While you chase workers who don’t exist, smart dairies are cutting labor 60% with 18-month ROI. The $32B question: Are you predator or prey?

While you’re reading this, 5,000 dairy jobs are going unfilled across North America, and by 2030, that number will reshape which farms survive and which close their doors forever.

The industry doesn’t want you to know that this isn’t just another labor “shortage” that higher wages will fix. This fundamental transformation is already deciding which operations will dominate the next decade and which will become cautionary tales. The farms positioning themselves now aren’t just surviving the labor crisis—they’re using it as their competitive weapon.

The Bottom Line Up Front: The dairy industry faces a domestic labor gap that will reach critical levels by 2030. But here’s the contrarian truth—this crisis is creating the biggest opportunity for strategic advantage since the introduction of artificial insemination. The question isn’t whether your farm will be affected. The question is whether you’ll be the predator or the prey.

Why Your “Hire More Workers” Strategy Is Already Dead

Let’s destroy the most dangerous dairy myth: this labor shortage is temporary and solvable through traditional recruitment.

Data Box: The Brutal Employment Reality (2024-2025)

- Farm Employment Decline: 3.4% between March 2024-April 2025

- Agricultural Labor Costs: Exceeding $53 billion in 2025

- Dairy Immigrant Workforce: 51% of all dairy workers

- Milk Production Dependency: 79% of U.S. milk from immigrant-staffed farms

- Geographic Production Shift: Kansas +15.7%, Texas +8.9%, California -1.8%

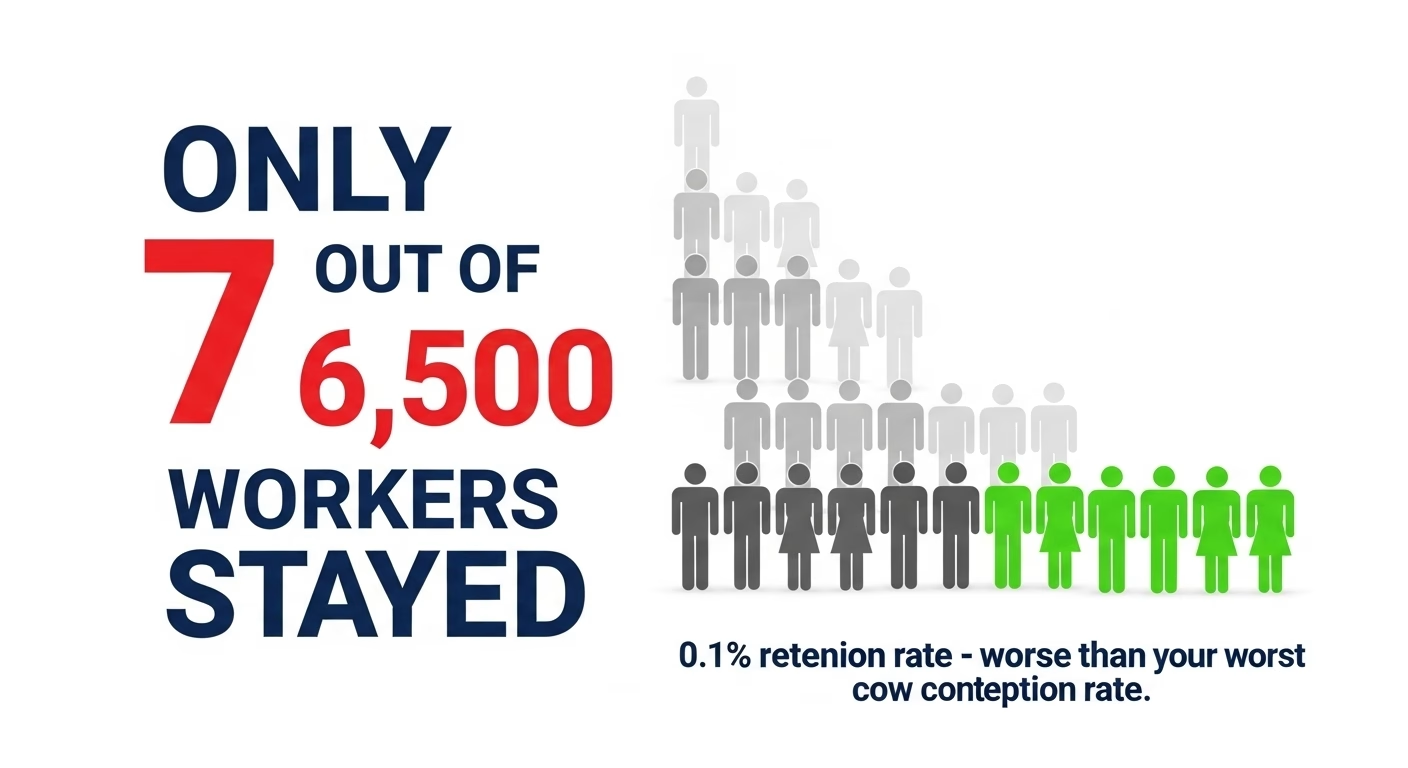

The Uncomfortable Data: In 2011, a program offered 6,500 agricultural jobs to domestic workers. Only 268 Americans applied. A mere seven stayed for the full season. Seven. Out of 6,500 openings. That’s a 0.1% retention rate—worse than your most problematic cow’s conception rate.

According to The Bullvine’s analysis, immigrant workers constitute 51% of the U.S. dairy workforce and are responsible for producing 79% of our milk supply, with substantial portions of these workers undocumented. This isn’t a workforce strategy—it’s a house of cards built on political quicksand.

Here’s the Critical Question: If domestic workers won’t take dairy jobs at current wages, and immigration policy remains hostile to agricultural labor, what’s your Plan B?

International Crisis Comparison: The Global Meltdown

Data Box: Global Dairy Labor Catastrophe (2024-2025)

| Region | Labor Crisis Indicator | Production Impact |

| United States | 51% immigrant workforce producing 79% of milk | Geographic shift: Kansas +15.7%, California -1.8% |

| European Union | Only 12% of farmers under 40 | Milk production down 1.8% in Q1 2025 |

| Canada | 5.4% dairy job vacancy rate | Projected to lose 50% of farms by 2030 |

| Australia | 55% of farmers are considering an exit | 30-year production low projected |

| New Zealand | 4,000 critical staffing shortage | Policy changes threatening migrant workers |

Case Study Sidebar: The Wisconsin Catastrophe

Wisconsin exemplifies the demographic disaster facing dairy. According to The Bullvine’s immigration analysis, Wisconsin’s dairy industry relies on 70% immigrant labor, with more than 10,000 undocumented workers performing essential functions. The University of Wisconsin-Madison puts it bluntly: “Without them, the whole dairy industry would collapse overnight.”

This isn’t just labor dependency—it’s an existential threat to America’s Dairyland itself.

The $32 Billion Elephant in the Milking Parlor

Challenging Conventional Wisdom: The industry consistently downplays immigration’s role, treating it as a “preference” rather than an existential dependency. This isn’t preference—it’s survival.

The Bullvine’s economic analysis reveals that eliminating all immigrant labor in the U.S. could result in a catastrophic $32.1 billion economic output loss and over 200,000 job losses. Retail milk prices could spike by an alarming 90.4% to $7.60 per gallon. Even a 50% reduction in immigrant labor could result in 3,506 dairy farm closures.

Data Box: The Hidden Cost of Labor Instability

- High Turnover Impact: 1.8% decrease in milk production

- Biological Costs: 1.7% increase in calf loss, 1.6% increase in cow death rates

- Average Recruitment Cost: $4,425 per employee

- Industry Turnover Rate: 30-38.8% annually

- 200-Cow Dairy Annual Cost: Over $11,000 in recruitment alone

But the biological costs are even more devastating: according to comprehensive industry analysis, employee turnover has been linked to a 1.8% decrease in milk production, a 1.7% increase in calf loss, and a 1.6% increase in cow death rates. Your labor instability is literally killing your livestock profitability.

The Technology Revolution: Separating Vendor Fiction from Farm Reality

Challenging the Automation Sales Pitch: While, at minimum, a 50 percent spike in dairy farm wages would add almost $1 per cwt. to the cost of production, making “robotic milking and other labor-saving technologies more cost effective,” the reality is more complex.

Here’s what the robot salesmen won’t tell you: the performance of robotic milking systems has “almost nothing to do with the hardware you bought and everything to do with how you manage it.” Farms with identical robots show dramatically different results based solely on management practices.

Case Study Sidebar: Dave Kammel’s Wisconsin Success

Wisconsin farmer Dave Kammel exemplifies successful strategic automation. According to The Bullvine’s robotic financing analysis, his installation of 2 robotic units delivered:

- 3 hours of daily labor savings

- “Best investment I’ve ever made” assessment

- Dramatic quality of life improvements

- Immediate operational efficiency gains

His experience demonstrates that automation transforms labor rather than eliminating it.

Data Box: Verified Automation ROI (2022-2025)

- Initial Investment per Robot: $150,000-$275,000

- Annual Labor Savings: $32,000-$45,000 per robot

- Direct Milking Labor Reduction: 60%

- Milk Yield Increase: 8.66% average, up to 28.5% with proper management

- Payback Period (Normal): 4-10 years

- Payback Period (Crisis Conditions): 18-24 months

According to The Bullvine’s robotic financing research, delaying robotic adoption costs mid-sized farms up to $160,600 per year in lost profit potential, with top-performing robots generating a $500 per day difference compared to average implementations.

The Wage Competition Fallacy: Why Paying More Won’t Save You

Data Box: The Wage Reality Check (2025)

- Farm Worker Average Wage: $17.55/hour – only 61% of non-farm wages

- Dairy Labor Costs: 10-15% of production costs for 200+ cow herds

- Estimated Range: $1.80-$2.30 per hundredweight

- Competitive Wage Spike Required: Minimum 50% increase

- Production Cost Impact: Nearly $1.00 per hundredweight increase

Analysis proves that competing with other sectors “based solely on wage would imply at minimum a 50 percent spike in dairy farm wages, which would add almost $1 per cwt. to the cost of production.” At that point, robotic milking becomes more cost-effective than wage competition.

This demolishes the conventional wisdom that “just pay more” solves labor shortages. The math doesn’t work.

Your Strategic Decision Framework: The Three-Pillar Transformation

Pillar 1: Labor-Light Operations

Immediate Actions (Next 30 Days):

- Audit labor-intensive tasks vulnerable to disruption

- Model ROI scenarios under both normal and crisis conditions

- Research automation vendors before crisis-driven demand inflates pricing by 15-25%

12-Month Implementation: Based on verified performance data from comprehensive industry analysis:

- Automated milking systems (60% labor reduction, 3-15% production increase)

- Automated feeding systems ($75,000-$125,000 investment, 35-45% annual ROI)

- Wearable sensors ($150-$200 per cow, 12-18 month payback)

Pillar 2: Human Capital Revolution

Case Study Sidebar: Progressive Employee Investment

The Bullvine’s human capital research shows that progressive dairy farms are discovering the “real cost of cheap labor.” One Wisconsin operation saw turnover drop from 7% to less than 1% after investing in employee housing—creating a waiting list for employment.

The Proven ROI of Human Investment:

- Structured onboarding: 50% reduction in training time, 60-70% productivity boost

- Quality housing: Dramatic retention improvements

- Career pathways: 69% more likely to remain 3+ years

- Employee development: $263,096 total ROI, including efficiency gains

Pillar 3: Market Positioning Advantage

While competitors struggle with labor costs, position yourself in premium markets. Escalating labor expenses compounds the difficulties faced by dairy farmers,” making premium positioning essential for funding automation and employee programs.

Table: The True Cost of Inaction vs. Strategic Adaptation (5-Year Projection)

| Scenario | Labor Cost Impact | Production Impact | Total Financial Impact | Competitive Position |

| Status Quo | $55,000+ recruitment costs | -1.8% annually | -$200,000+ | Declining rapidly |

| Wage-Only Strategy | 50% increase required | Minimal improvement | -$150,000 | Temporarily stable |

| Partial Automation | 30% reduction | +8.66% average | +$100,000 | Moderately competitive |

| Full Transformation | 60% reduction | +15-20% | +$300,000+ | Market leadership |

Your 30-Day Crisis Response Plan

Week 1: Crisis Assessment

- Calculate true labor cost, including turnover, lost production, and biological impacts

- Model three scenarios: current state, 50% labor reduction, full automation

- Research automation financing options before crisis-driven demand

Week 2: Strategic Planning

- Visit three automated operations in your region

- Interview farmers with 2022-2025 installations for real-world insights

- Calculate payback periods: 18-24 months under crisis vs. 4-10 years normal

Week 3: Financial Modeling

- Explore innovative financing models: 0% manufacturer deals, leasing options, pay-per-liter programs

- Assess infrastructure readiness: internet, power, barn layout

- Develop implementation timeline: AMS (6-8 months), feeding systems (3-4 months)

Week 4: Implementation Decision

- Choose the highest-impact, fastest-payback automation investment

- Establish vendor partnerships before crisis-driven demand escalates costs

- Create employee transition and retraining programs (90-120 days for competency)

The Bottom Line: Your Competitive Crossroads

Remember that shocking statistic from our opening? While 5,000 dairy jobs will go unfilled by 2030, smart operators aren’t just adapting—they’re using this transformation to eliminate competition and dominate market share.

The Harsh Reality: More than two-thirds of the country’s 9.36 million dairy cows are milked by immigrant workers,” yet policy uncertainty threatens this foundation. Meanwhile, The Bullvine’s analysis shows a potential $32.1 billion in economic losses if this workforce disappears.

Your Strategic Choice: The labor shortage isn’t your problem to solve—it’s your opportunity to seize. Every farm that closes due to labor challenges removes a competitor. Every operation that successfully automates gains market share.

Consider this final analogy: in the 1980s, the dairy industry faced a similar transformation with the shift from tie-stall to freestall housing. Farms that adapted early gained competitive advantages that lasted decades. Those who waited struggled to catch up or simply didn’t survive.

The labor crisis is today’s tie-stall to freestall moment—a fundamental operational transformation disguised as a temporary staffing problem.

Here’s your immediate next step: Calculate what your operation would look like with verified automation improvements: 60% labor reduction from robotics, 8.66% higher milk yields, and $160,600 annual profit potential per optimized robot. Then ask yourself: Are you building the farm that thrives in that reality or the one that becomes a historical footnote?

The farms that will dominate by 2030 aren’t those that solved the labor shortage—they’re the ones that made it irrelevant to their success through strategic technology adoption and workforce transformation.

Because in this industry, adaptation isn’t just about survival anymore—it’s about who defines the future of North American dairy farming.

KEY TAKEAWAYS

- Automation ROI Accelerates Under Crisis: Robotic milking systems delivering $32,000-$45,000 annual labor savings per robot with payback periods compressed from 4-10 years to just 18-24 months under severe labor shortage conditions, while increasing milk yields 3-15% and reducing somatic cell counts 15-20%.

- Hidden Labor Costs Devastate Operations: High employee turnover (30-38.8% industry average) triggers cascading biological impacts including 1.8% milk production decline, 1.7% calf loss increase, and 1.6% cow death rate increase, costing 200-cow dairies $11,000+ annually in recruitment before accounting for lost productivity.

- Geographic Production Shift Signals Winners: Kansas exploded 15.7% in milk production while traditional stronghold California declined 1.8%, proving labor-efficient regions are capturing market share as farms master automated feeding systems ($75,000-$125,000 investment) with 35-45% annual ROI.

- Immigration Dependency Creates $32B Risk: With immigrant workers producing 79% of U.S. milk supply, potential policy disruptions threaten 90.4% retail price spikes and 3,506 farm closures, making strategic automation a hedge against political volatility rather than mere efficiency upgrade.

- Technology Transforms Rather Than Eliminates Labor: Successful farms shift from labor-intensive to management-intensive operations, requiring new skills in equipment operation, data interpretation, and troubleshooting—creating “robot operator” and “automation technician” roles that replace jobs nobody wanted with careers people value.

EXECUTIVE SUMMARY

The dairy industry’s “just hire more workers” strategy is dead—and here’s the $32.1 billion proof. With 51% immigrant workforce producing 79% of U.S. milk and 5,000 jobs going unfilled by 2030, the labor crisis isn’t temporary—it’s permanent transformation that separates winners from casualties. High turnover rates of 30-38.8% annually are costing 200-cow dairies over $11,000 in recruitment alone, while also triggering 1.8% milk production losses and 1.7% calf mortality increases. Strategic automation now delivers 60% labor reduction with crisis-accelerated paybacks of 18-24 months versus normal 4-10 years, making robotic milking systems and automated feeding essential survival tools, not luxury upgrades. From Kansas (+15.7% production) to California (-1.8% decline), geographic winners are emerging as farms master labor-light operations while competitors cling to obsolete hiring strategies. The farms dominating by 2030 won’t be those who solved the labor shortage—they’ll be the ones who made it irrelevant through strategic technology adoption and workforce transformation.

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More:

- Winning the Workforce War: How Top Dairies Are Solving Labor Shortages in 2025 – Reveals practical strategies for building employer brands, implementing non-wage compensation packages, and structured training programs that cut turnover rates without breaking your budget.

- 2025 Dairy Market Reality Check: Why Everything You Think You Know About This Year’s Outlook is Wrong – Demonstrates how component optimization and strategic processor relationships create the cash flow necessary to fund automation investments while labor costs escalate by 20%.

- 5 Technologies That Will Make or Break Your Dairy Farm in 2025 – Exposes specific ROI data on smart calf sensors, AI analytics, and precision feeding systems that early adopters are using to achieve payback within 7 months.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!