Why the ‘wait and save’ genetics game is bankrupting family dairies nationwide

EXECUTIVE SUMMARY:

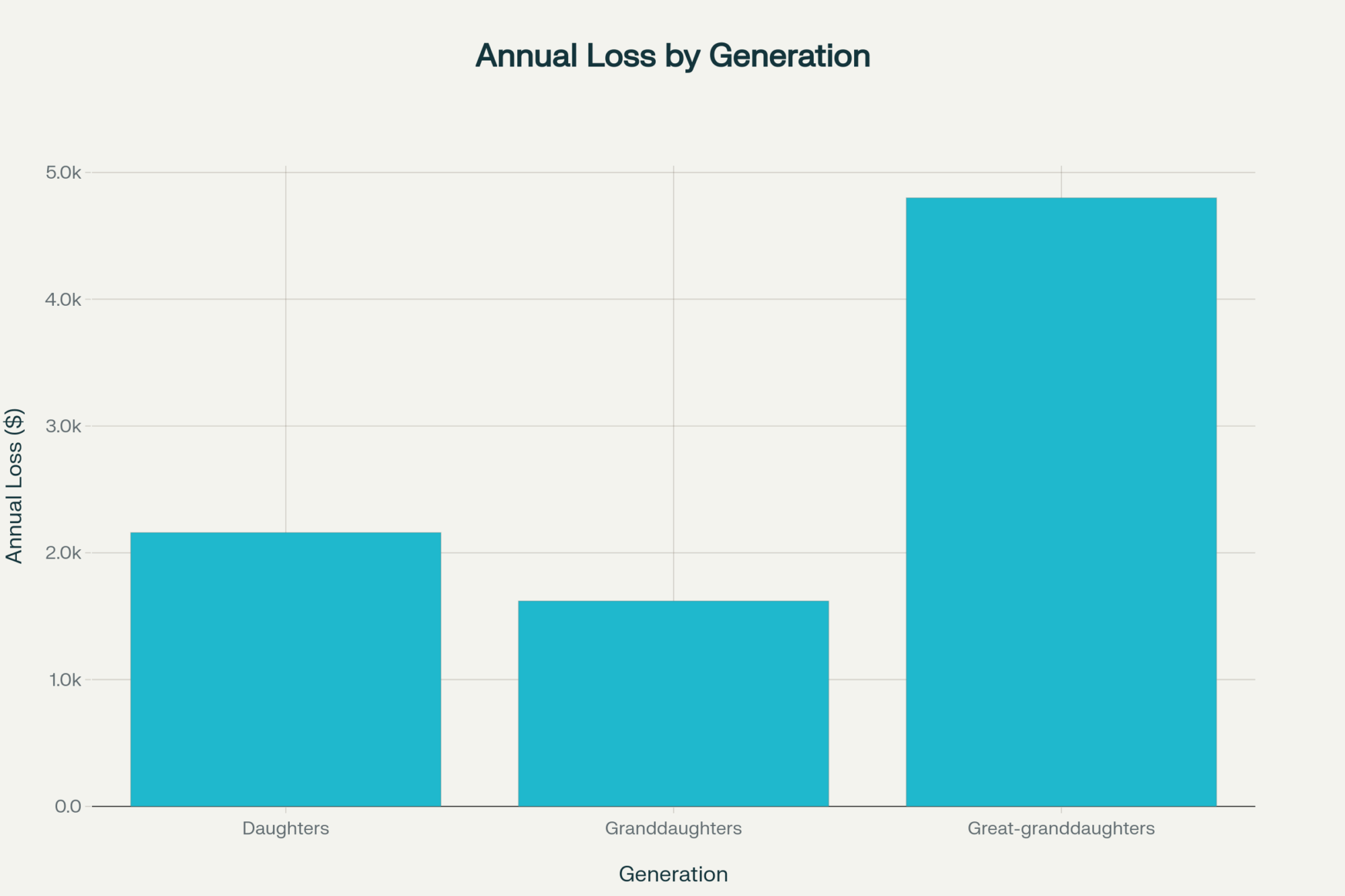

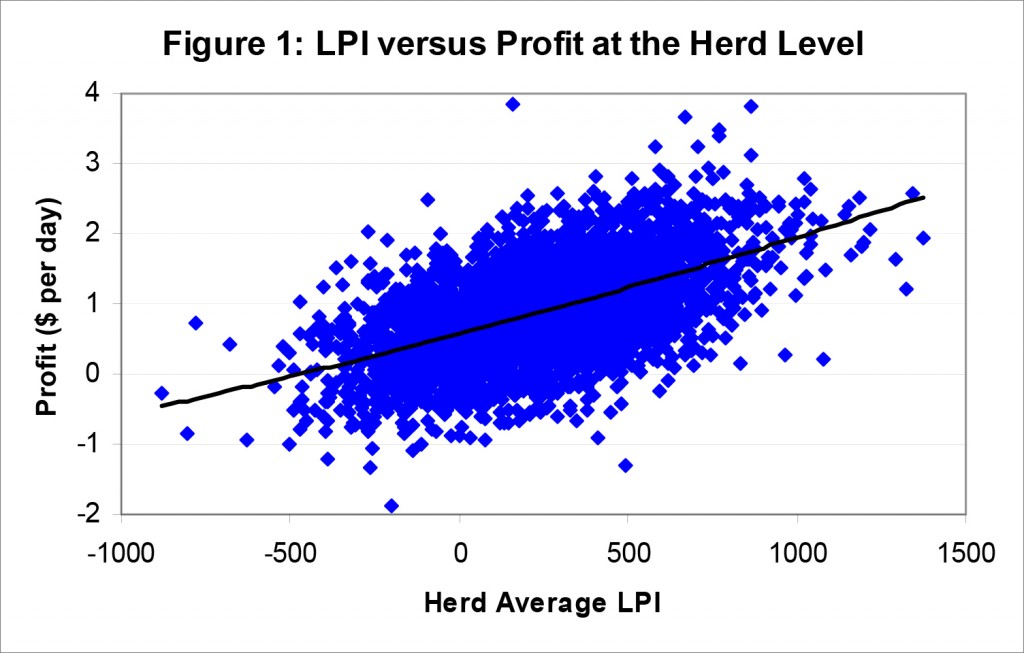

Here’s what we discovered: Waiting for semen prices to fall isn’t saving farmers money; it’s costing the average producer nearly $90,000 over 15 years due to lost genetic progress. Data from USDA shows bulls improved genetic merit by $80 annually post-genomics, while generation intervals shrank from 7 to under 2.5 years, accelerating the divide. Mega-dairies, spending 3-4% of gross income on genetics, harness 90% of gains, whereas smaller farms capture just 30-40%. Consolidation has wiped out nearly 16,000 farms since 2017, reshaping U.S. dairy communities. Our investigative analysis reveals how the genetics arms race deepens inequality and forces hard choices. The future belongs to those who invest strategically; hesitation means losing ground in a market that waits for no one.

KEY TAKEAWAYS:

- Capture up to $80/year in added genetic merit with timely semen investment, avoiding a $90K lifetime loss.

- Understand the compressed 2.5-year generation intervals driving genetic gain and stay ahead of the curve.

- Prioritize strategic genetic budgets—mega-dairies allocate 3-4% gross income; smaller farms must adapt to survive.

- Recognize consolidation trends wiping out 40% of US dairies in 5 years and plan accordingly.

- Leverage peer-reviewed science and USDA data to challenge conventional genetics purchasing myths.

You know, I was at World Dairy Expo last fall, and this producer from Iowa — good guy, been milking 350 head for twenty years — he’s telling me how he’s waiting for semen prices to drop from forty bucks down to thirty before he breeds his heifers. Thinks he’s being smart with his money, right?

Well, here’s the thing… Dr. Albert De Vries, this economics wizard down at the University of Florida, he ran the numbers back in 2015 and — get this — you’d need those prices to crash nearly 50%, all the way down to about $21 a dose, just to break even on what you lose by waiting.

Fifty percent! Can you believe that? I mean, when’s the last time you saw premium genetics lose half their value overnight? Never happens.

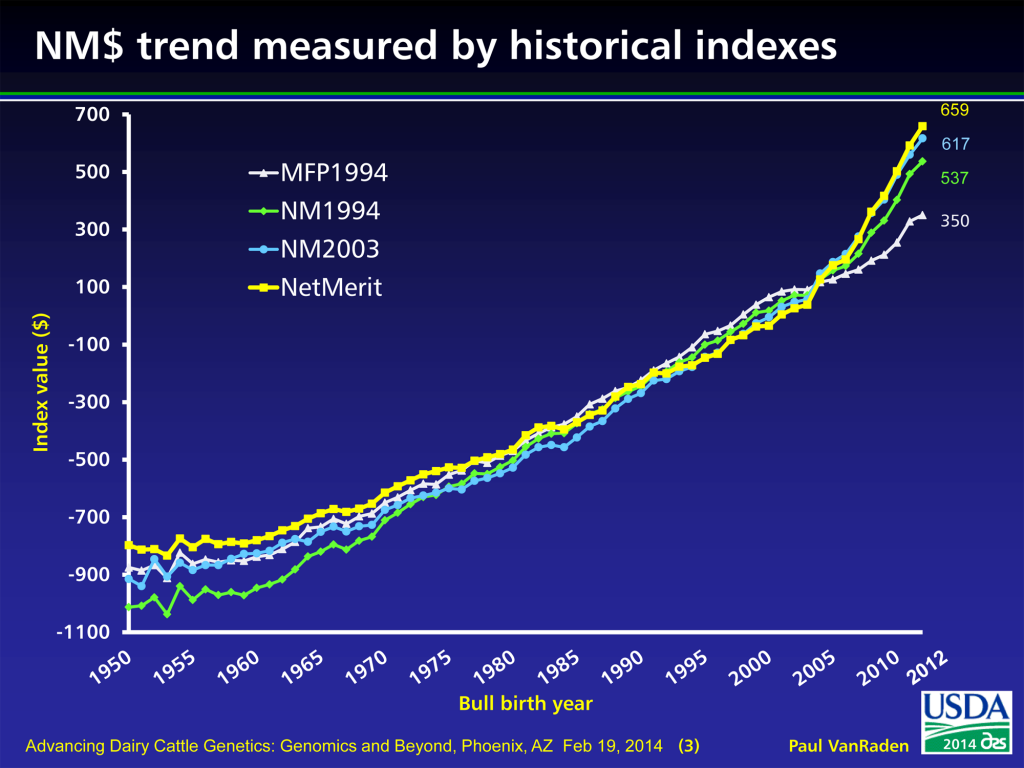

But those California mega-dairies running ten thousand head? They’re not waiting around. As soon as new genetics drop, they’re buying. And why wouldn’t they? The USDA data from 2016 to 2020 shows bulls improving about $80 per year in Net Merit since genomics took over. That’s real money — compounds through every heifer, every lactation…

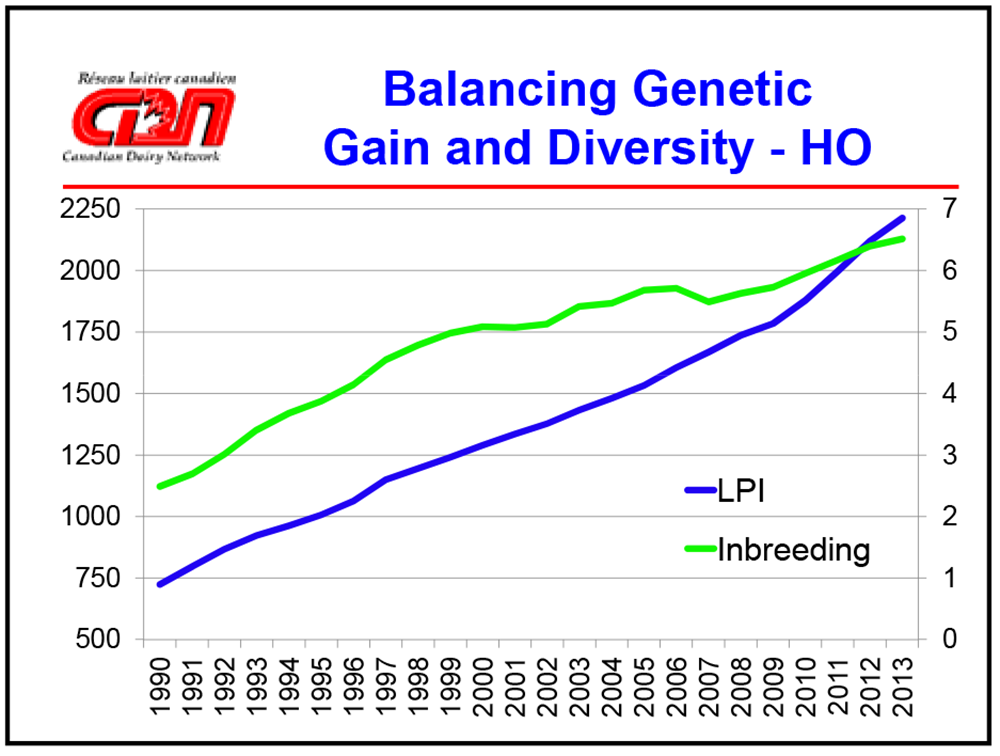

Actually, here’s what really gets me fired up. The whole breeding game got turned upside down when generation intervals — that’s how long it takes genetics to flow through — got slashed from seven years down to under two and a half. García-Ruiz’s team published this in some fancy journal, the Proceedings of the National Academy of Sciences, back in 2016.

So if you’re still making breeding decisions like it’s 2005 — and I know plenty of guys who are — you’re already behind. Way behind.

I call it the acceleration trap, and man, it’s caught more farms than I can count. Especially up in Wisconsin… you know how butterfat tanks during those brutal July heat waves? Well, some of that’s genetics catching up with you.

The Caste System Nobody Talks About

Here’s what’s really sneaky about all this. There’s this whole genetic hierarchy forming, and most folks don’t even see it happening.

At the top, you got your mega-dairies — I’m talking thousands of head, mostly out west — throwing 3 to 4 percent of their gross straight into the hottest genetics. Industry analysis suggests these operations are grabbing about 90 percent of the real genetic gains.

Then there’s the middle tier… farms like a lot of the New York and Pennsylvania operations I know. They’re hanging on, getting maybe 60 to 70 percent of those gains. Staying competitive, but it’s getting harder every year.

And then — this is the uncomfortable part — you got the rest of us. Smaller outfits, 200 to 500 cows mostly, are scraping by on what appears to be maybe 30 to 40 percent of genetic progress. You feel it every time those components drop, every time the breeding season scramble gets worse.

Let me tell you about this farmer — we’ll call him John — from down around Zanesville in Ohio. Sharp guy, really. Thought he was making a smart call waiting on that expensive semen, saving himself 200 bucks upfront.

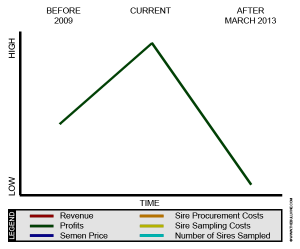

But four years later? Those daughters were costing him about $27 each per year in lost production — that’s using De Vries’ economic modeling framework. Twenty heifers, four lactations… you’re looking at $2,160 missing from the milk check annually.

Then his granddaughters started calving — another $1,620 lost every year. Great-granddaughters? We’re talking over $4,800 annually, all from that one “smart” decision to wait.

Total it up over fifteen years using standard dairy economic projections, and John’s $200 savings cost him roughly $90,000 in foregone profit. Makes your stomach turn, doesn’t it?

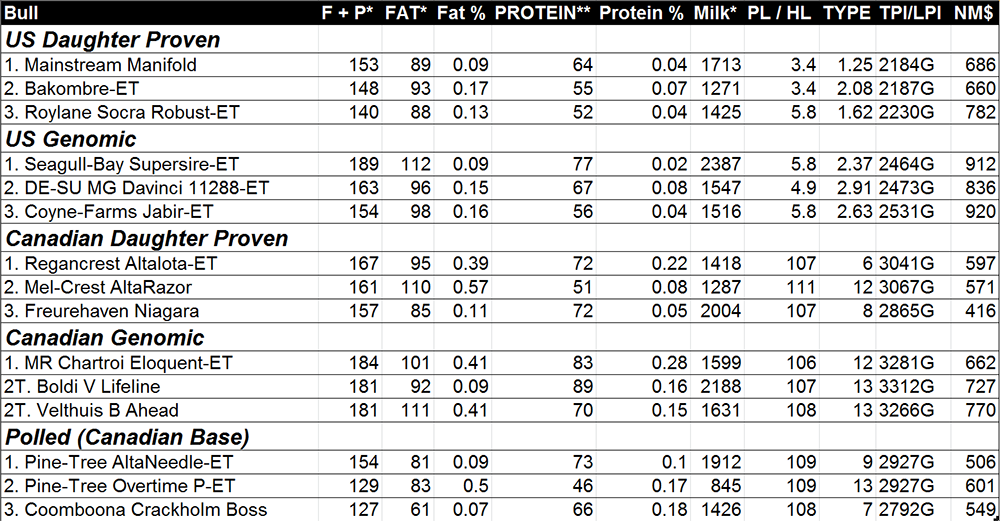

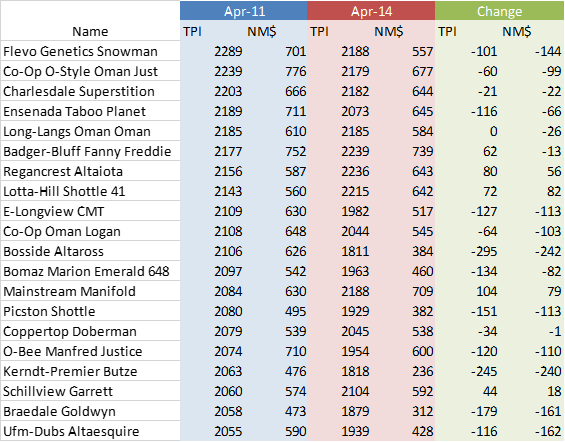

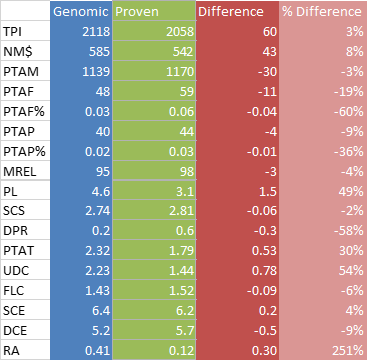

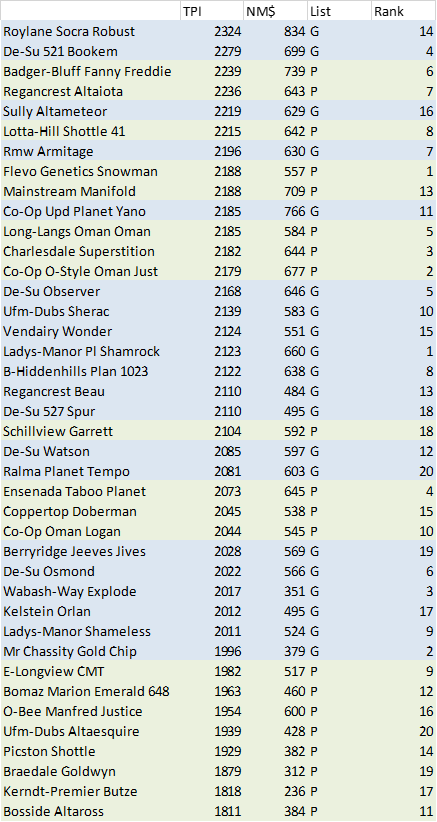

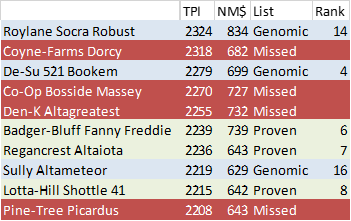

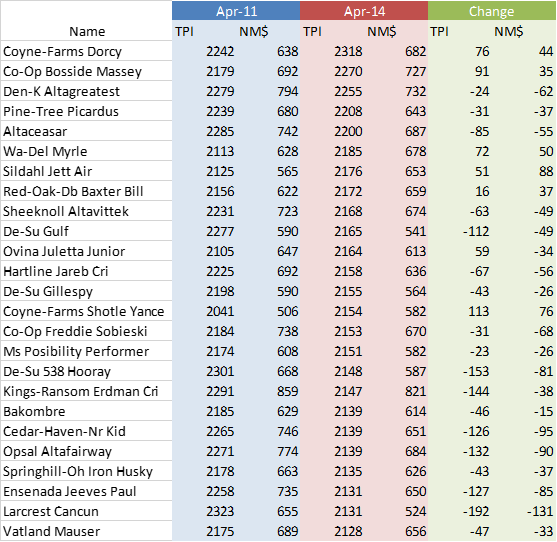

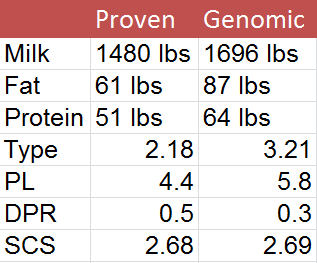

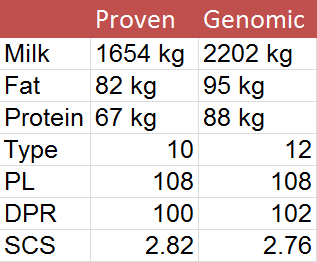

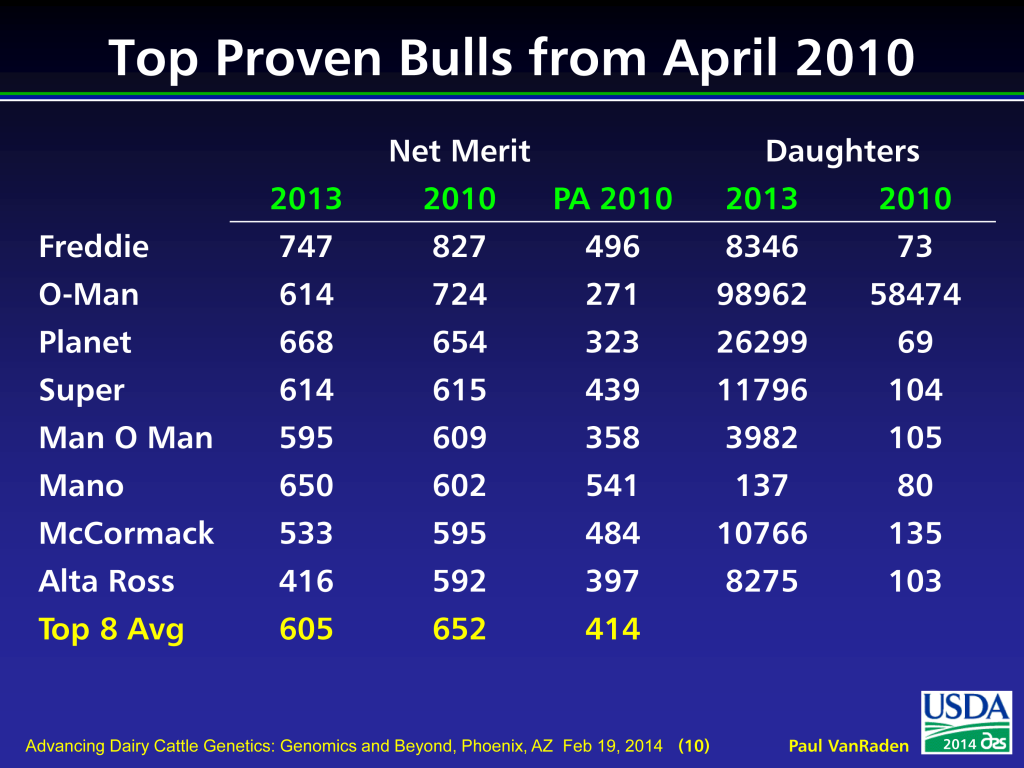

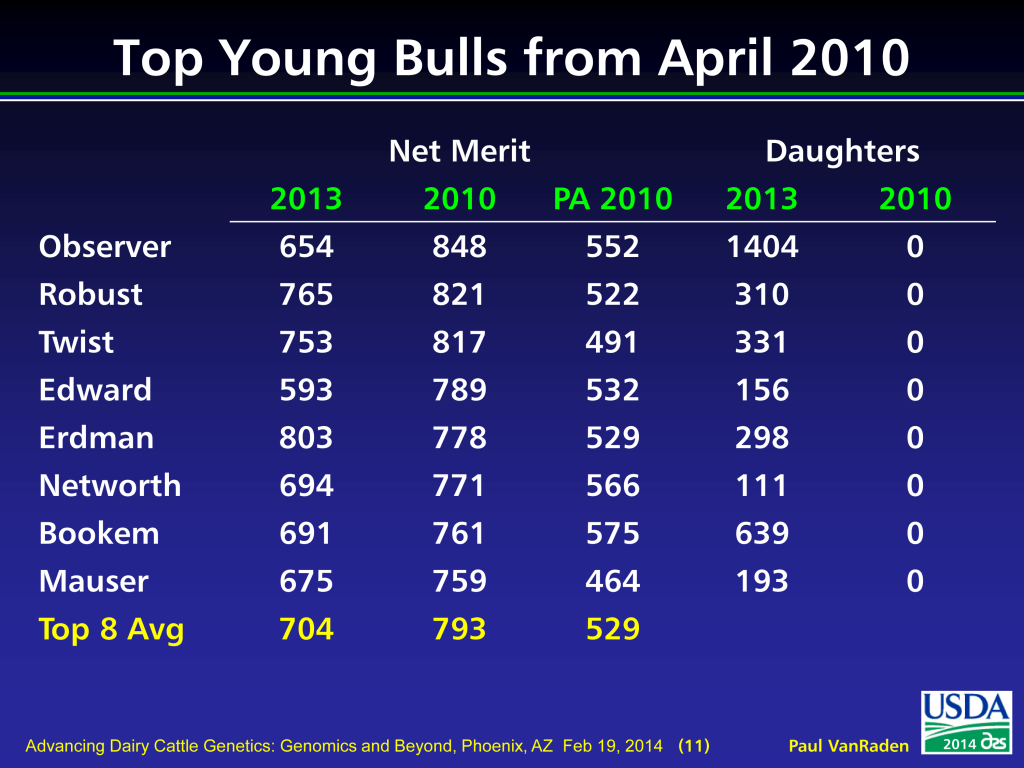

But here’s the real kicker — and I heard this from another producer down near Lancaster during corn harvest — those “proven” bulls everyone’s still buying? By the time they prove themselves through daughters, the young genomic bulls have already lapped them. Often at 70 percent reliability, but way ahead genetically because the baseline keeps moving up.

The Niche Market Fantasy That’s Crushing Dreams

Now, I get it. Everyone’s looking at organic, grass-fed, A2 milk, thinking that’s their salvation. Who doesn’t want premium pricing, right?

But let’s talk reality here… Based on the latest USDA organic market reports and industry data through 2025, organic milk’s sitting around 5 to 6 percent of total U.S. production. Grass-fed? Barely registers at under 1 percent. A2’s growing — I’ll give you that — but it’s still niche scale.

The brutal math? These markets can’t absorb even half the farms getting squeezed by this genetic stratification. Most of that “niche transition” advice? It’s false hope designed to keep struggling operations producing commodity milk for a few more years.

Meanwhile, consolidation keeps hammering us. According to USDA Census data released in 2024, we lost nearly 15,866 dairy farms between 2017 and 2022 alone. That’s not just numbers — that’s communities, families, generations of farming knowledge… gone.

And the big players? They’re snapping up the pieces, buying land and cows and basically owning the future.

What This Really Means for Your Operation

So here’s your reality check. If you’re running a small or mid-sized operation, you’ve got maybe twelve to eighteen months — tops — to commit to a survival strategy.

Scale up fast — get to a thousand cows with the genetics budget that requires — or find a genuine niche that pays the bills, or start planning your exit while your assets still have value.

Because genomics changed the rules permanently. No more waiting for better deals. No more hoping the old ways will work.

I’m not sure what to make of all this sometimes, but one thing I know for certain — ignoring these facts is like watching your neighbor’s barn burn down and wondering why your hay’s getting hot.

The clock’s ticking faster than most folks realize. The mega-dairies figured this out years ago. They’re counting on the rest of us not figuring it out until it’s too late.

So what do you think? You gonna keep waiting for a deal that never comes, or are you gonna get ahead of this thing before it’s too late?

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More:

- Boost Your Dairy Profits: Proven Breeding Strategies Every Farmer Must Know – This article provides tactical steps to optimize your breeding program. It offers practical strategies for using sexed semen and beef genetics to manage heifer inventories and maximize profitability, complementing the main article’s call for strategic investment.

- The New Dairy Playbook: 5 Trends Redefining Profitability in 2025 – This piece offers a strategic overview of economic trends shaping the industry. It reveals how factors like heifer scarcity, component premiums, and new processing investments create urgent opportunities, enabling producers to better understand the long-term market dynamics.

- Genetic Revolution: How Record-Breaking Milk Components Are Reshaping Dairy’s Future – This article delves into the technological and market drivers behind the genetic revolution. It demonstrates how genomic advancements and the updated Net Merit $ formula are directly creating value in components, providing a blueprint for future-focused breeding decisions.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!

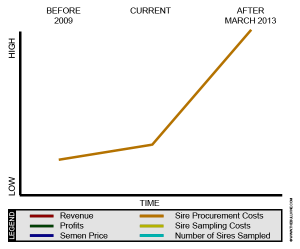

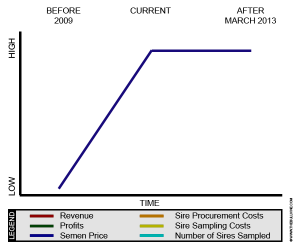

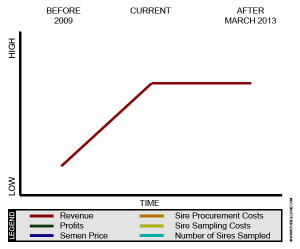

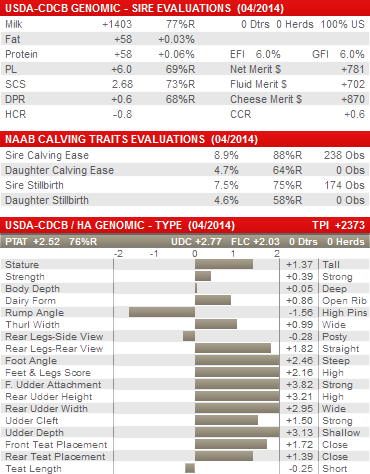

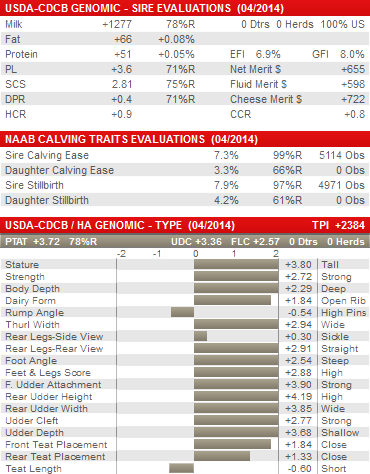

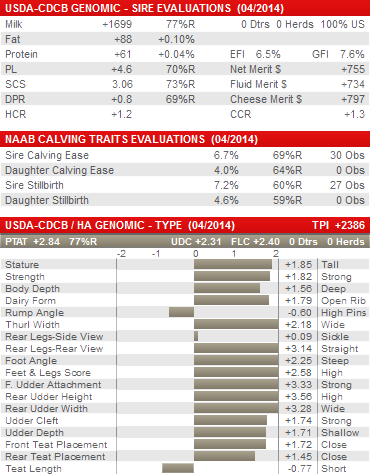

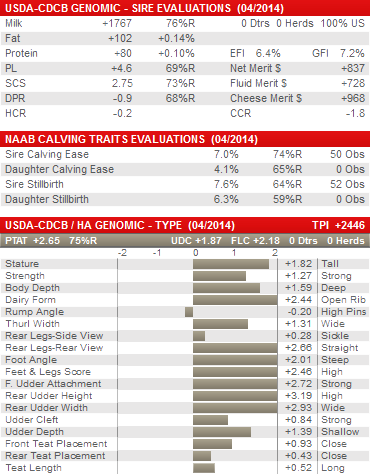

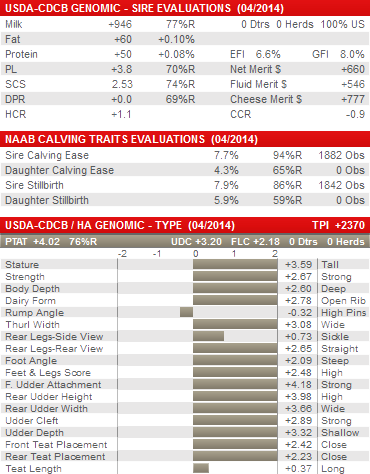

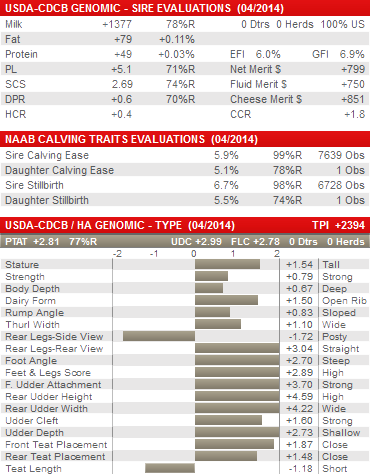

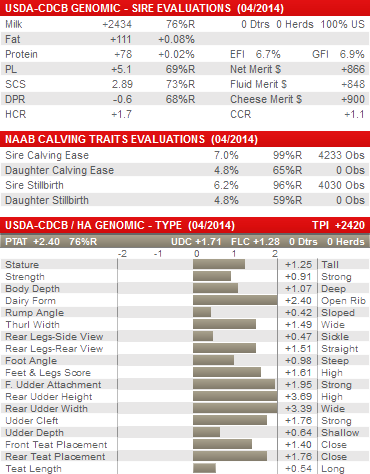

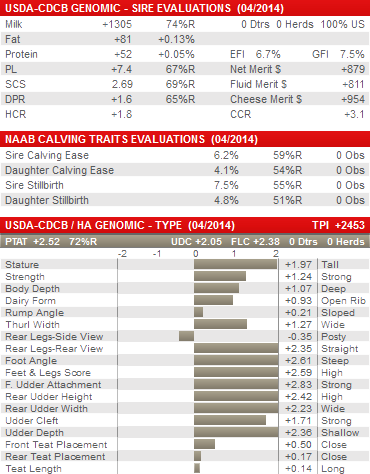

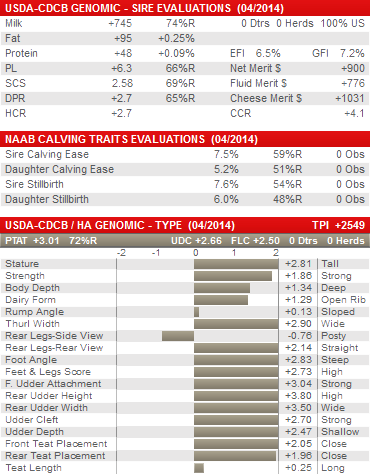

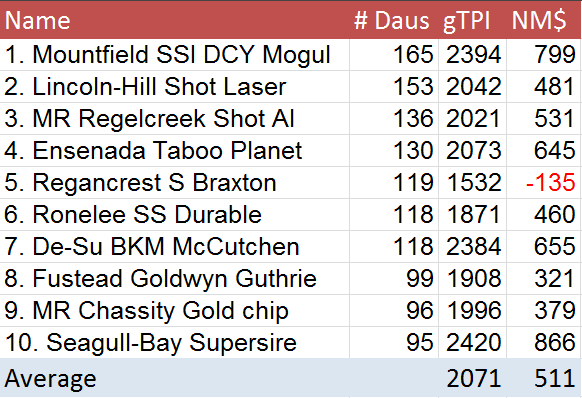

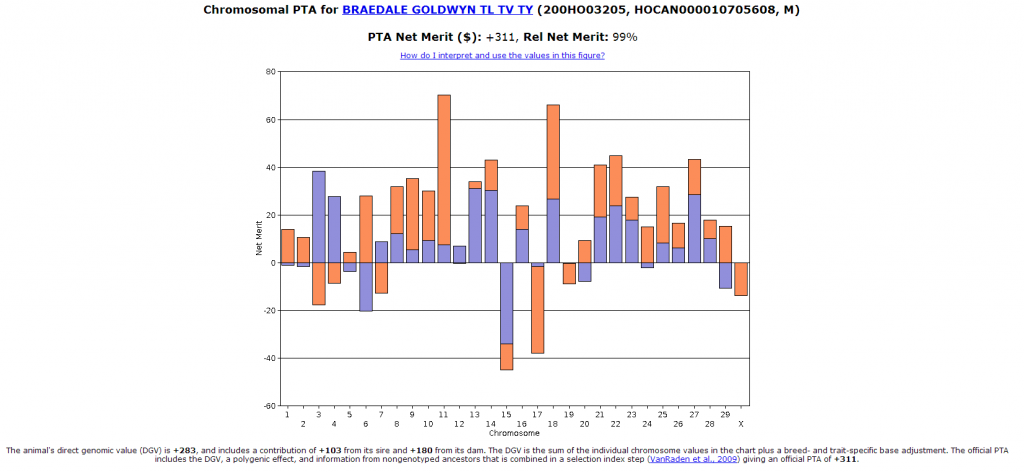

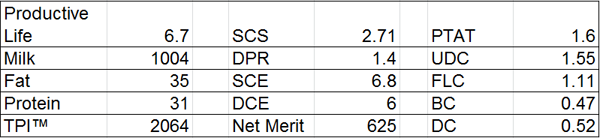

It is interesting to understand how Shot became the youngest ever. This is perhaps a sign of things to come. You see Shot is not a total product of the “Genomic Era.” However “with the release of genomic data, SHOT was identified as one of Shottle’s most elite sons,” explains Rick VerBeek, sire analyst with Select Sires. “This helped drive his semen sales significantly. SHOT has been the No. 1 selling bull for Select two out of the past three years and is on pace to be the No. 1 selling bull in 2014. He has shattered nearly every semen production and sales record at Select Sires, including setting the record for yearly sales in 2012 with 311,824 units sold.” The interesting part about this is that SHOT’s second-crop daughters are just entering his proof now. So, for the most part, he has driven this level of interest heavily on his genomic proof and about 300 daughters (# of daughters in his proof in April 2013). Unlike sires in the past that did not receive significant use until they had a solid proven sire proof, Shot has been Select’s top selling sire based mainly on a limited number of daughters in his proof but especially because of his Genomic data. This is certainly a sign that times are changing and young sires are indeed accounting for a much more significant portion of the overall sales for A.I. units. The challenge with this is that, unlike the case with SHOT, most young sires are not great semen producers. Indeed it is very hard for A.I. units to keep up with the demand for these elite genomic sires. So there is a supply and demand issue in the industry today. As is the case in any industry, when supply is less than demand, the price is sure to increase. This has been the case for elite young sire semen in recent years.

It is interesting to understand how Shot became the youngest ever. This is perhaps a sign of things to come. You see Shot is not a total product of the “Genomic Era.” However “with the release of genomic data, SHOT was identified as one of Shottle’s most elite sons,” explains Rick VerBeek, sire analyst with Select Sires. “This helped drive his semen sales significantly. SHOT has been the No. 1 selling bull for Select two out of the past three years and is on pace to be the No. 1 selling bull in 2014. He has shattered nearly every semen production and sales record at Select Sires, including setting the record for yearly sales in 2012 with 311,824 units sold.” The interesting part about this is that SHOT’s second-crop daughters are just entering his proof now. So, for the most part, he has driven this level of interest heavily on his genomic proof and about 300 daughters (# of daughters in his proof in April 2013). Unlike sires in the past that did not receive significant use until they had a solid proven sire proof, Shot has been Select’s top selling sire based mainly on a limited number of daughters in his proof but especially because of his Genomic data. This is certainly a sign that times are changing and young sires are indeed accounting for a much more significant portion of the overall sales for A.I. units. The challenge with this is that, unlike the case with SHOT, most young sires are not great semen producers. Indeed it is very hard for A.I. units to keep up with the demand for these elite genomic sires. So there is a supply and demand issue in the industry today. As is the case in any industry, when supply is less than demand, the price is sure to increase. This has been the case for elite young sire semen in recent years.

YOWZA

YOWZA MCCUTCHEN

MCCUTCHEN BUMBLEBEE

BUMBLEBEE BALISTO

BALISTO DOORMAN

DOORMAN TOPSY

TOPSY WILLIE

WILLIE MOGUL

MOGUL LUCID

LUCID SUPERSIRE

SUPERSIRE CAMARO

CAMARO FLAME

FLAME![330px-Diffusion_of_ideas.svg[1]](https://www.thebullvine.com/wp-content/uploads/2014/08/330px-Diffusion_of_ideas.svg1_.png) The reason for this has nothing to do with the merits of genomic sires versus proven sires. Rather it has to do with the historical patterns of adoption of new technologies. The theory behind this is called the Diffusion of Innovations. According to this theory, consumers differ in their readiness and willingness to adopt new technology. There are the innovators (2.5 percent of the population), the early adopters (13.5 percent), the early majority (34 percent), the late majority (34 percent), and the laggards (16 percent), who are also the people who still don’t have cell phones or who are not on Facebook.

The reason for this has nothing to do with the merits of genomic sires versus proven sires. Rather it has to do with the historical patterns of adoption of new technologies. The theory behind this is called the Diffusion of Innovations. According to this theory, consumers differ in their readiness and willingness to adopt new technology. There are the innovators (2.5 percent of the population), the early adopters (13.5 percent), the early majority (34 percent), the late majority (34 percent), and the laggards (16 percent), who are also the people who still don’t have cell phones or who are not on Facebook.

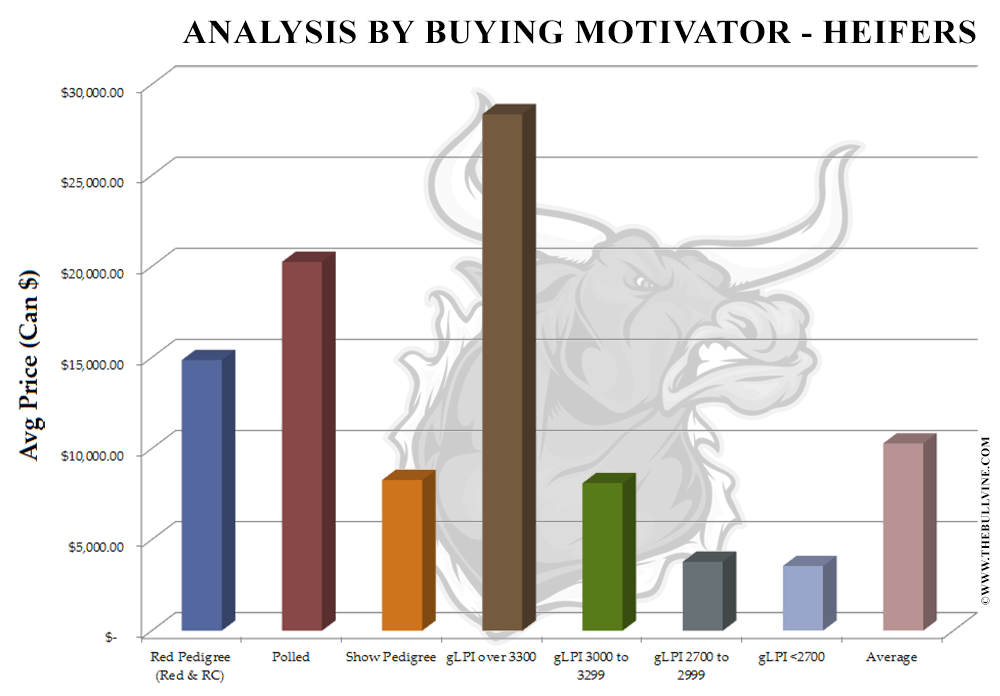

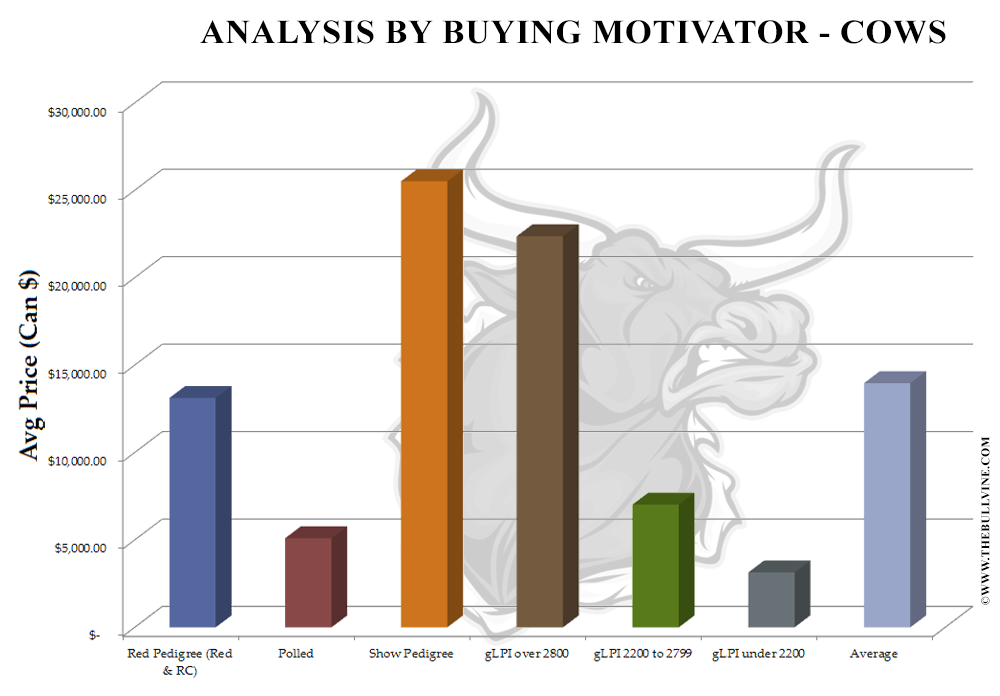

“This cow is being stolen!” cries out Horace Backus, from the auctioneer’s box at the US National Convention sale. ‘A beautiful Jasper daughter with such a magnificent pedigree gets such a low offer – that is pure robbery!” adds Backus. Pounding his fists onto the podium, Backus has a point, since they are getting less than $5,000 for a very productive cow and moments earlier a very young calf sired by a genomic young sire sold for over $20,000. Here you have an animal already proving her profitability versus a calf that has nothing more to show for herself then a simple little test? I ask you ”Does the marketplace have it all wrong?”

“This cow is being stolen!” cries out Horace Backus, from the auctioneer’s box at the US National Convention sale. ‘A beautiful Jasper daughter with such a magnificent pedigree gets such a low offer – that is pure robbery!” adds Backus. Pounding his fists onto the podium, Backus has a point, since they are getting less than $5,000 for a very productive cow and moments earlier a very young calf sired by a genomic young sire sold for over $20,000. Here you have an animal already proving her profitability versus a calf that has nothing more to show for herself then a simple little test? I ask you ”Does the marketplace have it all wrong?”