When a Welsh dairy farmer sat in that boardroom and voted to slash his own income by £78,000 a year, he wasn’t being foolish. He was being a fiduciary. And that distinction matters for every cooperative member reading this.

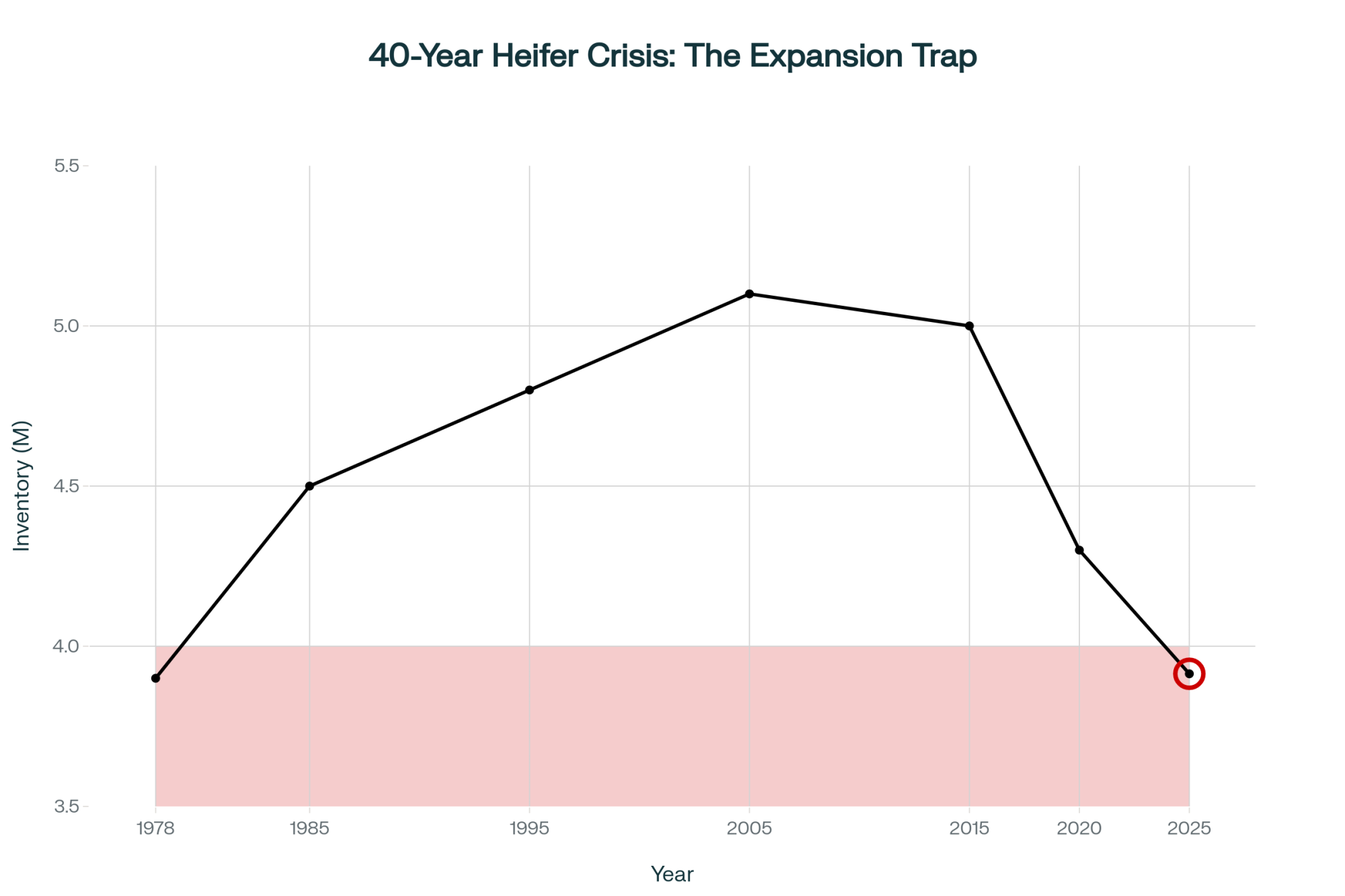

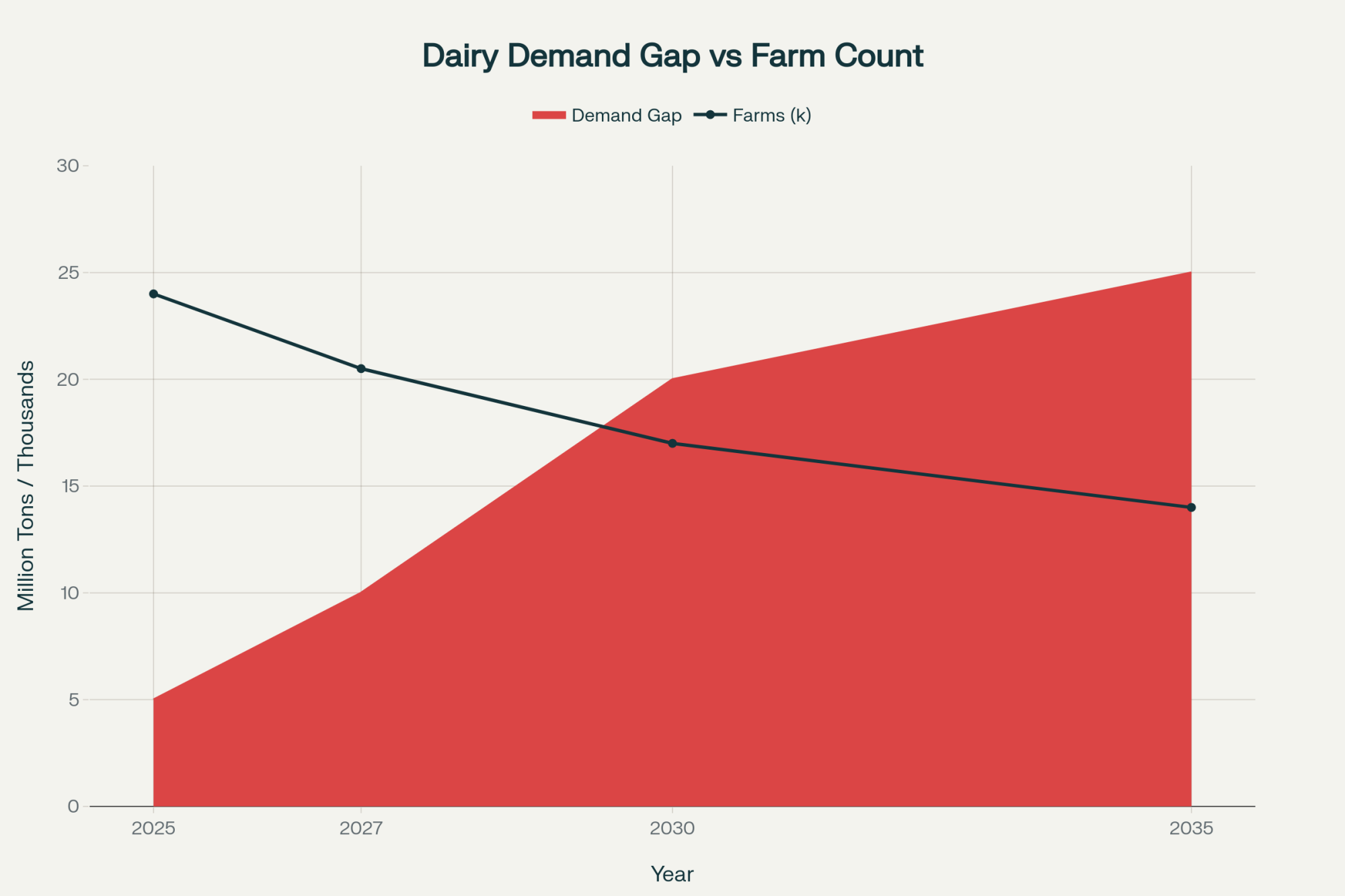

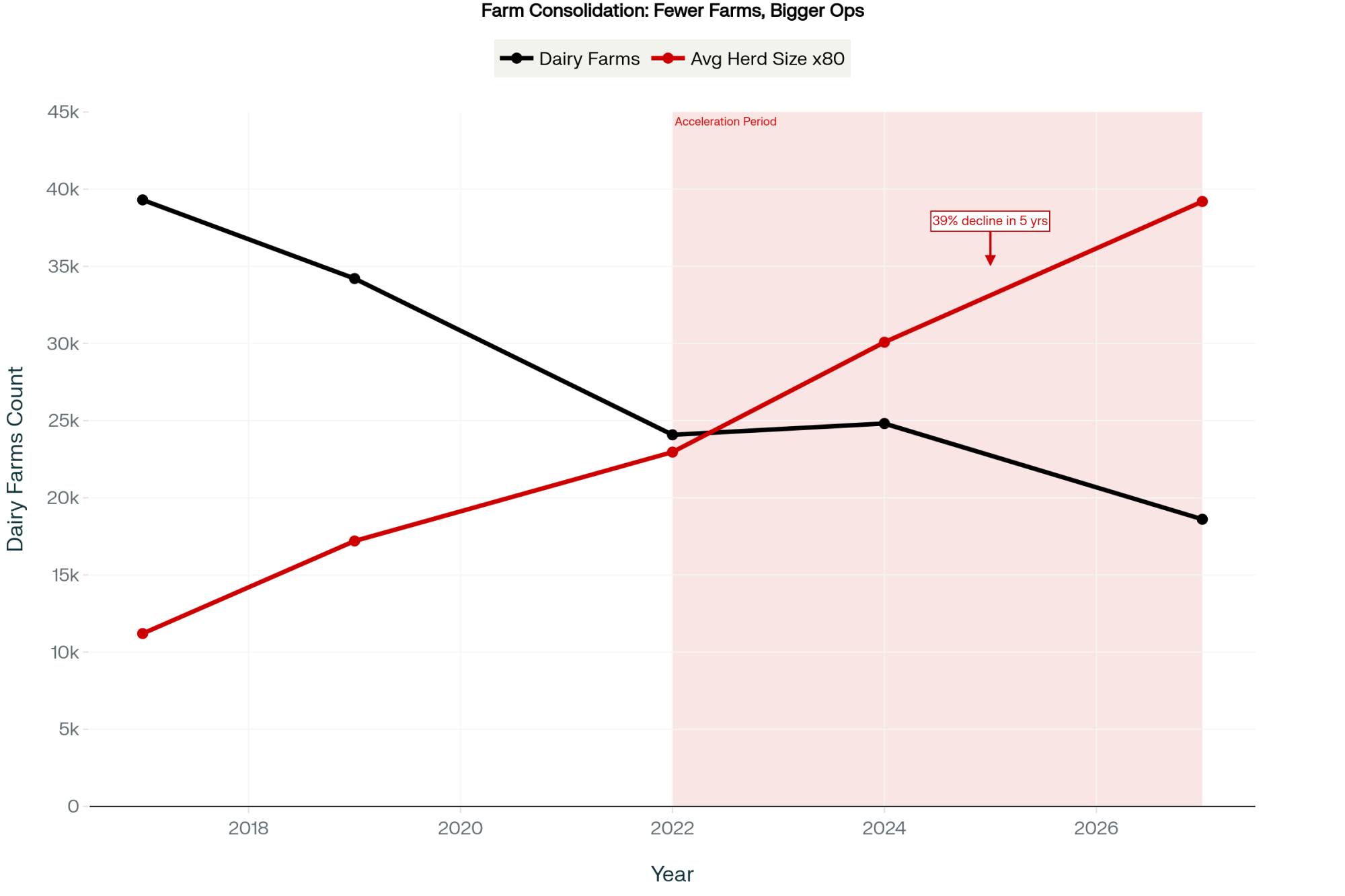

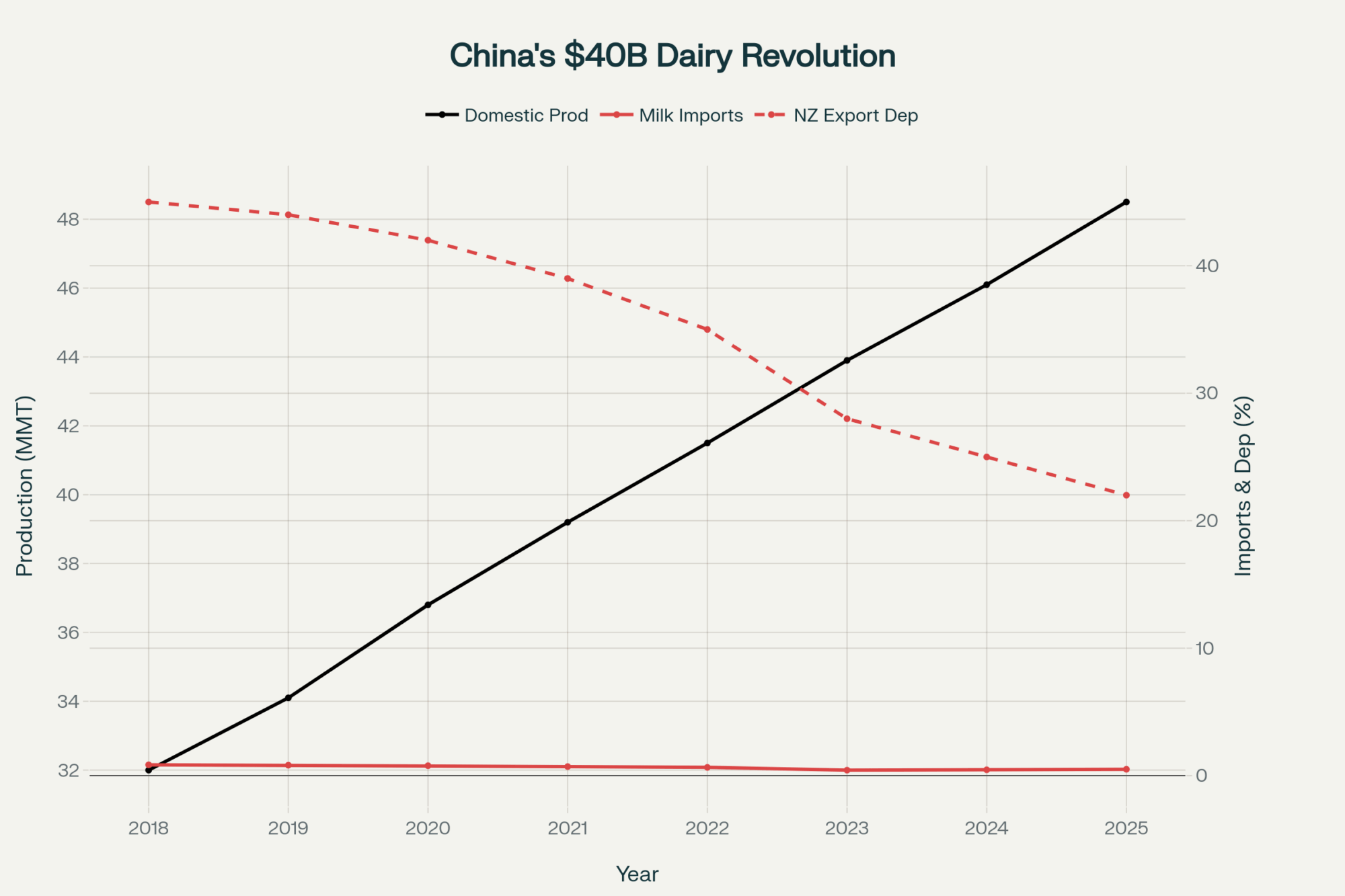

Executive Summary: Mike Smith milks 450 cows in Wales and serves as vice chairman of First Milk. This month, he voted to cut his own milk price to 32.25p—a decision that costs his operation approximately £6,500 every month. He wasn’t being foolish. He was fulfilling his legal duty: UK company law requires cooperative directors to protect the enterprise first, even when farmgate prices fall below the 43-47p most producers need to break even. That tension between member interests and cooperative survival explains why UK dairy has consolidated from 35,000 farms in 1995 to roughly 7,000 today—and why analysts project just 4,000-5,000 by 2030. Cooperatives deliver real value: market access, collective bargaining, shared risk. But insulation from global oversupply? That’s not part of the deal. North American producers shipping through DFA, Agropur, or provincial marketing boards face the same structural dynamics—and understanding them now, while you still have options, is the point.

Mike Smith runs a 450-cow dairy in Pembrokeshire, Wales. He’s also vice chairman of First Milk, one of the UK’s largest British-headquartered farmer-owned cooperatives. This month, he sat in a boardroom and voted to cut his own milk price—a decision that will cost his operation roughly £6,500 every single month.

That image stuck with me as I worked through what’s happening across UK dairy right now. A farmer-owner, voting against his own short-term interest, because the alternative was watching the cooperative face serious financial difficulty. It tells you something important about how cooperative economics actually work when markets turn challenging—and it’s something Wisconsin, Ontario, and every other cooperative-heavy dairy region should understand.

The Numbers Behind the Decision

First Milk announced its January 2026 price at 32.25 pence per litre, down a staggering 3.6ppl from the prior month. That’s no small adjustment. According to Mike Smith in First Milk’s official announcement: “This change reflects the continuing challenges in the market. UK and global milk production remain at record levels, and there is still no sign of improvement in the supply/demand imbalance.”

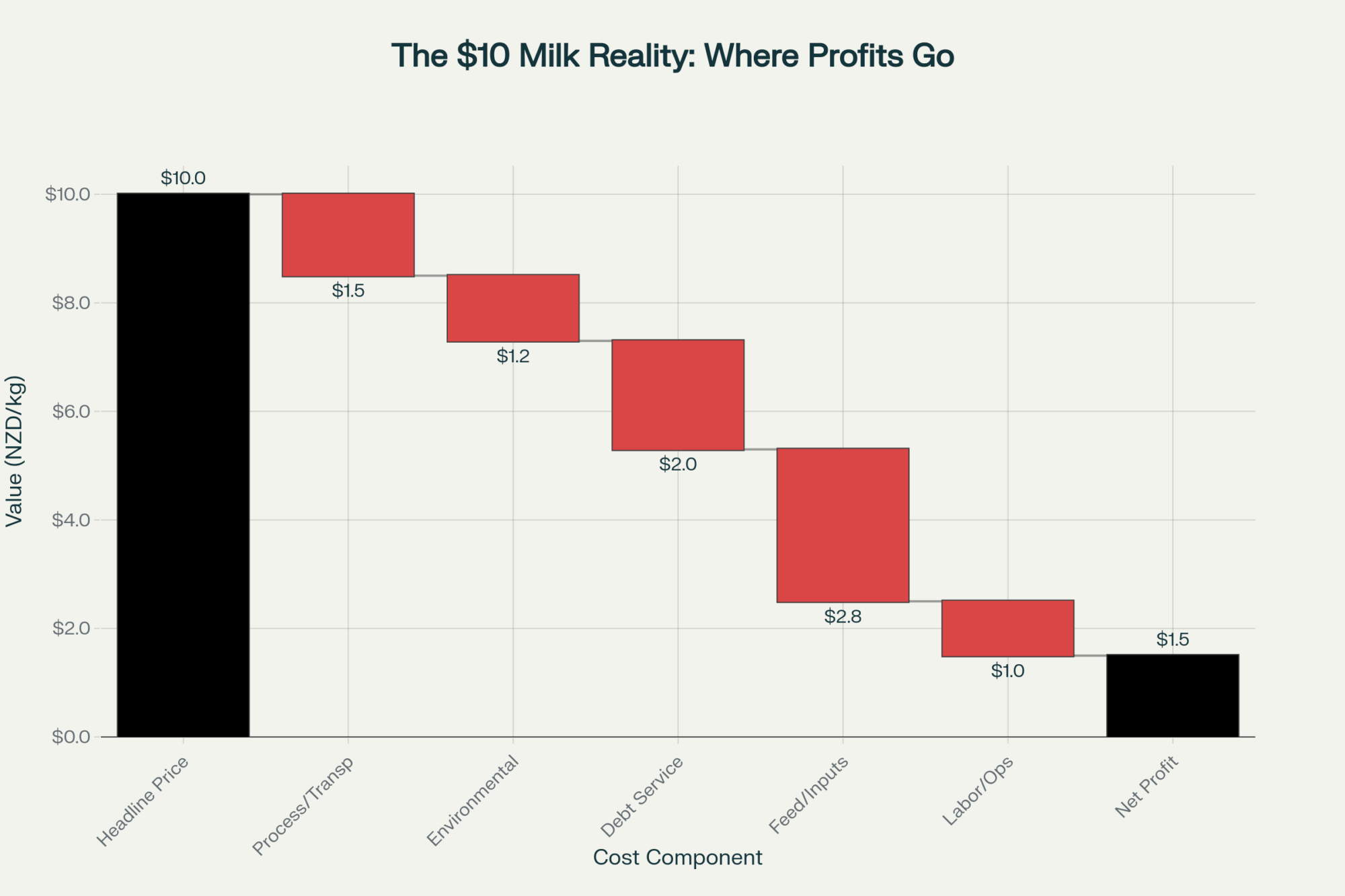

Production costs vary significantly across UK dairy operations. What’s interesting here is that grazing systems generally run lower than housed herds, and regional differences in feed and labor costs create quite a range. Industry benchmarking from AHDB and farm business consultancies like Kite Consulting consistently shows that fully-housed systems average somewhere in the mid-to-upper 40s pence per litre when all costs, including unpaid family labor, are accounted for. According to Promar International’s UK Dairy Producer Cost Analysis 2025, leading producers sustain production costs of 41-43 pence per litre.

Let’s run some realistic numbers on a 150-cow herd shipping about 103,000 litres monthly. If we assume production costs around 43ppl—reasonable for a well-managed system:

- Monthly revenue at 32.25ppl: £33,217

- Monthly production cost at 43ppl: £44,290

- Monthly shortfall: Around £11,073

That’s burning through £133,000 or more each year before the family draws any income for living expenses. The 3.6ppl cut alone strips roughly £3,700 monthly from an already tight position.

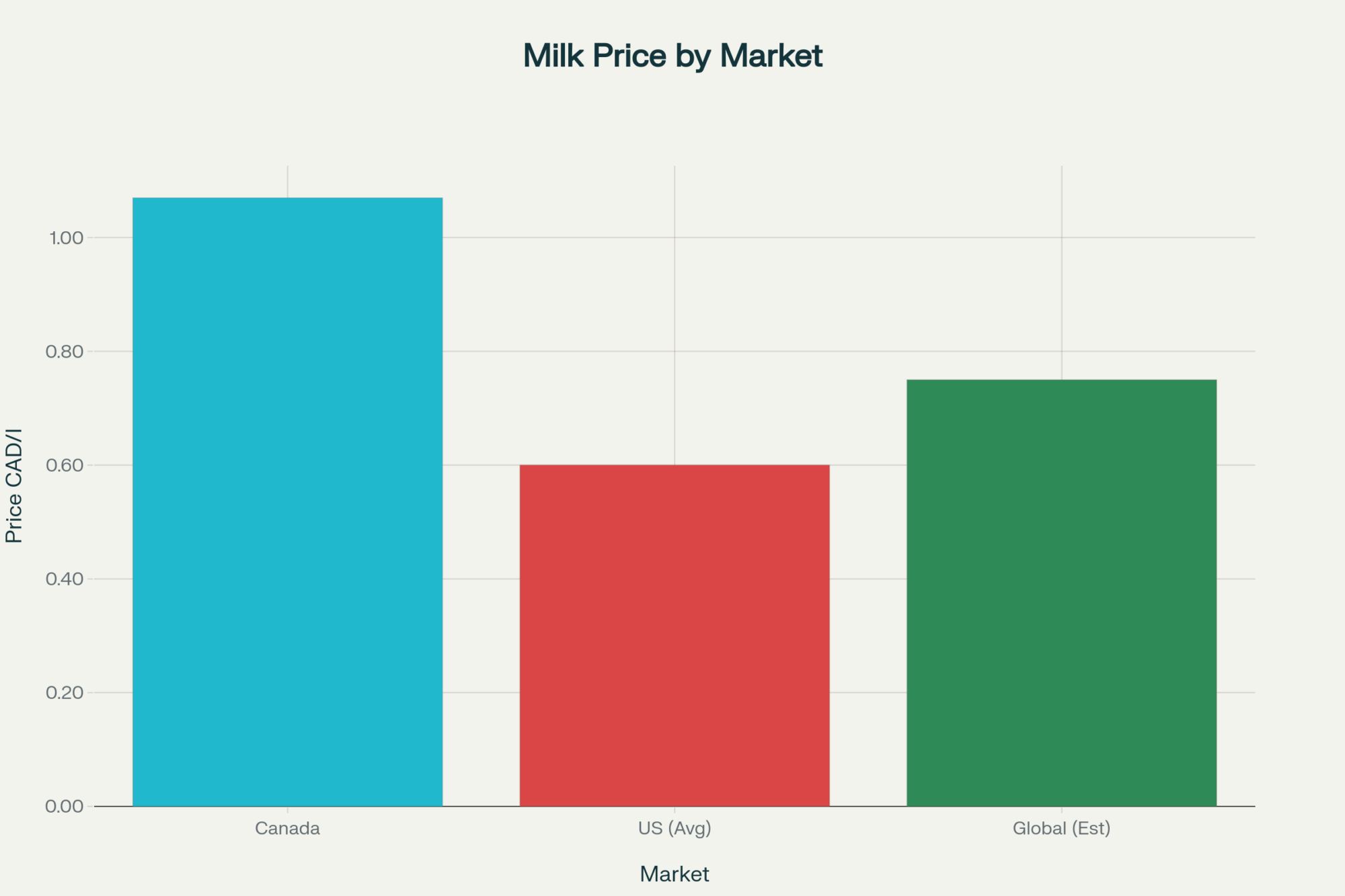

Here’s what’s worth noting, though. First Milk has maintained a strong corporate performance—the BV Dairy acquisition significantly expanded its processing capacity. But those processor-level numbers don’t change the reality that farmgate prices have to track global commodity markets, regardless of how well the creameries perform. The processing business can be healthy while the farm business struggles. That disconnect frustrates producers, understandably so.

Understanding Why Cooperative Boards Make Difficult Choices

I’ve followed cooperatives across three continents over the years, and the pattern at First Milk is one I’ve seen before. Understanding these mechanics matters because they apply across all cooperatives that handle commodity dairy.

First, let’s acknowledge what cooperatives genuinely provide—and these benefits are real and significant. Collective bargaining power. Guaranteed market access even when spot buyers disappear. Shared infrastructure investment that individual farms couldn’t finance alone. There’s a good reason the cooperative model has endured for over a century in dairy.

But when global supply substantially exceeds demand—as it does currently—those benefits don’t override fundamental market dynamics.

First Milk’s board includes farmer directors like Mike Smith, who manage substantial operations themselves. These aren’t distant executives making decisions about someone else’s livelihood. They’re producers facing the same pressures as every other member.

Why did they vote for reductions? Three factors typically converge in these situations.

There’s a fiduciary duty. UK company law—specifically Section 172 of the Companies Act 2006—requires directors to act in the best interest of the enterprise as a going concern. When the cooperative faces potential covenant pressure on significant debt, preserving the business takes legal precedence over maximizing short-term member returns.

Then there’s the volume obligation built into the cooperative structure. Unlike corporate processors who can decline volume, cooperatives generally must accept what members ship. When global supply surges, that milk needs processing—even when margins suffer. Müller’s agriculture director Richard Collins acknowledged this pressure directly in their November announcement: “We’re seeing market price reductions, and daily collection volumes are still significantly higher than they were last year.”

And competitive positioning matters more than many producers realize. Arla UK set December prices at 39.21ppl (down 3.50ppl). Müller moved to 38.5 ppl (down 1.5 ppl). Freshways went to 30.4ppl. If First Milk holds significantly above market while competitors price lower, retailers shift contracts. Volume drops. Fixed processing costs are spread across fewer litres. The trajectory from there becomes concerning.

How One Welsh Family Is Working Through the Numbers

What follows is a composite based on industry figures and conversations with UK dairy advisors—not a specific identifiable operation, but representative of decisions many families are working through right now.

The Morgans milk 165 cows on 200 acres outside Carmarthen. Third generation on the land. Two children—one considering returning to farm after agricultural college, one leaning toward other opportunities.

Their numbers heading into 2026:

- Monthly production: 114,000 litres

- First Milk price (January): 32.25ppl = £36,765 revenue

- All-in production cost: 44ppl = £50,160

- Monthly gap: Around £13,395

They’re carrying about £340,000 in debt—equipment loans, a 2019 cubicle shed, and an operating line. Their debt-to-asset ratio sits around 45%. DEFRA’s Balance Sheet Analysis suggests that’s actually in reasonable shape compared to many UK dairy operations.

The family has been running scenarios this autumn:

Scale up option: Adding 80-100 cows would require roughly £400,000 in new investment—buildings, livestock, and slurry capacity. At current prices, that creates a larger shortfall with more debt service. They’d need milk to recover to 38-40ppl within three years for expansion to work financially. That’s possible, but far from certain.

Exit option: Cull cow prices are historically strong right now. AHDB’s weekly livestock reports from late 2025 showed deadweight cows averaging well above the five-year average. Land in their area has traded around £8,500/acre recently, according to Farmers Weekly market reports. They could likely clear debt and retain meaningful equity. But three generations of work and the children’s potential inheritance make this more than a financial calculation.

Reduce and reassess: They’re seriously considering culling 25-30 head this winter, generating £40,000-50,000 in cull revenue while beef prices hold. That cuts feed costs immediately and gives 18 months to see how markets develop. It’s not a permanent solution—more of a managed pause that preserves options.

| Herd Size | Monthly Litres | Revenue @ 32.25p | Cost @ 43p | Monthly Loss | Annual Bleed |

|---|---|---|---|---|---|

| 100 cows | 68,000 | £21,930 | £29,240 | -£7,310 | -£87,720 |

| 150 cows | 103,000 | £33,218 | £44,290 | -£11,072 | -£132,864 |

| 200 cows | 137,000 | £44,183 | £58,910 | -£14,727 | -£176,724 |

| 300 cows | 205,000 | £66,113 | £88,150 | -£22,037 | -£264,444 |

| 450 cows (Mike Smith) | 308,000 | £99,330 | £132,440 | -£33,110 | -£397,320 |

The son, home for Christmas, asked his father what he thought would happen to UK dairy over the next decade. The response was sobering: “A lot of the farms that are here now won’t be in ten years. The question is whether we’re among those who continue or those who don’t.”

The Global Supply Dynamics Driving These Pressures

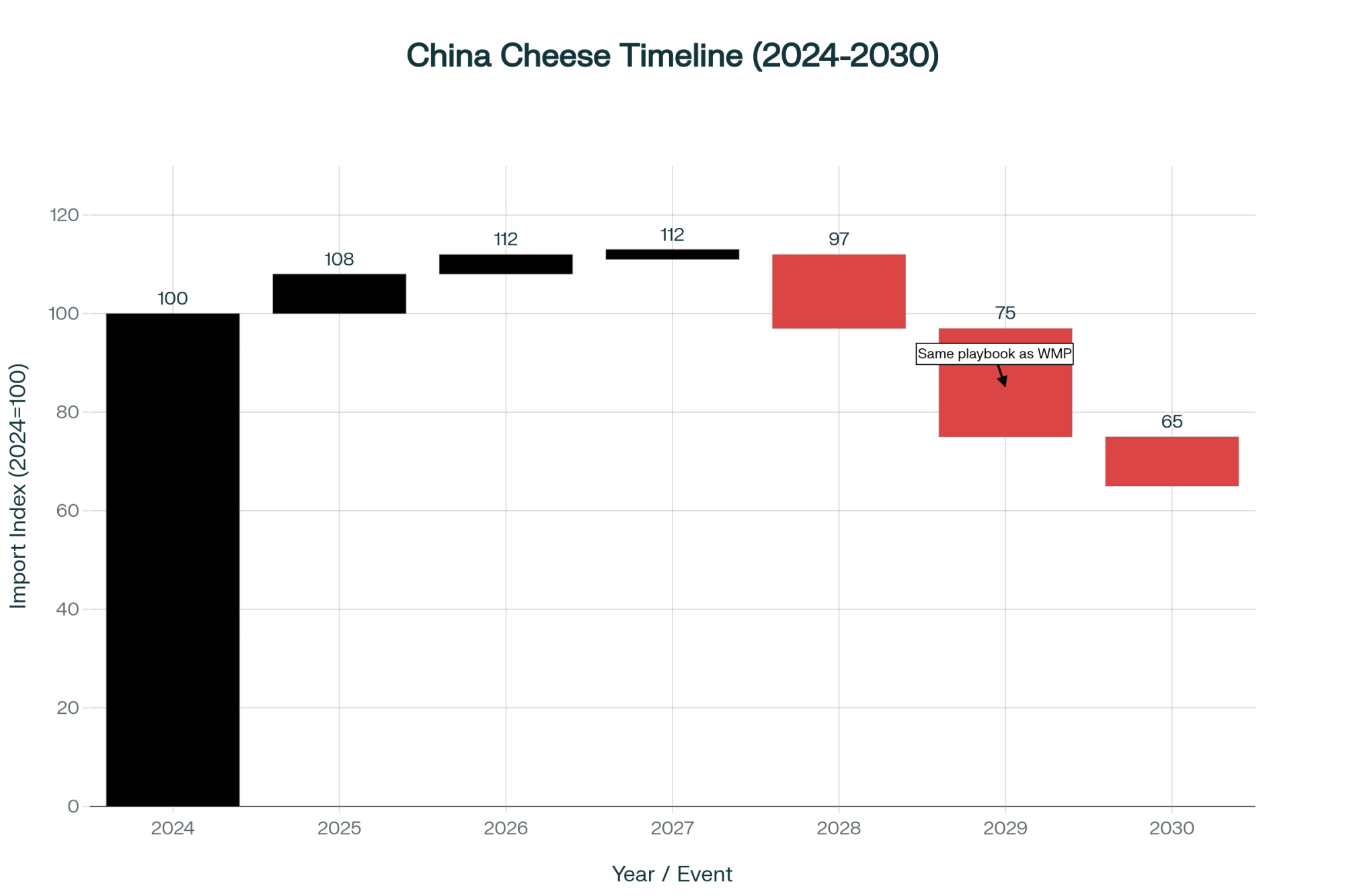

This situation feels different from previous dairy downturns—and that distinction matters for how farmers might respond.

The 2015-16 downturn was largely demand-driven. Russia embargoed EU dairy. Chinese buying slowed significantly. When those external factors resolved, prices recovered. This time, pressure is coming from the supply side. That’s more challenging because there’s no single external event to wait out.

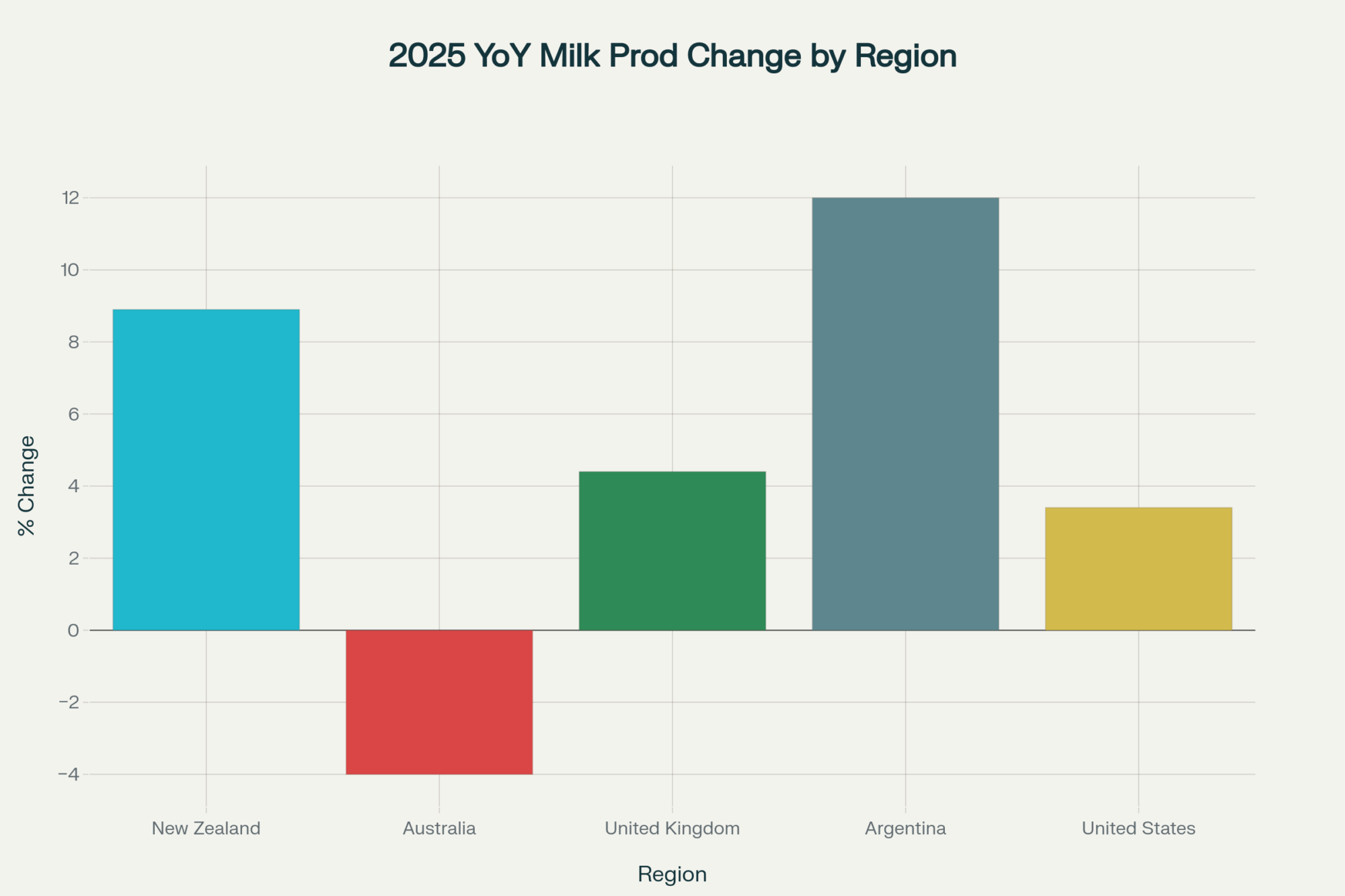

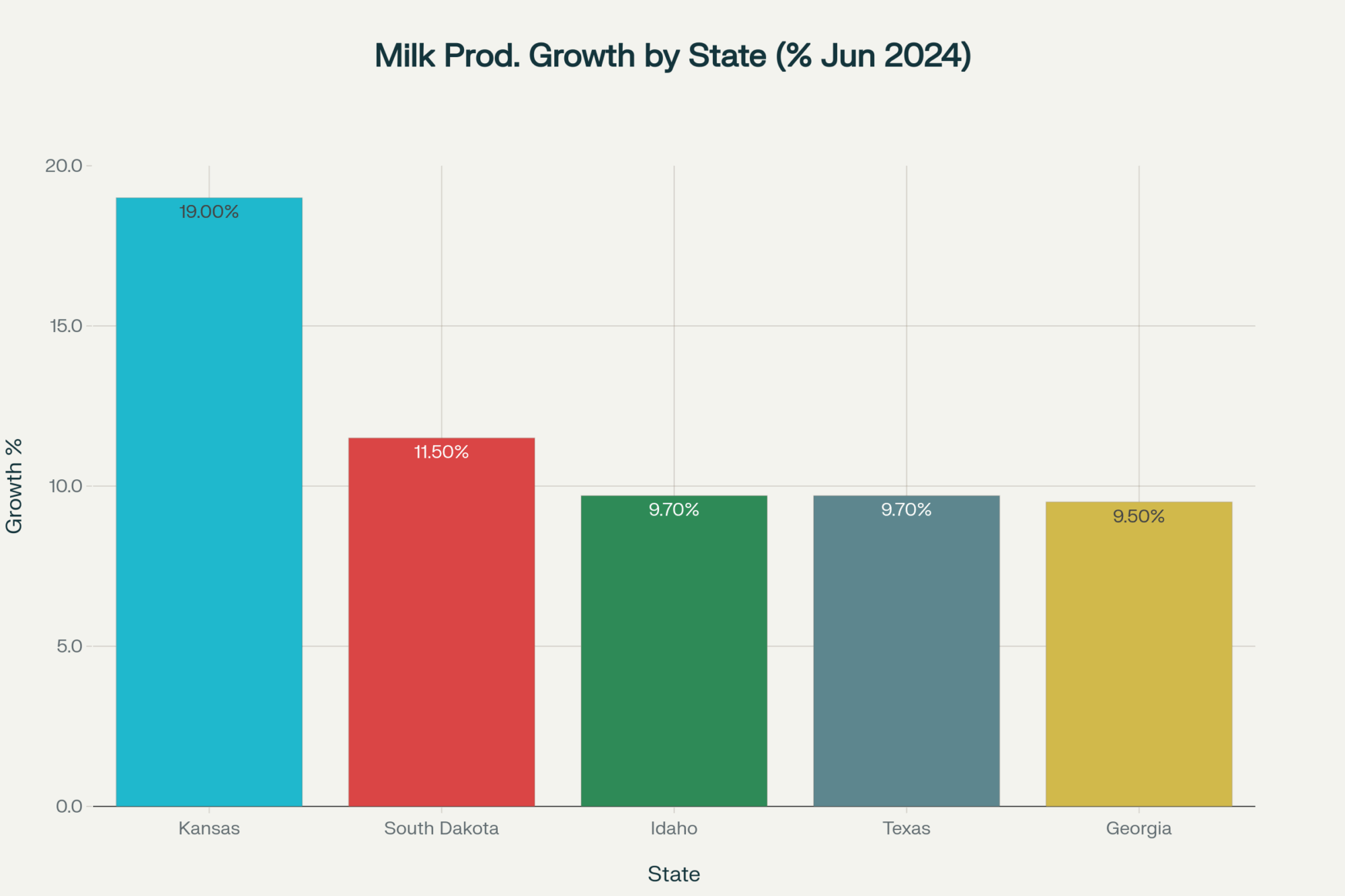

Irish milk production increased substantially through 2025. AHDB’s tracking shows January-May 2025 Irish output running 7.6% above the same period in 2024—with March up 8%, April up 13%, and May up 7%. That’s farmers pushing volume ahead of tightening nitrate regulations—an understandable response to policy changes, but one that’s flooding markets with additional supply.

Meanwhile, European production dynamics are complex. USDA’s Foreign Agricultural Service EU Dairy Forecast from February 2025 showed EU milk deliveries forecast to decline marginally by 0.2% in 2025, with low farmer margins and environmental restrictions pushing some smaller producers out. But GB production tells a different story entirely—AHDB’s December 2025 forecast update projects UK milk production for 2025/26 at a record-breaking 13.05 billion litres, up 4.9% from the previous milk year.

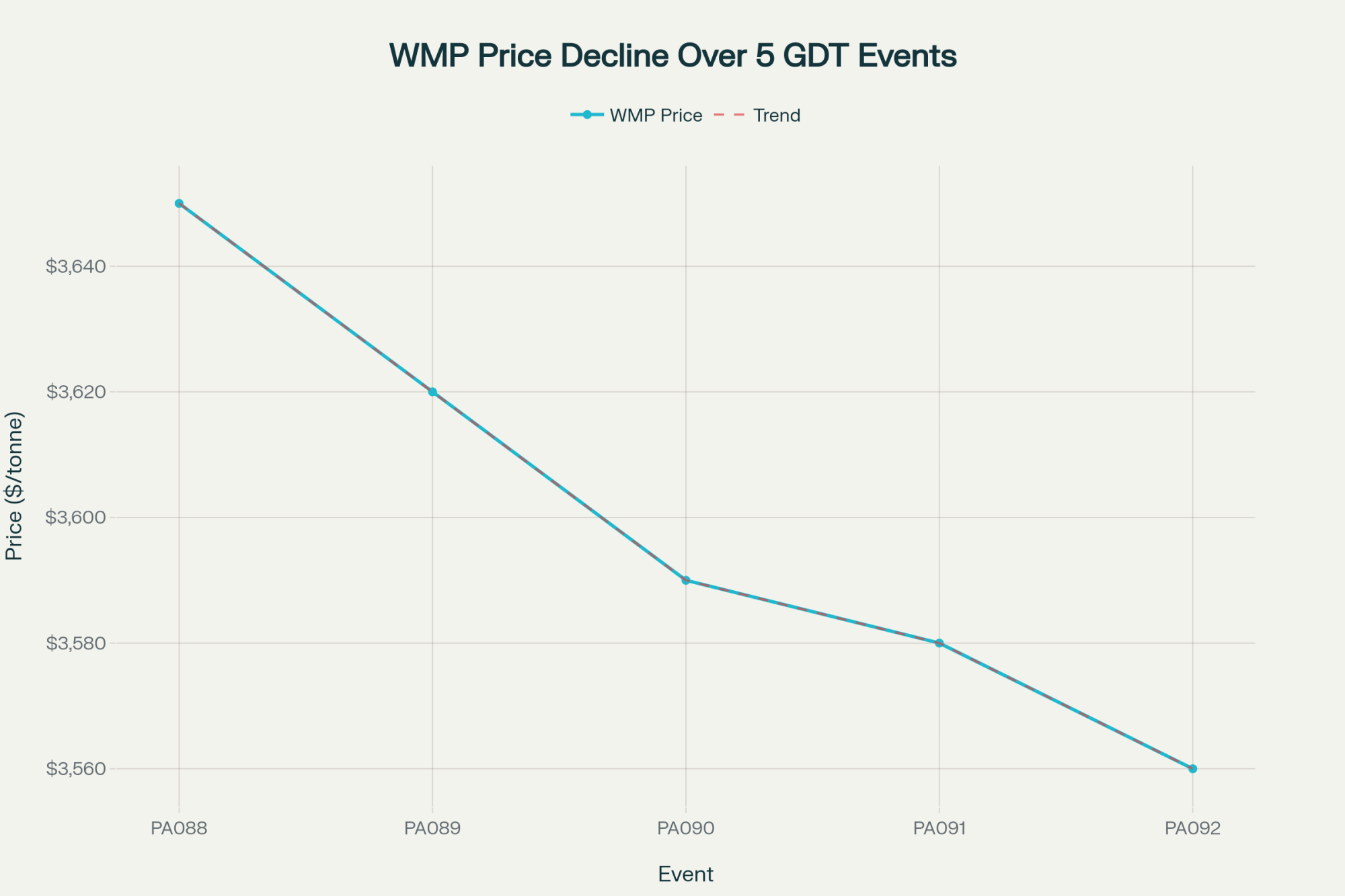

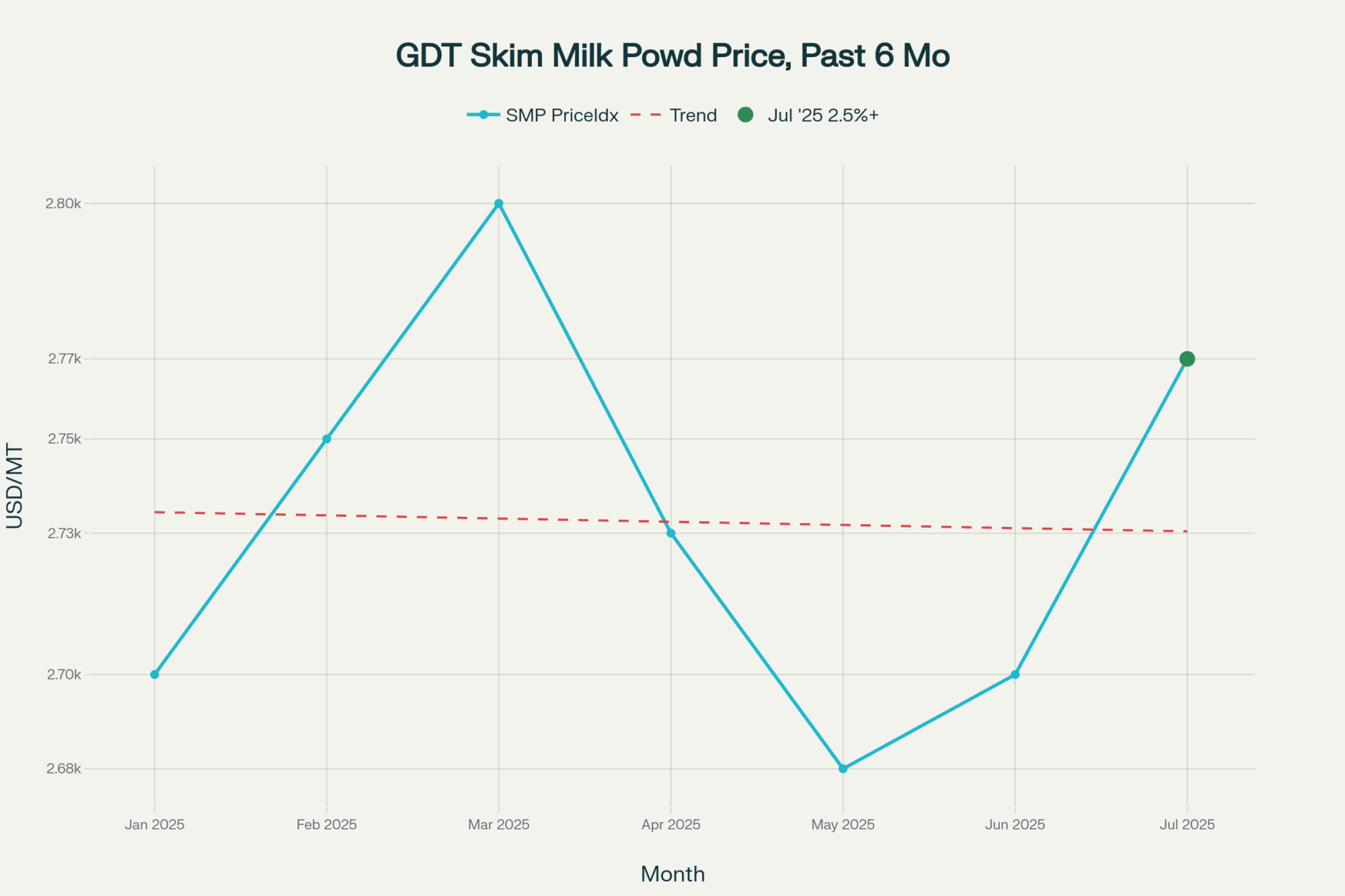

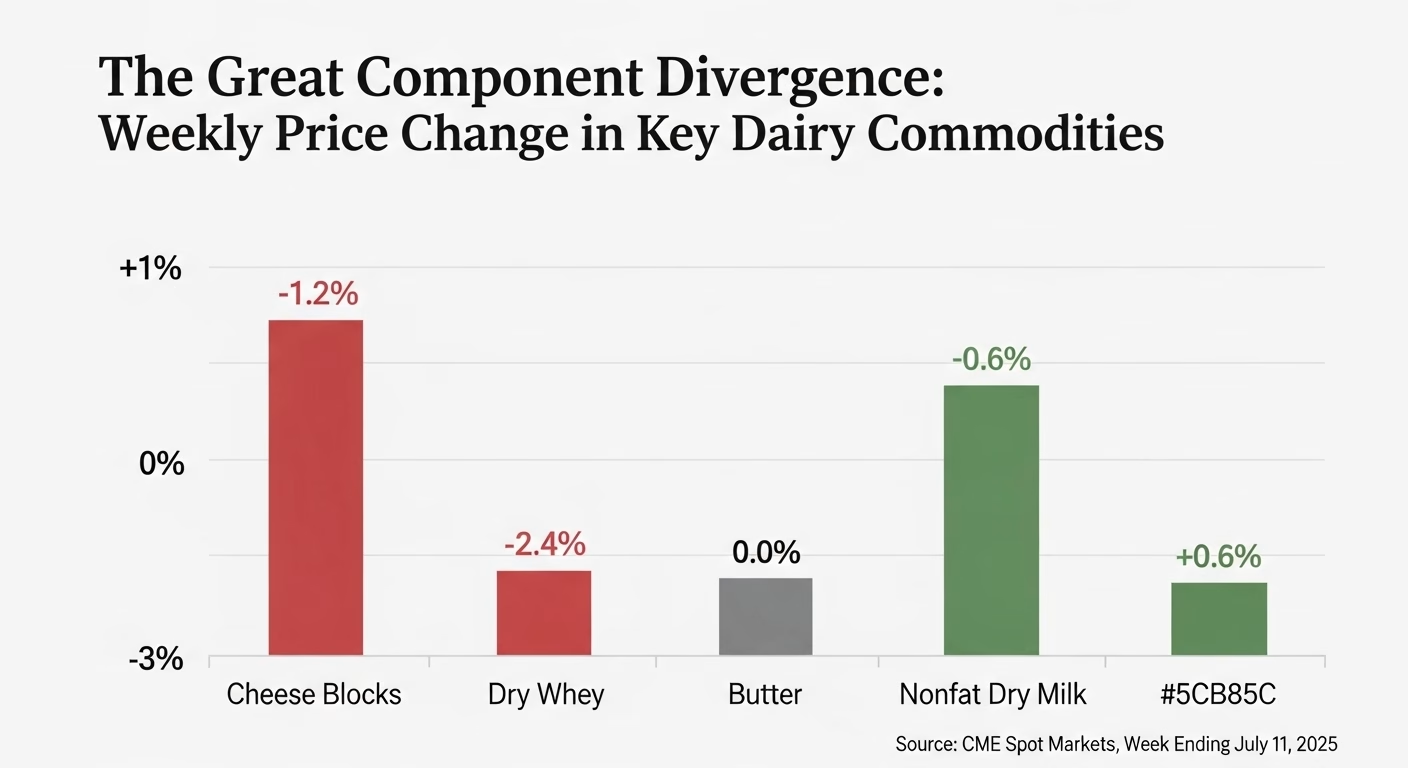

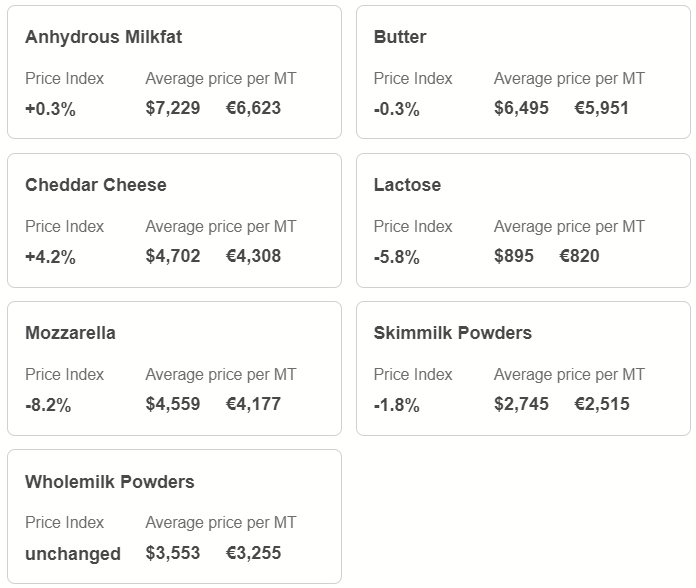

The Global Dairy Trade auction results reflect these dynamics. The December 2025 auction saw the index decline 4.3%—the eighth consecutive decline—with butter crashing 12.4% to US$5,169 per tonne. AHDB noted that “increasing global dairy milk supplies and product stocks are weighing heavily on prices currently.”

Independent dairy analyst Chris Walkland offered a stark assessment in late November: some producers could face milk payments between 30 and 35 pence per litre for eight to nine months.

The Brexit Trade Dimension

Everything described so far applies to dairy producers globally. But UK farmers are navigating the same supply environment while operating outside the EU’s single market. That creates additional complexity.

Trade data analyzed by Logistics UK shows UK dairy and egg exports to the EU declined approximately 6% since Brexit. The documentation requirements have proven substantial.

The mechanics are straightforward but add costs. Every dairy shipment to the EU requires export health certificates, veterinary sign-off, and potential border inspections under the sanitary and phytosanitary (SPS) control framework introduced in 2024. An analysis by Stone X noted that “the UK and EU now treat each other as ‘third countries,’ meaning any dairy products moving across the Channel are subject to rigorous SPS checks.”

John Lancaster, head of EMEA and Food Consultancy at Stone X, observed: “Volatility is nothing new for the dairy sector, but the nature of that volatility is evolving. The UK, traditionally a net importer of dairy, has seen strong milk collections in recent months, likely leading to reduced imports in 2025. This elevated supply, combined with administrative barriers to export, has meant that local spot prices can swing more sharply.”

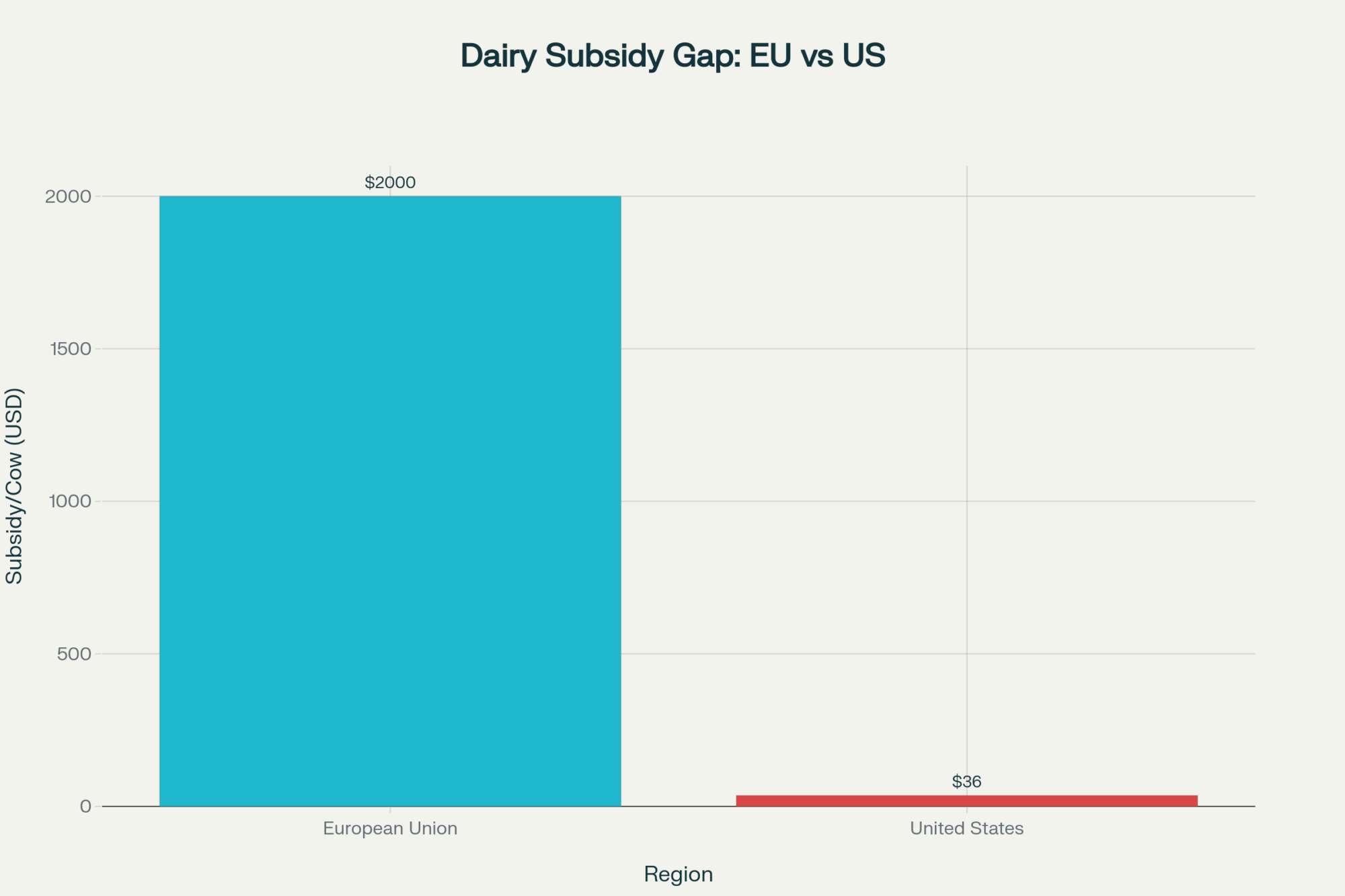

Ireland and the Netherlands face similar global supply pressures. But they operate within the single market—frictionless trade, shared regulations, and access to EU support mechanisms. UK producers are competing with additional administrative and cost burdens that other major producing regions don’t face.

What Successful Adaptation Looks Like

Alongside these challenges, some operations are finding paths forward. The strategies vary but share a common element: reducing pure commodity exposure.

Millbrook Dairy in the West Midlands has developed direct export relationships, particularly targeting Middle Eastern markets where UK cheese commands a premium positioning. According to Dairy Reporter’s coverage from May 2025, the company has faced Brexit, COVID-19, the Red Sea crisis, and US tariffs—but rising global demand for premium cheese and butter has created opportunities for those willing to navigate the complexity.

Several Welsh operations have moved toward organic certification and secured premium contracts. While conventional prices have crashed below 35ppl for some, organic producers continue receiving prices in the upper 50s ppl—First Milk’s organic price remains at 57.95ppl, unchanged from the conventional cuts.

We’re actually seeing similar patterns in North America. Some Upper Midwest producers have moved into farmstead cheese or on-farm processing to capture more margin. A few Ontario operations have built agritourism components that complement their dairy income. These aren’t easy pivots—they require capital, skills, and market access—but they show the “expand or exit” framework isn’t the only path available.

None of these approaches fit every situation. They require specific circumstances and opportunities that vary significantly by region and operation. But they illustrate that other paths exist for those positioned to pursue them.

Questions Worth Asking Your Cooperative

For North American farmers watching the UK situation, there’s practical value in understanding what to monitor closer to home. DFA handles a substantial share of the US milk supply through cooperative structures. Canadian cooperatives like Agropur and provincial marketing boards face similar dynamics when global markets shift.

Having specific questions ready when cooperative leadership presents forecasts or pricing updates can be valuable:

On volume management:

- Is the cooperative implementing or considering base-excess programs or volume adjustments?

- What percentage of members are shipping above base allocation?

- How does the cooperative plan to balance supply if market conditions weaken?

On financial position:

- What are the cooperative’s current debt covenants, and how much flexibility exists?

- What milk price level would create covenant concerns?

- How much of the operating profit comes from processing versus member milk margin?

On forward planning:

- What price scenarios is management modeling for the next 12-24 months?

- At what price level would capacity rationalization become necessary?

- How are competing processors positioned, and what’s the risk of contract shifts?

These aren’t confrontational questions—they’re the kind of information that business owners should reasonably have about enterprises they collectively own.

Indicators Worth Watching

The UK situation offers a framework for what to monitor. Several metrics are worth tracking.

Supply growth provides early signals. USDA’s monthly Milk Production report is the primary source. If year-over-year growth exceeds 3% for six consecutive months, supply is outpacing demand. That pressure eventually reaches farmgate pricing. Wisconsin producers might watch regional production trends particularly closely, given the concentration of cooperative membership in the Upper Midwest.

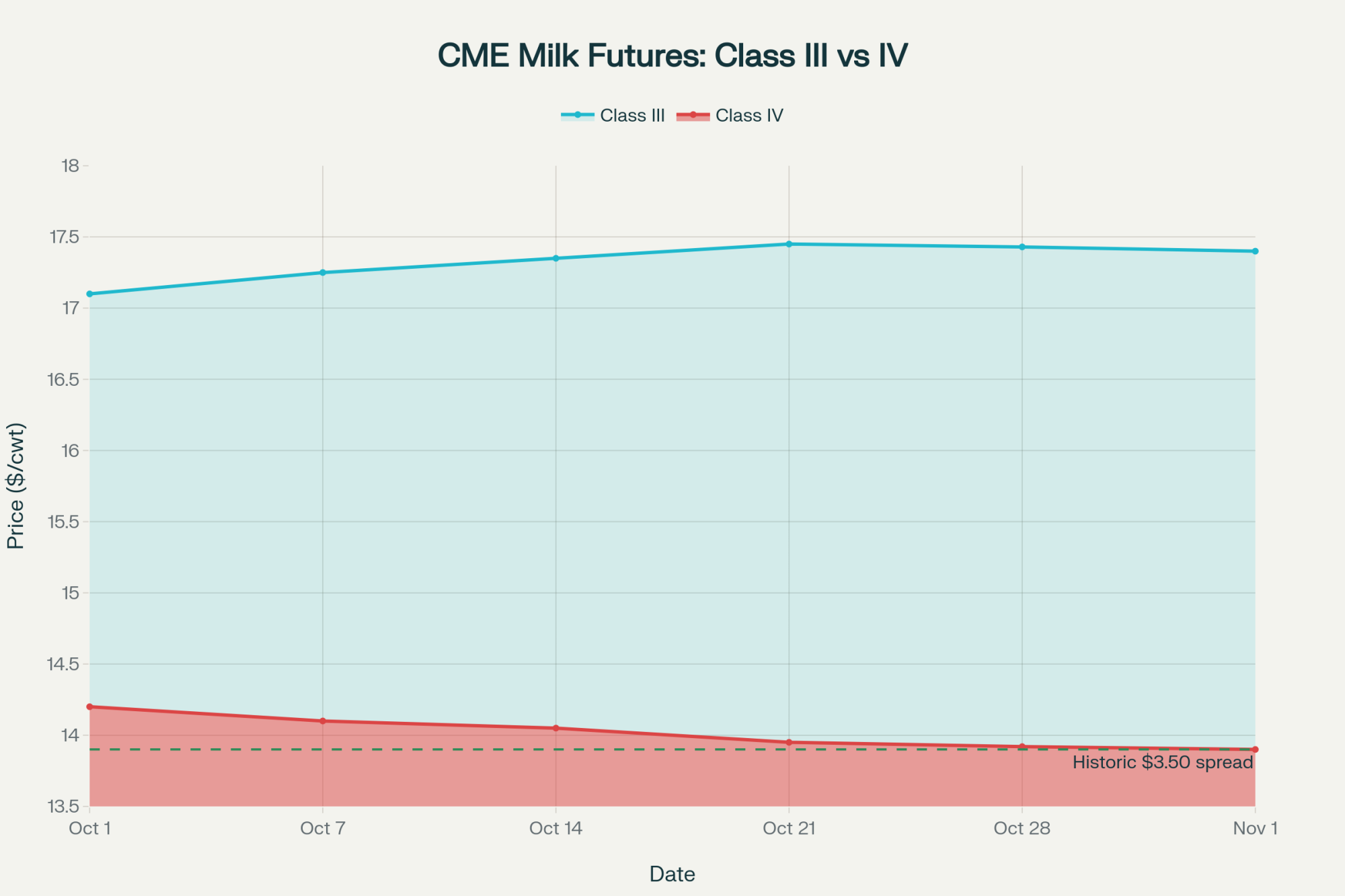

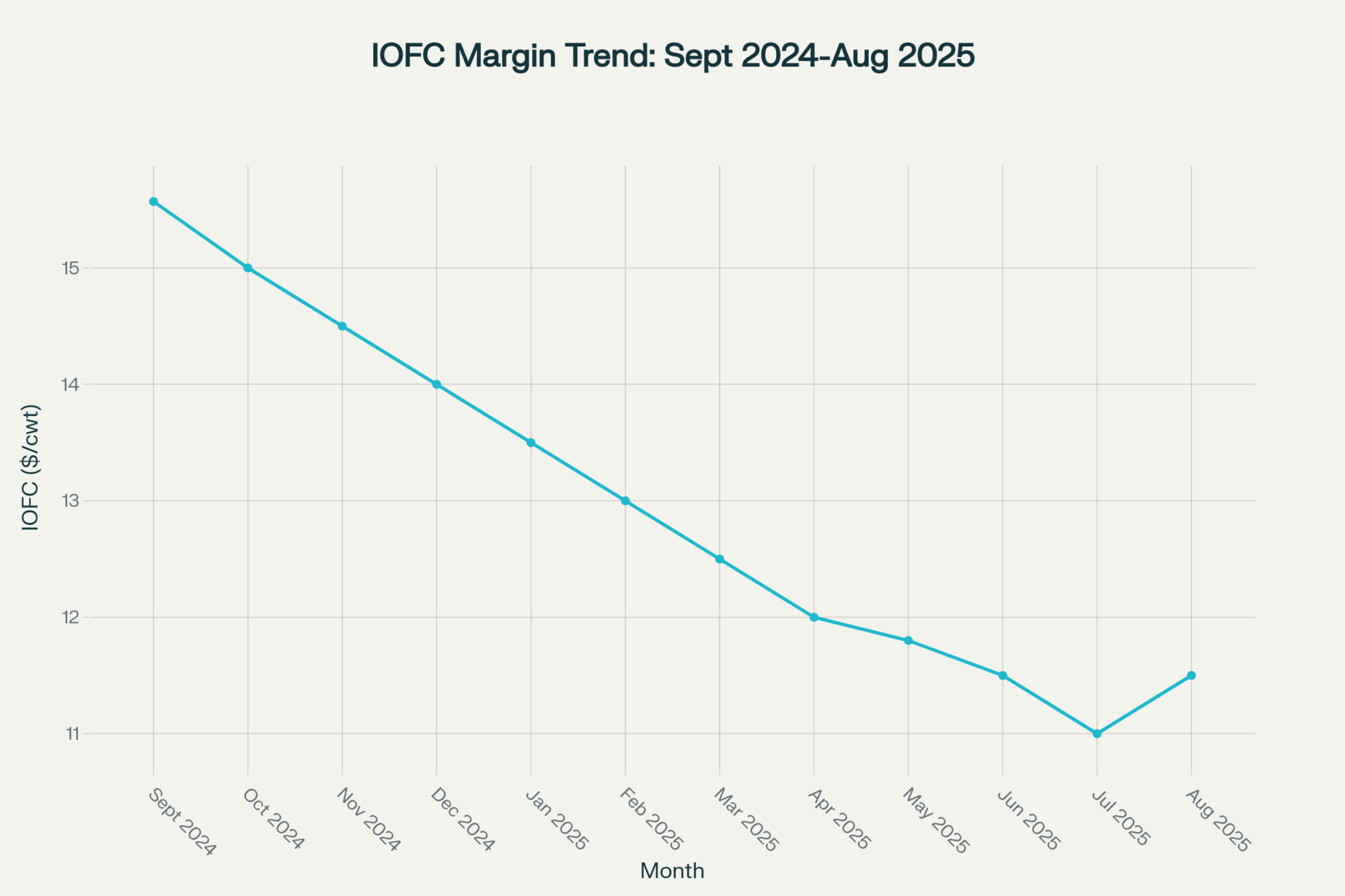

Futures markets offer forward visibility. CME Class III cheese futures below $17/cwt for extended periods suggest markets are pricing in oversupply conditions. Monthly checks of forward curves provide useful context for planning.

Cooperative communications often signal direction if you listen carefully. When leadership emphasizes “supply balance,” “market alignment,” or “production discipline,” they may be preparing ground for pricing adjustments. Richard Collins at Müller noted they’re “keeping a close eye on supply and demand”—that language often precedes action by 60-90 days.

Cull market conditions indicate exit dynamics. Strong cull prices create exit incentive—but also suggest culling hasn’t reached levels that would meaningfully reduce supply.

When multiple indicators converge, the UK pattern becomes more relevant to local planning.

The Broader Industry Pattern

After three decades in this industry—starting with a Master Breeder operation and later founding The Bullvine—I keep returning to a pattern that deserves direct discussion.

Cooperative commodity dairy, by its structural design, tends to address supply-demand imbalances partly through changes in membership. That’s not necessarily a failing of the model—it’s inherent to how cooperatives function in commodity markets. When global supply exceeds demand, and prices fall below production costs, cooperatives adjust farmgate pricing to maintain processing viability. Those price adjustments create pressure on higher-cost operations. Some exit. Supply eventually contracts. Prices stabilize for continuing producers.

The cooperative continues. Membership consolidates. The cycle continues.

AHDB’s latest survey of milk buyers revealed an estimated 7,040 dairy producers in GB as of April 2025—a loss of 190 producers (2.6%) since the previous year. Against a backdrop of rising volumes, this suggests a continued shift toward fewer, larger farms. Industry exits typically occur during the winter months, before housing and other input requirements rise seasonally.

This isn’t an argument against cooperatives. Their benefits remain genuine—market access, collective bargaining strength, shared risk, and infrastructure investment beyond individual farm capacity. But it does argue for a realistic understanding of what cooperative membership provides. Insulation from global market forces isn’t among those benefits.

Practical Considerations by Situation

For operations with strong balance sheets—debt-to-asset below 40%: This environment may present opportunities. Industry transitions often create acquisition possibilities. Operations that can achieve competitive production costs at scale, with family commitment to a long-term horizon, may be well-positioned for the consolidation ahead.

For operations with moderate leverage—40-60% debt-to-asset: Focus on cash preservation and maintaining flexibility. Cull strategically to generate near-term cash while beef prices remain favorable. Explore loan restructuring while lenders remain accommodating. Develop realistic exit valuations to understand your position. The objective is to navigate 24 months without eroding equity, then reassess.

For operations with higher leverage—above 60% debt-to-asset —the situation requires an honest assessment. At current UK price levels, highly leveraged operations face compounding challenges that can steadily erode equity. Voluntary, well-planned transition while cull and land markets remain favorable often preserves more family wealth than delayed, pressured decisions. That’s a difficult conversation, but an important one.

For all operations: Know your actual cost of production—including properly valued family labor. Understand your cooperative’s financial position and be prepared to ask informed questions. Watch the indicators that might signal your region following similar patterns. And recognize that choosing your timing generally produces better outcomes than having timing determined by circumstances.

Editor’s Note: All pricing data cited in this article comes from official processor announcements and AHDB reports from November-December 2025. Production cost figures reference AHDB, Promar International, and Kite Consulting industry benchmarks. National and regional averages may not reflect your specific operation’s circumstances. We welcome producer feedback and regional case studies for future reporting. Contact: andrew@thebullvine.com

Resources for Ongoing Monitoring:

- AHDB Dairy Market Indicators: ahdb.org.uk/dairy (free registration provides full cost tracker access)

- USDA Milk Production Reports: usda.gov/nass

- Global Dairy Trade Auction Results: globaldairytrade.info

- CME Dairy Futures: cmegroup.com/markets/agriculture/dairy

Key Takeaways

- 32p milk, 43p costs. First Milk’s January 2026 price leaves most UK producers hemorrhaging cash—£11,000+ monthly on a mid-size herd. The gap isn’t a glitch. It’s global oversupply working exactly as markets do.

- A farmer voted to cut his own pay. Vice Chairman Mike Smith slashed his milk price by £6,500/month because UK law requires cooperative directors to protect the enterprise first. Fiduciary duty trumps member income when the cooperative’s survival is at stake.

- Cooperatives manage consolidation—they don’t prevent it. UK dairy shrank from 35,000 farms to 7,000 over thirty years. Cooperative membership provided orderly exits and market access for survivors, not insulation from structural economics.

- The supply glut is structural, not seasonal. Irish milk up 7.6% through May. GB production at record highs. Eight straight declines in the Global Dairy Trade auction. There’s no external shock to wait out—this is the new baseline until supply contracts.

- Your turn is coming. DFA, Agropur, and provincial marketing boards face identical cooperative economics. The producers who understand these dynamics now—and position accordingly—will have options when pricing pressure arrives. The rest will have the options the market gives them.

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More:

- Decide or Decline: 2025 and the Future of Mid-Size Dairies – This strategic guide targets the “squeezed middle” (700-1,200 cows), outlining three specific survival paths: intended expansion, rigorous optimization, or strategic exit. Essential reading for producers needing to calculate if their debt-to-asset ratio supports the scale required to survive current consolidation trends.

- Global Dairy Market Dynamics: Navigating Volatility and Strategic Opportunities in 2025 – Expand your understanding of the supply-side pressures mentioned above with this deep dive into 2025 Global Dairy Trade (GDT) indices and regional production forecasts. It provides the broader economic context needed to anticipate price floor movements before they hit your milk check.

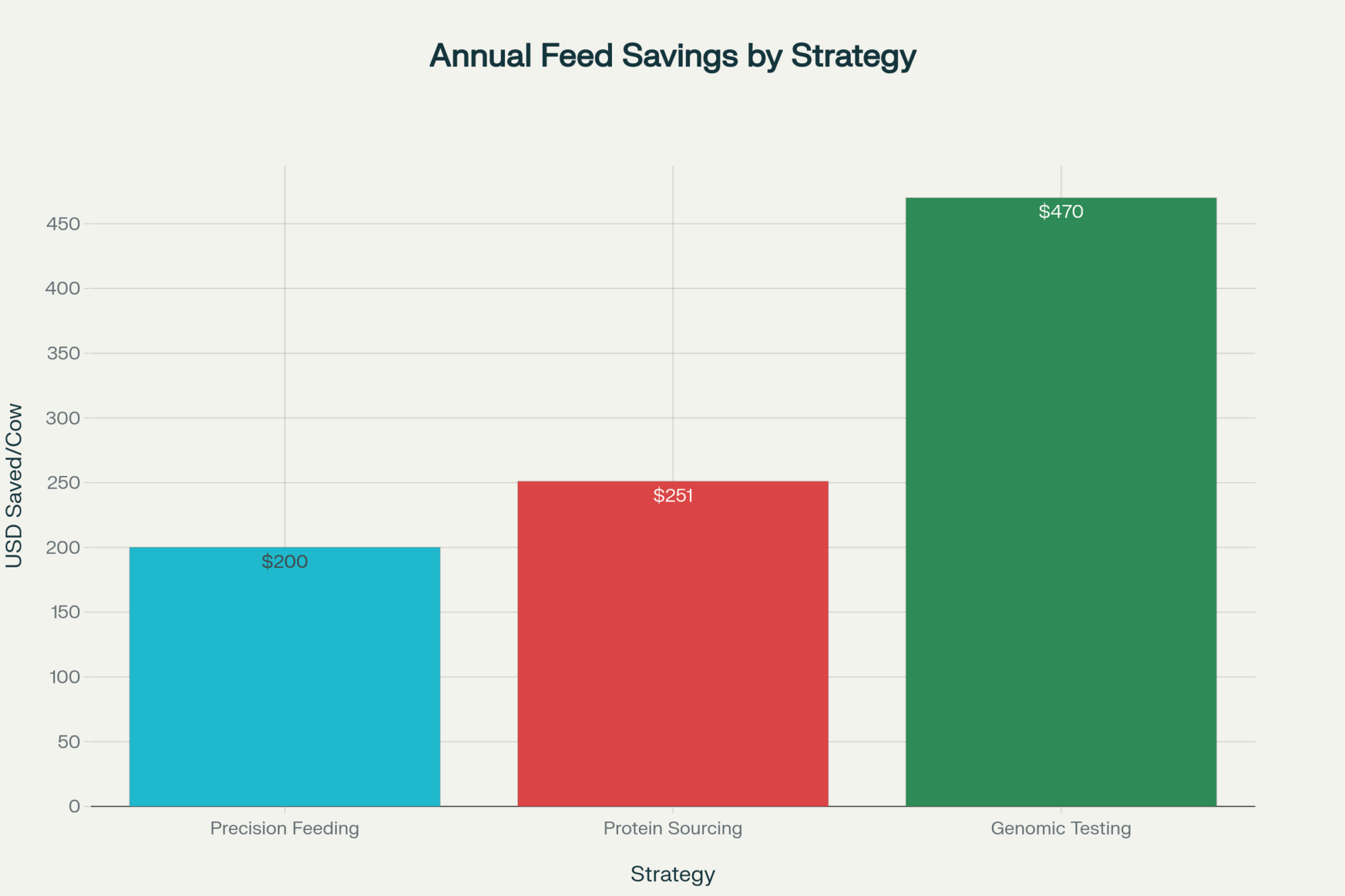

- Digital Dairy: The Tech Stack That’s Actually Worth Your Investment in 2025 – Move beyond buzzwords with this ROI-focused analysis of farm automation and data integration. It demonstrates how integrating specific technologies—like AI-driven feed management—can slash costs by 5-10%, offering a tangible way to protect margins when milk prices fall below production costs.

The Sunday Read Dairy Professionals Don’t Skip.

The Sunday Read Dairy Professionals Don’t Skip.

Every week, thousands of producers, breeders, and industry insiders open Bullvine Weekly for genetics insights, market shifts, and profit strategies they won’t find anywhere else. One email. Five minutes. Smarter decisions all week.

The Sunday Read Dairy Professionals Don’t Skip.

The Sunday Read Dairy Professionals Don’t Skip.