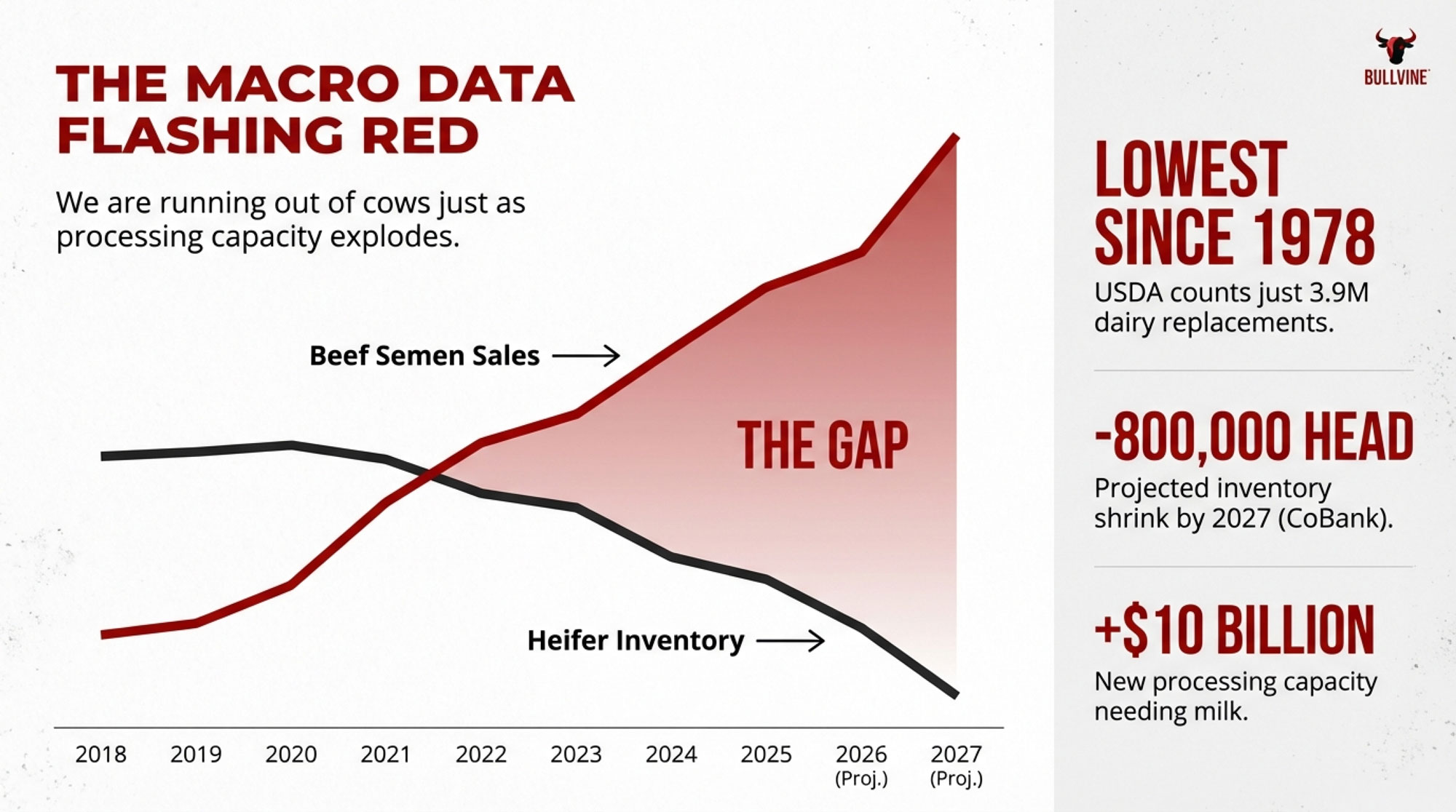

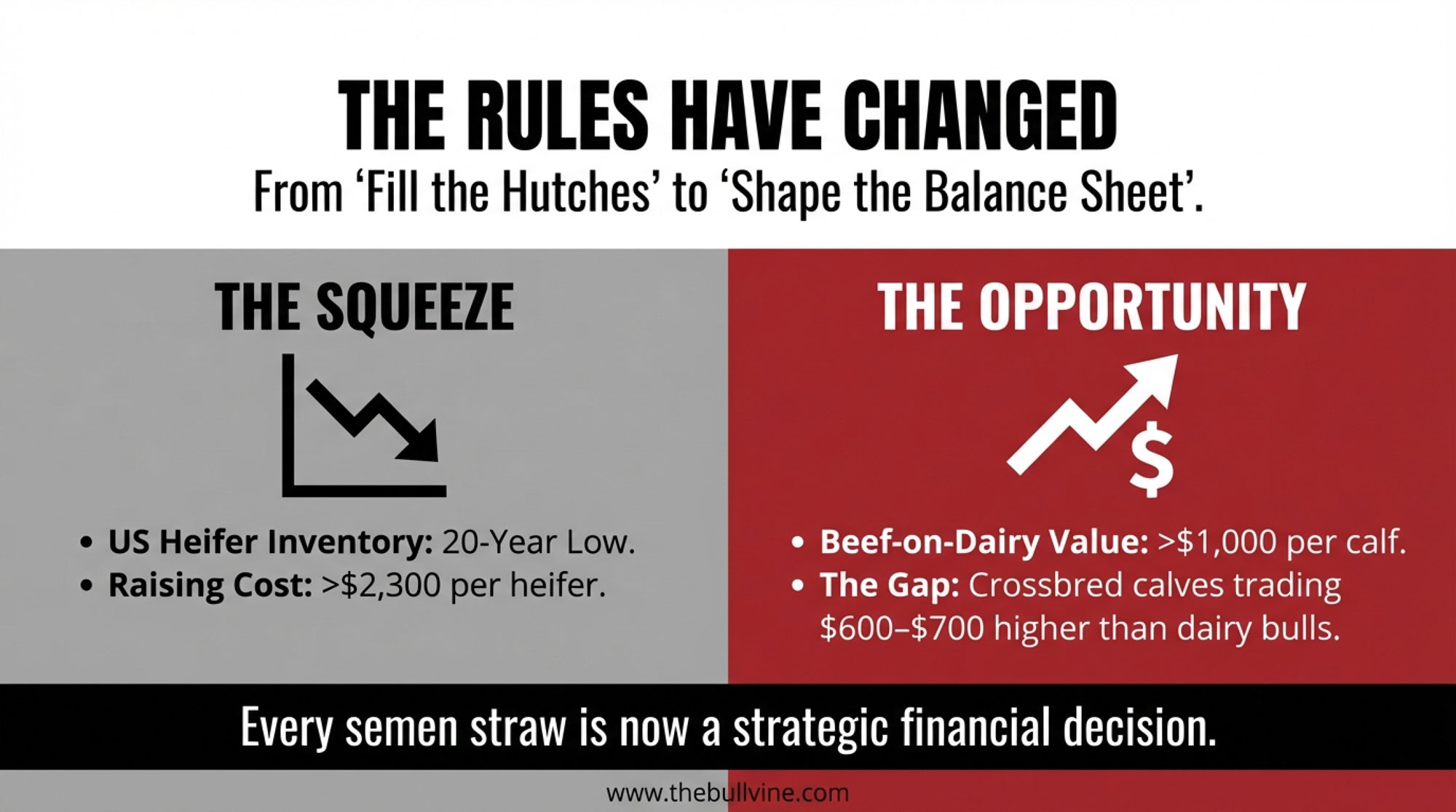

You chased beef premiums. CoBank says 800,000 heifers vanished. Where does your breeding plan land in that math?

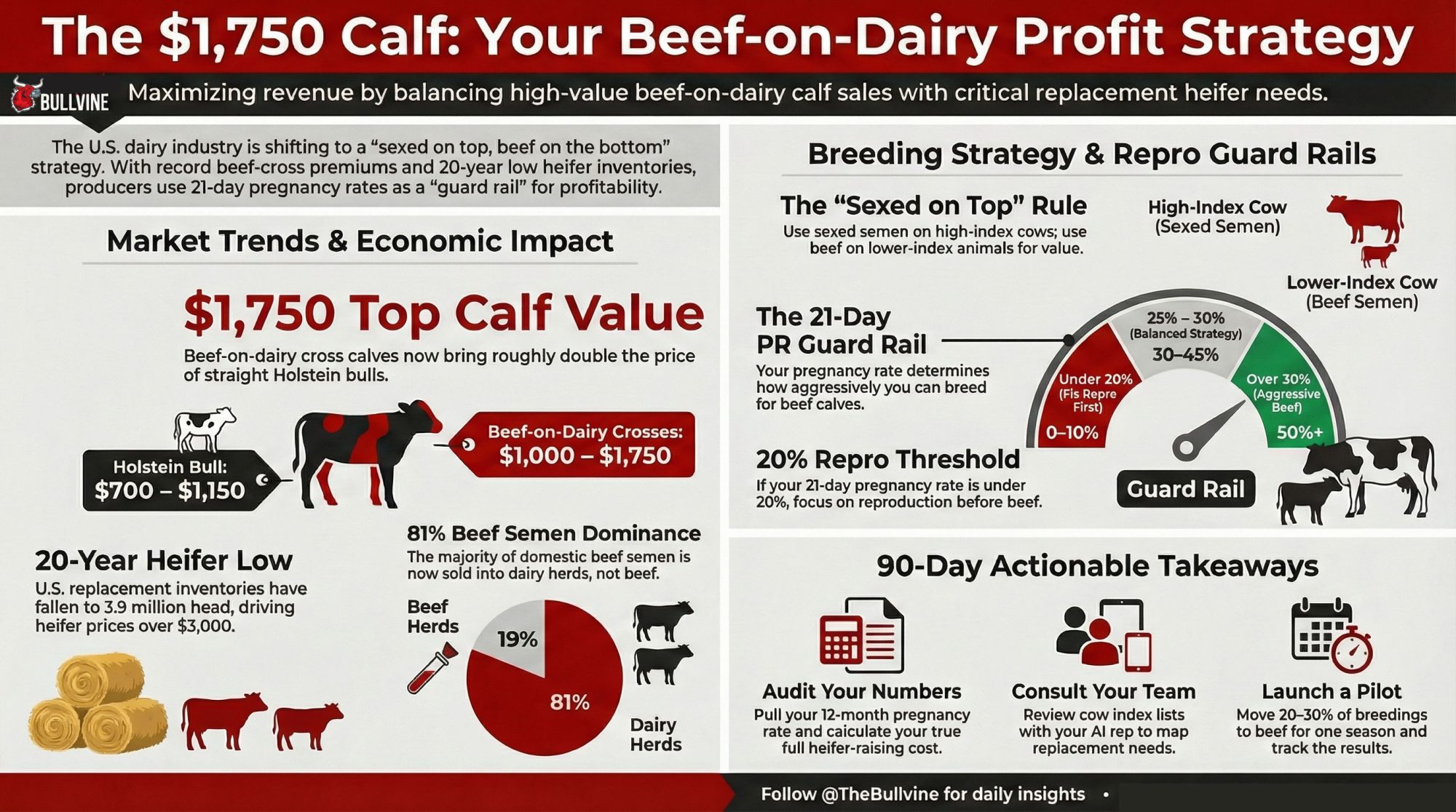

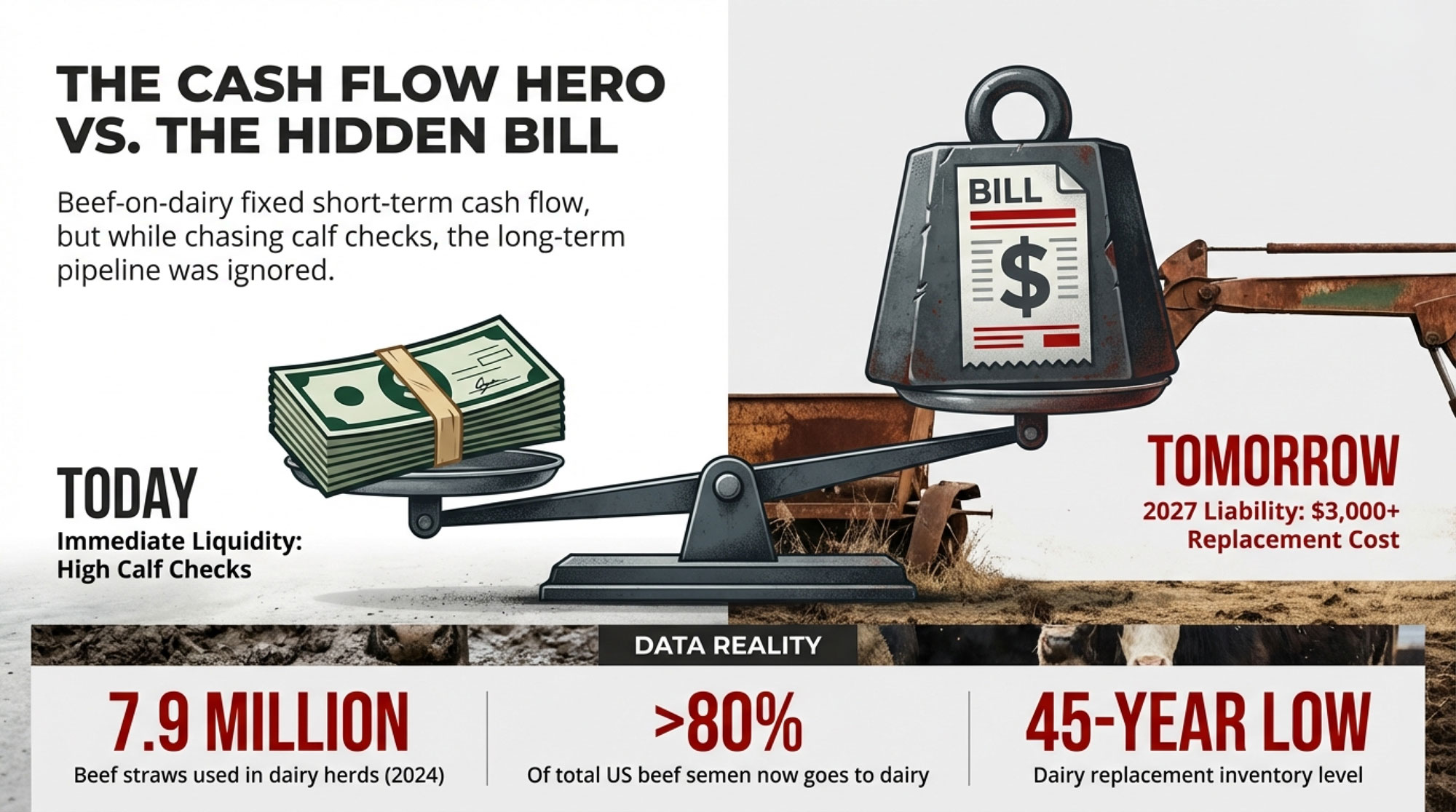

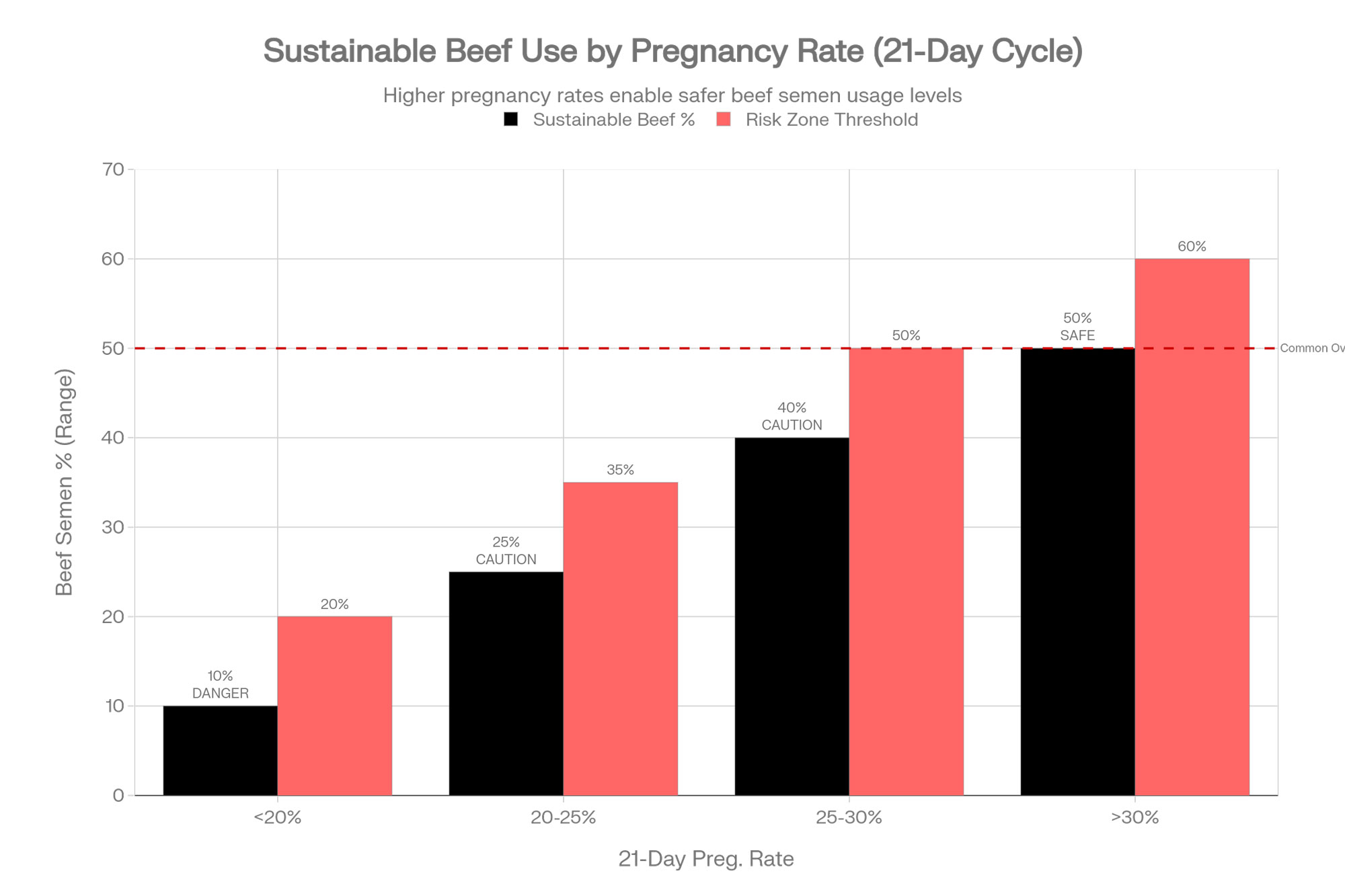

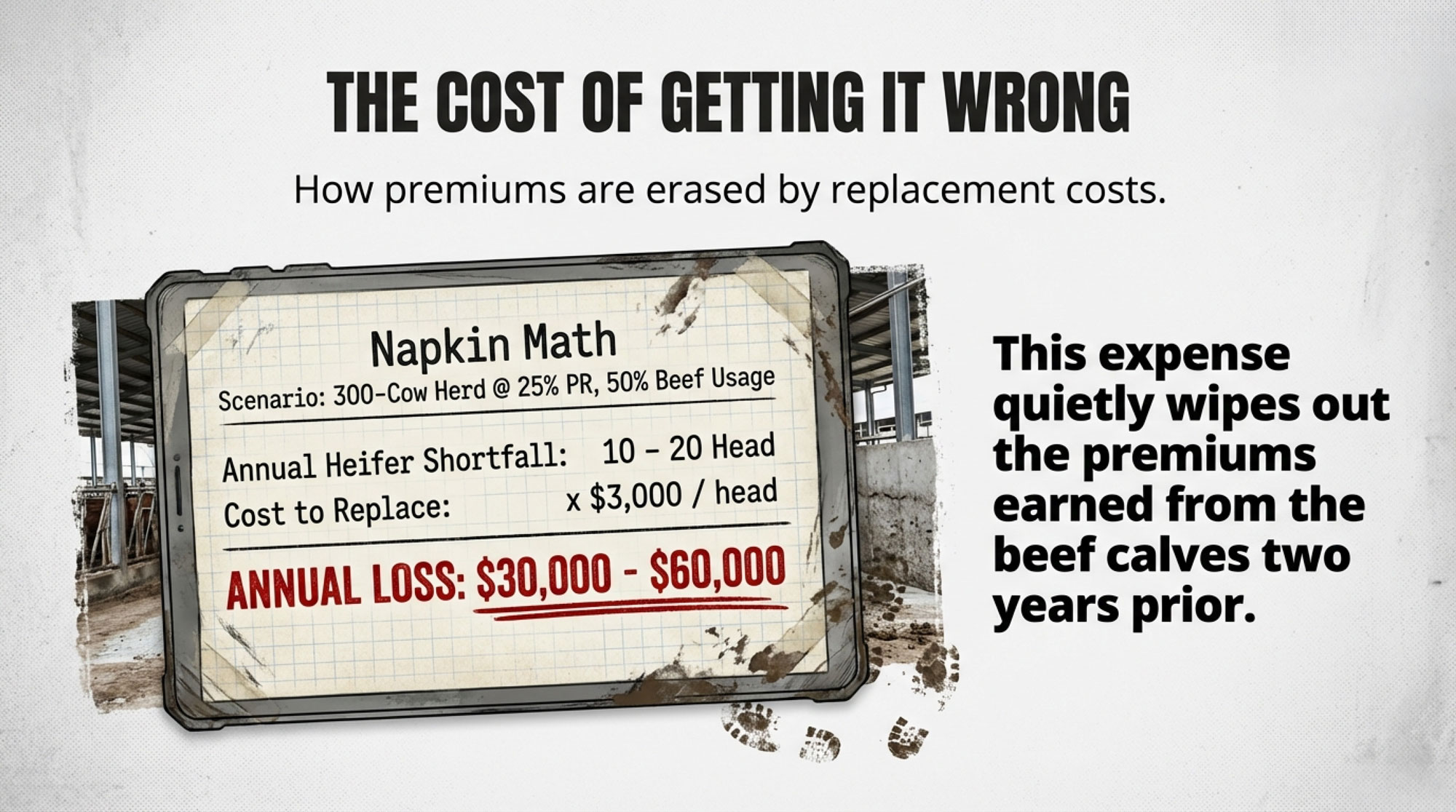

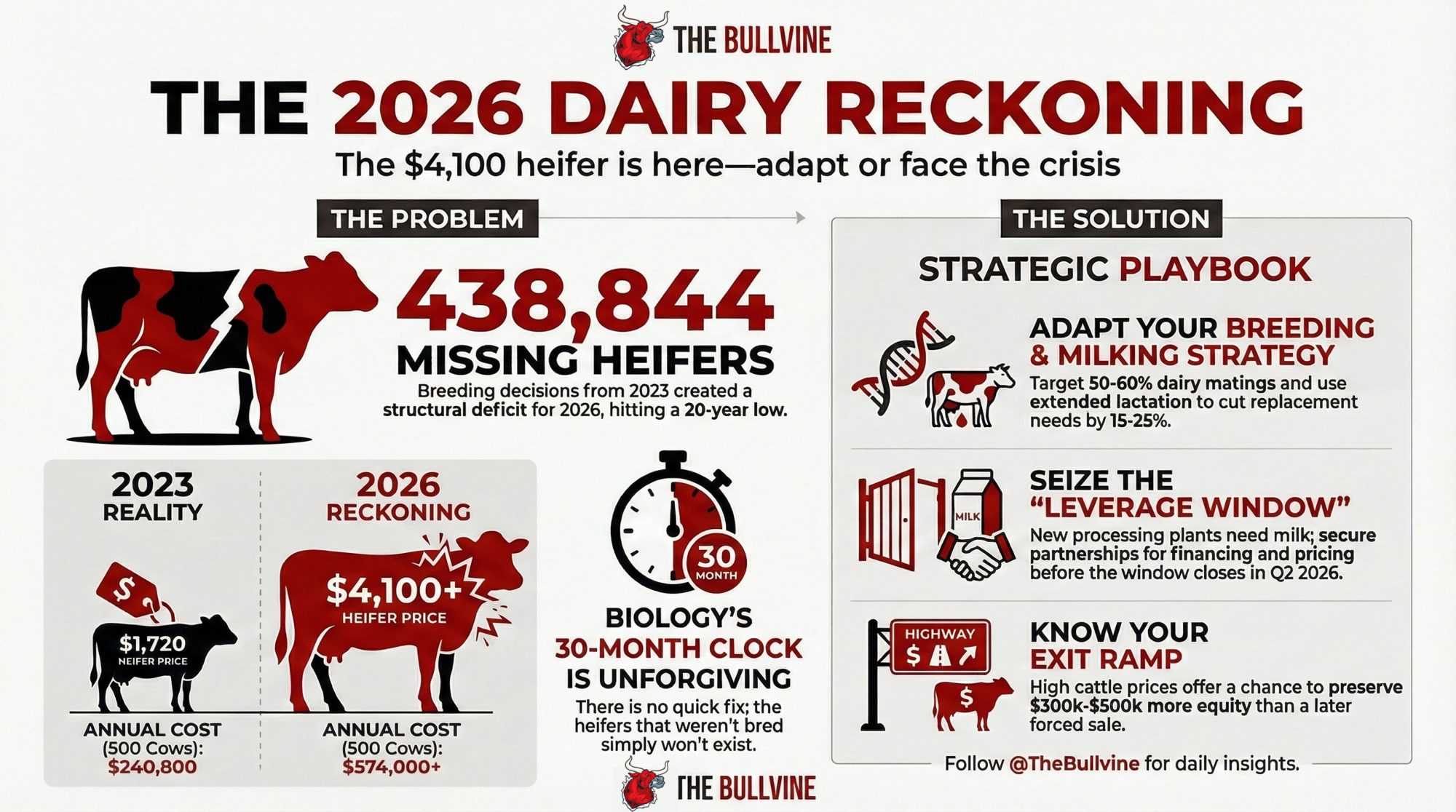

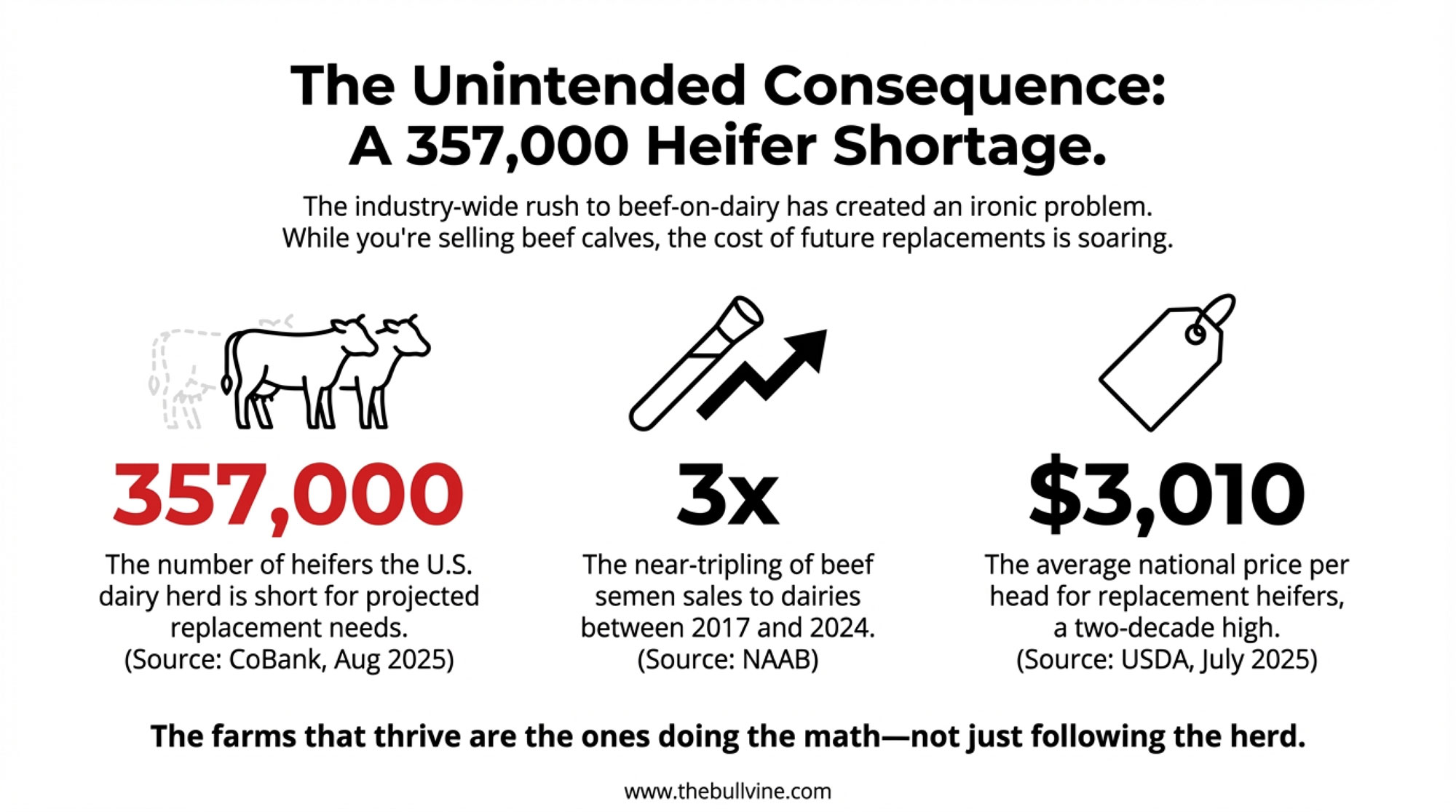

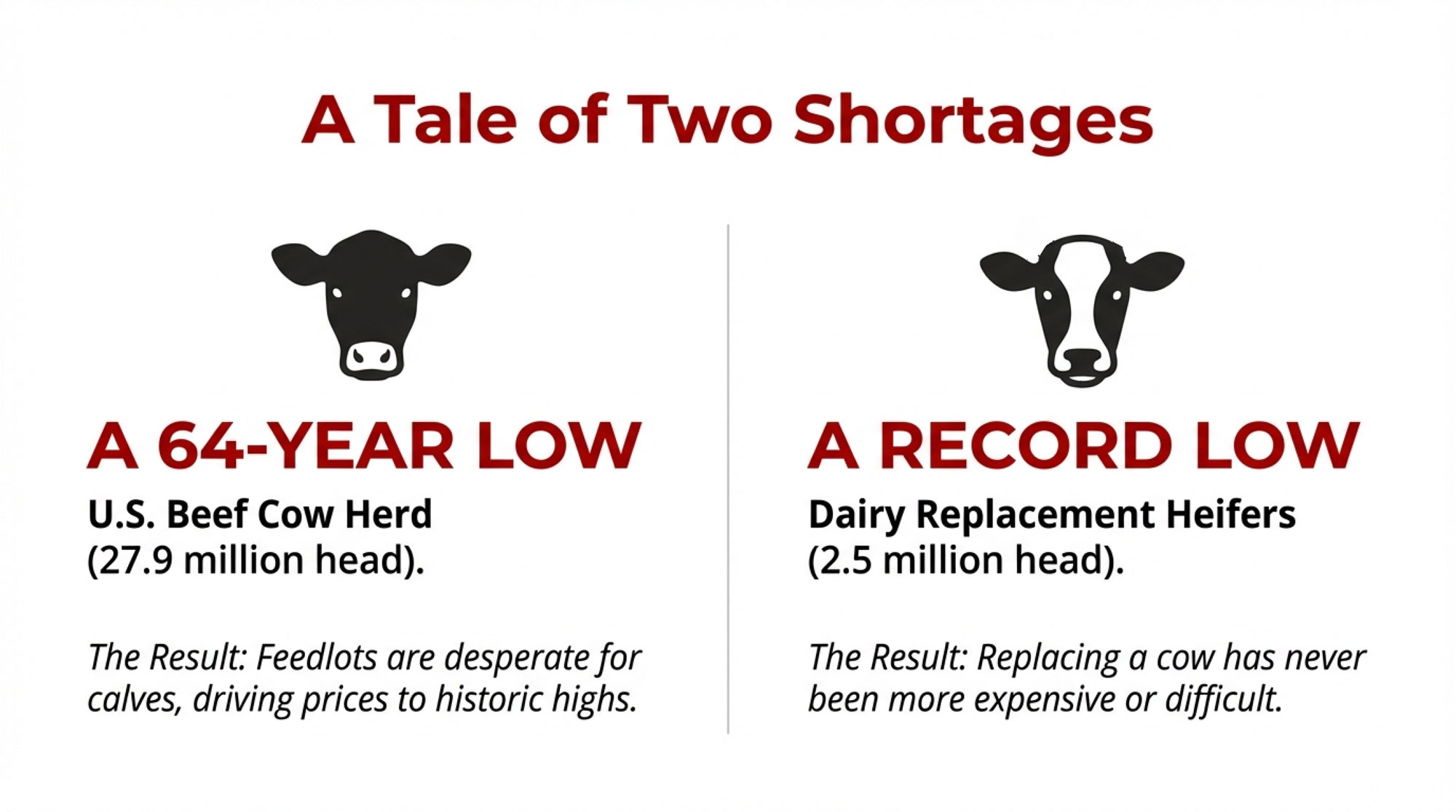

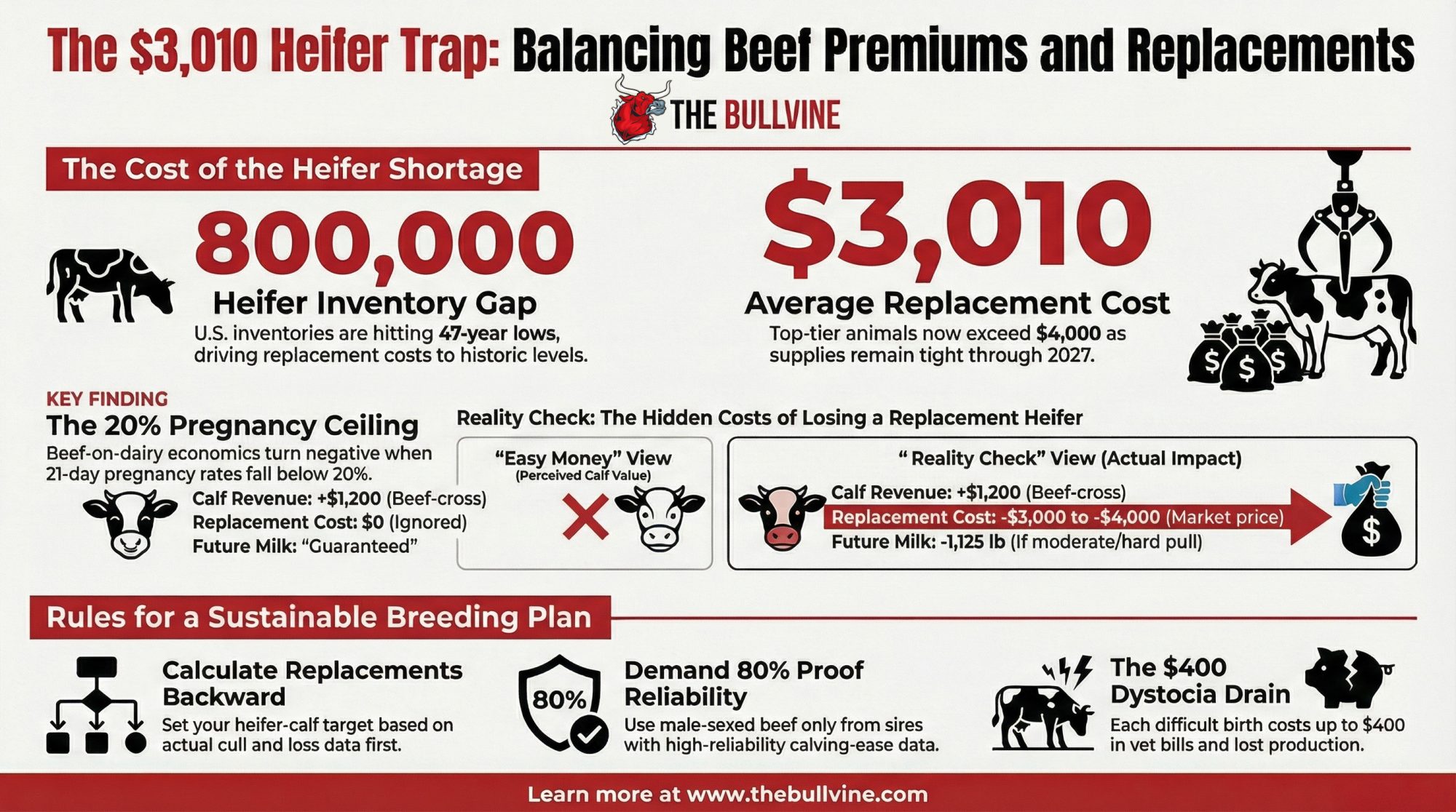

Executive Summary: CoBank is warning that U.S. dairy heifer inventories will drop by about 800,000 head through 2026, pushing average replacements to roughly $3,010 and over $4,000 for top animals in some regions. In the same window, U.S. dairies used 7.9 million beef semen doses in 2024 — more than 80% of all beef semen sold — which guarantees fewer dairy heifer calves in the pipeline. That’s turned male sexed beef from an $1,000–$1,500 “easy money” calf into a potential replacement trap if 21‑day pregnancy rates sit below about 20% or if calving‑ease proofs aren’t rock‑solid. Dystocia research shows each moderate–hard pull can cost $150–$400 plus around 1,125 lb of lost milk per lactation, and early culls now mean paying $3,000–$4,000 to bring in a heifer. Herds working with UW‑Madison’s Victor Cabrera and others have already cut beef use from the mid‑30s down toward 20–30% after realizing they’d “used too much beef semen” and didn’t have enough replacements. The piece lays out simple rules: use your actual cull and loss data to set a minimum heifer‑calf target, treat 21‑day pregnancy rate as the ceiling for beef‑on‑dairy, and demand high‑reliability calving‑ease data before betting on male sexed beef. For executives and herd decision‑makers, the core question is whether your current beef‑on‑dairy plan still works if calf premiums soften and you have to buy 10–20 heifers at today’s prices in 2028.

CoBank warned us in ’25. Now the bill is due.

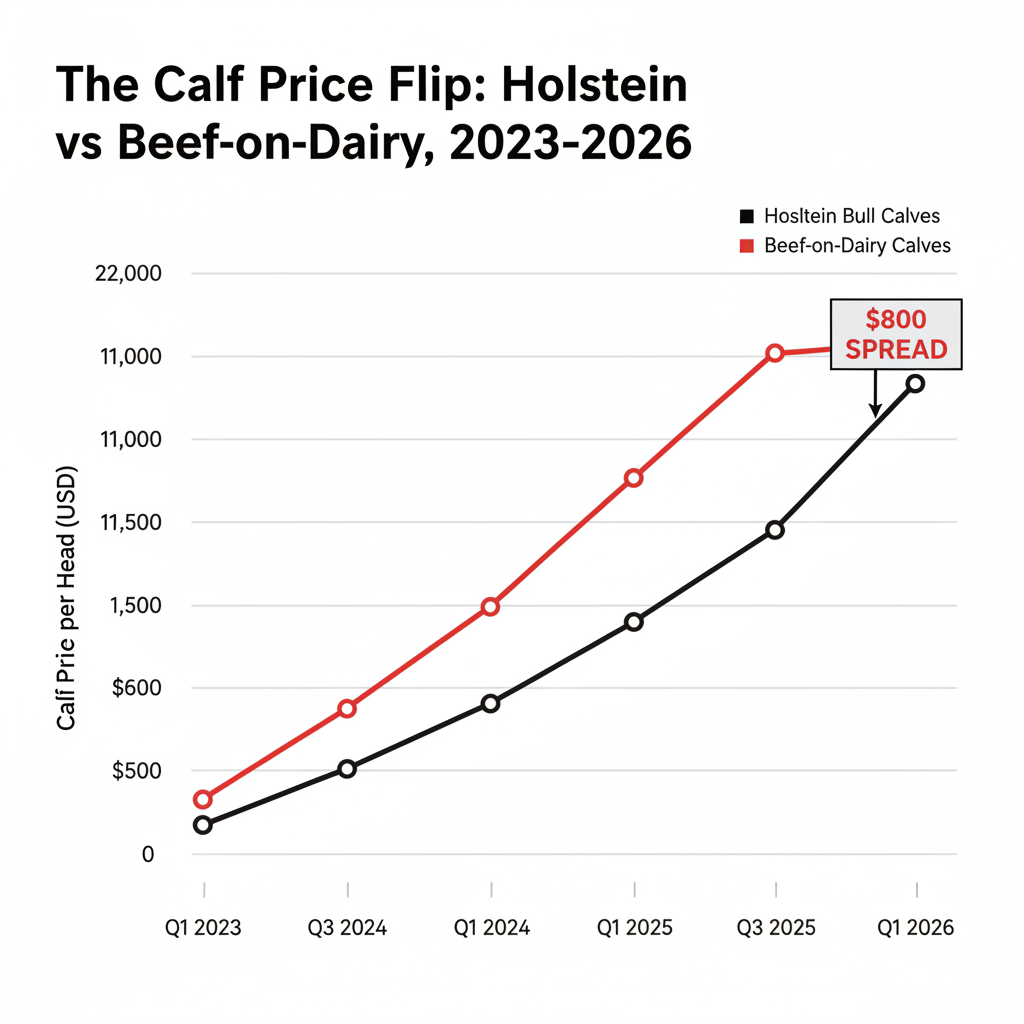

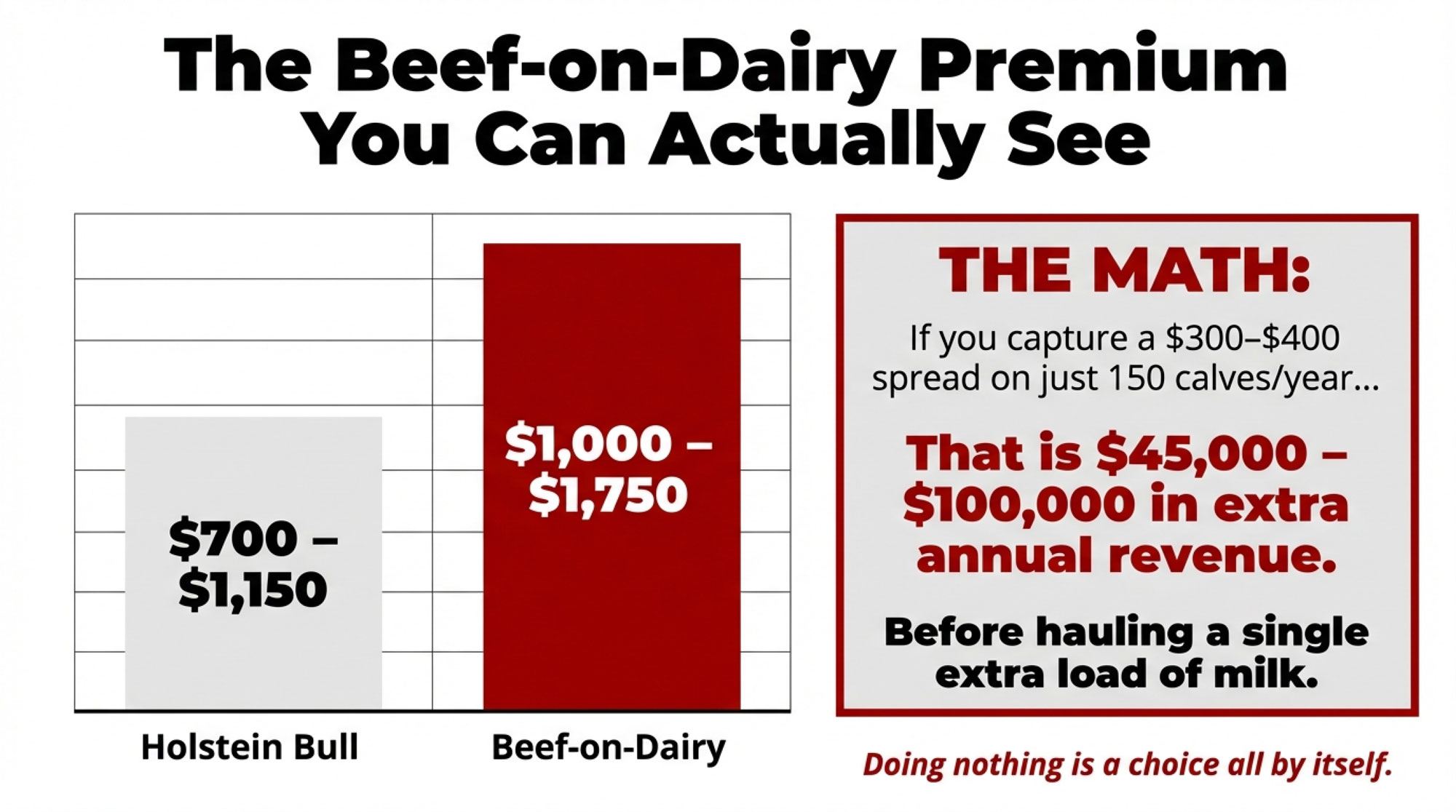

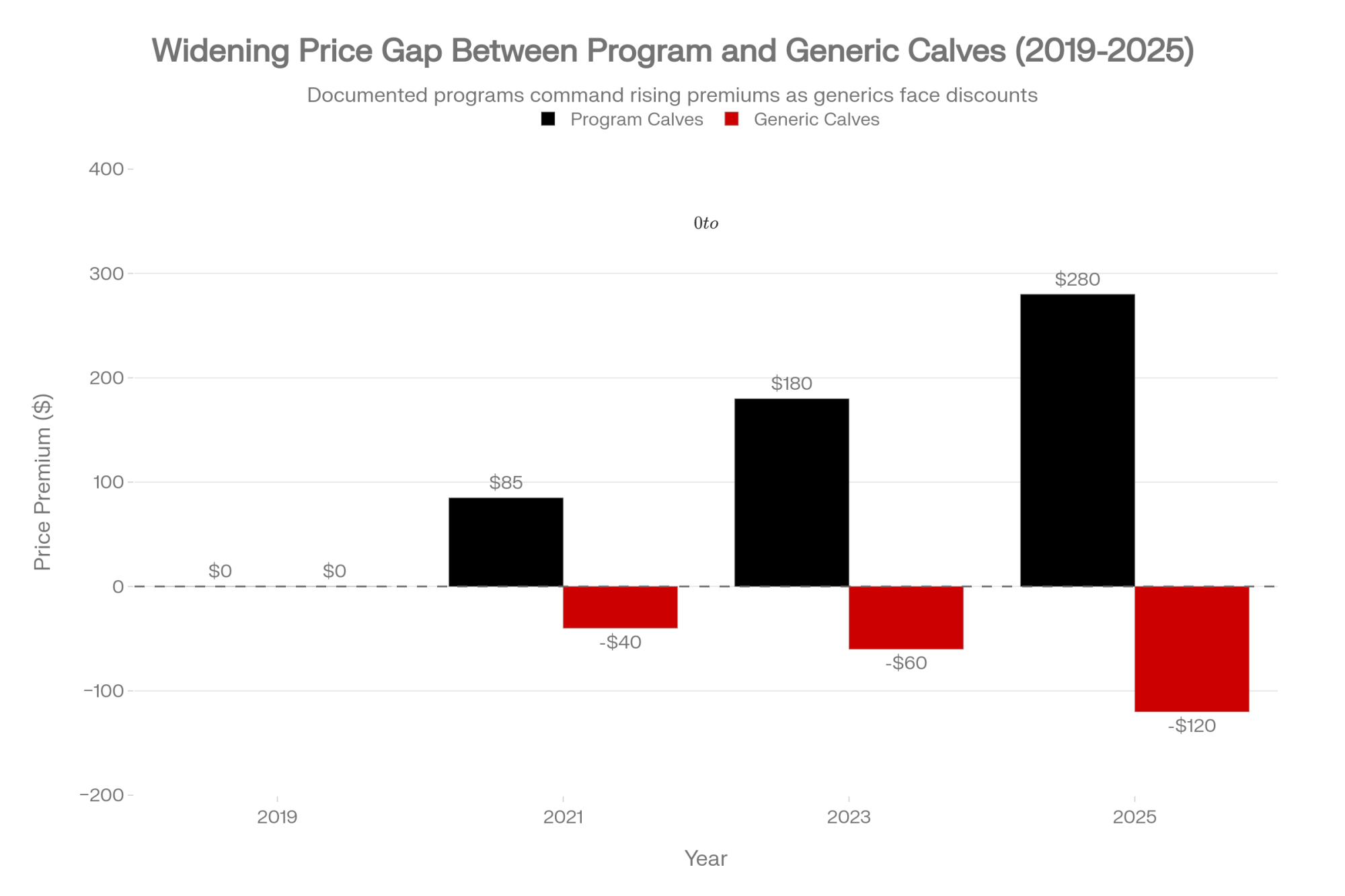

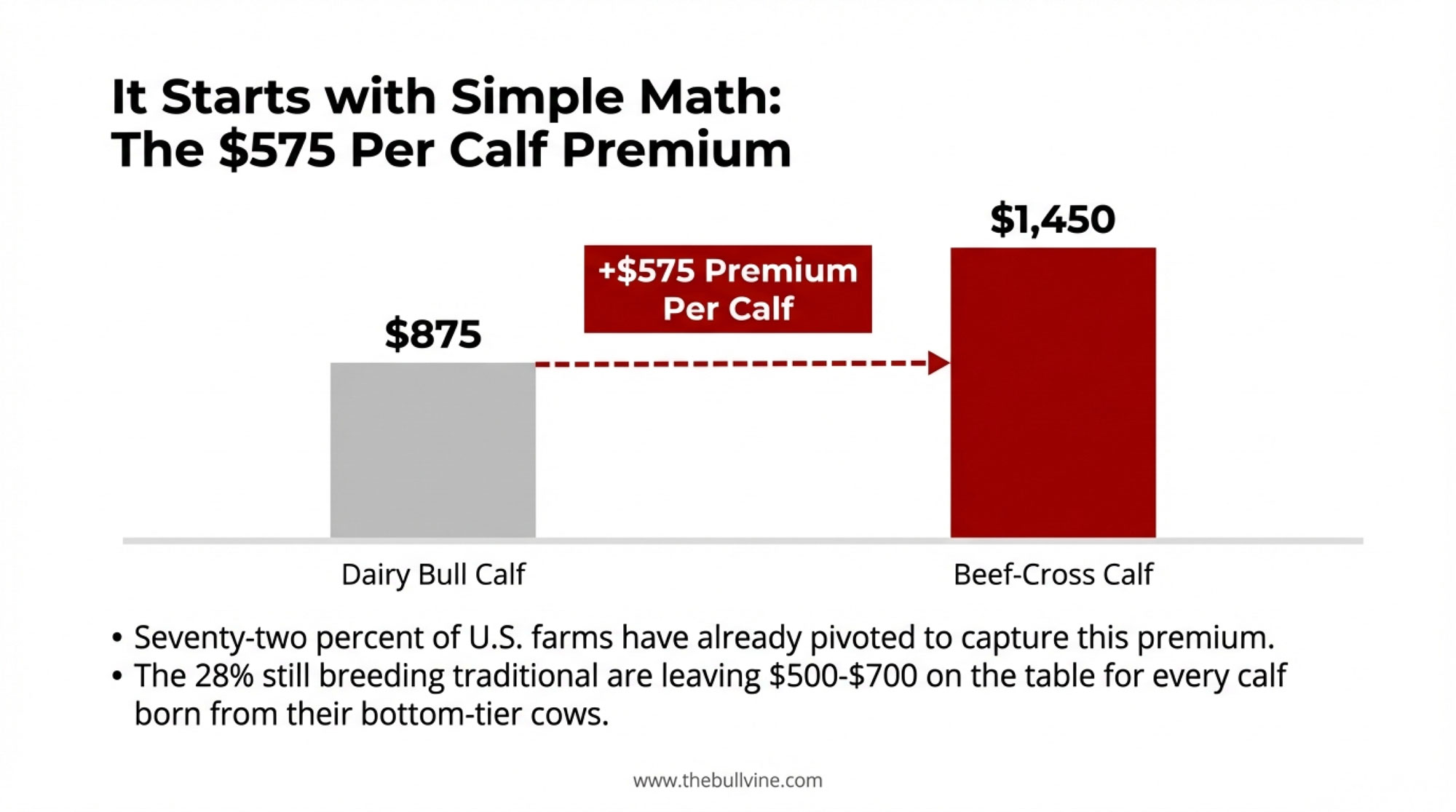

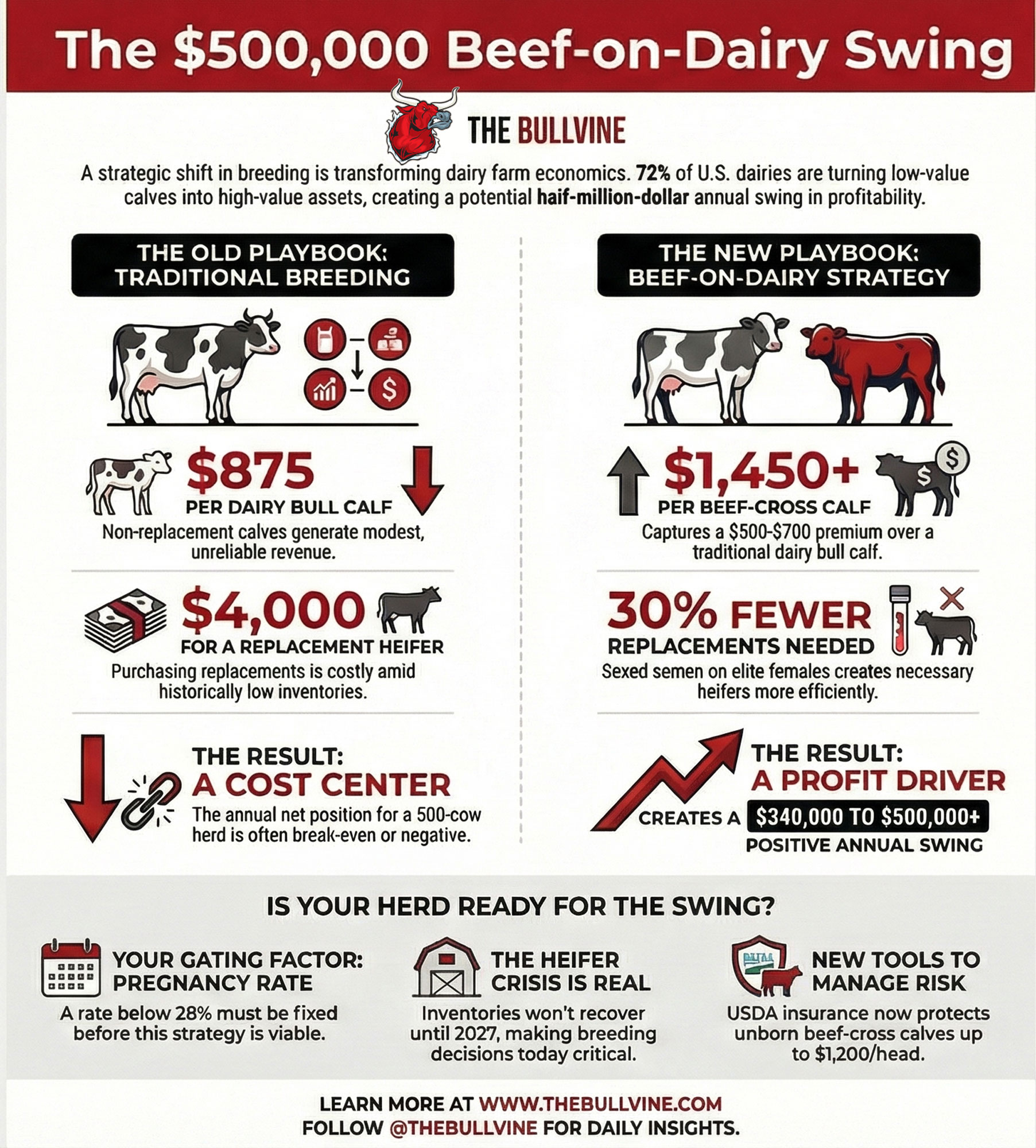

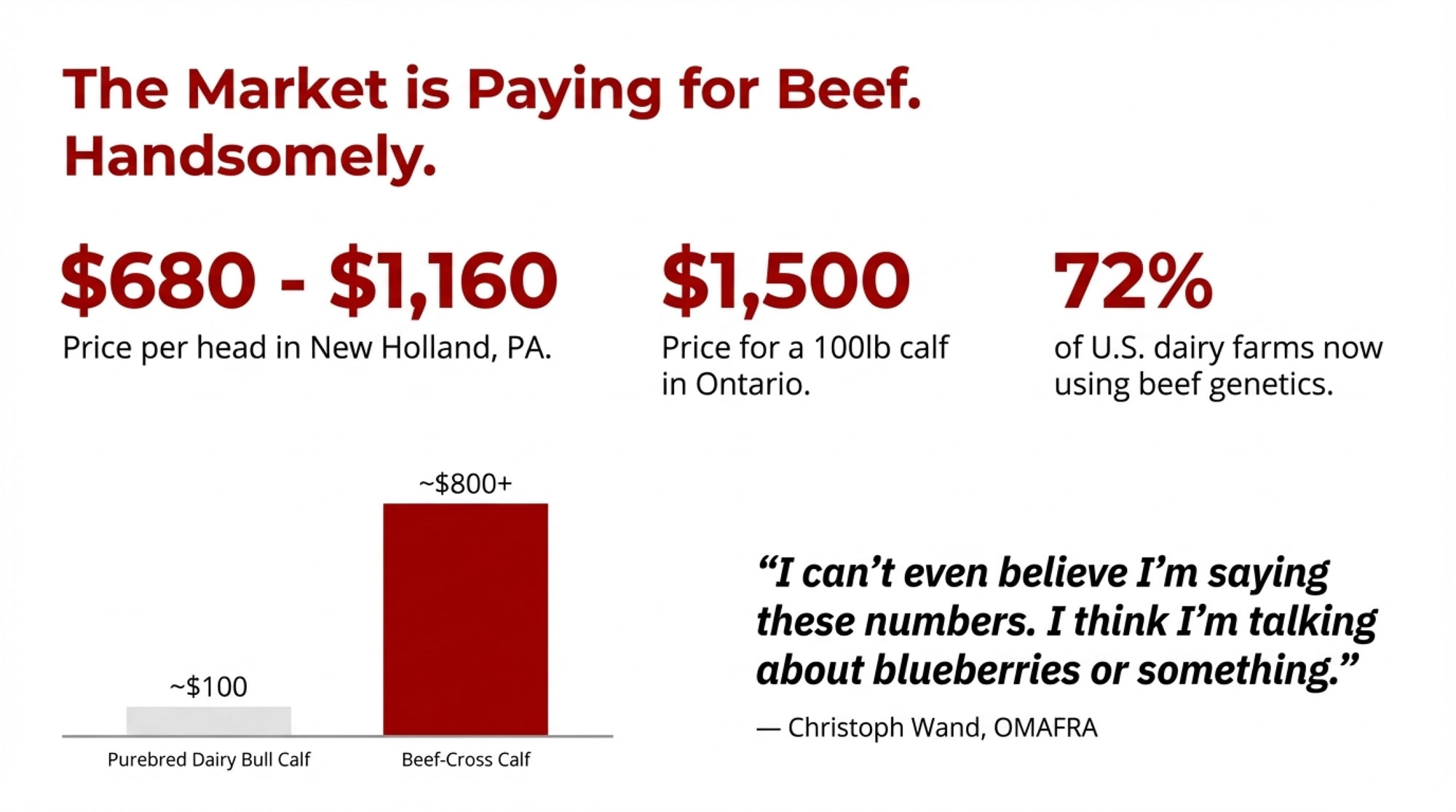

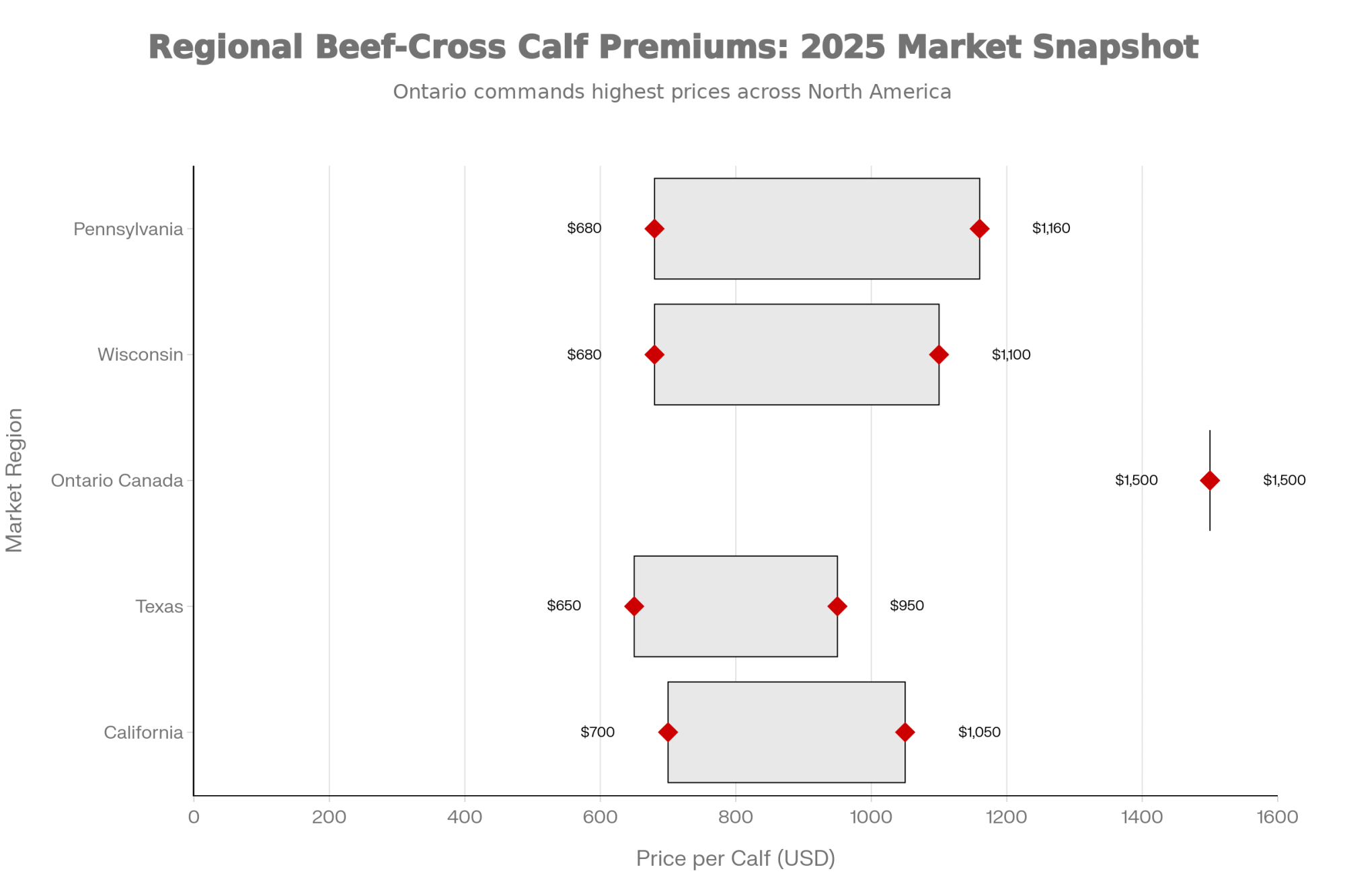

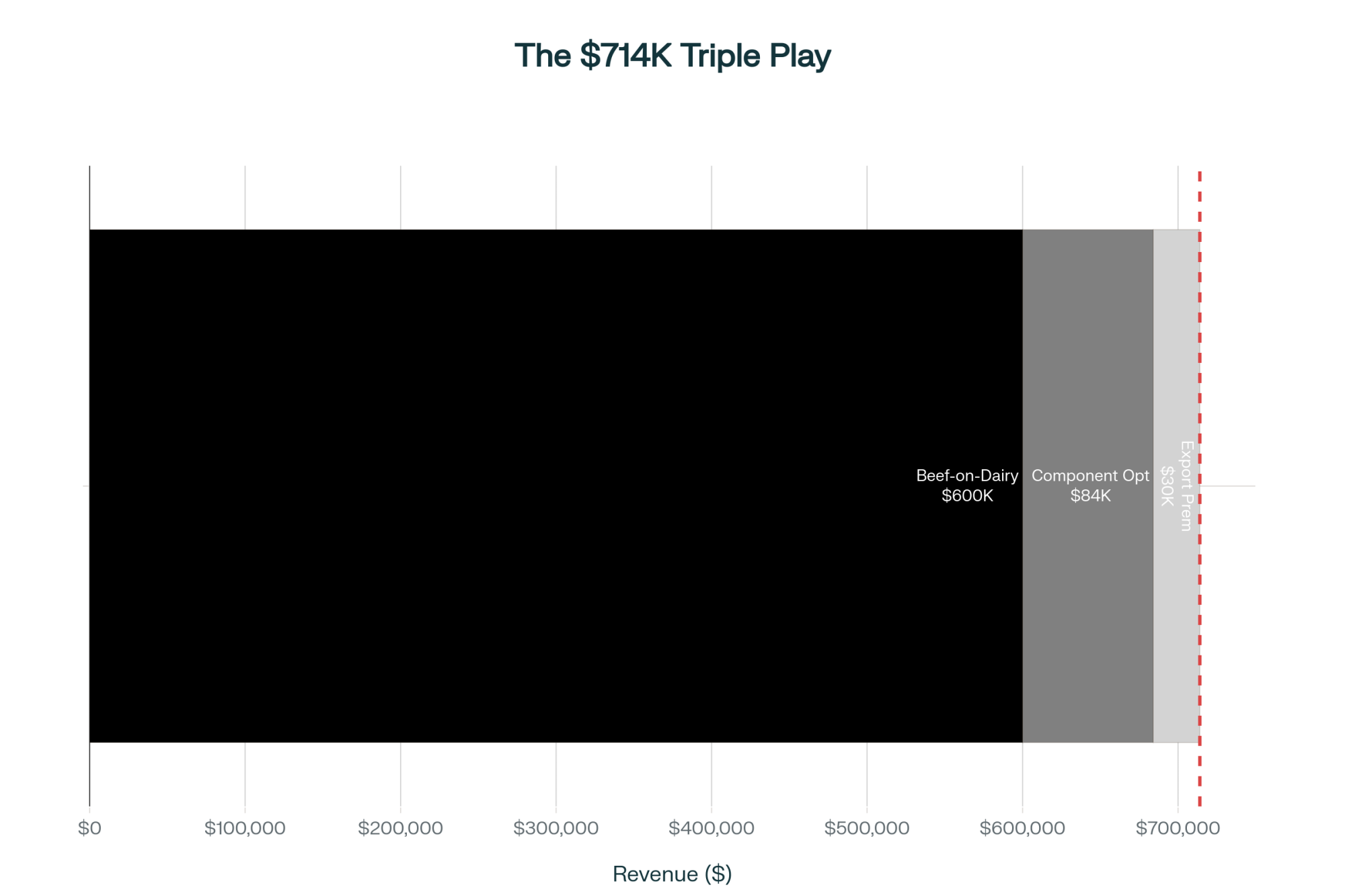

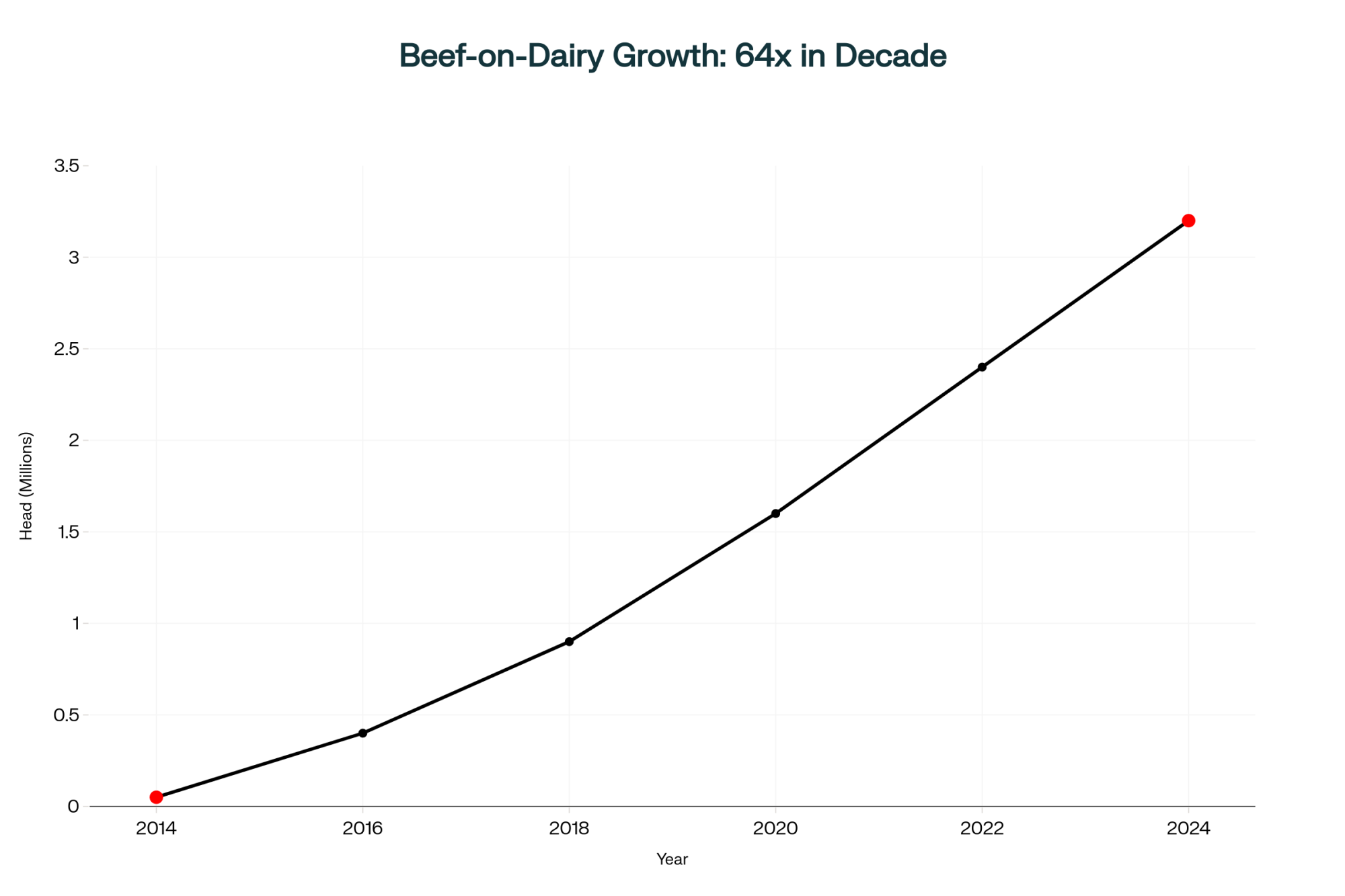

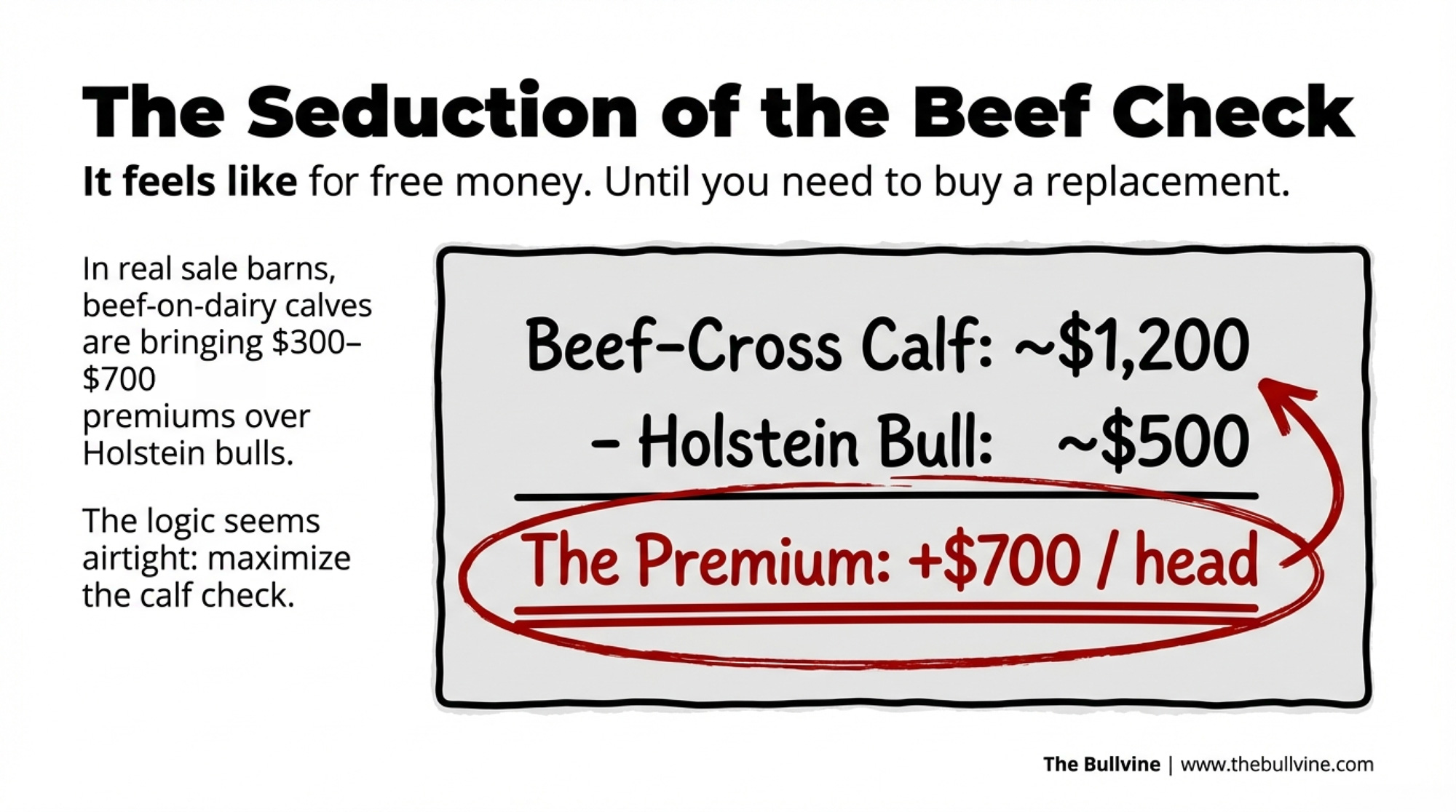

The conversation usually starts the same way. A lender, a calf buyer, or a trusted advisor looks across the desk at a 300‑cow dairy and says, “You should be maximizing beef value.” Beef‑on‑dairy calves are bringing $1,000–$1,500, and in some regions newborn crossbreds have topped $1,600. Straight Holstein bull calves are usually $500–$1,000, depending on quality and region, which makes paying $15–$20 more for Y‑sorted beef semen feel like easy money. In real U.S. sale barns through late‑2025 and early‑2026, that’s often a $300–$700 premium for a beef‑cross calf over a straight Holstein bull, depending on region and weight.

It is — until you stack that strategy against a U.S. replacement heifer inventory that’s already 800,000 head short and ask how many heifers your own breeding plan actually produces.

The CoBank Numbers Behind the Heifer Squeeze

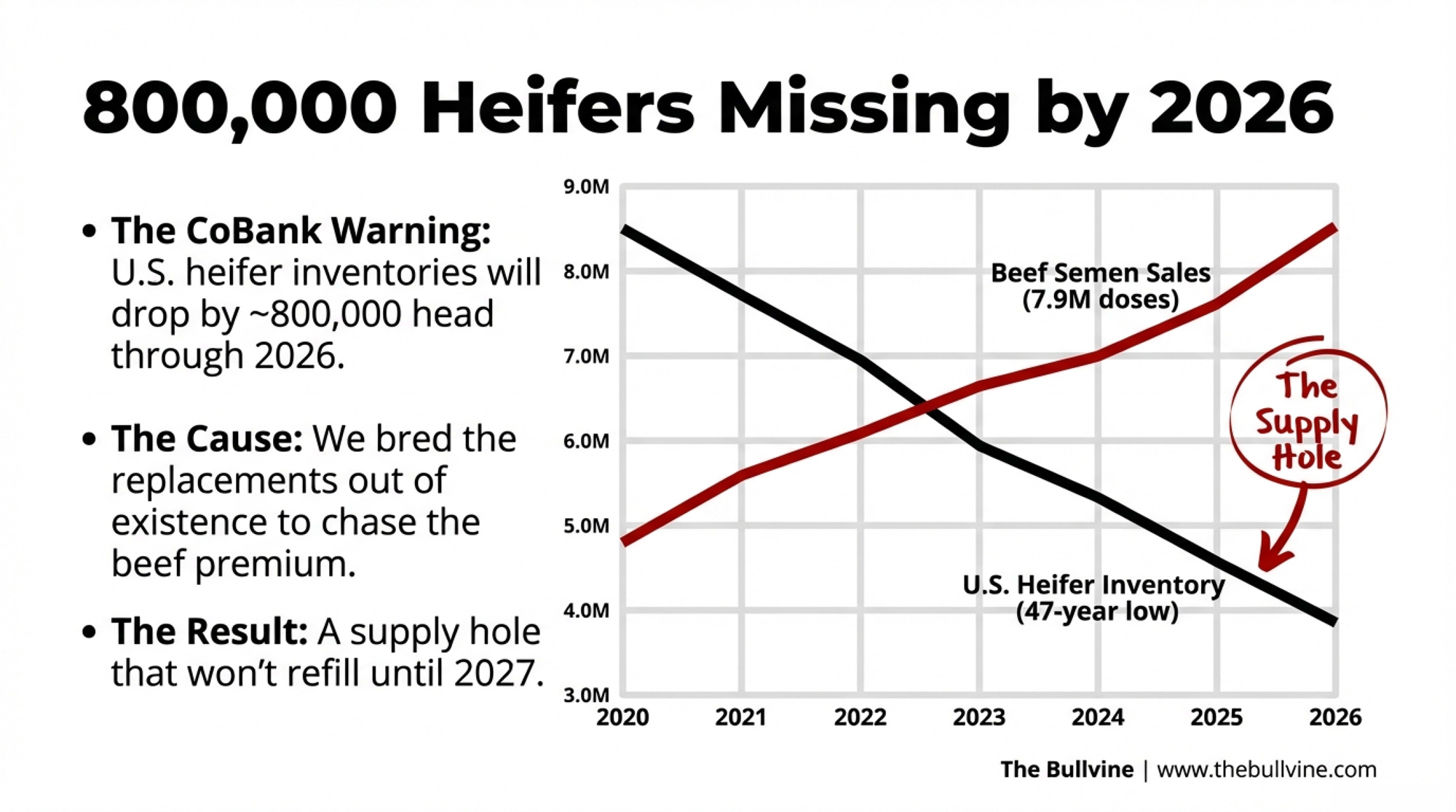

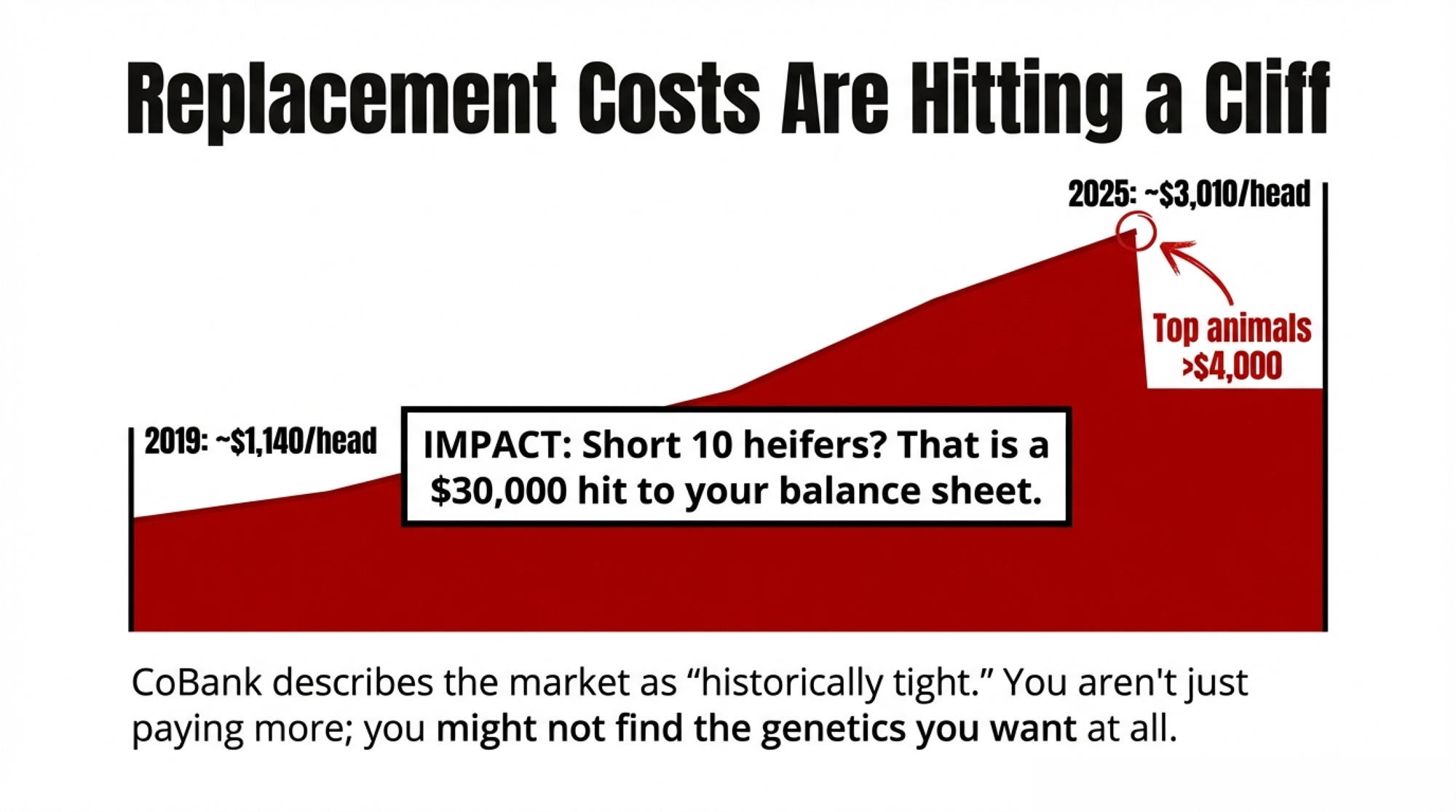

In August 2025, CoBank’s Knowledge Exchange group dropped a report that should’ve been required reading before anybody loaded more sexed beef straws into the tank. Economist Corey Geiger and co‑author Abbi Prins modeled what beef‑on‑dairy is doing to replacement heifer supplies.

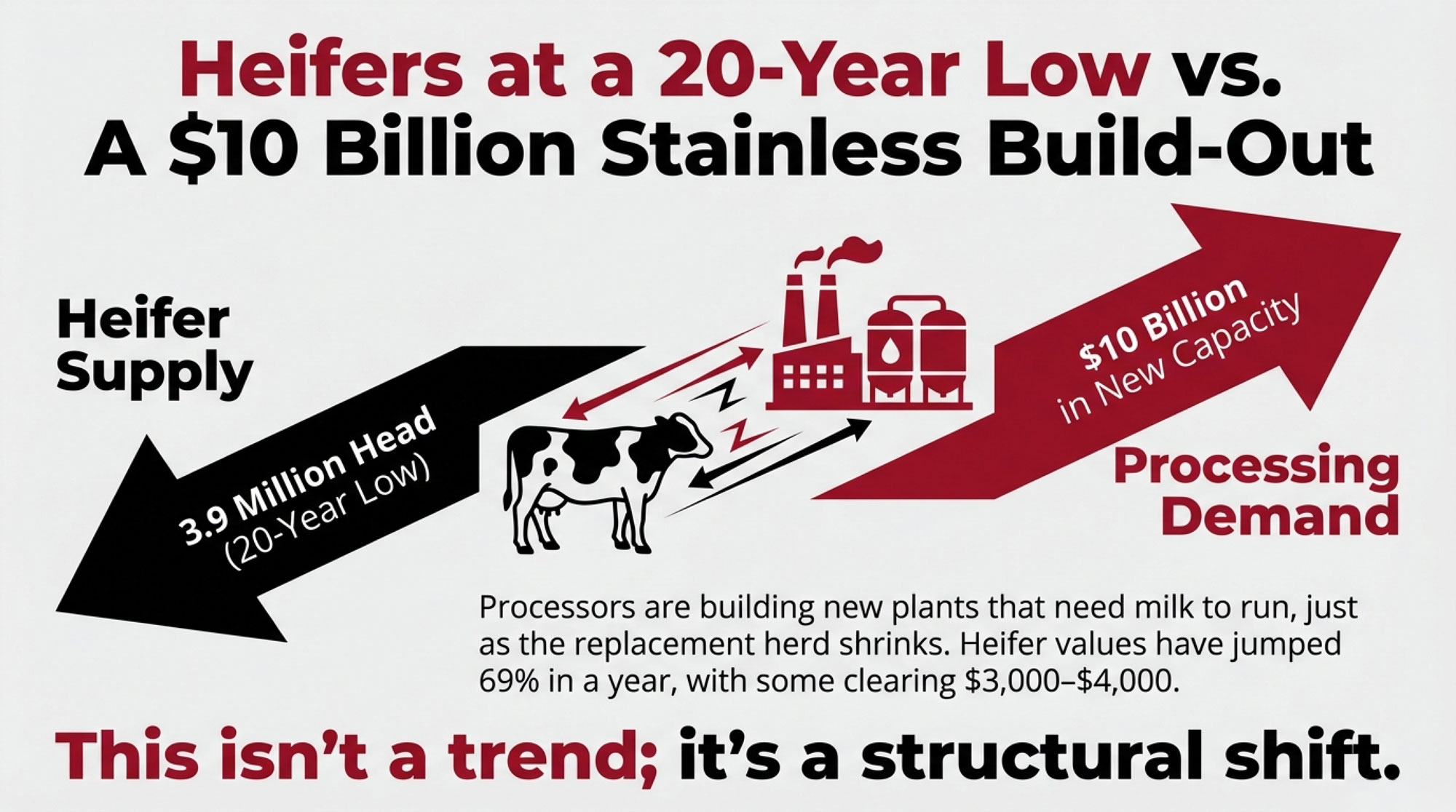

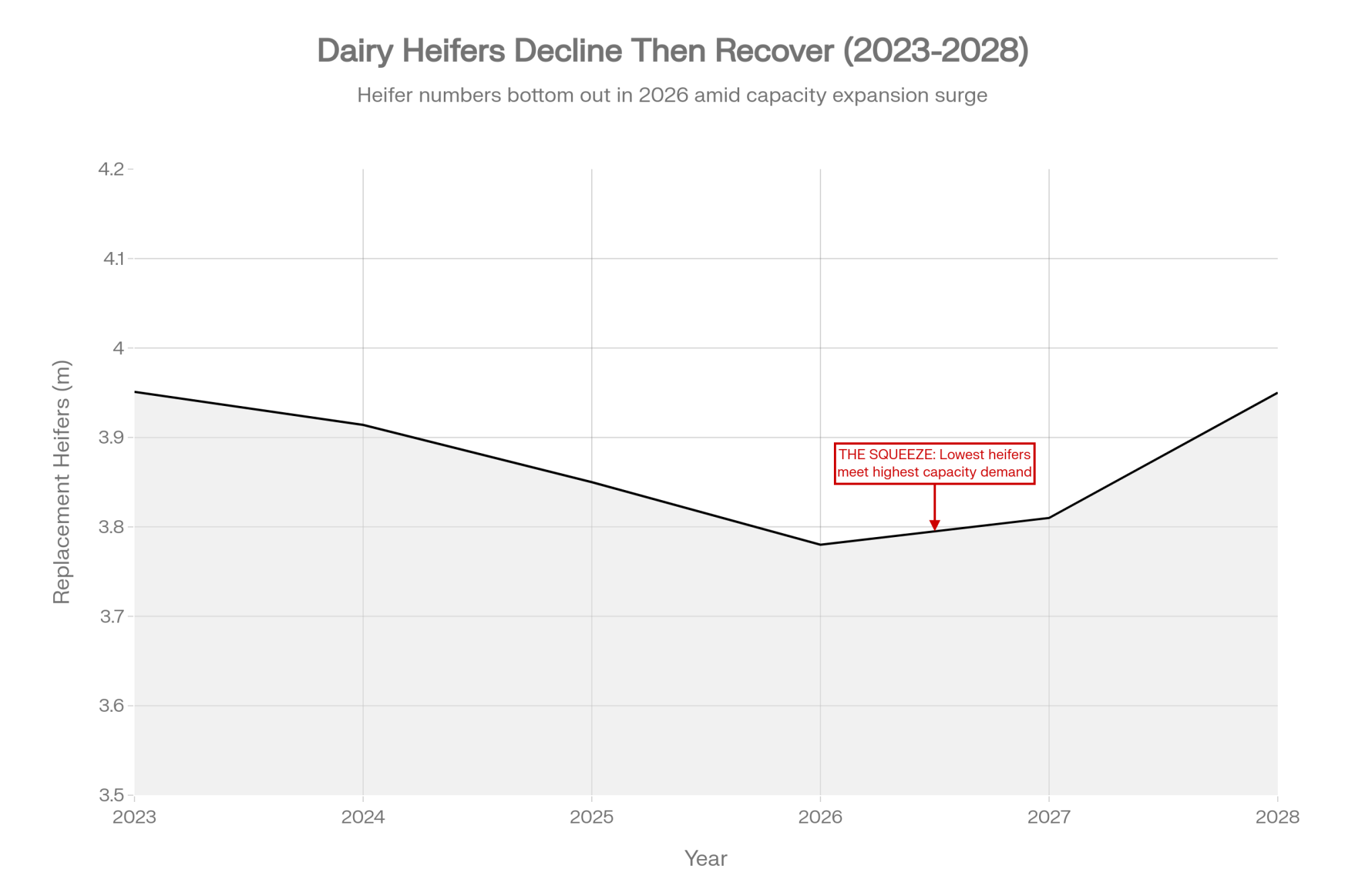

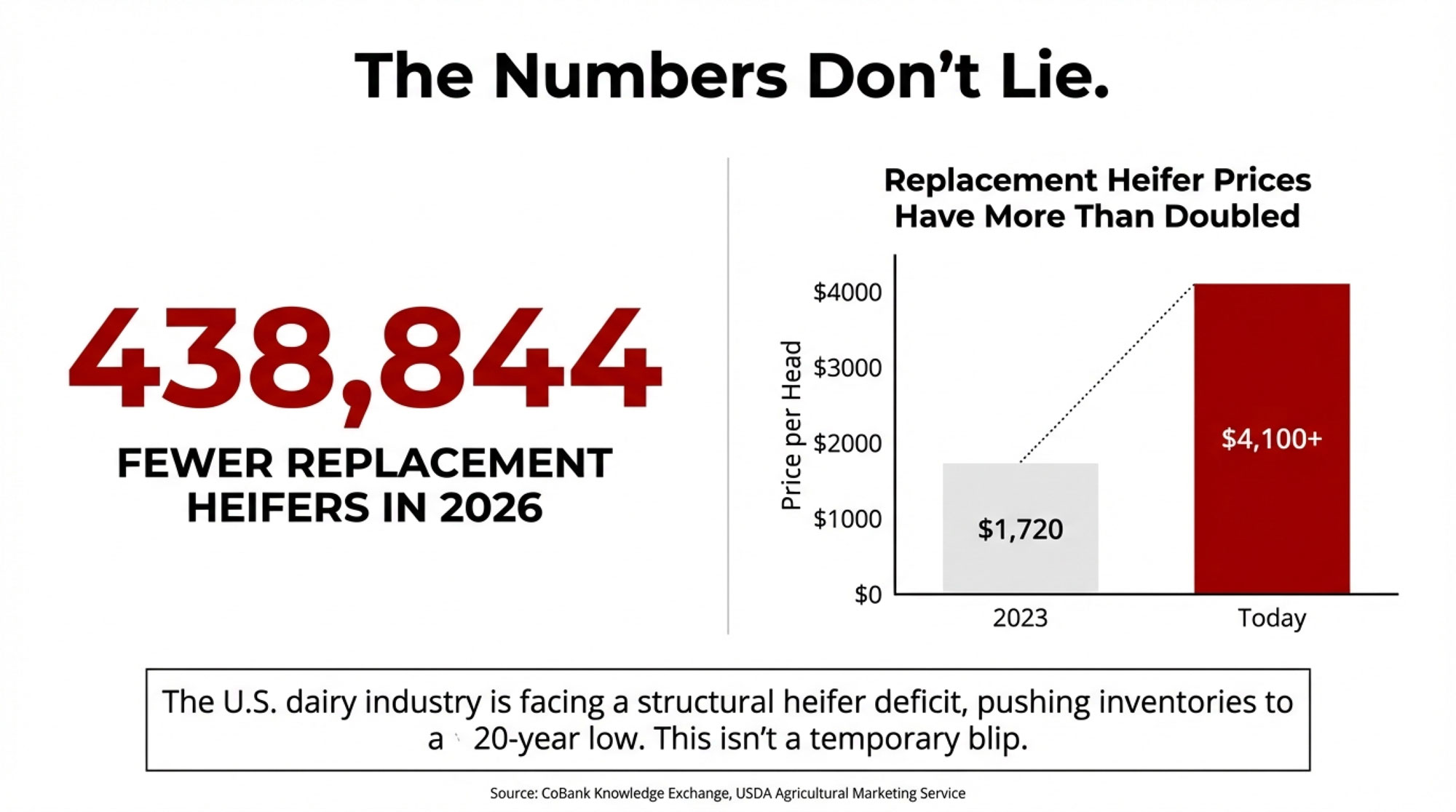

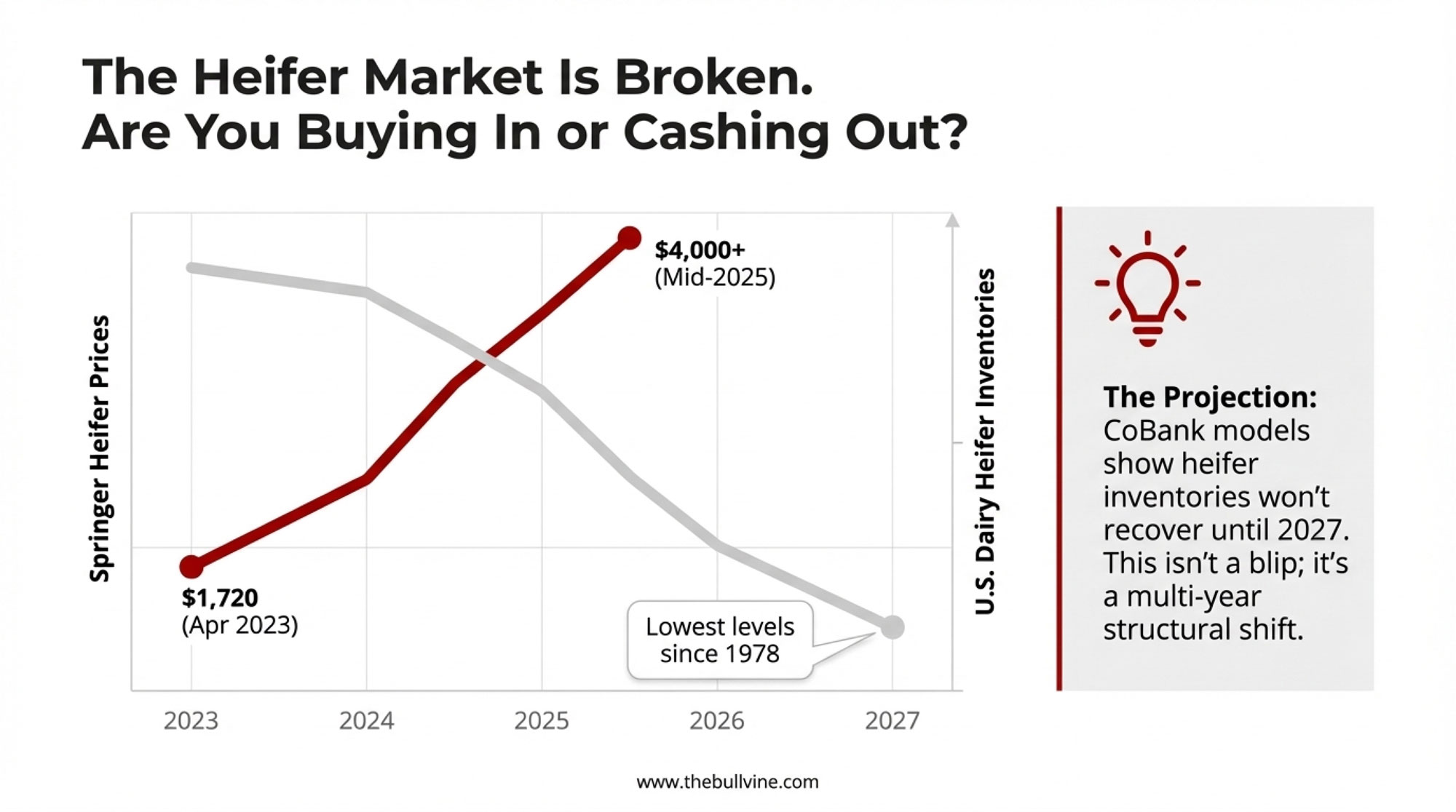

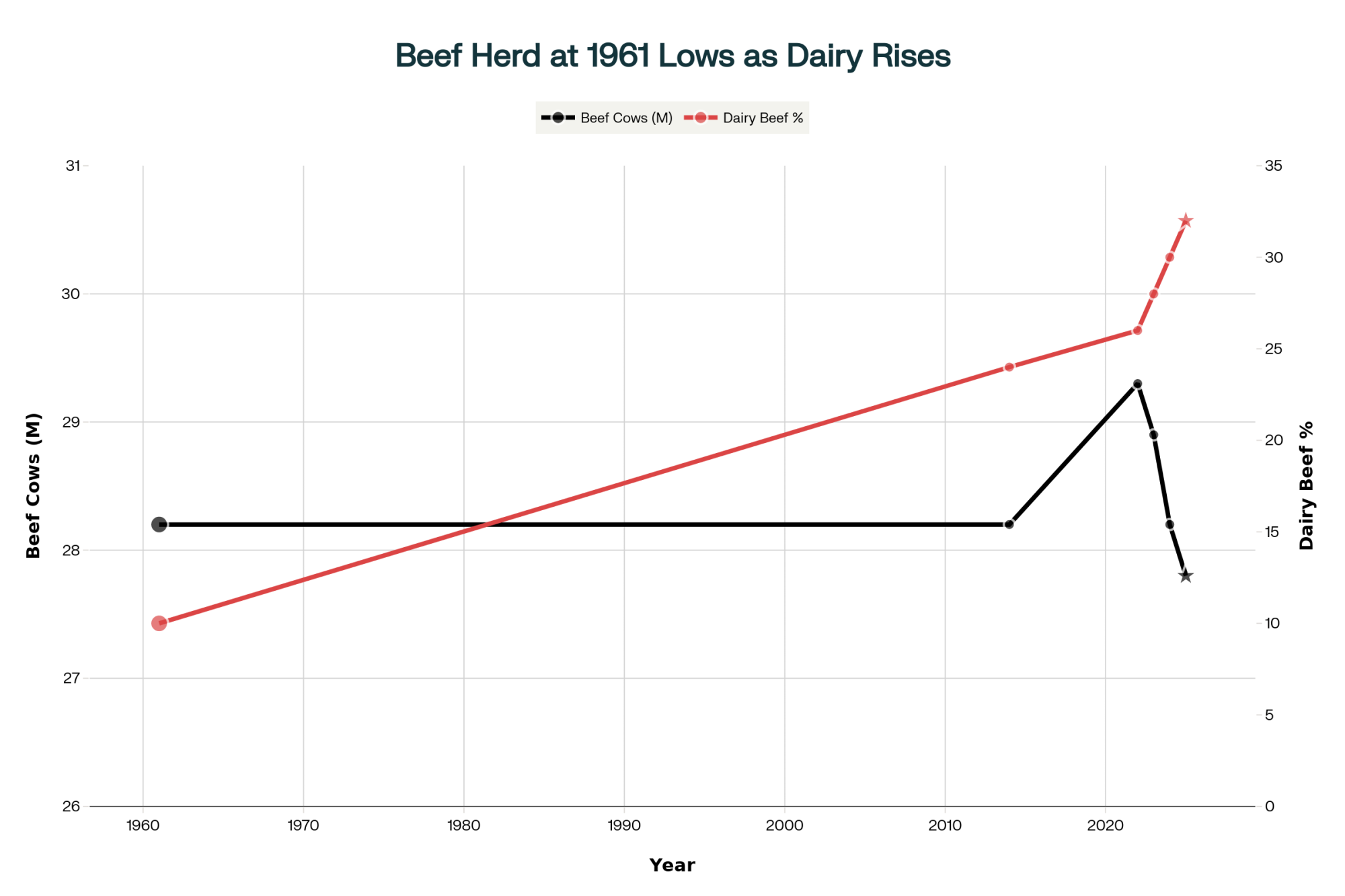

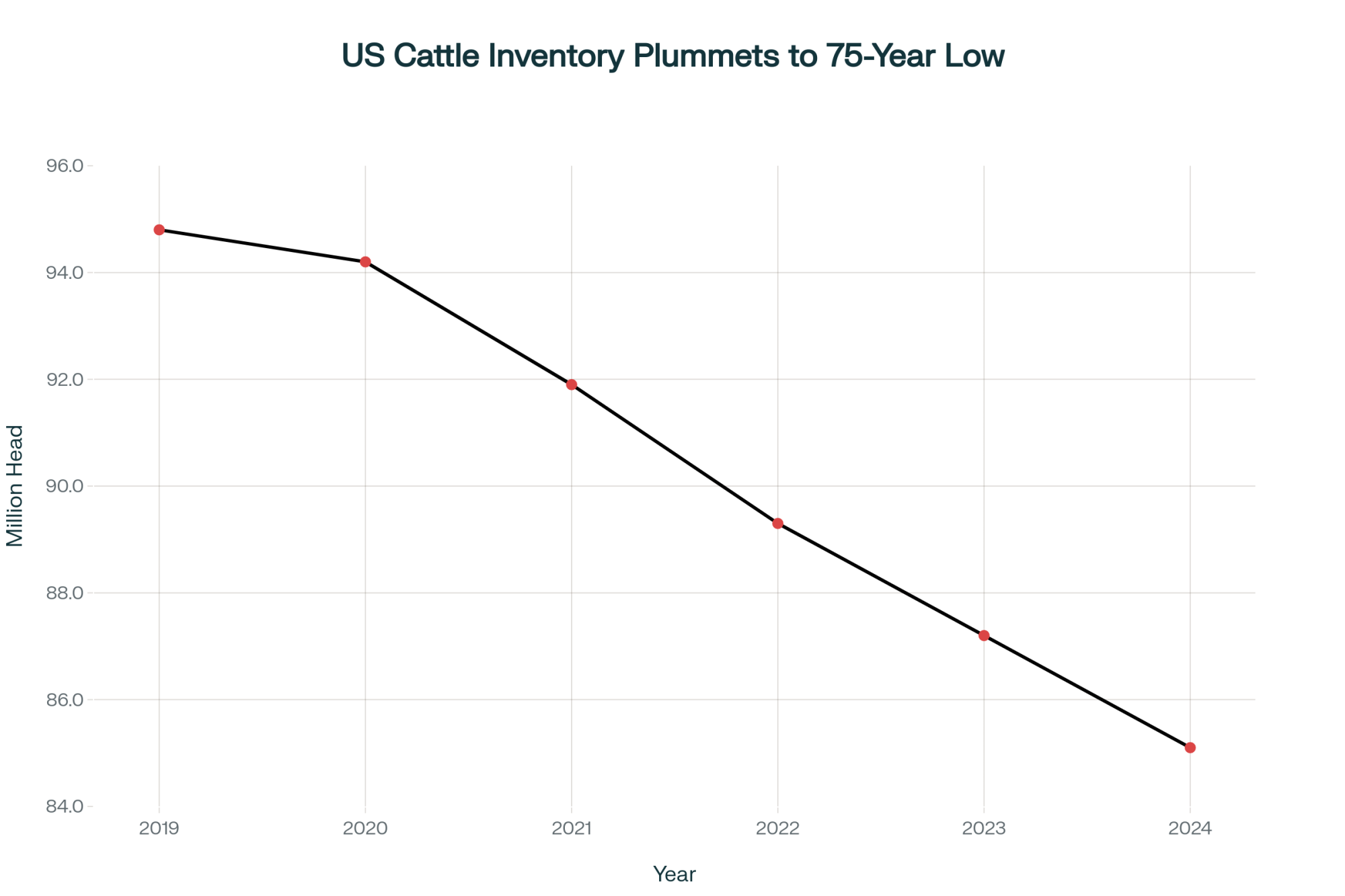

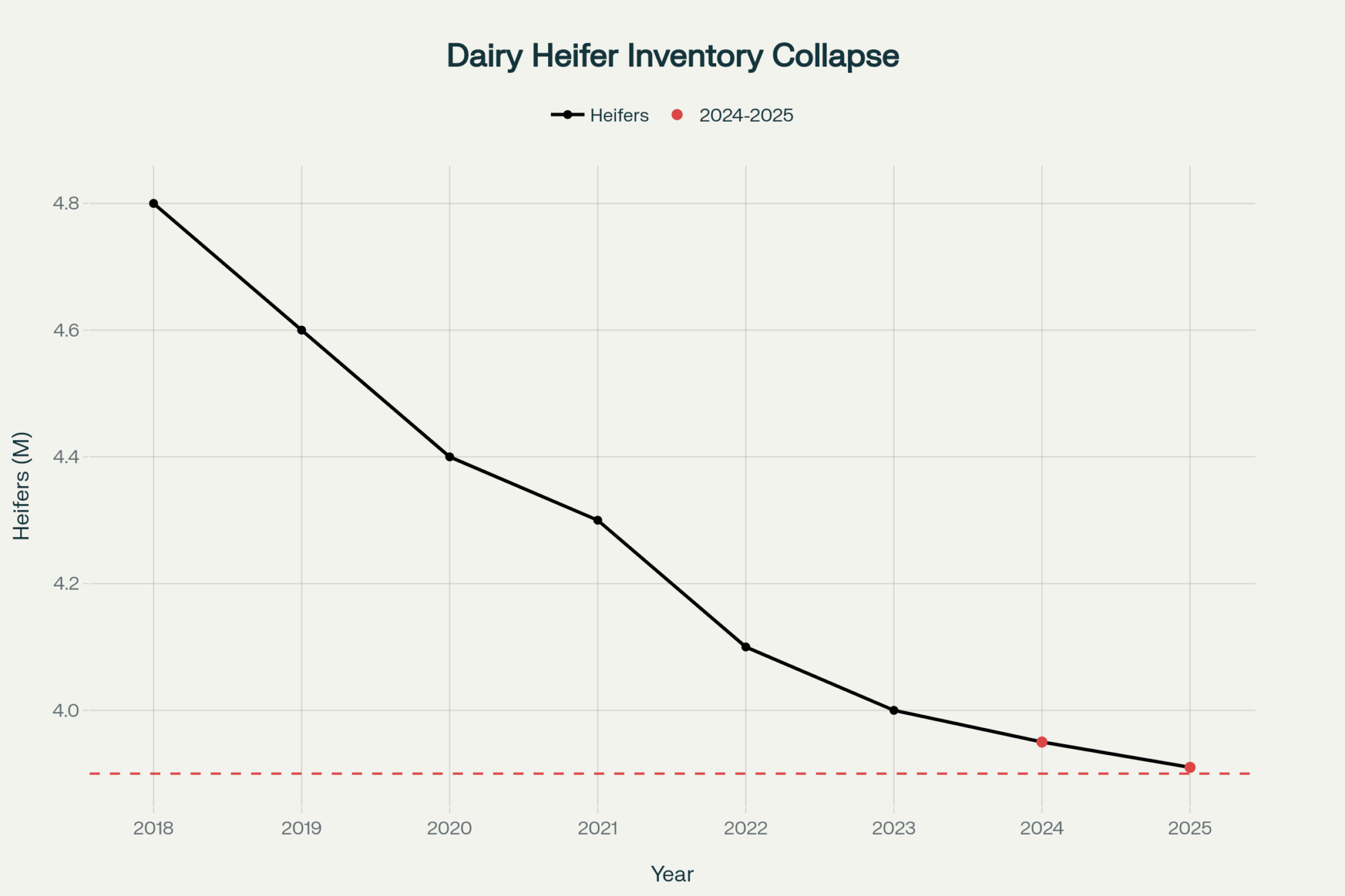

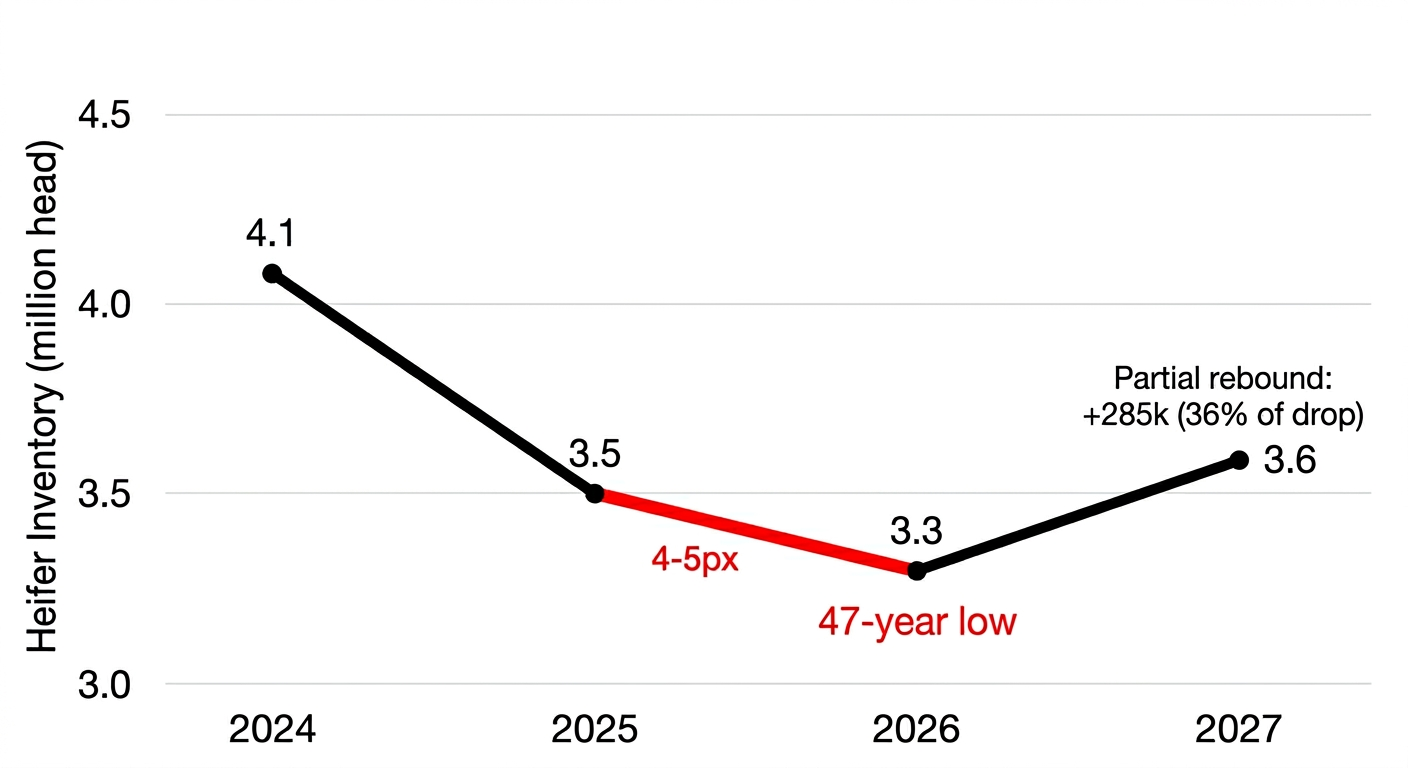

Their conclusion: dairy heifer inventories will shrink by an estimated 800,000 head over 2025 and 2026 before they even begin to rebound in 2027. That rebound is only about 285,000 heifers, which doesn’t come close to filling the hole.

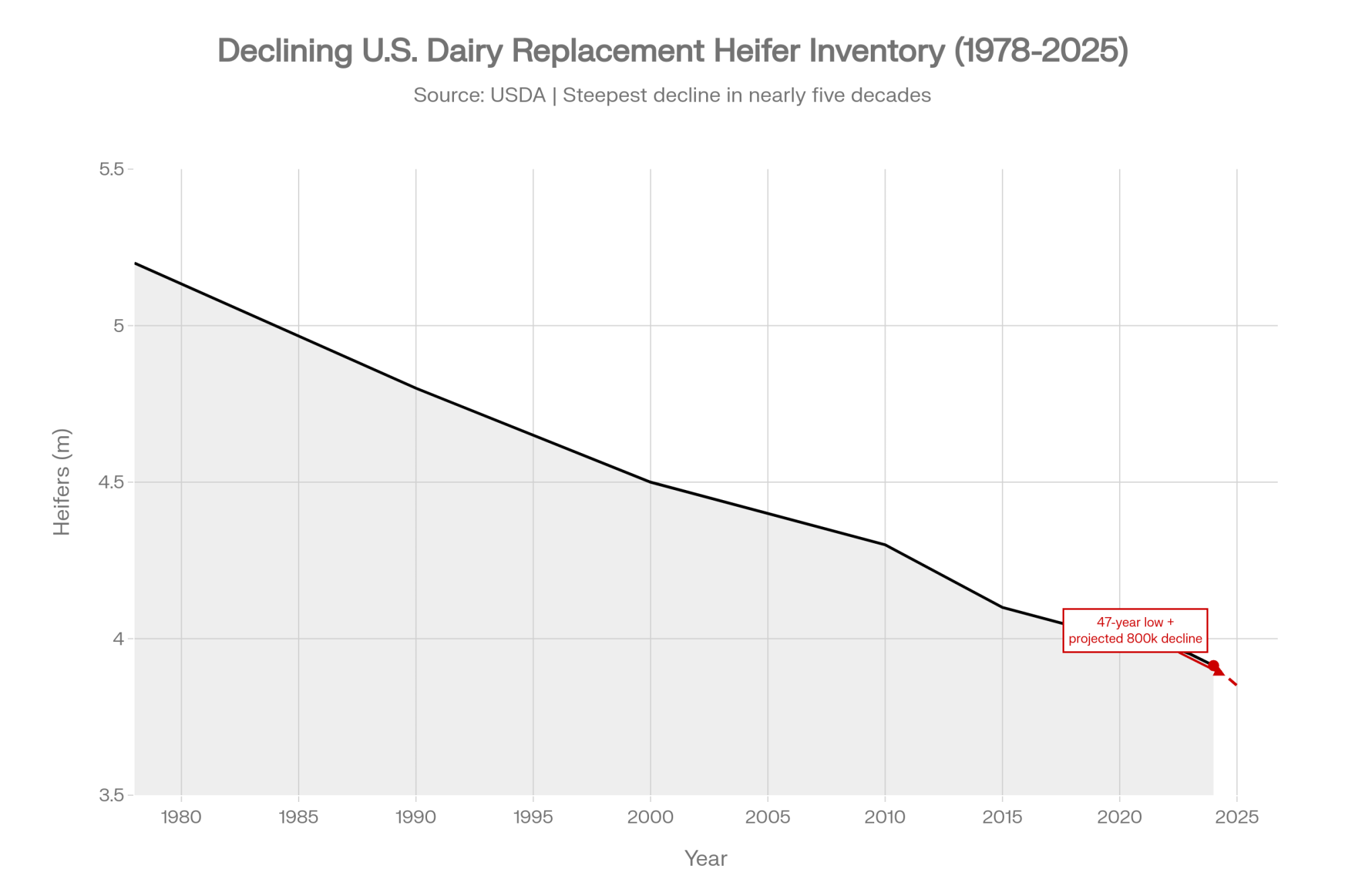

USDA’s January 2025 cattle report put U.S. dairy replacement heifers at 3.914 million head, the lowest level since the late 1970s — a 47‑year low. Trade coverage has been blunt: supplies remain tight, and the heifers that are out there are expensive.

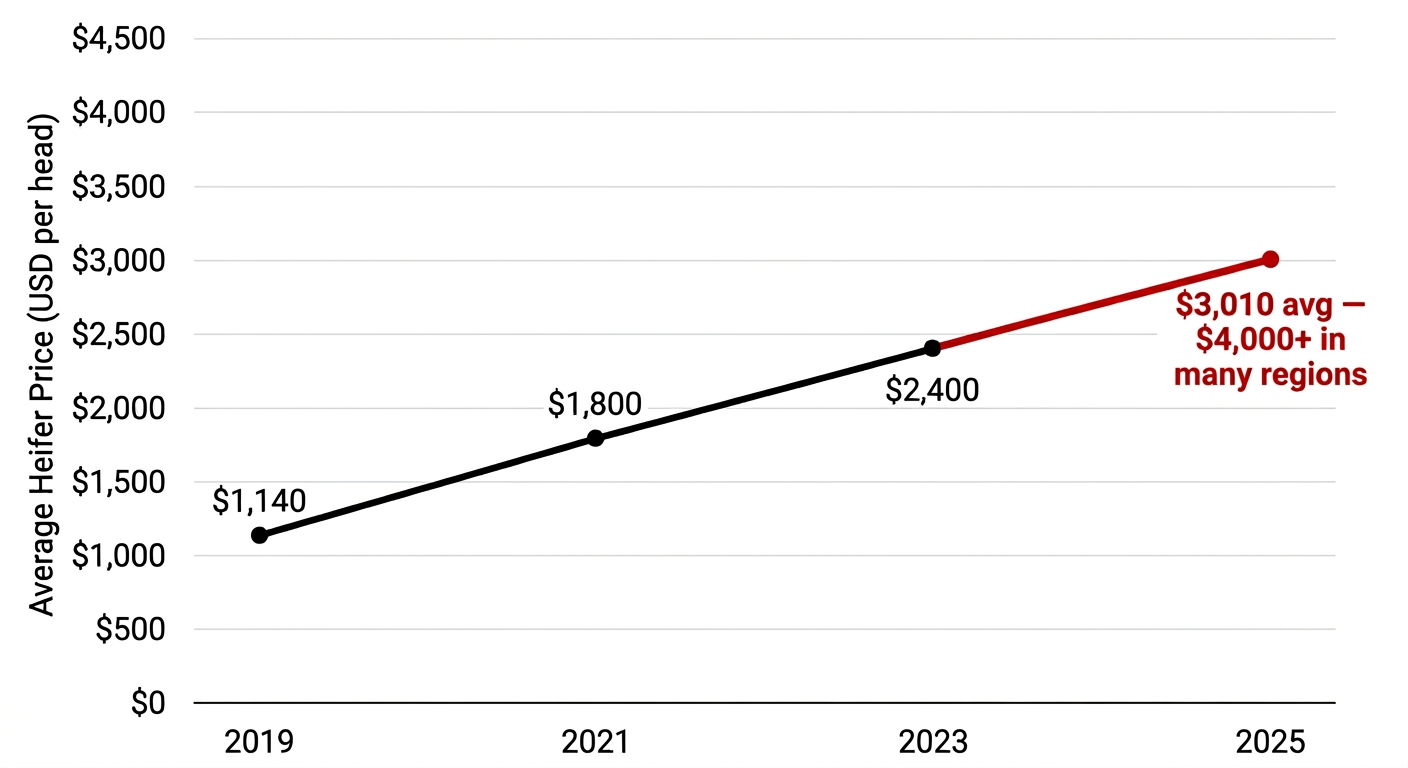

CoBank leans on USDA data showing that average replacement heifer values climbed from roughly $1,140 per head in April 2019 to about $3,010 by mid‑2025, with many regions seeing $4,000‑plus for the kind of heifer you’d actually want in your own string. That’s not a gentle slope. That’s a cliff in the rearview mirror — and it’s reshaping replacement heifer prices in every serious dairy region.

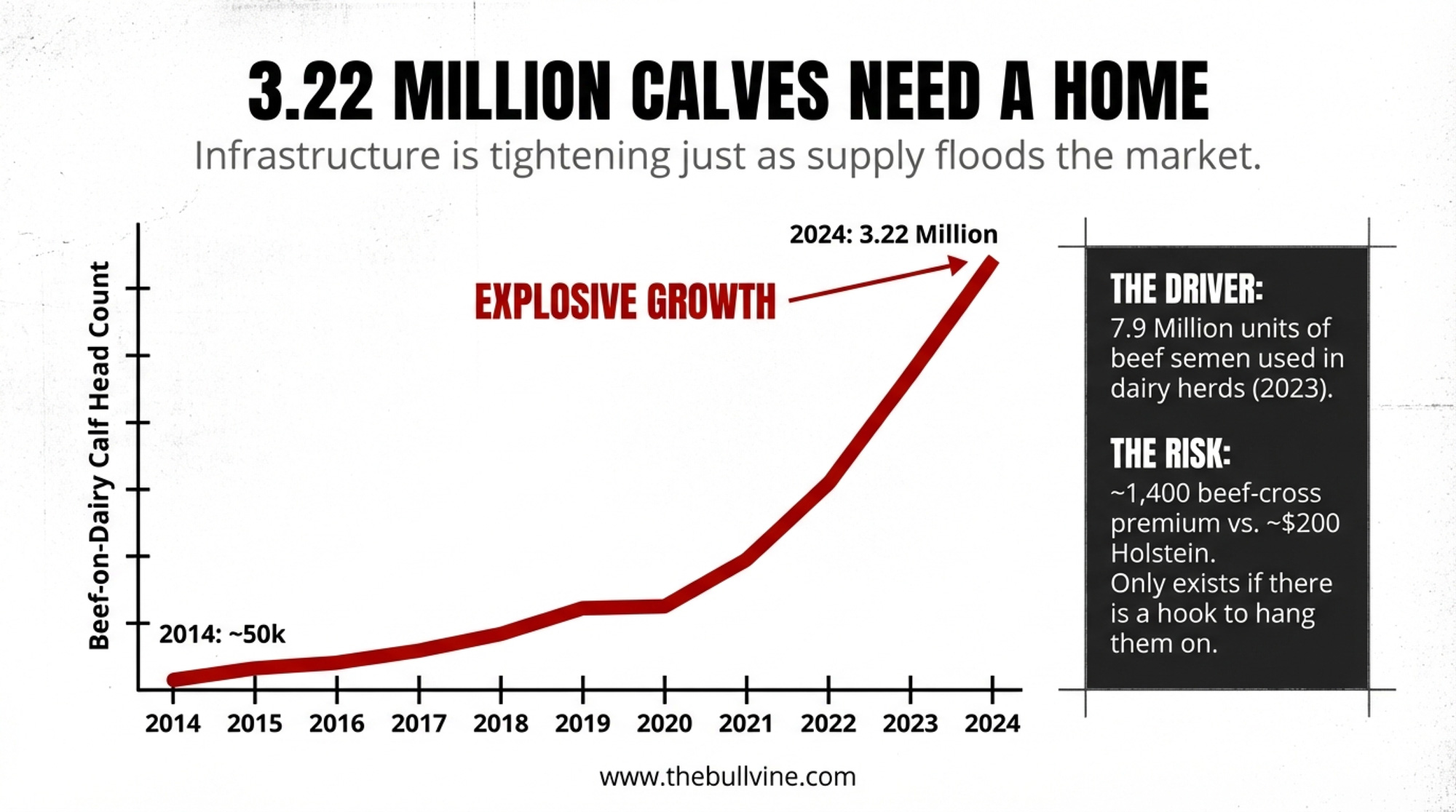

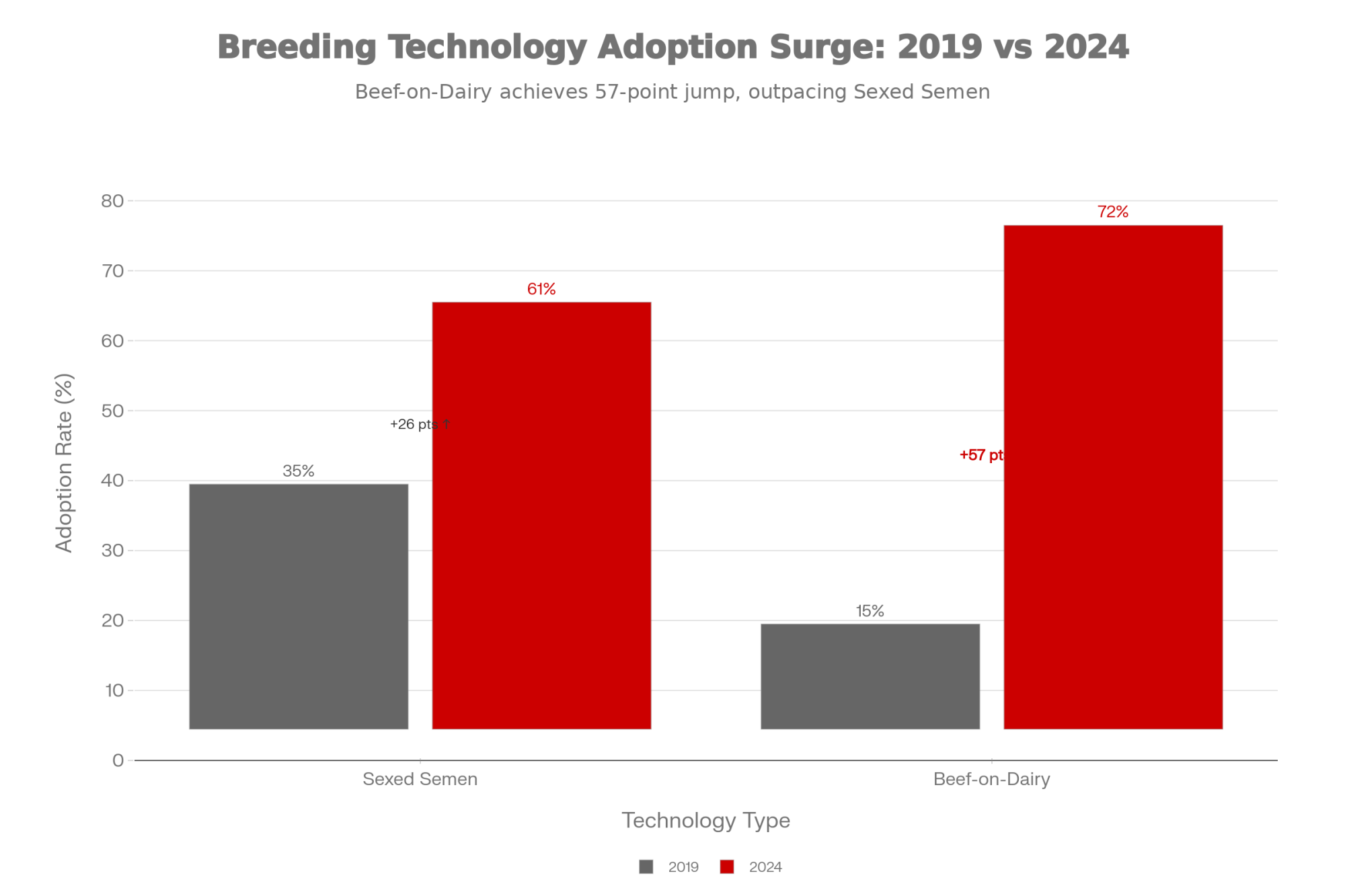

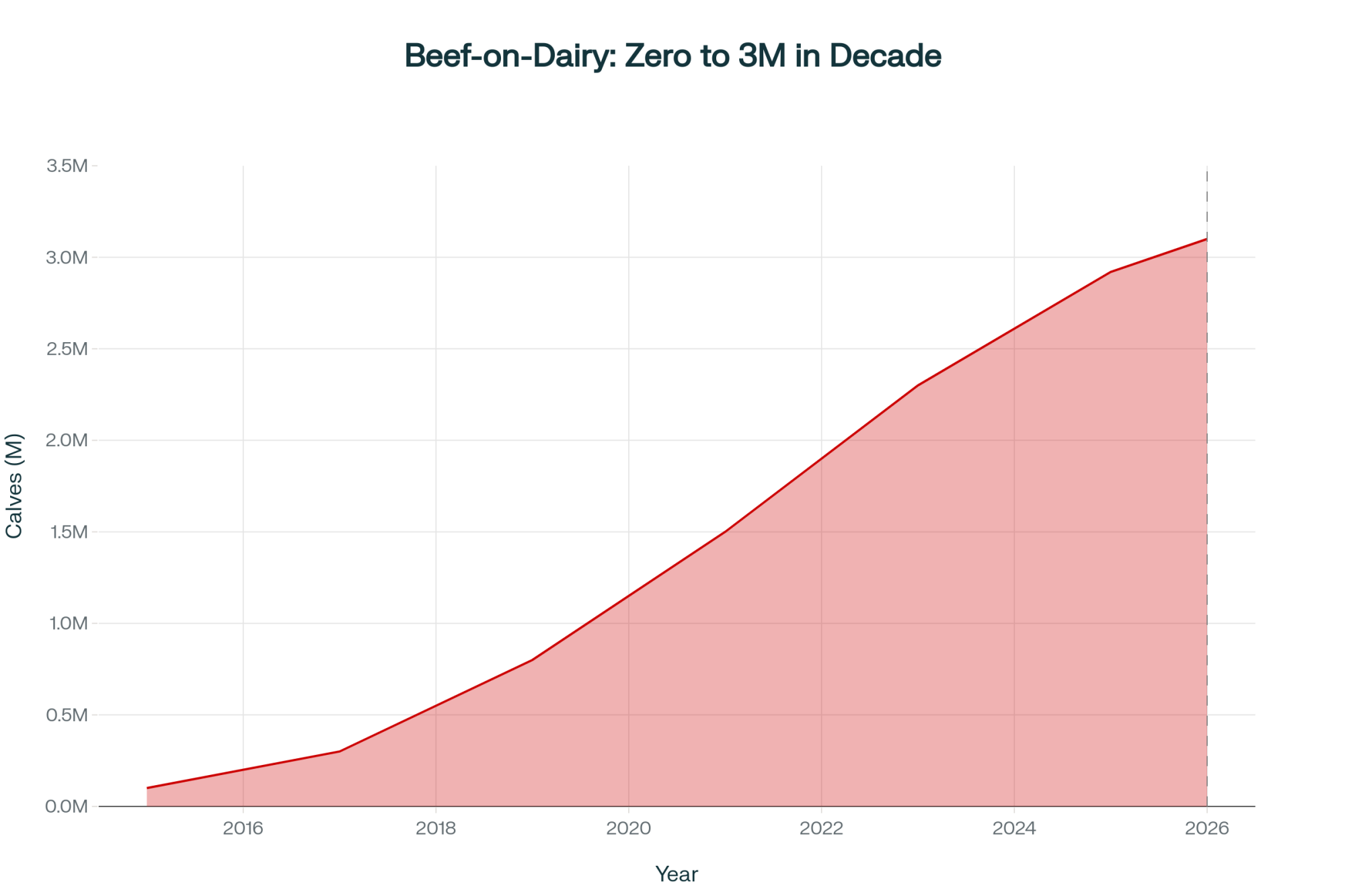

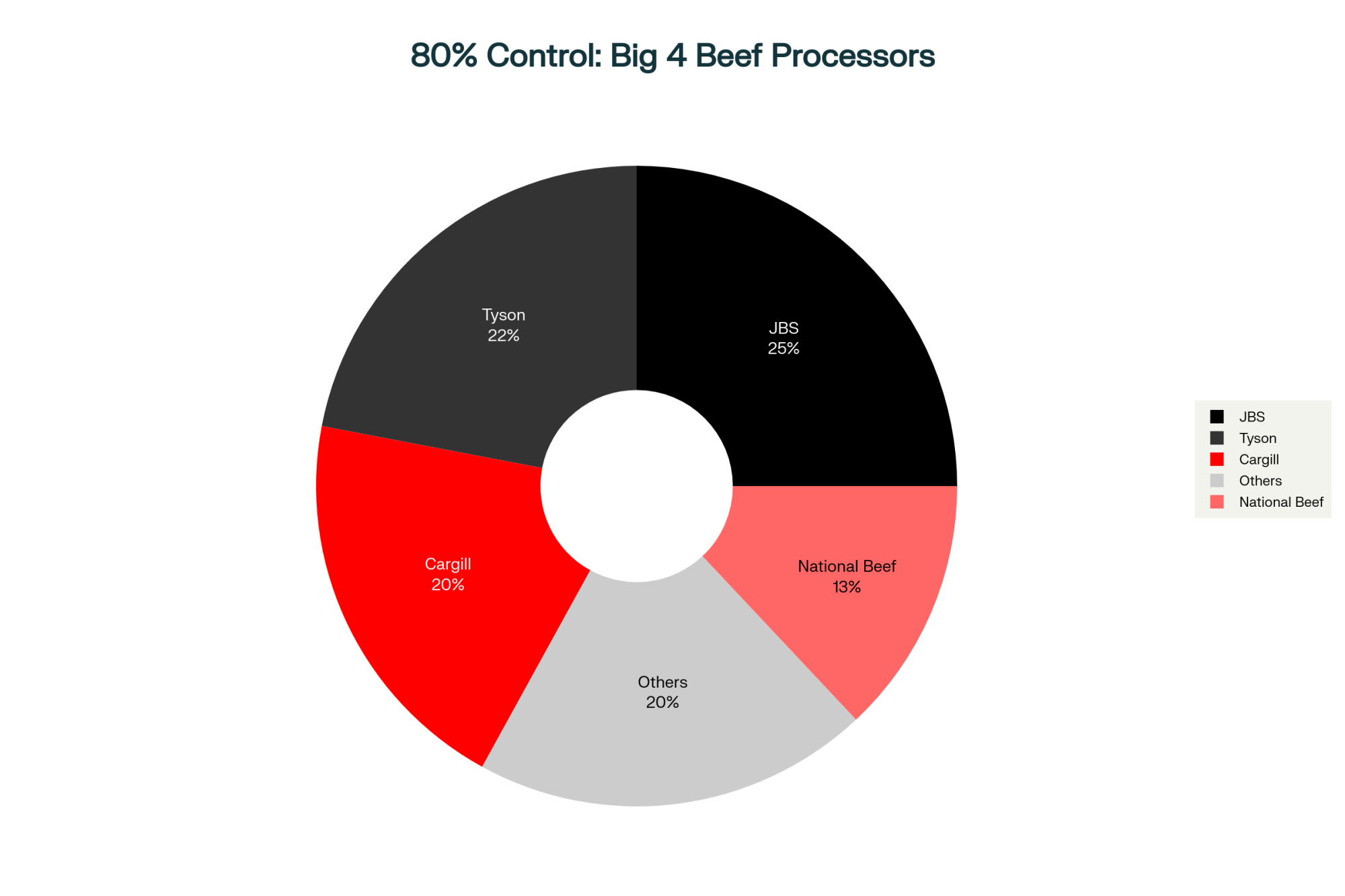

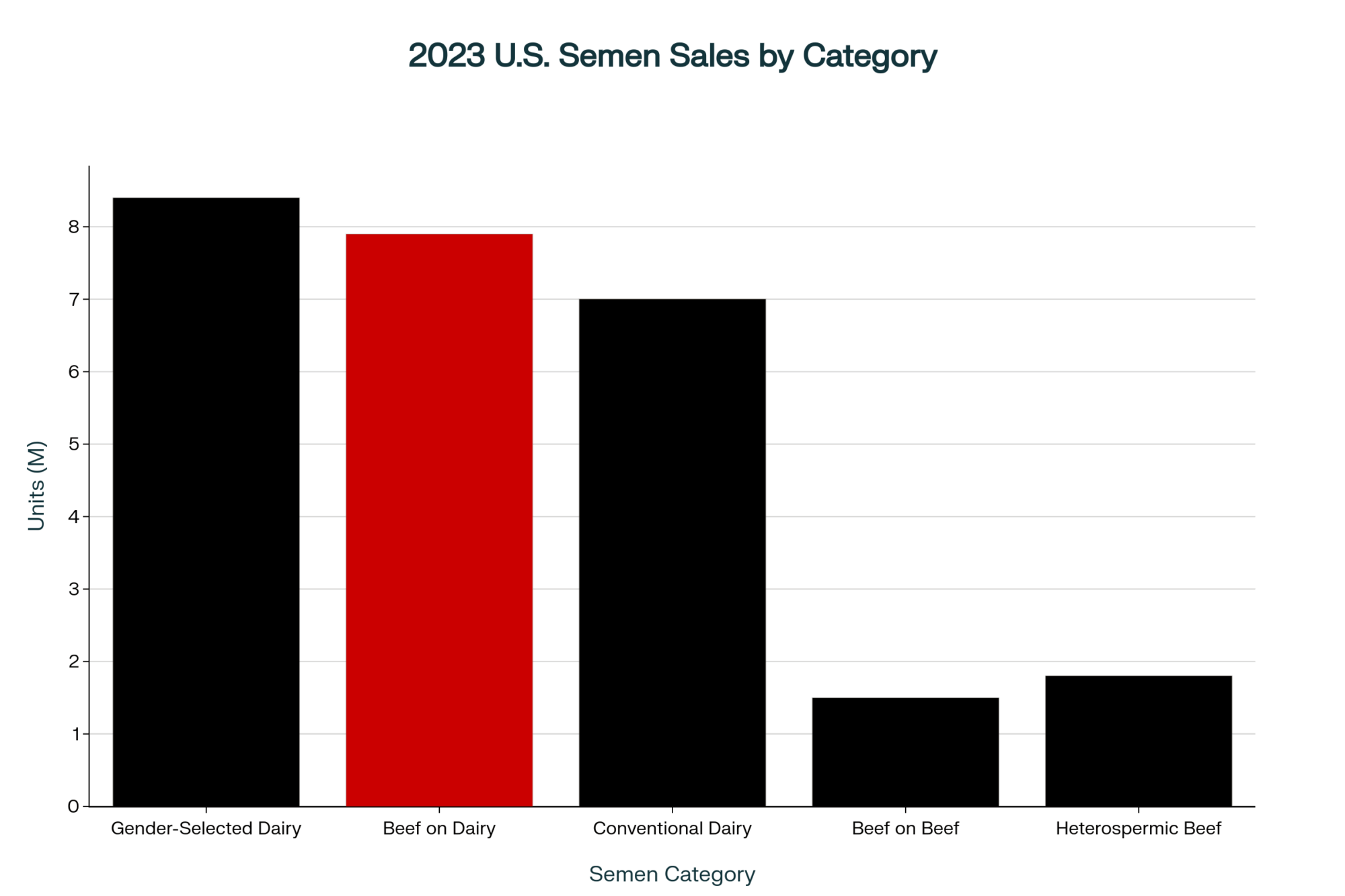

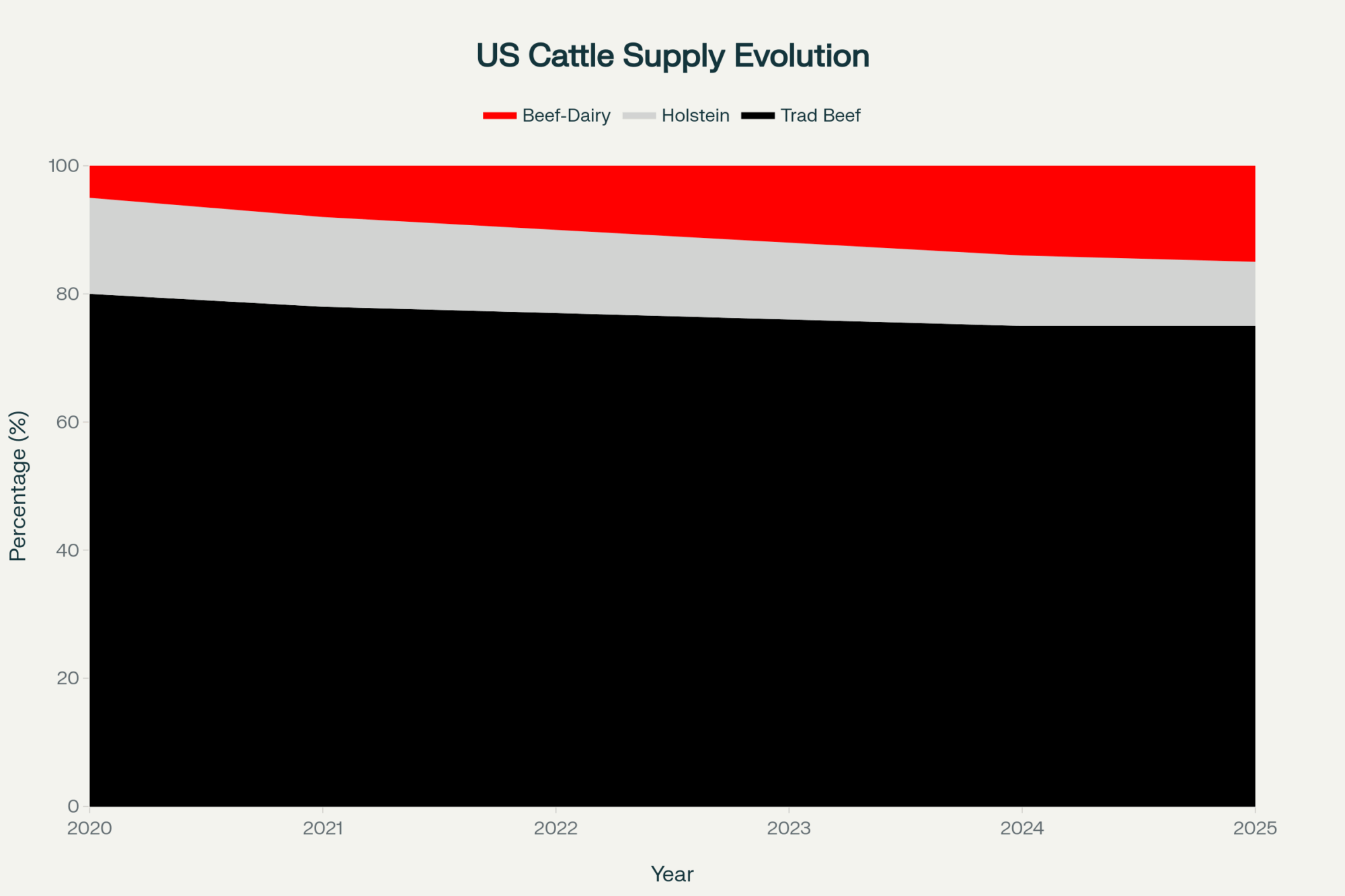

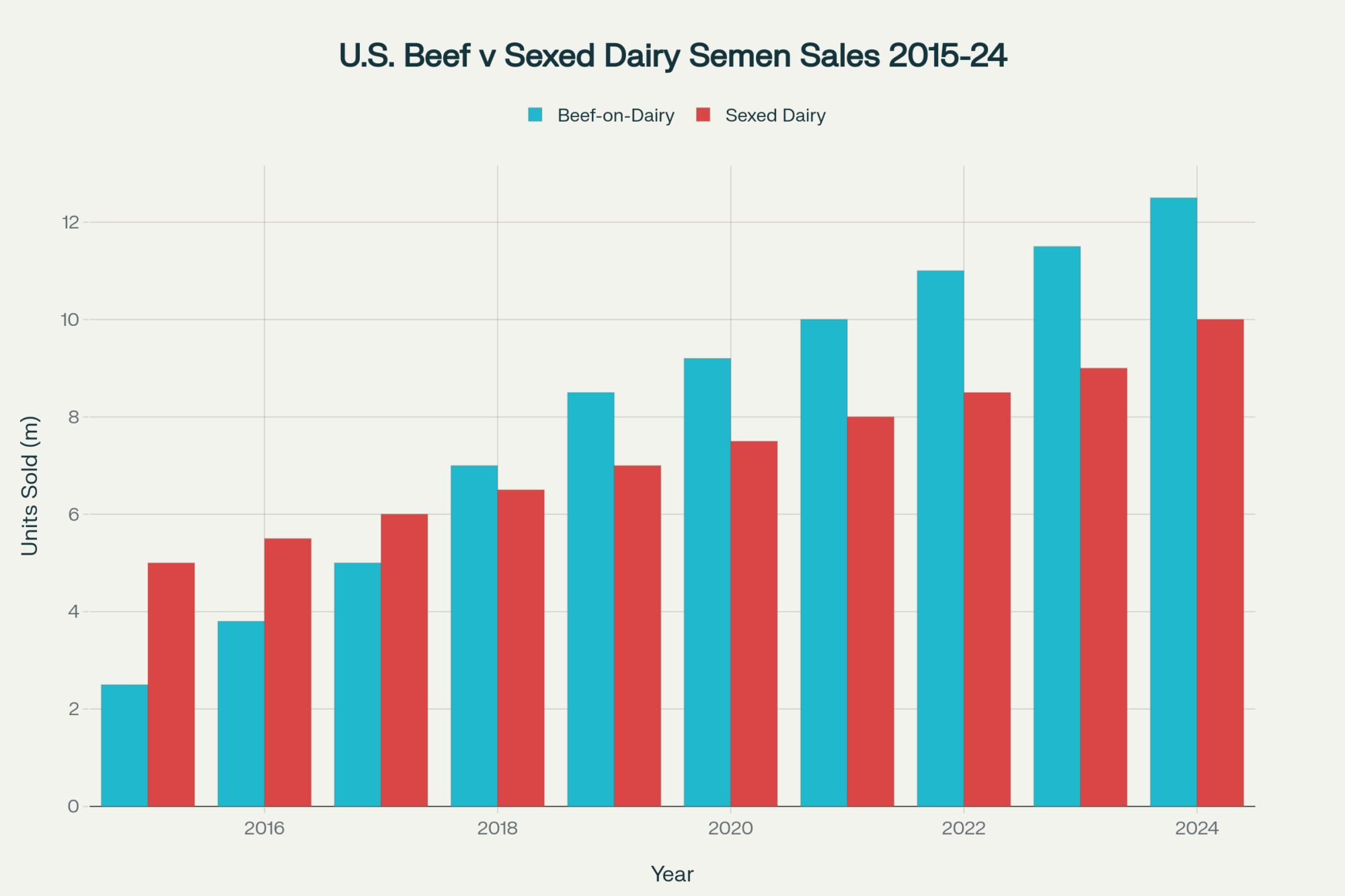

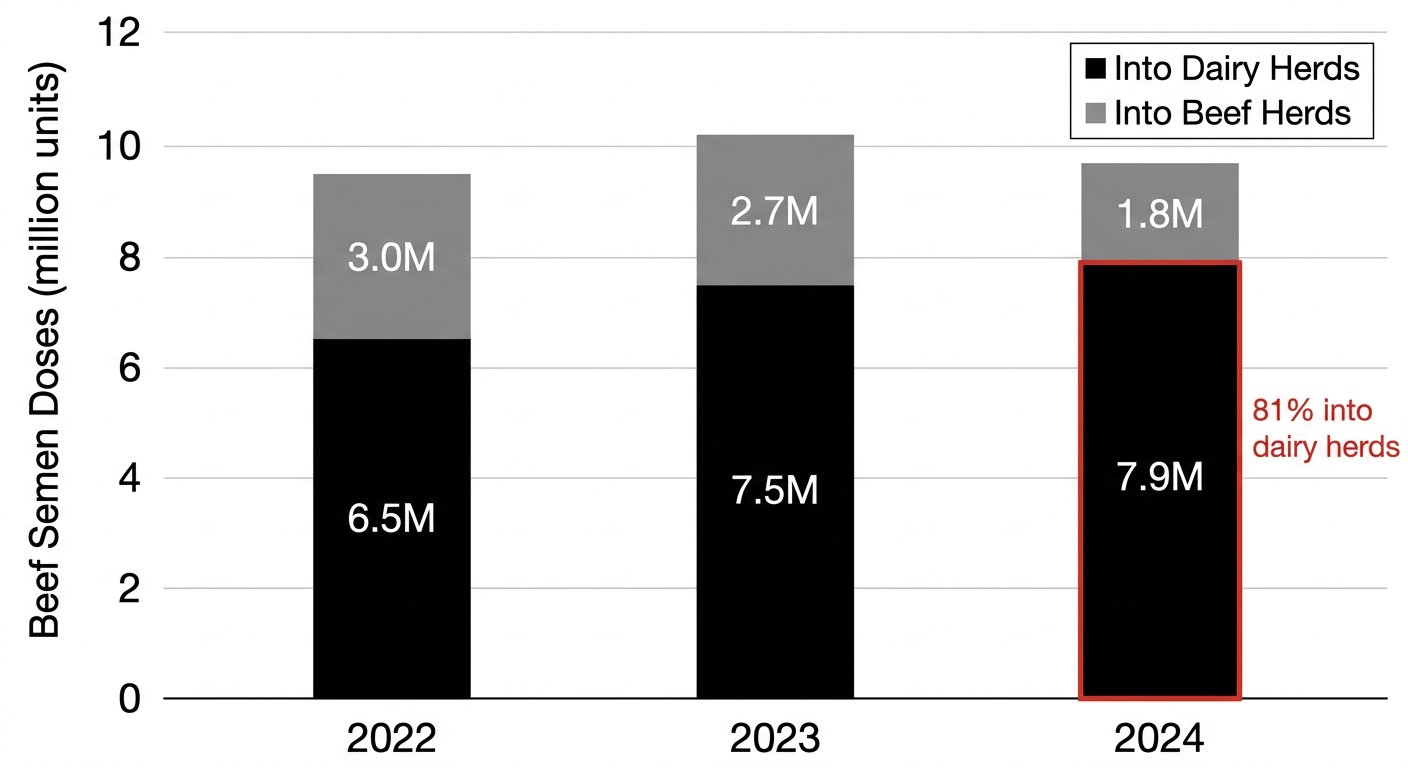

In that same window, the National Association of Animal Breeders reports that U.S. studs sold 9.7 million units of beef semen in 2024 — and 7.9 million of those doses went into dairy herds. That’s about 81% of domestic beef semen sales, up 4% from the year before.

CoBank’s wording is direct: “This market dynamic has pushed dairy farmers to send more calves to beef feedlots and fewer to milk barns”. That’s where the replacement crunch starts.

The De Vries Math — and the Double Whammy of Male Sexed Beef

On paper, beef‑on‑dairy looks bulletproof — as long as your repro engine is humming.

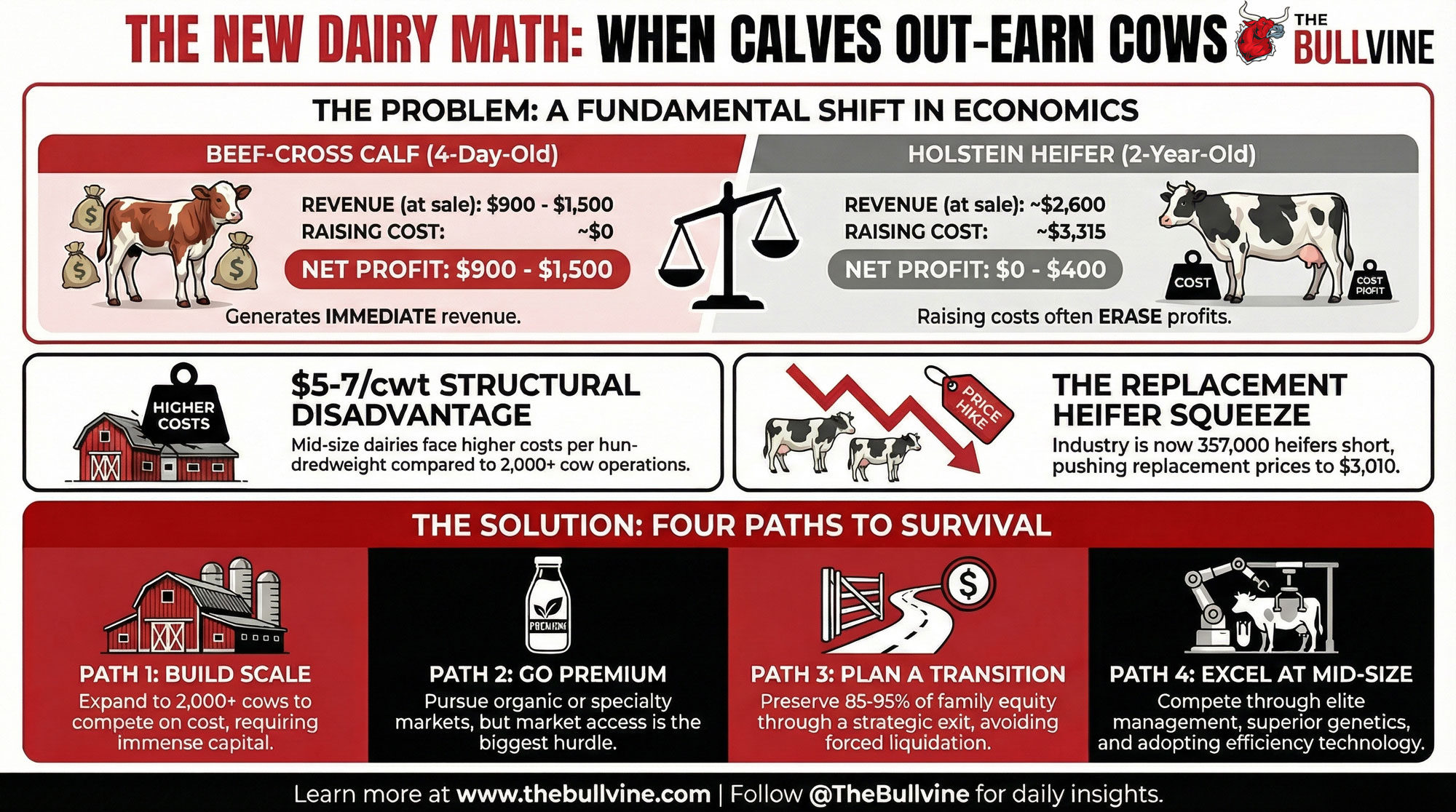

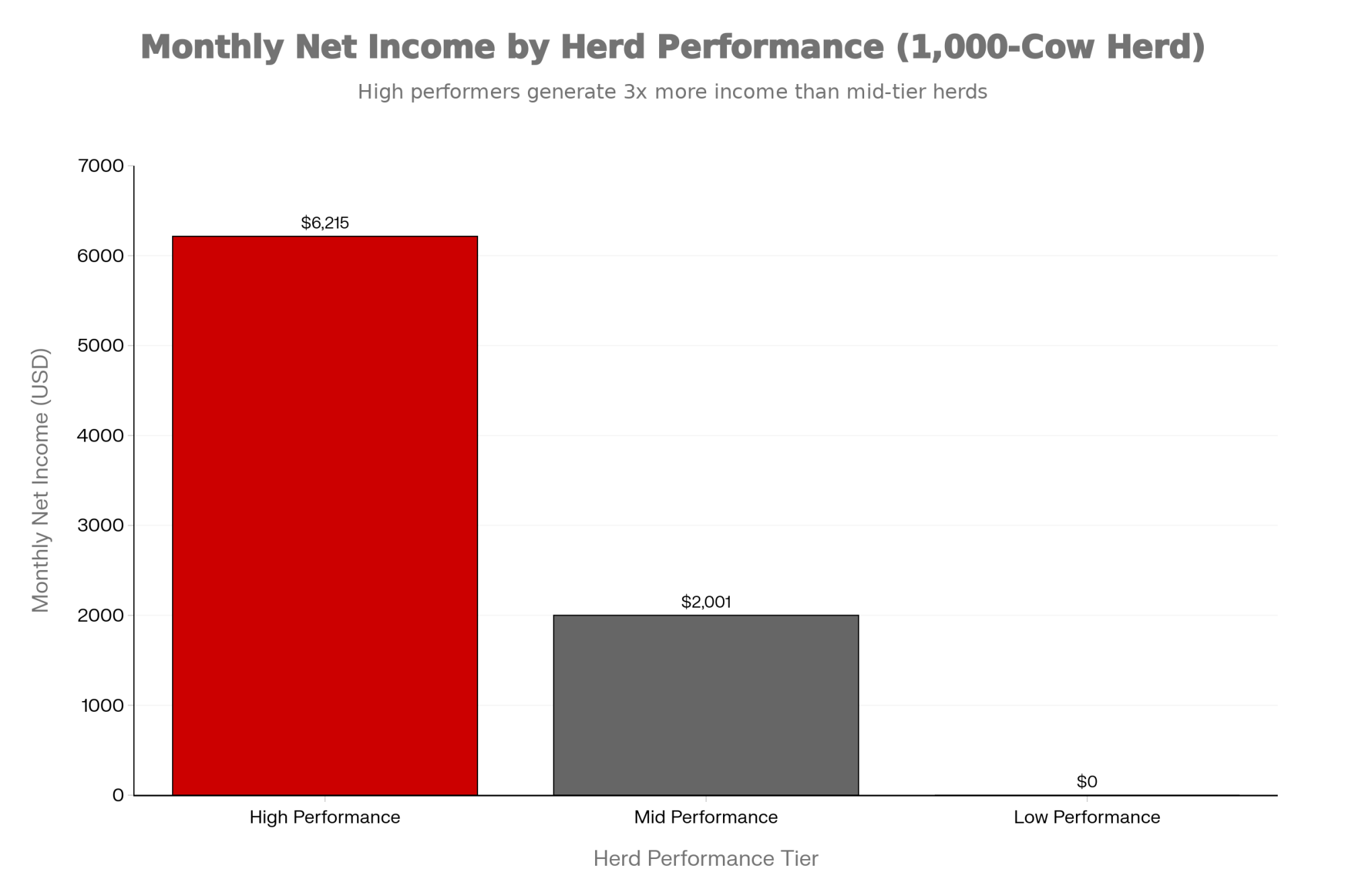

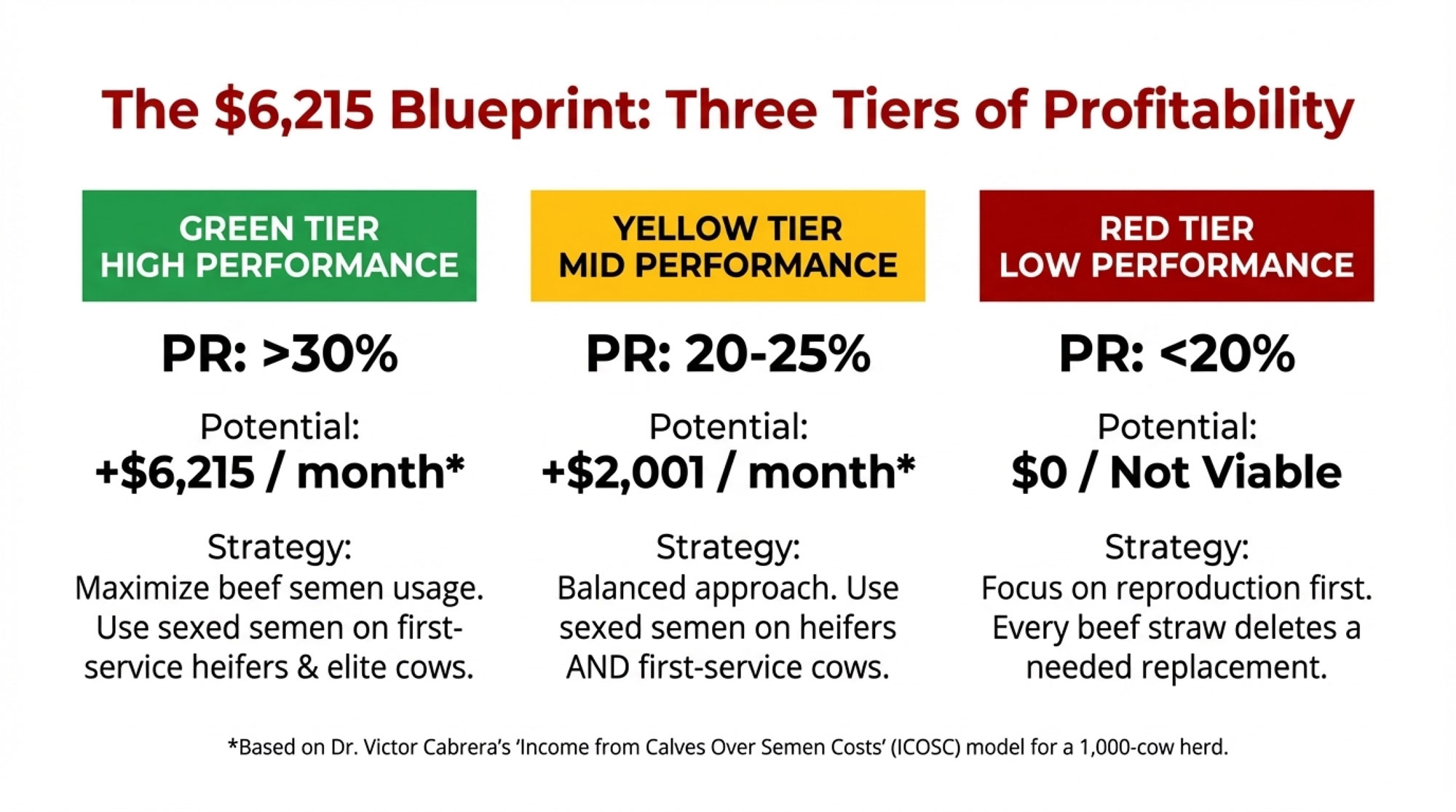

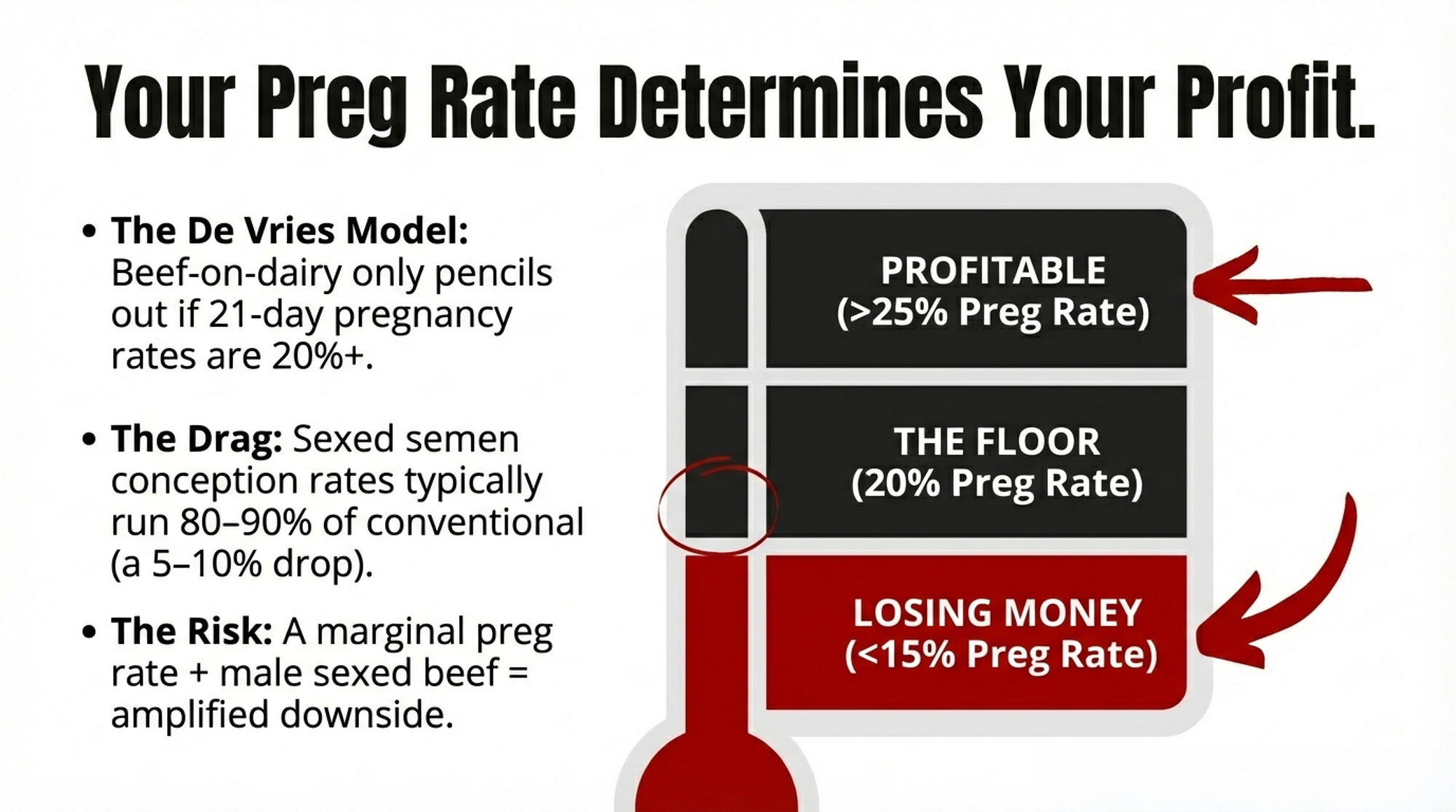

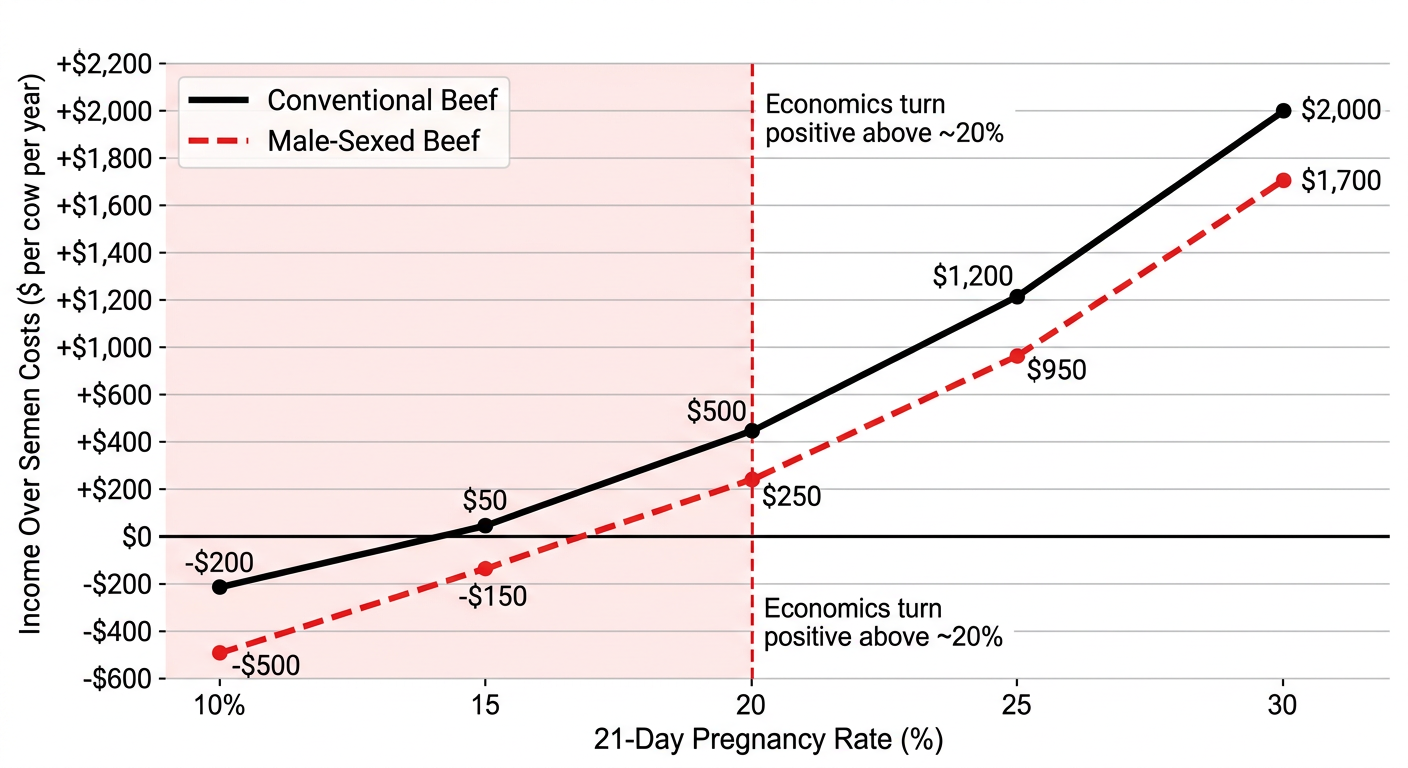

A 2021 simulation by Dr. Albert De Vries and colleagues at the University of Florida looked at the economics of using beef semen in dairy herds. In their model, beef calves sell for about 4× the price of dairy calves, and sexed semen costs about 2.3× that of conventional semen. When 21‑day pregnancy rates are 20% or higher, the optimal breeding strategy generated roughly:

- $2,001 in income from calves over semen costs (ICOSC) for average‑performance herds.

- $6,215 for high‑performance herds with 30%+ 21‑day pregnancy rates.

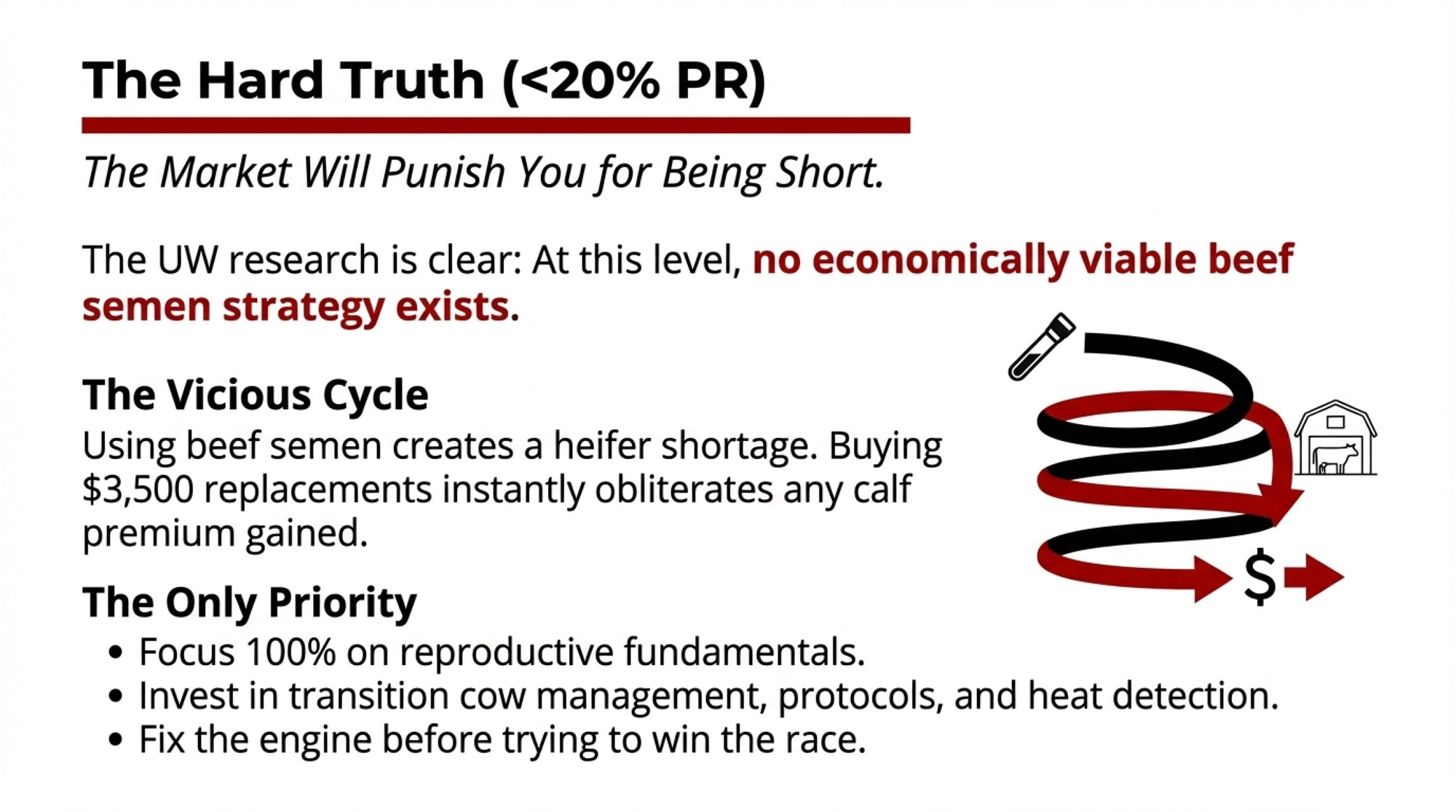

That’s real money. But De Vries’ team also showed that once 21‑day pregnancy rates drop to ~15%, optimal ICOSC becomes negative or marginal. And they explicitly noted that their model didn’t include gestation‑length changes or calving‑difficulty effects from beef semen on dairy cows.

Now, stack male sexed semen on top of that.

Sexed semen conception rates typically run 80–90% of conventional. In practice, that’s about a 5–10‑percentage‑pointdrop in pregnancy per AI for many herds. If your 21‑day rate is already 16–17%, you’re getting hit twice:

- You’re already below the economic sweet spot for beef‑on‑dairy in the De Vries model.

- Then you give away more conception with male‑sorted semen, and every conception you do get is a bull calf, which makes any calving‑ease miss more expensive.

The double whammy is simple: a marginal pregnancy rate plus male sexed beef doesn’t just shave profit. It amplifies the downside when calving goes sideways.

Heavier Calves, Higher Stillbirth — and More Rough Nights in the Maternity Pen

Sex‑biased beef semen doesn’t change the biology of calves. It just ensures that every beef‑cross calf you get is a bull.

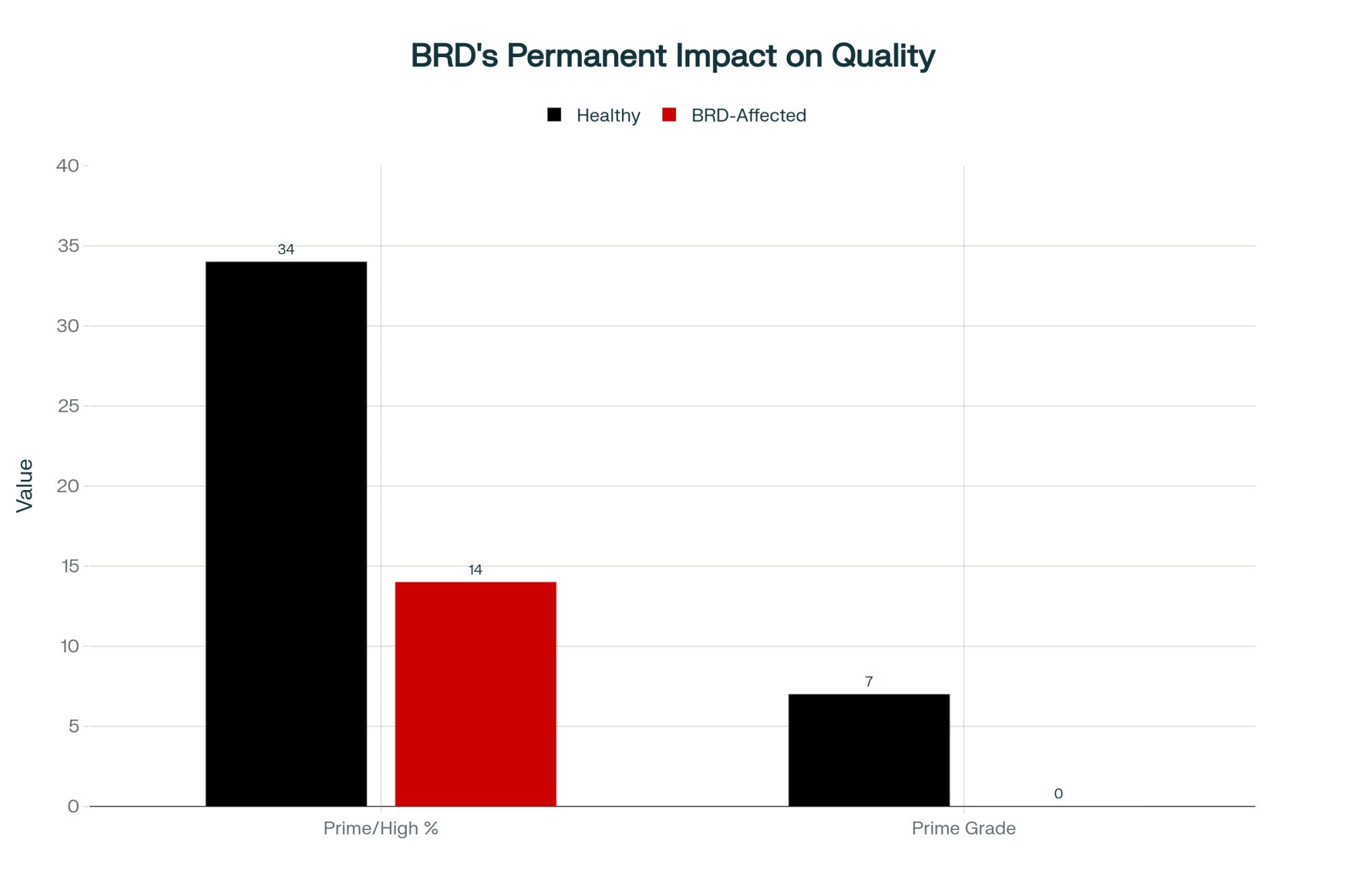

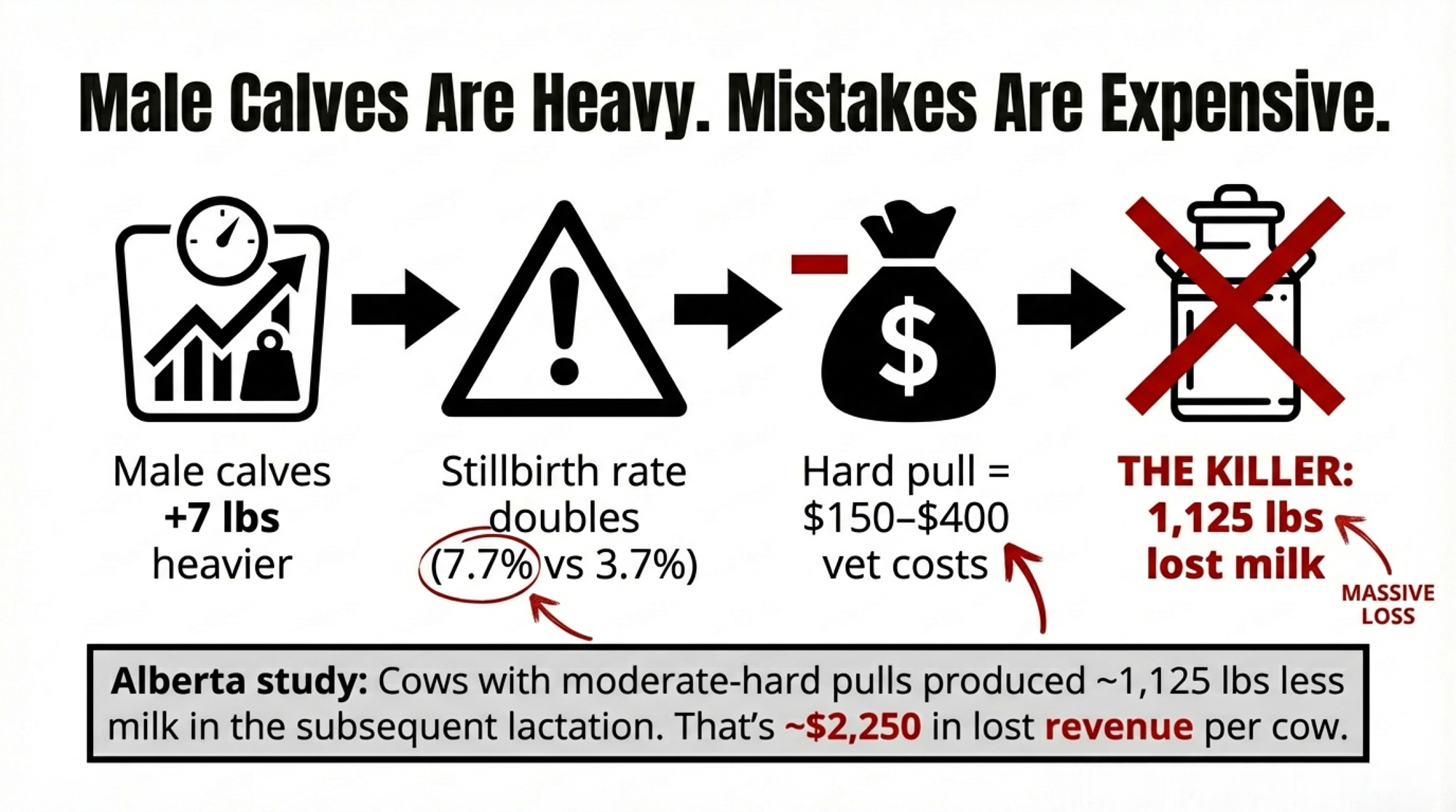

Across studies, male calves average about 3.2 kg (7 lb) heavier at birth than females. That extra weight shows up in stillbirth and calving‑ease numbers. One large study reported stillbirth rates of 7.7% for male calves vs 3.7% for females — more than double.

European data behind the Nordic Beef‑on‑Dairy Index tells a similar story. Beef‑cross bull calves out of dairy cows show a higher stillbirth risk than heifer calves, and cow mortality jumps as calvings move from “no help” to “hard pull with the vet in the pen”. A 2025 review on dystocia management clearly pulled the pattern together: more assistance at calving increases the risk of retained placenta, metritis, metabolic disease, reduced milk production, and earlier culling.

Each of those steps carries a cost. Guard and other herd‑level cost studies put a moderate dystocia case in roughly the $150–$400 band once you factor in vet time, drugs, lost milk, and reproductive setbacks.

The dollars aren’t the worst part. It’s the way those cases pile up in a fresh‑cow pen that’s already under pressure.

The Hidden Cost of “Just a Few Tough Calvings”

You don’t need a horror story year for male sexed beef to sting. A “normal” bad patch is enough.

Take a 300‑cow herd where 80 cows freshen to two beef sires that were a little too optimistic on calving ease. If 10–15% of those calvings turn into moderate–hard pulls, that’s 8–12 difficult births tied to those bulls.

A 2023 study from 21 Alberta dairy farms found that cows with a moderate–hard pull produced 510 kg less milk per lactation than unassisted cows — roughly 1,125 lb. If you’ve got 10 cows in that bucket, that’s roughly 11,250 lb of milk you don’t ship.

At $20/cwt, you’ve just given up about $2,250 in milk income — and that’s before we talk vet bills.

Now add in transition disease. Extension summaries based on Guard and others put retained placenta/metritis and related issues in the $150–$250 per‑case range, and ketosis/DA cases often in the $250–$375 band once you include follow‑on losses. If half of those 10 hard‑pull cows each pick up at least one extra transition disease, you’re easily looking at another few thousand dollars spread across that group.

Cows that calve hard don’t breed back like cows that calve easily. The Alberta team also found cows with moderate–hard pulls had a higher hazard of being culled over that lactation. Other work has shown lower conception rates and more services per conception after dystocia. Even if you assume each of those 10 cows needs just one extra service and stays open 20–25 days longer, you’ve added a few hundred dollars in extra semen and labor and roughly $700–$800 in days‑open opportunity cost across those cows.

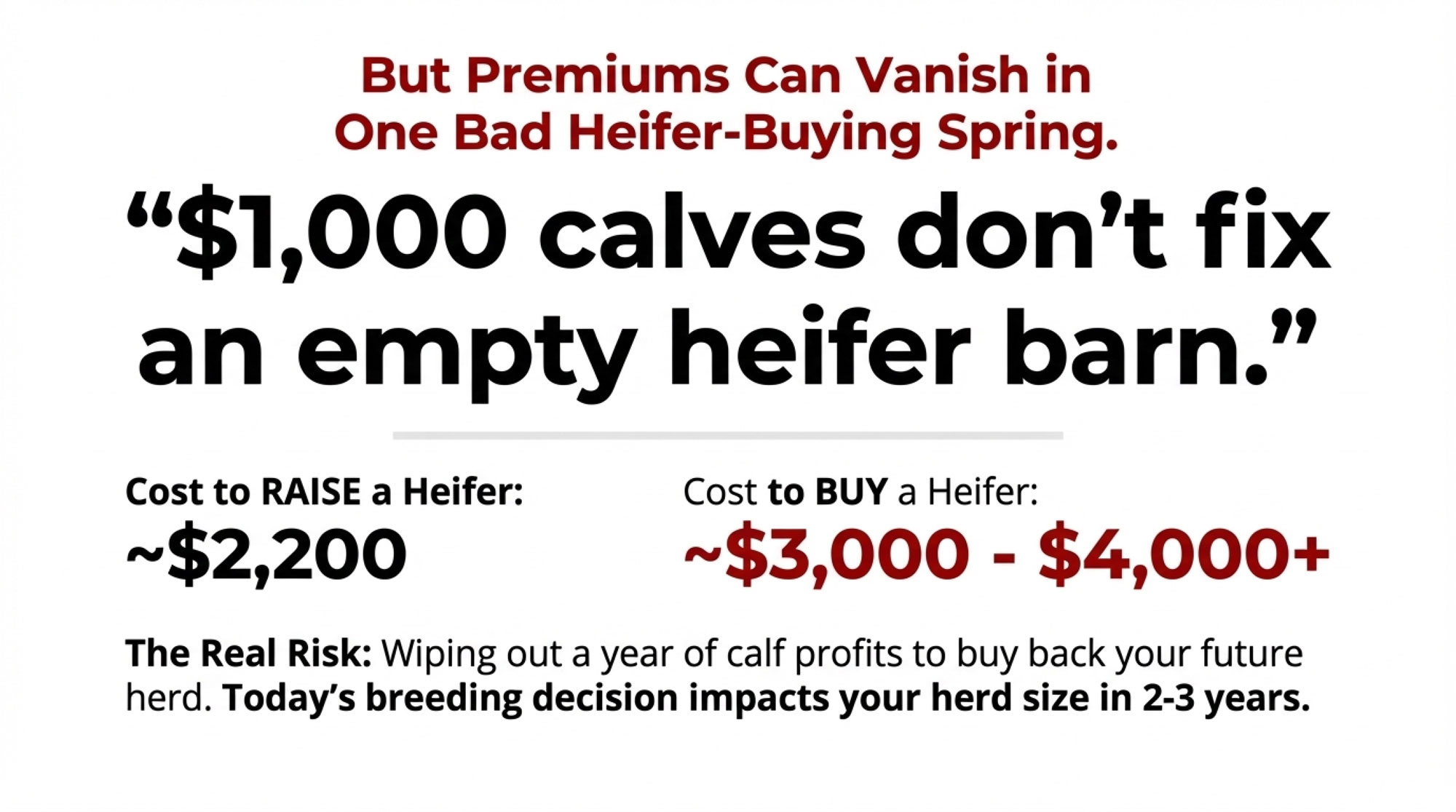

And then there’s the part the ledger doesn’t show until months later: early culls. If 2–3 of those 10 cows leave the herd a lactation earlier than planned, you’re replacing them with heifers that now cost around $3,000 to $4,000 per head in many U.S. markets. That’s $6,000–$12,000 in replacement cost alone.

Finally, each dead beef‑cross bull calf is a $1,000–$1,500 cheque that never shows up in most U.S. markets today, with some regions seeing even more. If those two bulls cost you even 2–3 extra dead calves compared to a truly easy‑calving sire, that’s another $1,600–$3,300 gone.

| Cost Category | “Easy Money” View | “Reality Check” View |

|---|---|---|

| Calf revenue | +$1,200 | +$1,200 (same — not “free” once costs counted) |

| Replacement cost | $0 (ignored) | −$6,000 to −$12,000 (2–3 early culls @ $3–4k each) |

| Dystocia + vet | Minimal (assumed) | −$1,500 to −$4,000 (10 hard pulls @ $150–400 each) |

| Lost milk | “Guaranteed” | −$2,250 (~1,125 lb/cow × 10 cows, $20/cwt) |

| Transition disease | Rare (assumed) | −$1,000 to −$2,000 (5 cases @ $200–400 each) |

| Extra repro + days open | $0 | −$1,000 to −$1,500 (extra services + opportunity cost) |

| Dead/discounted calves | $0 | −$1,600 to −$3,300 (2–3 stillbirths @ $1,000–1,500 each) |

| TOTAL NET IMPACT | +$1,200 per calf (pure upside) | −$12,150 to −$22,850 for one calving season |

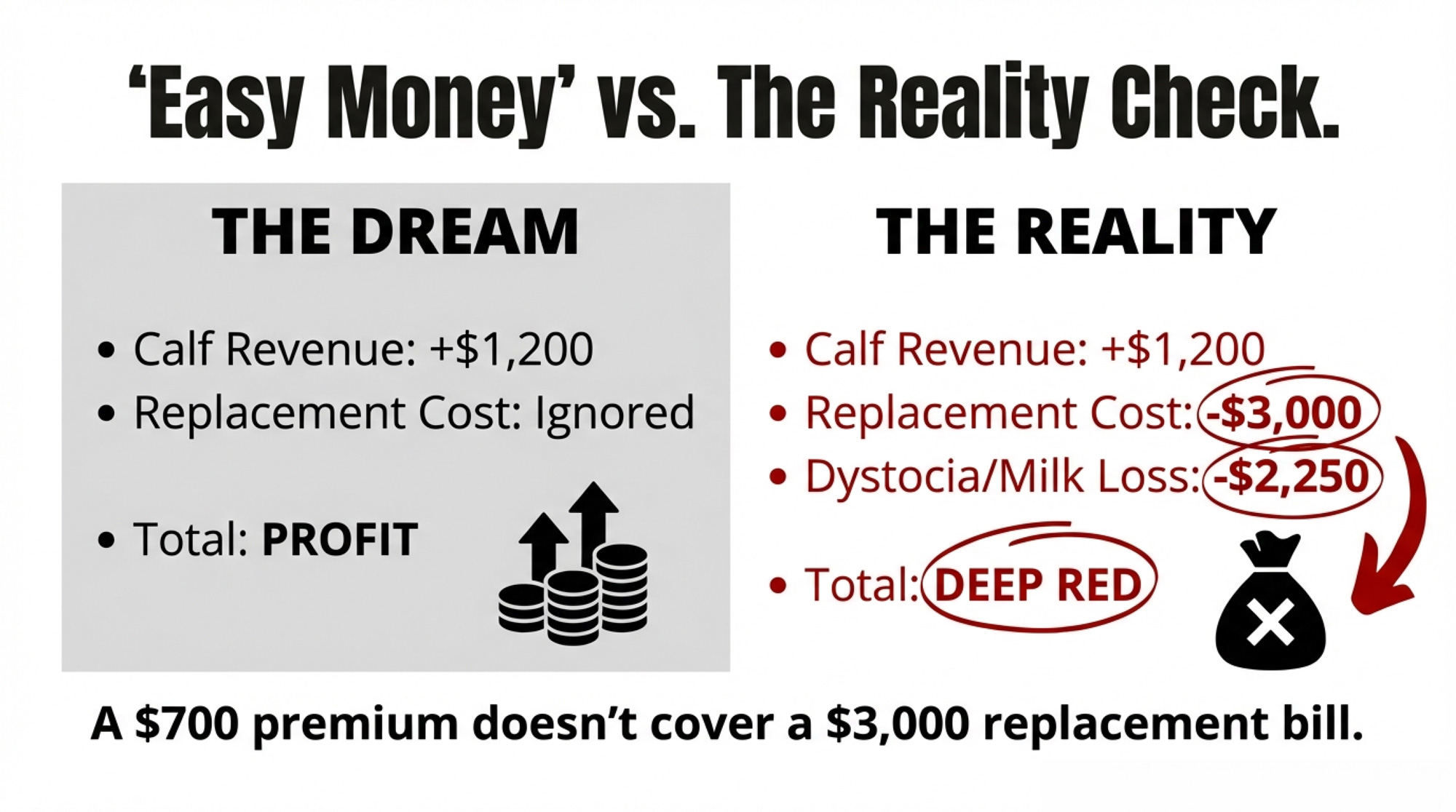

Easy Money vs Reality Check — at a Glance

| Metric | The “Easy Money” View | The “Reality Check” View |

| Calf revenue | +$1,200 (beef‑cross bull calf, mid‑range of $1,000–$1,400 in many markets) | +$1,200 (same cheque — just not “free” once replacements and calving risk are counted) |

| Replacement cost | $0 (ignored in the moment) | −$3,000 to −$4,000 if a replacement heifer has to be bought later |

| Dystocia risk | Minimal (assumed) | $150–$400 per hard calving in vet, drugs, and lost milk |

| Future milk | “Guaranteed” | −1,125 lb per lactation if that calving was a moderate–hard pull |

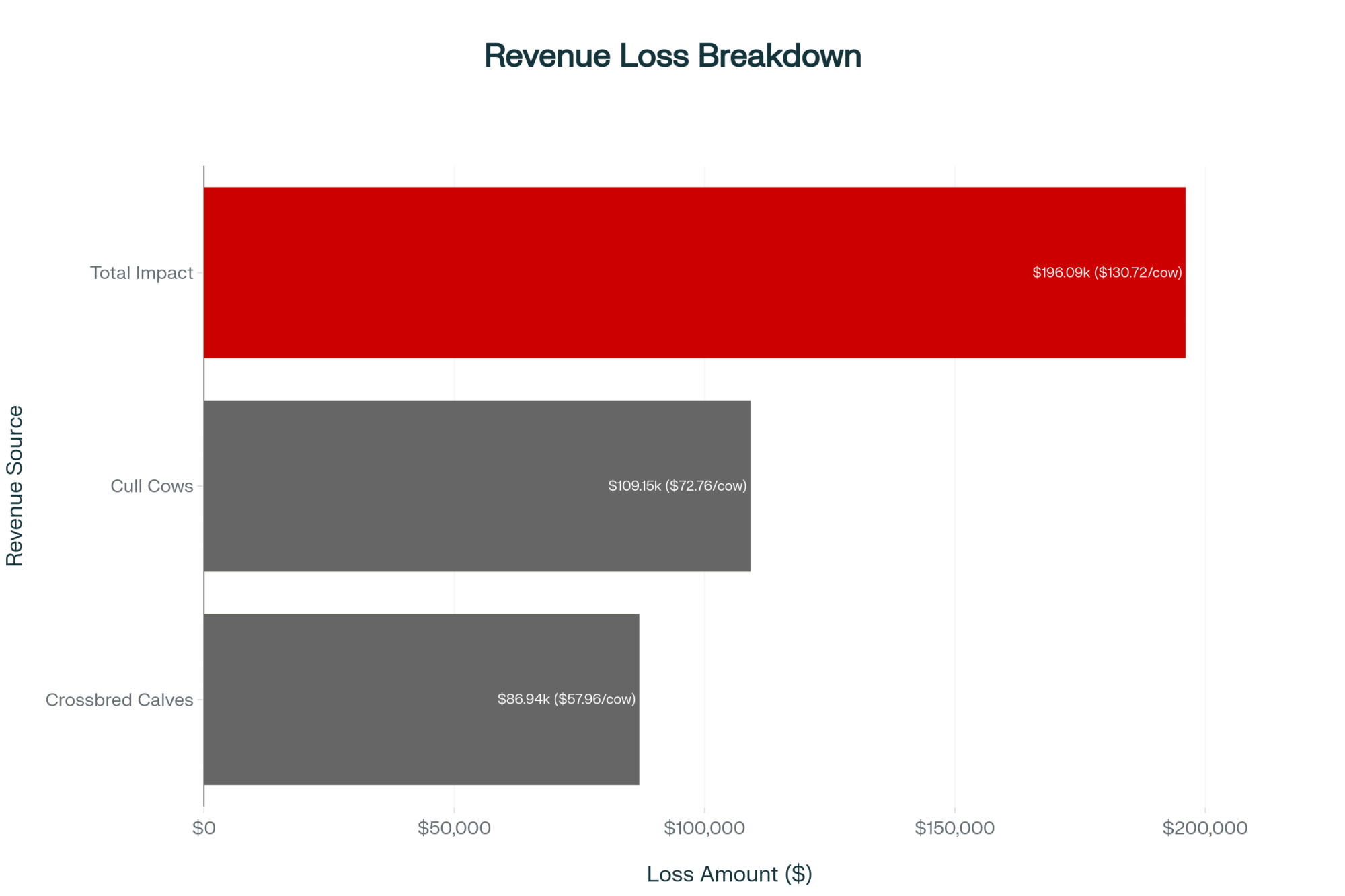

Stack conservative numbers across that season:

- Milk loss: about $2,250.

- Transition disease: a few thousand dollars more across that group.

- Extra repro + days open: roughly $1,000–$1,500.

- Early culls and replacements: $6,000–$12,000.

- Dead/discounted calves: $1,600–$3,300.

You’re in the low‑to‑mid five figures for one calving season tied to the wrong bulls. On paper, it looks like “just” 8–12 tough calvings. In the books, it looks like $12,000–$20,000+ that quietly evaporated when a calving‑ease prediction missed.

How Many Heifers Does Your Breeding Plan Actually Produce?

CoBank’s 800,000‑head gap is the national picture. The barn math is the part you control.

Start with what actually leaves. A 200‑cow herd turning over at 35–38% needs 70–76 replacements entering the string each year. Add a realistic 15% loss from birth to freshening — dead calves, do‑not‑breeds, heifers sold or culled — and you’re looking at the low‑80s to high‑80s dairy heifer calves born annually to stand still.

That’s before anyone talks about growth.

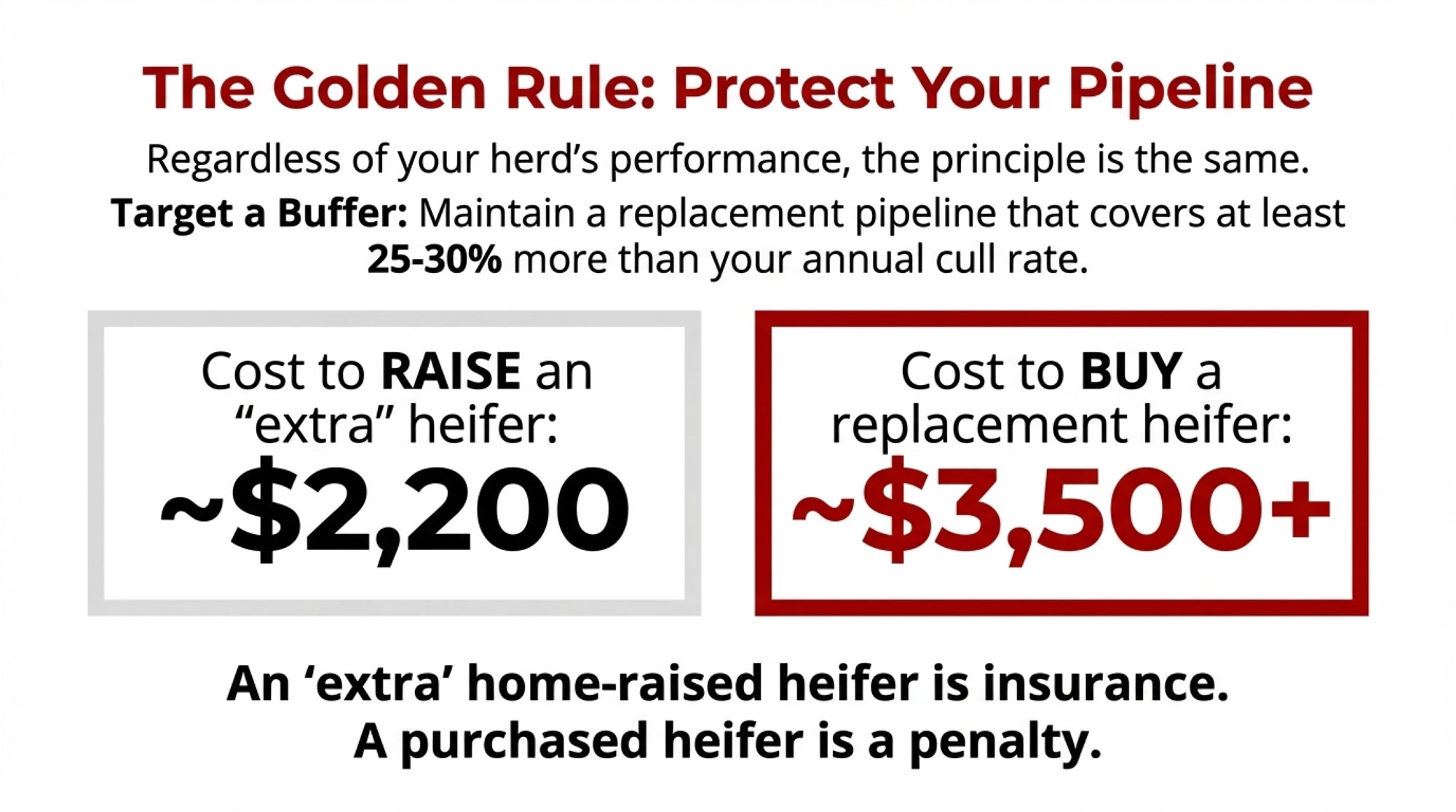

With CoBank’s mid‑2025 replacement value at roughly $3,010 per head, a shortfall of 10 heifers costs about $30,000. A shortfall of 20 — entirely plausible if you’ve been breeding 40–50% of the herd to beef for a few years without counting backward — pushes you north of $60,000. And that assumes you can even find 20 heifers with the genetics and health status you want, in a market CoBank describes as historically tight.

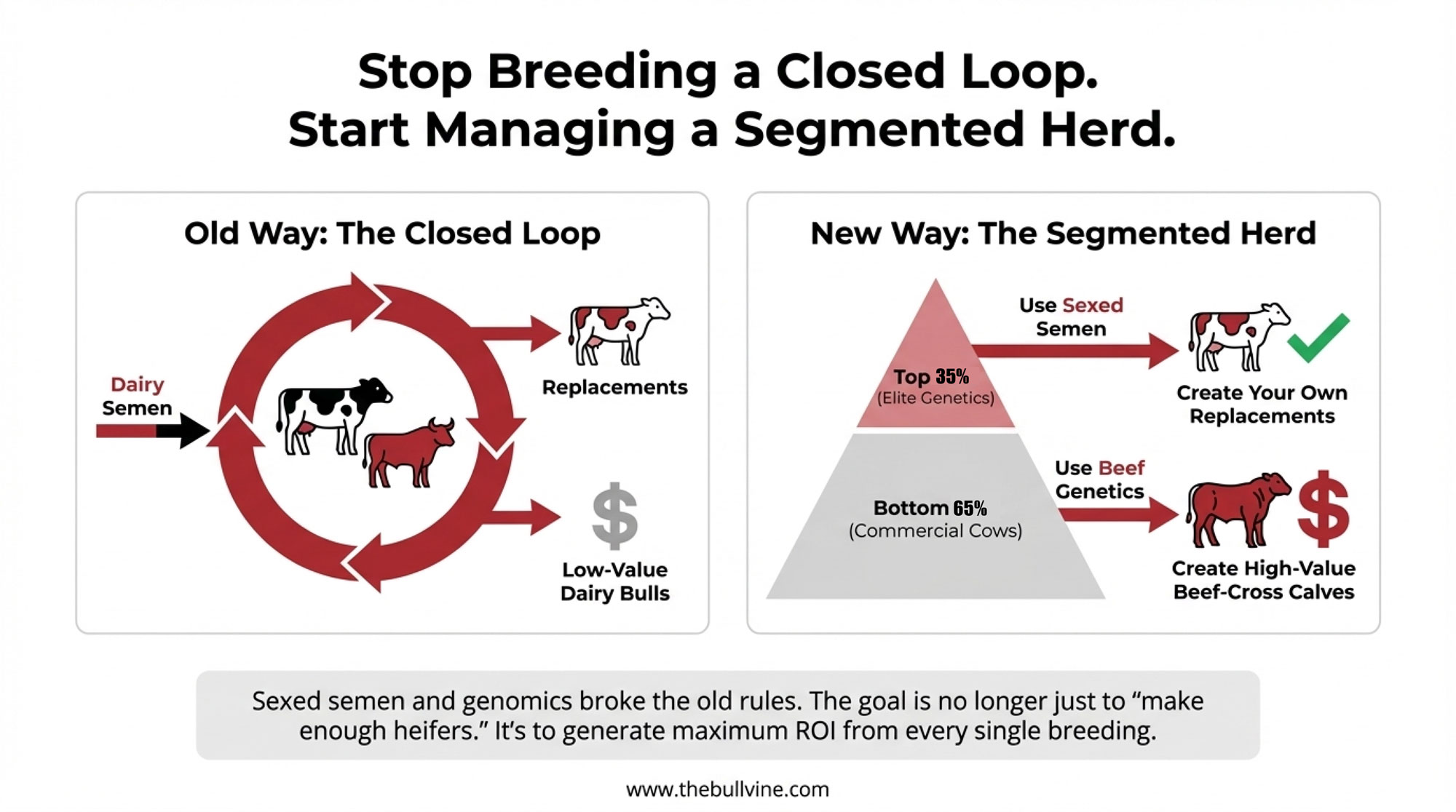

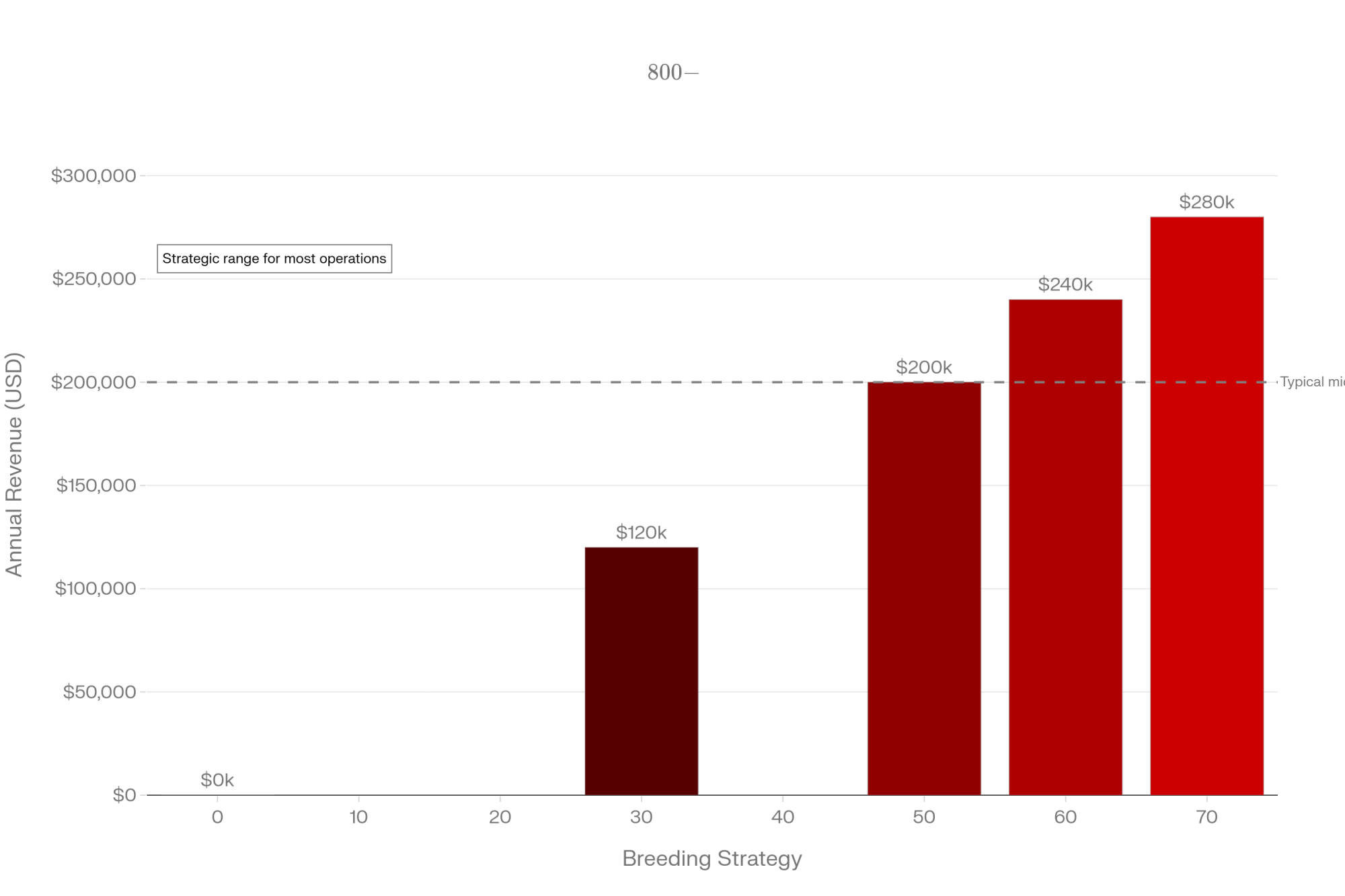

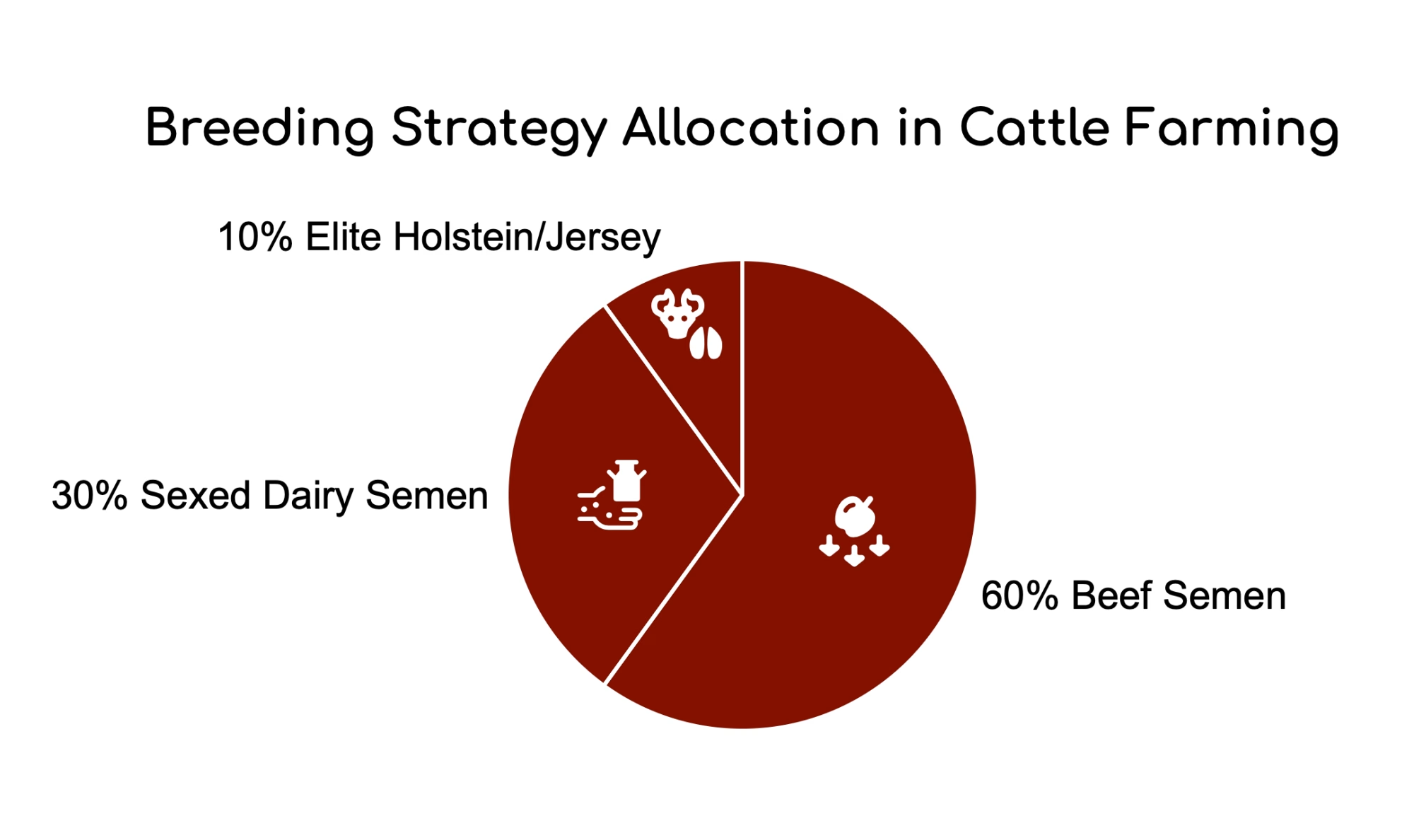

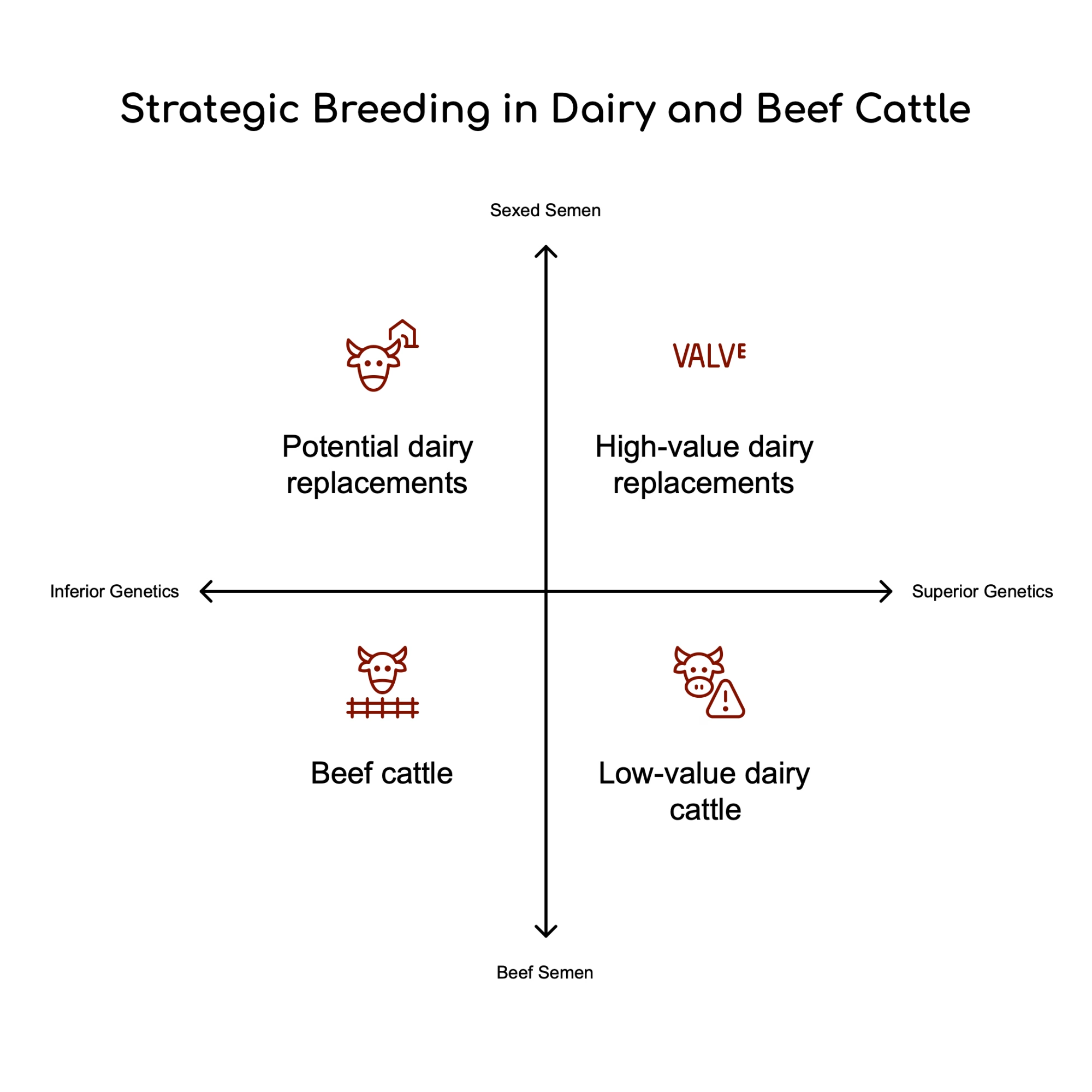

The default planning mistake is to start with a beef percentage (“We’ll go 40–50% beef”) and then hope the replacement math works itself out. The smarter move is the opposite: figure out how many heifer calves you need born per year from your own records, then see what male sexed beef percentage is left after that target is covered.

| Herd Size (cows) | Cull + Death Rate | Replacements Entering String | Heifer Calves Needed Born(15% loss) | Safe Beef % Available |

|---|---|---|---|---|

| 200 | 35% | 70 | 82 | ~25–30% |

| 500 | 38% | 190 | 224 | ~20–25% |

| 1,000 | 36% | 360 | 424 | ~22–28% |

Two Very Different Ways to Think About Calving‑Ease Risk

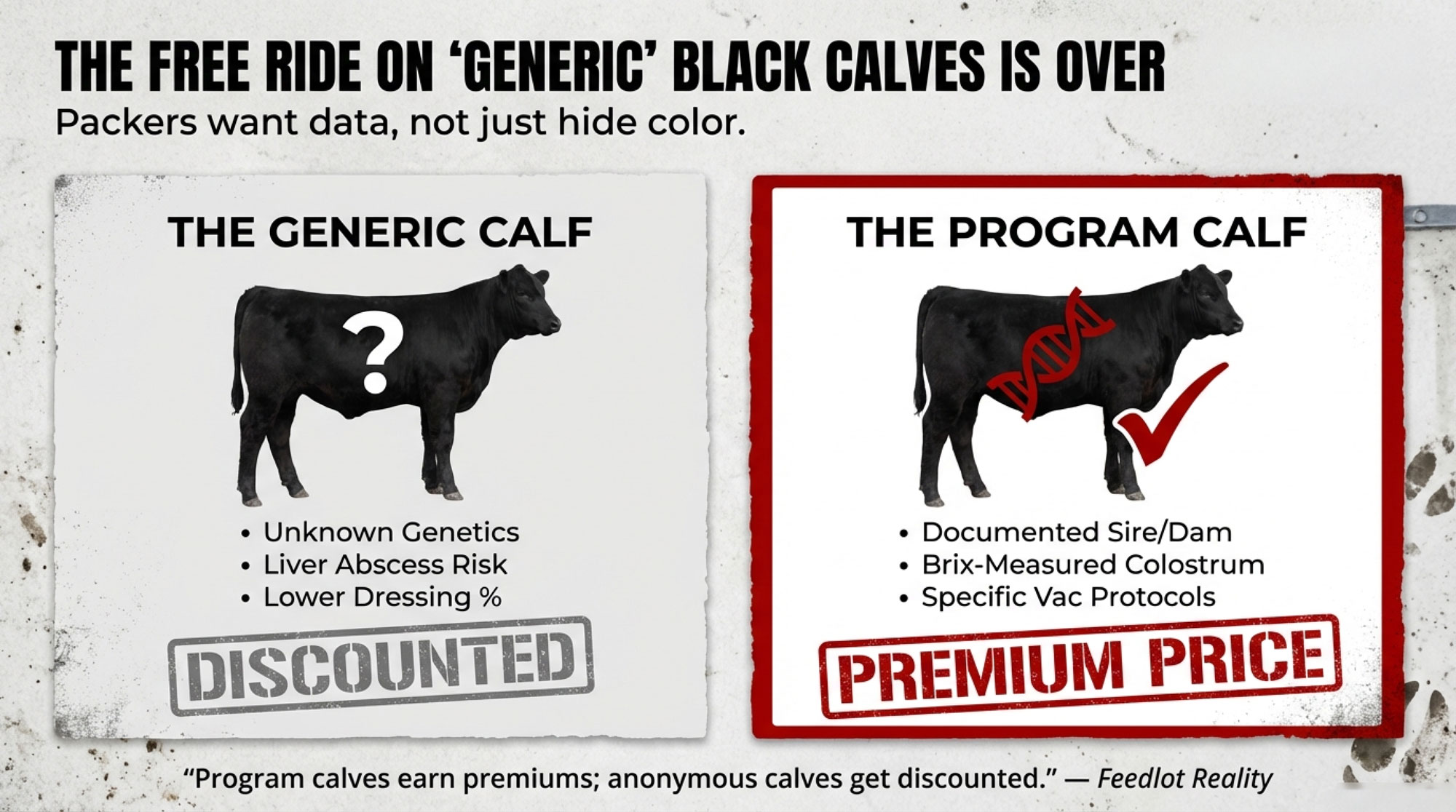

North American studs are understandably excited about beef‑on‑dairy demand. In 2024, beef semen volume into dairy herds grew to 7.9 million units, and male sexed beef is where the premium sits. The question is how much calving‑ease risk they’ll carry before sex‑sorting — and how much of that risk falls back on your cows.

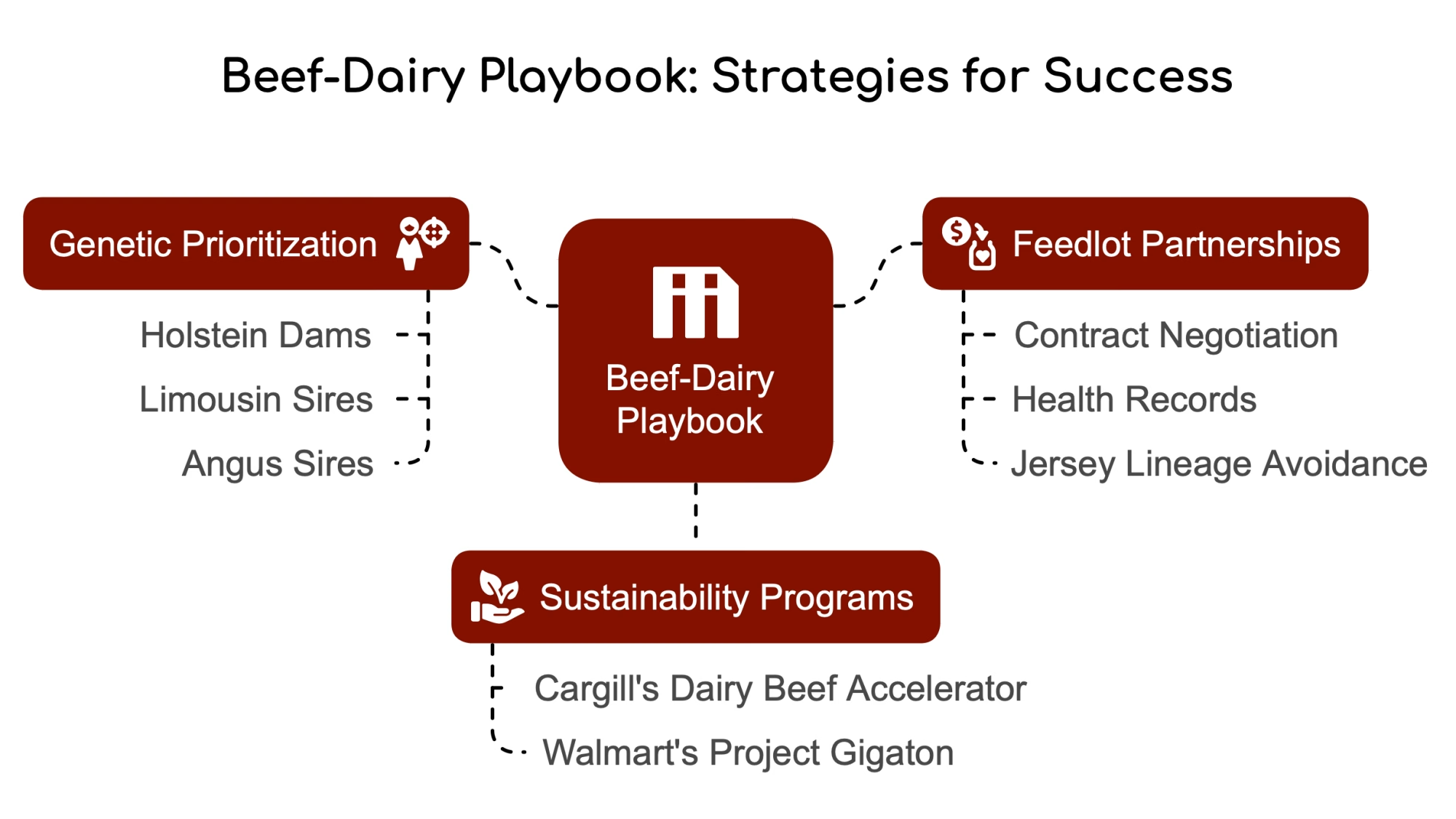

In Scandinavia, VikingGenetics has drawn a hard line. Head of beef, Reni Nielsen, says they wait for actual calving ease data from progeny before they lean into beef‑on‑dairy use. In practice, that means large numbers of recorded calvings before a bull is promoted heavily for this role, with calving‑ease reliability in the high 80s or above.

Viking points to Danish Blue sires like VB Nase, with more than 8,000 crossbred offspring and 97% reliability on the Nordic Beef‑on‑Dairy Index, as the kind of data density they want behind a beef‑on‑dairy sire. When you’re working with that many recorded calvings, you’re making a bet with much firmer odds than a genomic bull with no daughters on the ground.

The Nordic Beef‑on‑Dairy Index (NBDI) even models what happens when male sexed semen is used — the economic value of calf survival and calving ease increases sharply in those scenarios. The downstream message is simple: when every calf is a bull calf, the cost of getting calving ease wrong multiplies, so the bar for data should go up.

In Ireland, Dunmasc Genetics leans harder into genomics. Their leading Angus and Hereford sires — Legacy and Very Smart — are genomic selections backed by ICBF evaluations for calving ease, carcass traits, and commercial performance, but they don’t wait for Viking‑level progeny numbers first.

Dunmasc notes that these sires have already generated strong interest among progressive dairy farmers, even though they’re still early in their breeding careers, because of the combination of calving‑ease predictions and carcass potential backed by the ICBF system. ICBF data summarised in the Irish Farmers Journal shows that, over a recent five‑year window, daughters of genomic sires have averaged about €25 higher EBI than daughters of proven sires — roughly 3–4 years of genetic gain compressed into one. The flip side is that proofs still move as more daughters are born, especially for younger genomic bulls.

On the dairy‑replacement side, that volatility is often manageable — you’re betting on cows that live in your own barn. On the beef side with male sexed semen, you’re betting on heavier calves meeting pelvic limits in fresh cows.

Bullvine Note: North America’s “speed‑first” genomic model and Europe’s “prove it in thousands of calvings” model both work — but they carry different risks. With male sexed beef, you’re not just choosing a bull; you’re choosing which risk profile you’re comfortable calving into your fresh pen.

The uncomfortable North American question is this: if Viking insists on high‑reliability calving‑ease data before really pushing a bull in beef‑on‑dairy programs, and even Ireland’s genomic‑first programs acknowledge proof movement, why is almost nobody on this side of the Atlantic requiring that level of validation before marketing male sexed beef?

Why Won’t Your Index Sheet Save You at 2 AM?

The NBDI and Ireland’s Dairy Beef Index are genuine advances. They let you line up different beef sires across breeds and sort them on a single scale for dairy cows. But they do what indices always do: average across traits.

A bull with a composite score of 120 can get there a couple of ways:

- Very easy calving and average carcass.

- Average calving, very strong growth, and carcass.

The composite doesn’t tell you which story you’re buying. With conventional semen and mixed‑sex calves, that averaging is manageable. With male sexed semen — all bulls, all the time — the calving‑ease piece matters more than the growth piece, and the index doesn’t automatically reweight itself because you chose Y‑sorted.

Your index doesn’t know your cows. It doesn’t see the thin second‑calver that milked off her back last lactation, or the crossbred with a narrow pelvis, or the heifer that already had a rough pull the first time she calved. When you bet on male‑sexed beef, you’re betting she can handle a bull calf — and if you’re wrong, the index won’t pay the vet bill.

Parity, body size, body condition, and previous calving history are enormous drivers of dystocia risk, and none of them lives in the bull proof.

Use NBDI or DBI to build the short list. Then, before you ever think about male‑sorting a bull or using male sexed beef on a given cow group, look straight at:

- Calving‑ease or “Birth” sub‑index.

- Gestation length.

- Reliability on those traits, and whether it comes from daughters or just a genomic chip.

Heifers, small‑framed cows, and fresh cows with any history of calving trouble should only see the highest‑calving‑ease sires — even if that means giving up some carcass index. That’s true even with conventional semen. With male sexed beef, it’s non‑negotiable.

What Happens When U.S. Herds Dial Back from 50% Beef?

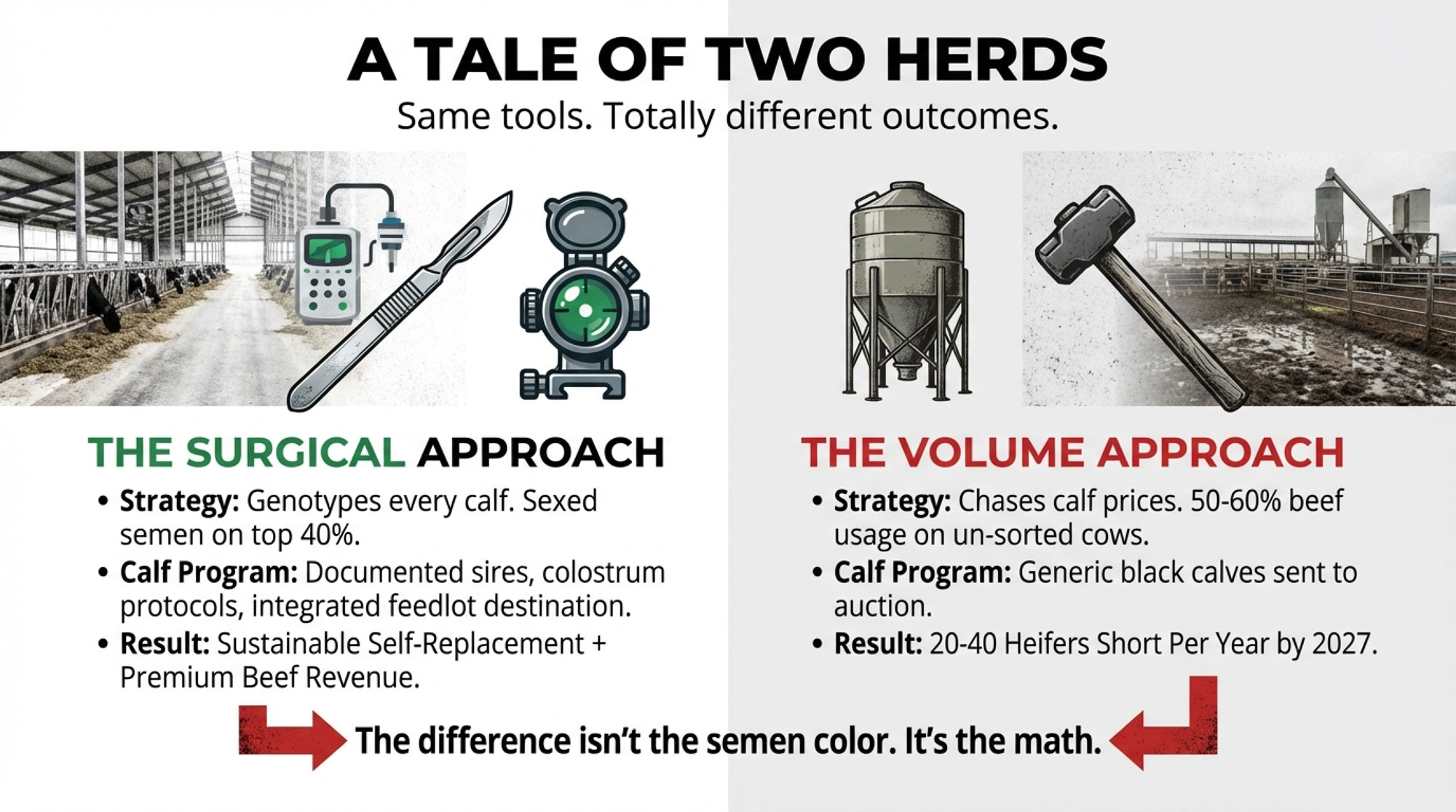

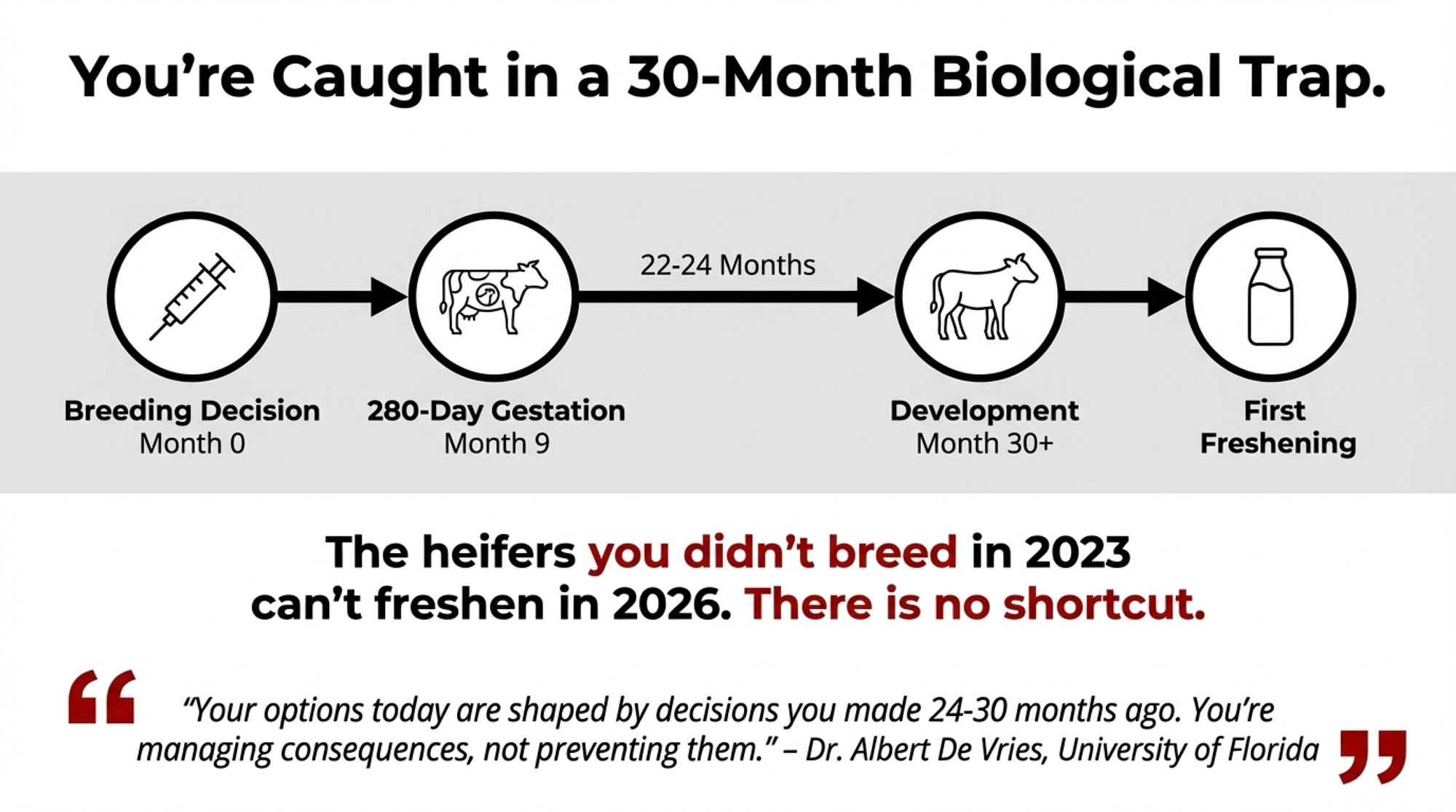

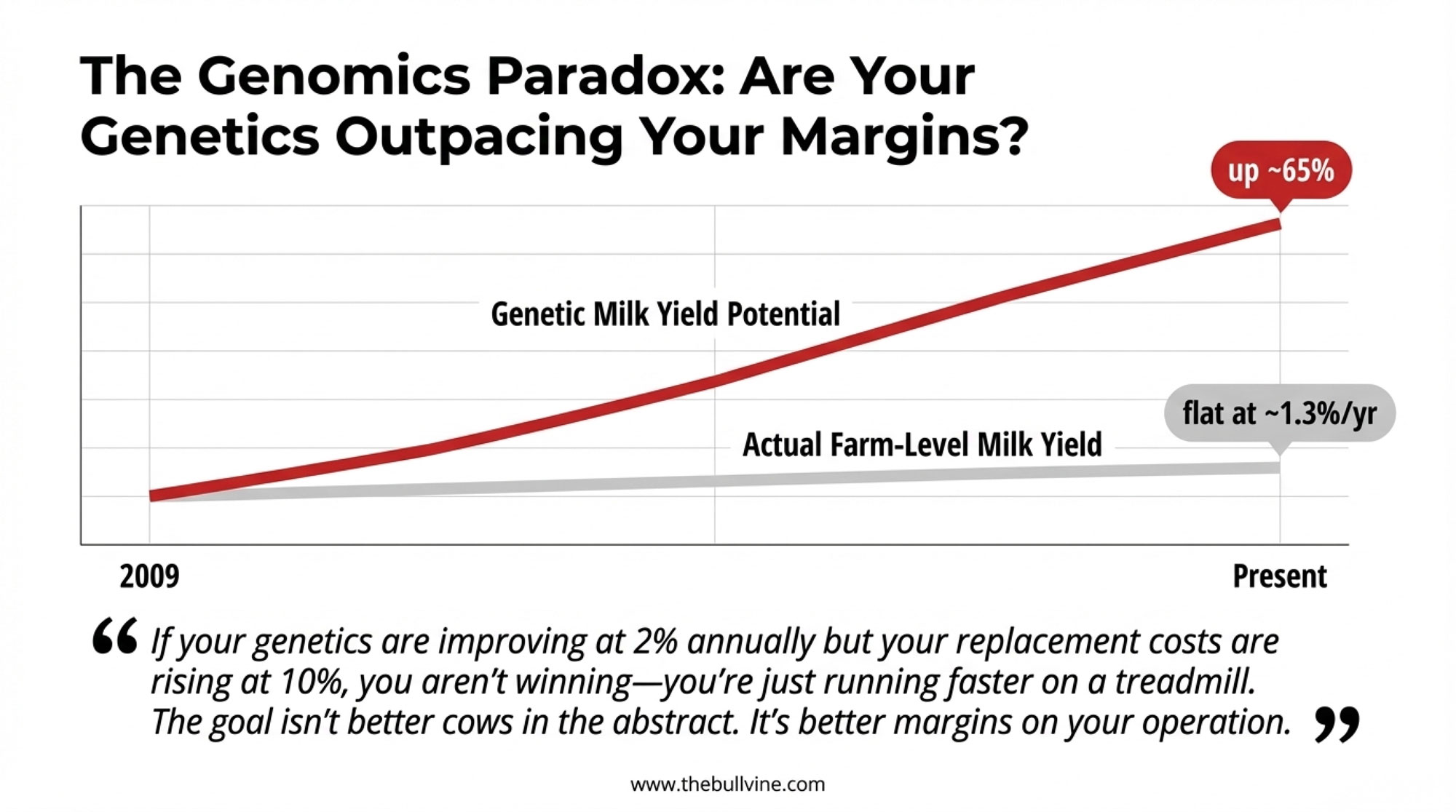

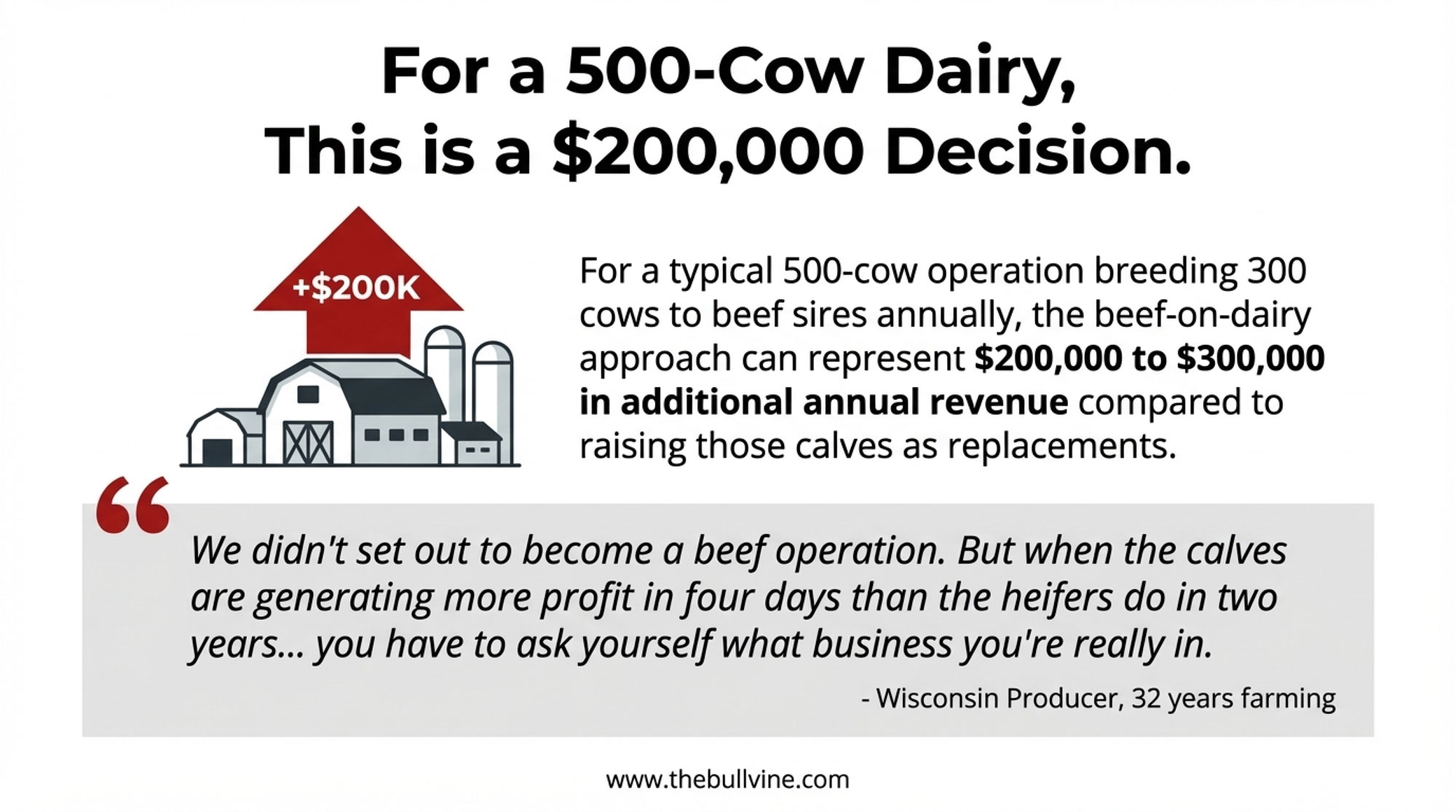

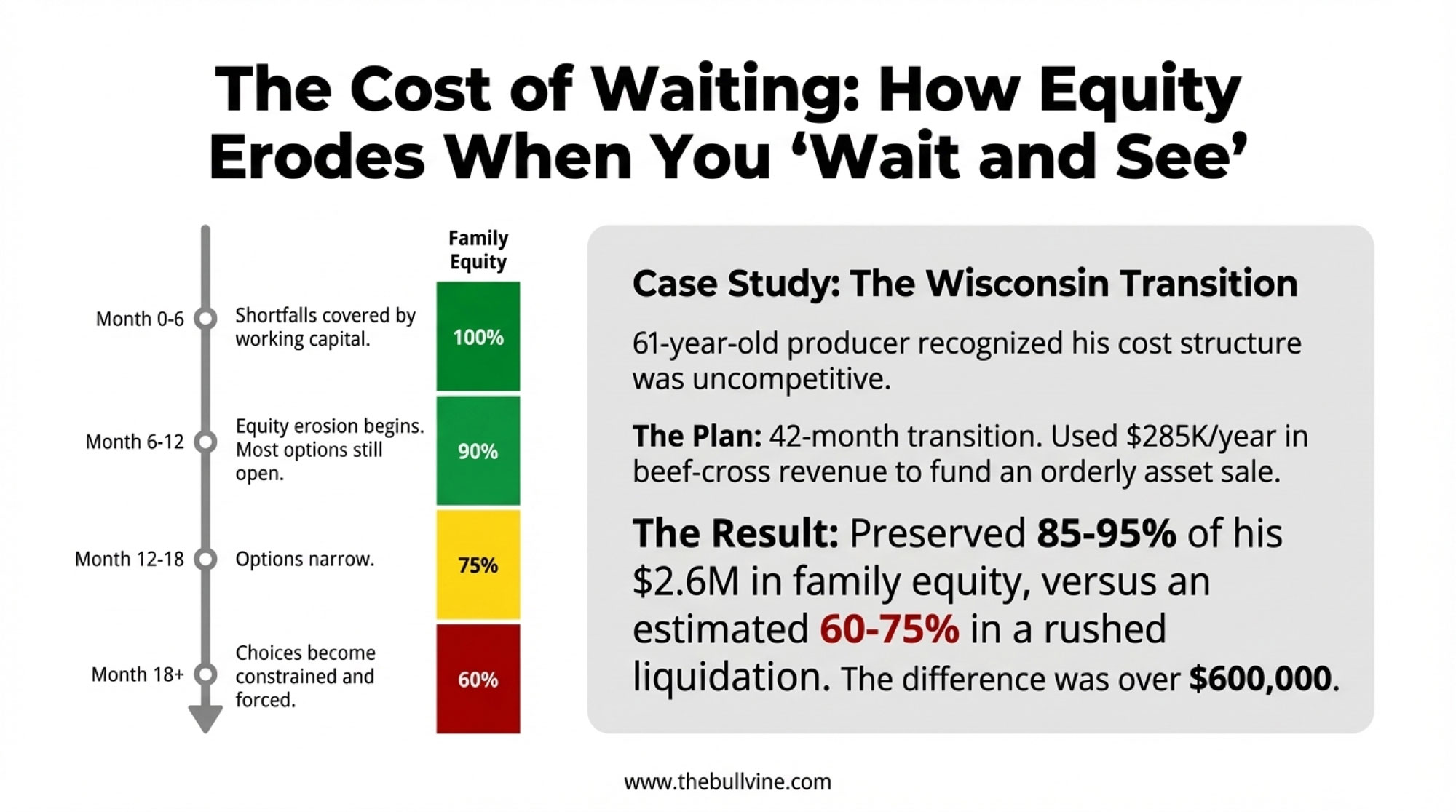

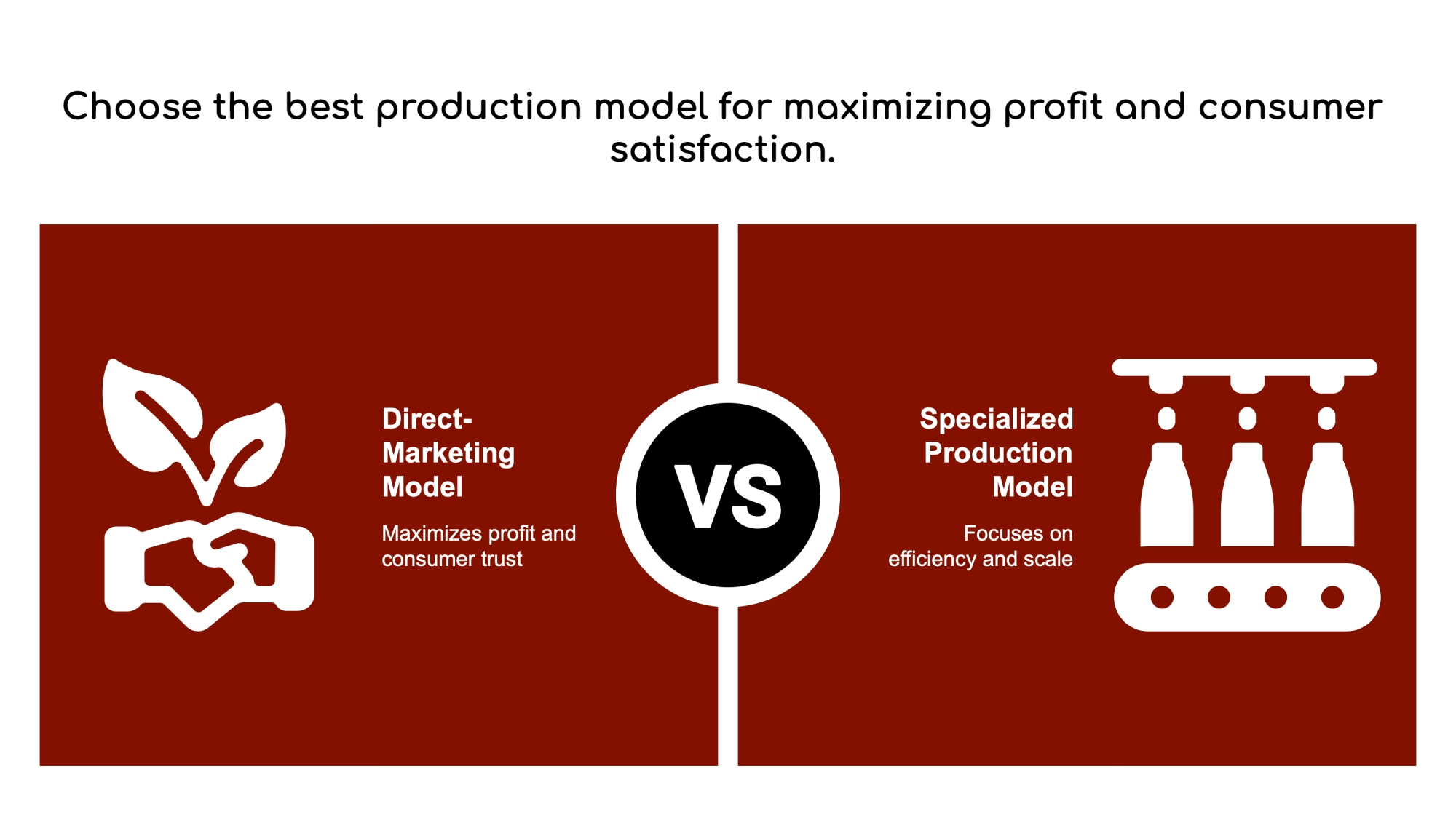

Dr. Victor Cabrera at the University of Wisconsin‑Madison — the researcher behind much of the foundational beef‑on‑dairy economics — saw it happen in the herds he works with. “We looked at the opportunity, and we were having better reproduction performance, and we used too much beef semen,” Cabrera told The Bullvine. “We entered into the problem — which I think now we are coming out of — which was having not enough replacements”.

He’s not alone. After CoBank’s August 2025 report landed, Wisconsin producers who read the numbers closely immediately reduced their beef breeding from 35% to 25% and locked in contracts with custom heifer growers at $1,250 per head before prices climbed further. As one of them put it at a co‑op meeting: “The premiums are great, but you can give it all back in one bad heifer‑buying spring”.

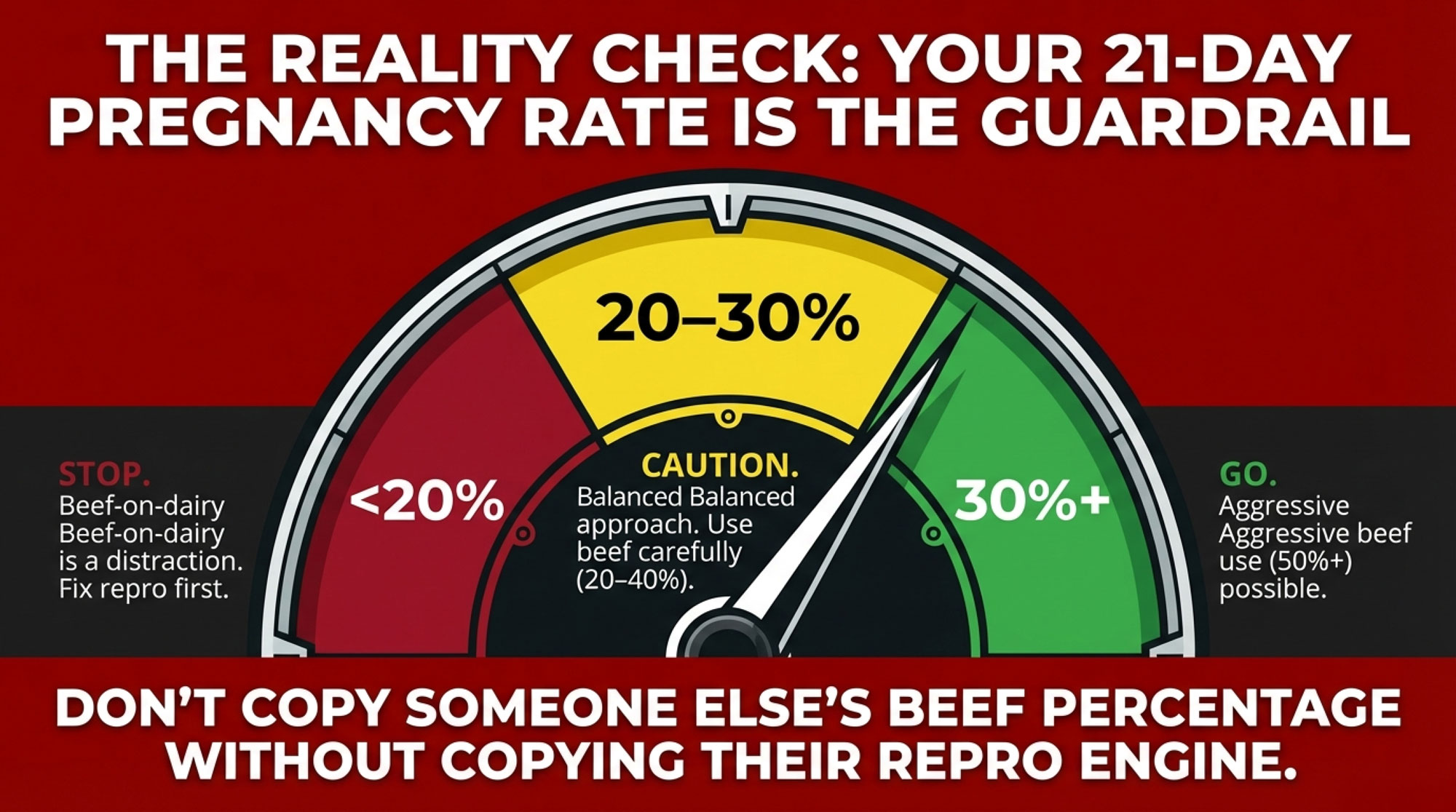

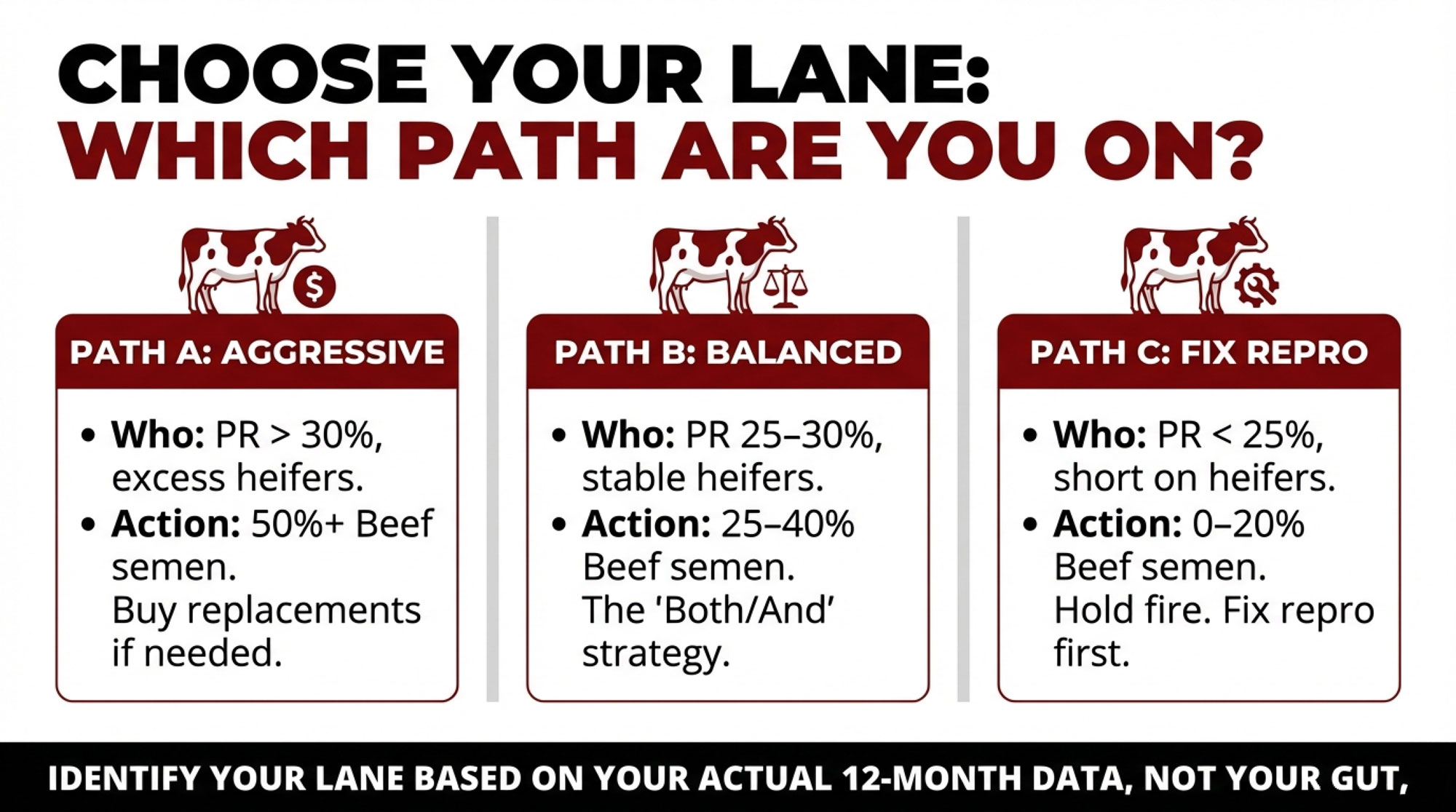

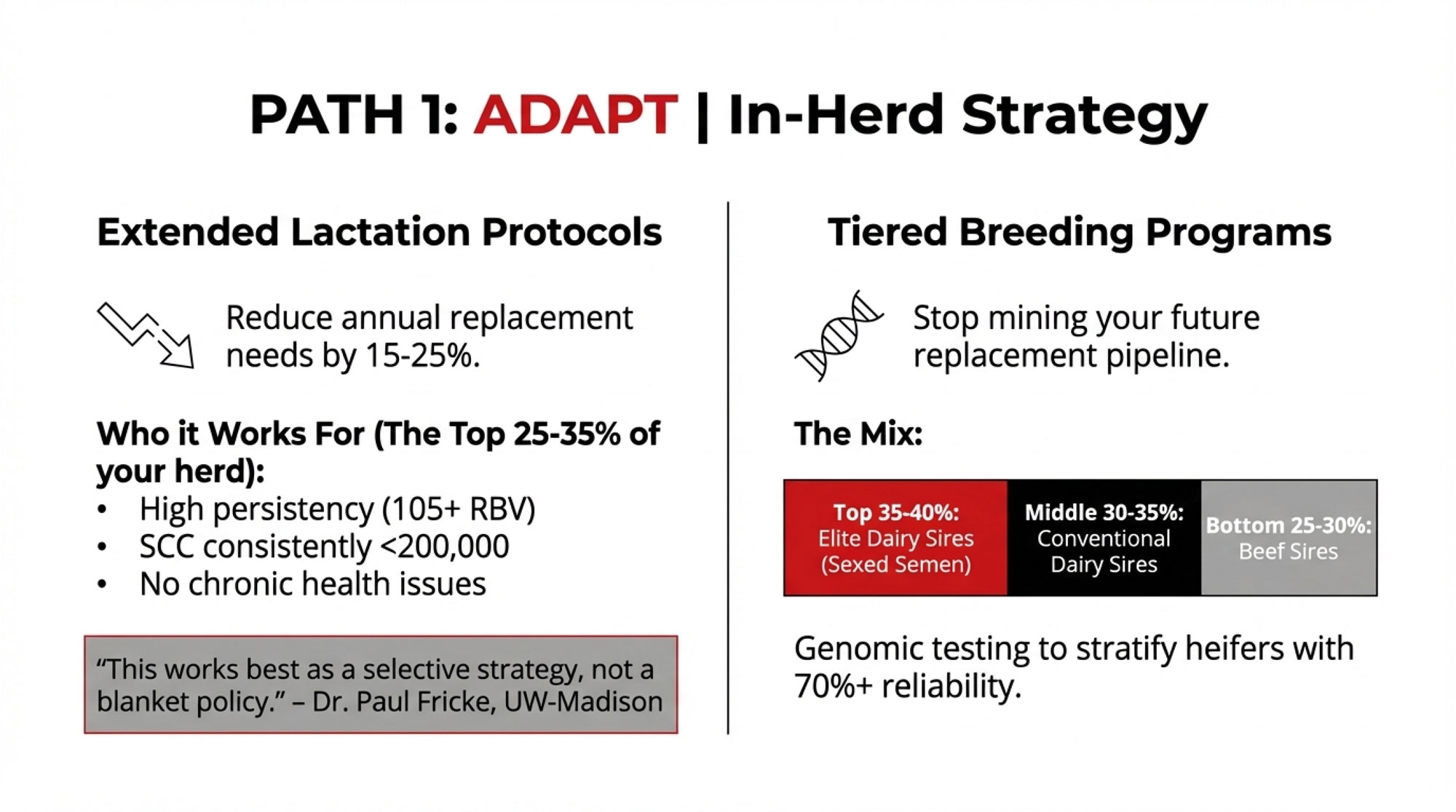

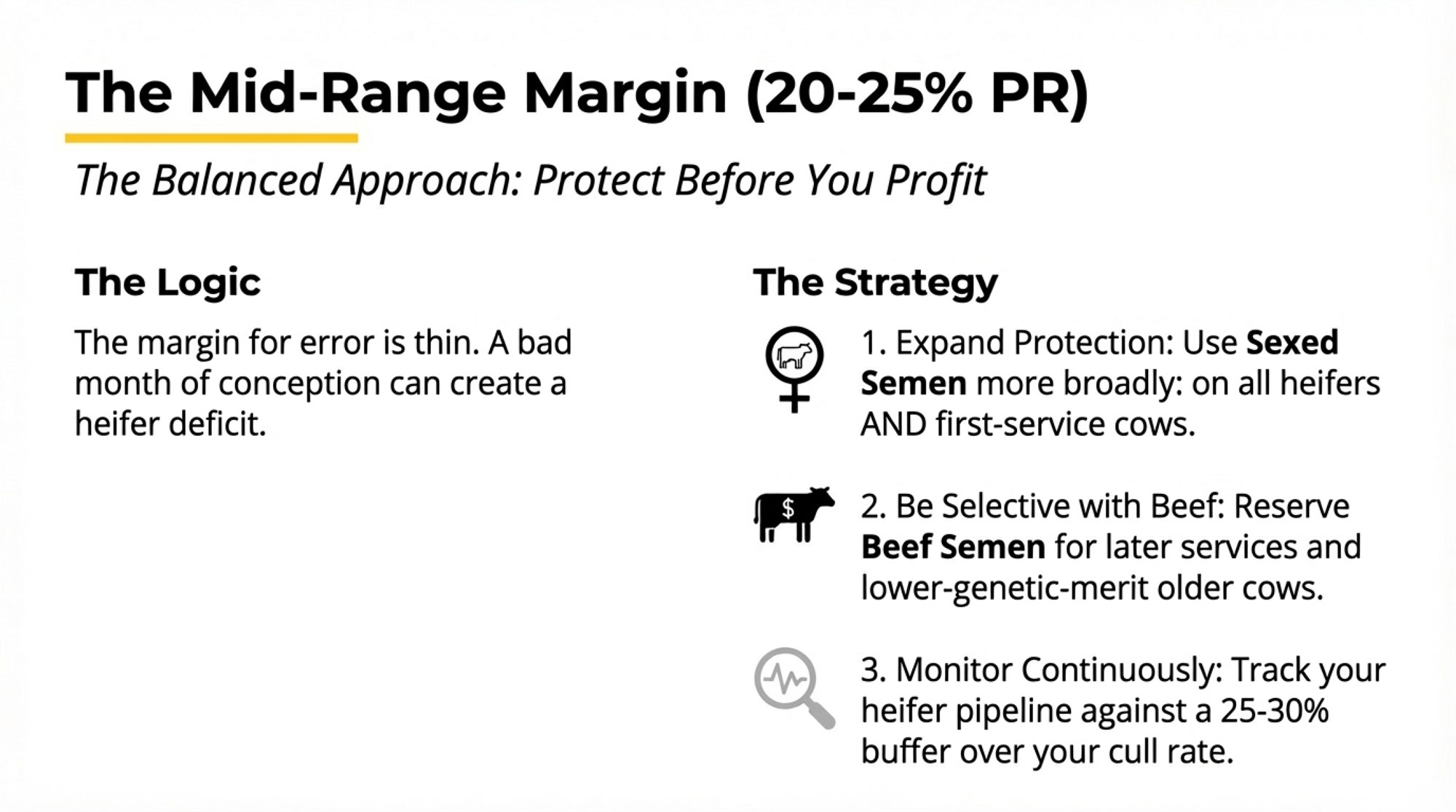

When herds actually run this math on their own cull rates, heifer losses, and contract terms, the “safe” beef percentage often ends up closer to the 20–30% range than the 40–50% some advisors pitch. They discover three things at once:

- At their actual cull and death rate, plus heifer losses, 40–50% beef leaves them one rough repro year away from a very expensive heifer hole.

- Their 21‑day pregnancy rate isn’t consistently strong enough to carry aggressive sexed‑dairy plus high beef and still hit replacement targets every year.

- The calf buyer’s or lender’s “maximize beef value” line doesn’t include any guarantee of future calf prices or replacement costs.

Those herds don’t abandon beef. They reshape the plan.

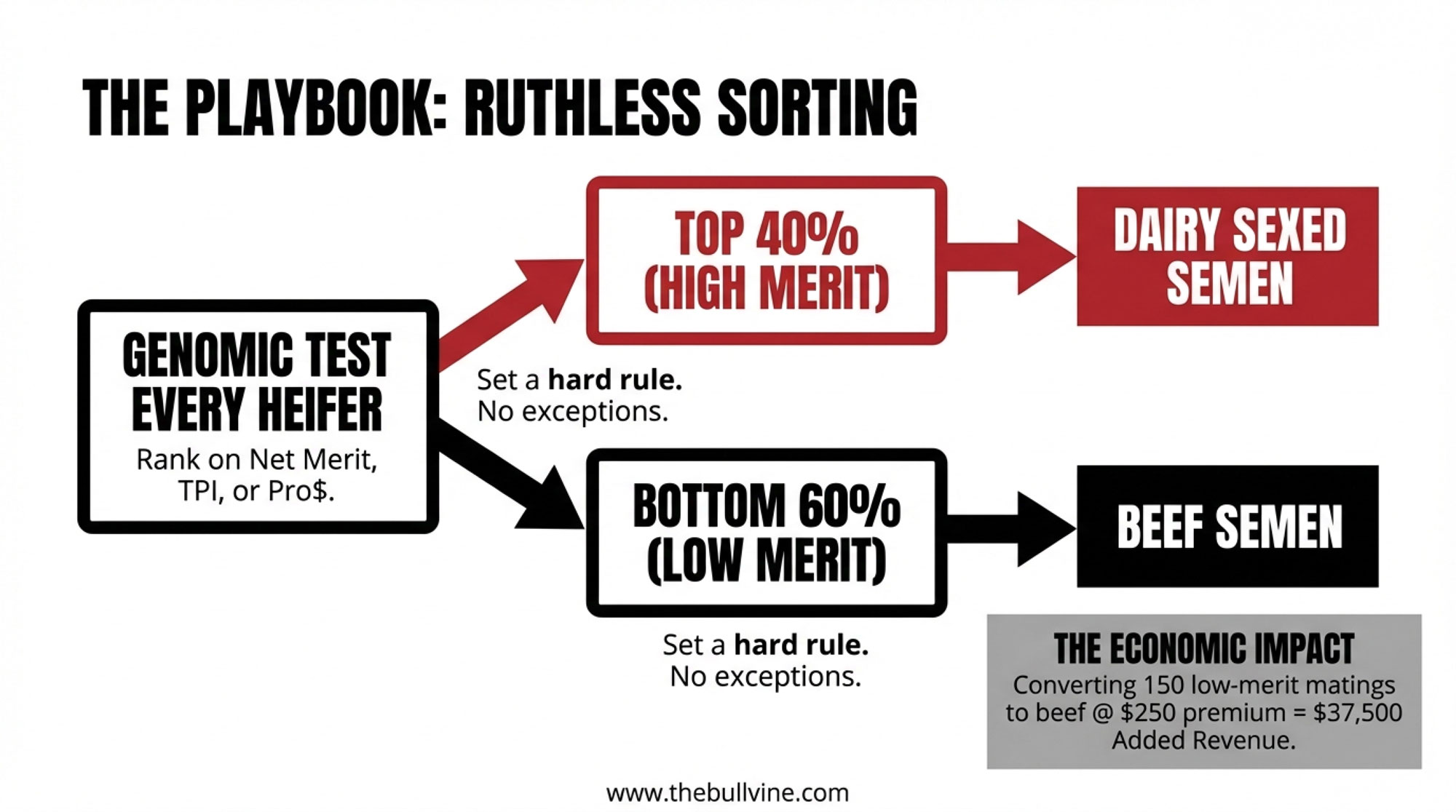

Sexed dairy semen leans hard into the top 30–40% of cows and heifers. Beef goes on later‑service cows, lower‑merit animals, and groups where the calving‑ease and gestation‑length proofs really fit. There’s a hard ceiling on beef percentage tied to a specific heifer‑calf target, not a round number that sounded good in a meeting.

Herds that do manage to keep 40–50% beef in the mix without wrecking their replacement pipeline almost always share the same basic profile: 25–30%+ 21‑day pregnancy rates, tight genomic testing and cow grouping, a clear replacement plan counted in dollars, and stronger beef‑calf contracts where specs and premiums are more predictable, not just promised.

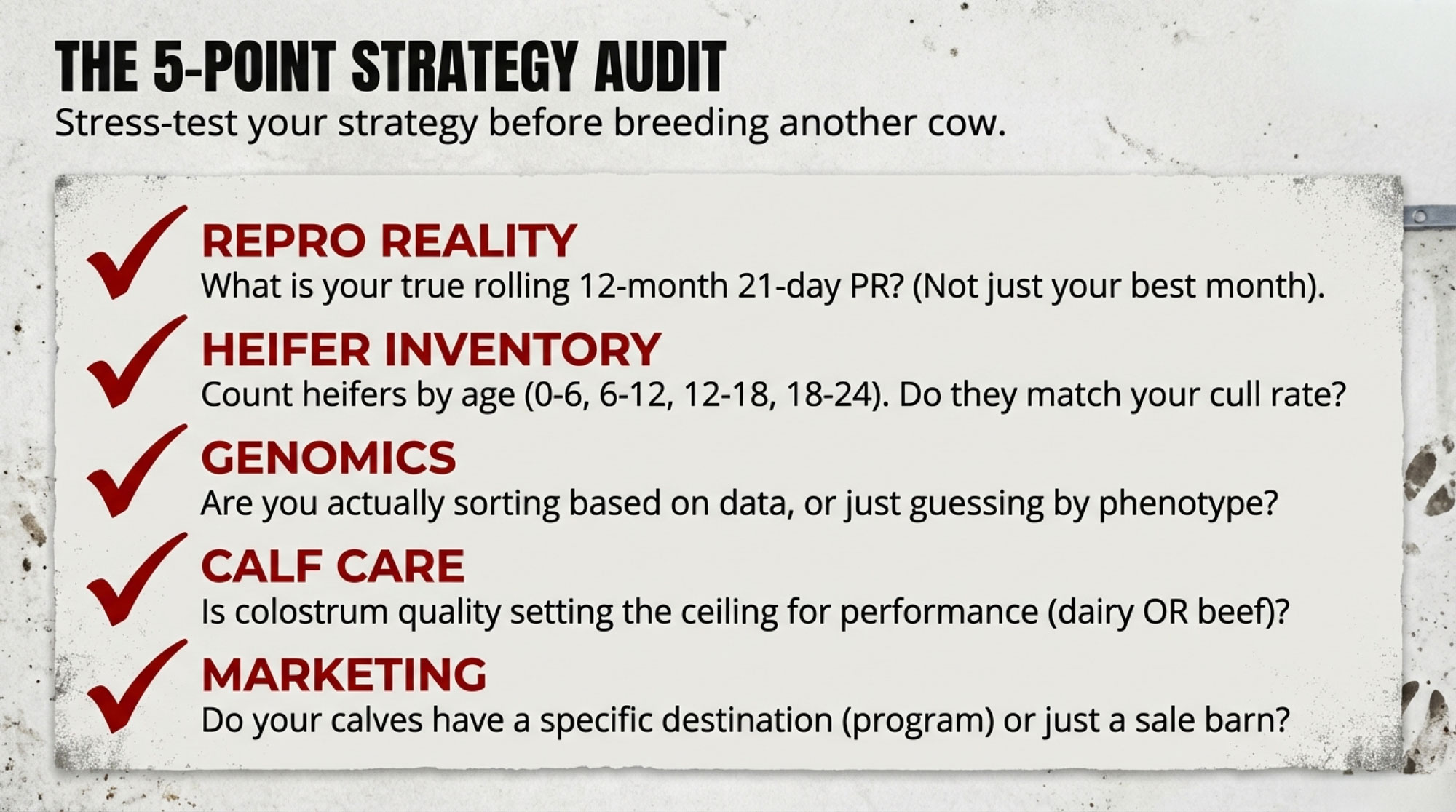

What This Means for Your Operation

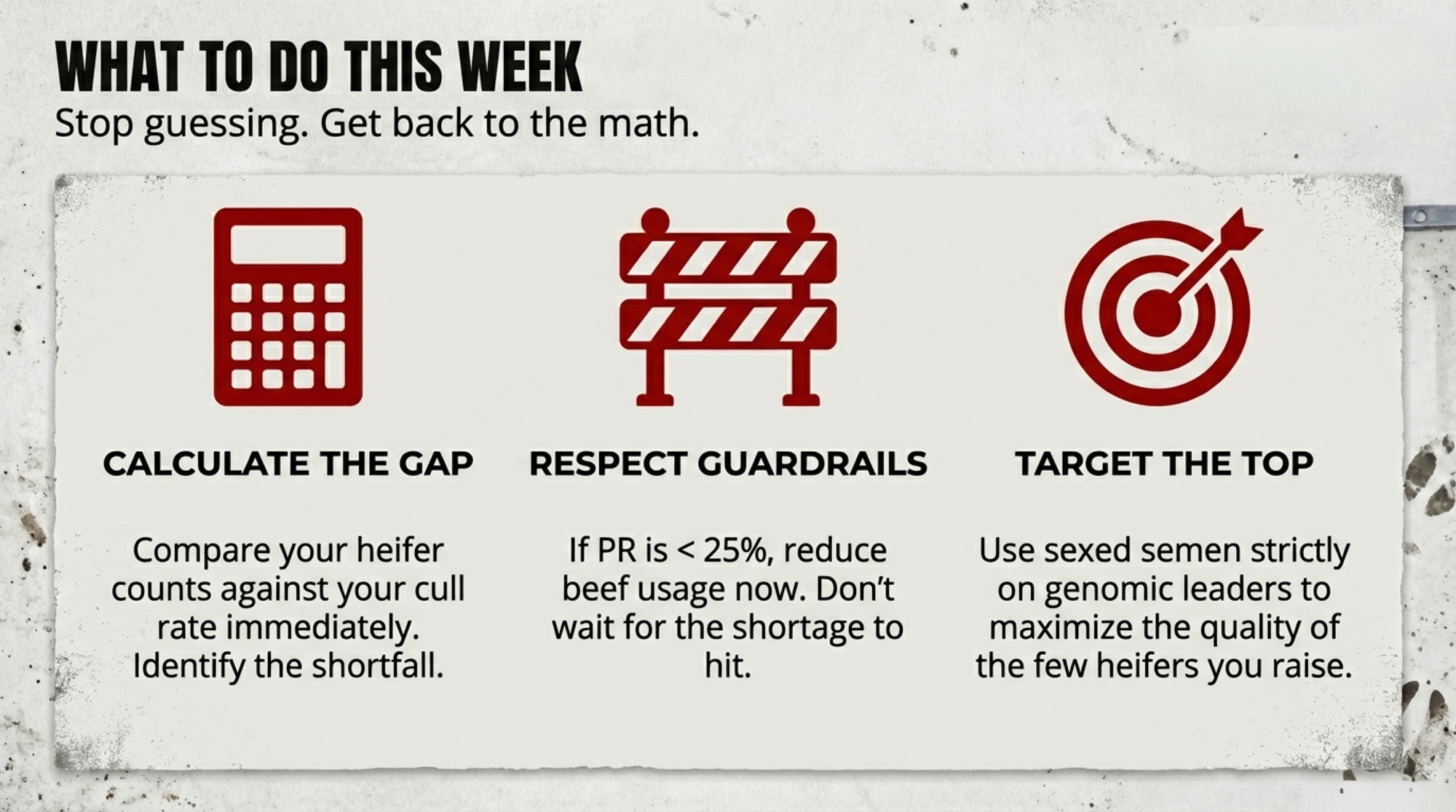

- Flip the starting point. Don’t start with “What percent beef can we run?” Start with, “At our real cull and death rate, plus heifer losses, how many dairy heifer calves do we need born each year?” Work backward from a replacement target, not forward from a round beef percentage.

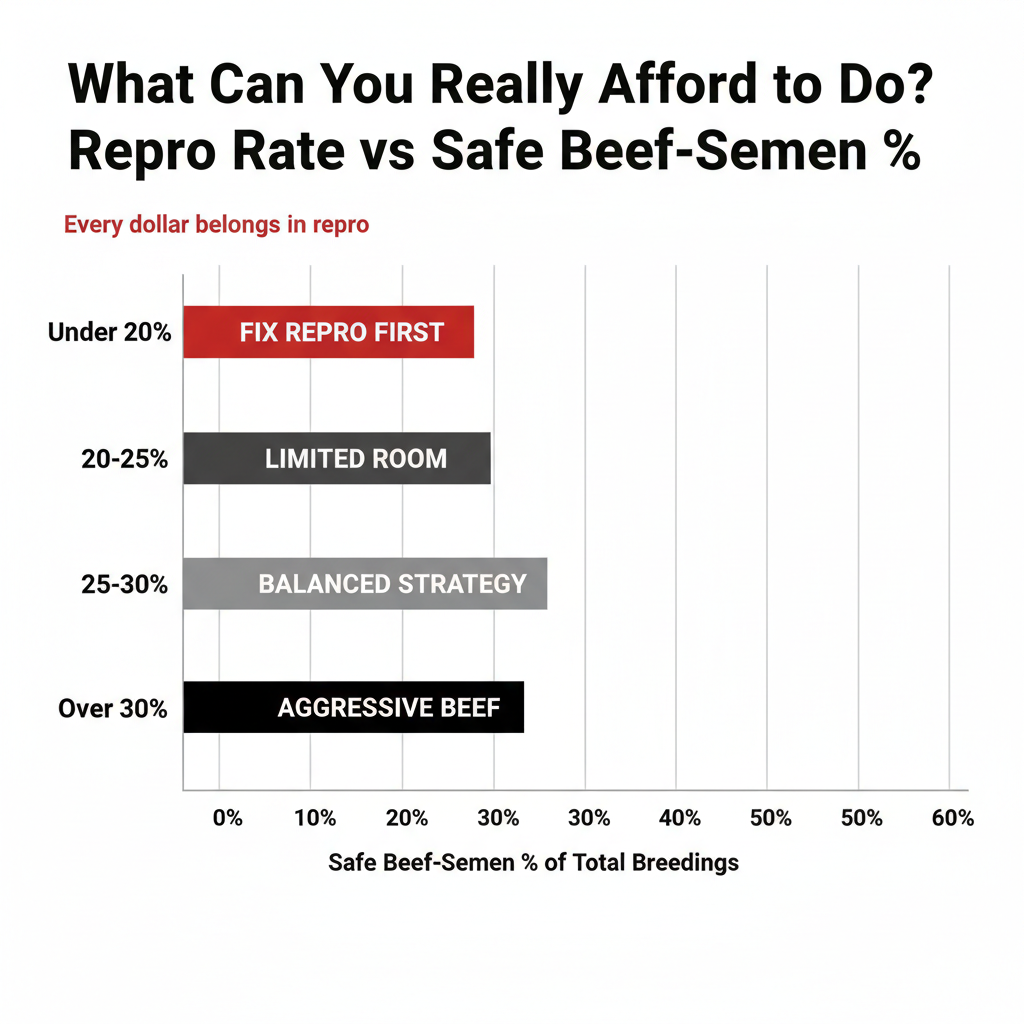

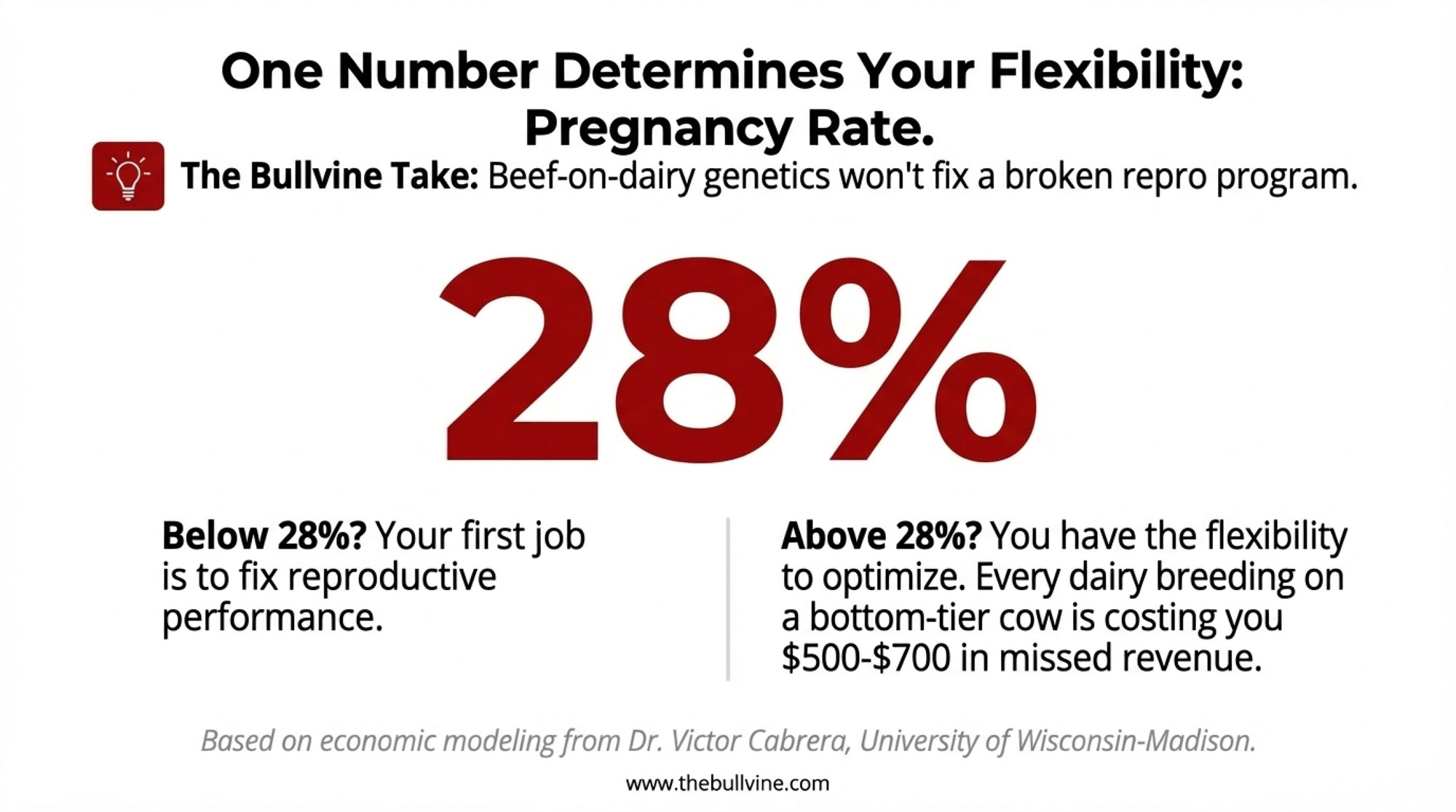

- Use your 21‑day pregnancy rate as a ceiling, not a logo. De Vries’ work shows the economics soften below a 20% 21‑day pregnancy rate when you throw beef into the mix. If you’re living in the mid‑teens, the priority is fixing repro, not doubling down on sexed beef.

- Ask harder questions about calving‑ease reliability. For every beef bull in your tank, write down his calving ease or Birth index, gestation length, and reliability. If you can’t tell whether those numbers come from daughters or a DNA chip, you don’t know enough to bet male sexed semen on him.

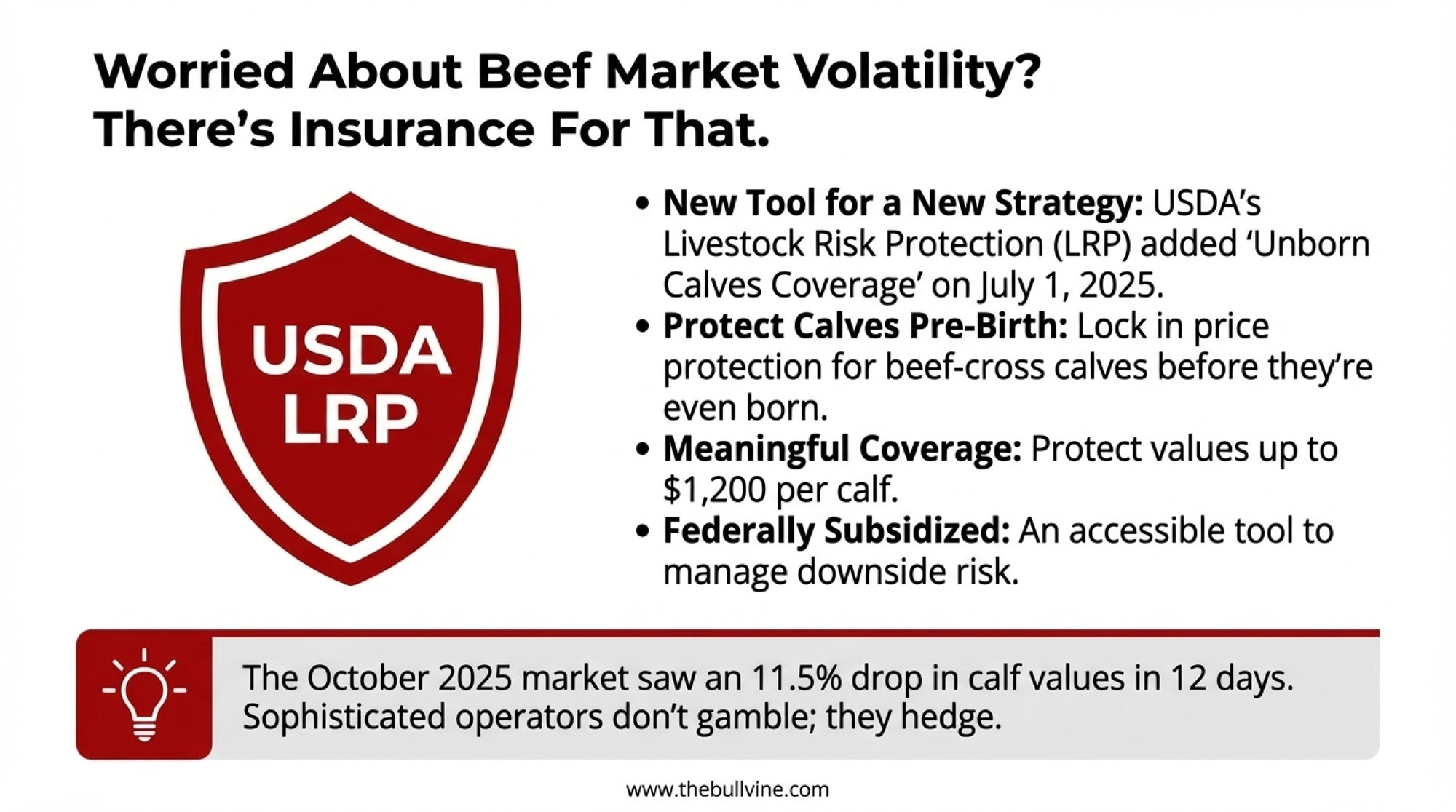

- Treat beef‑on‑dairy like a three‑year bet, not a three‑month bonus. CoBank is clear that the heifer squeeze runs through at least 2027. If your breeding plan only pencils with today’s calf prices and today’s replacement costs, you’re not managing risk — you’re hoping the market stays put.

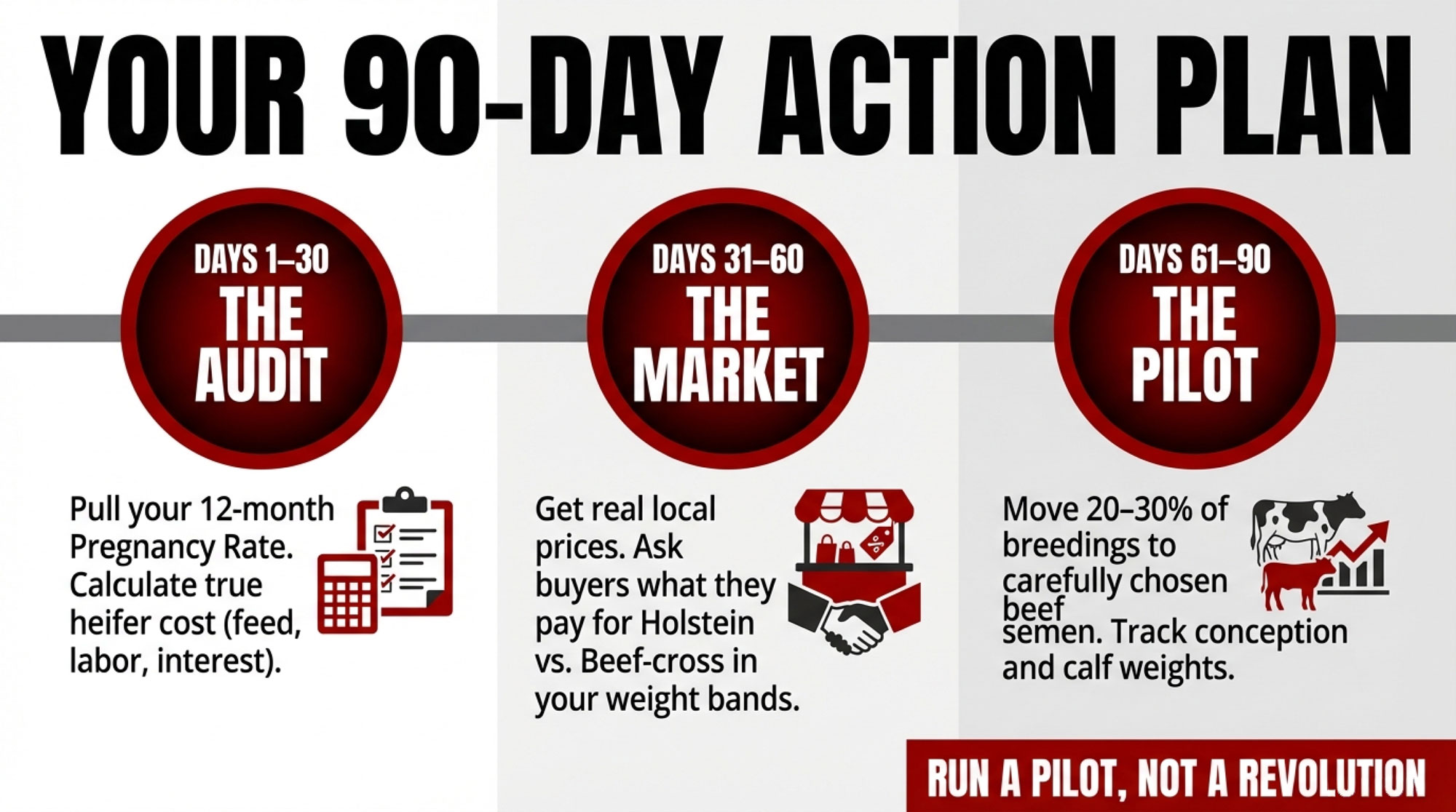

Within the next 30 days: Pull your last three years of cull and death data — including cows quietly sold as “do‑not‑breed.” From that, calculate your real replacement rate and how many heifer calves you need born per year after losses to keep the herd at its current size. Put that number on paper before the next conversation about “maximizing beef value”.

Within 90 days: For every beef bull you’re actually using, list calving‑ease reliability and gestation length. Any bull under about 80% reliability on calving ease should be off the male‑sexed list for heifers and second‑calvers until you have more data. No exceptions.

Within a year: Run two simple scenarios with your lender or advisor:

- Beef‑cross calf prices stay where they are, and your heifer plan works perfectly.

- Beef‑cross premiums drop 20%, and you have to buy 10–20 heifers at roughly $3,000–$4,000 each in 2028.

If scenario two blows up your cash flow, your current beef-and-sexed-semen plan is more aggressive than your balance sheet can handle.

Key Takeaways

- If your 21‑day pregnancy rate is under 20%, male sexed beef is a luxury, not a base plan. Fix repro first; then decide how much beef your herd can carry.

- If you don’t know how many heifer calves you need born each year, you don’t know how much beef you can safely run. Count backward from actual cull and loss data, not forward from a beef percentage.

- If a beef bull’s calving‑ease numbers are mostly genomic with low reliability, think twice before betting male sexed semen on heifers and second‑calvers. Use those bulls where the pelvis and the calving history give you more margin.

- If your beef‑on‑dairy plan only works at today’s calf prices and today’s heifer costs, you’re not managing risk; you’re gambling that CoBank’s 800,000‑heifer hole won’t matter at your mailbox.

The Bottom Line

CoBank projects no real rebound in the heifer supply before 2027. The breeding decisions made in 2024 and 2025 already locked in what will be freshened in 2026 and 2027. The choices you make this spring lock in 2028.

How many heifers does your breeding plan actually produce — and what happens if the market moves before they get there?

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More

- Beef-on-Dairy’s $6,215 Secret: Why 72% of Herds Are Playing It Wrong – Stop the guesswork and find your profit tier. This guide breaks down the specific reproductive “guard rails” that separate top-tier earners from those losing ground, providing a Monday-morning blueprint for maximizing monthly revenue.

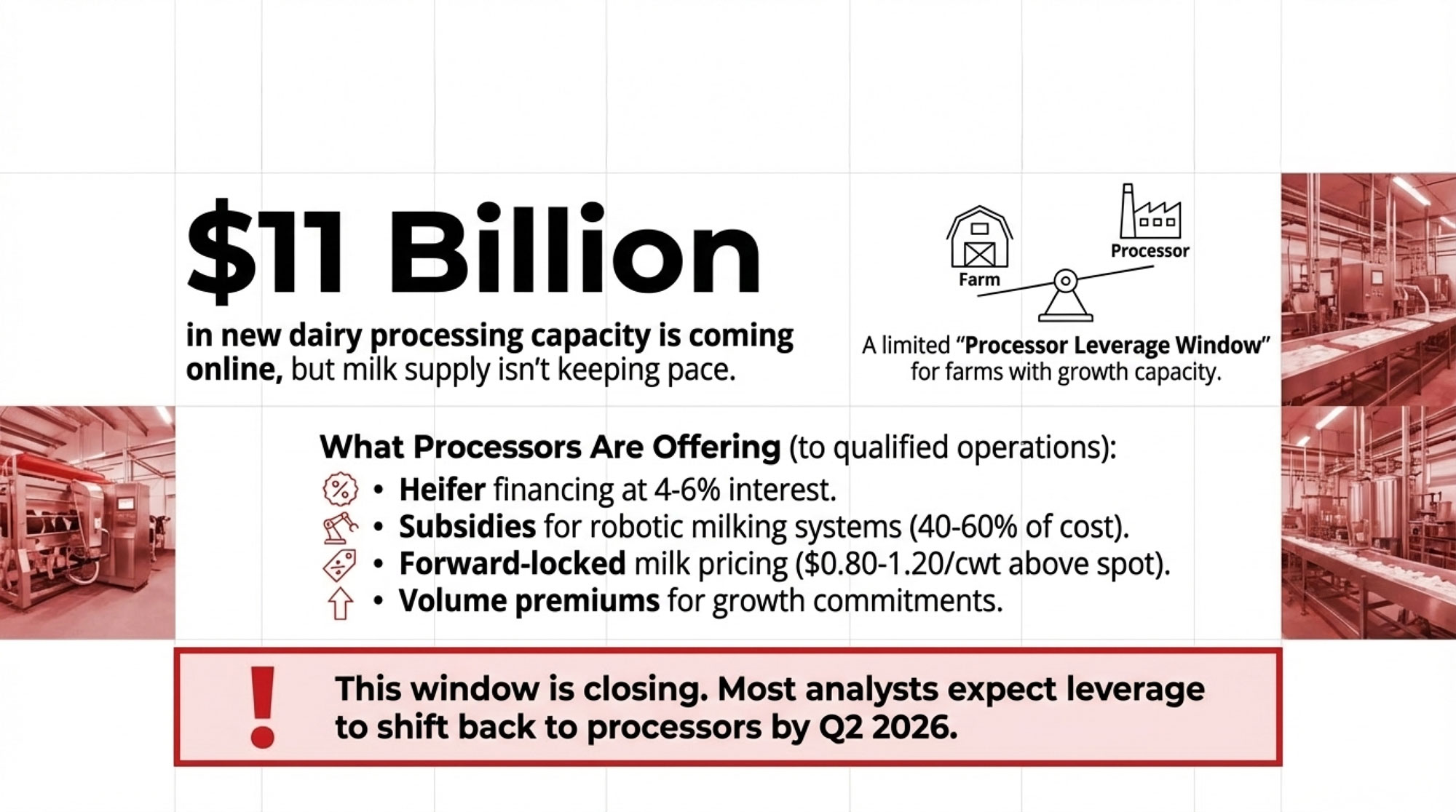

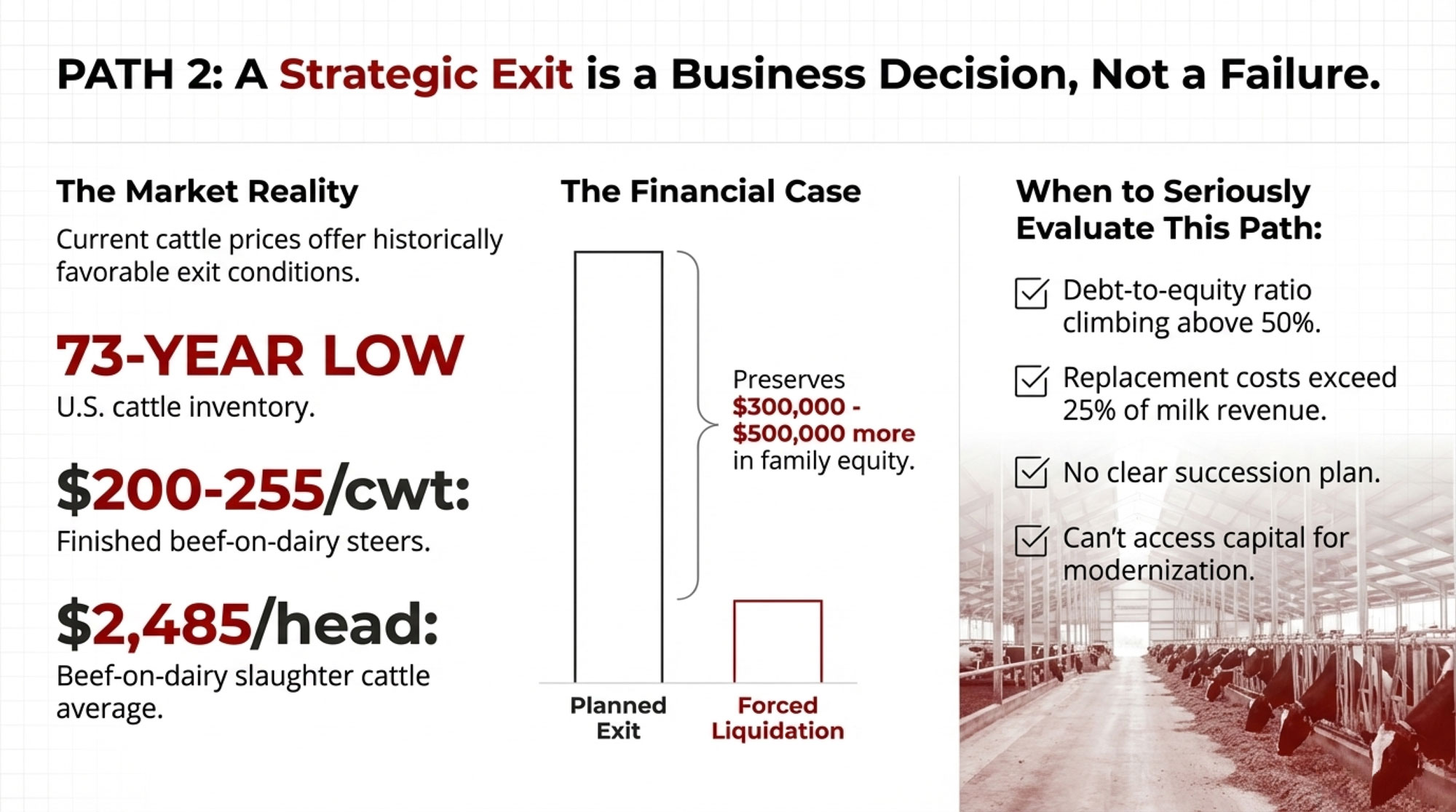

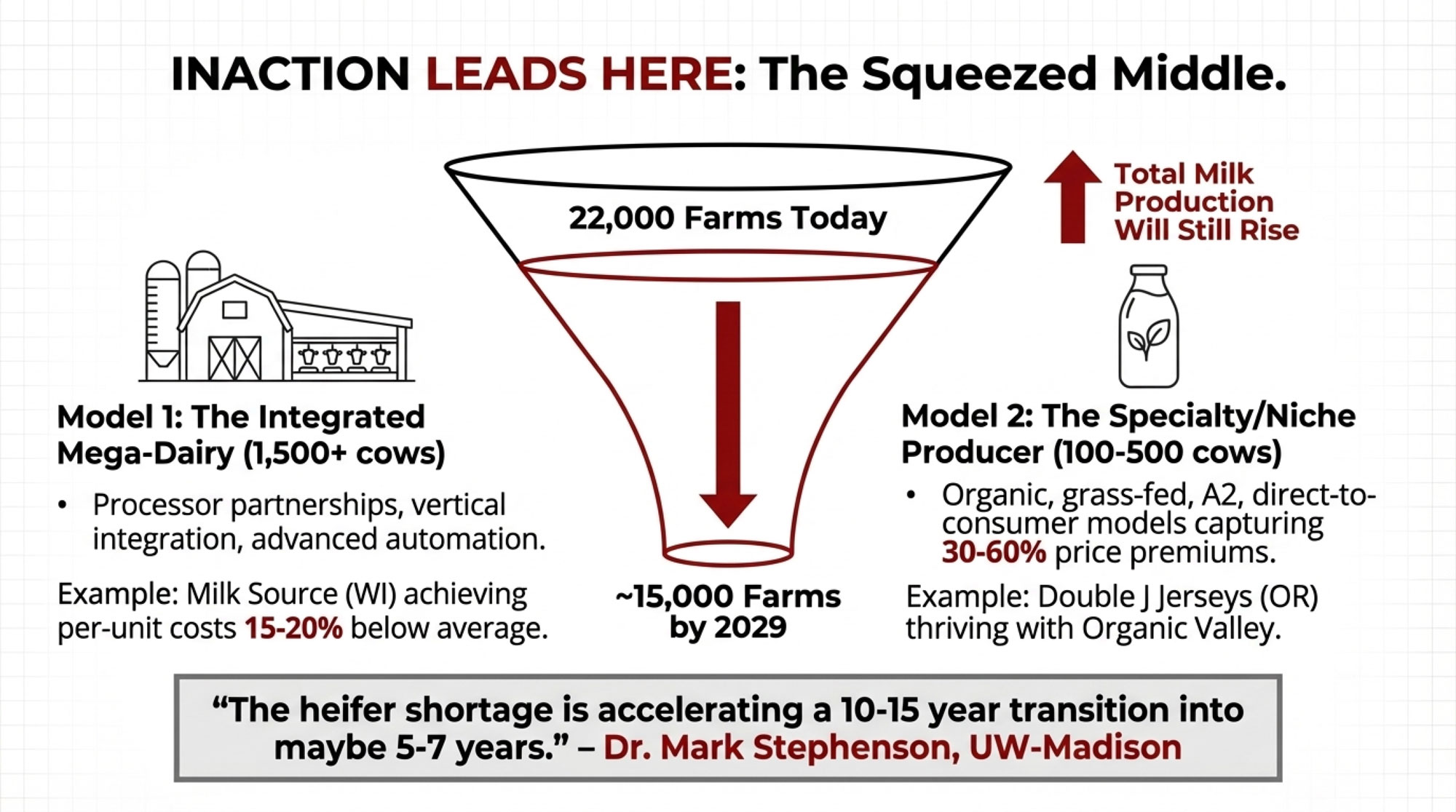

- 438,000 Missing Heifers. $4,100 Price Tags. Beef-on-Dairy’s Reckoning Has Arrived. – Position your dairy for a structural reset. This analysis exposes the 2026–2027 heifer inventory gap, arming you with the market intelligence to navigate $4,100 price tags and secure elusive processor partnerships before the window closes.

- The Next Frontier: What’s Really Coming for Dairy Cattle Breeding (2025–2030) – Unlock the next decade of genetic advantage. This feature reveals how breakthroughs in casein selection and AI-driven health markers can generate an extra $5,000 per cow, transforming your breeding program into a high-value protein factory.

The Sunday Read Dairy Professionals Don’t Skip.

The Sunday Read Dairy Professionals Don’t Skip.

Every week, thousands of producers, breeders, and industry insiders open Bullvine Weekly for genetics insights, market shifts, and profit strategies they won’t find anywhere else. One email. Five minutes. Smarter decisions all week.

The Sunday Read Dairy Professionals Don’t Skip.

The Sunday Read Dairy Professionals Don’t Skip.