Liver abscesses pose a significant health concern within the beef-on-dairy cross industry, with an occurrence rate as low as 2% in some breeds and as high as 80% in others. In recent years, it seems that roughly 10% to 20% of slaughtered cattle displayed some instance of a liver abscess. These discrete, circumcised focal sites of bacterial infection are the result of bacteria’s journey from the rumen to the liver, ultimately leading to polymicrobial infections.

From an economic viewpoint, liver abscesses contribute to roughly a whopping $60 million annual loss within the cattle industry, as per the 2018 estimates. With the progression of an infection, processing plants end up spending more time and labor on infected cattle. If an abscess ruptures, it taints the surrounding meat, resulting in wasted product.

Deconstructing the Causes of Liver Abscesses in Crossbred Cattle

Let’s delve deeper into the world of modern cattle feedlots. It is rather interesting to note that liver abscesses in beef-on-dairy crosses are closely linked to an aggressive grain-feeding regimen. This aggressive approach not only increases the animal’s susceptibility, but it also plays a key role in the incidence rate of liver abscesses, which ranges from roughly 12 to 32%.

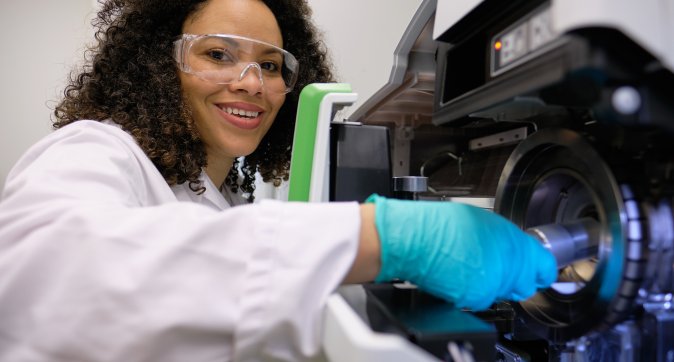

A significant breakthrough in this domain comes from the K-State researchers. In their research, they’ve revealed an innovative approach to detecting liver abscesses in cattle. This game-changing method has the potential to revolutionize how we understand and manage this prevalent health issue among crossbred cattle.

Interestingly, the researchers discovered certain biochemicals that are unique to liver abscesses. These biochemicals could serve as valuable “biomarkers” in live cattle. In essence, these biomarkers act as identifiable biological signs that indicate the presence, or risk, of the disease.

It introduces a constellation of possibilities, one of them being that breeders can make more informed decisions about breeding and management practices. Identification of these markers could indeed assist in reducing the cattle’s susceptibility to liver abscesses. This would, in turn, decrease reliance on antimicrobial treatments from which liver abscess control heavily depends.

In an encouraging development, Dr. Dale Woerner from Texas Tech University received a $300,000 grant to construct a model for genomic, blood, and microbial markers. The objective? To provide a more comprehensive understanding of liver abscesses in beef cattle. Dr. Woerner’s work is seizing the opportunity to find biomarkers, mitigate risk, and essentially get a step ahead of this common cattle health issue.

On another note, studies have also shown that multiple liver abscesses from the same animal exhibit similar microbial communities. This interesting facet only deepens the intrigue as scientists work tirelessly to understand the complex and multilayered causes of liver abscesses in crossbred cattle.

The next phase of study involves experimentally inducing abscesses in live cattle to identify these elusive biomarkers. Without question, these promising developments have paved the way for better prevention, earlier detection, and more effective treatment of liver abscesses in beef-on-dairy crosses. And as we continue to learn, we can ensure that our future livestock management decisions are grounded in knowledge and guided by innovation.

Prevention Strategies for Liver Abscesses in Beef-on-Dairy Crosses

Taking measures upfront to prevent liver abscesses in beef-on-dairy crosses could prove to be cost-effective and beneficial in the long run. As it turns out, proactive prevention in livestock rearing hinges on purposeful breeding, careful dietary regulation, and strategic use of antimicrobials.

Control of liver abscesses primarily relies on antimicrobial compounds. Specifically, antibiotics have shown to inhibit ruminal F. necrophorum, a bacteria implicated in the development of liver abscesses. By using such antibiotics as part of a regular medication regime, producers can put a substantial dent in the prevalence of this condition.

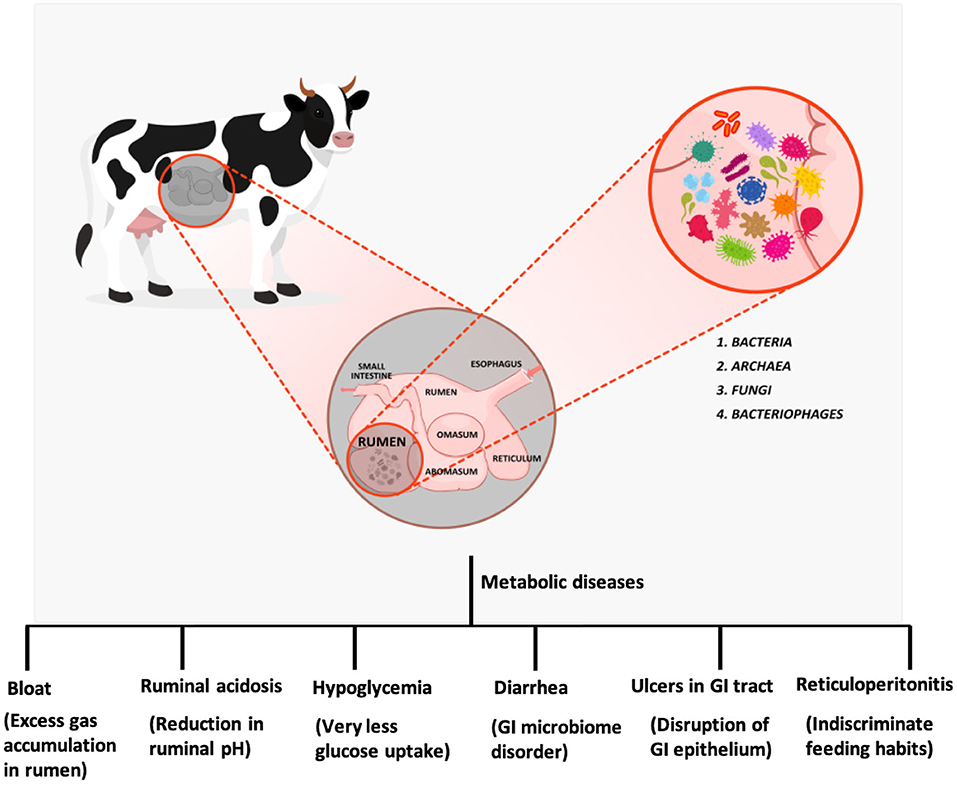

One common factor identified in the cause of liver abscesses is aggressive grain-feeding programs. High grain diets cause mechanical damage to the rumen walls, creating a direct path for bacteria to enter the bloodstream and travel to the liver. Therefore, adopting a more balanced diet that includes sufficient fiber can make a big difference, reducing the chance of bacteria penetration.

In addition, there’s ongoing research into the potential of using particular biochemical elements, unique to liver abscesses, as biomarkers in live cattle. Recent studies spearheaded by K-State researchers have shed light on possible non-invasive detection methods. Such advancements have huge implications for the industry- they could pave the way for early detection and subsequent timely interventions.

Furthermore, genetics can play a crucial role in the susceptibility of cattle to liver abscesses. By employing careful breeding strategies that take into account the likelihood of developing this condition, producers can gradually breed healthier, more robust, and resistant cattle. And with promising research from the likes of Dr. Dale Woerner of Texas Tech University, we could soon have genomic tools at our disposal for informed breeding decisions.

Remember, the average incidence rate of liver abscesses in feedlots runs from a concerning 12% to 32%. Given the stealthy nature of this condition—with cattle often showing no clinical signs until processing—we cannot overstate the importance of preemptive steps toward prevention. The future of health and productivity in the beef-on-dairy industrycould depend on the action we take today.

Effective Treatment Approaches for Liver Abscesses in Crossbred Cattle

From my experiences as a veterinarian, I’ve found that the primary means of controlling liver abscesses in feedlot cattle hinges on the appropriate use of antimicrobial compounds. Particularly, the antibiotic Tylosin has proven to be remarkably effective in hampering the development and spread of liver abscesses. Nonetheless, reliance on this treatment approach should not be absolute as it brings with it pressing questions about antimicrobial resistance.

It’s important to understand how liver abscesses typically occur in beef-on-dairy crosses. Often, they’re the result of aggressive grain-feeding programs. While these feeding methods may accelerate weight gain and provide a higher yield of beef, they create an environment conducive to the bacteria F.necrophorum, whose ruminal growth is inhibited by antibiotics.

As a pivot from antimicrobial dependency, there has been an interesting development in treating and preventing these abscesses. Researchers fromK-State, led by Dr. Dale Woerner from Texas Tech University, received a $300,000 grant to create and validate a model for genomic, blood, and microbiological markers for liver abscesses in beef cattle.

These innovative works aim to present biomarkers, biochemicals unique to the healing of liver abscesses, that could be detected in live cattle. This groundbreaking research could bring about a transformative change in how we approach liver abscess problems in beef-on-dairy crosses. Identifying these markers early on would not only allow for timely treatment but also enable producers to make more informed breeding and management decisions.

Remember, we need to counter this persistent problem of liver abscesses in cattle, which averages from 12 to 32% incidence in feedlots, could lie in a collaboration between scientific advances and sound farm practices. Brighter and healthier days are ahead for our crossbred cattle.

The Economic Impact of Liver Abscesses on Crossbred Dairy and Beef Farms

As statistical data indicates, the incidence of liver abscesses in feedlots ranges from 12 to 32%; a daunting figure considering the financial implications. Recognizing liver abscesses as a critical economic liability is no overstatement. Each case results in associated treatment costs, reduced weight gain, liver condemnations, and, in severe instances, it can lead to cattle mortalities.

That’s where the importance of early diagnosis comes into the picture. Groundbreaking research conducted at K-State University led to the discovery of a potential detection method for liver abscess in cattle. This critical finding introduces a tool for timely intervention, allowing producers to minimize the losses due to the occurrence of abscesses.

Adding to these efforts, Dr. Dale Woerner, from Texas Tech University, secured a $300,000 grant to develop a model for identifying genomic, blood, and microbiological markers for liver abscesses in beef cattle. By identifying these markers, cattle producers could make more informed breeding and management decisions. The model could potentially reduce susceptibility in cattle and decrease reliance on antimicrobial treatments. This would not only result in healthier herds but could also significantly curb economic losses.

Besides, the exploration of biochemicals unique to liver abscesses may offer new direction. These could be used as biomarkers in live cattle, paving the way for early detection and preventive care. Despite control of liver abscesses in feedlot cattle heavily relying on antimicrobial compounds currently, these compounds may pose a threat to our constant battle with antibiotic resistance. Therefore, shifting towards such biomarkers might be a healthier and more sustainable practice in the long run.

Last but not least, the statistical discrepancies in relative abundance between animals with and without abscesses paint a significant picture. These differences indicate the need for continuous research and innovative prevention strategies. The more we understand the prevalence and causatives of liver abscesses, the better we can manage and mitigate its impact on the cattle industry, and, consequently, our economy.

The Bottom Line

Addressing liver abscesses in beef-on-dairy crosses is a complex challenge that requires a comprehensive approach. The groundbreaking efforts of researchers, such as Raghavendra Amachawadi, T.G. Nagaraja, and Dr. Dale Woerner, provide promising pathways towards more effective diagnostic and intervention strategies, including potential utilization of genomic, blood, and microbiological markers. Understanding the impact of dietary and tylosin supplementation on the incidence and treatment of these abscesses further underscores the importance of tailored management strategies. Ultimately, preventing liver abscesses is crucial not only for improving animal wellbeing but also for mitigating considerable economic losses within the crossbred dairy and beef industry.

As a dedicated dairy farmer, improving the health and productivity of your herd ranks high on your priority list. By now, you are certainly familiar with the critical role that rumen fermentation plays in ruminant nutrition. Yet, what you might not know is how recent discoveries in the fields of rumen fermentation and nutrient-rumen microbiota interactions can assist you in optimizing the health of your cows and bolstering

As a dedicated dairy farmer, improving the health and productivity of your herd ranks high on your priority list. By now, you are certainly familiar with the critical role that rumen fermentation plays in ruminant nutrition. Yet, what you might not know is how recent discoveries in the fields of rumen fermentation and nutrient-rumen microbiota interactions can assist you in optimizing the health of your cows and bolstering  Imagine being able to rapidly test animals for antibiotic treatments, efficiently and economically. Well, the team at Wageningen Food Safety Research (WFSR) has brought this vision to life. They’ve developed a groundbreaking method that permits immediate insight into antibiotic use.

Imagine being able to rapidly test animals for antibiotic treatments, efficiently and economically. Well, the team at Wageningen Food Safety Research (WFSR) has brought this vision to life. They’ve developed a groundbreaking method that permits immediate insight into antibiotic use.  Climate change is not simply a subject of debate; it’s a present and pressing issue, especially in our agricultural sectors. With its relentless rise in temperature, hot days and heat waves are becoming common occurrences. These changes are posing increasing risks of heat stress for livestock, particularly

Climate change is not simply a subject of debate; it’s a present and pressing issue, especially in our agricultural sectors. With its relentless rise in temperature, hot days and heat waves are becoming common occurrences. These changes are posing increasing risks of heat stress for livestock, particularly  Imagine a bustling Australian

Imagine a bustling Australian  Get ready for a fish-out-of-water journey into the world of dairy farming with Emmy-nominated sketch comedian and actress Vanessa Bayer. Brought to you by U.S. dairy farmers, processors and importers, “Dairy Diaries” premieres on April 22 exclusively on the Roku Channel in the U.S. and takes viewers behind the scenes at Beck Farms, a fourth-generation dairy in upstate New York.

Get ready for a fish-out-of-water journey into the world of dairy farming with Emmy-nominated sketch comedian and actress Vanessa Bayer. Brought to you by U.S. dairy farmers, processors and importers, “Dairy Diaries” premieres on April 22 exclusively on the Roku Channel in the U.S. and takes viewers behind the scenes at Beck Farms, a fourth-generation dairy in upstate New York. Discover the hidden secrets of feed efficiency in US Holstein heifers through a comprehensive genomic evaluation. Will this change the future of dairy farming?

Discover the hidden secrets of feed efficiency in US Holstein heifers through a comprehensive genomic evaluation. Will this change the future of dairy farming? Discover the untapped potential in beef-on-dairy matings. Our in-depth analysis of mean breed performance could revolutionize your livestock strategy. Are you ready to unlock growth?

Discover the untapped potential in beef-on-dairy matings. Our in-depth analysis of mean breed performance could revolutionize your livestock strategy. Are you ready to unlock growth? It’s often said that social factors are key determinants of disease in both humans and laboratory animals. However, there appears to be a significant knowledge gap when it comes to the application of this understanding to farm animals. This article ties into a recent study which set out to determine if the unpredictability and competitiveness inherent in certain social environments affect the behavior and health of

It’s often said that social factors are key determinants of disease in both humans and laboratory animals. However, there appears to be a significant knowledge gap when it comes to the application of this understanding to farm animals. This article ties into a recent study which set out to determine if the unpredictability and competitiveness inherent in certain social environments affect the behavior and health of

Rooted in the bucolic state of Pennsylvania, a narrative is unfolding that sees two men, Ruthy Herr and Ethan Wentworth, currently imprisoned. Their crime? Ultrasounding

Rooted in the bucolic state of Pennsylvania, a narrative is unfolding that sees two men, Ruthy Herr and Ethan Wentworth, currently imprisoned. Their crime? Ultrasounding  Following an entire year of decline, US dairy exports have made an unexpected and impressive comeback. According to the numbers crunched by Italian dairy economic consulting firm CLAL, the recovery was observed in February. The engine that drove this resurgence? Cheese exports – to be specific, an increase of more than 10,000 tons, which indicates a 32.1% year-on-year growth.

Following an entire year of decline, US dairy exports have made an unexpected and impressive comeback. According to the numbers crunched by Italian dairy economic consulting firm CLAL, the recovery was observed in February. The engine that drove this resurgence? Cheese exports – to be specific, an increase of more than 10,000 tons, which indicates a 32.1% year-on-year growth.  Imagine a company standing the test of time, delivering goodness in a glass bottle to doorsteps for nearly a century. That’s the story of Oberweise Dairy, a iconic home milk delivery company, headquarted in North Aurora, Illinois. However, as of late, this 97 year-old dairy business has had to file for bankruptcy, a sober moment not only for the company, but for the countless households who have faithfully awaited their glass-bottle deliveries over the years. Oberweise Dairy not only handled milk delivery, but successfully ran nearly 40 ice cream and dairy stores in both Illinois and Missouri.

Imagine a company standing the test of time, delivering goodness in a glass bottle to doorsteps for nearly a century. That’s the story of Oberweise Dairy, a iconic home milk delivery company, headquarted in North Aurora, Illinois. However, as of late, this 97 year-old dairy business has had to file for bankruptcy, a sober moment not only for the company, but for the countless households who have faithfully awaited their glass-bottle deliveries over the years. Oberweise Dairy not only handled milk delivery, but successfully ran nearly 40 ice cream and dairy stores in both Illinois and Missouri.