The upcoming trade review isn’t just policy noise—it’s a deadline that’s separating dairy operations positioned for the future from those still hoping the past will return.

EXECUTIVE SUMMARY: Trade deals don’t kill dairy farms—the inability to scale and manage debt during the “waiting periods” does. The CUSMA 2026 review will dominate headlines for the next 18 months, but the real selection pressure is already here: Rabobank analysis shows 2,000-cow operations produce milk at $10/cwt less than 200-cow farms. That cost gap—not trade policy—explains why 39% of U.S. dairy farms exited between 2017 and 2022. Canadian producers face identical economics; farm numbers dropped from 12,000 to 9,200 this past decade despite supply management and CA$4.8 billion in government support. The squeeze is accelerating: Class III futures for 2027 sit at $17.00-17.25/cwt, down $5.50 from 2024’s $22.61 all-milk price. Operations that use the next 60 days to model breakeven costs, stress-test debt service ratios, and have hard conversations with lenders and processors will be positioned to act—whether to expand, optimize, or transition with leverage. The producers still dairying in 2030 won’t be those who waited for political salvation; they’ll be the ones who used this window to get better at fundamentals while others hoped the next compensation check would save them.

Somewhere in Oxford County, Ontario, a producer is sitting on CA$3.2 million in quota, watching the headlines about the upcoming CUSMA review and weighing whether to expand, hold steady, or start having serious conversations about transition planning. About four hours southwest, in Marathon County, Wisconsin, a 450-cow operation’s owners have been hearing for months that expanded Canadian market access will mean better milk prices—but the numbers on their actual milk check haven’t reflected much change at all.

Both producers are working through the same fundamental question: What does the next 18 months actually mean for my operation, and what should I be doing about it right now?

Having covered the North American dairy trade for over a decade and grown up on a dairy operation in Ontario, I’ve watched several of these negotiation cycles unfold. What strikes me about this particular moment is how much is converging at once—and how the nuances often get lost in the official talking points from all sides.

What’s Actually on the Table

When U.S. Trade Representative Jamieson Greer testified before Congress on December 17, 2025, dairy made the list of priorities. But here’s what’s worth understanding: it was part of a much broader agenda.

According to his testimony and subsequent reporting from CBC News and CTV, the full list includes expanded dairy market access, resolution of concerns about Canadian protein exports, modifications to Canada’s Online Streaming Act—which regulates platforms like Netflix, Spotify, and YouTube—addressing provincial alcohol distribution restrictions, and reforms to procurement practices in Ontario, Quebec, and British Columbia.

The scope matters more than most initial coverage suggested. The Online Streaming Act affects U.S. technology companies worth trillions of dollars. The alcohol restrictions have created significant challenges for American distillers, with companies like Brown-Forman reportedly seeing substantial impacts on Canadian sales. And Mexico brings its own priorities to the review, particularly around automotive rules and energy policy, that shape the overall negotiating dynamic.

What this context suggests for dairy operations: expanded Canadian market access is one priority among several, and the final outcome will likely involve trade-offs across multiple sectors. That doesn’t diminish dairy’s importance in the discussion—it just means the result will reflect broader strategic calculations.

The ITC Investigation: Adding Data to the Conversation

The U.S. International Trade Commission announced in May 2025 that it would examine “competitive conditions” in the nonfat milk solids market, with findings expected by March 23, 2026—roughly three months before formal CUSMA review discussions intensify.

The investigation, initiated at the request of the Senate Finance Committee, examines whether Canadian dairy protein exports have exceeded the agreed parameters under USMCA. Under the current agreement, Canada committed to limiting combined skim milk powder and milk protein concentrate exports to 35,000 metric tonnes annually. Current exports remain well below that threshold, but U.S. industry representatives have raised questions about whether high-protein concentrates classified under different trade codes might be creating additional market pressure.

There’s an interesting counterpoint worth considering here. Canadian economist Al Mussell, in an August 2025 analysis published through Agri-Food Economic Systems, noted that the United States is itself the world’s largest exporter of nonfat dry milk and skim milk powder, with volumes that significantly exceed Canada’s in both absolute and relative terms. U.S. exports have grown even as prices have softened—a pattern that, from an economic perspective, parallels some of the concerns raised about Canadian practices.

What to expect: The ITC report will provide valuable data for all parties as discussions move forward. How that data shapes the actual negotiations remains to be seen—these processes often involve considerations beyond the technical findings.

Understanding the Market Access Math

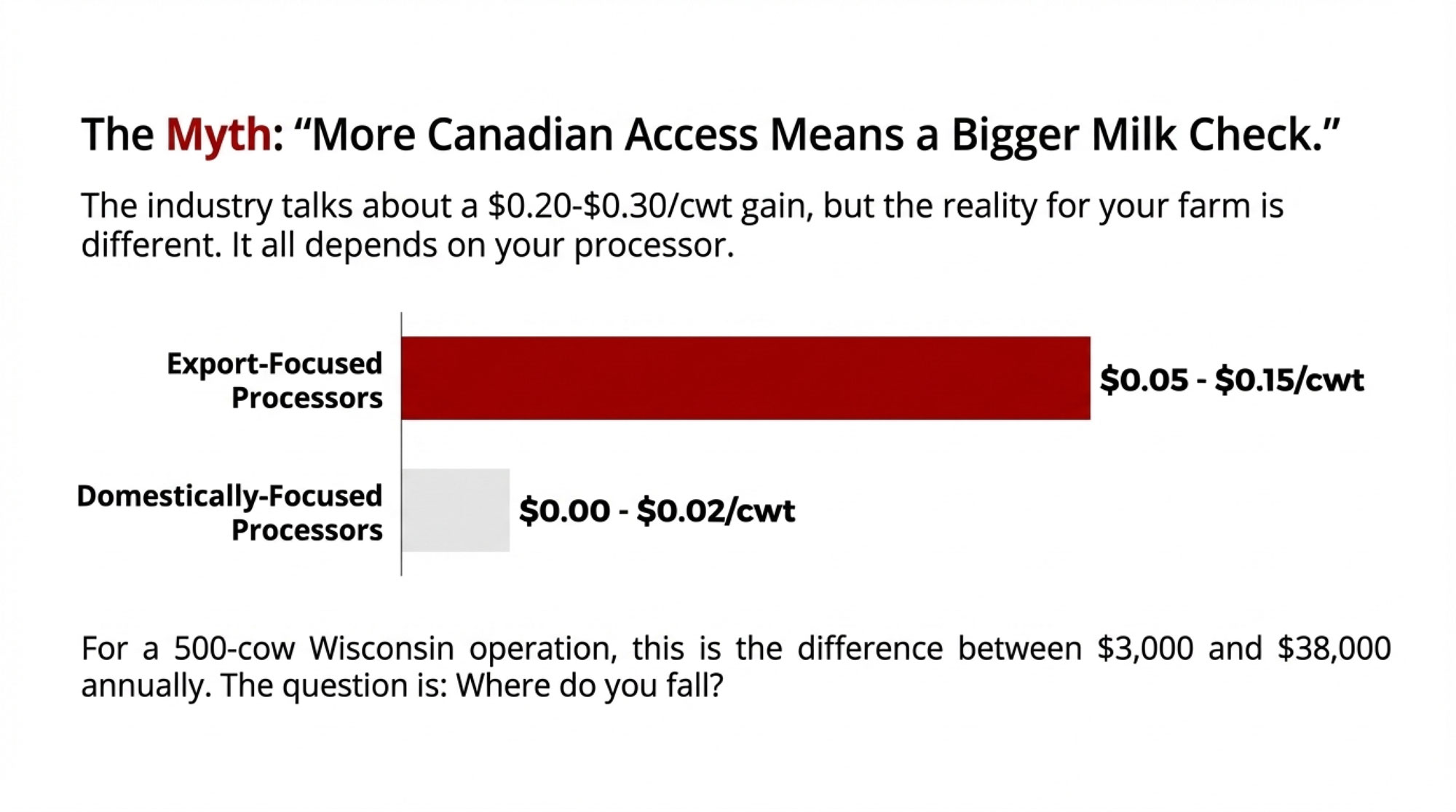

If you’re a U.S. producer, particularly in border states like Wisconsin, Minnesota, or New York, you’ve likely heard projections that expanded Canadian market access could mean $0.20-0.30/cwt in additional revenue. Industry analysis has cited figures in this range when discussing potential benefits.

Those aggregate numbers reflect real calculations. Expanding U.S. access from 3.5% to 5-6% would open roughly 300 million additional pounds of milk equivalent to Canadian buyers. For products commanding premium prices—particularly perishable items like cream or specialty cheeses—that additional market could generate meaningful value.

The distribution of that value, though, varies significantly by operation. According to USDA Foreign Agricultural Service data, approximately 42% of the USMCA dairy quota was utilized in the 2022/23 dairy year. The processors capturing that opportunity tend to be those with established Canadian relationships and export infrastructure already in place.

I recently spoke with a mid-sized Wisconsin producer whose cooperative has minimal business in Canada. His assessment was straightforward: “We watch these negotiations closely, but I’m realistic about what it means for our milk check specifically.” That perspective reflects what many operations experience—the aggregate benefits and individual impacts can look quite different.

A more nuanced breakdown based on processor positioning:

- Operations supplying export-focused processors: Potential uplift of $0.05-0.15/cwt on milk moving to Canadian accounts

- Operations supplying domestically-focused processors: Minimal direct impact, likely $0.00-0.02/cwt

- Industry-wide aggregate: $0.20-0.30/cwt as typically reported

For context, a 500-cow Wisconsin operation shipping roughly 127,500 cwt annually could see an annual impact of anywhere from $3,000 to $38,000, depending on processor relationships. Understanding where your operation falls in that range helps calibrate expectations.

| Processor Type | Likely Impact ($/cwt) | Annual Impact (500-cow op) | Who This Describes |

|---|---|---|---|

| Export-Focused Cooperative | $0.10-0.15 | $12,750-$19,125 | Processors with established Canadian customer relationships and export infrastructure; typically larger cooperatives in border states |

| Regional Cooperative with Some Export | $0.03-0.07 | $3,825-$8,925 | Mid-size co-ops that occasionally move product to Canada but it’s not core business |

| Domestically-Focused Cooperative | $0.00-0.02 | $0-$2,550 | Most regional co-ops with primarily U.S. customer base; minimal current Canadian business |

| Proprietary Processor | Variable | Variable | Depends entirely on specific processor’s Canadian market strategy; ask directly |

THE BULLVINE TRUTH: Trade deals don’t kill dairy farms. The inability to scale and manage debt during the “waiting periods” does. Every negotiation cycle produces winners who used the uncertainty to get stronger—and casualties who spent those same years hoping politics would save them from economics.

The Canadian Perspective

On the Canadian side, the CUSMA review comes after nearly a decade of cumulative market-access changes that have meaningfully shifted the competitive landscape.

CETA opened approximately 1.5-2% of the domestic dairy market to European imports starting in 2017. CPTPP added roughly 3.25% to Asia-Pacific trade in 2018. USMCA provided about 3.5% access for U.S. dairy beginning in 2020. Combined, that represents approximately 8.4% of Canada’s domestic dairy market, now open to foreign competition, according to Dairy Farmers of Canada estimates. When historical WTO minimum access commitments are included, DFC projects that imports now meet 18-20% of domestic demand.

The federal government has responded with substantial support programs totaling approximately CA$4.8 billion across initiatives for farmers, processors, and industry investment, according to Agriculture and Agri-Food Canada. For producers, the Dairy Direct Payment Program has provided annual payments based on quota holdings—government documentation from 2019 indicated an 80-cow operation would receive around $28,000 in the first year, with amounts varying by program year and quota held.

What’s particularly worth watching is the structure of the current CUSMA-related compensation package. Running from 2023-24 through 2028-29, the program makes a total of CA$1.2 billion available. The payment schedule appears designed to decline over the program period rather than remain level.

That structure suggests something important about how policymakers view these funds—as transition support with defined parameters rather than permanent protection. Producers planning beyond 2029 may want to consider that trajectory in their financial projections.

Prime Minister Carney has stated clearly that supply management is “not on the table” in these discussions. That’s a significant political commitment. At the same time, the cumulative pattern of incremental access concessions across multiple trade agreements suggests the system continues to evolve, even as its core structure remains intact.

The Consolidation Reality: What’s Actually Driving Farm Exits

Here’s the part of this conversation that needs more honesty: the structural consolidation reshaping dairy production on both sides of the border will affect more operations than any trade agreement ever will. And blaming CUSMA—or any trade deal—for farm losses is often easier than confronting the harder truth about dairy economics.

The data is unambiguous. According to USDA analysis, approximately 65% of the U.S. dairy herd now resides on operations with 1,000 or more cows. The 2022 agricultural census documented a decline from 39,303 dairy operations in 2017 to 24,082 in 2022—roughly a 39% reduction in five years. That’s not a typo. Nearly 40% of American dairy farms have exited in the past half-decade.

In Canada, farm numbers have declined from over 12,000 in 2014 to approximately 9,200 today, per Statistics Canada and Agriculture Canada data. And here’s the part that should give everyone pause: this happened despite supply management’s price stability provisions. The system designed to protect smaller producers hasn’t stopped consolidation—it’s just changed who captures the exit value.

$10/cwt: The cost gap between 2,000-cow and 200-cow operations. That’s not policy—that’s physics.

Let’s be direct about what’s happening. Trade policy makes a convenient scapegoat because it’s external. It’s easier to blame Ottawa or Washington than to acknowledge that your neighbor with 2,000 cows is producing milk at $8-10 less per hundredweight than your 200-cow operation. That’s not a rounding error—that’s the difference between surviving a down market and drowning in it. Lucas Fuess, Senior Dairy Analyst at Rabobank, put it plainly: farms milking more than 2,000 cows can operate about $10 less per hundredweight than farms with 100-199 cows. It’s easier to wait for the next compensation package than to have the hard conversation about whether your cost structure is viable for the next decade.

The economics have been clear for thirty years: dairy rewards scale, efficiency, and access to capital. Every cycle, some producers use the “uncertainty period” to modernize facilities, improve genetics, tighten their feed costs, and strengthen processor relationships. Others spend those same years attending protest rallies and waiting for political salvation.

Look at the survivors from NAFTA. Look at who’s still standing after CETA, CPTPP, and USMCA. It’s not the operations that had the best lobbyists. It’s the operations that used every window—including the uncertainty windows—to get better at the fundamentals: cost per hundredweight, components, cow comfort, and cash flow management.

I know a 600-cow operation in central Wisconsin that used the USMCA uncertainty window to lock in a 10-year processor contract, refinance at historically low rates, and invest in parlor automation. They’re now positioned as a preferred supplier with costs competitive with operations twice their size. That’s what using a waiting period looks like.

This consolidation trend operates completely independent of trade policy outcomes. Whether CUSMA is extended, modified, or faces more significant changes, the underlying economic pressures favoring efficient, well-capitalized operations will continue. Trade deals just accelerate what was already inevitable—and give struggling operations something to blame besides their own balance sheets.

What This Means By Farm Type

The strategic calculus looks different depending on where you sit:

- Large operations (1,000+ cows): You’re positioned to weather trade uncertainty, but don’t get complacent. The real question is whether to use this window to expand further or consolidate your position. Processor relationships matter more than ever—operations with strong component performance and consistent volume will find themselves in the driver’s seat as supplier bases shrink. Your risk is overextension during a pricing downturn, not trade policy. The operations capturing that $10/cwt advantage aren’t just bigger—they’re running tighter genetic programs with higher Net Merit sires and component-focused breeding decisions that compound over time.

- Mid-size operations (200-500 cows): This is the squeeze zone, and the next 18 months will determine who breaks through to the next tier and who gets caught in the middle. Your cost structure likely sits between the efficiency of large operations and the flexibility of small ones—without the advantages of either. The hard question: Can you scale up to capture economies of scale, or should you optimize for profitability at your current size? Waiting to decide is itself a decision.

- Smaller operations (<200 cows): Let’s be direct—the economic headwinds are real, regardless of what happens with CUSMA. Your path forward likely depends on one of three strategies: a niche-market premium (organic, A2, direct sales), exceptional cost discipline that defies the averages, or a clear-eyed transition timeline. What won’t work is hoping trade policy or compensation packages will restore the economics of a previous era.

Reading the Processor Signals

One of the more informative indicators of industry direction comes from tracking processor investment patterns—both the amounts and the types of projects receiving capital.

Major cooperative and multinational processors have been directing significant resources toward automation and efficiency improvements rather than primarily adding raw capacity. In Wisconsin and across the Upper Midwest, you’re seeing investments focused on doing more with optimized supplier networks rather than simply expanding volume.

Cross-border investment patterns tell a complementary story. Agropur committed $168 million to its Little Chute, Wisconsin, facility in 2021, creating 250 jobs and adding substantial cheese-making capacity. This fall, Lactalis finalized its NZ$4.22 billion acquisition of Fonterra’s consumer business—shareholder approval came in late October, with completion expected in early 2026.

These moves reflect companies building flexibility and optionality across borders—positioning for multiple potential scenarios rather than betting on any single outcome.

For individual producers, the practical implications depend on your specific processor relationships. Operations investing in automation generally aim to optimize for fewer, larger, more consistent suppliers. If your processor is focused on efficiency improvements rather than capacity expansion, that signals something about supplier priorities going forward.

The encouraging dimension here—and this matters: operations that establish themselves as preferred suppliers through consistent volume, strong component levels, and reliable delivery schedules will find processors competing for their milk even as overall supplier numbers decline. Component performance is increasingly decisive—with over 90% of the nation’s milk now priced by multiple components, producers delivering above-average butterfat and protein are capturing meaningful premiums. National butterfat levels reached a record 4.23% in 2024 according to CoBank analysis, and the genetic momentum suggests this trend will continue. There’s a genuine opportunity in this environment for well-managed operations, not just survival pressure.

Four Areas Worth Monitoring

Rather than predicting specific outcomes, here are four areas where developments over the next 12-18 months will provide meaningful signals for strategic planning.

1. Price trajectory indicators

Class III futures for 2027 have been trading in the $17.00-17.25/cwt range based on current CME Group data—down roughly $5.50 from the 2024 all-milk price of $22.61/cwt reported by USDA. If that pricing materializes, operations with tighter margins or higher leverage will face real decisions.

Practical step: Model your cost of production against those futures levels. If your breakeven sits above $17.50/cwt, what specific changes would close that gap? Understanding your options now provides lead time if conditions tighten.

2. Processor direction

Practical step: Early in 2026, have direct conversations with your milk buyer about their outlook: “Are you planning to increase milk purchases, hold steady, or reduce over the next three years? Are your investments focused on adding capacity or improving efficiency?” The specificity of the answers—and the confidence behind them—provides useful information.

3. Financial positioning

Operations with debt service exceeding roughly 35% of gross revenue at current prices face elevated vulnerability if margins compress. That threshold isn’t absolute, but it’s generally where lender comfort levels begin to shift, and operational flexibility narrows.

Practical step: Calculate your debt service ratio at current prices and at the futures-implied 2027 levels. Review those numbers with your lender and gauge their perspective. Lenders often see industry stress developing before individual operations feel it—their read on your position provides a valuable external perspective.

4. Policy evolution (particularly for Canadian operations)

When subsequent compensation packages are announced—likely in 2027-2028 if additional access concessions occur—the structure will signal policy direction more clearly than the headline amount.

Practical step: Watch how the total compares to current programs. Are payments front-loaded (suggesting transition orientation) or level (suggesting ongoing support)? Does the allocation shift toward processors and “innovation” initiatives rather than direct producer payments? The structure tells you what policymakers actually believe about the future, regardless of what they say publicly.

Questions Worth Asking

For your lender:

- “At $17/cwt sustained for 12 months, how does my current debt structure look from your perspective?”

- “If I wanted to expand significantly in the next 24 months, what would you need to see to support that?”

- “What’s your realistic read on asset values if I were considering a sale in the next 18 months?”

For your processor:

- “What’s your outlook on milk needs for 2026 and 2027?”

- “Are your regional investments primarily adding capacity or improving efficiency?”

- “How do you see expanded Canadian access affecting your business, if at all?”

For your own planning:

- “Am I positioned as a supplier my processor wants to retain and grow with, or am I more marginal to their plans?”

- “If prices remain soft through 2027, can I manage 12 months without significant additional borrowing?”

- “What would need to be true for me to still be operating successfully in 2030?”

These conversations can be uncomfortable. But producers who engage with them now, while options remain open, generally navigate transitions more successfully than those who defer until circumstances force decisions.

A Reasonable Outlook

Supply management in Canada will probably persist through this CUSMA cycle—Quebec’s political dynamics make elimination essentially impossible. But persistence doesn’t mean unchanged. Another 1-2 percentage points of market access, bringing total foreign access toward 10%, seems plausible, likely accompanied by compensation that’s somewhat smaller and more transition-oriented than previous packages.

The CUSMA review will most likely result in a 16-year extension, with modifications that allow all parties to claim gains. For most U.S. producers outside immediate border regions, the practical milk check impact will be modest—aggregate industry numbers will feature in announcements while individual operation effects remain considerably smaller.

The more significant factor shaping dairy’s future is the consolidation dynamic, which shows no signs of slowing. By 2028, both countries will have fewer dairy operations, larger average herd sizes, and processors with increasingly concentrated supplier relationships.

Moving Forward

If you’re working through this at the kitchen table or in the farm office, here’s the essential takeaway:

The next 18 months offer a window for thoughtful positioning—before trade uncertainty peaks, before 2027 pricing scenarios become current reality, before the next consolidation phase accelerates. Operations that are operationally efficient, appropriately leveraged, and aligned with processors investing in growth have the strongest position. Those facing structural challenges—compressed margins, elevated debt, processors not expanding—benefit from clear-eyed assessment now rather than reactive decisions later.

The goal isn’t to perfectly time markets or anticipate political outcomes. It’s to understand clearly where your operation stands, to engage the difficult conversations with lenders and family while time remains to act thoughtfully, and to choose your direction deliberately rather than have circumstances choose for you.

Priority Actions for the Next 60 Days

- Model your economics against 2027 futures pricing. Understand your breakeven and debt service ratios at those levels. The math works, or it doesn’t—better to know now.

- Schedule substantive conversations with your lender. Ask directly about their confidence in your operation under stressed conditions. Listen carefully to both words and tone.

- Engage your processor about their investment plans and volume outlook for 2026-2027. What they’re building (or not building) tells you something about where you fit.

- Clarify your strategic direction: Pursuing growth, maintaining a resilient mid-size position, or positioning for transition. If you can’t articulate your path clearly, developing that clarity is the first priority.

- For Canadian operations: Monitor compensation program structures closely, not just announcement totals. Declining, front-loaded, processor-oriented packages signal transition support; steady, producer-focused programs signal continued defense.

| Farm Profile | Strategic Position | Priority Action (Next 60 Days) | Key Question to Answer |

|---|---|---|---|

| Large Operations(1000+ cows) | Strong efficiency position; risk is overextension | Model expansion scenarios against $17/cwt sustained pricing; stress-test debt service at futures levels | Can I scale further without creating vulnerability if margins compress 12+ months? |

| Mid-Size Operations(200-500 cows) | Squeeze zone—need to scale up or optimize current size | Calculate breakeven at current size vs. cost to reach 800-1000+ cows; have lender conversation about both paths | Do I have capital access to break through to next efficiency tier, or should I optimize profitability at current scale? |

| Smaller Operations(<200 cows) | High cost structure; need differentiation or transition plan | Evaluate niche-market premium potential (organic, A2, direct sales) OR develop clear transition timeline with advisor | Can I capture a premium that closes my $8-10/cwt cost gap, or is it time for an exit strategy? |

| All Operations | Trade uncertainty creates positioning window | Schedule processor conversation about 2026-27 volume outlook; verify you’re a preferred supplier vs. marginal | Am I a supplier my processor is building around, or one they’re planning to replace? |

The Bottom Line

The producers who use this window to develop clarity—even when that clarity is uncomfortable—will be better positioned than those waiting for circumstances to simplify. The cost of waiting another six months for clarity? The positioning options that exist today—favorable refinancing terms, processor relationship conversations, expansion opportunities, and transition planning with leverage—may no longer be available once the ITC report drops in March and markets price in the new reality.

That pattern has held through every trade cycle I’ve observed over the past decade, and there’s no reason to expect this one will be different.

KEY TAKEAWAYS

- The $10/cwt gap is killing more farms than any trade deal. Rabobank analysis: 2,000-cow operations run $10/cwt cheaper than 200-cow farms. That cost physics—not CUSMA—explains why 39% of U.S. dairy farms vanished between 2017 and 2022.

- Supply management can’t outrun economics. Canadian farm numbers dropped from 12,000 to 9,200 this decade despite CA$4.8 billion in government support. Same consolidation, different flag.

- 2027 futures say $17/cwt. What does your breakeven say? Class III is down $5.50 from 2024’s all-milk price of $22.61. If you’re above $17.50, hoping for better prices isn’t a plan.

- Your processor is picking winners now. Automation investments mean fewer, larger, more consistent suppliers. The real question: Are you a supplier they’re building around, or one they’re planning to replace?

- The next 60 days matter more than 18 months of trade theater. Model your breakeven. Stress-test your debt service at $17/cwt. Have the hard conversation with your lender. The positioning leverage you have today evaporates when the ITC report drops on March 23.

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More

- The Four Numbers Every Dairy Producer Needs to Calculate This Week – You’ll gain a concrete 90-day survival roadmap. This breakdown of your true cost per cwt and liquidity runway arms you with the exact numbers needed to decide between expansion or a strategic, equity-preserving exit before spring.

- 2025 Dairy Year in Review: Ten Forces That Redefined Who’s Positioned to Thrive Through 2028 – Exposes the ten structural forces, like the 800,000-head heifer deficit, reshaping your long-term equity. It delivers a 2028 foresight blueprint that reveals why scale alone won’t save you if your capital allocation remains stuck in 2022.

- New Sensor-Based Milking Speed Trait from CDCB Debuts August 2025 – Reveals a breakthrough genetic advantage that directly optimizes parlor throughput and slashes labor costs. By leveraging the new sensor-based milking speed trait, you gain measurable efficiency that offsets the rising expense of managing a larger, more complex herd.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!