Whoa! Feed errors cost you $1,200+ per cow yearly—that’s serious cash walking out your barn door. Time for real talk.

You know that feeling when you’re walking past the feed bunk on a busy Tuesday morning, watching the TMR get pushed up, and something just doesn’t sit right? Like there’s money walking out the door that never shows up on your milk check?

Well, here’s the uncomfortable truth nobody wants to talk about at the co-op meetings: if you’re calculating feed costs the way most dairies do, you’re probably underestimating your true costs by more than $3.50 per hundredweight.

Think about that for a minute. On a 200-cow dairy averaging 85 pounds per cow daily, that’s over $50,000 annually, that’s just… gone. Not stolen, not lost to market volatility—just miscalculated into thin air while you’re focused on everything else.

I’ve been digging into this across operations from Wisconsin to California, and what I’m seeing is pretty sobering. These aren’t isolated bookkeeping errors we’re talking about. They’re systematic blind spots that have become so commonplace that most producers don’t even realize they’re happening.

Here’s what really gets me fired up about this: The market volatility we’ve all been living through has made these calculation errors absolutely brutal. Income Over Feed Cost swung a staggering $12.05 per hundredweight from the depths of 2023 to early 2024—and farms flying blind with bad baseline numbers got hammered twice as hard.

The Thing About Feed Costs That Keeps Me Up at Night

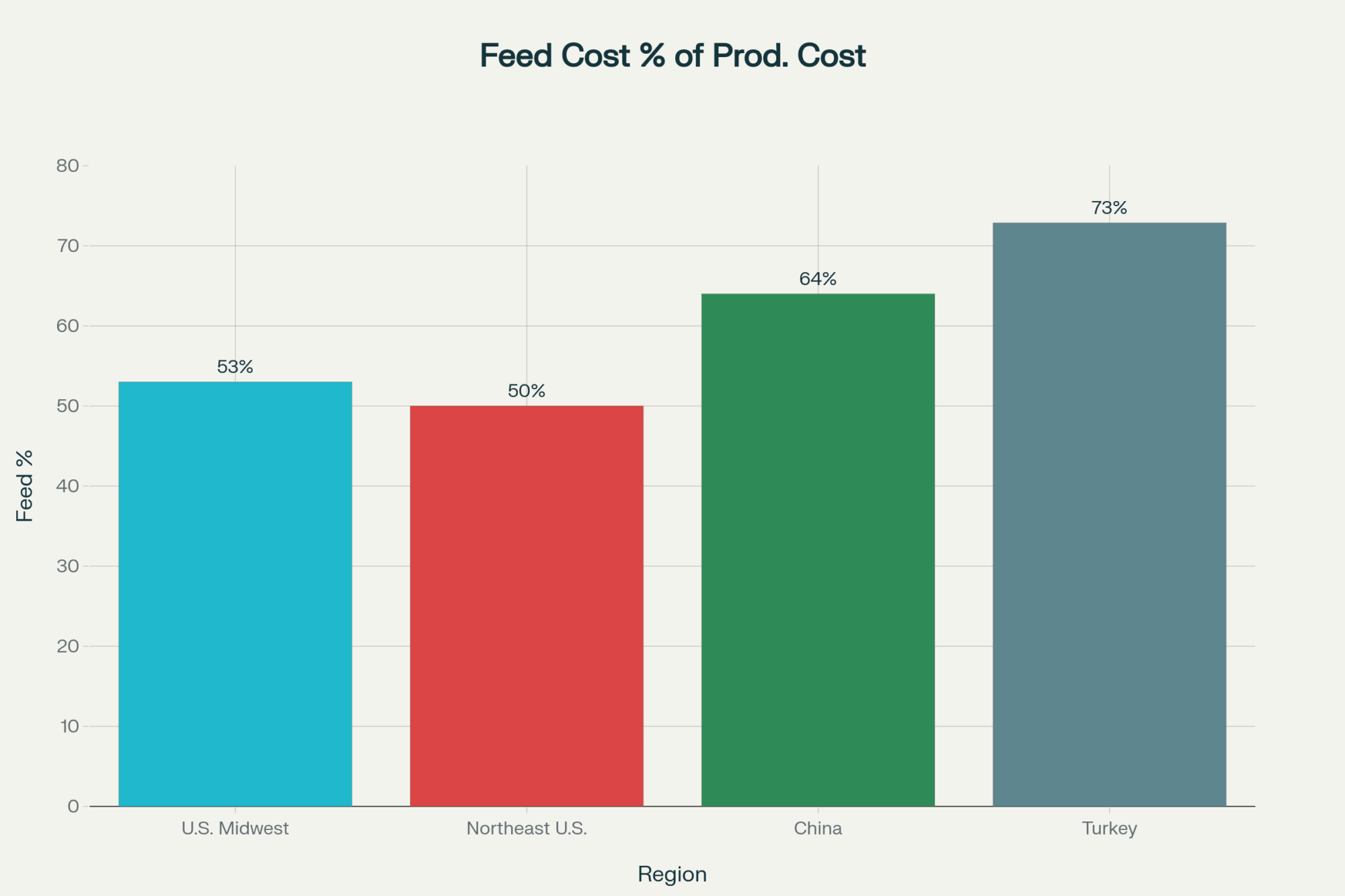

Feed is the ultimate financial lever on your operation. Period. We’re talking about 50-60% of your total production costs in most systems, sometimes exceeding 70%. When you’re looking at numbers like Illinois farms reporting nearly $3,000 per cow annually on feed, even small calculation errors get magnified fast.

What strikes me about visiting different operations is how the same fundamental mistakes keep showing up, regardless of herd size or management philosophy. It’s as if we’ve collectively agreed to overlook basic economic principles when it comes to the largest expense line on our balance sheets.

Here’s the brutal math: when feed represents 60% of your costs, a 5% calculation error doesn’t just ding your margins—it can wipe out your entire profit for the year. I’ve seen operations that looked profitable on paper discover they’d been operating at a loss once we corrected their feed costing methodology.

The “As-Fed” Trap That’s Killing Your Numbers

Let me paint you a picture I see way too often. You’ve got two trucks of corn silage arriving, both quoted at $60 per ton as-fed. Your first instinct? They’re the same deal.

Wrong.

The first load tests were at 30% dry matter, the second at 40%. When you run the actual numbers on a dry matter basis, that first load is costing you $200 per ton of nutrients, while the second is $150. That’s not a rounding error—that’s a 33% difference in value sitting right there in plain sight.

Yet I still walk onto farms where buying decisions are made on as-fed weights. New Mexico State Extension puts it bluntly: “The water component contains no nutrients,” yet we continue to pay for it as if it did.

This is especially painful when you’re dealing with wet byproducts or variable-moisture silages. I was on a farm in central Wisconsin where they were consistently overpaying for wet distillers grains because nobody was converting to a dry matter basis. Once we fixed that calculation method, they saved over $15,000 in the first four months.

Your “Free” Forage Isn’t Free (And You Know it)

Here’s where even experienced producers trip themselves up: treating homegrown forage as if it were free or pricing it at last year’s production costs. Look, I get the psychology. You grew it, chopped it, stored it—it feels like it shouldn’t cost anything extra to feed it.

But economically? Every ton of silage going into those bunks is a ton you’re not selling. The USDA Economic Research Service prices homegrown feeds at current market values for exactly this reason. That “free” corn silage has a very real opportunity cost.

I was working with a farm in southern Minnesota where the owner was convinced his dairy was highly profitable. Milk production appeared to be good, the cows were healthy, and the cash flow seemed positive. Then we repriced his homegrown feeds at market rates and discovered his crop enterprise was essentially subsidizing a marginally profitable dairy operation.

Without accurate costing, he couldn’t make informed decisions about land use, expansion, or even whether he should be in the dairy business at all. That’s not just bad accounting—that’s strategic blindness.

The Invisible Herd Costing You Big

Now here’s where even sharp managers stumble: calculating feed costs only for the milking string while completely ignoring dry cows and replacement heifers.

This is huge. Industry analysis reveals that this omission underestimates true feed costs by approximately 38%. You’re looking at a $3.16 per hundredweight error just from calculation scope alone.

Think about the math here—if you’ve got 200 milking cows, you’re probably feeding another 40-50 dry cows and maybe 180-200 replacement animals of various ages. All eating, none producing milk that hits your bulk tank. Factor that into your cost per hundredweight, and suddenly those feed costs look very different.

I see this error constantly, even from operations that are sophisticated in other areas. They’ll invest in genomic testing and precision breeding, but calculate feed costs as if it were 1985. The disconnect is jarring.

Feed Shrink: The Silent Profit Killer Nobody Talks About

Let’s dive into something that doesn’t get nearly enough attention—shrink. That’s the feed you paid for that never actually reaches a cow’s mouth.

Research from Hubbard Feeds indicates an average shrinkage of 5.42% for purchased feeds, with losses reaching 8.06% for commodities in open storage. However, what really concerns me is that I’ve documented shrink rates exceeding 12% on farms with inadequate storage and handling protocols.

I visited a 1,000-cow operation that tracked its shrink losses and found it was losing $5,733 over just 47 days. That’s nearly $45,000 annually vanishing into thin air—or more accurately, into bird bellies and blowing away with the wind.

The economics are staggering. Move from an open commodity shed to proper enclosed storage, and you’re looking at potential savings of $135,000+ annually for a 1,000-cow dairy. Often, that saves enough to pay for the new building through feed cost reduction alone.

However, what really bothers me about shrinkage it’s not just volume loss. You’re losing the lightest, most nutrient-dense particles first. The expensive stuff. So you pay twice: once for the lost feed, again through the imbalanced ration that’s left behind.

When Good Metrics Go Bad: The Feed Efficiency Trap

Even when costs are calculated correctly, they can be applied wrong, leading to terrible management decisions. I frequently observe this with feed efficiency metrics.

The classic mistake? Using average feed conversion rates to predict responses from additional feeding. The biologically correct metric is the marginal response—what you actually get from that next increment of feed.

I worked with a producer who was convinced that adding two pounds of concentrate would generate six additional pounds of milk based on his average conversion rate. Reality? He obtained perhaps two extra pounds of milk, which increased the marginal feed rate to three times his average rate. Instead of the profitable margin he calculated, he was barely breaking even.

Some operations push this even further, chasing feed efficiency numbers in isolation without considering the economic implications. I’ve seen cows pushed so hard they start milking off their backs—sacrificing body condition and future fertility for short-term efficiency gains.

The Real Cost: Adding It All Up

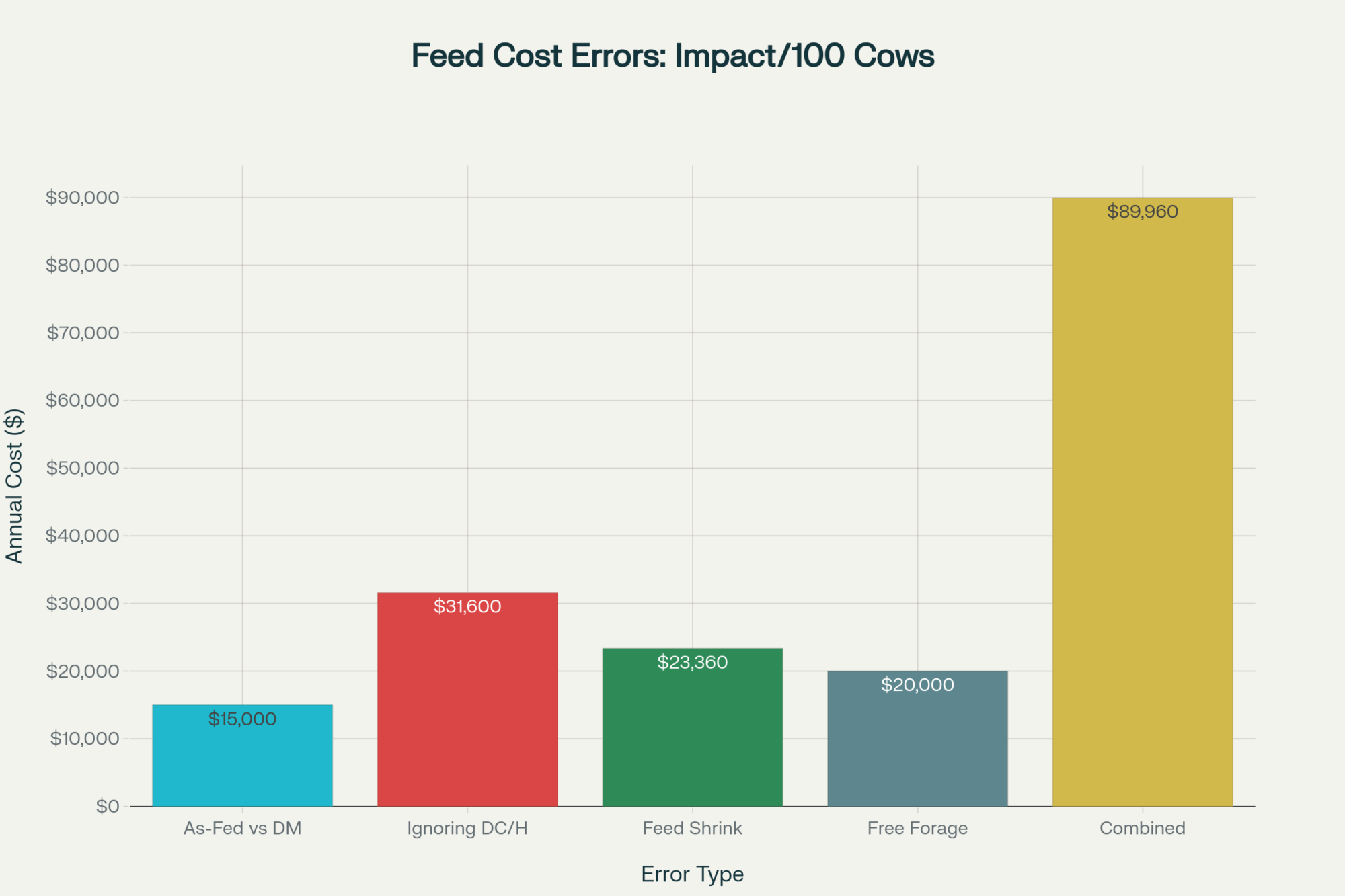

When you combine all these errors—as-fed pricing, “free” forage, incomplete herd costing, unaccounted shrink—you could be miscalculating costs by $1,200+ per cow annually.

On a 200-cow dairy, that’s a quarter-million-dollar blind spot. But here’s the opportunity: every one of these errors is fixable.

I’ve documented case studies where correcting these calculation methods delivered dramatic returns:

- Strategic nutritional grouping: Moving from a single TMR to distinct diets for high and low producers can save $400+ per cow annually

- Feed center upgrades: Reducing shrink from 8% to 3% through better storage infrastructure

- Precision feeding implementation: AI-driven optimization saving $31 per cow annually through improved efficiency

Technology: The Great Divide

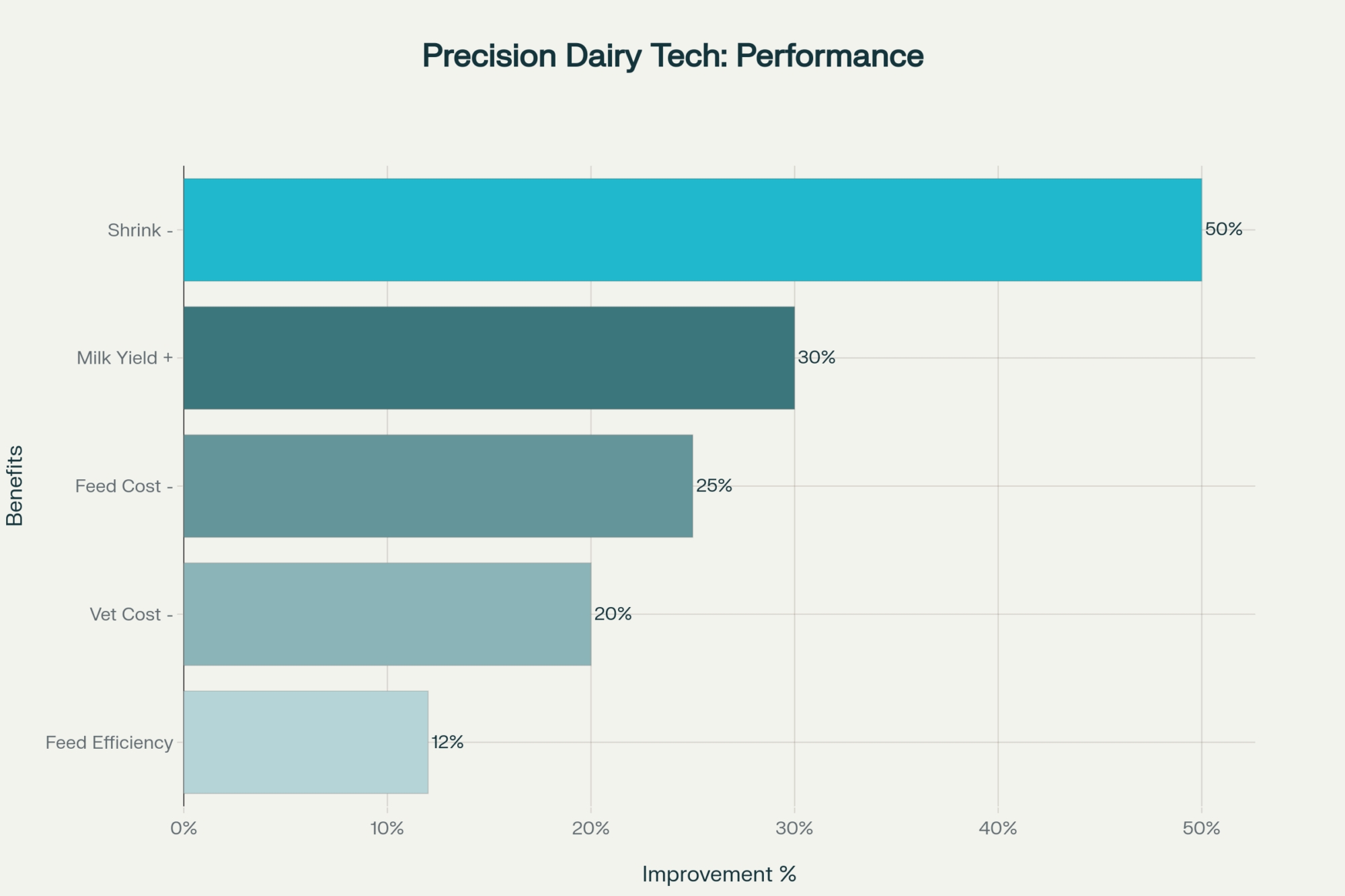

What’s particularly striking is how the adoption of technology is creating two distinct dairy industries. Progressive operations are implementing AI-driven feed optimization, real-time monitoring systems, and precision feeding platforms to enhance efficiency.

Research shows these systems deliver 7-12% reductions in feed costs while actually improving production. One study I reviewed found that AI-driven feed optimization could save $31 per cow annually by fine-tuning diets with precision that is impossible for humans to achieve.

However, here’s the problem: this technology isn’t inexpensive, and it requires expertise that many smaller operations lack. We’re seeing a widening gap where larger farms capture these efficiencies while smaller operations compete with higher cost structures.

This isn’t just about efficiency anymore—it’s about survival. Farms that get feed costing right have accurate baselines for risk management, better decision-making data, and a foundation for sustainable profitability.

The Global Context We Can’t Ignore

While we’ve been focused on domestic markets, global trends are reshaping feed costs that most U.S. producers aren’t tracking closely enough.

China’s dairy expansion is fundamentally altering global feed demand. With feed representing 64% of production costs in Chinese systems, their procurement strategies are affecting commodity prices worldwide.

European producers are facing environmental regulations that are driving diverse approaches to feed efficiency and waste management. Their focus on precision feeding and nutrient management isn’t just about costs—it’s about compliance with increasingly strict environmental standards.

These global pressures are coming to North America. We’re already seeing early discussions about carbon pricing and environmental compliance that could dramatically affect feed sourcing and cost structures.

Your 90-Day Implementation Roadmap

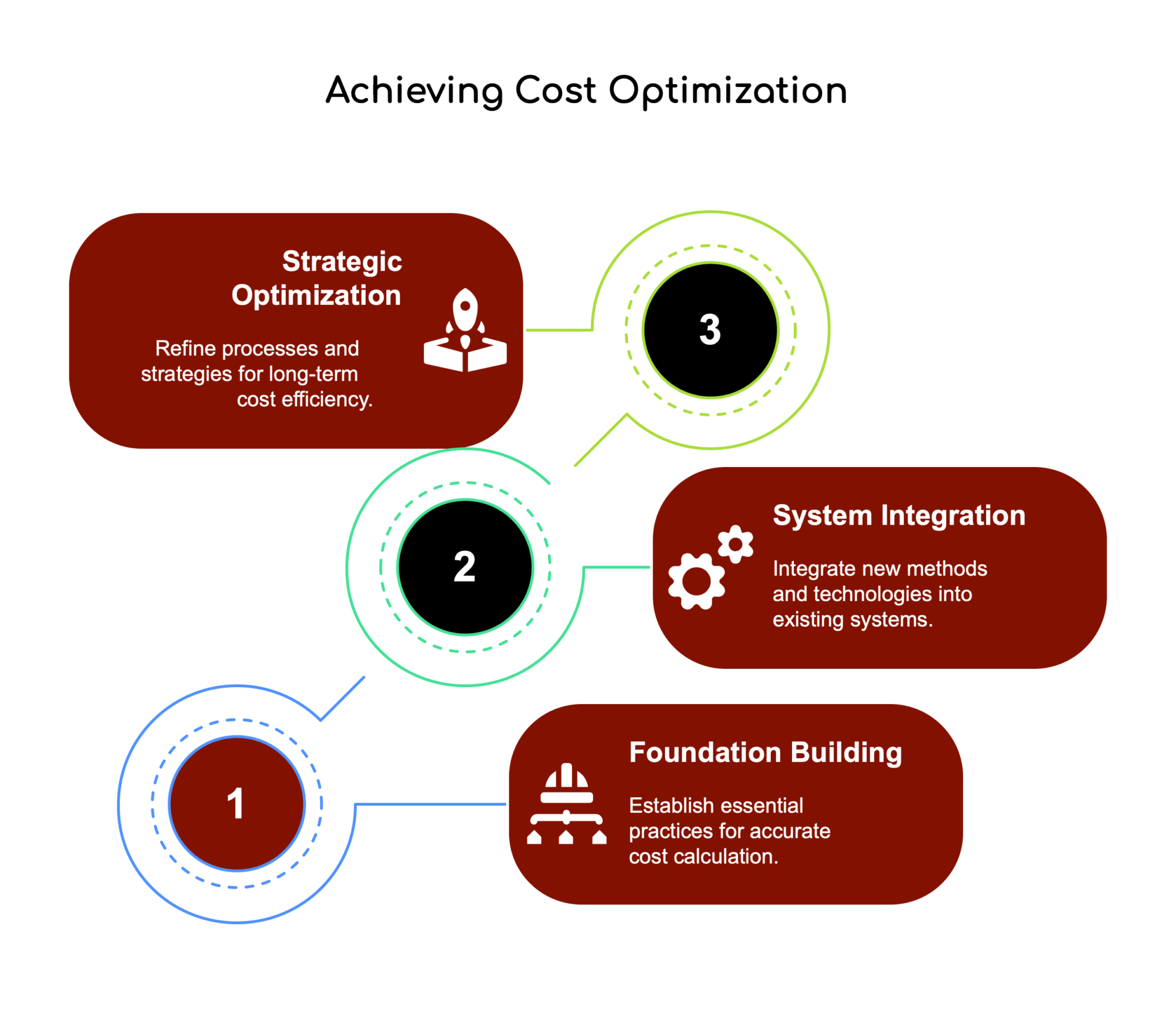

Based on what I’ve seen work across different operations, here’s a practical approach to fixing these calculation errors:

Days 1-30: Foundation Building

- Audit your current method: Calculate feed costs using only lactating cows, then recalculate including the entire herd plus shrink adjustments

- Implement dry matter testing: Start testing all forages and wet byproducts weekly

- Price homegrown feeds at market rates: Use current commodity prices, not historical production costs

- Measure actual shrink: Start simple—track deliveries versus consumption

Days 31-60: System Integration

- Switch to comprehensive costing: Include all animals and shrink in your cost per hundredweight calculations

- Benchmark against industry standards: Compare your numbers to University of Minnesota FINBIN data showing average feed costs of $10.38 per hundredweight

- Evaluate technology needs: Assess whether your scale justifies feed management software

- Train your team: Ensure everyone understands the new calculation methods

Days 61-90: Strategic Optimization

- Implement precision feeding: Consider nutritional grouping if herd size warrants it

- Assess infrastructure needs: Calculate ROI for feed center improvements

- Develop risk management strategies: Use accurate cost baselines for forward contracting and insurance decisions

- Create monitoring protocols: Establish regular reviews and adjustment procedures

The Uncomfortable Questions

Here are the questions every dairy producer needs to ask themselves:

When was the last time your feed cost calculations were really audited? Not just checked for arithmetic, but examined for methodology, scope, and assumptions?

Are you making major business decisions based on incomplete cost data? Expansion plans, equipment purchases, land acquisitions—all depend on accurate profitability calculations.

How do your feed costs compare to industry benchmarks? University of Minnesota FINBIN data indicate an average feed cost of $10.38 per hundredweight. If you’re significantly higher, these calculation errors may be the reason.

What Progressive Operations Are Doing Differently

The operations that are thriving in this volatile environment share some common characteristics:

They treat feed costing like genetic evaluation—data-driven, regularly updated, and fundamental to every major decision.

They invest in accurate measurement systems—whether that’s precision feeding technology, improved storage infrastructure, or just better protocols for tracking shrink.

They understand the difference between cost and value—focusing on Income Over Feed Cost rather than just minimizing feed expenses.

They benchmark religiously—knowing exactly where they stand relative to industry standards and top performers.

Looking Ahead: Industry Disruption

The dairy industry is heading toward a fundamental split. Operations that master precision cost management will capture increasing market share, while those stuck with outdated methods will find themselves squeezed out during market downturns.

This isn’t just about technology adoption—it’s about management philosophy. The old approach of “close enough” cost calculations worked when margins were wider and markets were more stable. Today’s environment demands precision.

Climate change is adding another layer of complexity. Variable weather patterns are affecting forage quality and availability, making accurate costing even more critical for risk management.

Regulatory pressure is increasing. Environmental compliance will likely require more detailed tracking of feed efficiency and waste, making sophisticated cost management systems essential for regulatory reporting.

The Bottom Line Reality Check

This isn’t just about better accounting—it’s about survival in an industry where margins are thin and volatility is the norm. Farms that get feed costing right have accurate baselines for risk management, better decision-making data, and the foundation for sustainable profitability.

The ones that don’t? They’re the operations getting squeezed out when markets turn tough, often without understanding why their seemingly profitable enterprises suddenly can’t pay the bills.

Here’s my challenge to you: Calculate your feed costs using the comprehensive method I’ve outlined. Include the entire herd, account for shrink, price everything on a dry matter basis, and value homegrown feeds at market rates. Then compare that number to what you’ve been using for business decisions.

I’m willing to bet the difference will shock you. More importantly, it will give you the accurate baseline needed to build a truly resilient operation in an increasingly challenging industry.

The question isn’t whether you can afford to make these changes—it’s whether you can afford not to. Because while you’re debating the value of precision cost management, your more sophisticated competitors are already capturing the profits you’re leaving on the table.

Your Turn

What’s been your experience with feed cost accuracy? Have you caught any of these calculation errors on your operation? More importantly, what’s holding back widespread adoption of more precise methods?

Drop your thoughts in the comments below. This is exactly the kind of discussion that moves the industry forward—and helps all of us avoid the costly mistakes that are quietly bankrupting operations across North America.

The data is clear, the methods are proven, and the technology exists to fix these problems. The only question left is: will you be among the operations that act decisively on this information, or will you let market forces decide for you?

KEY TAKEAWAYS:

- Pocket $444 per cow annually by switching to nutritional grouping—separate your high producers from your low producers and watch feed efficiency skyrocket while costs plummet.

- Slash feed shrink losses from 8% to 3% through better storage and handling—one farm saved over $100,000 yearly just by upgrading their feed center design. That’s real ROI.

- Boost cost accuracy by 40% by switching to dry matter basis and including your entire herd (yes, those dry cows and heifers count too!)—no more profitability illusions.

- Leverage AI-powered feed management to squeeze out 3-5% efficiency gains—in today’s volatile market, that margin improvement could be the difference between thriving and just surviving.

- Use your accurate baseline for smart risk management—when you know your true breakeven, tools like Dairy Revenue Protection and forward contracting actually work instead of just burning cash.

EXECUTIVE SUMMARY:

Here’s the deal—most dairy operations are underestimating their true feed costs by over $1,200 per cow every single year. That’s not pocket change… that’s mortgage payment money. The culprits? Simple stuff like using as-fed weights instead of dry matter, treating homegrown forage as “free,” and forgetting to count dry cows and heifers in your calculations. With feed representing 50-60% of your total costs and recent market swings pushing Income Over Feed Cost by a jaw-dropping $12+ per hundredweight, you can’t afford sloppy math anymore. Sure, your genomic testing and milk yields look great on paper, but if your feed cost foundation is shaky, your profitability might be pure illusion. The farms that get this right aren’t just saving money—they’re building bulletproof businesses that can weather the extreme volatility we’re seeing in 2025. Bottom line: fix your feed calculations now, or watch your competitors pull ahead while you’re wondering where the profit went.

Sources & Further Reading:

- University of Wisconsin Dairy Market Analysis, 2025

- Illinois Farm Business Farm Management Association Data, 2023

- University of Minnesota FINBIN Database

- USDA Economic Research Service Dairy Market Outlook

- Cornell University Feed Shrink Studies

- New Mexico State University Extension on Dry Matter Pricing

- Journal of Animal Science: Individual Cow Diet Optimization

- Penn State Extension: Managing Income Over Feed Costs

This analysis represents a synthesis of industry observations and research. Individual results may vary based on specific operational factors, market conditions, and implementation approaches.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!