Just about a year ago we drew attention to the fact that, when Dairy Breeders could genomic test their own bulls, it would start to cause the beginning of the end of the seed stock business (Read more: How Genomics Is Killing The Dairy Cattle Breeding Industry).These predictions were pretty easy to make because these changes were necessary in order for A.I. Companies to thrive in this new genetic environment. With March 2013 now behind us and breeders able to genomic test their own sires, these predictions are coming true. The challenge with these changes is that, while they make great business sense for the artificial insemination companies, they could spell the end of the seed stock business, as we have known it

At the recent Farnear Focus on the Future Sale, Alta Genetics paid $185,000 for a Massey daughter from Larcrest Case VG-86-2yr with a gTPI of +2505 (Read more: Farneer Focus on the Future Sale Averages $15,471 on 112 lots) . While Alta Genetics owning females is not new (Read more: Should A.I. Companies Own Females?), it does mark the resurgence of their program and certainly a significant investment by Alta Genetics probably indicating that they are looking for new ways to control their sire procurement costs. Of course Alta Genetics is not the only A.I. company that currently owns females. Others, especially some of the smaller companies, have taken to owning top females in order to secure procurement of valuable and unique genetics and to differentiate their genetic offering (Read more: A Wake-Up Call To All A.I. Companies). There are also those who have taken a very public stance against ownership of females (Read more: Select Sires vs. Semex – A Contrast in Cooperatives). This too may be a move to watch, as the competition for breeder-bred bulls will decrease with less competition for them from other A.I. companies. Thus Semex and others too may start to see procurement costs subside. Of course the market will decide just how low this price will go, as the other studs will always be watching the cost of production versus the cost of procurement.

What Has Caused This to Happen?

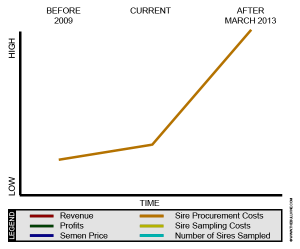

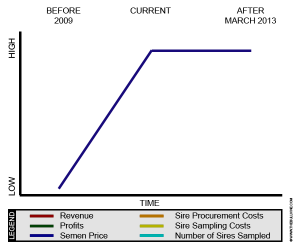

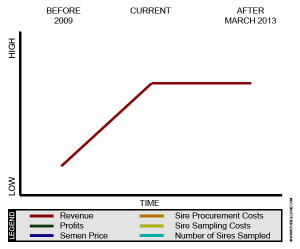

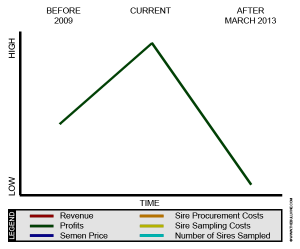

Since March 2013, breeders have had the ability to test their own bulls before negotiating the deal with an A.I. company. This results in a much greater negotiating position for bull breeders. The estimated effects of this change are as follows:

How A.I. Companies are Reacting

There are not substantial enough profit margins in the A.I. industry to support such a change in profitability. As a result, A.I. companies are being forced to take one of the following actions:

- Increase semen price

Since they now have greater expenses, A.I. companies will be forced to increase price. As demonstrated in many other industries, the market will not respond favorably to this and ultimately will drive prices back down.

END RESULT: No change - Cap contracts

So if A.I. companies cannot increase revenues they will have to try and cut their costs. The procurement of sires will become the major expense they will look to control. One way to do this will be to cap bull contracts. However, as the NHL has shown us, even if A.I. could introduce a cap, some members will break that rule and other breeders will not stand for it.

END RESULT: No change - Produce their own product line

If A.I. companies cannot buy the bulls at a cheaper price, then they will have to go out and buy females and produce their own product. This will lead to cheaper acquisition costs. A.I. companies can now buy the females for $50,000 to $250,000 and only need to have that female produce one son. That will still be cheaper than leasing the son on an open lease. This also allows them to have greater control of their bloodlines, accelerate their genetic advancement and develop their own distinctive product.

END RESULT: Cheaper product development costs and a distinctive product.

What does this mean to YOU the average seed stock producer?

For the initial stage, which we are currently in, as A.I. companies buy into the female side, prices will rise. Once they have the base genetics, they will not need to buy any more and they will stop buying. Also currently we see top genetic breeding programs investing more in the top .1% of the genetics market. The money for this is not coming as much from the female side as it is from the current or future revenue potential of semen lease deals. The problem is that these bull breeders will be out of the market, as more and more A.I. companies STOP leasing from them, because they are now producing their own genetics.

With A.I. companies starting to own more of the top genetics, especially in the health and fertility and polled bloodlines( an area the market is heading to in the future) this will leave the seed stock breeder with a product or cattle that do not top the lists like they used to. Also, now the A.I. companies will not release their new high genomic sires until they have mated them on all their own females first. This will give A.I. companies a substantial advantage in generating list toppers. Bull breeders, on the other hand, will not have the lease deals that they currently enjoy, so they will not have the same revenues from the sale of high index animals.

The Bullvine Bottom Line

Nobody likes to be told “I Told You So” and the reason I bring this up is not to do that, but rather to open the eyes of breeders to what is happening and what the future still holds. While there will always be a seed stock business selling females to other breeders, as the bull market continues to change, so will the prices for the top genomic females. You will continue to see a spike for a few years, while the genetics companies stock up on top genetics. However, after that, you will start to see prices drastically decline. Your best course of action would be to ride the wave while it lasts, and then plan on all future sales/revenue (3-4 years from now) to start to be from females only, with only a very small, select group of sires being contracted by A.I. companies in the future.

Not sure what all this hype about genomics is all about?

Want to learn what it is and what it means to your breeding program?

I find it hard to believe many of the animals who have sold for $50 000+ in the past year will get a ROI.