Discover why milk processors make big profits while dairy farmers struggle. What factors create this gap in the dairy industry? Find out now.

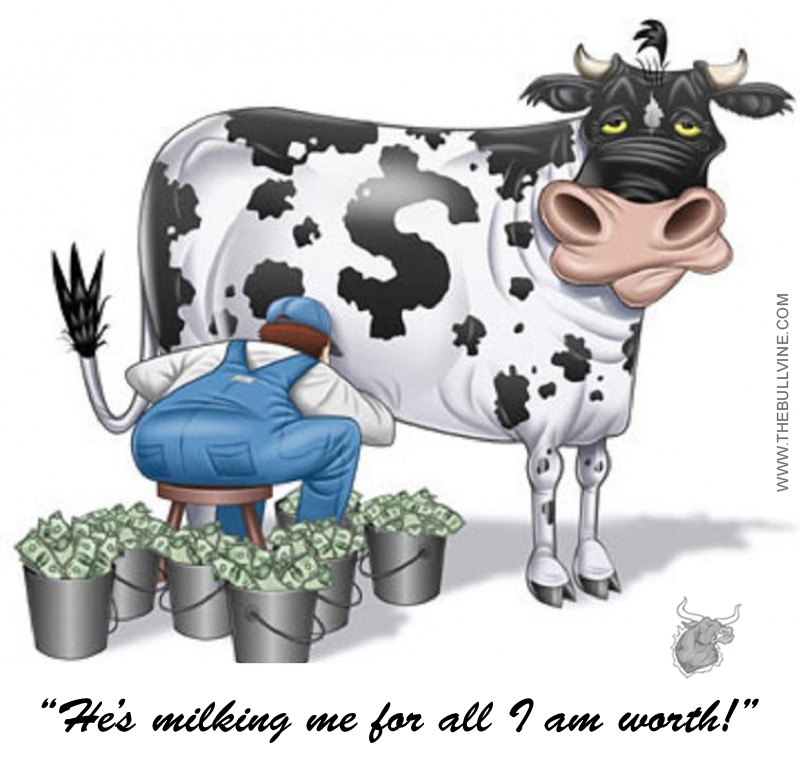

The dairy industry , a crucial link between the farm and your breakfast table, is marred by a troubling disparity. While milk processors bask in record profits, dairy farmers are left grappling with financial hardships. This stark contrast raises pressing questions about the fairness of our food system.

Milk processors benefit from large-scale operations, advanced technology, and robust market strategies. In stark contrast, dairy farmers grapple with high production costs, fluctuating milk prices, and tight profit margins. This stark reality underscores the growing economic gap and the urgent need for change.

“The reality is stark: the processors are thriving, while those who produce the milk are barely getting by.”

Why does this gap exist, and what does it mean for the future of dairy farming and consumers? This crucial issue touches on ethical, economic, and social dimensions. We’ll explore the factors behind this financial divide and discuss potential solutions.

Join us as we unpack why milk processors make record profits while dairy farmers struggle to survive.

A Century of Transformation: From Family Farms to Corporate Giants

The dairy industry has transformed drastically over the past century. Originally, dairy farming was a small-scale family affair. Farmers sold milk locally. But with industrialization and tech advances, things changed.

Pasteurization in the late 19th century was crucial. It allowed milk to last longer and be transported farther, ending the local farm-to-table model.

World War II accelerated changes. The demand for milk soared, and the government supported increased production with policies like price support. However, these policies also favored more extensive dairy operations over small farms.

Post-war advances in refrigerated transport and milk processing changed the industry. Large-scale processors took over, pushing many family farms to grow or exit the market. Policies promoting deregulation and corporate consolidation in the 1980s and 1990s intensified this trend.

The dominance of a few big processors, leveraging economies of scale and vertical integration, has significantly impacted the dairy industry. This has led to a situation where they are more profitable, while small farms are grappling with high production costs and low milk prices, threatening their very existence.

The modern dairy industry is marked by corporate concentration and challenging times for small farmers. Understanding this evolution is critical to solving the current crisis and supporting processors and farmers.

The Unseen Struggles: How Fluctuating Markets and High Costs Undermine Family Dairy Farms

The economic landscape for dairy farmers is undeniably challenging. Fluctuating milk prices significantly impact their stability. One season’s profits can quickly turn into the next season’s losses. Global trends often dictate local prices, making it hard for farmers to plan and sustain their businesses.

High production costs make things more challenging. Family farms have overwhelming feed, equipment, labor, and maintenance expenses. Small dairy farmers can only easily absorb these costs compared to large industrial farms, severely impacting their financial health.

Global trade policies, often favoring exports and corporate profits, have a detrimental effect on local dairy markets. These policies, overlooking the needs of small farms, force farmers to compete with cheaper, imported milk and dairy products. This competition significantly erodes their market share and income, exacerbating their financial struggles.

Addressing the issues in the dairy industry necessitates a comprehensive, multifaceted approach. This includes implementing fair pricing mechanisms, ensuring production costs are covered, and revisiting trade policies to support local businesses. Without these measures, small dairy farmers will continue to face mounting economic pressures, jeopardizing their livelihoods and the sustainability of rural communities.

The Power Imbalance: Corporate Consolidation and Its Impact on Dairy Farmers

At the core of the issue is market power and consolidation. Major milk processors and retailers have taken over the dairy market in recent decades. This allows a few big corporations to control terms, often leaving smaller dairy farmers with little bargaining power and dwindling profits.

These large processors and retailers use their size to negotiate lower prices for raw milk. While this can mean cheaper prices for consumers, farmers often get paid less than the cost of production. This can push small farms to the edge of financial collapse.

With fewer large players in the market, competition decreases. A few corporations set prices and policies prioritizing their profits, not the farms. Corporate consolidation is a significant factor in the dairy sector’s crisis. Small family farms are finding it hard to survive.

Big processing and retail companies can absorb short-term losses, something smaller farms can’t do. They can wait out market fluctuations, tightening their grip on the market and pushing out smaller competitors.

So, while the milk you buy might come from a local farm, a few large milk processors control the market. This consolidation undermines small dairy farms and threatens the diversity and sustainability of rural communities.

Decoding the Financial Struggle: Supply Chain Dynamics Between Dairy Farmers and Milk Processors

| Year | Average Dairy Farmer Profit Margin | Average Milk Processor Profit Margin | Milk Wholesale Price (per gallon) | Retail Milk Price (per gallon) |

|---|---|---|---|---|

| 2018 | 3.5% | 15% | $1.45 | $3.20 |

| 2019 | 2.8% | 16% | $1.30 | $3.15 |

| 2020 | 2.0% | 18% | $1.25 | $3.10 |

| 2021 | 1.7% | 20% | $1.20 | $3.05 |

| 2022 | 1.5% | 22% | $1.15 | $2.95 |

Understanding the supply chain dynamics between dairy farmers and milk processors sheds light on why farmers struggle while processors profit. Key factors include pricing, contracts, and bargaining power.

Pricing is vital. Farmers sell milk at prices dictated by national or regional milk marketing orders, leading to fluctuations that make financial stability challenging. Meanwhile, processors enjoy stable prices through long-term contracts and hedging.

Contracts can either help or hurt farmers. They outline milk delivery amounts and prices but often favor processors. These contracts can include strict quality standards and penalties that tighten farmers’ profits.

Bargaining power significantly impacts financial outcomes. Large processors leverage market dominance to set terms, leaving farmers little negotiation power. Farmers may have to accept poor terms or risk their livelihoods.

In summary, while processors secure substantial profits, farmers struggle due to the imbalance in bargaining power, volatile pricing, and strict contracts. This creates financial instability for farmers while processors continue to thrive.

Policy Pitfalls: How Government Subsidies Favor Big Processors Over Family Farms

Government policies and subsidies in the dairy industry often favor large milk processors. These policies, aimed at market stability and food security, have unintentionally created an uneven playing field.

History of Favoritism: Programs like the Dairy Margin Coverage (DMC) were meant to support farmers during tough times. However, these aids are usually based on production volume. Large processors, benefiting from scale, receive more subsidies. This leaves smaller and medium-sized farms, vital to rural America, struggling to cover operational costs.

The Price Issue: The Federal Milk Marketing Orders (FMMO) set minimum milk prices. While this aims for fairness, larger processors, unlike smaller farms, can better handle price fluctuations. This forces smaller farms to sell their milk cheaper to survive.

Impact on Small and Medium-Sized Farms: These policies heavily impact smaller farms. More enormous subsidies mean reduced income for family farms. Struggle to maintain them and invest in sustainability without enough revenue. Many small and medium-sized dairy farms are closing. This trend, worsened by corporate consolidation, deepens the financial issues for these farms.

Recognizing this imbalance is crucial. Without policy adjustments, rural America’s cultural and economic landscape will shift toward large, corporate-dominated production. Reevaluating and reshaping these policies is essential to supporting diverse and resilient agricultural communities.

Technological Innovations: Bridging a Digital Divide in the Dairy Industry

Technological advancements are transforming the milk processing industry, smoothing operations, reducing costs, and improving product quality. Modern machinery and automation handle large volumes efficiently, minimizing waste and enhancing consistency. Innovations like ultra-high-temperature (UHT) processing and new packaging technologies extend milk’s shelf life, opening broader markets and increasing profitability.

However, these advancements come at a high cost for dairy farmers. Many small farms operate on tight margins and can need help to afford the latest equipment. Additionally, farmers often need more technical support and training to use advanced technology effectively. This creates a significant divide in the dairy industry. While processors benefit from tech progress, farmers need help to keep up, leading to financial hardships and inefficiencies. The economic burden of modernization, fluctuating market prices, and high production costs challenge family farms’ survival.

To bridge this gap, we need targeted policies and support to help farmers access and use technology. Such measures are necessary for the technological divide to grow, threatening the future of small dairy farms.

Consumer-Driven Evolution: How Shifts in Dairy Preferences Leave Family Farms Behind

| Year | Conventional Milk | Organic Milk | Plant-Based Milk |

|---|---|---|---|

| 2010 | 92% | 4% | 4% |

| 2015 | 88% | 7% | 5% |

| 2020 | 82% | 10% | 8% |

| 2022 | 74% | 12% | 14% |

Source: U.S. Department of Agriculture, Dairy Industry Reports

Over the last decade, consumer preferences in the dairy market have changed dramatically. People are increasingly choosing organic, grass-fed, and non-dairy alternatives like almond, soy, and oat milk. Health and environmental concerns are driving these choices.

Milk processors have adapted quickly. They’ve added these alternatives to their product lines and invested in new lactose-free and fortified milk technologies. This allows them to charge higher prices and capture more market share.

Family dairy farms, however, often struggle to keep up. Switching to organic or grass-fed milk requires significant changes and investment. Certification processes are strict and time-consuming.

The rise of non-dairy alternatives adds further pressure. Most small-scale farms can’t profitably switch to growing crops like almonds or oats. As a result, farmers are often left struggling, while milk processors benefit from meeting new consumer demands.

Success Stories in Sustainability: How Small Dairy Farms Are Adapting and Thriving

Consider Schultz Family Farms in Wisconsin. Five years ago, they switched to organic milk production, investing in organic feed and pasture management. Despite the costs, they met the demand for organic products and secured a premium price. Raising grass-fed milk brought even higher returns, albeit with greater sustainability commitments. It was tough, but the higher returns and consumer appreciation kept them going.

Similarly, Clover Hill Dairy in upstate New York faced low prices and switched to grass-fed milk. This required rotational grazing and cutting out grain, supported by grants and loans. They found financial stability and expanded by attracting loyal customers willing to pay a premium. However, they still struggle with higher labor costs and the need to educate consumers about the benefits of grass-fed milk.

These stories highlight family farms’ challenges and resilience when switching to organic or grass-fed milk. While there’s a premium market, the transition is challenging, yet it offers a possible path forward for conventional dairy farmers.

Innovative Policy Reforms: Charting a Path to Sustainability and Fair Competition

One promising solution is creating policies for fair pricing. Instead of focusing on export markets, these policies could set price floors to cover farmers’ production costs. Wisconsin dairy farmer Sarah Lloyd emphasizes fair prices to sustain businesses and rural communities.

Addressing corporate consolidation in the food industry is crucial. Stricter antitrust regulations could break up monopolies and foster a competitive market. Rebecca Wolf from Food & Water Watch notes that corporate consolidation drives the dairy crisis and harms family farms.

Government subsidies need to be rethought. Instead of benefiting large processors, subsidies should directly support small and mid-sized farms. Revising current agricultural policies could prioritize sustainability and local economic health over export capabilities.

Another avenue is encouraging cooperative models through legislative support. Small farmers can pool resources, gain better market access, and achieve economies of scale by promoting and funding cooperatives. This levels the playing field, giving small farms more bargaining power.

Investing in technology tailored for small farms is critical. Government grants and subsidies could help provide affordable tech that improves efficiency and cuts costs. Small dairy farmers can stay competitive in a rapidly changing market by bridging the digital divide.

Exploring Solutions: Cooperative Models, CSA Programs, and Digital Marketing

There’s hope for bridging the economic gap between milk processors and dairy farmers. One way is through cooperative models. Farmers can pool resources, share risks, and gain negotiating power by joining forces. This can lead to better milk prices and reduced operational costs.

Another effective solution is Community-Supported Agriculture (CSA) programs. In CSA, consumers buy shares of a farm’s output in advance, giving farmers upfront capital. This direct connection ensures a market for their produce and creates loyalty among consumers who value local agriculture. Cutting out middlemen helps establish fairer prices for everyone.

Investing in direct-to-consumer sales channels and digital marketing platforms can also help. E-commerce platforms, social media, and online marketplaces can expand reach and increase profitability without traditional intermediaries.

Embracing these solutions can help family farms survive and thrive in a challenging marketplace.

The Bottom Line

As we’ve explored, while milk processors continue to make record profits, dairy farmers struggle against fluctuating markets, high operational costs, and a power imbalance that favors corporate consolidation. This economic disparity is driven partly by supply chain dynamics and policies prioritizing large processors over family farms. Additionally, shifts in consumer dairy preferences further challenge small farms attempting to stay afloat.

Addressing these economic disparities is crucial to preserving a diverse and sustainable dairy industry. Solutions include ensuring fair prices that cover production costs. Implementing tax breaks for small farms can provide them with the financial flexibility needed for investment and expansion. Lastly, fostering an environment that supports small to midsize dairy operations is vital. These measures can help create a more equitable system where dairy farmers and large milk processors can thrive together.

Key Takeaways:

- Large milk processors are experiencing record profits, while small family dairy farms are battling high production costs and inconsistent milk prices.

- The dairy industry has seen significant transformation over the past century, with a shift from small family-run farms to large corporate entities.

- Market fluctuations and increasing operational costs are primary factors undermining the sustainability of small dairy farms.

- Corporate consolidation has led to a power imbalance, allowing big processors to dominate the market and influence prices, often at the expense of farmers.

- Government policies and subsidies tend to favor large-scale processors over independent family farms, exacerbating the financial disparities.

- Technological advancements in the dairy industry are costly, creating a digital divide that small farms struggle to bridge.

- Consumer preferences toward certain dairy products are shifting, leaving some family farms behind and unable to compete.

- Some small dairy farms are adapting through sustainable practices and innovative marketing strategies but still face substantial challenges.

- Policy reforms and cooperative models are being explored to address these issues and create a fairer, more sustainable marketplace for all stakeholders.