Does thinking bigger always mean better profits in dairy? The numbers say otherwise, and it’s shaking up everything.

Here’s what’s really happening: The dairy industry isn’t just consolidating—it’s splitting into two completely different businesses. Mid-sized farms with the right tech stack are finding ways to compete that have nothing to do with herd size. And the economics are proving that smarter, not bigger, is becoming the key to long-term profitability.

You know what I keep hearing at every farm meeting from here to Wisconsin? Guys running 400 to 600 cows are asking if they should just throw in the towel. They see these mega-dairies popping up like grain elevators across the countryside and figure their number’s up.

But here’s what’s got me scratching my head—some of the sharpest operators I know, the ones milking that sweet spot of 400 to 600 cows, they’re not just hanging on. They’re actually expanding while their bigger neighbors are sweating debt payments and wondering how they’re gonna make the next loan payment.

Something’s shifting in this business, and it’s not what most folks think.

The Numbers Don’t Lie—But They Don’t Tell the Whole Story

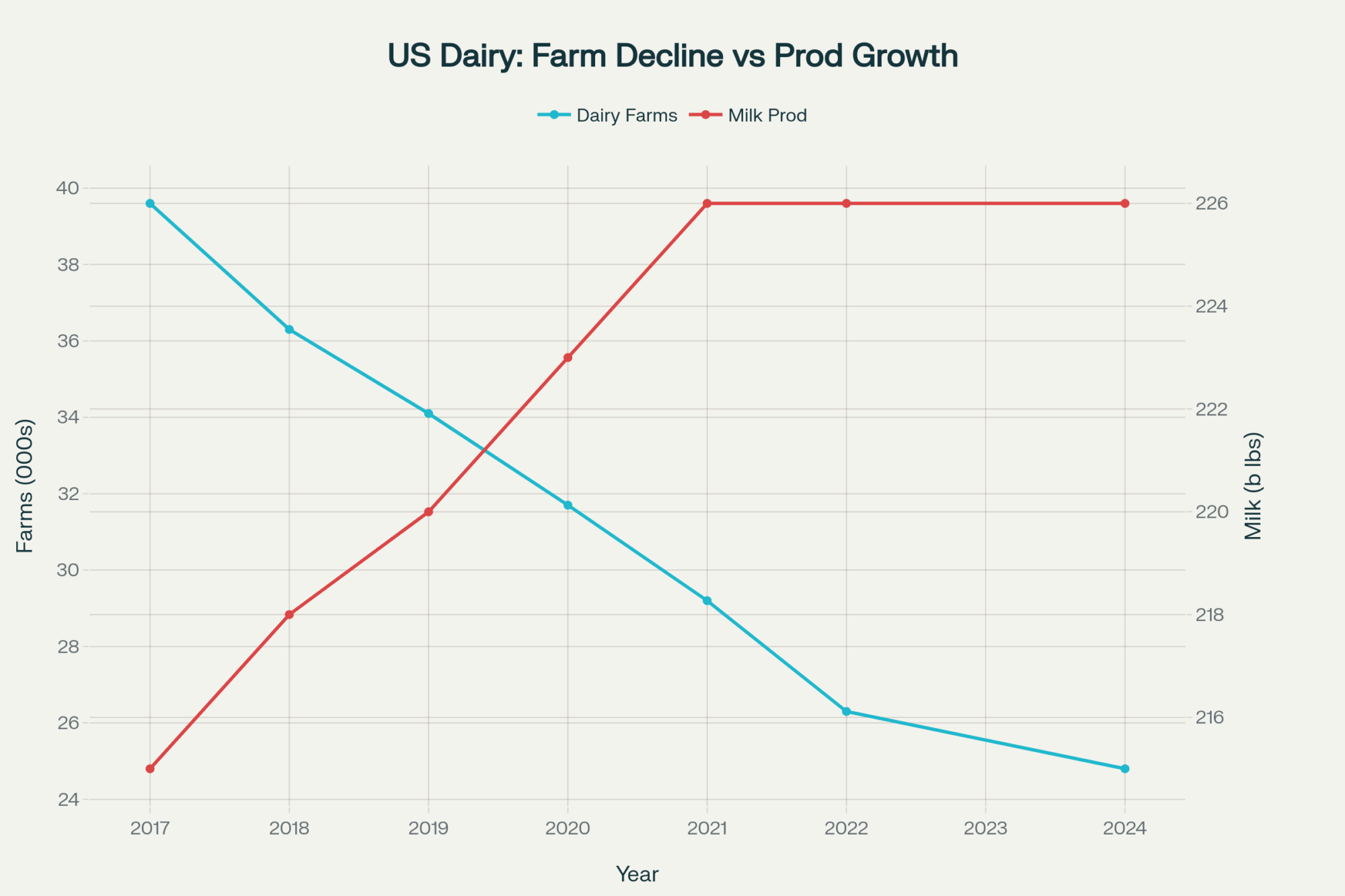

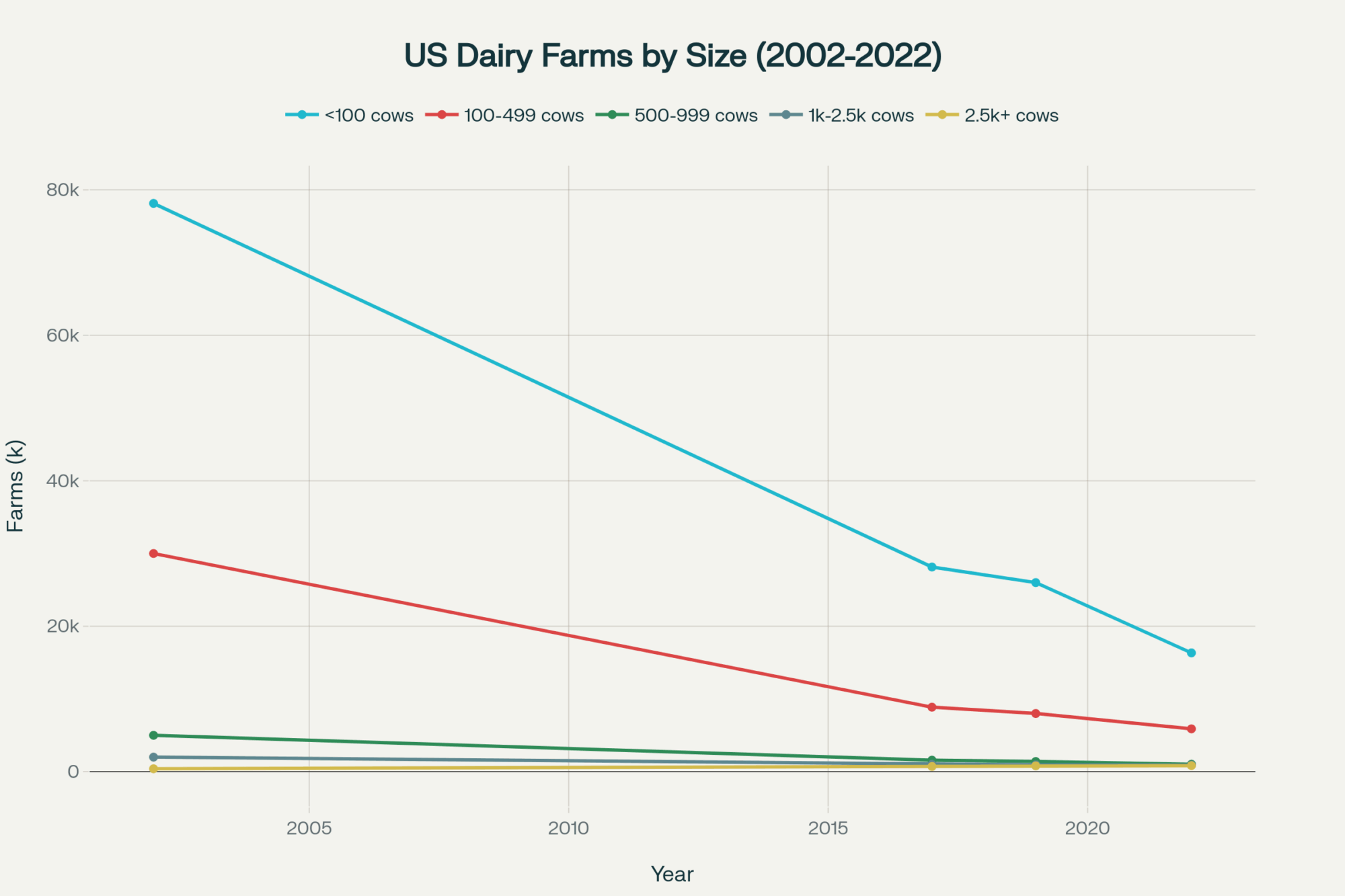

Let me throw some data at you that’ll make you sit up straighter than a fresh heifer at her first milking. Between 2017 and 2022, we lost nearly 40% of our dairy farms—dropping from about 39,600 operations to just 24,000 according to the latest USDA Census. That’s not consolidation, that’s a stampede for the exits.

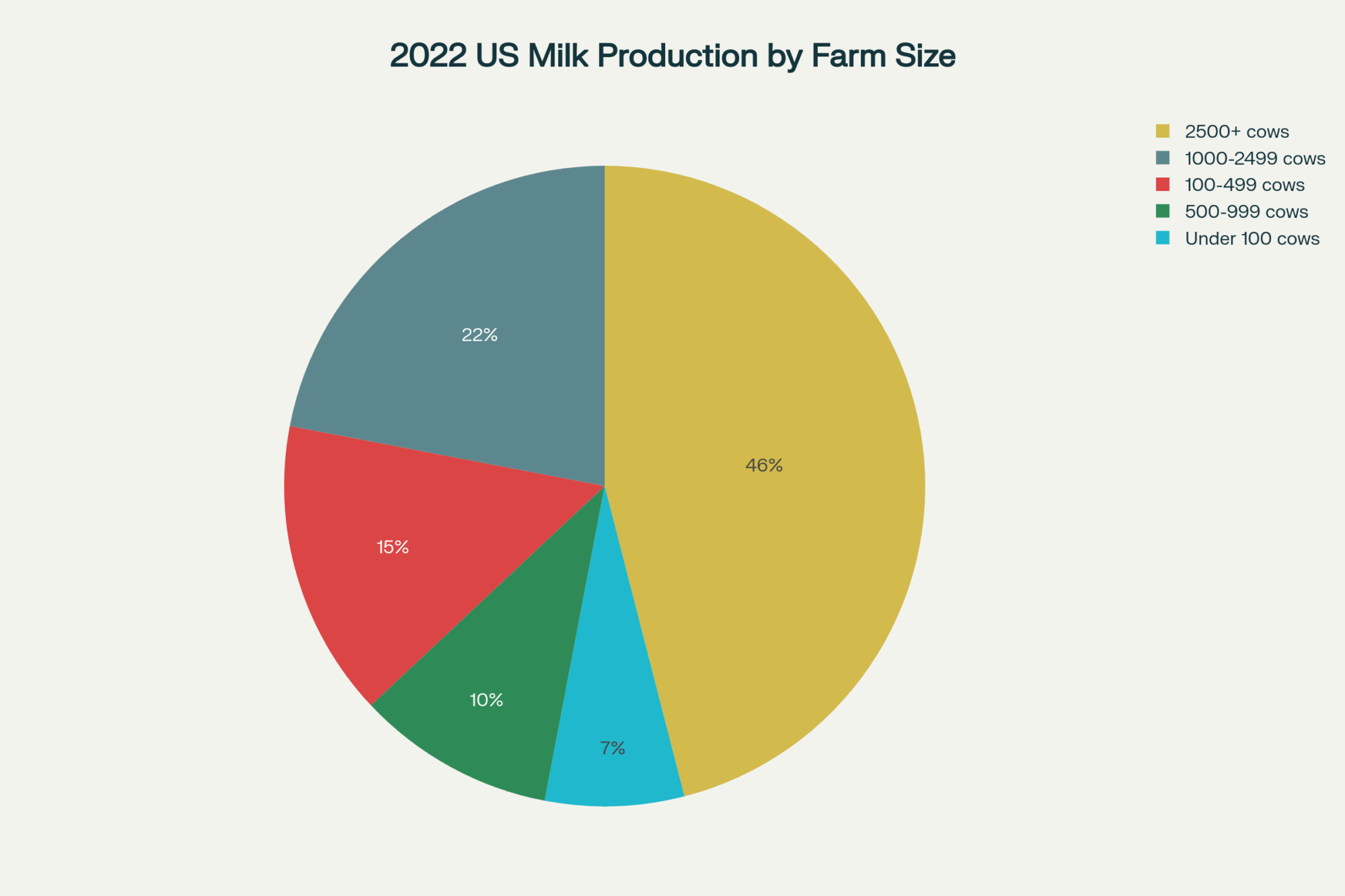

But here’s the kicker everyone’s missing: while all these farms disappeared, milk production actually climbed 5%. How’s that work? Those mega-dairies with 2,500+ cows grew by 16.8% and now control 46% of all U.S. milk production.

Meanwhile, small farms under 100 cows—the ones we used to call the backbone of dairy—they’re down to producing just 7% of the nation’s milk. The middle is getting squeezed tighter than a Jersey’s teats in January.

What keeps me thinking, though: if bigger was always better, why are some of those mid-sized operations I know posting better margins than operations twice their size?

The Real Cost of Going Big—And Why It’s Scarier Than You Think

Now, don’t get me wrong—the big operations do have advantages. They get better deals on feed, which still eats up about 60% of what we spend, according to the latest ERS data. And with labor costs hitting $53 billion industry-wide, every efficiency matters.

But here’s where the math gets ugly fast. With milk prices bouncing around $21 to $23 per hundredweight, margins are thinner than skim milk. One hiccup—market drop, feed spike, labor shortage—and suddenly you’re looking at red ink that could drown a Holstein.

As producers often describe the challenge, expansion can feel like hooking a boat anchor to your tractor—sure, you’re moving, but good luck stopping when conditions change. The real cost isn’t just the upfront capital. We’re talking multi-million-dollar investments with 7-10 year payback periods, assuming everything goes perfectly. And when’s the last time everything went perfectly in dairy?

The Tech Revolution That’s Changing Everything

Here’s where things get interesting, and I mean really interesting. Robotic milking isn’t just for the deep-pocket operations anymore. Approximately 5% of U.S. dairies currently utilize robots, with adoption rates even higher in Canada. These systems cut hands-on milking labor by 30-40%—and that’s not just convenience, that’s a game-changer for family operations.

I was talking to a producer from central Wisconsin at a field day last summer. He told me, “When that storm knocked out power at 2 a.m. twice last week, I didn’t lose sleep worrying about milking. My robots picked up right where they left off when the lights came back on.”

Cloud-based management platforms like Ever.Ag are helping farms save on transport costs and cut administrative time significantly. Now, company-provided data should always be taken with a grain of salt, but reports from the field suggest the efficiency gains are real.

Real Numbers from Real Farms

Consider this common scenario based on figures from farm financial consultants:

Case Study: 420-Cow Wisconsin Operation

- Pre-technology: $18.50/cwt cost of production

- Post-technology (robotics + precision feeding): $16.80/cwt cost of production

- Annual savings: $95,000

- Technology investment: $180,000

- Payback: ~22 months

Compare that to their neighbor, who expanded from 300 to 800 cows:

- Capital investment: $1.8 million

- Current debt service: $22,000/month

- Breakeven milk price: $19.20/cwt (versus market average $21.50)

- Financial stress level: Through the barn roof

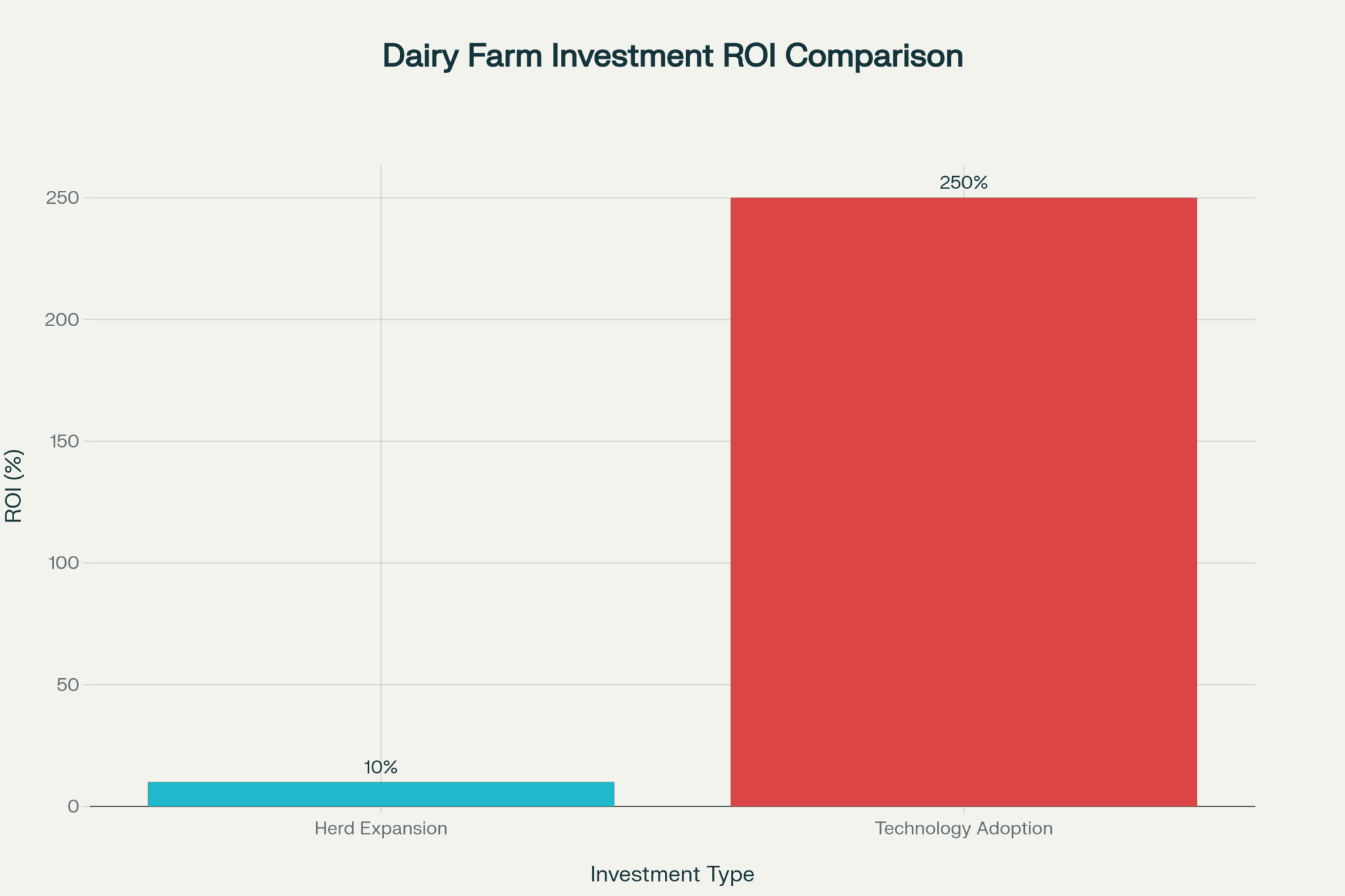

The smart money appears to be going toward making existing operations more efficient rather than simply expanding them.

Butterfat, Protein, and the Premium Game

Here’s something that’s caught my attention at the milk plant lately. Component levels are creeping up—protein’s averaging 3.32% nationally, butterfat’s hitting 4.23%. That matters because specialty processors and cheese makers pay premiums for those higher numbers.

Take this past spring in the Upper Midwest. We had three straight weeks of sideways rain that turned every field road into a mud wrestling match. The operations I know that were nimble enough to adjust rations daily—tweaking for muddy conditions, stressed cows, delayed feed deliveries—they maintained production while some of the bigger operations with rigid feeding protocols struggled to adapt.

That agility advantage? It’s real, and it’s valuable.

Learning From Our Neighbors Up North and Across the Pond

What’s happening in Europe is worth watching. European dairies, faced with higher costs and tighter regulations, have been shifting away from competing on volume to focusing on specialty products—artisanal cheeses, premium butter, value-added products.

This has led to significant price premiums for specialty dairy products, with some reports indicating increases of over 15% in recent years. They’ve figured out that winning on dollars per gallon beats winning on gallons produced.

Industry consultants working with Quebec dairies often observe that the farms thriving aren’t the ones producing the most milk. They’re the ones producing the most valuable milk.

The Authenticity Advantage—Why Scale Can’t Buy Trust

Here’s where things get really interesting from a marketing perspective. Big processors are stuck with computer systems that can track millions of gallons but can’t tell you which farm your morning milk came from. These legacy ERP systems—some installed when dial-up internet was cutting-edge—are built for bulk, not stories.

But consumers increasingly want to know their food’s story. That creates opportunities that no scale in the world can buy.

Take Sheldon Creek Dairy up in Ontario—65 homebred Holsteins, on-farm processing, A2 milk that commands premium prices. They’re not competing on volume; they’re competing on trust. Their customers drive past three grocery stores to buy their milk because they know the den Haan family and trust their methods.

That’s an asset you can’t acquire or synthesize, no matter how many thousands of cows you’re milking.

Regulations: The Small Farm’s Secret Weapon

Canadian dairy farmers are dealing with stricter animal welfare standards through the proAction program. Here’s what’s interesting—smaller operations are adapting faster. Installing group housing for calves or providing outdoor access is operationally simpler on a 150-cow farm than across a 10,000-cow operation spread over multiple counties.

And those welfare improvements aren’t just compliance costs anymore. They’re marketing differentiators. Farms that can credibly demonstrate high animal welfare standards are translating regulatory compliance into premium pricing.

The Agility Advantage Across Seasons:

- Winter: Smaller facilities are easier to heat, monitor, and maintain when it’s 20 below

- Spring: Flexible feed sourcing adapts to weather delays and flooded fields

- Summer: Individual cow monitoring prevents heat stress losses when it hits 95 degrees

- Fall: Rapid herd management decisions for breeding season

The labor shortage isn’t going away either. Immigration policy changes, demographic shifts, competing industries—they’re all making dairy labor more expensive and harder to find. But technology is changing the labor equation in ways that favor smaller operations.

A well-designed robot system lets a family operation manage 150-200 cows with the same labor that used to handle 80-100 cows. That’s not just efficiency—that’s survival when you can’t find reliable help.

2030: Two Different Games, Two Different Winners

Based on what I’m seeing and recent industry analysis, by 2030, we’ll have two completely different dairy businesses:

The Volume Engine: Mega-dairies grinding out commodities, fighting for cents per hundredweight, competing globally on efficiency and scale. Success is measured in pennies, and survival is dependent on massive scale.

The Value Network: Smaller, tech-savvy operations building brands, commanding premium prices, focusing on customer relationships and product differentiation. Success is measured in dollars per gallon, not gallons produced.

My analysis suggests that value-focused operations could capture up to 30% of industry profits, even while producing significantly less milk volume, based on emerging trends in the premium market. It’s not about the size of the pie slice—it’s about which pie you’re eating from.

So What’s Your Move?

Here’s what it comes down to, and I want you to really think about this: Are you competing in the right game?

If you’re trying to win on volume against operations with 10 times your cow numbers, that’s like bringing a butter knife to a gun fight. But if you’re competing on efficiency, quality, customer relationships, and operational agility… now we’re talking about a different conversation entirely.

Some questions worth pondering over your next cup of coffee:

- What’s your actual cost per hundredweight, including your time and sanity?

- Could technology solve your three biggest operational headaches?

- Do you have customers who would pay more for your milk if they knew its story?

- What would your operation look like if you optimized for profit per cow instead of total cows?

The Bottom Line

What I’ve learned from talking to producers from here to California is this: the industry isn’t just consolidating—it’s evolving into two different businesses with different rules, different customers, and different definitions of success.

Mega-dairies will continue to dominate commodity markets. That’s their strength, and they’re damn good at it. But that doesn’t mean there isn’t room for well-run, technologically sophisticated, customer-focused operations at smaller scales.

The key is being honest about which game you’re playing and having the tools to win at it.

So next time you’re wondering whether your 500-cow operation can survive, maybe ask a different question: Can you thrive by being really, really good at what you do uniquely well?

Because from where I’m sitting, the answer might surprise you.

Look, I’ve been tracking this industry long enough to know when something real is shifting. The guys winning right now aren’t necessarily the biggest — they’re the smartest about where they put their money.

What’s your take on all this? Are you seeing similar trends in your neck of the woods? Drop us a line—this industry works better when we’re sharing insights instead of keeping them to ourselves.

KEY TAKEAWAYS:

- Robotic milking systems slash hands-on labor by 30-40% — letting family operations manage 150-200 cows with the same workforce that used to handle 80-100 cows. Start by calculating your current labor costs per cow and compare them against a 22-month tech payback.

- Cloud-based platforms like Ever.Ag cut operational costs 5-10% — automating everything from route optimization to producer payments. Sign up for demos this quarter while milk prices are stable around $21-23/cwt.

- Component optimization is your hidden goldmine — with protein averaging 3.32% and butterfat hitting 4.23% nationally, cheese plants are paying premiums for quality. Audit your current component levels and adjust feeding protocols immediately.

- Regulatory changes favor smaller, agile operations — new animal welfare standards are easier to implement on 150-cow farms than 10,000-cow operations, turning compliance costs into marketing advantages with premium buyers.

- Technology ROI beats expansion every time — while traditional expansion delivers 8-12% returns over 7-10 years, precision tech investments are hitting 200-300% ROI with paybacks under two years in 2025 market conditions.

EXECUTIVE SUMMARY:

Here’s what’s really happening out there — the old “get big or get out” playbook isn’t the only path to profitability anymore. Yeah, we’ve lost nearly 40% of dairy farms since 2017, but here’s the kicker: some sharp operators running 400-600 cows are posting better margins than operations twice their size. The secret? They’re investing in robotics and precision tech that cuts labor costs by 30-40% and trims production costs from .50 to .80 per hundredweight. Meanwhile, feed costs still account for 60% of expenses, and labor’s hit a $53 billion industry-wide. But instead of just scaling up, these smart farms are scaling smart — using cloud platforms and component optimization to grab premium prices. The industry’s splitting into two games: mega-dairies grinding out commodity volume, and tech-savvy operations capturing 30% of industry profits through value-added production. Bottom line? Your next investment should be in your barn’s brain, not just its size.

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More:

- The New Dairy Playbook: 5 Trends Redefining Profitability in 2025 – This article provides a tactical deep-dive into the five key market forces—from heifer scarcity to processor demands—shaping farm profitability. It offers immediate, actionable strategies for leveraging genomic gains and feed efficiency to boost your milk check now.

- 2025 Dairy Market Reality Check: Why Everything You Think You Know About This Year’s Outlook is Wrong – Go beyond herd management with this strategic analysis of the economic landscape. It breaks down how global trade, component values, and new processing investments are creating opportunities for producers who understand the big picture and can position their operation accordingly.

- AI and Precision Tech: What’s Actually Changing the Game for Dairy Farms in 2025? – Explore the future with this look at innovative technologies. The article demonstrates how AI health monitoring, virtual fencing, and advanced robotics are delivering tangible ROI, revealing methods for boosting yield and slashing costs through next-generation farm management.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!