Is spending $10 on binders smarter than waiting 2 weeks to wean?

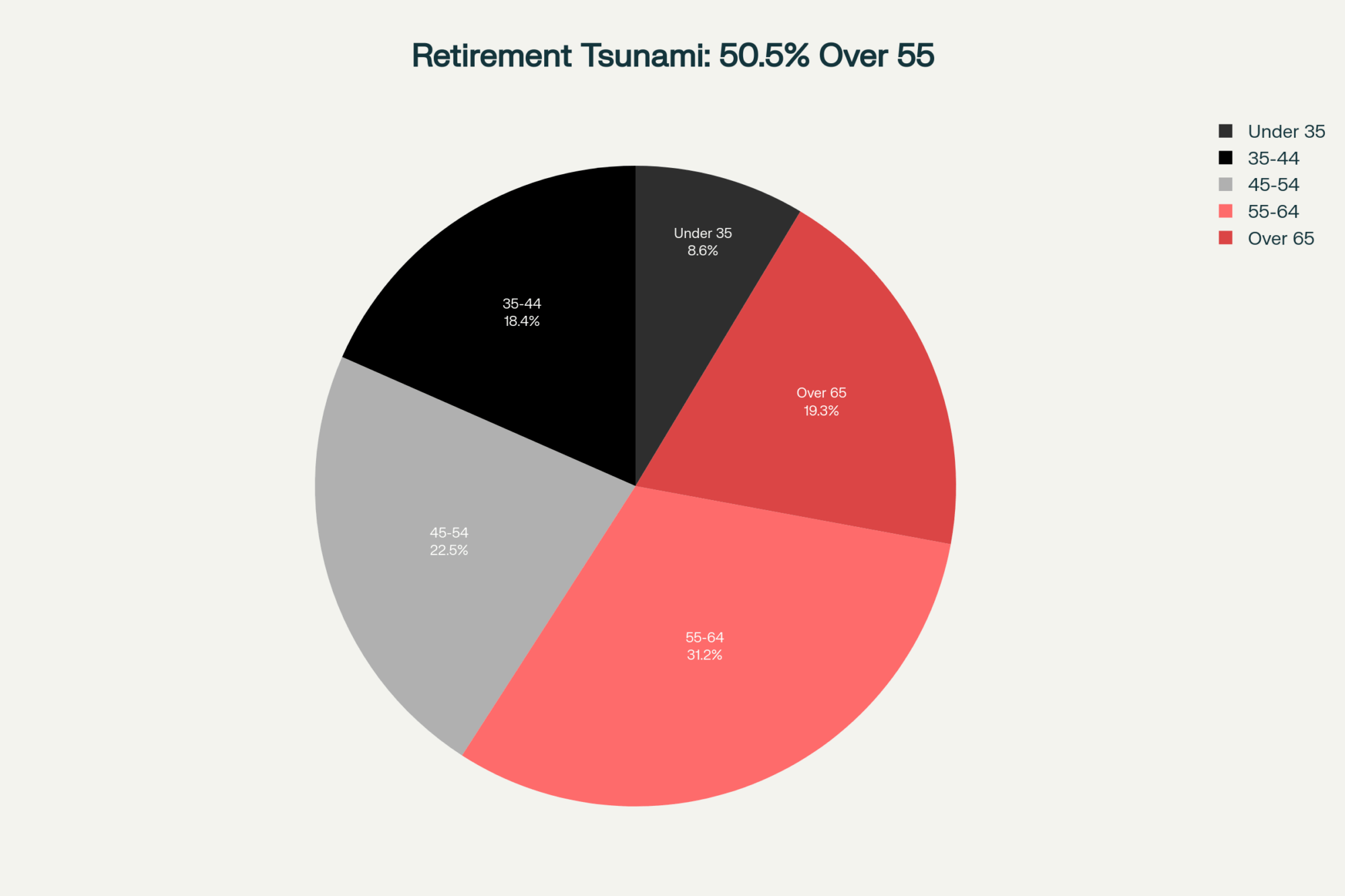

EXECUTIVE SUMMARY: What farmers are discovering about calf weaning might surprise you—the most successful operations aren’t necessarily the ones buying the most supplements. According to 2024 extension data, farms using gradual weaning protocols based on starter intake (2.75 pounds daily for three days) rather than calendar dates are seeing treatment costs drop by 20-30% while maintaining or improving growth rates. Dr. Michael Steele’s research at Guelph shows that managing ruminal pH during transition prevents the bacterial die-offs that release endotoxins in the first place, potentially eliminating the need for those $6-10 per calf binders many of us have accepted as necessary. Regional variations matter too—southern operations extending weaning during heat stress and northern farms using pair housing during winter are both finding better results by adapting to their specific conditions rather than following rigid protocols. Here’s what this means for your operation: whether you’re milking 50 cows or 5,000, the principle remains the same—healthy transitions based on biological readiness lead to healthier heifers and better lifetime production. The tools and knowledge are available through your extension service, and the potential returns make this worth examining carefully for any operation looking to improve both calf health and economics.

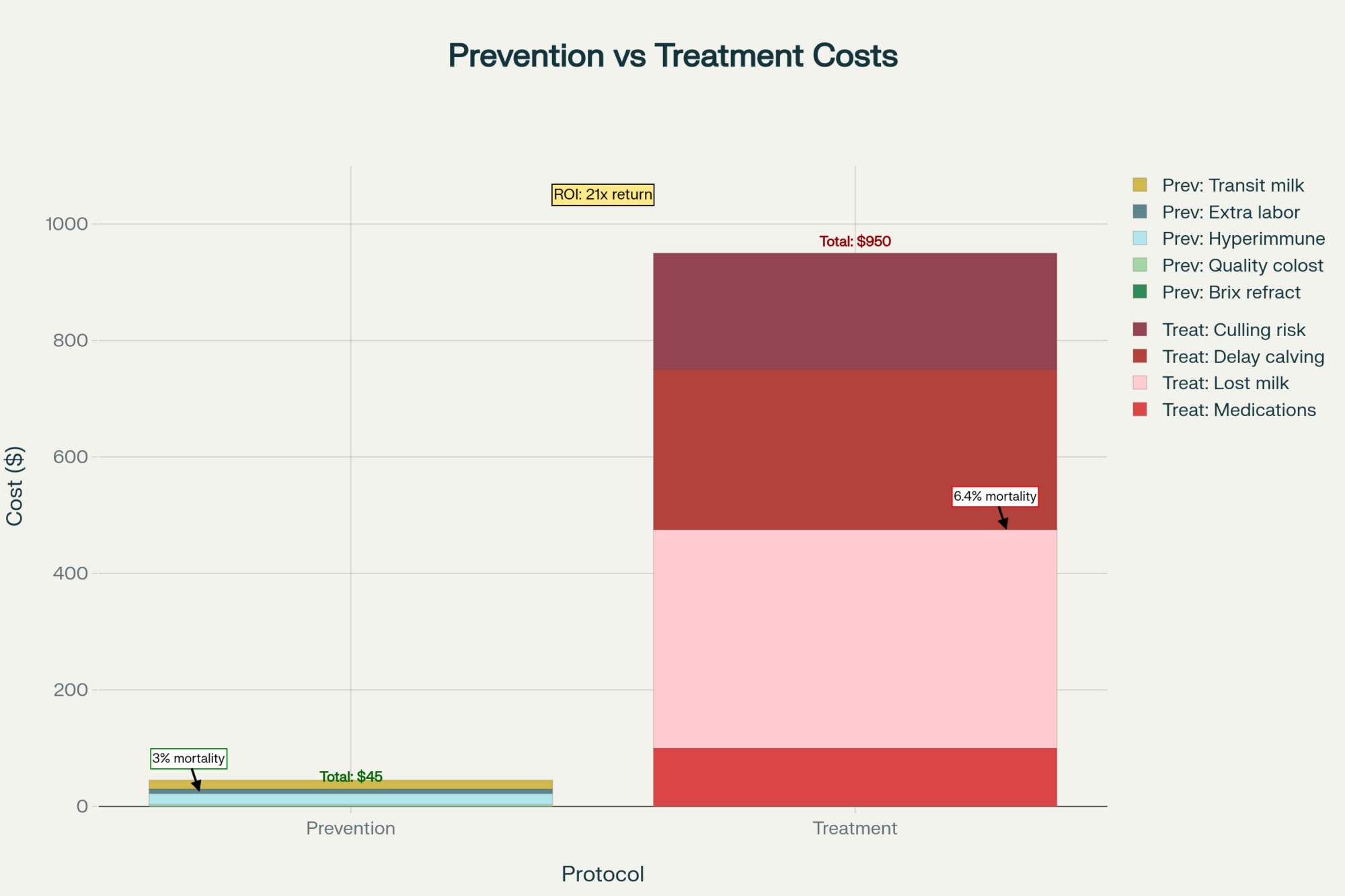

You know how weaning season always gets us thinking about what we’re spending versus what we’re getting? I’ve been talking with producers across the dairy belt lately, and here’s what’s interesting—we’re all looking at those endotoxin binder bills (running $6 to $10 per calf annually according to 2024-25 feed supplier pricing) and wondering if there might be a smarter approach to this whole transition period.

What I’ve found digging through extension publications and chatting with nutritionists is that we might be looking at this from angles we haven’t fully considered. Not that supplements don’t have their place—sometimes they’re exactly what we need—but maybe there are management pieces that could make a real difference.

What’s Actually Happening During Weaning

When we transition calves from milk to starter, most operations do this around 6-8 weeks, according to the USDA’s National Animal Health Monitoring System data—their digestive system essentially has to reinvent itself. The rumen begins producing volatile fatty acids as fermentation commences, and that’s where things can become complicated.

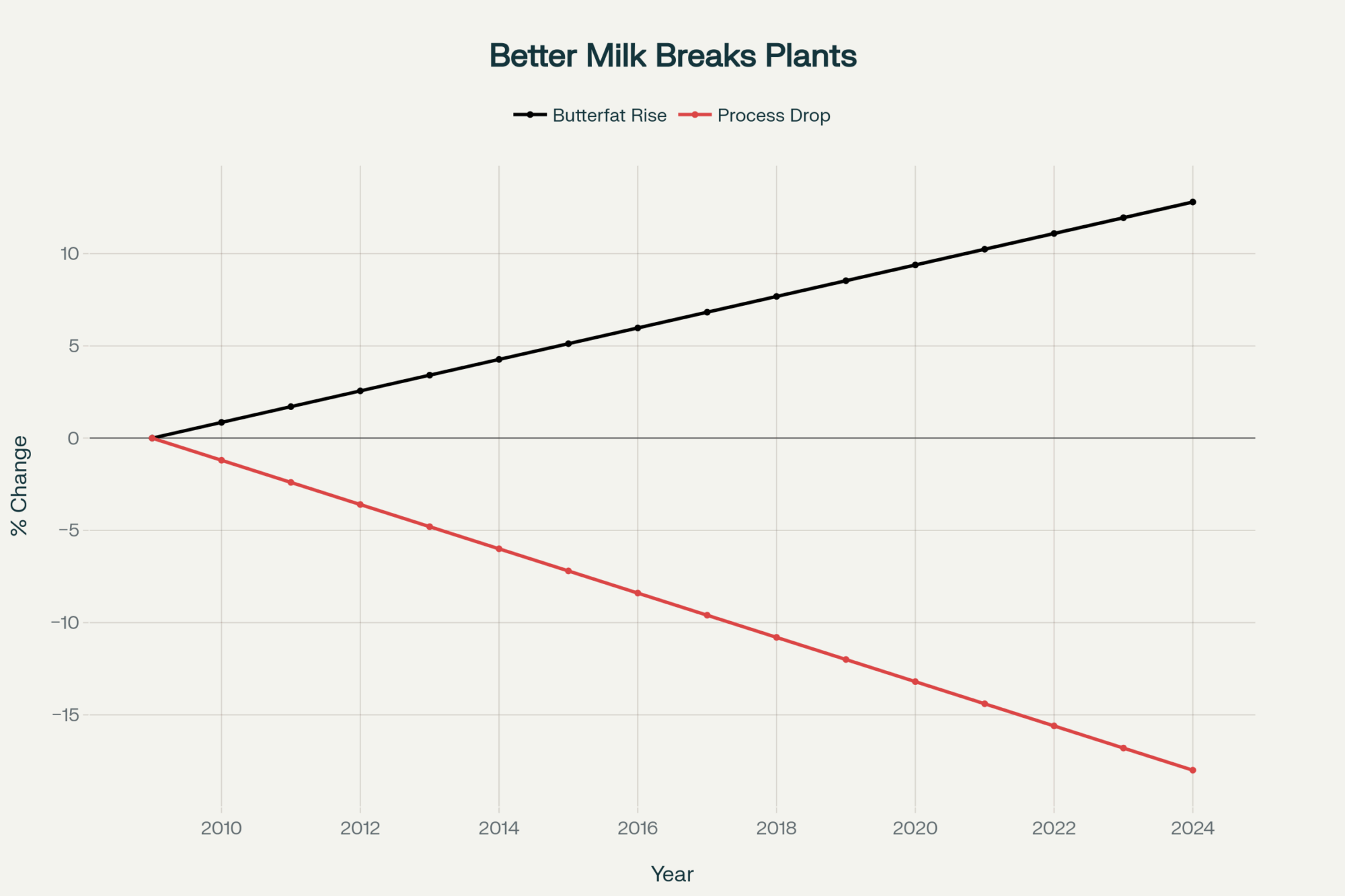

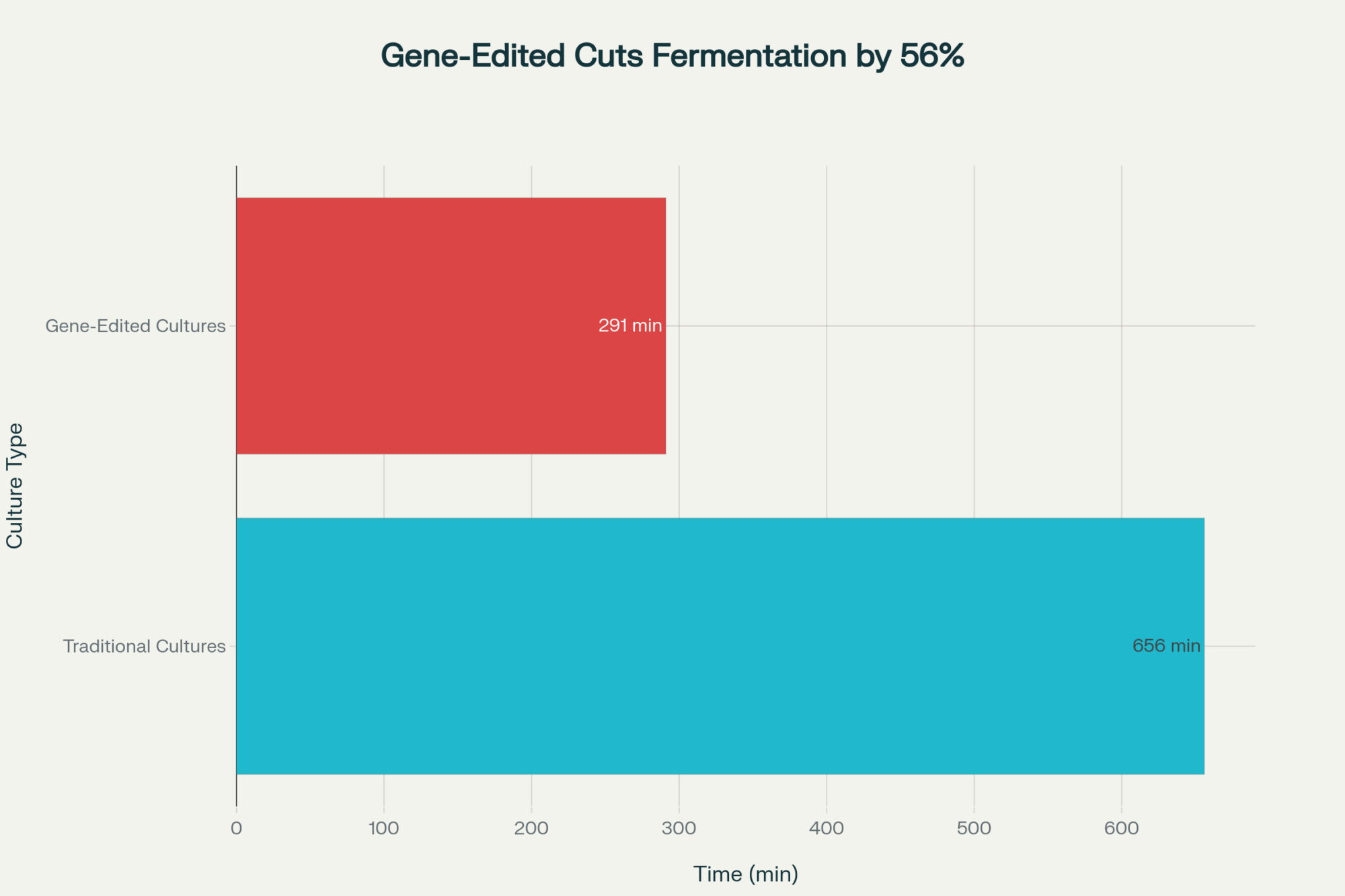

Dr. Michael Steele, Professor of Ruminant Nutrition at the University of Guelph, and his team have been studying this for years, publishing their findings in the Journal of Dairy Science. Their research shows how these bacterial population changes during weaning can really affect gut function. What happens is that the ruminal pH can drop significantly during this transition—sometimes to a level that causes substantial bacterial die-off.

And when those gram-negative bacteria die? They release endotoxins—technically called lipopolysaccharides—that can trigger inflammatory responses. That’s why the feed industry developed these binders we’re all familiar with. According to 2024 feed industry surveys, lots of operations have found them helpful, especially during challenging periods.

However, it’s worth noting that extension services and university research programs are increasingly interested in whether we can prevent some of these issues through effective management before they even develop.

Learning from Different Approaches

What I find fascinating is how different operations handle weaning, and they’re all getting results worth considering. Some individuals are extending milk feeding to 10-12 weeks instead of the traditional 6-8 weeks. Others are focusing on really gradual transitions—taking two or three weeks to reduce milk rather than doing it quickly.

Research from land-grant universities supports this idea that gradual transitions might help keep the rumen more stable during weaning. Makes sense when you think about it…we already do this everywhere else in dairy management. When we change rations for the milking herd, we take our time. Dry cow transitions are carefully managed. So why rush weaning?

I was talking with a dairy nutritionist from Iowa last month who put it perfectly: “We spend all this time balancing transition cow rations to the gram, then we expect baby calves to handle abrupt diet changes like it’s nothing.”

What’s encouraging is that there’s no single “right” answer here. Different operations face different realities—labor constraints, facility limitations, disease pressures—and what works needs to fit those circumstances.

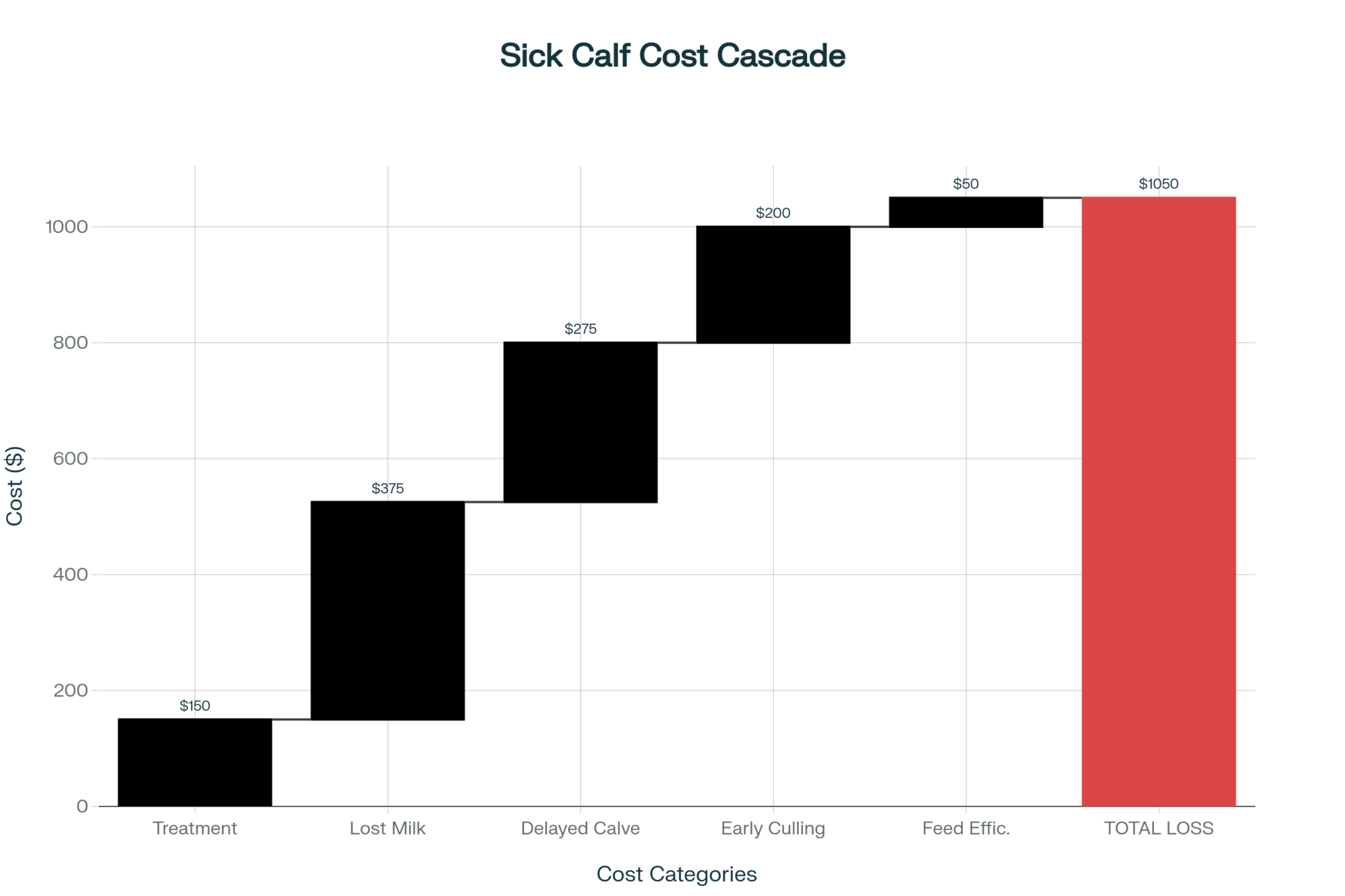

The Money Side of Things

Weaning Economics: Traditional vs. Extended Approaches

Traditional Protocol (6-8 weeks):

- Milk/replacer costs: Baseline standard

- Endotoxin binders: $6-10 per calf annually (2024-25 pricing)

- Treatment costs: $15-30 per affected calf (regional averages)

- Typical treatment rate: 20-30% of calves

Extended Protocol (10-12 weeks):

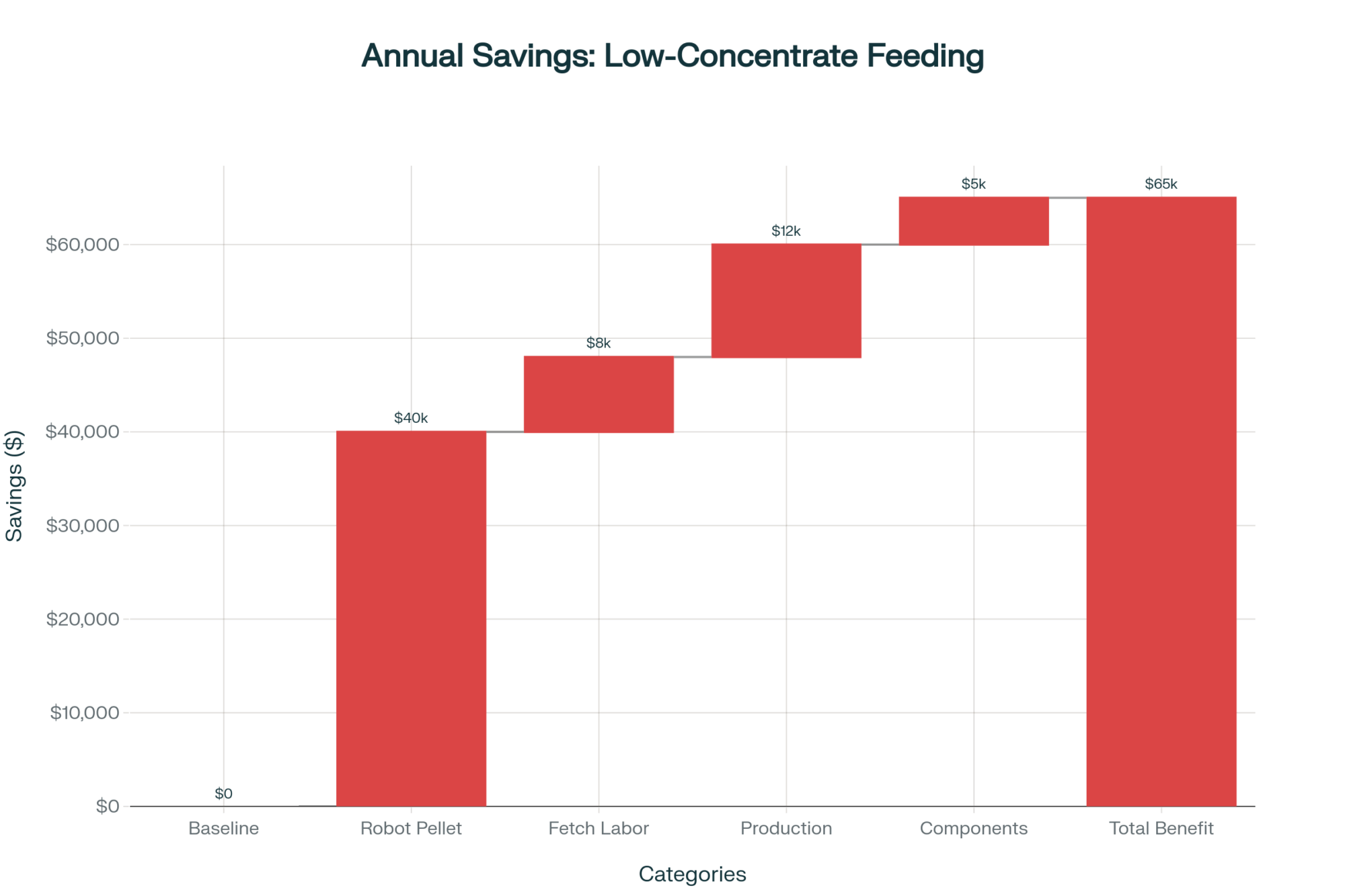

- Additional milk costs: $25-40 per calf (varies by region)

- Binder use: Often reduced or eliminated

- Treatment costs: Lower incidence reported

- Labor: May vary depending on the system

Penn State Extension has been consistent in its recommendations, which can be found in their calf management bulletins, updated in 2024. They suggest waiting until calves are eating approximately 2.75 pounds of textured starter daily for three consecutive days before starting to cut milk. It’s about biological readiness, not what the calendar says.

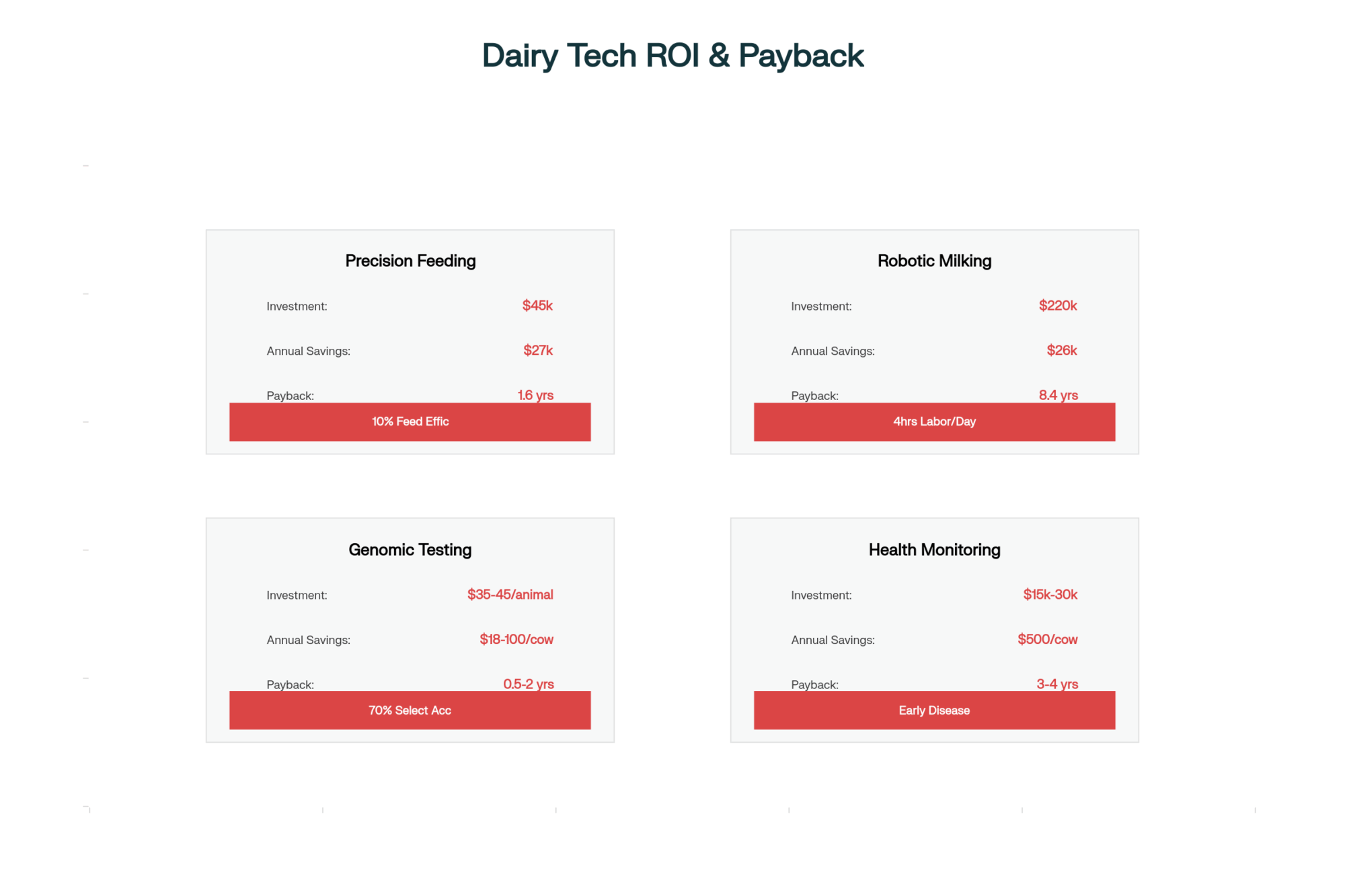

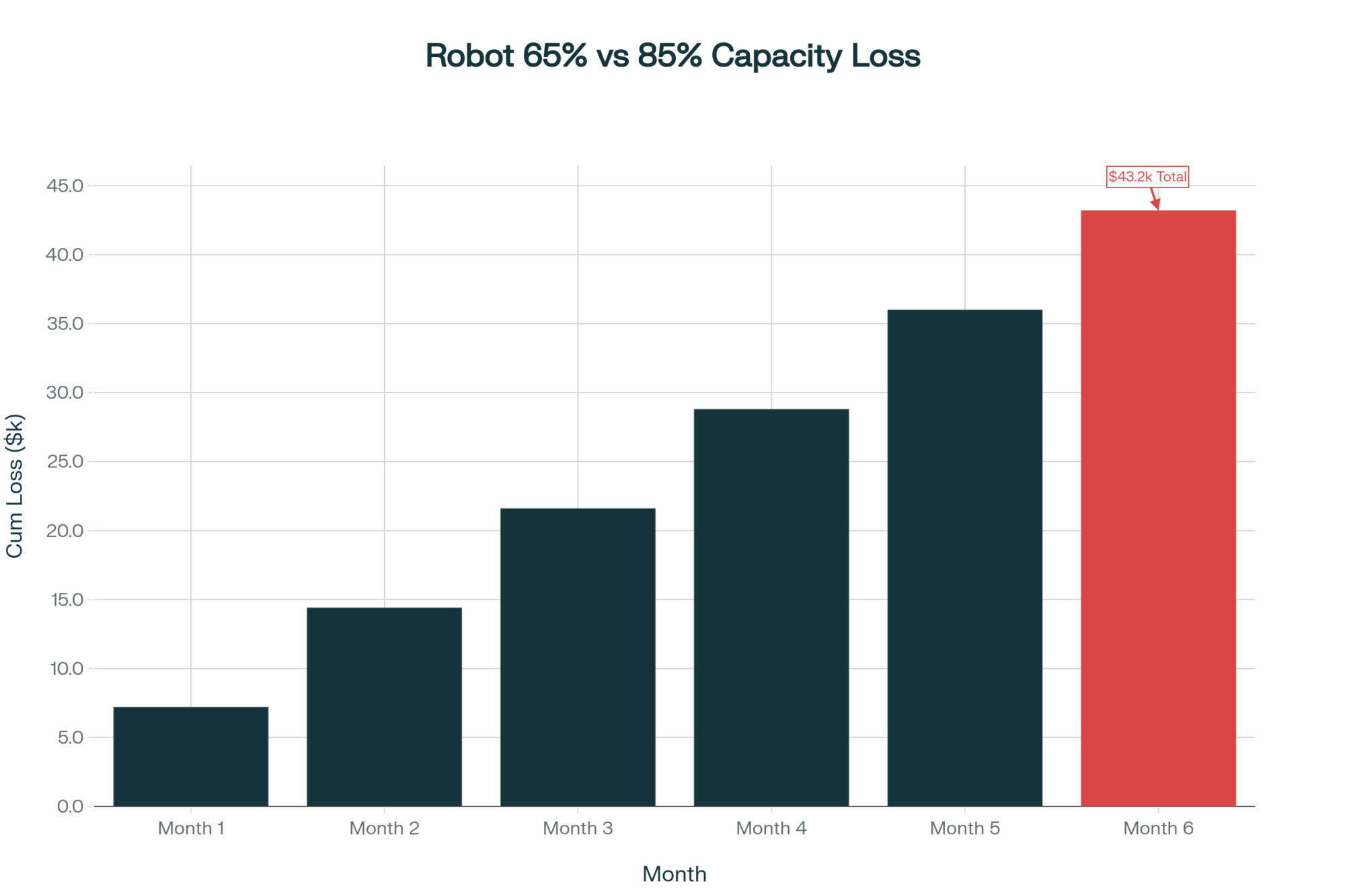

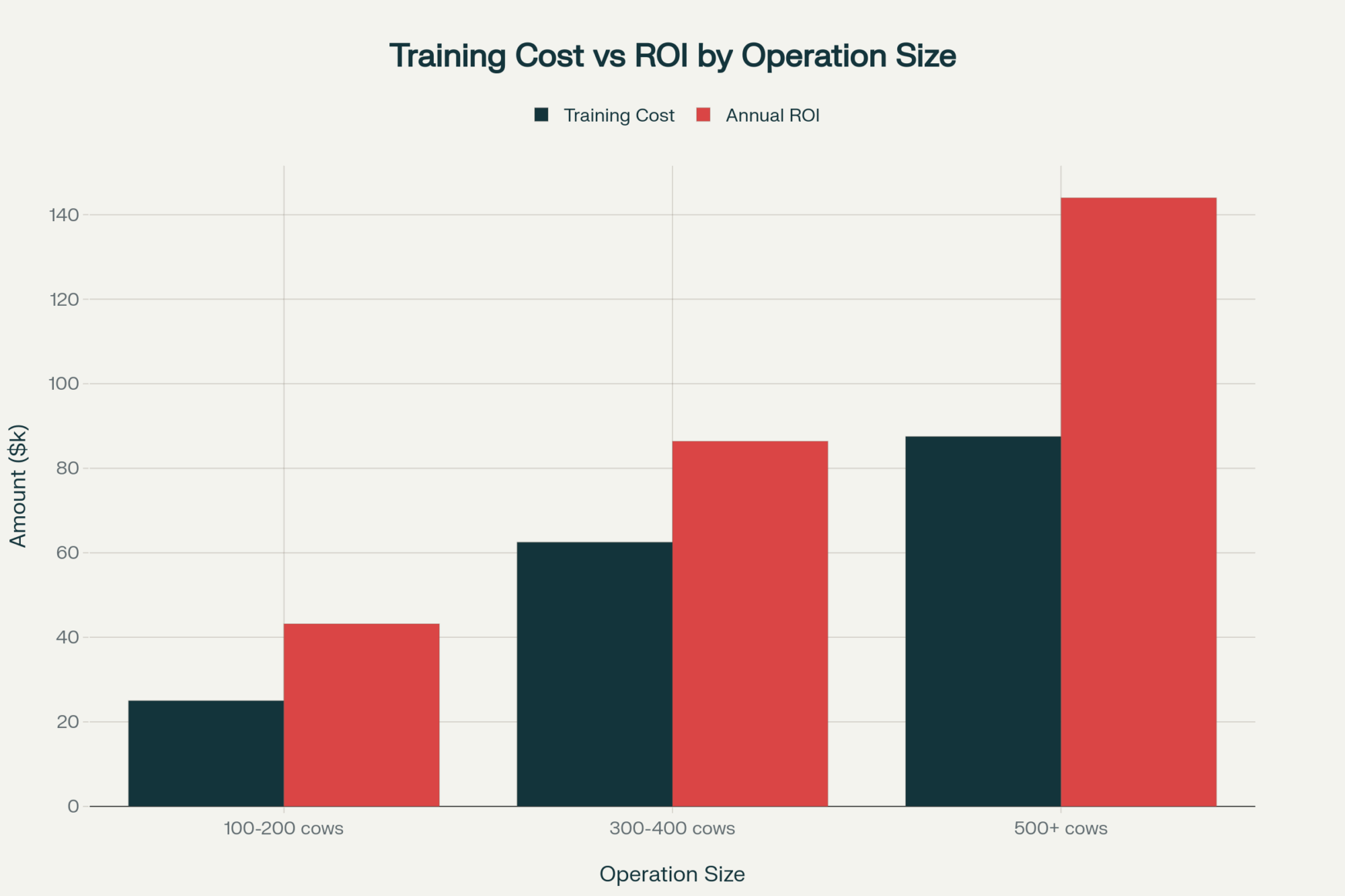

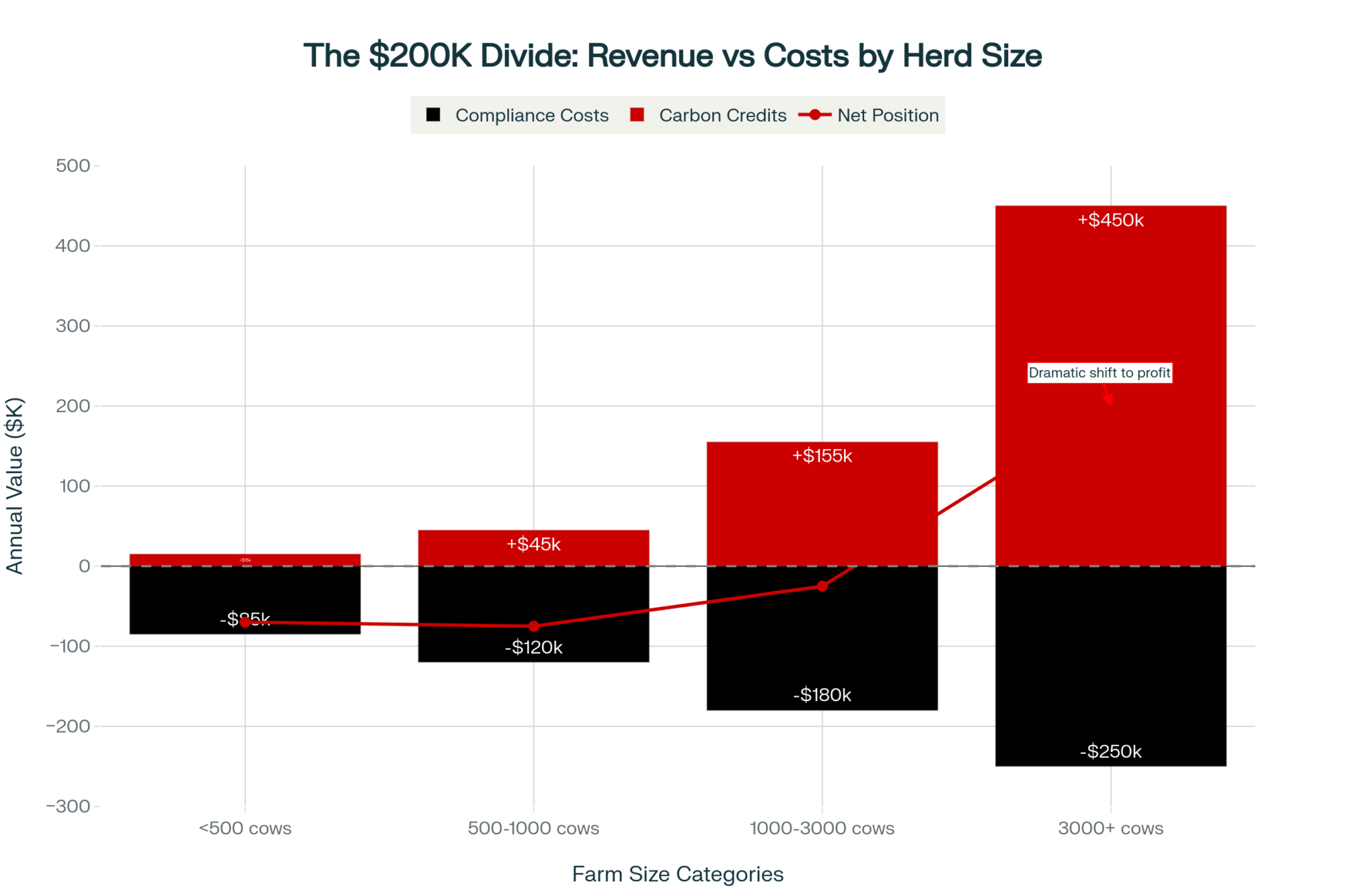

Now, if you’re running a larger operation—say, 200-plus calves—you might be looking at those automated monitoring systems. Based on 2024 manufacturer quotes, the cost ranges from $85,000 to $110,000 installed for systems handling 150 or more calves. Some operations report they help with labor and catching health issues earlier, though results vary by management. For smaller farms? Careful observation and basic intake monitoring often work just as well. There’s definitely no one-size-fits-all solution here.

How Location Changes Everything

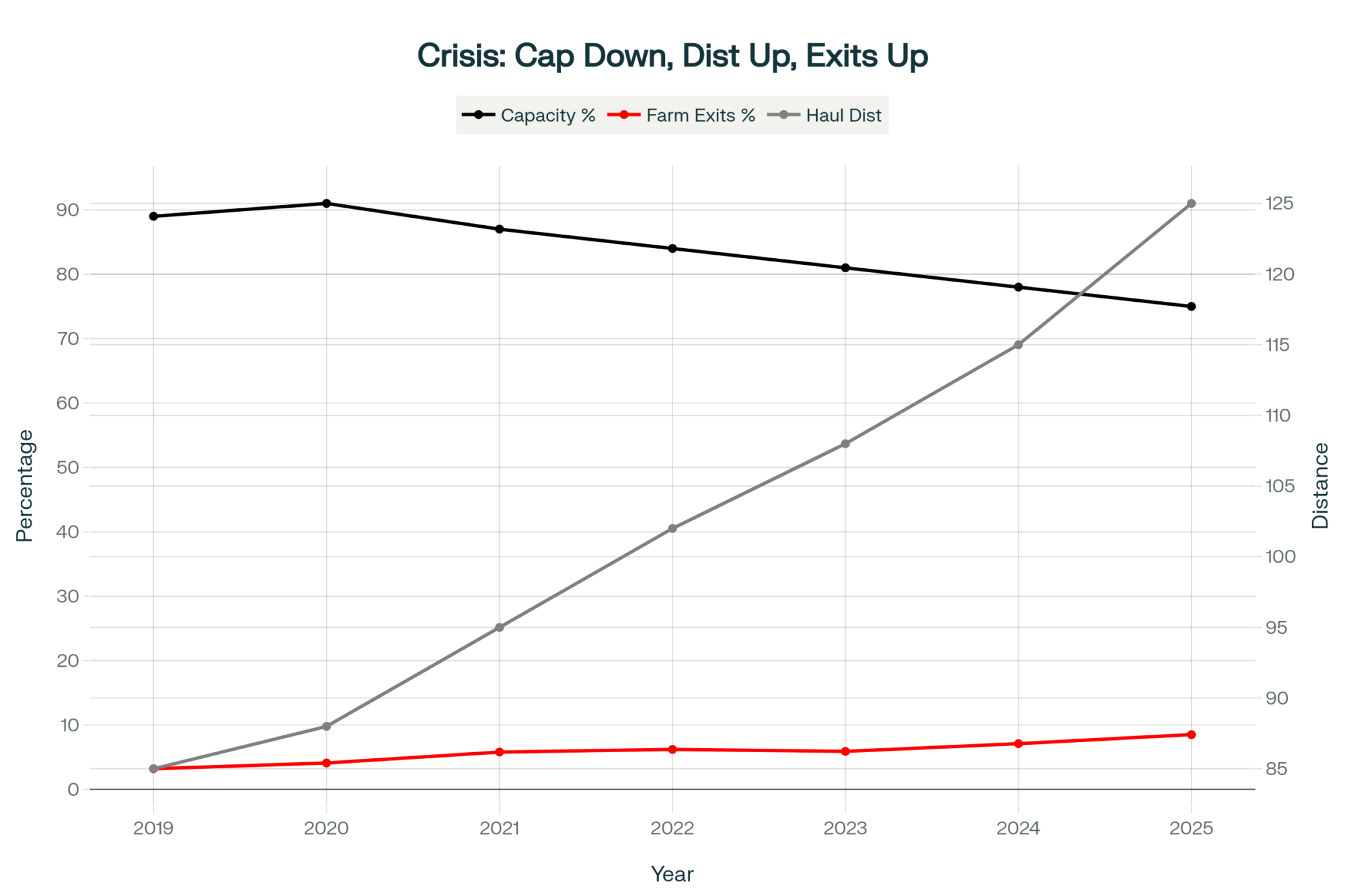

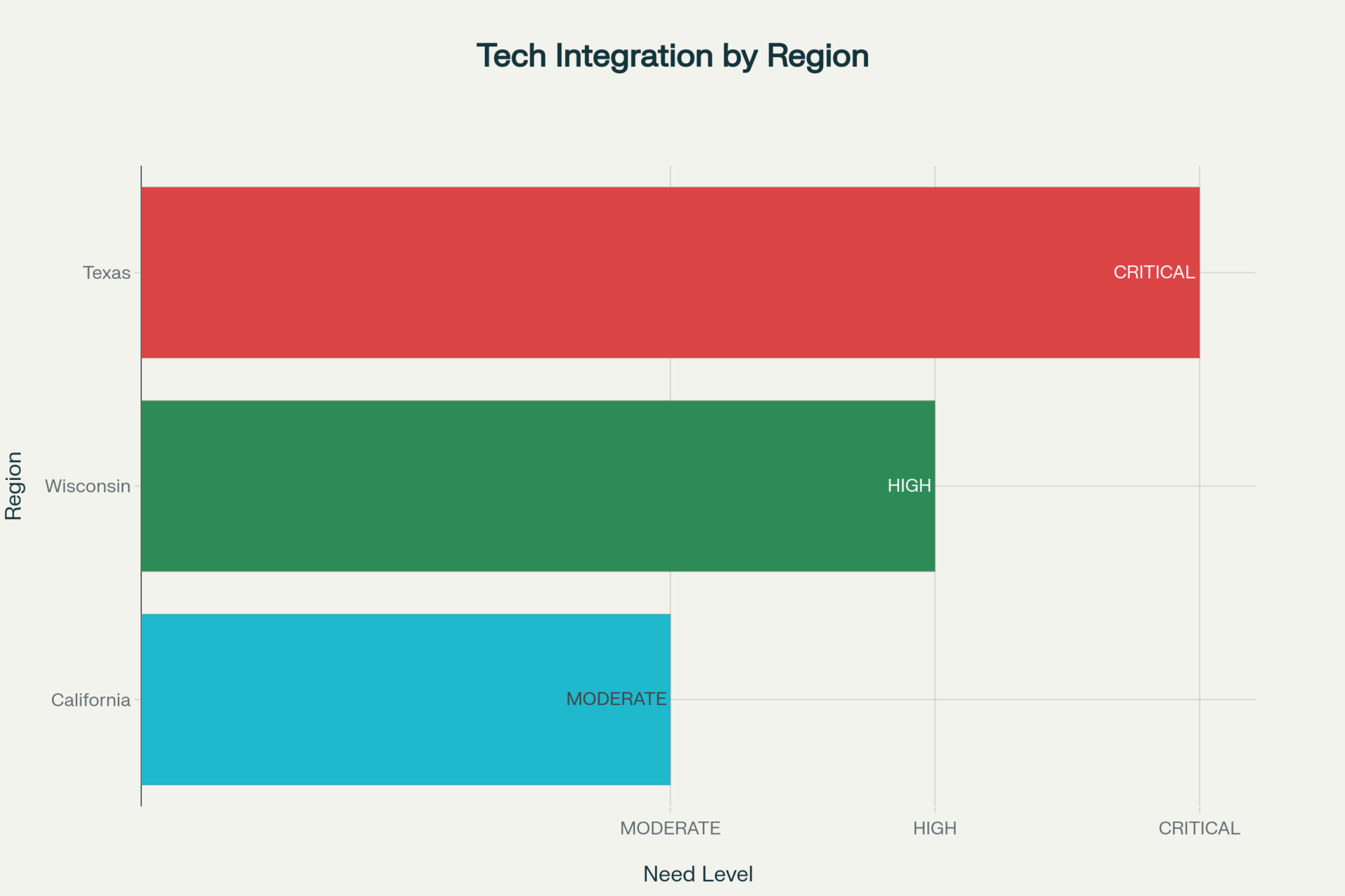

Climate makes a huge difference in how we approach this. Southern producers dealing with heat stress face completely different challenges than what we see up north. Texas A&M Extension recommends extending weaning timelines during those brutal summer months (when the temperature-humidity index exceeds 72) because calves handle the transition better when they’re not fighting heat stress as well.

Meanwhile, in Wisconsin and Minnesota, winter housing creates its own set of challenges. University of Minnesota research, published in 2024, suggests that different housing strategies—such as pair housing during cold months—might help reduce weaning stress behaviors by providing social support during the transition.

Out in California’s Central Valley, I’ve heard from extension dairy advisors about operations experimenting with three-stage weaning programs. They’re gradually shifting calves through different housing and feeding setups. It takes some logistics to figure out, but according to the 2024 regional dairy reports, several farms have seen their post-weaning treatment costs drop after implementing these systems.

Making Changes That Actually Work

Practical Weaning Readiness Checklist

✓ Starter Intake: Consistently eating 2.75+ pounds daily

✓ Rumination: Active cud chewing (3-5 hours daily by 8 weeks)

✓ Body Condition: Maintaining or gaining during milk reduction

✓ Behavior: Normal activity, minimal vocalization

✓ Growth: Meeting breed-appropriate weight gains

Here’s what I find really practical—you don’t need to revolutionize everything overnight. Start with better starter intake monitoring. Weighing refusals daily and keeping track can tell you a lot about when calves are actually ready to be weaned.

One thing that research from Cornell Pro-Dairy suggests helps is spacing out stressful events. If you’re vaccinating, consider waiting until after weaning. Their 2024 calf health guidelines indicate that separating these events by 10-14 days can improve how calves respond to both the vaccine and the weaning transition.

And staff training…that’s crucial. When your calf feeders understand why they’re doing something—not just following a protocol but actually getting the biology behind it—everything works better. Wisconsin Extension’s 2024 dairy workforce development data show that operations spending even just four hours training their calf feeders results in measurable improvements in protocol compliance.

Finding What Works for Your Farm

Looking at the broader picture, endotoxin binders aren’t the enemy. They serve real purposes, especially if you’re dealing with unavoidable management constraints or specific disease challenges. The American Association of Bovine Practitioners’ position papers acknowledge that both management-focused and supplement-supported approaches have merit depending on your situation.

Some operations combine strategies really successfully. They use gradual weaning as their standard practice, but keep binders on hand for high-stress periods—like those brutal summer months or when they’re training new staff. They track everything to see what’s actually working.

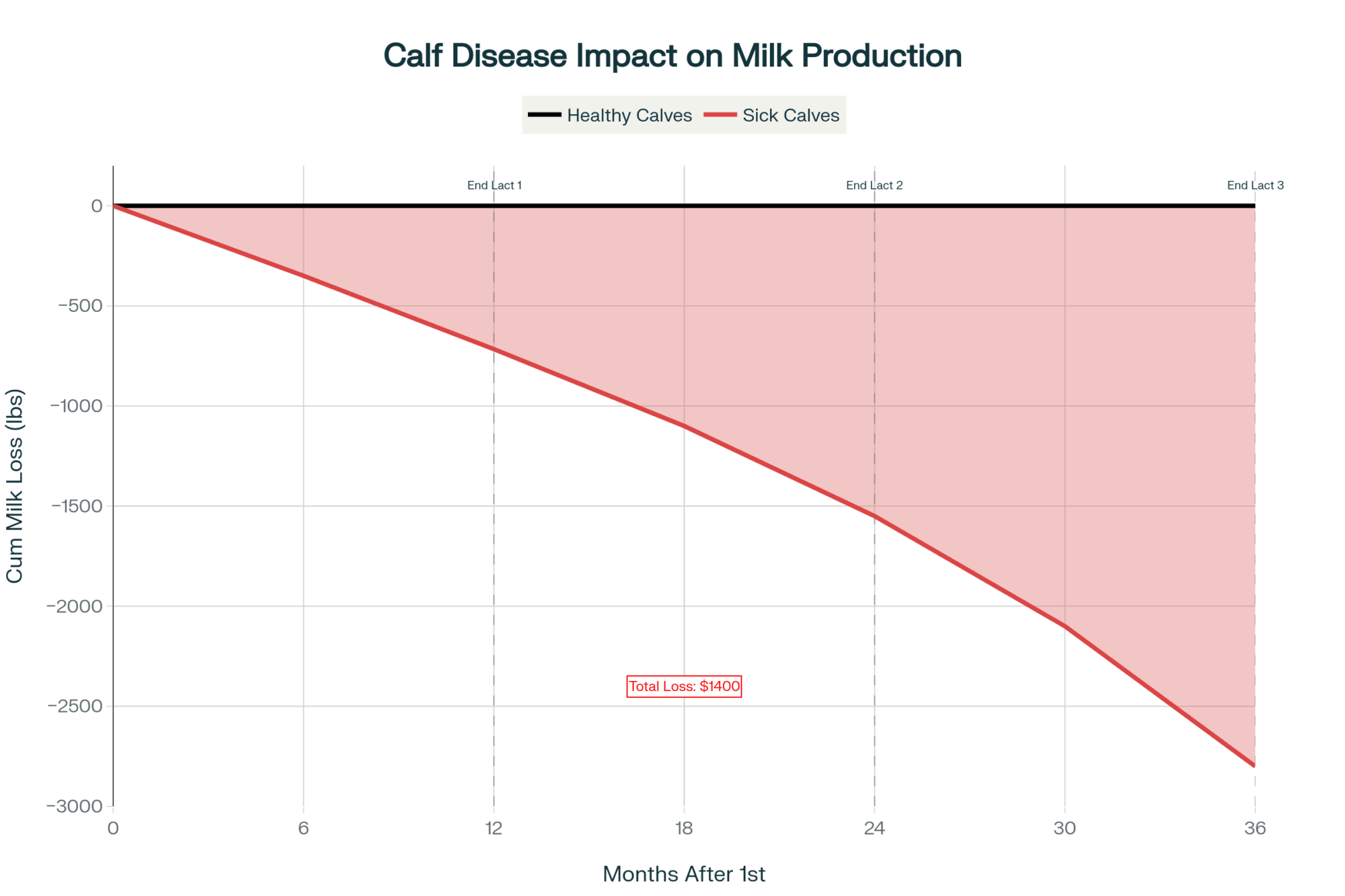

According to economic analyses from Iowa State Extension (2024), it is essential to consider the entire picture over several months, rather than just weaning costs. Operations that track total cost per pound of gain through approximately four months of age often make different decisions than those that only consider weaning expenses.

Where Things Are Heading

Extension services continue to develop better resources to help us figure this out. Most land-grant universities have updated their cattle management guidelines in the past two years, and there are webinars and decision-support tools available to help. You can find many of these through your state’s extension dairy website.

What’s particularly interesting is how nutritionists, veterinarians, and producers are collaborating more closely to develop farm-specific protocols. Instead of generic recommendations, we’re seeing more customization tailored to what individual farms can actually achieve. According to 2024 field reports from extension dairy specialists across the Midwest, this approach appears to be working better across the board.

Your calves are constantly communicating with you through their behavior. A calf that’s eating well, spending hours chewing cud, maintaining body condition during transition—that’s telling you your management is on track. Sometimes we just need to pay better attention to those signals.

Making Smart Decisions for Your Operation

Whether it’s October or any other time of year, it’s worth taking a hard look at your weaning protocols. Track what’s actually happening, not what you think is happening. Monitor starter intakes. Document how long transitions really take. Keep track of health events, particularly during weaning.

Most of us already have a fairly good sense of when calves are ready to be weaned. They’re aggressive at the starter bunk, they’re ruminating well, and they look vigorous and healthy. Sometimes we just need to trust those observations more than the calendar.

Where to Find More Information:

- Your state’s extension dairy programs (most updated 2024-25)

- Penn State Extension’s calf management resources

- Cornell Pro-Dairy calf health publications

- University of Wisconsin’s Dairyland Initiative

- Regional dairy conferences and workshops

The economics will vary by operation—your milk costs, labor situation, and facilities all factor in. But the principle stays consistent: healthy transitions lead to healthy heifers. And healthy heifers become profitable cows.

Every calf you wean has the potential to become a high producer in two years. Getting this transition right now—whether through traditional methods, alternative approaches, or a combination of both—that’s an investment that pays dividends down the road. The research is available, the tools are accessible through extension services, and the potential returns make it worthwhile to take a careful look at what might work better for your specific operation.

After all, in this business, we’re always looking for that edge—that one percent improvement here, two percent there. Sometimes it’s not about adding something new. Sometimes it’s about doing what we’re already doing just a little bit smarter.

KEY TAKEAWAYS:

- Save $30-50 per calf by extending milk feeding 2-3 weeks while monitoring starter intake—the additional milk costs ($25-40) are offset by reduced treatment expenses and eliminated binder costs

- Track biological readiness, not calendar dates: Wait for consistent 2.75-pound daily starter consumption, active rumination (3-5 hours daily), and maintained body condition before reducing milk

- Adapt protocols to your region: Southern operations benefit from extending timelines during summer heat stress, while northern farms see improvements with pair housing during winter months

- Space management stressors by 10-14 days: Separating vaccinations from weaning improves antibody response and reduces transition stress—a no-cost change that Cornell Pro-Dairy research shows makes a measurable difference

- Both approaches have merit: Endotoxin binders serve valuable purposes during unavoidable management constraints—the smartest operations combine gradual weaning as standard practice with strategic supplement use during high-stress periods

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More:

- Revolutionizing Calf Rearing: 5 Game-Changing Nutrition Strategies That Deliver $4.20 ROI for Every Dollar Invested – This practical guide provides step-by-step methods for implementing stress-free weaning. It reveals how strategies like using nose flaps or fence-line weaning can reduce sickness by up to 22% while boosting daily gain and cutting post-weaning stress.

- Maximizing Calf Performance: The Million-Dollar Investment in Your Dairy’s Future – This article connects pre-weaning growth to future profitability. It demonstrates how a 1 kg increase in average daily gain translates to 850 kg more milk in the first lactation, providing the economic rationale for investing in calf health and nutrition.

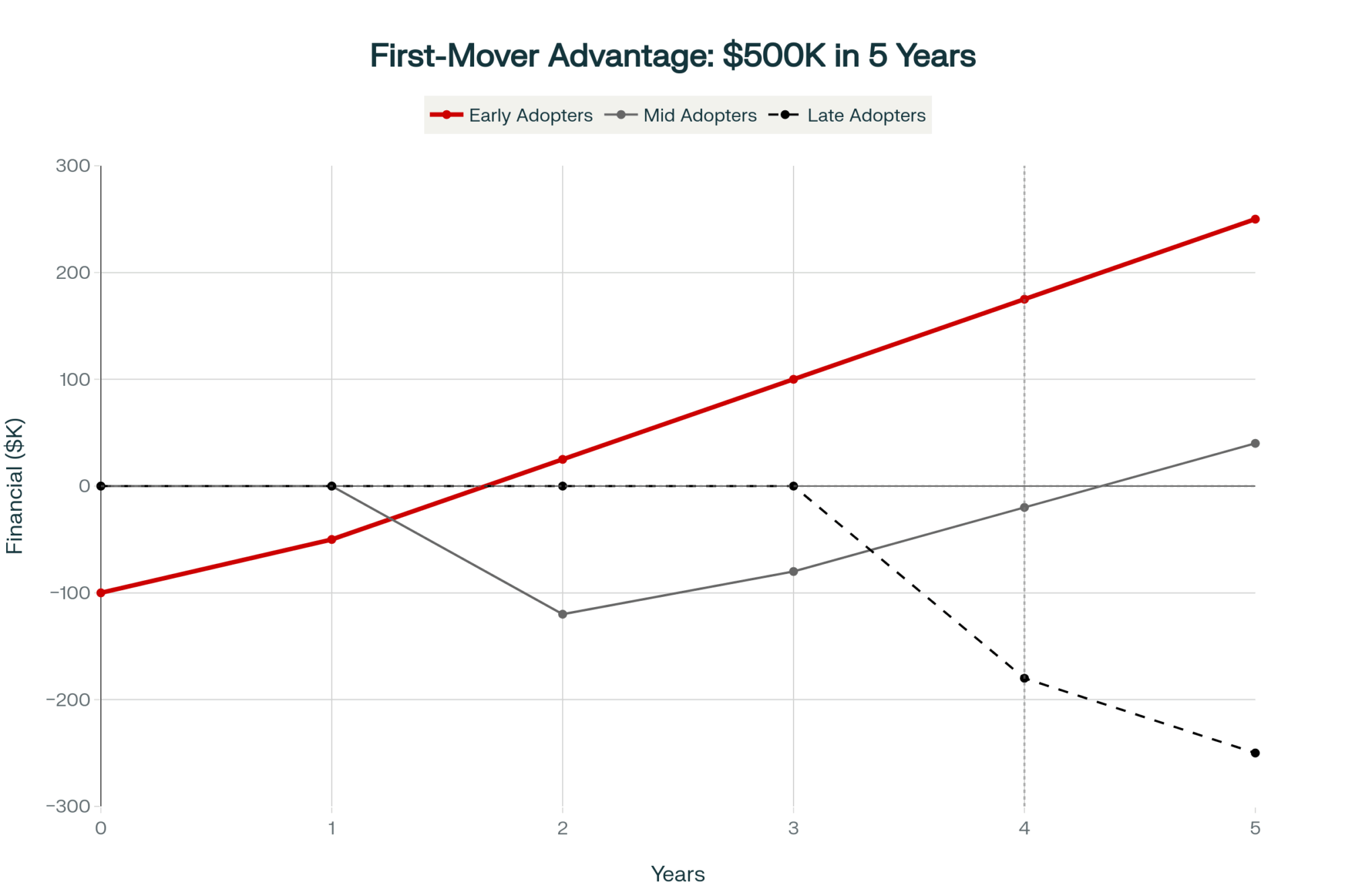

- The $500000 Precision Dairy Gamble: Why Most Farms Are Being Sold a False Promise – This analysis provides a candid look at the ROI of expensive calf automation. It offers a realistic cost-benefit breakdown of automated feeding systems and sensors, helping you decide if the technology is right for your operation or if a more traditional approach is more profitable.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!