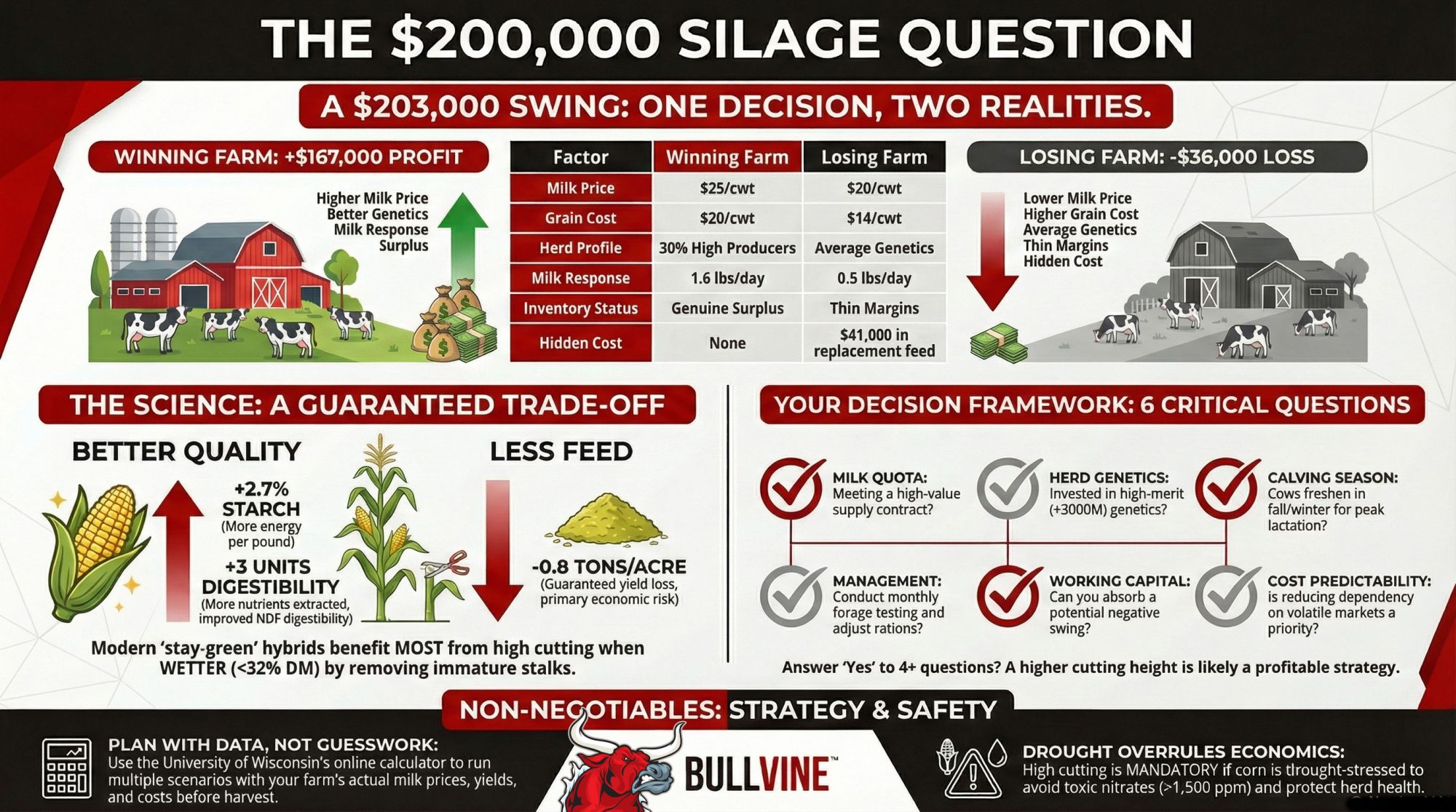

6 inches or 18 inches? Wrong answer costs $36,000. Right answer gains $167,000. Context determines which.

EXECUTIVE SUMMARY: Two neighboring farms made the same cutting height adjustment—one gained $167,000, the other lost $36,000, and new Wisconsin research explains exactly why. A meta-analysis of 35 studies shows that raising corn silage cutting height from 6 to 18 inches consistently increases starch by 2.7% and digestibility by three units, while sacrificing 0.8 tons/acre in yield. But whether this trade-off pays off depends entirely on your context: milk price, grain cost, herd genetics, inventory buffer, and management sophistication determine whether you’re the winner or the loser. Modern stay-green hybrids have completely reversed traditional thinking—immature stalks now hurt starch concentration more than fiber quality, making wetter corn benefit more from high cutting. This guide provides the exact decision framework, economic calculator strategies, and implementation timeline needed to position your farm on the profitable side of this $200,000 swing.

Every August, producers make a mechanical adjustment that swings profitability by six figures. The decision on cutting height has evolved from a simple harvest preference to a complex economic gamble that affects everything from milk production to inventory security.

A new 2024 comprehensive meta-analysis from the University of Wisconsin—Dr. Luiz Ferraretto’s team pulled together 35 studies with over 150 observations—challenges everything we thought we knew about corn maturity and cutting height. When combined with today’s volatile markets, the data is fascinating—and a little scary.

Under the right conditions, adjusting your cutting height could generate an extra $167,000 annually for a 500-cow dairy. But that exact same decision, under different circumstances, could cost you $36,000. Here’s why the context matters more than the setting.

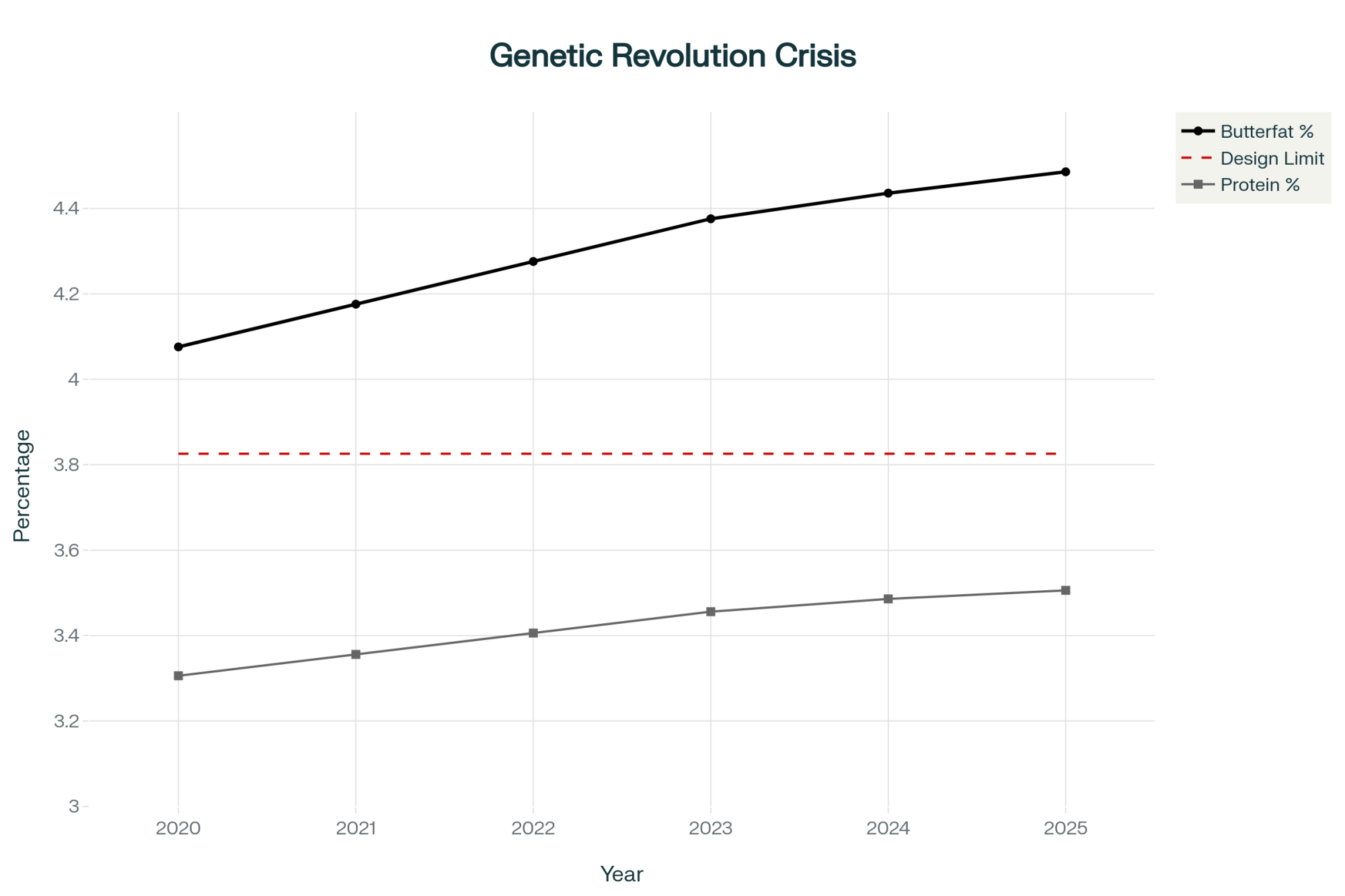

The Science That’s Changing Everything

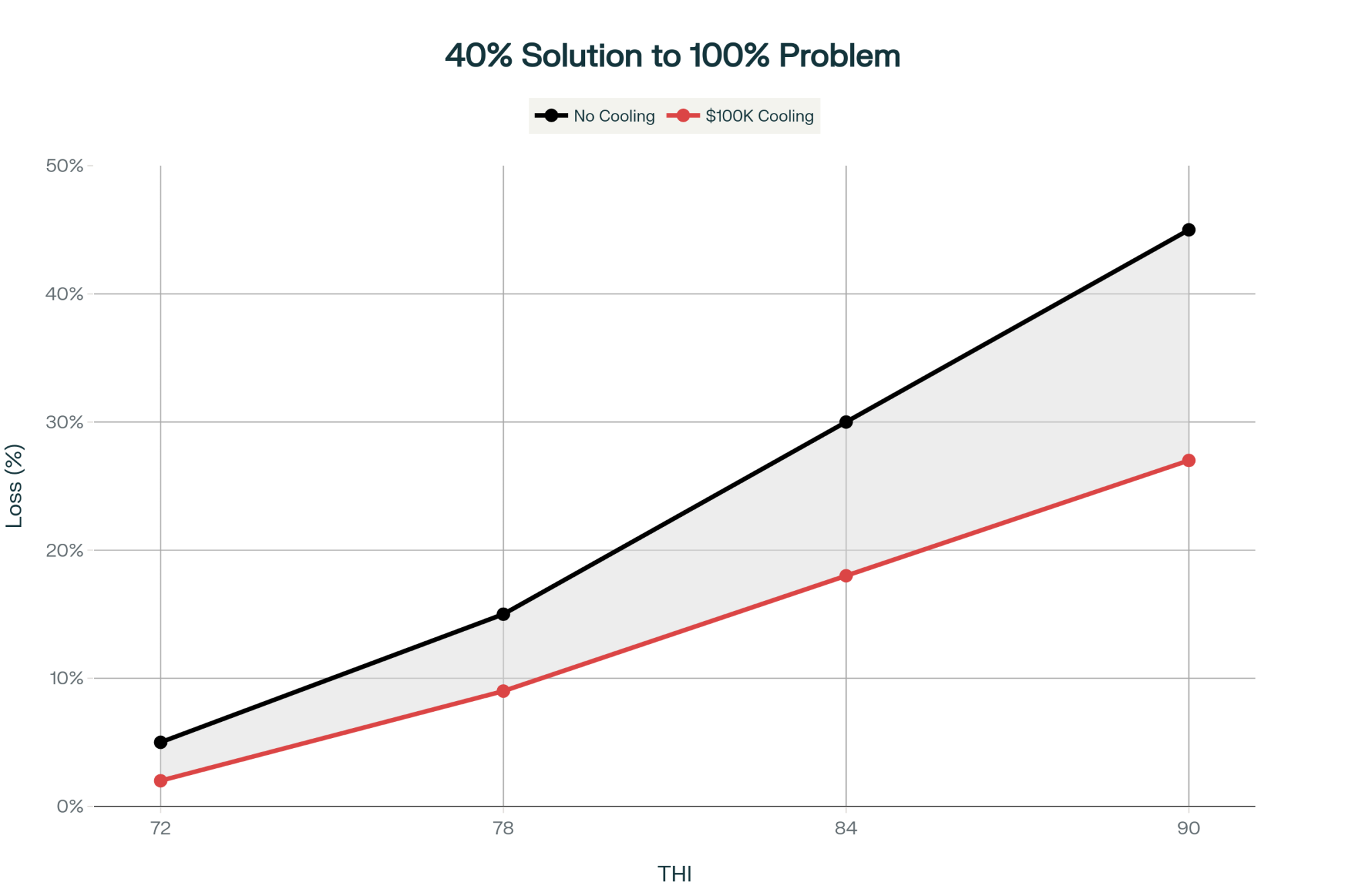

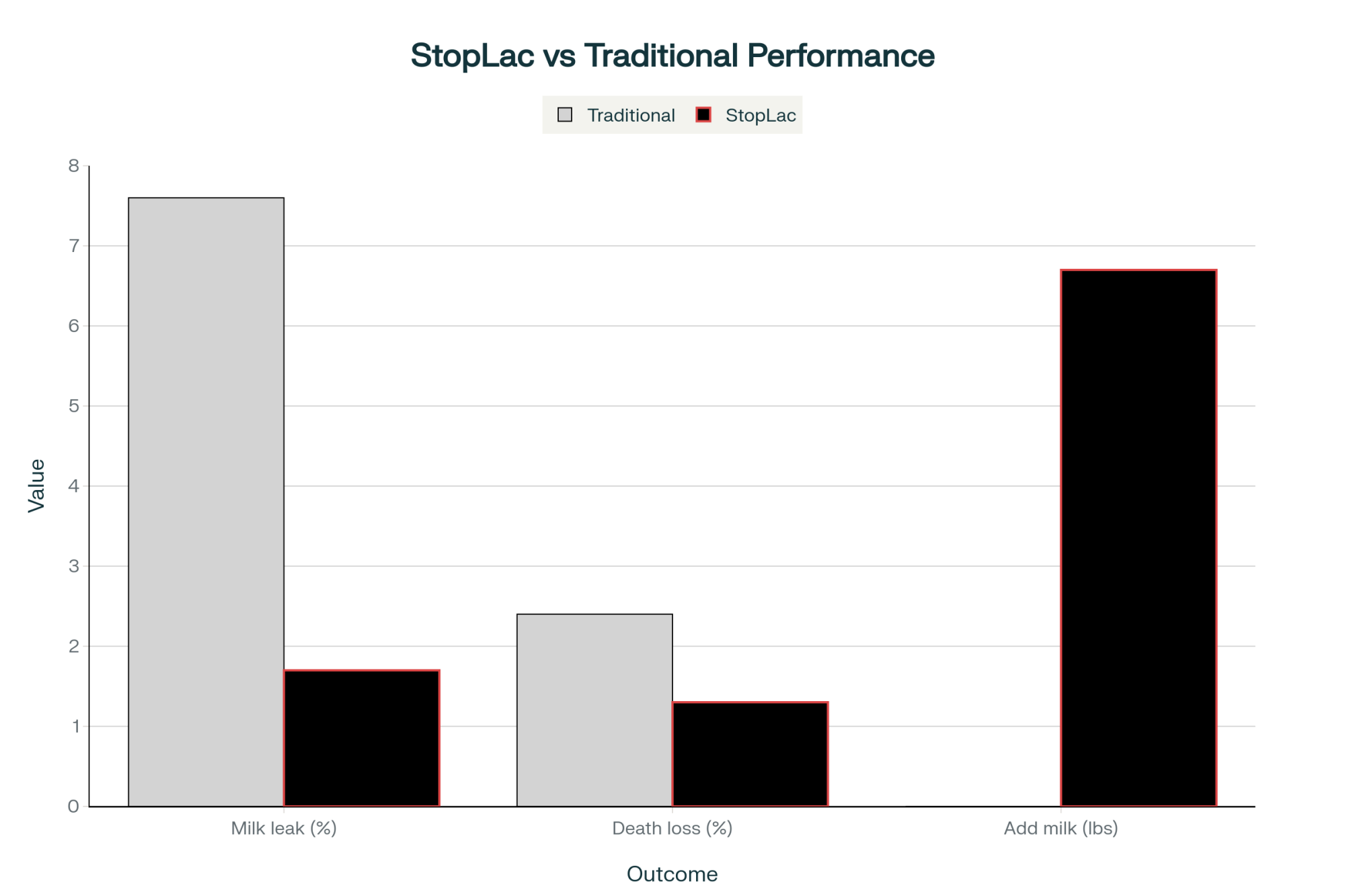

So Ferraretto’s Wisconsin team discovered something remarkably consistent across all those studies. For every centimeter you raise that cutting height—that’s about 0.4 inches for those of us still thinking in imperial—your corn silage gains 0.09 percentage units of starch and 0.08 units of NDF digestibility. But you’re also losing 0.06 tons per acre in yield. Every single time.

Now, those numbers might sound small, but let’s put this in perspective. When you raise your cutting height from 6 inches to 18 inches—a 30-centimeter increase—here’s what happens:

- Your starch content jumps from around 28% to 30.7% (that’s a 2.7 percentage point gain)

- NDF digestibility improves from 55% to 58% (3 units better)

- NDF content drops from 45% to 42.3% (2.7 points lower)

- But you’re losing approximately 0.8 tons per acre in yield

The quality improvements are remarkably consistent across different hybrids and growing conditions—that’s what made the research so compelling. The yield loss? That’s guaranteed too. But whether that trade-off makes economic sense… well, that depends entirely on your specific situation.

When Modern Genetics Flip the Script

Here’s where it gets really interesting—and honestly, it caught me off guard when I first saw the data. Those stay-green hybrids that dominate the seed market now? They’ve completely decoupled ear maturity from stalk maturity in ways that flip our conventional wisdom on its head.

The Wisconsin research revealed that wetter corn below 32% dry matter shows the strongest starch response to increased cutting height—we’re talking 0.10 percentage units per centimeter. Meanwhile, drier corn above 37% DM shows greater fiber digestibility (0.12 units per centimeter) but lower starch digestibility.

This contradicts what most of us learned years ago, doesn’t it? But when you think about how stay-green genetics actually work, it makes sense. These hybrids keep stalks green and photosynthesizing while the grain matures normally—it’s like the ear and stalk are running on completely different schedules. So at lower whole-plant moisture, you’ve got these mature ears sitting on relatively immature, high-moisture stalks. The bottom portions haven’t fully lignified yet, which makes them more of a starch-diluting factor than a fiber-quality problem.

What we’re seeing is that those immature stalks hurt you more by watering down starch concentration than by adding indigestible fiber. By the time you hit 37% DM, those stalks have finally lignified, and suddenly the cutting-height benefit shifts from starch concentration to improved fiber digestibility. Complete reversal of traditional thinking.

Two Scenarios, Same Decision, Completely Different Outcomes

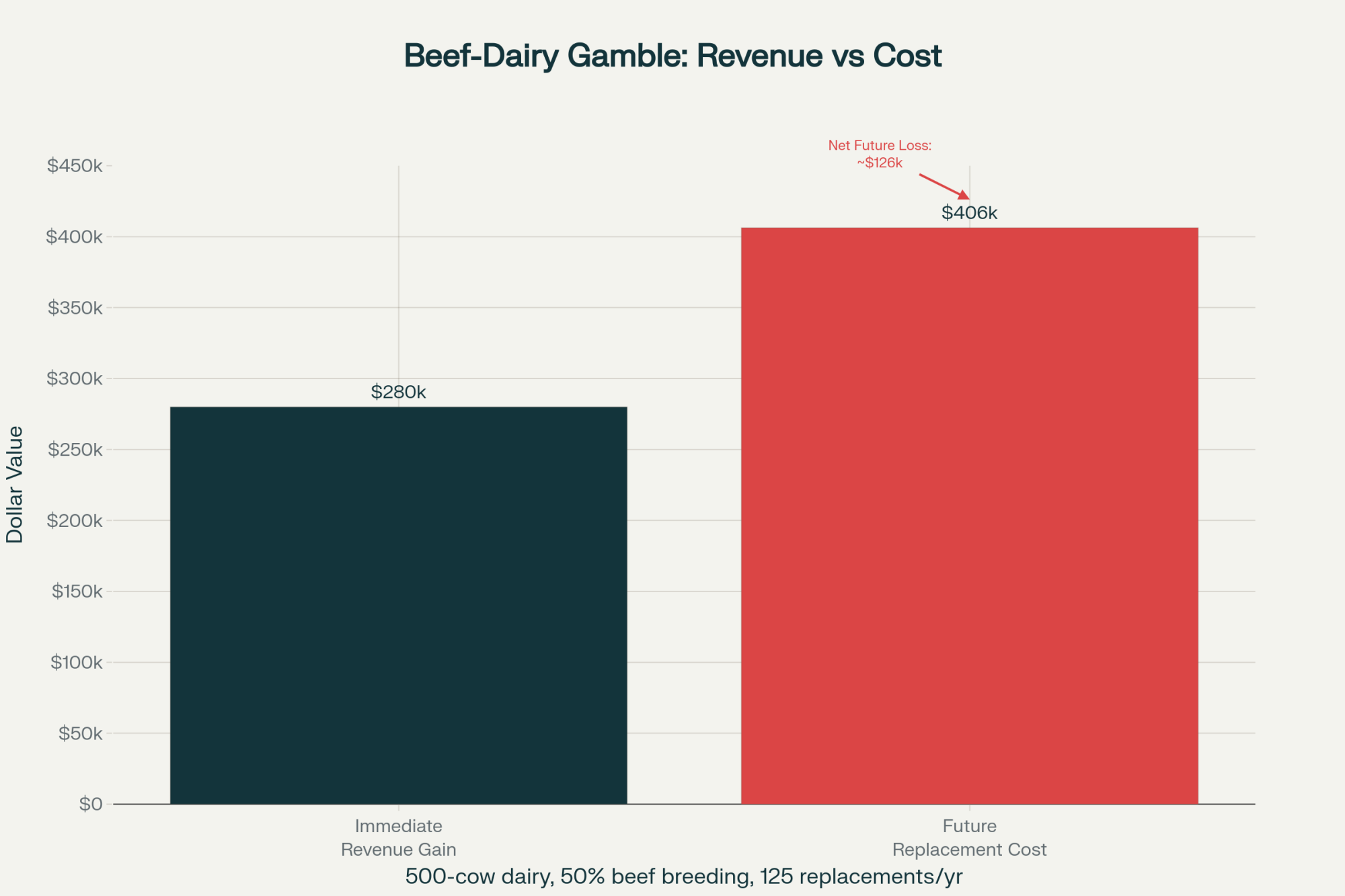

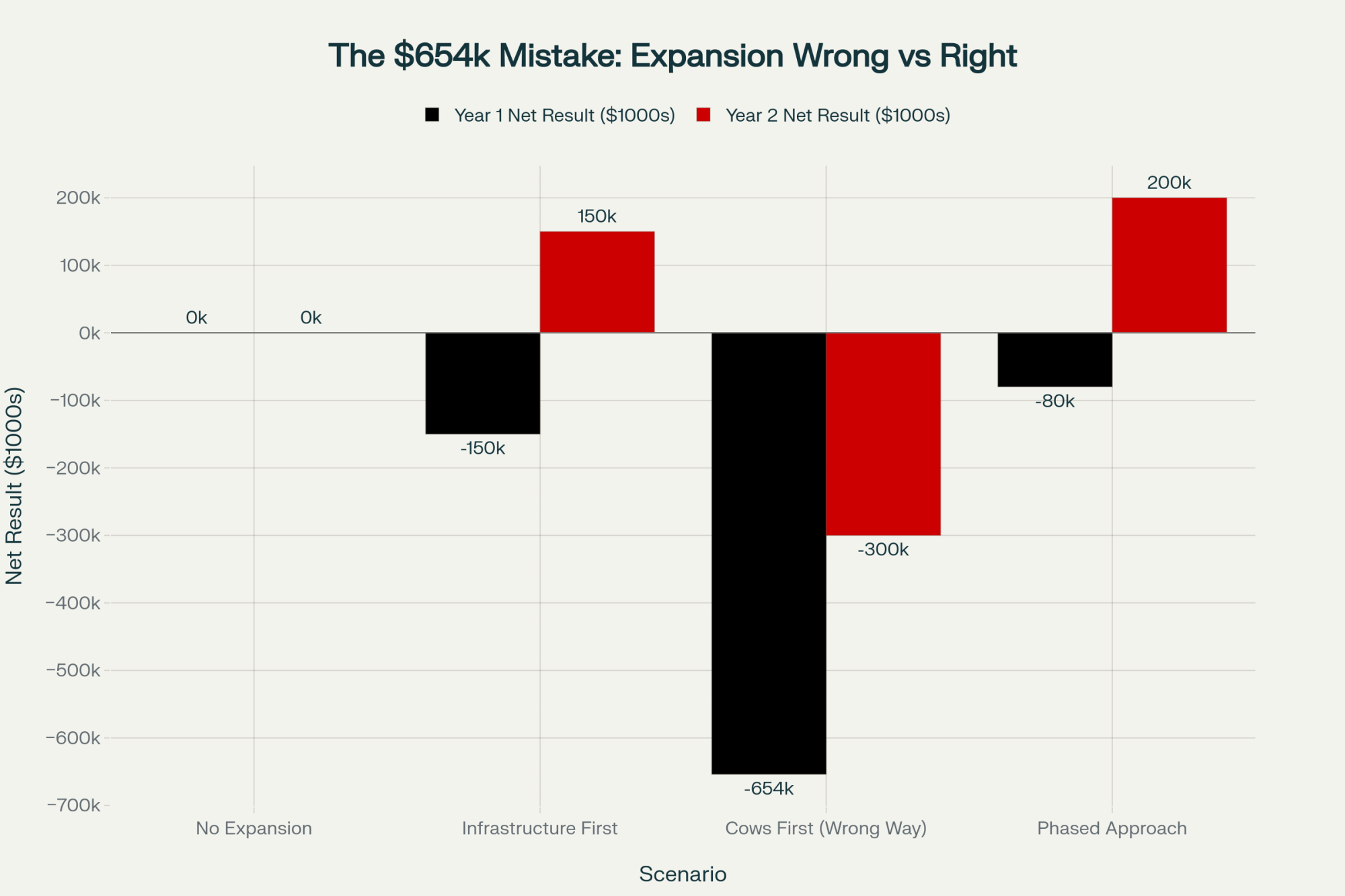

Let me share two economic scenarios that really drive home why context matters more than the cutting height itself. These are based on detailed modeling using actual market conditions.

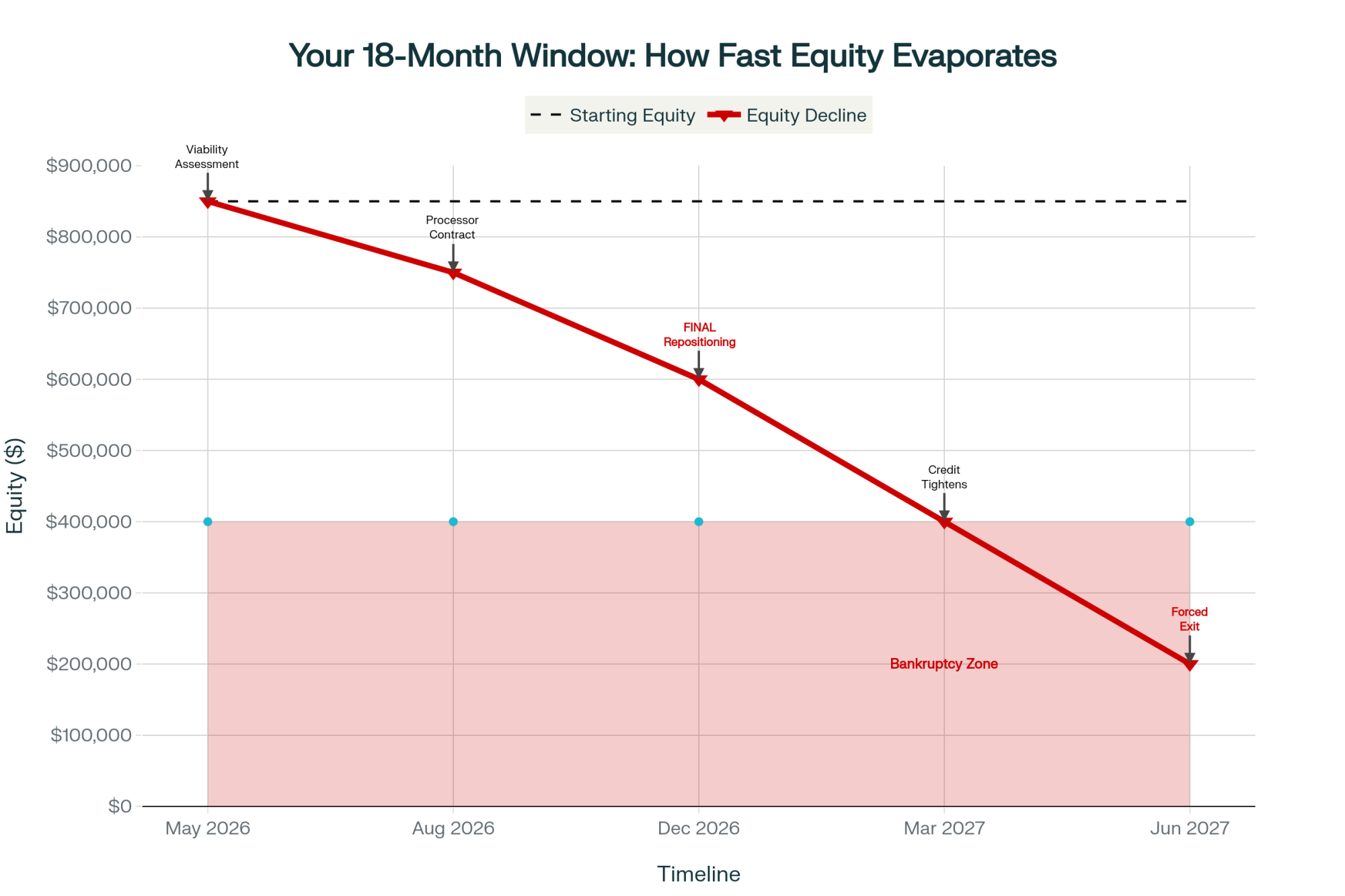

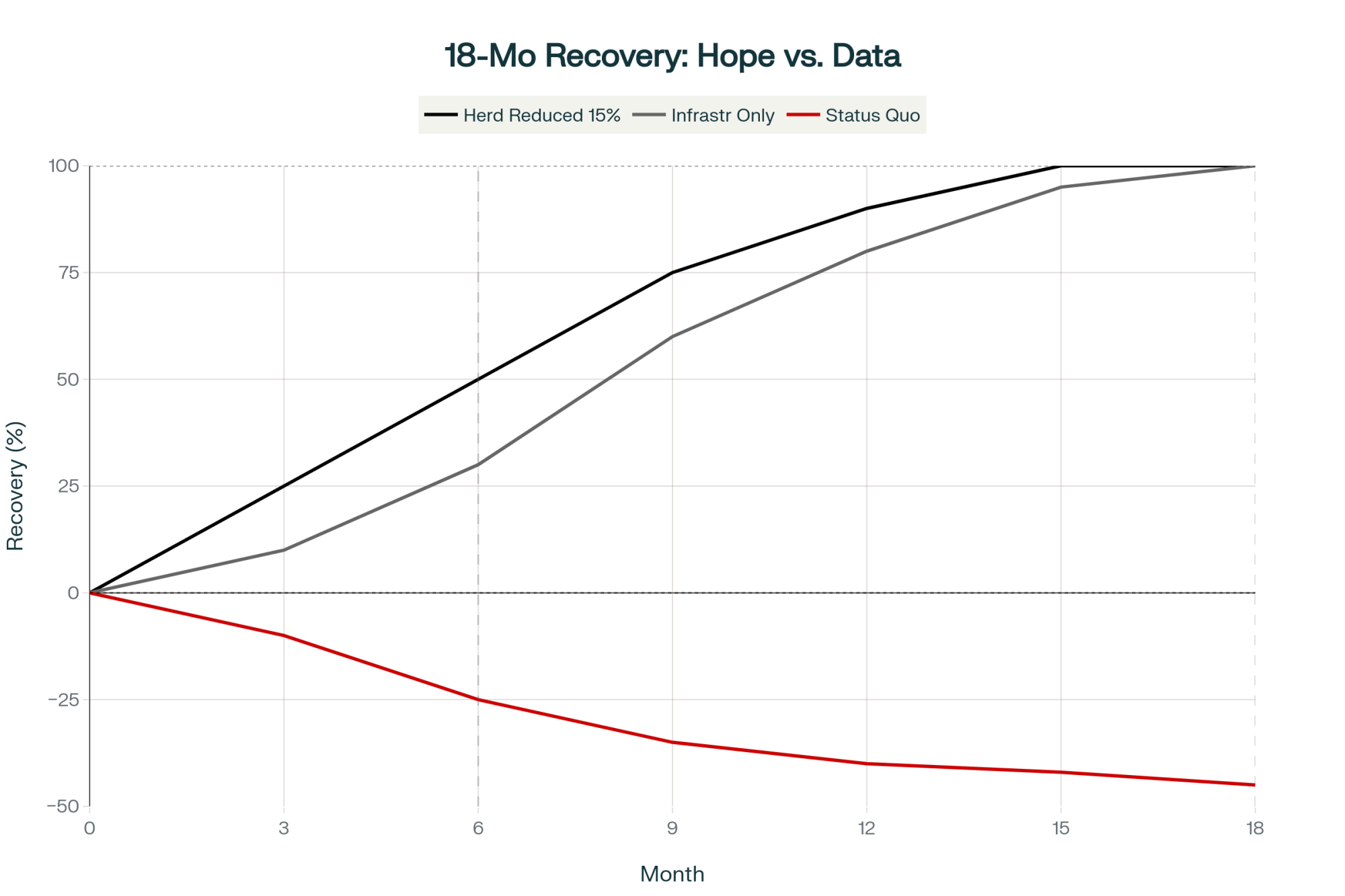

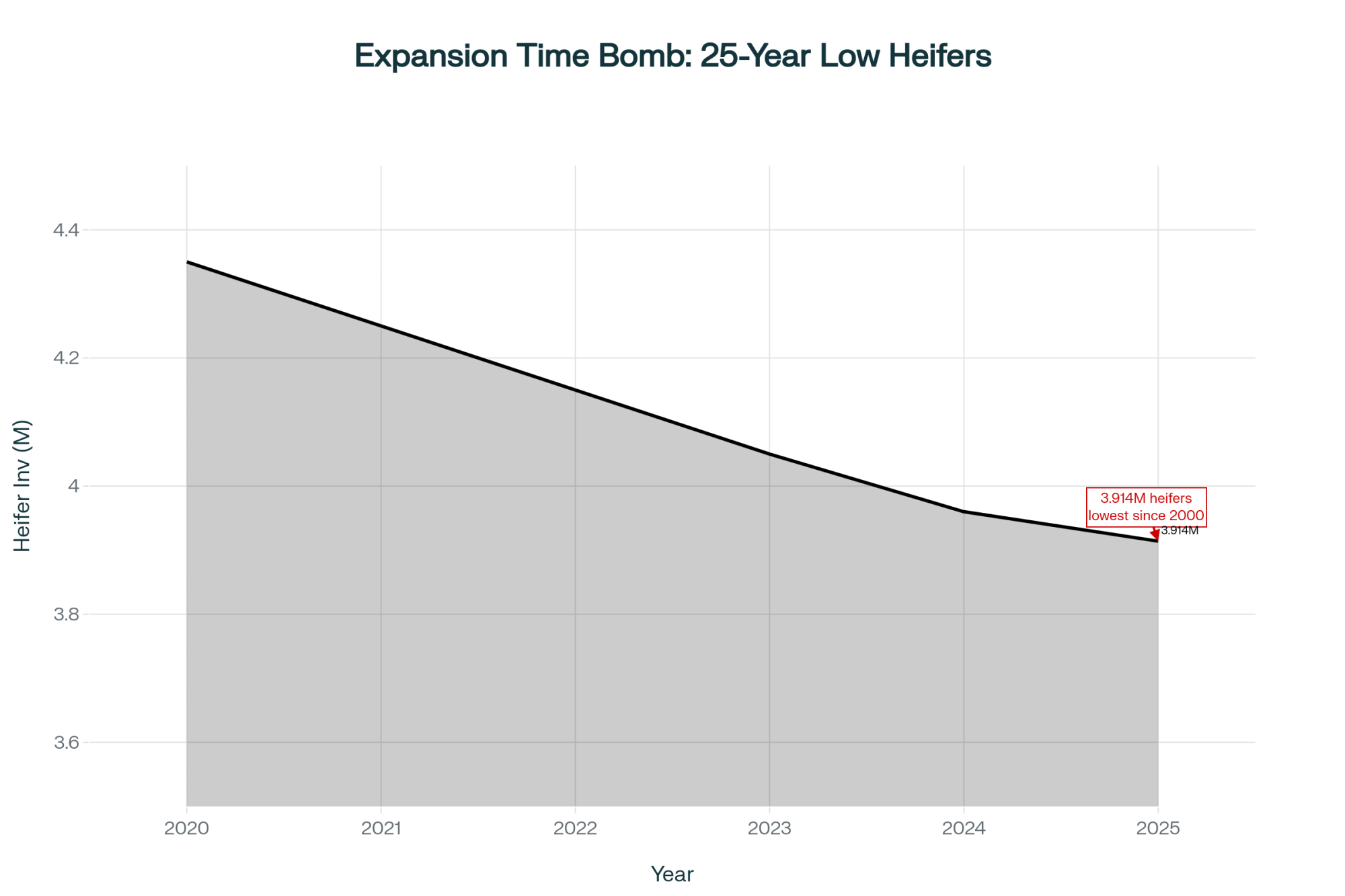

Scenario One: When Things Go Wrong—A $36,000 Loss

Picture a typical 500-cow dairy facing 2024 market conditions: milk at $20/cwt, corn at $3.90/bushel, and what seems like adequate inventory levels. They’ve read the Wisconsin research, seen those quality improvements from high cutting, and decide to chop at 18 inches instead of their usual 6 inches.

On paper, the math looks solid. They’re expecting a realistic 0.5 lbs/day milk response (reasonable for average genetics), worth about $18,250 annually. Grain savings from better forage quality add another $8,600. Against a silage yield loss valued at $10,820, they’re projecting a comfortable $16,000 gain.

But here’s where reality bites. That yield loss leaves them with dangerously thin inventory margins—something that doesn’t become apparent until March. A mold outbreak costs them a week’s silage. Weather delays compound the shortage. By April, they’re scrambling to buy replacement forage at $180/ton—typical spring pricing in the upper Midwest. Production drops 8 lbs/day when silage runs short because cows simply can’t eat enough alternative feeds. When you run all the numbers, it’s a $36,000 net loss from a decision that looked profitable in August.

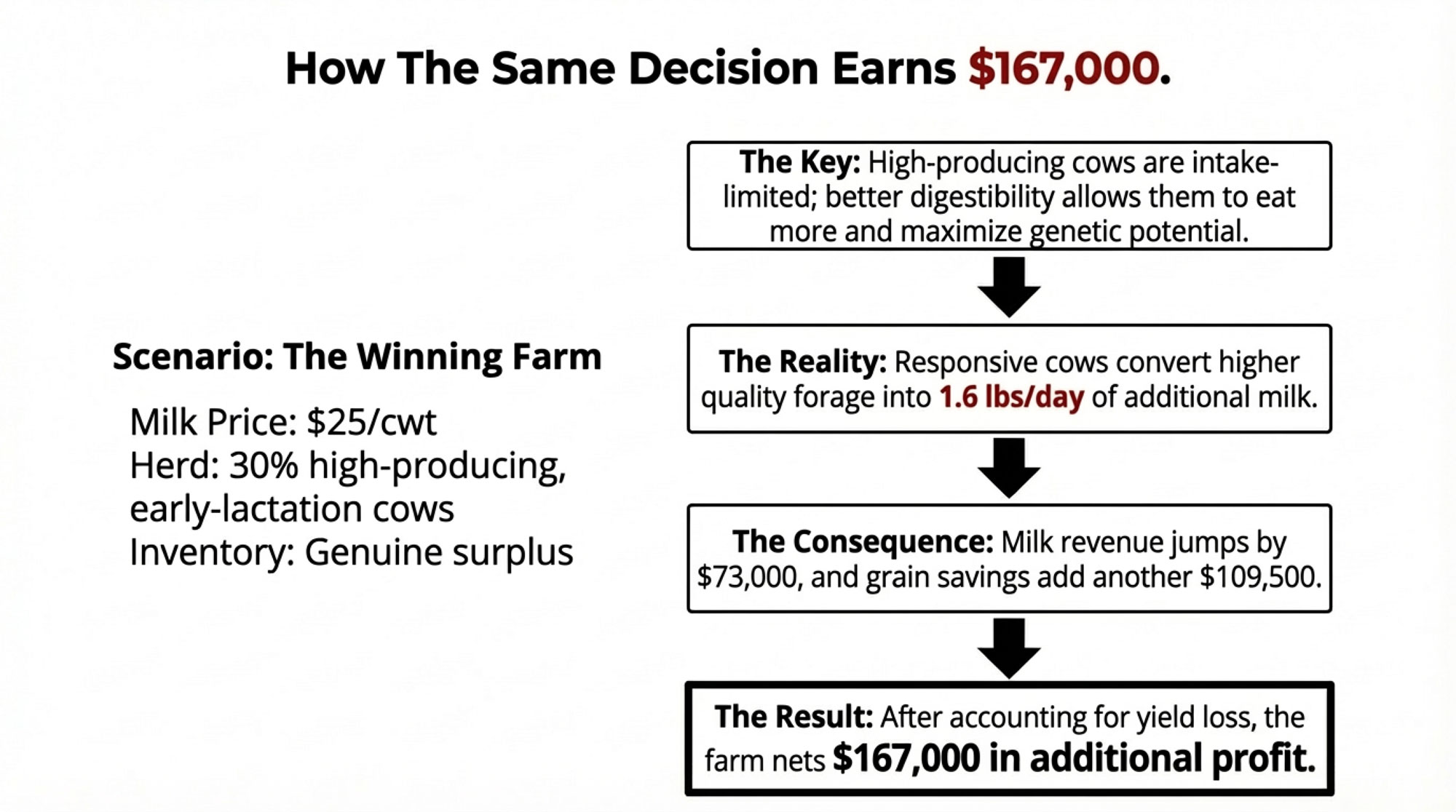

Scenario Two: When Everything Aligns—$167,000 Additional Profit

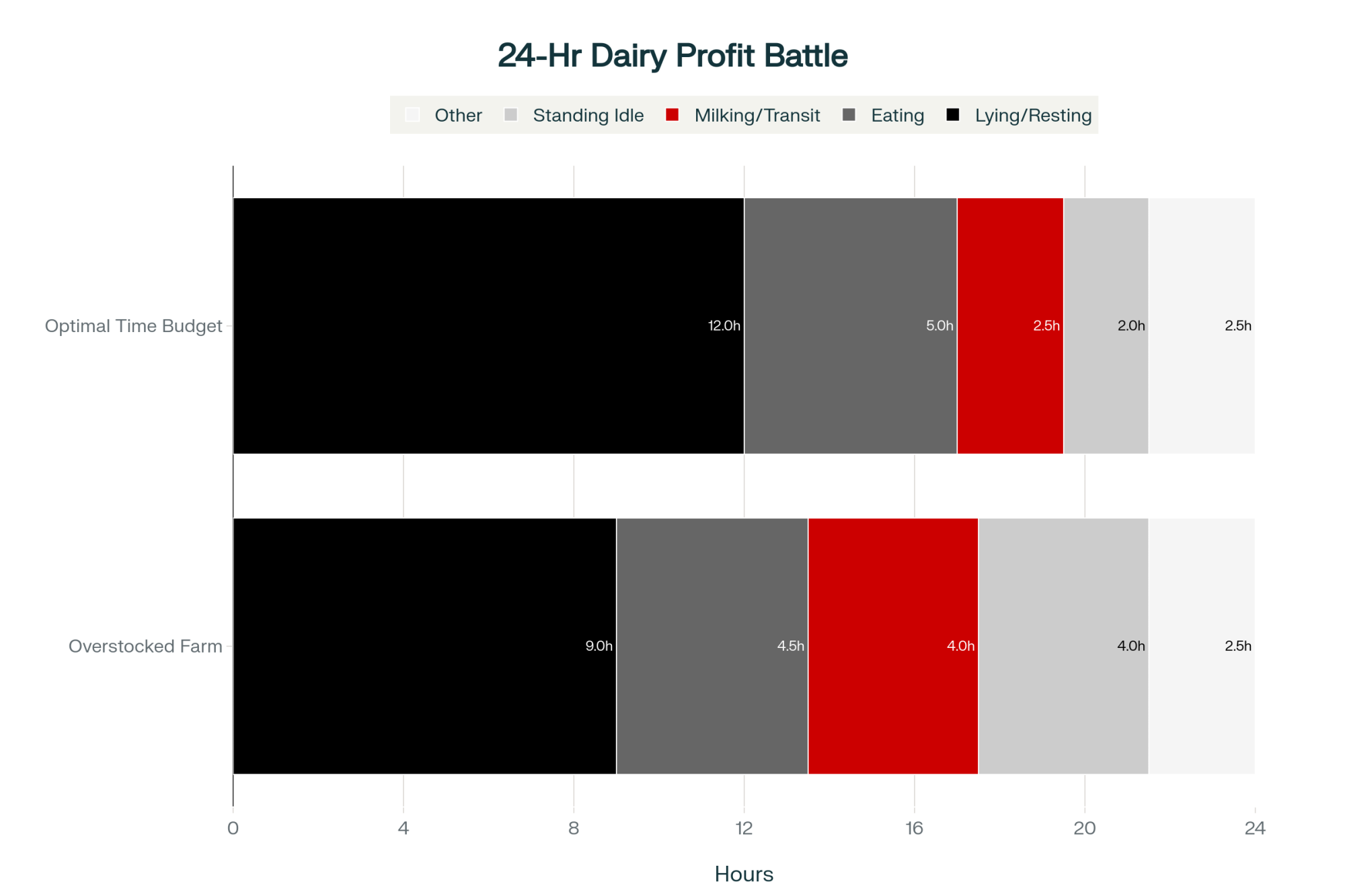

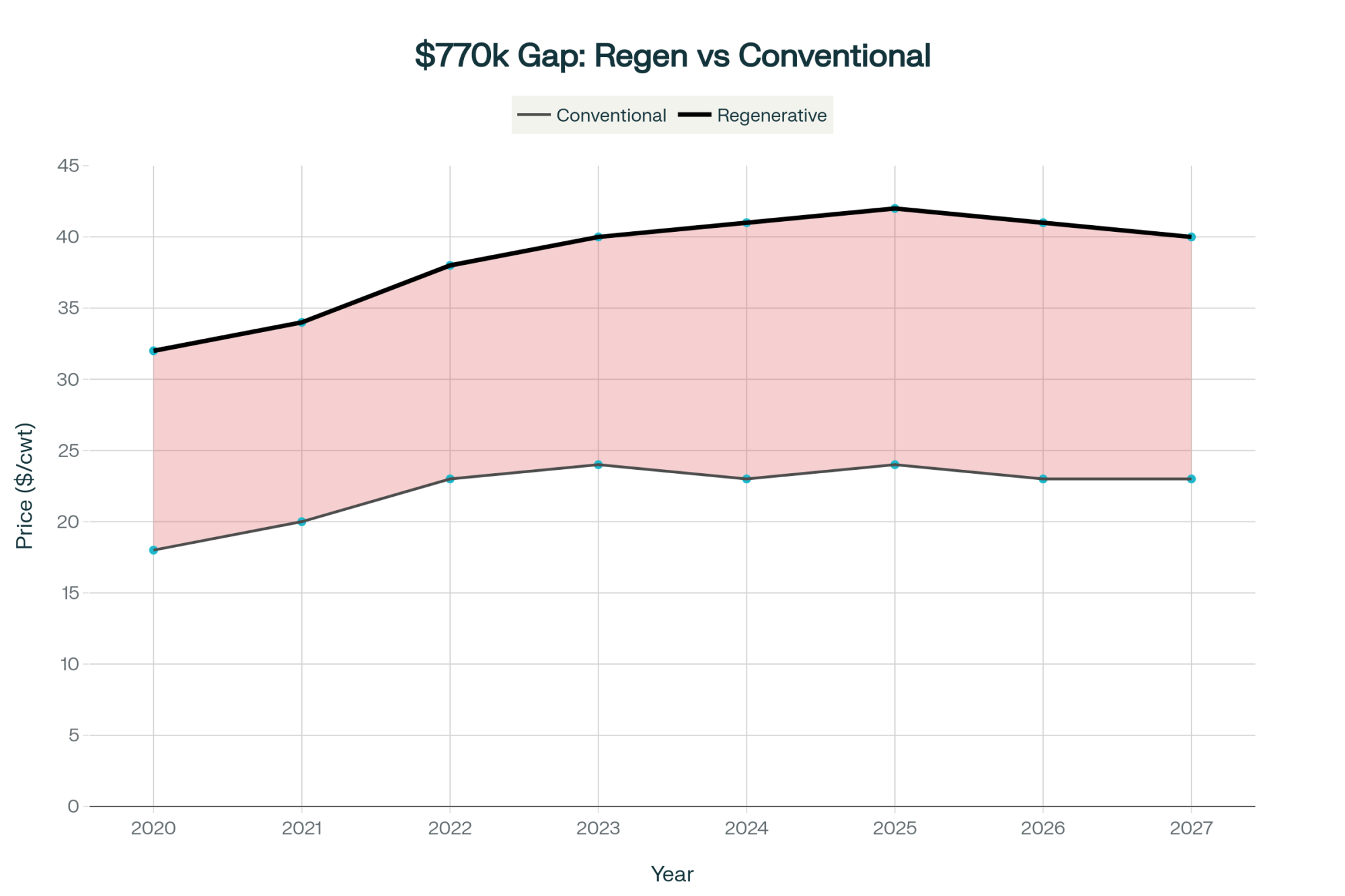

Now consider the same 500-cow size, but under different conditions: milk at $25/cwt (as we saw in 2022-2023), grain at $20/cwt, with about 30% of the herd being high-producing, early-lactation cows averaging 55 lbs/day. This operation has genuine surplus inventory—not just “probably enough” but a real buffer—and excellent ration management with monthly forage testing.

Here’s what makes the difference: Those high producers physically can’t eat enough low-quality forage to maximize their genetic potential. They’re maxed out on intake. Better fiber digestibility from high cutting means lower rumen fill and higher passage rates, allowing more intake. In this scenario, the modeling shows these responsive cows converting the quality improvement into 1.6 lbs/day additional milk—worth $73,000 annually.

At $20/cwt, reducing supplementation by 3 lbs/cow/day saves $109,500. Against a $15,500 silage yield loss, the net result is $167,000 in additional profit. Same decision, completely different outcome.

The Tale of Two Farms: Economic Comparison

| Factor | Losing Farm | Winning Farm |

| Milk Price | $20/cwt | $25/cwt |

| Grain Cost | $14/cwt | $20/cwt |

| Herd Profile | Average genetics | 30% high producers (55 lbs/day) |

| Milk Response | 0.5 lbs/day | 1.6 lbs/day |

| Inventory Status | Thin margins | Genuine surplus |

| Spring Shortage | $41,000 replacement feed | None |

| Annual Result | -$36,000 loss | +$167,000 profit |

The Middle Ground: A Practical Framework for Real Decisions

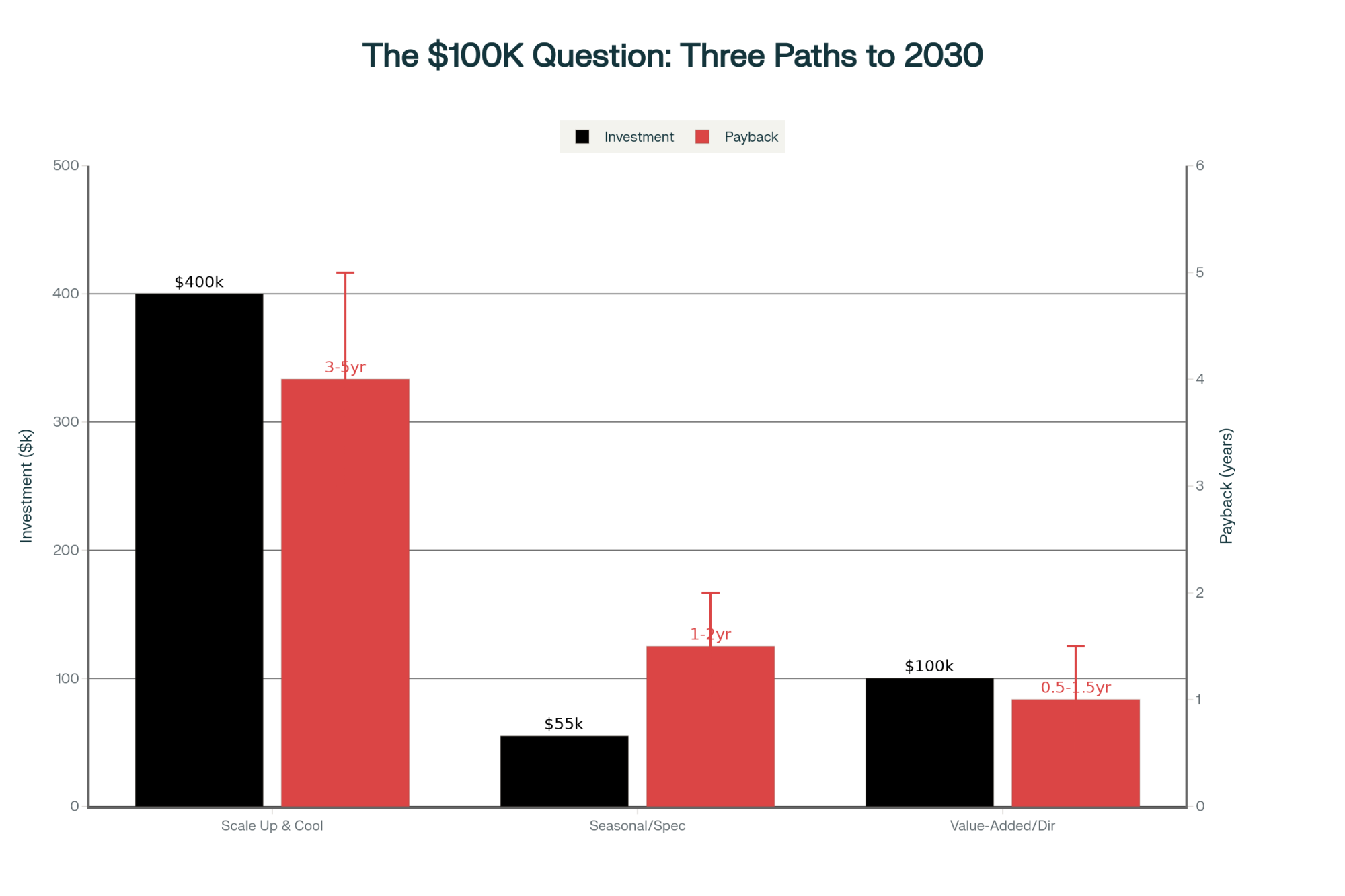

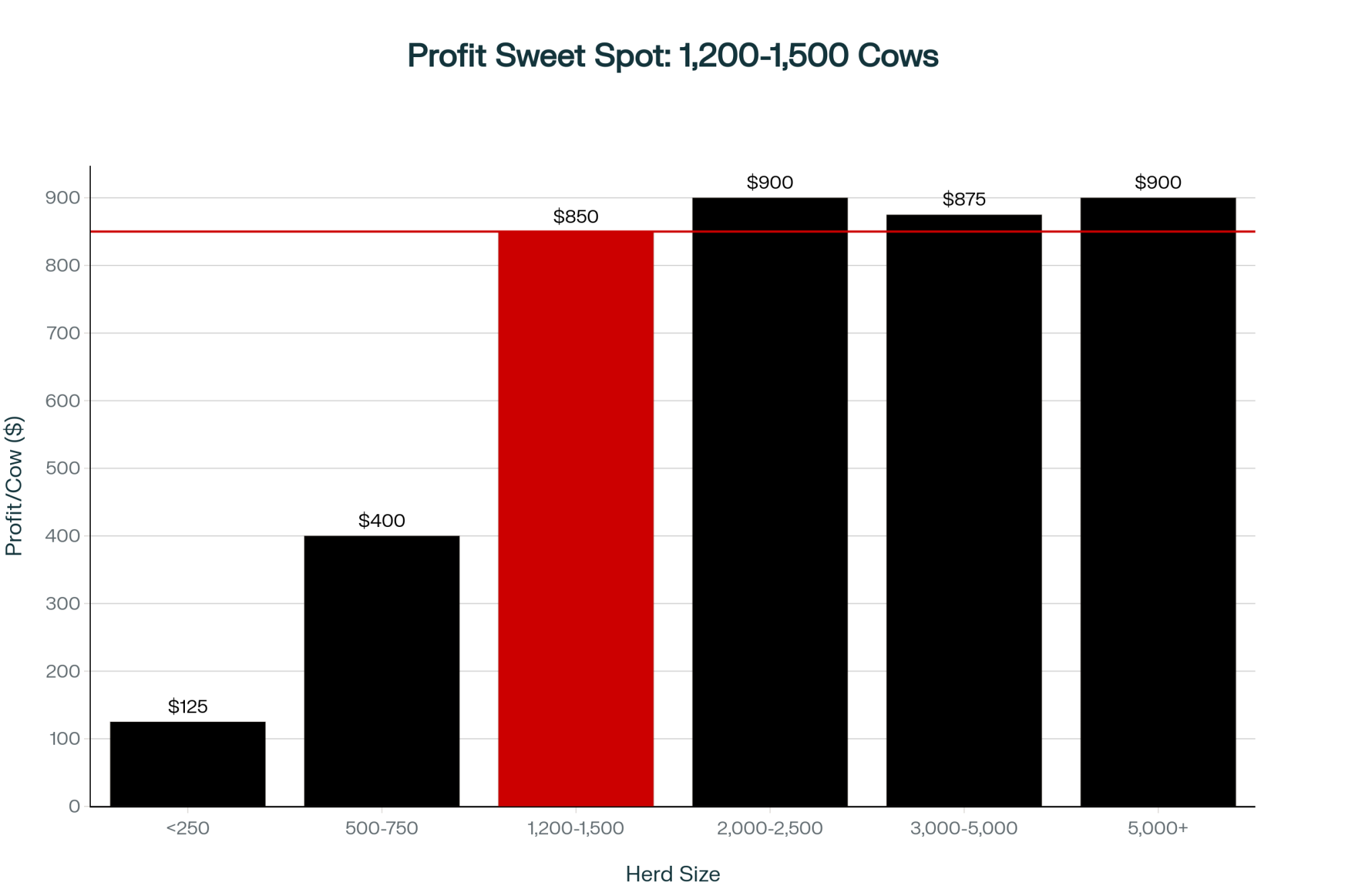

Most operations I work with fall somewhere between these extremes, facing milk prices around $21-22/cwt and moderate conditions where the economics don’t clearly point one direction. For these farms, the Wisconsin research suggests looking beyond pure economics to what I call the six critical tiebreaker questions:

The 6 Tiebreaker Questions

1. Are you meeting milk quota or supply contracts? If you’re under quota, extra milk has real value. But if you’re already flush and dumping or selling at lower prices? There’s zero upside to additional production. This is especially relevant for farms in Federal Order areas with base programs.

2. What are your herd genetics for feed efficiency? Those genomically selected, high-merit cows with +3000M genetics—they respond better to forage quality improvements than average commercial genetics. If you’ve been investing in genetics, you need to feed for it.

3. When do your cows freshen? Fall and winter fresh cows are in peak early lactation when feeding that high-quality silage—exactly when they’re most responsive. Spring calvers? They’ll be mid-to-late lactation by the time new silage is fed. Makes a huge difference.

4. How sophisticated is your forage testing and ration management? Monthly testing and active ration adjustments capture quality gains. If you’re testing once or twice a year, you’re probably missing the optimization window entirely.

5. What’s your working capital situation? Can you absorb an $80,000 swing if things go sideways? Tight margins mean lower risk tolerance—that’s just reality for many operations right now.

6. How important is feed cost predictability? High-cut silage reduces grain dependency, providing more stable feed costs when grain markets are volatile. For farms with locked-in milk contracts, this predictability has real value.

What I’ve found is that farms answering “yes” to four or more of these should lean toward high cutting. Those with two or fewer “yes” answers should favor conventional height. It’s not perfect, but it’s been remarkably consistent in predicting success.

The Wisconsin Calculator: More Strategic Tool Than You Think

The University of Wisconsin’s Corn Silage Cutting Height Calculator has become an essential tool—you can find it at dairy.extension.wisc.edu under their forage resources. But here’s what I’ve learned: it’s not about plugging in numbers once and calling it done.

The strategic farms run three milk price scenarios—conservative at $20, realistic at $22, and optimistic at $25. They test different yield baselines using their worst-case, average, and best-case historical yields. They vary baseline forage quality inputs to see how much improvement actually matters for their specific situation.

What’s really valuable is how the calculator makes the cost-per-ton reality impossible to ignore. When it shows your silage cost rising from 5/ton DM at conventional cutting to 3/ton at high cutting, you have to ask yourself: Do I genuinely believe my herd can convert that quality into enough milk to justify paying an /ton premium? That’s the real question, isn’t it?

Regional Variations Matter More Than You Think

Something I’ve noticed working with farms from California to New York—the optimal strategy varies significantly by region. In the Northeast, where purchased forage is readily available but expensive, inventory buffer matters less than in the upper Midwest, where replacement forage might be 200 miles away. California dairies with year-round production and minimal seasonality in fresh cow patterns face different economics than Pennsylvania operations with strong seasonal calving.

In the Southwest, where corn is often harvested multiple times per year, the risk of inventory shortages is lower, making high-cut strategies more viable. Meanwhile, in areas like Idaho, where transportation costs for replacement feeds are substantial, that 0.8 tons/acre yield loss becomes much more costly to replace if things go wrong.

Implementation Reality: The 60-75% Achievement Factor

Even with perfect planning, field reality introduces complications that the research can’t fully capture. Modern forage harvesters, even good ones, maintain cutting height within plus or minus 2-3 inches at best. That creates quality variation across every field.

Your 250-acre field isn’t flat. You’ve got valleys where the header runs at 13 inches, ridges where it hits 22 inches, all while you’re targeting 18 inches. You end up with four distinct quality profiles in a single harvest. When your forage test shows 29.5% starch instead of the projected 30.7%, that’s not necessarily a management failure—it’s equipment variation meeting field reality.

Given equipment consistency limitations and field variability, farms with basic equipment are likely to capture 60-75% of research-projected benefits, while precision-equipped operations may achieve 80-90%. But we’re talking an additional $15,000-25,000 for that precision equipment. Is capturing that extra 15% worth twenty grand? That depends on your operation’s scale and economics.

When Safety Trumps Everything: The Drought Factor

Drought-stressed corn throws all economic calculations out the window. Ohio State and Penn State Extension research demonstrates that nitrate accumulation in drought-stressed corn can reach 5,524 ppm in the lower third of stalks, compared to just 17 ppm in ears. With livestock safety thresholds at 1,000 ppm NO3-N, high cutting becomes mandatory regardless of economics.

The 2012 Midwest drought provided stark lessons about nitrate risk management. Extension reports from that period show that farms implementing high-cutting strategies and testing for nitrates generally avoided the livestock health issues—including animal deaths and reproductive failures—that affected operations using conventional cutting practices. No amount of saved tonnage is worth risking your herd’s health.

If you’re dealing with drought stress, the protocol is clear: test for nitrates before harvest, chop at 12+ inches minimum if levels exceed 1,500 ppm, and allow 3-4 weeks fermentation before feeding. It’s not about economics at that point—it’s about keeping your cows alive and healthy.

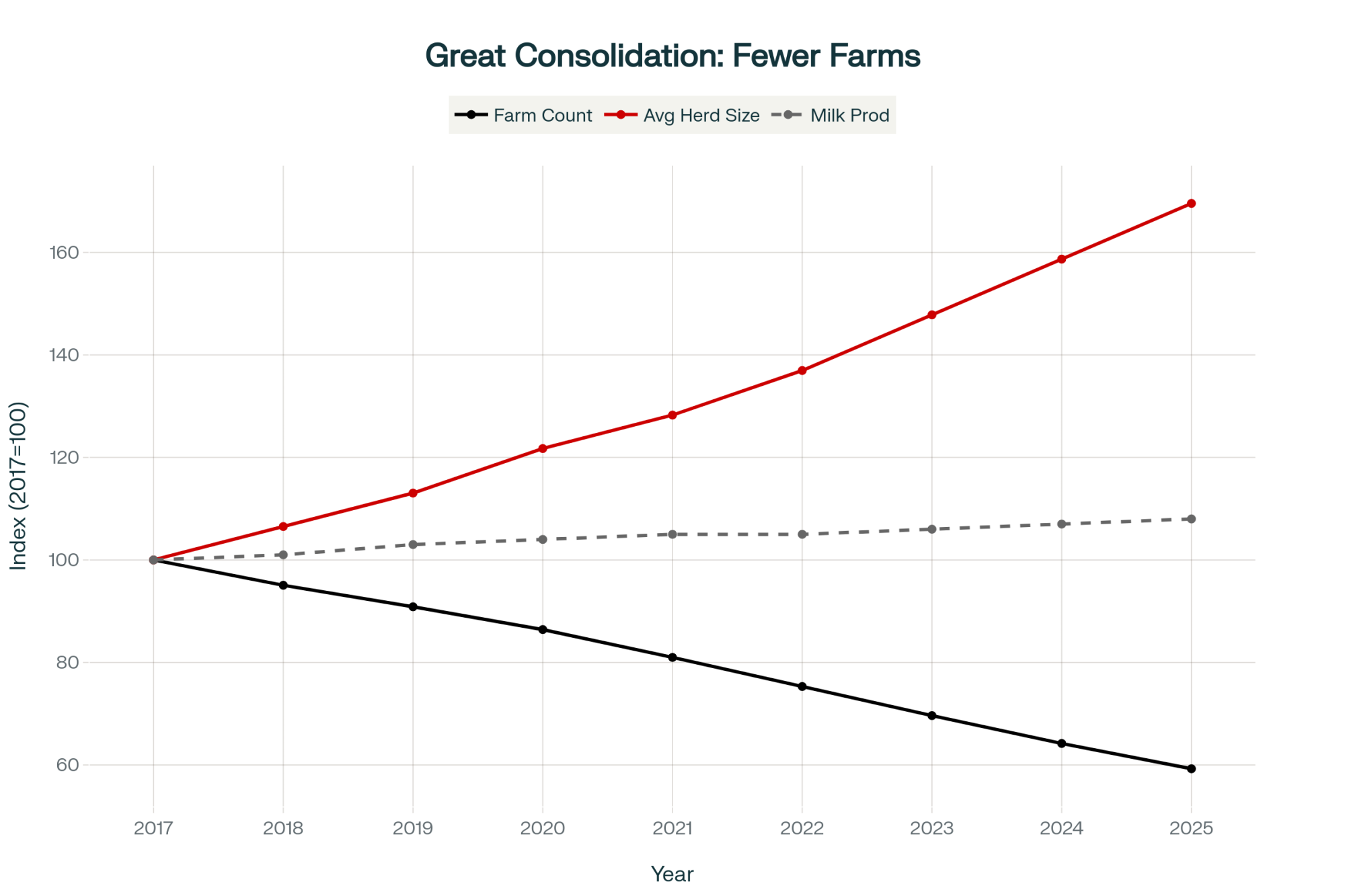

Why Are Seed Companies Silent on Harvest Strategy?

Here’s something that frustrates me, and probably you too: We’re spending $400 per bag on stay-green hybrids without anyone explaining how those genetics should influence harvest decisions six months later. I’ve sat through dozens of seed sales presentations, and they focus on yield, standability, and disease resistance—all important—but remain completely silent on how stay-green characteristics affect cutting-height optimization.

This communication gap means we’re making genetic investments in March that fundamentally alter our harvest economics in August, yet the connection is rarely made explicit. You’d think a simple matrix showing recommended cutting heights and quality responses by hybrid would be standard by now. But I haven’t seen a single major seed company provide this information.

The companies have their reasons, of course. Testing the cutting-height response for each hybrid is expensive. It complicates marketing. And honestly, they see it as a harvest management issue, not a seed selection issue. Fair enough from their perspective, but it leaves us in the dark when we’re trying to make informed decisions.

Critical Decision Timeline for Success

Looking at operations that consistently get this right, timing is absolutely critical. Here’s the timeline that actually works:

March-April (Seed Selection): Identify which hybrids have stay-green genetics. Note any “delayed senescence” or “premium stay-green” traits. Understand that these will respond differently to cutting height.

Late July (Critical Planning Week): Run the Wisconsin Calculator with multiple scenarios. Test drought-stressed fields for nitrates (5-10 plants, lower third). Score yourself on those six tiebreaker questions. Document your cutting height decision per field—in writing.

Early August (Harvest Preparation): Communicate specific targets to your harvest crew. Calibrate equipment, verify header consistency. Plan for that plus-or-minus 2-3 inch variation around the target.

During Harvest: Test first loads immediately for DM and quality. Adjust if quality differs from projections. Document actual versus planned for next year’s reference.

Post-Harvest: If nitrates were elevated, ferment for at least 3-4 weeks. Retest before feeding. Share results with your nutritionist for ration adjustments.

Key Takeaways for Strategic Implementation

What’s become clear from both the research and what we’re seeing in the field is that successful operations aren’t looking for a universal cutting height strategy. They’re the ones asking hard questions in July, testing their assumptions, and adapting their approach to match their specific economic reality.

The economics are incredibly context-dependent. That same cutting height that could generate $167,000 under optimal conditions might cost $36,000 under different circumstances. Your specific combination of milk price, grain cost, herd genetics, inventory situation, and management capability determines the outcome—not the height itself.

Quality improvements are real but not automatically bankable. Lab results consistently show improved starch and digestibility. But whether your cows convert that into milk depends on everything from ration reformulation to rumen microbiome variation to what percentage of your herd is actually in early lactation when you’re feeding that silage.

Variable strategies often work best. Instead of a single height across all fields, the smartest operators I know cut stay-green hybrids higher, conventional hybrids at standard height, and drought-stressed fields at a higher height, regardless of variety. It’s more complex, sure, but it captures value where it exists while avoiding losses where risk is high.

Looking Ahead

The decision on corn silage cutting height has evolved far beyond a simple mechanical adjustment. It’s become this sophisticated economic optimization that requires integrating agronomy, nutrition, economics, and risk management. The farms that recognize this complexity and plan accordingly are capturing significant value. Those that don’t? Well, they’re leaving money—sometimes substantial amounts—in the field.

The Wisconsin research provides the scientific foundation we needed. Their calculator and other economic modeling tools offer practical decision frameworks. But ultimately, each farm has to evaluate their unique situation against volatile markets, uncertain weather, and the biological variability that’s just part of dairy farming.

The $200,000 question isn’t whether to cut high or low. It’s whether you’re making that decision with complete information, at the right time, for your specific operation. In an industry where margins keep tightening and every decision counts, that level of strategic thinking around something as seemingly simple as cutting height might just be the difference between profitability and loss.

What’s interesting is how this all connects back to the bigger picture of precision management in dairy. We’re no longer in an era where one-size-fits-all recommendations work. The profitable farms of tomorrow—probably including yours—will be those that can integrate complex information, make field-specific decisions, and execute with discipline. Even on something as basic as where to set the chopper head.

You know, at the end of the day, it’s about being intentional with every decision. And that’s what separates the operations that thrive from those just trying to survive.

Additional Resources

Wisconsin Corn Silage Cutting Height Calculator: dairy.extension.wisc.edu/articles/corn-silage-cutting-height-calculator-background-and-guide/

Nitrate Testing Guidelines:

- Ohio State Extension: Nitrate Toxicity in Livestock

- Penn State Extension: Managing Drought-Stressed Corn Silage

Key Decision Thresholds:

- Nitrate Safety: <1,000 ppm NO3-N

- High-Cut Consideration: 4+ “yes” on tiebreaker questions

- Economic Breakeven: Typically 0.5-1.0 lb/day milk response needed

KEY TAKEAWAYS

- Same decision, $203,000 difference: Context (milk price, genetics, inventory) determines if you win or lose

- Quality gains are guaranteed, profits aren’t: 2.7% more starch costs 0.8 tons/acre—the math only works with the right conditions

- Stay-green genetics changed everything: Wetter corn now benefits MORE from high cutting than dry (opposite of tradition)

- Winners plan in July, losers react in August: Use Wisconsin’s calculator to model YOUR specific scenario

- Drought corn = mandatory high cut: Nitrates >1,500 ppm override all economics—it’s about safety

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More:

- Maximize Dairy Profits with High-Quality Corn Silage: Top Strategies for Success – Analyzes 1,800 silage samples to reveal how specific starch and fiber targets drive milk revenue, offering a nutritional roadmap that validates why the cutting height quality trade-offs discussed above are economically vital for high-producing herds.

- The Feed Price Paradox Crushing Dairy Margins – Explains why lower feed costs haven’t translated to higher profits for many producers, providing the essential economic context for why efficiency plays like optimized cutting height are critical for survival in the current margin environment.

- Your Feed Room’s Hidden $58,400 Leak – And How Smart Dairy Farms Are Plugging It – Uncovers how precision tracking technology identifies invisible feed shrink losses, offering a high-tech solution to preserve the valuable inventory you just worked so hard to harvest and store efficiently.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!