Michigan State researchers found treatment costs varying threefold across similar operations. The difference wasn’t the antibiotics. It was the decisions.

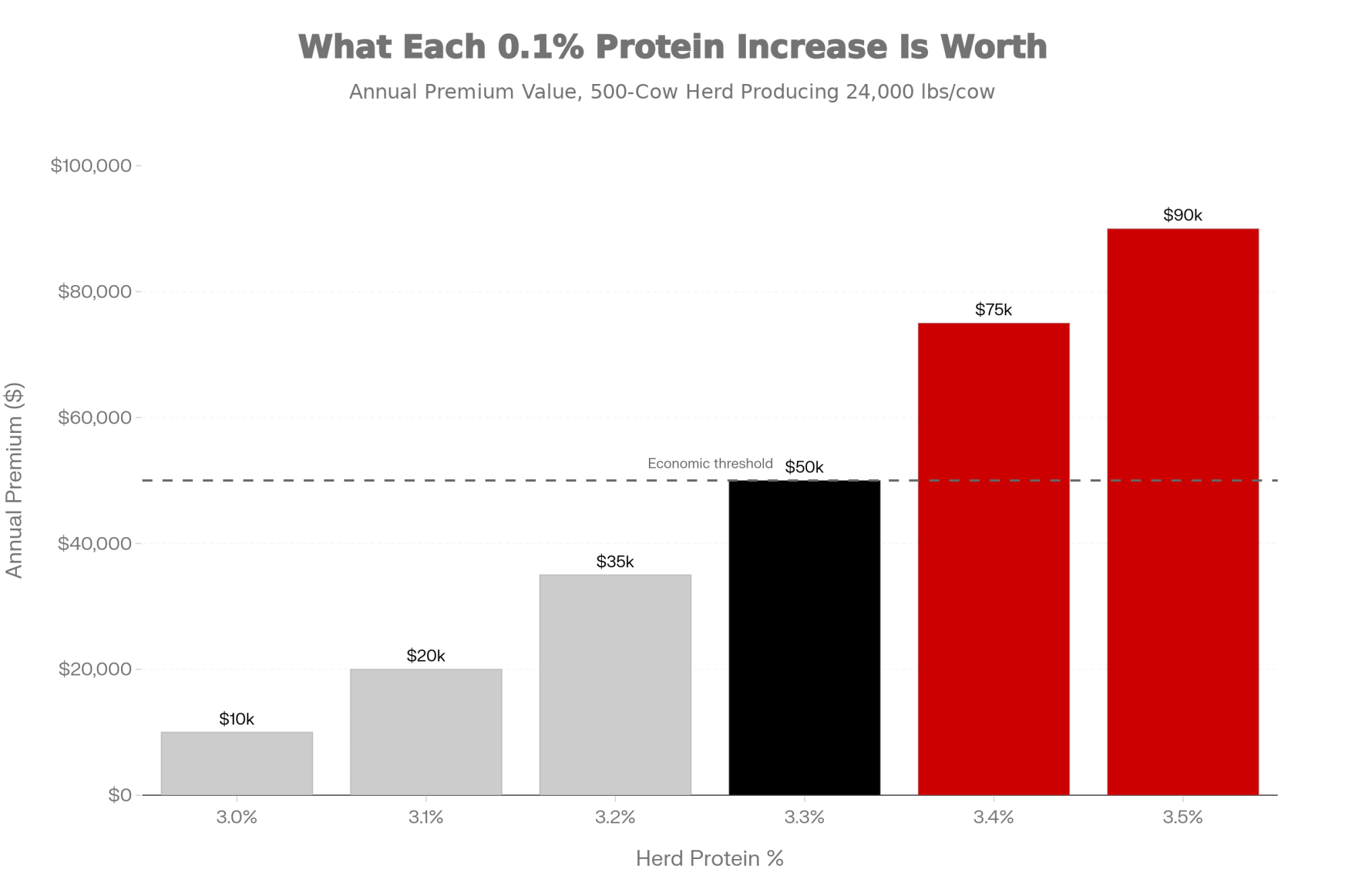

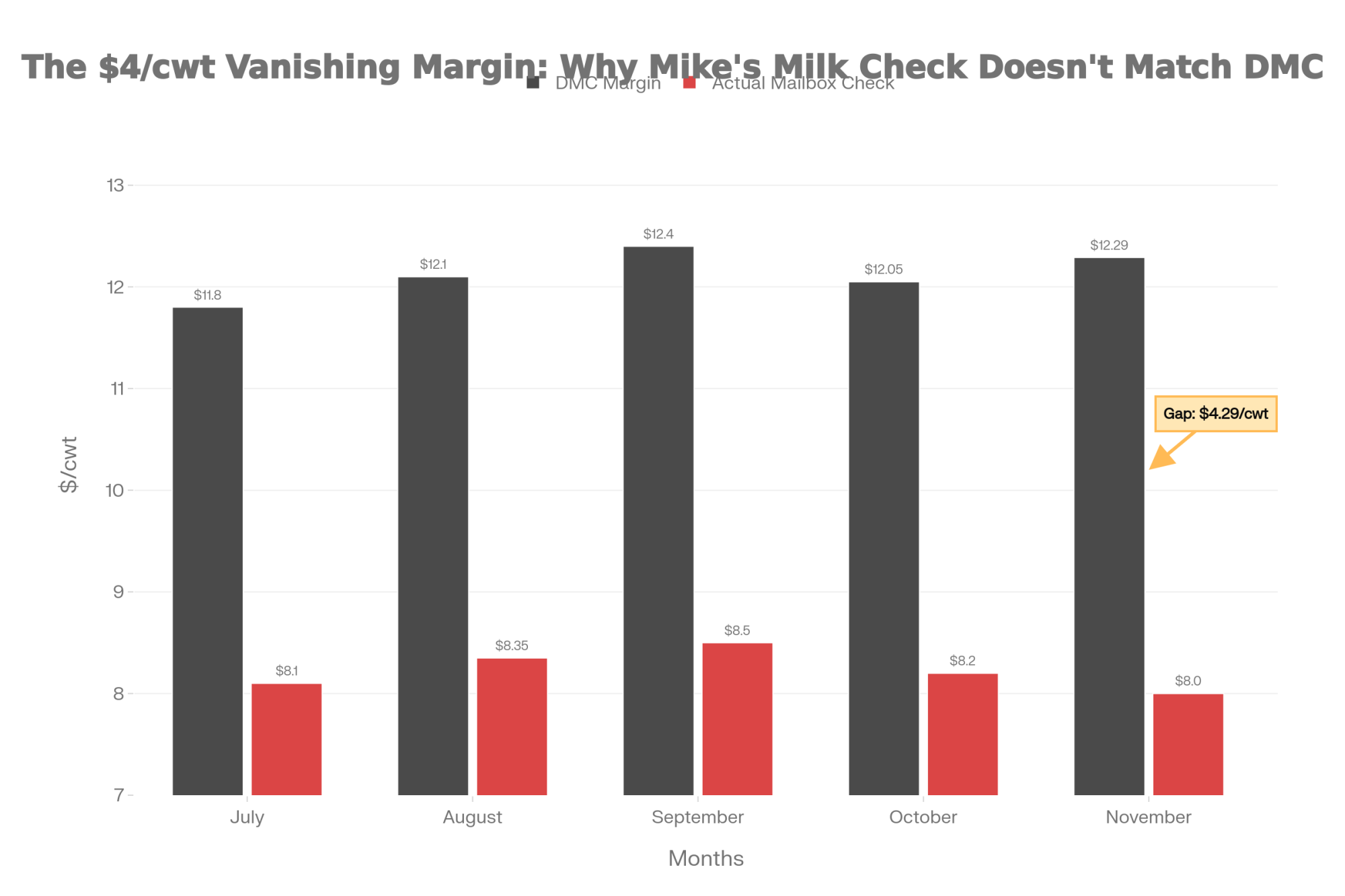

EXECUTIVE SUMMARY: With Class III averaging $17-18 and margins under pressure, there’s $30,000-50,000 per year hiding in your mastitis protocols—and Michigan State research shows exactly where to find it. Dr. Pamela Ruegg’s team tracked 37 commercial dairies and found treatment costs varying threefold ($120 to $330 per case) for identical infections, with the gap driven entirely by decisions, not antibiotics. The core issue: 83% of producers treat longer than label minimum, adding $65/day in unnecessary milk discard because we treat until milk looks normal—even though bacterial cure precedes visual cure by 24-48 hours. On-farm culture cuts antibiotic use in half while maintaining outcomes, with typical payback under 90 days. The hardest part isn’t the protocol change; it’s trusting the science when you’re staring at off-looking milk on day three. But the economics don’t lie—and in today’s market, leaving $30K on the table isn’t something most operations can afford.

You know, when Dr. Pamela Ruegg’s team at Michigan State University started digging into mastitis economics across 37 commercial dairies—operations averaging around 1,300 cows each—they found something that really made me sit up and take notice. Out-of-pocket treatment costs for cases that were essentially identical ranged from $120 to $330 per farm. Same antibiotics. Same case severity. Nearly three times the cost difference.

That finding deserves some thought because it points to something a lot of us have probably sensed over the years but rarely put numbers to. We’ve accepted for a long time that mastitis runs about $250 per case and somewhere around $2 billion annually across U.S. operations—figures the National Mastitis Council has been citing for years now. Those numbers get repeated so often they’ve almost become white noise at conferences and in the trade publications. But here’s what the Michigan State work actually shows: those averages hide enormous variation in real-world outcomes. Some operations are spending well under $250 per case while getting solid results. Others are spending considerably more and still can’t seem to get ahead of their udder health challenges.

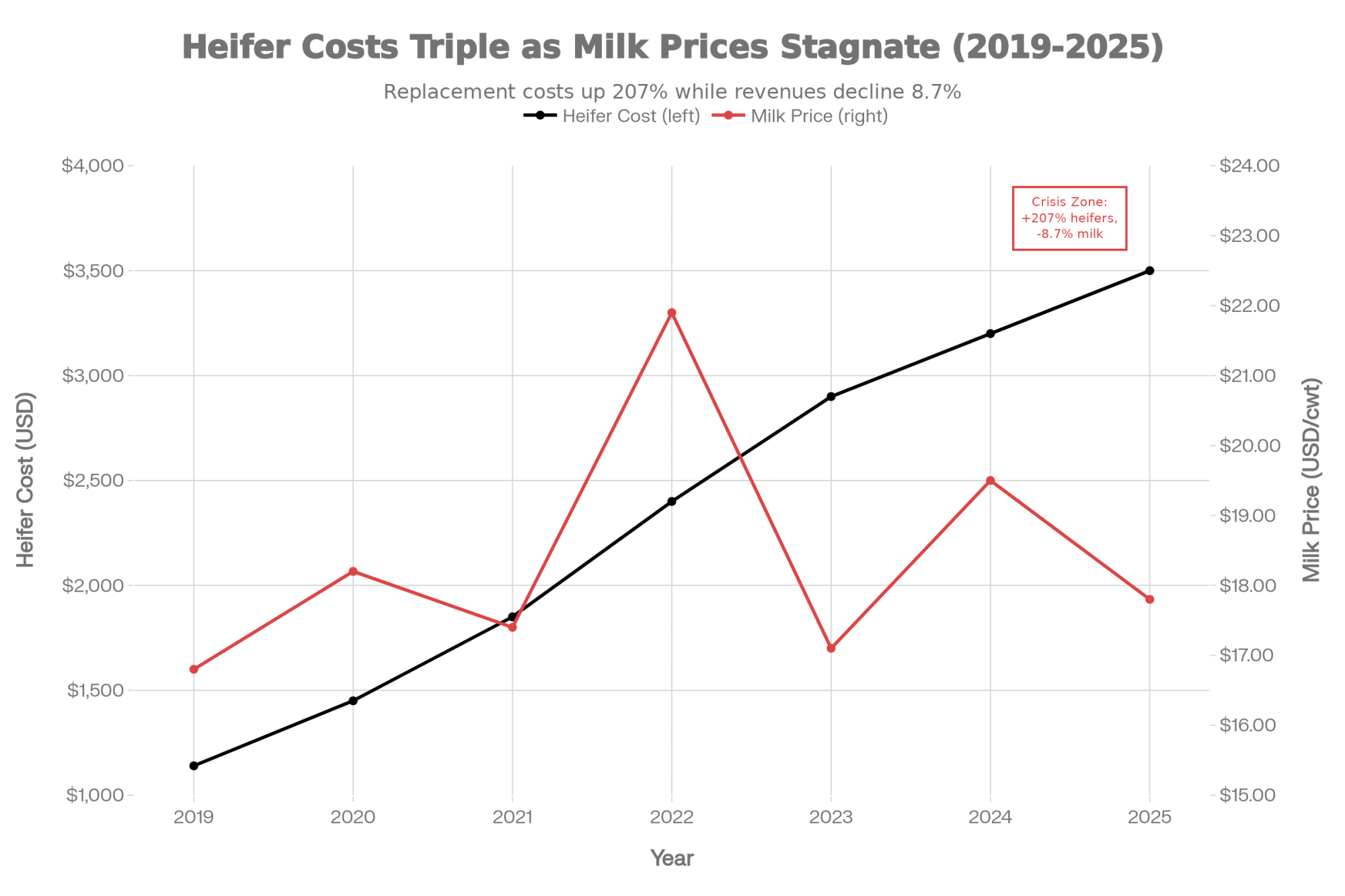

The difference, as Dr. Ruegg’s research suggests, comes down to decisions we can control: treatment duration, pathogen identification, prevention investment, and culling calculations. None of this requires fancy new technology or major capital investment. It does require taking a fresh look at some practices we might not have questioned in a while. And with 2024-25 margins under pressure—Class III averaging in the $17-18 range, feed costs still elevated—the buffer that used to absorb inefficiency just isn’t there anymore.

The Math Most of Us Have Been Using—And What the Research Actually Shows

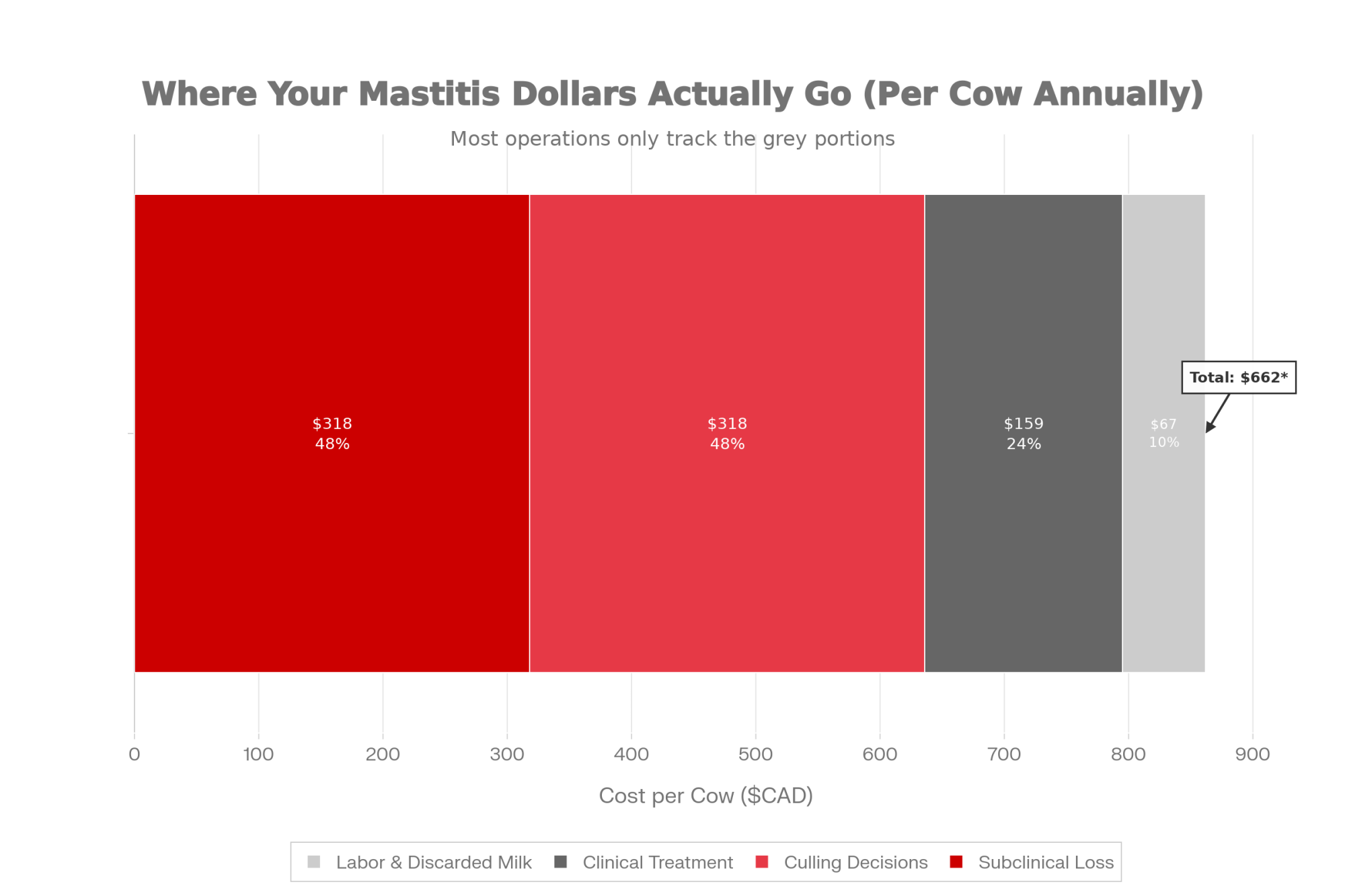

Here’s where things get interesting. The way most of us have been calculating mastitis costs doesn’t capture what’s actually happening economically. Take a look at how traditional thinking stacks up against what the research reveals:

| Factor | Traditional Math | The Real Math | Annual Impact (500-cow herd) |

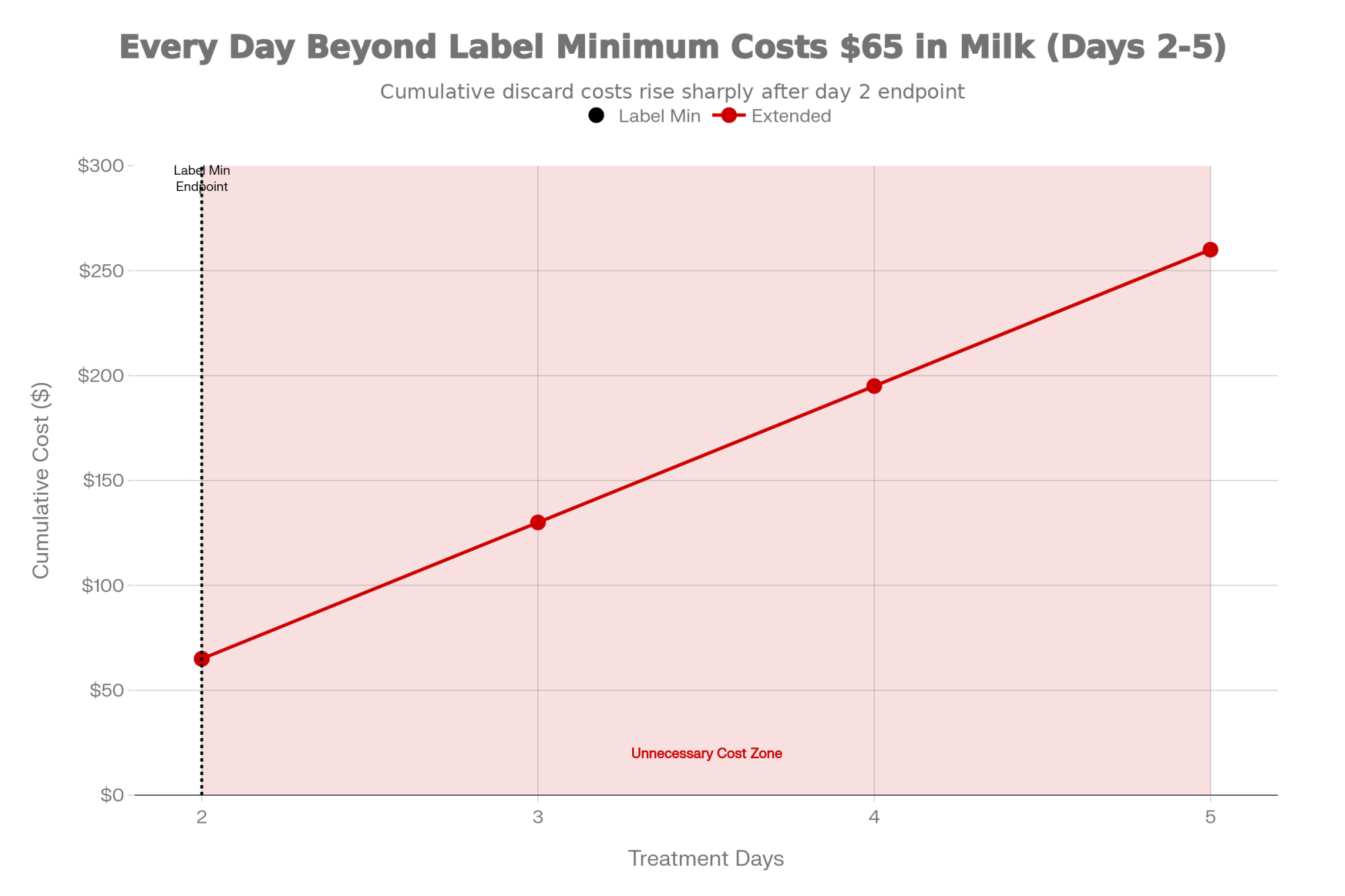

| Treatment Duration | Treat until milk looks normal (5+ days) | Label minimum often sufficient (2-3 days) | $6,500+ in unnecessary discard |

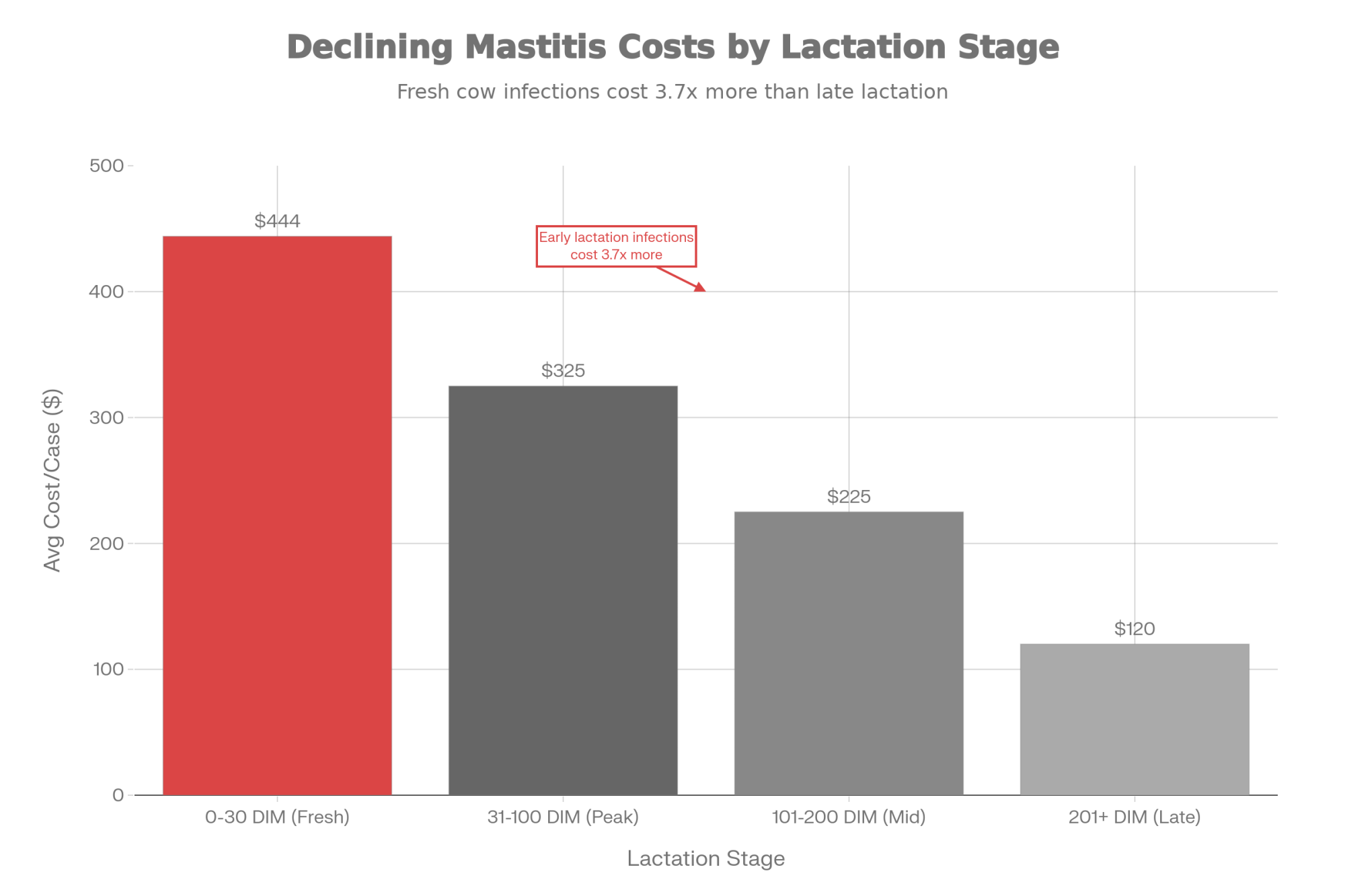

| Days in Milk Impact | All cases cost ~$250 | Early lactation: $444; Late lactation: ~$120 | Varies 3-4x based on timing |

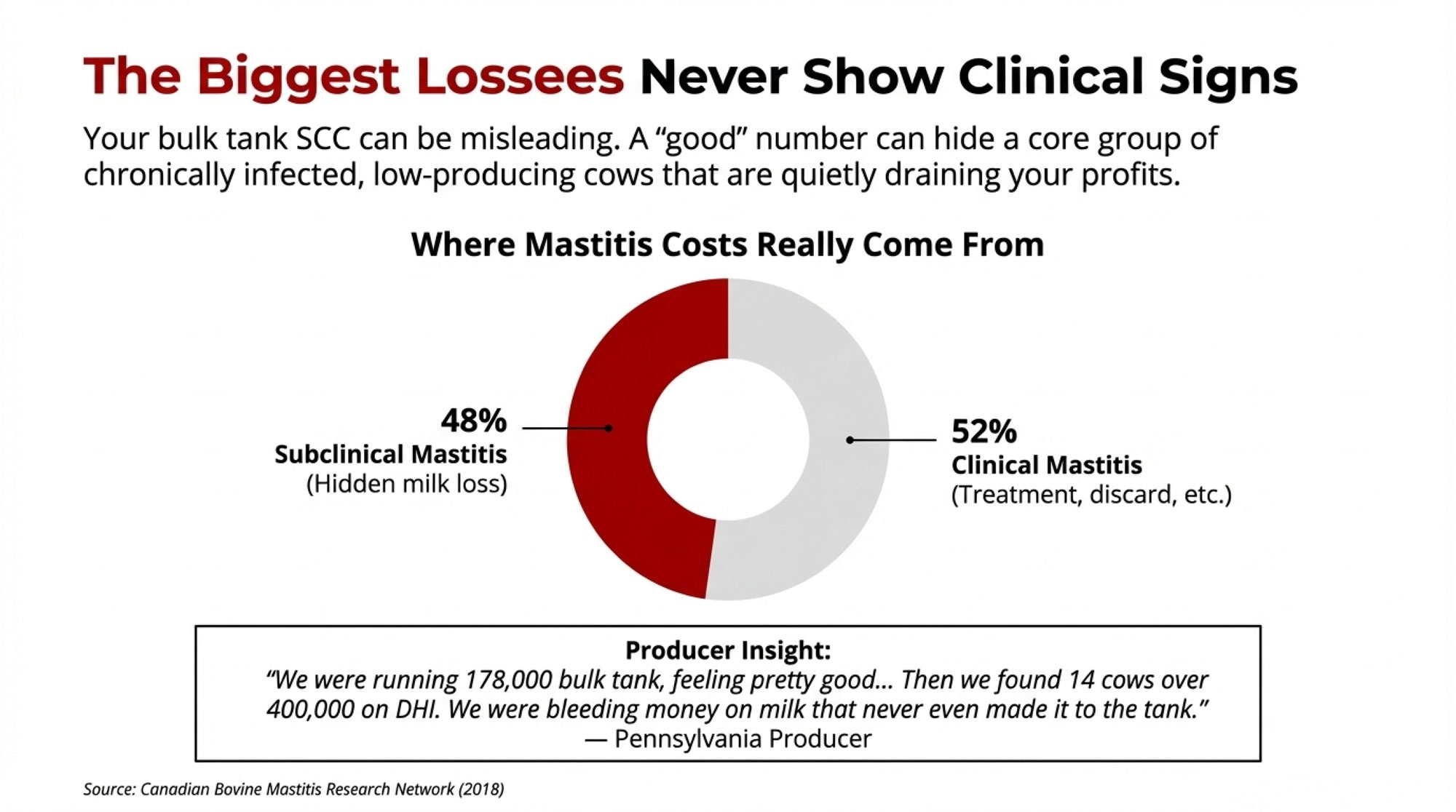

| Subclinical Loss | “Not a problem if the bulk tank is fine.” | Accounts for 48% of total mastitis costs | $33,000+ in hidden losses |

| Culling Decisions | Heifer cost minus cull value | Future profit potential over the planning horizon | Culling = 48% of clinical mastitis costs |

Sources: Michigan State University (Ruegg, 2021); Canadian Bovine Mastitis Research Network (Aghamohammadi et al., 2018)

Understanding Where Cost Variability Comes From

Dr. Ruegg’s work at Michigan State, published in the Journal of Dairy Science back in 2021, breaks down exactly where this variation originates—and honestly, the findings offer some pretty clear direction for anyone willing to act on them.

Timing matters more than most of us probably realize. A case hitting a cow in her first 30 days fresh averages around $444 in total impact because that production hit follows her through the entire lactation. That same infection at 200 days in milk? You’re looking at something closer to $120, simply because there’s less lactation left to affect. Makes sense when you think about it, but how often do we actually factor timing into our treatment intensity decisions? In my experience, not often enough.

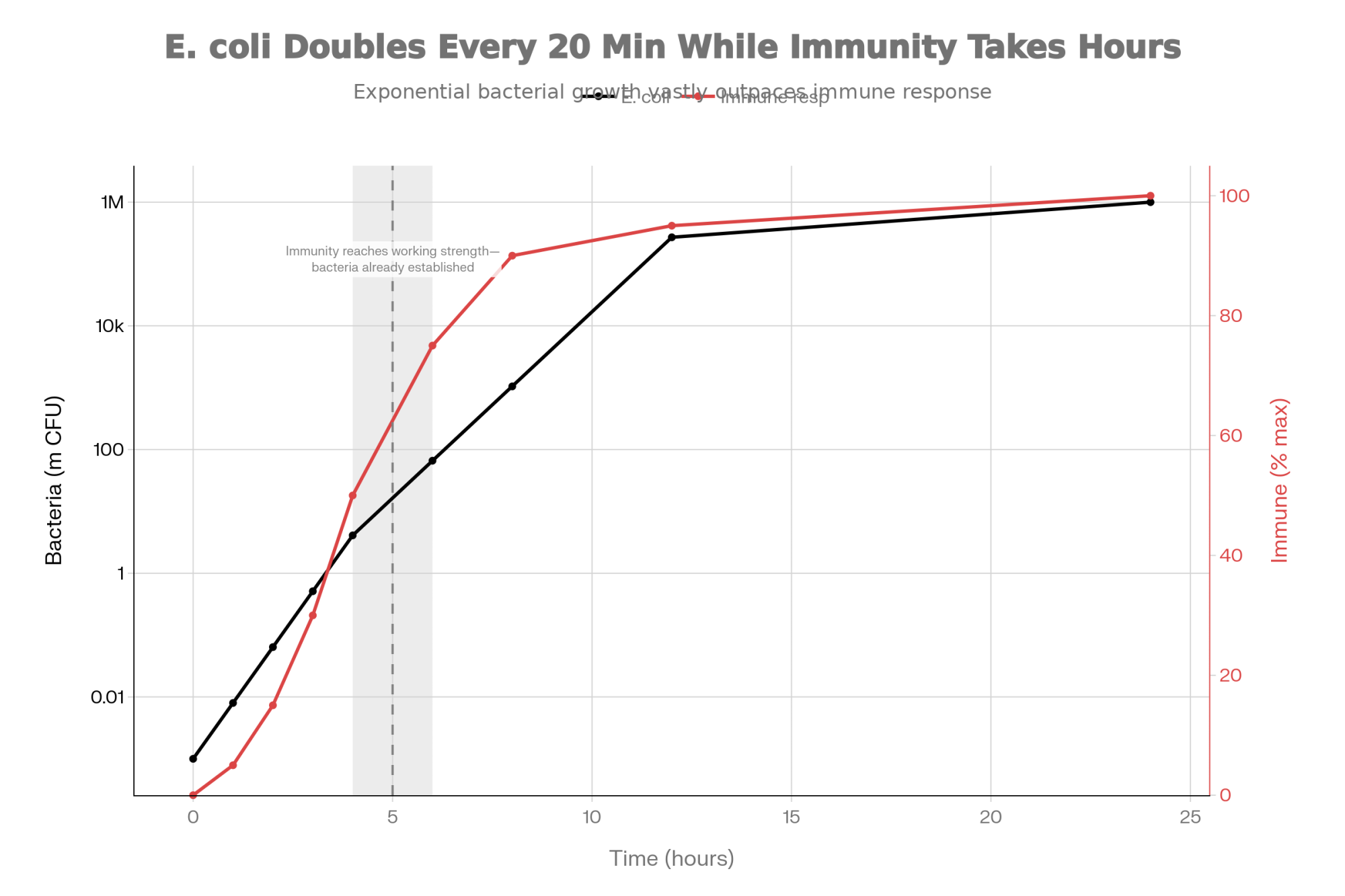

What’s causing the infection matters quite a bit, too. Your gram-negative cases—E. coli, Klebsiella—tend toward more dramatic presentation but often resolve without intervention. Meanwhile, gram-positive infections generally respond well to appropriate treatment but won’t clear up on their own. The research consistently shows that gram-negative infections incur higher total costs due to their severity, even though many will self-cure if given time.

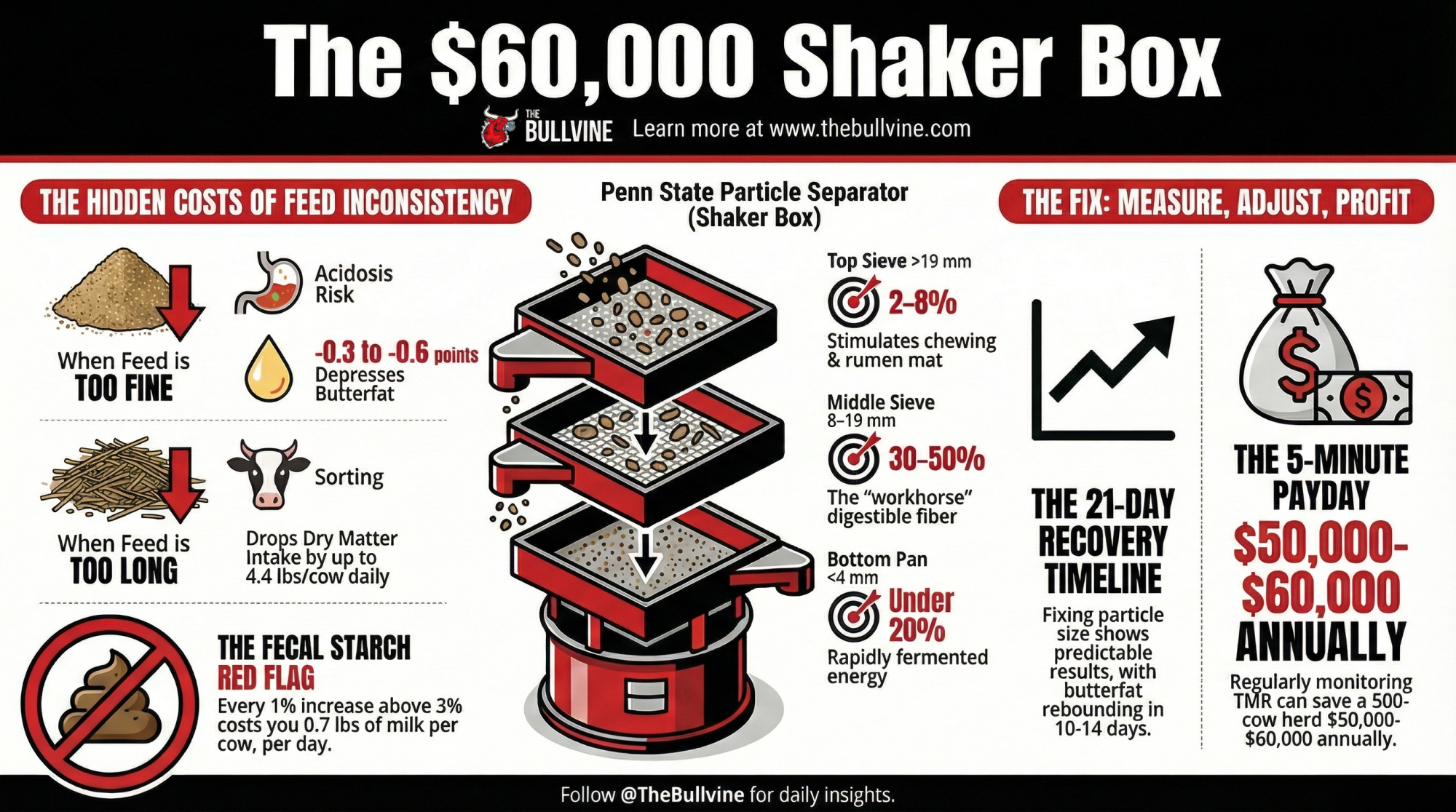

And then there’s treatment duration. This is where the Michigan State findings become immediately useful. Their data showed that each additional treatment day beyond label minimum costs approximately $65 in discarded milk and extended withdrawal. Think about what that actually means on your operation: an 80-pound cow at $18 per hundredweight generates $14.40 in daily milk value. Extend treatment for three days beyond what’s actually necessary? That’s $43 in direct milk loss right there, plus your antibiotic costs, plus labor time. It adds up faster than most of us realize.

The Hidden Economics Most of Us Miss

What I’ve come to appreciate over years of following this research—and talking with producers who’ve really dug into their numbers—is that our standard accounting does a surprisingly poor job capturing actual mastitis costs. We track what shows up on invoices. We miss what accumulates quietly in the background.

A study published in Frontiers in Veterinary Science back in 2018 really quantified this gap in a way that hit home for a lot of folks I’ve discussed it with. Researchers from the University of Montreal and the Canadian Bovine Mastitis Research Network tracked 145 commercial operations and calculated total mastitis costs at CAD $662 per cow annually across the herd. Now, that’s not per case—that’s per cow in the milking string, whether she had clinical mastitis or not. And here’s the kicker: subclinical mastitis accounted for nearly half of those costs, with milk yield reduction being the biggest hidden driver.

Think about what typically shows up on your books: antibiotic purchases, discarded milk during withdrawal, vet visits for the severe cases, and labor during treatment. Now think about what usually doesn’t show up anywhere: the production drop that persists after an early-lactation infection clears, the extra days open that subclinically infected cows tend to accumulate, the culling decisions made without complete economic analysis, the bulk tank SCC that hovers just under penalty thresholds but quietly costs you quality premiums month after month.

I’m not pointing fingers here—the economic feedback most operations receive is simply incomplete. But that incomplete picture can lead us to underinvest in prevention and make treatment decisions that don’t really optimize for what matters most to the bottom line.

Reconsidering How Long We Treat

This is where the research translates most directly into money you can actually keep.

That same Canadian study found something really interesting about how producers actually handle treatment. Among farmers using a single protocol for mild or moderate cases, 83% were treating for longer than the labeled regimen—averaging about two extra days beyond the protocol’s duration. Only 17% were following the label duration exactly. If you think about your own habits or watch what happens in your parlor, those numbers probably ring true.

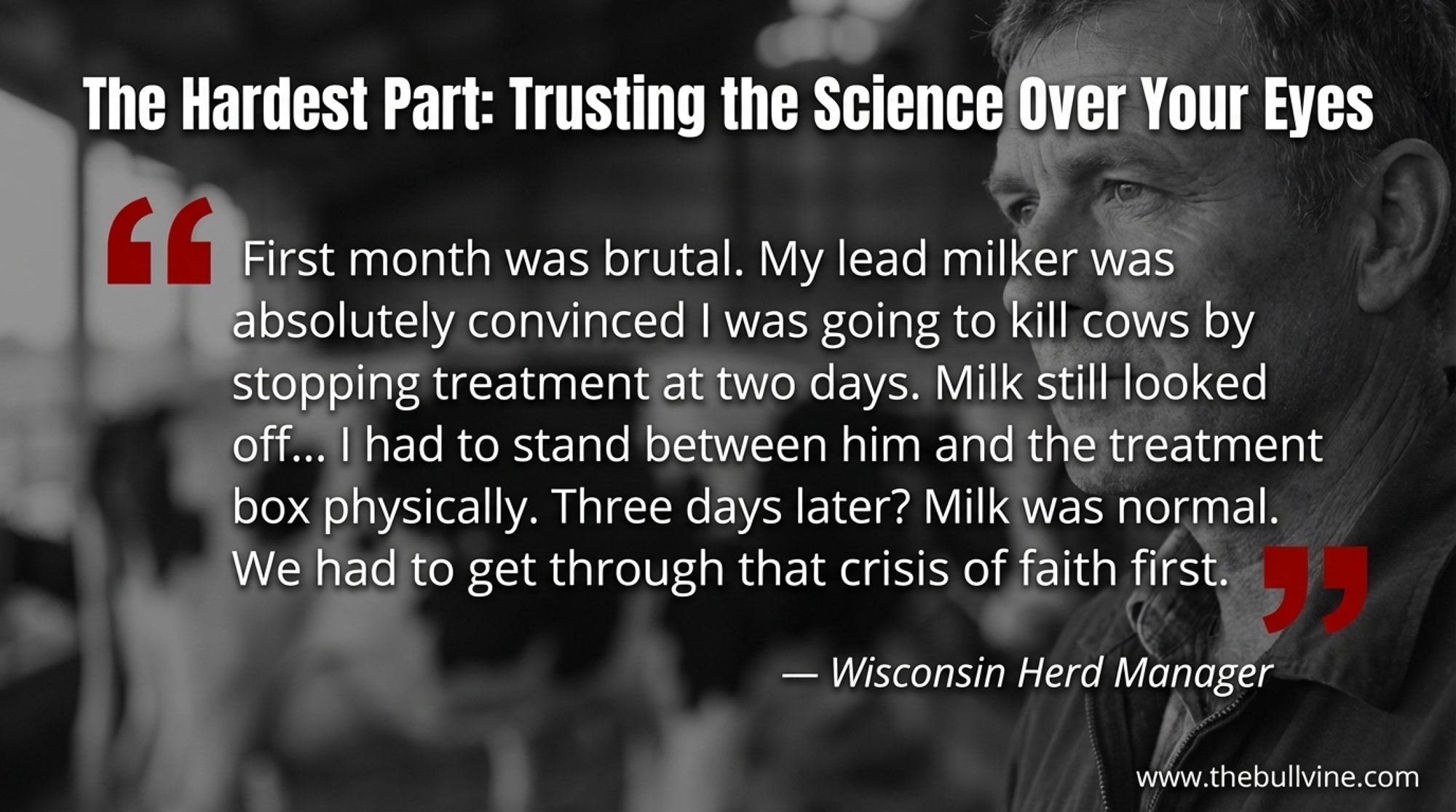

And look, the tendency to keep treating when milk still looks abnormal makes complete sense. You’re looking at clumpy milk on day three, and every instinct you’ve developed over years of working with cows tells you “she’s not better yet.” That’s a reasonable instinct. I get it.

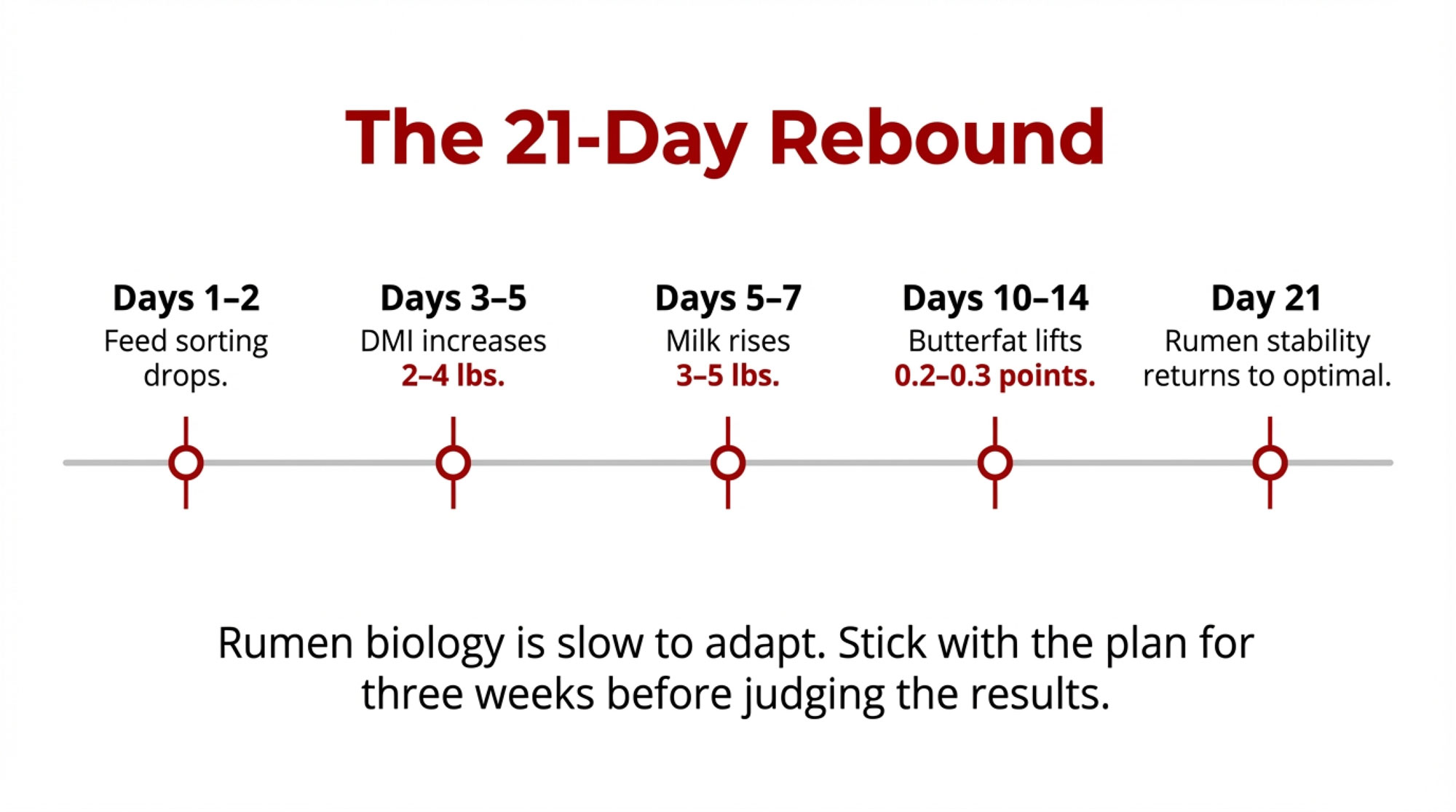

But here’s what the biology actually shows, and this is worth really understanding: clinical cure—milk appearance returning to normal—lags biological cure by 24-48 hours. The bacteria can be cleared while the inflammation is still resolving. The udder is healing, even though the milk still doesn’t look quite right. Treating through visual normalization often means you’re medicating a cow whose infection has already resolved. As Dr. Ruegg puts it, the abnormal milk appearance is due to inflammation, and it’s not predictive of whether bacteria are still present.

Research from California, published in the Journal of Dairy Science, tracked non-severe gram-negative cases across different treatment protocols and found that a 2-day treatment achieved equivalent clinical outcomes to a 5-day treatment—at meaningfully lower cost. For operations running a typical mastitis incidence, those savings compound pretty quickly over a year.

I talked with a Wisconsin herd manager not long ago who shared his experience implementing shorter protocols: “First month was brutal,” he told me. “My lead milker was absolutely convinced I was going to kill cows by stopping treatment at two days. Milk still looked off in a couple of them. I had to stand between him and the treatment box physically. Three days later? Milk was normal. He’s a believer now, but we had to get through that crisis of faith first.”

That psychological barrier—trusting the biology over what your eyes are telling you—seems to be the hardest part of making this change. The research supports shorter treatment for non-severe cases. The economics favor it clearly. But in the moment, standing in front of a cow showing abnormal milk… it takes real discipline to trust the science over your instincts.

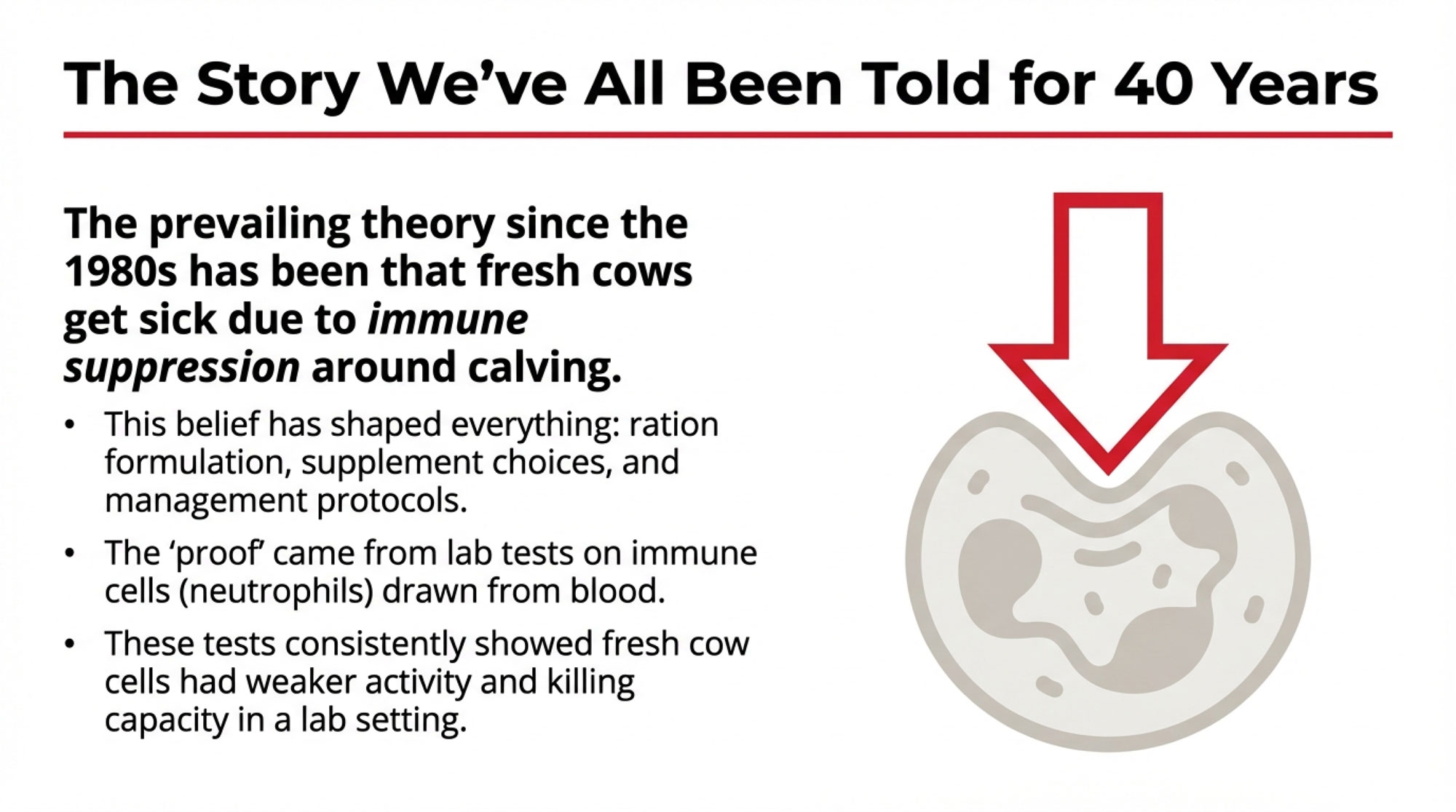

Why Some Infections Just Won’t Clear—The Biology Most of Us Never Learned

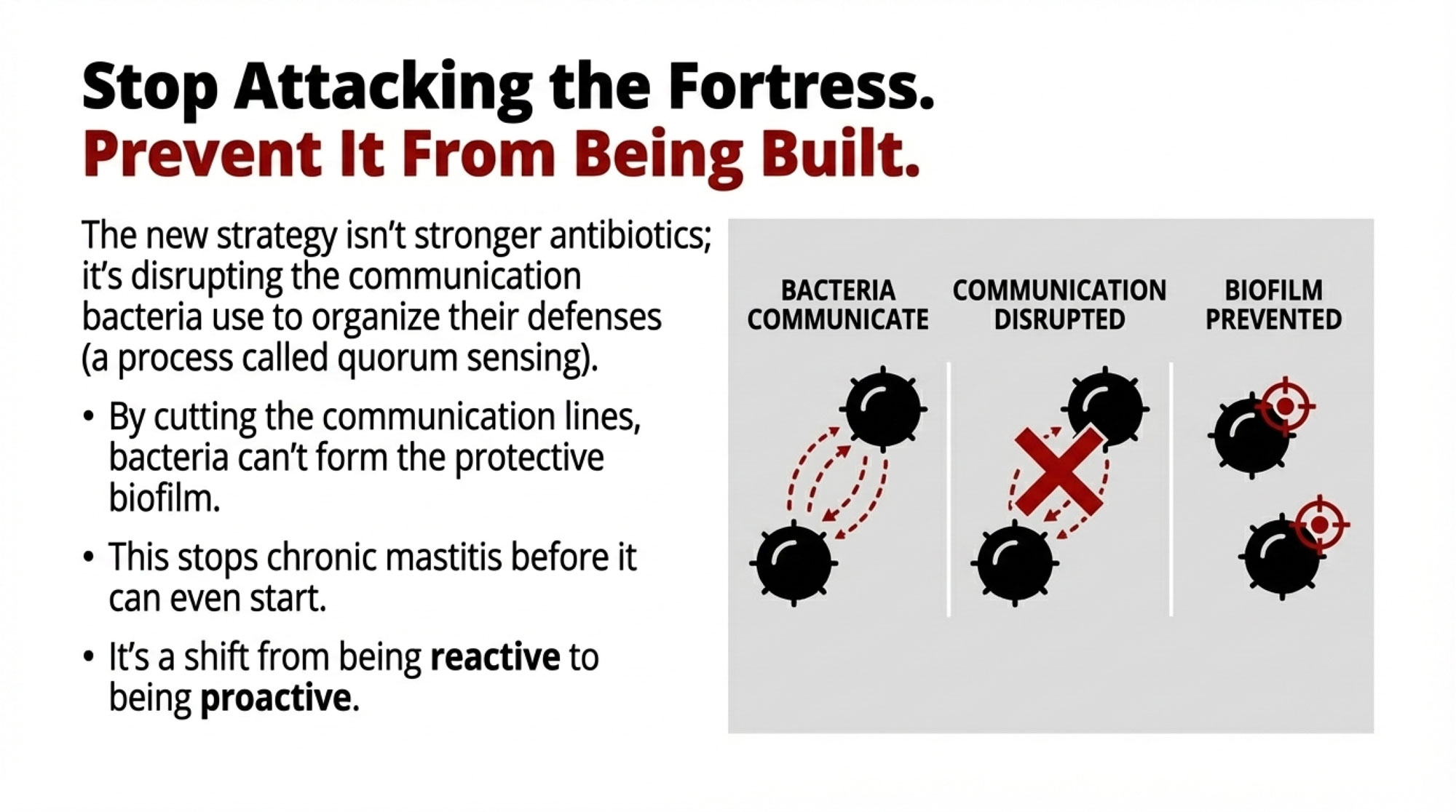

Here’s something that wasn’t in the textbooks when most of us were coming up: bacteria talk to each other. And that communication—scientists call it quorum sensing—might explain why that chronic mastitis case keeps coming back no matter what you throw at it.

The basic concept is this: bacteria aren’t just mindless individual cells floating around waiting to be killed by antibiotics. They’re sophisticated communicators. Through quorum sensing, they release signal molecules to detect how many similar bacteria are nearby. When the population reaches a critical mass, they undergo what researchers describe as a phenotypic shift—essentially flipping a switch that triggers coordinated group behavior.

And one of the most important things that switch turns on? Biofilm formation.

You’ve probably seen biofilm in your water troughs or pipeline—that slimy layer that builds up over time. The same thing happens inside the udder. Research published in Frontiers in Veterinary Science in 2021 confirms that Staphylococcus aureus, one of our most problematic mastitis pathogens, forms biofilm communities inside udder tissue. Once established, these bacterial fortresses become remarkably difficult to eliminate.

Here’s why that matters for treatment: bacteria within a biofilm can be up to 1,000 times more resistant to antibiotics than the same bacteria floating freely. It’s not that the antibiotic doesn’t work—it’s that the biofilm creates a physical barrier AND, perhaps more importantly, bacteria inside biofilms actually change their gene expression. They essentially turn off the cellular processes that antibiotics are designed to target.

Dr. Johanna Fink-Gremmels, a veterinary pharmacology specialist, puts it this way: “Bacteria within a biofilm change their gene expression. They may turn down protein or membrane synthesis, which are common antibiotic targets, making the antibiotics ineffective because their target is gone.”

That’s a fundamentally different problem than what we typically think about with treatment failure. We’re not just dealing with resistant bacteria—we’re dealing with bacteria that have essentially hidden themselves and gone dormant until the threat passes.

This helps explain some patterns we’ve all probably noticed. That quarter that clears up after treatment but flares again three weeks later? Likely a biofilm reservoir that was never eliminated. The chronic subclinical case that never quite gets below 400,000 SCC no matter what you do? Same story.

What’s particularly interesting—and honestly, a bit concerning—is that sub-therapeutic antibiotic exposure can actually trigger biofilm formation. The bacteria sense a threat that isn’t quite strong enough to kill them, and they respond by building more protection. It’s a reminder that partial treatment or insufficient duration can sometimes make things worse rather than better.

The emerging research is exploring ways to disrupt quorum sensing itself—blocking the bacterial communication that coordinates biofilm formation in the first place. Some plant-derived compounds show promise for jamming these bacterial signals. A study from Texas A&M found that certain phytogenic compounds can reduce biofilm formation by 60-88% by interfering with quorum sensing pathways.

Now, I want to be careful here—this is still relatively emerging science, and I’m not suggesting everyone should abandon proven protocols for the latest thing. But understanding these mechanisms helps explain why:

- Chronic S. aureus infections are so difficult to cure (biofilm formation is particularly strong)

- Early-lactation infections can establish persistent problems (bacteria have time to form biofilms before immune function fully recovers)

- Prevention consistently outperforms treatment economically (avoiding biofilm establishment is far easier than eliminating it)

- On-farm culture matters more than we might think (knowing you’re dealing with a biofilm-prone pathogen changes the calculus)

For practical purposes, this biology reinforces what the economics already tell us: preventing infections from establishing is worth far more than treating them after the fact. And when you do have persistent problems, understanding that you may be dealing with protected bacterial communities—not just stubborn individual cells—changes how you think about the challenge.

It’s also worth noting that biofilm can form in your equipment, not just in udders. That slimy layer in water troughs or pipeline? Research from the University of Wisconsin suggests it can reduce water palatability enough to cut intake—and every pound of reduced water consumption costs you roughly a pound of milk. Keeping equipment truly clean, not just visibly clean, matters more than most of us probably realize.

The Value of Actually Knowing What You’re Treating

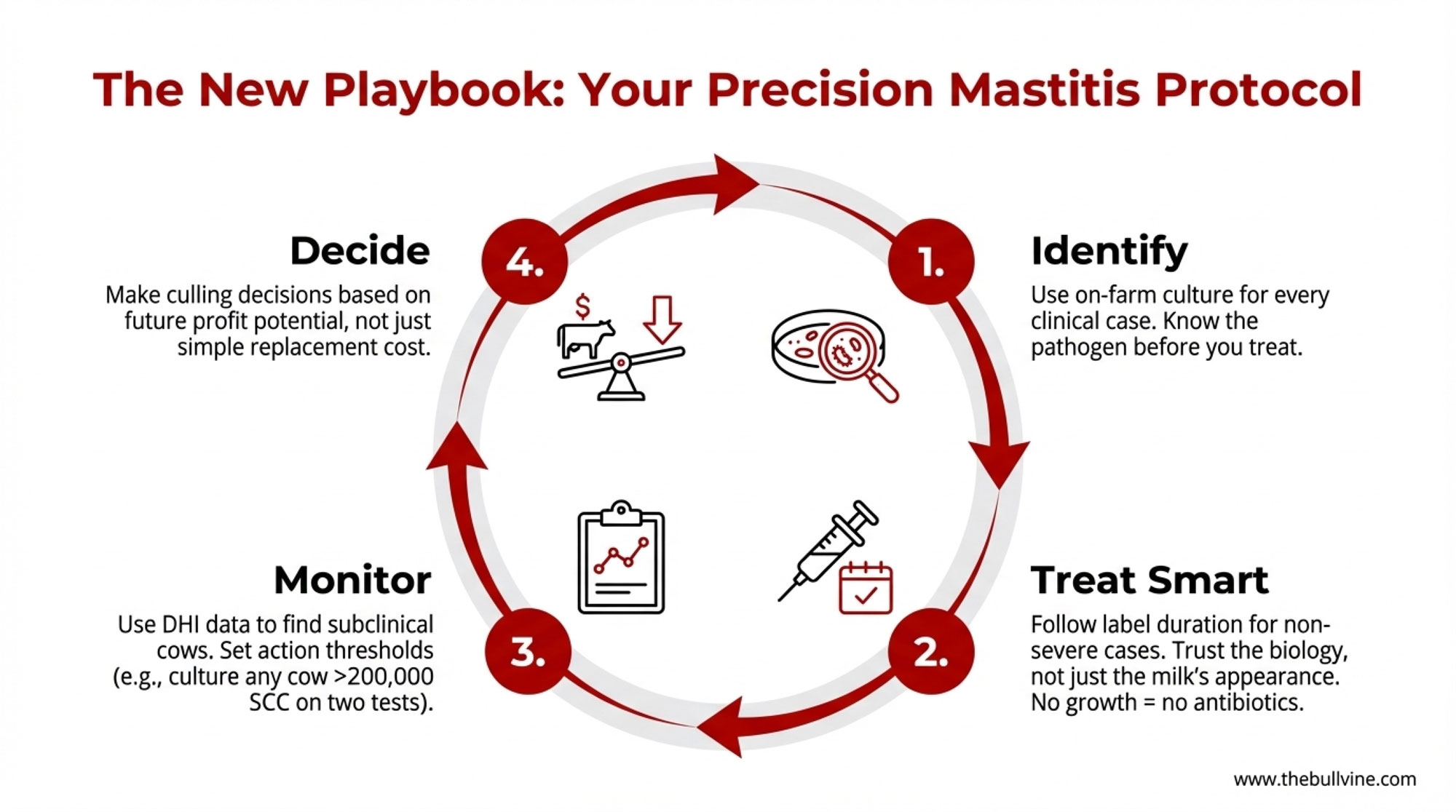

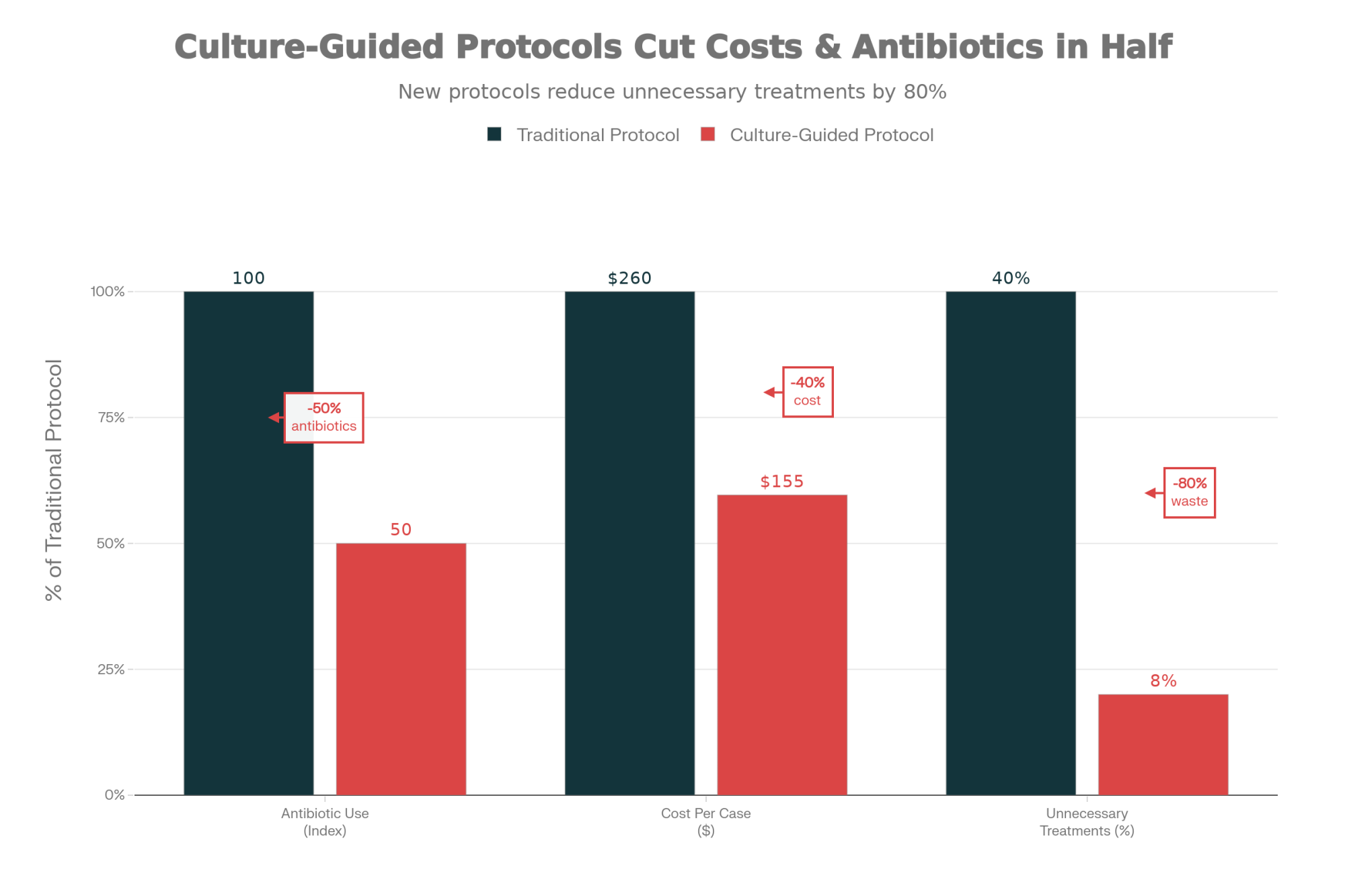

If treatment duration is probably the most accessible economic lever, bacterial identification might be the most impactful one over the long haul. The value of knowing what you’re actually dealing with becomes pretty obvious when you look at pathogen-specific outcomes.

Penn State extension has documented this stuff for years now. Here’s what systematic culturing typically reveals—and what it means for your treatment decisions:

| Culture Result | Frequency | Recommended Action | Economic Impact |

| No Growth | 10-40% | Do not treat | Saves antibiotics + 2-5 days milk discard |

| Gram-Negative | 25-35% | Supportive care; short duration if treated | Prevents 2-3 days of unnecessary discard |

| Gram-Positive | 30-50% | Targeted antibiotic therapy | Higher cure rate with appropriate treatment |

Source: Penn State Extension; Journal of Dairy Science

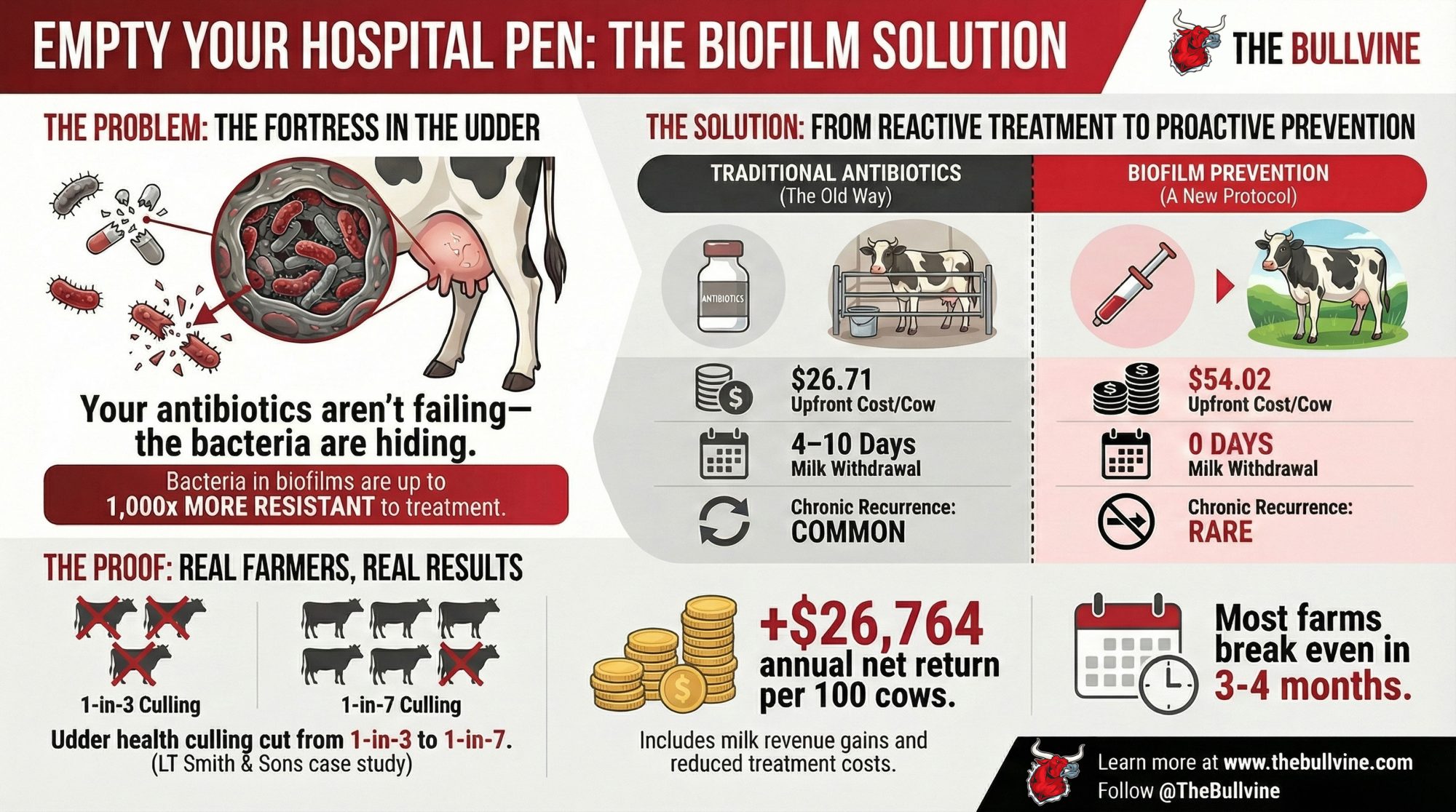

Farms implementing on-farm culture consistently report around 50% reductions in antibiotic use while maintaining or even improving cure rates. They’re using half the antibiotic and achieving comparable or better outcomes because they’re matching treatment to what’s actually happening in that quarter.

The economics pencil out for most operations:

- System cost: $2,500-3,000 for a quad-plate setup

- Per-case culture cost: ~$10-15, including supplies and labor

- Typical payback: 60-90 days for operations running industry-average mastitis incidence

Penn State’s extension materials emphasize that trained producers can achieve high accuracy in decisions that actually matter—distinguishing gram-positive from gram-negative from no growth. You don’t need laboratory-level precision here. You need enough accuracy to guide treatment decisions, and that’s absolutely achievable with proper training and consistent technique.

| Culture Result | Frequency | Recommended Action | Economic Impact Per Case |

|---|---|---|---|

| No Bacterial Growth | 10-40% of cases | NO treatment needed | Save $130-195 |

| Gram-Negative (E. coli, Klebsiella) | 25-35% of cases | Supportive care; short duration if treated | Save $65-130 |

| Gram-Positive (Staph, Strep) | 30-50% of cases | Targeted antibiotic therapy (2-3 days) | Optimize drug selection |

| Contaminated Sample | 5-15% (poor technique) | Re-sample with better aseptic technique | Waste $10-15 |

Prevention Economics – Where the Real Returns Hide

There’s a tendency in our industry to view prevention as an expense category and treatment as the necessary response to problems that inevitably arise. The research suggests we might have that framing exactly backwards.

Post-milking teat disinfection emerges across virtually every study as the highest-ROI intervention. That Canadian study I mentioned earlier found 97% of participating farms were already using post-milking teat dipping—it’s become nearly universal because the returns are so clear and immediate. For any operation that isn’t doing this consistently, it’s probably the clearest opportunity out there.

Selective dry cow therapy is another area where research increasingly supports approaches different from the traditional blanket treatment most of us grew up with. Dr. Ruegg’s team at Michigan State examined what happens when farms move from blanket treatment to selective protocols—treating only infected or high-risk cows based on SCC history while applying internal teat sealants universally. They found potential for about 50% reduction in antibiotic use and estimated savings of roughly $5.37 per cow with equivalent or superior early-lactation udder health outcomes.

Now, this approach does require more management intensity and solid record-keeping, so it won’t fit every operation equally well. But for farms with the systems to implement it properly, the economics look pretty favorable.

| Intervention | Initial Investment | Payback Period | Annual Savings (500-cow herd) | Antibiotic Use Impact |

| On-Farm Culture System | $2,500-3,000 | 60-90 days | $6,500+ | -50% |

| Post-Milking Teat Dip | $800-1,200/year | Immediate | $8,000-12,000 | Prevents infections |

| Selective Dry Cow Therapy | $1,500-2,000 setup | 4-6 months | $2,685 | -50% |

| Extended Treatment (Beyond Label) | $0 | Loses $6,500/year | -$6,500 | +35% (wasted) |

The Norwegian dairy industry offers what might be the most comprehensive example of what prevention-focused economics can achieve at a whole-industry scale. Their systematic implementation of prevention priorities, mandatory health recording, and selective treatment protocols reduced national mastitis costs from 9.2% to 1.7% of milk pricebetween 1994 and 2007. They now report the lowest antibiotic use per kilogram of livestock biomass among all the European countries being tracked.

That kind of transformation didn’t happen overnight or by accident—it required infrastructure investment, aligned incentives across the supply chain, and genuine cultural change throughout their industry. But it demonstrates what becomes possible when prevention rather than treatment becomes the default mindset.

The Culling Calculation Worth Revisiting

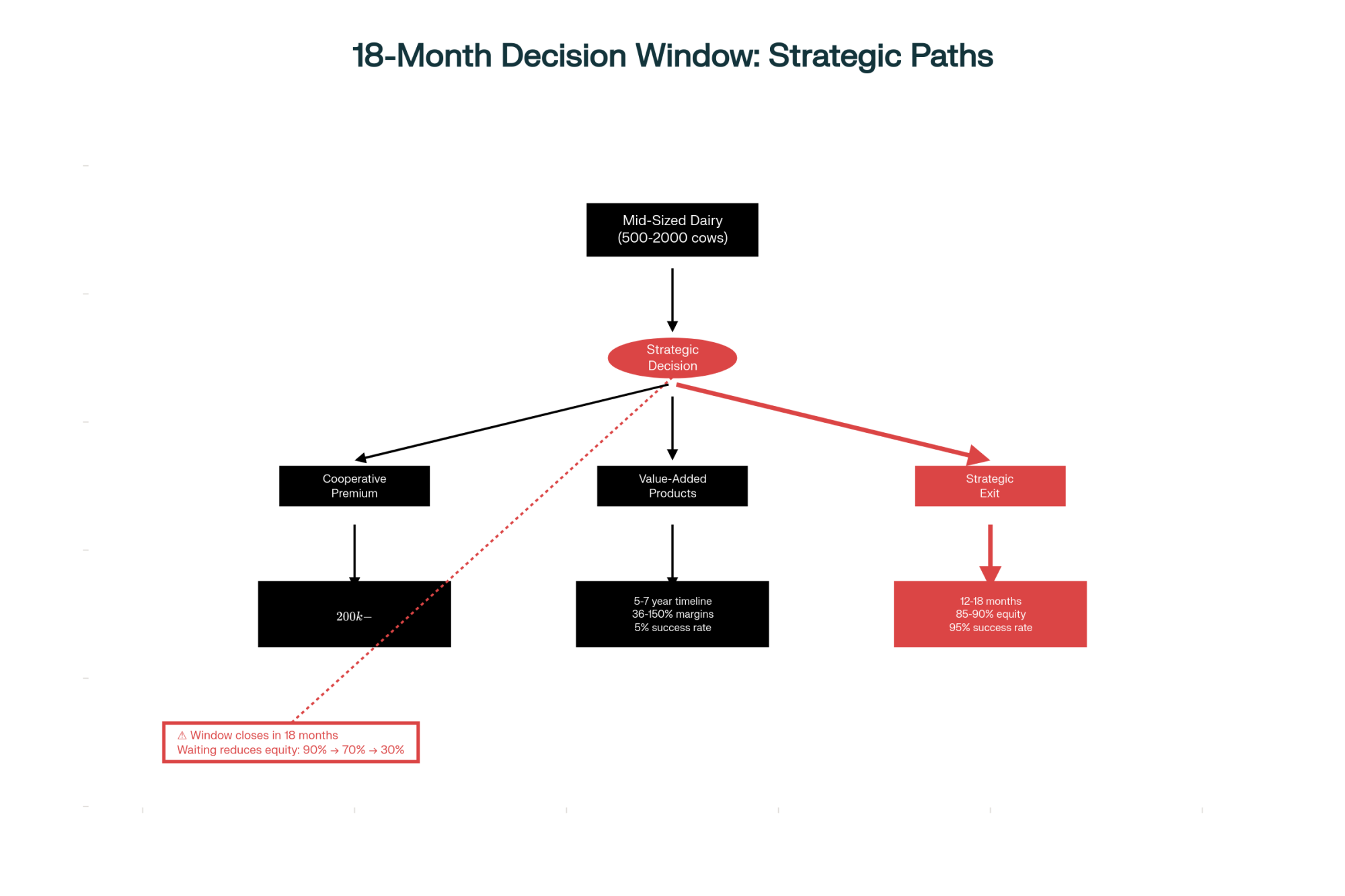

Here’s a calculation I think a lot of farms are getting wrong, and it’s costing real money in both directions—keeping cows too long and culling too soon.

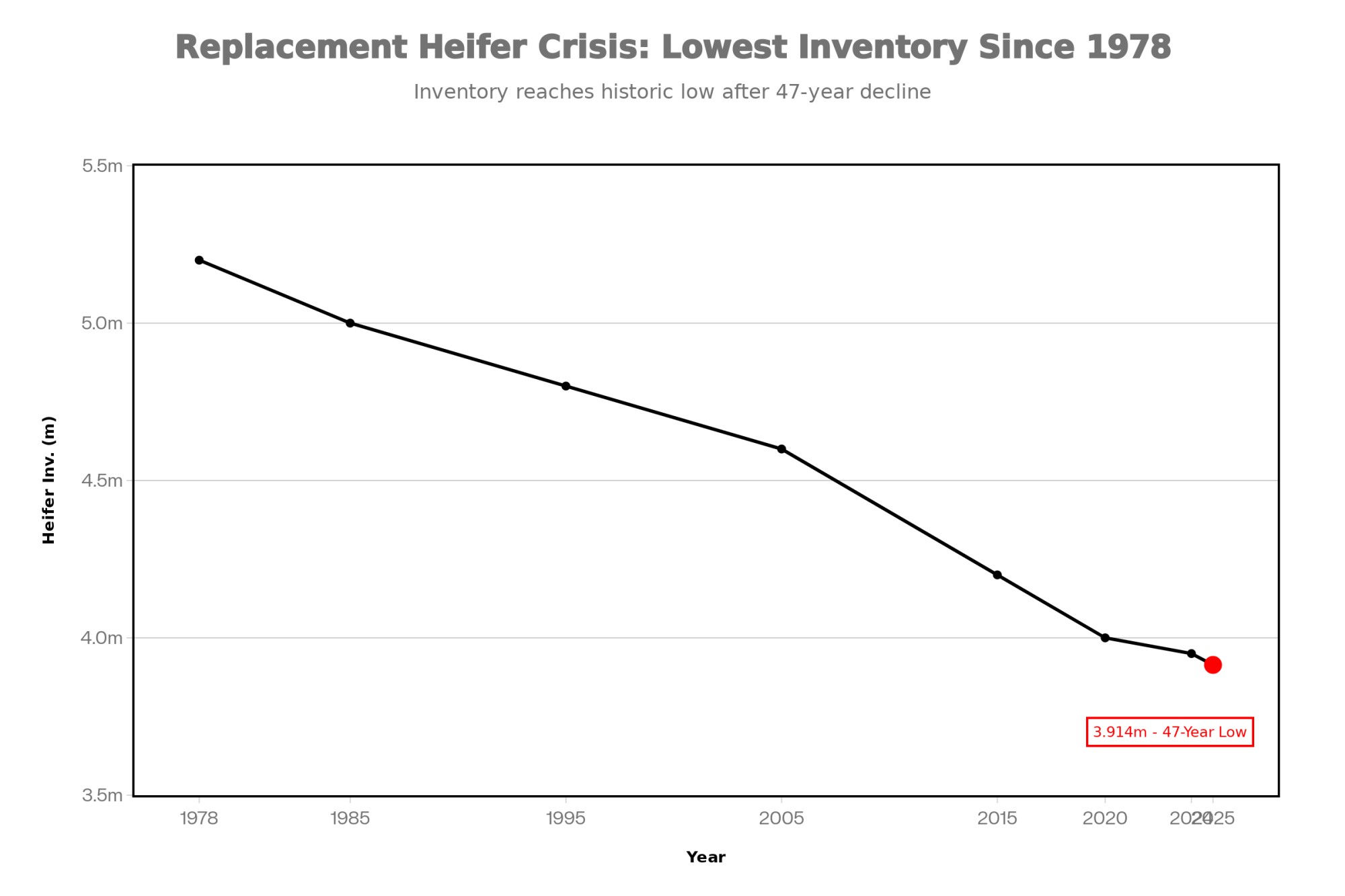

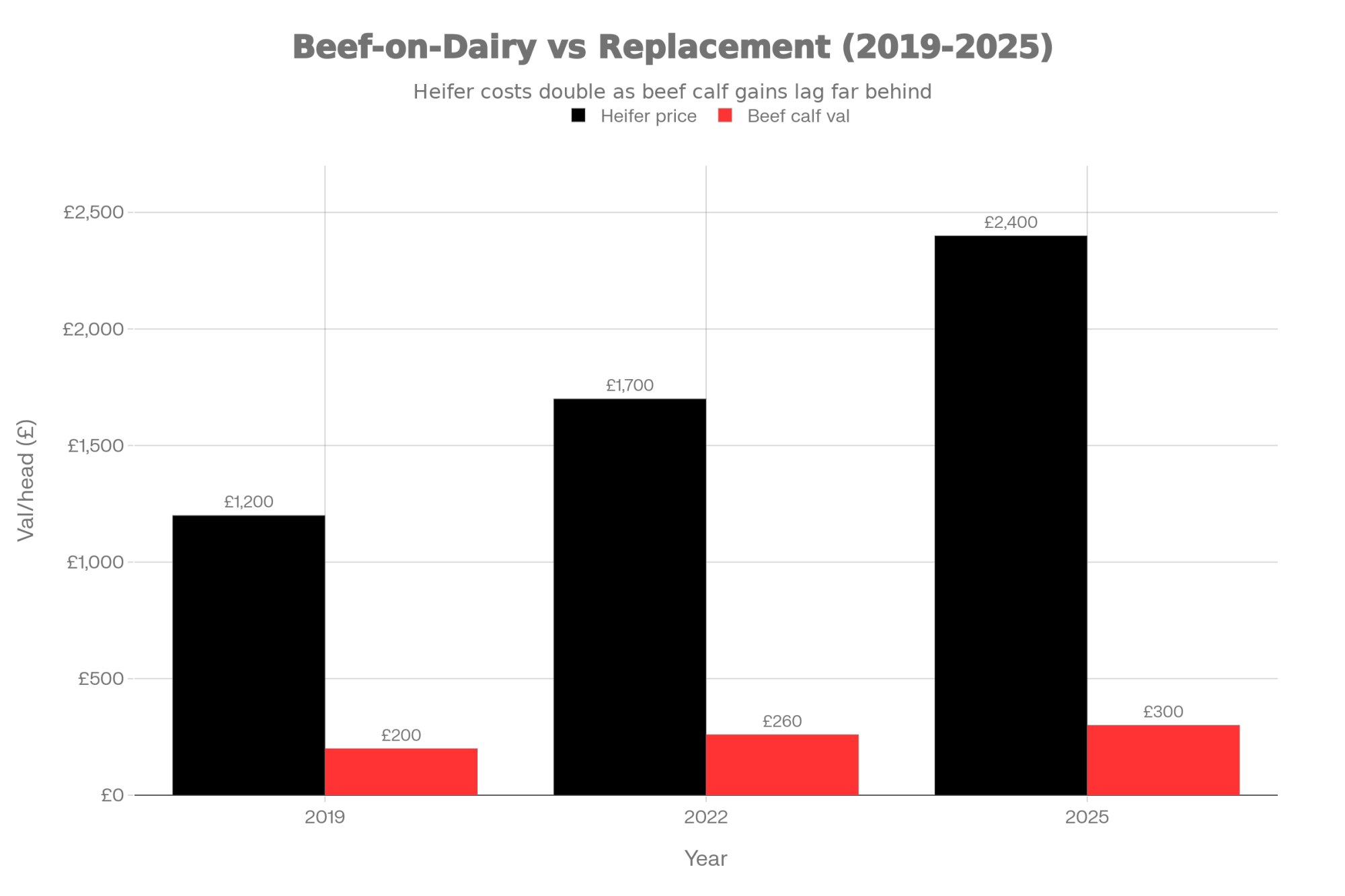

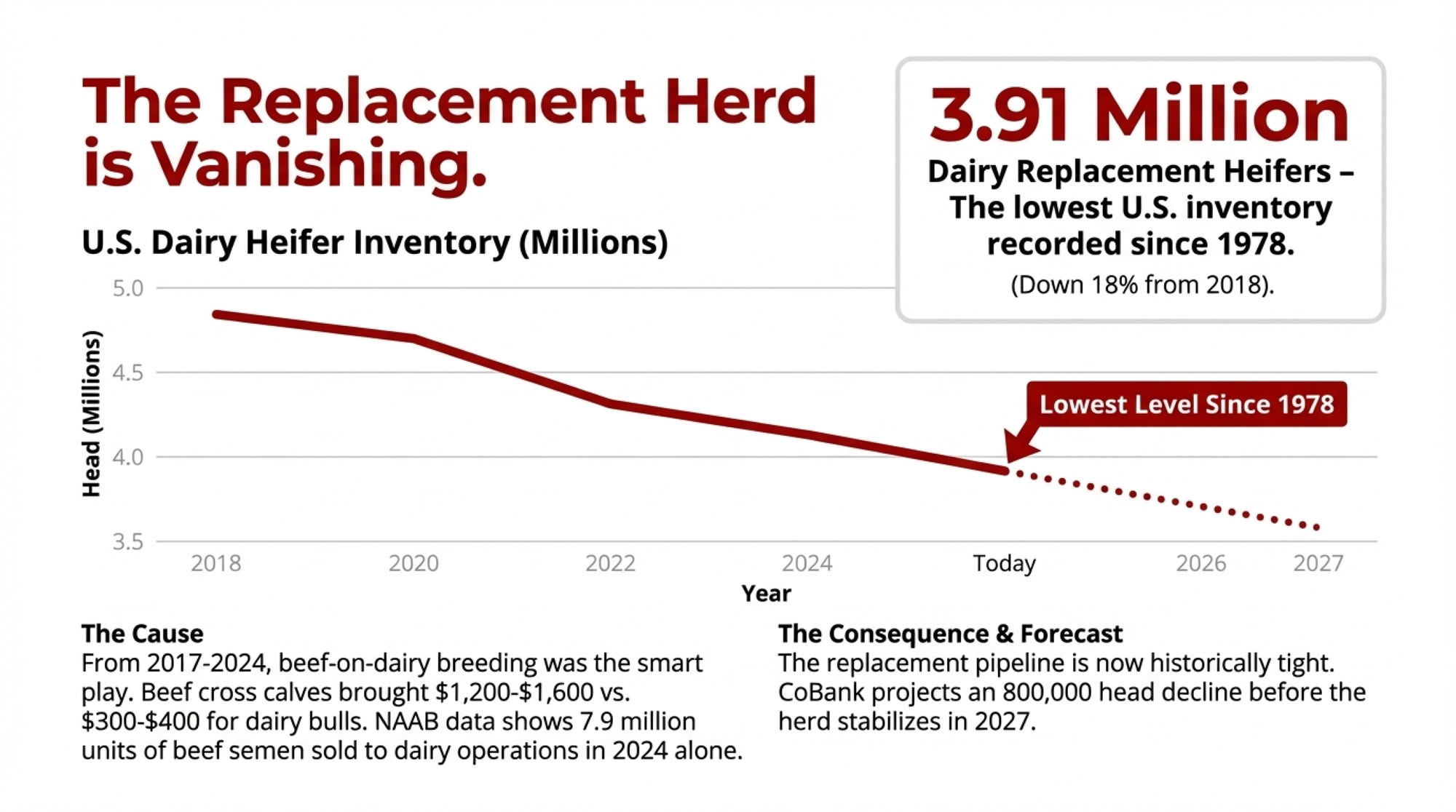

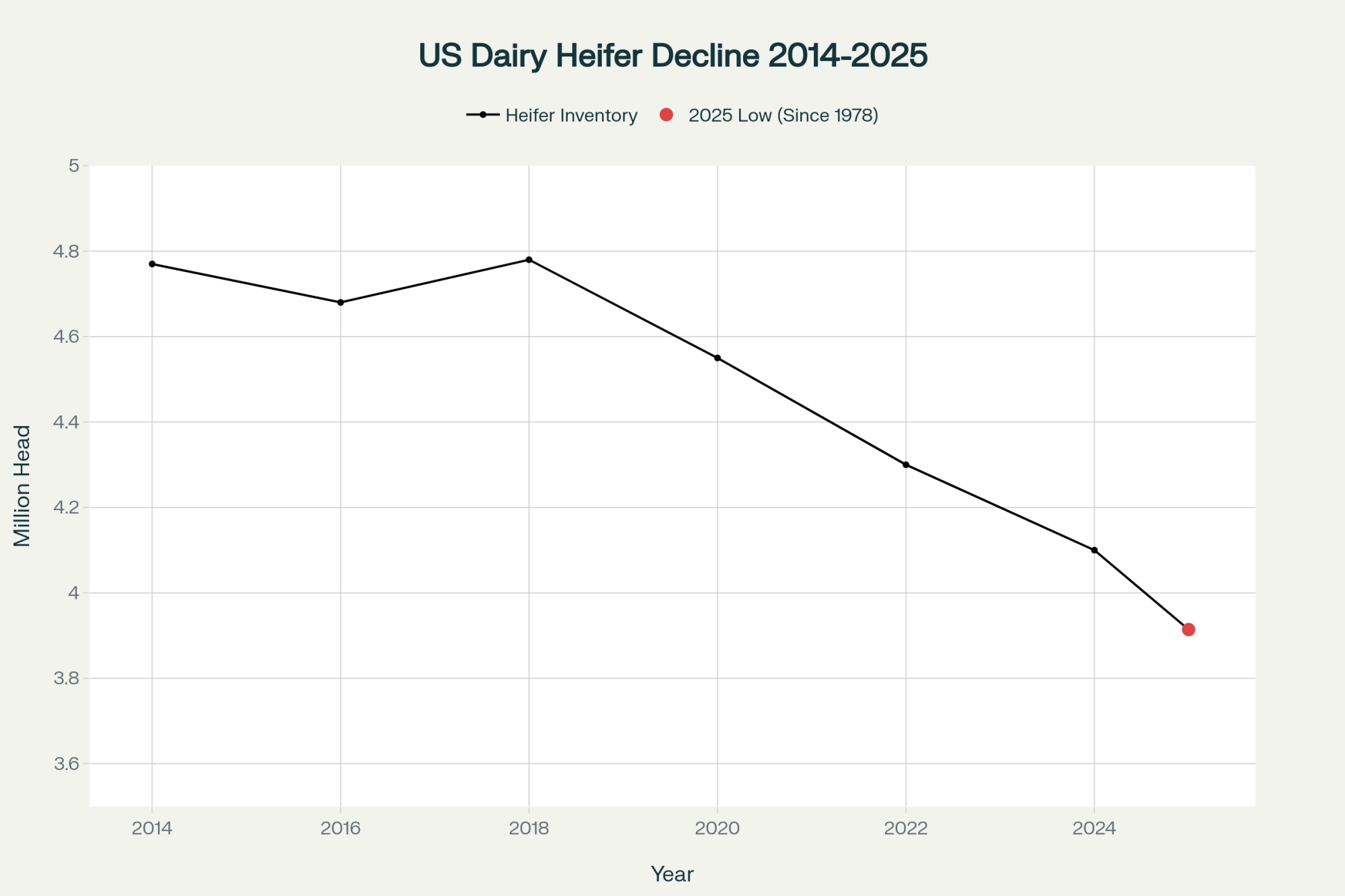

The common approach most of us use: replacement heifer cost minus cull cow sale value. With heifers running $3,000-4,000 and cull cows bringing $1,800-2,300 these days—those cull values are at historic highs, by the way—that math suggests a $1,200-2,200 replacement cost from culling. The narrowed gap might make culling seem more attractive on paper, but that simple calculation still misses what actually matters.

What’s the difference in future profit potential between keeping this specific cow versus replacing her with a specific heifer?

Think through a practical example. A second-lactation cow at 150 days in milk develops mastitis. Production drops from 75 to 68 pounds daily. She’s open but otherwise healthy.

- Simple transaction math says culling costs around $1,500 (heifer price minus elevated cull value).

- A complete economic analysis considers her remaining profit potential—finishing this lactation, completing a third lactation at mature-cow production levels, and eventual cull value—compared with what a replacement heifer would generate over the same timeframe.

That fuller analysis often favors keeping her despite the mastitis episode. The infection dropped her production, sure, but she may still be worth more than her replacement over the relevant planning horizon.

What’s particularly telling: that Canadian study found culling represented the largest single cost component for both clinical and subclinical mastitis—accounting for about 48% of clinical mastitis costs. That magnitude suggests these decisions deserve more systematic analysis than they typically get.

Even with today’s elevated cull values narrowing the replacement cost gap, the fundamental point remains: cows that would have been clear culling candidates when heifers cost $1,800 now have positive retention value at $3,500 heifers. The economic decision point has shifted. The question is whether our decision frameworks have shifted along with it.

The Subclinical Challenge That Keeps Nagging

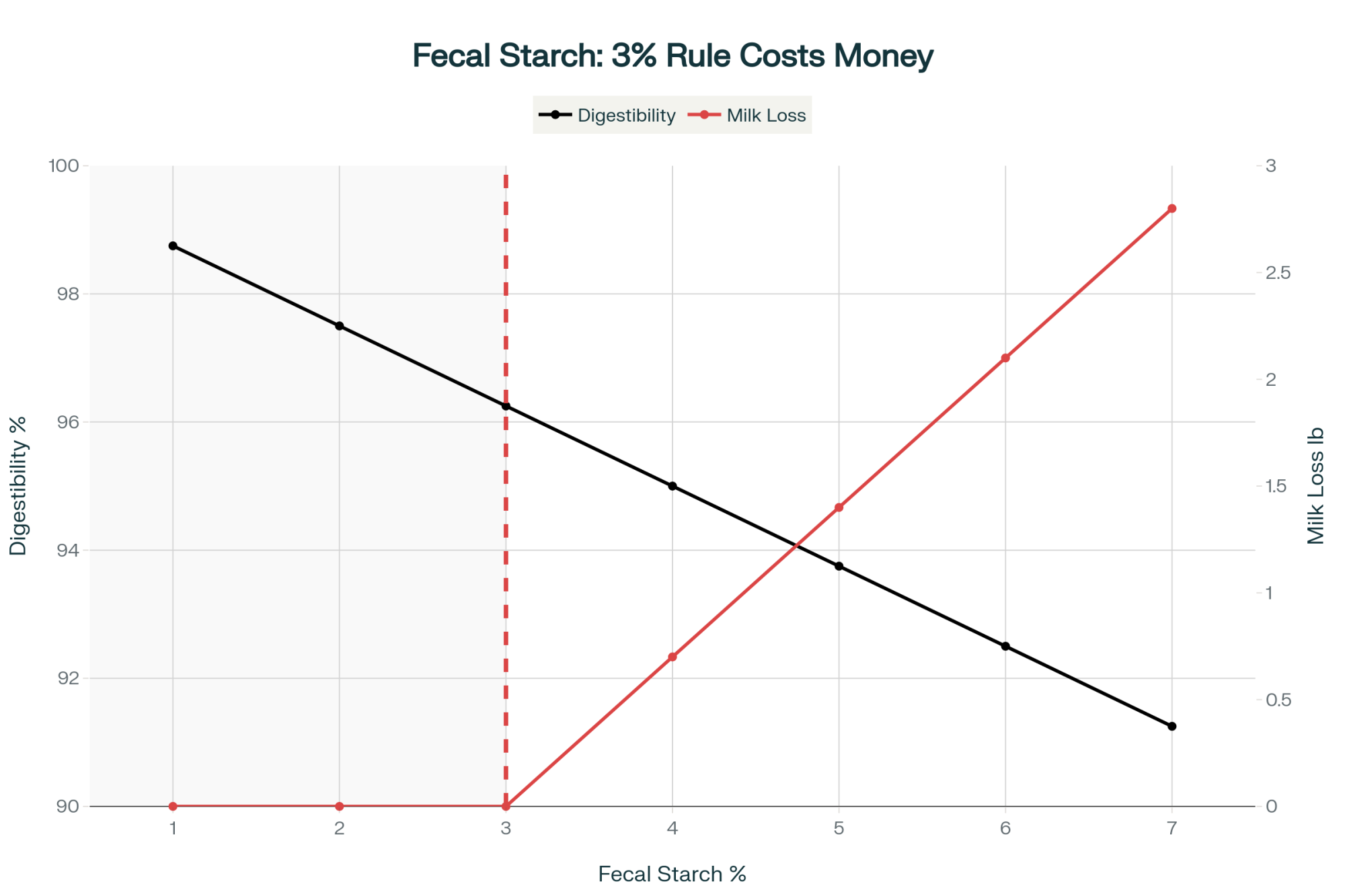

Bulk tank SCC shows up on every pickup report. It’s probably the most frequently measured metric we have in dairy. Yet subclinical mastitis continues to cause estimated annual U.S. losses of $1 billion+, according to the National Mastitis Council. Why does that gap between measurement and management persist?

The limitation is that bulk tank SCC only tells you the aggregate average. It doesn’t tell you which cows are infected, how long they’ve been dealing with it, or whether the situation is trending better or worse.

A reading of 185,000 cells/mL could represent a herd with 85% healthy cows and 15% chronic infections. Or it could mean widespread low-grade infection that’s building toward clinical outbreaks. Same number, completely different situations requiring completely different responses.

A Pennsylvania producer shared a story with me that illustrates this really well: “We were running 178,000 bulk tank, feeling pretty good about ourselves,” he said. “Then we actually pulled the DHI data and found 14 cows averaging over 400,000 that weren’t showing any clinical signs. Given the production losses those cows were experiencing, we were bleeding money on milk that never even made it to the tank. The bulk tank number had us thinking everything was fine when it really wasn’t.”

Farms that manage subclinical mastitis effectively tend to have systematic protocols that convert data into specific, actionable decisions. They set clear thresholds: culture any cow over 200,000 on consecutive tests; immediate intervention at 400,000; and specific action plans at each level. They review watchlists weekly rather than just filing the DHI report and moving on to the next thing.

Regional and Seasonal Context

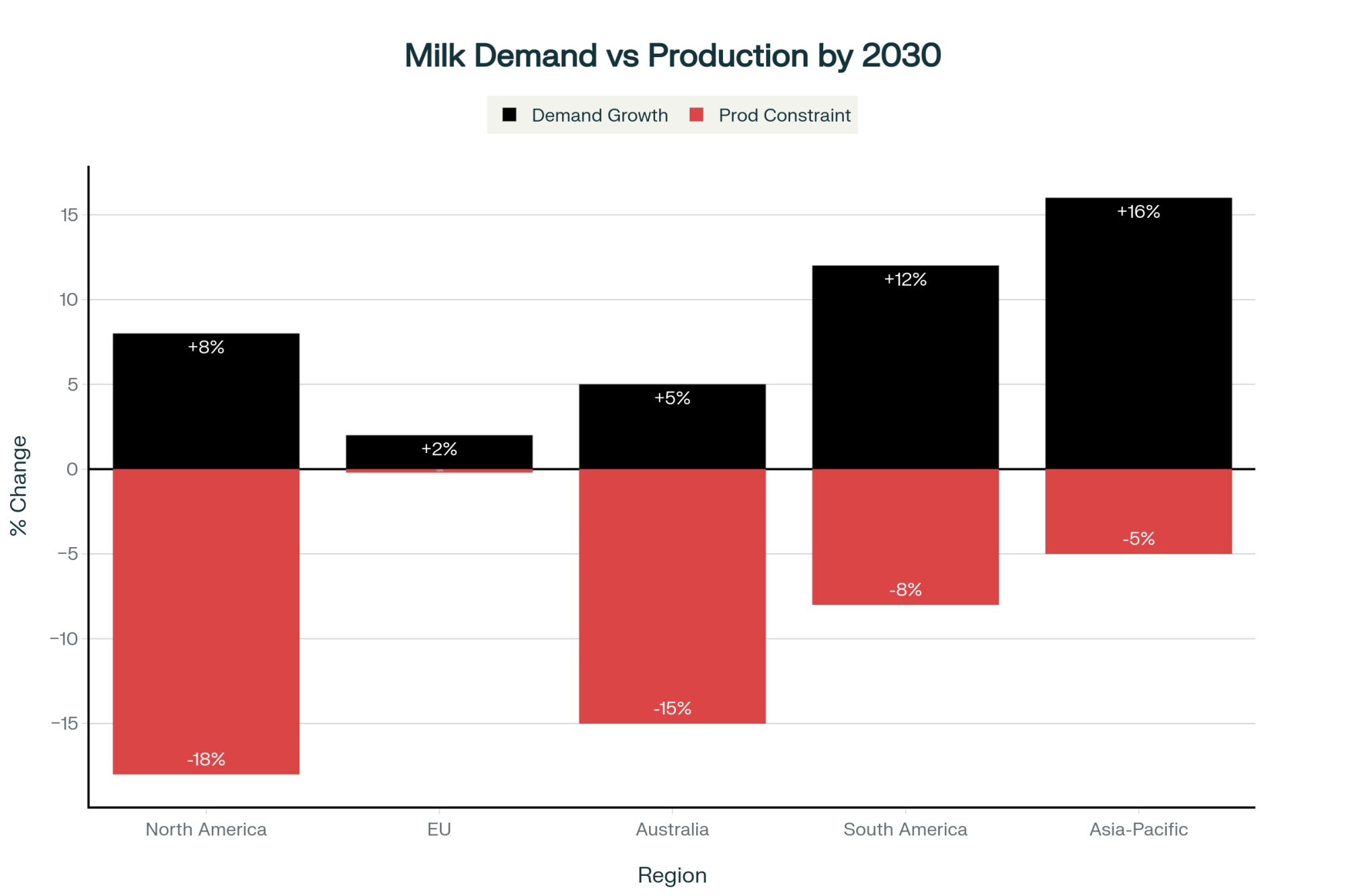

These economics aren’t uniform everywhere, and that’s worth acknowledging directly. The figures I’ve been citing primarily reflect Upper Midwest, Northeast, and Canadian commercial operations—the regions where most of this research has been conducted.

Southeast dairies deal with different realities. Heat stress and humidity create environmental mastitis challenges that shift the pathogen mix considerably. Summer months typically see more E. coli and Klebsiella from bedding contamination, while contagious pathogens spread more readily in winter housing. California’s large dry lot operations have different exposure patterns than Wisconsin freestalls. Organic operations face additional considerations regarding treatment options that significantly affect the calculations.

Smaller operations may find some interventions don’t quite pencil out at their scale—the fixed costs of on-farm culture systems require sufficient case volume to justify the investment.

The principles apply broadly: know your pathogens, match treatment to actual need, invest in prevention, and make culling decisions based on complete economics. But the specific numbers need local calibration.

The Implementation Reality

It’s worth being direct about why more farms haven’t adopted practices the research so clearly supports. The economics favor on-farm culture and selective treatment. Payback periods are short. Returns are well-documented. And yet adoption remains pretty modest across the industry.

Part of it is the psychology I already mentioned—trusting biology over visual appearance, accepting that abnormal-looking milk doesn’t always mean more treatment is needed. That runs against instincts we’ve built over entire careers.

Part of it is implementation discipline. The farms that succeed with culture-based protocols treat them like any other systematic management approach: written protocols everyone follows, trained staff at every level, and regular review of outcomes. The farms that struggle tend to treat it more casually—doing it when convenient, following culture results except when it doesn’t feel right. That second approach rarely holds up over time.

Sample contamination is another common practical failure point. Without solid aseptic technique, you get plates showing multiple bacterial species that can’t actually guide treatment decisions. When contamination rates run too high, farms often conclude the whole system doesn’t work—when really their collection technique just needs some refinement.

A veterinarian who consults with a lot of Upper Midwest operations framed it this way when I talked with him: “The farms that succeed have written protocols, trained staff, and monthly review meetings where we examine outcomes together. The farms that struggle treat it like a suggestion. That second approach just doesn’t hold up.”

Looking Ahead

Several forces seem likely to shape mastitis economics over the coming years.

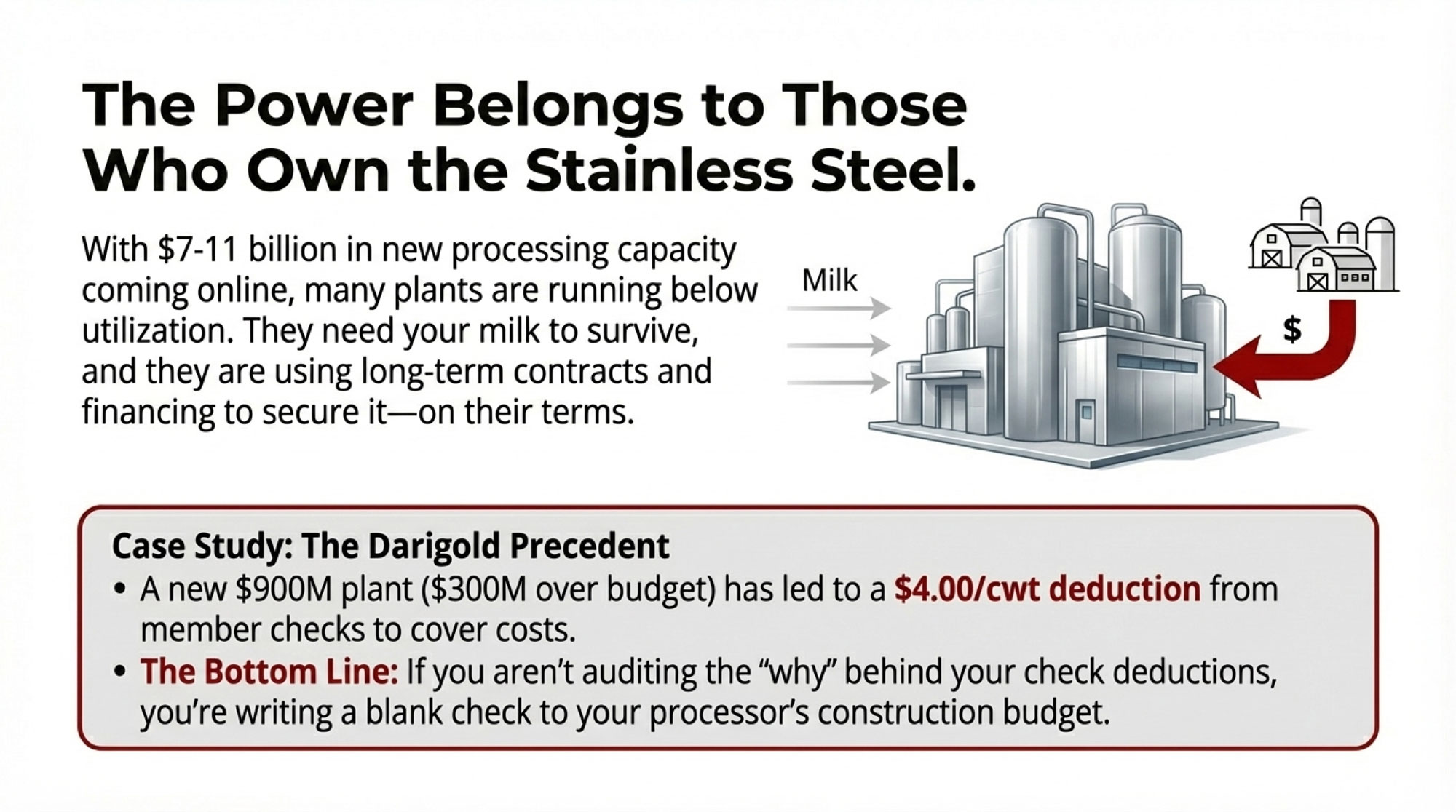

Processor requirements are evolving beyond simple SCC penalties toward documentation of antimicrobial stewardship practices. Export markets and retail buyers increasingly demand verification of responsible antibiotic use, pushing processors to ask more of their suppliers. This trend isn’t going away—and producers who wait for processors to mandate culture-based protocols will find themselves implementing under pressure rather than capturing savings on their own timeline.

Technology keeps making selective treatment more practical. Activity monitoring systems from companies like SCR, Afimilk, and others increasingly incorporate udder health alerts that flag quarters before clinical signs appear. Inline sensors that measure conductivity and other milk parameters can detect problems earlier than visual observation alone. As these systems become more prevalent and affordable, the practical obstacles to selective treatment continue to diminish.

And economic pressure keeps forcing optimization throughout the industry. At current input costs and milk prices, the margins that once absorbed some inefficiency just don’t do that as comfortably anymore. Avoidable mastitis costs that might have been tolerable at better margins become harder to carry when overall profitability is tight.

Key Takeaways

On treatment economics:

- Research supports label-minimum treatment durations for non-severe cases

- Each extra treatment day costs approximately $65 in discarded milk

- Biological cure precedes visual normalization by 24-48 hours—milk can look abnormal even after the infection has cleared

On bacterial identification:

- On-farm culture systems typically achieve a 60-90 day payback

- 10-40% of clinical cases show no bacterial growth—treating these provides zero benefit

- Knowing the pathogen enables targeted therapy with better economic outcomes

On prevention investment:

- Post-milking teat disinfection consistently shows the highest returns

- Selective dry cow therapy can reduce antibiotic use by approximately 50% while maintaining udder health

- Subclinical mastitis accounts for nearly half of the total mastitis costs in most studies

On culling decisions:

- Simple transaction math (heifer cost minus cull value) still misses future profit potential—even with today’s elevated cull prices

- At current heifer prices, many cows previously culled now have positive retention value

- Culling accounts for 48% of clinical mastitis costs—these decisions matter

On implementation:

- Written protocols consistently outperform verbal agreements

- Cross-training multiple staff members prevents knowledge loss when people move on

- Regular reviews make ROI visible and maintain protocol adherence

- Veterinary partnership provides valuable expertise for protocol development and troubleshooting

Resources for Further Reading

For producers interested in exploring these approaches further, several university extension programs offer detailed implementation guidance:

- Penn State Extension: On-farm culture training materials and mastitis treatment protocols at extension.psu.edu

- University of Wisconsin Milk Quality Program: Decision support tools and economic calculators at milkquality.wisc.edu

- Michigan State University Extension: Mastitis economics research and practical recommendations at canr.msu.edu/dairy

- National Mastitis Council: Industry guidelines and research summaries at nmconline.org

The Bottom Line

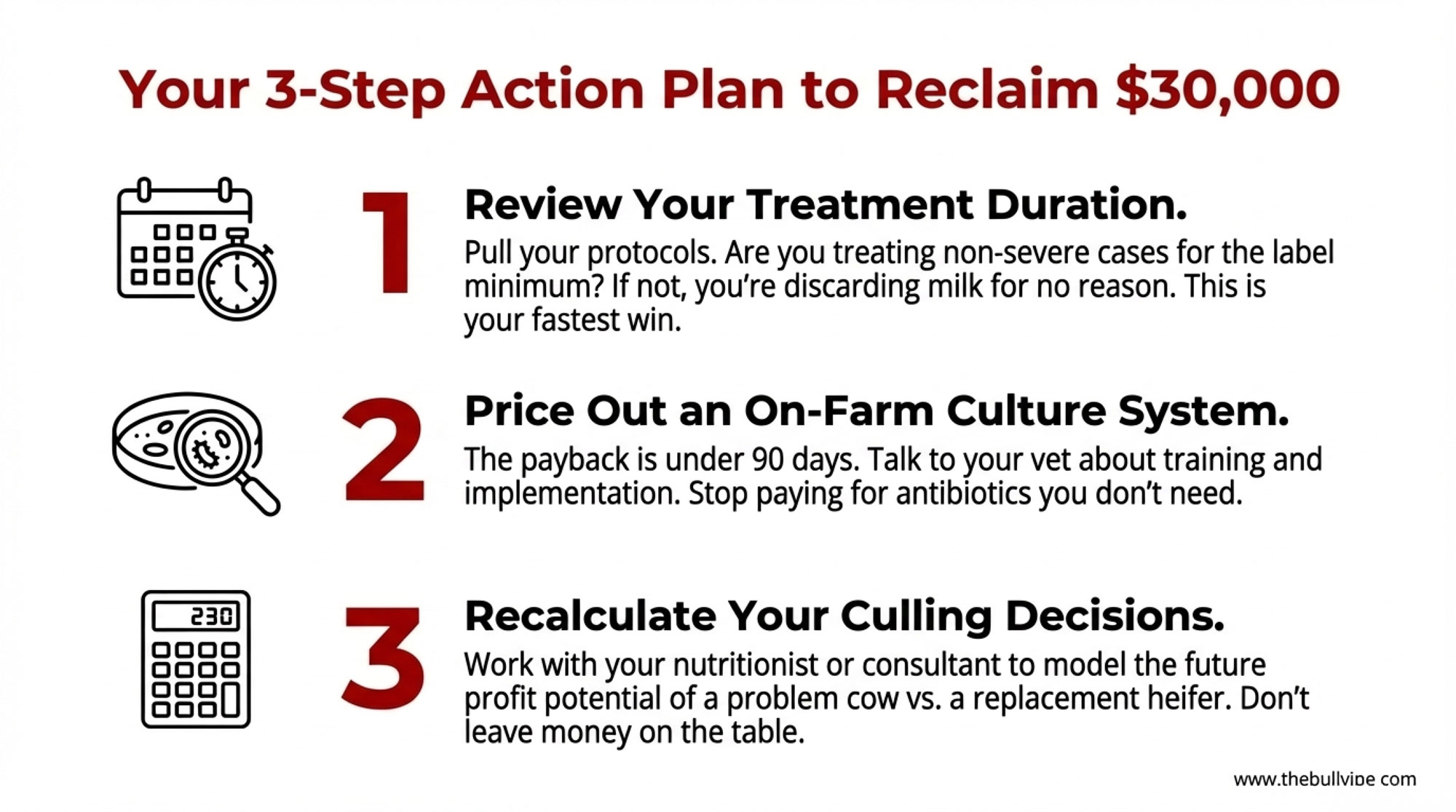

The research points toward real opportunities for operations willing to examine their protocols against current evidence. The changes involved aren’t revolutionary—optimized treatment duration, bacterial identification, systematic prevention, more complete culling calculations—but the cumulative impact on farm economics can be pretty substantial. For a 500-cow herd running industry-average mastitis rates, the difference between optimized and traditional protocols could mean $30,000-50,000 in annual margin. That’s real money sitting in decisions you make every day.

For operations considering these approaches, documenting your current costs as a baseline, followed by a veterinary consultation on protocol options, provides a sensible starting point. The economics appear favorable for most situations. Implementation requires discipline and systematic follow-through. Whether that fits your operation’s circumstances, capabilities, and management style is ultimately a judgment only you can make—but at least now you’ve got solid numbers to inform that decision.

Next time you’re standing in the parlor on Day 3 of a treatment, put the tube back in the box and trust the biology. Your bottom line will thank you.

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More

- 17-26x ROI: Why Top Dairies Stopped Saving Calves and Started Preventing Loss – Stop the $1,050-per-head drain on your future milk check with this breakdown of “saving” vs. preventing loss. It delivers a clear 26x ROI protocol you can implement Monday to protect your herd’s long-term performance and efficiency.

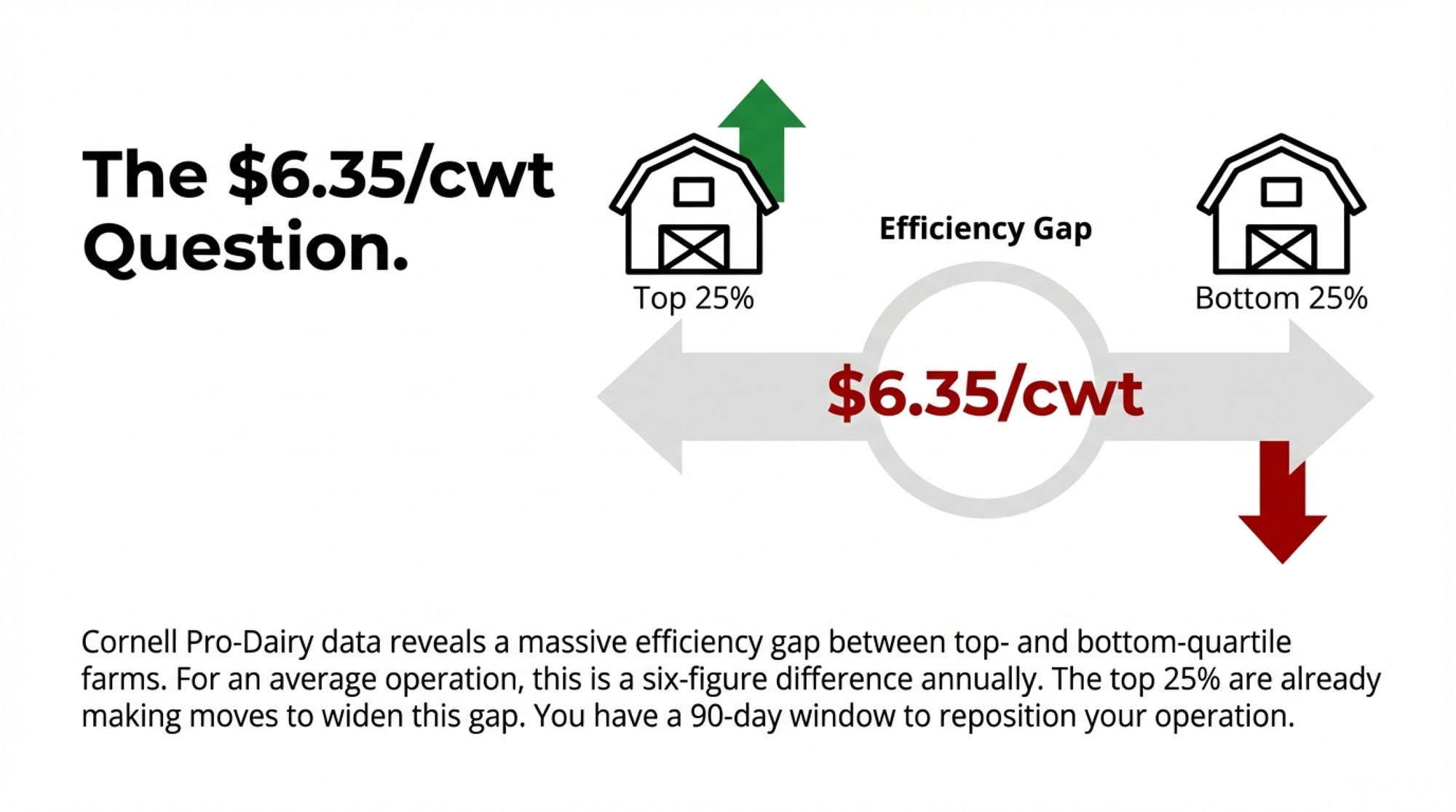

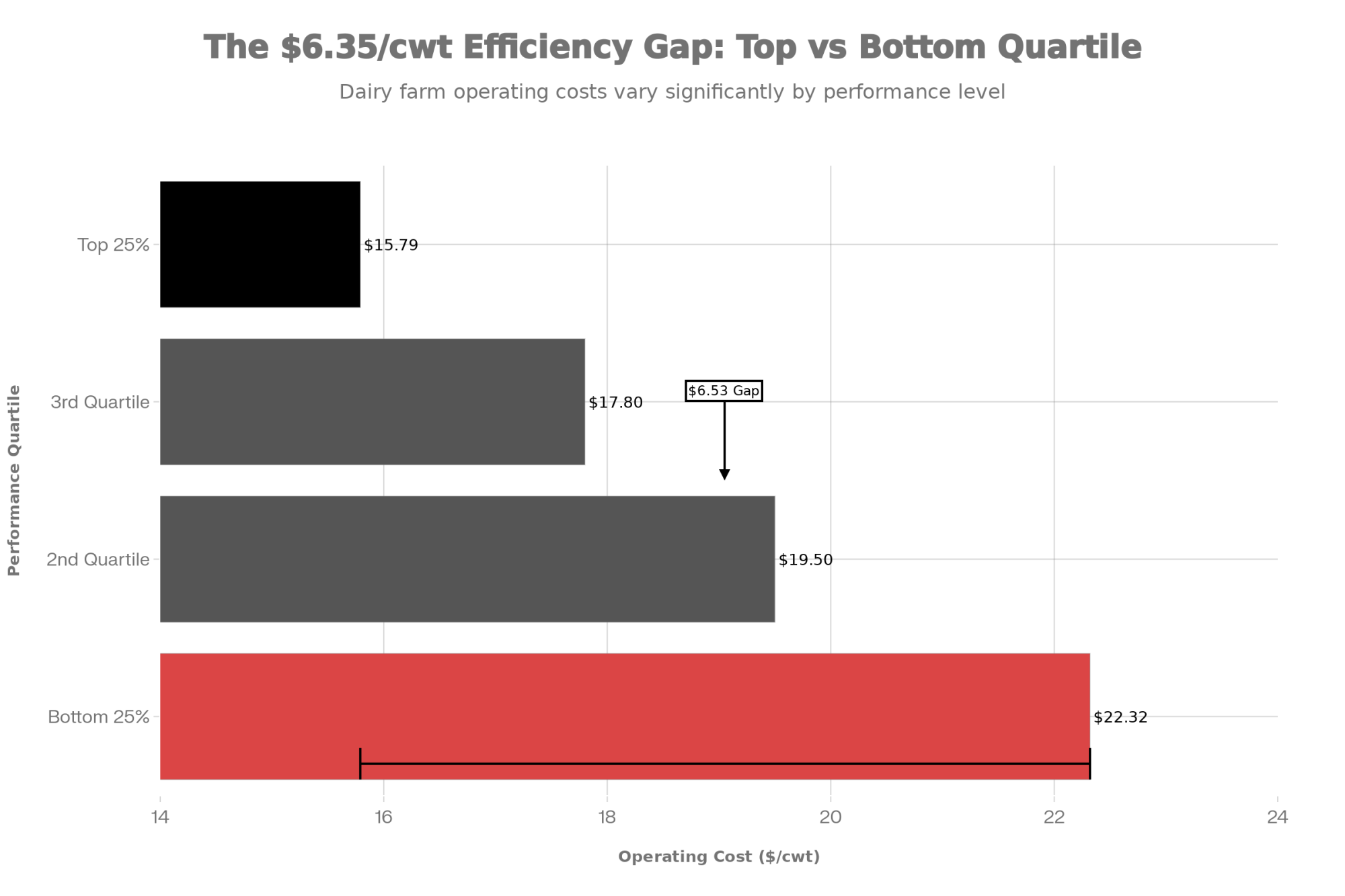

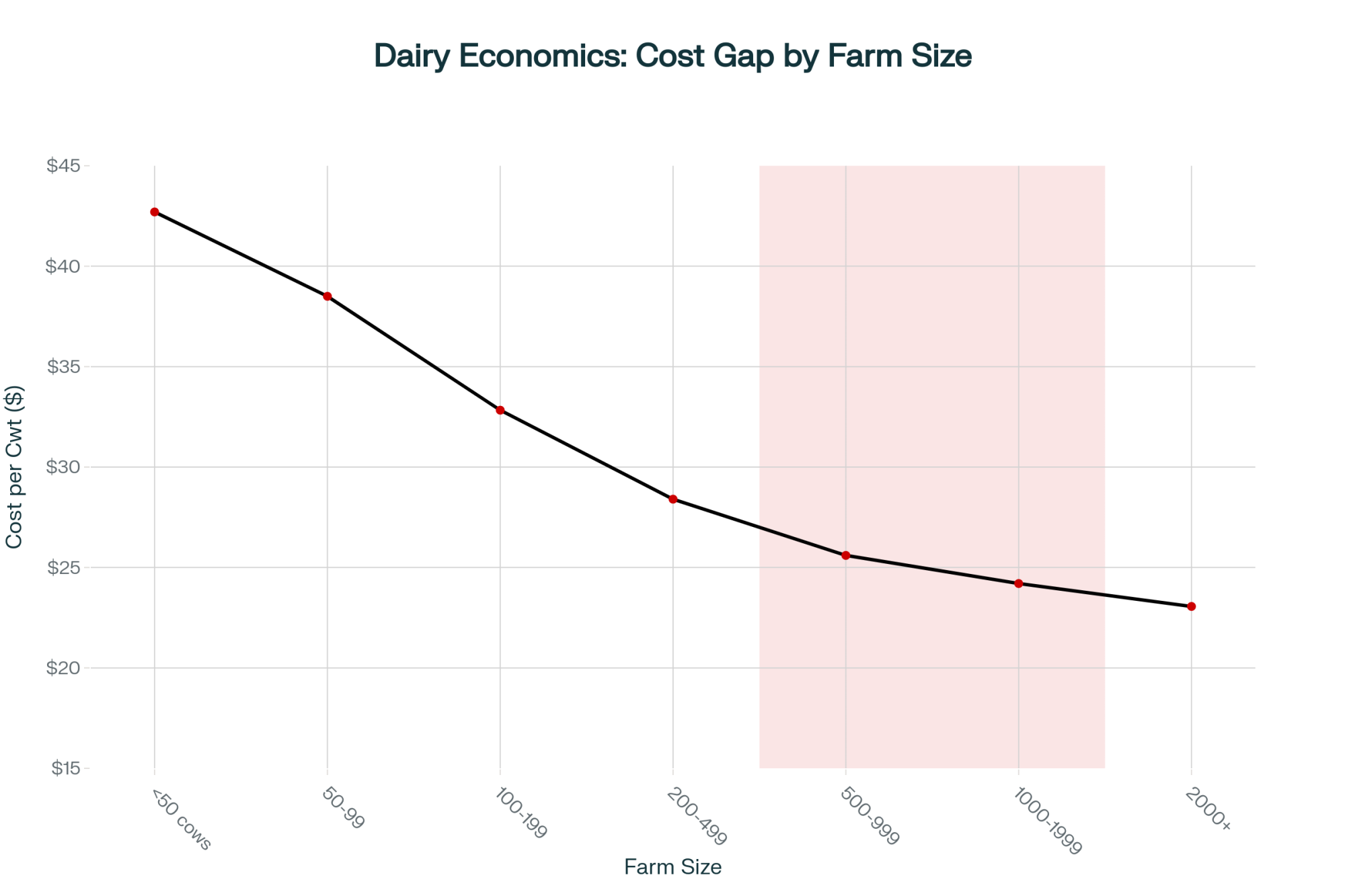

- Stop Tightening Your Belt: Dairy’s $6.35/cwt Gap and Your 90-Day Window to Close It – Capture a $6.35/cwt competitive advantage by closing the efficiency gap currently separating top-quartile dairies from the middle. This strategic guide arms you with a 90-day playbook to navigate structural shifts and the record-low heifer inventories hitting in 2026.

- Revolutionizing Dairy Farming: How AI, Robotics, and Blockchain Are Shaping the Future of Agriculture in 2025 – Gain 99.8% mastitis detection accuracy by leveraging AI-powered sensors that catch infections a full week before symptoms emerge. This deep dive reveals how emerging “Cow Butler” tech saves €1,500 per case and fundamentally redefines the economics of parlor efficiency.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!