While you track milk prices, smart dairies bank $400+ per cow from carbon credits. Here’s the enrollment window closing fast.

Here’s a statistic that should wake up every dairy operator: anaerobic digestion systems are generating up to $450 per cow annually in carbon revenue, with documented cases showing realistic annual revenue figures in the range of $400 to $450 per cow for high-value projects producing Renewable Natural Gas (RNG). That’s equivalent to $1.50 per hundredweight in additional income, and it’s happening right now while most producers focus solely on traditional revenue streams.

The problem? Most dairy operations are missing this opportunity because they assume carbon credits are too complex, too risky, or “not for farms like theirs.” The bigger problem? With carbon credit markets experiencing a documented “flight to quality” favoring permanent, verifiable reductions over questionable soil claims, early adopters are locking in the most favorable terms before capacity limits are reached.

Here’s what the industry doesn’t want you to know: Three legitimate programs are currently accepting new enrollments, government funding covers up to 85% of implementation costs through programs like OFCAF, and documented case studies prove this isn’t theoretical—it’s transforming dairy economics across North America.

Challenging the “Environmental Compliance as Cost Burden” Myth

Let’s confront one of the dairy industry’s most expensive misconceptions: that environmental initiatives are purely cost centers that drain profitability without generating returns. This conventional wisdom isn’t just wrong—it’s costing you six figures annually.

The Evidence Against Conventional Thinking:

The comprehensive analysis reveals that capital-intensive methane abatement technologies, particularly anaerobic digesters producing RNG, represent a high-reward pathway with documented earnings reaching $400-$450 per cow annually, driven by high-value compliance markets like California’s Low Carbon Fuel Standard. One documented case study of a large 5,500-cow Western U.S. dairy reported generating $1.4 million in annual carbon credit revenue after expenses, equating to roughly $255 per cow—revenue that exceeded the farm’s profit from milk production in a good year.

Why the Old Mindset Persists:

The dairy industry’s resistance stems from decades of viewing environmental programs through a regulatory compliance lens. But here’s where conventional wisdom fails catastrophically: carbon markets represent a fundamental shift from regulatory compliance to market-based incentives. Instead of paying penalties for emissions, farms now get paid for reductions.

The New Reality Creating Millionaires:

Research shows that feed additive programs alone have generated substantial returns. Across three carbon projects initiated in 2021 and 2022, U.S. dairy farmers using the feed additive Agolin Ruminant received nearly $3 million in carbon-asset payments. The profitability hinges on carbon credit prices being high enough to offset the daily cost of the additive, estimated at $0.15 to $0.30 per cow per day.

The Three-Tier Carbon Revenue Strategy (Verified by Real Farm Data)

| Technology/Practice | Farm Size (Cows) | Capital Cost Range | Annual Revenue per Cow (Low) | Annual Revenue per Cow (High) | Implementation Timeline | Government Support Available |

| Anaerobic Digester + RNG (Large) | 2,500+ | $5M – $10M+ | 400 | 450 | 18-36 months | Yes (ACT, OFCAF) |

| Anaerobic Digester + RNG (Medium) | 1,000-2,500 | $2M – $5M | 250 | 350 | 12-24 months | Yes (ACT, OFCAF) |

| Feed Additive (Bovaer) | 300-1,000 | Minimal | 35 | 160 | 30 days | No |

| Feed Additive (Agolin) | 300-1,000 | Minimal | 35 | 100 | 30 days | No |

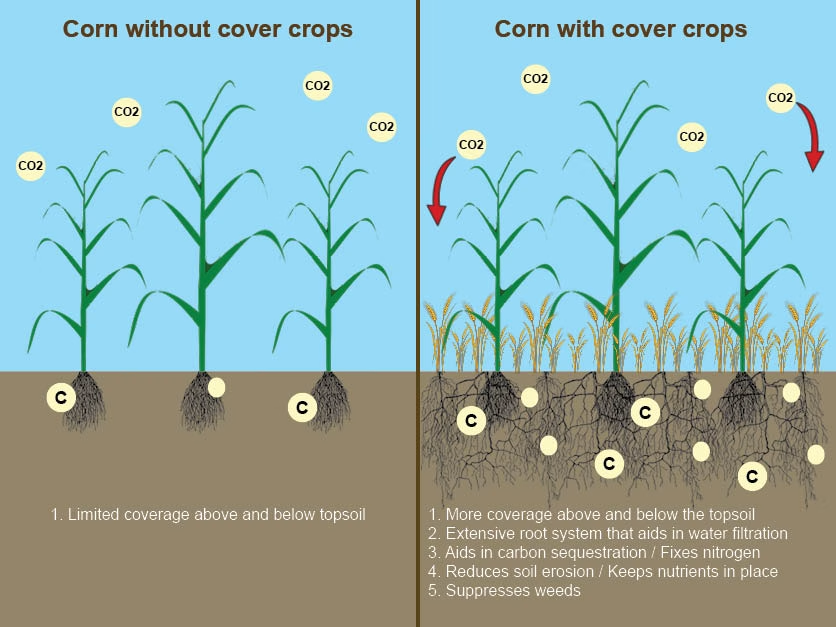

| Cover Cropping | <300 | Low | 2 | 10 | 1 season | Yes (OFCAF) |

| No-Till Farming | <300 | Low | 2 | 8 | 1 season | Yes (OFCAF) |

| Rotational Grazing | 100-500 | Low-Medium | 5 | 25 | 6 months | Yes (OFCAF) |

| Manure Management | 500+ | Medium | 15 | 40 | 6-12 months | Yes (OFCAF) |

Tier 1: The RNG Gold Rush (Large Operations)

For operations with 2,500+ cows, anaerobic digestion systems represent the “gold standard” technology for maximizing carbon revenue. The captured biogas can be used in two main ways: electricity generation for on-farm use or grid sale, or upgraded to pipeline-quality RNG for injection into natural gas grids as low-carbon transportation fuel.

The Financial Reality: With capital costs running from $3 million to over $10 million, this opportunity is largely accessible only to the largest dairy operations or those able to secure significant grant funding. However, the returns justify the investment—documented payback periods range from 3 to 7 years under favorable market conditions.

Tier 2: The Feed Additive Sweet Spot (Medium Operations)

Feed additives that reduce enteric methane represent a rapidly developing area with significant potential. Specific, scientifically validated feed additives can be incorporated into a cow’s diet to inhibit the microbes that produce methane.

Proven Technologies:

- Agolin Ruminant: This proprietary blend of essential oils has been certified by The Carbon Trust for methane reduction and is the foundation for carbon inset projects that have resulted in nearly $3 million in payments to U.S. dairy farmers

- 3-Nitrooxypropanol (3-NOP/Bovaer): Scientifically shown to consistently reduce enteric methane emissions in dairy cattle

The Implementation Reality: The first verified transaction through Athian’s livestock carbon insetting marketplace involved Texas dairy farmer Jasper DeVos generating nearly 1,150 metric tons of CO2e reduction, which was purchased by Dairy Farmers of America.

Tier 3: The Soil Carbon Foundation (Small Operations)

For smaller operations, soil carbon sequestration through cover cropping, reduced tillage, and rotational grazing offers an entry point, though returns are more modest. An example from Alberta’s Conservation Cropping Protocol showed net returns to farmers of just $0.87 to $1.73 per acre after aggregator fees. A 2013 study found most participating Alberta farmers earned between $1,000 and $5,000 total from their contracts, representing only about 1% of average gross farm income.

Here’s What Dairy Cooperatives Don’t Want You to Discover About Carbon Revenue

| Program/Platform | Revenue Share to Farmer | Verification Standard | Track Record | Key Partners | Red Flags |

| Athian (Livestock Carbon) | 75% | Third-party verified | Documented DFA purchase | DFA, Elanco, Newtrient | None identified |

| Concord Agriculture Partners | 85% | Third-party verified | $3M paid to farmers | Alltech, Agolin | None identified |

| Carbon by Indigo | 75% | Climate Action Reserve | $30/credit in 2022 | Major food companies | None identified |

| Farmers Edge (Warning) | Variable/Unclear | Unclear process | Multiple complaints | Unknown | Payment delays, high fees |

| Unnamed Aggregators (Red Flag) | 50% or less | No verification | No documented payments | Unknown | No transparency, high upfront costs |

The Insetting Revolution That Changes Everything:

The most significant development transforming carbon markets is the rise of “insetting”—where credits are purchased by companies within the dairy value chain rather than unrelated buyers. This creates more stable, predictable demand because dairy processors need these credits to meet their own supply chain (Scope 3) emissions targets.

Programs Worth Your Time (With Verified Track Records):

Athian – The Dairy Industry’s Insider Secret

- Revenue Split: 75% to farmer, 25% to platform

- Key Partners: Dairy Farmers of America, Elanco Animal Health, Newtrient

- Why It Works: Keeps value within the animal agriculture value chain, creating built-in demand from dairy processors

Concord Agriculture Partners – The Feed Additive Specialist

- Revenue Split: Industry-leading 85% to farmer, 15% to platform

- Focus: Enteric methane reduction using Agolin Ruminant feed additive

- Track Record: Part of projects that have delivered nearly $3 million to U.S. dairy farmers

Carbon by Indigo – The Soil Carbon Leader

- Revenue Split: 75% to farmer, 25% to platform

- Registry: Climate Action Reserve (CAR) for high credibility

- Performance: Paid $30 per credit in 2022, higher than initially projected $20

Government Funding: Your Secret Weapon for Million-Dollar Projects

| Support Type | Funding Level | Maximum Amount | Eligible Technologies | Application Status |

| OFCAF Cost-Share | 65-85% of costs | $75,000 CAD | Cover crops, rotational grazing, nitrogen management | Ongoing intakes |

| ACT Program Funding | 50% of costs | $2M CAD | Anaerobic digesters, clean technology | Ongoing |

| USDA REAP Grants | 25-75% of costs | $1M USD | Renewable energy systems, digesters | Ongoing |

| LCFS Credit Multiplier | 28x CO2 value | No limit | RNG production, dairy methane capture | Automatic for qualified projects |

| Investment Tax Credits | 30-50% of investment | No limit | Anaerobic digesters, renewable energy | Available |

Federal Support That Changes the Math:

On-Farm Climate Action Fund (OFCAF): This $200 million fund provides direct cost-share funding for beneficial management practices. The Ontario program offers 65% cost-share, with a specialized stream for organic farms offering up to 85% of eligible costs, maximum $75,000 per operation.

Agricultural Clean Technology (ACT) Program: Targeted at larger-scale projects, providing non-repayable contributions of up to 50% of project costs, maximum $2 million—critical funding for anaerobic digester investments.

Provincial Opportunities:

- Alberta: Operating under TIER regulation, the most mature provincial system with government-approved protocols for agricultural offset projects

- Quebec: Cap-and-Trade system linked with California’s allows specific agricultural offset protocols including methane mitigation through slurry pit covering and biomethanization

Why Major Dairy Associations Haven’t Promoted These Opportunities Aggressively

The Market Transformation Creating Six-Figure Opportunities:

The carbon market is experiencing a documented “flight to quality,” where demand shifts toward credits representing real, verifiable, and permanent GHG reductions. This trend strongly favors credits from direct methane abatement technologies like anaerobic digesters over less certain soil carbon sequestration.

Compliance Markets vs. Voluntary Markets:

Compliance market prices are generally higher and more predictable, tied to government-mandated schedules. Voluntary market prices can fluctuate significantly, but the insetting model addresses volatility by creating stable demand within the dairy value chain.

Calculate Your Operation’s Carbon Earning Potential

Realistic Financial Projections by Farm Size:

| Farm Size (Cows) | Technology/Practice | Est. Capital Cost | Est. Annual Revenue/Cow | Net Revenue/Cow (Post-Fees) |

| 2,500+ | Anaerobic Digester + RNG | $5M – $10M+ | $400 – $450 | $150 – $250+ |

| 300-1,000 | Feed Additive (Agolin) | Minimal | $35 – $160 | $0 – $100+ |

| <300 | Cover Cropping/No-Till | Low | $2 – $10/acre | $0 – $5/acre |

Source: Smart Prosperity Institute comprehensive analysis

Critical Cost Considerations:

- Measurement, Reporting, Verification (MRV): $10,000 to $20,000 per individual farm project

- Aggregator Fees: Range from 15% to 50%, with transparent programs like Athian stating 75%/25% split

- Transaction Costs: Often underestimated but essential for program integrity

Programs to Avoid: The $100,000 Mistake

The Farmers Edge Cautionary Tale:

Multiple farmers in Manitoba and Saskatchewan report being misled by programs bundling expensive services with vague carbon revenue promises, receiving invoices for tens of thousands—in one case over $100,000—while receiving no carbon payments. In documented instances, farmers were told companies would not sell generated credits “due to current values,” highlighting the risk when aggregators control timing of credit sales.

Red Flags to Identify:

- Programs bundling expensive services with non-guaranteed carbon revenue

- Unclear payment timelines or aggregator-controlled credit sales

- Revenue projections not backed by existing program performance

Your Strategic Enrollment Framework

The Due Diligence Protocol That Prevents Six-Figure Losses:

Before signing any carbon market contract, secure clarity on critical contractual clauses that can have profound, long-term implications:

Essential Questions for Program Evaluation:

- What is the exact revenue-sharing model and are there hidden fees?

- What is the process and timeline for payment after credits are generated?

- Who covers third-party verification costs?

- What are contract length and early termination penalties?

- Who owns the farm data and how will it be protected?

Critical Contract Clauses:

Additionality Requirements: Practices must be “additional” to business-as-usual, often rendering progressive farmers who have practiced conservation for years ineligible—a perverse incentive that penalizes early adopters.

Permanence Obligations: Contractual requirements to maintain specific practices for 10-20 years or more, creating long-term encumbrances that can complicate farm succession planning.

Reversal Liability: Risk that sequestered carbon could be released back into the atmosphere, with reputable programs managing this through buffer pools—for example, Indigo holds back up to 20% of credits for this purpose.

The Bottom Line: Why Smart Operators Are Moving Now

While dairy operators nationwide focus on volatile milk prices and rising costs, comprehensive analysis shows progressive farms are building substantial revenue streams through carbon credit programs. The earning potential is verified through documented case studies: realistic annual revenue of $400-$450 per cow for anaerobic digestion systems, nearly $3 million paid to farmers through feed additive programs, and significant government support covering up to 85% of implementation costs.

Three critical takeaways backed by verified research: First, program quality varies dramatically—legitimate platforms like Athian offer transparent 75% farmer revenue shares with documented transactions, while others have left producers with unpaid bills exceeding $100,000. Second, government funding through ACT and OFCAF programs provides essential cost-share support that research confirms as critical for project viability. Third, timing matters more than perfection—the documented “flight to quality” in carbon markets favors early adopters of permanent, verifiable reduction technologies.

The research is clear: The carbon credit opportunity is “sharply bifurcated” between high-reward, capital-intensive projects accessible to large operations and more modest returns for smaller farms. However, the comprehensive analysis recommends that producers prioritize practices delivering tangible on-farm co-benefits—improved soil health, operational efficiency, reduced input costs—as the primary return on investment, with carbon credits viewed as a potential bonus, not a guaranteed foundation.

Your immediate action step: This week, assess your eligibility for government cost-share programs and identify which carbon credit pathway aligns with your operation’s scale and risk tolerance. Whether you’re considering a multi-million dollar digester with documented 48% gross margins or a feed additive program with proven methane reduction, understanding available support is your first step toward joining the documented ranks of farms already banking substantial carbon revenues.

The carbon credit revolution is transforming dairy economics—but only for operations that act while opportunities remain open. The question isn’t whether environmental programs will become part of dairy economics, but whether you’ll position your operation to profit from this transition or watch others capture the first-mover advantages that are creating six-figure revenue streams right now.

KEY TAKEAWAYS

- Transform Environmental Compliance into Profit Centers: Large operations (1,000+ cows) can achieve $400-$450 annual revenue per cow through anaerobic digestion systems producing RNG for California’s Low Carbon Fuel Standard, with documented payback periods of 3-7 years when leveraging government cost-share funding up to $2 million through Canada’s ACT Program.

- Feed Efficiency Meets Carbon Revenue: Medium-scale dairies (300-1,000 cows) using scientifically validated feed additives like Agolin Ruminant can generate $35-$160 per cow annually with minimal capital investment, while the additive costs just $0.15-$0.30 per cow daily—creating positive cash flow within 30 days of enrollment in legitimate programs offering 75-85% farmer revenue shares.

- Government Funding Changes the ROI Equation: Smart operators are stacking OFCAF’s 65-85% cost-share funding (maximum $75,000 per farm) with carbon credit programs to de-risk investments, positioning beneficial management practices like cover cropping and enhanced manure management as profit centers rather than compliance costs.

- Insetting Revolution Creates Stable Demand: The first verified transaction through Athian’s livestock carbon marketplace—where Texas dairy farmer Jasper DeVos sold 1,150 metric tons of CO2e credits directly to Dairy Farmers of America—signals the shift toward value-chain integration that provides more predictable pricing than volatile voluntary offset markets.

- Warning: Program Quality Varies Dramatically: While legitimate platforms like Athian (75% farmer share) and Concord Agriculture Partners (85% farmer share) offer transparent terms with documented payouts, multiple Manitoba and Saskatchewan farmers report losses exceeding $100,000 from programs bundling expensive services with unfulfilled carbon revenue promises—making due diligence absolutely critical before signing long-term contracts.

EXECUTIVE SUMMARY

The dairy industry’s biggest lie? That environmental programs drain profits instead of generating them. Comprehensive analysis reveals anaerobic digestion systems are generating realistic annual revenue of $400-$450 per cow through Renewable Natural Gas production, with one documented 5,500-cow Western operation reporting $1.4 million in annual carbon revenue—exceeding their milk profits in strong market years. Feed additive programs have already delivered $3 million to U.S. dairy farmers across just three projects using scientifically validated methane-reducing supplements, while government cost-share funding through Canada’s OFCAF program covers up to 85% of implementation costs with $75,000 maximum per operation. The market is experiencing a documented “flight to quality” favoring permanent methane destruction over questionable soil carbon claims, creating premium pricing for dairy-specific technologies just as processors like Dairy Farmers of America begin purchasing credits directly from their supplier farms. Three legitimate programs are accepting enrollments now, but compliance market capacity limits and tightening qualification requirements mean early adopters are securing advantages that late entrants won’t access. Evaluate your operation’s carbon earning potential immediately—the window for optimal positioning closes as programs reach capacity and competition intensifies.

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More:

- How Canadian Dairy Farmers Can Cash In on Carbon Markets – Reveals the step-by-step certification process and documentation requirements for entering carbon markets, including specific platforms and verification standards that turn sustainable practices into verified revenue streams.

- How Smart Dairy Operators Are Turning Cow Burps into Cold Hard Cash – Demonstrates how DFA’s $22.8 million USDA investment creates immediate opportunities for methane reduction technologies, with practical guidance on feed additive implementation across different management systems.

- The Carbon Credit Goldmine: How Forward-Thinking Dairy Producers Are Turning Methane Reduction into Cash Flow – Provides farm-size-specific implementation roadmaps and reveals why data management capabilities determine which operations will successfully capitalize on carbon opportunities while others struggle with verification requirements.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!