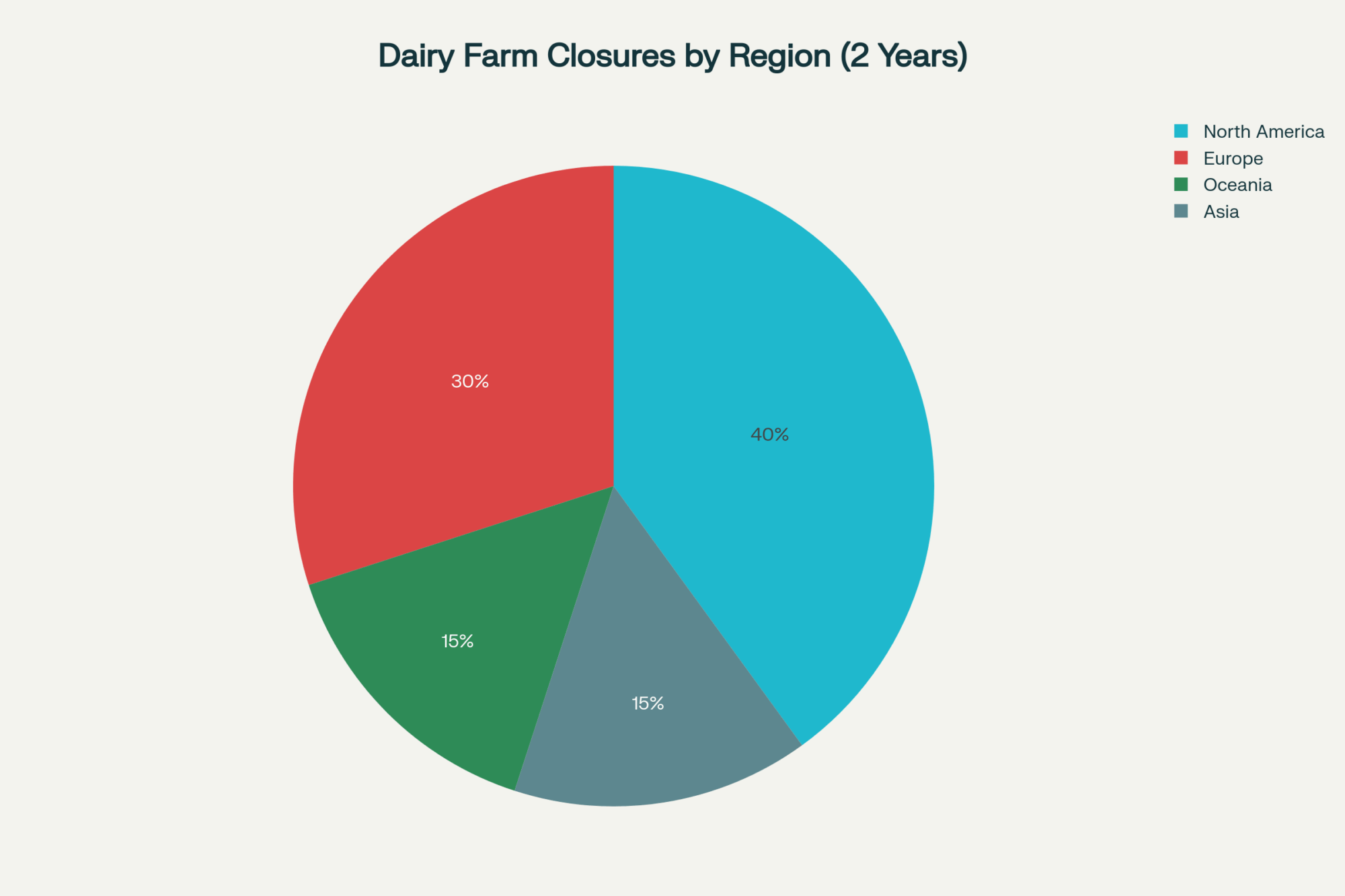

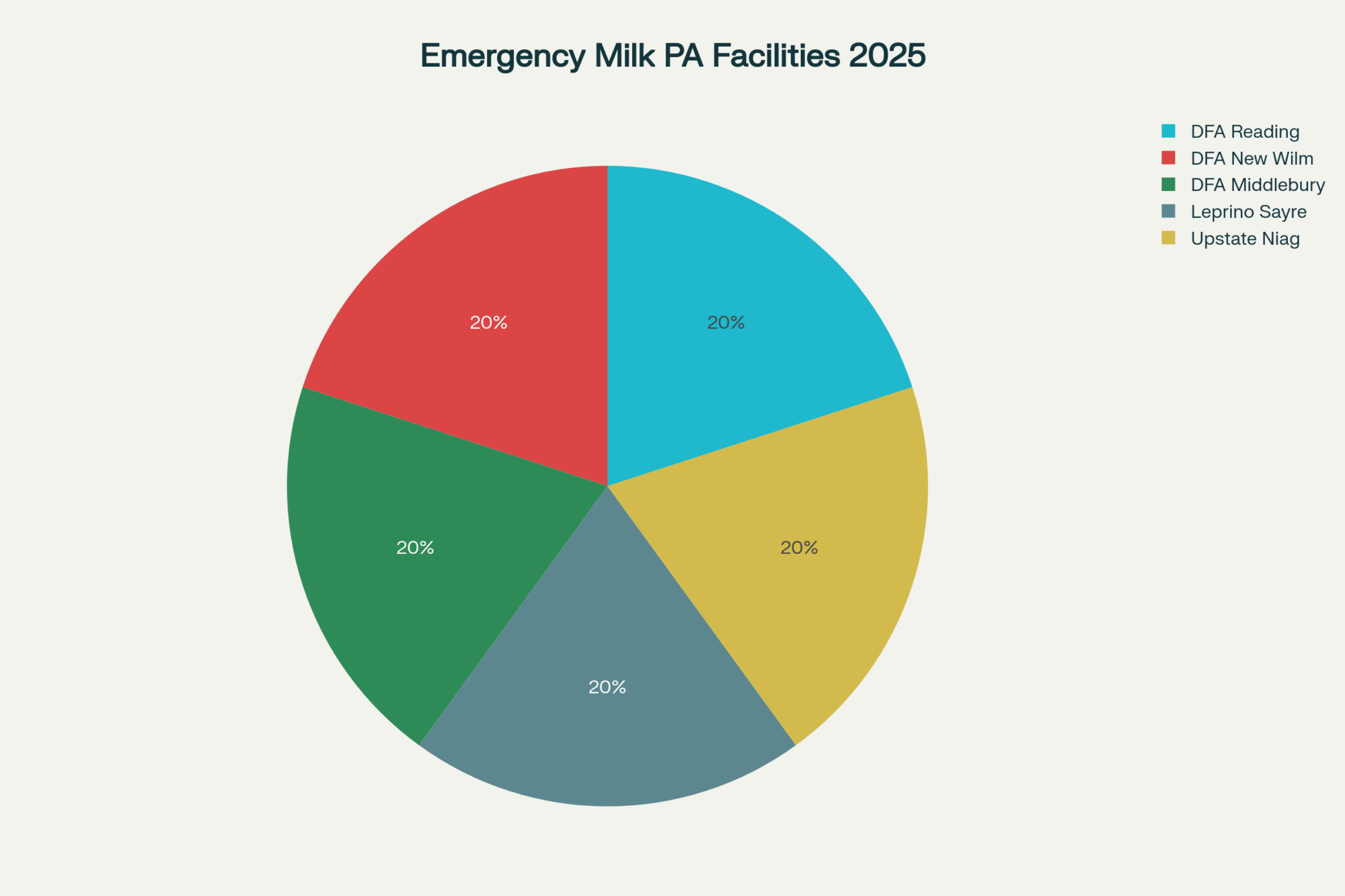

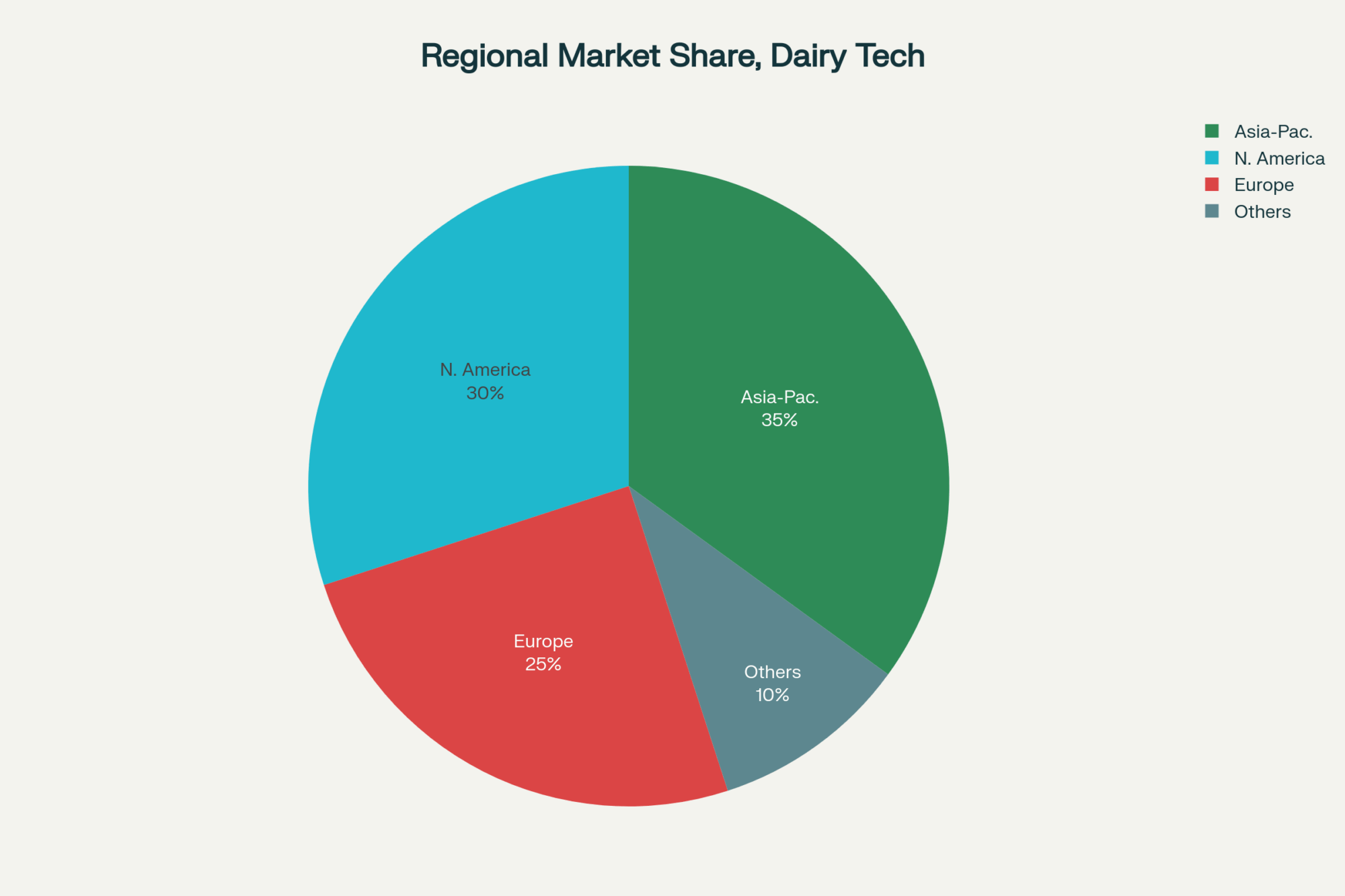

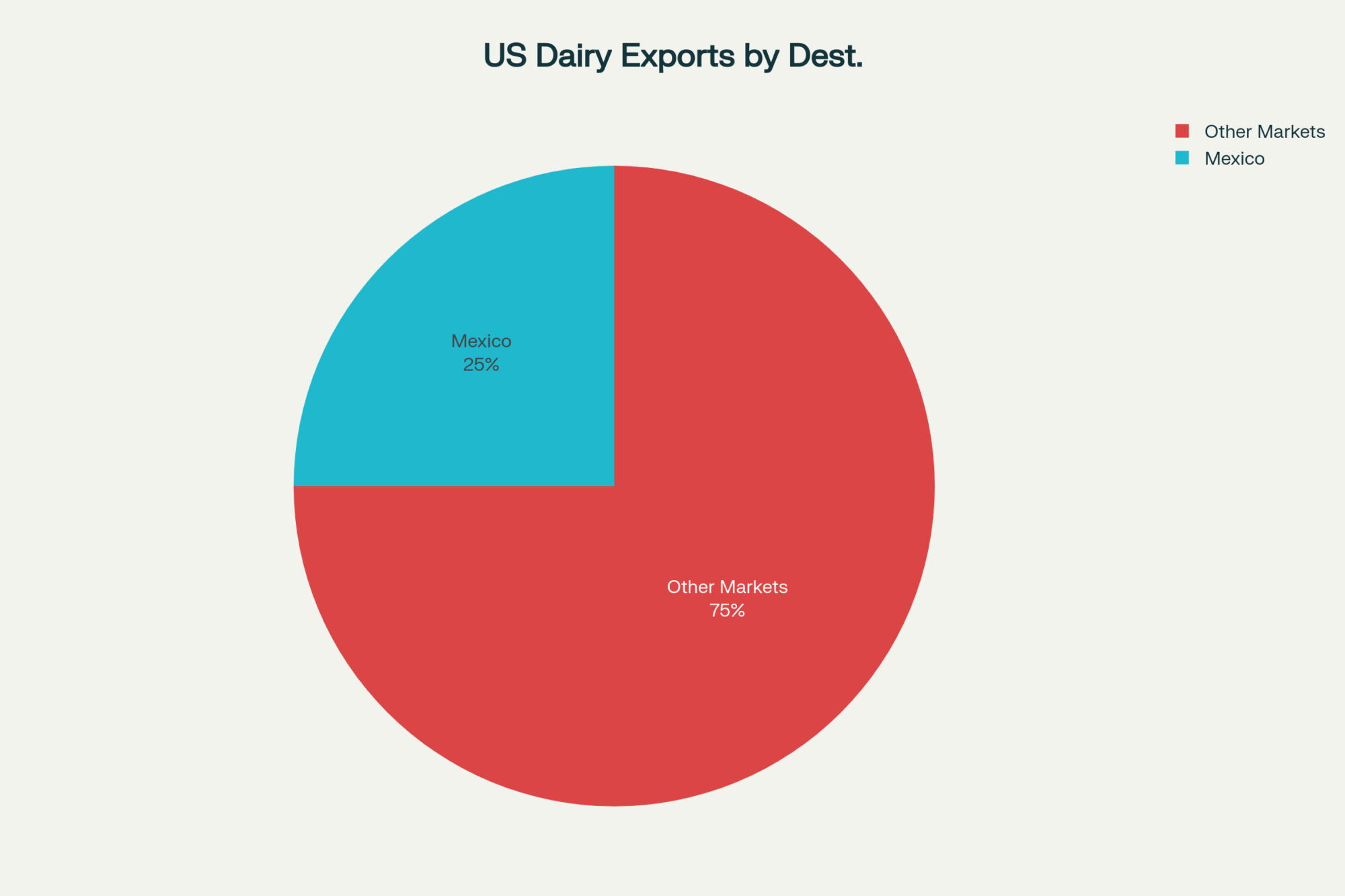

The U.S.–Taiwan trade agreement, signed on February 13, eliminates tariffs on all U.S. dairy products and preempts nontariff barriers. Taiwan is the third-largest destination for U.S. fluid milk exports. USDEC president and CEO Krysta Harden called it a deal that “improves our competitiveness compared to other suppliers.”

Good news: this deal is structurally safe from the SCOTUS ruling. It’s a bilateral trade agreement negotiated under standard trade authority, not an IEEPA executive order. The legal basis is entirely separate.

But context matters. The deal was negotiated while IEEPA tariffs of 20%+ gave the U.S. significant leverage. With the baseline tariff now at 15% under Section 122 — and likely headed to zero after July 24 — Taiwan’s incentive to maintain generous terms may shift. For now, the agreement stands, and it’s a genuine win for U.S. dairy exporters in Asia.

The bigger question is what Ohio State’s Sheldon flagged on February 22: “A lot of countries are now questioning the validity of the deals that they signed.” The EU was already backing away. Countries that negotiated under the threat of 34% tariffs may no longer feel bound by the same terms now that the threat has been invalidated.

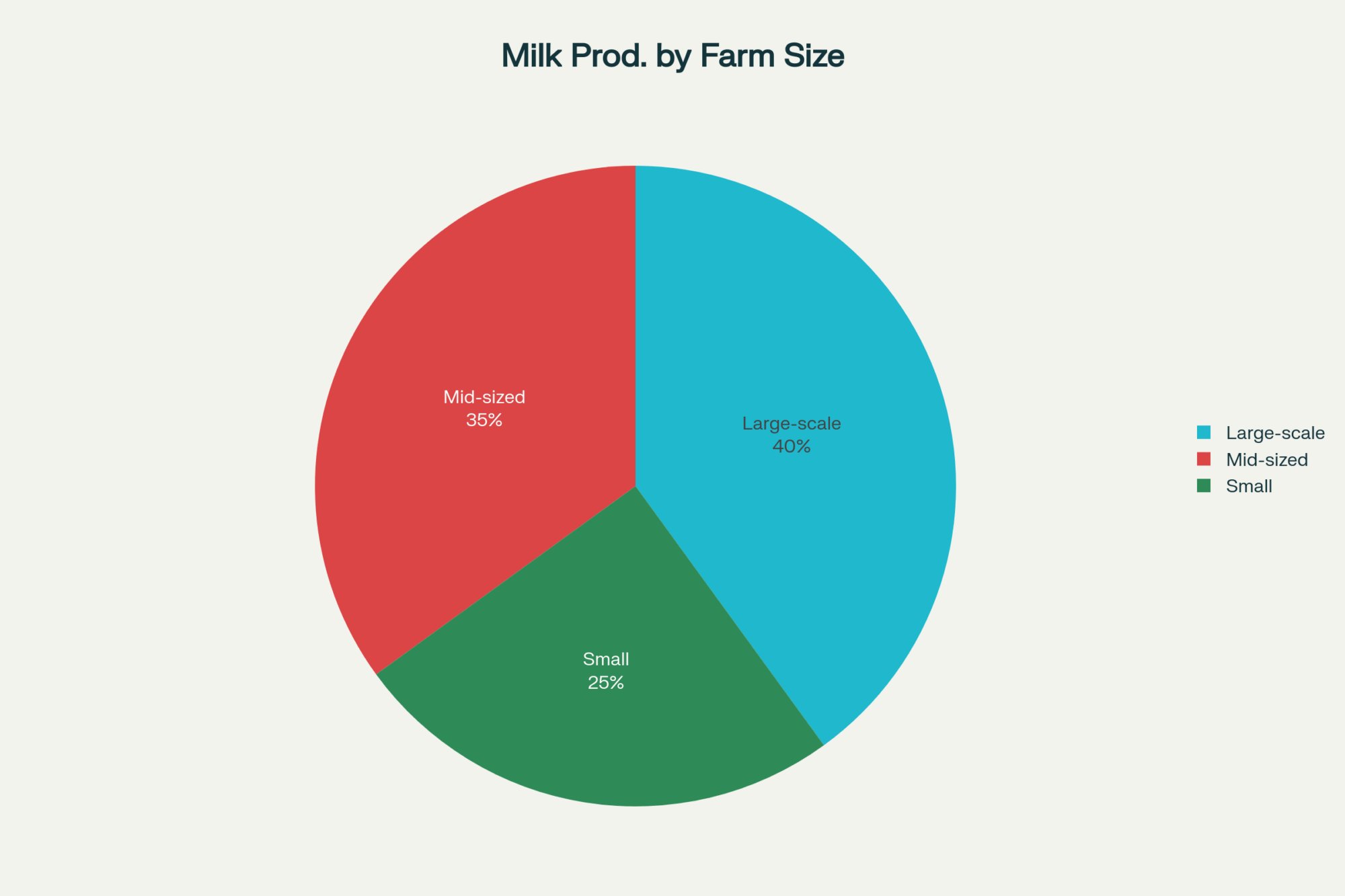

For dairy specifically, Taiwan is the bright spot. But it’s a $300 million market, not a $3 billion one. Mexico and Canada are where the volume lives — and both of those relationships just got more complicated.

Canada’s TRQ Gambit Gets New Cover

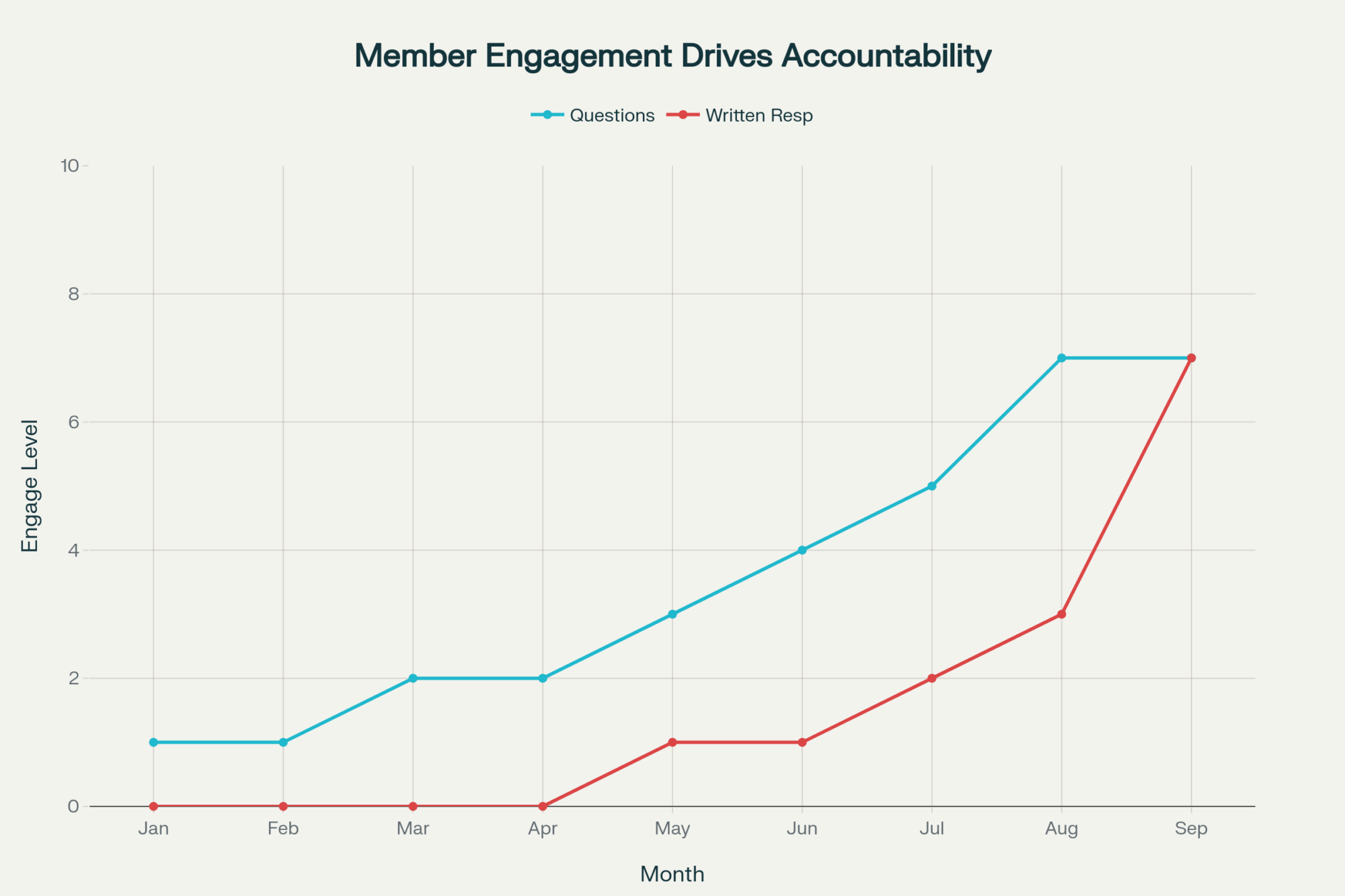

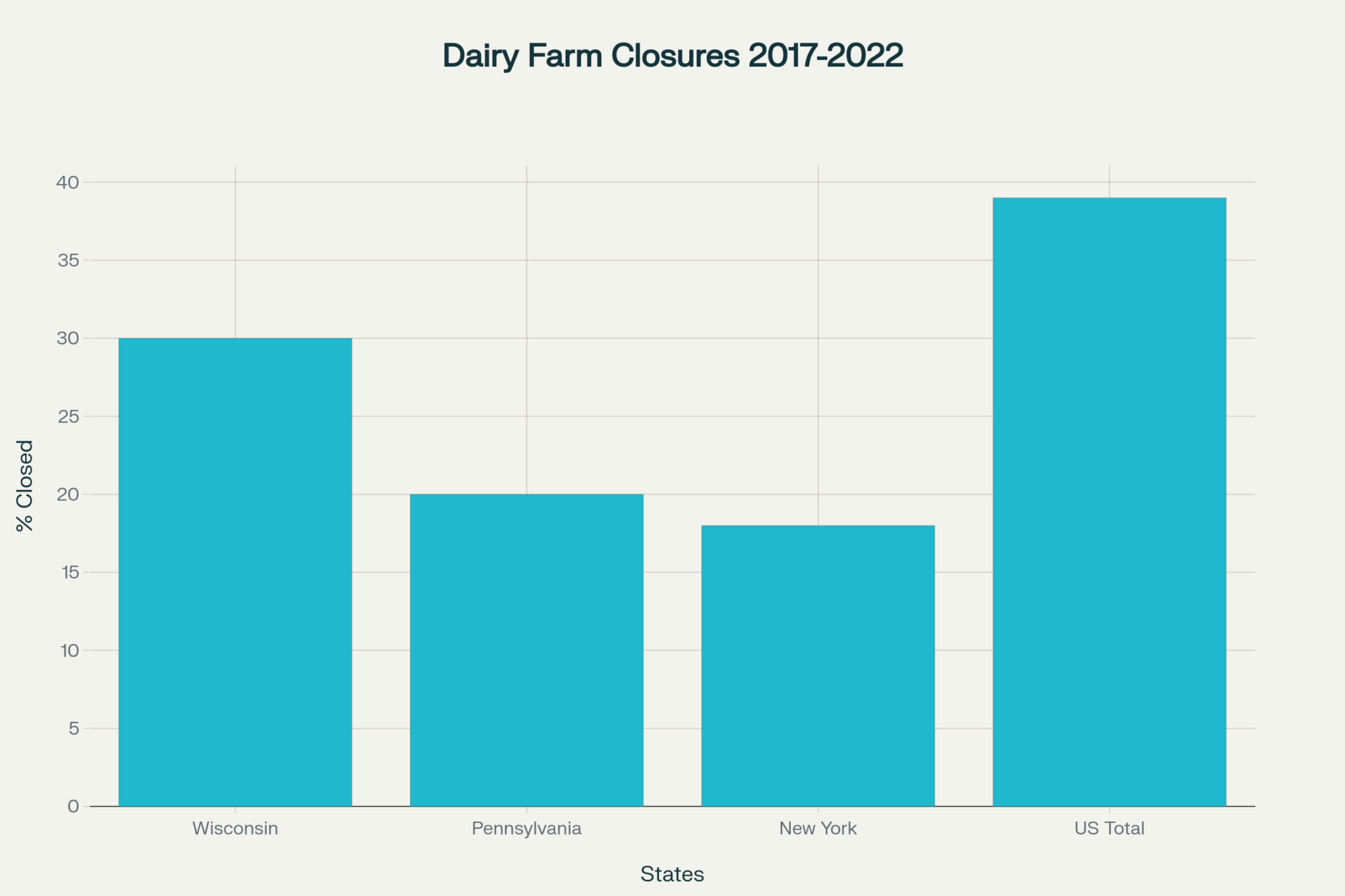

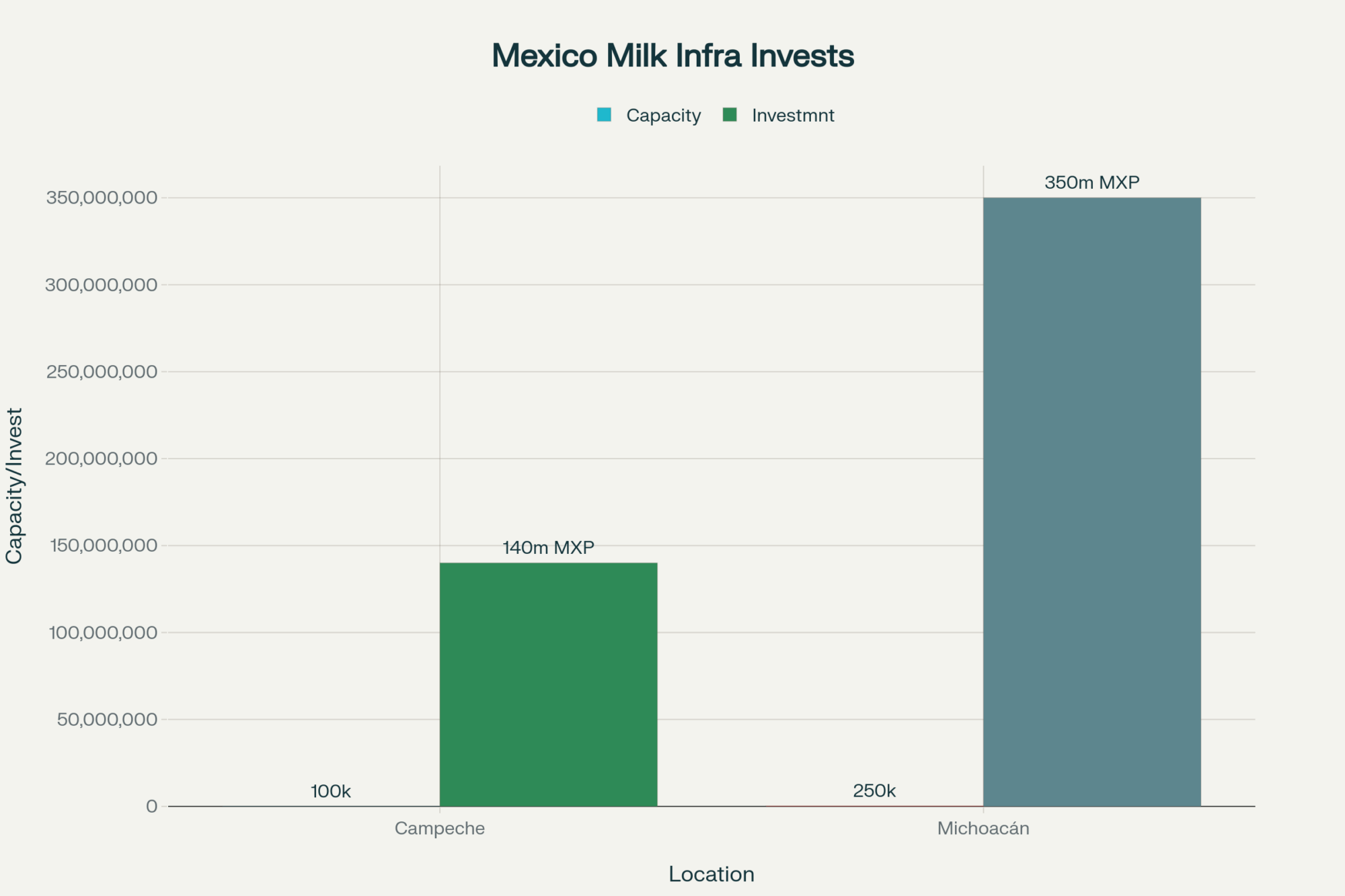

This is where the ruling connects directly to what Vander Schaaf told the Senate. Canada has been obstructing USMCA dairy tariff-rate quotas since the agreement took effect. Only about 42% of the dairy access the U.S. negotiated under USMCA is actually being utilized — not because American producers aren’t trying, but because Canada’s allocation system effectively locks out retailers, food service operators, and other importers who would actually bring in American product.

The U.S. won the first USMCA dispute panel in January 2022. Canada made “insufficient changes.” The U.S. filed a second dispute. The panel ruled Canada hadn’t acted unreasonably — a devastating outcome for American dairy exporters.

Now the SCOTUS ruling removes the 25% fentanyl-based IEEPA tariff that was the biggest stick the U.S. had against Canada outside of USMCA’s own dispute mechanism. The 15% Section 122 tariff explicitly exempts USMCA-compliant goods, so it provides no additional leverage.

Sheldon’s warning lands hardest here. If countries are questioning the validity of deals signed under IEEPA pressure, Canada has even less reason to move on dairy TRQ compliance. The legal mechanism still exists — but the political leverage that made enforcement credible just evaporated.

For producers whose co-ops or processors export to Canada, this is a 365-day watch item. Canada’s dairy TRQ year runs August 1 through July 31, with allocation announcements typically published in the months prior. If fill rates stay where they are, the $200 million in theoretical access remains exactly that — theoretical.

The Refund Question: $133.5 Billion and Counting

One angle that hasn’t gotten enough attention in dairy media: the Court didn’t just stop future IEEPA tariffs. It invalidated all of them retroactively. Every importer who paid IEEPA duties is entitled to refunds plus interest.

U.S. Customs and Border Protection reported $133.5 billion in IEEPA tariff collections through December 14, 2025. The Penn Wharton Budget Model estimates the total refund liability — including collections through February 2026 and accrued interest — at up to $175 billion. That makes this potentially the largest single government refund event in U.S. history, affecting roughly 301,000 importers across 34 million import entries.

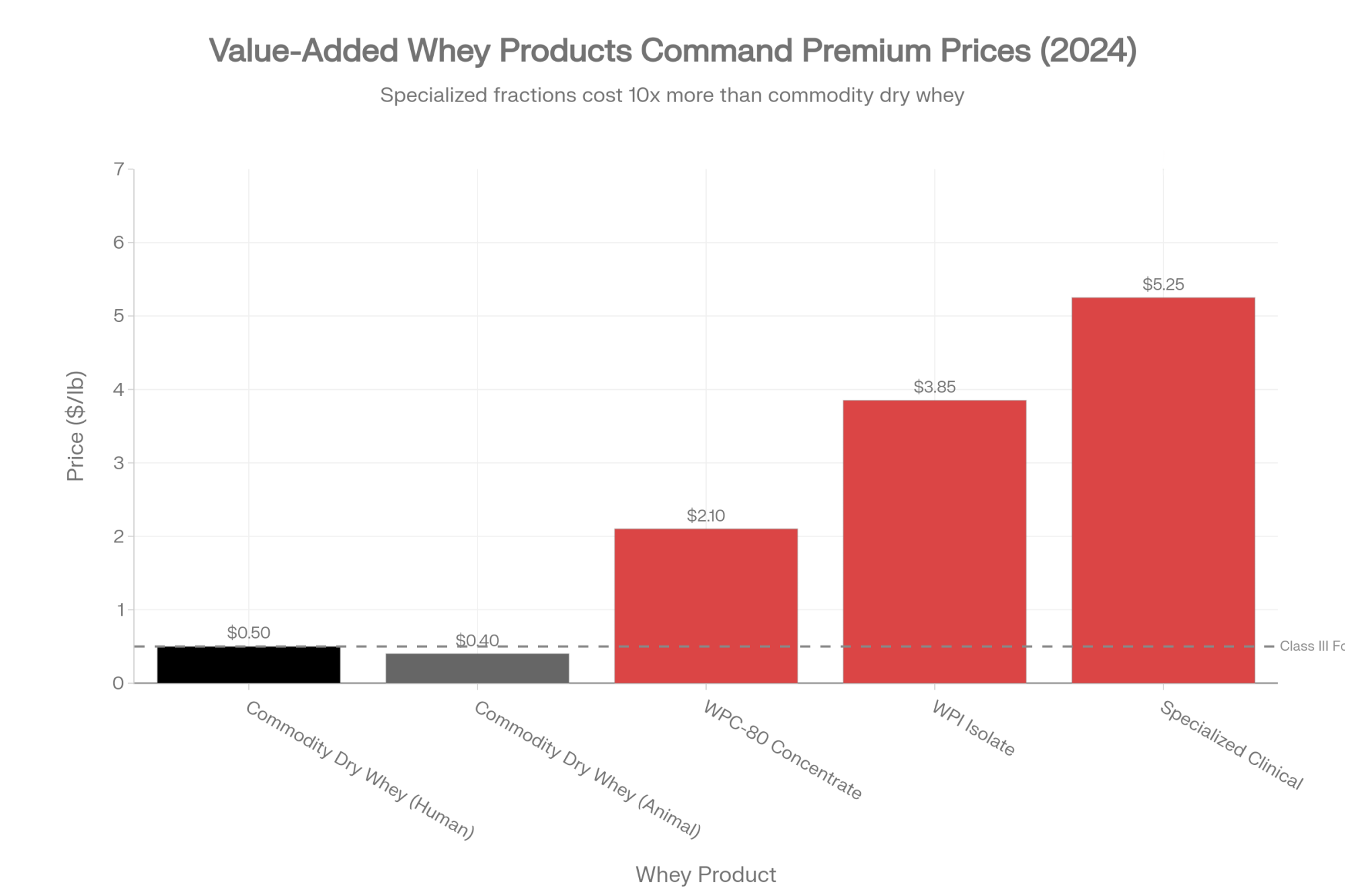

For dairy specifically, processors who imported ingredients, packaging materials, or equipment subject to IEEPA tariffs can file Post Summary Corrections on unliquidated entries or administrative protests on liquidated entries within 180 days. The legal authority for refunds is clear. The timeline for actually getting money back is not — CBP generally liquidates entries within 314 days, and the volume of claims will be enormous. Interest accrues at approximately 3–4% annually from the deposit date, but small businesses are already warning they can’t wait months for bureaucratic processing.

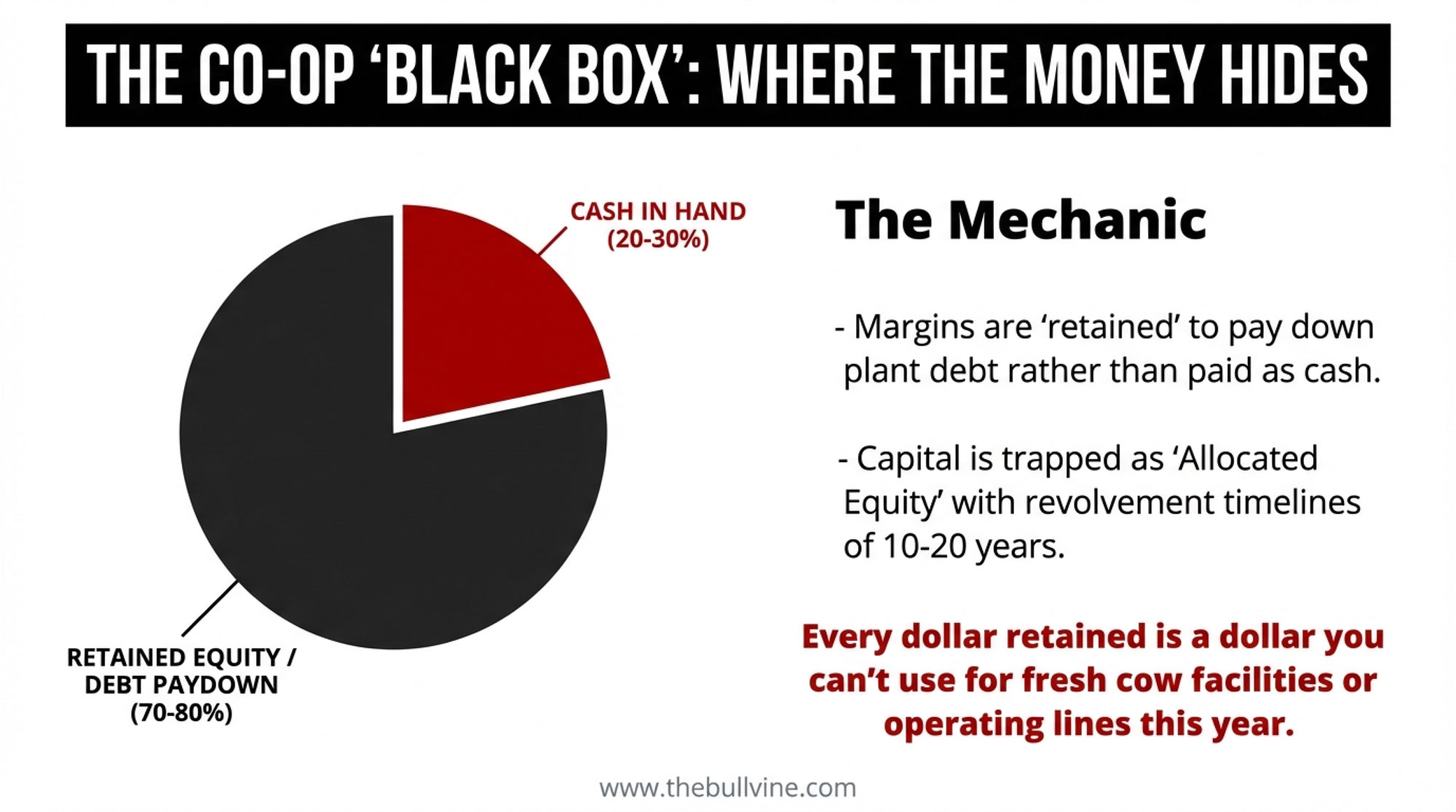

If your processor has been passing through tariff surcharges on imported inputs, ask them directly: when do those surcharges come off, and will any refund savings flow back to the farm gate? The answer will tell you a lot about where you stand in the value chain.

| Refund Category | Who’s Eligible | Estimated Exposure | Timeline to Receive | What to Ask Your Processor |

| Imported Ingredients | Processors who paid IEEPA duties on whey, lactose, specialty proteins | $8–12B (dairy-specific est.) | 180–365 days (CBP backlog) | “When do tariff surcharges come off our milk check?” |

| Packaging & Equipment | Processors, suppliers | $2–4B (across food/ag sectors) | 180–365 days | “Will refund savings flow back to farm gate pricing?” |

| Total IEEPA Refund Pool | 301,000 importers across all sectors | $175B | Unclear—largest government refund in U.S. history | “Are you sharing refunds, or keeping them above my milk check?” |

| Direct Farm Impact | Dairy producers | Zero automatic pass-through | Depends on processor transparency | Call your co-op today |

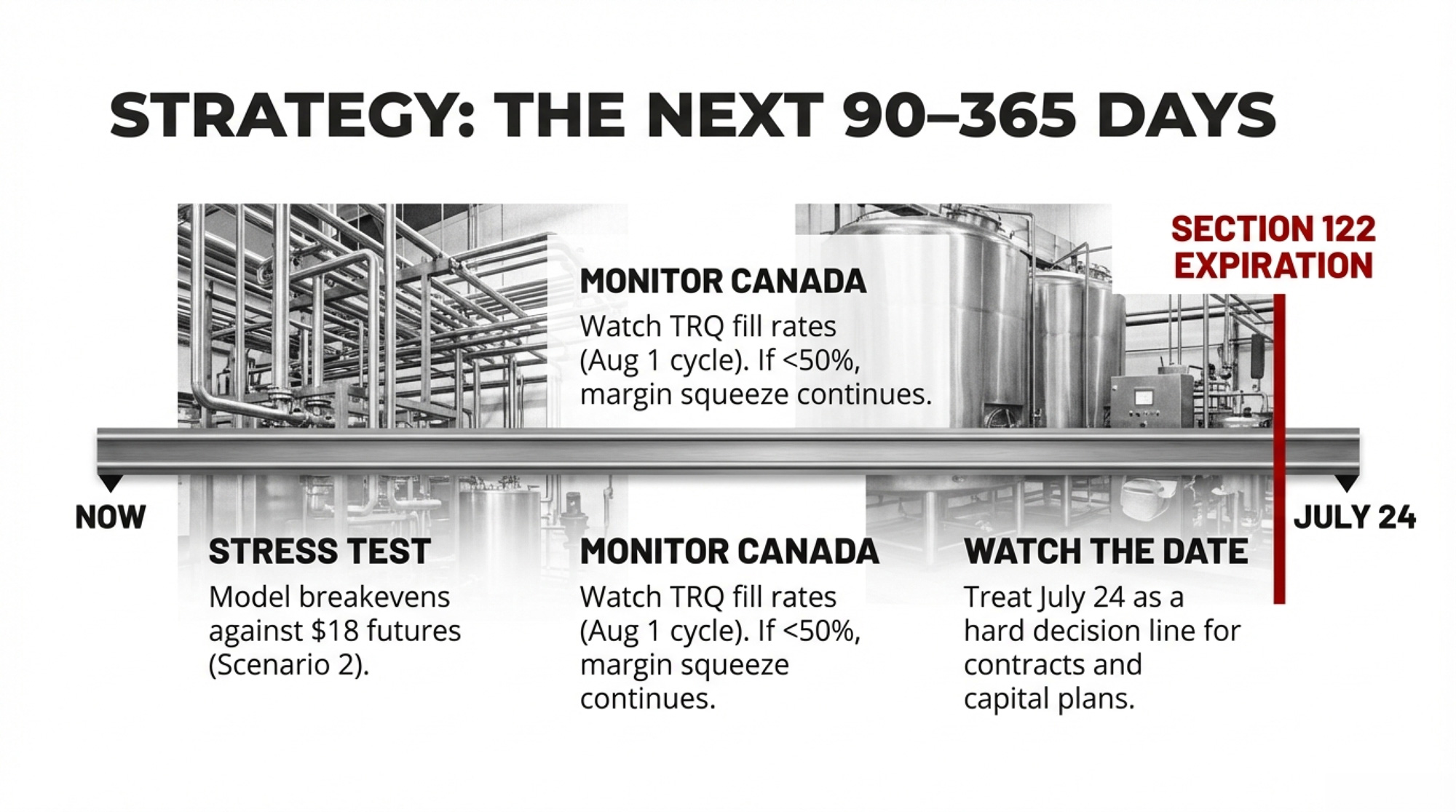

What This Means for Your Operation

| Timeline Window | Key Decision | Action Item | Risk If You Wait | Data Point to Watch |

| Next 30 Days (Now – Mar 24) | DMC 2026 enrollment | Lock in Tier 1 coverage (6M lbs) at 25% discount for 2026–2031 | Miss expanded coverage; pay higher premiums in 2027 | Class III Feb 3 low: $14.53/cwt |

| Next 90 Days (Now – May 24) | Forward contract evaluation | Model margin against Scenario 2 (15% tariff holds); consider locking Q3 production | July volatility spike when Section 122 expires—contracts tighten | CME Q3 2026 futures: $18.26–$18.35/cwt |

| 90–150 Days (May 24 – July 24) | Export contract renegotiation | Press co-op on Mexico/Canada export commitments; ask about Taiwan volume | Co-op export margin squeeze = lower premiums | Section 122 expires July 24 |

| Next 365 Days (Now – Feb 2027) | Strategic repositioning | Track Canada TRQ fill rates (Aug 1 allocation); monitor Section 301 investigations | $147K margin spread crystallizes without plan | Canada TRQ utilization: 42% (still stranded) |

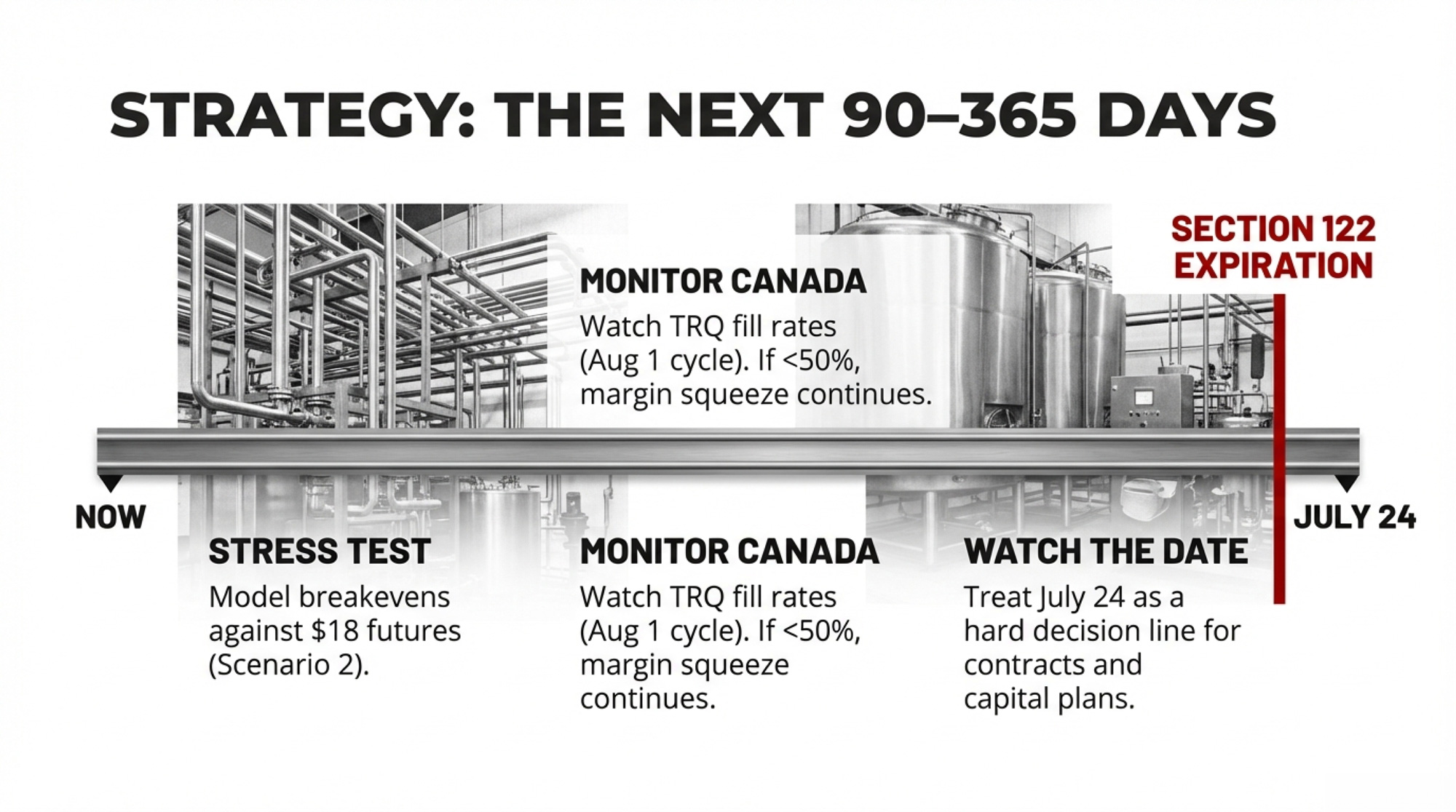

Don’t wait for clarity. The 150-day window is the decision window. Here’s what to do with it:

In the next 30 days:

- Re-run your DMC enrollment math. The 2026 signup deadline is February 26 — two days from now. This year’s enrollment includes expanded Tier 1 coverage at 6 million pounds (up from 5 million) and a new option to lock in coverage levels for 2026–2031 at a 25% premium discount. With Class III sitting at $15.07/cwt and the $14.53 low from early February still fresh, this isn’t optional. Contact your local FSA office today.

- Call your co-op or processor. Ask two questions: (1) Are they passing through any tariff-related surcharges on imported inputs, and when do those come off now that IEEPA duties are being refunded? (2) What does the 15% Section 122 tariff mean for their export commitments to Mexico or Canada?

- If you’re carrying equipment or parts debt tied to tariff-inflated prices, check whether you’re eligible for a refund. Your dealer or equipment supplier should know.

In the next 90 days:

- Model your margin against Scenario 2 (15% replacement holds). Class III Q3 2026 futures are currently trading in the $18.26–$18.35/cwt range on the CME. If those hold, consider locking in a portion of production before the Section 122 expiration creates another volatility spike around July 20. If they soften toward $17, the risk-reward on forward contracts shifts.

- Watch Section 301 investigation announcements. If the administration fast-tracks dairy-related investigations (such as China dairy ingredients), new tariffs could land before old ones fully unwind.

In the next 365 days:

- Track Canada’s next dairy TRQ allocation cycle. The TRQ year runs August 1 through July 31, with allocations announced in the months prior. If fill rates stay below 50%, your co-op’s Canadian export margin is getting squeezed, whether you see it on your milk check or not.

- Monitor whether the Taiwan bilateral actually moves dairy volume. USDEC’s initial framing was optimistic. Check against actual trade data by Q4 2026.

- If your processor ships to Mexico, ask them what happens to their purchase commitments if the Section 122 tariff goes to zero with no replacement. Mexico’s retaliatory posture could shift in either direction.

Key Takeaways

- The Supreme Court killed IEEPA tariffs and dropped dairy into a 150‑day, 15% Section 122 experiment that likely can’t stand past July 24.

- On a 500‑cow, 117,500‑cwt herd, the gap between tariffs gone, a 15% replacement, or ongoing limbo is roughly $147,000 in annual margin.

- Taiwan is now a zero‑tariff bright spot, but Canada’s USMCA TRQ games just got new cover, leaving as much as 58% of U.S. dairy access to Canada stranded on paper.

- Importers have paid $133.5 billion in IEEPA tariffs, with refund exposure up to $175 billion — if your processor doesn’t drop tariff surcharges or share savings, that’s real margin left above your milk check.

- The only safe “wait and see” is on Twitter; on the farm, the next 30–365 days are for re‑running DMC, stress‑testing breakevens against $18‑class futures, and renegotiating contracts with July 24 circled in red.

The Bottom Line

Pull your last three milk checks. Calculate your per-cwt margin at current input costs. Class III hit $14.53 on February 3 — a 52-week low. If that’s not the bottom but the new floor, what exactly are you changing before July 24?

Vander Schaaf told the Senate the leverage was slipping. The Court agreed. What you do with the 150-day window between now and July 24 is the only part of this you control.

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More

- The $15,800 DMC Wake-Up Call: Tier 1 Just Jumped to 6 Million Pounds. Don’t Sign ‘Same as Last Year.’ – Arms you with an optimized 48-hour strategy to capture the expanded 6-million-pound Tier 1 cap before the February 26 deadline. It breaks down how a single production-history reset can save a 300-cow herd $16,000 in annual premiums.

- More Milk, Fewer Farms, $250K at Risk: The 2026 Numbers Every Dairy Needs to Run – Reveals the $250,000 margin gap currently threatening 500-cow operations and delivers a survival checklist for $17-milk scenarios. It prepares your balance sheet for the 2026 “biological trap” by benchmarking full economic costs against tightening futures.

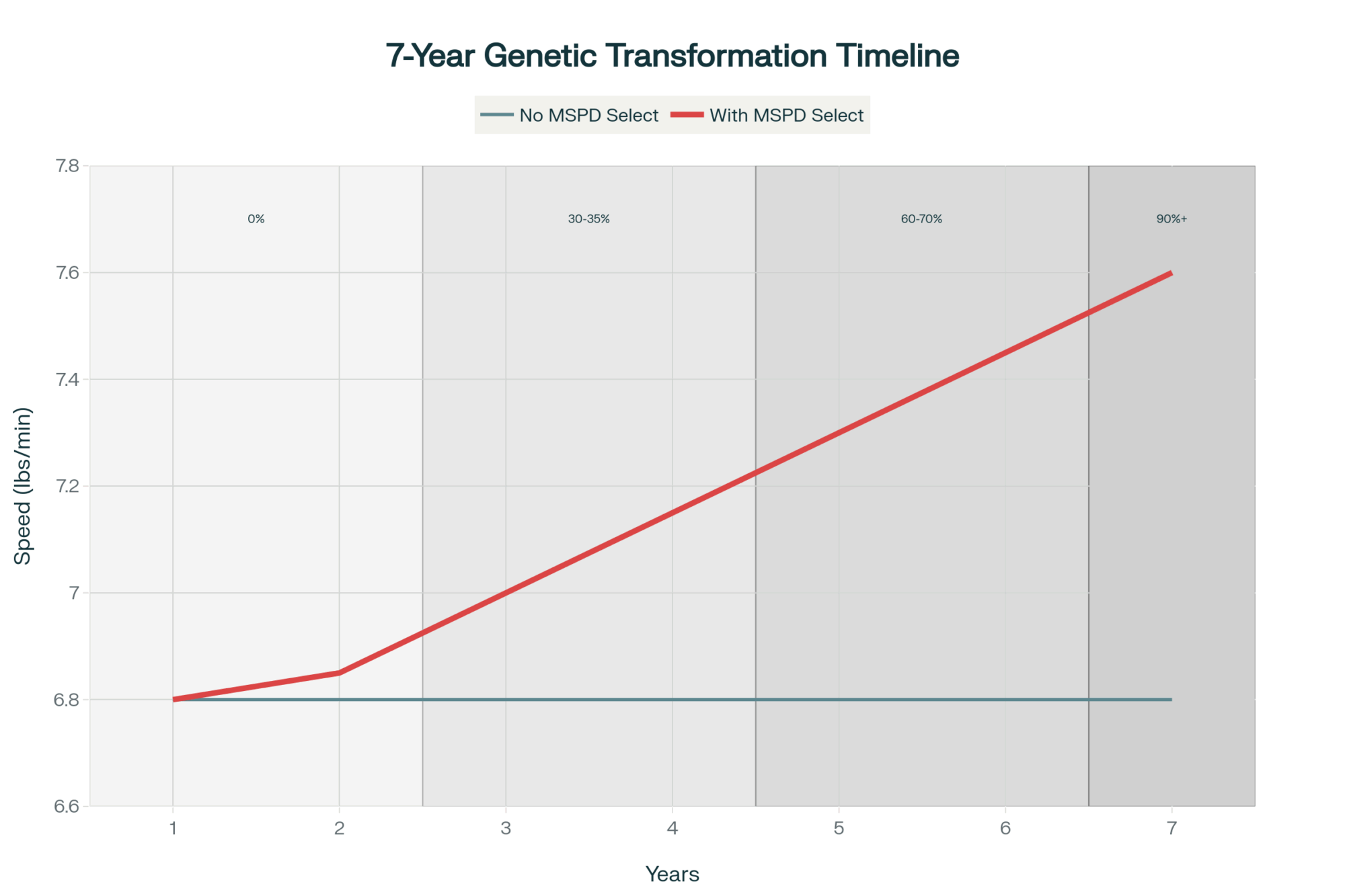

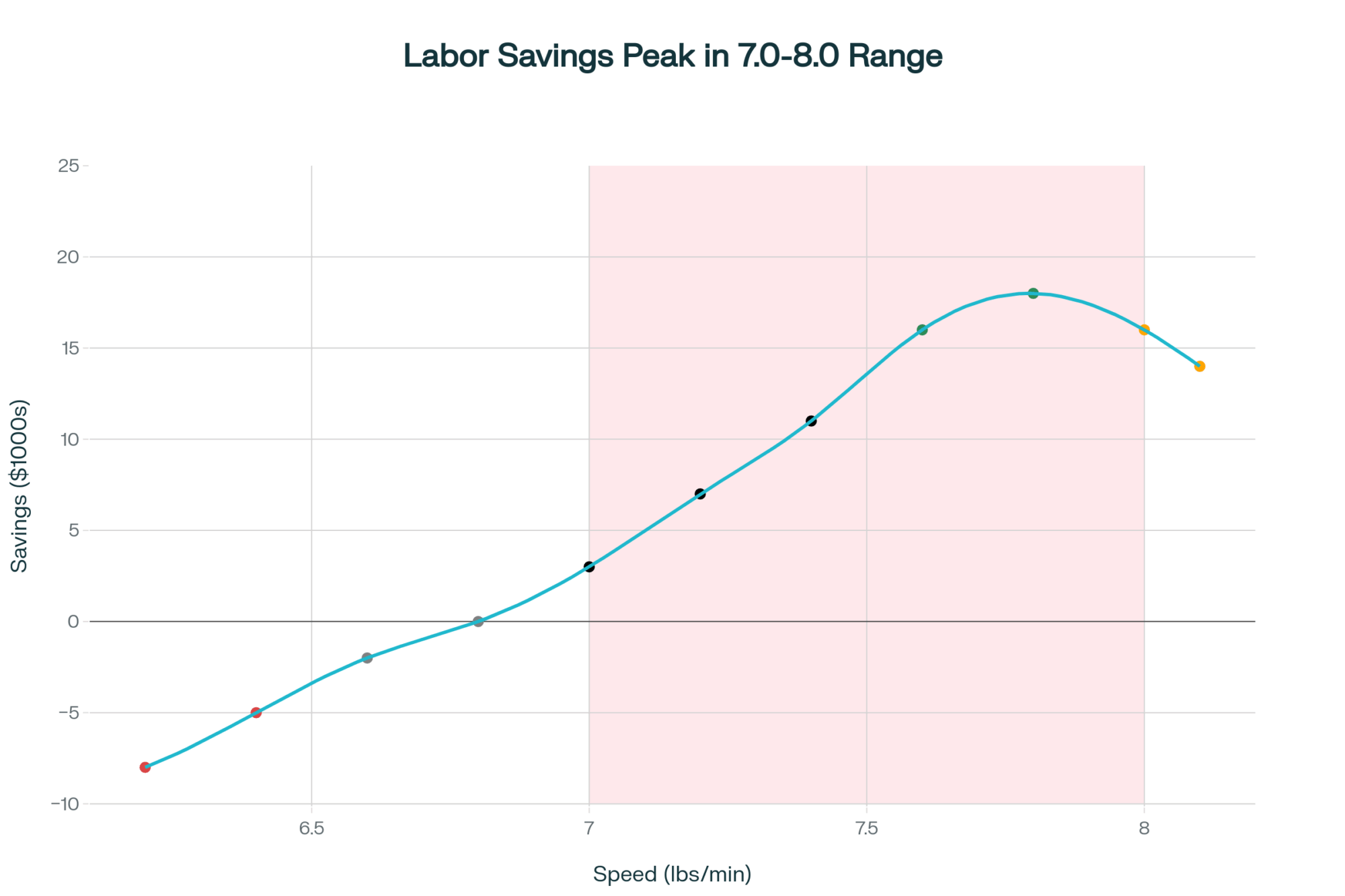

- Your Cheese Plant’s New Bacteria Can Run 56% Faster – Why This Technology Decides Which Processors (and Farms) Survive 2030 – Exposes how CRISPR-enhanced fermentation is fundamentally reshaping processor capacity and your future milk check security. This disruptive insight identifies which supply chains will thrive in an automated era, giving you a distinct competitive advantage through 2030.

The Sunday Read Dairy Professionals Don’t Skip.

The Sunday Read Dairy Professionals Don’t Skip.

Every week, thousands of producers, breeders, and industry insiders open Bullvine Weekly for genetics insights, market shifts, and profit strategies they won’t find anywhere else. One email. Five minutes. Smarter decisions all week.

The Sunday Read Dairy Professionals Don’t Skip.

The Sunday Read Dairy Professionals Don’t Skip.