$337M vanished from producer pools in 90 days, while cooperatives counted processing profits

EXECUTIVE SUMMARY: Here’s what we discovered: while cooperatives sold “technical modernization” to members, they orchestrated regulatory changes that transferred $337 million from producer pool values to processing advantages in just three months. Farm Bureau’s analysis reveals that make allowance increases of 26-60% across dairy commodities will slice 85-90 cents per hundredweight from milk prices—but here’s the kicker: cooperatives with processing operations capture these enhanced cost recovery mechanisms through their manufacturing divisions. Geographic warfare is surgical: California faces $94 million in annual losses, while the Mid-Atlantic regions gain $2.20/cwt through Class I differential increases, systematically advantaging politically connected fluid-milk territories over efficient manufacturing regions. December brings another redistribution wave as component assumptions jump to 3.3% protein, creating pool formulas that reward genetic and nutritional investments while penalizing volume-focused operations. This isn’t market evolution—it’s regulatory capture disguised as industry progress, and the data proves your cooperative helped design the very mechanisms now draining your milk checks.

Look, I’m gonna start with something that might sting a little.

Your cooperative just sold you out.

I know, I know… that’s harsh. But honestly? Sometimes the truth cuts deep, especially when it’s been buried under two years of “technical modernization” doublespeak and regulatory complexity designed—and I mean specifically designed—to hide what amounts to the largest wealth transfer from dairy producers to processors in modern history.

$337 million.

That’s how much money vanished from producer pool values between June 1st and August 31st this year. The American Farm Bureau Federation just released their quarterly analysis, and I’ve been poring over these numbers for weeks, trying to wrap my head around the scale of what just happened. Not because of feed costs going crazy. Not weather disasters. Hell, not even the usual corporate greed we’ve all grown accustomed to dealing with.

This is something way worse—systematic regulatory changes that, regardless of intent, redistributed massive wealth from the farm gate to processing margins.

While cooperatives were telling members about “updating outdated formulas” and “technical improvements”—you know, the same buzzwords they always use when major changes are coming—they were actually implementing reforms that drained $337 million from farmer milk checks to processor profit margins in just 90 days.

And here’s what really gets me: the National Milk Producers Federation—supposedly representing your interests as a farmer—spent over two years designing these proposals. Two years to figure out how to help farmers, and the end result is the biggest wealth transfer in dairy history.

Now, to be fair, NMPF and their supporters argue these changes were necessary to “modernize” pricing formulas and improve industry competitiveness. However, when you examine who actually benefits versus who pays, the math tells a different story than their press releases.

The Make Allowance Money Grab: When “Technical Updates” Create Winners and Losers

Alright, let me strip away all the regulatory jargon and show you exactly what happened to your money.

Make allowances… they sound innocent enough, right? Manufacturing cost deductions are processors’ claims against milk prices when they produce cheese, butter, or powder. These hadn’t been comprehensively updated for over a decade—which, by the way, gave everyone involved the perfect justification for what they successfully marketed as “technical modernization.”

Here’s where it gets interesting, though. USDA and NMPF argued these increases were based on actual cost increases in processing operations. They commissioned studies, held hearings, and gathered input from the industry. The whole regulatory process looked legitimate from the outside.

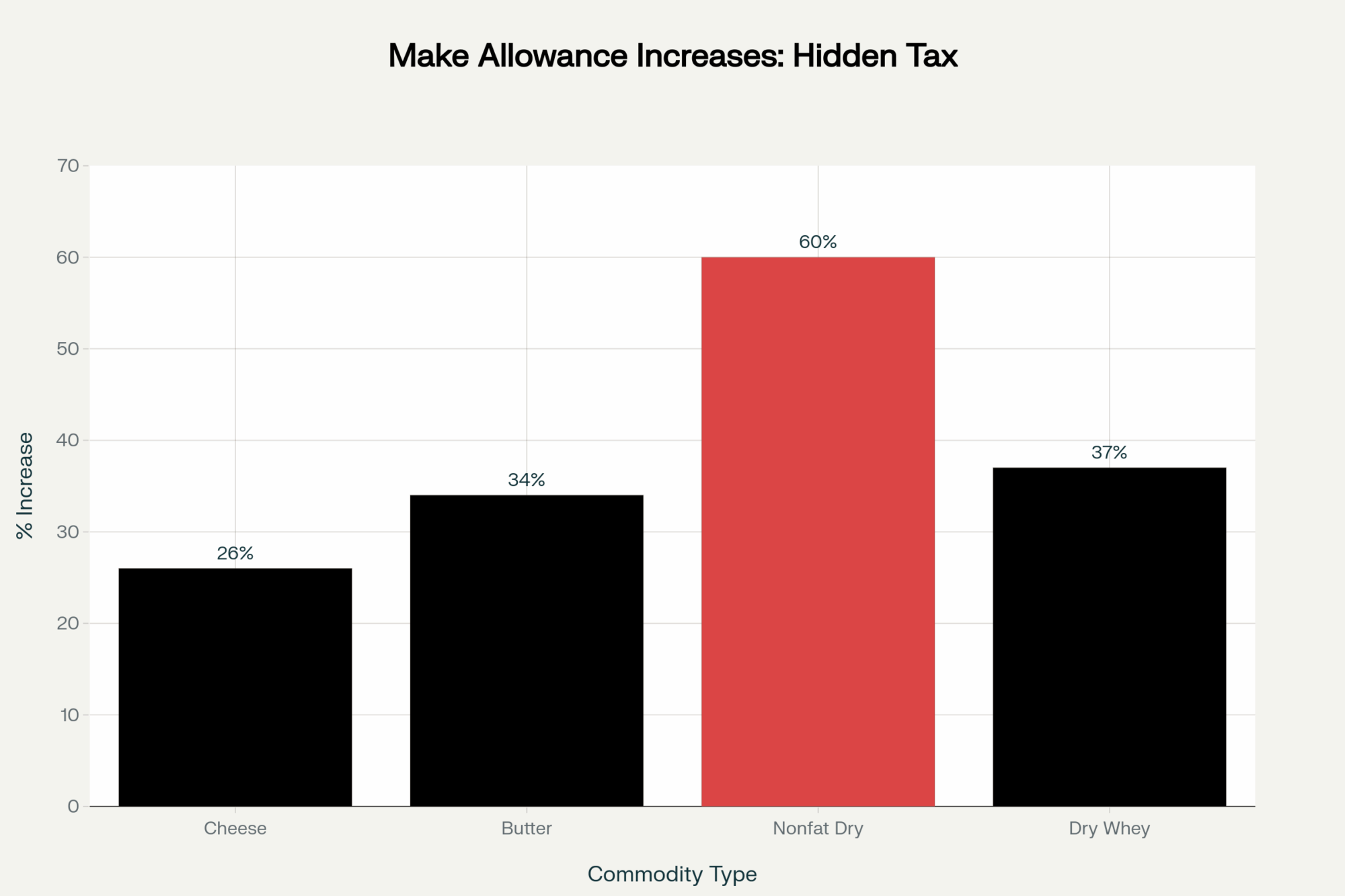

But here’s what really happened. Check out these numbers from the USDA’s final decision:

Cheese allowance: Jumped 26% from twenty cents to 25.19 cents per pound

Butter allowance: Spiked 34% from seventeen cents to 22.72 cents per pound

Nonfat dry milk: Get this—exploded 60% from fifteen cents to 23.93 cents per pound

Dry whey: Climbed 37% from 19.5 cents to 26.68 cents per pound

Danny Munch—he’s the economist over at Farm Bureau who actually crunched these numbers instead of just accepting industry explanations—calculates these increases slice 85 to 90 cents per hundredweight from milk prices across all classes. Every single class.

Now, NMPF would tell you these increases reflect genuine cost inflation in processing operations since… well, since they were last comprehensively updated. Labor costs, energy costs, equipment costs—all legitimate concerns. And honestly? Some of that argument holds water.

However, what they don’t emphasize is that while these “cost adjustments” reduced producer pool values by $337 million in three months, cooperatives with processing operations receive enhanced make allowance cost recovery through their manufacturing facilities.

Think about the dynamic here. You ship milk to your “farmer-owned” cooperative. They process it into cheese. Those new make allowances let them claim extra cents per pound as “manufacturing costs” before calculating what they owe back to the pool. So your co-op’s processing division captures the benefit while your farm-gate price absorbs the cost.

Industry defenders would argue that this reflects economic reality—processing really does cost more than it did years ago. And they’re not entirely wrong. However, when cost increases are passed down to producers while the processing benefits flow to cooperative manufacturing divisions, that represents a fundamental shift in how value is distributed throughout the system.

What Your Cooperative’s Official Position Doesn’t Tell You

NMPF’s public justification emphasizes modernizing outdated formulas and improving competitiveness. Their white papers discuss aligning with current processing realities, supporting rural economies, and strengthening the industry’s global position.

And you know what? Some of those arguments aren’t completely without merit. Processing costs have increased significantly. Energy, labor, compliance costs—they’ve all gone up.

However, what their official positions overlook is that the industry cost studies justifying these increases primarily came from companies and cooperative processing divisions that benefit most from higher allowances. The processors provided the studies that justified their own enhanced cost recovery.

That’s not necessarily a case of fraud or conspiracy. It may simply be a matter of how regulatory processes work when complex industries are required to provide their own cost data. However, the conflict of interest becomes apparent when one steps back and examines it.

Industry trade groups framed these changes as an economic necessity rather than a move driven by advantage-seeking. And maybe they genuinely believe that. But notice what’s missing from all the official justifications? Any mechanism to ensure these “cost adjustments” flow back to producers through higher over-order premiums when processing operations benefit.

The Geographic Warfare: When Good Intentions Create Regional Winners and Losers

Here’s where the FMMO reforms get really complicated, and honestly, where some of the industry’s official reasoning starts to fall apart.

The changes didn’t just redistribute money between producers and processors—they systematically advantaged some regions while disadvantaging others. Now, USDA would argue this reflects legitimate differences in transportation costs and market dynamics. And again, that’s not entirely wrong.

The Protected Class: Northeast and Mid-Atlantic operations got massive Class I differential increases that more than offset the make allowance hits. Federal Order 5, which covers the Mid-Atlantic region, saw differentials increase from $3.40 to $5.60 per hundredweight, according to USDA implementation data.

The official justification? Higher transportation costs, market premiums for fluid milk, and regional economic factors. All legitimate considerations that regulators weighed during the hearing process.

The Sacrifice Zones: California, the Upper Midwest, and Western orders—basically, the regions where most of the milk is actually processed for manufacturing—they absorb the full impact of milk allowance increases with zero offsetting benefits.

In California, they’re examining what Edge Dairy Farmer Cooperative calculated as a $94 million annual reduction in pool value. Southwest Order? They’re expecting $72 million in annual losses.

Now, USDA would argue these manufacturing-heavy regions benefit from lower transportation costs and established processing infrastructure. The regulations aren’t deliberately targeting anyone—they’re just reflecting economic realities.

However, here’s the problem with that reasoning: when regulatory changes systematically favor politically connected fluid-milk regions while disadvantaging efficient manufacturing areas, the practical effect appears to be deliberate economic engineering, regardless of the official intent.

Edge Dairy Farmer Cooperative released an analysis acknowledging that the reforms “would slightly decrease the minimum regulated price private milk buyers have to pay to pooled milk producers.” That’s cooperative-speak for “your margins just got systematically compressed through regulatory changes.”

The Complexity of Regulatory Intent vs. Practical Impact

What strikes me about the regional disparities is how they align so perfectly with political influence rather than economic efficiency. The regions that benefit most from Class I differential increases happen to be the areas with the strongest political representation in dairy policy discussions.

Is that deliberate favoritism? Or just how regulatory processes naturally work when different regions have different levels of political sophistication and influence?

The USDA would argue that they’re simply responding to economic data on transportation costs, market premiums, and regional factors. They’d point to studies showing legitimate cost differences between regions that justify differential adjustments.

But when the practical effect systematically advantages less efficient regions while penalizing more efficient ones, the intent becomes less important than the outcome.

You talk to any Pennsylvania or Maryland producer, and they’ll tell you those differential increases help cushion the blow from higher make allowances. Meanwhile, down in Wisconsin or California—the backbone of American cheese production—they’re getting hammered by make allowance increases with no relief.

The Cooperative Dilemma: Competing Loyalties and Conflicting Interests

And this is where it gets really complicated, because I don’t think most cooperative leadership deliberately set out to screw their members.

The National Milk Producers Federation spent over two years developing these proposals through extensive consultation with the industry. They held meetings, commissioned studies, and gathered member input. NMPF President Gregg Doud genuinely believes the final decision provides “a firmer footing and fairer milk pricing.”

From their perspective, these changes represent necessary modernization that will ultimately strengthen the entire industry in the long term. They’d argue that stronger processing margins benefit everyone by supporting infrastructure investment, improving competitiveness, and stabilizing markets.

And honestly? That’s not entirely a bogus argument. A strong processing infrastructure benefits producers by providing market outlets and value-added opportunities.

But here’s where the cooperative model creates inherent conflicts: when your “farmer-owned” organization also owns processing facilities that receive enhanced make allowances, which interest takes priority?

The Governance Challenge of Dual Roles

Modern cooperatives have evolved far beyond their origins as farmer-protection organizations, and this evolution creates genuine dilemmas rather than simple betrayals of their founding principles. They’ve become processor stakeholders through joint ventures, shared manufacturing facilities, and board governance that has to balance multiple interests.

Your co-op’s leadership may genuinely believe that stronger processing margins will ultimately benefit all members through improved services, a stronger market position, and enhanced competitiveness. That’s not necessarily wrong—it’s just a different theory of value creation than direct milk price maximization.

The problem lies in governance structures that concentrate decision-making power among the largest operations—exactly those most likely to benefit from processing partnerships and enhanced allowances. When delegates representing 5,000-cow operations with processing deals outvote representatives from 500-cow farms focused purely on milk prices, that’s not a conspiracy. That’s just how voting power works in cooperative governance.

But the practical effect is the same: systematic advantages for the largest, most diversified operations at the expense of smaller, milk-focused producers.

You’re running 500 or 800 cows in Ohio or Wisconsin? Your voice gets drowned out by delegates representing mega-operations with processing partnerships. Small and mid-scale producers… we lack the influence to counteract delegate votes that favor processing investments over farm-gate returns.

Industry position differences during the hearing process suggest that some cooperative leadership recognized these tensions. The question is whether they had realistic alternatives given the political dynamics of regulatory change.

The Price Discovery Changes: Technical Complexity vs. Market Impact

The removal of 500-pound barrel cheese from Class III pricing calculations represents another layer of regulatory change that official explanations struggle to justify convincingly.

USDA’s reasoning focused on streamlining price discovery and reducing complexity in commodity pricing formulas. They argued that barrel pricing created volatility and confusion in market signals.

From a technical regulatory perspective, that argument has some merit. Simpler pricing mechanisms can reduce administrative complexity and improve market transparency.

But the practical effect concentrates price-setting power among fewer market participants, which typically benefits buyers more than sellers. When you reduce the number of pricing points used to set commodity values for the entire industry, you typically reduce competitive pressure.

Block cheese producers lobbied for these pricing changes during the hearing process, and their arguments about market efficiency and price discovery weren’t entirely without merit. But they got exactly what they wanted: reduced competitive pressure from barrel pricing.

The Challenge of Technical vs. Political Justifications

What bothers me about pricing formula changes is how technical complexity provides cover for market advantages. When regulatory changes require specialized expertise to understand, most participants can’t effectively evaluate whether the changes serve broader industry interests or specific player advantages.

USDA’s technical justifications for barrel removal sound reasonable in isolation. However, when you combine these with allowance increases and regional differential changes, the overall pattern systematically favors certain players while disadvantaging others.

Is that deliberate market manipulation? Or just the inevitable result of complex regulatory processes where different players have different levels of technical expertise and political influence?

The answer probably depends on your position in the industry hierarchy. If you benefit from the changes, they represent necessary modernization. If you’re disadvantaged, they looks like regulatory capture.

What This Really Means Long-Term: Competing Visions of Industry Structure

The $337 million first-quarter transfer from Farm Bureau’s analysis represents more than just money moving between accounts. It reflects competing visions of how the dairy industry should be structured and who should capture value at different points in the supply chain.

NMPF and their supporters would argue that these regulatory changes strengthen the industry by improving processing margins, encouraging infrastructure investment, and enhancing global competitiveness. They’d point to expansion plans and processing investments as evidence that their approach is working.

From this perspective, temporary producer pain leads to long-term industry strength that eventually benefits everyone through stronger markets, better services, and enhanced competitiveness.

However, critics, such as Edge Dairy and the Farm Bureau, view a systematic wealth transfer from efficient producers to processing interests that may never be reflected in farm-gate prices. Their analysis suggests continued consolidation pressure in manufacturing-focused regions that could undermine the industry’s competitive foundation.

Industry analysts are already projecting different scenarios depending on whether these regulatory structures drive beneficial investment or simply redistribute wealth from producers to processors without creating genuine value.

The honest answer? We won’t know which vision proves correct for several years. However, the immediate impact is clear: $337 million was transferred from producer pool values to processing advantages in just three months.

Regional Implications and Competitive Dynamics

You’re going to see the Northeast and Mid-Atlantic regions positioned to benefit from permanent Class I premiums and processing investments that capture regulatory advantages. Whether that strengthens or weakens overall industry competitiveness depends on whether protected regions utilize their advantages for genuine improvement or merely engage in rent-seeking.

Meanwhile, California, the Upper Midwest, and Western operations face continued pressure from regulatory disadvantages that may force consolidation or exit. If those regions represent the industry’s most efficient production, it could undermine long-term competitiveness, regardless of short-term improvements in processing margins.

The global implications are murky. Enhanced make allowances might improve U.S. processing competitiveness by providing guaranteed cost recovery. Or they might create artificial advantages that reduce incentives for genuine efficiency improvements.

International buyers increasingly value supply chain consistency and reliable quality over marginal regulatory advantages. Whether FMMO changes enhance or undermine those qualities remains to be seen.

Component Factor Changes: Modernization or Redistribution?

Starting December 1st, the assumed protein content increases from 3.1% to 3.3%, while other solids rise from 5.9% to 6.0%, according to the USDA implementation schedule.

The USDA’s justification emphasizes the recognition of genuine improvements in milk quality and genetic progress over the past decade. And honestly? That argument has solid support. Average component levels have improved significantly through genetic selection and nutrition management.

From a technical perspective, updating component assumptions to reflect current reality makes perfect sense. If most producers are achieving higher components than the formulas assume, the assumptions should be updated.

However, here’s where technical accuracy creates practical consequences: these changes will benefit operations already achieving high efficiency while disadvantaging those still focused on volume production.

The December changes don’t create new value—they redistribute existing pool money based on component assumptions that favor certain production strategies over others.

The Question of Fair vs. Advantageous Updates

Smart operators are already adjusting their breeding programs and ration formulations to capitalize on these regulatory advantages. Whether that represents a necessary adaptation to industry evolution or regulatory changes in gaming depends on your perspective.

USDA would argue they’re simply updating formulas to reflect current industry reality. Producers achieving higher components deserve recognition for their genetic and management investments.

But producers focused on volume production—often smaller operations with older genetics or limited nutritional resources—will subsidize their higher-component competitors through pool redistribution formulas.

Is that fair recognition of superior management? Or systematic disadvantaging of producers who can’t afford the latest genetic and nutritional technologies?

The answer probably depends on whether you view dairy as a commodity industry where efficiency should be rewarded, or as a rural economic system where smaller operations deserve protection from technological displacement.

Down in Pennsylvania, I was speaking with a producer who has been pushing his nutritionist hard on component manipulation strategies. He’s targeting 3.8% butterfat and 3.3% protein specifically because of these December changes. He said he’s not going to subsidize his neighbors who haven’t yet figured out the new game.

And honestly? This is no longer about milk volume. It’s about maximizing value per pound in a system that’s been restructured to reward components over quantity.

You’re still focused on pounds per cow? You’re gonna get killed in this new regulatory environment.

Fighting Back: Navigating Complex Realities Rather Than Simple Villains

Look, the wealth transfer is happening whether the motivations were pure or calculated. Your milk checks already reflect these new realities, regardless of whether cooperative leadership intended to disadvantage smaller producers or genuinely believed they were modernizing industry structures.

Independent producers who refuse to accept systematic disadvantages must move aggressively, but the solutions are more complex than simply fighting “bad actors.”

Component Optimization: Adapting to Regulatory Realities

Target 3.8% butterfat and 3.3% protein through systematic genetic selection and precision nutrition management. Whether the December component changes represent fair modernization or regulatory favoritism, they’re happening.

Work with nutritionists who understand component manipulation strategies, rather than just focusing on volume maximization. Focus on rumen-degradable protein levels that support component synthesis while maintaining the health of the cow.

Utilize genomic services to identify high-genetic potential within your existing herd. Cull animals that can’t achieve competitive component levels regardless of management inputs.

The reality is that operations unable to compete on components will subsidize those that can, starting December 1st. Whether that’s fair or not doesn’t change the economics.

And honestly, if your fresh cows aren’t consistently meeting these component targets, you need to refine your transition cow management. Because starting December 1st, every cow below these assumptions is subsidizing your competitors.

Strategic Milk Marketing: Working Within Flawed Systems

Negotiate over-order premiums with processors who receive enhanced make allowance cost recovery. Document your component achievements and demand premiums that reflect true quality rather than just pool averages.

These processors are capturing regulatory advantages whether they deserve them or not. Demand your share through premium negotiations based on documented quality metrics.

What I’m seeing work in Ohio is producers forming marketing groups to negotiate collectively rather than accepting whatever pools provide. When you consistently achieve high component targets, you have leverage regardless of regulatory advantages.

Explore partnerships with regional processors willing to share value-added margins rather than just paying pool prices. Direct-to-market alternatives bypass FMMO redistribution entirely.

Coalition Building: Addressing Systemic Issues

Pool resources with other disadvantaged producers to challenge regulatory methodologies through formal petitions or legal action. Whether the original intent was benign or calculated, the practical effects are documentable and challengeable.

The power structure that created these advantageous changes can be influenced through organized pressure, but it requires coordination across regional and cooperative boundaries.

What strikes me about current producer responses is that most operations are adapting individually rather than organizing collectively to address systemic disadvantages. That approach might preserve individual operations, but it won’t change the underlying regulatory structures.

Political Engagement: Long-term Structural Reform

Launch campaigns targeting legislators in manufacturing-disadvantaged regions with specific evidence of regulatory impacts. Whether the original changes were intentional or accidental, the documented effects provide concrete evidence for advocacy.

Frame regulatory reform around fairness and competitive balance rather than conspiracy theories about deliberate theft. Focus on documented outcomes rather than speculated motivations.

Partner with consumer groups and rural development organizations to widen coalitions beyond agriculture. Position regulatory reform as supporting competitive markets and rural economic vitality.

The key is addressing the systemic issues that allow regulatory processes to systematically advantage certain players while disadvantaging others, regardless of whether that outcome was originally intended.

Down in Wisconsin, there’s already talk about organizing producer groups to pressure state legislators. The question is whether enough people realize they’re being systematically disadvantaged and actually do something about it.

The Bottom Line: Complex Problems Require Sophisticated Responses

The dairy industry has just experienced its largest wealth redistribution in decades, thanks to regulatory changes that may have been well-intentioned but have created systematic disadvantages for independent producers. $337 million transferred from farmer milk checks to processing advantages in three months, with more likely to follow.

Whether cooperative leadership deliberately betrayed producer interests or genuinely believed they were modernizing industry structures matters less than the documented outcomes. The regulatory process systematically advantaged certain players while disadvantaging others, regardless of original intent.

This isn’t simply about fairness versus unfairness—it’s about competing visions of industry structure and value distribution. The challenge is building sufficient political and economic pressure to rebalance regulatory outcomes without getting trapped in conspiracy theories about deliberate betrayal.

Strategic Response Framework

This month: Adapt to regulatory realities through component optimization while documenting the costs of regulatory disadvantages for advocacy purposes. Those December component changes are coming fast.

- Audit your herd’s genetic potential for 3.8% butterfat and 3.3% protein targets

- Begin processor premium negotiations based on documented quality metrics

- Calculate your operation’s specific losses from the 85-90¢/cwt make allowance impact

Next three months: Form coalitions with other disadvantaged producers to pool resources for legal challenges and political pressure targeting regulatory rebalancing. The Farm Bureau analysis gives you concrete numbers to work with.

- Join regional producer alliances across cooperative boundaries

- Pool resources for economic and legal expertise on regulatory challenges

- Document specific financial impacts for legislative advocacy

Through 2025: Implement marketing strategies that capture value outside regulated pool formulas while supporting broader reform efforts. But honestly? Most of us lack the expertise for complex workarounds.

- Explore direct-to-market partnerships bypassing FMMO pools

- Negotiate over-order premiums, capturing regulatory advantages

- Support cooperative governance reform requiring transparent processing profit disclosure

Strategic thinking: Support regulatory process reforms that require independent verification of industry cost claims and broader representation in policy development.

The $337 million wealth transfer already happened, according to Farm Bureau’s analysis. Whether it represents deliberate theft or unintended consequences, the practical effect is systematic disadvantaging of independent producers who lack processing partnerships and political influence.

Your response determines whether you adapt successfully to capture remaining value while building pressure for fairer regulatory processes… or watch your operation subsidize others’ advantages through government formulas that may never be rebalanced without sustained political pressure.

The regulatory game is complex, but the outcomes are clear. Understanding that complexity is essential for developing effective responses rather than just complaining about unfairness.

Your milk didn’t become less valuable. The formulas valuing your milk got restructured in ways that systematically favor certain players over others. The only question now is what you’re gonna do about it.

KEY TAKEAWAYS

- Target 3.8% butterfat and 3.3% protein immediately—December component changes will redistribute pool money from operations below new assumptions to those hitting higher targets through systematic genetic selection and precision nutrition management

- Negotiate over-order premiums with processors benefiting from enhanced make allowances—document your component quality and demand sliding-scale premiums that capture portions of the regulatory advantages flowing to processing margins

- Form regional coalitions across cooperative boundaries to challenge regulatory methodologies—Farm Bureau’s $337 million documentation provides concrete evidence for legal petitions and political pressure targeting make allowance reversals

- Calculate your operation’s specific losses from the 85-90¢/cwt make allowance impact—operations shipping 2,000 cwt monthly face $17,000-$18,000 annual reductions that cooperative processing divisions now capture as enhanced cost recovery

- Explore direct-to-market alternatives, bypassing FMMO pool redistribution—regional partnerships with specialty processors willing to share value-added margins offer escape routes from regulatory formulas systematically favoring large-scale operations with processing partnerships

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More:

- Seizing the Moment: Maximizing Milk Solids Output Through Strategic Nutrition and Genetics – This guide provides actionable strategies for raising butterfat and protein content, directly addressing the December component changes. It reveals nutritional and genetic methods to adapt your operation, ensuring you capture premiums instead of subsidizing competitors.

- FMMO Reality Check: Why 2025’s $2.3 Billion Dairy Pricing Revolution Exposes the Fatal Flaw in American Milk Marketing – This article provides a broader, more critical analysis of the entire FMMO system, framing the recent changes as part of a larger structural flaw. It deepens your understanding of how the system operates to favor processors and offers strategic insights for long-term reform.

- AI and Precision Tech: What’s Actually Changing the Game for Dairy Farms in 2025? – While the main article focuses on regulatory challenges, this piece details how technology can help you overcome them. It provides concrete ROI data on precision feeding, AI health monitoring, and robotics, demonstrating how to use innovation to cut costs and boost margins.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!