$4.60/cwt gap between 4.23% and 3.69% butterfat = $370K annually. Your genomic testing strategy better be dialed in.

EXECUTIVE SUMMARY: Look, I’ve been walking through barns for twenty: years, and the conversation’s completely changed. We’re not in the milk business anymore – we’re in the component business, and most producers are still stuck in the old mindset. Recent Journal of Dairy Science research shows butterfat production jumped 30.2% while milk volume only grew 15.9% since 2011, creating a $4.60 per hundredweight premium for high-component milk. That’s real money – a 500-cow operation shipping 4.23% butterfat versus 3.69% banks an extra $370,000 annually from the same cows eating the same feed. With genomics now driving 70% of production gains and processors investing $8 billion in component-focused facilities through 2026, the writing’s on the wall. You need to get serious about component optimization right now, because while you’re deciding, your competitors are already capturing that premium.

KEY TAKEAWAYS

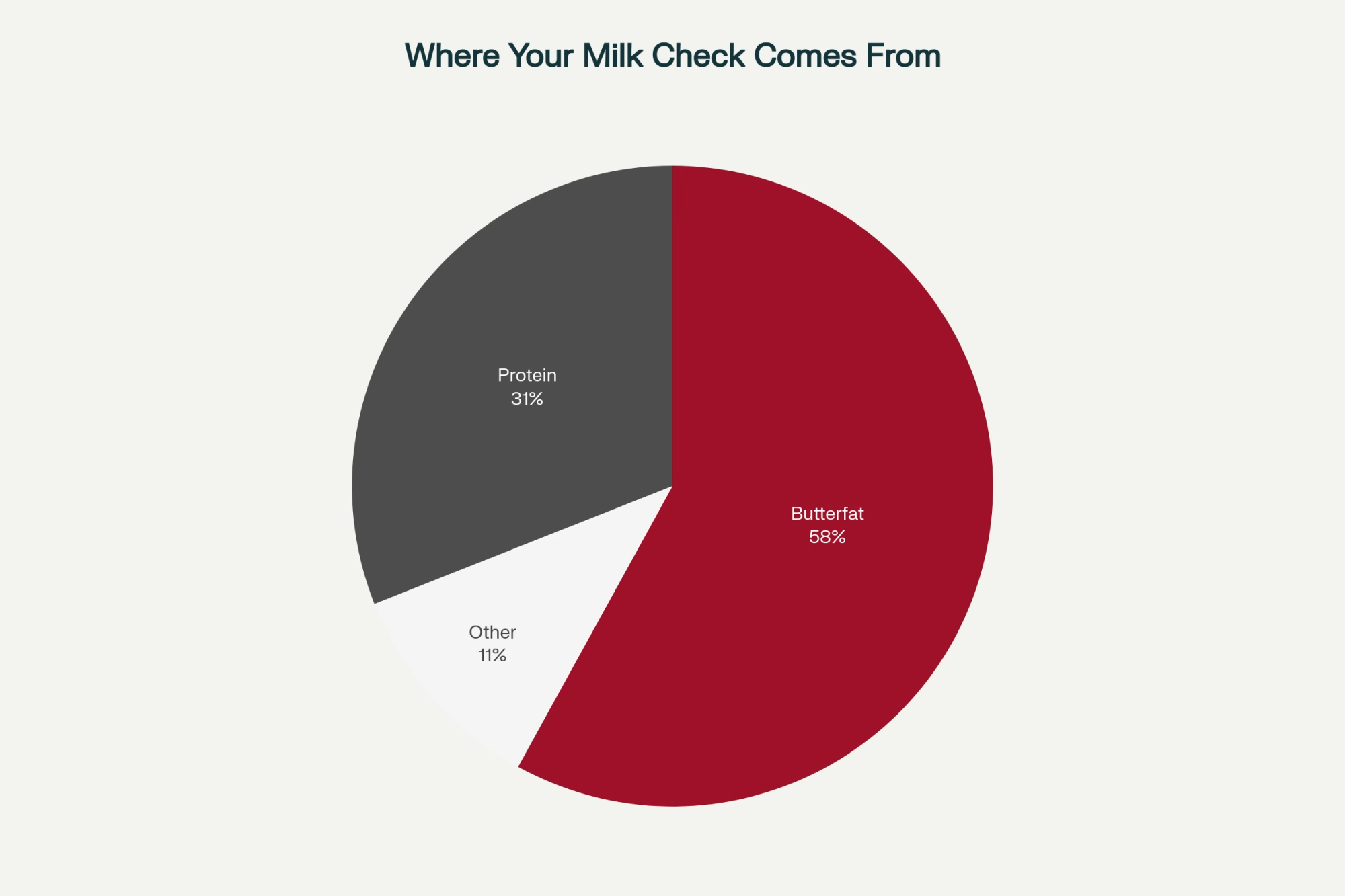

- Component Premium Reality Check: Butterfat accounts for 58% of your milk check, protein another 31% – that’s 89% of your income from solids, not water. Start tracking your monthly component trends against regional averages and identify which cow groups are dragging down your bulk tank performance.

- Genomic ROI That Actually Pays: With over 10 million animals now genotyped and genomics driving 70% of production gains, systematic genomic testing of heifer calves gives you 70% accuracy on future component potential. Implement testing on your top 25% for breeding decisions – the genetic gains are permanent and cumulative.

- Heat Stress = Money Walking Out the Door: I watched Midwest operations lose 0.3-0.4 percentage points of butterfat during July 2024’s heat waves – that’s thousands in lost revenue. Invest in effective cooling systems ($400-800 per cow) and optimize feeding times to avoid peak heat periods in these 2025 climate conditions.

- Processing Competition Works in Your Favor: With $8 billion in new cheese and butter plants coming online, processors are competing for component-rich milk that maximizes their efficiency. Farms consistently delivering high-component milk are becoming price makers instead of price takers – leverage this to negotiate better processor relationships.

- Export Dependency Creates Opportunity: The U.S. exports 69% of its skim solids production while importing butterfat to meet domestic demand. This structural imbalance means component-focused operations are positioned to capture both domestic premiums and global market stability through 2025 and beyond.

You know what caught my attention at the farm show last month? It wasn’t the latest robotic milker or some fancy new TMR mixer. It was a conversation I overheard between two Wisconsin producers in the coffee line.

“Dave’s shipping the same pounds I am,” one guy was saying, shaking his head. “But somehow he’s banking an extra grand every single day.”

What’s the difference? Dave’s cows are averaging 4.23% butterfat, while his neighbor’s herd remains at 3.69%. That gap—that seemingly small difference in butterfat numbers—is worth $4.60 per hundredweight on every load leaving the farm.

Scale that across a 500-cow operation shipping around 22,000 pounds daily… you’re looking at over $1,000 in additional revenue every single day. That’s $370,000 in incremental income annually from what amounts to the same cows eating roughly the same feed.

Here’s what that difference looks like at a glance:

| Factor | High-Component Herd (4.23% BF) | Average Herd (3.69% BF) | Edge for High-Component |

| Butterfat (%) | 4.23 | 3.69 | +0.54 pts |

| Component Premium ($/cwt) | +$4.60 | — | +$4.60 |

| Daily Revenue Gain (500 cows) | +$1,000 | Baseline | +$1,000 |

| Annual Revenue Gain | +$370,000 | — | +$370,000 |

| Feed Program | Same TMR | Same TMR | No added cost |

| Strategic Focus | Genomics + Components | Volume | Higher Margin |

Here’s the thing, though… this isn’t some future trend we need to prepare for. This transformation is happening right now, and it’s accelerating faster than most producers realize.

The Shift That’s Redefining Everything

The thing about major industry changes is they tend to sneak up on you. One day, you’re doing business the way your dad did, the next day, the entire game has changed. What are we seeing in dairy right now? It’s that pivotal moment when everything clicks into place.

I’ve been walking through barns across the Midwest for over two decades, and the conversations I’m having today are fundamentally different from even five years ago. Maybe it hit you when your nutritionist started asking about butterfat targets instead of milk per cow. Or when your milk check jumped despite shipping fewer pounds last month.

According to recent work from the Journal of Dairy Science, the numbers tell a clear story: from 2011 to 2024, while milk production increased by a modest 15.9%, butterfat production increased by 30.2% and protein production climbed by 23.6%. Think about what this means for your bottom line… the same number of cows, managed with similar protocols, are now producing fundamentally different milk—and way more valuable—than what they produced a decade ago.

What’s happening is we’ve moved from a simple commodity model to something much more sophisticated. Raw milk isn’t just a fluid anymore; it’s become a sophisticated, customizable raw material where value is defined by its solids content, not water.

And this brings us to an important consideration…

The Genomic Revolution That Actually Delivered

Remember when genomic testing was an expensive experiment that only the largest operations could justify? Well, according to the Council on Dairy Cattle Breeding, the industry has now tested over 10 million animals through genomic programs. That’s created what researchers are calling the most comprehensive genetic database of any domestic animal species except humans and lab mice.

What this reveals is that genomics now accounts for over 70% of the production gains on U.S. dairy farms—a complete flip from previous decades when management practices were the dominant factor. This isn’t just about having better bulls in your breeding program (though that’s certainly part of it). It’s about fundamentally altering what comes out of your cows.

The April 2025 genetic evaluations from Holstein Association USA revealed something that would have been considered impossible just five years ago—genetic improvements on butterfat that are honestly pretty remarkable. Because butterfat and protein are among the most heritable traits (with heritabilities of 20-25% according to multiple peer-reviewed studies), the genetic gains we’re making today will compound across generations.

The surprising part is that most producers I work with are still underestimating just how powerful this genetic momentum has become. Every young bull entering your breeding program today has genetic potential that would have been science fiction just a few years ago.

However, here’s the challenge… and this is something that consistently arises in my conversations with producers: genetic change is a generational phenomenon. You’re looking at 18-24 months before you start seeing meaningful improvements in your bulk tank. That’s a long time to wait when your neighbor is already capturing that premium today.

Where Your Milk Check Money Actually Lives Now

Let me ask you something that might surprise you: if you’re still thinking about milk pricing the way you did in 2010, are you missing the biggest profit opportunity in modern dairy farming?

Under Multiple Component Pricing (MCP)—which governs over 90% of the U.S. milk supply through Federal Milk Marketing Orders—butterfat now accounts for 58% of the average milk check, with protein contributing another 31%. That means nearly 90% of your milk check value comes from the components, not the water your cows produce.

The financial impact is honestly staggering. Recent USDA Agricultural Marketing Service data shows Class III milk prices averaging $18.82 per hundredweight for June 2025, while Class IV prices were $18.30 per hundredweight. But here’s the kicker: butterfat hit $2.7448 per pound, demonstrating just how much premium value fat components carry.

Component Premium Assessment Tool

Take a moment to evaluate your current position:

- What’s your current herd average butterfat percentage?

- How does this compare to your county or regional average?

- What’s the spread between your highest and lowest producing groups?

- Are you tracking component trends on a monthly basis or just looking at annual averages?

If you can’t answer these questions off the top of your head, you’re probably leaving money on the table.

What’s interesting is that each 0.1% increase in butterfat can add $15-20 in monthly revenue per cow. For a 1,000-cow operation, that translates to $15,000-$20,000 in additional monthly income from what amounts to a relatively small improvement in component levels.

However, this leads to a crucial point: despite this production boom, the U.S. remains a net importer of butterfat. Consumer demand has grown even faster than our supply gains, creating a unique market dynamic where domestic demand continues to outpace production.

The Consumer Story That’s Actually Driving Everything

This isn’t just about supply—it’s about a fundamental shift in how Americans eat dairy, and I’ve watched this play out in real time over the past few years.

Recent USDA Economic Research Service data shows per capita consumption of dairy products reached 661 pounds per person in 2023, matching the all-time record set in 2021. But here’s what’s really fascinating: while fluid milk consumption continues its long-term decline, butter consumption hit 6.5 pounds per person (highest since 1965) and cheese consumption reached 42.3 pounds per person.

Americans aren’t abandoning dairy—they’re fundamentally changing how they consume it. They’re shifting from fluid milk as a beverage toward manufactured, higher-fat dairy products, such as butter, cheese, and premium yogurt. This trend accelerated with everything from the home-baking renaissance during COVID to the rise of social media food trends, such as the elaborate charcuterie boards that are now ubiquitous.

What’s particularly fascinating is the science behind this shift in consumer behavior. Research published in the Journal of Dairy Science shows that dairy fat is the most complex edible fat found in nature, comprising over 400 distinct fatty acids with different chain lengths and chemical structures. The unique milk fat globule membrane (MFGM) that encases fat globules plays a crucial role in the digestion and metabolism of dairy fat.

This brings us to an important consideration from a health perspective: multiple prospective cohort studies now show that consumption of full-fat dairy is associated with neutral or even reduced risk of major health outcomes, including cardiovascular disease, type 2 diabetes, and metabolic syndrome. Some compelling evidence suggests that a high intake of full-fat dairy is actually associated with a decreased risk of developing type 2 diabetes, an outcome not observed with low-fat dairy.

The $8 Billion Processing Bet That’s Changing Everything

Here’s something that should catch your attention: the U.S. dairy industry is investing over $8 billion in new processing capacity through 2026, with approximately half of the investment targeting cheese production. This isn’t just expansion—it’s a massive bet on the continued growth of component-driven demand.

Think about what this means for your operation. When processing capacity is expanding this aggressively, it creates competition for your milk—and that competition is specifically for component-rich milk that can maximize plant efficiency and profitability.

I’ve seen firsthand how this plays out. Operations that can consistently deliver high-component milk are finding themselves with multiple buyers competing for their product, while those still producing average-component milk are becoming price takers rather than price makers.

Regional Variations That Really Matter

The geography of American dairy is changing, and it’s being driven by the same component economic components that are reshaping individual operations. The May 2025 USDA Milk Production report indicates 19.1 billion pounds of milk production in the 24 major states, representing a 1.7% increase from May 2024.

However, the surprising part is that component production has consistently outpaced fluid milk growth, with butterfat levels improving from 4.17% to 4.24% between May 2024 and May 2025. That improvement yielded 1.8 pounds more butterfat per cow, representing a 2% yield gain per cow.

What I’m seeing in different regions is honestly fascinating. In the Upper Midwest—specifically, Wisconsin, Minnesota, and Michigan—producers face different challenges than those in the Southwest or California. Heat stress management becomes absolutely crucial in Arizona and Texas (as we saw firsthand during last summer’s heat waves), while in Wisconsin and Minnesota, producers are focusing more on forage quality and barn ventilation systems.

The spring flood issues we saw across parts of Iowa and Illinois this year? That created some interesting butterfat challenges as producers dealt with compromised forage quality and had to adjust their nutrition programs on the fly.

Regional Component Optimization Strategies

Upper Midwest (Wisconsin, Minnesota, Michigan):

- Focus on high-quality forage production during short growing seasons

- Invest in advanced barn ventilation for summer heat stress management

- Leverage strong genetics programs from local breeding cooperatives

Southwest (Arizona, Texas, New Mexico):

- Prioritize heat stress abatement systems (evaporative cooling, shade structures)

- Optimize feeding times to avoid peak heat periods

- Consider night milking schedules during extreme weather

California Central Valley:

- Navigate drought conditions with drought-resistant forage varieties

- Manage seasonal feed cost volatility

- Balance component production with regulatory compliance requirements

The message for your operation is clear: regardless of where you’re located, you need to be thinking about how to produce the kind of milk that processors are building billion-dollar plants to handle.

How Smart Producers Are Capturing This Component Premium

Now that you understand the forces driving this transformation, let’s discuss its implications for your operation. The primary strategic shift is moving from a “milking for volume” mindset to “milking for margin.”

The Genetics Game-Changer

The genetic gains achieved through genomics are permanent and cumulative, ensuring that strategic breeding decisions you make today will pay dividends for decades. Here’s what that means practically…

You need to leverage component-focused selection indexes, such as Net Merit ($ NM), which now places substantial weighting on butterfat and protein values. Work with A.I. companies that can provide genomic young sires specifically bred for component production, and implement systematic genomic testing of your own heifer calves to identify the top 25% for breeding and the bottom 25% for terminal mating.

The economic weighting for butterfat in selection indexes has increased by 13% to reflect current market values, demonstrating the industry’s commitment to component optimization.

But here’s something I’ve learned from working with producers who’ve made this transition: don’t expect immediate results. Genetic change is generational, and you’re looking at 18-24 months before you start seeing meaningful improvements in your bulk tank.

Decision Framework: Is Your Genetics Program Component-Optimized?

Ask yourself these questions:

- What percentage of your breeding decisions are based on component traits versus volume traits?

- Are you systematically using genomic testing to replace heifers to identify genetic potential early?

- Do you have a clear genetic plan for the next 5 years, or are you just buying the “hot bull” of the moment?

- How do you balance component gains with other important traits, such as health and fertility?

If you can’t answer these confidently, you might be missing the biggest opportunity in modern dairy farming.

Nutrition: The Other Half of the Equation

Even the best genetics won’t deliver results without precision nutrition management. The key is creating rumen conditions that maximize acetate production—the direct precursor to milk fat.

University extension research shows that feeding high-quality, highly digestible forages promotes acetate production in the rumen. Maintaining a stable rumen pH through proper fiber management and strategic buffering is critical, as acidosis can disrupt fatty acid metabolism and lead to milk fat depression.

This reveals the crucial role of heat stress management. It causes cows to reduce feed intake, particularly of forages that support fat synthesis. This past summer, I watched operations in the Midwest lose 0.3-0.4 percentage points of butterfat during the July heat wave—that’s real money walking out the door.

Here’s where it gets challenging, though: every operation is different. What works for a 500-cow freestall in Wisconsin might not work for a 5,000-cow operation in California’s Central Valley. Feed costs, climate conditions, and labor availability —all of these factors affect your ability to optimize for components.

I’ve seen producers get so focused on chasing butterfat numbers that they forget about the bigger picture. Cow health, reproductive performance, longevity—these all matter too. The most successful producers I work with are those who optimize for components while maintaining overall herd performance.

The Trade-Off Most Producers Don’t Consider

This leads to a crucial point that honestly keeps me up at night thinking about the industry’s future…

The U.S. dairy industry’s component-focused model creates a critical dependency on skim solids exports. While we consume most of our butterfat domestically, we export massive quantities of skim milk powder, nonfat dry milk, and whey products to balance the market.

According to USDA Agricultural Outlook Forum data, the U.S. exported a record 17.8% of its total milk solids production in 2022, with 78% of those exported solids being in the form of dry skim milk ingredients. The exports-to-production ratio for dry skim milk products reached 69%.

This export dependency makes the industry vulnerable to trade disputes, tariffs, and protectionist policies in key markets, such as Mexico, Canada, and China. A major trade disruption could destabilize the entire domestic milk pricing structure by flooding the market with skim solids that can’t find export homes.

The Risks We Need to Talk About

While the component boom presents tremendous opportunities, it also creates new vulnerabilities that strategic operators must understand and manage.

The Processing Bottleneck Challenge

The $8 billion processing investment wave carries significant timing risks. If these large facilities come online simultaneously and consumer demand fails to keep pace, the industry could face severe oversupply conditions, leading to sharp price declines.

Processors are already experiencing what some call a “cream tsunami,” with butter manufacturers acting as a relief valve to absorb surplus cream, often at discounted prices. This is creating manufacturing imbalances, with butter and American cheese production rising while other traditional uses of butterfat decline.

The surprising part is whether these new plants are truly optimized to handle the increasingly component-rich milk being produced. Traditional processing equipment was designed for lower-solid milk, and running higher-solid milk through it can create inefficiencies that could erode processor margins and, eventually, the premiums paid to farmers.

Implementation Challenges: The Reality Check

Let’s be honest about something that doesn’t get discussed enough: transitioning to component-focused production isn’t easy, and it’s not inexpensive.

I’ve worked with producers who have invested heavily in genomics and precision nutrition, only to see modest improvements in their bulk tank. Why? Because component optimization is a systems approach that requires everything to work together—genetics, nutrition, management, facilities, and even seasonal timing.

Take heat stress management, for example. Installing effective cooling systems can cost $400 to $ 800 per cow, depending on your setup. That’s a significant investment, and the payback period varies dramatically based on your climate, facility design, and current production levels.

Feed costs are another reality check. High-quality, highly digestible forages that support fat synthesis often cost more than maintenance-level feeds. Rumen-protected fats, dietary buffers, precision additives—these all add up. I’ve seen operations increase their feed costs by $0.50-1.00 per cow per day while optimizing for components.

Labor is probably the biggest challenge of all. Component optimization requires more management attention, more frequent monitoring, and often additional skilled labor. In today’s labor market, that’s not always easy to find or afford.

Technology Disruption: The Precision Fermentation Question

Here’s something that honestly makes me uncertain about the long-term future: the emergence of precision fermentation technology, which utilizes microorganisms to produce dairy proteins without the need for cows.

While the technology is still in early commercial phases, companies are already investing heavily in this space. The timeline for significant market impact remains unclear, but if precision fermentation can eventually produce commodity dairy ingredients at lower costs than traditional agriculture, it could potentially disrupt the skim solids export model that supports current component pricing structures.

This reveals how different segments of the industry may be affected differently. Premium, local, and specialty dairy products might be less vulnerable to this disruption than commodity ingredients.

What This Means for Your Operation Going Forward

The component revolution isn’t coming—it’s here. Every day that you operate with a volume-focused mindset rather than a component-focused strategy, you’re potentially leaving money on the table and falling behind competitors who have made the transition.

Your Strategic Roadmap

Right Now (Next 30 Days): Start by auditing your current genetic program to ensure component traits are properly weighted. Analyze your milk checks from the last 12 months to understand your component performance trends. Are you consistently above or below average? What’s your seasonal pattern? Are there specific groups of cows that are dragging down your overall performance?

Evaluate your nutritional program for optimal rumen health and fat synthesis. This may involve collaborating with your nutritionist to review your current ration formulation or investing in more advanced feed management systems.

Most importantly, assess your processor relationships for component pricing competitiveness. Are you getting paid appropriately for the quality of milk you’re producing? If not, it might be time to explore alternatives.

Medium-Term (Next 6-12 Months): Implement systematic genomic testing of heifer calves. This is becoming more common across the industry, and the ROI data is compelling. But don’t just test—develop a systematic approach to using that information in your breeding decisions.

Consider upgrading your nutrition management systems for precision feeding. This may involve investing in new TMR mixers, feed management software, or more sophisticated monitoring systems.

Develop risk management protocols for component price volatility. The reality is that component prices can be more volatile than traditional milk prices, so you need strategies to manage that risk.

Long-Term Positioning (Next 2-5 Years): Build operational flexibility to adapt to changing market demands. This may involve diversifying your product mix, exploring direct-to-consumer opportunities, or developing niche market positions.

Invest in technologies that improve efficiency and reduce labor dependency. Automation, monitoring systems, and decision support tools will become increasingly important as the industry evolves.

Create sustainability metrics that support premium market positioning. Consumers and processors are increasingly interested in environmental and social responsibility, and these factors are likely to become more important in the future.

The Global Context That Matters

What’s happening in the U.S. isn’t occurring in isolation. European dairy producers face similar component-driven market forces, albeit within different regulatory frameworks. New Zealand’s dairy industry—always a benchmark for efficiency—is seeing comparable trends in component optimization.

Research from Teagasc in Ireland shows similar patterns emerging across European dairy systems, with component pricing becoming increasingly important. However, the U.S. market’s unique structure—with our heavy reliance on skim solids exports—creates both opportunities and vulnerabilities that other dairy economies don’t face.

Key Questions to Consider:

- How will changing trade relationships affect your ability to capture component premiums?

- What role will sustainability requirements play in future component pricing?

- How might climate change affect your ability to optimize for components?

- What new technologies might emerge that could change the game again?

The Bottom Line: Where We Go From Here

The dairy industry has undergone fundamental changes, and the most successful operations of the next decade will be those that recognize and adapt to this new reality. The component boom isn’t just about producing different milk—it’s about building a different kind of dairy business, one that’s optimized for profitability, sustainability, and long-term competitive advantage.

What keeps me optimistic about this industry is seeing how innovative producers are embracing these changes. I’ve watched farms transform their operations, improve their genetics, and build more profitable businesses by focusing on component quality rather than just volume.

But I’d be lying if I said this transition is easy or guaranteed. The producers who succeed will be those who approach it systematically, with realistic expectations about timelines and costs, and with a clear understanding of both the opportunities and the risks.

The question isn’t whether you can afford to make this transition—it’s whether you can afford not to. Because while you’re deciding, your competitors are already capturing the premium, and that gap is growing every day.

This transformation represents the most significant shift in dairy economics since the introduction of bulk tanks… and the producers who master it will be the ones who thrive in the decades to come.

So here’s my challenge to you: stop thinking about milk production the way your dad did. Start thinking about it the way your kids will have to. Because the future of dairy isn’t about more milk—it’s about better milk. And that future? It’s already here.

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More:

- Maximizing Milk Solids Output Through Strategic Nutrition and Genetics – Reveals practical strategies for boosting DMI and implementing targeted supplementation programs that can increase milk solids by up to 6% while reducing feed costs through precision nutrition management.

- Global Dairy Market Trends 2025: European Decline, US Expansion Reshaping Industry Landscape – Demonstrates how regional production shifts create strategic opportunities for component-focused operations, with specific insights on capturing premium pricing in evolving global markets.

- 5 Technologies That Will Make or Break Your Dairy Farm in 2025 – Explores cutting-edge innovations like smart calf sensors and AI-driven analytics that early adopters use to achieve 40% mortality reductions and 20% yield increases through precision management.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!