Decide or decline: 2025 is the year mid‑size dairies prove that clarity—not cow count—decides success.

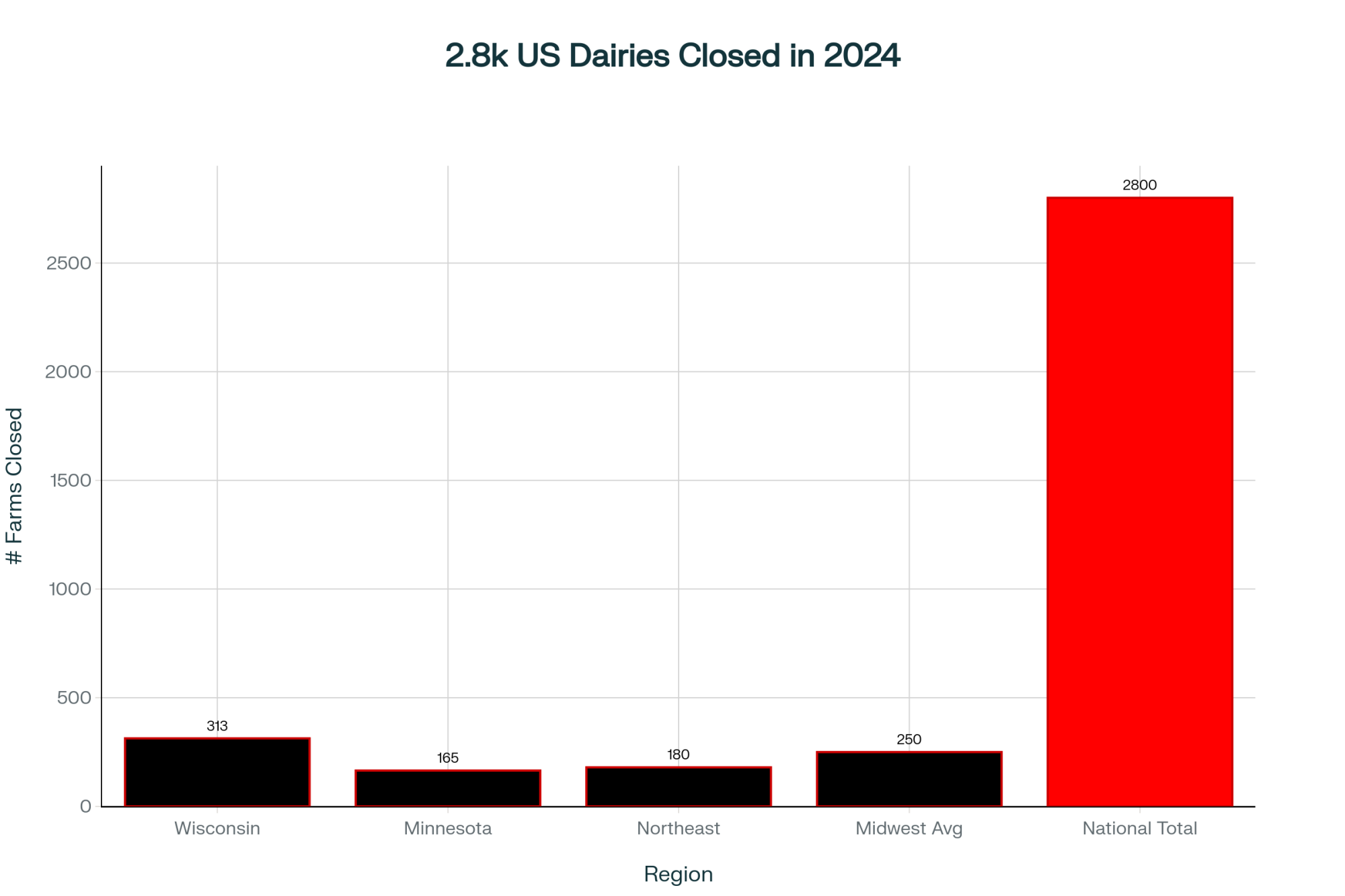

If you’ve been milking through the last 20 years, you already know how fast the middle has lost ground. The 800‑cow herds that once anchored local supply chains are now caught between higher costs and tighter credit. It’s not a lack of effort that’s hurting these farms—it’s the system moving faster than most can react.

Rising input costs, tighter labor markets, new regulations, and rising interest rates are changing what “sustainability” means. But what’s interesting here is that the challenge isn’t purely economic. It’s directional.

According to the USDA Economic Research Service, farms milking more than 2,000 cows now produce over 50% of U.S. milk, and they do so 20–25% more efficiently than smaller commercial herds. Meanwhile, Cornell Dairy Markets data shows that smaller farms—under 500 cows—are re‑emerging through organic, grass‑fed, and local marketing models, earning 30–60% above commodity prices.

And that leaves the middle squeezed. Roughly 2,800 U.S. dairies closed in 2024, many of them right in that 700‑ to 1,200‑cow range.

So, what can farms in this category do? Choices look different for everyone—and sometimes hesitation isn’t fear, it’s fatigue. But the operations pulling ahead are finding ways to convert that fatigue into focus, using data, advice, and discipline to move forward deliberately rather than reactively.

Three Viable Paths Forward

That pressure has created three distinct strategies that are working across 2025. Each one is viable—but only with clarity, discipline, and execution.

1. Expansion with Intention

Growth still works in regions where infrastructure supports it, particularly in Idaho, Texas, and parts of the Southern Plains. The Idaho Dairymen’s Association reports milk production up 3% year‑over‑year, driven by mid‑size operations expanding to 2,500‑cow scale.

Land values in productive regions remain reasonable—$6,000–$8,000 per acre, according to USDA NASS Land Values—and processors continue adding demand to match consolidation trends.

The most successful expansions share three core strengths:

- Debt ratios under 35%. Leverage only where cash flow already proves out.

- Trained management teams. Family ownership paired with experienced outside managers works best.

- Nutrient management foresight. Expansion means more scrutiny—planning here protects future flexibility.

Producers in new freestall and dry lot systems report labor efficiency gains of 25–35%, but these gains materialize only when training and system design precede construction. As one veteran Idaho producer put it recently: “Scale magnifies everything—your efficiency and your inefficiency.”

2. Right‑Sizing and Smarter Technology

For many in the Northeast, Upper Great Lakes, and Atlantic Canada, expansion isn’t realistic. The focus has shifted toward doing fewer things better—and technology is the enabler.

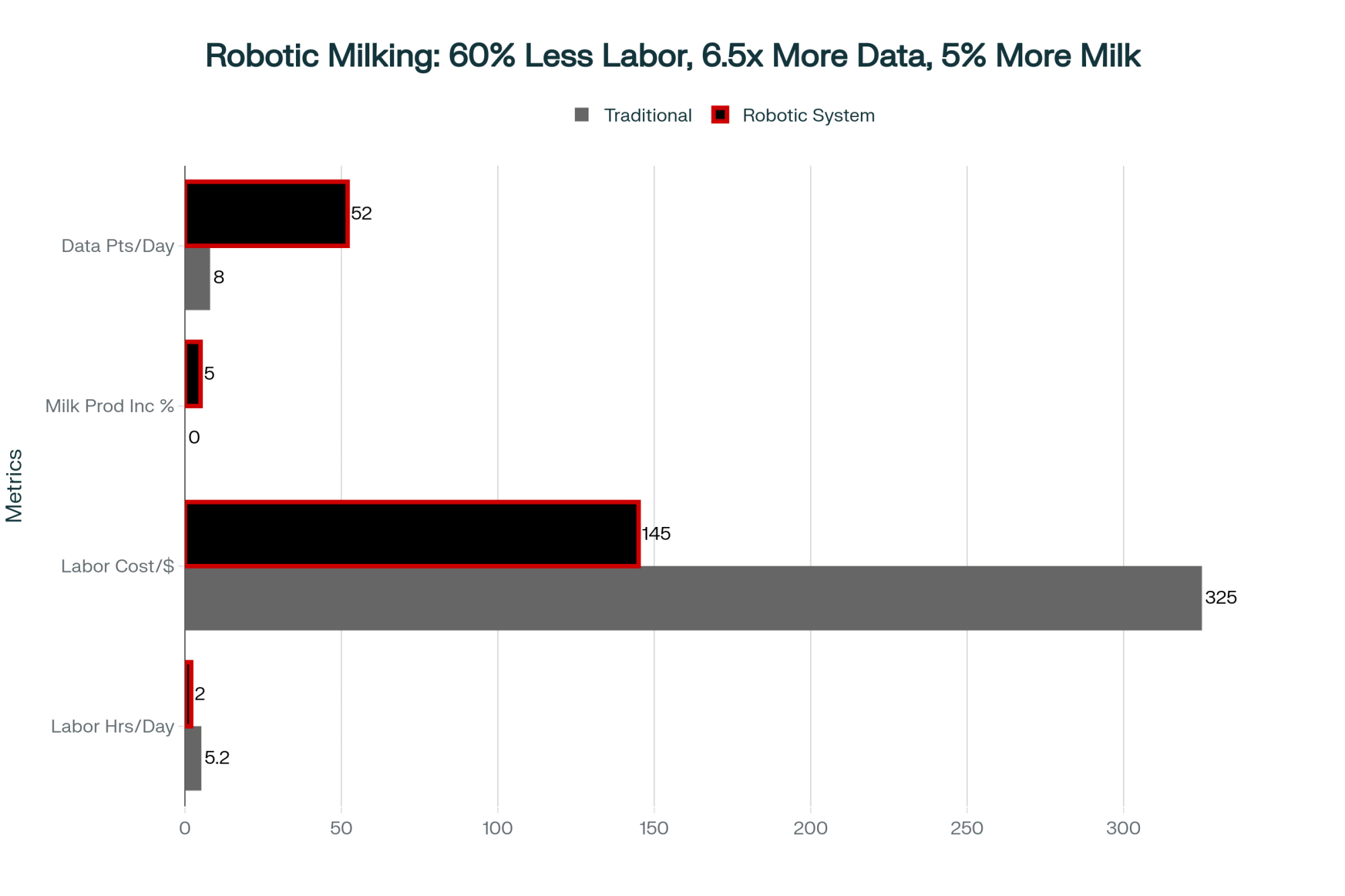

The University of Vermont Extension’s 2024 Robotic Dairy Study found that herds between 400 and 600 cows reduced labor costs by about 30% while maintaining or improving milk yield. Precision feeding and cow‑monitoring technology allowed smaller herds to compete through performance rather than scale.

What’s fascinating is that this same pattern holds north of the border. In Ontario and Quebec, under supply management, the economics differ, but the management philosophy doesn’t. Canadian producers are pushing robotics, automation, and stall utilization to maximize returns per kilogram of quota. As one Ontario nutritionist remarked, “Efficiency isn’t negotiable just because prices are stable. It’s the only real lever left.”

A Vermont dairy that converted to organic alongside robotic milking saw its milk price climb to $31.50 per hundredweight—right in line with national organic averages—but its bigger victory was time. Streamlined routines meant more focus on genetics, forages, and cow health.

These examples don’t make smaller easier—they make it more intentional. For the producers making it work, every investment serves a clear purpose: finding a way to manage cattle and people without burning out either one.

3. Optimization over Expansion

Across Wisconsin, Minnesota, and parts of Eastern Canada, the sweet spot has become refining economics within existing boundaries.

A benchmarking study reports farms that lifted their income over feed cost (IOFC) from $7.50 to $10 per cow per day captured roughly $820,000 more annual margin in 900‑cow herds.

That didn’t come from spectacular innovation; it came from fundamentals: tighter TMR consistency, better feed push‑up frequency, controlled parlor scheduling, and enhanced reproductive consistency.

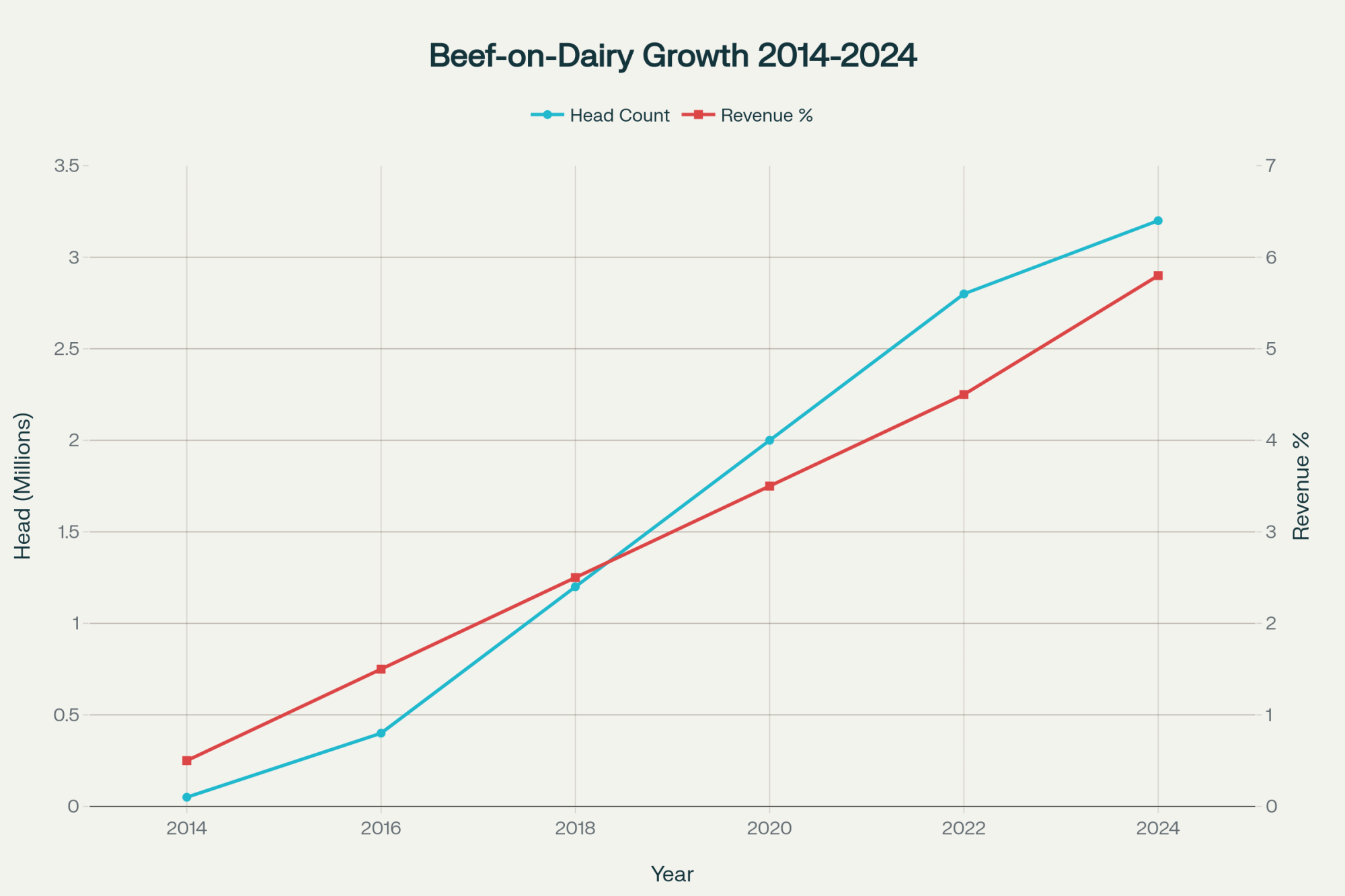

Those farms also focused on butterfat performance above 4.0%, earning premiums of $0.50–$0.75/cwt. Meanwhile, strategic use of beef‑on‑dairy genetics added $350–$400 per calf, according to University of Wisconsin Dairy Research, 2025.

Optimization is about reliability—the daily grind of doing the same things more precisely than the week before. As one Wisconsin producer told me, ‘We stopped chasing bigger and started chasing better—the shift from production expansion to business refinement. And it’s changing how success is measured: not more cows, but more predictable profit.

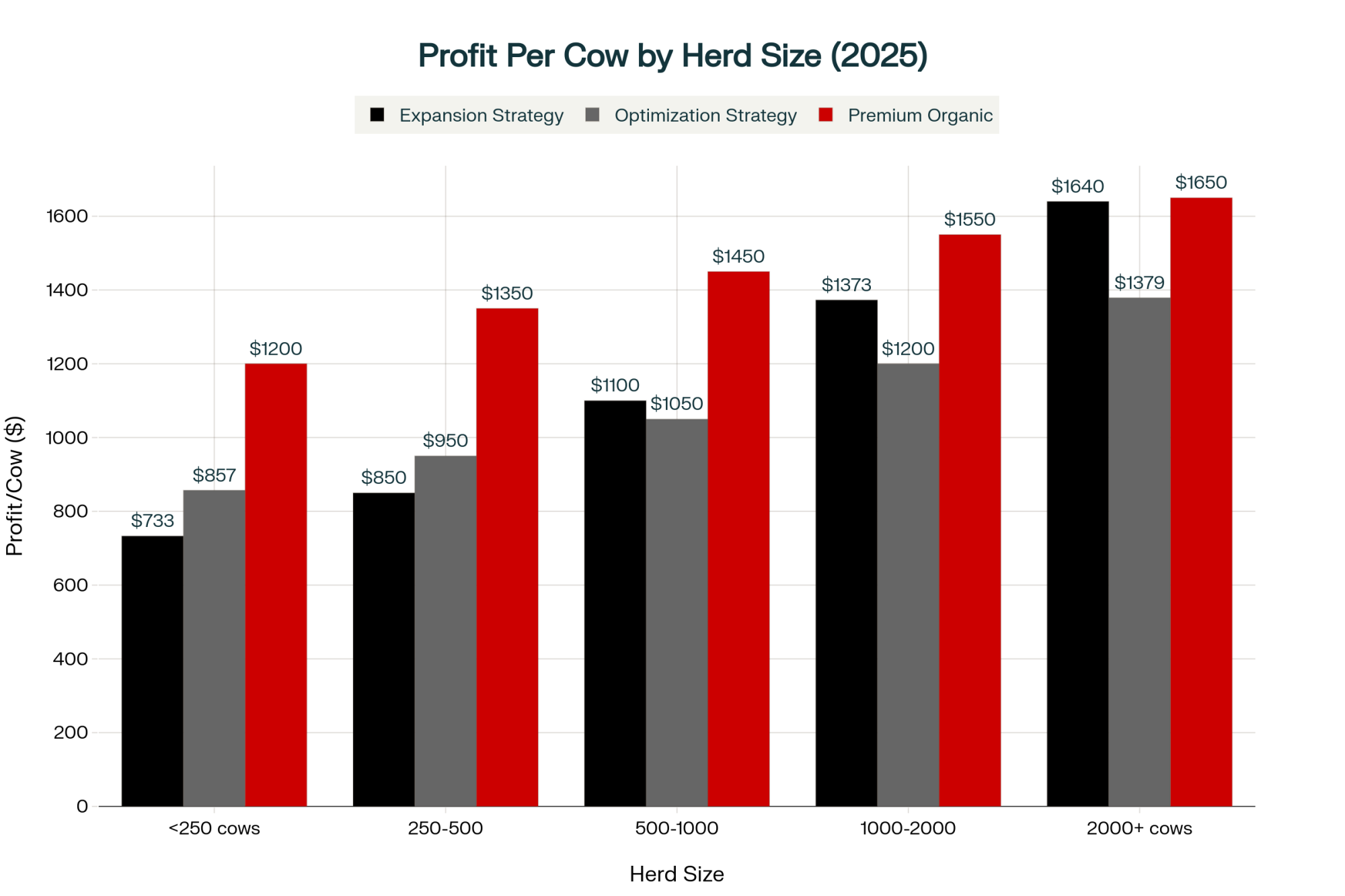

The Profit Illusion: Why Size Doesn’t Always Mean Success

At first glance, most producers expect small family dairies to earn more profit per cow, while large commercial herds rely on volume to make up thinner margins. But the data — shown in the chart below — tells a more nuanced storyAt first glance, most producers expect small family dairies to earn more profit per cow, while large commercial herds rely on volume to make up thinner margins. But the data — shown in the chart below — tells a more nuanced story.This visualization, “Three Paths to Profitability: Annual Profit Per Cow by Herd Size (2025),” reveals how performance and efficiency—not size alone—shape economic outcomes across the industry. The chart compares three strategic paths mid-size dairies are following today:

- Expansion with Intention – scaling to 2,000+ cows in strong infrastructure regions like Idaho and Texas.

- Right-Sizing + Technology – mid-tier herds (400–600 cows) adopting automation, robotics, and precision management.

- Optimization over Expansion – 700–1,200-cow herds refining feed, reproduction, and butterfat performance instead of adding capacity.

The higher bar for larger herds doesn’t simply mean big farms take more money home. Instead, their fixed costs — buildings, equipment, professional staff, financing — are spread over thousands of cows, so cost per unit drops while profit per cow rises modestly. Conversely, smaller farms, even when they receive premium prices for organic, grass-fed, or local milk, often operate with higher feed and labor costs per cow, which narrows daily profit margins.

But here’s the twist: while smaller dairies may show lower profit per cow, the total income is often concentrated in a single family. A 300-cow family farm might return $250,000 in annual profit that supports one household. In contrast, a 2,500-cow operation could generate $2 million in total profit — but that figure is usually divided among multiple owners, investors, lenders, and management teams.

That’s why this chart matters. It debunks the myth that a larger herd size automatically leads to better take-home profit. The true divide isn’t just scale — it’s about who captures the value. Whether driven by volume, precision, or premium branding, profitability in today’s dairy industry is still deeply personal.

Regional Realities Still Matter

It’s tempting to think every dairy could apply the same model, but geography dictates strategy more than ever.

In the Western U.S., large‑scale operations thrive on efficiency, infrastructure, and climate.

In the Midwest and Ontario, cooperative structures and component‑based pricing reward consistency and milk quality over expansion.

In the Northeast and Quebec, sustainability and locality drive brand value, with consumers drawn to transparency and traceability.

No matter the region, the takeaway is the same: you can’t copy‑paste a business plan from across the border. The economics—and the culture—demand regional authenticity.

Lessons Learned from Those Who Tried

Every evolution comes with its scars. One Midwestern family who downsized from 850 to 500 cows underestimated the adjustment period after installing robots. Production dropped nearly 15% for a year as cows and staff adapted. They built it back, but only thanks to strong lender trust and patience.

Meanwhile, in Idaho, several expansions paused midway as interest costs bit into construction financing. Those who made it through had one thing in common—extra contingency funds.

The common thread in both cases is timing. Transition phases nearly always take longer and cost more than projected.

The Habits of Survivors

The dairies still standing out—on both sides of the border—tend to have three things in common:

- Financial clarity. Debt ratios under 30% and three‑month operating cash reserves. Equipment and upgrades are justified only by measurable efficiency gains.

- Revenue diversification. Beef‑on‑dairy programs, custom forage work, or digesters providing supplemental income that stabilizes the primary enterprise.

- Generational transparency. Farms with succession plans already in motion make faster, cleaner business decisions.

At the 2025 Canadian Dairy XPO, one Quebec producer put it best: “You can borrow money for cows, not for uncertainty.” It’s a kind of clarity every mid‑size farm needs right now.

The Price of Standing Still

The Compeer Financial Producer Insights 2024 Report warned that dairies without defined five‑year plans lost 6–8% of equity annually due to deferred maintenance, inefficiency, and missed opportunities.

As one producer shared at a Dairy Strong conference in Wisconsin, “We thought doing nothing was the safe move. Turns out, the slow leak was killing us.”

A decade ago, waiting felt like patience. Today, it feels like pressure. Between higher interest, constant tech change, and unpredictable milk prices, even standing still costs money. Most farmers know what they need to do—it’s finding the time, cash, and confidence to do it that’s the battle.

Why 2025 Matters

When the dust settles, 2025 may be remembered less for its milk price trends and more for its management decisions. Expansion, specialization, or optimization—all three can succeed. The real test for mid‑size dairies is whether they’ll commit to one.

As one Idaho producer said, ‘The biggest gamble we took was standing still.’ Across barns and borders, you hear the same thing now: success starts when you stop waiting for the perfect signal. Nobody’s certain—but everyone who’s moving, is learning.

The Bottom Line

Whether you’re milking 200 cows in Quebec or 2,000 in Idaho, the shift facing mid‑size dairies isn’t about capacity—it’s about clarity. The farms that emerge stronger will be those that choose their lane and drive it with intent.

This year, the biggest risk isn’t expansion or automation—it’s indecision. As the market keeps changing, so does the window for action.

What steps are you taking on your operation to define your path for 2025 and beyond?

Key Takeaways

- Decisiveness defines survival. The mid‑size dairies thriving in 2025 are those that choose a direction and commit fully.

- Play to your region’s strengths. Expansion works out West, optimization excels in the Midwest, and value branding wins in the East and Canada.

- Technology can level the field. Automation and precision tools make smaller herds competitive again—but only when data drives decisions.

- Measure like a business, not a tradition. Top dairies track IOFC, butterfat, and repro weekly to stay ahead of volatility.

- The real cost is waiting. Every season without a plan quietly drains equity, opportunity, and control.

Executive Summary:

Across the U.S. and Canada, mid-size dairies are facing a make-or-break moment. Once the steady foundation of milk production, 800–1,200 cow farms are now being squeezed between large-scale efficiencies and small-farm premiums. But what’s interesting is how the survivors are rewriting the playbook. From robotic systems in Vermont to data-driven optimization in Wisconsin and quota-smart efficiencies in Ontario, producers are proving that success doesn’t depend on herd size—it depends on clarity. The dairies making bold, informed decisions—whether to expand, modernize, or specialize—are staying strong. In 2025, waiting for perfect conditions isn’t safety anymore—it’s surrender.

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More:

- Why This Dairy Market Feels Different – and What It Means for Producers – This strategic analysis provides the latest market data behind the consolidation trends mentioned in the main article. It reveals specific technology costs and ROI timelines, helping you financially plan for the necessary strategic shifts your operation needs to make now.

- Robotic Milking Revolution: Why Modern Dairy Farms Are Choosing Automation in 2025 – For producers considering the “Right-Sizing” path, this article offers a deep dive into the real-world impact of automation. It demonstrates how robotic systems deliver measurable gains in labor efficiency, data collection, and herd health, justifying the capital investment.

- BST Reapproval: The Key to Unlocking Dairy Sustainability – This piece offers a tactical guide for the “Optimization” strategy, focusing on a specific tool to improve feed efficiency and profitability without expansion. It provides clear protocols and data to enhance your farm’s economic and environmental performance within your current footprint.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!