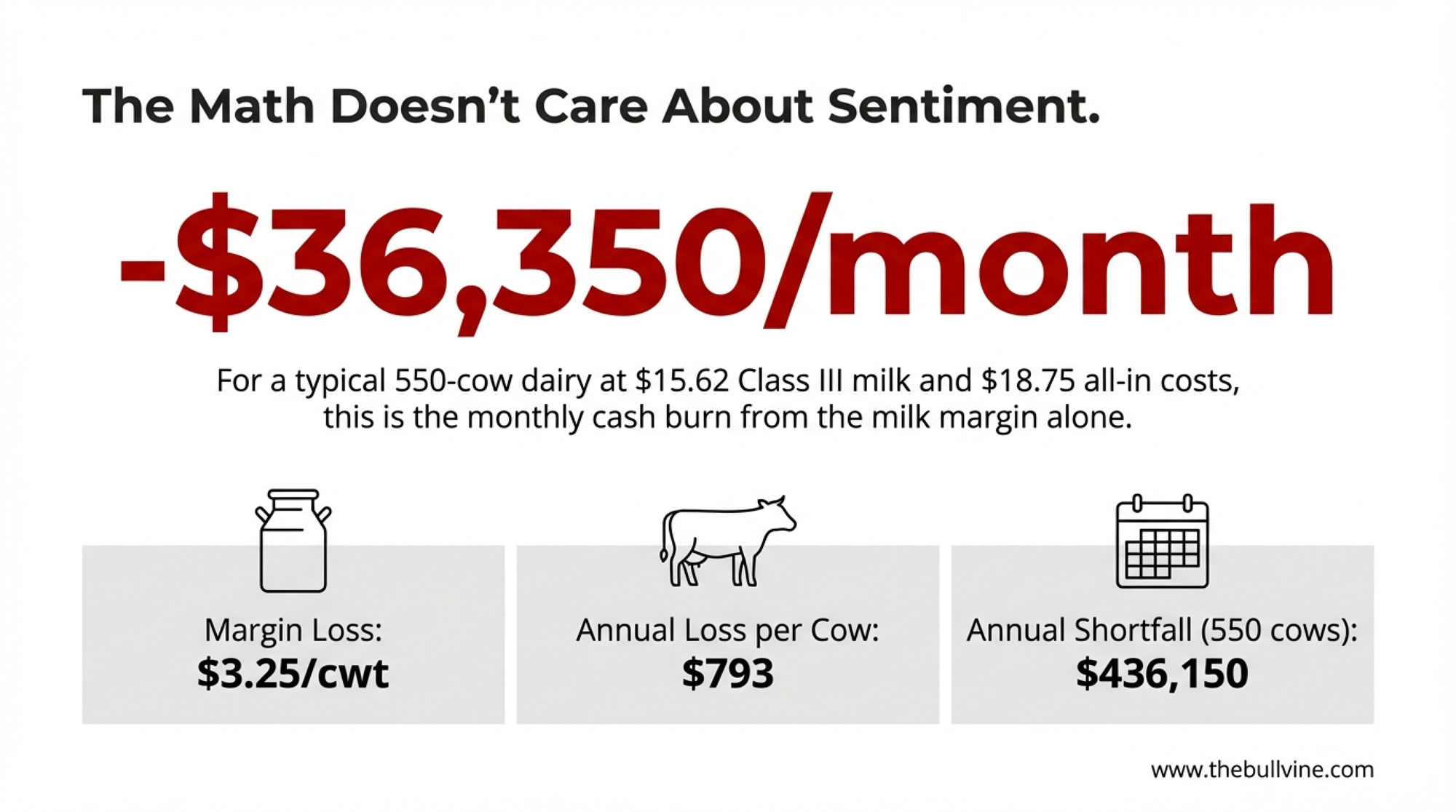

The math doesn’t care about sentiment. At $15.62 milk and $18.75 costs, a 550-cow dairy burns $36,350/month. What’s your number?

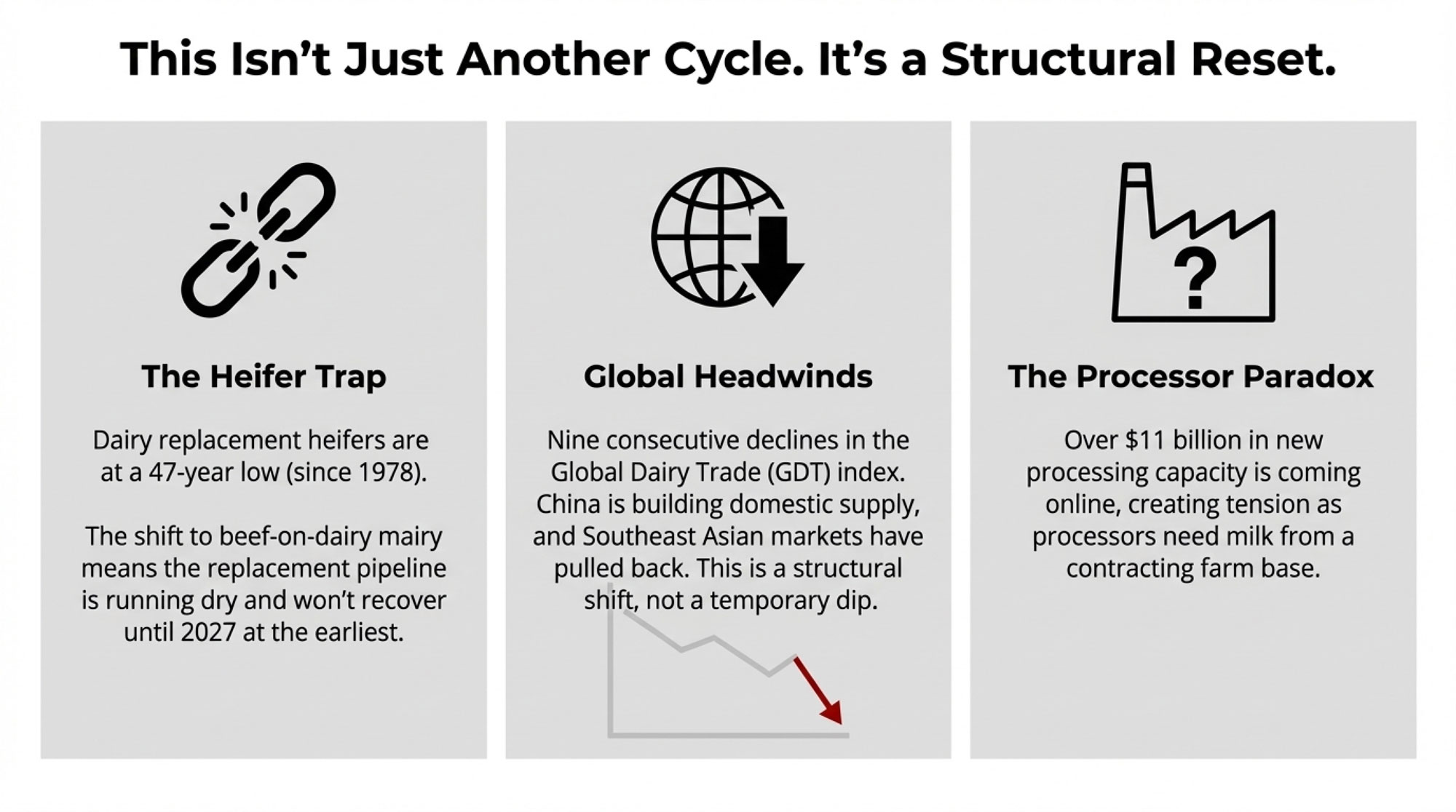

EXECUTIVE SUMMARY: At $15.62 Class III milk and $18.75 all-in costs, a 550-cow dairy burns $36,350 every month—and the math doesn’t care about sentiment. Heifer inventories have hit a 47-year low. Nine consecutive GDT auctions have declined. Over $11 billion in new processing capacity is coming online while farms contract. This isn’t a cycle; it’s a structural reset. For producers with costs in the $17-19 range and limited liquidity, the window to preserve family equity through a controlled transition is roughly 90 days. The frameworks are here—true cost of production, liquidity runway, decision pathways—because knowing your real numbers is the difference between making decisions and having them made for you.

You know how it goes this time of year. You’re wrapping up evening chores, maybe checking futures on your phone while the parlor finishes up, and the numbers just don’t add up the way you need them to.

Class III contracts for early 2026 have been trading in the mid-teens on the CME—January 2026 recently settled around $15.62—and for a lot of operations, that’s a couple of dollars or more below what’s needed to cover everything. Not just feed and labor. Everything. The mortgage, the equipment note, and family living expenses.

Here’s what makes this moment unusual, though. Feed costs have actually come down. Corn’s running around $4.40-4.45 a bushel on the Chicago Board of Trade as of mid-December. Soybean meal’s around $300-320 a ton—well below where it was a couple of years back. Butter inventories look manageable. Domestic cheese demand is holding steady.

So why does the math still feel so difficult?

After spending the past few weeks going through the data—conversations with economists, reports from CoBank and the extension services, watching the Global Dairy Trade auctions—I’ve come to believe that what we’re looking at in early 2026 isn’t just another down cycle. Global supply growth, shifting export dynamics, and significant new processing capacity all arriving at once… these conditions seem likely to reshape dairy’s structure over the next several years.

This isn’t about waiting for prices to recover. It’s about understanding where your operation actually stands—and thinking through your options while they’re still open.

The Numbers Nobody Wants to See

The Global Dairy Trade auctions have been tough to watch lately. The December 16th event marked the ninth consecutive decline, with the index dropping 4.4% according to GDT Event 394 results. The auction before that fell 4.3%. Whole milk powder values have softened enough to create real headwinds for exporters trying to move product internationally.

On the domestic side, butter’s been trading in the mid-$2 range per pound, down from earlier this fall. Block cheese has settled into the mid-$1.60s after pushing toward $1.90 in October, based on CME spot market data. Not terrible, but not where most of us need it to be either.

What’s worth noting—and this is something that’s frustrated a lot of folks—is what’s happening with Dairy Margin Coverage. The program triggered a solid payment in January 2024 when margins dipped below $9.50, according to USDA Farm Service Agency records. Since then? With feed costs lower than they were, the formula shows margins that look healthy on paper, even when your cash flow is telling a very different story.

Danny Munch, an economist at the American Farm Bureau Federation, has spoken to this dynamic. When corn and soybean meal prices drop, the DMC calculation can paint a rosier picture than what many farms are actually experiencing. The safety net’s still there, but the way the formula works means it doesn’t always deploy when you’d expect it to.

💰 THE MATH THAT MATTERS

What margin pressure actually looks like per cow:

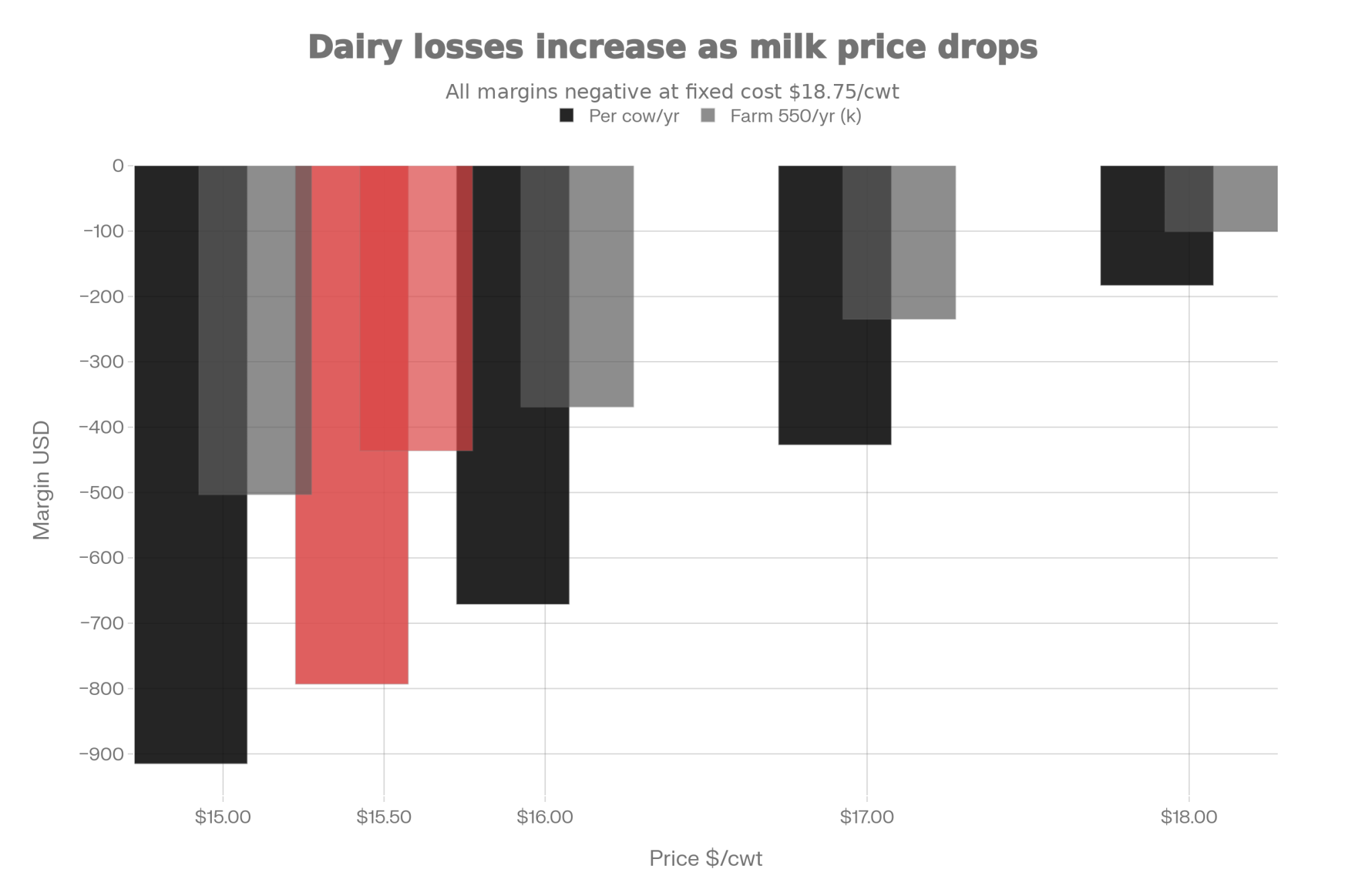

At $18.75 all-in cost and $15.50 Class III milk:

- $3.25/cwt margin loss

- Average U.S. cow produces ~24,375 lbs/year (that’s from USDA’s December 2025 Economic Research Service forecast)

- That works out to 244 cwt × $3.25 = $793/cow/year loss

For a 550-cow dairy:

- $436,150 annual margin shortfall

- $36,350/month cash burn from milk margin alone

And that’s before you add debt service, family living, and depreciation. You can see why liquidity evaporates faster than most folks expect.

The Heifer Trap

Those of us who’ve been through 2009, 2015-16, and 2018 know what price cycles look like. We’ve navigated them before. But a few things are converging now that really do set this period apart.

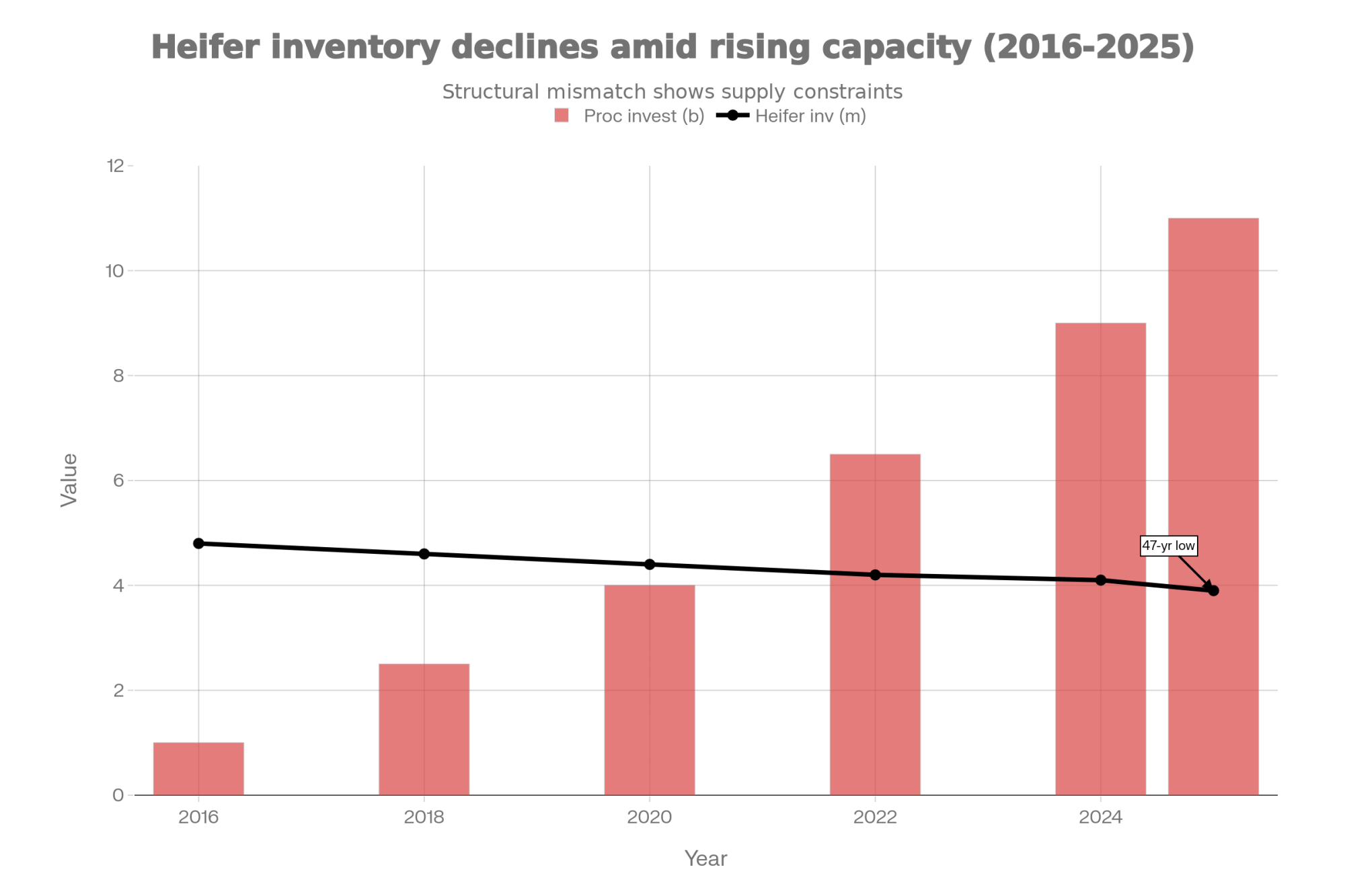

The replacement pipeline is running dry. USDA’s cattle inventory data from January 2025 showed dairy replacement heifers over 500 pounds at around 3.9 million head—the lowest since 1978, according to the National Agricultural Statistics Service. That’s a 47-year low. Let that sink in for a moment.

How did we get here? Well, you probably know, because you may have made some of the same decisions I’ve seen across the industry. When beef-on-dairy started penciling out so well, a lot of operations shifted their breeding programs. NAAB data shows beef semen use on dairy operations climbed substantially over the past decade. It made economic sense at the time—those crossbred calves brought good money, and they still do. But it means fewer heifers in the replacement pipeline, and that’s not something that corrects quickly.

CoBank’s August 2025 Knowledge Exchange report projected that heifer inventories will likely tighten further before any meaningful recovery, probably not until 2027 at the earliest. Biology takes time. You can’t speed up gestation.

Export markets have shifted underneath us. China has been building domestic production capacity for years now. USDA Foreign Agricultural Service and OECD-FAO analyses show they’re meeting most of their dairy needs internally these days internally, with imports focused more on specific ingredients than on bulk commodities. That’s a structural change, not a temporary dip.

Several Southeast Asian markets—Indonesia, Vietnam, the Philippines—have also pulled back from where they were a few years ago, according to USDA’s Dairy: World Markets and Trade reports. There’s still an opportunity there, but competition has intensified considerably.

Processing is expanding while farms contract. According to IDFA data released in October 2025, more than $11 billion in new and expanded dairy processing projects are underway across 19 states, with over 50 facilities scheduled to come online between 2025 and early 2028. That represents significant demand for raw milk—but also creates some interesting pressure on the supply side.

This creates a tension that’s worth watching closely. Processors built capacity expecting continued production growth. The heifer shortage complicates that considerably. And margin pressure is affecting decisions across the board. Everyone in the supply chain is working through the same challenges simultaneously.

Editor’s note: We’re working on a follow-up piece—”What Your Milk Buyer Wants You to Know About 2026″—examining how processors are managing supplier relationships during this consolidation period. If you’re a processor willing to share perspective, reach out to us at info@thebullvine.com.

Know Your Real Numbers

I’ve been talking with financial consultants and extension specialists about what metrics matter most right now. Every operation is different—different debt structures, different facilities, different family circumstances—but a few numbers keep coming up in those conversations.

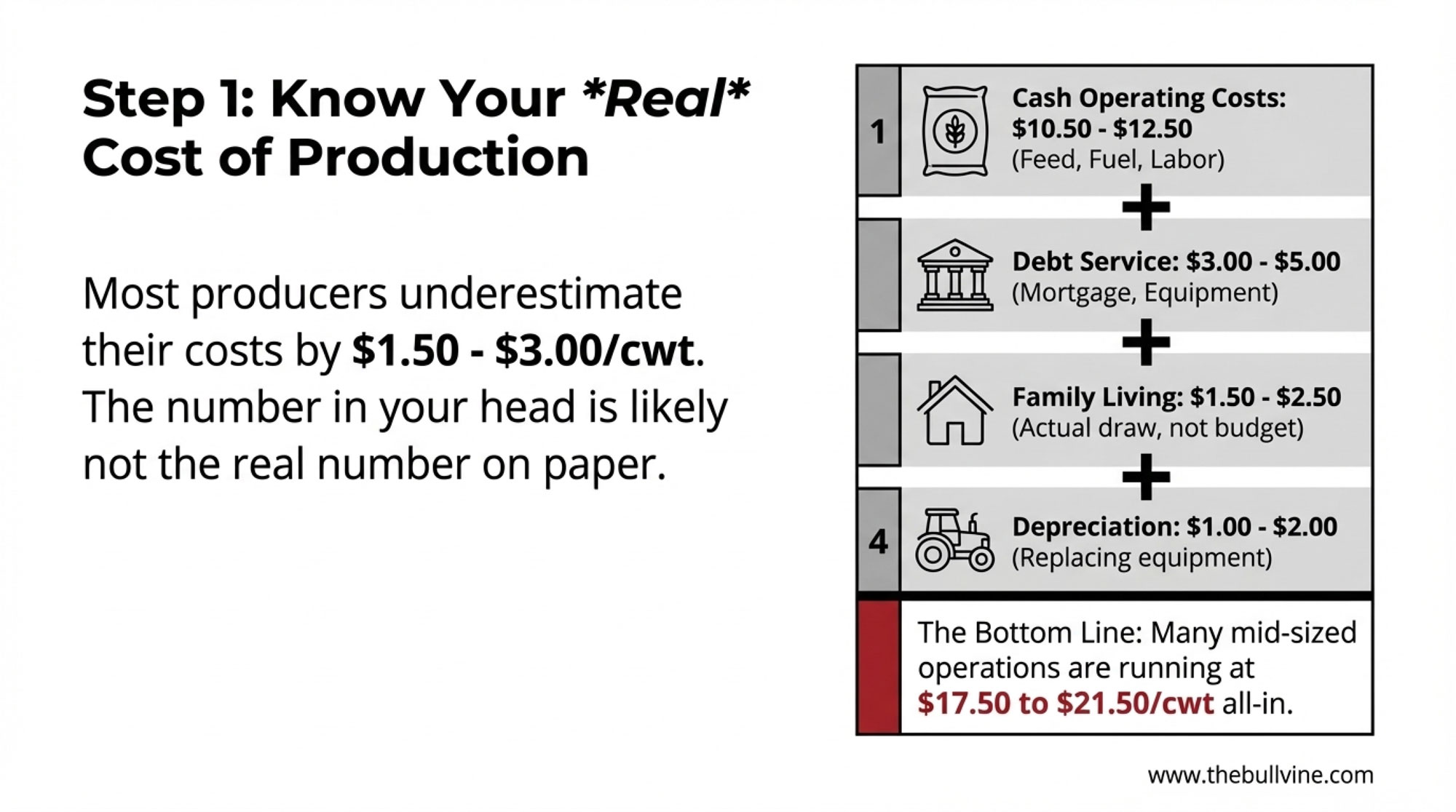

Your Actual Cost of Production

This is probably the most important number you can know. It’s also the one most commonly underestimated.

A farm financial analyst who works with Midwest dairies shared something that stuck with me: most producers he sits down with think they know their cost of production, but once they work through everything carefully, they often find they’re $1.50 to $3.00 higher than they thought. That’s a significant gap when margins are already tight.

A complete picture typically includes:

- Cash operating costs—feed, fuel, labor, utilities, supplies. For most operations, that’s somewhere in the $10.50-12.50 per hundredweight range, according to Penn State Extension dairy breakeven analyses.

- Debt service—equipment payments, real estate, operating lines. That can add another $3-5 per hundredweight depending on your situation.

- Family living—what you actually draw, not what you budgeted. Another $1.50-2.50. And be honest here.

- Depreciation—what it really costs to maintain and replace equipment and facilities over time. Perhaps $1-2 more.

When you add everything up, many mid-sized operations are running $17.50 to $21.50 per hundredweight all-in. The Penn State Extension dairy breakeven tools, the Wisconsin Center for Dairy Profitability benchmarking data (which compares over 500 farms annually), and the University of Minnesota extension work all show similar ranges.

Regional pricing differences matter here, too. Your mailbox price depends heavily on where you’re located and your Federal Order. California’s quota system creates dynamics different from those in FMMO regions. Upper Midwest producers in Order 30 generally benefit from proximity to processing—Wisconsin’s weighted average hauling charge runs around 47 cents per hundredweight, according to Federal Order 30 market administrator data from May 2025.

| Cost Scenario (all‑in) | Margin per cwt (USD) | Margin per cow per year (USD) | 550‑cow farm margin per year (USD) | Monthly cash flow (USD) |

| $17.00/cwt | -1.00 | -244 | -134,200 | -11,183 |

| $18.50/cwt | -2.50 | -610 | -335,500 | -27,958 |

| $20.00/cwt | -4.00 | -976 | -536,800 | -44,733 |

But if you’re in the Northeast under Order 1 or the Southeast under Order 7, you’re facing different math entirely. The June 2025 FMMO reforms increased Class I differentials specifically to reflect the higher cost of servicing fluid markets in those regions—the Southeast saw the largest increase nationally at $1.74 per hundredweight on average, according to USDA analysis. Recently passed intraorder transportation credits are helping offset some of those long-haul costs for Southeast producers, according to Progressive Dairy’s 2025 State of Dairy report. Still, when you’re calculating your margins, make sure you’re using your actual milk check, not a national average.

If your true cost is north of $18 and milk’s in the mid-teens, the gap becomes challenging to manage for very long. You know this already. The question is what to do about it.

The Runway Calculation

This next calculation can be uncomfortable, but it’s genuinely important.

📊 YOUR LIQUIDITY RUNWAY

The Formula: (Available Cash + Remaining Operating Credit) ÷ Monthly Loss at Current Prices = Months of Runway

What It Means:

- 6+ months: Time to evaluate options strategically

- 3-6 months: Decisions needed in next 30-60 days

- Under 3 months: Urgent situation requiring immediate action

Example: $87,000 cash + $140,000 credit line = $227,000 total liquidity At $21,000 monthly loss = 10.8 weeks of runway

Farm finance advisors tell me that many mid-sized operations—the ones in that $18-19 breakeven range—have roughly 3-4 months of liquidity right now. Factor in what’s already been drawn during Q4, and some folks are looking at eight to twelve weeks before things get genuinely difficult.

Can Growth Change the Equation?

Some producers are thinking: if I could get bigger, spread fixed costs over more milk, maybe I could bring my per-hundredweight costs down enough to make this work.

Sometimes that does pencil out. Often it doesn’t.

Here’s one way to think about it: take the investment required—new parlor, additional cows, facility improvements—and divide it by the capital you can realistically access. If that ratio gets much above 2.0, the new debt service often consumes the efficiency gains. I’ve seen operations attempt to grow their way out of margin pressure and find themselves worse off because interest payments exceeded the cost savings they achieved.

What About Premium Markets?

Organic, grass-based, A2—there are genuine opportunities in specialty markets. Premiums in the $22-28 range exist for the right product in the right market.

But transitions require time and capital. Organic certification is a three-year process under the USDA National Organic Program rules. That’s three years of meeting the requirements without receiving the premium. If your liquidity runway is 12 months, that timeline just doesn’t work, regardless of the long-term potential.

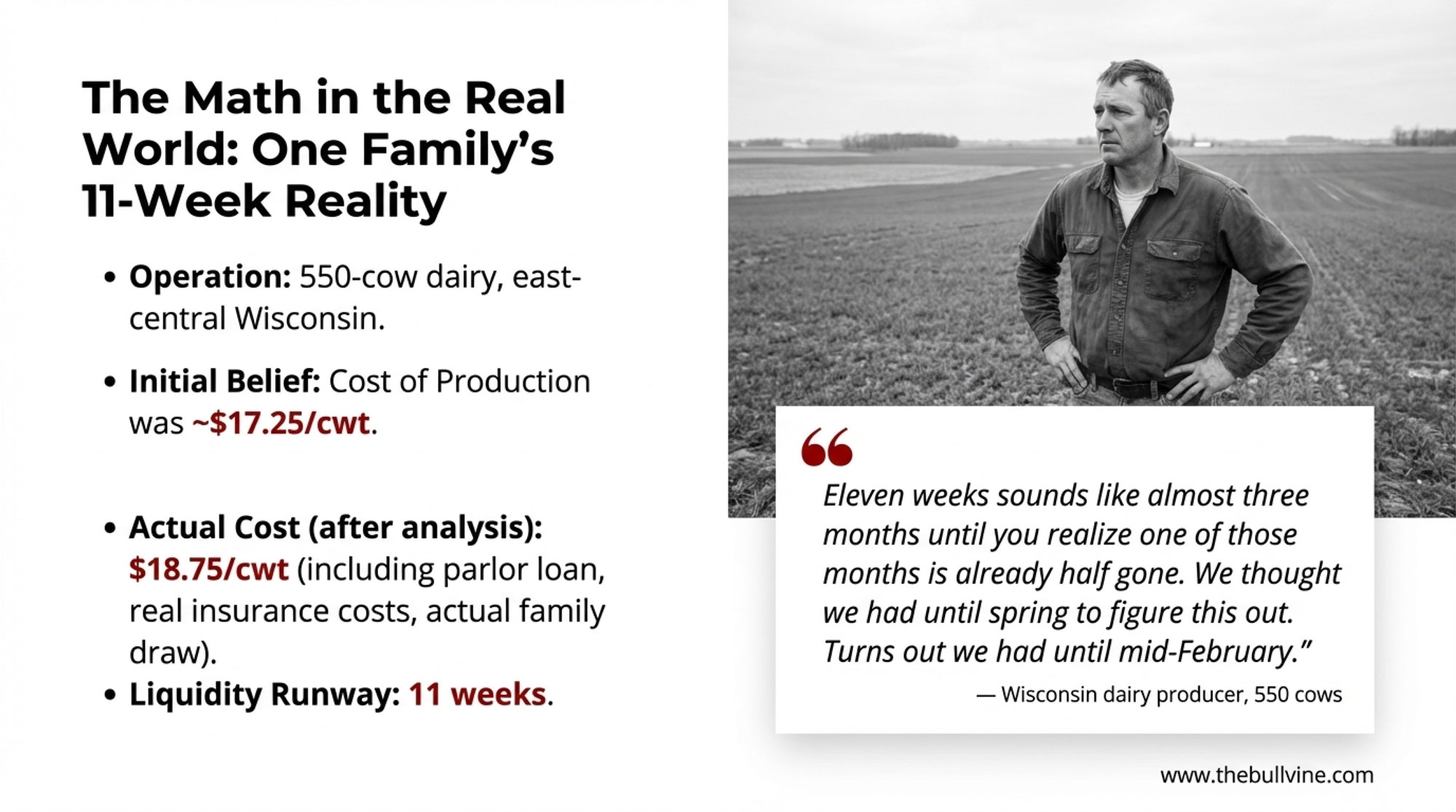

One Family’s Experience

Let me share what this analysis looks like in practice. I spoke with a 550-cow dairy in east-central Wisconsin a few weeks ago. The family asked me not to use their names, but they were willing to walk through their numbers openly.

When they sat down in early December to really nail down their cost of production, they initially thought they were at about $17.25. That’s the figure they’d been carrying in their heads. But once they included the equipment loan from their 2021 parlor renovation, actual family health insurance costs, and what they’d really been drawing for living expenses—not the budget, but actual spending—they landed at $18.75.

Their available cash was $87,000. Operating line had about $140,000 remaining. Total liquidity: $227,000.

At current milk prices, their monthly cash burn worked out to roughly $21,000. That gave them about 11 weeks.

“Eleven weeks sounds like almost three months until you realize one of those months is already half gone. We thought we had until spring to figure this out. Turns out we had until mid-February.”

— Wisconsin dairy producer, 550 cows

They’re now working with their lender on an orderly timeline. Not the outcome anyone hoped for. But better to understand the situation in December than to discover it in April when options have narrowed considerably.

Three Paths Forward

Based on where your numbers fall, you’re likely looking at one of three general situations. And I want to be clear about something—these aren’t judgments about management ability. Cost structures reflect decisions made over decades, regional differences, facility age, land costs, and interest rates at the time of financing. This is simply about matching current circumstances to realistic options.

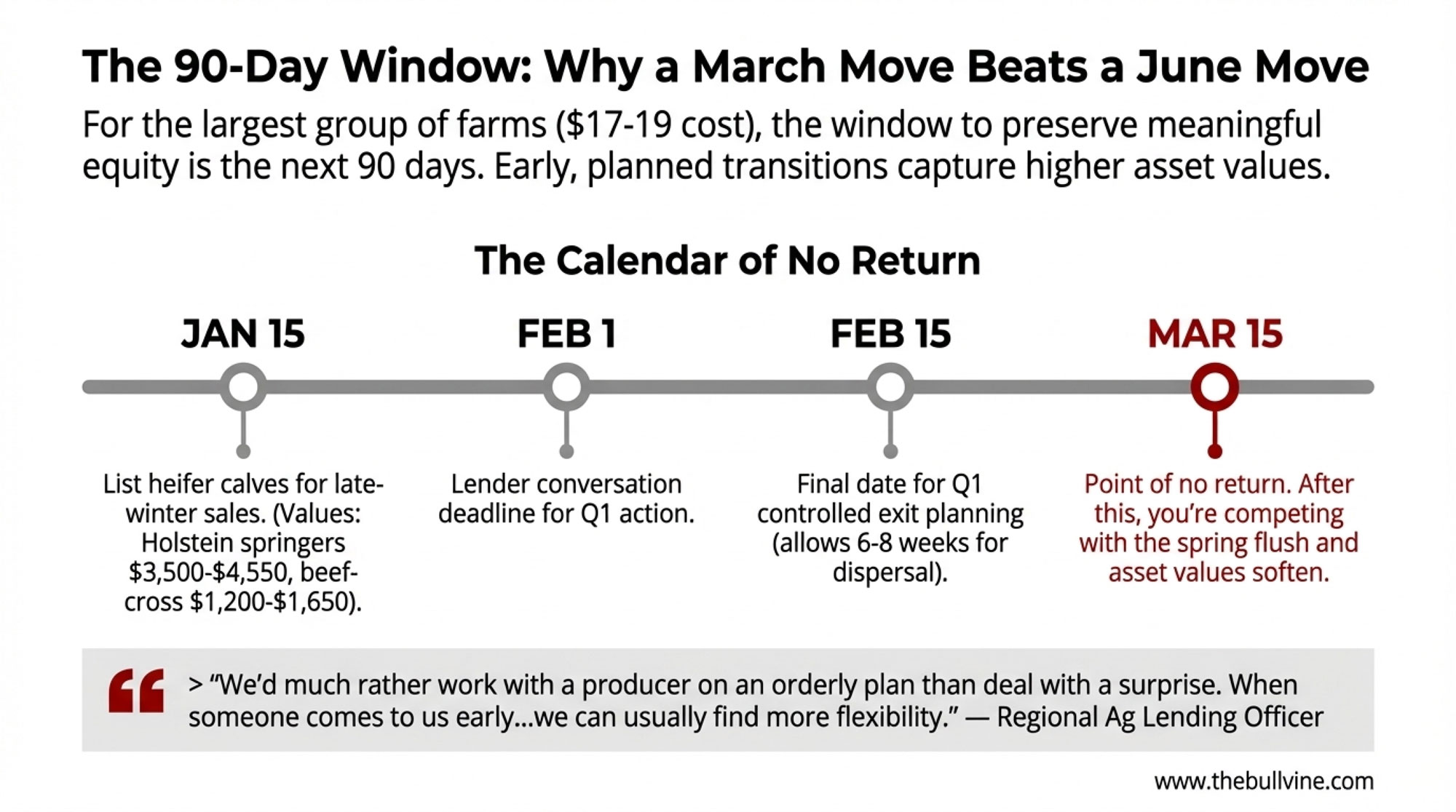

📅 CALENDAR OF NO RETURN: Key Decision Windows

If you’re considering a controlled transition, timing affects value significantly:

| Date | Decision Point | Why It Matters |

| Jan 15, 2026 | Final date to list heifer calves for late-winter sales | Heifer calf values typically are strongest before the spring flush; Dairy Herd Management reported Holstein springers hitting $3,500-$4,550 and beef-cross calves commanding $1,200-$1,650 at fall 2025 auctions |

| Feb 1, 2026 | Lender conversation deadline for Q1 action | Banks close Q1 books in March; flexibility drops significantly after February conversations |

| Feb 15, 2026 | Last reasonable date for Q1 controlled exit planning | Allows 6-8 weeks for orderly herd dispersal before the spring flush depresses values |

| March 15, 2026 | Point of no return for spring timing | After this date, you’re competing with spring flush volumes; asset values typically soften as supply increases |

These windows assume a controlled transition. Crisis liquidations follow different, more compressed timelines.

| Situation | Key Indicators | Primary Focus |

| Well-Positioned | Costs under $17/cwt, 6+ months liquidity, solid debt coverage | Strategic positioning for the consolidation period |

| Middle Ground | Costs $17-19/cwt, 3-6 months liquidity, tight but manageable debt | Evaluate controlled transition within 90 days |

| Immediate Pressure | Costs above $19/cwt, under 3 months liquidity, debt coverage below 1.0 | Proactive restructuring or professional consultation |

The Strong Position Play

All-in costs under $17, 6+ months of liquidity, solid debt coverage, and a good lender relationship.

This describes a minority of operations currently—more common among larger Western dairies with scale efficiencies and some newer Midwest facilities with recent upgrades. If this is your situation, you have the runway to work through the consolidation period ahead.

What tends to make sense here: lock in feed costs while they’re favorable. Ensure your Dairy Revenue Protection coverage is in place for 2026. Have substantive conversations with your milk buyer about 2026-27 arrangements. If heifer availability improves through processor partnerships—and CoBank reports some buyers are offering co-financing to maintain key supplier relationships—you may be positioned to grow at reasonable terms.

The key discipline is avoiding overextension. The operations that emerged strongest from 2015-16 were often those that stayed conservative even when they had the capacity to expand. There’s wisdom in that.

The 90-Day Window

Costs in that $17-19 range, three to six months of liquidity, and debt coverage that’s manageable but tight.

Many farms fall into this category—probably the largest group, honestly. For this group, the window for a controlled transition that preserves meaningful equity is roughly 90 days.

Financial advisors who work with dairy operations consistently report that farms executing planned transitions early in a downturn preserve significantly more equity than those who wait until circumstances force their hand. The Wisconsin Center for Dairy Profitability has tracked these patterns through multiple price cycles.

Timing matters because asset values—particularly herd values—typically soften when many farms are selling simultaneously. Operations moving in March or April will likely realize stronger prices than those waiting until May or June if exit activity accelerates as some expect. Dairy Herd Management’s fall 2025 auction reports showed Holstein springers commanding $3,500-$4,550 per head and beef-cross calves bringing $1,200-$1,650—but these premiums depend on moving before the market gets crowded.

What does a controlled transition look like? Liquidate heifer calves first while prices remain firm. Market cull cows and productive animals over six to eight weeks rather than all at once. Apply proceeds strategically to debt, prioritizing real estate obligations. Communicate openly with your lender throughout.

I spoke with a regional agricultural lending officer in the Upper Midwest who’s worked with dairy borrowers for over 20 years. His perspective: “We’d much rather work with a producer on an orderly plan than deal with a surprise. When someone comes to us early and says, ‘Here’s what I’m seeing in my numbers, here’s what I’m thinking,’ we can usually find more flexibility than if they wait until they’ve missed payments and we’re both in a corner.”

An operation with $6 million in assets and $4.5 million in debt can potentially preserve $1 million or more in family equity through well-timed management. That’s meaningful capital for whatever comes next—whether that’s a different agricultural venture, off-farm investment, or retirement.

When Restructuring Is the Reality

Costs above $19, less than three months of liquidity, and debt coverage below 1.0.

A growing number of farms find themselves here. For this group, the question isn’t whether restructuring happens—it’s whether you’re making the call or someone else is.

Chapter 12 bankruptcy was designed specifically for family farm operations under the Bankruptcy Abuse Prevention and Consumer Protection Act. It provides court protection for three to five years. Lenders can’t foreclose during that period, and debt typically gets reduced by 30-50%.

An agricultural bankruptcy attorney in Iowa who handles dairy cases offered this perspective: file proactively rather than waiting for your lender to accelerate the note. Farmers who seek advice before they’re in full crisis tend to have better outcomes than those who wait until foreclosure is imminent.

The honest reality with Chapter 12: it works when restructured debt levels actually allow the operation to generate positive cash flow going forward. For situations where even halving the debt wouldn’t create sustainable margins at current milk prices, restructuring may delay the outcome rather than change it. That’s a hard truth, but it’s worth considering carefully.

Hard-Won Wisdom

I reached out to several producers who navigated the 2015-16 downturn to ask what they learned from it. Their perspectives are worth hearing.

A 400-cow producer in upstate New York—he asked to remain anonymous—emphasized the lender relationship: “Your banker isn’t working against you. They don’t want to foreclose—that’s a loss for them too. But they need to know what’s happening. The worst thing you can do is go quiet and let them be surprised.”

A manager at a 2,200-cow operation in California’s San Joaquin Valley offered additional perspective. Scale doesn’t eliminate these challenges, he noted—it changes the arithmetic. “We have more runway because of volume, but we also have more at stake. The weight of these decisions feels the same.”

Several people I spoke with mentioned the difficulty of separating emotional attachment from financial analysis. These are multi-generational operations. Family history, land that’s been worked for decades, identity tied to being a dairy farmer—that’s all profoundly real. But financial calculations don’t account for sentiment. And the operations that survive to transition to the next generation potentially require decisions grounded in numbers.

Where to Find Help

If you’re working through these calculations and want assistance, the land-grant universities offer genuinely valuable tools:

Penn State Extension provides a dairy breakeven cost worksheet that walks through the analysis in detail, available at extension.psu.edu.

The Wisconsin Center for Dairy Profitability has benchmarking tools that compare your numbers against more than 500 farms, accessible through the UW-Madison Division of Extension.

University of Minnesota Extension offers financial planning worksheets through their farm management program.

Your local extension dairy specialist can often sit down with you and work through the numbers—that’s exactly what they’re there to help with. Don’t hesitate to reach out.

For DMC specifically, the USDA Farm Service Agency maintains a decision tool on their website at fsa.usda.gov.

Five Questions to Answer This Week

If you take nothing else from this piece, sit down sometime in the next few days and work through these:

- What’s your true all-in cost of production? Not the number you’ve been carrying in your head. The real figure, including debt service, family living, and depreciation.

- What’s your actual liquidity runway at current prices? Cash on hand plus remaining credit, divided by monthly losses. Be honest about what you find.

- What would need to change for your operation to cash flow at $16 milk? Is that achievable, or would it require changes that aren’t realistic?

- When did you last have a substantive conversation with your lender about your financial position? If it’s been more than 90 days, that conversation is overdue.

- What does your best realistic outcome look like two years from now? Not the hopeful scenario—the one you’d actually bet money on.

The Road Ahead

If your position is strong, use this time wisely—secure favorable feed costs, strengthen processor relationships, and maintain discipline on growth decisions.

If you’re in that middle ground, recognize that the window for preserving equity through a managed transition is perhaps 90 days. Earlier timing—March or April—will likely yield better outcomes than waiting until mid-summer.

If you’re facing immediate pressure, consult with professionals now, before you’re in crisis. Outcomes improve significantly when decisions are proactive rather than reactive.

The Bottom Line

The dairy industry that emerges from 2026-27 will look different from what we see today. More consolidated. Different economics of scale. That’s a difficult reality to acknowledge—these are real families, real communities, real legacies at stake.

But the market data is clear. The frameworks for decision-making are available. What remains is the hard part: making choices based on numbers rather than hope, and making them while options remain.

The producers I’ve come to respect most aren’t those who never faced difficult decisions. They’re the ones who faced them honestly, made the best choice available with the information they had, and found a way forward.

Whatever path makes sense for your operation, the most challenging choice may be making no choice at all.

KEY TAKEAWAYS

- Run your numbers this week: At $15.62 Class III and $18.75 all-in costs, a 550-cow dairy loses $793/cow/year—that’s $36,350 in monthly cash burn.

- Recognize this for what it is: Heifer inventories at a 47-year low, nine consecutive GDT declines, $11B in new processing capacity arriving. This isn’t a down cycle. It’s a structural reset.

- Calculate your true cost of production: Include debt service, actual family draw, and depreciation. Most producers discover they’re $1.50-$3.00/cwt higher than the number they’ve been carrying.

- Know your liquidity runway: (Cash + remaining credit) ÷ monthly loss at current prices = months until decisions get made for you.

- Act while options remain: For operations in the $17-19 cost range with limited liquidity, the window to preserve family equity through a controlled transition is roughly 90 days. March moves beat June moves.

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More

- The 90-Day Dairy Pivot: Converting Beef Windfalls into Next Year’s Survival – Arms you with a tactical toolkit to stack $266 per cow in immediate returns. This breakdown reveals how leveraging beef-on-dairy premiums and component bonuses can generate critical cash flow to bridge the 2026 gap.

- 2800 Dairy Farms Will Close This Year—Here’s the 3-Path Survival Guide for the Rest – Exposes the structural bifurcation of the industry and delivers a clear roadmap for the next 18 months. You’ll gain the strategy to choose between premium differentiation or mega-scale efficiency before market forces decide for you.

- From -43% to +0.8%: The Genetic Shift Powering Dairy’s First Fluid Milk Growth Since 2009 – Reveals how the “fairlife model” is repricing every cow in your barn. Learn why the 15-year decline in fluid milk is over and how A2 and high-fat genetics can capture premiums that volume-only herds will never see.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!