Your poultry neighbor spends 2% on labor. You spend 25%. Here’s why that gap is about to kill traditional dairies.

You know that gut punch feeling when you’re heading out for morning milking and catch sight of your neighbor’s broiler barns? Dead quiet at 5 AM. Twenty-five thousand birds are getting fed, watered, and climate-controlled automatically while he’s probably still in bed with his second cup of coffee.

I’ve been walking through dairy operations across the heartland for thirty years now, and what really gets me about this moment we’re living through… It’s how dramatically the competitive landscape has shifted, while most of us had our heads down, just trying to get through another day. While you were scrambling to cover for another weekend no-show, your poultry and swine neighbors essentially engineered their way around the entire labor nightmare.

Here’s what keeps me up at night—and should keep you up too.

The latest data from Cornell shows that dairy operations are losing 20-30% of their production budget to labor costs. Meanwhile, those automated broiler houses down the road? They’re operating with labor costs that barely register on the spreadsheet—somewhere between 1.6%-2.4% of total expenses. Your pig farming neighbors aren’t much different, with labor costs running at around 9%.

Do the math on a million-pound operation. We’re talking about a $150,000+ annual disadvantage before you even factor in the headaches of finding reliable help who will show up on Christmas morning.

But here’s the kicker that really frustrates me… Recent research from Cornell shows that dairy farms embracing automation are cutting their labor costs by over 21%. Some operations are seeing savings approaching 29%. Yet only about 5% of U.S. dairies use robotic milking systems.

The real stunner? Those automated farms produce 45% of our nation’s milk supply.

The consolidation everyone’s complaining about at every farm meeting? This labor-automation gap is what’s driving it. And it’s accelerating faster than most producers realize.

The Thing About Automation… Each Sector Found Its Own Sweet Spot

What strikes me about what’s happening across livestock right now is that it’s not just technology adoption. It’s a fundamental reshuffling of who stays viable and who gets priced out. Each sector found its own route through this maze, and honestly, some of the strategies were pretty brilliant.

Take poultry—those massive integrators like Tyson and Perdue basically told their contract growers, “Here’s exactly what equipment you’ll install, here’s how you’ll run it, and here’s how we’ll pay for it.” When you control everything from the hatchery to the processing plant, you can mandate technology across thousands of operations practically overnight.

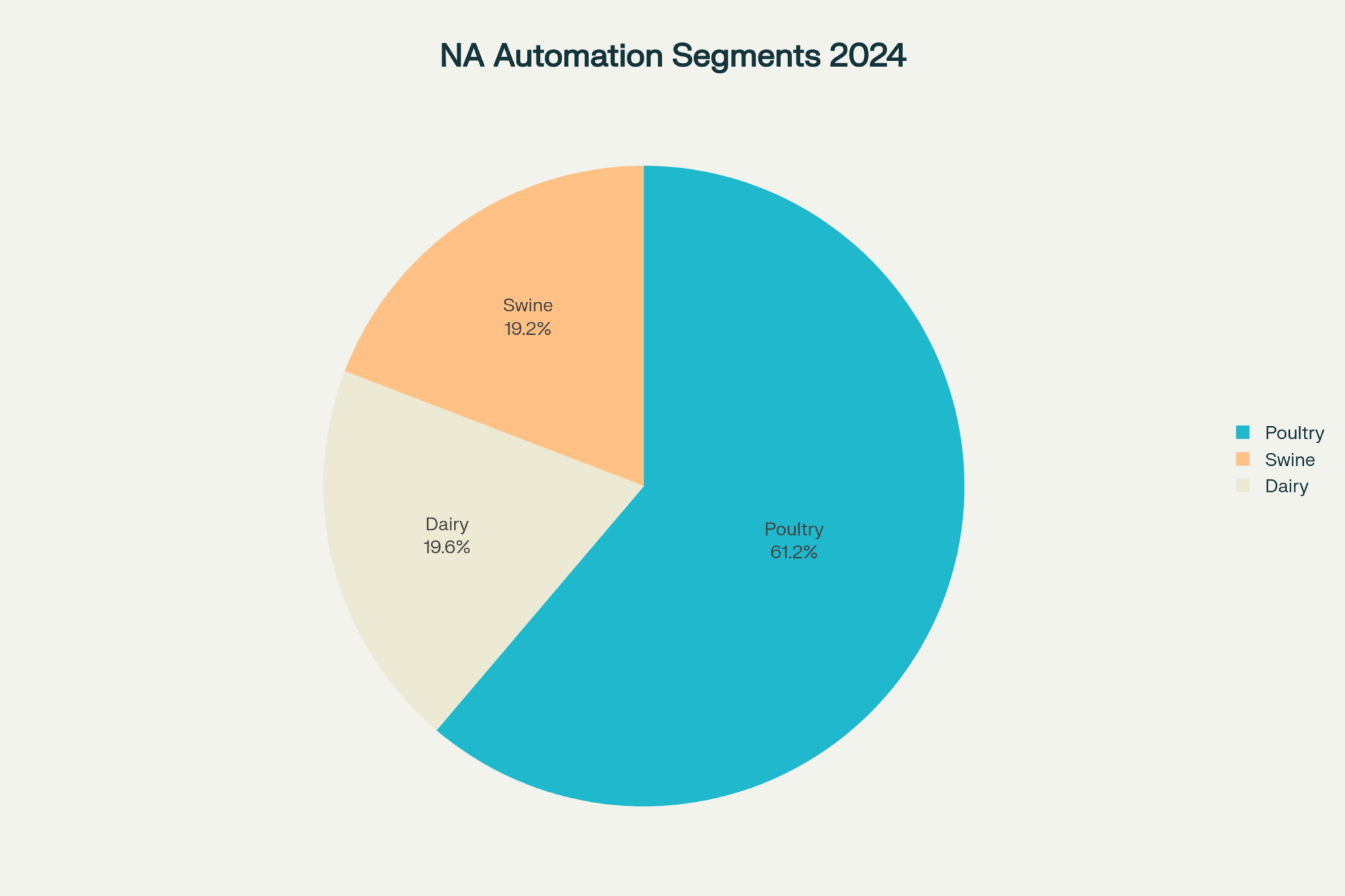

It’s like having a benevolent dictator who happens to love robots… and it created a $2 billion North American automation market faster than most of us could blink.

This gave equipment manufacturers something dairy has never had: guaranteed demand. They knew they had customers lined up around the block, so they invested heavily in comprehensive, integrated systems. Walk into a modern commercial broiler house today, and you’ll see climate control that adjusts automatically based on outside weather, bird age, and humidity levels. Feed delivery systems that measure rations down to the gram. Manure handling that runs on preset schedules.

The result? While you’re running three shifts to milk 1,200 cows, that broiler complex produces 25,000 market-ready birds with less than one full-time employee per house.

Now, here’s what’s particularly fascinating about swine… they found their automation catalyst in the most unlikely place—animal welfare pressure. As California’s Proposition 12 and EU regulations prompted producers to move away from gestation stalls, they faced a significant management challenge. How do you feed sows individually when they’re housed in groups?

Anyone who’s dealt with aggressive sows at feeding time knows this isn’t some theoretical problem.

Electronic Sow Feeders became the solution. These systems use RFID ear tags to recognize individual sows and dispense customized rations based on body condition and gestation stage. The global ESF market hit $1.31 billion in 2024, with projections showing it’ll reach $2.72 billion by 2032.

There’s this case study that really drove it home for me… International operations installing ESF systems are seeing dramatic workforce reductions while boosting production. One operation cut their workforce from 25 employees to just 10, while increasing output from 25 to 28 weaned piglets per sow annually.

Those aren’t projections from some sales brochure. That’s real-world results.

Quick Assessment: Where Does Your Operation Stand?

Before we dive deeper, take a moment to assess your current situation honestly:

Labor Dependency Check:

- How many times in the past six months have you had to milk alone because someone didn’t show up?

- What percentage of your herd management decisions are delayed because you can’t find reliable help?

- Are you currently paying over $18/hour for weekend milking coverage?

Technology Readiness Indicators:

- Do you have consistent internet connectivity in your barn?

- Can you access and interpret basic production data digitally?

- Have you visited an automated operation of a similar size in the past year?

Financial Position Reality:

- Can you access over $ 200,000 in capital for automation investment?

- Are your current labor costs exceeding $4.00 per hundredweight?

- Is your debt-to-asset ratio below 30%?

If you answered “yes” to most of these questions, you’re in the automation consideration zone. If not, we’ll discuss your options as well.

What’s Really Going on with Farm Labor (And Why It’s Getting Worse Fast)

This labor situation we’re all dealing with… it’s unlike anything I’ve seen in thirty years of working with producers. And I’m not just talking about the usual gripes about finding good help. The fundamentals have shifted in ways that make automation less of a nice-to-have upgrade and more of a survival strategy.

The Workforce Is Aging Out—Fast

The agricultural workforce is aging out, and we’re not replacing them. According to recent USDA demographic data, the average age of foreign-born farmworkers has increased significantly between 2006 and 2022. That’s not a trend—that’s falling off a cliff.

Meanwhile, immigrant workers make up 51% of the labor on U.S. dairy farms. These farms produce 79% of our nation’s milk supply. Some industry specialists I talk with think the dependency might be even higher—maybe 60% of total production relies on immigrant labor.

Think about that for a minute. More than half our milk supply depends on workers who… well, let’s be honest about the regulatory challenges they face.

The H-2A Program Dead End

However, here’s the regulatory nightmare that really gets under everyone’s skin: the H-2A guest worker program that crop farmers use. It’s legally inaccessible for year-round operations, such as dairy. The program is statutorily designed for “temporary or seasonal” work.

Perfect if you need harvest crews for three months. Completely useless if you need milkers 365 days a year.

It’s like having a fire department that only works weekdays. Doesn’t make sense, but that’s where we are.

This forces dairy into an impossible position: compete for domestic workers who often won’t do the work (and honestly, who can blame them for not wanting to work weekends and holidays?), or rely on a workforce that immigration enforcement can disrupt overnight.

Your automated competitors have largely engineered around this structural flaw in federal policy.

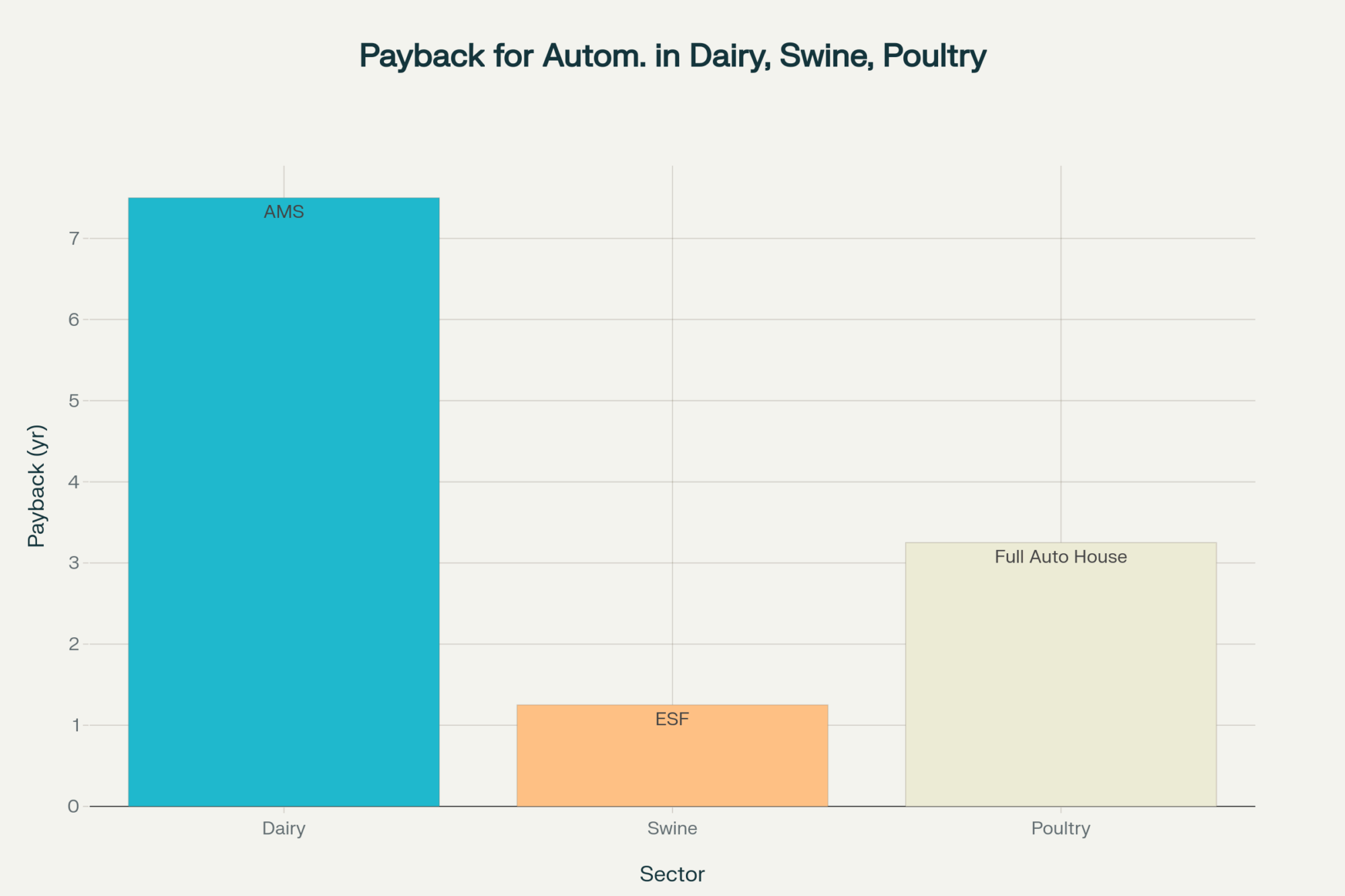

I was speaking with producers in California’s Central Valley last month—dairy wages have reached $22 per hour in some areas, with mandatory overtime requirements. In Wisconsin, I’m seeing $18-20 becoming the norm, especially if you want reliable weekend coverage. At those wage rates, automation payback periods collapse to 3-4 years instead of the traditional 7-10 year projections.

But what really concerns me… what happens when you simply can’t find workers at any price?

That’s not hypothetical anymore. I know of operations in the Central Valley that have had ‘Help Wanted’ signs up for eight months. Eight months. They’re not being picky—they literally cannot find people willing to do the work.

Regional Reality Check: What I’m Seeing Across Different Areas

The labor situation isn’t uniform across dairy regions, and that’s creating some interesting competitive dynamics.

California’s Central Valley: Labor costs are exceeding $ 22 per hour, but large-scale operations can still justify automation investments. The smaller 200-500 cow dairies? They’re getting squeezed hard.

Wisconsin’s Traditional Dairyland: Still seeing some family labor, but the next generation often has other opportunities. Operations that cannot transition to automation are being sold to neighbors who can.

Idaho’s Growth Corridor: New operations are being built with automation from day one. It’s becoming the baseline expectation, not an upgrade.

Texas Expansion Areas: Interesting mix—some massive automated facilities, others still trying to compete on low-cost labor. The automated ones are winning.

Northeast Pressures: Higher land costs, stricter environmental regulations, and premium labor markets are forcing faster automation adoption than anywhere else.

What’s really interesting is how this plays out differently depending on your region’s feed costs, energy prices, and local labor markets. A robotic milking system that pencils out beautifully in Vermont might struggle in parts of Texas where labor is still more readily available.

Here’s What Automation Actually Delivers (And the Numbers Don’t Lie)

Recent research from Cornell on large AMS operations revealed results that genuinely surprised even me. Farms adopting robotic milking systems saw average labor cost reductions of 21% or more, with some operations reporting savings of up to 29%.

But labor savings are just the entry fee. The real money comes from secondary benefits that compound over time.

Let me put some concrete numbers on this production boost everyone talks about. On a 500-cow herd averaging 70 pounds per day, a 7% production increase from more frequent milking generates 2,450 additional pounds daily. At current milk prices of around $22.00 per hundredweight—and everyone knows those prices fluctuate, but let’s use today’s numbers—that’s $490 in extra revenue every single day.

That’s $178,850 annually. That’s not small change. That’s new equipment money.

What’s particularly interesting is that 58% of farms adopting AMS report higher milk production, largely because robotic systems enable more frequent milking. When you transition from twice-daily conventional milking to a voluntary system where fresh cows might get milked 3+ times daily, you’re looking at production increases of 5-10% pretty consistently.

Now, the feed efficiency piece varies more by management, but automated feeding systems deliver TMR consistency that manual mixing simply can’t match. I’ve seen 1,000-cow operations save $50,000 annually simply by achieving better mixing precision and reducing waste. Even small efficiency improvements generate massive returns when you’re talking about large herds.

However, here’s where modern systems really shine—and this is something I’m seeing everywhere now—they transform you from a reactive to a proactive management approach. Health sensors that monitor for mastitis or lameness have the fastest ROI of any dairy tech at just 2.1 years, according to multiple extension studies.

Think about it. One prevented case of mastitis saves $300-$ 500 in treatment costs and lost production. Early lameness detection can save over $1,000 per cow when you factor in treatment, extended lactation impacts, and replacement costs.

As one Wisconsin producer told me after installing his first robots, “It wasn’t just about the labor savings. It was about finally being able to attend my son’s football games on a Friday night.”

The numbers add up fast when you’re managing 500+ animals. But there’s this quality of life component that spreadsheets don’t capture.

Technology Decision Tree: Finding Your Starting Point

Here’s a practical framework I use when talking with producers about where to begin:

If you’re milking 150-300 cows: Start with automated identification and health monitoring systems ($25,000-$40,000 range). These deliver quick paybacks and help you become comfortable with data management before making bigger investments.

If you’re in the 300-600 cow range: Consider partial automation—maybe start with automated feed pushers and sort gates while evaluating AMS for your next facility expansion.

If you have more than 600 cows, you’re likely already considering comprehensive automation. The question becomes integration strategy, not whether to automate.

If you’re planning new construction, Design around automation from day one. Retrofitting is always more expensive and less efficient than purpose-built facilities.

The key insight I’ve learned over the years is that You Shouldn’t try to automate everything at once. Start with your biggest pain point, prove the concept, and then expand systematically.

The Management Reality Nobody Wants to Talk About

This might surprise you, but management quality dramatically affects automation returns. I’ve seen identical AMS technology deliver wildly different results depending on who’s running the operation.

Data from dairy farms using robotic milking reveals a performance gap that’s honestly startling: the top 25% of farms achieve 4,200 pounds of milk per robot daily, while the bottom 25% manage only 2,900 pounds. That’s a 42% difference in output from identical hardware.

The difference isn’t the technology. It’s management practices—optimizing cow flow patterns, interpreting data proactively, and maintaining system efficiency standards. I’ve watched DeLaval units perform like champions on one farm and struggle on another down the road, purely because of management differences.

This reality underscores a crucial point that equipment dealers often overlook: automation isn’t a “plug-and-play” solution that compensates for poor management. Rather, it’s a powerful amplifier of whatever management capabilities you already have.

A skilled manager can leverage the technology to achieve new efficiency levels, while someone less prepared may struggle to achieve positive ROI, given the high capital and maintenance requirements.

The lesson? If you’re considering automation, invest in your management skills first. Learn to interpret data streams, optimize workflows, and monitor system performance metrics. The hardware is just the beginning.

What Separates the Top Performers

I’ve spent time on farms in that top 25% performance category, and here’s what they do differently:

Data Discipline: They check robot performance metrics every morning, not just when something breaks. Weekly performance reviews are standard.

Cow Flow Optimization: They understand that robot efficiency depends on consistent cow traffic patterns. Poor barn layout kills robot utilization.

Preventive Maintenance: They follow the manufacturer’s service schedules religiously and maintain detailed logs.

Staff Training: All staff members who work with the system receive proper training, not just the farm manager. This is huge.

Continuous Improvement: They continually tweak settings, monitor results, and make incremental improvements.

The bottom performers? They install the system and hope it runs itself. Spoiler alert: it doesn’t.

Where Dairy Stands Today—The Great Divide

The automation split is creating what I call a two-tier dairy industry, and the gap is accelerating faster than most people realize. I’ve watched this develop over the past five years, and it’s getting dramatic.

While only 13% of dairy farms utilize computerized milking systems—and that includes everything from robotic milkers to advanced parlor data systems, not just robots—these operations account for 45% of U.S. milk production. The largest operations, those running 2,500 cows or more, are the only farm-size category that’s actually growing in numbers.

What the Leaders Are Banking On

Here’s what these operations are achieving that smaller farms simply can’t match:

They’re running 100-120 cows per full-time equivalent, compared to the industry average of 50-60. They have integrated data systems enabling precision management decisions. They’ve got automated health monitoring, preventing costly treatments before they become expensive problems.

But here’s what’s interesting… it’s not just about size anymore. I’m seeing 400-cow operations outcompeting 1,000-cow dairies that haven’t embraced technology. Efficiency per cow is becoming more important than raw scale.

The Mid-Size Squeeze Gets Tighter

The brutal reality for mid-size operations? Too small to justify massive AMS investments, too large to survive on family labor alone.

These farms—typically ranging from 100 to 499 cows—face an existential squeeze between rising labor costs and their inability to match the efficiency of automated competitors.

Census data tells a stark story. Dairy farms in that 100-499 cow category took a major hit between 2017 and 2022. They’re being squeezed between large, automated operations above and small, family-owned farms below.

But mid-size operations can compete with the right automation strategy. I worked with a 500-cow operation in Wisconsin last year that invested $380,000 in two AMS units, along with automated feed pushers. Their annual labor savings are $85,000, achieved through the elimination of 3.2 full-time positions at $20 per hour.

Break-even projection: 4.5 years, with additional benefits in milk quality scores and automated health monitoring.

The key insight? You don’t need to automate everything at once. Start with the highest-impact investments and build systematically based on your operation’s specific bottlenecks.

Regional Success Stories:

Let me share some specific examples that illustrate different approaches:

Vermont Family Farm (320 cows): Installed two Lely robots in 2023. Went from working 70-hour weeks to having time for their kids’ school activities. Production increased by 8%, while labor costs decreased by 23%.

Texas Partnership (1,200 cows): Built new facility with six robots from day one. Managing 200 cows per full-time employee. Targeting 90,000 pounds per cow annually.

Wisconsin Cooperative (450 cows): Started with automated ID and health monitoring, added robotic feed pushers, now planning AMS installation for 2026. Methodical approach, proving each step.

California Corporate (2,800 cows): Full automation including robotic milking, feeding, and manure handling. Benchmarking at 105,000 pounds per cow with 1.2 full-time employees per 100 cows.

Each operation found their own path, but they all share common characteristics: management commitment to learning new systems, willingness to invest in training, and realistic expectations about implementation timelines.

What’s Coming Down the Pipeline – And It’s Not Science Fiction

Based on what I’m seeing in the field and hearing from equipment manufacturers, we’re headed toward a fundamentally different industry structure by 2035.

The global milking robot market is projected to grow from $3.39 billion in 2024 to $6.03 billion by 2029, with a compound annual growth rate (CAGR) of 15.4%. That kind of growth creates momentum that’s hard to stop.

Technology costs will decline through volume production—we’re already seeing this with health sensors and basic automation components. Management expertise will spread through producer networks and extension programs. Supply chain advantages will increasingly favor operations with consistent, traceable production data.

Here’s the stark reality… operations that delay automation past 2028 may find themselves permanently locked out of competitive markets. That’s not hyperbole—that’s mathematics when you factor in the compounding effects of efficiency gains over time.

The Technology Pipeline Isn’t Wishful Thinking

The next-generation systems currently in beta testing include AI-powered health prediction using multiple sensor inputs (three companies are currently field-testing this), robotic feed mixing and delivery systems (prototypes are running in Wisconsin and California), automated calf raising with individual feeding protocols, and supply chain integration for complete traceability.

However, what excites me most… unlike the early days of AMS, when you had to build everything from scratch, these new systems are designed to integrate with existing infrastructure. That opens up automation opportunities for farms that couldn’t justify a complete facility rebuild.

Emerging Technologies Worth Watching:

AI-Powered Predictive Health: Systems that can predict mastitis 48-72 hours before clinical symptoms appear. One prototype in Iowa claims an 87% accuracy rate.

Robotic Calf Feeders: Automated milk and starter feeding with individual growth monitoring. Early trials showed 15% improvement in weaning weights.

Drone Monitoring: Daily herd health checks using thermal imaging and behavior analysis. Still early, but fascinating potential.

Voice-Activated Management: Systems you can query about specific cows or production metrics using natural language. Sounds gimmicky, but surprisingly practical in field conditions.

The key insight? These aren’t replacing human judgment—they’re amplifying it. The successful farms of 2030 will be those that learn to work with these tools, not against them.

Your Decision Framework—Where Do You Really Stand?

The path forward depends entirely on your operation’s current position and resources. Here’s how successful producers I work with are thinking through this decision—and it’s not always about having the biggest checkbook.

Be Brutally Honest About Financial Readiness

First, financial readiness. You need debt-to-asset ratios below 30%, consistent positive cash flow for at least three years, access to $ 200,000 or more in investment capital (whether in cash or credit), and, most importantly, management capability for learning new systems.

Current labor costs exceeding $4.00 per hundredweight are a red flag. Difficulty finding qualified workers—when was your last successful hire that lasted more than six months?

However, I’ve noticed something interesting… some of the most successful automation adoptions I’ve seen weren’t necessarily those with the most financial resources. They were the ones with the clearest understanding of their current inefficiencies and the strongest commitment to learning new systems.

Different Strategies for Different Farm Sizes

For 200-400 cow operations, I typically recommend starting with health sensors and automated identification systems, with an investment range of $25,000-$ 50,000. Add automated feed pushing and sorting gates next. Only then evaluate AMS adoption after proving you can manage the data and workflow complexity.

Target: 15-20% labor cost reduction in Year 1.

For 400-800 cow operations, The strategy shifts. Implement comprehensive herd management software first—this is your foundation. Install 2-3 AMS units with integrated health monitoring as the centerpiece. Automate feeding and manure handling simultaneously to capture system synergies.

Target: 25-30% labor cost reduction within three years.

Operations with more than 800 cows: You should design new facilities around automated workflows from day one. Integrate all systems through a common data platform; avoid cobbling together different vendors whenever possible. Implement predictive analytics for proactive management decisions.

Target: match industry leaders at 100+ cows per full-time equivalent.

Automation Readiness Checklist

Before you write any checks, work through this assessment honestly:

Technical Infrastructure:

- Do you have reliable high-speed internet in your barns?

- Can your electrical system handle additional automated equipment?

- Is your barn layout compatible with robotic systems, or would you need major modifications?

Management Readiness:

- Are you comfortable using smartphones and computers for farm management?

- Do you currently track and analyze production data on a regular basis?

- Can you commit time to learning new systems and training staff?

Financial Position:

- Can you access capital without jeopardizing farm financial stability?

- Do you have a cash flow cushion for the transition period?

- Have you calculated realistic payback periods based on your specific situation?

Operational Fit:

- Does your current herd health and fertility performance justify investing in automation?

- Are your facilities and cow flow patterns compatible with automated systems?

- Do you have backup plans for system downtime?

If you can’t honestly answer “yes” to most of these questions, focus on getting ready before investing in major automation.

Your 90-Day Action Plan

Here’s the strategic approach I recommend to producers who are serious about making this transition:

Days 1-30: Assessment and Education Phase

Complete an honest assessment of current labor costs, efficiency metrics, and management capabilities. But don’t just look at spreadsheets—actually time your current processes. How long does milking really take? What’s your actual labor cost per hundredweight?

Visit three automated operations similar to yours, not bigger operations that might not be relevant to your situation. Ask about the real challenges, not just the benefits. What would they do differently? What surprised them about the transition?

Get concrete ROI projections from at least two equipment providers. Make sure they’re using your actual numbers, not industry averages.

Days 31-60: Decision and Planning Phase

Secure financing pre-approval if moving forward. This isn’t just about the equipment cost—factor in facility modifications, installation, training, and the cash flow required for the transition period.

Select a technology partner based on service capability, not just equipment price. The cheapest system often ends up being the most expensive when you factor in downtime and poor support.

Begin management training on data interpretation and system optimization. Many equipment providers offer online courses—start now, not after installation.

Days 61-90: Implementation Preparation

Finalize the installation timeline in coordination with seasonal demands. Don’t install robots during your busy season or when you’re short-staffed for other reasons.

Prepare staff for workflow changes—this is often overlooked but critical. Resistance to change kills more automation projects than equipment failures.

Establish baseline metrics for measuring improvement post-installation. If you don’t know where you started, you can’t prove where you ended up.

Common Mistakes to Avoid

From watching dozens of automation implementations, here are the mistakes that kill ROI:

Underestimating the learning curve: Plan for 6-12 months to fully optimize any new system. Budget for this transition period.

Skimping on training: Every person who interacts with the system requires proper training, not just the farm manager.

Poor vendor selection: The cheapest equipment often comes with the most expensive service problems.

Facility compromises: Trying to retrofit systems into poorly designed facilities. Sometimes you need to build properly first.

Unrealistic expectations: Automation amplifies good management but won’t fix fundamental problems.

The successful implementations I’ve seen all share one characteristic: realistic expectations combined with commitment to mastering the new systems.

The Final Reality

After thirty years in this business, I’ve never seen competitive gaps develop this fast or this decisively. At 20-30% of production costs, labor represents your largest controllable expense after feed. Every day you delay automation, competitors bank efficiency advantages that compound over time.

The technology has matured beyond the early-adopter phase. Financing options have expanded with the introduction of USDA programs and equipment leasing. Competitive pressure has reached a critical threshold, where automation transitions from optional to essential for long-term viability.

The automation divide isn’t just about technology—it’s reshaping who survives and who thrives in the dairy farming industry. Non-adopters, particularly small- to mid-sized farms, will face an existential squeeze between rising labor costs and the efficiency advantages of automated competitors. For these operations, the future is stark: automate, find a niche market, or exit the industry.

The producers who’ll succeed are those who view automation as a strategic investment in long-term competitiveness, not just a labor replacement tool. They understand that the real value isn’t in the robots themselves—it’s in the data, efficiency, and management capabilities these systems enable.

That quote from the Wisconsin producer about finally being able to attend his son’s football games is a powerful reminder that automation’s value isn’t just financial—it’s deeply personal. It’s about regaining time, balance, and the ability to live life on your own terms amid the relentless demands of modern dairy farming. The freedom to choose when you work, rather than being enslaved by the twice-daily milking schedule, represents a quality of life transformation that no spreadsheet can fully capture.

The choice is binary at this point: invest in automation now while you can still finance and implement it strategically, or face the inevitable squeeze when circumstances force your hand. The window for strategic decision-making is closing faster than most people realize.

In ten years, will you be the one sleeping in while your robots handle the 4 AM milking? Or will you still be the one driving past automated operations, wondering what might have been?

The technology is here. The financing is available. The competitive pressure is real. Choose wisely, and choose soon.

Questions for Your Next Producer Meeting:

How do your current labor costs per hundredweight compare to these benchmarks? What would a 20% reduction in labor costs mean for your operation’s profitability and growth potential? If reliable labor becomes unavailable at any price, what’s your backup plan?

KEY TAKEAWAYS

- Labor efficiency doubles with AMS implementation – Automated farms achieve 100-120 cows per FTE compared to 50-60 conventional, translating to direct savings of $1.06-$1.36 per cwt. Start by calculating your current labor cost per hundredweight—if it’s above $4.00, automation pays for itself in 3-4 years at today’s wage rates.

- Health sensors deliver fastest ROI in the barn – Average payback of just 2.1 years by catching mastitis and lameness early, saving $300-1,000 per prevented case. Begin with automated ID and monitoring systems ($25,000-40,000 range) to get comfortable with data management before bigger investments.

- Feed efficiency gains compound rapidly at scale – Automated feeding systems reduce waste by 25% while improving TMR consistency, generating $50,000+ annual savings on 1,000-cow operations. Install robotic feed pushers first—they have a 2.1-year payback and integrate easily with existing systems.

- Production increases of 5-10% are standard with robotic milking – 58% of AMS adopters report higher milk yields due to more frequent voluntary milking. On a 500-cow herd averaging 70 lbs/day, that’s an extra $178,850 annually at current milk prices—enough to justify the technology investment alone.

- The competitive gap widens daily in 2025 – Operations delaying automation past 2028 risk permanent lockout from competitive markets as efficiency advantages compound. If you’re planning new construction, design around automation from day one—retrofitting costs 40% more and delivers inferior results.

EXECUTIVE SUMMARY

Look, I’ve been walking dairy operations for thirty years, and I’ve never seen anything like what’s happening right now. The automation divide isn’t just changing the game—it’s completely rewriting who survives in dairy farming. Here’s the brutal math: while you’re bleeding 20-30% of your budget on labor costs, automated poultry operations run at 1.6-2.4%. That’s a $150,000+ annual disadvantage on a million-pound operation before you even factor in the headache of finding reliable weekend help. Cornell’s latest research shows farms embracing robotic milking are cutting labor costs by over 21%, with some seeing savings approaching 29%. Meanwhile, those automated operations are managing 100-120 cows per full-time employee versus your 50-60. The kicker? Only 5% of US dairies use robotic systems, but they’re producing 45% of our nation’s milk supply. The window for strategic automation decisions is closing fast—and honestly, you can’t afford to wait much longer.

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More:

- Robotic Milking Revolution: Why Modern Dairy Farms Are Choosing Automation in 2025 – Demonstrates step-by-step how robotic milking systems outperform humans with real case studies showing 60% labor reduction and immediate milk quality improvements you can implement.

- Solving Dairy’s $32 Billion Labor Problem: Policy vs. Automation – Reveals why smaller herds under 260 cows are achieving 18-month automation paybacks and practical strategies for navigating the H-2A visa crisis affecting your workforce.

- 5 Technologies That Will Make or Break Your Dairy Farm in 2025 – Identifies emerging smart technologies delivering 40% mortality reduction and 20% yield increases, with specific ROI timelines and implementation priorities for competitive advantage.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!