190 ‘average’ UK farms disappeared in 12 months—not from poor milk, but from processor power plays. Here’s the brutal truth.

You’ve heard the official spin: those farms were ‘underperforming’ and naturally left the business. Let me tell you, that’s a load of nonsense. These were solid operations, producing right at national averages, wiped out not by poor performance but by a rigged system designed to squeeze independent farmers dry. Here’s the raw truth you won’t hear at the boardroom tables.

I’ve been in dairy all my life, seen trends come and go, but what’s happening now in UK dairy is something else. The decline is sharp and cruel, and while the suits wave their statistical flags about efficiency and ‘market corrections,’ the reality on the ground is brutal.

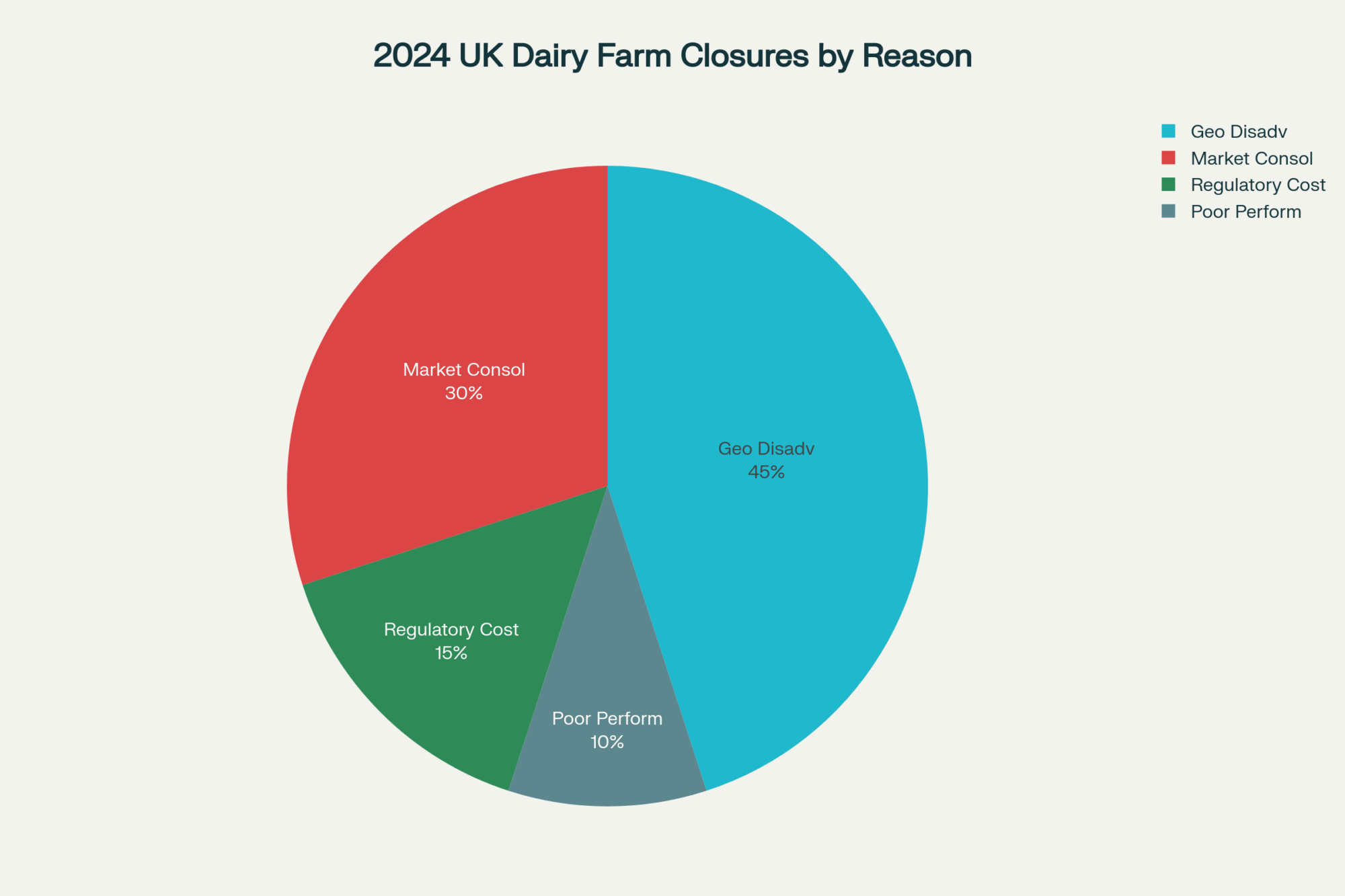

According to the latest AHDB survey, we lost around 2.6% of dairy farms between April 2024 and April 2025—that’s 190 fewer producers nationally, many of whom were running respectable herds with good health and production standards (AHDB, 2024). The trend’s accelerating, and if you think you’re safe because you’re hitting your targets, think again. Take it from the researchers who’ve been digging into this mess: these closures aren’t about poor farming—they’re about location and infrastructure favoring giants while shutting out decent operators who don’t fit the new distribution map.

When ‘Good Enough’ Means Getting Kicked to the Curb

Now, the industry blames ‘underperformance’ for these closures, but let’s be clear: many of these farms hit targets that most of us would be proud of—averaging 7,000 to 8,000 litres per cow annually with solid somatic cell counts around 200,000.

These farms followed vet guidance, managed fresh cows well, and kept butterfat steady. Yet they were marked for extinction.

Why? Because survival now hinges far more on where you are than how well you run the place.

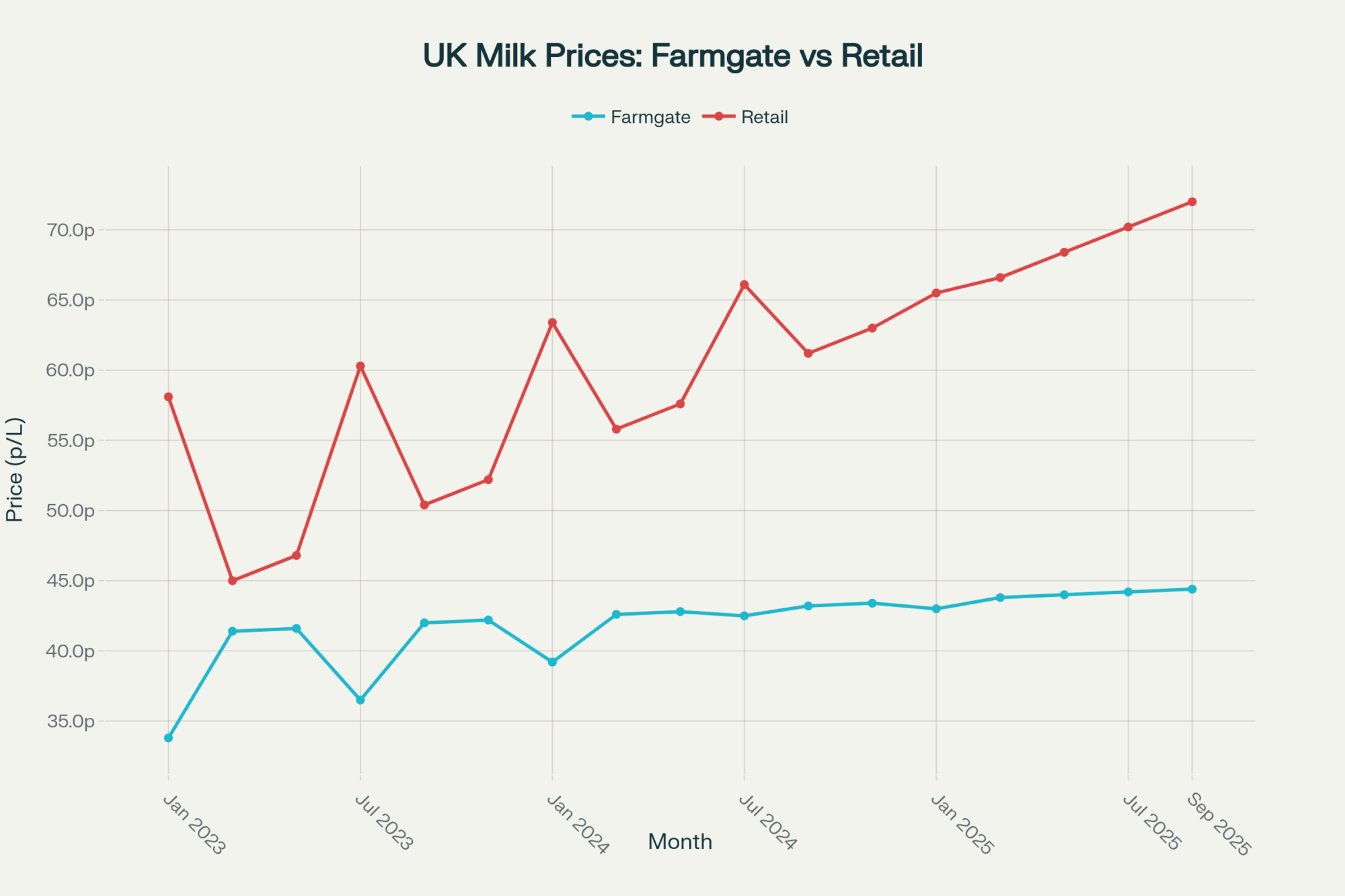

Dairy prices tell a stark story. The farmgate price in July 2025 averaged 44.39p per litre (AHDB, 2025), while consumers were paying about 65p per pint at the shop—which roughly translates to 72p per litre (ONS, 2025). That margin between farm and mouth is no accident; processors and retailers are padding their pockets while we get squeezed.

You know what happens when a million-litre operation loses just 10p per litre? That’s £100,000 straight off the bottom line. Meanwhile, the processors keep their margins stable by shifting all the volatility onto us.

The Power of Location: Why Geography Is Your Death Sentence

You can’t spin geography. If you’re outside certain processing hubs—places like Bridgwater, Severnside, Taw Valley, and Davidstow—you’re at the back of the queue.

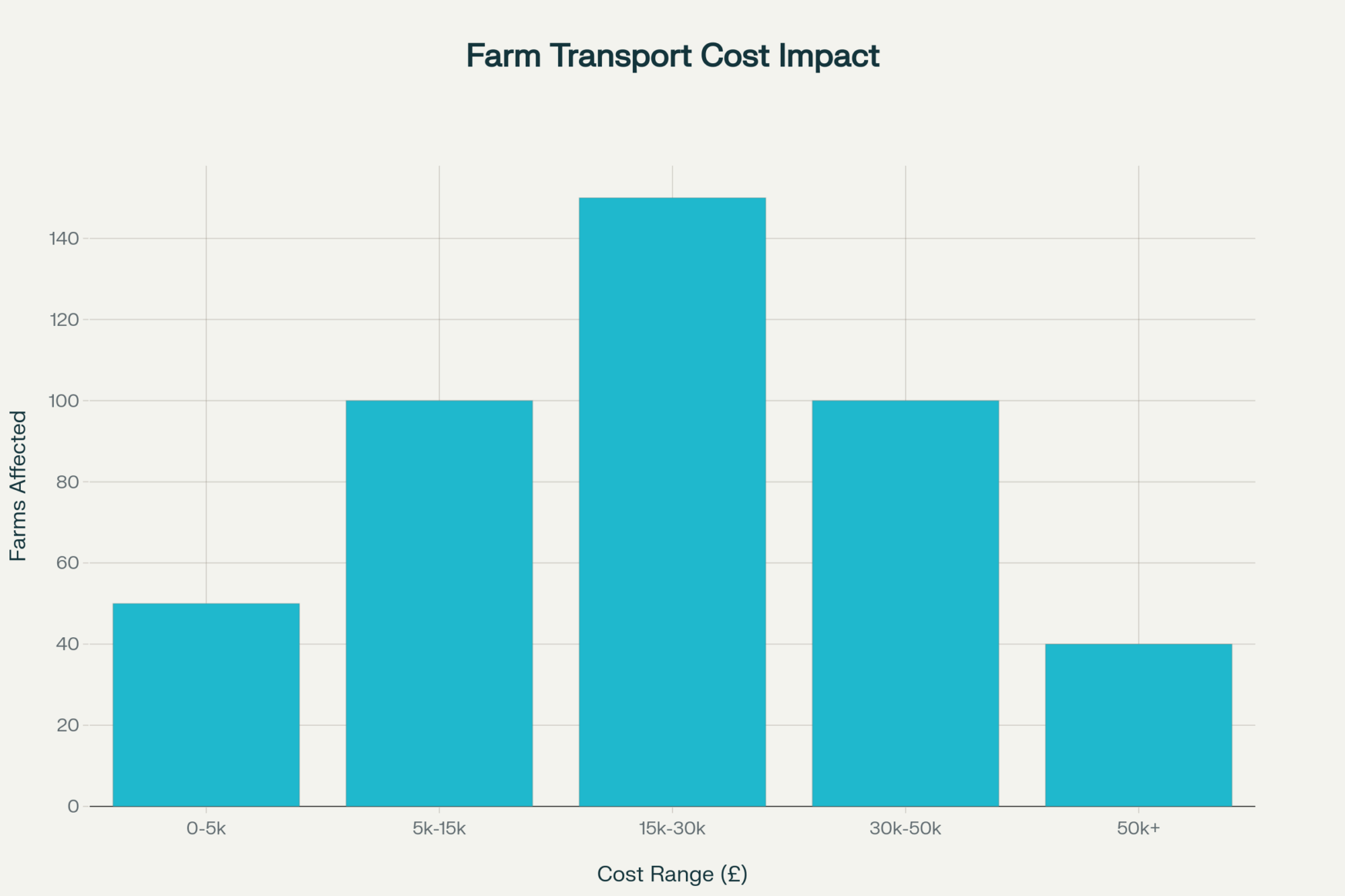

Here’s the brutal math: dairy collection costs can range from 2 to 4p per litre if you’re well-positioned. But those outliers, hanging farther from collection points, are shelling out up to 12% more in transport alone. On a million-litre farm? That’s tens of thousands lost before you even think about feed costs or vet bills.

One route driver I know put it bluntly: “We’re always balancing tank loads and route times—those farms seven or eight miles off the beaten track become money pits. Doesn’t matter if their milk’s quality is gold; they’re just too expensive to collect.”

This isn’t market forces. This is cold, calculated redlining.

The Market’s Closed Doors: No Room for Alternatives

Forget the fairy tale that if one processor kicks you out, there’s a cozy alternative waiting.

Building or running a new processing plant these days? You’re looking at £50 to £100 million before you even think about breaking even. The big players—Muller, Saputo, Arla—control the infrastructure, and without thousands of litres committed upfront, new entrants can’t get off the ground.

The oligopoly keeps the market tight. Only the chosen suppliers get to play; everyone else gets fenced out.

Add your farm’s location to the mix—if you’re beyond that 50-mile sweet spot for collection, you’re effectively landlocked.

Contracts used to bind farmers exclusively to one processor. Despite recent regulations trying to loosen that grip (The Fair Dealing Obligations Regulations, 2024), the loopholes remain wide enough to drive a milk tanker through.

The Grim Reality Behind Prices and Investments

Those price gaps tell the real story: farmgate at 44p, retail at 72p. You’re catching crumbs from a feast when you should be at the table.

The academics have it right—retailers have mastered positioning themselves as heroes while hoarding the lion’s share of value. It’s a slick scam dressed up as customer advocacy.

Then there’s the relentless pressure of capital investment.

The latest WWF analysis shows that meeting environmental standards could cost the average farm nearly half a million pounds over the next decade—roughly 2p per litre in added costs (WWF, 2025).

If you’re running 100 cows and pulling in £350k annually, that investment burns a hole in your pocket before you even think about replacing that knackered tractor or fixing the parlor roof.

The bigger operations? They dilute those expenses across massive volumes. For the rest of us, it’s a death sentence dressed up as progress.

Why the ‘Direct-to-Consumer’ Dream Is Mostly Hot Air

We see endless hype about going direct—vending machines, farm shops, online milk clubs.

Sure, some farms succeed, but here’s the rub: the barriers are sky-high.

Launching a proper direct-sales operation can set you back £30k or more. Plus, marketing isn’t just another task—it’s a full-time game requiring skills most of us never learned.

I spoke with a Somerset dairy farmer who made the transition after decades of conventional production: “I had cash saved before I made the leap. Most struggling farms can’t front that capital, and even if they could, they’re farmers, not marketers.”

The scale mismatch bites hard, too. Trying to move millions of litres through local markets or vending networks? Good luck with that.

The Media Failed Us When We Needed Them Most

Let’s be brutally honest about agricultural media’s role in this mess.

While markets crushed farmers and supermarkets made hay, much of the agricultural press stuck to safe territory—promoting optimization, efficiency gadgets, and the latest breeding trends.

All well and good, but who was telling the wider public our stories? The struggles, the disappearances?

When people hear about dairy farming, it’s through activist documentaries or celebrity-endorsed hit pieces. The industry effectively handed over its narrative to everyone except farmers.

Contracts That Strip Away What Little Power We Had

The new mandatory contracts under The Fair Dealing Regulations (2024) promised protections but mostly formalized existing power imbalances.

These agreements allow processors to adjust quality measures and delivery schedules while shifting risk back onto farmers.

The big retailer-backed milk pools? They lock farmers into arrangements that benefit retail giants while leaving producers vulnerable to every market hiccup.

Look at Saputo’s move in early 2025—13 decent farmers got their contracts terminated despite solid outputs, given legally binding notice periods but no feasible alternative buyers (Telegraph, Feb 2025).

That’s not business; that’s execution with paperwork.

The Few Paths Forward That Actually Work

Despite the carnage, some innovative operations are finding cracks in the system.

About 400 milk vending machines operate nationally now, with operators pulling £1.20 to £1.60 per litre—way above wholesale rates. These farms invested heavily and retrained themselves to think like retailers, not just producers.

I know a Gloucestershire dairy that transitioned from managing 180 cows under traditional contracts to operating a dozen vending locations. “That move from producing for processors to producing for consumers changed everything. Fresh cow management and butterfat optimization matter like never before, but now I control the price.”

The regenerative agriculture movement offers another route. Farms adopting these practices show better resilience and profit margins while accessing premium markets.

Programs like Nestlé’s natural capital initiative pay real premiums for environmental improvements—soil health, biodiversity measures in places like Cumbria and Ayrshire (Cambridge Institute, 2018).

Unlike processors who profit from our dependence, these brands need authentic farm stories. Their success depends on supplier success, not exploitation.

The Bottom Line

It’s no longer enough to be ‘good enough’ at farming. You need to be competent at marketing, storytelling, and diversifying markets.

Immediate actions:

- Check your geographic vulnerability—if you’re outside main collection loops, start exploring alternatives today

- Budget £5k-£10k annually for professional storytelling and marketing support

- Seek partnerships with brands offering genuine premiums for quality and sustainability

- Join or form cooperatives to build collective bargaining power

- Diversify your buyer base—never depend on a single processor who can eliminate you at will

The harsh reality? If you ignore this advice, expect to join the next wave of closures.

Because this system isn’t designed to help you survive. It’s designed to make you a casualty of convenience.

The 190 farms that disappeared in the last year weren’t failures—they were warnings. The question is whether you’ll heed those warnings or become the next statistic in a rigged game where only the biggest and best-located players get to stay.

Your milk quality won’t save you. Your production efficiency won’t save you. Only building direct relationships and alternative markets will give you the power to survive what’s coming next.

KEY TAKEAWAYS:

- Geographic vulnerability kills profitability: Farms beyond a 50-mile collection radius face £30,000-50,000 annual transport penalties—map your risk now before 2026 route optimizations eliminate more “inconvenient” suppliers regardless of butterfat consistency or fresh cow management

- Direct-consumer premiums offer 300%+ markup potential: Vending operations pull £1.20-£1.60 per litre versus 44p wholesale, but require £30,000+ upfront investment plus full-time marketing skills most producers lack—only farms with cash reserves can access these escape routes

- Professional storytelling becomes a survival skill: Budget £5,000-10,000 annually for consumer relationship building that commodity contracts can’t provide—farms without marketing capabilities become next elimination targets as the processor oligopoly tightens control

- Corporate sustainability partnerships pay real premiums: Programs like Nestlé’s natural capital initiative in Cumbria and Ayrshire deliver measurable environmental bonuses while building authentic supply chain narratives for competitive brand differentiation

- Collective action creates negotiating power: Join producer cooperatives focused on market access rather than technical optimization—individual farms can’t solve systematic coordination problems affecting bulk tank pickup schedules and contract vulnerability

EXECUTIVE SUMMARY:

The official story about UK farm closures is corporate spin designed to hide systematic market manipulation that’s gutting independent dairy operations. AHDB data reveals 190 dairy farms vanished between April 2024-2025—a brutal 2.6% contraction—but these weren’t failing operations hitting 4,000L per cow with mastitis problems. They were competent producers, averaging 7,000-8,000L annually, with solid somatic cell counts under 200,000. However, they were eliminated not by performance but by geographic discrimination that favored processor convenience over farming excellence. With farmgate prices stuck at 44.39p per litre while retail hits 72p, that 62% markup reveals who’s really profiting from this “efficiency drive.” Transport cost penalties of up to £50,000 annually for farms outside optimal collection zones prove that location now trumps herd management in determining survival. Unless farmers build direct consumer relationships and break free from commodity pricing, expect 300+ additional closures by 2027 as consolidation accelerates under the guise of market optimization—and your production records won’t save you.

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More:

- The Great UK Dairy Cull: What’s Really Driving the Farm Exodus – This article provides a stark, data-driven analysis of the market forces, including processor dominance and labor costs, that are driving the farm closures. It complements your piece by offering further economic context and specific numbers that underscore the systemic challenges.

- Death of ‘Get Big or Get Out’? Why Tech-Savvy 500-Cow Dairies Are Outperforming Mega-Farms – This strategic piece refutes the common “scale is king” narrative by demonstrating how precision technology and component premiums are enabling smaller operations to achieve higher profitability. It provides an innovative counterpoint to the consolidation trend discussed in your article.

- Unlock the Secret to Captivating Dairy Farmers with Content Marketing – Since your article argues that storytelling is a survival skill, this piece provides the tactical blueprint. It reveals actionable methods for building a compelling brand narrative and using digital channels to connect directly with consumers, generating crucial revenue streams.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!