Cheap feed is a trap. Every cow that should’ve been culled is still milking—and $14 Class III is the price we’re all paying.

EXECUTIVE SUMMARY: Class III is testing $14. EU butter crashed 43% year-over-year. Cheddar blocks hit $1.29—their lowest since May 2020. Welcome to synchronized oversupply: EU-27+UK November milk surged 4.6%, the U.S. dairy herd is near a 30-year high, and cull rates are at historic lows because $4.25 corn makes even marginal cows cash-flow positive. That’s the trap—cheap feed was supposed to ease the pain, but it’s keeping underperforming cows in barns across the industry and delaying the correction prices desperately need. GDT Pulse finally showed signs of life Sunday (WMP +1.0%, SMP +2.1%), but until someone starts culling, $14 milk isn’t going anywhere.

Futures Markets: Still Searching for a Floor

The futures boards told a grim story last week—and frankly, nobody’s quite sure where the bottom is yet.

EEX European Futures moved 4,550 tonnes (910 lots), with Wednesday posting the busiest session at 1,905 tonnes. Butter futures took the worst of it. The Jan26-Aug26 strip dropped 4.5% to average €4,199. SMP held up better, down just 0.2% to €2,200, while whey slipped 0.7% to €1,021.

Over on the SGX Asia-Pacific exchange, volume ran heavier at 15,116 lots—dominated by WMP at 12,287 lots. The Jan26-Aug26 curves tell you pretty much everything about current sentiment:

| Product | Average Price | Weekly Change |

| WMP | $3,359 | –1.2% |

| SMP | $2,703 | –0.8% |

| AMF | $5,821 | –1.4% |

| Butter | $5,278 | –0.1% |

What’s particularly notable on the CME is how Class III futures tested sub-$14 territory multiple times last week. January through May contracts all notched life-of-contract lows before bouncing slightly Friday. February settled at $15.05—down a dime on the week. Class IV fared worse, with February closing at a brutal $13.86, down a nickel.

For producers who don’t actively trade futures, here’s why those life-of-contract lows matter: they signal that professional traders—people who make a living betting on where milk prices are headed—see no near-term catalyst for recovery. When the market establishes new lows across multiple contract months simultaneously, it’s pricing in an extended period of pain.

What this means for your operation: If you’re not already penciling out cash flow at $15 Class III and $14 Class IV through mid-year, you’re planning with the wrong numbers. DMC payments look increasingly likely for January through at least April, according to analysts at Ever.Ag.

European Quotations: The Butter Collapse Continues

The weekly EU quotations released January 14 painted a picture of a market still trying to find its footing after months of oversupply pressure.

Butter took another beating. The index dropped €171 (–3.9%) to €4,237. French butter got hit hardest—down €513 (–10.6%) to €4,310 in a single week. German and Dutch butter held steadier at €4,300 and €4,100 respectively.

Here’s the number that should grab your attention: EU butter is now down €3,176 (–42.8%) year-over-year. That’s not a correction. That’s a fundamental repricing of European milkfat. I’ve been covering dairy markets for years, and you rarely see a commodity give back nearly half its value in twelve months without some structural shift underneath.

SMP actually showed some strength—climbing €38 (+1.9%) to €2,085. German SMP rose €45 to €2,085, Dutch jumped €100 to €2,100, while French slipped €30 to €2,070. Still, SMP sits 17.3% below year-ago levels, so “strength” is relative here.

Whey eased €5 (–0.5%) to €996, though it’s actually up €123 (+14.1%) year-over-year. That makes whey one of the few genuine bright spots in European dairy commodity markets right now.

Cheese indices were mixed:

| Commodity | Current Price | Weekly Δ | Y/Y Δ | Market Status | Strategic Note |

|---|---|---|---|---|---|

| EU Butter | €4,237/100kg | –3.9% | 🔴 –42.8% | CRISIS | Demand collapse |

| Class III (CME) | $13.95/cwt | –0.7% | 🔴 –32.0% | CRISIS | Life-of-contract lows |

| Cheddar Block | $1.29/lb | –1.9% | 🔴 –27.5% | WEAK | Multi-year lows |

| SMP (EU) | €2,085/100kg | +1.9% | 🟡 –17.3% | WEAK | Algeria returning |

| WMP (GDT) | $3,359/MT | –1.2% | 🟡 –18.5% | WEAK | Pulse bounce +1.0% |

| Nonfat Dry Milk | $1.255/lb | –0.8% | 🟡 –14.2% | STABLE | Mexico demand OK |

| Whey (CME) | 73.5¢/lb | +4.8% | 🟢 +14.1% | STRENGTH | Protein demand high |

| Milk Price (U.S. avg) | $14.05/cwt | –0.7% | 🔴 –30.5% | CRISIS | Feed savings insufficient |

| Corn (March) | $4.25/bu | –4.5% | 🟢 –52.0% | STRENGTH | Record crop relief |

USDA’s Dairy Market News describes European conditions as “orderly” and “measured”—values are cautiously higher to start the year after what can only be called the bloodbath of Q4 2025.

GDT Pulse: Finally, a Sign of Life

Sunday’s GDT Pulse Auction (PA098) delivered the first meaningful uptick we’ve seen in months (Global Dairy Trade, January 18, 2026).

Fonterra Regular C2 WMP won at $3,395—up $35 (+1.0%) from the last full GDT event and up $240 (+9.0%) from the previous pulse auction. That’s a real move, not just noise.

Fonterra SMP Medium Heat – NZ came in at $2,660, up $55 (+2.1%) from the last GDT and up $165 (+8.4%) from pulse.

Arla SMP Medium Heat – EU hit $2,485, up $95 (+4.0%) from the last GDT.

Total volume was modest at 2,358 tonnes with 54 bidders participating. The question everyone’s asking: genuine trend change, or dead cat bounce?

Tomorrow’s GDT Event TE396 will be the real test. Fonterra’s offered volumes:

| Product | Volume (MT) |

| WMP | 15,588 |

| SMP | 5,630 |

| Butter | 1,920 |

| AMF | 2,680 |

| Cheddar | 540 |

Butter and AMF volumes were adjusted for Cream Group Flex at 15% applied to C1 and C2, while total milkfat supplied remains unchanged on the forecast. What I’ll be watching closely is whether the buying interest that showed up Sunday sticks around when larger volumes hit the auction block.

U.S. Spot Markets: Whey Holds While Everything Else Sinks

CME spot trading told a mixed story last week.

- Butter bounced off multi-year lows, climbing 5.5¢ to $1.355 per pound. That’s still near the basement, but at least the bleeding stopped for now.

- Cheddar blocks kept sinking, down 2.5¢ to $1.29—a level we haven’t seen since May 2020. Twenty loads traded, bringing the YTD total to 63 loads—a record for early January. When you see that kind of spot volume combined with falling prices, people are desperate to move product. That’s not a healthy market dynamic.

- Nonfat dry milk slipped a penny to $1.255. Demand from Mexico is improving, and inventories are “tight” according to USDA’s Dairy Market News, but it wasn’t enough to hold the line.

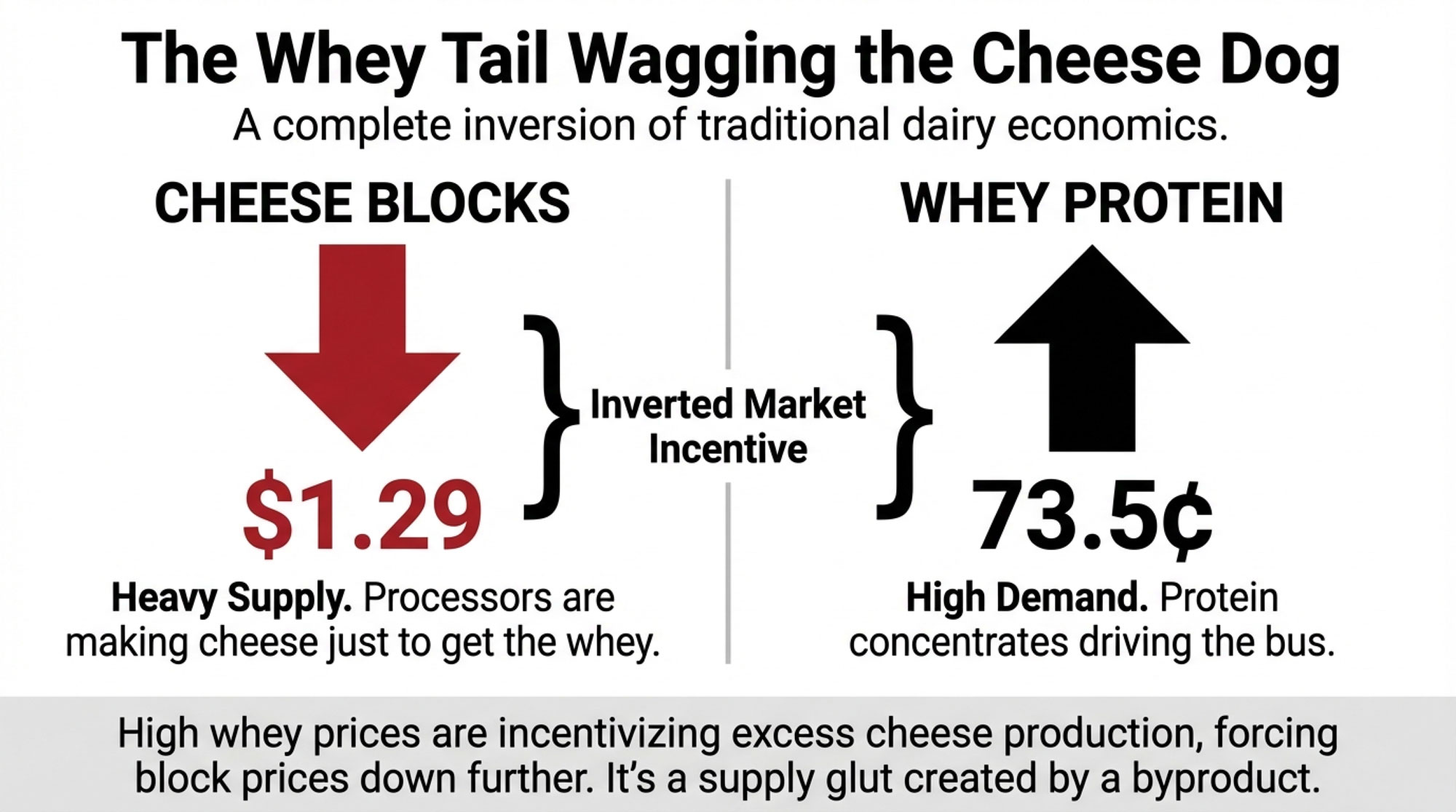

- Whey was the standout, rallying 3.5¢ to 73.5¢. Strong demand for whey protein concentrates is driving this—Dairy Market News reports some cheese processors are actually ramping up production “ultimately to produce more whey as prices and demand of whey protein concentrates remain high.”

Let that sink in for a moment: they’re making cheese not because cheese demand is strong, but because they need the whey. That’s a complete inversion of traditional dairy economics, and it tells you something important about where the real demand growth is happening right now.

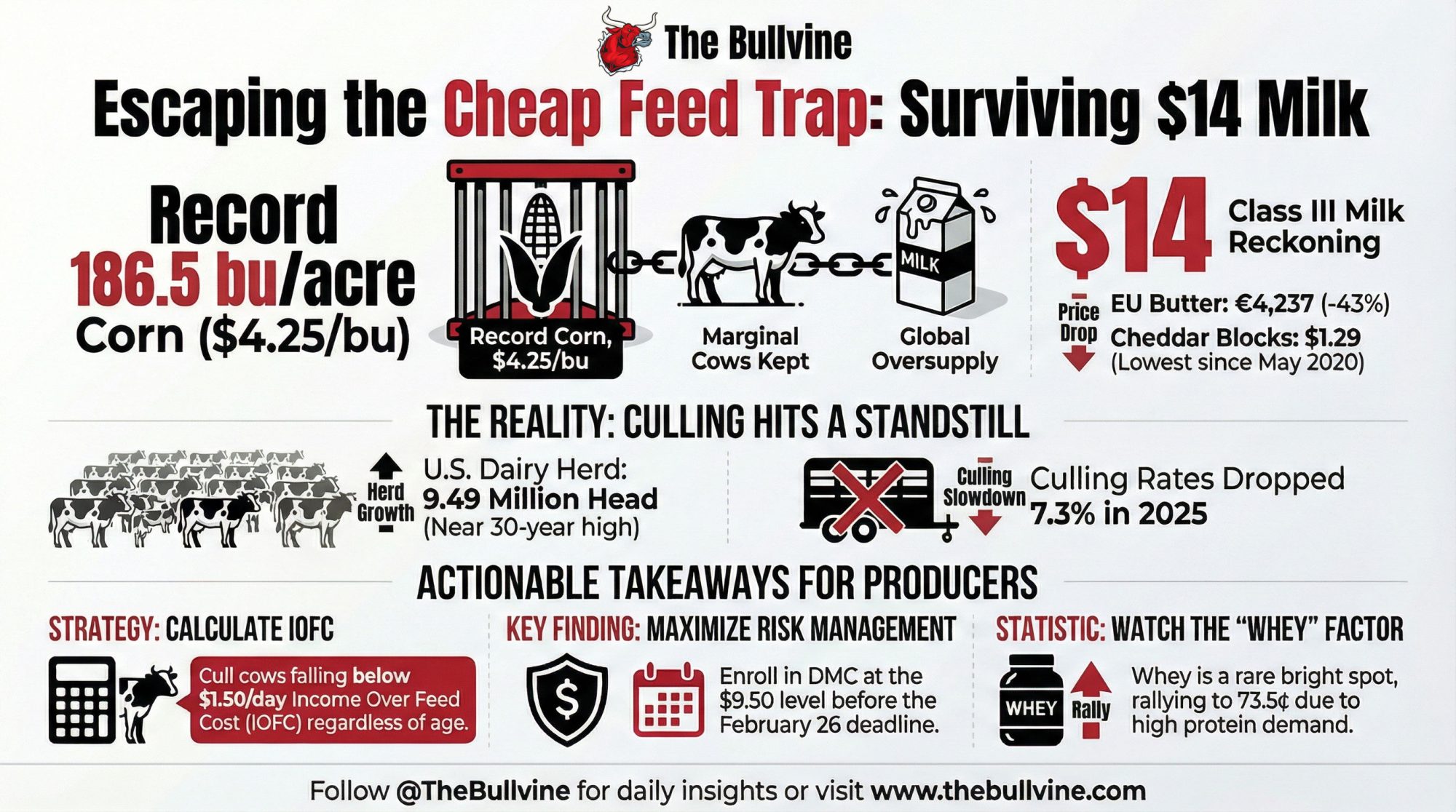

The Culling Connection: Why Cheap Feed Is Delaying Recovery

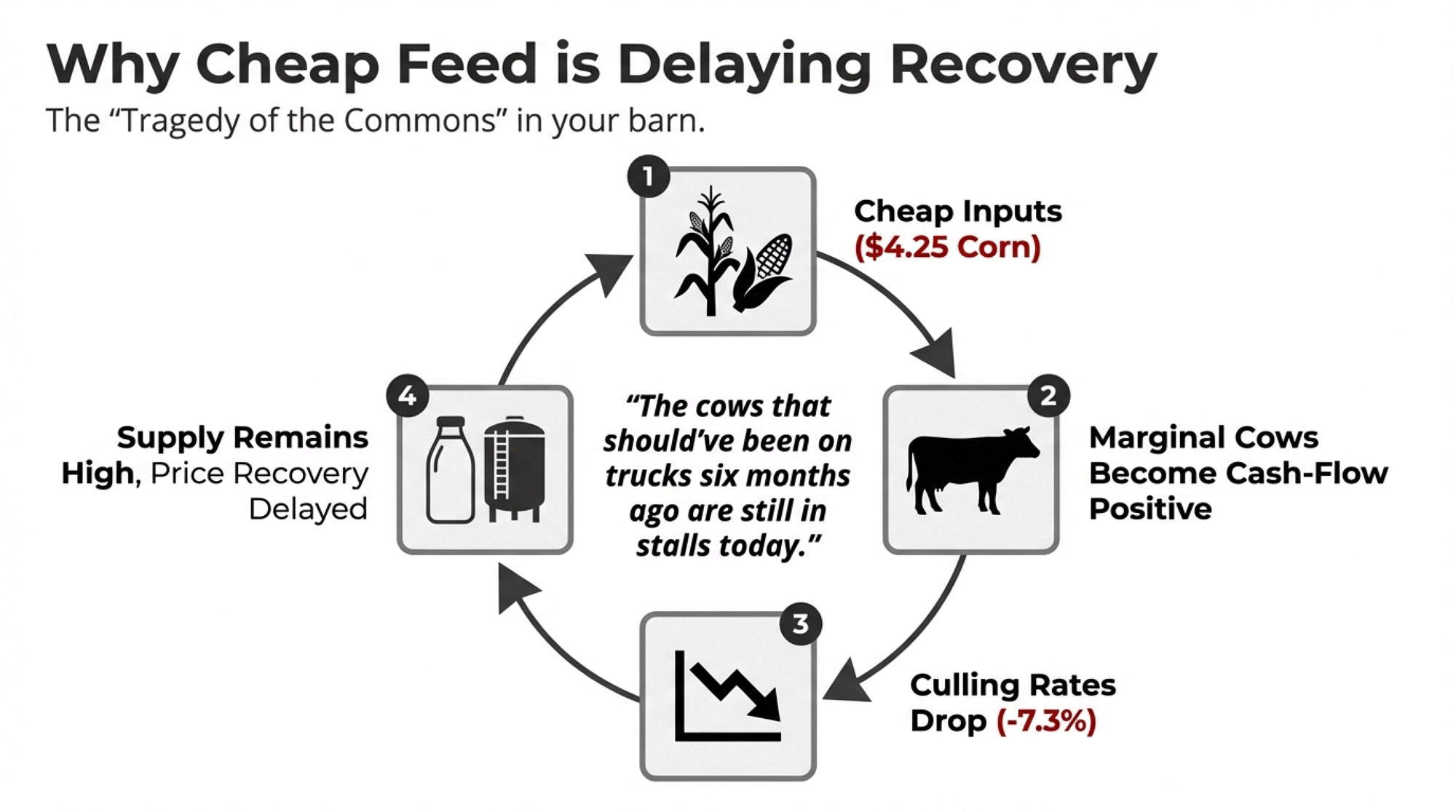

Cheap corn isn’t just helping your margins—it’s keeping marginal cows in the herd longer and delaying the supply correction that would help prices recover.

The numbers are stark. Dairy cow culling dropped to historic lows through the first half of 2025, down 7.3% from the same period in 2024 (Southern Ag Today, January 13, 2026). The seven-month total through July was the lowest since 2008 (eDairy News, August 2025). Even as milk prices slid through the fall, weekly dairy cow slaughter through the last four weeks of 2025 was only slightly above year-earlier levels (USDA Livestock, Dairy, and Poultry Outlook, January 2026).

Why aren’t producers culling more aggressively?

Two factors, and they’re both working against a price recovery:

- First, cheap feed makes borderline cows profitable enough to keep. When corn was running $6+, and soybean meal was north of $400, that seven-year-old cow giving 60 pounds was bleeding money. At $4.25 corn and $290 meal, she’s suddenly cash-flow positive—barely. So she stays. Multiply that decision across thousands of operations, and you’ve got an oversupply situation that won’t self-correct.

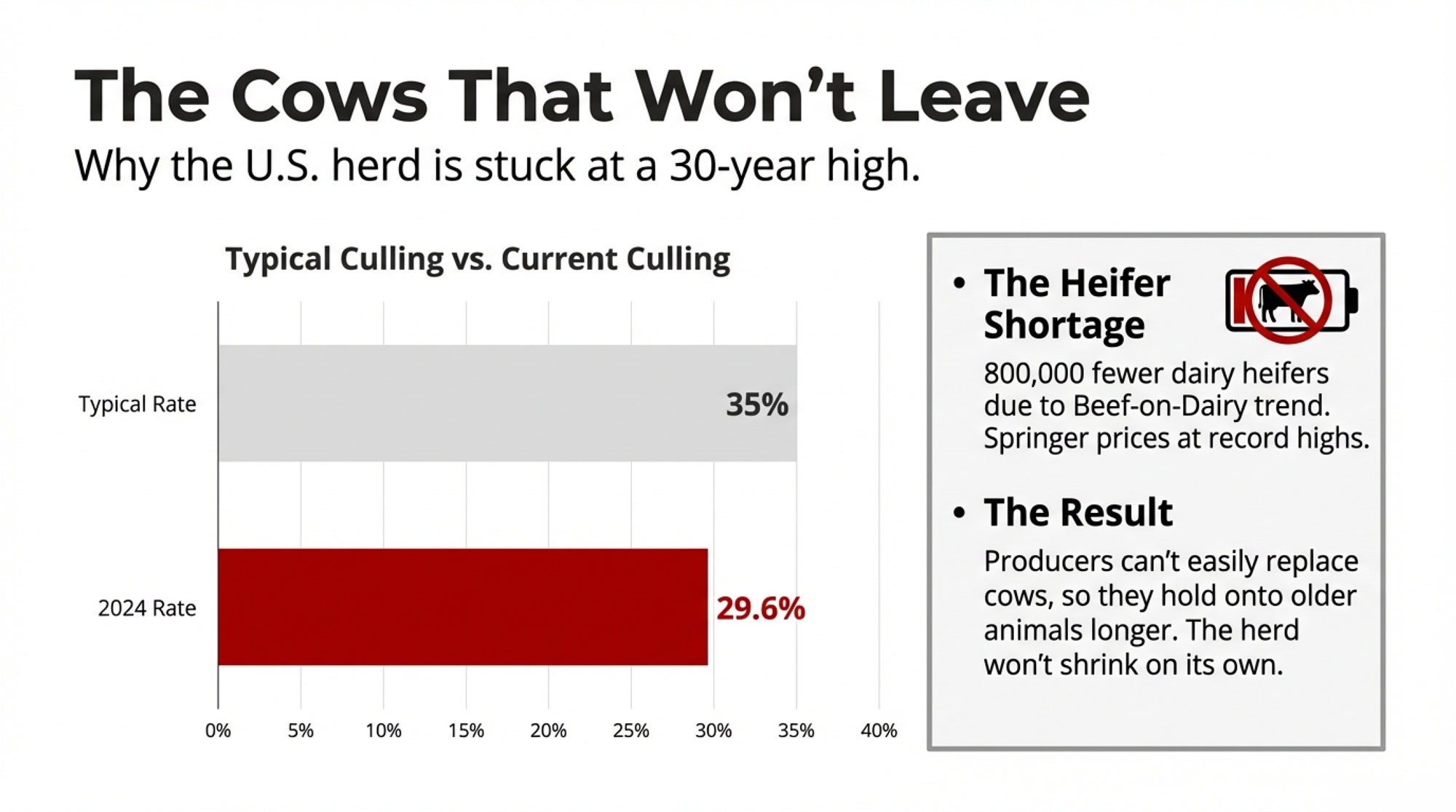

- Second, the heifer shortage makes replacement expensive. Beef-on-dairy economics have drained the replacement pipeline. Springer heifer prices are at or near records, and with 800,000+ fewer dairy heifers in the system (Dairy Herd Management, November 2025), producers can’t easily replace culled cows even if they wanted to. Cull rates dropped to 29.6% in 2024—well below the typical 35-37% turnover that supports strategic herd improvement (Dairy Herd Management, August 2025).

The U.S. dairy herd now sits at approximately 9.49 million head—near the highest level since the early 1990s. USDA’s January Livestock, Dairy, and Poultry Outlook revised the annual dairy cow inventory to 9.490 million head and projects the herd will remain large well into 2026.

What’s interesting here is the game theory at play. Every individual producer benefits from keeping their cows in milk when feed is cheap. But collectively, those decisions are extending the timeline for everyone’s price recovery. It’s a classic tragedy of the commons, playing out in real-time across American dairy barns.

The strategic response some progressive operations are taking: Rather than culling primarily based on age or reproductive metrics, they’re calculating income over feed cost (IOFC) for each cow and moving out animals consistently below $1.50 per cow per day (The Bullvine, December 2025). That’s the math-based approach that makes sense when feed is cheap, but margins are thin.

| Cow Profile | Prod’n (lbs) | BF/Protein | Daily Revenue | Daily Feed | Daily IOFC | Decision |

|---|---|---|---|---|---|---|

| Cow A: 4yr, 75# prime | 75 | 3.8% / 3.2% | $10.50 | $8.20 | $2.30 | ✅ KEEP |

| Cow B: 6yr, 65# good | 65 | 3.7% / 3.1% | $9.10 | $7.80 | $1.30 | 🔶 BORDERLINE |

| Cow C: 7yr, 55# fading | 55 | 3.6% / 3.0% | $7.70 | $7.40 | $0.30 | 🔴 CULL |

| Cow D: 5yr, 70# solid | 70 | 3.8% / 3.2% | $9.80 | $8.00 | $1.80 | ✅ KEEP |

| Cow E: 8yr, 48# poor | 48 | 3.5% / 2.9% | $6.72 | $7.10 | –$0.38 | 🔴 CULL |

| Cow F: 3yr, 82# premium | 82 | 3.9% / 3.3% | $11.48 | $8.40 | $3.08 | ✅ KEEP |

Don’t expect a supply-side correction to rescue prices anytime soon. The cows that would have been on trucks six months ago, when feed was expensive, are still in stalls today. That’s good for individual cash flow in the short term, but it’s extending the pain for everyone.

The Production Surge: Why This Is Happening

November milk collections confirm what the futures already priced in—global oversupply is real and accelerating.

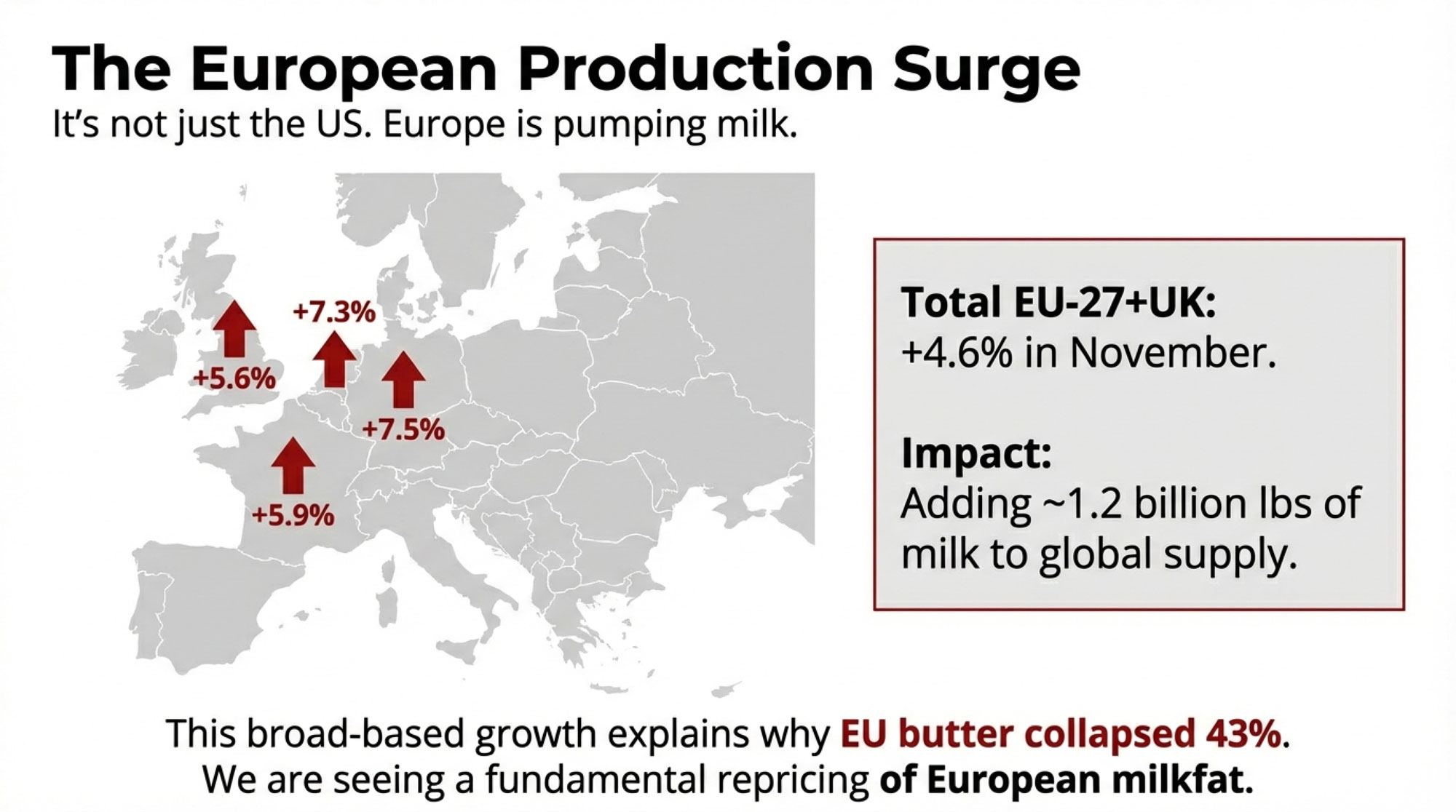

European Production Explosion

EU-27+UK pumped out 12.94 million tonnes in November, up 4.6% year-over-year. To put that in perspective, that’s nearly 1.2 billion pounds more milk than November 2024—equivalent to adding all of Michigan’s November production to the global supply, plus change.

| Country | Nov 2025 Production (kt) | Y/Y Growth | Key Signal |

|---|---|---|---|

| Germany | 2,643 | +7.5% | 🔴 Highest absolute growth |

| France | 1,954 | +5.9% | Steady surge |

| UK | 1,329 | +5.6% | Post-Brexit stabilization |

| Netherlands | 1,145 | +7.3% | 🔴 Second-highest % growth |

| Poland | 1,089 | +5.3% | Eastern EU leading |

| Belgium | 375 | +10.1% | 🔴 Highest % growth—warning sign |

| Denmark | 449 | +0.7% | Only modest growth |

| EU-27+UK TOTAL | 12,940 | +4.6% | 1.2B lbs MORE than Nov 2024 |

Cumulative EU-27+UK production through November hit 150.75 million tonnes, up 1.9% year-over-year after adjusting for the leap year. Milksolid collections were up 5.2% in November alone, which tells you butterfat and protein content are running strong across European herds.

French milksolids jumped 6.6% in November, with cumulative 2025 collections at 1.63 million tonnes (+1.5% y/y). French butter production hit 28.3kt in November (+0.8% y/y), with YTD production up 5.2% to 337.6kt.

Danish milksolids were up 1.5% in November, with cumulative collections at 431kt (+2.7% y/y).

What I find notable is how broadly based this European production surge is. It’s not just one country driving the numbers—Germany, France, the Netherlands, Poland, and the UK are all posting substantial gains. That kind of synchronized growth is rare, and it explains why European commodity prices have fallen so hard.

U.S. Production Outlook

USDA kept their 2025 forecast unchanged at 115.70 million tonnes in the January WASDE—a 2.4% increase over 2024. But they raised the 2026 forecast, citing “higher production per cow” as the primary driver (USDA WASDE, January 2026). If realized, that’s another 1.3% increase on top of an already elevated base.

Spot milk loads traded as much as $4 under Class III last week (Dairy Market News). When processors are paying that far below class price for spot loads, it tells you they have all the contracted milk they need—and then some.

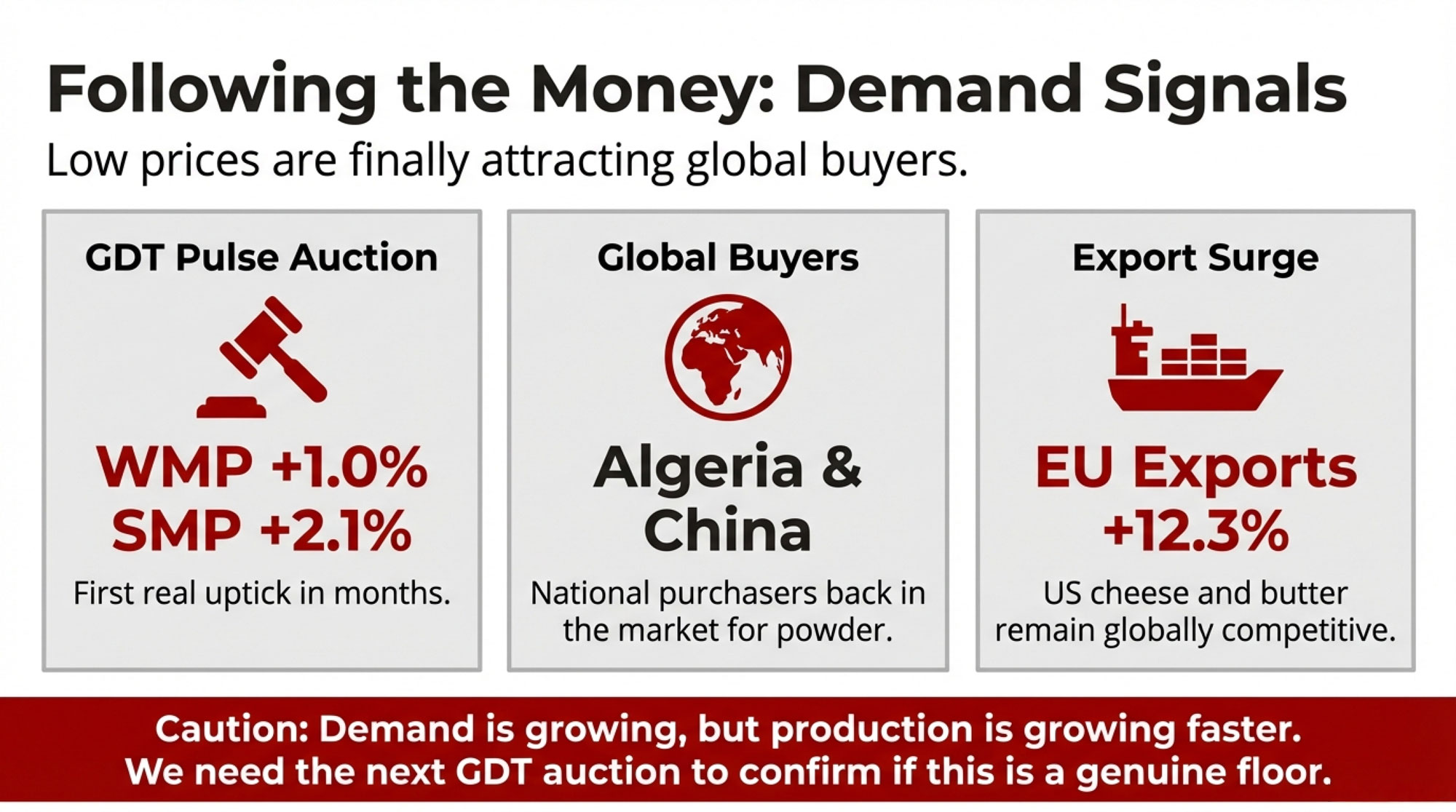

Where’s the Demand? Following the Money

The good news: low prices are finally attracting buyers. The bad news: it’s not enough yet.

Algeria is back in the market. ONIL, their national dairy purchase program, is bidding for milk powder again. That’s significant—Algeria is historically one of the world’s largest SMP importers, and their return to active purchasing is exactly what you’d expect when global prices fall this far.

Chinese buyers are consistently attending GDT auctions. Chinese SMP inventories dropped to a one-year low in November, so merchants may need to step up purchases even though domestic consumption remains soft. It’s worth noting that Chinese dairy demand has been disappointing for nearly two years now, so I’d want to see sustained buying before getting too optimistic.

EU exports surged 12.3% in November:

| Product | Y/Y Change | Key Destinations |

| SMP | +39.6% | Algeria, Egypt, Saudi Arabia, Morocco |

| Butter | +14.9% | Most destinations except S. Korea, China |

| Cheese | +8.9% | Japan, Korea, and China improved |

| WMP | +33.2% | — |

| Casein | +66.8% | — |

U.S. exports are holding firm. The U.S. is currently the least-expensive global supplier for cheese and butter, shipping enough product abroad to keep inventories in check despite record output (Dairy Market News). For cheese, domestic demand is “solid,” and export demand is “strengthening.” For butter, Dairy Market News reports that “interest from international buyers is keeping domestic bulk butter spot loads tight.”

This is actually one of the more encouraging aspects of the current market. Demand isn’t collapsing—it’s growing. The problem is that production is growing faste than it isr.

Feed Markets: The One Bright Spot

USDA’s January WASDE dropped a bombshell on corn markets (USDA WASDE, January 13, 2026).

Corn yield came in at a record-shattering 186.5 bushels per acre—half a bushel higher than December estimates. Total production hit 17.021 billion bushels, smashing the previous record by 11%.

Ending stocks jumped to 2.227 billion bushels, on par with stockpiles from 2016-2019 when corn averaged roughly $3.50 per bushel. That historical comparison gives you a sense of where corn prices might be headed if demand doesn’t materialize.

March corn dropped 20¢ on the week to settle at $4.25 (CME Group). March soybean meal closed at $290 per ton, down $13.70.

What this means for your operation: Feed costs are genuinely cheap—the lowest since October 2020 on a DMC basis (Ever.Ag). But here’s the math problem that keeps coming up: milk prices are dropping faster than feed costs are falling. A 35-50¢ per cwt feed savings doesn’t offset a $1.80 drop in the all-milk price.

The record corn crop is a real relief for your feed bill. But if you’re counting on cheap feed to save your margins while milk stays at $14-15, rerun those numbers.

| Product | Sunday Pulse PA098 | Previous GDT | Y/Y (Jan 2025) | TE396 Watch |

|---|---|---|---|---|

| WMP (C2) | $3,395 (+1.0%) | $3,360 | $3,155 (+7.6% y/y) | Needs to hold $3,350+ |

| SMP (MH) | $2,660 (+2.1%) | $2,605 | $2,495 (+6.6% y/y) | Needs to hold $2,600+ |

| Butter | $5,395 (est.) | $5,150 | $5,820 (–7.3% y/y) | Watch for $5,200 support |

| Cheddar | $3,270 (est.) | $3,310 | $3,760 (–13.0% y/y) | Critical: Hold above $3,200 |

The Week Ahead: What to Watch

Tuesday, January 20: GDT Event TE396 results. This is the auction that matters. If WMP and SMP can hold or extend Sunday’s gains with larger volumes on offer, we might actually be seeing a floor form. If they give it all back, buckle up for more pain.

The GDT Floor Test — What to Look For on Tuesday, Jan 21

🔴 FLOOR FAILURE SCENARIO:

• WMP falls below $3,350 (gives back Sun gain + more)

• SMP drops below $2,600 (momentum breaks)

• Volume is weak (less than 2,000 MT total)

→ Result: Expect further selling; $14 milk locks in

🟢 FLOOR HOLDING SCENARIO:

• WMP holds $3,350–$3,400 (sustains Pulse momentum)

• SMP holds $2,600–$2,650 (shows buying interest)

• Volume is healthy (2,500+ MT; strong participation)

→ Result: Floor forming; recovery narrative begins

🟡 CRITICAL THRESHOLD:

If Butter holds $5,200–$5,300 on larger volumes (TE396

has 1,920 MT offered), that signals structural demand

at lower price levels—a genuine floor signal.

Key data releases this week:

- New Zealand December milk collections — Will signal if Fonterra’s production growth is moderating heading into the back half of their season

- U.S. December milk collections — Confirms whether the herd expansion continued through year-end

- Chinese December dairy imports — Tests whether inventory drawdowns are translating to actual purchases

The Bullvine Bottom Line

Tomorrow’s GDT auction is the market’s next referendum. If WMP and SMP hold Sunday’s gains, we might have found a floor. If they give it back, prepare for $14 Class III to stick around through spring.

Here’s the uncomfortable reality that this week’s data makes clear: cheap feed is keeping this market oversupplied longer than it otherwise would be. Every producer making the individually rational decision to keep marginal cows in milk is collectively extending everyone’s price recovery timeline. It’s nobody’s fault exactly, but it’s everybody’s problem.

The strategic question for your operation isn’t whether to keep milking—it’s whether you’re keeping the right cows milking. Run those IOFC calculations. That seven-year-old giving 45 pounds might be cash-flow positive at $4.25 corn, but she’s dragging down your herd average and, in a small way, dragging down everyone’s milk price too.

Watch the GDT numbers on Tuesday. And if you haven’t maxed out your DMC coverage at $9.50 for 2026, the enrollment deadline is February 26. Based on where futures are trading, those payments are looking increasingly likely through at least mid-year.

Key Takeaways

- Pandemic-level prices are back: Class III testing $14. Cheddar blocks at $1.29. EU butter down 43% y/y. This is what three continents overproducing at once looks like.

- Cheap corn is the problem, not the solution: At $4.25/bu, even marginal cows stay cash-flow positive. Every cow that should’ve been culled months ago is still milking—and that’s delaying the correction we all need.

- The herd won’t shrink on its own: U.S. dairy cows near a 30-year high. Cull rates are at historic lows. Springer heifers are too expensive to replace aggressively. Until that changes, oversupply persists.

- GDT finally has a pulse: WMP +1.0%, SMP +2.1% on Sunday’s Pulse auction. Tomorrow’s TE396 is the real test—if it holds, we might have found a floor.

- Your move: Budget $15 Class III through Q2. Max out DMC at $9.50 before the Feb 26 deadline. And calculate IOFC on every cow in your barn—because $4 corn doesn’t make a 45-lb cow worth her stall.

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More

- The $200K Dairy Margin Trap: What Cheap Feed Won’t Tell You About 2026 – Gain immediate margin enhancement by mastering the “math over sentiment” approach. This breakdown reveals how weekly NIR forage analysis and rigid IOFC-based culling thresholds recover hidden losses before cheap feed masks your true operational inefficiency.

- USDA Says $18, Futures Say $16: The $150K Gap That’s Rewriting 2026 Dairy Budgets – Avoid a six-figure budgeting disaster by understanding why USDA projections and futures markets are currently $2 apart. This analysis arms you with the “stress-test” methodology required to protect your equity against the volatile price realities of 2026.

- 211,000 More Dairy Cows. Bleeding Margins. The 2026 Math That Won’t Wait. – Disrupt the cycle of overproduction by exposing how beef-on-dairy premiums have hijacked traditional culling logic. It delivers a new genetic playbook focused on protein-first selection (CM$) to restore your herd’s profitability in a volume-saturated market.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!