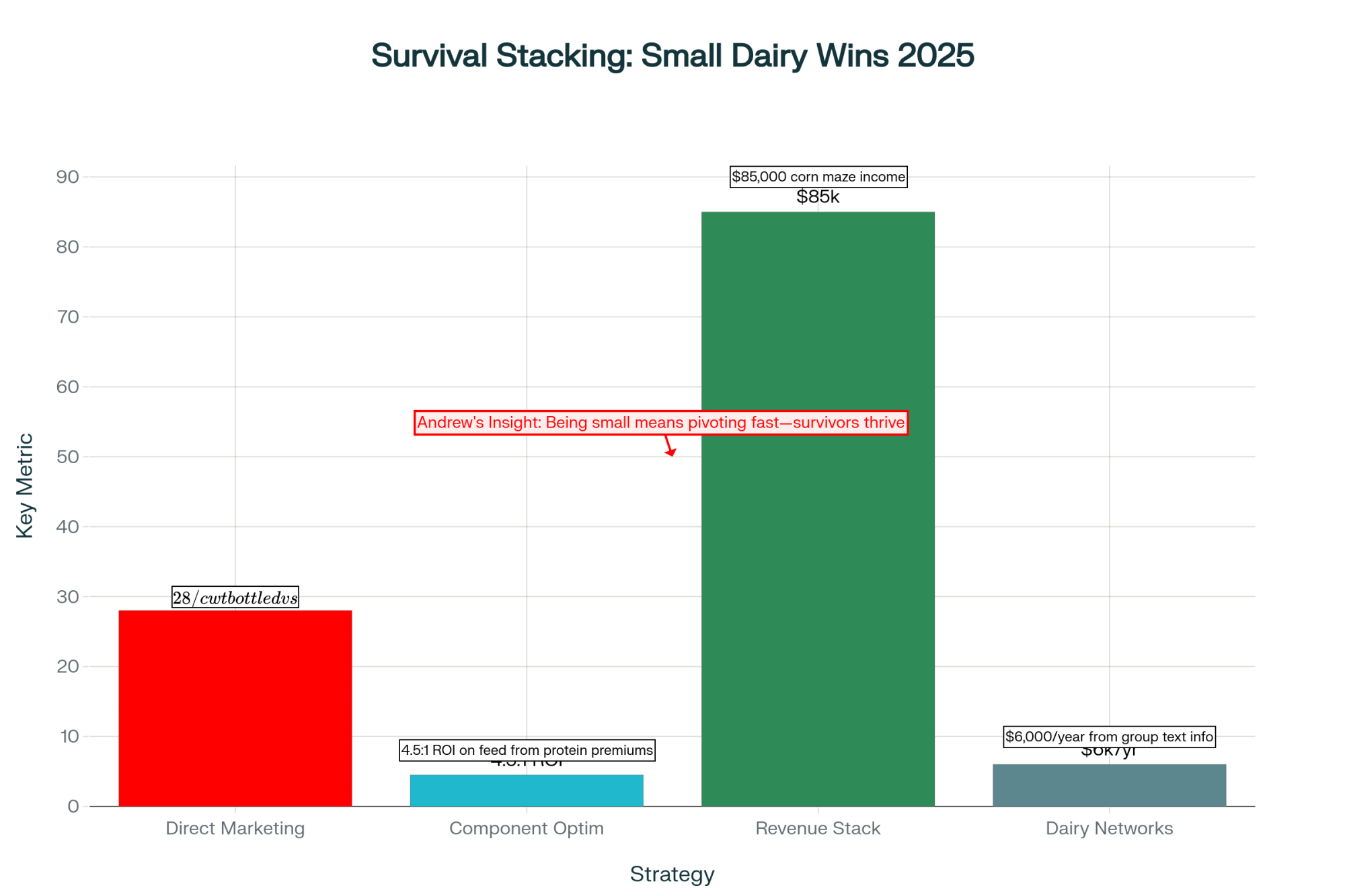

Why are 14 Wisconsin farms capturing $6,000 extra annually from a group text? The answer changes everything.

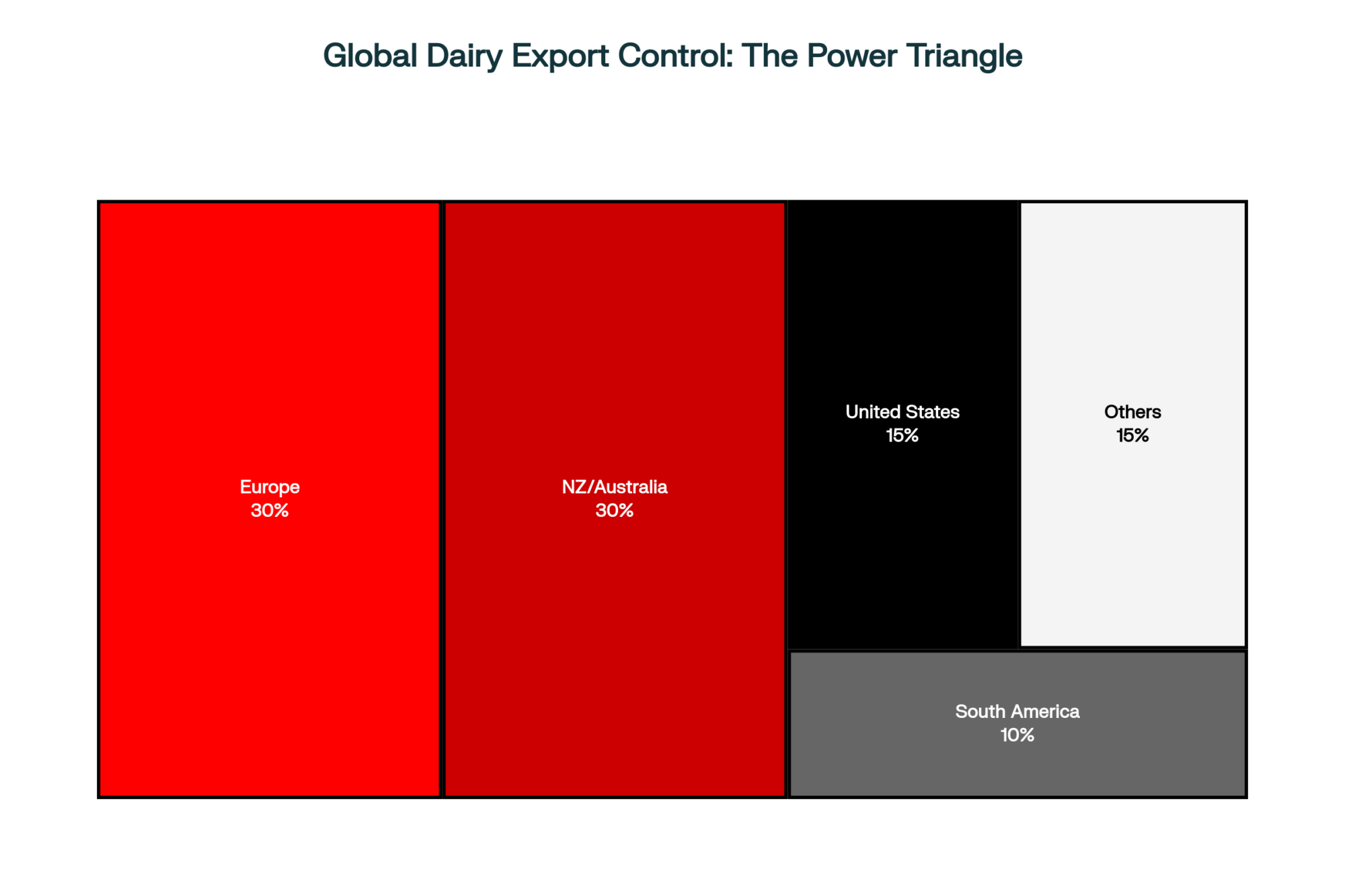

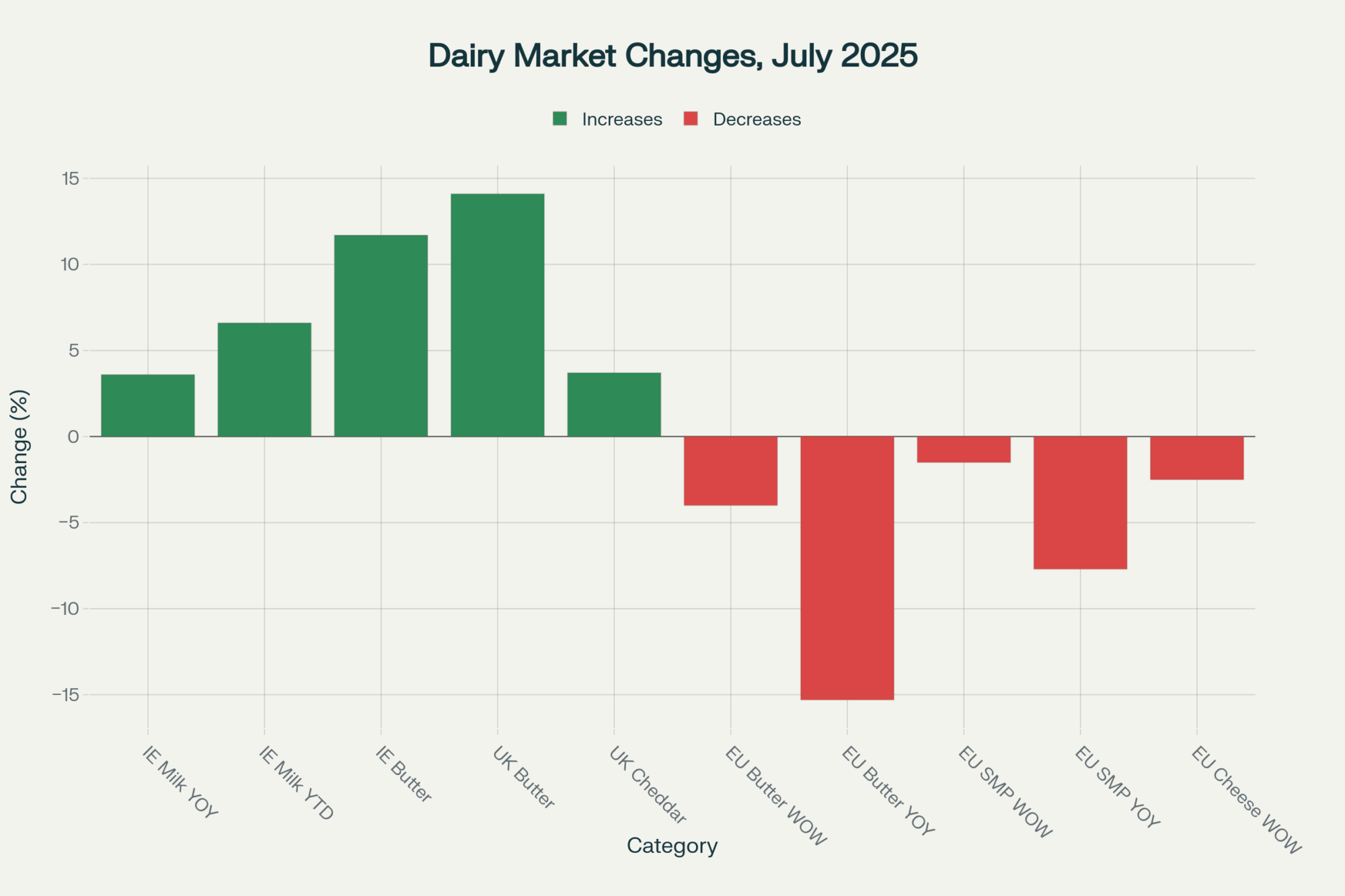

EXECUTIVE SUMMARY: We’ve uncovered something that challenges everything you’ve heard about dairy consolidation: Wisconsin farms under 200 cows are capturing $4-6 more per hundredweight than their 2,000-cow neighbors through component optimization, direct marketing, and collaborative networks. Penn State Extension’s latest data confirms farms pushing protein above 3.5% are banking an extra $5,110 annually on just 200 cows—that’s a 4.5:1 return on feed investment. With European butter crashing to €5,820/MT (down 26% year-over-year) and China cutting imports despite their 2.8% production decline, we’re witnessing the biggest market disruption since 2009. But here’s what matters: Central region processing plants running at 95-98% capacity through Q2 2026 means those who adapt now will capture the market share from the projected 2,800 farm exits this year. Cornell’s data shows milk solids production up 1.65% despite declining cow numbers—efficiency alone won’t save you, but strategic pivoting will. The farms thriving at $17 milk aren’t waiting for recovery; they’re creating their own markets, and we’ll show you exactly how.

Monday morning, 6 AM. Coffee’s hot, but the numbers are cold.

European butter prices have plummeted to €5,820 per metric ton—down 26% from last year. Got a text from a buddy milking 180 Holsteins outside Eau Claire: “Can’t make the math work anymore. Not at these prices.”

But here’s where it gets weird…

Ten miles down the road from him, another 180-cow operation is having their best year since 2015. Same milk price. Same feed costs. Guy’s actually thinking about buying another robot. Posted pictures of his new Ram 3500 on Facebook last week.

What the hell’s going on?

REGIONAL BREAKEVEN REALITY CHECK

| Region | Breakeven Price ($/cwt) | Main Challenge | Competitive Edge |

| Northeast | $20-22 | Trucked grain | Long-term stability |

| Upper Midwest | $18.50-19.50 | Local corn | Networked knowledge |

| Southeast | $21-23 | Heat stress | Alternative revenue |

| California | $19-21 | Water cost | Market access |

Northeast: $20-22/cwt (trucked grain, 1970s tie-stalls)

Upper Midwest: $18.50-19.50/cwt (local corn helps)

Southeast: $21-23/cwt (heat stress kills everything)

California: $19-21/cwt (water ain’t free) Your Farm: $_____?

The October Numbers That Matter (Spoiler: They’re All Bad)

Let me paint you the picture: Class III is bouncing between $16.50 and $ 17.00/cwt, while your breakeven’s probably north of $19. Maybe $20 if you’re honest about that new loader payment.

The Europeans? They’re drowning in milk. French production jumped 4% year-over-year. Germans added 2.1%. The entire EU bloc produced 13.75 million tonnes in August—up 3.3%. Their reward? That €5,820 butter price that keeps sliding like a fresh cow on ice.

Meanwhile, the USDA’s September outlook indicates that we are heading for 230 billion pounds in 2025. Another 231.3 billion forecast for 2026. More milk into markets, such as China.

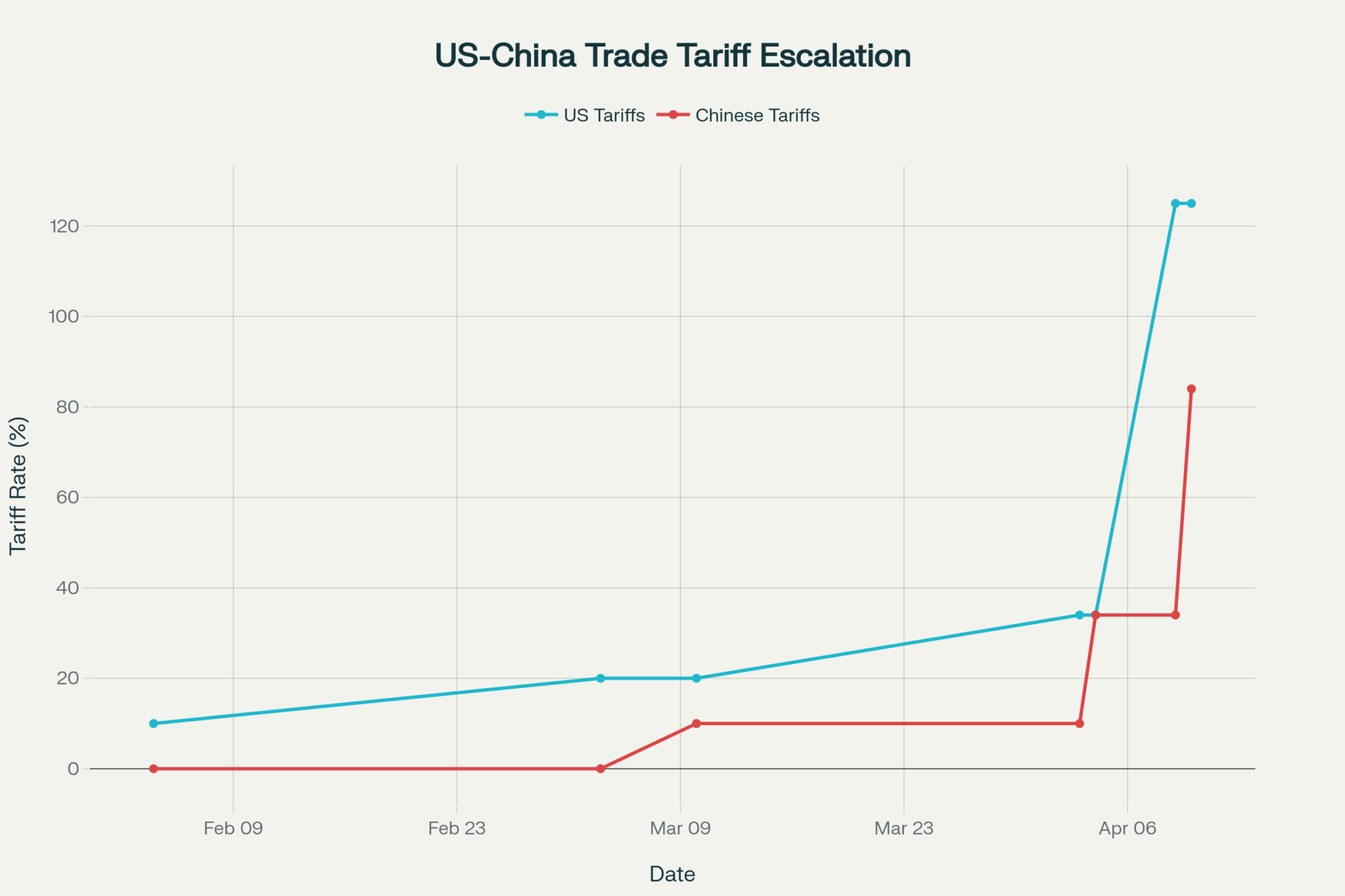

The thing about China—and nobody at World Dairy Expo wanted to say this out loud—they’re done buying. Down 2.8% in domestic production, sure, but they’re cutting imports anyway. Why? Because over 90% of Chinese dairy farms are hemorrhaging money. They’d rather have empty shelves than lose more cash buying our powder.

That growth story we built our entire export strategy around? It’s not coming back. And if you’re waiting for it to, you might want to update your resume.

Small Farms Are Beating Big Dairies (No, Really)

This is gonna sting for some of you, but those small farms everyone said would die? Some of them figured out what the 2,000-cow operations missed.

Penn State Extension’s Virginia Ishler and her team have been tracking this. Farms under 200 cows doing direct marketing or adding value on-farm? They’re capturing $4 to $ 6 more per hundredweight. That’s not a rounding error. That’s the difference between bankruptcy court and buying that neighbor’s 40 acres when he quits.

“I started bottling 20% of my production in June. Same milk that would’ve gotten me $17 at the co-op, I’m getting the equivalent of $28 on the bottled stuff. Yeah, there’s more work. Yeah, I’m tired. But tired beats broke.”

— Vermont producer, 165 cows

What really strikes me about Wisconsin is how fast this shift is happening. Brody Stapel at Double Dutch Dairy near Cedar Grove—you might know him, as he sells at the Sheboygan Farmers Market—started bottling in May. Non-homogenized, low-temp pasteurized, glass bottles. It turns out that lactose-intolerant individuals can actually drink it. He now has home delivery routes, featuring the Farm Stapels brand, in three Piggly Wigglys.

Still ships 95% to Sargento. But that 5% bottled? That’s where his profit lives.

Success Metric: Of the 14 Wisconsin farms in that information network, 12 are expanding operations while the state average is contracting. That’s not luck—that’s strategy.

Three Things That Actually Work (With Real Numbers, Not BS)

1. The Component Game (AKA Your Only Lever)

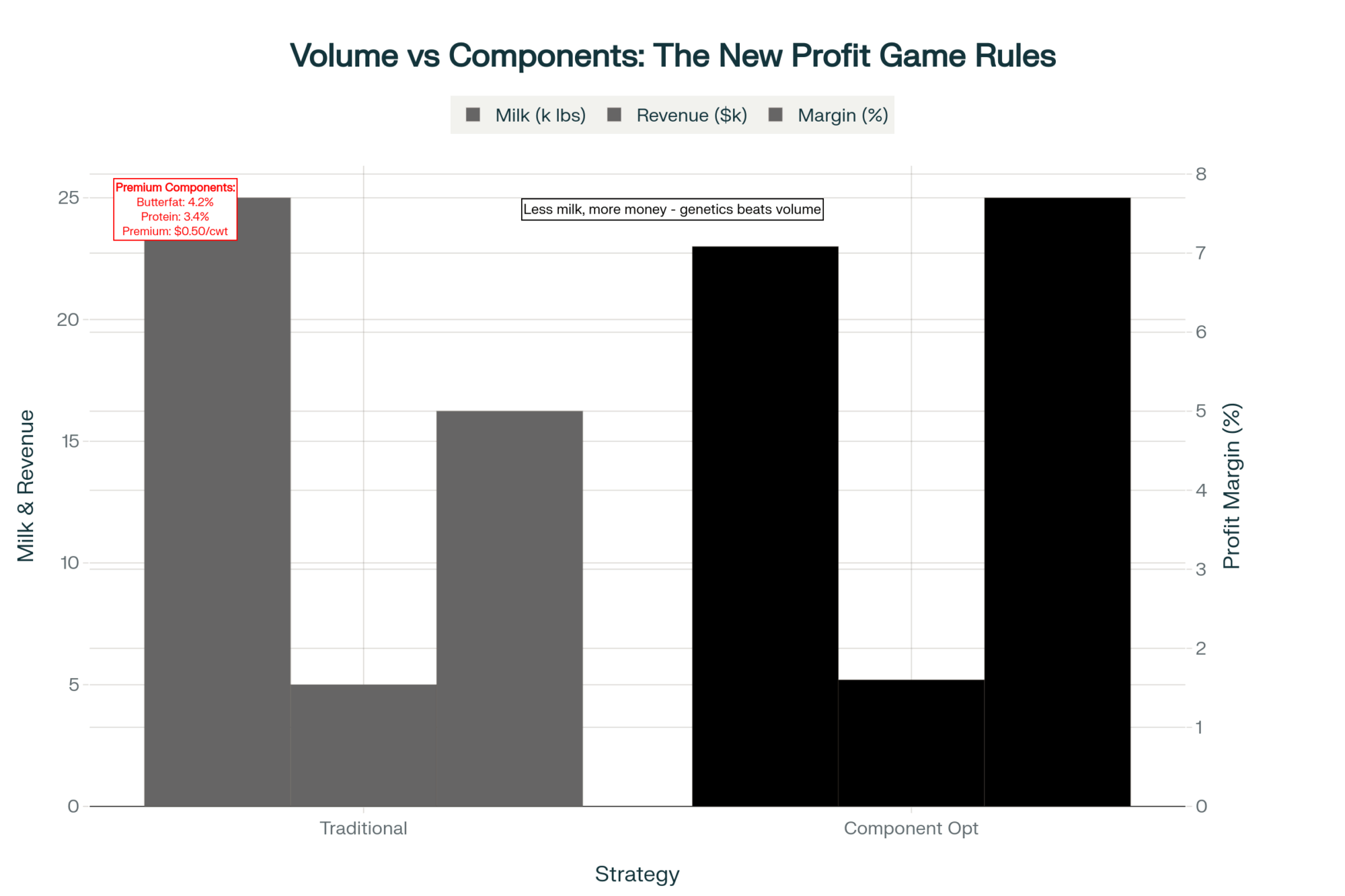

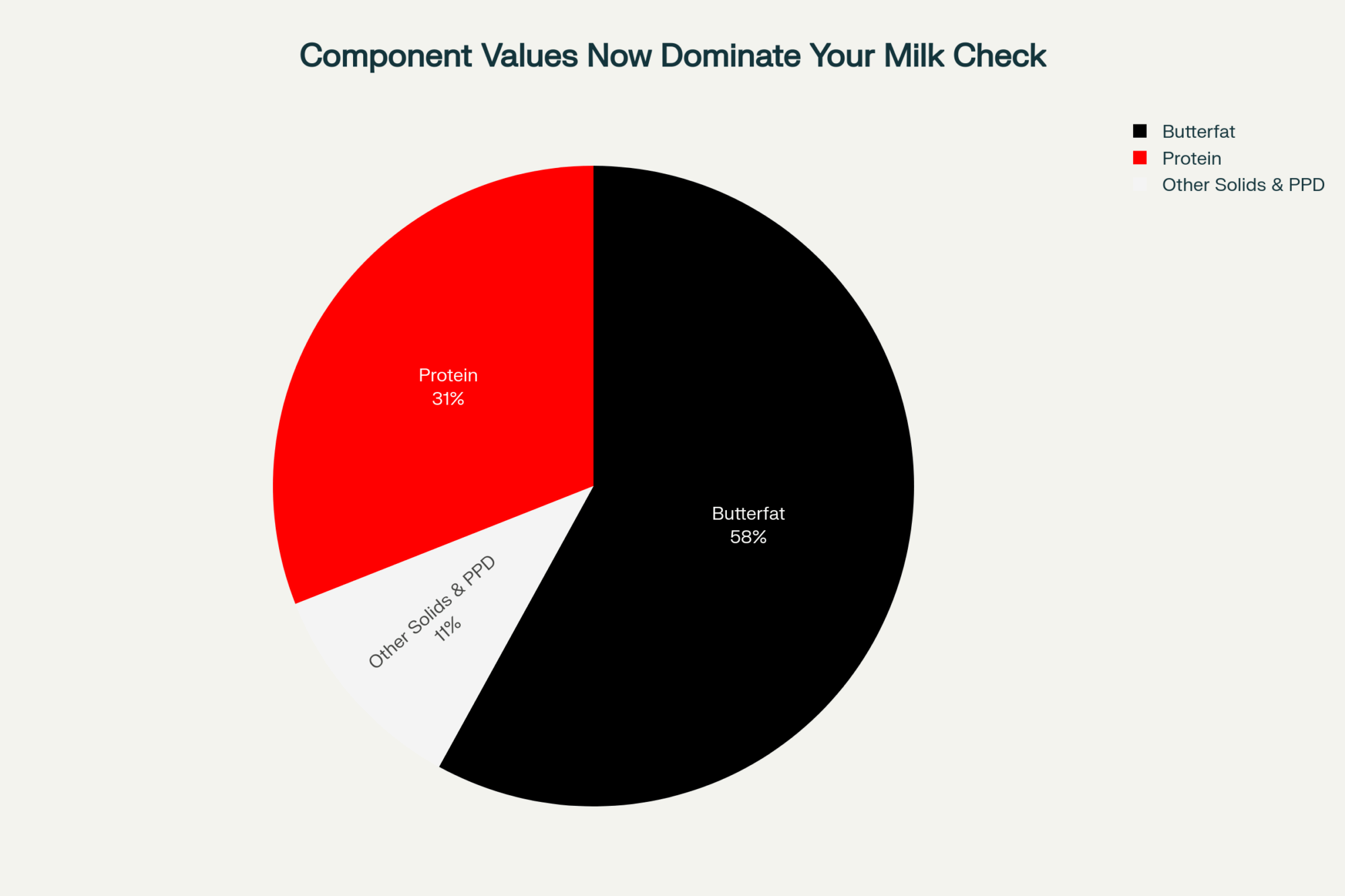

Forget the noise for a minute. The national average is 4.23% butterfat and 3.29% protein. But here’s what matters—farms pushing protein above 3.5% are banking on that 10-cent premium. Every. Single. Shipment.

COMPONENT PREMIUM REALITY (October 2025)

Butterfat: 4.23% average = Base price

Protein: 3.29% average = Base price

Protein: 3.50% achieved = +$0.10/cwt premium

Protein: 3.70% achieved = +$0.18/cwt premium Your Components: ___% fat % protein = $ premium?

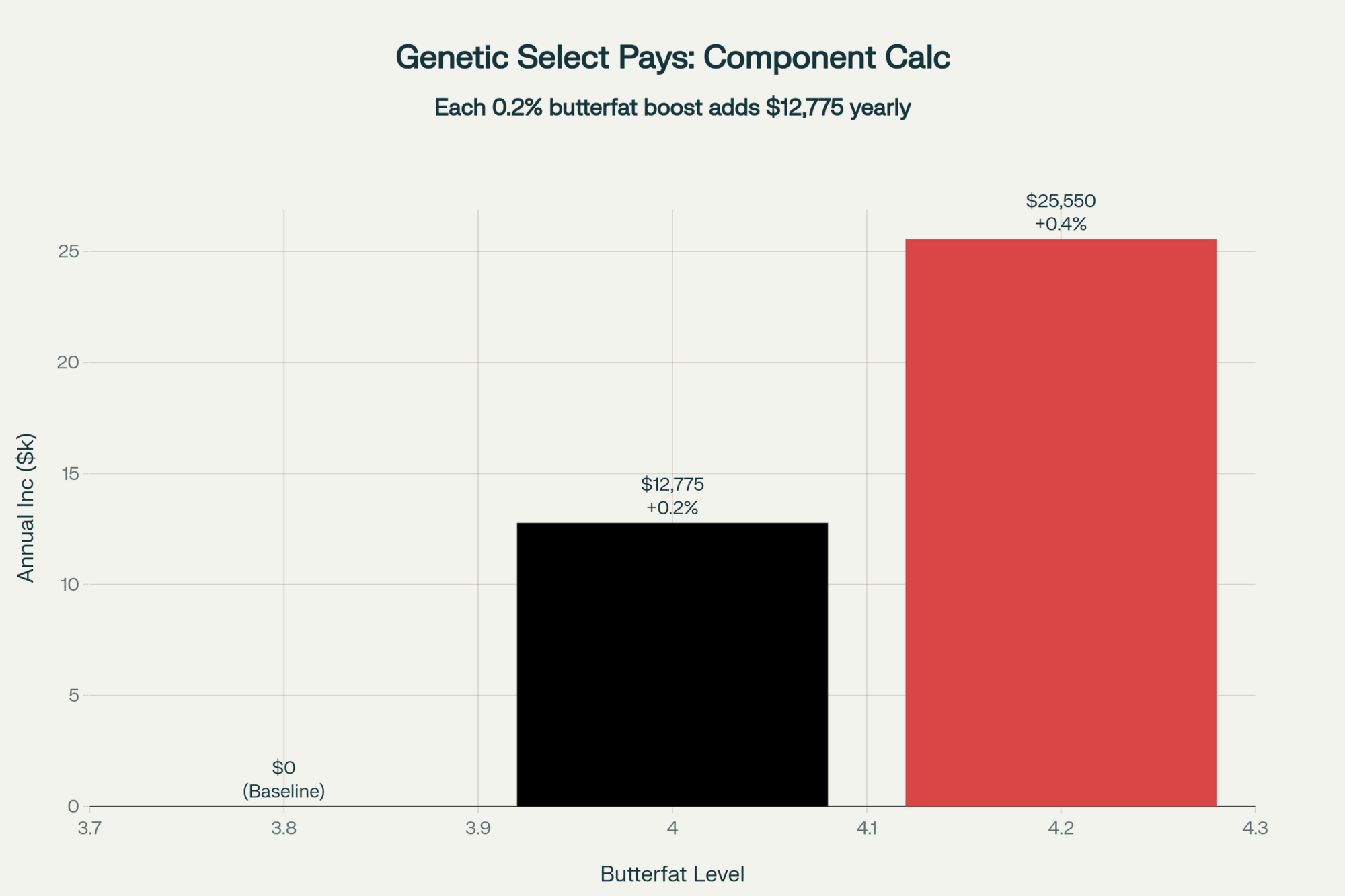

Here’s the Math Nobody Shows You:

200-cow dairy pushing protein from 3.29% to 3.50%:

- Daily production: 14,000 lbs (70 lbs/cow average)

- Premium captured: $0.10/cwt

- Annual premium: $5,110

- Feed cost increase: ~$1,500

- NET GAIN: $3,610

That’s your property tax. Or three months of health insurance. Or that used feed mixer you’ve been eyeing on Craigslist.

Wisconsin’s MILK2024 program breaks it down even further. Every 0.1% protein increase? Worth $8,000-10,000 annually on a 200-cow dairy. That 180-cow farm in Eau Claire? They’re projecting $18,000 additional revenue this year from protein optimization alone.

Feed cost to achieve it? Maybe $4,000 if they’re buying bypass protein. That’s a 4.5:1 return. Show me another investment doing that right now.

2. The $6,000 Group Text (Information Arbitrage)

Here’s something the old-timers absolutely hate but works. Fourteen producers in central Wisconsin formed a text group. Not a co-op, not an LLC, just a group text.

Tuesday morning: “Agropur taking spot loads at $17.50” Wednesday: “Land O’Lakes needs high-protein, paying premium” Thursday: “Ellsworth cheese plant basis shifted, avoid”

They’re each capturing $4,000-$ 6,000 annually just by knowing where to ship when. One guy ships to three different plants in a week sometimes. His dad would’ve called that crazy. His banker calls it smart.

“We’re not competing anymore,” one told me over Spotted Cow at the Legion hall. “We’re surviving together. Competition’s a luxury we can’t afford.”

3. Revenue Stacking (The Small Farm Secret Weapon)

Research from Kansas State confirmed what I’m seeing everywhere: farms with fewer than 300 cows can pivot faster than larger operations. They’re not more efficient. They’re more flexible.

Real examples from this month:

Pennsylvania, 150 cows: Added agritourism. Corn maze, birthday parties, and “pet a calf” experiences. Bringing in $85,000 annually. That’s $567 per cow, which has nothing to do with milk prices. Their bank loves them now.

Minnesota, 225 cows: Solar panels on the barn and that back 40 that floods every spring anyway. Twenty-year lease at $1,200/acre/year. Better than growing $4.50 corn on ground that might flood.

Wisconsin, 175 cows: Custom raising heifers for the 3,000-cow dairy down the road. Gets $2.75/head/day. Better margins than milk. No market risk—the big farm owns the heifers.

Iowa, 190 cows: Went seasonal. Dry everyone off from December through February. Match spring flush to fluid premiums. Capturing $1.50/cwt more April-August. Cows are healthier. He’s definitely healthier.

The Processing Disaster Nobody’s Discussing

Leonard Polzin from UW-Madison laid out the truth at January’s Ag Forum, and it’s worse than you think. That “$11 billion in new processing capacity” everyone’s talking about? Most won’t be operational until Q2 2026. Some won’t happen at all if milk stays at $17.

Central region plants running at 95-98% capacity isn’t temporary. It’s your reality through next summer at a minimum. Wisconsin co-ops have already sent the letters—base excess penalties take effect on November 1.

One co-op (you know which one) is implementing tiered pricing:

- Base production: $17.00/cwt

- 101-110% of base: $14.50/cwt

- Over 110%: $13.00/cwt

Minnesota’s actually worse. A producer near Winona told me that anything over 105% of base gets $13.00. Thirteen dollars! That’s 1995 prices with 2025 costs.

What happened at Hastings Creamery should terrify everyone. Processing 150,000 pounds daily until the discharge permit is issued. Farmers had milk, but the plant couldn’t take it. Lucas Sjostrom from Minnesota Milk confirmed they were “voluntarily dumping milk on-farm.”

That’s not oversupply. That’s infrastructure collapse.

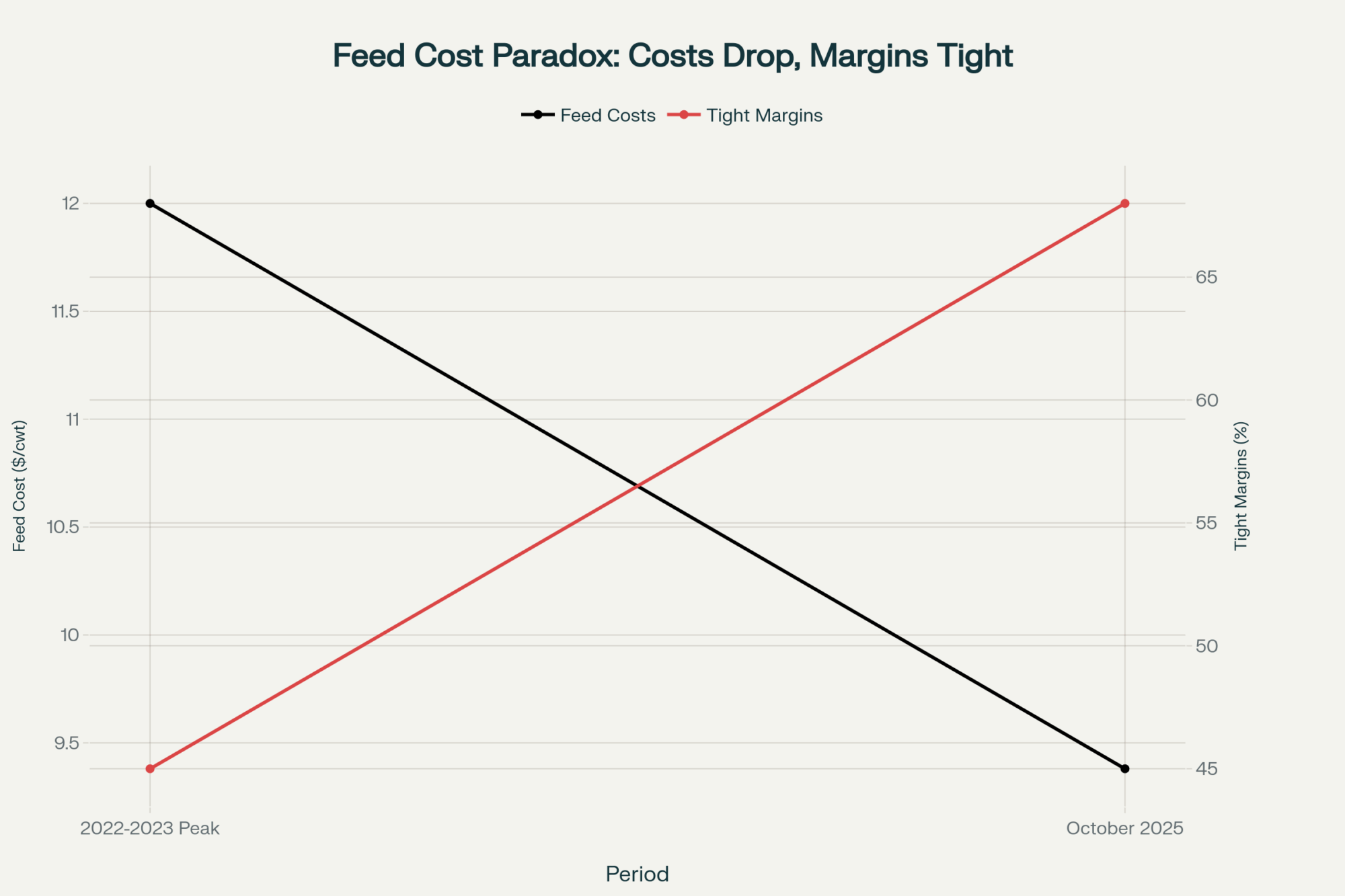

Your Feed Market Reality (It Gets Worse)

Current markets, if you’re buying this week:

- December corn: $4.45-4.65/bu (my neighbor who grows corn says $5 by January)

- Soybean meal: $285/ton and climbing

- Quality hay: Good luck finding any under $280/ton

Talked to a nutritionist who manages 15,000 cows across Wisconsin. His take? “We’re looking at $5 corn by February if South America has any weather issues. These guys buying hand-to-mouth are gonna get crushed.”

Your feed costs are rising while the milk price is falling. That’s not a squeeze—that’s a vice.

THE REAL BOTTOM LINE

Waiting for $20 milk is like waiting for your ex to apologize.

It might happen, but you’ll probably die first.

Finding ways to make $17 work? That’s survival.

What Winners Do Different (Hint: Everything)

Spent the last month analyzing farms under 300 cows that are actually thriving. Not surviving—thriving. Banking money. Taking vacations. Sleeping at night.

Three patterns kept showing up:

Ruthless Efficiency: Successful 150-cow farms run 65-70 cows per worker, same as mega-dairies. Automated gates, crowd control gates, and possibly even a robot. One guy near Dodgeville milks 150 cows faster than his dad milked 50. “We work smarter, not harder. Had to—can’t afford hired help at $20/hour.”

Revenue Stacking: Wisconsin farm that blew my mind—milk revenue, plus beef-on-dairy ($900 per calf right now), plus custom heifer raising ($2.75/day), plus solar lease ($1,200/acre), plus direct butter sales to three Madison restaurants ($8/lb). Five revenue streams. Same 180 cows. Same land. Same family.

Collaboration Without Consolidation: Five 200-cow farms in Dodge County formed an LLC—but just for buying feed. They’re getting loads at 1,000-cow pricing but keeping independence. Another group shares a nutritionist, vet, and relief milkers. “We compete Tuesday, cooperate Wednesday,” as one put it.

The Uncomfortable Math on Consolidation

Let’s talk real numbers. Wisconsin lost 455 farms last year. Ninety-four in October alone. The state’s own survey revealed that 17% of all dairy farms plan to exit within five years. Farms under 100 cows? Twenty-two percent say they’re done.

Those aren’t statistics. Those are your neighbors.

But here’s the weird part—Cornell data shows milk solids production up 1.65% year-to-date despite fewer cows. We’re getting more efficient at producing milk nobody wants. It’s like running faster toward a cliff.

Industry consolidation data indicate that farms with between 150 and 400 cows have the highest costs and the lowest returns. Too big for small-farm premiums, too small for commodity efficiency. That’s the kill zone.

Your Next 90 Days (The Only Timeline That Matters)

Week 1-2: Face Reality, Get brutal about costs. Penn State’s got worksheets. Cornell’s got spreadsheets. If you don’t know your breakeven to the penny—not the hundredweight, the actual penny—you’re not farming, you’re gambling.

Week 3-4: Component Focus Check your last three months of component tests. Calculate what 0.1% more protein means for your check. The Center for Dairy Excellence ECM calculator shows exactly this. That 180-cow farm pushing protein? They check tests like day traders check stocks.

Week 5-8: Find Your Stack. What else can your farm do? Direct sales? Custom work? Solar? Agritourism? Beef-on-dairy? Pick one. Start small. Test it.

Week 9-12: Make The Choice. Get creative or get out. Harsh? Yeah. True? Also yeah.

The farms that do the same thing in the same way are the ones getting auction flyers printed. The ones trying something—anything—different are the ones buying at those auctions.

The Decision That Can’t Wait

Met a 73-year-old dairyman in Marathon County last month. Just installed robots. At 73. Asked him why.

“Because standing still means dying, and I’m not ready for either.”

Markets don’t care about your grandfather’s legacy. Don’t care how many generations your family’s been milking. They care about supply, demand, and who produces the cheapest.

European futures signal more pain coming. GDT auctions confirm it—WMP at $3,650 and sliding. The Wisconsin harvest basis shows the whole rural economy’s stressed. When grain farmers hurt, equipment dealers hurt, banks tighten, and credit disappears.

The 2,800 farms are expected to exit this year? That’s market share for somebody. Question is whether you’re capturing it or becoming it.

Your Choice (And Yeah, You Have to Choose)

Your October check is what it is. November’s definitely worse. December… let’s not even go there.

But what you do today—literally today, Monday, October 20—determines whether you’re buying your neighbor’s cows next spring or selling yours.

That thriving 180-cow farm down the road? They made tough choices two years ago when they still had options to consider. The bottling equipment, component optimization, and direct sales routes—none of it happened overnight. They saw this coming and adapted early.

They chose to change when changing was optional.

Now it’s mandatory.

What’s your choice?

Because doing nothing? In this market, that’s choosing to fail. And failure’s got a really high acceptance rate right now.

KEY TAKEAWAYS

- Component Premiums = Immediate ROI: Push protein from 3.29% to 3.50% and capture $8,000-10,000 annually per 200 cows. Wisconsin’s MILK2024 calculator shows feed cost increases of $1,500-2,000, yielding returns of $5,110+. Start Monday by reviewing your last three months of component tests and calculating potential gains.

- Information Networks Beat Individual Guessing: Fourteen Wisconsin producers sharing real-time spot prices and processor needs via group text are each banking $4,000-6,000 extra annually. Create or join a trusted network this week—Tuesday’s spot load at $17.50 beats Wednesday’s regular haul at $17.00.

- Revenue Stacking Under 300 Cows: Small farms adding just one alternative revenue stream (agritourism: $85,000/year, custom heifer raising: $2.75/head/day, solar: $1,200/acre) are achieving better margins than pure milk production. Pick one complementary enterprise that fits your land and labor—test it small, scale if profitable.

- Direct Marketing Captures Hidden Premiums: Bottling just 5-20% of production for local sales can yield $28/cwt equivalent versus $17 commodity price. Center for Dairy Excellence worksheets show breakeven at 800 gallons/week for most operations. Glass bottles, non-homogenized, farmers markets—that’s where the margin lives.

- Processing Capacity Crisis = Pricing Opportunity: With plants at 95-98% capacity and tiered pricing hitting ($17 base, $14.50 over-base), strategic production management beats volume chasing. Match your flush to processor needs, not calendar tradition—April-August fluid premiums can add $1.50/cwt for seasonal producers.

Data Sources & References

Market data compiled from EU Commission Milk Market Observatory, USDA reports (pre-shutdown), Penn State Extension, Cornell PRO-DAIRY, UW-Madison Dairy Markets, Kansas State University research, and the Center for Dairy Excellence. Market prices reflect mid-October 2025 conditions. Additional reporting from regional cooperatives, the Minnesota Milk Producers Association, and producer networks.

Component Optimization Tools:

- Penn State Dairy Sense – Full cost analysis

- Cornell DFBS – Benchmarking tools

- Wisconsin MILK2024 – Feed efficiency calculator

- Center for Dairy Excellence ECM Calculator – Component value analysis

Learn More:

- Why Your Neighbor’s Making $1,000 More Per Day From The Same Cows (And What You Can Do About It) – This tactical guide reveals the specific genetic and nutritional levers needed to capture the $4.60/cwt butterfat premium—a critical complement to the main article’s protein focus. It includes actionable strategies for heat stress abatement and genomic testing to bank over $370,000 annually.

- 2025’s Dairy Dilemma: Record Exports, Falling Checks, and What Every Producer Must Decide Next – This strategic analysis digs into the brutal paradox of high export volumes coinciding with low prices, explaining how discount global pricing and the volatile CME spot market are directly eroding your base milk check. It’s essential context for long-term planning.

- The Tech Reality Check: Why Smart Dairy Operations Are Winning While Others Struggle – If you’re considering automation like the thriving 180-cow operation, this report is mandatory. It exposes the 40% hidden costs above sticker price and provides the honest 3.8-to-5-year ROI benchmarks necessary for profitable, risk-managed technology adoption.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!