Six farms, four countries, zero marketing budget — and more reach than $102.7M in anti‑dairy campaigns. Are you letting strangers explain your barn?

Nathan Ranallo — Nate the Hoof Guy — in west-central Wisconsin. He’d never edited a piece of footage before 2020. The 880 million views came because he didn’t bother starting.

Nathan Ranallo had been trimming hooves in west-central Wisconsin for more than two decades when he started filming his work and posting it online in 2020. “Maybe a year prior to that, I was still using a flip phone,” he told Wisconsin Public Radio. “I had never edited a single piece of footage in my life.” His reasoning, as he later told Wisconsin Public Radio: push back on viral clips that made standard procedures look like torture, and show what proper hoof care actually looked like.

Here’s why this matters to you, even if you never plan to post a single video: these farmers are building something the dairy industry has struggled to buy for decades — real consumer trust. If you’re not shaping the public story of your operation, someone else is telling it for you. They probably won’t get it right.

He told Wisconsin Public Radio he figured other farmers might watch — he never anticipated the broader audience. Two of his most popular TikTok videos have since pulled more than 150 million views combined (Wisconsin Public Radio, July 2024). His YouTube channel — launched in February 2020 — has grown to more than 1.7 million subscribers and passed 880 million total views as of February 2026 (Social Blade; VidIQ).

On TikTok, he’s at roughly 2 million followers. Facebook has 1.6 million users (The Tilt, August 2024). Ranallo — now known to the internet as Nate the Hoof Guy — didn’t see it coming. “Little did I know that it wouldn’t be just farmers watching this, but it would be many more people,” he told Wisconsin Public Radio. “It kind of exploded on me.”

What a Cow Pedicure Teaches About Trust

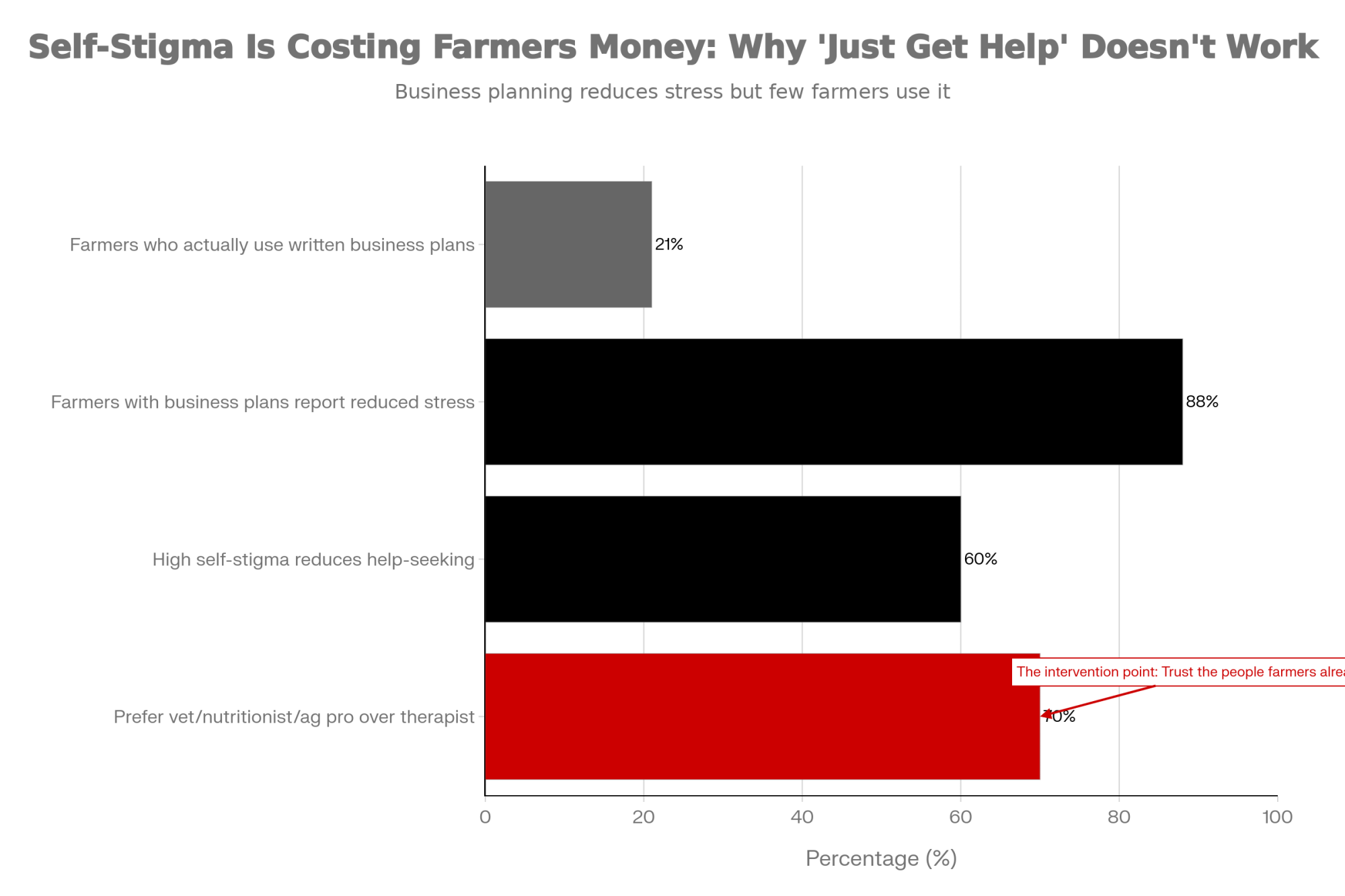

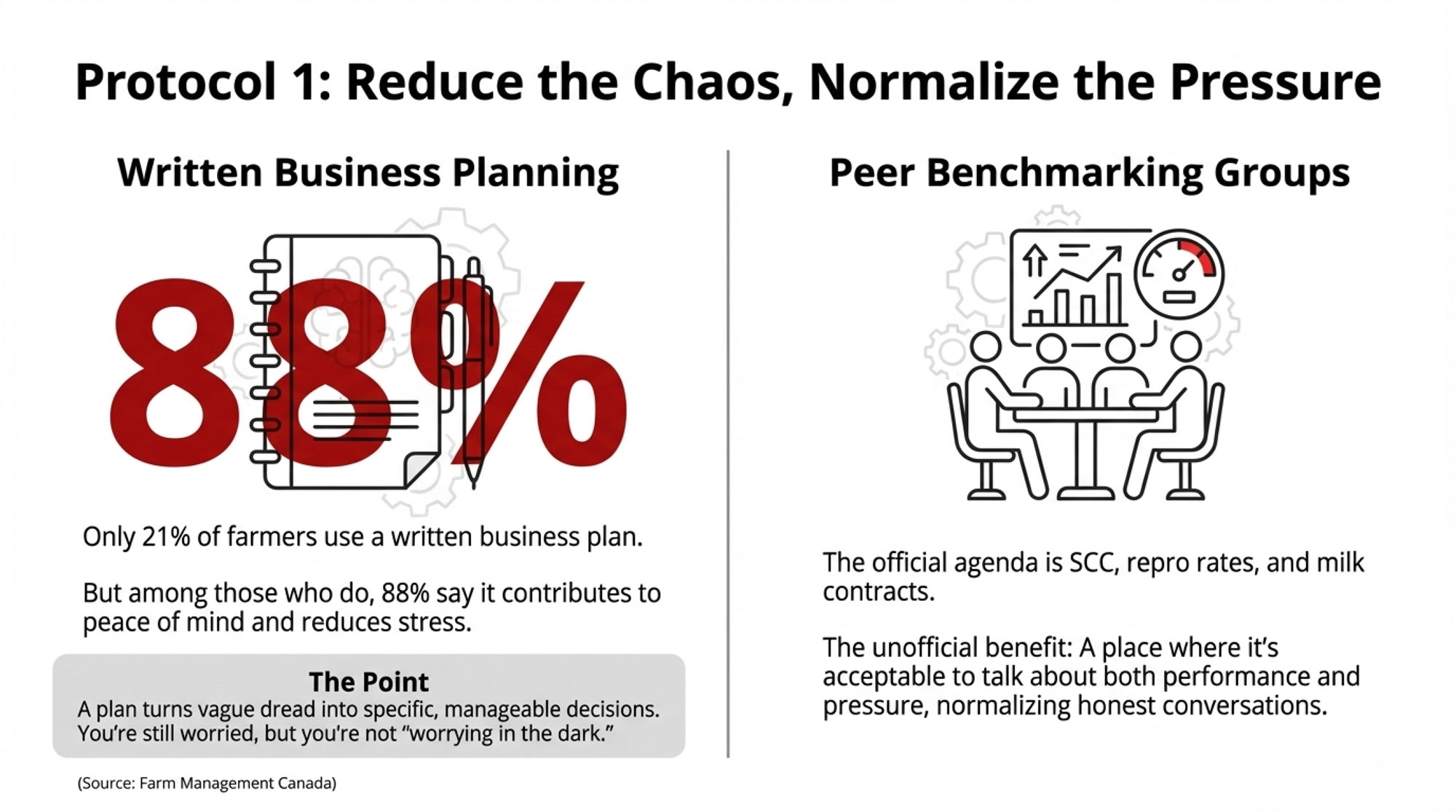

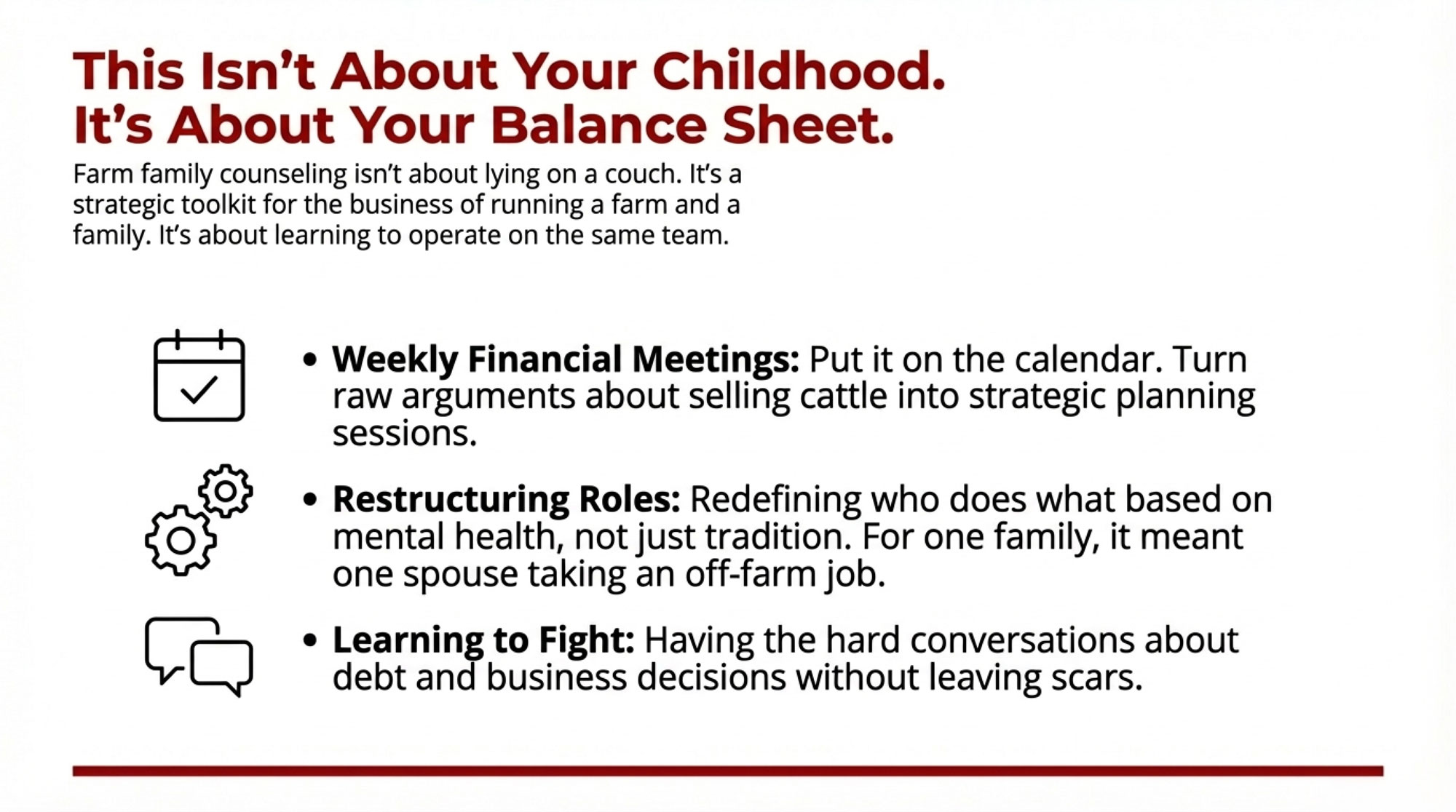

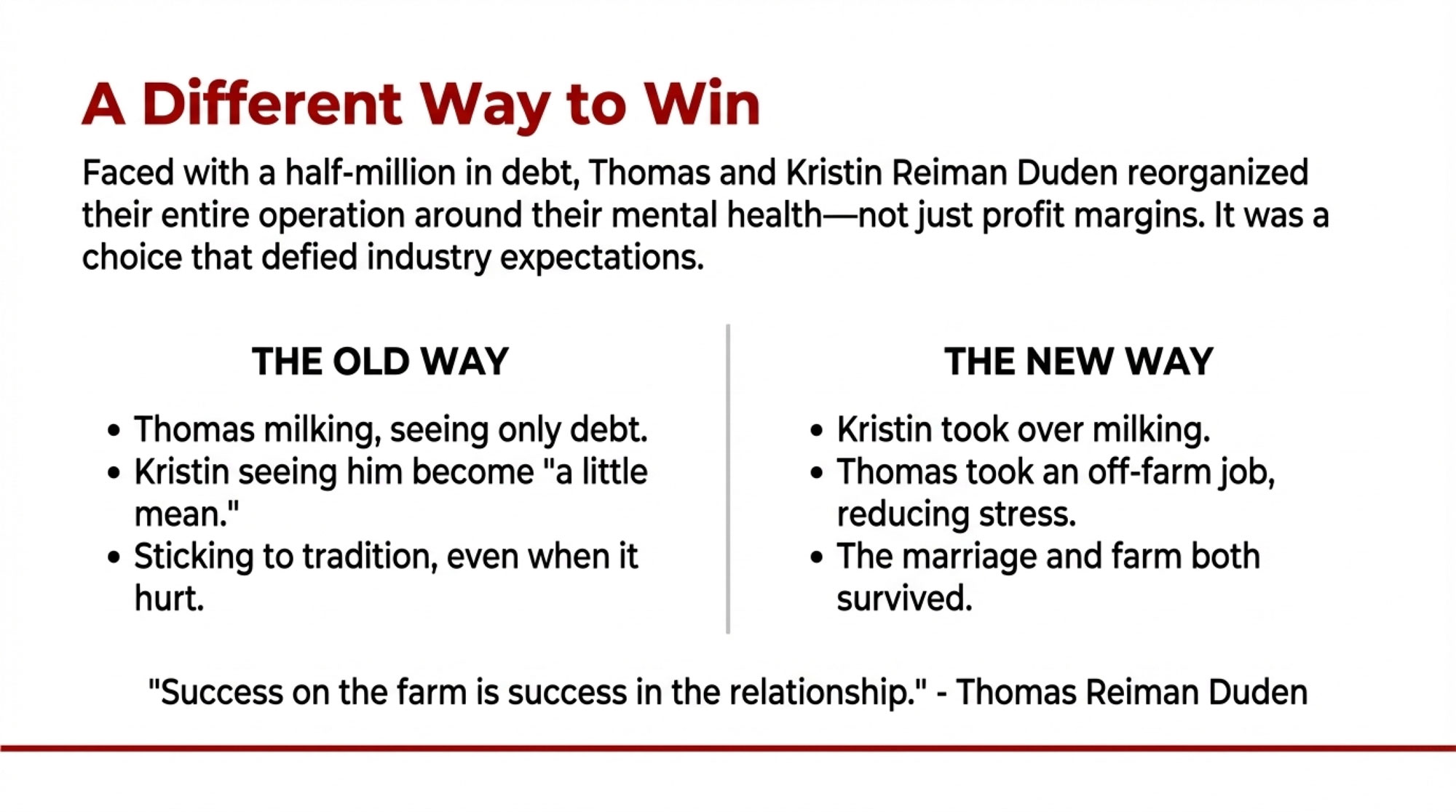

Social license sounds like something a consultant made up for a PowerPoint. But the concept is dead simple: it’s the informal permission the public gives your industry to keep operating. Lose it, and you get ballot initiatives, regulatory crackdowns, and retail buyers who want to talk to somebody else.

Ranallo builds social license without ever using the phrase. His videos look intense — paring overgrown claw, draining abscesses, clearing stones. But he explains every step.

Hoof horn is dead tissue, he tells viewers, much like a fingernail. “The analogy I like to use is: The hard hoof part that they walk on is like a boot that we would wear. We wouldn’t ever feel it if we were taking a rock out of the sole of our boot,” he told Wisconsin Public Radio. The lesions inside the claw are painful, and he’s clear about that, but careful trimming relieves the pressure — you can see the cow walk easier right after treatment.

For millions of viewers who’ve never set foot on a dairy, that’s the moment the industry stops being scary. The psychology mirrors power-washing videos and pimple-popping compilations: a visible problem, methodical work, satisfying relief. Ranallo adds something those genres don’t have — context and education.

The content side isn’t a hobby anymore, either. VidIQ’s algorithmic estimates — based on public view counts, not confirmed earnings — placed Ranallo’s monthly YouTube revenue at $8,000–$24,000 as of fall 2025. Those aren’t guaranteed numbers, and your mileage will vary wildly — but they’re worth weighing against the 30 to 50 hours a week he puts into content production. He also runs a Facebook paid-subscriber tier at $1.99/month and sells merchandise (The Tilt, August 2024). He told WiscNews that he spends 45 to 50 hours a week on hoof trimming and another 30 to 50 hours on content — essentially two full-time jobs.

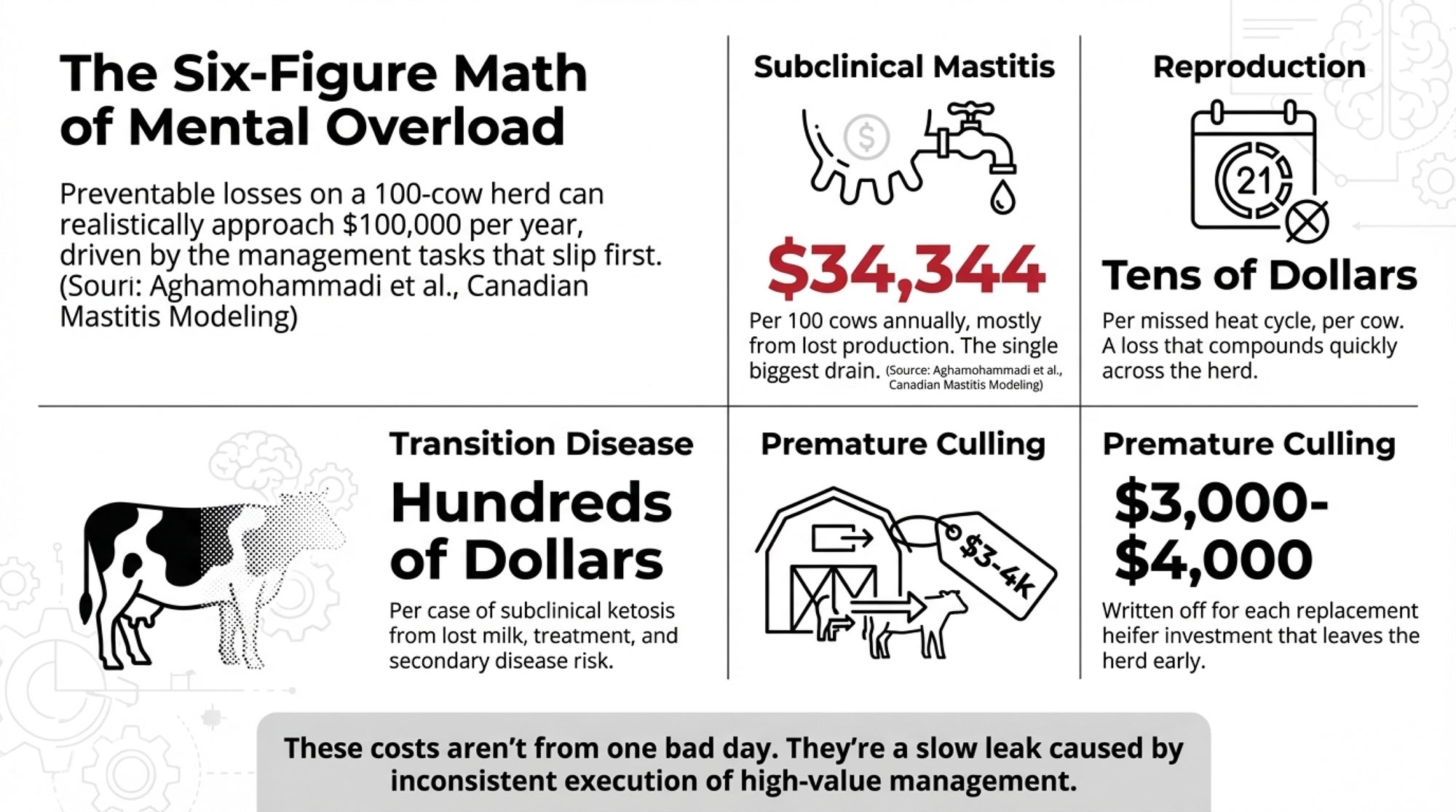

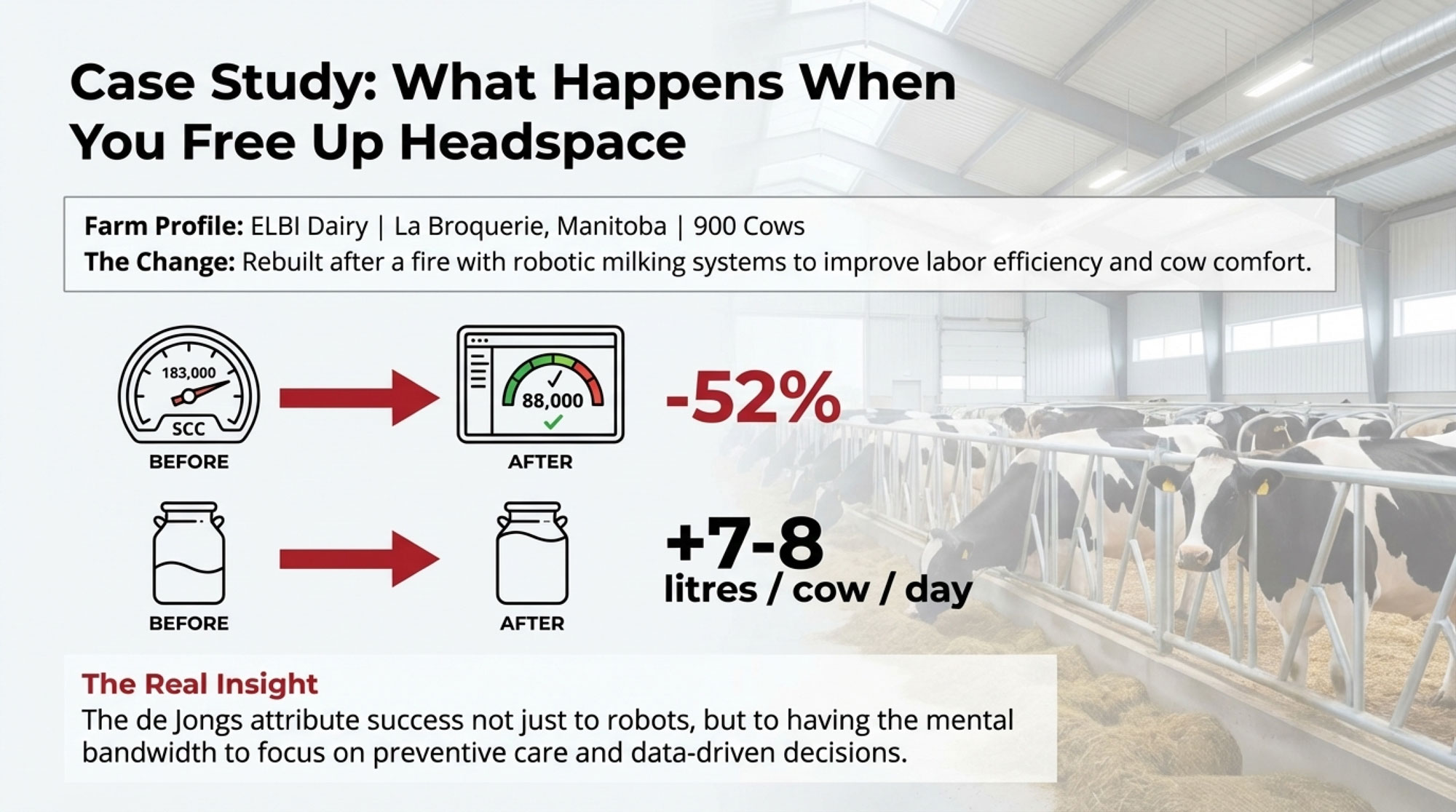

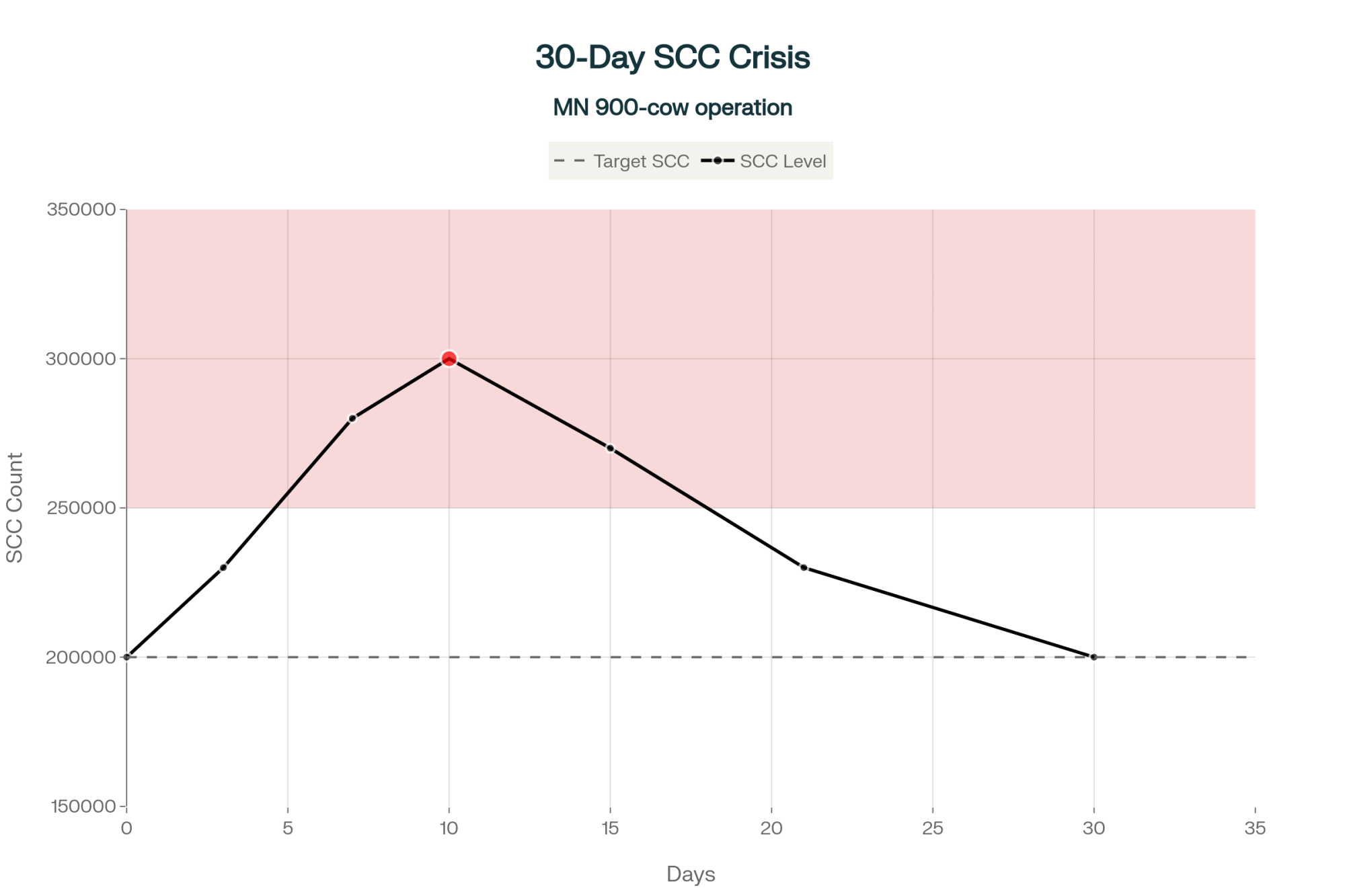

At the low end — $8,000 a month from YouTube, 30 hours a week producing content — that works out to about $62 an hour. At the high end — $24,000 a month, 50 hours a week — closer to $111. You won’t touch those numbers; he’s an extreme outlier with more than 1.7 million subscribers. But the real value for most farm creators isn’t ad revenue. It’s the consumer trust that already exists before a crisis hits your county. And if you want to understand the real cost of lameness — and why hoof health is your most underrated profit driver, the connection between what Ranallo shows on camera and what’s happening in your barn is tighter than you’d think.

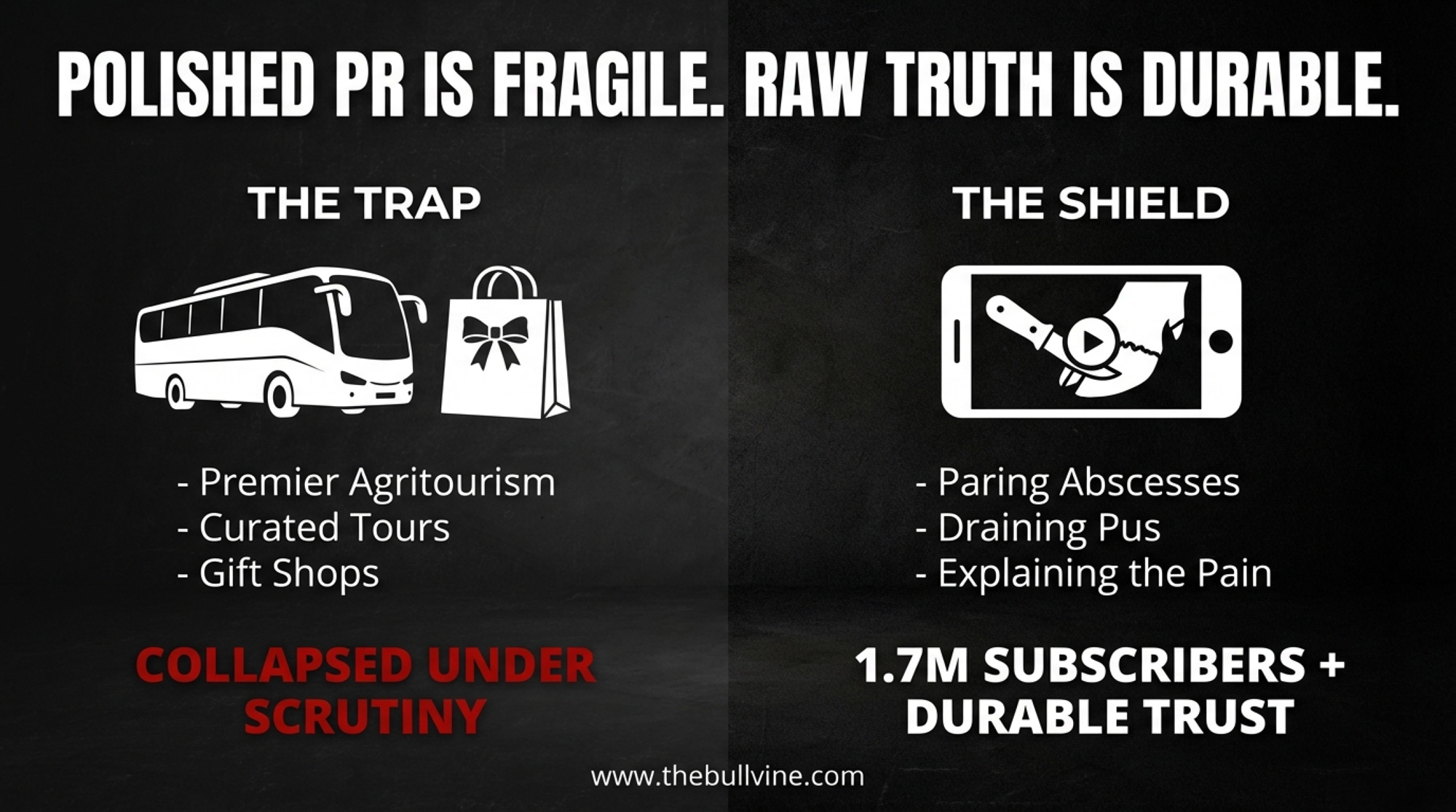

When Polished Transparency Shatters

And crises do hit. In June 2019, undercover footage from Fair Oaks Farms in Indiana went viral overnight (CBS News, June 2019). This wasn’t some anonymous operation with no public face — Fair Oaks was the Midwest’s premier agritourism destination, drawing more than 600,000 visitors a year to guided dairy tours and a birthing barn where visitors watched calves being born (Guardian, June 2019; IndyStar, June 2019).

Fair Oaks Farms in Indiana — 600,000 visitors a year, guided tours, a calf birthing barn. The actual working barns weren’t on the route. That gap is what collapsed in June 2019.

Retailers pulled Fairlife products from shelves. Owner Mike McCloskey posted a widely circulated video apology. Fair Oaks had invested more in public engagement than almost any dairy in the country — but it was the polished, curated kind. Guided bus tours and gift shops sat along the visitor route while the actual working barns didn’t (Center for Land Use Interpretation, 2013; IndyStar, June 2019).

When undercover footage showed what happened where the tours didn’t go, the gap between the brand and the barn destroyed trust more thoroughly than if there’d been no public face at all. That’s the distinction Ranallo, Pemberton, and Payne demonstrate in their own content: showing the raw, sometimes ugly, daily reality weathers scrutiny. A visitor center shatters under it.

A New York dairy that faced a PETA campaign offers the flip side. The owner called an AP reporter who’d requested an interview and invited her to the farm. The reporter declined the visit — but dropped the story entirely.

In her research, she’d found a news release from the New York Animal Agriculture Coalition about the farm’s NYSCHAP certification and contacted Cornell’s PRO-DAIRY program, which confirmed the farm’s reputation (Bovine Veterinarian, May/June 2016). The difference wasn’t size or budget. It was whether authentic trust existed before the camera showed up. That story — and others like it — speak to why social license is the issue dairy can’t afford to ignore.

Can a 4,500-Cow Operation Feel Personal?

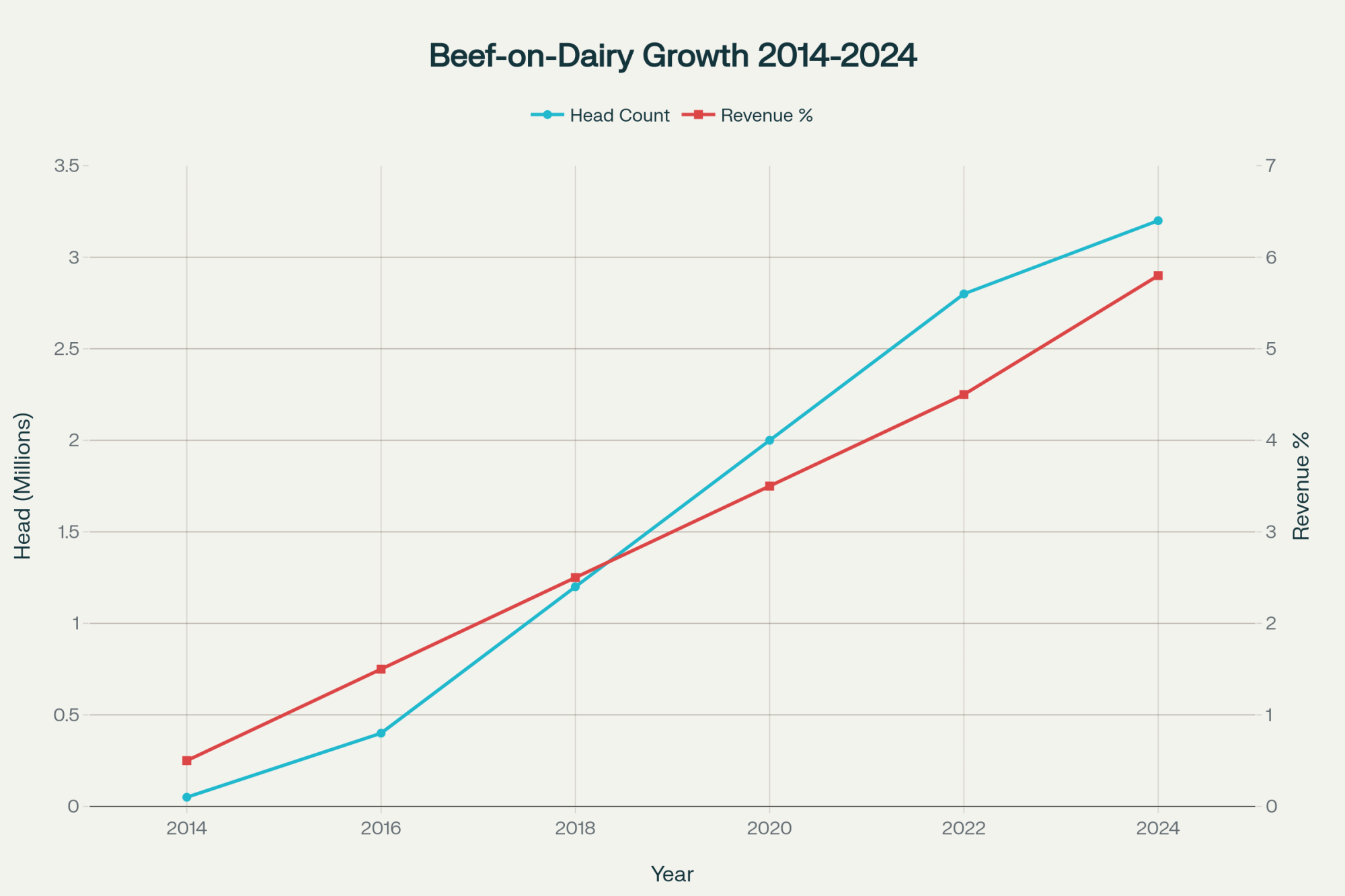

One of the most stubborn myths in the public dairy conversation — and one your consumers almost certainly believe — is that scale automatically equals cruelty. MVP Dairy in Celina, Ohio, is proving that assumption wrong one TikTok at a time.

MVP is owned and operated by two fourth-generation farming families: the McCartys of Colby, Kansas, and the VanTilburgs of Celina, Ohio. The operation milks 4,500 cows and supplies Danone North America (PR Newswire, June 2020). “As 4th generation farmers, we know the care we provide to our cows, land, and team members today can help create a more sustainable world tomorrow,” co-owner Ken McCarty told Dairy Reporter when MVP earned its B Corp Certification (Dairy Reporter, June 2020).

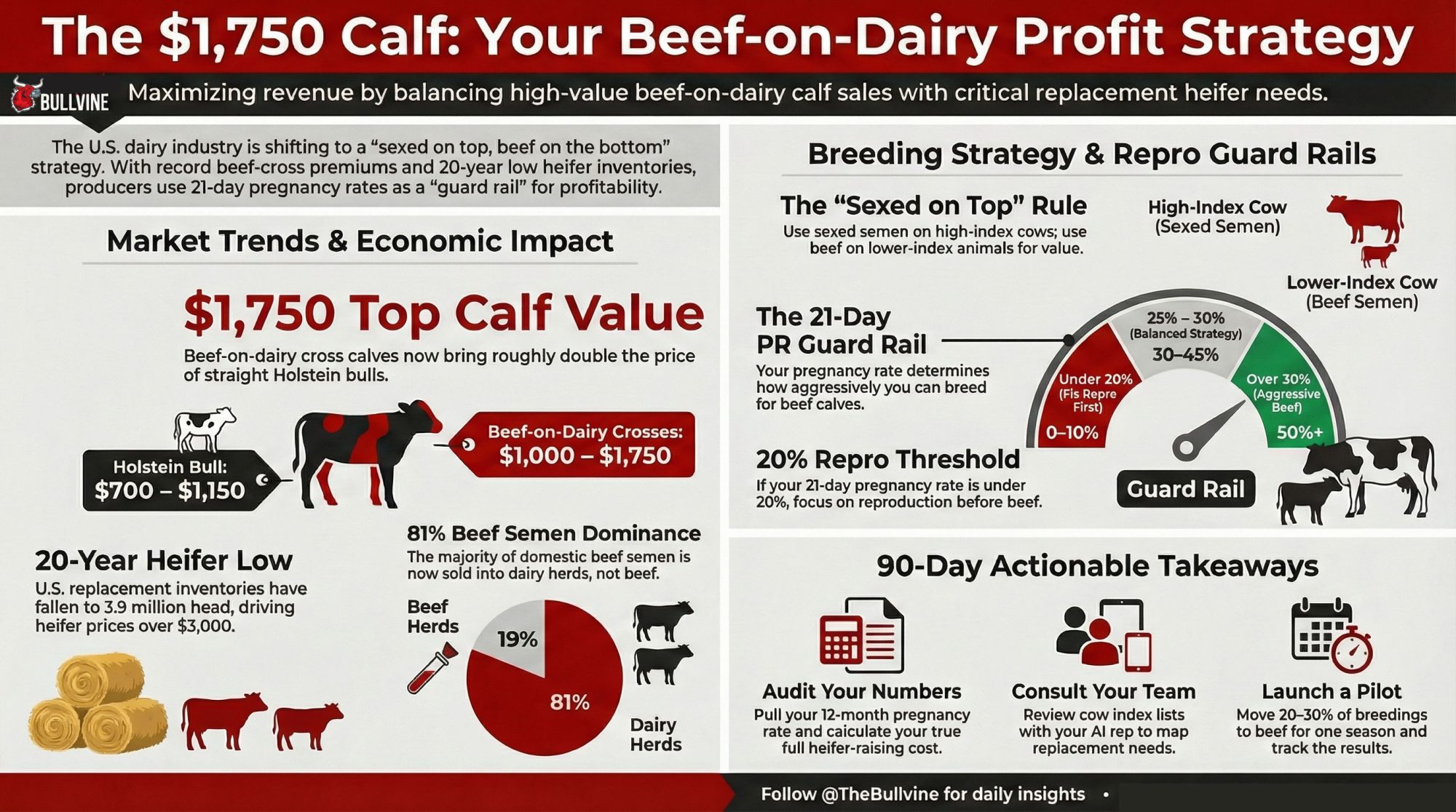

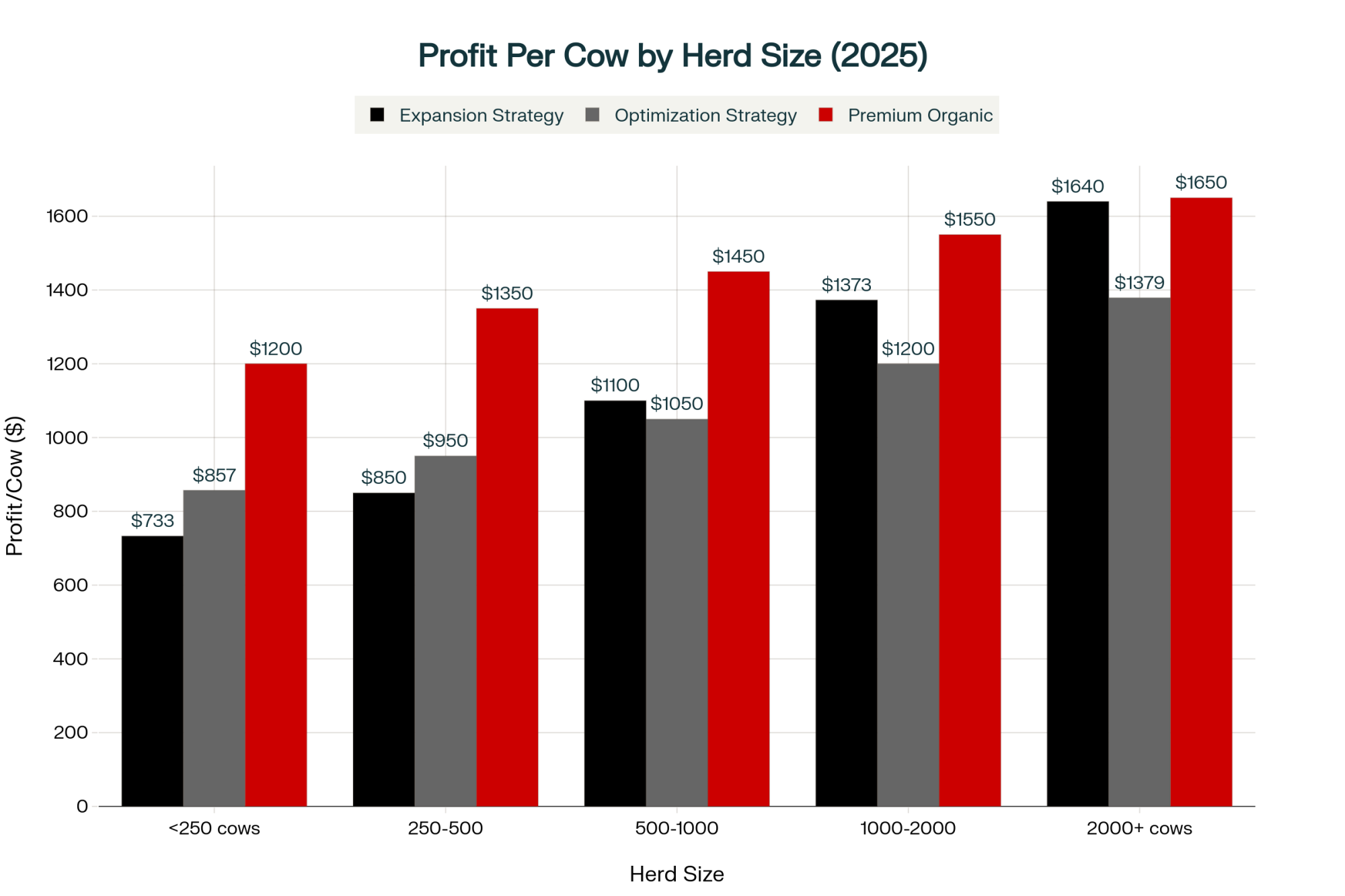

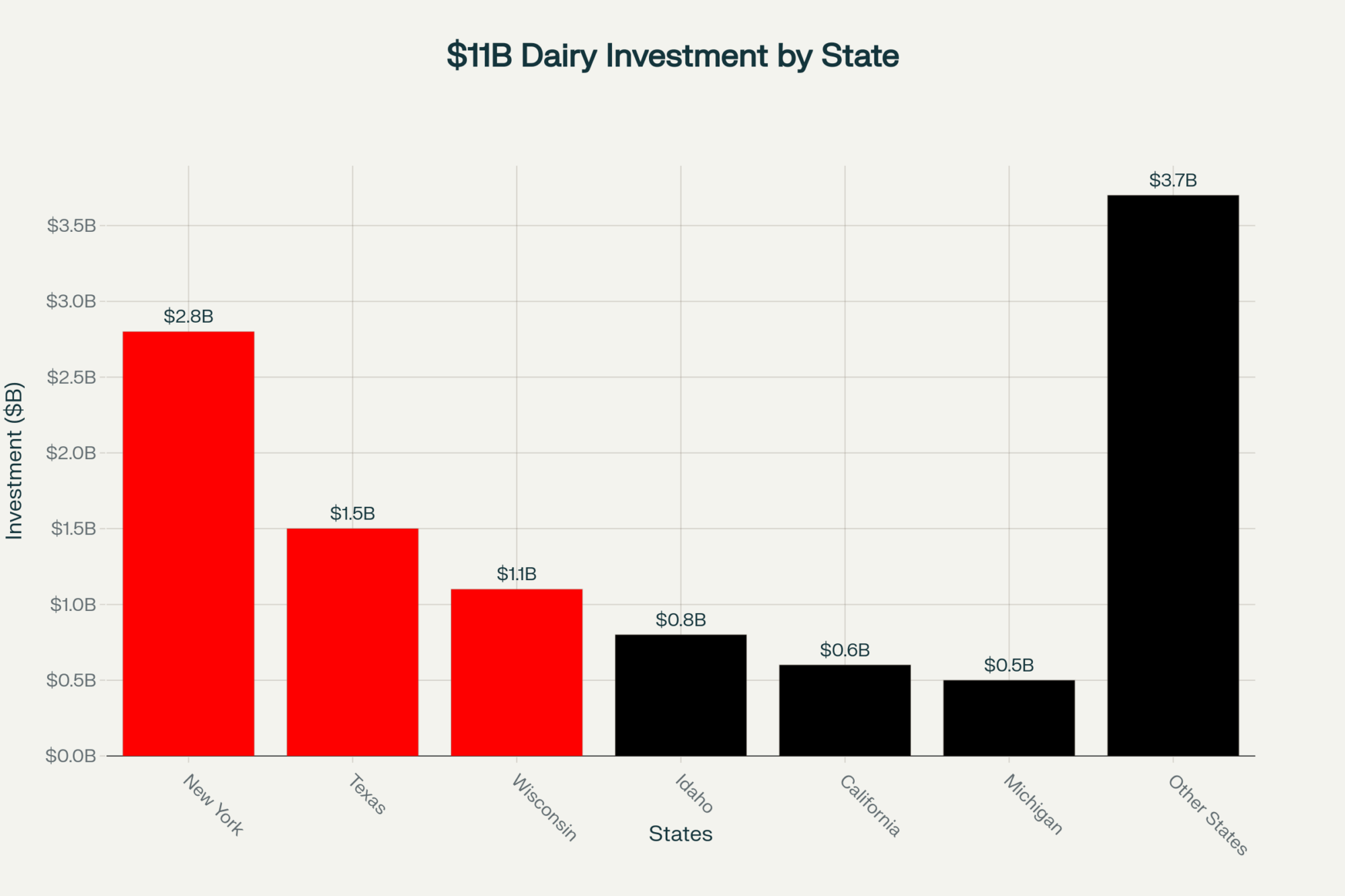

That certification carries weight. To become a B Corp, MVP completed B Lab’s Impact Assessment — covering governance, workforce, community, and environmental performance — scoring 106.3 at its initial 2020 certification, well above the 80-point minimum (PR Newswire, June 2020). B Lab’s current listing shows a score of 102.7 following recertification (bcorporation.net, accessed February 2026). The farm is also DairyCARE certified through Where Food Comes From and was named the 2020 Innovative Dairy Farm of the Year.

Those credentials sit behind the TikTok feed. On social media, MVP doesn’t look like a sustainability report — it looks like cow-comfort walkthroughs, parlor routines, and “pampering the girls” trends, shot by real people in the barn. An audit score north of 100, plus a person in coveralls talking to the camera? That combination makes a 4,500-cow dairy feel like a place you could walk through, not a place you’d protest outside.

MVP took that principle offline, too. The Dairy Learning Center, a nonprofit onsite, invites the public to explore interactive displays, view cows being milked on a carousel, and shuttle through the free-stall barns (dairylearningcenter.com; TripAdvisor, 2026). Unlike Fair Oaks, MVP pairs the physical experience with daily, unpolished social content and third-party verification. It’s the combination that builds durable trust.

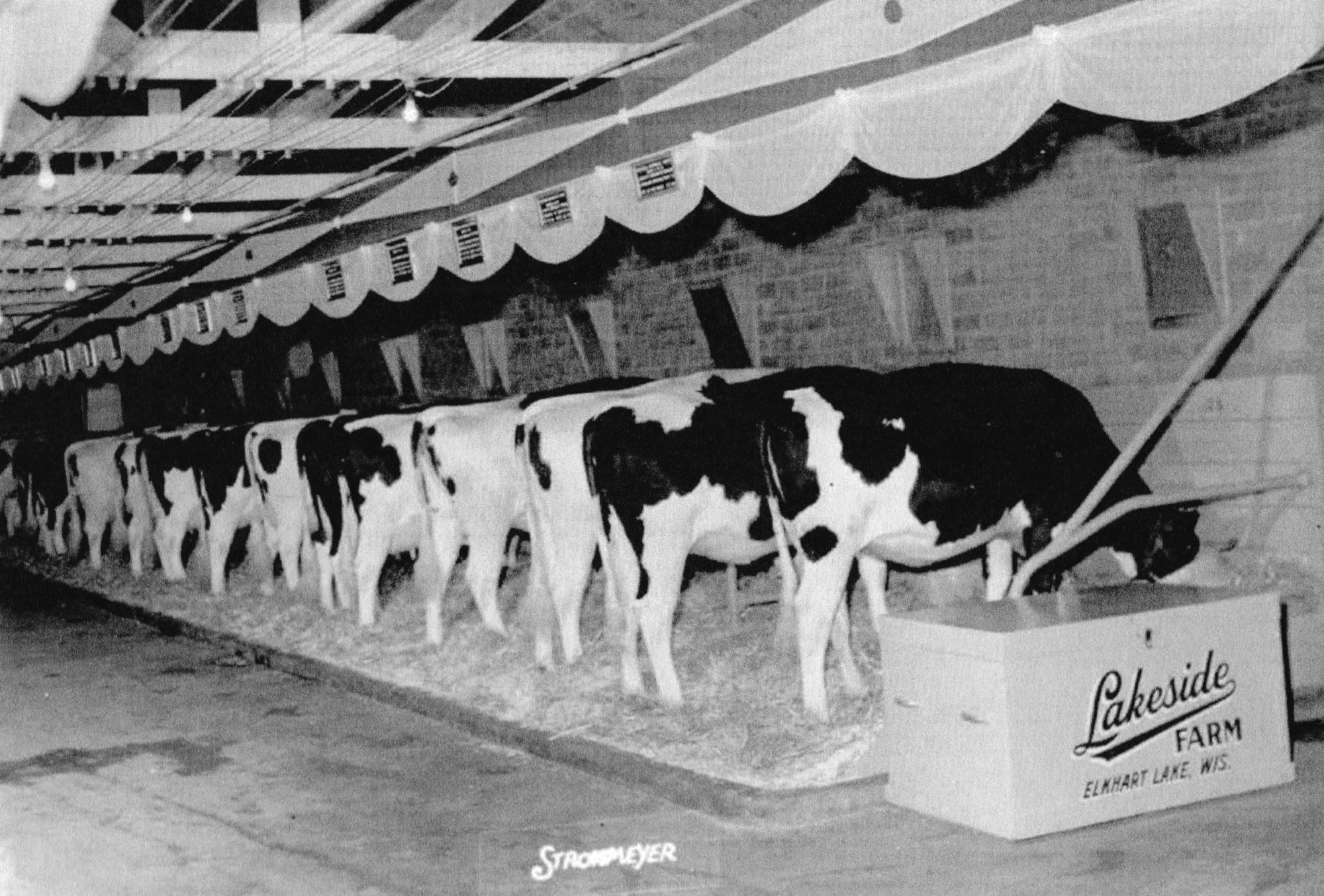

Inside MVP Dairy’s Learning Center in Celina, Ohio — a 4,500-cow operation that invites the public through the barns, not around them. B Corp certified. DairyCARE audited. Hands-on, not hands-off.

Should Your Dairy Farm Be on Social Media?

That’s the real question this whole trend forces. And the honest answer is: it depends on what you’re trying to accomplish, how much time you can spare, and what you’re protecting against. But the farmers building a real farm social media presence share patterns worth studying.

Tom Pemberton runs a mixed dairy-and-beef operation at Birks Farm near Lytham in Lancashire, England (BBC, November 2019). His YouTube channel has grown to 591,000 subscribers and more than 228 million views across over 1,000 uploads as of early 2026 (Social Blade, January 2026). What makes Pemberton worth your attention is what he doesn’t hide — the slurry, the silage, the equipment breakdowns, the days when nothing works. His audience returns not for highlights but because the full picture, grim days included, feels real.

What Makes a Cow Go Viral?

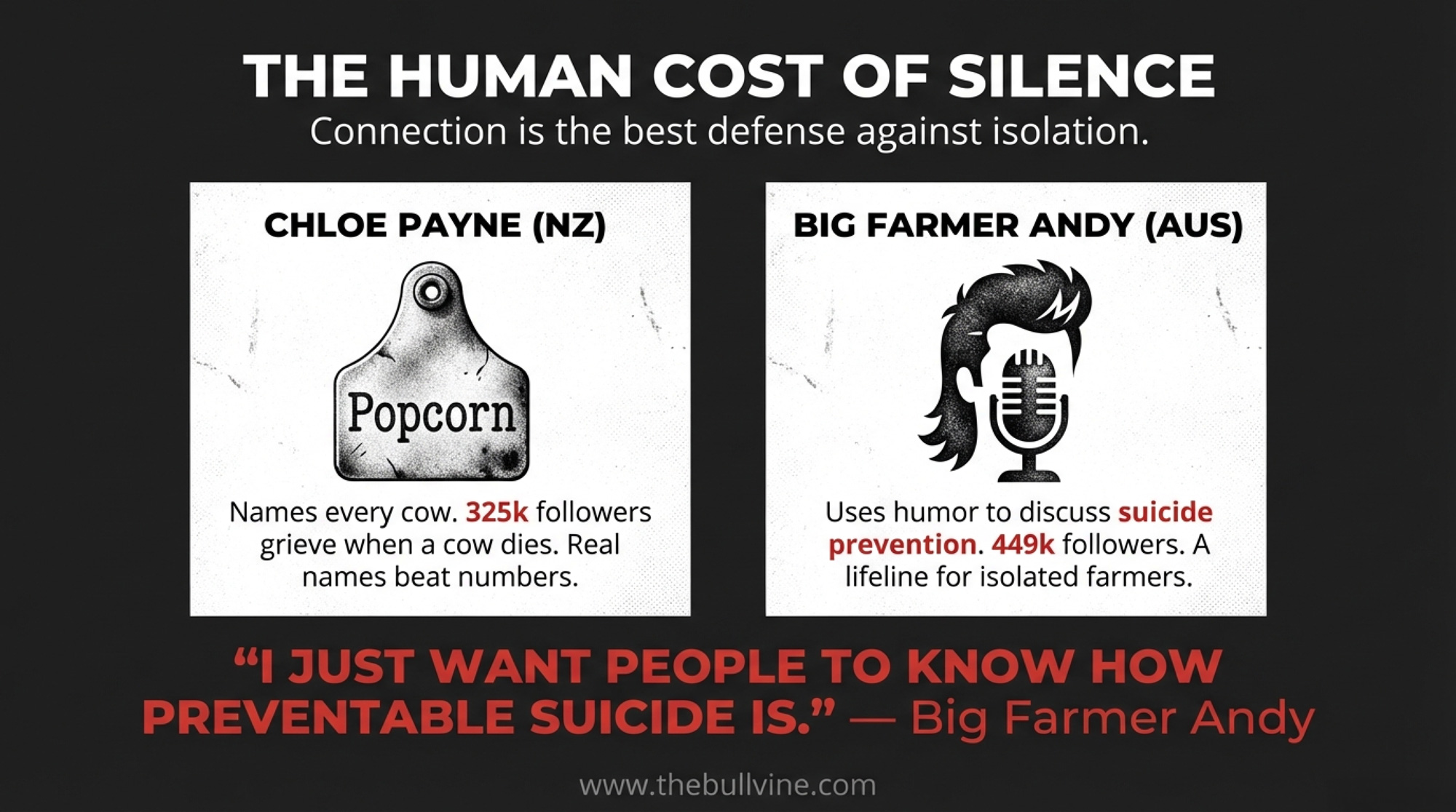

Down in Ikamatua on New Zealand’s West Coast, herd manager Chloe Payne took a completely different route to the same destination. She manages 600 mixed-breed cows — mainly Fleckvieh — on a 240-hectare milking platform, and owns 26 personally, all with names (Guardian Online, May 2024). Her Instagram account, Cows of New Zealand (@cowsofnewzealand), reached 325,000 followers by mid-2024 after gaining 270,000 in a single year.

Chloe Payne and friend, Ikamatua, New Zealand. The tattoo on her arm is Brown Sugar — a Jersey she loved enough to ink permanently. 325,000 Instagram followers showed up for exactly this.

A cow named Popcorn was one of her first viral stars — Payne told the Guardian that people still follow her account years later because of Popcorn. Then came Barbie, a Fleckvieh-Friesian calf whose photo pulled 2.4 million likes on Instagram and wound up on Khloe Kardashian’s account (NZ Dairy Exporter, January 2024). And Brown Sugar, a Jersey so beloved that Payne had a tattoo of her inked on her thigh (NZ Dairy Exporter, January 2024).

When Gingerbread — Brown Sugar’s daughter died in the spring of 2023, Payne compiled a video tribute to her life and shared it with her followers, many of whom had watched the calf grow up on their feeds (NZ Dairy Exporter, January 2024). “They see what happens on the farm and get to see that cows here are not just a number,” she told the NZ Dairy Exporter.

“If We Don’t Show It, Someone Else Will”

Jan Kielstra — SaskDutch Kid on YouTube — rounds out the picture from Saskatchewan. His parents, Bruce and Vicki, started milking 42 cows in 1996; today, Kielstra Holsteins runs roughly 380 head (YouTube channel description, 2026). His YouTube has grown to 223,000 subscribers and 63 million views (VidIQ, January 2026). His take on why he does it is the simplest version of the argument: “If we don’t show how we do things on a farm, someone will” (Sweet Peas Evening Ag News, March 2020).

Real dirt, real names, real problems outperform polish. They always have. For a different kind of story about the family that chose dairy chores over the NHL draft, the theme is the same — showing that the real thing beats selling the shiny version.

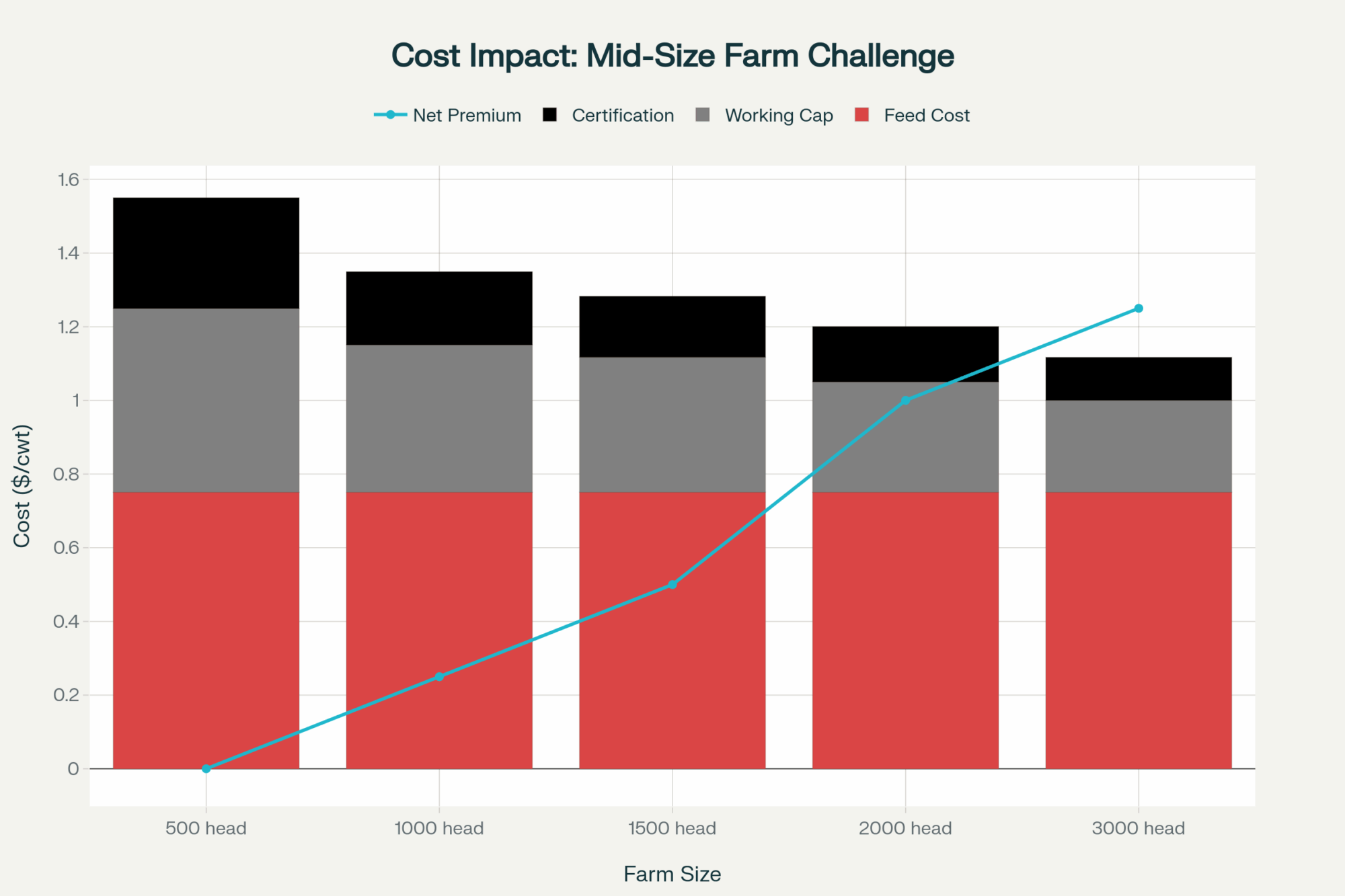

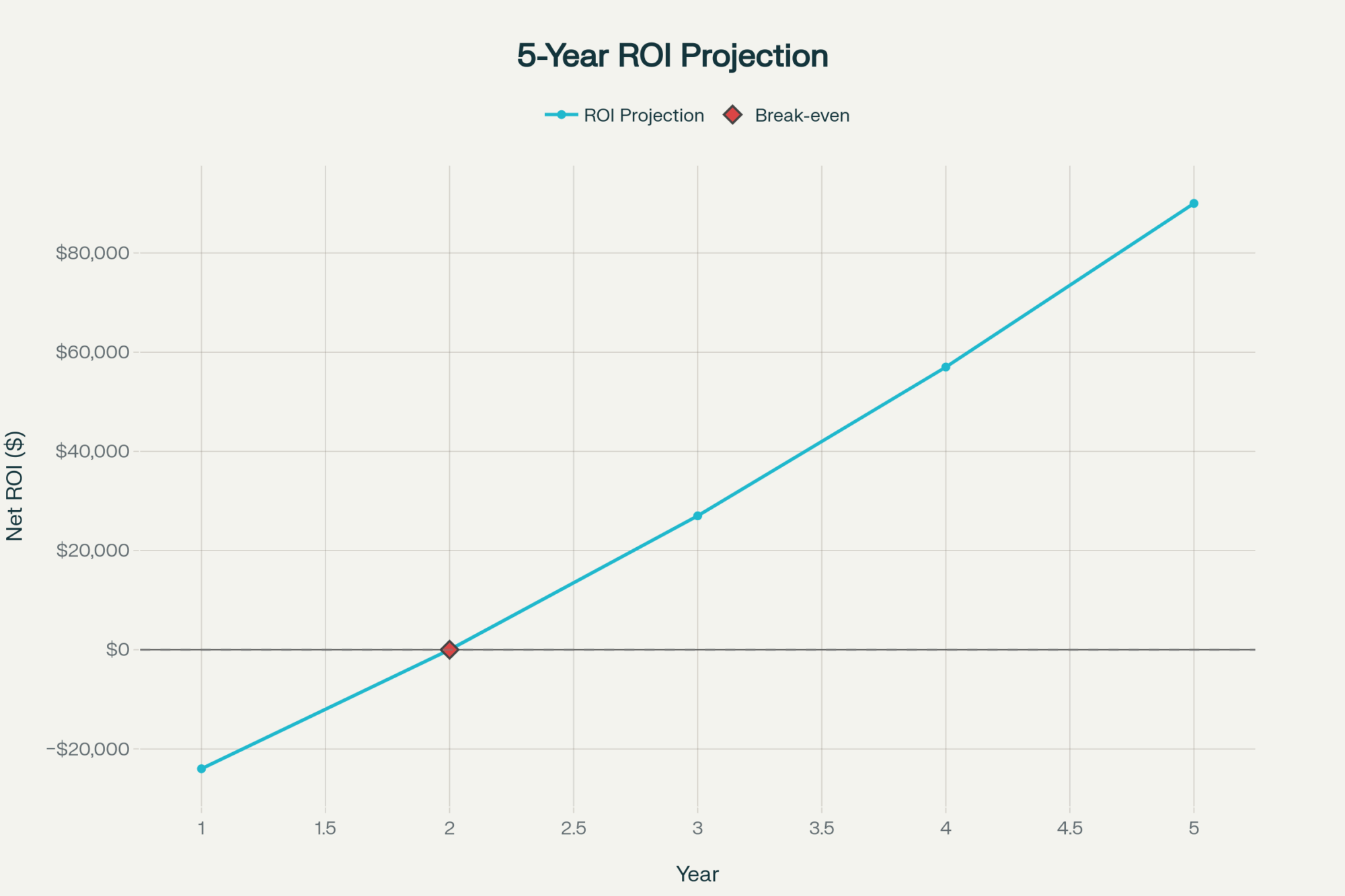

What Does Farm Social Media Actually Cost?

Chloe Payne is honest about the money. She told the Guardian in May 2024 that her Instagram is still a hobby and doesn’t generate much income — though she’d love to earn enough to eventually retire her pet cows. Even with 325,000 followers, the direct revenue isn’t there yet.

Big Farmer Andy — a third-generation dairy farmer in Australia whose grandfather emigrated from Holland in 1936 — started on TikTok almost by accident (Australian Farmers podcast, September 2022). A nose operation in November 2020 left him stuck inside for two weeks, so he posted some old farm videos to kill time. They blew up. His TikTok following stood at 449,200, with 14.5 million likes, as of early 2026 (TikTok, January 2026).

Big Farmer Andy — “Full time farmer, part time washed up tiktoker” — surrounded by what are very clearly not dairy cows. His humour built a TikTok audience of 449,200. His honesty about three mates lost to suicide is why they stayed.

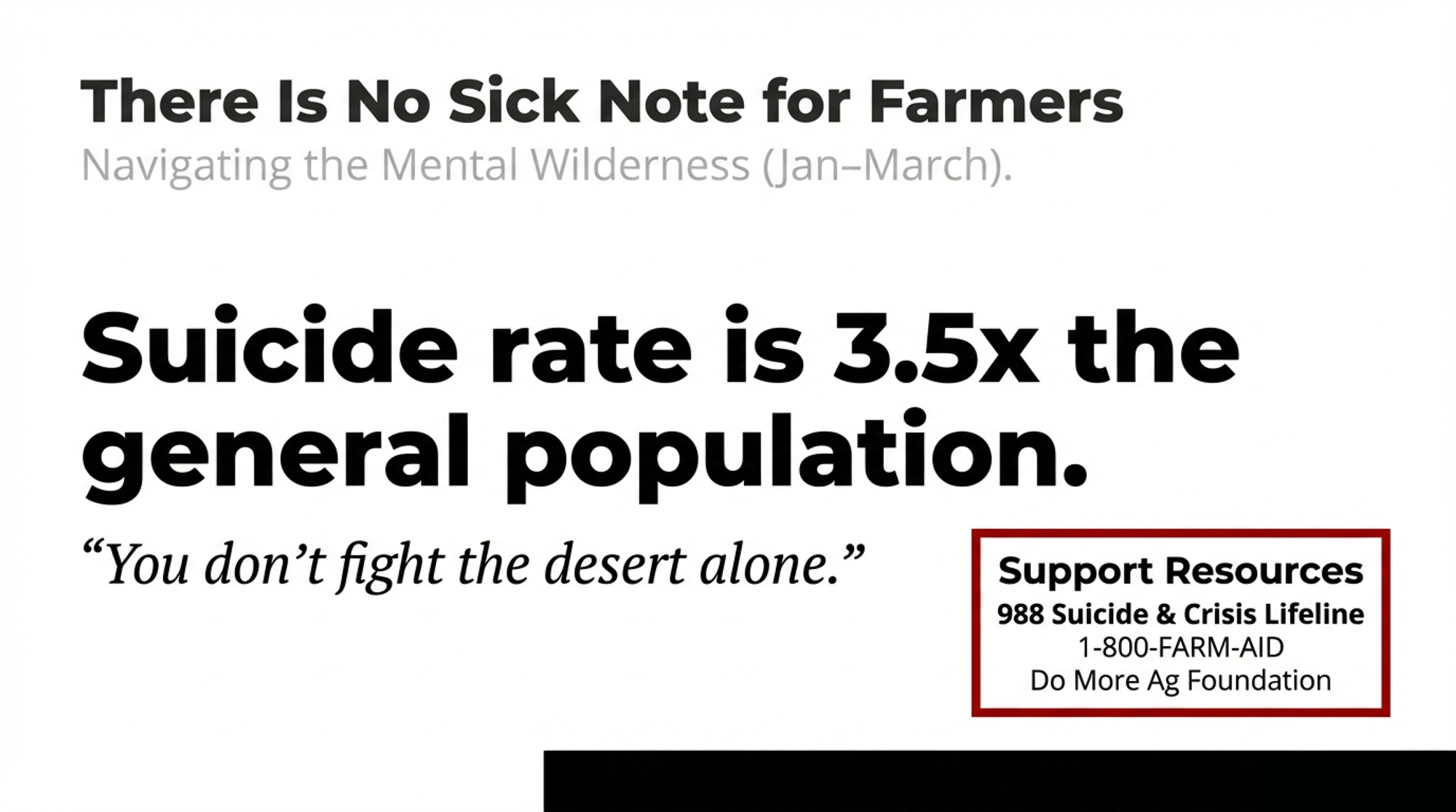

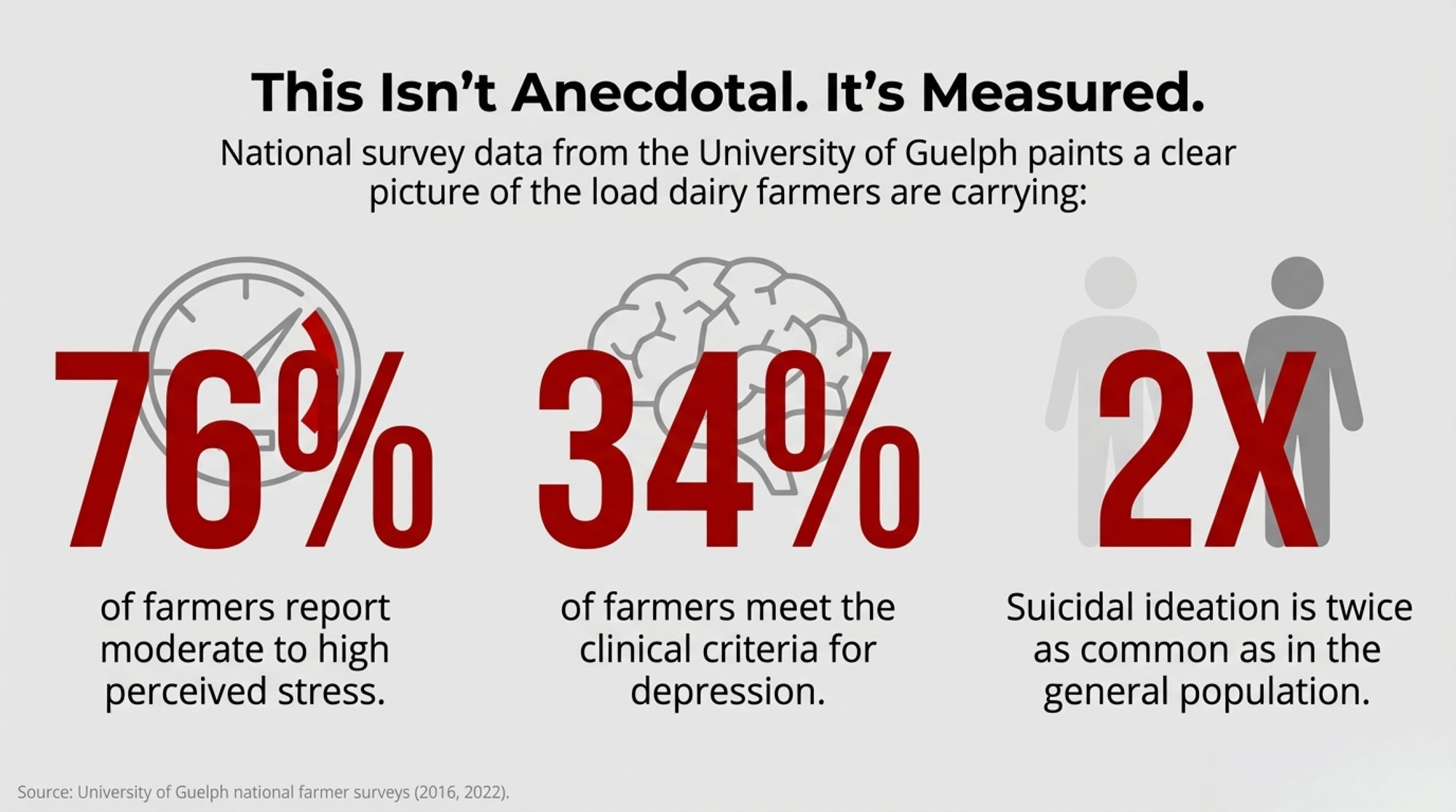

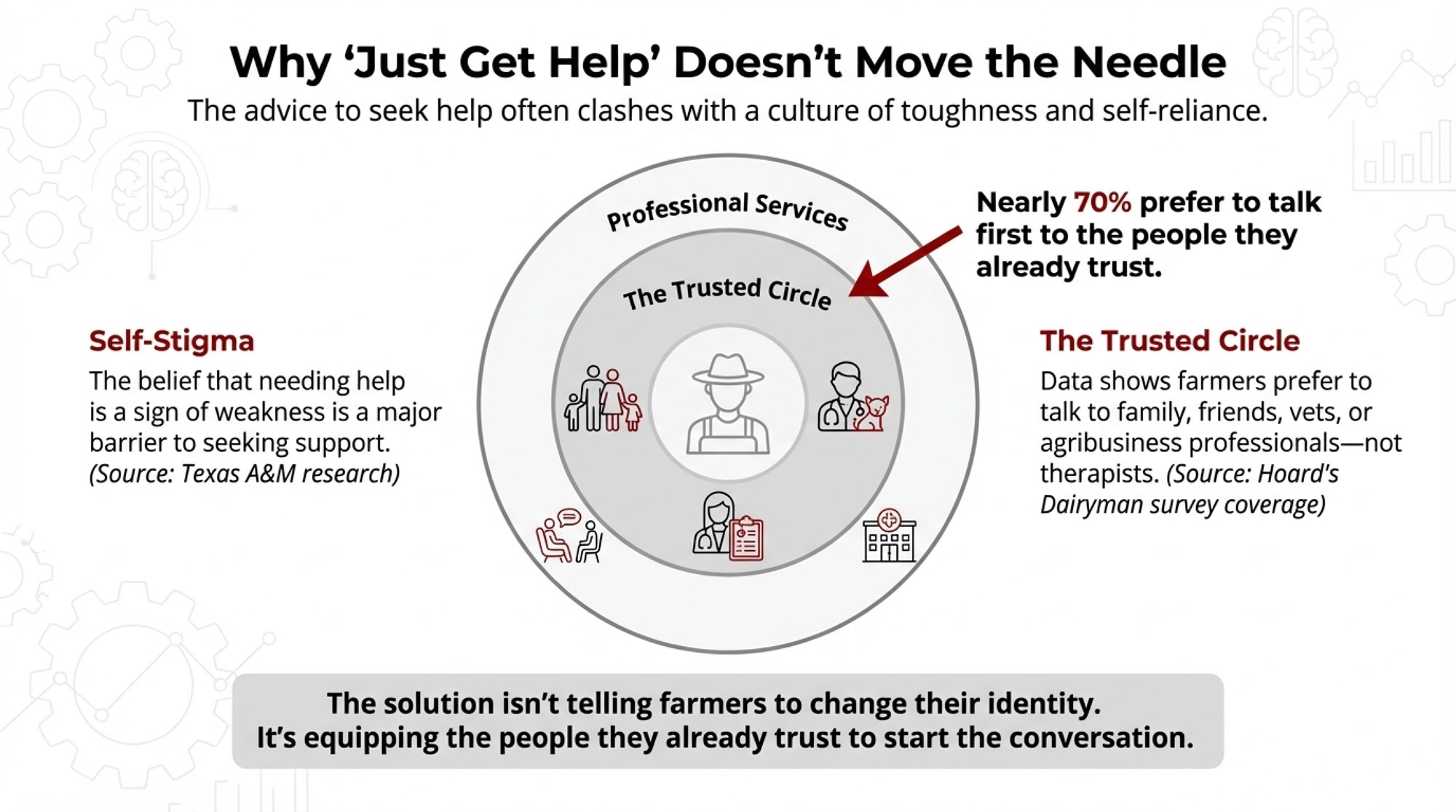

Andy’s hook is humour — his bio reads “Full time farmer, part-time washed-up TikToker.” But his most important content isn’t funny. He’s one of the few agricultural creators willing to talk openly about the mental health toll of farming. “I also know, in my life, three young men who have died from suicide,” he told the Australian Farmers podcast.

“I know there are a lot of people in the community who struggle and suffer in silence,” Andy said in the same interview. “I just want people to know how preventable suicide is.” He grew a fundraising mullet to raise money for Australia’s Black Dog Institute and directs followers to mental health resources (Australian Farmers podcast, September 2022; 4BC, March 2023).

That’s the trade-off nobody puts in the marketing deck. Social media gives dairy farmers a tool for consumer engagement, yes. But for isolated operators, it can also be a lifeline — a bridge to the outside world during stretches when the only conversations you’re having are with the herd. The flip side is real, too: visibility invites hate comments, trolls, and scrutiny you didn’t ask for. Payne told the Guardian she focuses on the followers who genuinely want to learn about the industry — that’s the right line. And if isolation is a factor on your operation, Andy’s experience points to something worth reading: the suicide risk dairy farmers face — and what your operation can do about it.

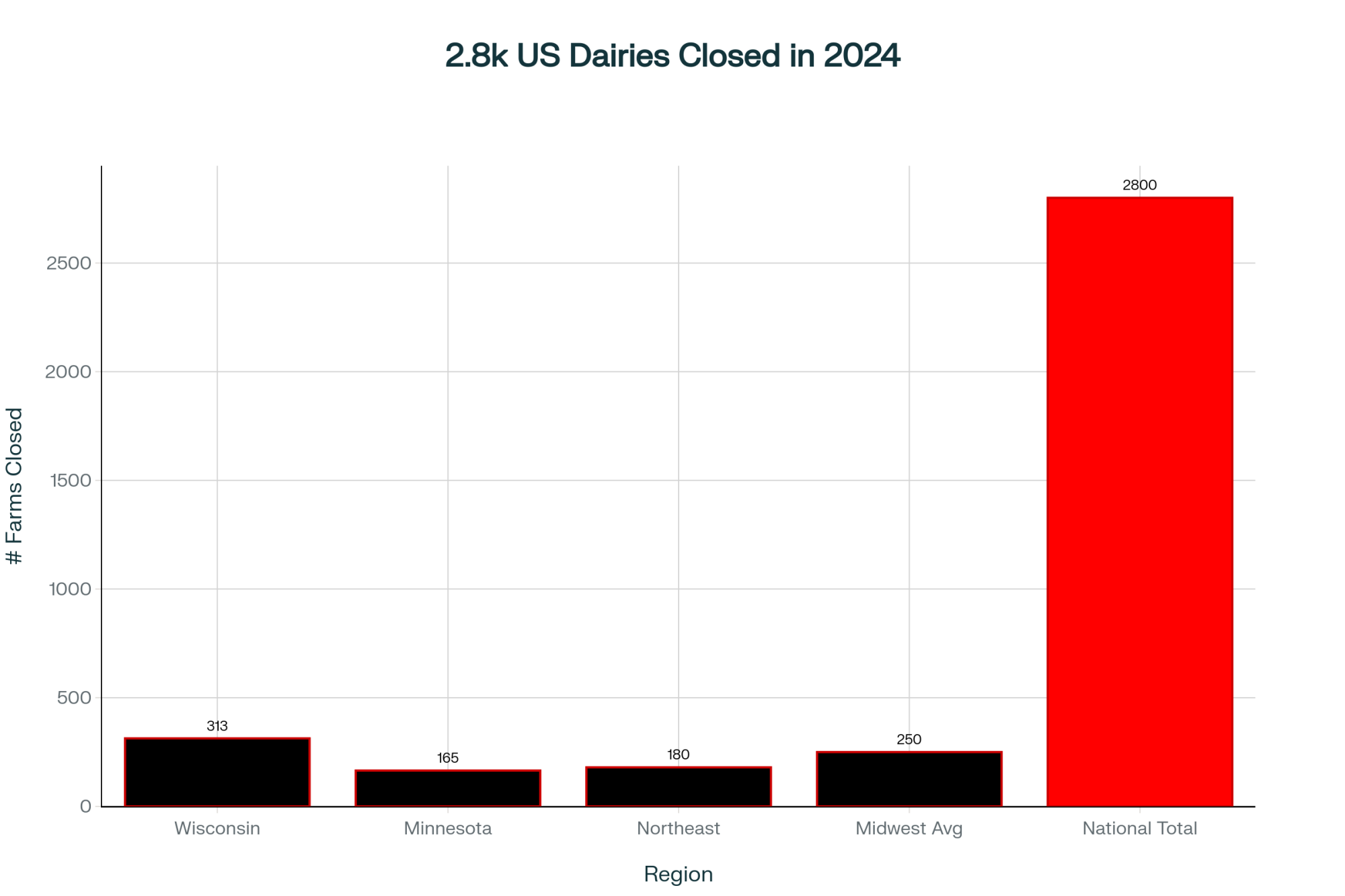

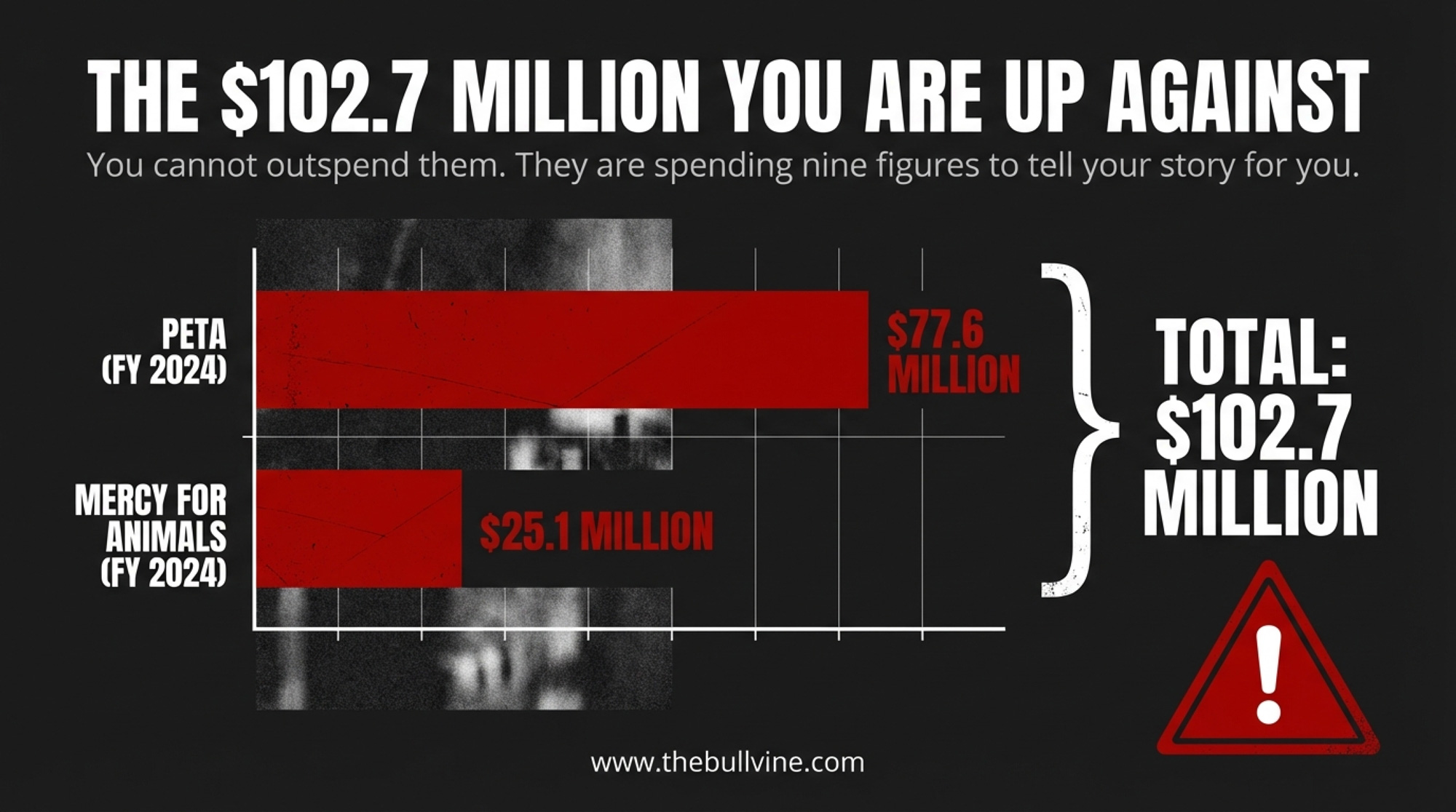

The $102.7 Million You’re Up Against

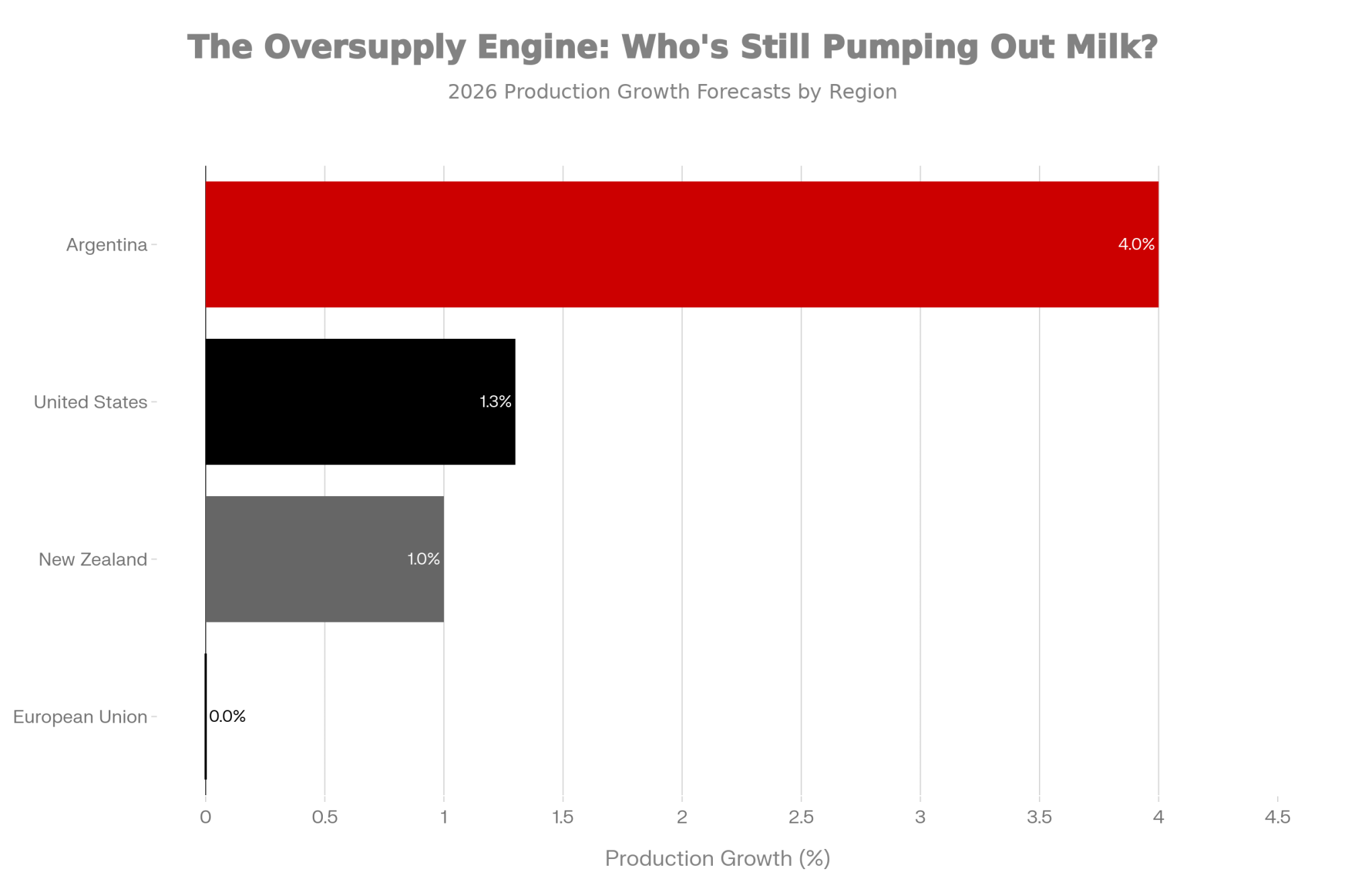

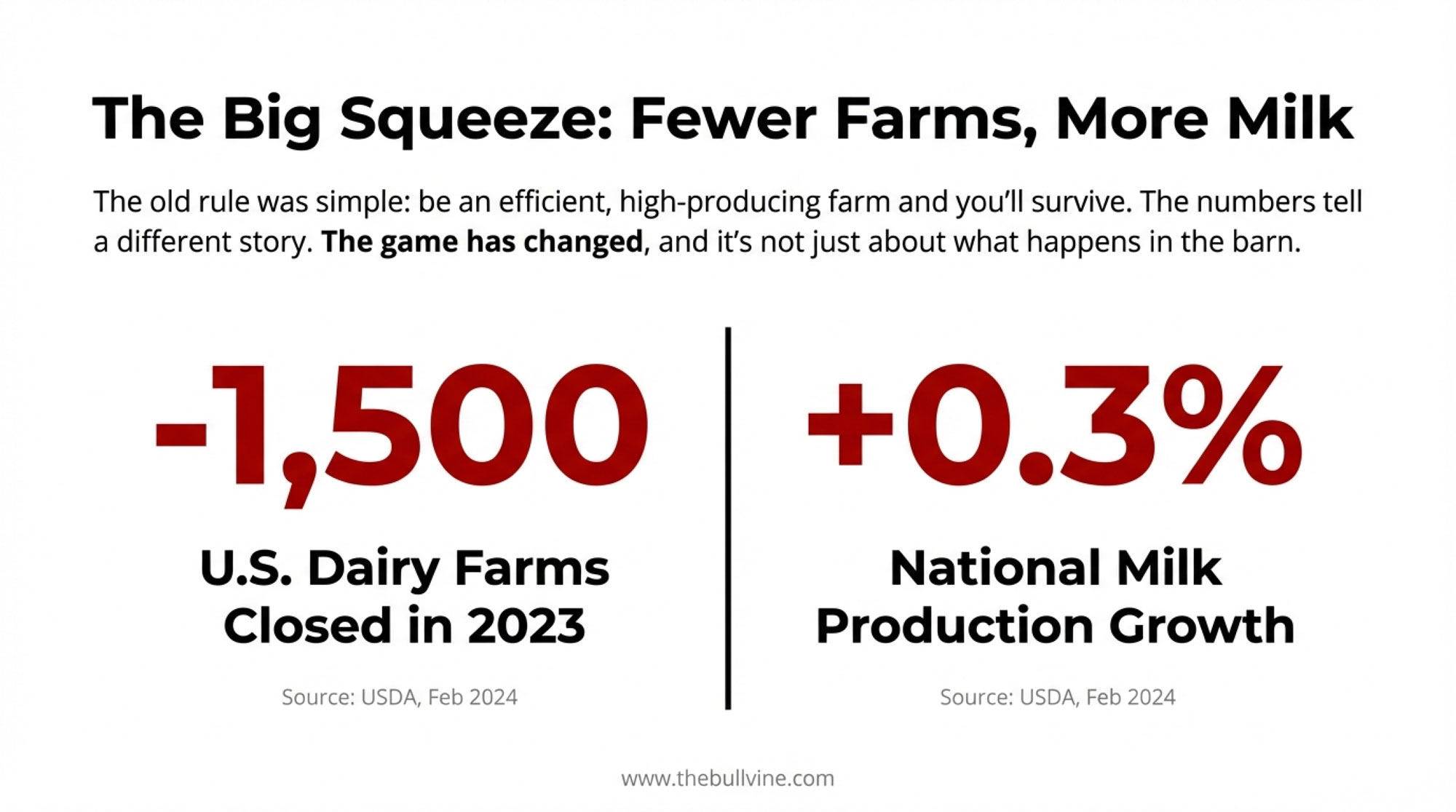

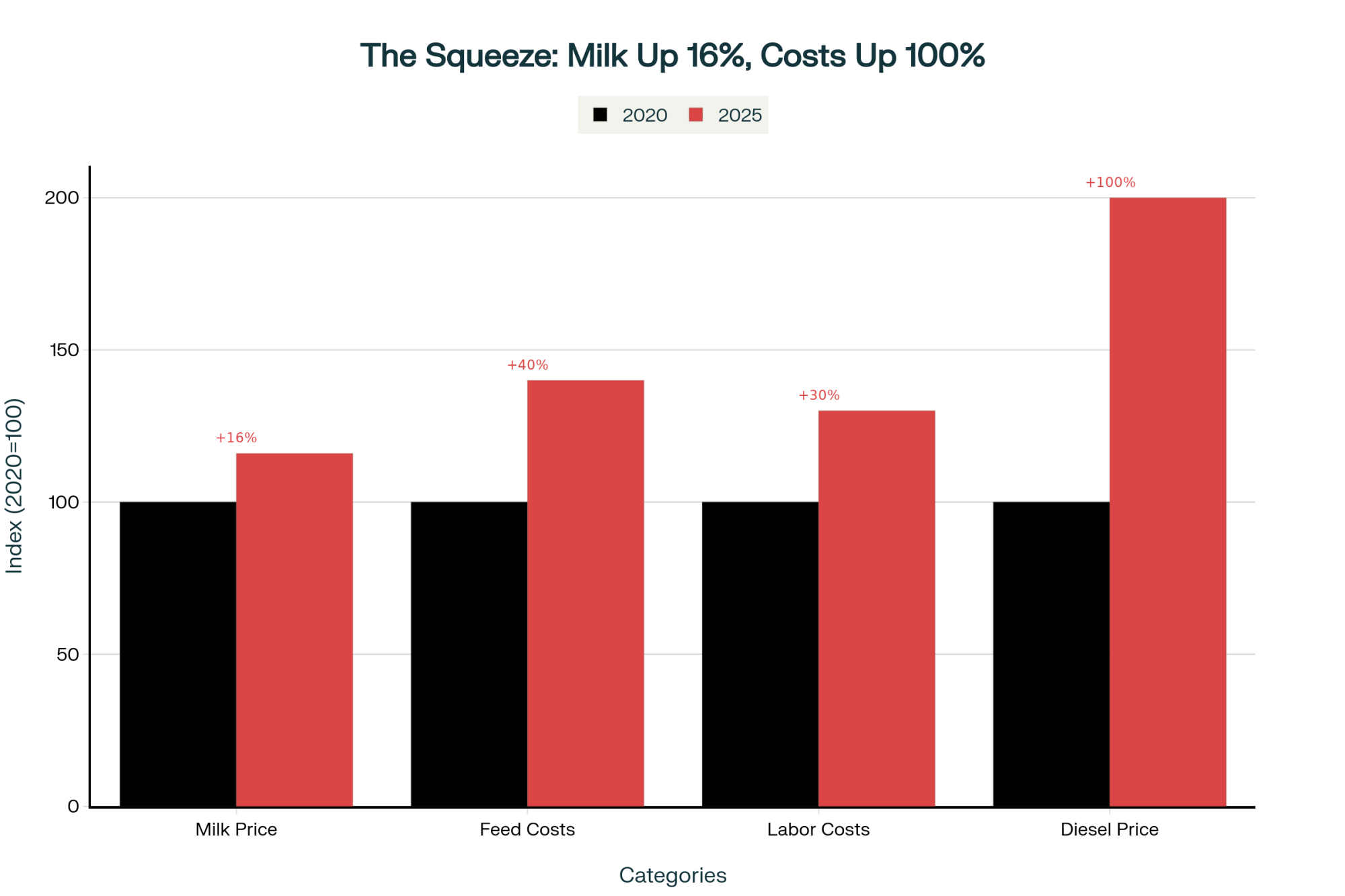

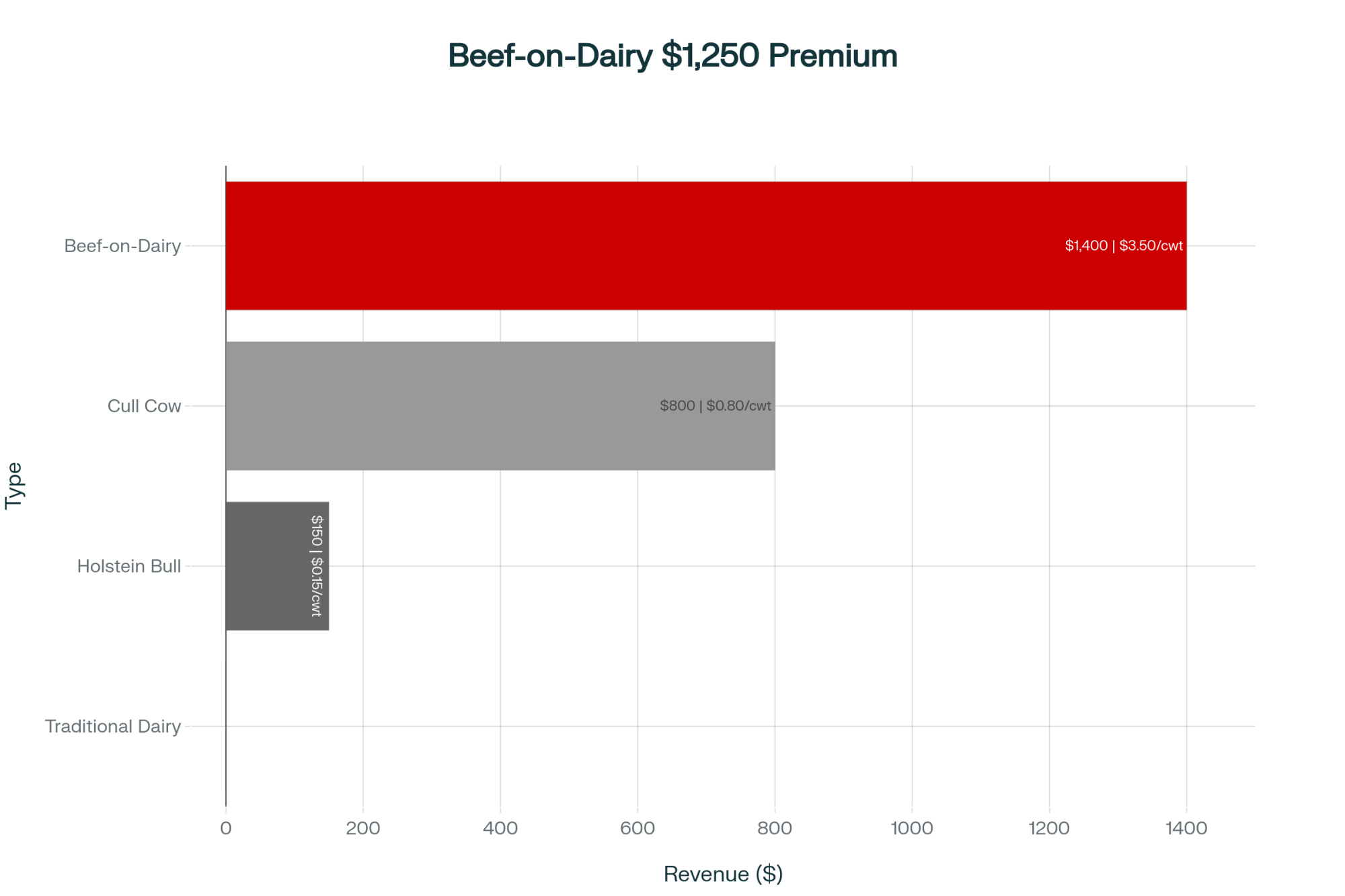

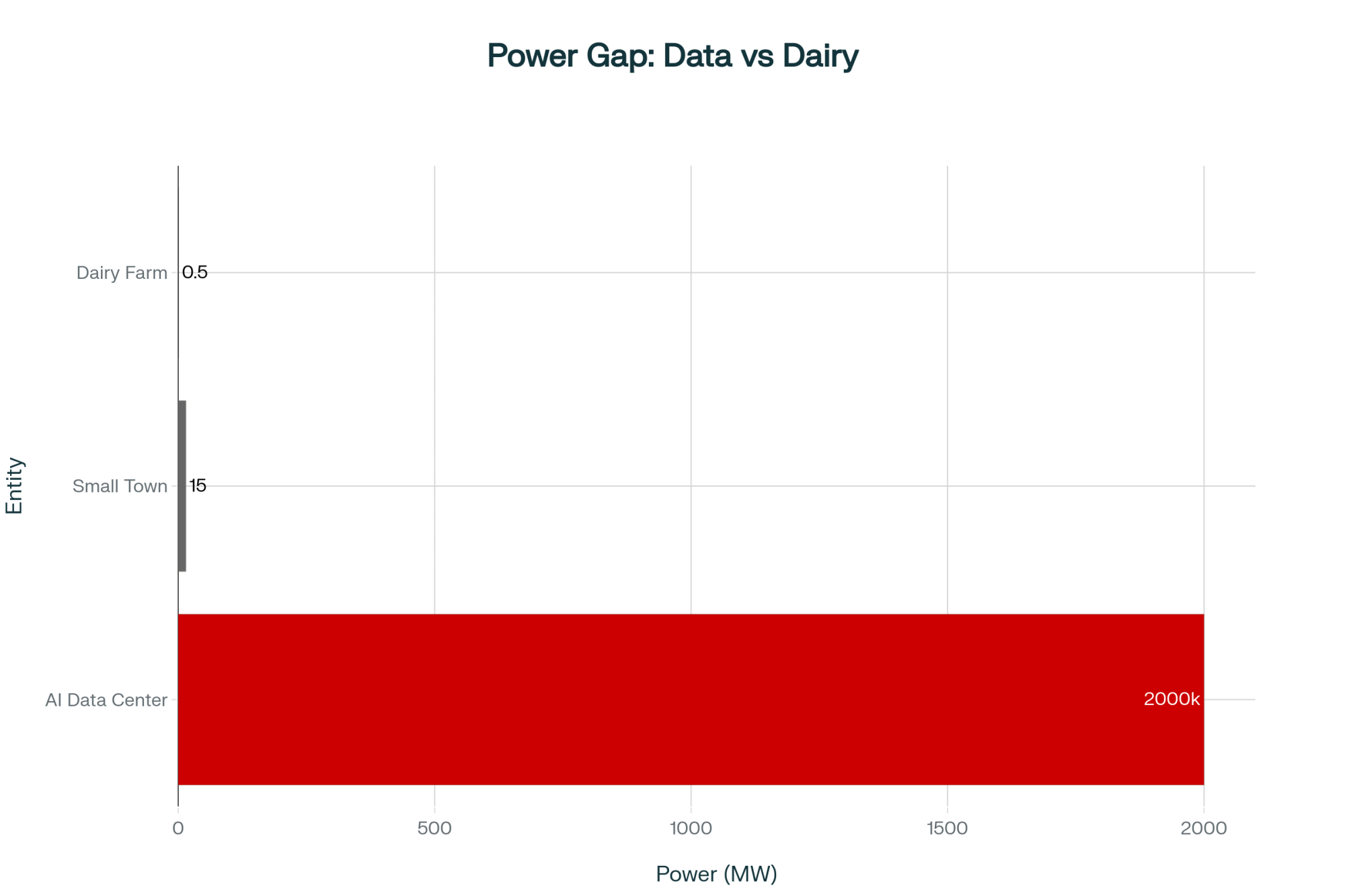

None of this replaces solid genetics, good nutrition, or profitable management. A TikTok account won’t fix your production costs. But consider what you’re up against.

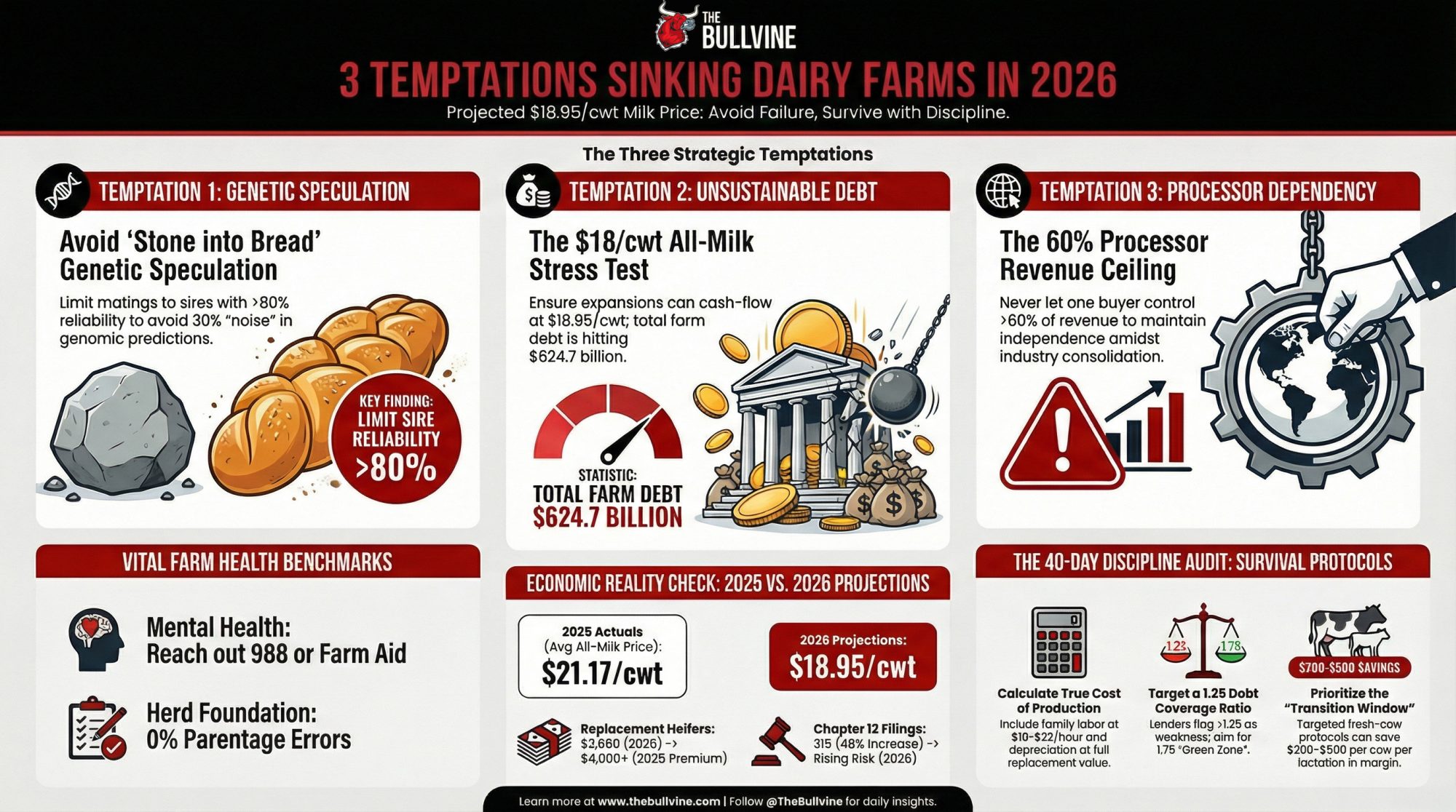

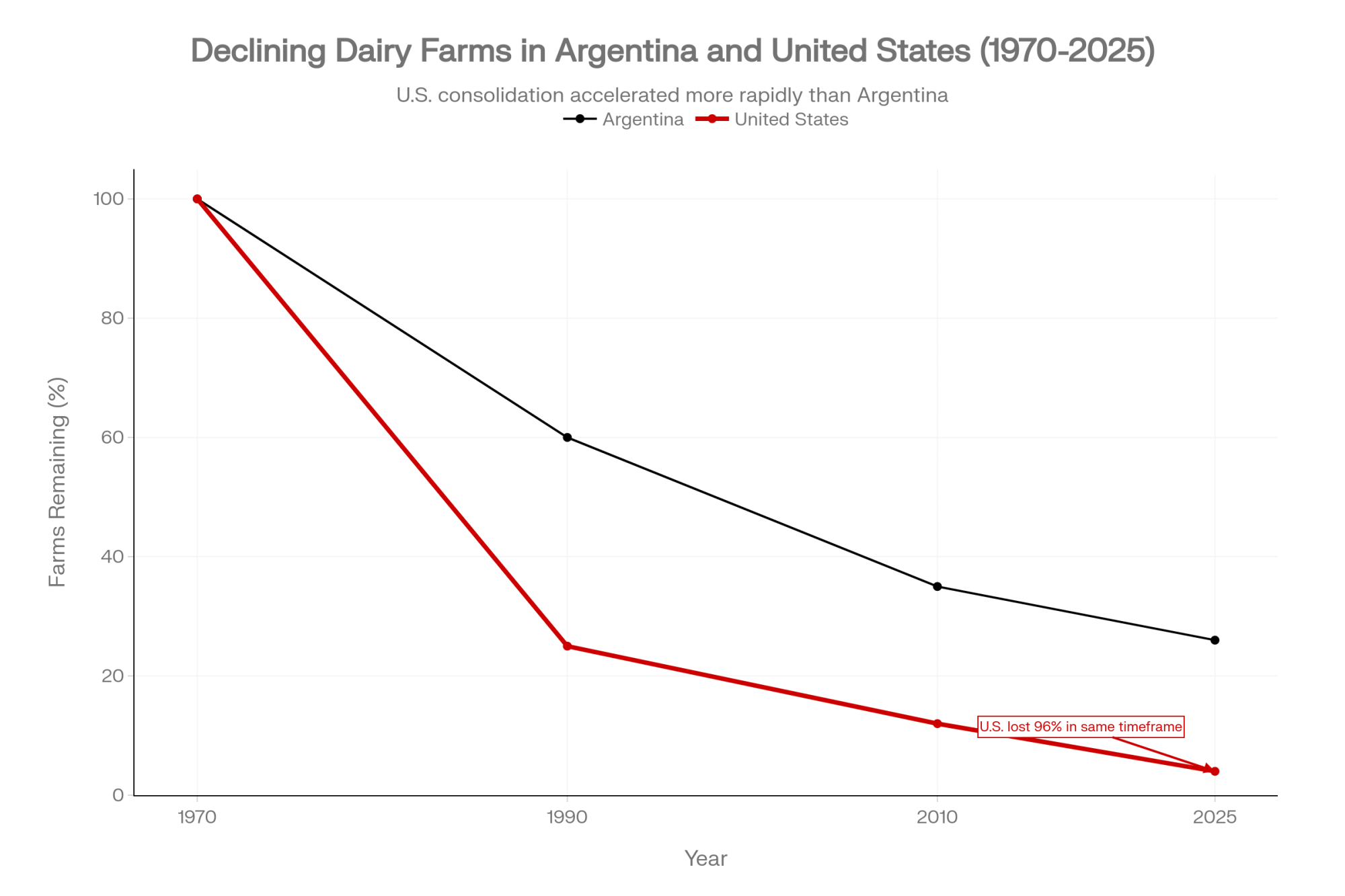

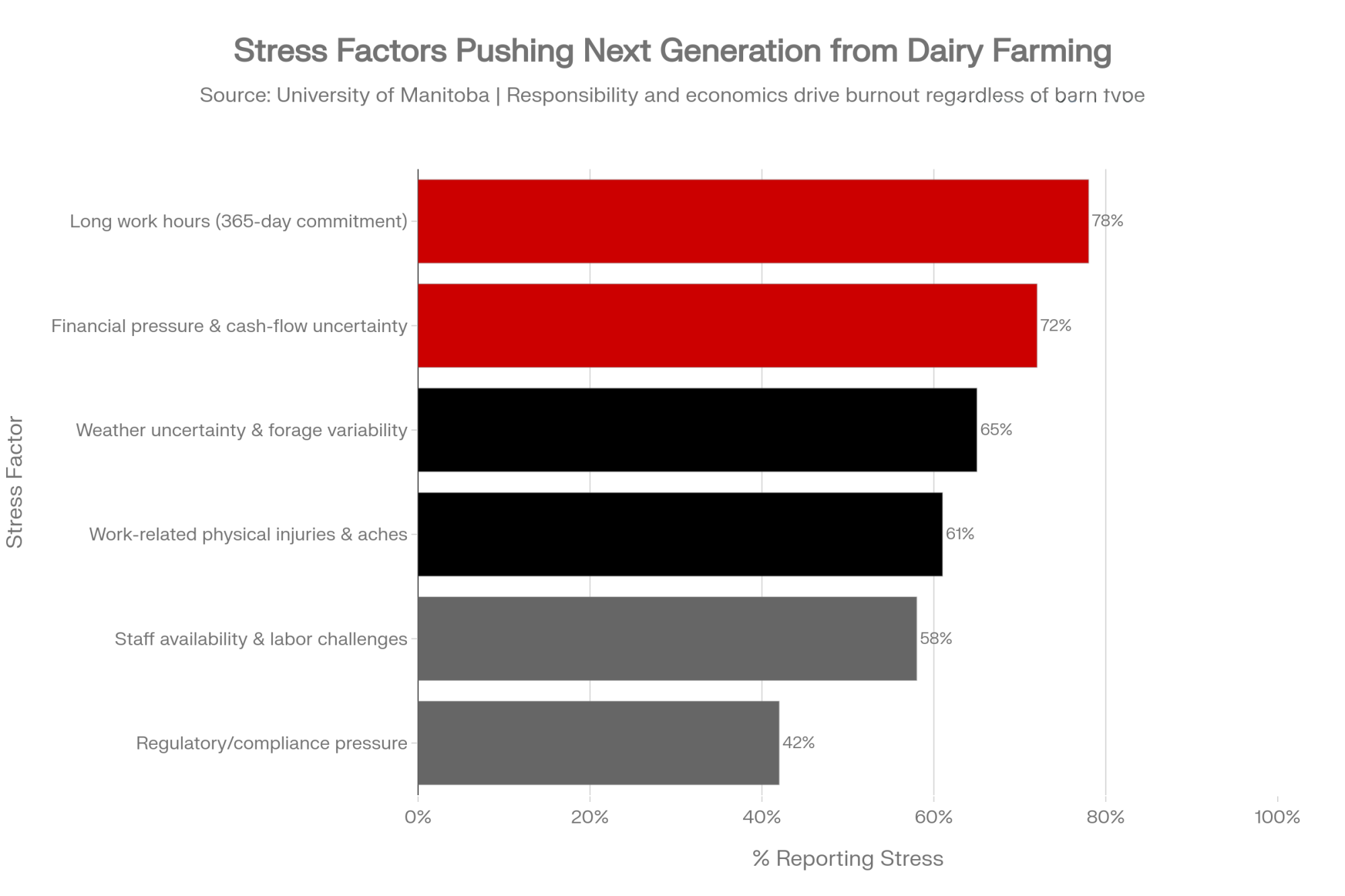

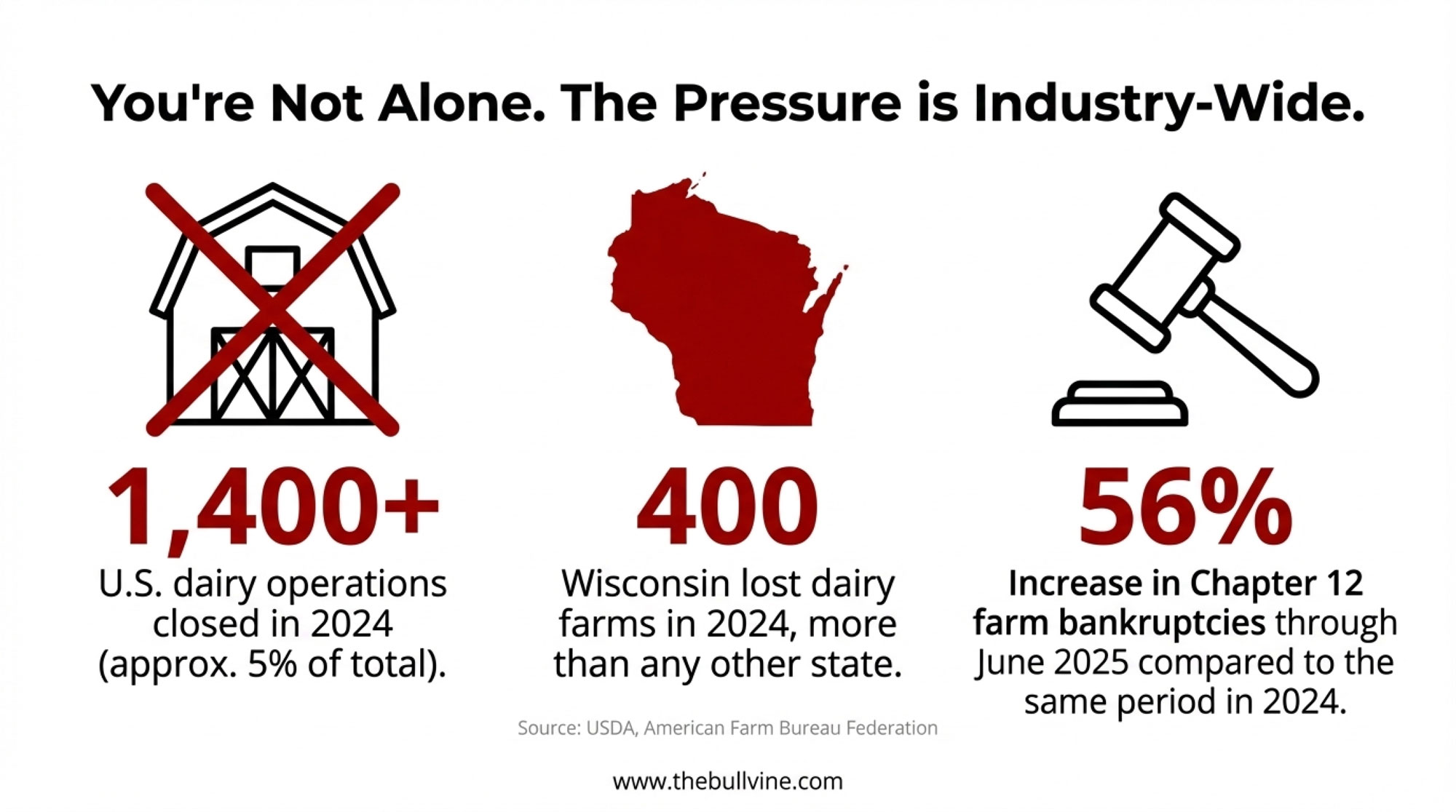

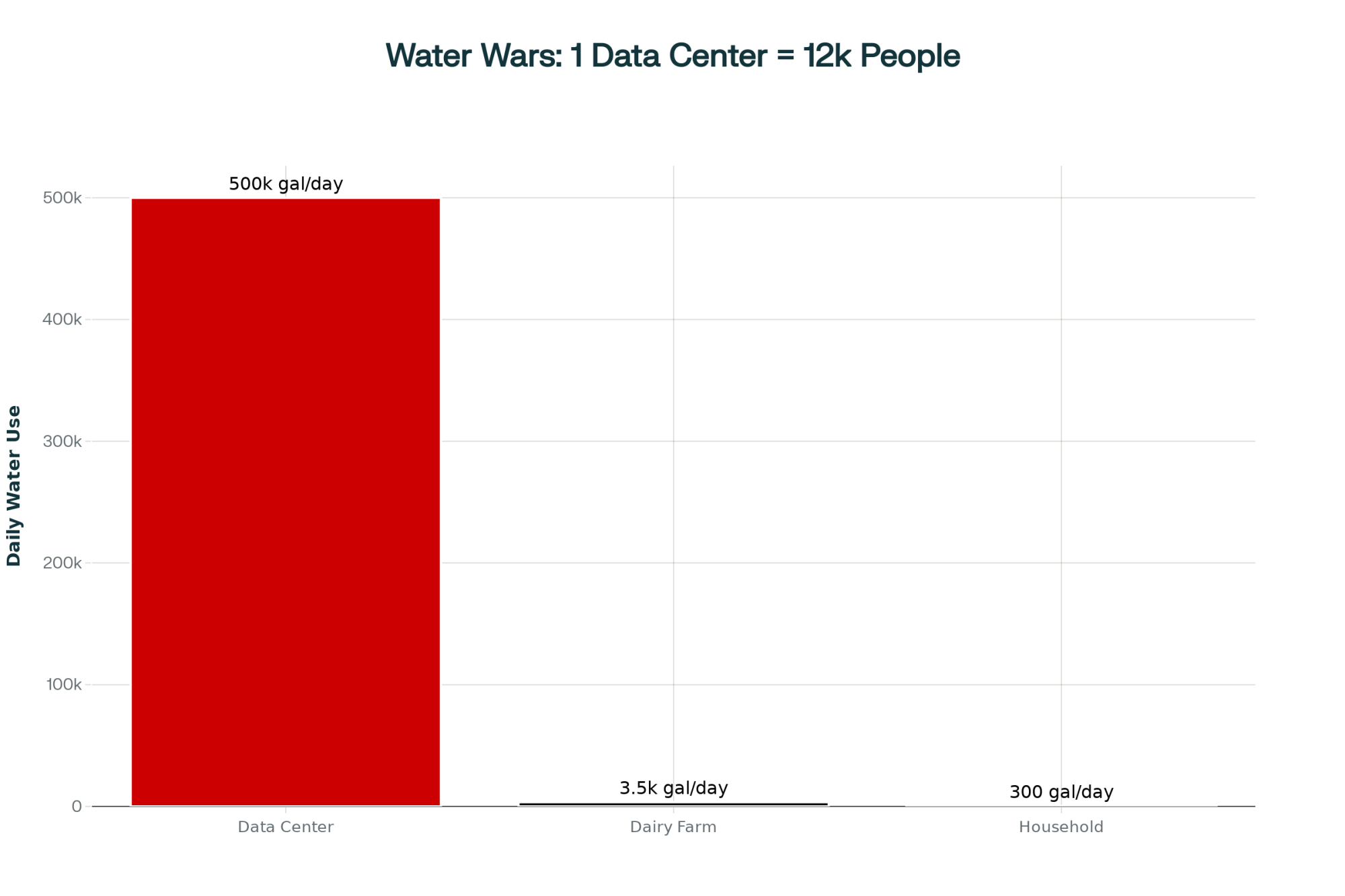

PETA alone spent $77.6 million in its fiscal year ending July 2024 (PETA financial report). Mercy for Animals reported another $25.1 million in consolidated spending for its FY 2024 (MFA audited financial statements, year ending December 31, 2024). That’s $102.7 million from just two organizations — before counting Humane World for Animals (formerly the Humane Society of the United States, rebranded February 2025), which dwarfs both. When you look at who really owns your milk check, the money flowing against dairy’s public image is part of the same picture.

You’re not going to outspend them. You can out-trust them — but only if the trust is already built before the camera shows up. Fair Oaks showed how fast a curated public image can collapse when the reality behind it doesn’t match. Ranallo, Pemberton, and Payne are showing the raw, unfiltered version holds up to scrutiny.

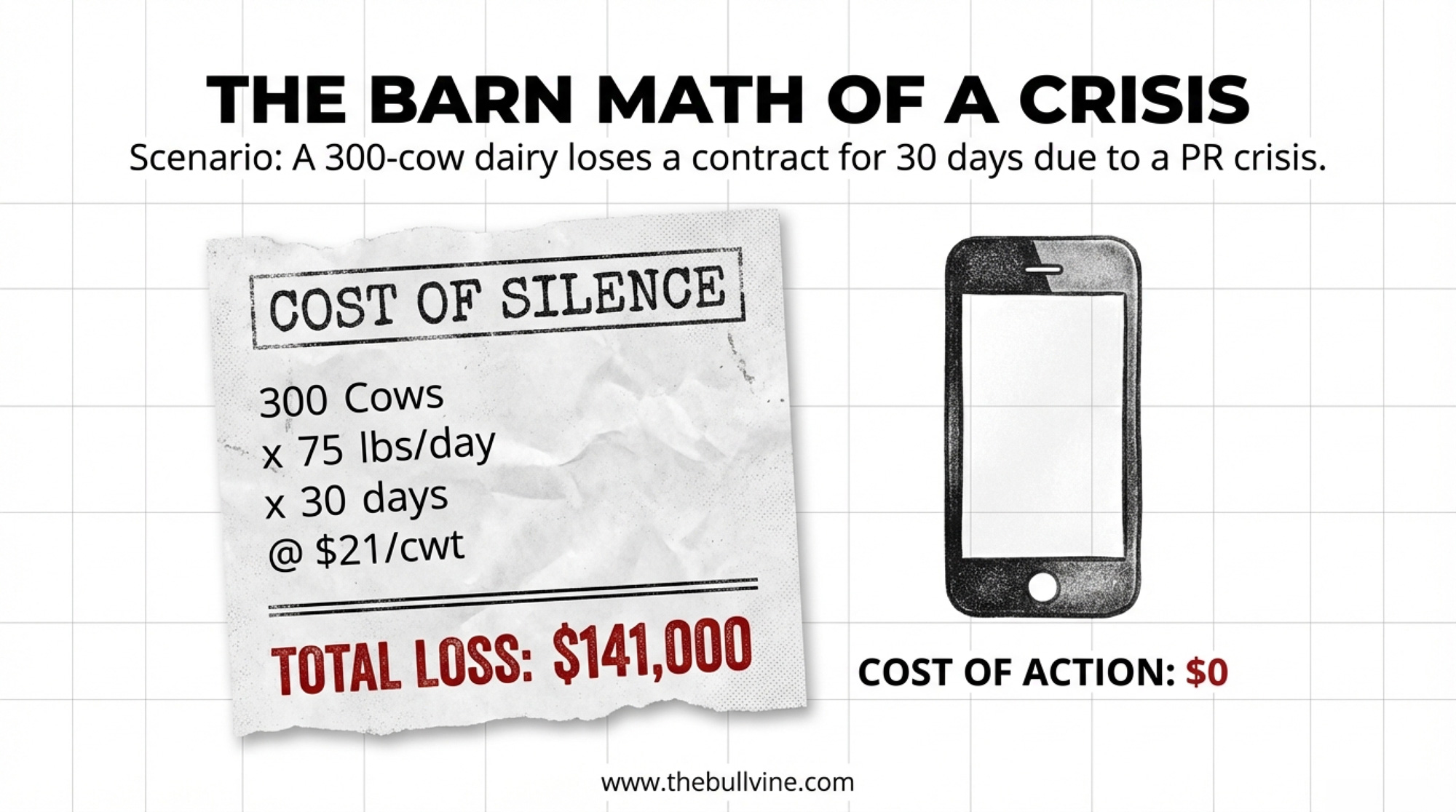

| Herd Size | Daily Production per Cow (lbs) | Milk Price ($/cwt) | Daily Revenue Loss | 30-Day Total Loss |

|---|---|---|---|---|

| 300 cows | 75 | $18 | $4,050 | $121,500 |

| 300 cows | 75 | $21 | $4,725 | $141,750 |

| 500 cows | 75 | $18 | $6,750 | $202,500 |

| 500 cows | 75 | $21 | $7,875 | $236,250 |

Think of it this way: if your 300-cow operation lost a processor contract for even 30 days over a consumer-trust crisis — at even $18/cwt on 75 lbs/day, and that’s conservative; USDA’s 2025 all-milk price ran around $21 (USDA WASDE, 2025) — that’s roughly $121,500 in milk revenue with nowhere to go. At $21/cwt, the hit climbs past $141,000. The cost of one phone and 20 minutes a week looks different against those numbers.

| Creator / Operation | Platform(s) | Total Reach / Followers | Herd Size / Scale | Core Content Approach |

|---|---|---|---|---|

| Nate the Hoof Guy (Nathan Ranallo) | YouTube, TikTok, Facebook | 880M+ YouTube views, 1.7M subscribers | Hoof-trimming service | Unedited hoof-care procedures with methodical explanations |

| Tom Pemberton (Birks Farm, UK) | YouTube | 228M+ views, 591K subscribers | Mixed dairy-beef | Equipment breakdowns, slurry, silage—full operational reality |

| Chloe Payne (Cows of New Zealand) | 325K followers | 600-cow mixed-breed herd | Named cows, viral personalities (Barbie, Popcorn), emotional storytelling | |

| Jan Kielstra (SaskDutch Kid) | YouTube | 63M+ views, 223K subscribers | 380 Holsteins, Saskatchewan | “If we don’t show it, someone else will”—daily farm life |

| Big Farmer Andy (Australia) | TikTok | 14.5M likes, 449K followers | Third-gen Australian dairy | Humour + mental health advocacy, suicide prevention fundraising |

| MVP Dairy (Ohio) | TikTok, onsite learning center | 4,500-cow B Corp (score 102.7) | 4,500 cows, Danone supplier | Third-party certification + unpolished social + physical tours |

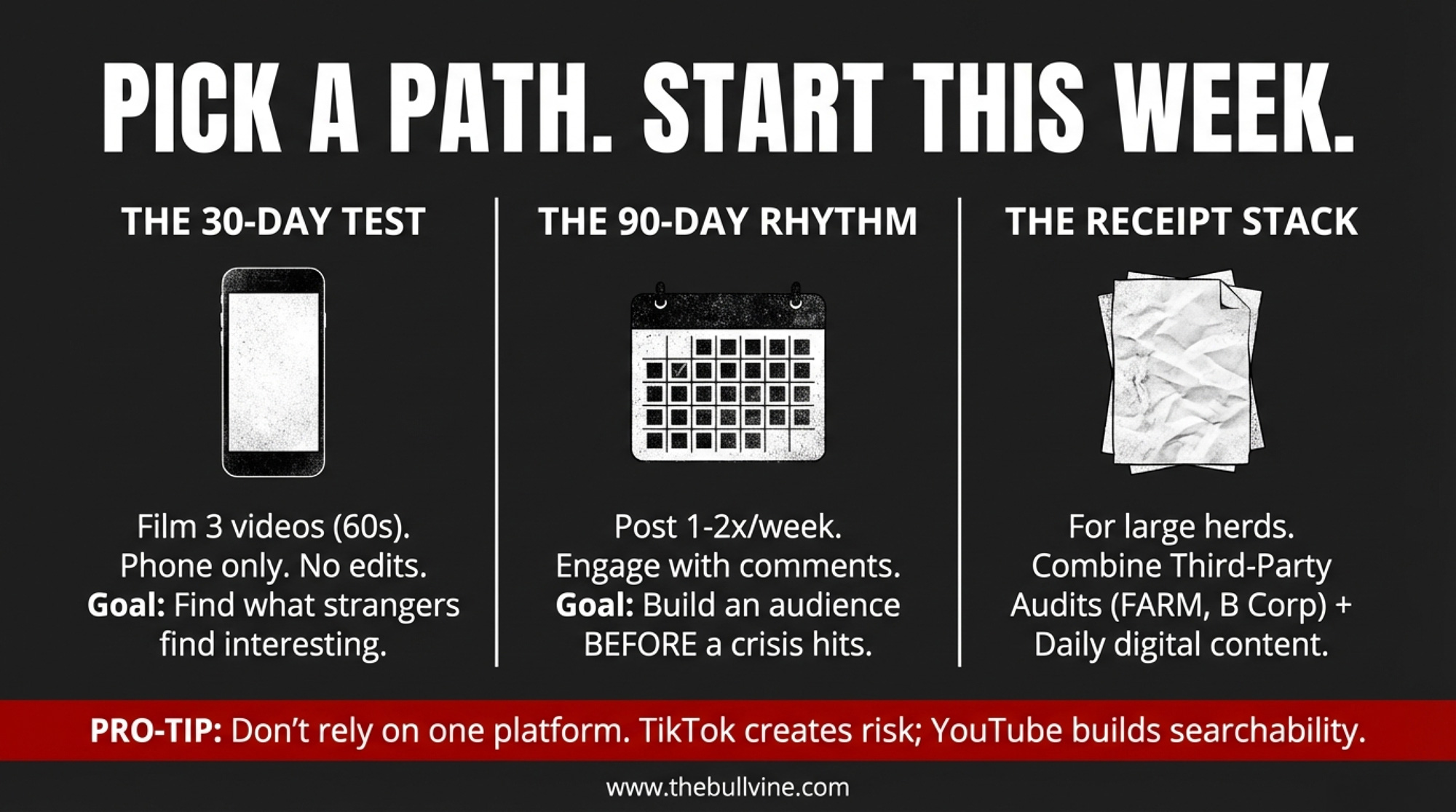

Three Paths — Pick One This Month

Not every dairy farmer needs a TikTok account or a YouTube channel. But every dairy should be asking who’s telling their story.

| Path | Time Investment | Financial Cost | Target Operator Profile | Primary Goal | When to Quit |

|---|---|---|---|---|---|

| Path 1: The 30-Day Test | 20 min/video, 3 videos/month | $0 (phone only) | Any operation curious about social media | Discover what audiences find interesting about your farm | If zero engagement after 90 days, switch platforms |

| Path 2: The 90-Day Rhythm | 2–4 hours/week | $0–$500 (optional editing tools) | Operations facing regional activist pressure or wanting steady trust-building | Build audience that trusts you before a crisis hits | After 90 days with zero engagement, reassess platform/content |

| Path 3: The 365-Day Strategy | 8–15 hours/week | $5,000–$25,000+ (audit fees, content tools, physical infrastructure) | Large operations supplying consumer-facing brands or in high-scrutiny regions | Turn scale into asset via third-party verification + raw content + public access | Don’t quit—this is crisis insurance, not an experiment |

Path 1: The 30-day test — just start. Film three short videos (60–90 seconds) of daily operations. Phone only. No editing, no script. Post on whichever platform your local consumers use most. Ranallo went from a flip phone to 880 million YouTube views — his early videos were rough, and that didn’t matter.

Kielstra’s advice: “Just pick up your phone and start taking pictures and videos of what you do around the farm” (Sweet Peas Evening Ag News, March 2020). Your goal in the first month isn’t to build an audience — it’s to discover what about your operation people find interesting. It’s rarely what you’d guess. Cost: 20 minutes per video. Time to first post: this week.

Path 2: Build a weekly rhythm — the 90-day commitment. Pick one platform and post consistently once or twice a week. Engage with every comment — Kielstra has said the early comments on each upload make the effort feel worthwhile. Find your farm’s “oddly satisfying” moment: the one thing a non-farmer would watch twice.

This path takes 2–4 hours per week. The trade-off is real time diverted from operations. The payoff is a growing audience that trusts you before any controversy hits. If you’re getting zero engagement after 90 days, switch platforms before quitting.

Path 3: Stack the receipts—the 365-day strategy. If you’re a larger operation, pair third-party audits (DairyCARE, B Corp, FARM Program) with a consistent digital presence. MVP Dairy’s model — a B Corp score well above the 80-point threshold, plus daily human-scale content, plus a physical learning center — is the strongest shield available when consumer perception is a direct business risk.

If you sell fluid milk or supply a processor with a public brand, this is you. The investment is significant, but it turns your size into an asset rather than a liability. Pair it with unpolished digital content and independent verification, or you’re building a facade instead of a foundation.

One caution across all three paths: don’t build your entire presence on a single platform. TikTok faced a U.S. divestiture mandate for most of 2025 before a joint venture deal closed on January 22, 2026 (Axios, January 2026) — Pemberton’s strength is YouTube, a long-form, searchable platform that doesn’t depend on any one app’s survival. Whichever path you’re on, the broader forces reshaping dairy operations aren’t slowing down. It’s worth understanding what consolidation means for your operation’s next move.

Key Takeaways

- If you supply a processor with a consumer-facing brand, your operation’s public visibility isn’t optional — it’s part of the trust chain. Ask your fieldman or co-op what their transparency expectations look like this month.

- If your region has faced activist campaigns or ballot initiatives, an established digital presence is cheaper insurance than crisis PR after the fact. One New York dairy’s years of NYSCHAP participation killed a PETA-driven AP story before it ran (Bovine Veterinarian, May/June 2016). Start with Path 1 this week — three videos, twenty minutes each.

- If you’re running a large operation with no authentic public face, study MVP Dairy’s model — then study what happened to Fair Oaks when curated transparency met undercover footage. The combination that holds is third-party audit, plus raw content, plus a willingness to let people see the real barn.

- If isolation is a factor on your operation — and on a dairy, it almost always is — content creation can serve double duty. Andy’s experience isn’t unusual. The digital connection matters even when the audience is small.

The Bottom Line

A herd manager in Ikamatua has 325,000 followers who know her cows by name. A hoof trimmer in Wisconsin — a guy who told Wisconsin Public Radio he’d never edited a single piece of footage in his life — built an audience of 880 million views. So who’s telling your story right now?

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More

- Zero Mastitis Tubes Since March: The Real Cost of Lameness – Delivers a brutal reality check on your bottom line. You’ll gain a high-precision method for calculating the hidden drain of lameness, transforming invisible losses into a targeted, actionable strategy for immediate profit recovery.

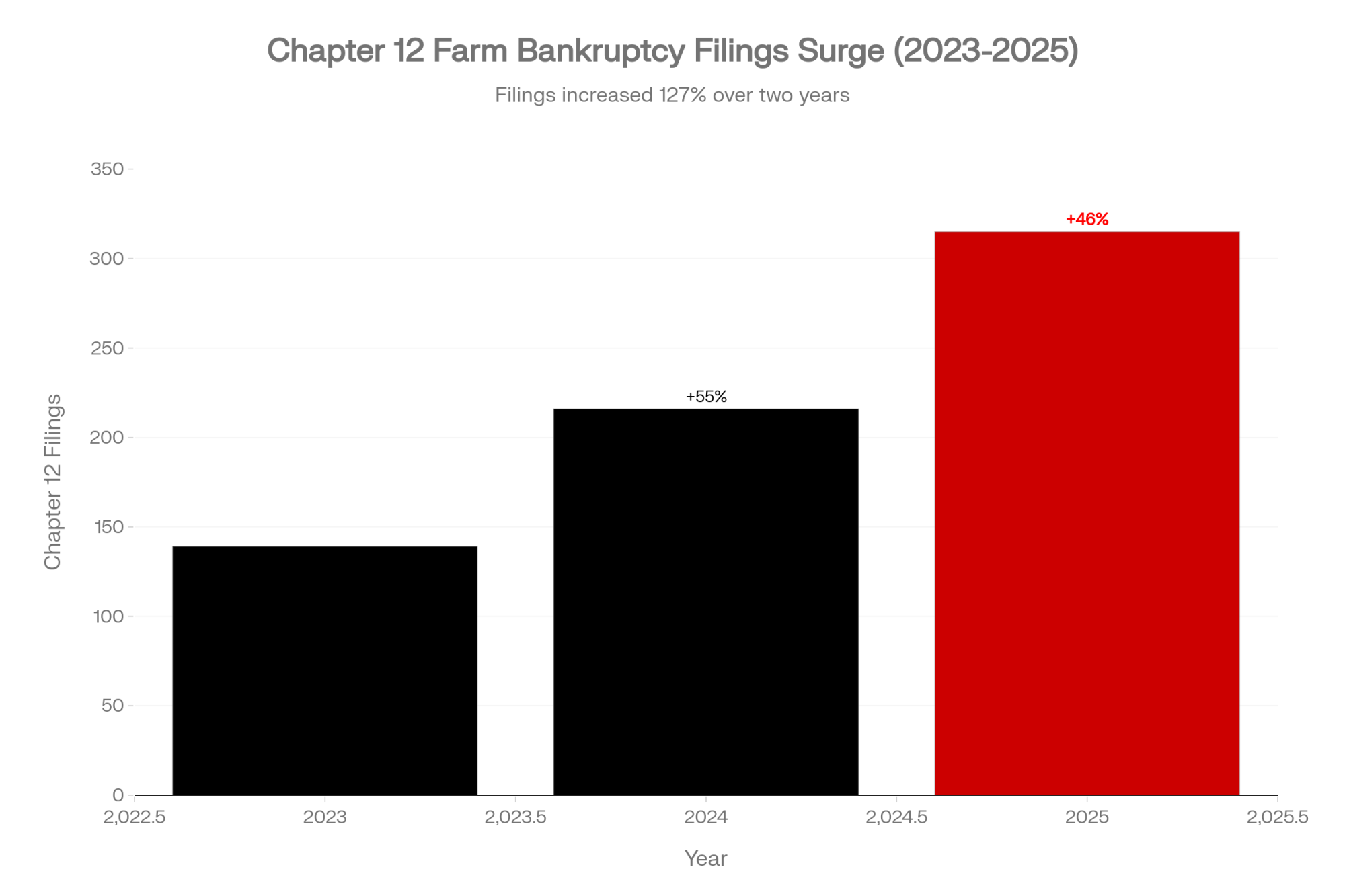

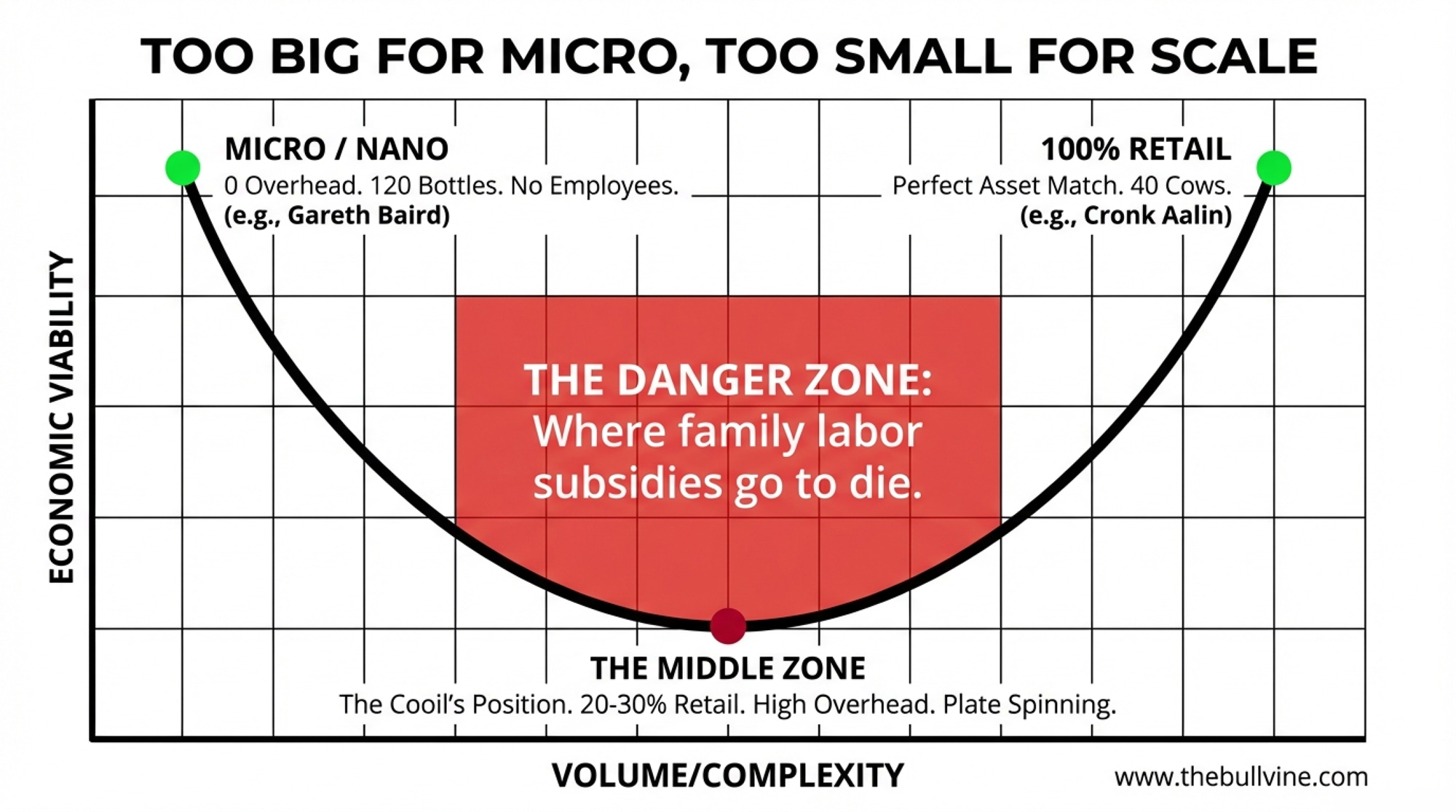

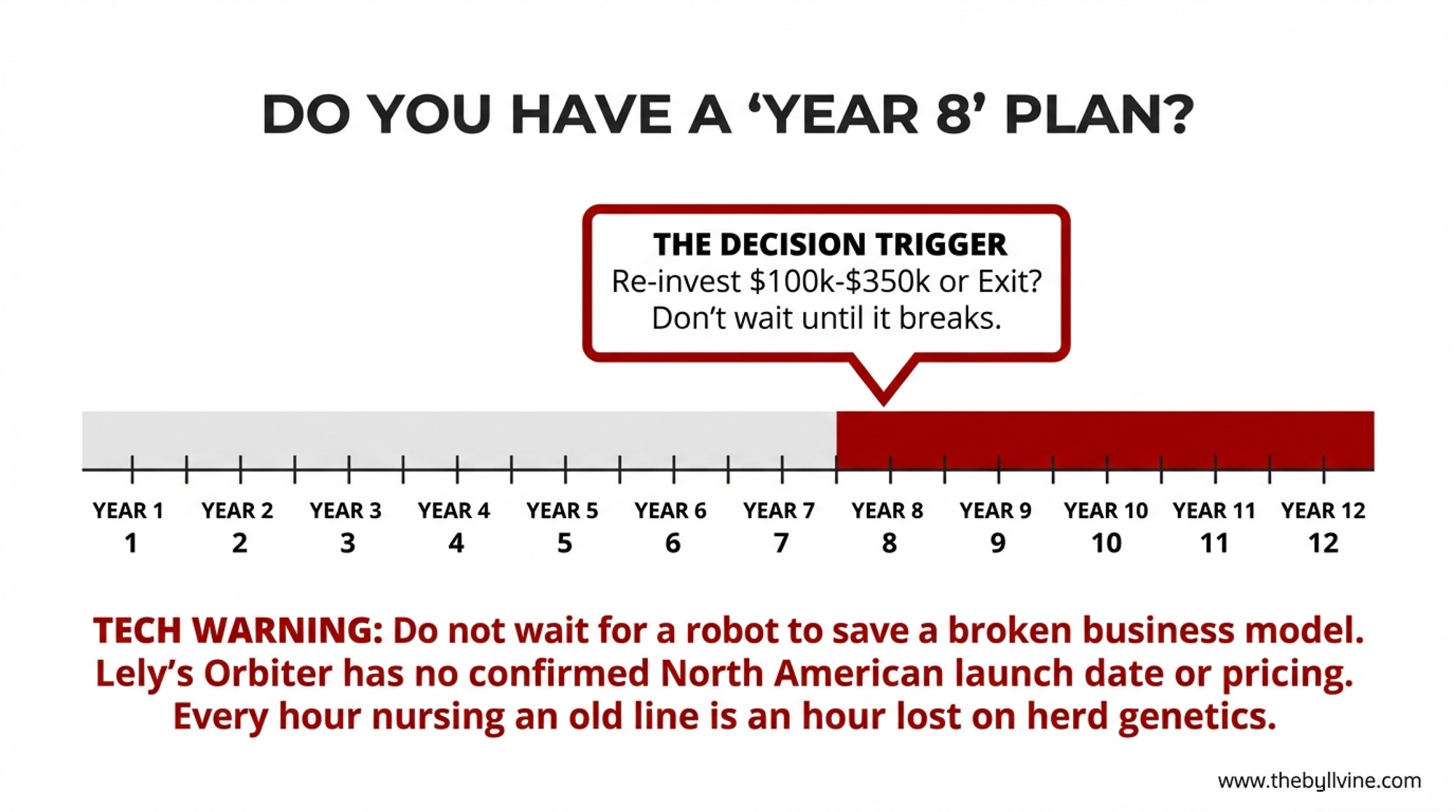

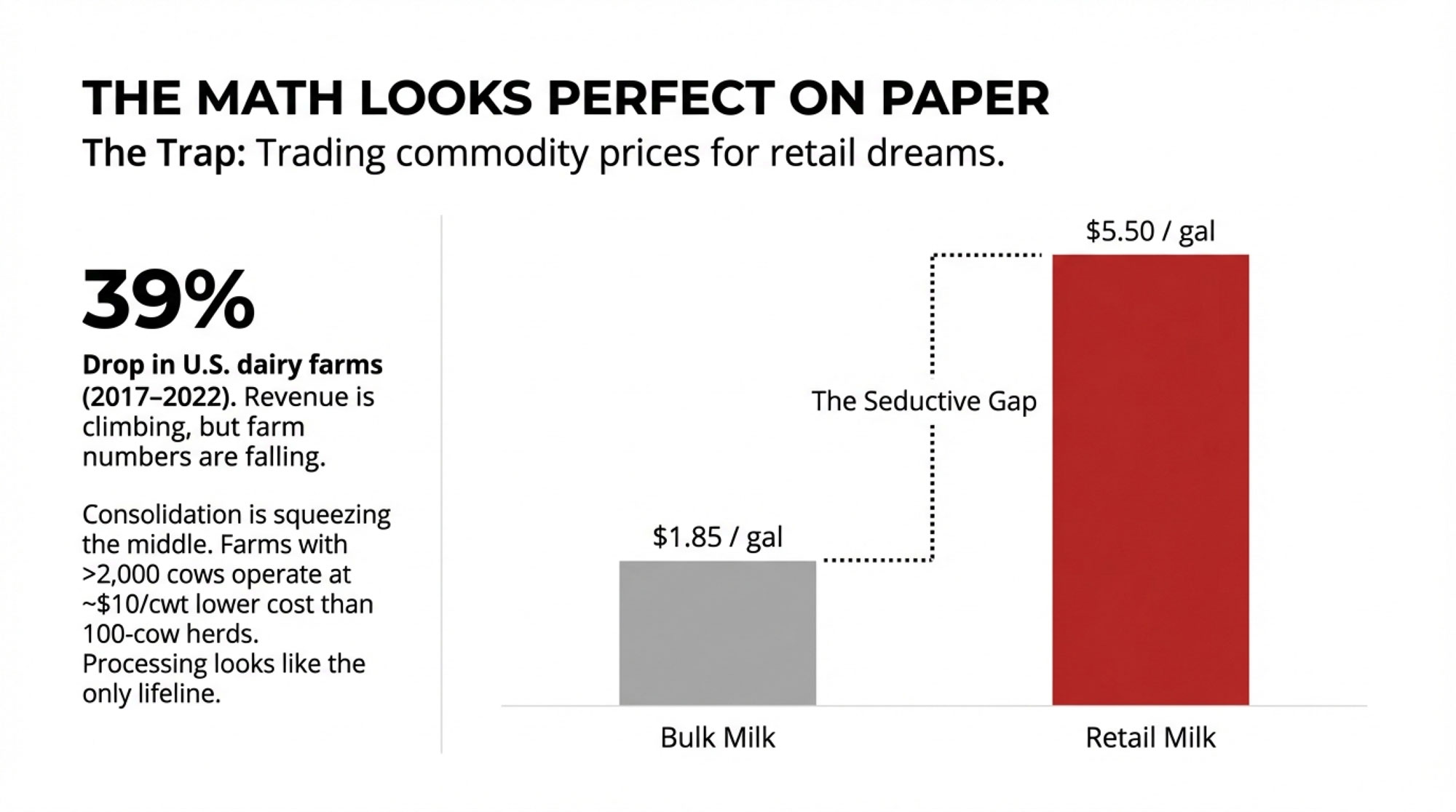

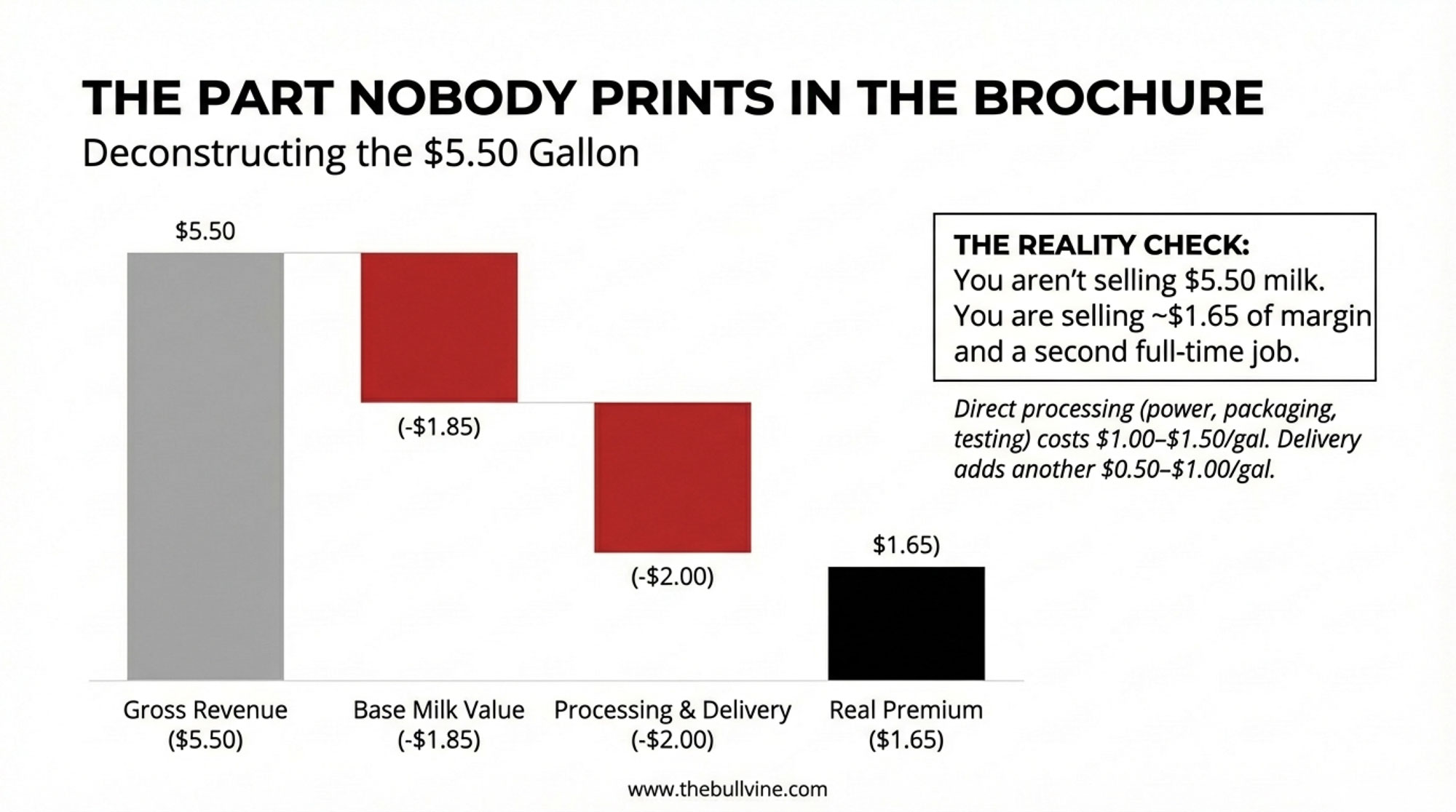

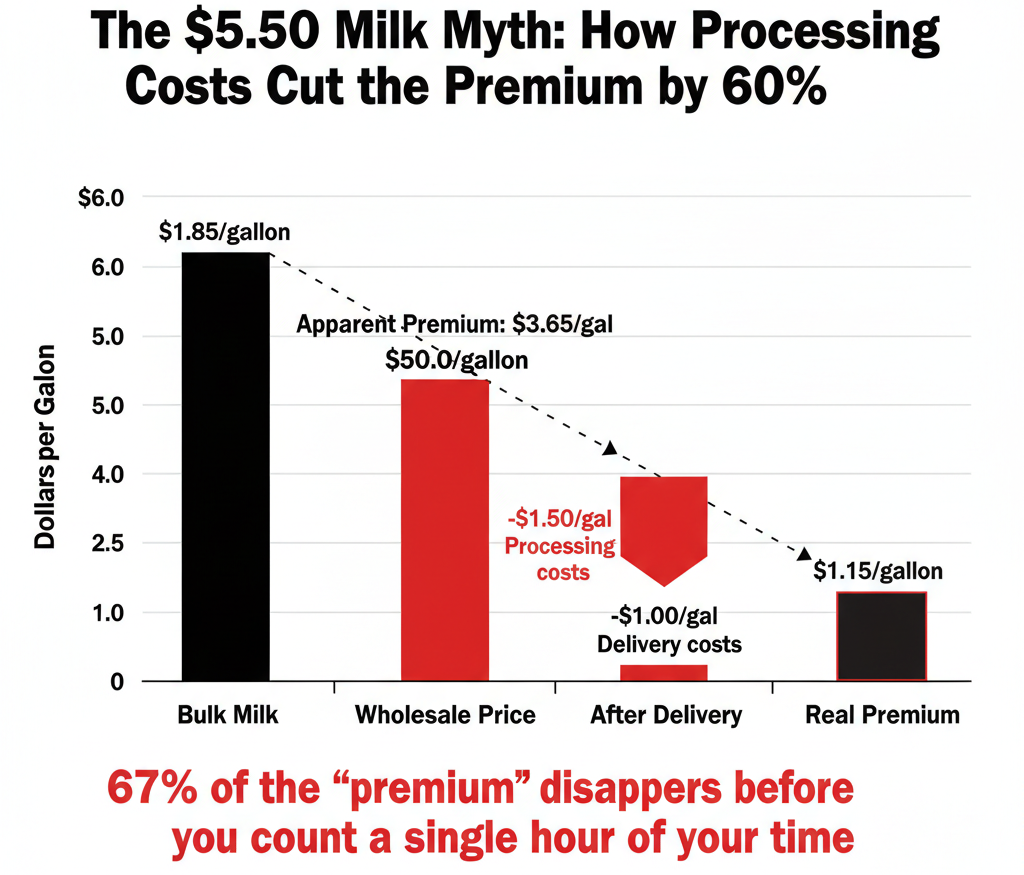

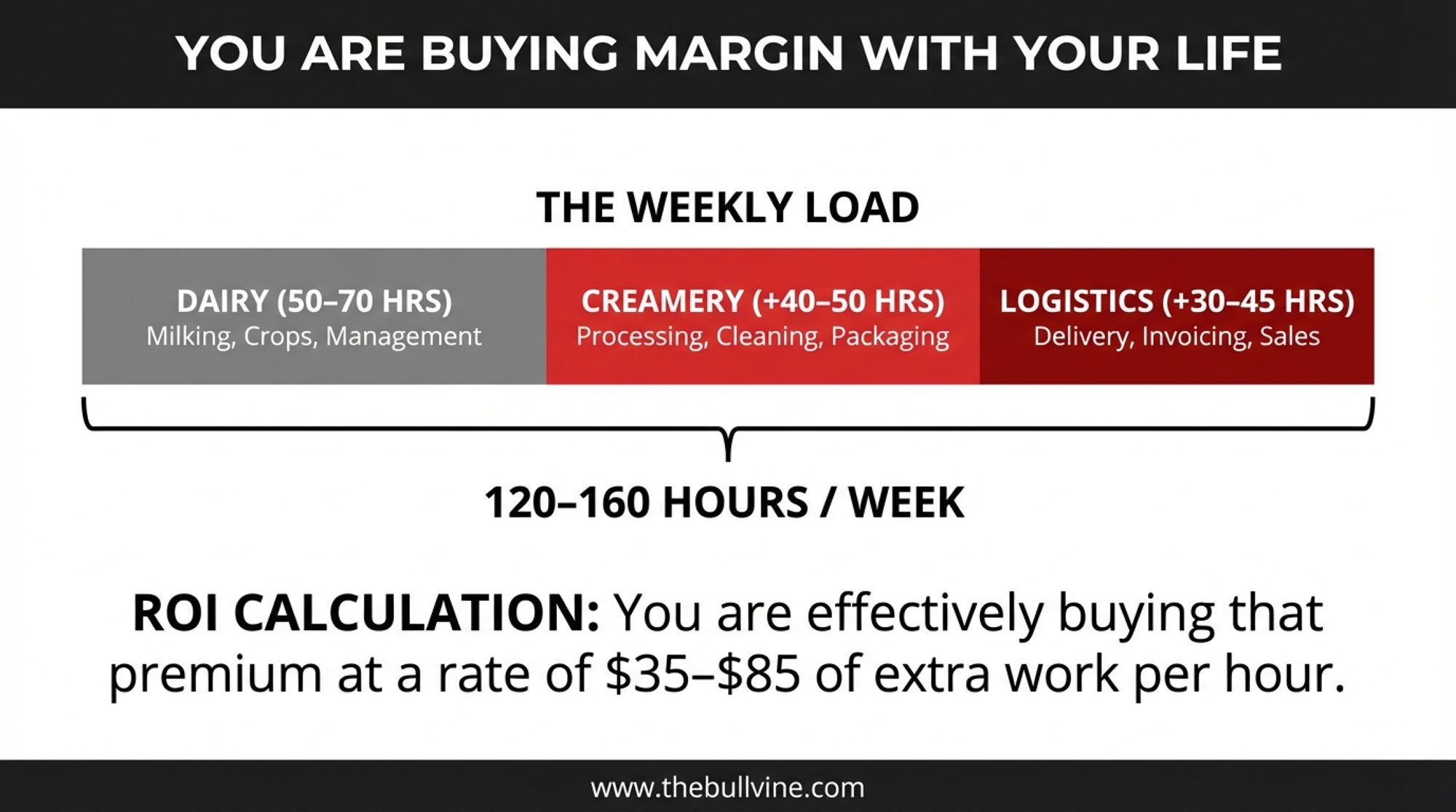

- The American Dairy Heist: Who Really Owns Your Milk Check? – Exposes the financial machinery syphoning your margins. This analysis arms you with the hard data on processor consolidation and global shifts, revealing exactly how to position your equity for the next five years of volatility.

- Social License: Why it is the biggest threat to the dairy industry – Reveals why “doing a good job” isn’t enough anymore. This deep dive breaks down how the industry’s boldest mavericks are weaponizing transparency to secure their social license and dominate the high-value consumer market.

The Sunday Read Dairy Professionals Don’t Skip.

The Sunday Read Dairy Professionals Don’t Skip.

Every week, thousands of producers, breeders, and industry insiders open Bullvine Weekly for genetics insights, market shifts, and profit strategies they won’t find anywhere else. One email. Five minutes. Smarter decisions all week.

The Sunday Read Dairy Professionals Don’t Skip.

The Sunday Read Dairy Professionals Don’t Skip.