Consistency isn’t a suggestion—it’s biology. Same time, same temp, same quality = 2.6 lb ADG and $100+ more per calf.

Good calf growth starts with steady habits—consistent feeding, clean water, and careful observation. From birth through 120 days, the calf’s diet and environment change rapidly, and how those changes are managed determines strength, health, and efficiency later on. Success comes from small, repeated actions done right every day.

Philosophy in Practice

Calves grow on consistency. Steady feeding times, clean water, dry air, and no sudden ration changes are the foundation of every good calf program.

Consistency Drives Growth

- Feed at the same times every day

- Keep milk solids and milk temperature consistent

- Replace the starter daily so it smells clean and fresh

- Make ration changes gradually over 4–7 days

Quick Start Essentials:

□ Buy Brix refractometer ($30)

□ Buy digital thermometer ($12)

□ Set feeding times and stick to them

□ Test first colostrum batch today

□ Check milk temperature at next feeding

Birth to Day 3 — Immunity and Metabolic Activation

A newborn calf is born without immune protection in its bloodstream. All early protection comes from colostrum, which provides antibodies (IgG) and energy for warmth and early growth. If the calf doesn’t receive enough high-quality colostrum quickly, long-term health and gain are compromised.

What must happen in the first 24 hours:

- Feed at least 4 quarts of clean, high-quality colostrum (Brix 24 or higher) within 2 hours of birth or 8.5%-10% of body weight

- Provide another 2 quarts in the next 8–12 hours

- Aim for 200+ grams of IgG total. A quick check is a Brix reading of 24% or higher

- Dip the navel and provide deep, dry bedding

- Offer warm water between liquid feedings

- Keep calf temperature above 100°F

Research confirms that colostrum quality varies significantly between cows, with IgG concentrations ranging from less than 50 g/L to over 150 g/L. Using a Brix refractometer to test colostrum is now standard practice; readings of 22% or higher indicate good quality, and readings below 18% suggest the colostrum should not be used as the first meal. The 2024 National Animal Health Monitoring System (NAHMS) dairy study found that 29% of colostrum samples tested below minimum quality thresholds, while producers estimated only 8% was of poor quality.

Why Water Matters

- Water and milk are not the same in the calf’s gut

- Free-choice water helps rumen microbes begin developing early

- No water equals weak fermentation, which equals slow rumen growth

- Dump, clean, and refill water buckets daily

Water consumption is critical even in the first days of life. Unlike milk, which bypasses the rumen through the esophageal groove, drinking water enters the rumen directly and supports bacterial establishment and fermentation.

Days 3–21 — Rumen Initiation and Microbial Establishment

By day 3, the rumen is waking up. A good calf starter stimulates chewing and microbial activity. When microbes ferment starch, they produce volatile fatty acids (VFAs), especially butyrate, which signals the rumen lining to grow papillae—the structures that absorb energy later in life.

Feeding goals for this stage:

- Feed milk replacer (20–24% CP, 20–22% fat) twice daily at consistent solids and temperature

- Introduce textured starter by day 5 and keep it fresh

- Starter formulation: 20–23% CP, 3–5% fat, 6–8% fiber

- Provide clean, room-temperature water at all times

- Maintain dry bedding and good airflow

Research demonstrates that VFA production, particularly butyrate and propionate, drives papillae development in young calves. Calves fed corn-based starters show improved rumen development compared to those fed barley or oats, with corn providing superior energy density and fermentability. Dr. Jud Heinrichs from Penn State, who’s been studying calf nutrition for 4 decades, emphasizes that these early days set the stage for lifelong digestive capacity.

Temperature consistency matters more than most realize. Research from Virginia Tech shows that milk temperature variations from 88 to 122°F within a single facility cause 40-65% more nutritional scours and 0.25-0.33 pounds of slower daily growth.

Days 21–49 — Transition, Frame Growth, and Stable Fermentation

By week 3, calves transition from monogastric to ruminant digestion. Microbes multiply rapidly, and fermentation patterns shift toward propionate and butyrate production. These VFAs fuel lean growth and the development of rumen papillae.

Targets for this stage:

- Starter intake: 1.5–3.0 lbs/day by week 6

- Starter formulation: 18–23% CP, 3–5% fat, 6–8% fiber

- Maintain uniform texture to prevent sorting

- Watch manure consistency for early feedback on rumen health

Studies show that calves consuming adequate starter during this period develop larger, more functional rumens with greater papillae surface area. The relationship between starter intake and rumen pH becomes more pronounced as calves increase dry feed consumption, though young calves appear more tolerant of lower pH than adult cattle.

Sponsored Post

Days 49–70 — The Weaning Window

Wean by intake, not age. Calves are ready for weaning when they consistently eat 3 lb of starter per day for three consecutive days and drink water freely. A premature milk pull can cause growth slumps that can take weeks to recover from.

Best practices for weaning:

- Taper milk gradually over 5–7 days

- Keep the same starter ration during taper and for 10–14 days after full wean

- Ensure dry housing, strong airflow, and adequate bunk space

- Calves should be at least 8 weeks old before weaning is completed

Research consistently shows that weaning based on starter intake (minimum 3 lbs for three consecutive days) rather than age alone reduces stress and maintains growth momentum. Dr. Emily Miller-Cushon at Florida found that calves weaned before adequate intake show 180-280% increases in muscle breakdown markers, literally catabolizing their own tissue to survive the energy deficit.

Days 70–120 — Early Grower Phase for Dairy-Beef Calves

Once fully weaned, calves function as true ruminants. The goal now is frame and muscle growth without digestive upset. A balanced grower with moderate starch, digestible fiber, and proper minerals supports this phase.

Key management points:

- Target ADG of 2.4–2.6 lbs/day

- Maintain 12–15% NDF from digestible fiber

- Keep feed fresh and bunks clean

- Manage heat with shade and airflow

Research on dairy-beef crossbred calves shows they can achieve exceptional growth rates when appropriately managed, with some studies reporting ADG exceeding 5.5 lbs/day on high-energy diets post-weaning. The optimal NDF level for starter diets appears to be in the range of 12-20%, with higher levels (above 27%) potentially reducing intake and growth.

This period is critical for marbling development. Research from South Dakota State shows that marbling adipocytes—the cells that determine quality grade—primarily form between days 70 and 120. Miss this window with inadequate nutrition, and those cells simply don’t form, costing 16.2 percentage points in Choice grading at harvest.

Common Mistakes and How to Avoid Them

- Weaning by age instead of intake

- Changing feed and pulling milk in the same week

- Letting water get dirty—calves notice first

- Feeding dusty or inconsistent starter

- Overcrowding pens and limiting bunk space

Feeding Benchmarks by Stage

| Stage | Milk Replacer (lb./day) 13.5% Solids | Calf Starter (lb/day) | Water (qt/day) | Target ADG (lb/day) |

| Birth–3 days | 1.12 – 1.68 | — | 2–4 | 0.8–1.0 |

| 3–21 days | 1.68 (6 quarts) | 0.25–1.0 | 4–6 | 1.2–1.6 |

| 21–49 days | 1.68 (6 quarts) | 1.5–3.0 | 6–8 | 1.6–2.0 |

| 49–70 days (wean) | — | 5.0–6.0 | 8–10 | 2.0–2.4 |

| 70–120 days | — | 6.0–8.0 (grower) | 8–12 | 2.4–2.6 |

Use these benchmarks as general guides. If calves fall below expectations, check water, environment, and feed freshness before adjusting the ration.

Nutritional Specifications by Stage

| Stage | CP (%) | Fat (%) | NDF (%) | Notes |

| Birth–3 days | — | — | — | Colostrum quality (Brix ≥24%), warmth, hydration |

| 3–21 days | 20–23 | 18–20 | <5 | Starter + water drive rumen start-up |

| 21–49 days | 18–20 | 3–5 | 6–8 | Uniform texture; watch manure form |

| 49–70 days | 16–18 | 3–4 | 8–10 | Wean by intake; avoid new feeds during taper |

| 70–120 days | 15–17 | 3–4 | 12–15 | Manage heat, bunk space, and cleanliness |

The Economic Impact

While high milk replacer programs promise rapid early gains, the economics tell a different story. Operations using this starter-focused, consistency-based approach typically see:

- 22% to 9% reduction in pre-weaning morbidity

- 26 kg heavier weaning weights

- 20 percentage point improvement in Choice grading

- $100+ per calf additional value at harvest

The investment? A $30 Brix refractometer for colostrum testing, a $12 thermometer for milk temperature, and attention to daily details. These simple tools prevent the cascading failures that cost producers thousands in lost performance.

Economic Cascade: How Precision Practices Build $100+ Value Per Calf

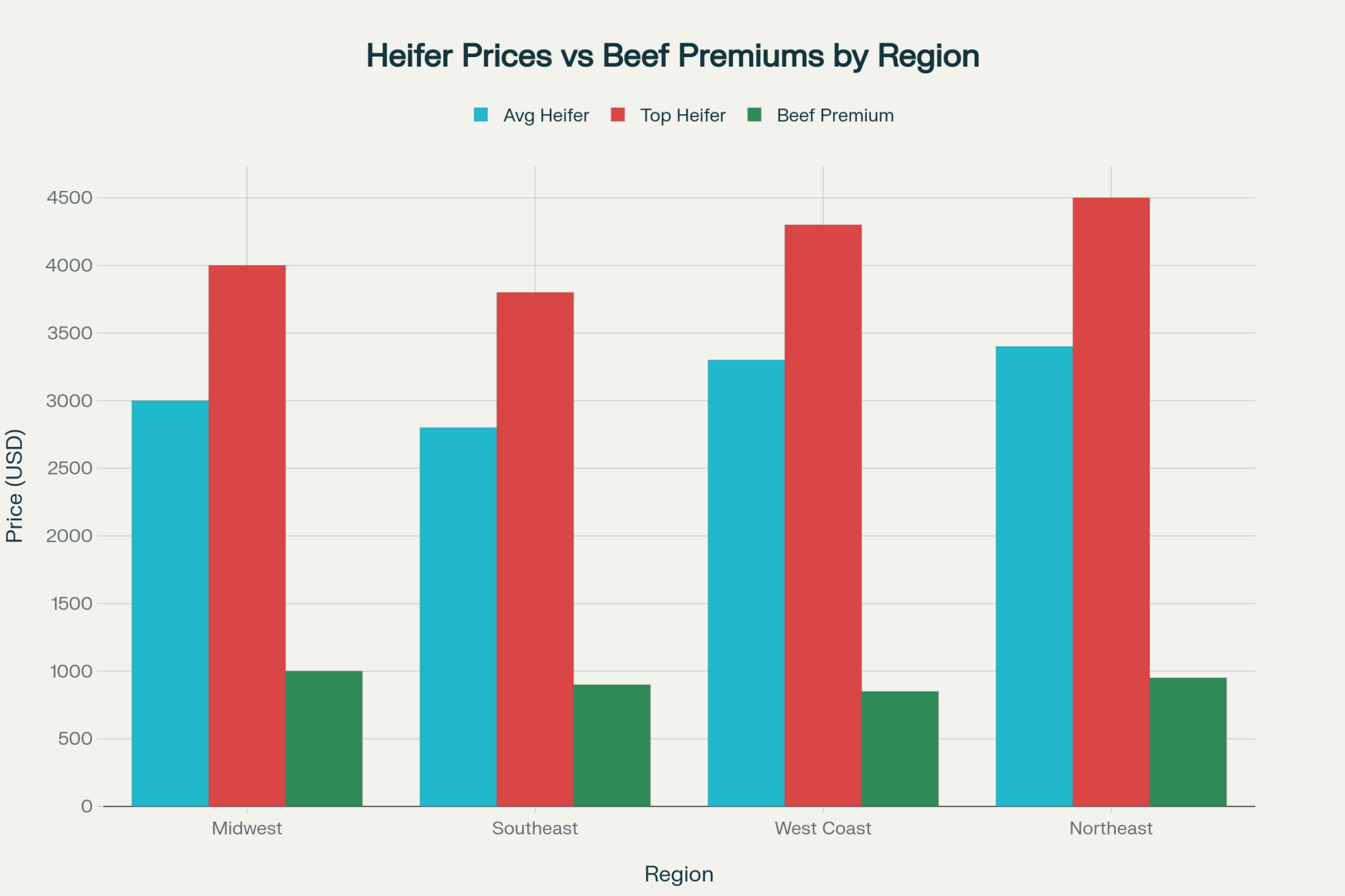

Regional Considerations

Northeast operations dealing with harsh winters need insulated transport containers and pre-warmed feeding equipment when temperatures drop below zero.

Southwest producers face the opposite challenge—preventing milk from overheating when ambient temperatures exceed 100°F. Cooling systems and shaded feeding areas become essential.

Southeast operations must manage humidity’s impact on both heat stress and feed stability, requiring more frequent starter replacement and enhanced ventilation.

Putting It All Together

Healthy calves grow on predictability. If intakes or gains stall, start by checking basics: water, air, bedding, and space. When these fundamentals are right, calves stay on feed, develop strong rumens, and finish efficiently later in life.

The transition from colostrum-dependent newborn to functional ruminant represents one of the most critical developmental periods in a calf’s life. Research consistently demonstrates that calves receiving optimal early nutrition—including timely, high-quality colostrum, gradual increases in starter intake, and consistent access to clean water—show improved first-lactation milk production, reduced morbidity, and enhanced lifetime productivity.

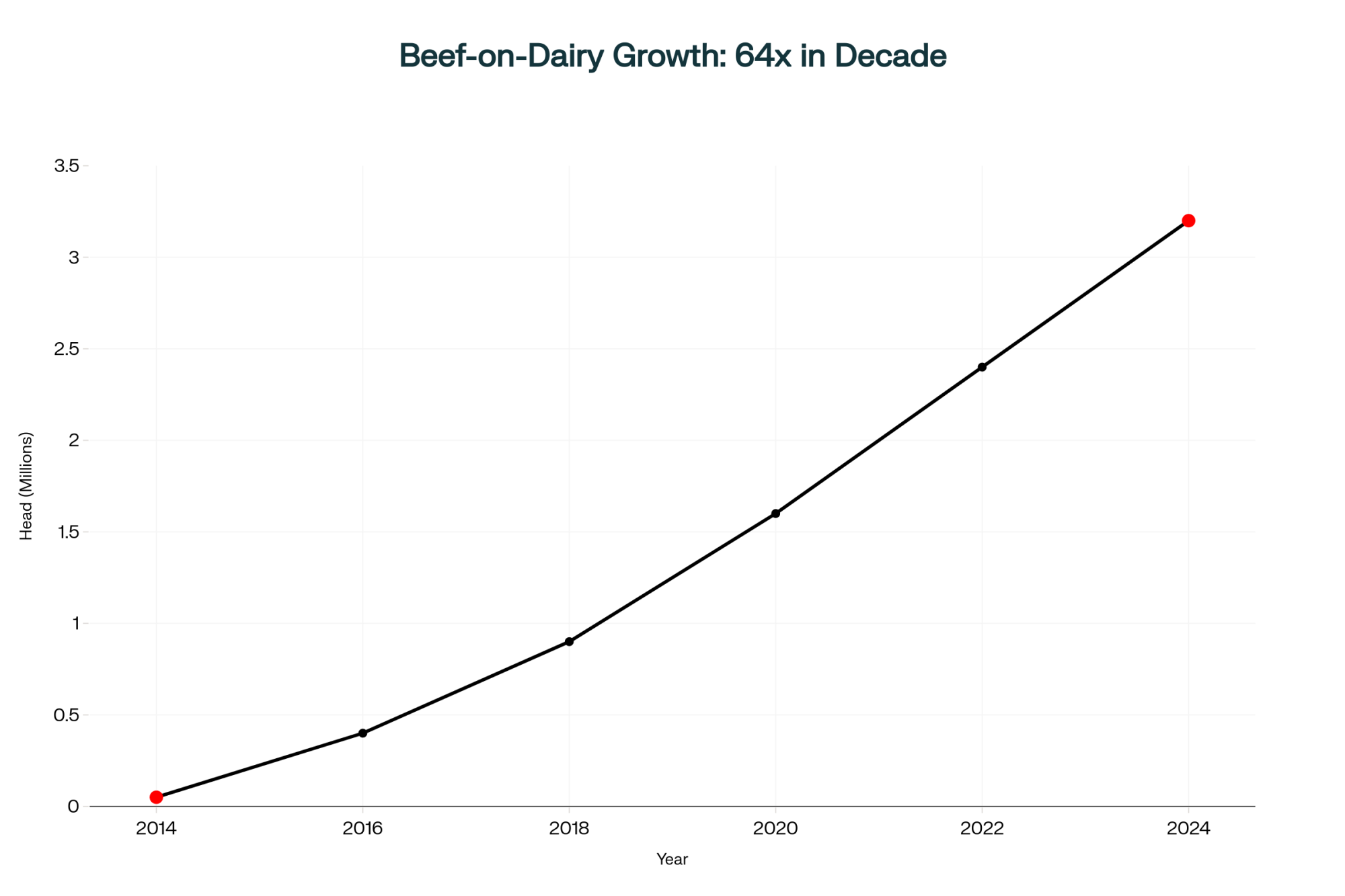

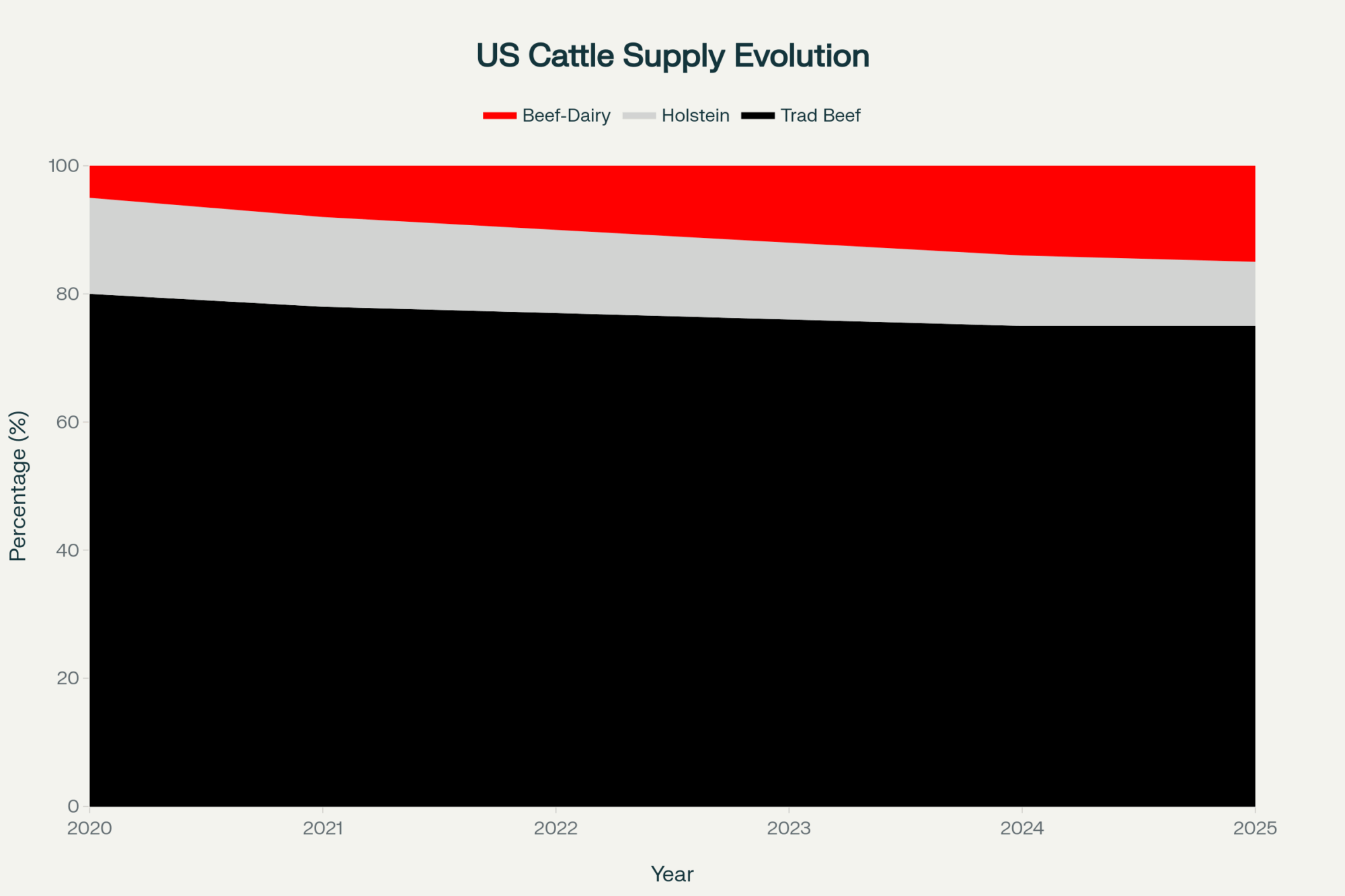

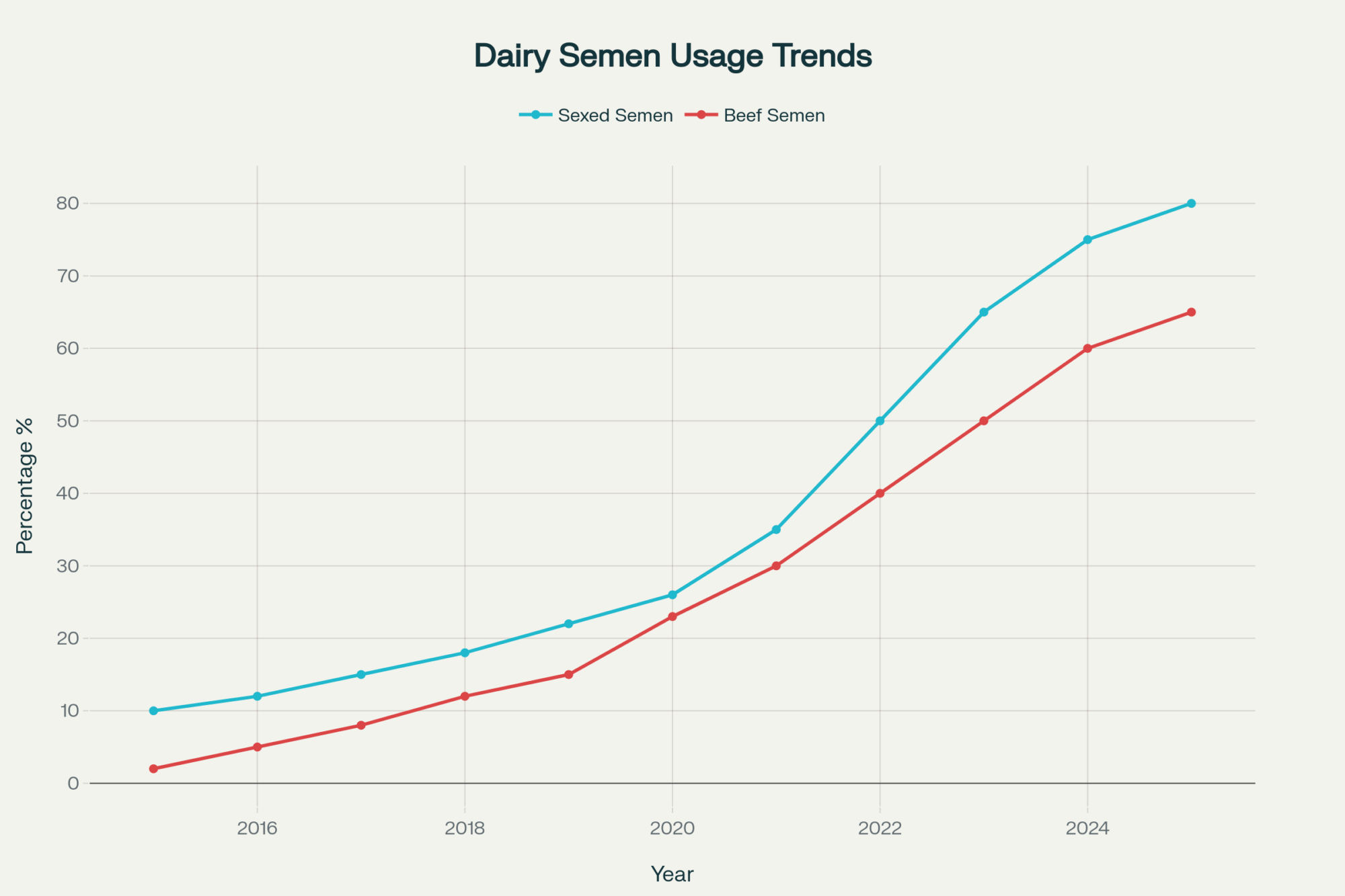

For dairy-beef crossbred calves specifically, proper early management becomes even more critical as these animals represent an increasingly important segment of beef production. USDA data shows the dairy-beef sector expanded approximately 23% from 2021 to 2024. When managed with attention to the physiological transitions outlined here, dairy-beef calves can achieve growth rates and feed efficiencies that rival or exceed those of traditional beef calves while producing high-quality carcasses.

The key is consistency—the same times, same temperatures, same quality, every single day. Biology operates on its own schedule. Our job is to support that schedule with predictable, quality nutrition and management. Miss these critical windows in the first 120 days, and no feeding program can fully recover what’s been lost.

KEY TAKEAWAYS:

- Consistency Drives Everything: Feed same time, same temp (102-105°F), same quality daily—variation of just 14°F causes 60% more scours and 0.3 lb/day slower growth

- Three Windows Program Forever: Immunity (0-3 days), rumen development (3-21 days), marbling formation (70-120 days)—miss any window and lose 16% Choice grade permanently

- Water From Day 3 Changes the Game: Clean, fresh water drives rumen microbes; no water = weak fermentation = compromised lifetime efficiency

- Wean by Intake, Not Calendar: 3 lbs starter/day for three consecutive days signals readiness—force it at 8 weeks and watch calves cannibalize their own muscle

- $42 Tools Prevent $100 Losses: Brix refractometer ($30) catches bad colostrum that looks good; thermometer ($12) prevents temperature swings killing performance

EXECUTIVE SUMMARY: The first 120 days determine everything—calves grow on consistency, not complexity —and missing critical windows creates permanent deficits that no feeding program can fix. From birth through weaning, success requires unwavering precision: colostrum within 2 hours (Brix ≥24%), milk at 102-105°F (not the 88-122°F range common on farms), clean water from day 3, and weaning based on intake (3 lbs/day), not calendar. Three biological windows program lifetime performance: immunity (days 0-3), rumen development (days 3-21), and marbling formation (days 70-120)—miss any one and lose 16% Choice grade, 500 kg lifetime milk equivalent, or worse. This guide provides exact feeding benchmarks and nutritional specifications for each stage, showing how to achieve 2.4-2.6 lb daily gains while reducing morbidity by 60%. The tools are simple ($30 refractometer, $12 thermometer), the schedule is specific, and the payoff is clear: $100+ more per calf through better health, heavier weights, and superior carcass quality.

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More:

- Cornell Study Proves Less Is More: Why Modern Colostrum Needs Just 2.5 Liters, Not 4 – Reveals why 2024 research suggests reducing colostrum volume in favor of higher concentration (Brix >24%) can actually improve IgG absorption efficiency by 24% and eliminate colic, challenging the traditional “more is better” dogma.

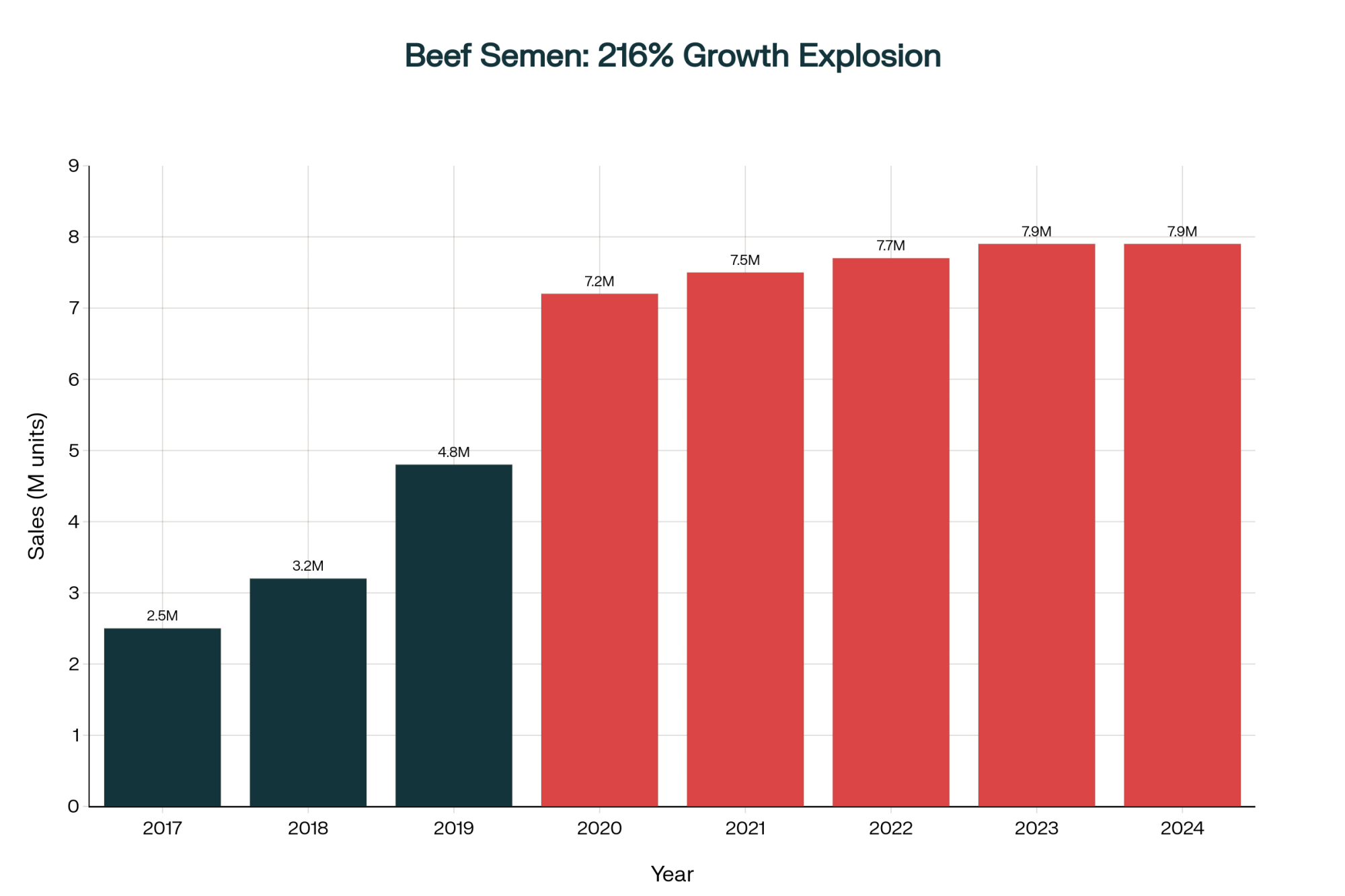

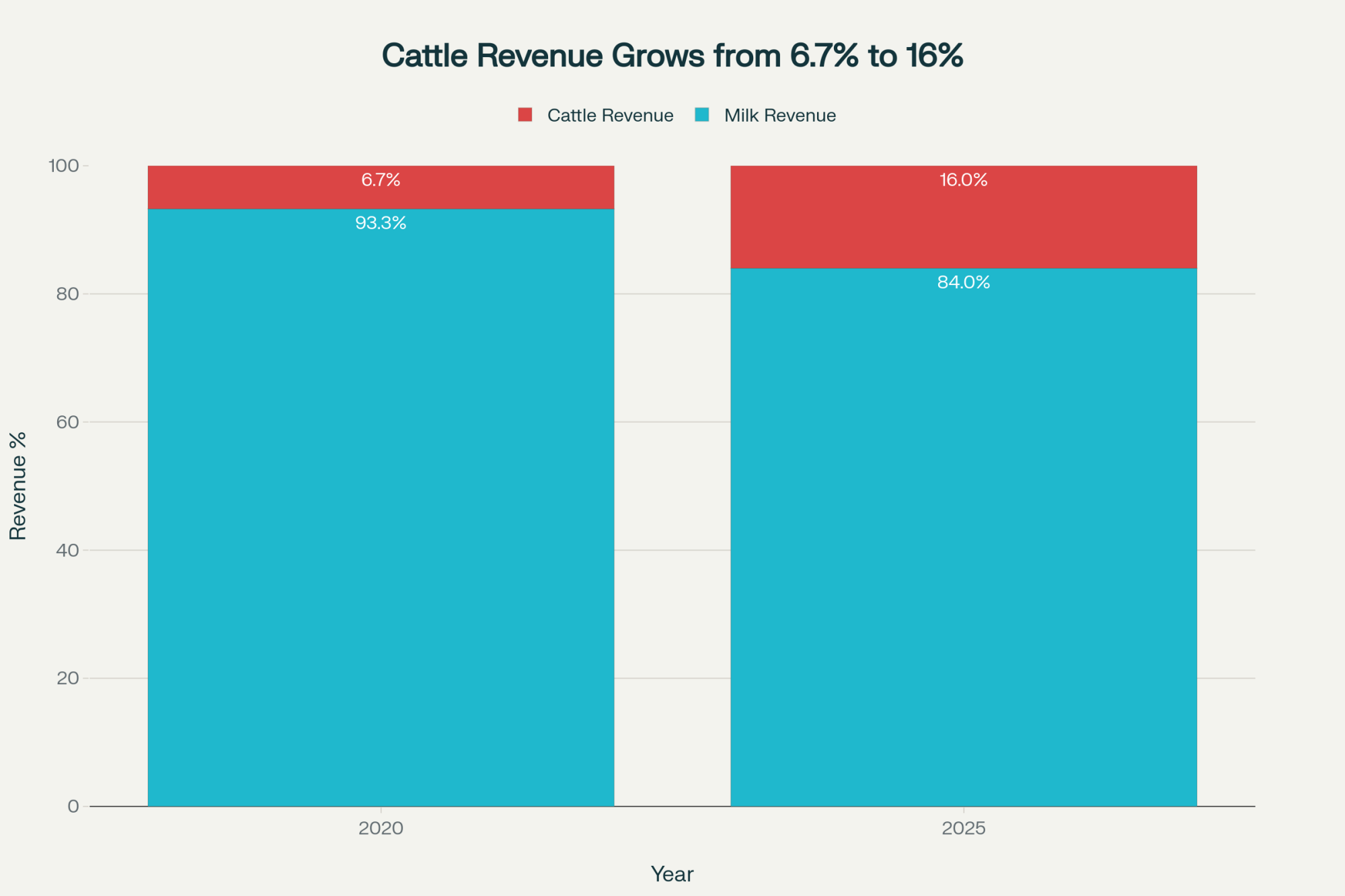

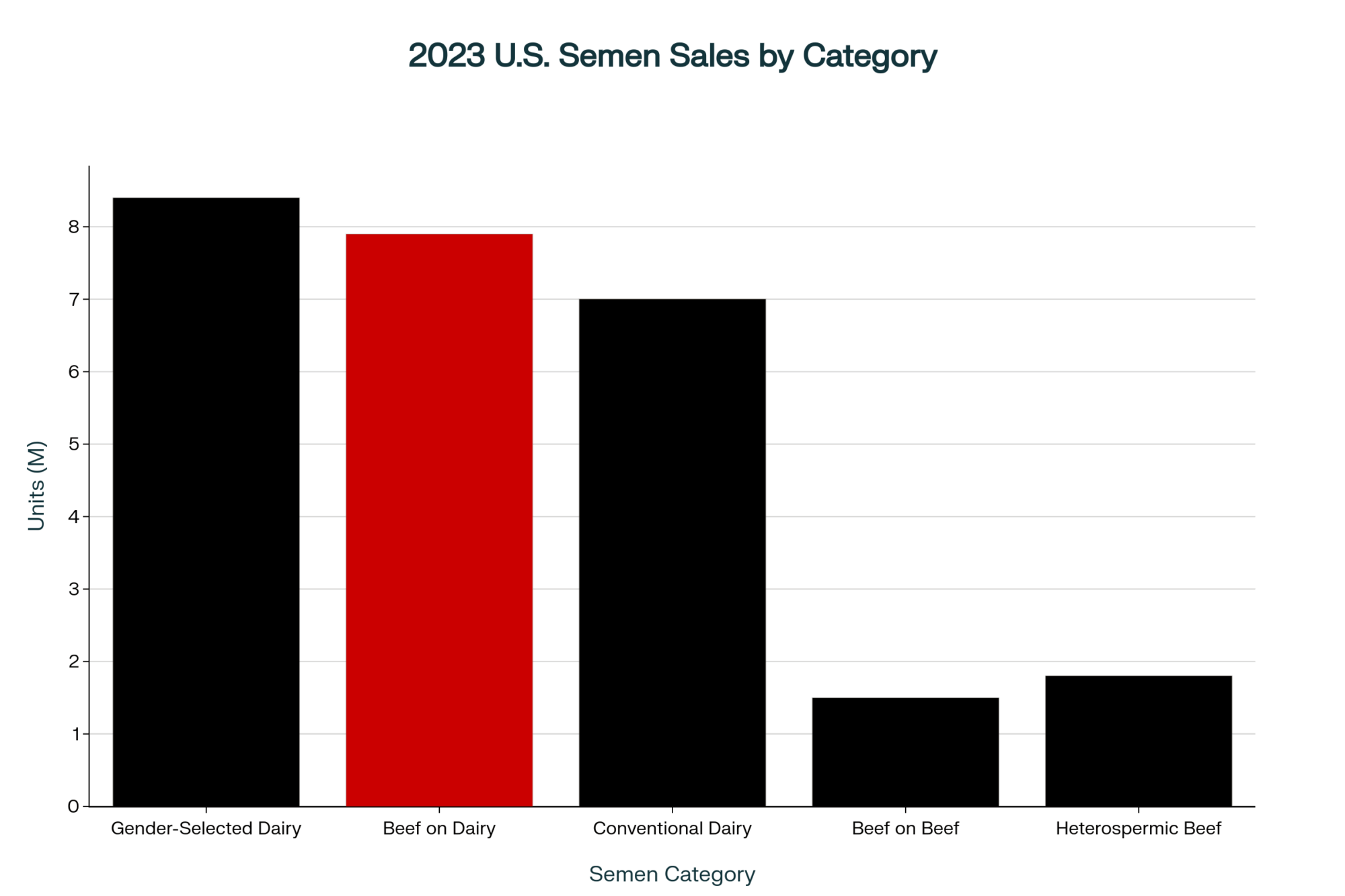

- The Beef-on-Dairy Wake-Up Call: What Some Farms Are Still Missing – Analyzes the critical market shift where beef semen now accounts for nearly 80% of sales, detailing the specific breeding and management strategies successful producers use to capture premium calf values that others leave on the table.

- Revolutionizing Calf Rearing: 5 Game-Changing Nutrition Strategies That Deliver $4.20 ROI – Provides a tactical blueprint for advanced protocols like pair housing and “Triple Threat” colostrum feeding, demonstrating how specific management shifts deliver a verified $4.20 return for every dollar invested.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!