Just found out our 90-lb cow loses $3/day while our 85-lb cow makes $10/day. The difference? 6kg of feed. This changes everything

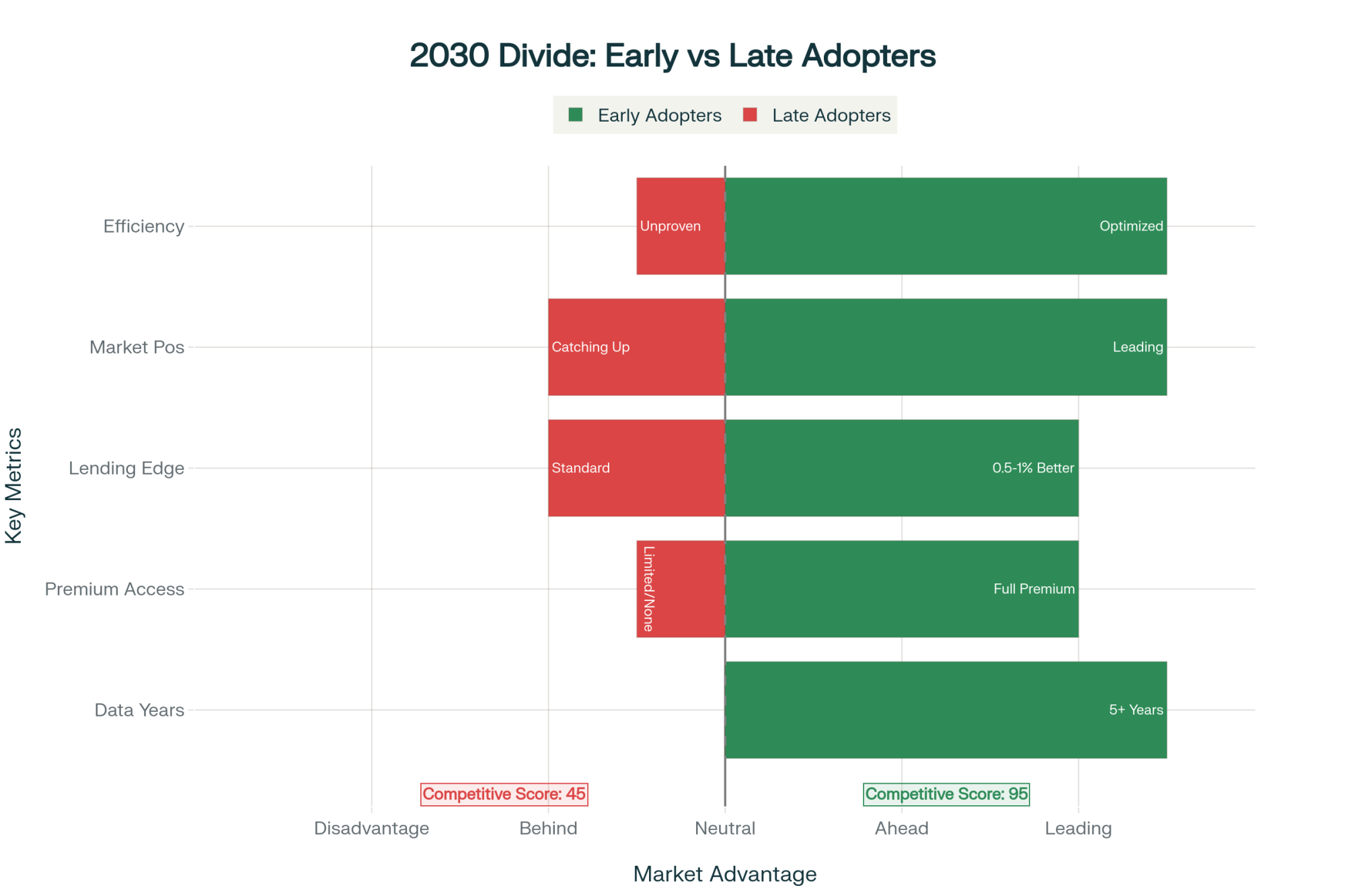

Executive Summary: What if your highest-producing cows are actually costing you money? Feed efficiency technology deployed across 3,000 dairy farms proves it’s not just possible—it’s common. The numbers are stark: cows producing identical 100-pound milk yields show daily profit swings from -$7 to +$10, based solely on whether they consume 17kg or 23kg of feed. Ryzebol Dairy transformed this insight into action, breeding inefficient cows for beef ($700 premiums) while focusing genetics on the efficient third that actually drives profit. At $75-150K investment returning $470/cow annually, payback takes just 3-5 years. The industry is splitting fast between operations still chasing volume, and those chasing profit—and the profit-chasers are pulling away.

For nearly a century, dairy farming has operated on a simple equation: more milk per cow equals more profit.

But what farmers are discovering through new feed efficiency technology is turning that fundamental assumption on its head. The highest-producing cows in many herds are actually the least profitable—a revelation that’s prompting forward-thinking operations to reimagine their breeding, feeding, and culling strategies completely.

I recently had a fascinating conversation with Clare Alderink, general manager of Ryzebol Dairy’s 3,000-cow operation in Bailey, Michigan. When his farm implemented Afimilk’s feed efficiency estimation system, the data revealed something that challenged everything he thought he knew about his herd.

“There’s no way the service knew these cows were from the same farm, yet all those cows found themselves on the top of the list as the most feed efficient.”

All of his most feed-efficient animals traced back to one group of purchased Holsteins—cows that weren’t his top milk producers but were generating the highest profit per dollar of feed consumed.

The Hidden Economics That Traditional Metrics Miss

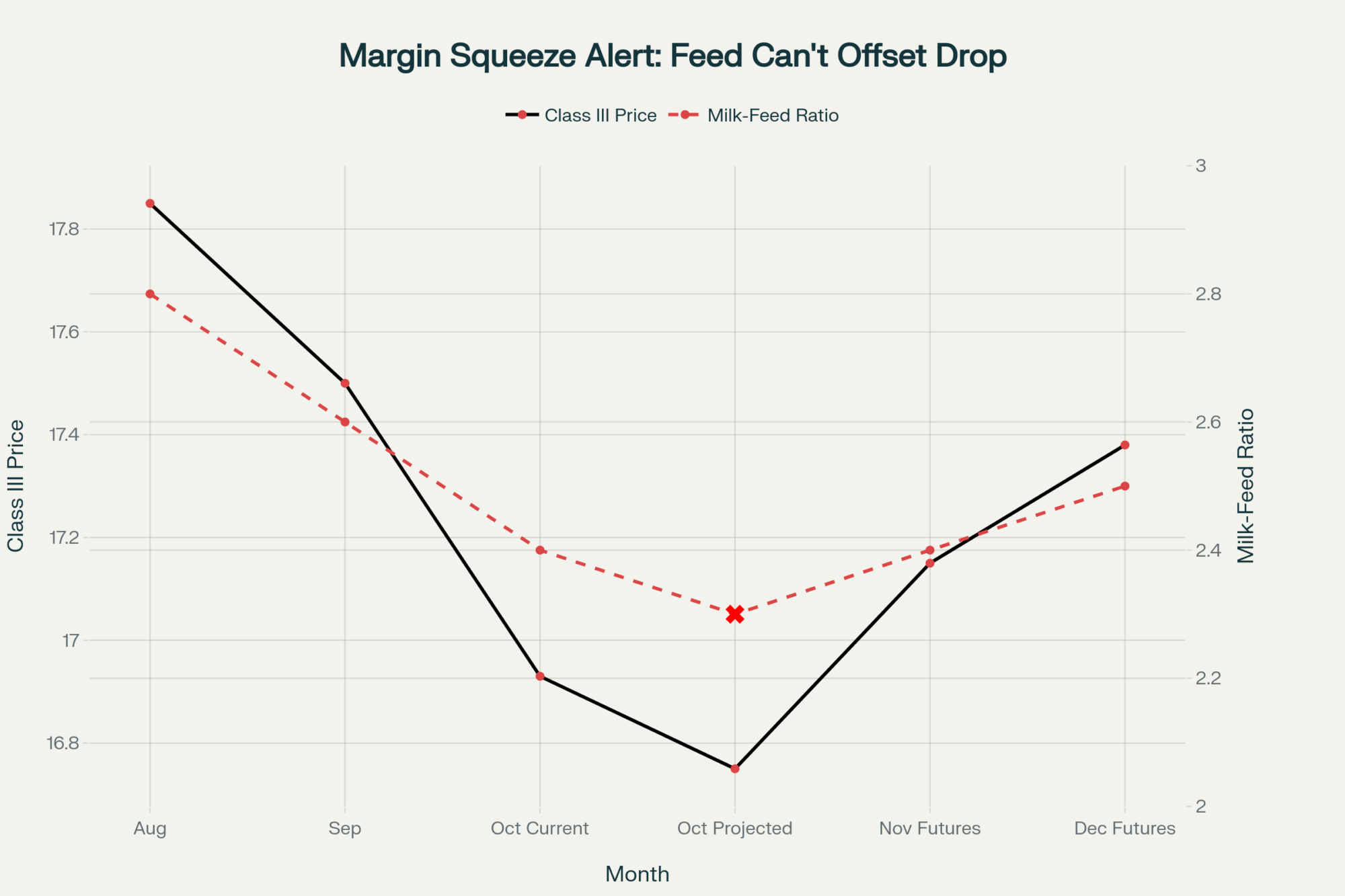

You know, what’s really striking when you dig into the economics is just how much variation exists between seemingly similar operations.

The folks at Vita Plus Corporation ran an analysis in 2024 examining 20 Midwestern herds—all shipping roughly 100 pounds of energy-corrected milk per cow daily. What they found should make every dairy farmer pause.

Income over feed cost ranged from less than $7 to greater than $10 per head per day.

Think about that $3.50 daily difference for a moment. On a 1,000-cow operation, we’re talking about over $1.2 million in margin opportunity annually. Money that’s essentially invisible if you’re only tracking milk production.

QUICK TAKE: THE EFFICIENCY GAP

| Cow Group | Dry Matter Intake (kg/day) | Difference (kg/day) | Cost Savings per Cow (lactation period) |

| Efficient | 17.30 | 6 | $700 |

| Inefficient | 23.30 | 6 | $0 |

What’s interesting here is that we’re finally understanding the mechanism behind this variation through individual cow measurement. A study published in Frontiers in Genetics in 2024 evaluated genomic markers for residual feed intake in 2,538 US Holstein cows.

The differences they found between efficient and inefficient animals were eye-opening:

- First-lactation cows? The most efficient animals consumed 17.30 kg of dry matter daily, while the least efficient needed 23.30 kg

- Second-lactation cows showed an even wider gap, with efficient cows eating 20.40 kg versus 27.50 kg for inefficient animals

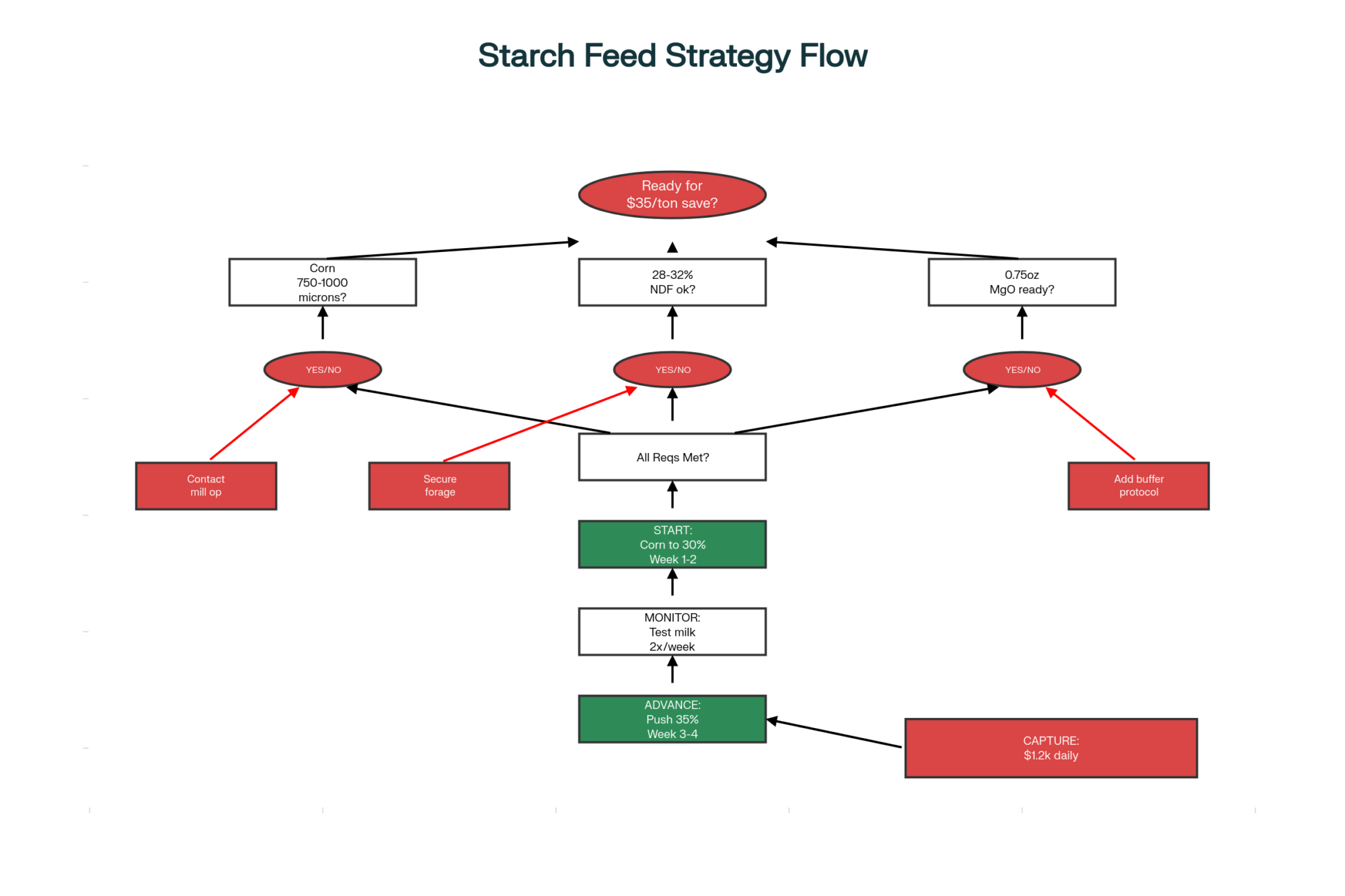

Now, here’s where it gets interesting for those of us looking at feed bills.

According to University of Wisconsin Extension data, feed costs in the Upper Midwest are averaging around $381 per ton of dry matter. That 6 kg daily difference? It represents roughly $700 per cow per lactation in feed cost variation between animals producing identical milk volumes.

Shane St. Cyr from Adirondack Farms in New York put it perfectly:

“You have the income half of the equation on most dairies. But without that expense equation, you’re really kind of flying blind.”

The Strategic Breeding Revolution: Beef-on-Dairy Meets Feed Efficiency

Perhaps the most dramatic shift I’m seeing—and I’ve been watching this space closely—is how farms are completely rethinking their breeding strategies once they have feed efficiency data in hand.

Instead of the old approach (trying to create replacement heifers from every cow that’ll stand still long enough to breed), operations are now using what’s essentially a three-tier system:

TOP 20-30% (HIGH EFFICIENCY):

- Bred with sexed dairy semen

- Create the next generation

- Keep these genetics forever

MIDDLE 40-50%:

- Conventional dairy semen

- Backup replacement strategy

- Flexible based on herd needs

BOTTOM 20-30% (LOW EFFICIENCY):

- Bred exclusively with beef semen

- Generate $350-700 premiums per calf

- Transform losses into profit centers

The beef-on-dairy market has absolutely exploded in ways that, honestly, nobody saw coming five years ago.

Purina Animal Nutrition surveyed 500 dairy producers in 2024 and found that 80% are now receiving premiums for beef-on-dairy calves. Some crosses are fetching over $1,000 in tight cattle markets, particularly in Texas and the Central Plains.

Think about this for a minute:

- Purebred dairy bull calf: $50-150 (if you’re lucky)

- Many producers: Actually paying disposal costs

- Same cow bred to beef: $500-850 per calf

The math here isn’t subtle, folks.

For Ryzebol Dairy, this strategic allocation based on feed efficiency data has completely transformed how they view their inefficient cows.

“I want that efficient cow to stay in my herd a long, long time,” Alderink explained. “Whereas the other inefficient cows I would want to use to make a beef calf because she’s a lower-value cow.”

What University Research Missed: The Power of Individual Variation

Here’s something that really drives home why on-farm measurement matters more than controlled research trials. Ryzebol’s experience with high oleic soybeans illustrates this perfectly.

The university studies—Penn State ran a trial with 48 Holstein cows in 2024, and Michigan State published similar work—showed that high-oleic soybeans improved energy-corrected milk and components. The improvements were significant, particularly for butterfat. Solid research. Peer-reviewed. Convincing stuff.

So Ryzebol implemented them herd-wide and saw improvements.

But then Alderink did something the research couldn’t do. He used individual cow feed efficiency data to dig deeper.

“Increasing the average doesn’t always tell the whole story. It may have made our best cows really efficient and done little for the low cows.”

What he discovered should make every nutritionist rethink how we apply research findings:

TOP 30% OF COWS:

- Excellent milk and component response

- Strong returns on premium ingredient cost

- Worth every penny

MIDDLE 40%:

- Marginal improvement

- Barely justified the extra cost

- Questionable economics

BOTTOM 30%:

- Little to no benefit

- Essentially throwing money away

- Better off with standard ration

This insight—that research-validated improvements don’t apply equally to all animals—represents a fundamental shift in how we can optimize nutrition economics.

The Technology Landscape: Understanding What’s Real vs. What’s Promised

Let’s talk about what this technology actually does, because there’s plenty of confusion out there.

Afimilk’s feed efficiency service represents a breakthrough in estimating individual cow feed efficiency through collar sensor data. The system tracks eating time and rumination patterns, then combines this with milk production information to generate efficiency values for each animal.

You’re entering weekly dry matter intake data from your feeding software to calibrate the estimates. According to validation studies at UW-Madison, the correlation between the algorithm’s estimates and actual measured intake has proven strong enough for commercial application.

THE NUMBERS THAT MATTER:

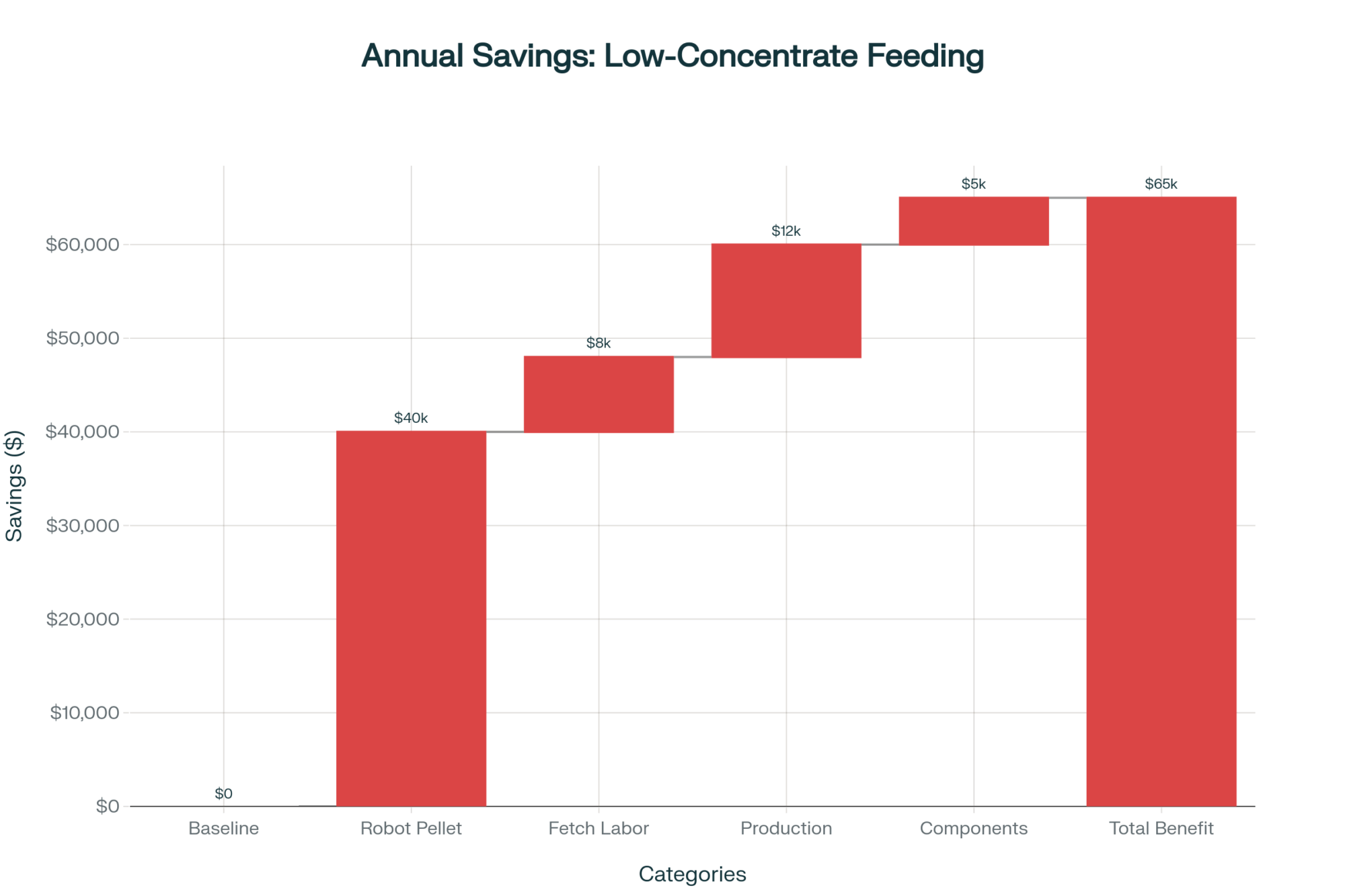

| Investment | Annual service | Payback period | ROI | Beef premium | Feed savings |

| $75,000-$150,000 (500 cows) | $10,000-$25,000 | 3-5 years | $470/cow/year | $350-700/calf | $700/cow/lactation |

Early adopters are reporting that the technology can deliver $470 per cow in annual profitability gains through better breeding and culling decisions.

On a 1,000-cow operation? That’s nearly half a million dollars in annual value.

Though I should note—and this is important—that’s assuming farms actually act on the data.

The Adoption Reality: Barriers Beyond Technology

Despite these clear economic benefits, several factors are creating real headwinds for adoption.

CAPITAL CONSTRAINTS We’re talking $75,000-$150,000 for basic sensor systems on 500 cows. Field data from early adopters suggests payback periods of 3-5 years. But that upfront investment? It’s tough when milk prices are volatile.

SYSTEM INTEGRATION Feed efficiency estimation needs to pull data from multiple sources:

- Milk meters

- Cow ID systems

- Feeding software

- Health records

According to Progressive Dairy’s 2024 tech adoption survey, approximately 70% of North American dairies have older equipment or mixed vendors. Additional integration costs that nobody mentions in the sales pitch.

PSYCHOLOGICAL RESISTANCE Here’s the barrier nobody wants to talk about. Kent Weisenberger from Vita Plus put it bluntly in a recent podcast:

“The technology works fine. Whether farmers will cull their favorite high-producing cow because she’s inefficient? That’s the real question.”

It’s worth noting that feed efficiency estimation isn’t a silver bullet for every situation. Grazing-based operations or farms with highly variable feed quality from homegrown forages might find the economics less compelling.

Environmental Benefits: The Profit-Sustainability Alignment

What I find particularly interesting about feed efficiency selection is how environmental benefits just naturally emerge from economic optimization.

You’re not trying to save the planet—you’re trying to make money—but the planet benefits anyway.

Research from Wageningen University in 2024 found that methane production varies by approximately 25% within herds due to genetic factors. The correlation between feed efficiency and methane reduction is strongly positive.

Since April 2023, Canada has been implementing national genetic evaluations for methane emissions through Lactanet. They’re projecting 20-30% reductions in breeding alone by 2050.

The Council on Dairy Cattle Breeding calculates that genomic selection for feed efficiency has already delivered $70 per cow per year in additional value—before accounting for any environmental benefits or carbon credits.

The key point? You don’t need expensive additives. Simply breeding from more efficient animals reduces methane automatically at zero additional cost.

Looking Ahead: The Industry Transformation

Here’s where things get really interesting for the bigger picture.

If enough operations start breeding away from high-volume, low-efficiency genetics, it fundamentally challenges what the breeding industry has been selling for decades.

VikingGenetics launched their Feed Efficiency 3.0 program earlier this year, explicitly prioritizing efficiency over raw production. Meanwhile, established players like Semex and Alta have scrambled to launch “sustainable genetics” programs.

The uncomfortable truth? While high producers generally dilute maintenance costs effectively (gross feed efficiency), metabolic efficiency—measured as Residual Feed Intake—is a distinct genetic trait. You can have a high producer that’s metabolically inefficient, or a moderate producer that’s exceptionally efficient at the cellular level.

For 40 years, the breeding industry chose production over efficiency. With feed accounting for 50-75% of operating costs, according to USDA data, the math increasingly favors a more nuanced approach.

THE BULLVINE BOTTOM LINE: Your Monday Morning Action List

IMMEDIATE ACTIONS (THIS WEEK):

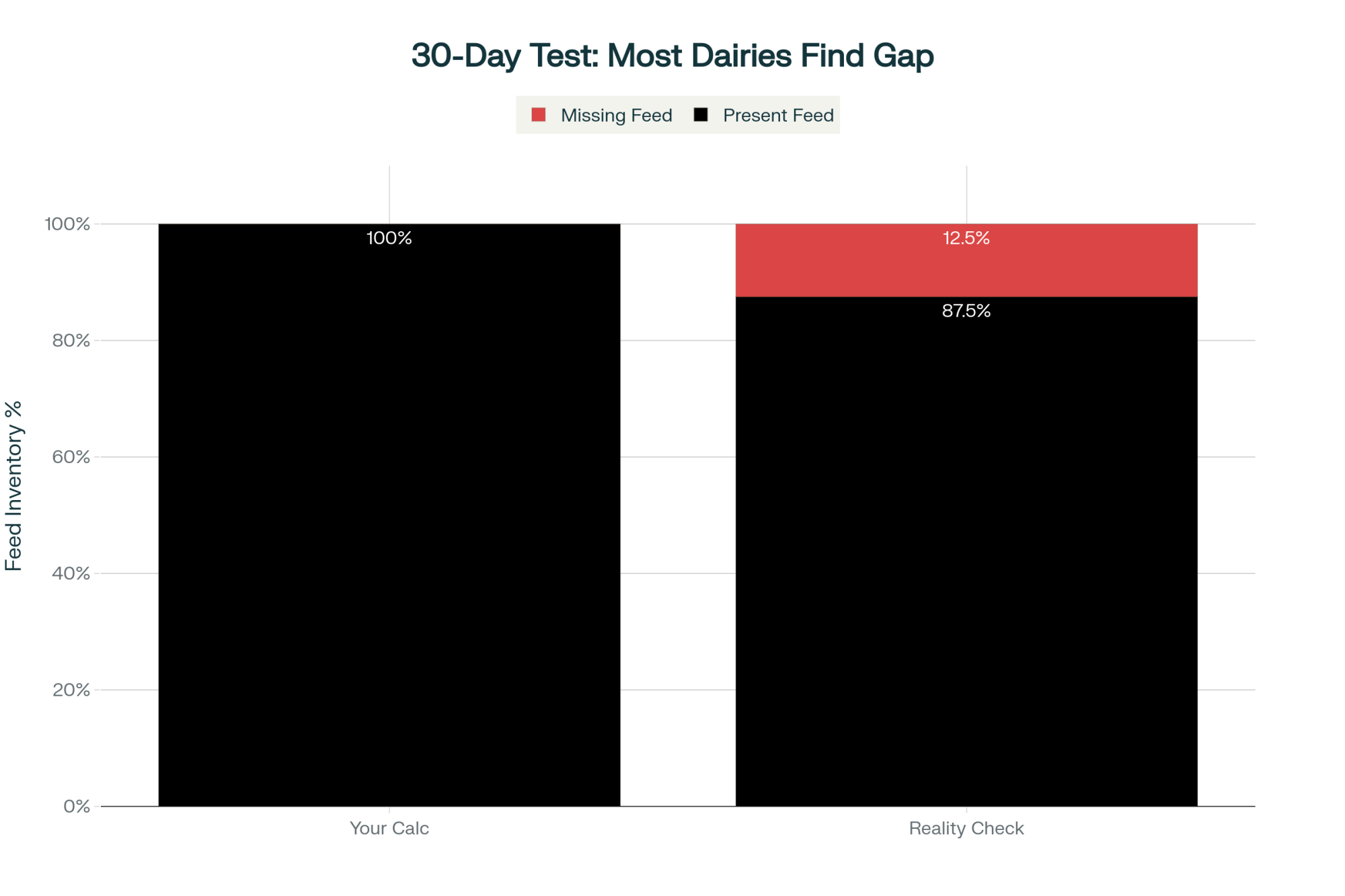

□ Calculate your current income over feed cost variance between top and bottom cows

□ Call your nutritionist—ask if they’ll support data-driven feeding changes

□ Visit a farm already using the technology (find one in your area)

EVALUATION PHASE (NEXT 30 DAYS):

□ Get quotes from 3 vendors for feed efficiency estimation systems

□ Run your herd’s numbers: What’s your potential at $470/cow/year?

□ Talk to your banker about financing options (3-5 year payback)

DECISION CHECKPOINT:

□ Can you afford to wait while neighbors gain $700/cow/lactation advantage?

□ Will you act on uncomfortable data about favorite cows?

□ Are you ready to challenge 40 years of production-first thinking?

The technology exists. The economics are proven. The only question: Will you act before your neighbors do?

As Alderink reflects: “I think we are just scratching the surface on all this, but it is taking us down a path where we can really start to look at these things because we have something to measure it.”

That ability to see which cows convert feed efficiently—versus which simply produce milk—represents the difference between optimizing for volume and optimizing for profit.

In today’s margin environment, that distinction increasingly determines which operations thrive and which struggle to survive.

Your move.

Key Takeaways:

- The $700 Discovery: Efficient cows (17kg DMI) and inefficient cows (23kg DMI) produce identical milk but differ by $700/lactation in profit—measure to know which you have

- Transform Your Breeding: Feed data creates three profit tiers → Top 30% get premium genetics | Bottom 30% produce beef calves ($350-700 each) | Middle 40% flex by needs

- Precision Feeding Pays: Individual response data shows premium feed additives only benefit ~30% of cows—saving $200+/cow by removing non-responders from expensive rations

- Competitive Clock Ticking: 3,000 early adopters gaining $470/cow annually are building herds 10-15% more efficient by 2030—each month you wait widens the gap

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More:

- The Beef-on-Dairy Wake-Up Call: What Some Farms Are Still Missing – Strategic Analysis: Challenges the lingering “Holstein purity” mindset that holds 20% of dairies back, detailing the exact opportunity cost of delaying genomic selection and why “old-school” breeding is bleeding money in the current market.

- The 90-Day Dairy Pivot: Converting Beef Windfalls into Next Year’s Survival – Market Strategy: Provides a financial survival guide for late 2025, demonstrating how to leverage record $2,000 cull cow prices and beef premiums to offset operating costs before the cattle cycle shifts again.

- 5 Technologies That Will Make or Break Your Dairy Farm in 2025 – Innovation Guide: Expands beyond feed efficiency to evaluate five specific 2025 investments—from calf sensors to precision feeding robots—helping you decide which tools deliver genuine ROI versus which are just expensive toys.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!