Everyone’s calling land values “stable” but your banker’s asking for more collateral. Something doesn’t add up.

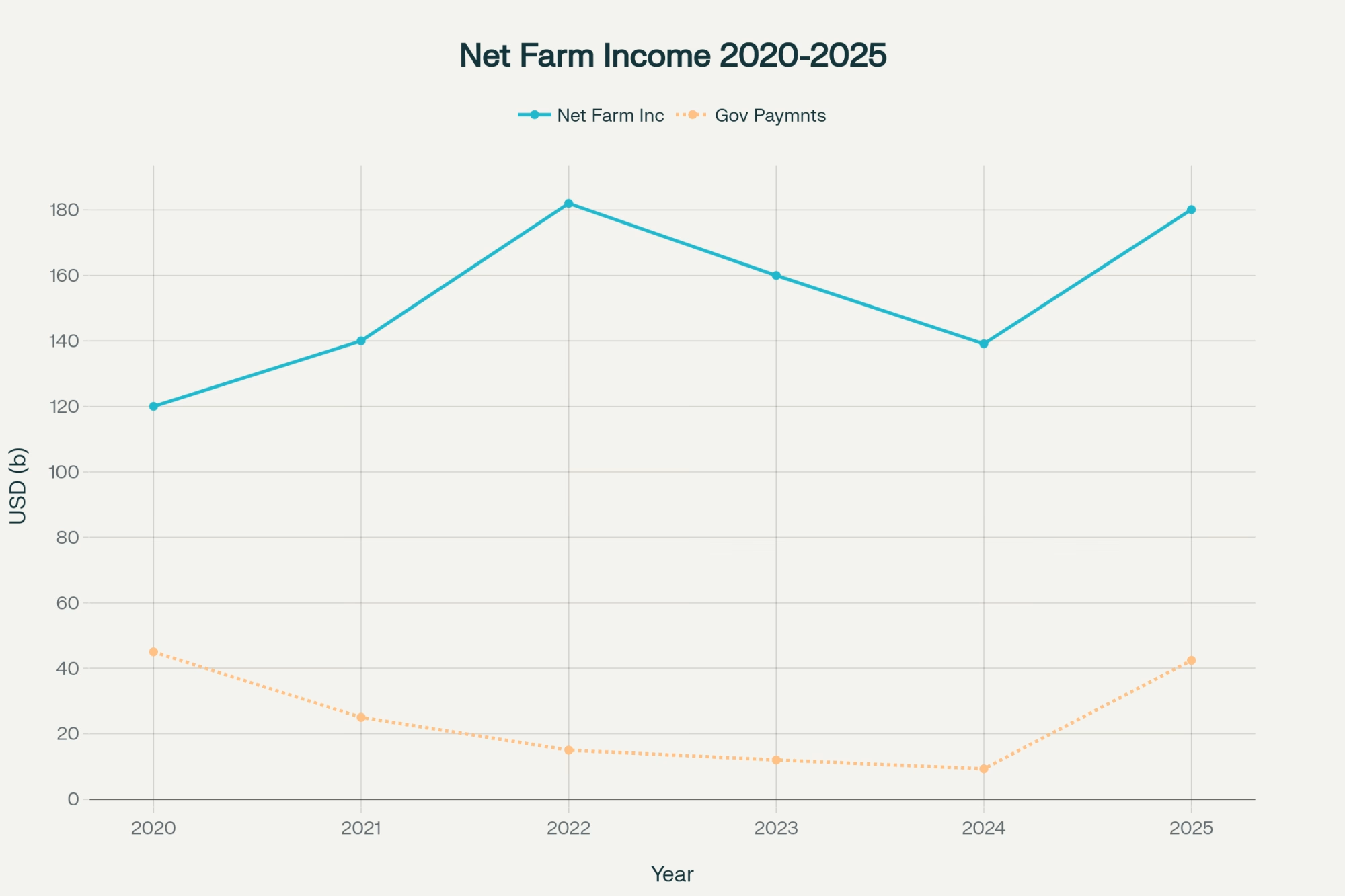

Executive Summary: Look, I’ve been watching this land market closely, and there’s a story here that affects every dairy operation in America. The “stable” farmland values everyone’s talking about are being propped up by one-time government disaster payments—not actual farm profitability. We’re talking about $33.1 billion in temporary support that won’t be there next year, while actual cash receipts from crops and livestock are dropping by $1.8 billion.Meanwhile, Federal Reserve surveys show loan repayment rates at their lowest since 2020, and bankers are demanding more collateral across all agricultural districts. For dairy producers, this means feed costs are climbing 5-7% while the land that grows your corn and hay is sitting on shaky financial ground. The smart money is already shifting—South Dakota’s up 11% while Iowa’s down 3% for the second straight year.Here’s what this means for your operation: now’s the time to shore up working capital and get real about your expansion plans before that 2026 “cliff effect” hits.

Key Takeaways

- Credit’s Getting Tight—Act Now: Agricultural lenders are seeing their worst loan performance since 2020, with 60% reporting lower farm income than last year. Get ahead of this by having that honest conversation with your banker about your working capital without counting on government payments. Those who wait might find themselves scrambling for operating loans at higher rates.

- Feed Cost Reality Check: With seed prices climbing 5-7% and fertilizer vulnerable to geopolitical shocks, your 2025 feed budget needs serious attention. Start locking in hay contracts now and consider diversifying your feed sourcing—operations in Wisconsin are seeing more stable costs than those in New York where alfalfa’s running $60-90 more per ton.

- Regional Arbitrage Is Real: While Iowa corn ground drops 3%, livestock-heavy regions like South Dakota are up 11%. If you’re in a dairy-dense area, your land values might hold better than row-crop regions, but don’t count on it lasting. Use this window to refinance or consider strategic sales of non-core assets.

- Technology Investment Window: With labor costs hitting $22/hour for milking and a 14% annual growth in robotic milking systems, now’s the time to evaluate automation. A $200,000 robot that eliminates 1.5 FTE positions pays for itself in 3.5 years—and that’s before you factor in the labor shortage getting worse.

- The 2026 Cliff Effect: Those massive government payments propping up farm income disappear next year. Smart operators are using this temporary cash flow boost to pay down debt and build reserves, not fund expansion. Calculate your true cash flow without government support—that’s your real financial picture.

You know that feeling when you’re at a dairy conference and someone mentions land values, and suddenly everyone gets quiet? Well, I’ve been digging into what’s really happening with farmland prices, and… let’s just say the conversation we’re not having is the one we need to have.

Here’s the thing about farmland values right now—everyone keeps using that word “stable,” but when I look at the numbers, I’m seeing something that looks more like a house of cards than solid ground.

I was just talking to a producer from Iowa last week, and he mentioned something that really stuck with me. His neighbor’s land sold for about 15% less than what similar ground brought two years ago, yet the headlines still claim market stability. Made me wonder—what story are we actually telling ourselves about where this market is headed?

For us in the dairy business, this isn’t just another market story. It’s about understanding whether the ground under our feet—literally and figuratively—is as solid as everyone’s saying it is.

The Illusion of Stability

The thing about market stability is that it’s not always what it seems. When I began examining regional data, the picture became significantly more complex than the national averages suggest.

Take Iowa, for instance. This is supposed to be the bellwether for farmland values, right? According to Farm Credit Services of America’s latest benchmark data, Iowa land values have decreased by 3% year-over-year, marking the second consecutive year of declines. Meanwhile, if you’re up in South Dakota, you’re seeing a completely different story—values there are up over 11%, driven mostly by strong demand for pasture and ranch land.

What strikes me about this regional split is how much it mirrors what we’re seeing in the dairy industry itself. If you’re in a livestock-heavy area, you’re probably feeling pretty good about your position right now. Strong consumer demand for dairy products, combined with relatively tight supplies, is creating a financial cushion that crop-heavy regions simply don’t have.

But here’s where it gets interesting—and a little scary. The USDA’s Economic Research Service released its February 2025 farm income forecast, showing what appears to be good news on paper. However, when you break it down, it’s both fascinating and concerning.

Stronger farming operations aren’t driving the dramatic increase in projected farm income. According to the USDA data, actual market-based cash receipts from crops and livestock are expected to decline. The entire income boost stems from a massive surge in direct government payments—specifically, billions in ad hoc disaster assistance, primarily from the Emergency Relief Program (ERP), Supplemental Disaster Relief Program (SDRP), and other congressional disaster assistance programs covering prior-year losses.

Now, I’m not saying these payments aren’t needed. Many producers have been severely impacted by weather and market conditions over the past couple of years. However, here’s what keeps me up at night thinking about it: these are one-time payments, not recurring income streams.

The Real-World Squeeze

Here’s what’s really squeezing today’s producers: a one-two punch that’s hitting operational cash flow from both sides.

First, let’s talk about input costs. Despite some easing from the record highs of 2022, we’re still dealing with elevated production expenses. Industry analysts are projecting that seed costs will continue their upward trend, with an expected increase of 5-7% in 2025. Fertilizer prices, while stabilized from their peak, remain vulnerable to geopolitical shocks. And natural gas prices—critical for nitrogen fertilizer production—are expected to see significant increases this year.

What’s interesting is how this plays out differently depending on where you’re farming. I recently spoke with a producer in Wisconsin, and he mentioned that their local feed costs have remained relatively competitive compared to other regions. But if you’re farming in upstate New York, you’re dealing with alfalfa costs that can run $60-90 per ton above Iowa levels, which really adds up when you’re feeding 1,500 head.

Then there’s the labor crisis. This isn’t just about finding seasonal help anymore—it’s become a structural problem. Industry surveys indicate that labor shortages are now impacting over 60% of large-scale agricultural producers. I was just at a farm in Pennsylvania where they’re paying $22 an hour for milking labor, when they can find it. That’s nearly double what they were paying five years ago.

The demographic trends driving this are unlikely to reverse anytime soon, either. Rural populations are declining, birth rates are lower, and we’re dealing with a more restrictive immigration policy environment that limits the flow of workers who have historically been essential to the agricultural workforce.

A producer I know in Nebraska put it this way: “When you can’t find help and feed costs keep climbing, something’s got to give. And usually, it’s your margins.”

The Financial Consequences

While land values are hanging in there—at least on paper—the credit markets are telling a completely different story. And this is where the rubber meets the road for dairy operations.

Federal Reserve agricultural credit surveys from multiple districts are reporting a consistent pattern: falling loan repayment rates, increasing loan renewals and extensions, and growing demand for operating loans at the highest levels since 2016.

The Chicago Fed’s latest AgLetter survey indicates that the index measuring loan repayment rates has fallen to its lowest level since the first quarter of 2020. The Kansas City Fed reported that 60% of lenders in their district observed lower farm income than a year prior, and the share of lenders requiring increased collateral has doubled.

What’s particularly troubling is what’s happening with working capital. In the Minneapolis Fed’s recent survey, one Wisconsin banker summed it up: “Working capital is stretched thin across the board. Many producers are carrying over debt they can’t comfortably service with current operational cash flow.”

For dairy operations specifically, this credit tightening is hitting at a time when we’re already dealing with elevated feed costs and labor shortages. When your banker starts asking for more collateral, that’s not a good sign for the underlying health of your operation.

I’ve been discussing this with lenders, and they’re noticing something interesting. The producer looks at their 2025 statements, sees those big government checks, and feels financially secure. But the banker? They’re examining the underlying operational cash flow, and they’re becoming nervous.

This creates a dangerous dynamic where farmers might feel optimistic about expanding or refinancing based on their temporarily improved balance sheets, but lenders are unwilling to underwrite loans based on non-recurring income. That’s a recipe for a credit crunch.

The Great Divide

As if the economic pressures weren’t enough, the adoption of technology is creating a growing gap in the dairy industry—and it’s accelerating due to the factors we’ve just discussed.

The global milking robot market is experiencing rapid growth, with a compound annual growth rate of approximately 14%. What’s driving this isn’t just convenience—it’s necessity. Research from dairy automation studies suggests that these robotic systems can reduce labor costs by 15-25% while enhancing milk quality and improving cow comfort.

I visited a farm in Wisconsin last month where they installed their third robot system. The owner told me something that really stuck: “It’s not about the technology being fancy—it’s about being able to maintain consistent milking schedules when good help is impossible to find.”

The economics are compelling. A modern robotic milking system, which costs $200,000 and eliminates 1.5 full-time positions paying $40,000 annually, breaks even in approximately 3.5 years, excluding the value of improved milk quality, reduced labor management stress, and operational flexibility.

However, what concerns me is that this technological shift is fundamentally altering farm balance sheets and increasing demand for specialized financing. The operations that can afford these investments are gaining competitive advantages that compound over time.

It’s not just about milking robots either. Automated feeding systems, environmental monitoring, and precision agriculture technologies—these are all becoming essential tools for competitive operations. The farms that can make these investments are pulling away from those that can’t.

Due to the financial pressure we discussed earlier, a clear divide is emerging between operations that have the capital to invest in labor-saving technology and those that’re struggling to maintain basic operations amid rising costs. This becomes a forward-looking analysis of who will win in the future.

Actionable Advice

So, where does this leave us? If you’re running a dairy operation, you’re probably wondering how to navigate all this uncertainty. Here’s what I think you need to do:

Immediate Actions (Next 90 Days):

- Treat any recent government payments as windfalls, not recurring income

- Calculate your working capital position without those government payments to see your true operational health

- Have frank conversations with your banker about their outlook and requirements

- Focus relentlessly on operational efficiency—optimize input usage, negotiate feed costs, maximize production per cow

Strategic Moves (Next 6-18 Months):

- Evaluate automation investments seriously, especially if you’re well-capitalized

- Consider strategic asset sales if you’re nearing retirement or own non-core assets

- Build cash reserves and strengthen your balance sheet while the “stable” market window exists

- Pay down high-interest debt using any available capital

Why This Urgency Matters—The 2026 Cliff Effect:

Here’s what really concerns me about the next 18 months: the “2026 cliff effect.” Those massive disaster payments propping up farm income in 2025 aren’t recurring. When that liquidity gets withdrawn from the system, the market will be forced to stand on the weakened foundation of its operational cash flows.

If there isn’t a significant improvement in commodity prices or a reduction in input costs, we could see a severe test of financial resilience that triggers a correction in land values. The trend of regional divergence is expected to continue and likely intensify.

The Bottom Line:

The dairy industry is at an inflection point, and the decisions we make in the next 18 months will determine who’s still farming in 2030.

Government payments and constrained supply prop up the “stable” land values we’re seeing. The underlying operational fundamentals—the ability to generate consistent cash flow from farming operations—are under pressure.

For dairy producers, this creates both risk and opportunity. Well-positioned operations will be able to expand through acquisition as less-efficient operations exit the industry.

I’ve seen too many sharp dairy producers caught off guard by transitions like this. The warning signs are there for those willing to look. The producers who thrive in the next five years won’t be the ones who got lucky—they’ll be the ones who saw the writing on the wall and acted with discipline.

What’s your plan when the government payments stop coming? How’s your working capital looking without those one-time checks? Can your operation generate positive cash flow based purely on milk sales?

These aren’t comfortable questions, but they’re the ones we need to be asking. The market is changing under our feet, and your readiness to adapt will determine whether you’re positioned for the opportunities ahead or caught off guard by the challenges.

Because when the dust settles—and it will—the operations that are prepared will be the ones that come out stronger. The question is: are you one of them?

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More:

- Strategies to Boost Cash Flow on Your Dairy Farm – Reveals practical methods for optimizing feed management, maximizing milk production, and diversifying revenue streams to immediately strengthen your operation’s financial position before the 2026 cliff effect hits.

- US Dairy Market in 2025: Butterfat Boom & Price Volatility – Demonstrates how to capitalize on record-high butterfat levels while protecting profits through strategic risk management tools, offering critical market insights that complement land value considerations for expansion decisions.

- Embracing Technology to Save the Family Dairy Farm – Provides comprehensive analysis of robotic milking systems’ ROI potential and implementation strategies, showing how automation investments can deliver the 15-25% labor cost reductions discussed in the land value analysis.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!