You paid 15¢/cwt into the dairy checkoff. A $500M cottage cheese deal didn’t need it. Are you funding TikTok trends or your own milk check?

Executive Summary: Dairy farmers are still paying 15¢/cwt into a national checkoff that now bets big on TikTok creators, fast‑food shakes, and retail algorithms, even as the hottest growth story in dairy — a $500 million-plus Good Culture cottage cheese deal — unfolded with no clear checkoff role at all. The article opens with Brenda Cochran’s two‑decade fight against mandatory assessments and Sarah Lloyd’s insider critique from the DMI board table to show how the same 15¢/cwt feels on very different farms. It then tracks the money through USDA’s 2022 Report to Congress and economist Oral Capps’ analysis, which claim an all‑dairy benefit‑cost ratio above 5:1 and suggest milk prices would sit about $1/cwt lower without the program. That glossy ROI is set against awkward facts: historically thin butter promotion despite booming butter demand, fluid milk’s modest 0.8% uptick, and a cottage cheese market that nearly doubled on its own. A simple barn‑math example walks a 300‑cow herd through what it actually takes for that 15¢/cwt to pencil out — and why it often doesn’t if your co‑op’s plant is still mostly pushing commodity powder instead of value‑added products. Finally, the piece gives producers a 30‑day checklist: pull their own checkoff and component numbers, press co‑op leadership on product mix and premiums, and decide whether reforms like the bipartisan OFF Act are worth backing before the next Farm Bill window closes.

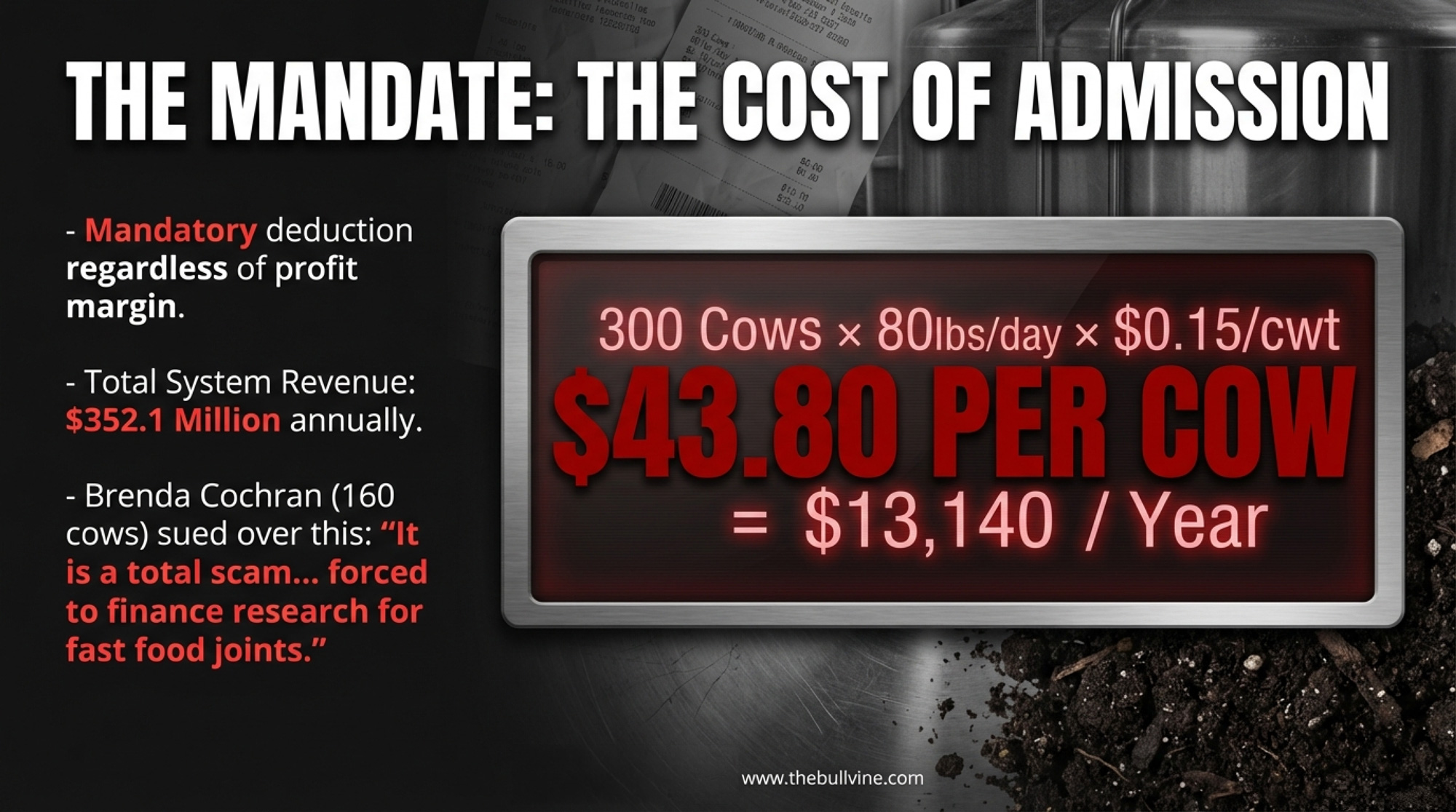

In April 2002, Brenda and Joe Cochran — dairy farmers in Westfield, Pennsylvania — sued the USDA over the mandatory dairy checkoff. “This is about our First Amendment rights, plain and simple,” Brenda told Farm and Dairy. Their 160-cow herd on 213 acres of Tioga County hillside shipped roughly 7,000 pounds a day, and the checkoff cost them nearly $4,000 a year. That money, the Cochrans argued in their filed complaint, represented “a significant portion of the gross profit margin” and kept them from “implementing essential farm management practices.”

The Cochrans weren’t co-op members. They marketed their own milk, negotiated their own contracts, and milked mostly Holsteins alongside Jersey and Normandy crosses—a pasture-based operation producing what they considered a differentiated product. Being forced to fund generic advertising that, as their complaint stated, amounted to “speech that denies there is any difference in milk” struck them as fundamentally wrong. So they hired the Institute for Justice and went to federal court.

They won.

A Federal Victory — and a Supreme Court Reversal

In February 2004, three judges on the Third Circuit declared the dairy checkoff unconstitutional, ruling it was compelled private speech that violated the Cochrans’ First Amendment rights. Brenda was “ecstatic” with the ruling, Farm and Dairy reported at the time.

That victory lasted about a year. In 2005, the Supreme Court ruled in a separate beef checkoff case — Johanns v. Livestock Marketing Association — that commodity checkoff programs constitute government speech, not private speech. The reasoning effectively gutted the Cochrans’ win. The dairy checkoff kept collecting.

By 2017, Cochran was writing publicly about what that meant for her family’s operation. “For years, the forced deductions from our milk checks being used to finance the generic dairy checkoff program have exceeded $4,500 annually,” she wrote in an essay for the Organization for Competitive Markets, “which is a huge financial loss from our already insufficient milk income.”

She was even more direct with the Daily Caller News Foundation in 2018: “It is a total scam… They have forced us to finance research on products that benefit fast food joints and pizza parlors. And they want me to develop cheese and yogurt? I’m very upset about it. Even just talking about it makes my blood pressure go up.”

The Cochrans raised 14 children on that Tioga County farm. The checkoff didn’t care about their herd size, their marketing approach, or their bottom line. It just took the 15 cents.

She Isn’t the Only One Asking

Eight hundred miles west, Sarah Lloyd farms with her husband, Nels Nelson, on the Nelson family operation outside Wisconsin Dells. Her herd runs about 350 cows. Lloyd holds a PhD in rural sociology from UW-Madison, and she’s served on both the National Dairy Promotion Board and the Wisconsin Milk Marketing Board — the bodies that oversee where your checkoff dollars go.

Her public assessment of the system is blunt.

Lloyd has spoken publicly about how checkoff-driven consolidation plays out at the local level. She told Grist that a neighboring dairy quadrupled in size to supply mozzarella to a nearby frozen pizza factory — while local infrastructure struggled to handle the waste. “We have massive water quality issues,” she said. “It’s a real crisis right now on all the legs of sustainability: ecologically, socially, economically.”

| Producer | Location & Herd | Marketing Approach | Checkoff Cost (Annual) | Core Critique |

|---|---|---|---|---|

| Brenda Cochran | Tioga County, PA 160 cows (Holstein, Jersey, Normandy) ~7,000 lbs/day shipped | Independent marketer Negotiates own contracts No co-op membership | ~$4,000/year | “Forced to finance research on products that benefit fast food joints and pizza parlors. It’s a total scam.”(red) |

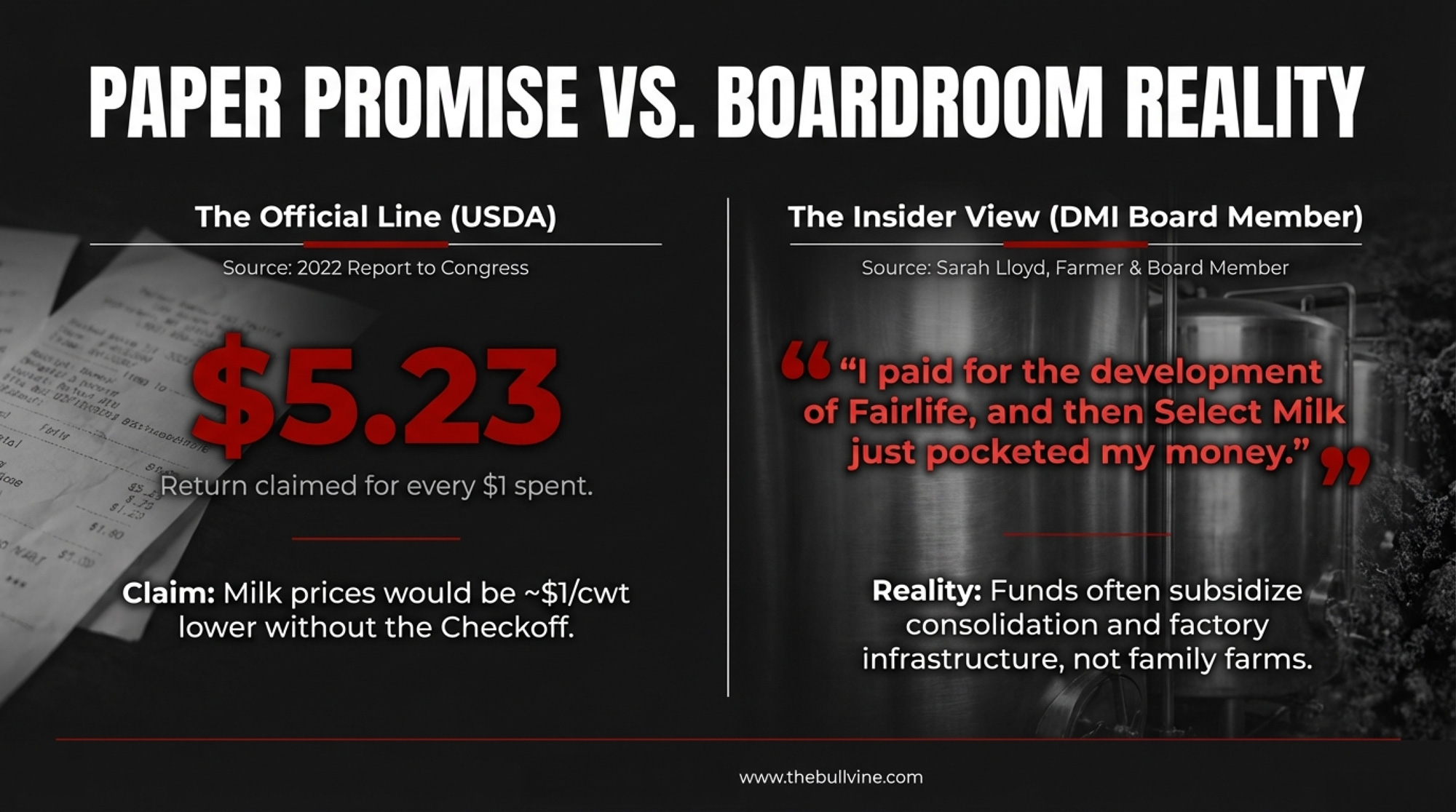

| Sarah Lloyd | Wisconsin Dells, WI 350 cows Nelson family operation | Co-op member Served on National Dairy Promotion Board & Wisconsin Milk Marketing Board | ~$9,500/year | “I paid for the development of Fairlife, then Select Milk just pocketed my money and took the profit when they sold to Coca-Cola.” (red) |

| System Impact | — | — | $352.1M (2022) all U.S. producers | Both producers pay 15¢/cwt regardless of herd size, product differentiation, or measurable return at the farm level. |

The checkoff helped create demand for that mozzarella. Whether it helps a family operation competing with the factory next door is a different question entirely.

Where Does $431.8 Million a Year Actually Go?

Cochran and Lloyd are asking the same question from different states, with different herd sizes, and from different angles. And in 2026, that question involves $431.8 million of producer and processor money.

Every U.S. dairy producer pays $0.15 per hundredweight of milk sold. In 2022 — the most recent audited year — that added up to $352.1 million in mandatory producer assessments, plus another $79.7 million from fluid milk processors through MilkPEP, according to USDA’s 2022 Report to Congress published in September 2024.

The money is split roughly 26% to Dairy Management Inc. (DMI), 23% to MilkPEP, and 51% to state- and regional-qualified programs. DMI is the entity that turns those dollars into demand campaigns — and some of those campaigns ended up going spectacularly viral.

From Courtrooms to TikTok: Where Cochran’s 15¢ Ended Up

While Cochran was filing legal briefs in Tioga County and Lloyd was raising transparency concerns from inside the boardroom, DMI was building something neither of them voted for — a social media marketing machine powered by producer assessments.

In September 2022, influencer chef Justine Doiron posted a TikTok of herself slathering butter onto a wooden board — sea salt, lemon zest, flower petals. The New York Times picked it up. CNN ran it. New York Magazine declared that “butter has become the main character.” What the audience didn’t know: Doiron was on a paid contract with DMI as part of their “Dairy Dream Team” of sponsored influencers. Her butter board video carried no advertising disclosure — and she’d posted a DMI-sponsored ad just two days before the viral hit. DMI told Grist that the specific video “was not itself technically part of the partnership,” but the organization claimed credit for the butter board trend in industry press.

The strategy runs deeper than social media. Since 2009, DMI has placed two dairy scientists directly inside McDonald’s headquarters to increase dairy across the menu. Less than a decade later, four in five McDonald’s menu items contained dairy, according to a DMI board member. When the Grimace Shake went viral in Q2 2023 — the hashtag hit 3 billion TikTok views, per McDonald’s CFO Ian Borden on the company’s Q2 2023 earnings call — it helped drive McDonald’s U.S. same-store sales up 10.3% for the quarter.

DMI also partnered with YouTube star MrBeast, staging a custom Minecraft gaming competition on National Farmer’s Day in October 2022 that featured dairy sustainability messaging. And MilkPEP has paid more than 200 influencers — including Emily Ratajkowski and Kelly Ripa — to promote milk on social media.

DMI CEO Barb O’Brien put the McDonald’s partnership plainly on a podcast in December 2023: “My hope is that farmers, when they see a new milkshake or a new McFlurry at McDonald’s, that they know that it’s their new product.”

Lloyd saw it differently. She told The American Prospect in April 2023 that she’d sat on the state checkoff board when they voted to fund product development at Fairlife. After the rollout, Select Milk Producers helped sell Fairlife to Coca-Cola. “I paid for the development of that product, and then Select Milk just pocketed my money and took the profit from that,” Lloyd said.

Does the Checkoff Actually Move Your Milk Price?

Here’s where the argument gets genuinely messy — for both sides.

USDA’s 2022 Report to Congress, authored by Texas A&M’s Oral Capps Jr., puts the aggregate all-dairy benefit-cost ratio at $5.23 per dollar spent — meaning the model estimates that for every dollar the checkoff collected, it generated $5.23 in economic value for the dairy sector. That’s the highest across four consecutive evaluations. In a separate analysis presented at the 2025 Joint Annual Meeting in Arlington, Texas, Dr. Capps and colleagues at the University of Missouri estimated that without the checkoff, the all-milk price would be “about $1 per 100 weight” lower. For a 300-cow herd producing 87,600 cwt per year, that’s $87,600 in theoretical price support. On paper, the system works.

But zoom in on individual categories, and the picture fractures.

| Year | All-Dairy BCR | Cheese BCR | Butter BCR |

|---|---|---|---|

| 2012 | 4.8 | 6.2 | 7.1 |

| 2013 | 5.1 | 5.8 | 6.4 |

| 2014 | 5.4 | 5.3 | 5.9 |

| 2015 | 5.6 | 4.9 | 5.2 |

| 2016 | 5.5 | 4.6 | 4.8 |

The aggregate looks strong. But the two highest-value component categories — butter and cheese — are both showing falling returns on checkoff spending. Fluid milk collapsed before partially recovering. When you dig into the 2016 numbers, the disconnect jumps out. It sure looks like the ‘return’ had very little to do with where your dollars actually went.. Despite this minimal spend, butter was already the fastest-rising demand category in the industry. It suggests a scenario where the reported ‘return’ may have had very little to do with the actual ‘investment’ of producer dollars.

| Category | % of Total Checkoff Spending (2016) | Market Performance | DMI’s Role |

|---|---|---|---|

| Butter | 0.5% | Fastest-rising demand category in dairy; consumer-driven surge | Minimal—growth happened independently |

| Fluid Milk | 33.5% | Modest 0.8% uptick after decades of collapse | Heavy investment, limited return |

| Cheese | ~35% | 41% of U.S. milk supply; BCR falling (6.2→4.6) | Pizza R&D, McDonald’s partnerships |

| Cottage Cheese | 0% | Market doubled; $1.75B in sales (+18% YoY, 2025) | None—$500M Good Culture deal with zero checkoff |

The 2022 report doesn’t provide the same level of detail to check whether that pattern holds.

The Cottage Cheese Paradox

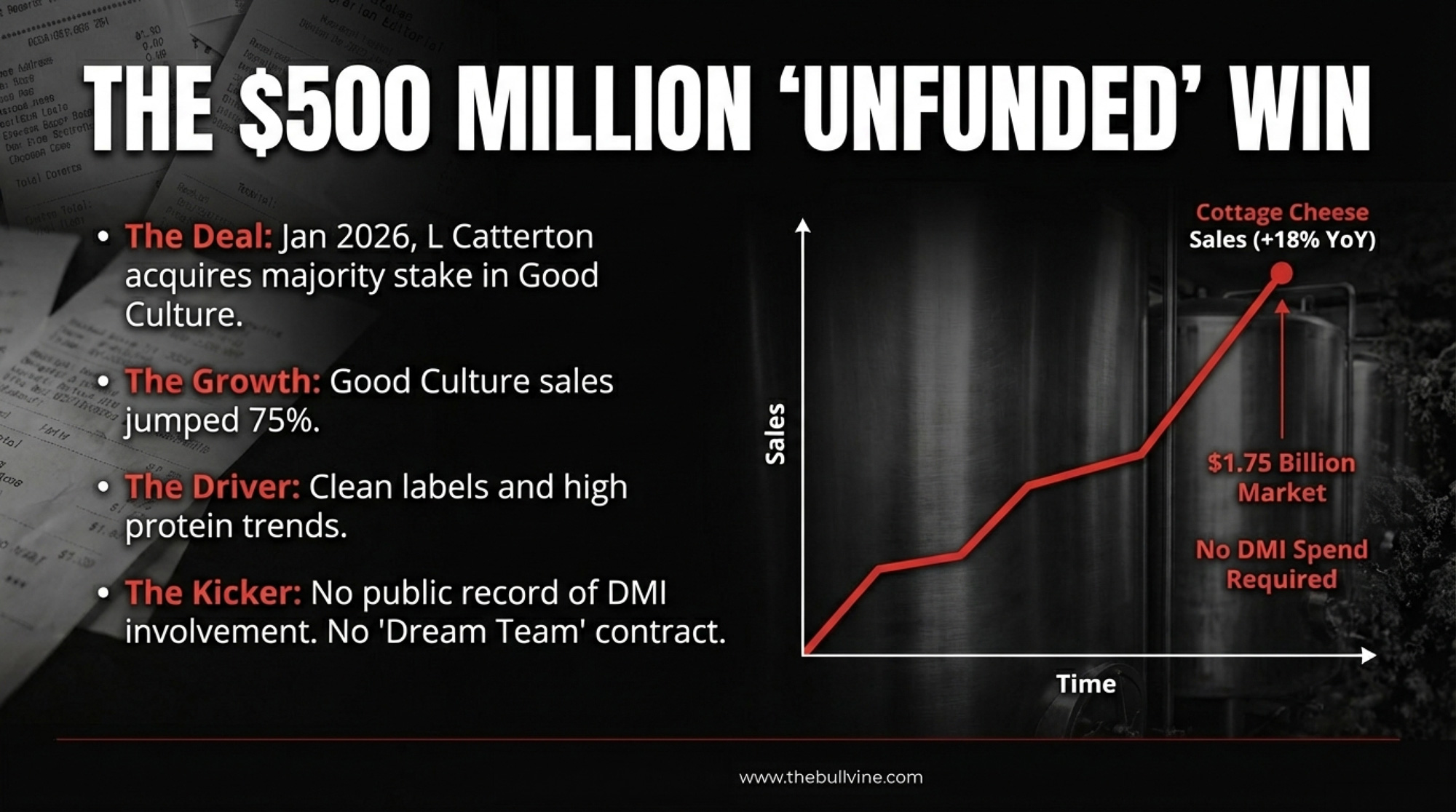

In January 2026, private equity firm L Catterton agreed to acquire a majority stake in Good Culture in a deal valued at more than $500 million, Reuters reported. Co-founder Jesse Merrill launched the cottage cheese brand in 2015 after being diagnosed with ulcerative colitis. “I had to rethink how I fueled my body completely,” Merrill wrote on LinkedIn. He built a clean-label, high-protein line in a category that hadn’t seen real innovation in decades.

Good Culture hit $187 million in dollar sales for the 52 weeks ending February 23, 2025 — up 75% year-over-year, per Circana data reported by Dairy Foods. The broader U.S. cottage cheese market reached $1.75 billion in total dollar sales over that same period, an 18% year-over-year jump.

There’s no public record of DMI involvement in the cottage cheese revival. No “Dream Team” contract. No branded editorial deal. The cottage cheese boom looks like a genuine consumer pull — the “protein hack” trend on TikTok collided with clean-label preferences and the category exploded without anyone from DMI touching it.

That’s the paradox: the biggest dairy demand story in a decade grew without the checkoff. Cochran has been funding the program with her checkoff dollars for more than two decades, and the half-billion-dollar success story happened in a category the program never touched.

The aggregate BCR says the system works. On paper, the system works. In cottage cheese, it clearly worked just fine without your 15¢/cwt.

What Does This Math Look Like at Your Tank?

Let’s get concrete.

On a 300-cow herd shipping 80 lbs/day at 4.2% butterfat, your mandatory checkoff costs $13,140 a year — that’s $43.80 per cow. When the Cochrans were shipping 7,000 lbs/day from Tioga County, they paid nearly $4,000 — and they shipped independently, without a cooperative to negotiate on their behalf. None of that money is optional.

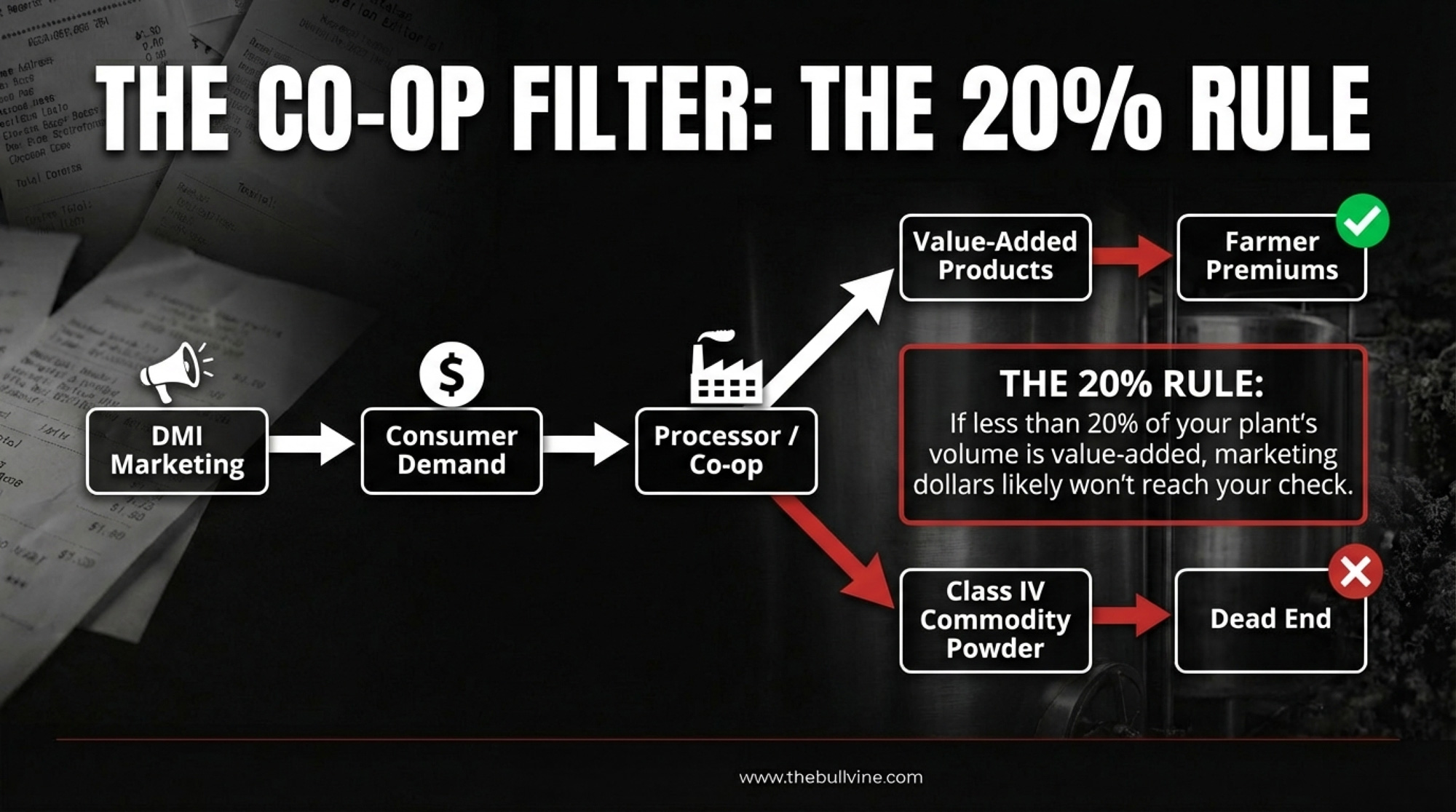

Nobody’s arguing DMI doesn’t create demand. Butter boards, Grimace Shakes, cheese-stuffed everything — the campaigns are real. The real question is whether that demand reaches your tank.

Context matters: the FMMO butterfat component price in 2025 swung from $2.9460/lb in January to $1.5831/lb by December — a $1.36/lb range and a 46.3% drop across 12 months, per USDA AMS class and component price announcements.

| Metric | Checkoff Cost | Price Lift Needed to Break Even |

|---|---|---|

| Per-Cow Annual | $43.80 | $61 |

| Herd-Level (300 cows) | $13,140 | $18,396 |

That same 300-cow herd produces roughly 367,920 lbs of butterfat per year. If checkoff-driven demand pushes the butterfat component price up just $0.05/lb above where it would otherwise land, that’s $18,396 — about $61 per cow. Your checkoff costs $43.80/cow. The math can work.

But — and this is Cochran’s point and Lloyd’s point — it only works if your co-op’s plant is positioned to capture premium demand. If your milk goes into commodity powder or Class IV, TikTok doesn’t show up on your check. One threshold worth asking about at your next board meeting: what percentage of your co-op’s plant volume goes to specialty or value-added products? Our rough benchmark: if the answer sits below 20%, the demand creation DMI is funding is likely not reaching your milk check in any meaningful way.

What Can You Actually Do About This?

There isn’t one right answer. But there are different ways to respond depending on where you sit.

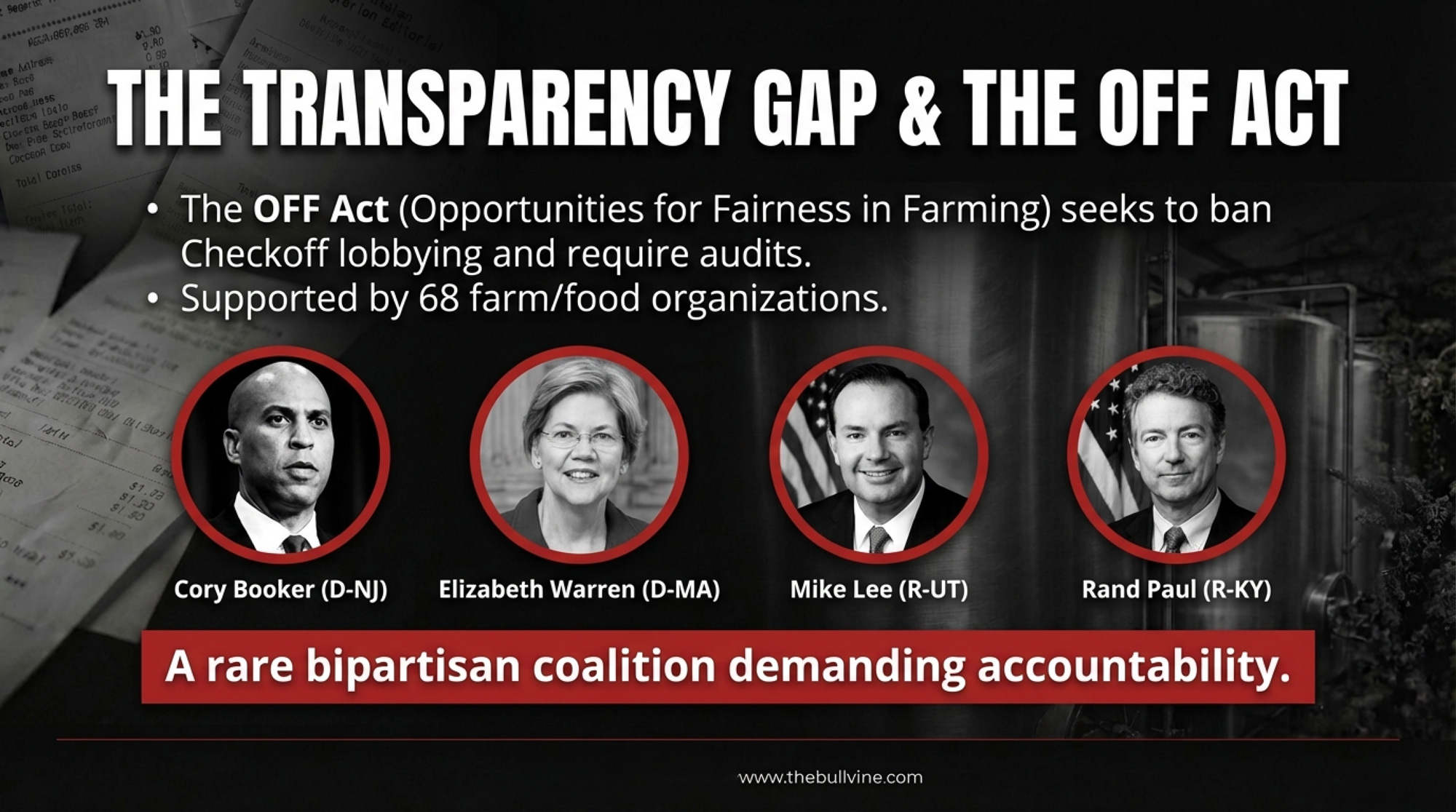

Push for transparency from the system. Sixty-eight farm and food organizations now back the OFF Act (Opportunities for Fairness in Farming), a bipartisan bill introduced in May 2025 by Senators Mike Lee (R-UT) and Cory Booker (D-NJ), with cosponsors Rand Paul (R-KY) and Elizabeth Warren (D-MA). The legislation would ban checkoff organizations from lobbying or contracting with lobbying groups, require program audits, and create an ombudsman for producer complaints. It hasn’t passed, and the dairy lobby has fought previous versions hard. But the bipartisan sponsor list — from Lee to Warren — tells you something about where the political pressure is building. If the OFF Act matters to you, contact your representatives this month while the Farm Bill is still in play; your voice carries the most weight then.

Run the math on your own operation. Pull your component test data — butterfat and protein pounds shipped per month — and calculate your annual checkoff cost at $0.15/cwt. Then compare that to your co-op’s announced component premiums and the FMMO component prices on your settlement statement. You’re looking for the gap between where DMI says demand is growing and where your milk check says the money actually lands. If there’s a disconnect, that’s a conversation to bring to your co-op’s member meeting.

Ask your co-op three specific questions. (1) What percentage of our plant volume goes to specialty or value-added products versus commodity products? (2) Has checkoff-funded demand creation measurably increased the component premiums we receive at the farm level? (3) What specific DMI or state checkoff programs directly benefit our marketing region? If your co-op can’t answer these, that tells you something, too.

| Phase | Timeline | Action Step | What You’re Looking For |

| 1. Pull Your Own Numbers | Days 1–7 | Request 12 months of milk settlement statements from your co-op. Calculate: (a) total cwt shipped, (b) total checkoff deducted ($0.15/cwt), (c) total lbs butterfat & protein shipped. | Your checkoff cost per cow (annual total ÷ herd size).Benchmark: $43.80/cow for 300-cow herd shipping 80 lbs/day at 4.2% BF. |

| 2. Press Co-op Leadership | Days 8–21 | Attend next member meeting or email board with three specific questions: (1) What % of our plant volume goes to specialty/value-added vs. commodity products?(2) Has checkoff-driven demand measurably increased our component premiums?(3) Which DMI programs directly benefit our marketing region? | Red flag if: <20% specialty volume, vague answers on premiums, or no regional program specifics.Green flag if: Board provides documented component price lift data and product mix breakdown. |

| 3. Run the Breakeven Math | Days 22–28 | Calculate what component price lift would be needed to justify your checkoff cost. Formula: (checkoff cost ÷ lbs butterfat shipped) = $/lb price increase required.Example: $13,140 checkoff ÷ 367,920 lbs BF = $0.0357/lb price lift needed. | Compare to FMMO butterfat price volatility (2025: $1.36/lb range).Question: Is your co-op capturing enough of that volatility through premium positioning to deliver the $0.04–$0.05/lb lift needed? |

| 4. Decide on OFF Act Support | Days 29–30 | Review OFF Act provisions: bans checkoff lobbying, requires program audits, creates producer ombudsman.68 farm/food orgs backing it (bipartisan: Lee, Booker, Paul, Warren).Contact your U.S. Representative and Senators. | Critical window: Farm Bill negotiations active now—your voice matters most before the bill is finalized, not after.Decide: Is transparency reform worth backing? |

Look at what’s working without checkoff support. The cottage cheese category surged 18% in dollar sales, without a DMI campaign. Consumer protein demand and clean-label preferences drove that growth on their own. If you’re considering value-added — farmstead cheese, bottled milk, direct-to-consumer — the market signal from cottage cheese is that real consumer demand doesn’t always need a $352 million marketing program behind it. Sometimes it just needs a product people want.

A Note for Canadian Producers

If you’re milking north of the border, your version of this debate plays out through Dairy Farmers of Canada’s promotion levy — currently CA$1.50 per hectolitre, confirmed by Western Producer. The structure differs from the U.S. system: supply management means DFC doesn’t need to stimulate demand the same way DMI does, and the levy funds are smaller. But the transparency questions are similar — where does your levy go, what measurable return does it deliver, and who decides? If quota holders are paying into a promotion system, they deserve the same level of allocation transparency that U.S. producers are fighting for through the OFF Act.

Key Takeaways

- If your co-op can’t tell you what percentage of its plant volume goes to specialty products, that’s your first question at the next member meeting. Below 20%, and the checkoff’s demand creation likely isn’t reaching your check.

- Pull your component test data this month and calculate your exact annual checkoff cost against what DMI’s demand programs would need to move your price by $0.05/lb butterfat to break even. On a 300-cow herd, that’s $43.80/cow in versus $61/cow out — but only if the demand hits your pool.

- Track the OFF Act. Sixty-eight organizations across the political spectrum are backing it. If Farm Bill negotiations are still active in your state, a call to your representative this month matters more than a call next year.

- Watch the cottage cheese signal. The biggest dairy demand story of the decade happened without checkoff funding. If consumer pull can drive $1.75 billion in cottage cheese sales without a marketing program, it raises a real question about what your $352 million is buying that the market wouldn’t deliver on its own.

The Bottom Line

Cochran has been paying into this system since before she sued the USDA in 2002. Lloyd’s been poking at it from inside the boardroom. Twenty‑four years later, the system’s still collecting, and the questions are bigger, not smaller. Your checkoff costs you $43.80/cow this year, whether you ask those questions or not. So ask them — and pay attention to who’s willing to answer.

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More

- USDA Says $18, Futures Say $16: The $150K Gap That’s Rewriting 2026 Dairy Budgets – Protect your equity from 2026’s brutal $2–$3 price gap. This 30-day action plan reveals why USDA forecasts fail, exposes a massive budgeting mistake, and delivers the stress-test framework you need to survive today’s Class III volatility.

- Why Dairy Markets Can’t Self-Correct Anymore: The Hidden Forces Reshaping the Dairy Industry’s Future – Position your operation to compete with multi-revenue mega-dairies that thrive even at $11 milk. This deep dive exposes the structural forces reshaping the industry and reveals how beef-on-dairy and energy contracts are permanently ending traditional price cycles.

- Dairy Tech ROI: The Questions That Separate $50K Wins from $200K Mistakes – Expose the truth behind trade-show promises and save your dairy from a six-figure automation blunder. This hard-hitting analysis reveals the actual $27/hour labor threshold for robotic breakeven and arms you with data to match technology to your specific scale.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!