There is no question that the introduction of genomics to the dairy cattle industry has greatly accelerated the rate of genetic advancement (Read – The Genomic Advancement Rate – The Battle for Genetic Supremacy) and could kill the seed stock industry as we know it. Read on.

The Introduction

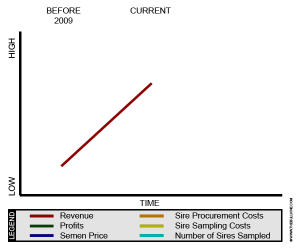

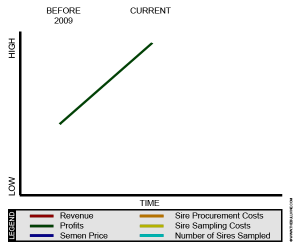

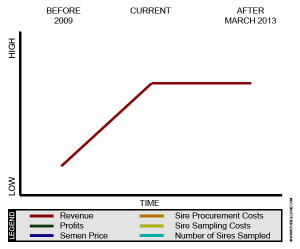

When artificial insemination companies first started using genomics to help identify which bulls had the genetics to excel and which bulls didn’t, it had the following effects

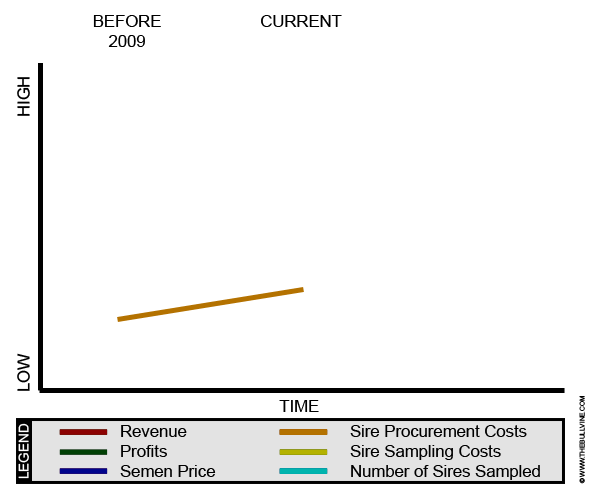

The cost of procurement went up slightly since their are capped leases and actually less risk. Some bulls where still purchased outright |

|

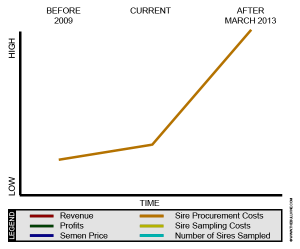

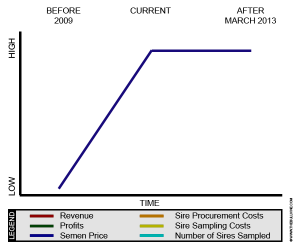

What will happen in March 2013

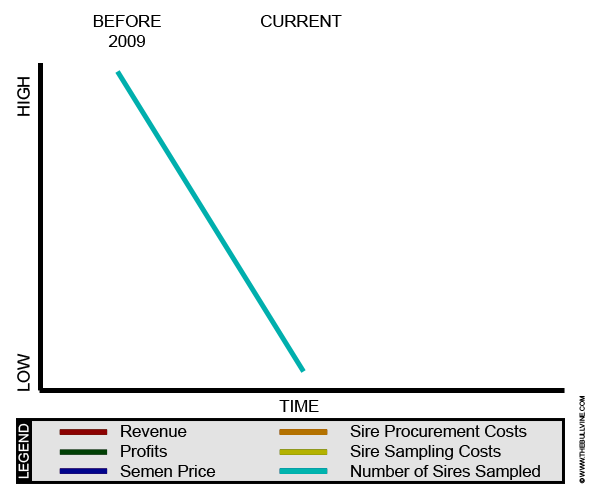

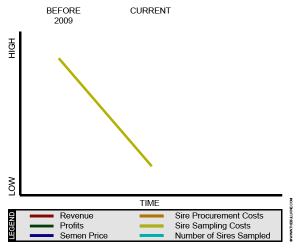

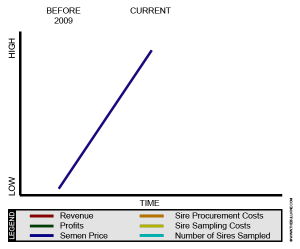

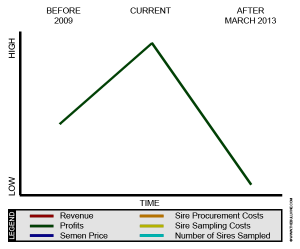

As of March 2013, breeders will have the ability to test their own bulls before negotiating the deal with the A.I. company, resulting in a much greater negotiating position for bull breeders. The estimated effects are as follows:

How Will A.I. Companies React?

There are not substantial enough profit margins in the A.I. industry to support such a change in profitability. As a result, A.I. companies will be forced to do the following:

- Increase semen price

Since they now have greater expenses, A.I. companies will be forced to increase price. As demonstrated in many other industries, the market will not respond favourably to this and ultimately will drive prices back down.

END RESULT: No change - Cap contracts

So if A.I. companies cannot increase revenues they will have to try and cut their costs. The procurement of sires will become the major expense they will look to control. One way to do this will be to cap bull contracts. However, as the NHL has shown us, even if they could introduce a cap, some members will break that rule and other breeders will not stand for it.

END RESULT: No change - Produce their own product line

If A.I. companies cannot buy the bulls at a cheaper price, then they will have to go and buy females and produce their own product. This will lead to cheaper acquisition costs. A.I. companies can now buy the females for $50,000 to $250,000 and only need to have that female produce one son. That will still be cheaper than leasing the sire on an open lease. This also allows them to have greater control of their bloodlines, accelerate their genetic advancement and develop their own distinctive product.

END RESULT: Cheaper product development costs and a distinctive product.

What does this mean to the average seed stock producer?

For the initial stage, when A.I. companies are buying into the female side, prices will rise. Once they have the base genetics, they will not need to buy any more and they will stop buying. (Read – Should A.I. Companies Own Females and Select Sires v.s. Semex – A Contrast In Cooperatives)

If you look at the current substantial increase in the prices of genomic heifers, you will notice that it is the current seed stock breeders who are buying and trying to get ahead. The money for this is not coming as much from the female side as it is from the current or future revenue potential from the semen lease deals. These people will be out of the market as more and more A.I. companies STOP leasing from these bull breeders because they are now producing their own genetics.

This will leave the seed stock breeder with a product or cattle that do not top the lists like they used to. Also, now the A.I. companies will not release their new high genomic sires until they have mated them on all their own females first. This will give A.I. companies a substantial advantage in generating list toppers. Bull breeders, on the other hand, will not have the lease deals that they currently enjoy, so they will not have any revenues from the sale of high index animals.

I believe that the show market will survive, since they are not as dependent on genetic advancement alone since they use a combination of genetics, management and chance. This is something I will explain further in a future article.

The Bullvine Bottom Line

The introduction of genomics first started off by generating greater profits for A.I. companies. Currently it is contributing to greater sales for seed stock producers. Ultimately it will lead to decreasing profits for A.I. companies and they will seek to regain control. The only way to do that will be to control product development —-it will either be do that or go broke. This will lead to the industry becoming dominated by whatever players are able to build the largest self-contained genetic pool and advance their genetics ahead of everyone else’s.

What can the average seed stock producer do? (Watch for the answer in a future article.)

Not sure what all this hype about genomics is all about?

Want to learn what it is and what it means to your breeding program?

A great example is the swine industry. Breeders produce show barrows. Maybe the dairy industry needs to look at the beef industry, they do an excellent job of retaining value for genetics

I’m interested to know whether you believe that we will see the seed-stock breeder base widen. I believe that AB companies have forged their relationships with a pretty narrow base. Genomics has meant that we can access some fairly good predictive data which might show that animals from some unlikely sources carries superior genetics to those likely suspects at the so-called elite farms. Personally, I can’t see that AB companies and their friends will relinquish their stranglehold on what we are led to believe is the best. Genomics should mean that, in time, every animal is DNA tested as a part of the registration process and the desired genetics selected accordingly, regardless of breeder/owner. Scientific selection, not preferred partners. Won’t happen, will it!

I truly find this as bad news, at least for dairy farmers outside the United States and Canada. For one, here in Colombia we can’t sample cows or bulls for genomics, and if your prediction becomes a reality, then it would mean that we would have to rely on the bulls bred by the AI companies, and not have the same access as before, to great bulls bred on farms like Regancrest or Comestar. Grave care we must take.