3 out of 4 dairies bred beef-on-dairy. Now 800,000 heifers are missing, and replacements are $3,010 a head. Where does your herd sit in that math?

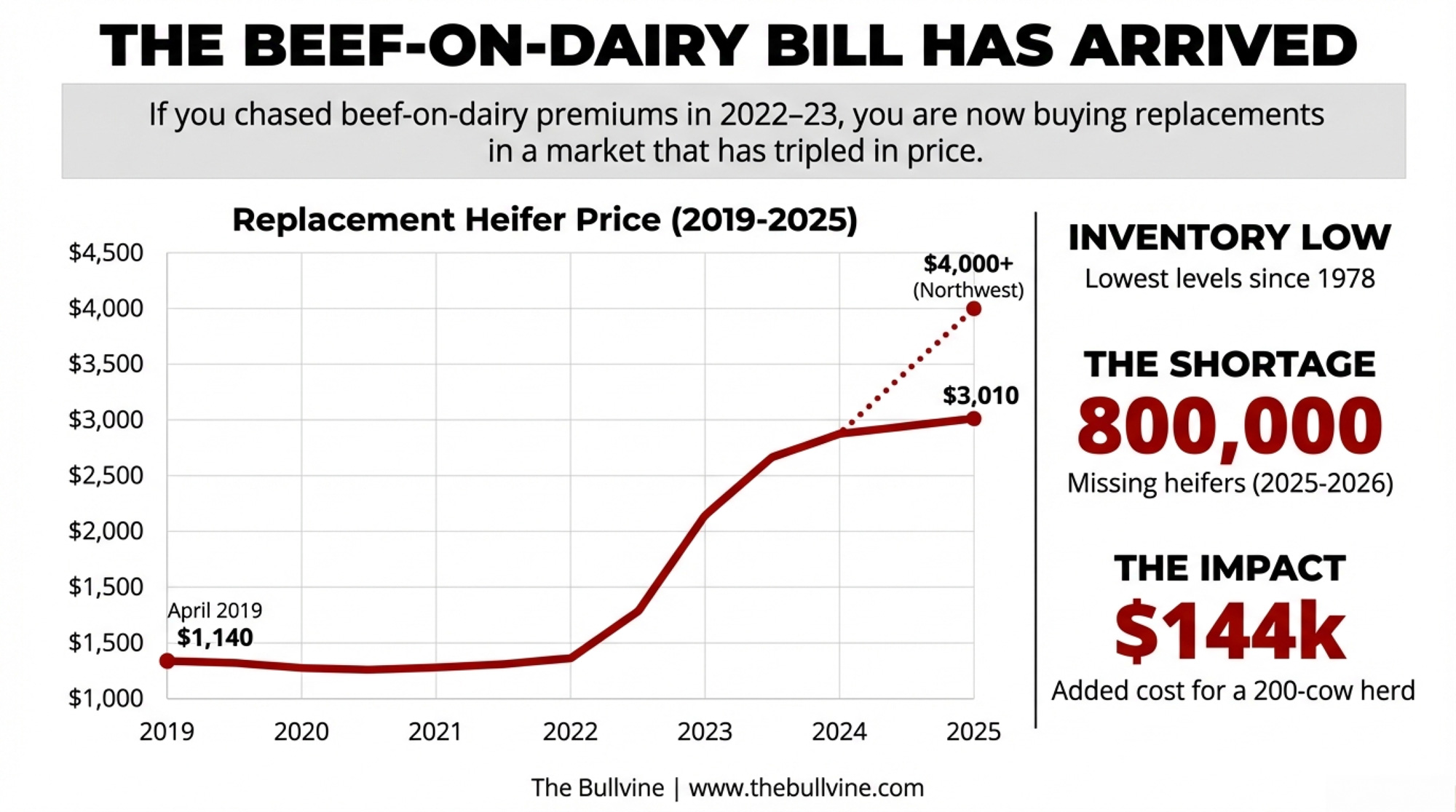

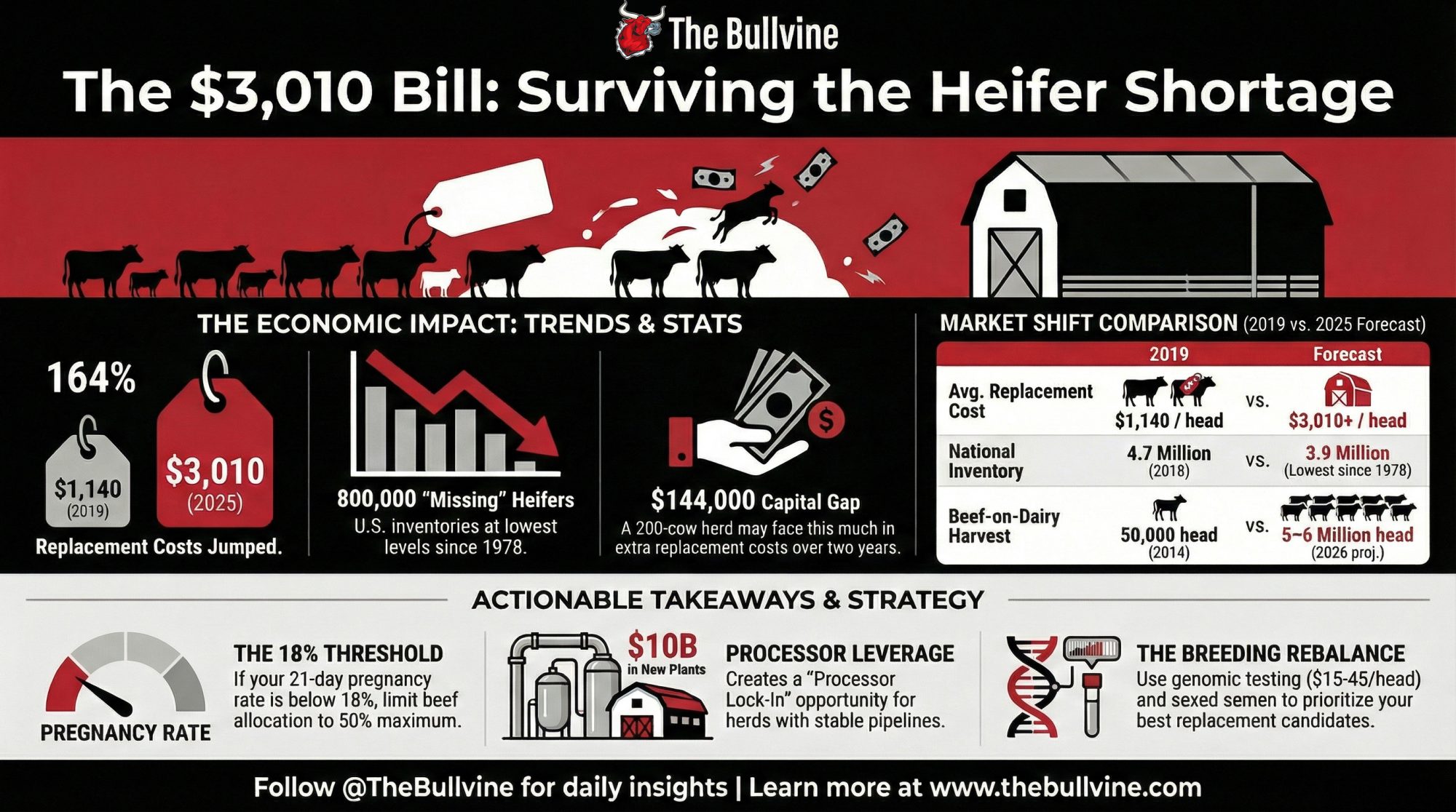

Executive Summary: If you chased beef‑on‑dairy premiums in 2022–23, you’re now buying replacements in a world where heifer prices jumped from $1,140 in 2019 to $3,010 in mid‑2025 and often top $4,000 in high‑demand regions. At the same time, U.S. replacement inventories have dropped to their lowest level since 1978, leaving roughly 800,000 “missing” heifers across 2025–2026 and making it harder—and more expensive—to keep herds at size. For a 200‑cow herd turning over 35–38% per year, that shift alone can mean an extra $126,000–$144,000 in replacement capital over the next two years if you have to buy those animals instead of calving them in. This piece breaks your options into four concrete paths—breeding rebalance, reduced culling, strategic exit, and processor lock‑in—and spells out where each helps, where it backfires, and the thresholds (like an 18% pregnancy rate or culling below 30%) that should force a rethink. It also links your barn‑level math to the bigger picture: beef‑on‑dairy calves now account for 12–15% of fed beef harvests, and roughly $10 billion in new dairy plants are scheduled to come online by 2027, keeping processor demand for reliable milk flows high even as replacements stay tight. The goal is simple: give you enough numbers and clear decision rules to decide whether your 2026 breeding sheet keeps you in the group processors treat as long‑term partners—or in the group scrambling for $3,000+ heifers with everyone else.

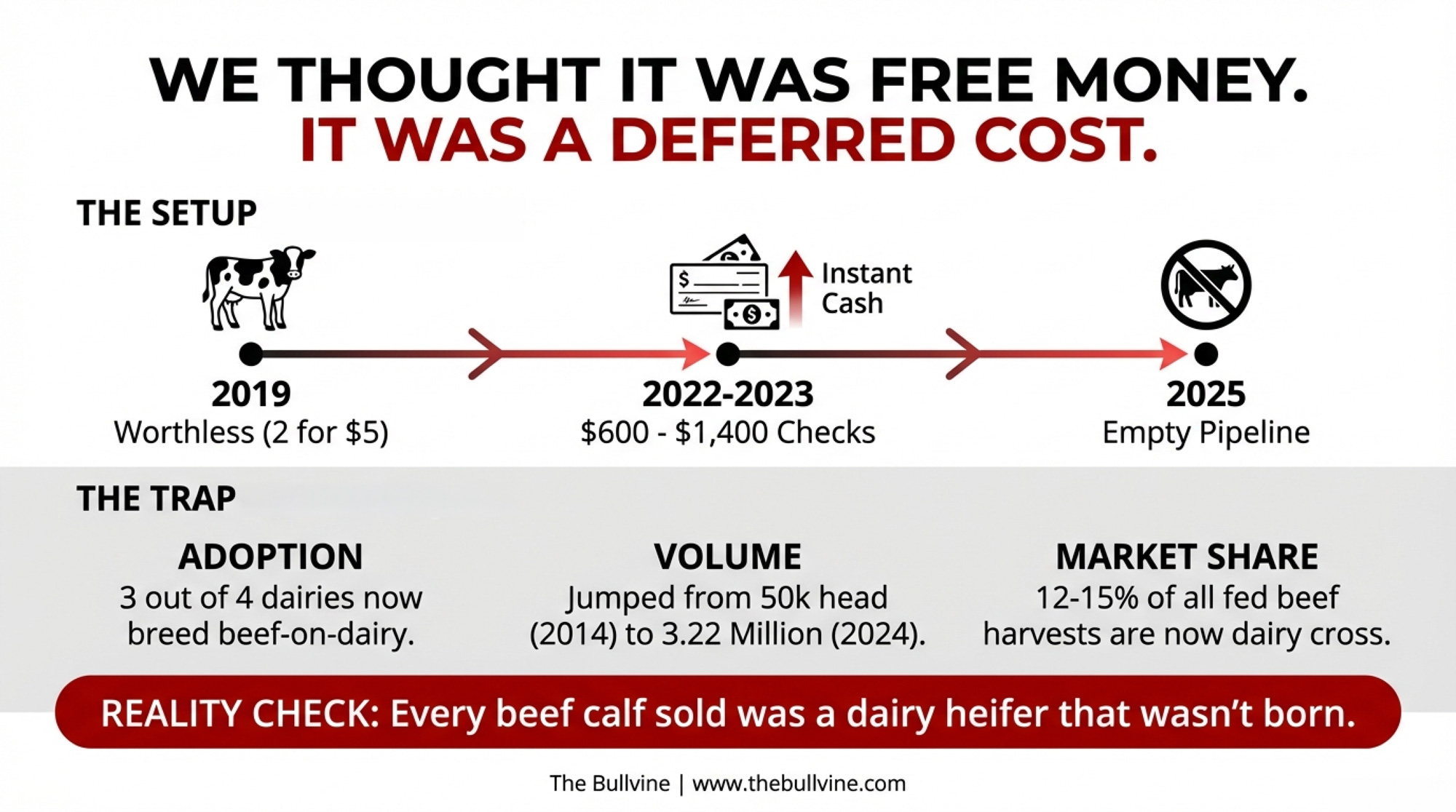

Ken McCarty of McCarty Family Farms still remembers trying to sell Holstein bull calves: “Two for $5″—with no takers. That painful baseline explains why dairy producers didn’t hesitate when beef-on-dairy calves started bringing $600, then $1,000, then $1,400 per head. The math seemed obvious. The check was immediate.

But it wasn’t free money. It was a deferred bill. And that bill has arrived.

CoBank data shows replacement heifer prices climbed from $1,140 per head in April 2019 to $3,010 by July 2025—with top-quality animals in California and Minnesota auction barns commanding $4,000 or more. USDA’s January 30, 2026, cattle inventory report confirmed the national herd continues to contract. For operations that bred heavily to beef in 2022 and 2023, the pipeline is now empty. For those who maintained balance, a window is opening.

The Scale Nobody Predicted

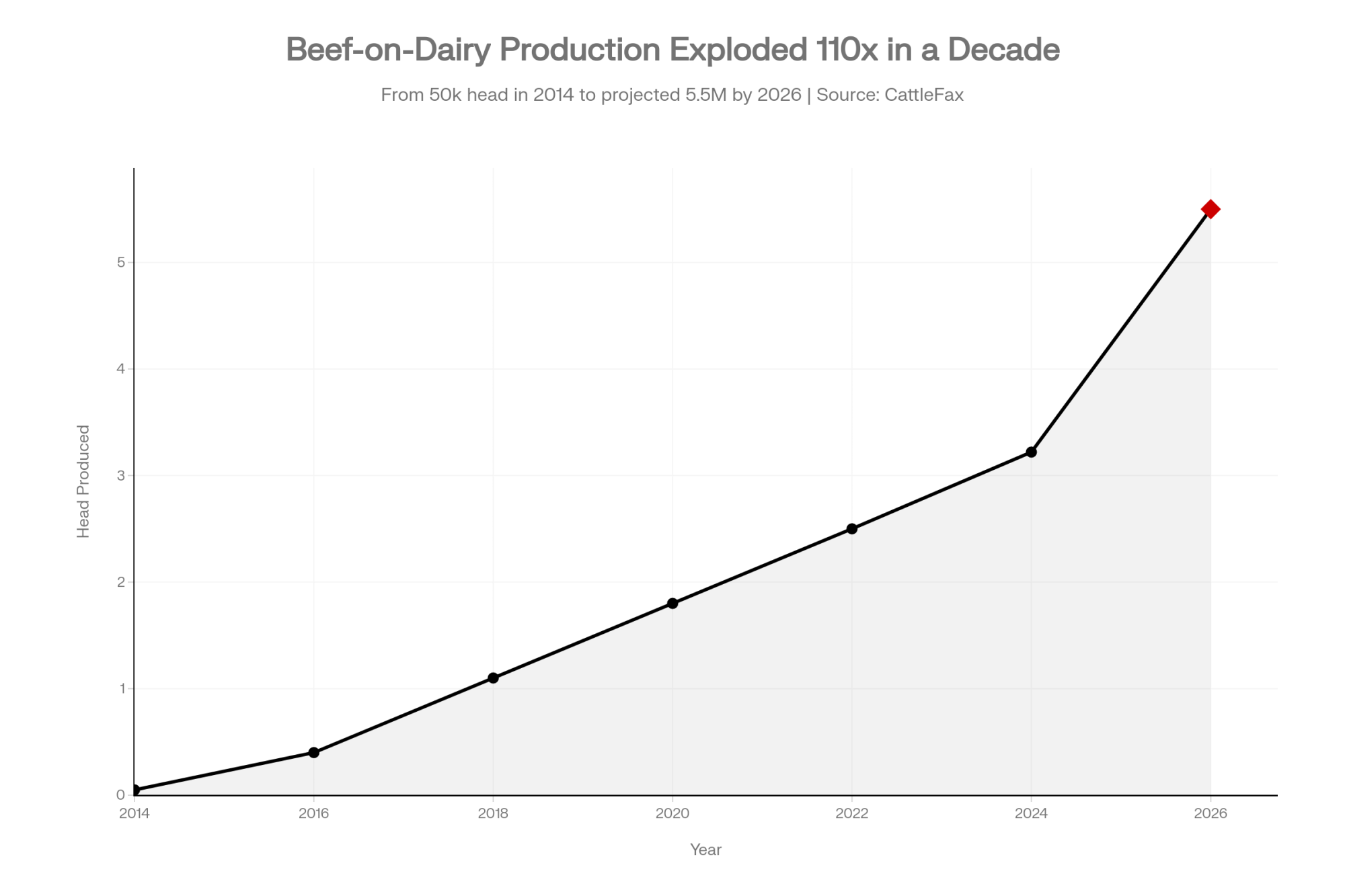

The adoption curve was staggering. Beef semen sales into dairy herds grew from 1.2 million units in 2010 to 9.4 million units by 2023—roughly 84% of which went into dairy cows, according to a 2024 Purina survey. That same survey found almost three-fourths of U.S. dairy farmers are now actively crossbreeding using beef genetics, with another 16% considering it.

CattleFax puts the production numbers in starker terms: beef-on-dairy calf production jumped from 50,000 head in 2014 to 3.22 million in 2024, with projections reaching 5–6 million head by 2026. These crossbred cattle now account for 12–15% of fed beef harvests.

Every one of those calves was a dairy heifer that wasn’t born.

The Pipeline Math That’s Already Locked In

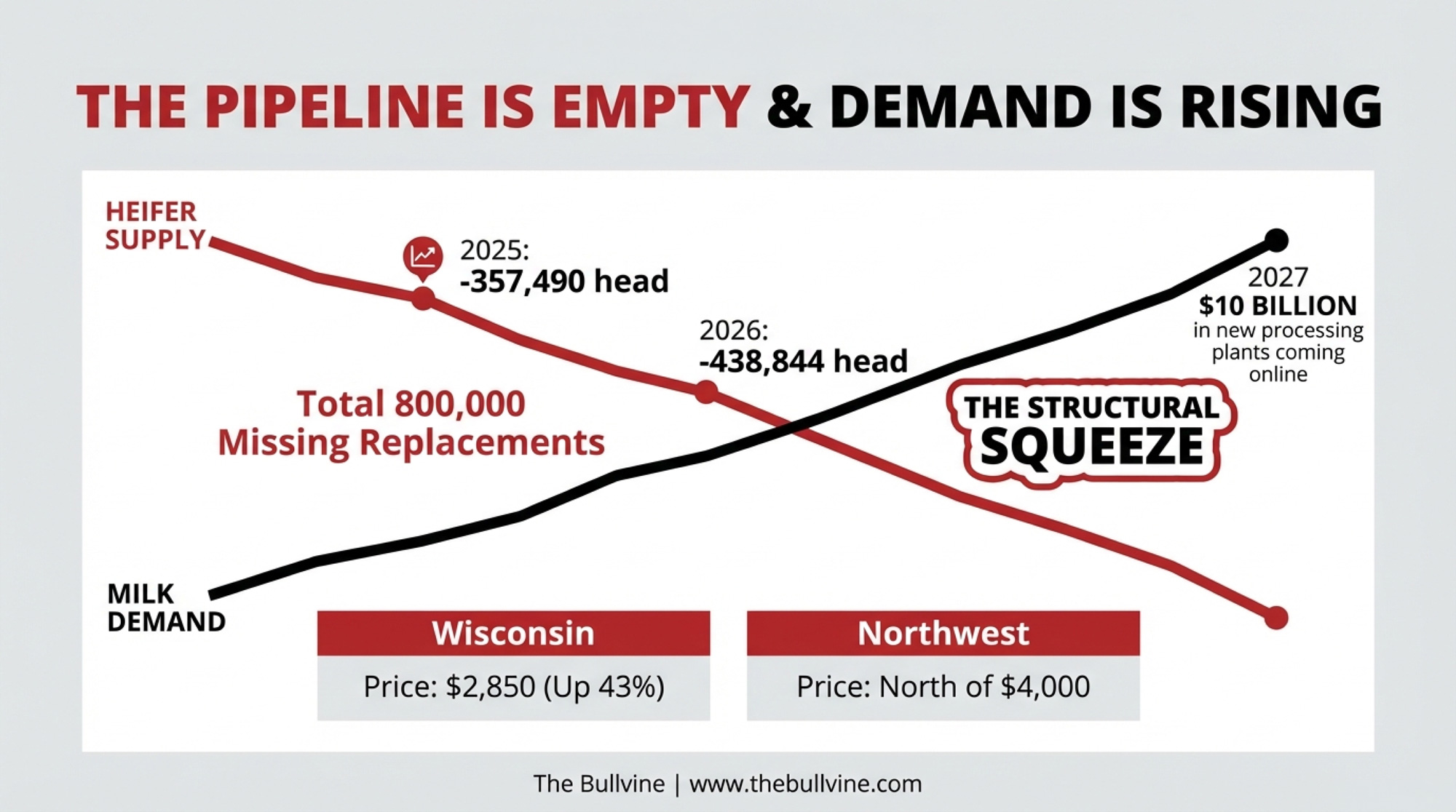

Sarina Sharp at the Daily Dairy Report flagged in early 2024 that dairy heifer inventories had declined for six consecutive years. USDA’s January 2025 snapshot put milk replacement heifers at 3.914 million head—the lowest since 1978, a full 18% below 2018 levels.

CoBank economist Corey Geiger quantified the gap in an August 2025 report: 357,490 fewer dairy heifers available in 2025, then 438,844 fewer in 2026. Add those up. That’s roughly 800,000 missing replacements across a two-year window. And as Geiger commented: “We don’t see a rebound until 2027, and that will be up 285-thousand, but you’ve got to remember, that’s going to be after 800-thousand fewer heifers”.

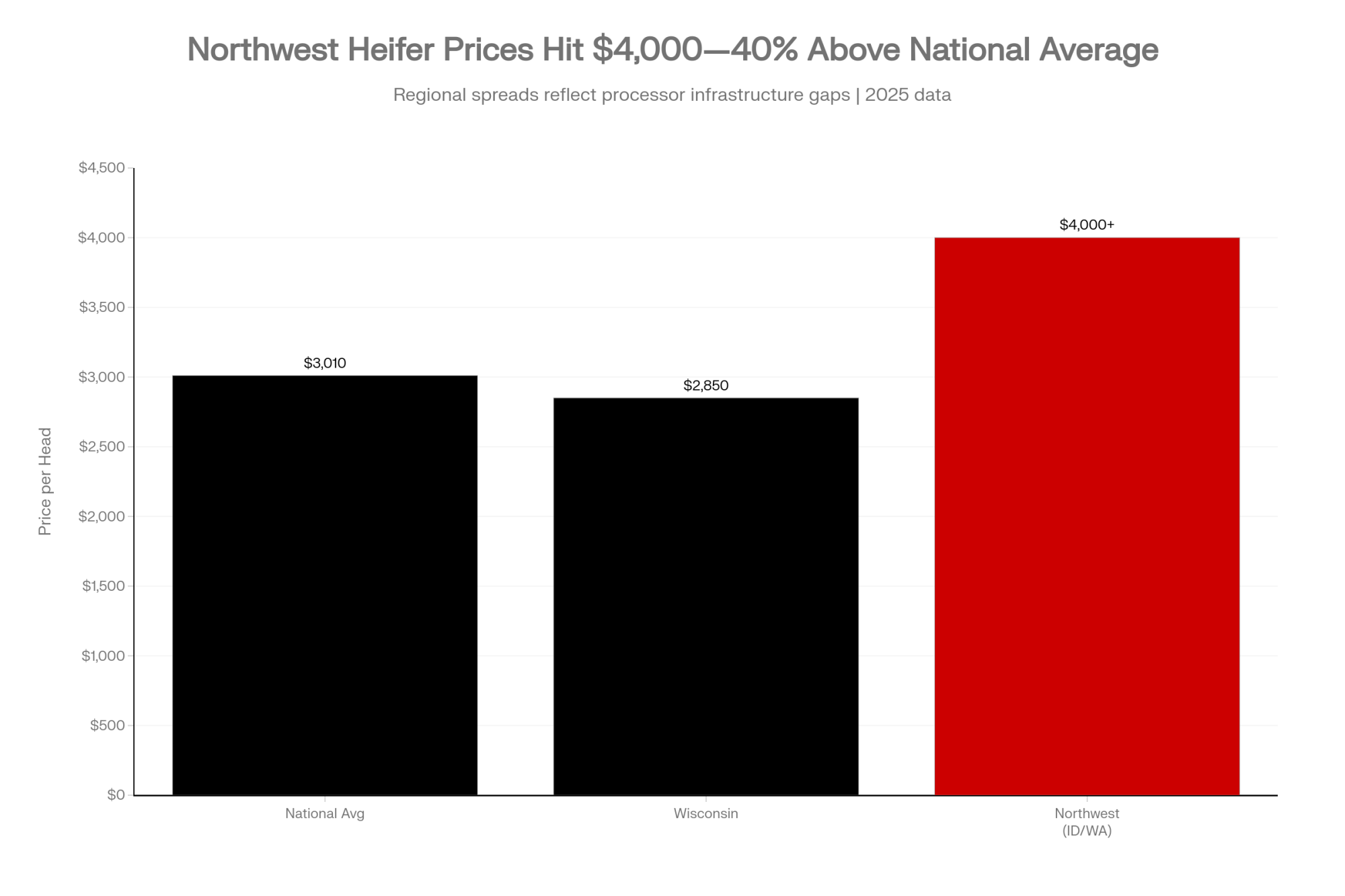

Regional variation tells its own story. Wisconsin replacement values jumped 43% year-over-year between October 2023 ($1,990) and October 2024 ($2,850), according to USDA data. Yet Wisconsin actually gained 10,000 heifers while Texas lost 10,000 head. “Watch” on the Northwest (Idaho/Washington), where prices have reportedly hit that $4,000+ “north of the border” threshold. That divergence comes down to processor relationships and infrastructure, not just breeding decisions.

The Beef-on-Dairy Miscalculation

Here’s what producers believed: beef-on-dairy premiums were an additive income. Extra revenue layered on top of normal operations without meaningful trade-offs.

Here’s what actually happened.

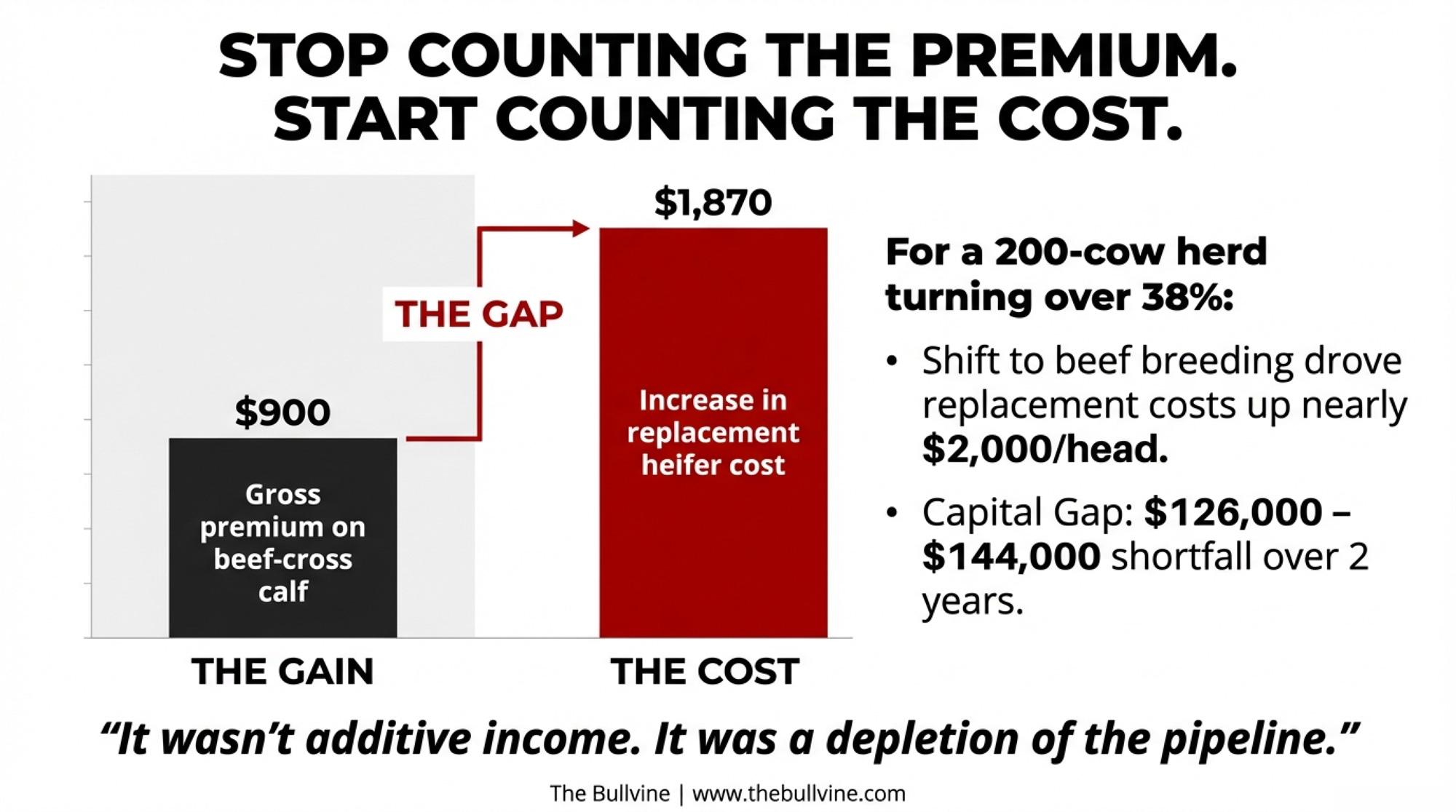

When beef-on-dairy calves climbed toward the $1,400 average that Purina’s Laurence Williams cited by 2024-2025, producers weren’t making a one-time decision. They were depleting a pipeline that takes three-plus years to rebuild. Every beef breeding looked like a $900 gain. What nobody penciled in was the replacement heifer that wouldn’t exist three years later—an animal that now costs $1,870 more than it did in 2019.

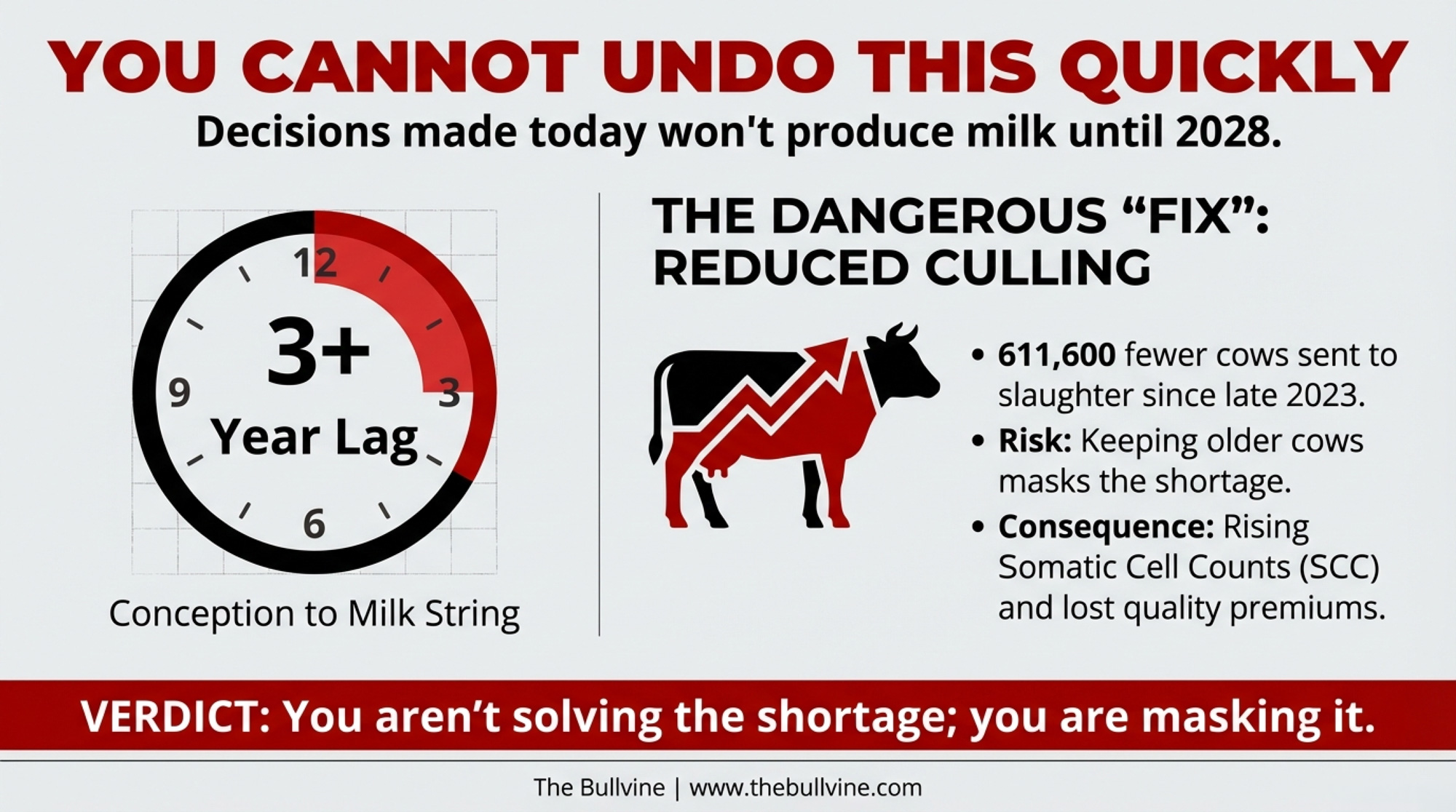

CoBank’s analysis is blunt: from conception to a cow in the milk string is a “three-plus year proposition”. You can’t undo aggressive beef breeding quickly.

And the 2024 NAAB semen sales data reveals how producers tried to have it both ways. Gender-sorted dairy semen surged 17.9%—an additional 1.5 million units. But beef semen held steady at 7.9 million units. No retreat.

How This Lands on Real Operations

When Mike North of Ever.Ag started seeing two-to-three-day-old beef-cross calves bringing $1,000, his framing captured the logic perfectly: “Why feed an animal for 18 months when the money’s sitting there at day three?”

But North also flagged the inflection point when the math flipped: “Some animals moving in the northwest last week were north of $4,000 an animal. That’s a pretty tall price, and so now, guess what? We’re seeing people starting to switch some of their breeding back to that replacement animal”.

One Minnesota producer’s current allocation illustrates the hedging strategy most operations have adopted: 10% of cows bred to sexed semen, while the rest go to beef; for heifers, 50% bred to sexed semen, while the other half go to beef. That’s not a correction—it’s a bet that partial measures will thread the needle.

Meanwhile, culling rates have collapsed. Dairy farmers have sent 611,600 fewer cows to slaughter since Labor Day 2023, according to CoBank’s analysis of USDA data. That keeps milk flowing but ages the herd.

Running the Numbers: Gross Premium vs. Net Replacement Cost

Here’s the full picture for a typical 200-cow Holstein operation in the Upper Midwest:

The spread:

- Beef-cross premium over Holstein bull: ~$750-$1,200/head (2024-2025 market)

- Incremental heifer cost increase (2019 vs 2025): ~$1,870/head at national averages

The math: If your replacement ratio means 1.5-2 beef breedings per “lost” heifer, and premiums average $900, you’ve captured $1,350-$1,800 in gross premium. But across the industry, the collective shift toward beef breeding drove replacement heifer costs up $1,870 per head. For a 200-cow operation needing 70-80 replacements annually (35-38% turnover), that gap represents $126,000-$144,000 in additional replacement capital over 24 months—if you can find animals to buy at all.

| Metric | Value | Notes |

|---|---|---|

| Herd Size | 200 cows | Typical Upper Midwest operation |

| Annual Replacement Rate | 35-38% | 70-76 replacements needed yearly |

| Beef-Cross Premium (2024-25) | $750-$1,200/head | Average $900 across regions |

| Gross Premium Captured | $1,575/replacement | Assumes 1.75 breedings per heifer @ $900 |

| Heifer Cost Increase (2019-2025) | +$1,870/head | From $1,140 to $3,010 national average |

| Net Gap per Replacement | -$295/head | Premium didn’t cover cost inflation |

| Total Additional Capital (24 months) | $126,000-$144,000 | For 140-152 replacements over 2 years |

| Critical Time Horizon | 2026-2027 | When depleted 2022-23 pipeline hits |

And here’s the kicker: The $10 billion in new dairy plants are set to come online through 2027, meaning processor demand for milk will keep climbing even as replacement supply stays pinched.

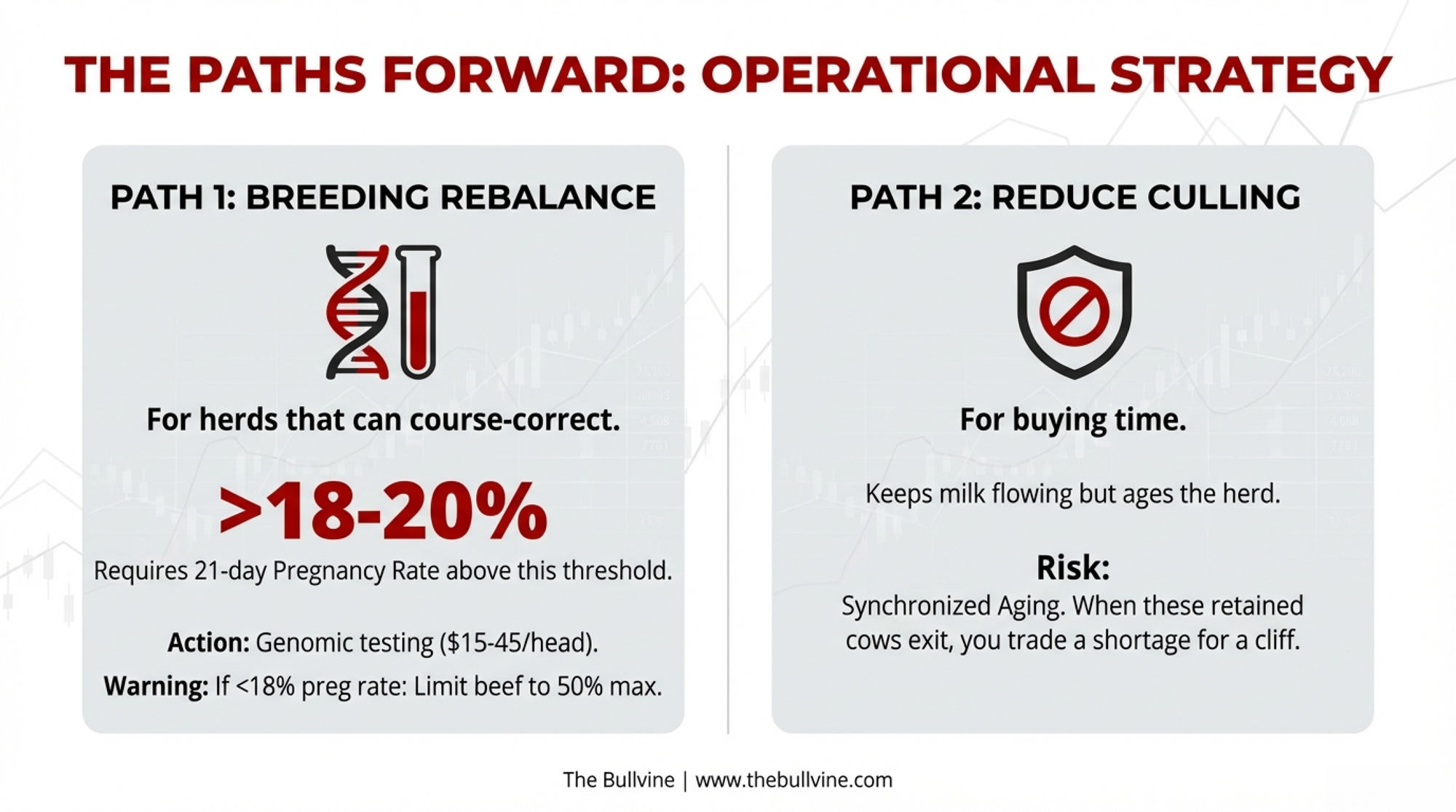

Four Paths Forward—And Where Each Can Backfire

Chris Wolf’s Michigan State analysis of 14,824 farm records found that performance variation among small farms is 38% farm-related compared to only 15% for large farms. Your response to this crisis matters more at 200 cows than at 2,000.

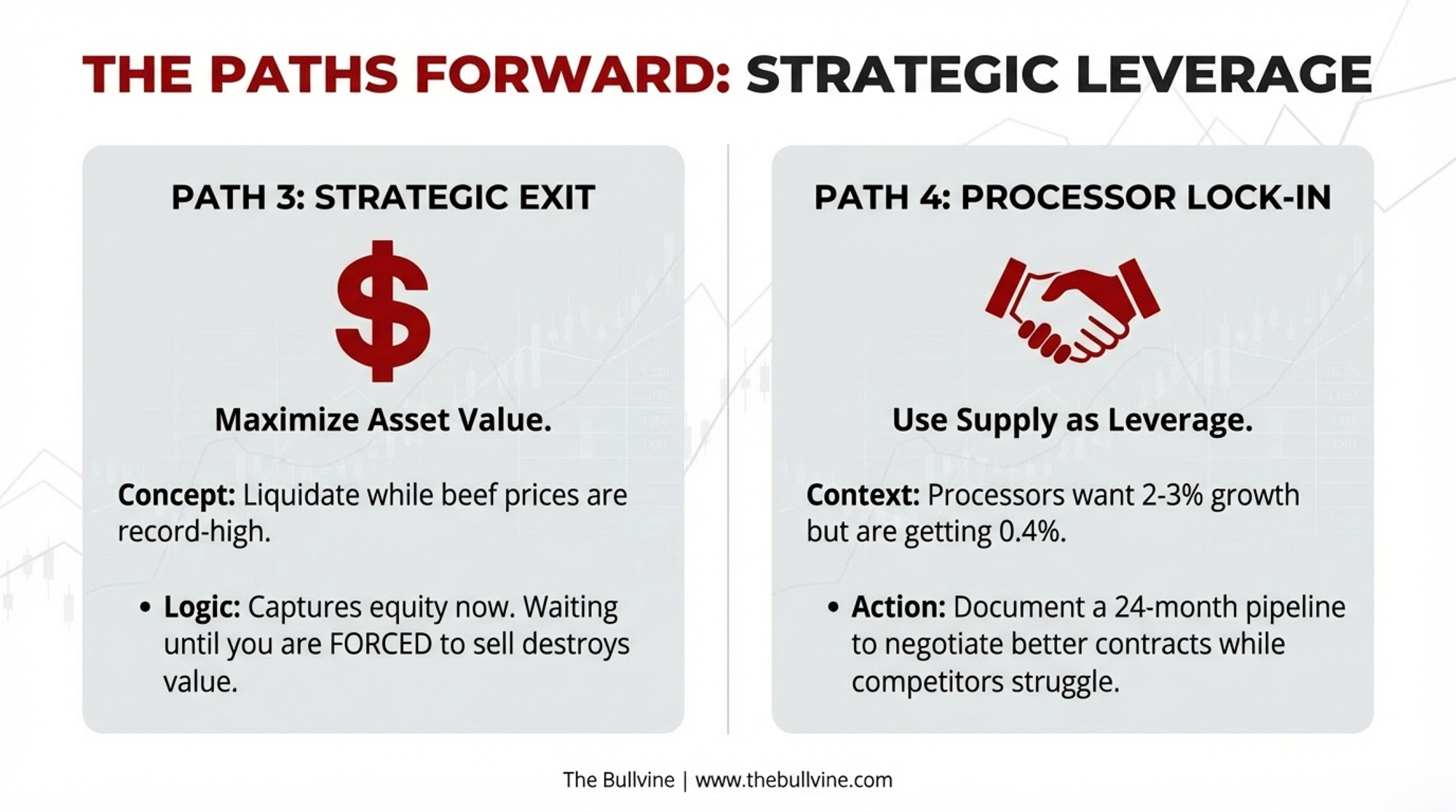

| Path 1: Breeding Rebalance | Path 2: Reduce Culling | Path 3: Strategic Exit | Path 4: Processor Lock-In | |

| Best for | Herds that can still course-correct the pipeline | Healthy older cows; buys time | Monthly losses; owners near retirement | Stable herds that can prove supply |

| Requires | Genomic testing ($15-45/head); sexed dairy on top 35-40% | Transition management; accept lower avg production | Honest market assessment before values erode | Documented 24-month replacement pipeline |

| ⚠️ Backfire risk | Below 18% pregnancy rate, can’t maintain pipeline AND premiums | Synchronized aging + rising SCC erodes quality premiums | Waiting erodes equity if exit becomes forced | Failing to deliver on the supply commitment damages the relationship |

| Key threshold | 21-day pregnancy rate ≥20% for optimal beef allocation | Monitor herd age distribution and SCC quarterly | Compare current liquidation value vs. projected 2027 value | Can you document pipeline sustainability? |

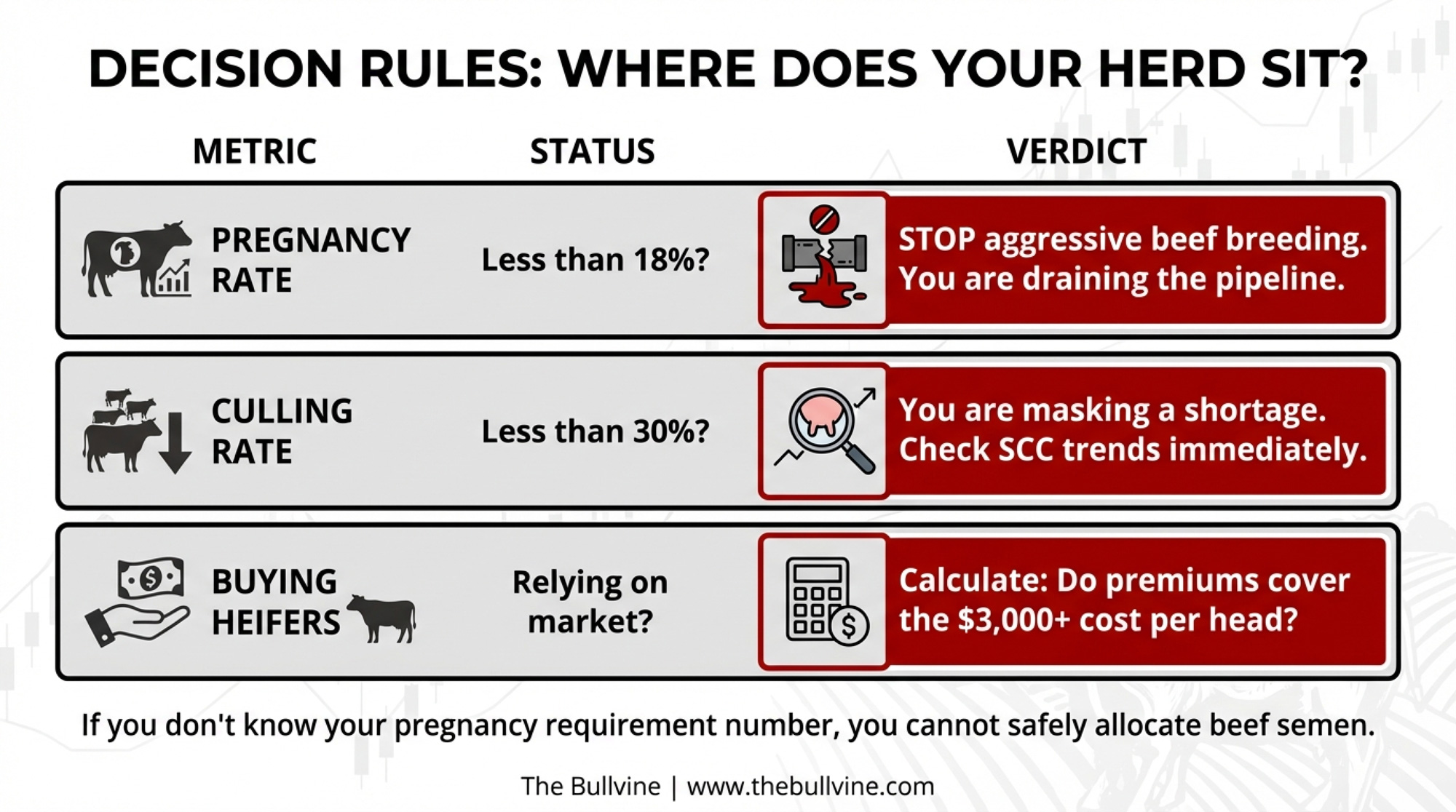

Path 1 is where the Journal of Dairy Science analysis matters most: beef semen becomes economically optimal when crossbred calf price hits at least 2x dairy calf price, AND herd achieves ~20% 21-day pregnancy rate. ⚠️ Below 18%, limit beef allocation to 50% maximum. Only about 10% of Florida producers use genomic testing, per University of Florida estimates—adoption rates vary significantly by region.

Path 2 carries a hidden cost. Retaining older cows often means rising somatic cell counts, which can erode quality premiums from your processor—compounding financial strain at exactly the wrong time. Worse, when a wave of retained cows exits simultaneously, you’ve traded a gradual shortage for a cliff.

Path 3 isn’t a failure. With beef cattle prices at record highs, liquidating today captures significantly more equity than waiting until the shortage resolves. ⚠️ Waiting preserves optionality but erodes equity if exit becomes forced rather than chosen.

Path 4 is the angle most producers haven’t considered. Strong signals suggest processors expecting 2-3% milk supply growth and getting 0.4% are becoming choosy about who they keep. If you can document pipeline sustainability, you may find yourself first in line for favorable contract terms as competitors struggle to guarantee supply.

Signals to Watch

Heifer inventory trajectory. CoBank projects inventories won’t normalize until 2027 at the earliest. Watch USDA semi-annual reports for evidence that national heifer numbers have stopped declining.

Regional price spreads. The gap between Wisconsin’s $2,850 and Northwest prices “north of $4,000” reflects infrastructure differences, not just supply. Where does your region sit?

Your own replacement math. How many dairy heifer pregnancies must you generate annually to maintain herd size at the target age structure? If you don’t know that number, you can’t evaluate your breeding allocation.

What This Means for Your Operation

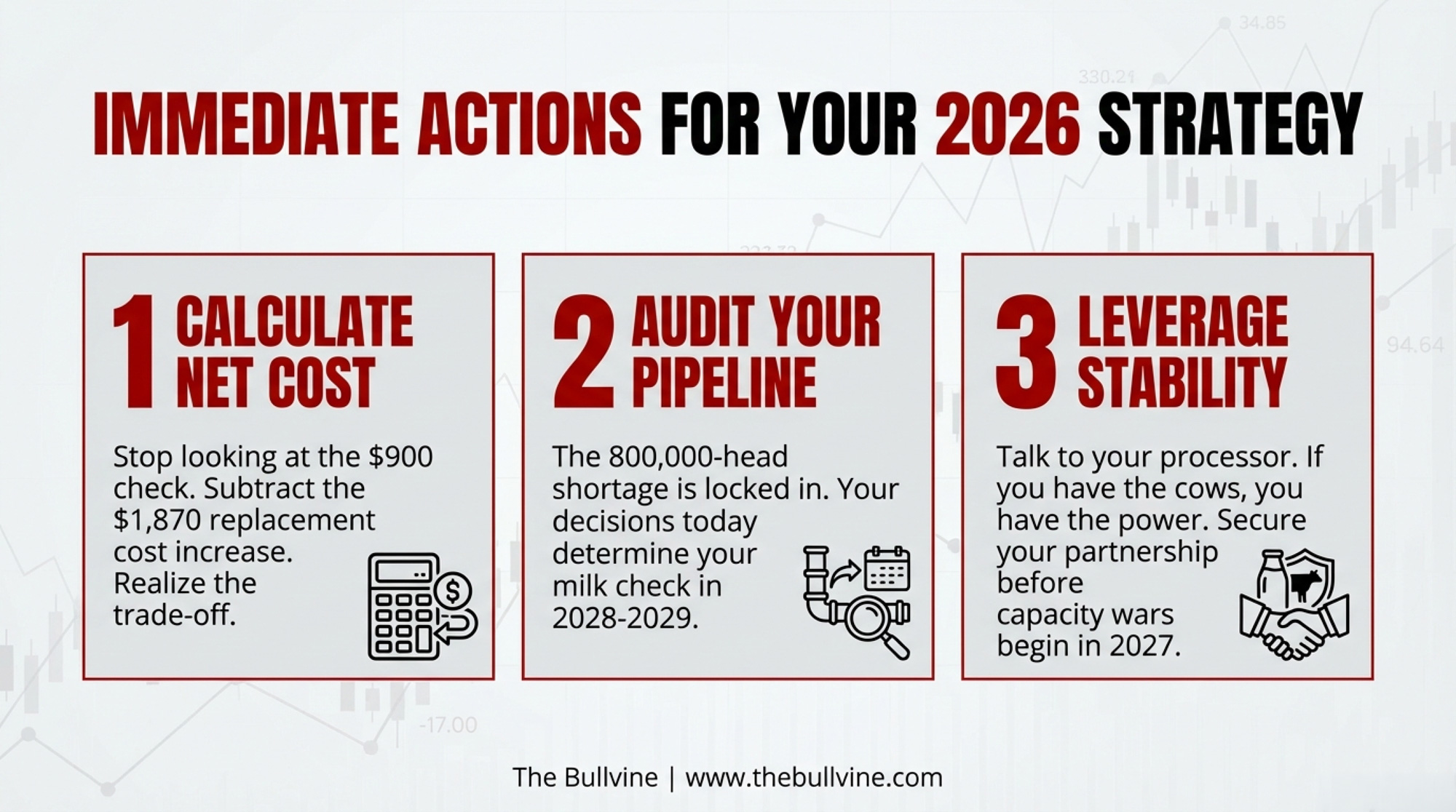

- Calculate the real cost, not the gross premium. The $900 beef-cross check was real income—but if replacement costs have jumped $1,500+ per head since 2022, determine whether premiums actually offset that increase or simply deferred it

- Run your replacement pipeline projection: at current breeding allocation and reproductive performance, will you have the heifers you need in 2028?

- If “hard to breed” or “lower producing” remain your primary beef allocation criteria, the room for instinct-based allocation has narrowed sharply

- Check your culling rate—if you’ve dropped below 30%, you’re likely masking a shortage rather than solving it—and check your SCC trends while you’re at it

- Ask your processor what they value. If you can demonstrate a documented 24-month replacement pipeline, you may be in a stronger negotiating position than you realize

- Opportunity signal: Balanced breeding programs with adequate heifer inventory could mean more favorable processor contracts as competitors struggle to guarantee supply

Key Takeaways

- The 800,000-head shortage is locked in through 2026. Breeding decisions made today won’t produce milking cows until 2028-2029. The next 18 months are about managing what’s already baked in.

- Don’t confuse gross premium with replacement reality. Across the industry, the collective shift drove replacement costs up $1,870 per head. For operations now buying replacements, the premium captured doesn’t come close to covering the increase in costs.

- The 18% pregnancy rate threshold matters. Below that level, aggressive beef allocation creates unavoidable replacement shortfalls regardless of premium levels.

- $10 billion in new dairy plants through 2027 means processor demand for milk keeps climbing while replacement supply stays pinched. Processors are likely choosing partners rather than just buying milk.

The Bottom Line

The operations that survive this won’t be those who avoided beef-on-dairy—many of the largest, most sophisticated dairies bred heavily to beef. They’ll be the ones who tracked replacement pipeline math while capturing premiums, rather than assuming the check today wouldn’t create a bill tomorrow.

Where does your operation sit on that spectrum—and what does your 2026 breeding sheet say about the answer?

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More

- Precision Breeding: How Genomic Testing Protects Your Heifer Investment – Arms you with a clear ROI breakdown for genomic testing, proving how a $45 investment eliminates the $3,000 risk of raising the wrong heifer. It delivers the discipline needed to stop breeding by instinct.

- The $10 Billion Opportunity: Securing Your Spot in the Future Processor Supply Chain – Exposes the massive structural shift as new plant capacity comes online through 2027. It reveals how to leverage your documented heifer pipeline to secure premium contracts while competitors scramble for supply in a pinched market.

- High-Value Crosses: The Next Phase of the Beef-on-Dairy Revolution – Breaks down advanced terminal crossbreeding strategies that maximize carcass value without sacrificing your herd’s future. It delivers the blueprints for “Elite Beef” programs that command significantly higher premiums than standard auction barn crosses.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!