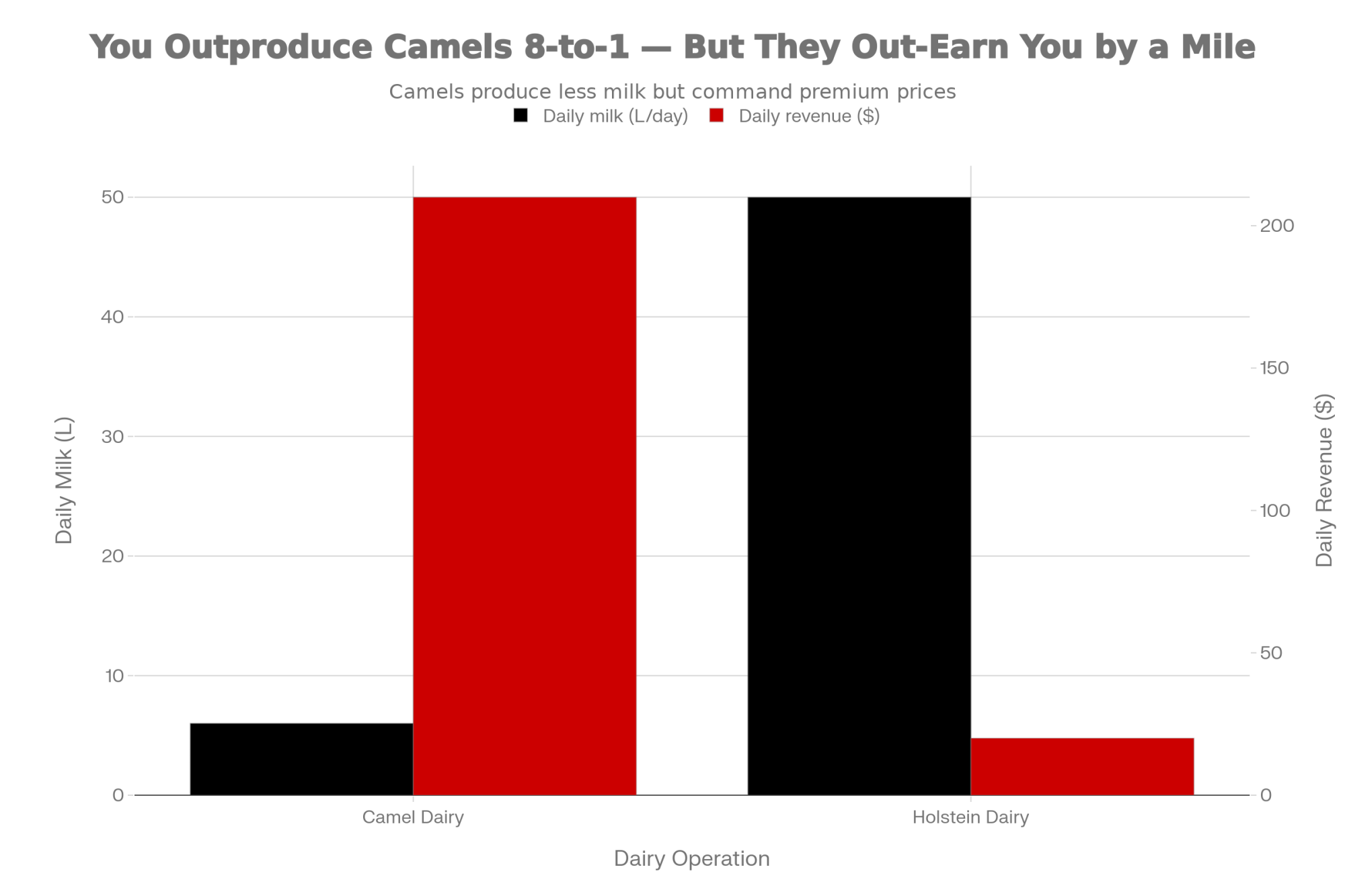

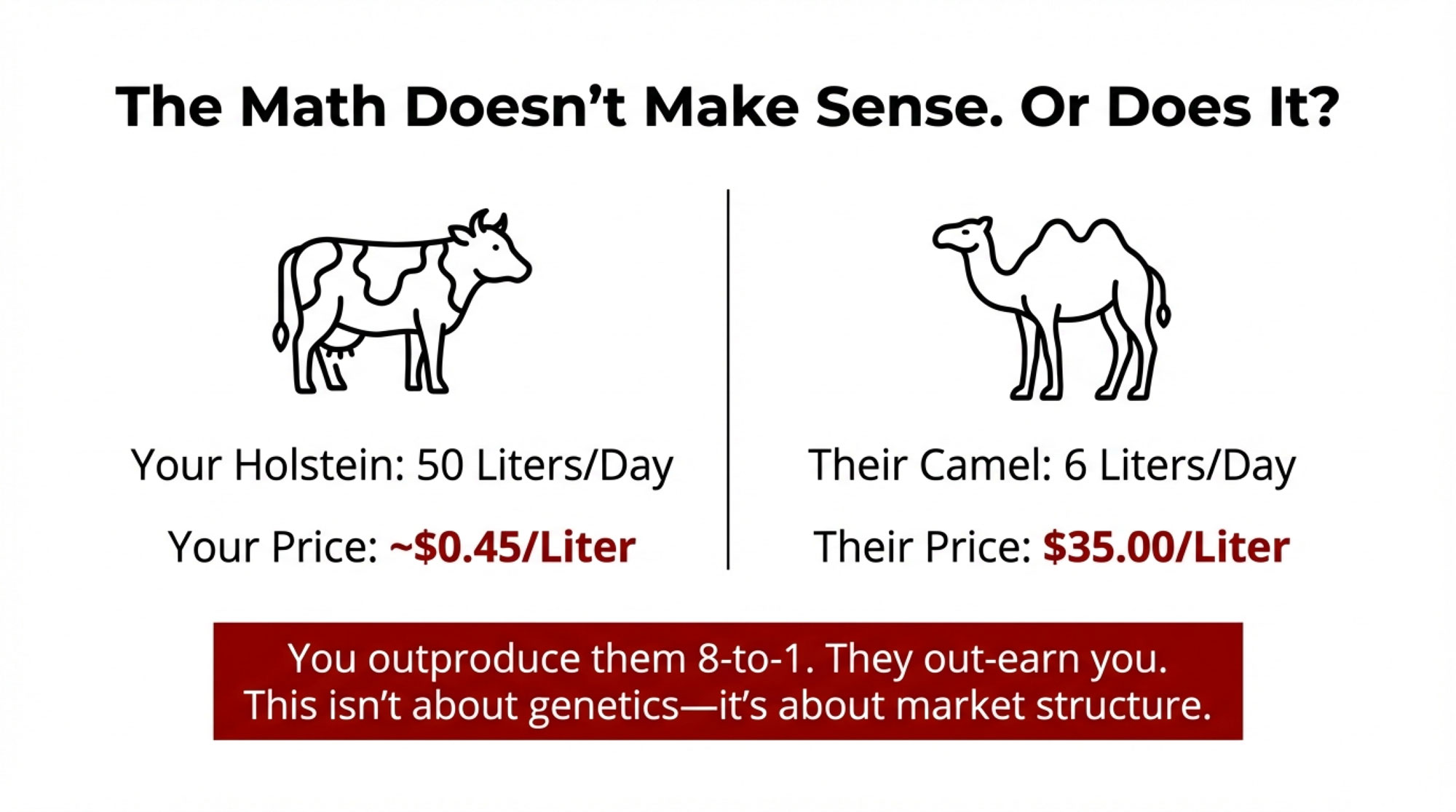

His camels make 6 liters/day at $35 each. Your Holsteins make 50 liters/day at blend price. You’re outproducing him 8-to-1. He’s out-earning you. Why?

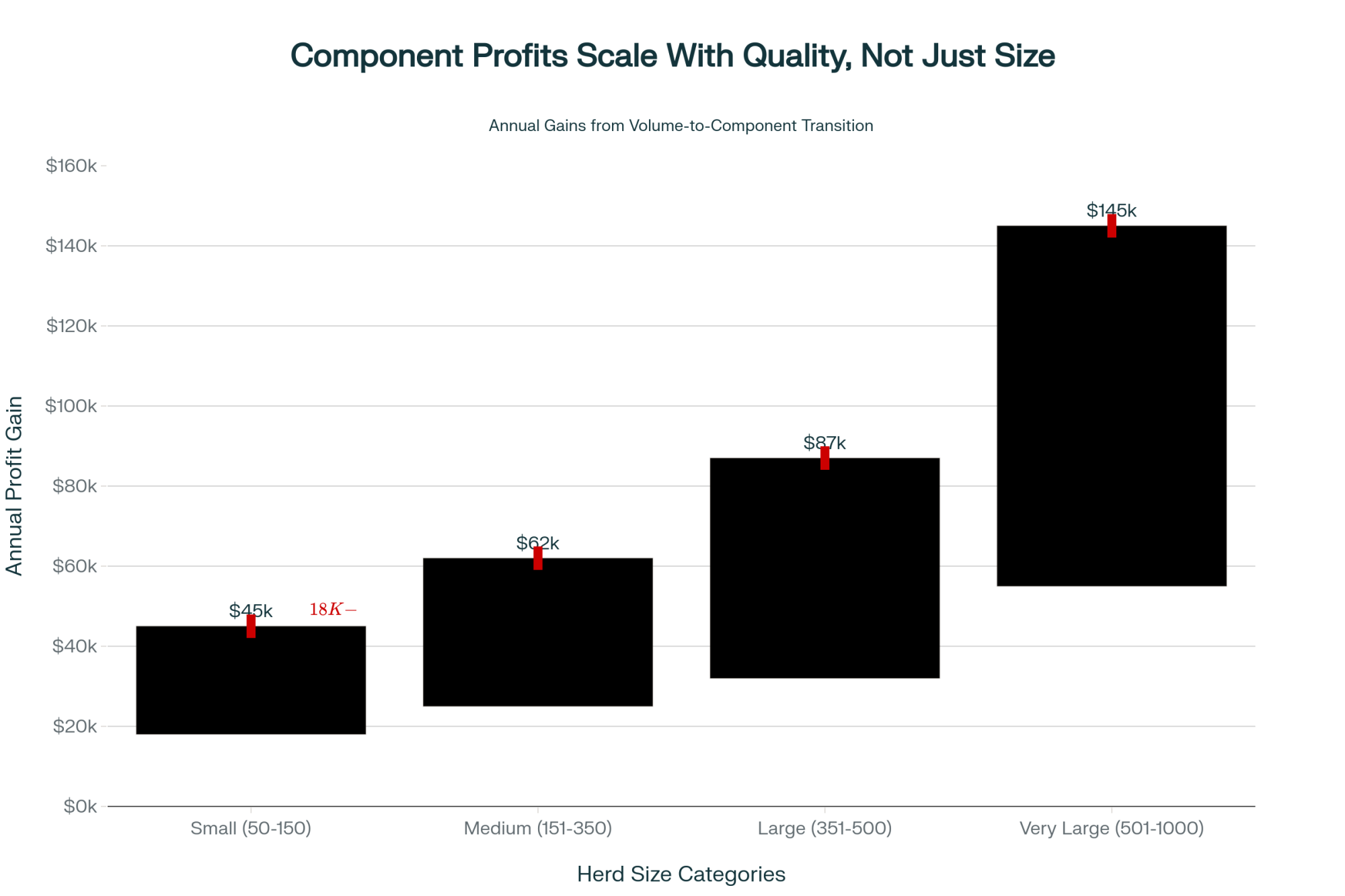

Executive Summary: You outproduce camel dairies 8-to-1. They out-earn you. That’s not genetics—it’s market structure. Three walls lock conventional dairy into commodity pricing: FMMO pooling eliminates farm-level quality premiums, processor contracts surrender your pricing power, and debt loads punish transition attempts. But walls can be climbed. UW-Madison, Iowa State, and Virginia Tech research reveals specific paths: validate customers before capital investment, test demand through co-packing, and choose positioning that competitors can’t easily copy. What follows covers the economics, the barriers, and the practical playbook—plus one question mid-size operations can’t ignore. Can you survive on efficiency gains alone when mega-dairies have scale and niche players have margins you’ll never touch?

When Sam Hostetler got a phone call from a doctor asking if he could supply camel milk for patients with digestive issues, he didn’t see dollar signs. He saw a problem he could solve.

Hostetler had spent four decades working with exotic animals at his operation in Miller, Missouri. Camels weren’t new to him. But milking them commercially? Different story.

“Twelve years ago, I was contacted by a doctor to see if I would consider milking camels,” Hostetler shared in a recent interview. “I said, ‘Milking a camel? I didn’t know they milked camels in this country.’ Then she said, ‘They don’t, but I need milk for a patient.’ To which I replied, ‘Well, I’ve been known to do some crazy things. One more won’t hurt me.'”

That conversation launched Humpback Dairy—now home to about 200 camels, including roughly 100 breeding-age females.

Here’s the number that should get your attention: Hostetler sells milk at around $26 per liter. Meanwhile, conventional dairy farmers—managing far more animals with far more infrastructure—fight for margins at $19-21 per hundredweight.

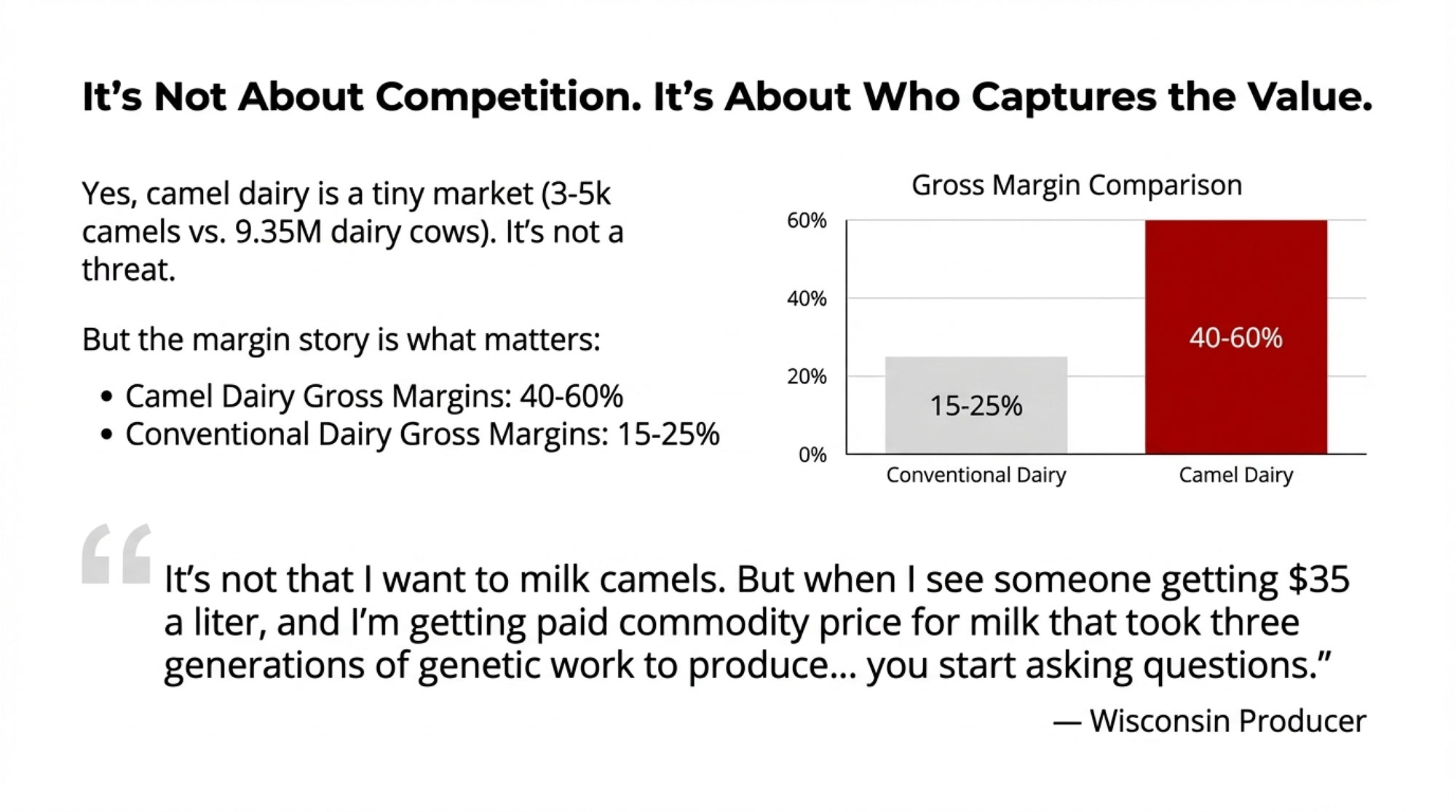

THE BOTTOM LINE: The U.S. camel dairy market hit $1.37 billion in 2024 and is projected to reach $3.16 billion by 2034, according to Research and Markets. But this isn’t about competition. It’s about understanding where premium value goes—and why you can’t access it.

Let’s Talk Scale First

Camel dairy is tiny. We’re talking 3,000-5,000 camels across the entire country. According to CBS4, Camelot Camel Dairy in Wray, Colorado, is one of only two fully licensed camel dairies in the United States.

Compare that to 9.35 million dairy cows tracked by USDA NASS for 2024.

Production per animal? Not even close. Camels produce 1-6 liters daily according to FAO research. Your Holsteins? 30-40 liters daily for typical operations, with top herds pushing 50+ liters in well-managed TMR systems.

So why does this matter?

The Price Gap Is Staggering

- Camel milk: $25-35 per liter retail. Desert Farms charges $35 per liter, according to SkyQuest market research.

- Your milk: $4.39 per gallon average in 2024, per USDA AMS data. That’s regional variation from $3.29 in Louisville to $5.92 in Kansas City.

- The margin story: Camel operators report 40-60% gross margins. Conventional dairy? 15-25% based on USDA ERS cost-of-production tracking.

A Wisconsin producer told me last month: “It’s not that I want to milk camels. But when I see someone getting $35 a liter, and I’m getting paid commodity price for milk that took three generations of genetic work to produce… you start asking questions.”

He’s asking the right questions.

| Model | Milk price received (USD/cwt) | Net margin per cwt (USD) | Net margin per cow per year (USD) |

| Commodity Holstein herd | 20.0 | 3.0 | 900 |

| Premium-positioned Holstein | 26.0 | 7.0 | 2,100 |

| Difference (premium – comm.) | 6.0 | 4.0 | 1,200 |

| % Advantage of premium herd | +30% | +133% | +133% |

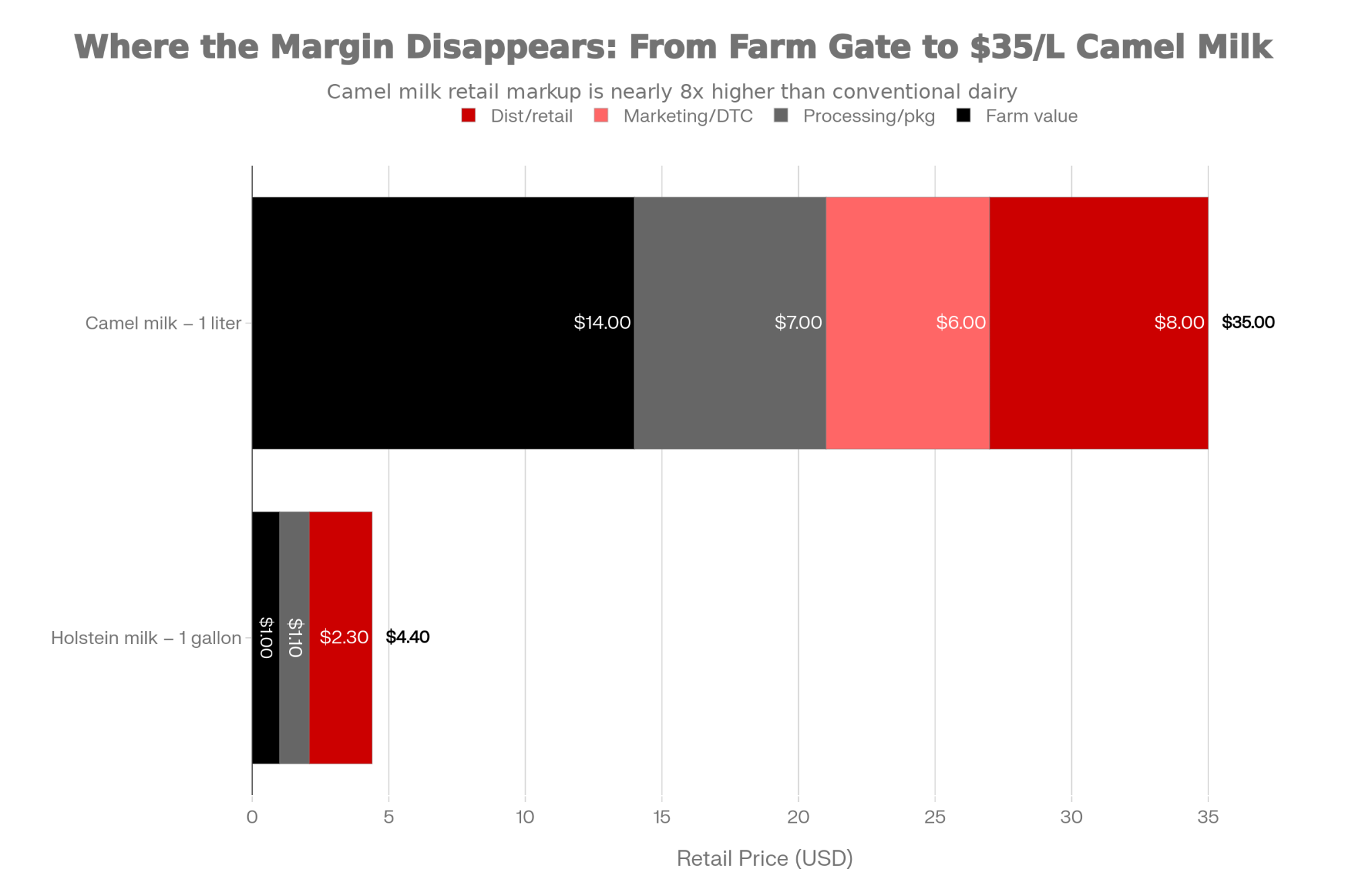

KEY INSIGHT: The gap isn’t about production. Holstein genetics have never been better. The gap is about market positioning and who captures the margin between your farm gate and the consumer’s refrigerator.

| Product | Farm value (USD) | Processing/packaging (USD) | Marketing/DTC operations (USD) | Distribution/retail profit (USD) | Total retail price (USD) |

|---|---|---|---|---|---|

| Holstein milk – 1 gallon | 1.00 | 1.10 | 0 | 2.30 | 4.40 |

| Camel milk – 1 liter | 14.00 | 7.00 | 6.00 | 8.00 | 35.00 |

This Isn’t Disruption. It’s Segmentation.

When investors see camel dairy’s growth, they think tech-style disruption. New thing kills old thing.

That’s not what’s happening here.

Mark Stephenson, Director of Dairy Policy Analysis at the University of Wisconsin-Madison, has studied dairy markets for over two decades. The distinction he draws matters: disruption makes the old model obsolete. Segmentation splits the market into different value tiers.

Camel dairy isn’t replacing anything. Even at $3.16 billion by 2034, it’s a rounding error on total dairy volume.

What it IS doing: capturing margin-rich slices of the market that conventional dairy structurally abandoned.

Premium Segments Punch Above Their Weight

Look at how premium dairy has evolved:

- Organic: ~7% of fluid milk volume (RaboResearch), commanding 25-30% premiums

- A2 genetics: 2-3% of volume, 50-100% premiums (a2 Milk Company data)

- Grass-fed: 1-2% of volume, premiums often exceeding 100% (American Grassfed Association)

- Specialty products: Under 1% of volume, 300-1000%+ premiums

Conventional dairy controls most of the volume but captures a shrinking share of total market value.

That gap? It’s billions in premium revenue that most of us can’t touch.

Why You Can’t Access Those Premiums

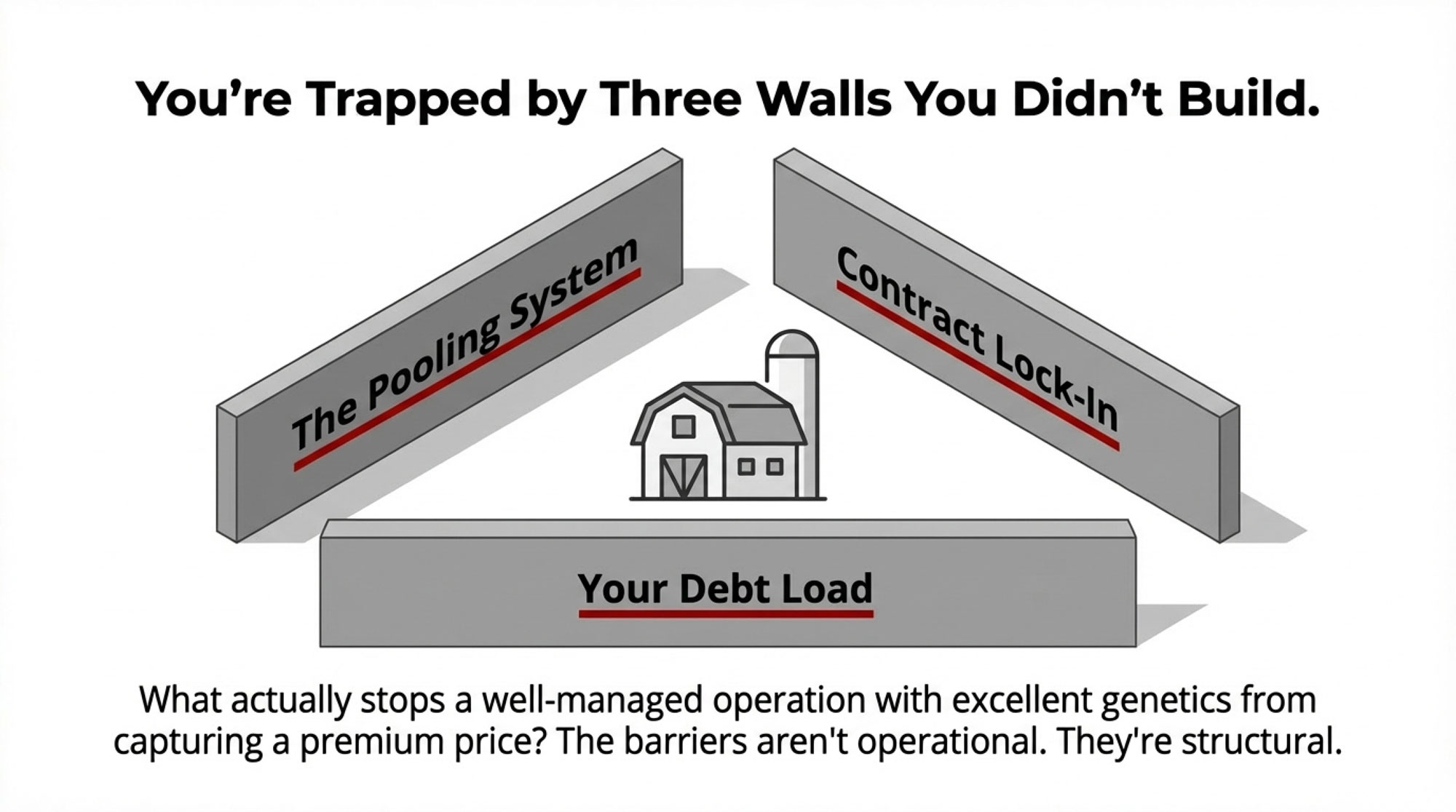

Here’s where it gets uncomfortable.

What actually stops a well-managed operation with excellent genetics and superior milk quality from capturing premium prices?

I’ve talked to producers who tried. I’ve reviewed extension research on premium transitions. The barriers aren’t operational. They’re structural.

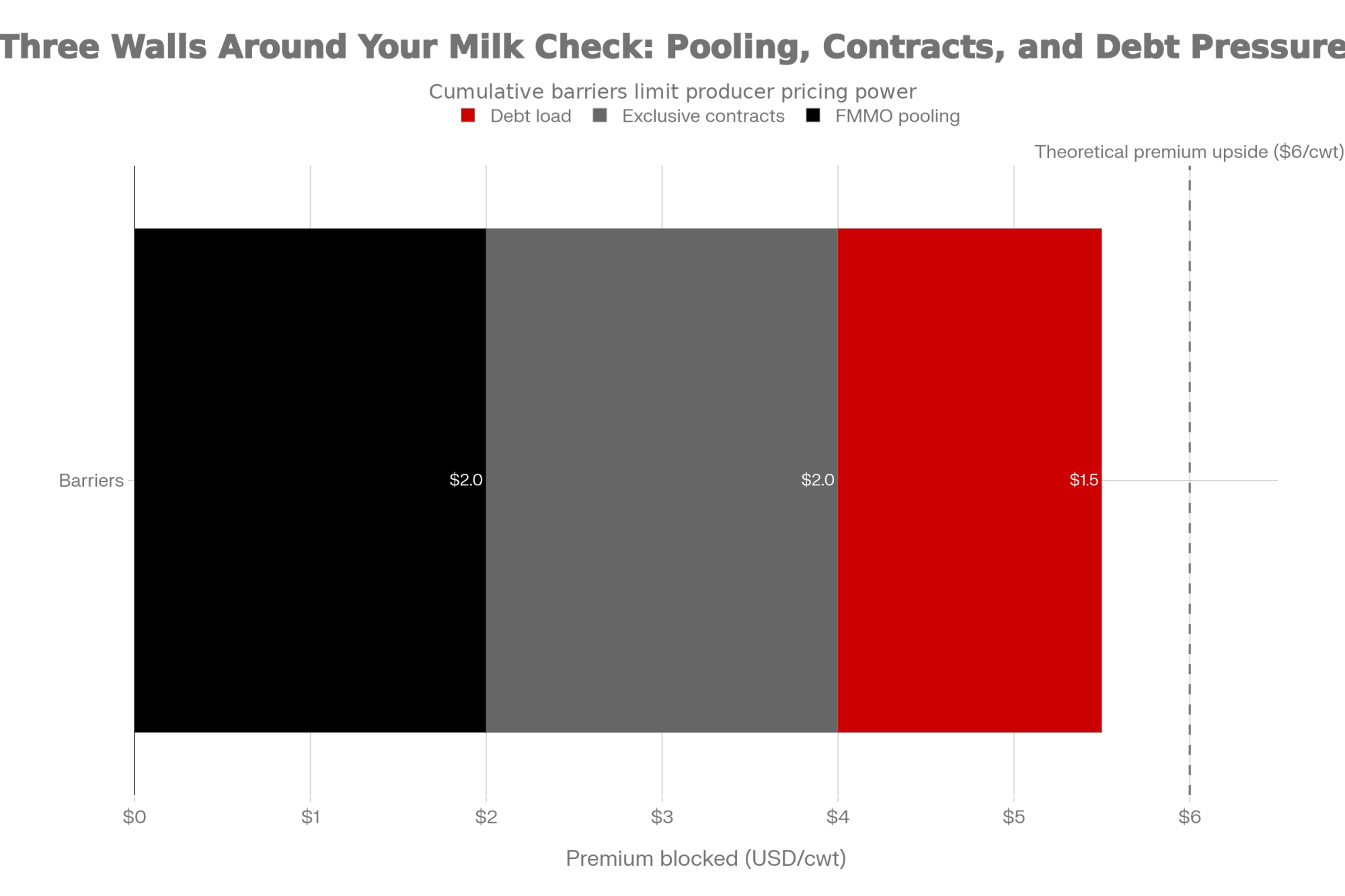

| Structural barrier | Premium blocked (USD/cwt) |

|---|---|

| FMMO pooling | 2.0 |

| Exclusive processor contracts | 2.0 |

| High leverage/debt load | 1.5 |

A California producer put it bluntly: “My SCC runs under 80,000, my butterfat is consistently above 4.2%, and my protein is top-tier for the region. But I get paid the same blend price as everyone else in the pool.”

Let’s break down the three walls standing between you and premium margins.

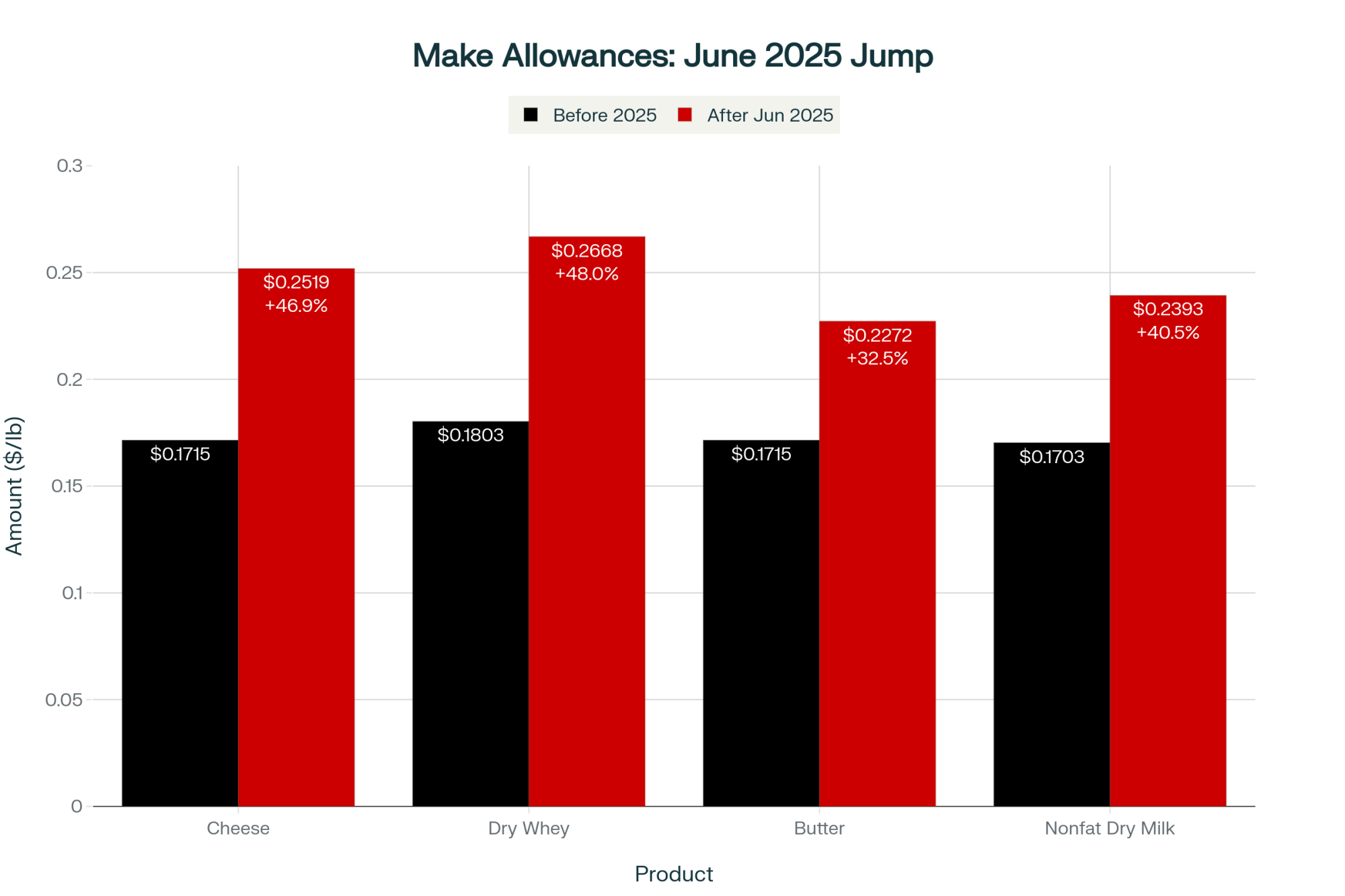

Wall #1: The Pooling System

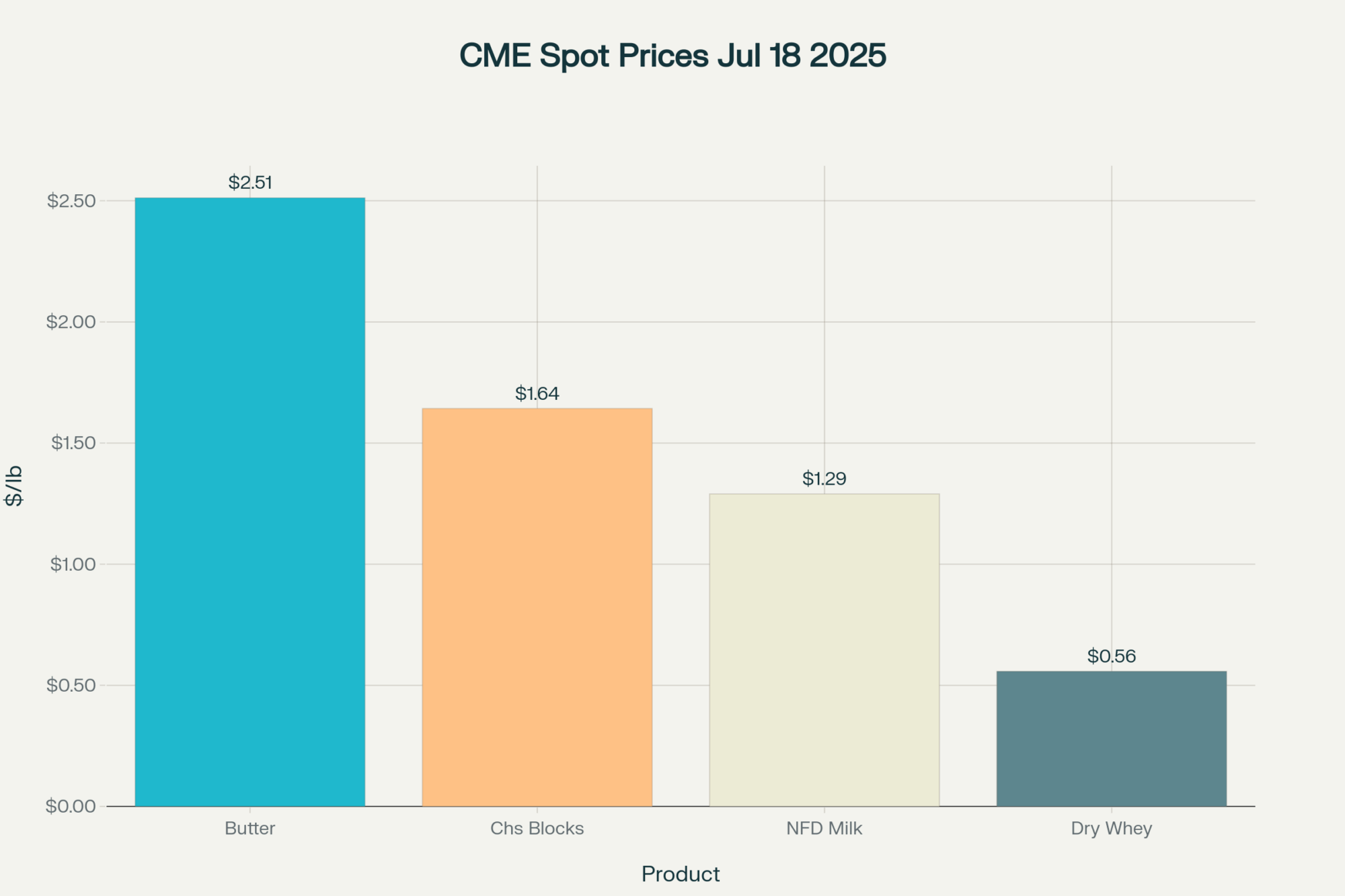

Under the Federal Milk Marketing Order system, your milk is pooled with other milk in regional pools. Prices get set by commodity markets—cheese, butter, and powder trading on the CME.

Everyone in the pool gets essentially the same blend price. Your superior milk—better components, cleaner production, stronger genetics—earns the same per hundredweight as lower-quality milk.

The system was designed to stabilize prices. It’s done that. But the tradeoff? It eliminates individual quality premiums at the farm level.

Yes, component premiums exist for butterfat and protein. Upper Midwest operations have benefited. But there’s no mechanism to capture extra value for A2/A2 genetics, exceptional SCC, or other differentiators.

The processor captures brand premium. You get blend price.

REALITY CHECK: The FMMO system isn’t broken—it’s working exactly as designed. The question is whether that design serves your operation’s future.

Wall #2: Contract Lock-In

Over 90% of conventional operations work under exclusive supply contracts with processors. These provide real benefits: guaranteed market access, predictable pickups, and reduced marketing burden.

Tom Kriegl, who spent years as a farm financial analyst at the University of Wisconsin Extension’s Center for Dairy Profitability, has written extensively about these economics. The tradeoff is clear: you gain stability but surrender pricing flexibility.

Processors aren’t villains here—they face their own margin pressure from retailers and foodservice. But the structure concentrates pricing power away from farms.

Wall #3: Your Debt Load

This is the one nobody talks about enough.

A typical 500-cow dairy carries $3-4 million in debt, based on USDA ERS data. That debt is collateralized against assets and depends on consistent cash flow from commodity milk sales.

Want to transition to premium positioning? You’ll need capital for processing, branding, and marketing infrastructure. You’ll face production disruptions. Revenue won’t stabilize for 12-24 months.

David Kohl, Professor Emeritus of Agricultural Finance at Virginia Tech, has studied this for decades. The dynamic he describes: lenders want stable, predictable revenue. Transition uncertainty makes them nervous.

A Northeast producer told me about approaching his lender: “They said they’d need 18 months of premium sales revenue before restructuring our terms. But I couldn’t build that history without capital to get started.”

Classic chicken-and-egg. And it keeps a lot of good farmers locked into commodity production.

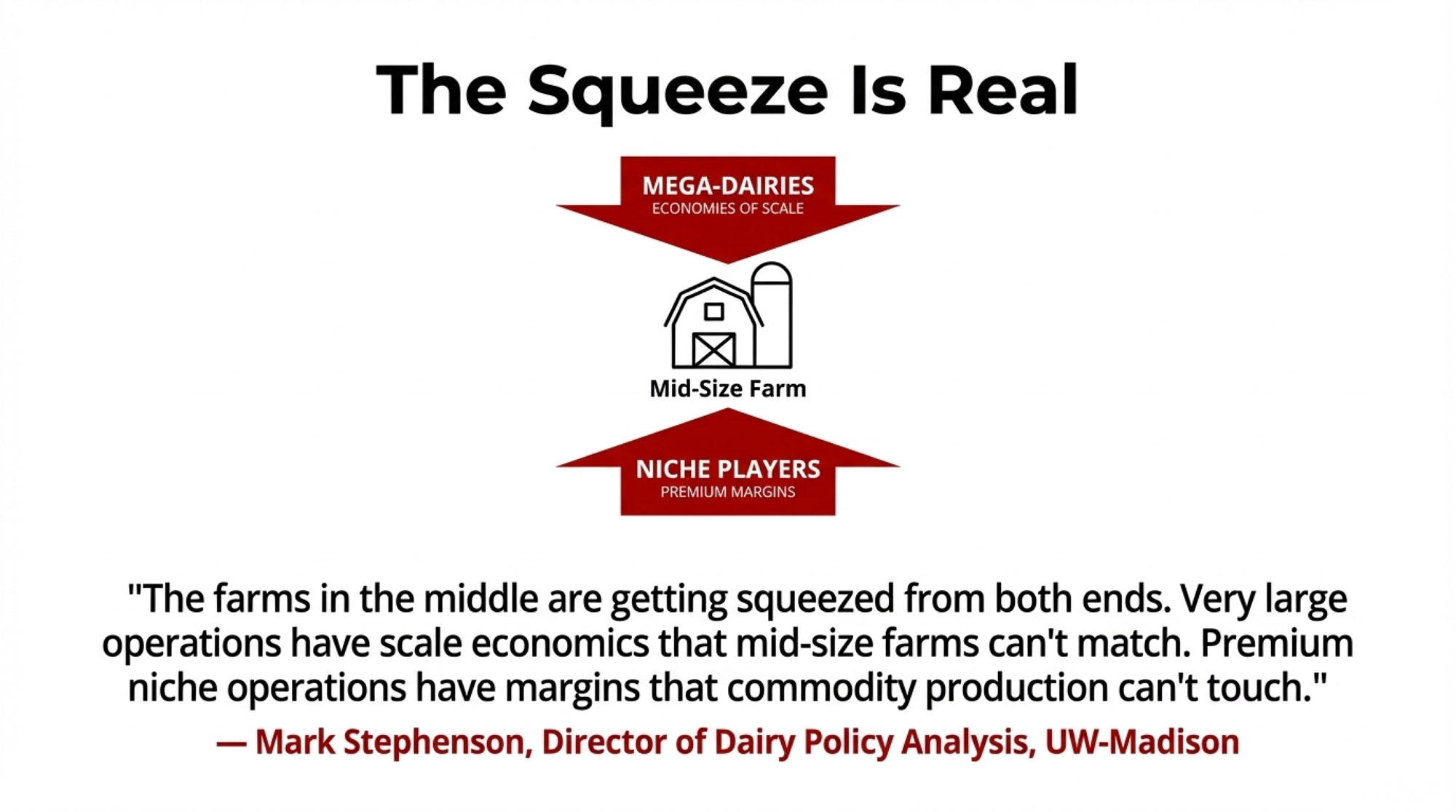

“The farms in the middle are getting squeezed from both ends. Very large operations have scale economics that mid-size farms can’t match. Premium niche operations have margins that commodity production can’t touch.”

— Mark Stephenson, UW-Madison

What Actually Works for Premium Positioning

Not everyone should chase premium markets. But if you’re considering it, here’s what the research shows about operations that succeed.

Get This Backwards, and You’ll Fail

Most farms considering premium positioning do it this way:

- Decide to transition

- Invest in infrastructure

- Convert production

- Search for buyers

That’s backwards.

Larry Tranel, dairy field specialist at Iowa State University Extension, has watched this play out with dozens of farms. The operations that succeed flip the sequence:

- Identify customers

- Validate willingness to pay

- Secure commitments

- THEN invest in production changes

Research in the Journal of Dairy Science found the same pattern. Farms with existing customer relationships experienced minimal disruption during organic conversion. Farms that converted first and sought markets later? Profitability problems that lasted years.

THE RULE: If you can’t get 30-50 people to put down deposits before you spend anything on infrastructure, you don’t have a market. Better to learn that early.

Why Camel Dairy Has Natural Protection

When someone pays $35/liter for camel milk, they’re not comparing it to your milk price. They’re asking if this specific product meets their specific needs.

The scarcity of camels—13-month gestation periods, two-year calving intervals, limited U.S. population, only a handful of licensed dairies—creates natural barriers to competition.

Compare that to A2 positioning. Any farm can test genetics and claim A2 certification. As more enter, premiums compress.

Durable premiums combine:

- Verifiable attributes

- Relationship-based customer loyalty

- Some barrier to easy replication

Pure attribute claims (“my milk is A2” or “my cows are grass-fed”) get competed away faster than relationship positioning, where customers connect with YOUR specific operation.

The Customer Service Reality Nobody Mentions

Premium operations accept that customer relationship management IS the product. Not overhead. Not a distraction. The actual product.

Direct-to-consumer dairy means substantial time on order management, delivery logistics, emails, complaints, and retention.

Tranel sees this all the time: producers try direct sales for 6 months and quit. Not because the economics don’t work. Because they’re spending 15 hours a week on customer service instead of their animals.

That’s not failure. That’s recognizing that premium positioning requires different skills than production excellence. Both paths are legitimate. They’re just different paths.

Lower-Risk Ways to Test Premium Markets

If you want to explore premium positioning without betting the farm, here are approaches extension specialists recommend.

The Co-Packing Model

Skip the $30,000-50,000+ for on-farm pasteurization. Many states let you produce Grade A raw milk and contract with a licensed processor for pasteurization and bottling under YOUR brand.

| Model | Startup capital required (USD) | Additional net income per year (USD) | Estimated payback period (years) | Extra weekly marketing time (hours) |

|---|---|---|---|---|

| Status quo commodity-only | 0 | 0 | – | 0 |

| On-farm processing/brand build-out | 40,000 | 60,000 | 0.7 | 20 |

| Co-packed, branded fluid milk pilot | 12,000 | 35,000 | 0.3 | 15 |

| Co-packed + subscription delivery tier | 15,000 | 50,000 | 0.3 | 18 |

Startup cost: $6,500-15,000 for branding, packaging, cold storage, and delivery setup (extension estimates)

Timeline: 8-10 weeks to first sales in states with straightforward pathways

Find a processor willing to do small runs—usually smaller regional plants with excess capacity. State dairy associations can point you in the right direction.

This lets you test demand before committing major capital.

The Validation Sequence

Months 1-2: Research customer segments. Test messaging at farmers markets, social media, and community groups. Collect contacts. Don’t sell yet—gauge interest.

Month 3: Survey interested people. What volumes? What prices? What delivery preferences? Separate real purchase intent from casual curiosity.

Months 4-5: Request deposits. A $50 commitment separates talkers from buyers.

Months 6+: With 30-50 committed customers, consider minimal infrastructure investment.

Positioning Options Compared

| Positioning | Premium | Protection | Timeline |

| Organic | 25-30% | Medium | 5-7 years to saturation |

| A2 genetics | 30-50% | Low | 2-3 years |

| Grass-fed | 50-100% | Medium | 3-5 years |

| Regenerative | 30-50% | Medium-High | 5-10 years |

| Hyper-local branded | 40-80% | High | Ongoing investment |

The pattern: Premiums last longer when you combine verifiable attributes with relationships and real barriers to replication.

Regulations: Check Before You Build

State rules on on-farm processing and direct sales vary wildly. This trips up a lot of producers.

Raw milk examples:

- Wisconsin: Prohibits retail sales; gray areas around farm-gate transfers

- Vermont: Permits sales with minimal licensing

- California: Requires extensive testing and licensing

- Pennsylvania: Allows sales with appropriate permits

On-farm pasteurization pathways exist in some states (New York and California have processes) but not in others. Co-packing rules depend on location and whether products cross state lines.

Before spending anything: Contact your state Department of Agriculture’s dairy division. Ask specifically about raw milk regulations, on-farm processing licenses, and co-packing arrangements. Get it in writing.

State inspectors are more helpful when you ask before building than after.

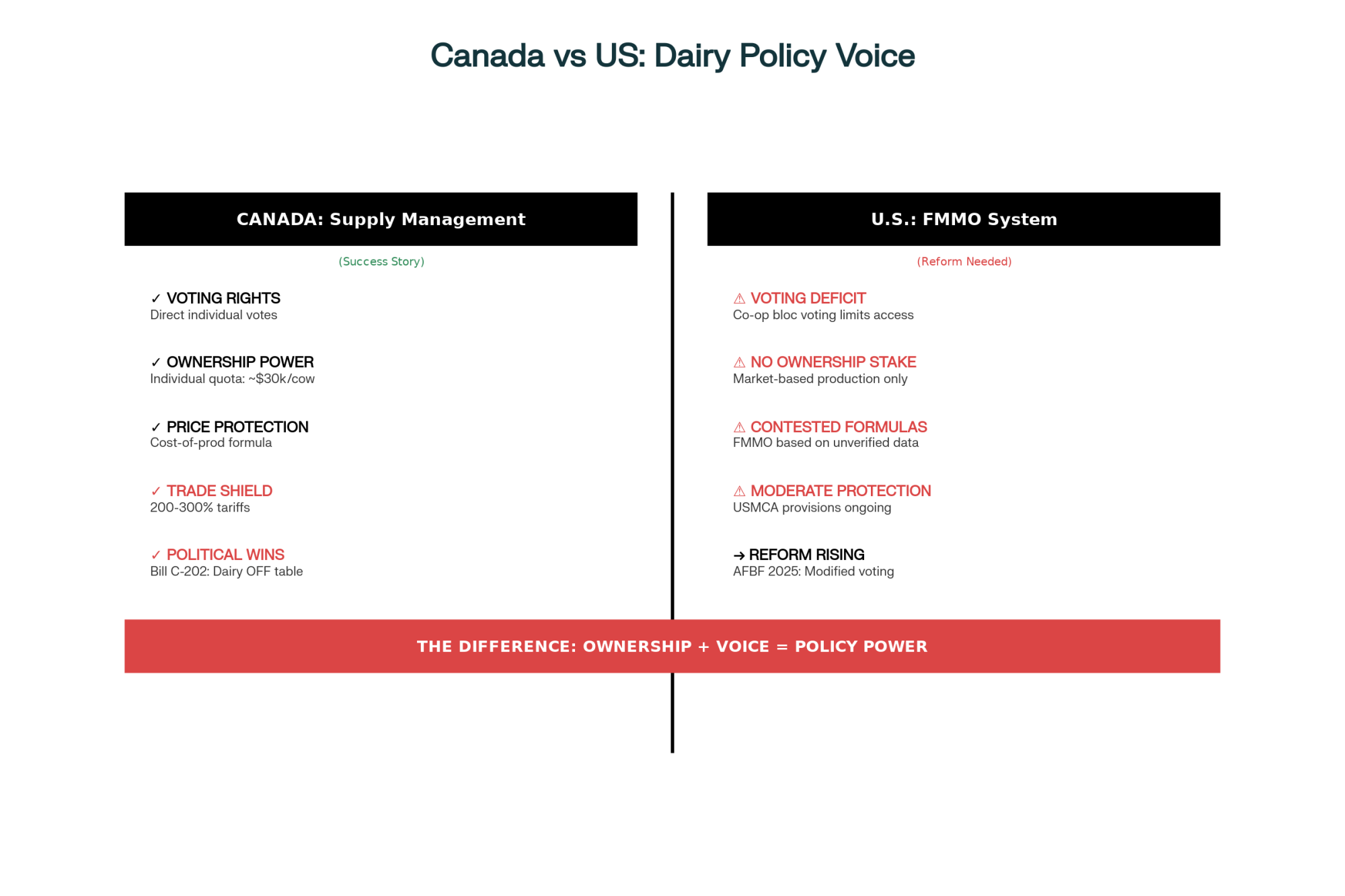

While we’ve highlighted US examples, the trend of margin-capture vs. commodity-volume is playing out across Canada, the UK, and Australia in similar ways.

Honest Questions Before You Decide

Does customer interaction energize or drain you? Premium positioning means hours of emails, delivery coordination, and complaint handling. If that sounds exhausting, this isn’t your path.

Can you handle 12-24 months of uncertainty? Premium revenue takes time. Do you have reserves or off-farm income to bridge gaps?

Is your positioning defensible? What makes your story compelling AND hard to copy?

Is your family aligned? This changes daily work patterns. Everyone affected needs to understand and support it.

If these questions raise concerns, that’s not failure. That’s valuable information for better decisions.

The Bigger Picture

Camel dairy’s success reflects something larger: dairy markets are stratifying into distinct value tiers where margins concentrate among operations that control their positioning, customer relationships, and narrative.

The Trends Reinforcing This

Vertical integration: Fairlife (Coca-Cola-owned), a2 Milk Company, major organic cooperatives—they capture production AND brand premiums by controlling the whole chain.

Consumer willingness to pay: IFIC Foundation research consistently shows that substantial segments are willing to pay premiums for health, environmental, or local-sourcing stories. This preference has stayed stable for years.

Technology lowering barriers: Online ordering, subscription management, delivery logistics—tools that once required custom development now cost $50/month.

THE STRATEGIC QUESTION: Is efficiency-focused commodity production, competing against ever-larger operations with superior scale economics, a viable long-term path for family-scale farms?

Key Takeaways

Premium markets are real. They capture disproportionate revenue despite modest volume.

Barriers exist, but aren’t absolute. Co-packing, graduated transitions, and customer-first approaches can manage risk.

Sequencing is everything. Build a customer base before investing capital.

Customer work is core. If you hate it, premium positioning isn’t for you.

Defensibility determines durability. Attributes get copied. Relationships and complexity hold value.

Question your assumptions. “Better genetics + lower costs = eventual reward” faces structural headwinds. Operations capturing premium value succeed through positioning, not just production.

The Bottom Line

Camel dairy at $35/liter isn’t a threat. It’s a signal.

Dairy markets have stratified. Commodity production remains essential—it serves the majority of consumption. The infrastructure, genetics, and management expertise we’ve developed over generations matter.

But the assumption that production excellence alone generates adequate returns—especially for mid-size operations squeezed between large-scale efficiency and premium margins—deserves hard examination.

The question isn’t whether to milk camels. It’s whether some version of premium positioning might complement commodity production as markets continue to evolve.

The operations best positioned over the next decade will figure out how to produce excellent milk AND capture value that currently flows elsewhere.

That’s what camel dairy’s unlikely success actually demonstrates. The animal matters far less than the market structure lessons embedded in those $35-per-liter prices.

Whether the industry is ready to learn those lessons… that’s the open question.

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More

- Dairy Farm Profitability: It’s Not Just About More Milk – Stop chasing pounds and start chasing profit with this operational overhaul. It delivers the specific cost-analysis tools you need to identify hidden leaks in your system, ensuring every management decision on Monday morning directly improves your bottom line.

- The Future of the Family Farm: Strategy Over Scale – Position your operation for the next decade by understanding the inevitable stratification of the global milk supply. This strategic guide exposes why the “get big or get out” mantra is failing and reveals how mid-size farms can reclaim their competitive advantage.

- A2 Milk and Beyond: The Real ROI of Niche Markets – Evaluate the genuine ROI of emerging premium tiers before you commit your herd’s genetics. This analysis strips away the marketing hype around niche attributes, delivering the data-backed reality of which certifications actually hold their value against future market saturation.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!