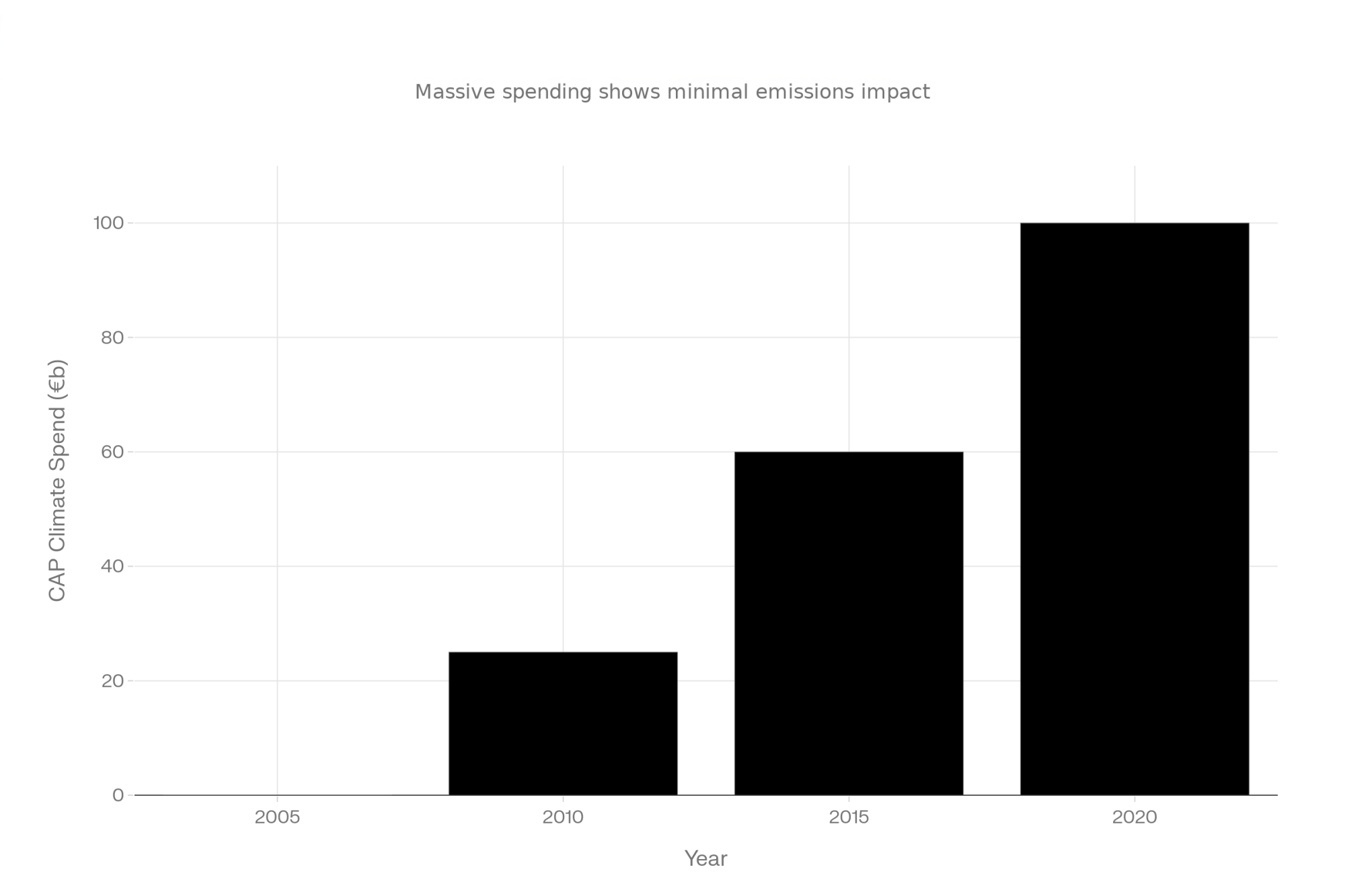

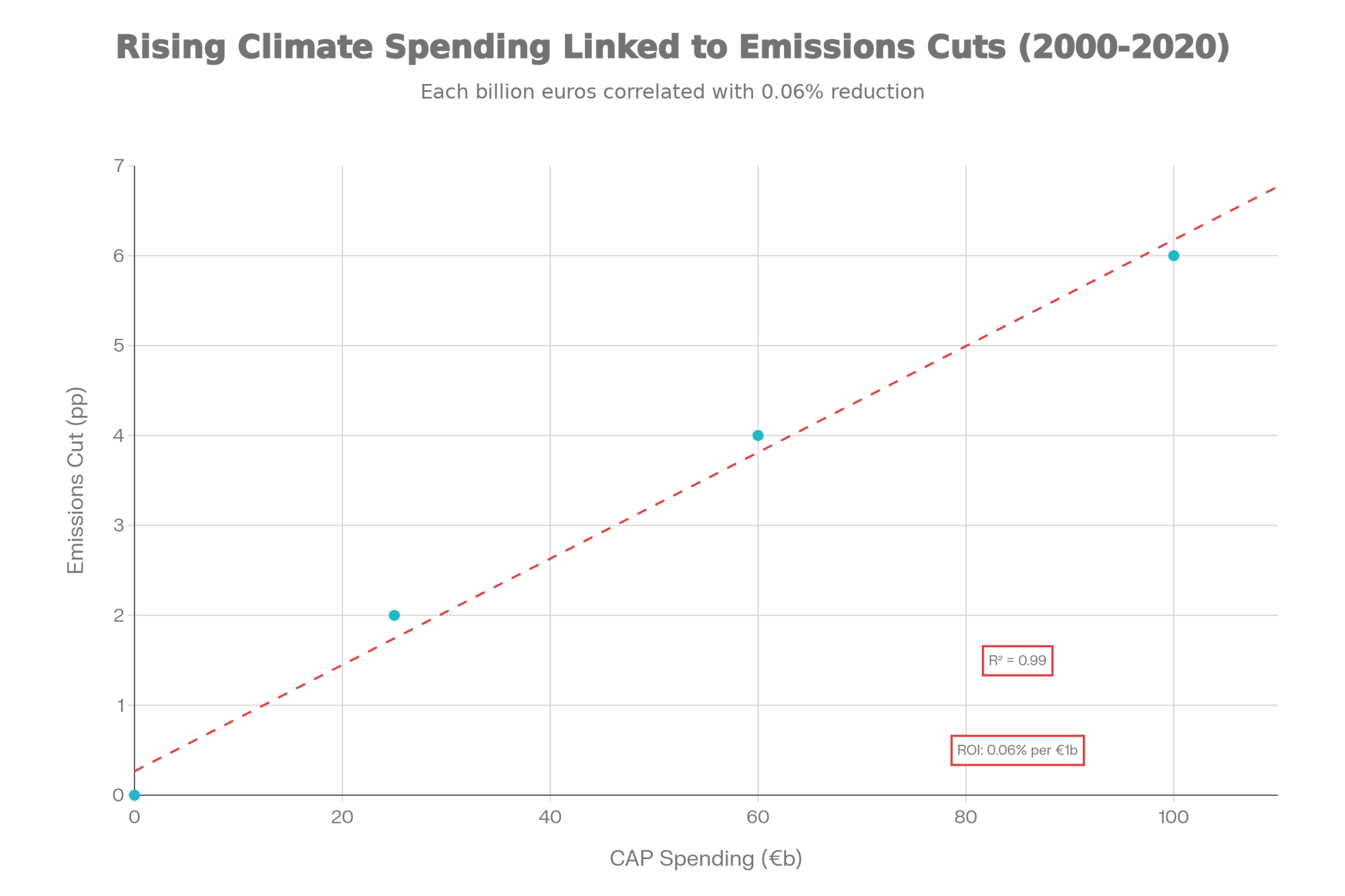

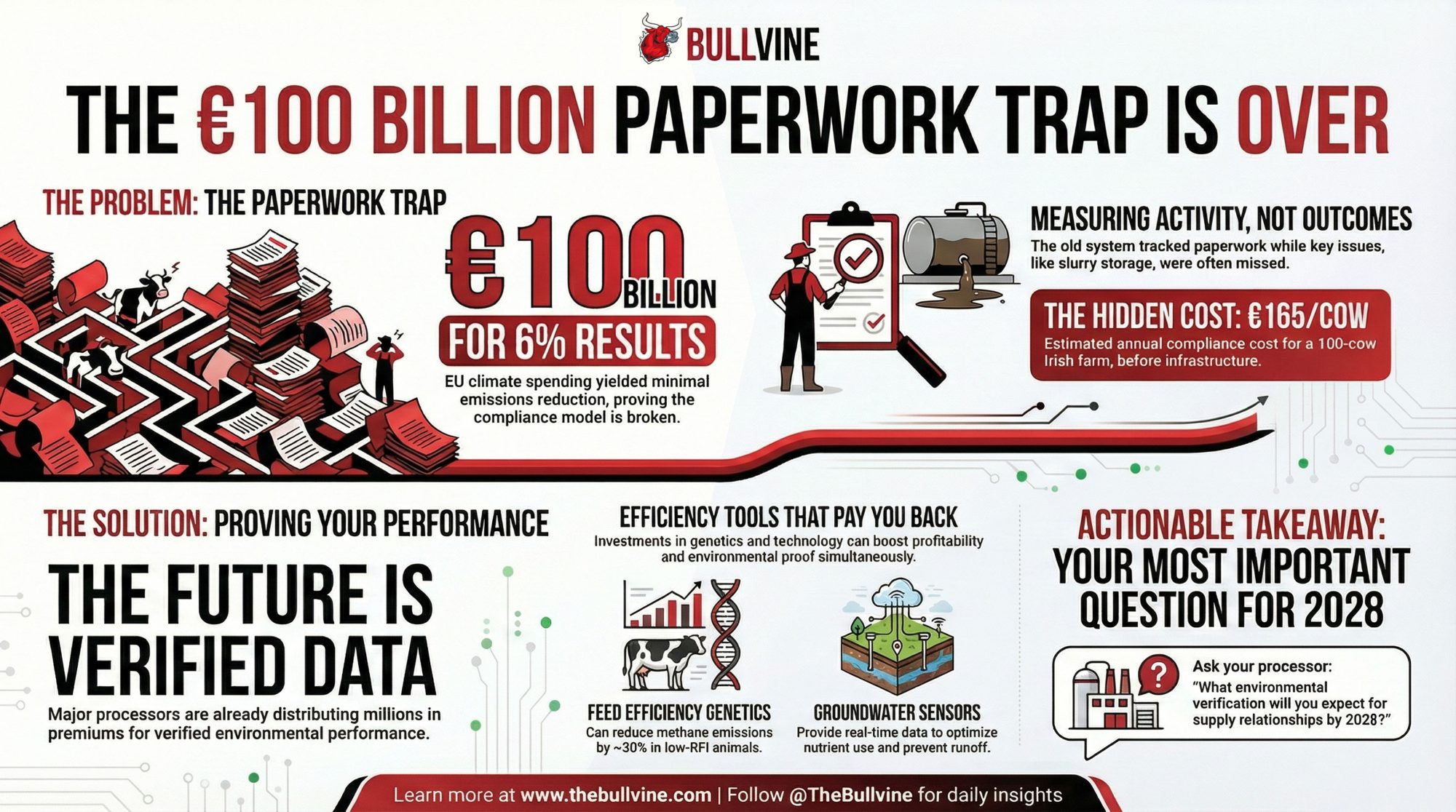

The EU just admitted €100 billion in farm compliance spending barely moved the needle. 6% emissions drop. Three decades. Now what?

EXECUTIVE SUMMARY: €100 billion spent. 6% emissions reduction. The European Court of Auditors called it “inadequate,” and November 2025’s CAP simplification finally admits the paperwork model failed. What’s replacing it: outcome-based verification. Sensors measuring actual water quality, not forms documenting practices. Arla’s Climate Check already covers 8,000 farms; FrieslandCampina distributes €245 million in sustainability premiums annually. The infrastructure exists. For dairy operations, this isn’t regulatory compliance anymore—it’s market positioning. Processors are signaling that verified environmental data will drive sourcing decisions by 2028. Farms building data capabilities now will have options. Farms without them will take what’s left.

If you’ve spent the last decade filling out environmental compliance forms, this math should make you pause. Here’s a number worth sitting with: one to two percent.

That’s roughly how much EU agricultural emissions have been declining each year. The European Environment Agency’s November 2025 analysis shows an overall drop of about six percent since 2005. And what did that take? Three decades of environmental compliance requirements. Roughly €100 billion in CAP climate spending between 2014 and 2020, according to the European Court of Auditors.

Six percent. For €100 billion.

When EU negotiators agreed in November 2025 to simplify agricultural rules—the European Commission estimates farmers will save around €1.6 billion annually across 9 million operations—the celebration naturally focused on reduced paperwork. But here’s what that simplification actually admits, and it’s something many of us have suspected for years: the compliance system wasn’t delivering results proportional to its costs.

So what might work better?

What All That Paperwork Actually Delivered

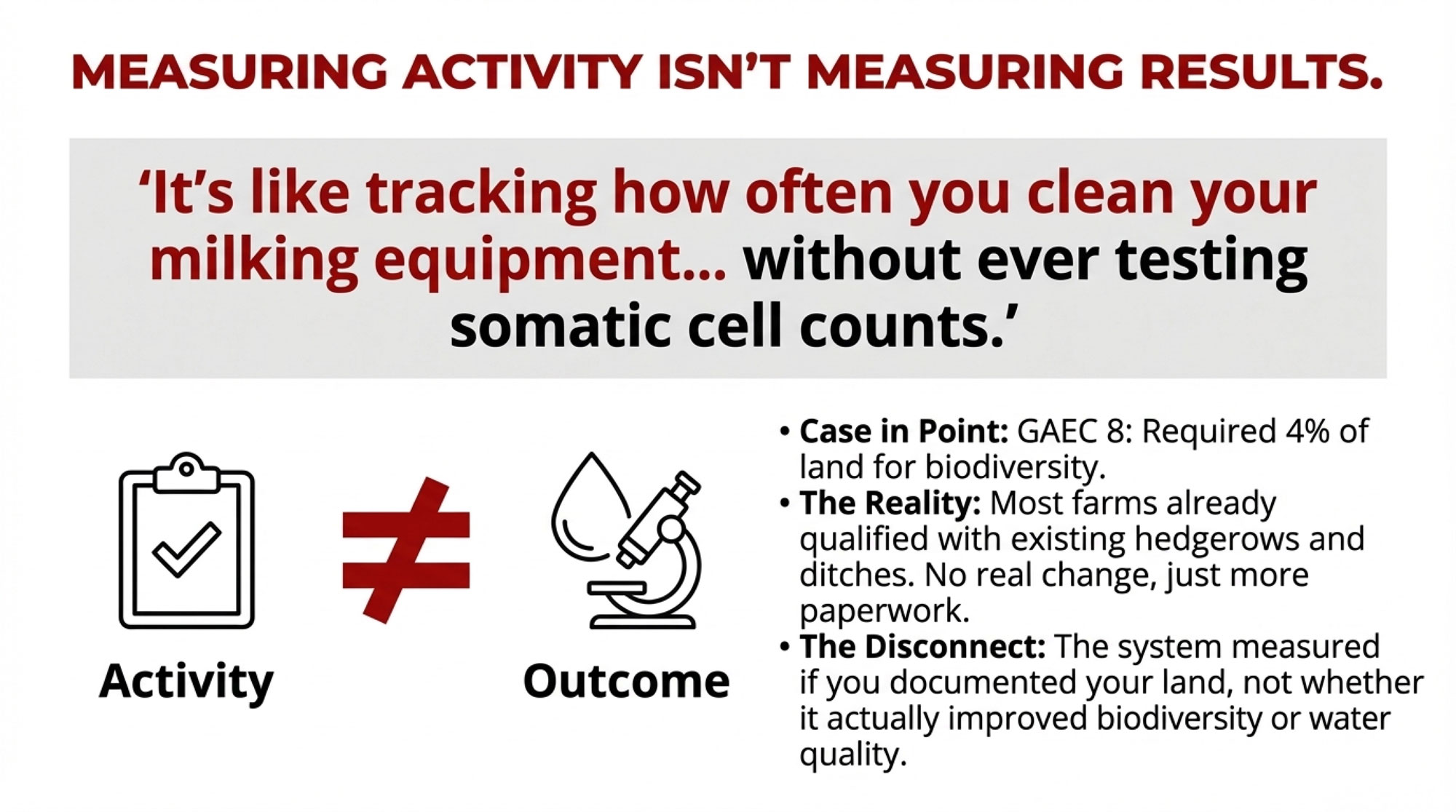

You know, I’ve been following these developments for about 15 years now, and what strikes me most is how compliance has become disconnected from actual outcomes. It’s a bit like tracking how often you clean your milking equipment without ever testing somatic cell counts. You’re measuring activity. Whether that activity produces results? That’s a different question entirely.

Take GAEC 8—the standard requiring farmers to dedicate 4% of arable land to non-productive areas for biodiversity. On paper, it sounds meaningful. In practice? Most farms already had hedgerows, drainage ditches, and those awkward corners that don’t work well for anything productive anyway. They qualified without changing much of anything.

What’s interesting is how consistently the research supports this. An academic analysis published in the European Review of Agricultural Economics found that, while greening requirements technically applied to 55% of farms and 86% of the utilized agricultural area, actual land reallocation in response to these requirements remained minimal. Most operations met the criteria through existing landscape features and current practices. The European Commission’s own assessments confirmed the pattern—requirements complex enough to generate consulting fees, designed with enough exemptions that nearly everyone already passed.

An Irish agricultural consultant I spoke with framed it pretty directly: “The system measured whether you documented your 4.8 hectares of non-productive area while saying nothing about whether nutrients were actually reaching waterways.”

And Ireland’s situation really illustrates the disconnect. Dairy farmers there face compliance costs that industry analysts estimate at €16,000 to €17,000 annually for a 100-cow operation. That’s real money going toward low-emission slurry equipment, reduced stocking rates, extended calf-keeping requirements, and soiled water storage. Yet water quality in intensive farming regions showed less improvement than anyone hoped for.

Here’s where it gets frustrating. Government consultation documents revealed that around 40% of Irish dairy farms weren’t actually compliant with slurry storage requirements—the infrastructure that directly affects water quality, as the Irish Farmers Journal reported in August 2021. So you had farmers completing paperwork while the practices that mattered most remained incomplete.

The outcome? Ireland’s nitrates derogation dropped from 250 kg/ha to 220 kg/ha. Not because paperwork was filed incorrectly, but because water quality wasn’t improving. Outcomes finally mattered more than documentation.

“I got tired of filling out forms that nobody seemed to read. Now I’m tracking what actually leaves my farm—in the water, in the air. It’s more work upfront, but I actually know where I stand.” — Pennsylvania dairy producer

The Real Cost of Compliance Theater

The European Court of Auditors didn’t mince words in their 2021 assessment. They found CAP environmental performance “inadequate”—their report explicitly stated that €100 billion in climate funds had “little impact” on agricultural emissions, which haven’t changed significantly since 2010.

That’s not just ineffective policy. It’s an expensive, ineffective policy.

When the European Milk Board calculated that EU dairy farmers averaged just €4.19 per hour in labor returns back in 2021, every hour spent on compliance paperwork instead of fresh cow management or forage quality represents a real opportunity cost. You probably know this already—time spent preparing for inspections is time not spent on the work that actually moves the needle on herd health and profitability.

Most dairy producers I talk to would rather be judged on their watershed results than on their binder organization. And honestly, that’s not anti-regulation sentiment—that’s wanting accountability systems that actually account for something meaningful.

What Outcome-Based Approaches Look Like

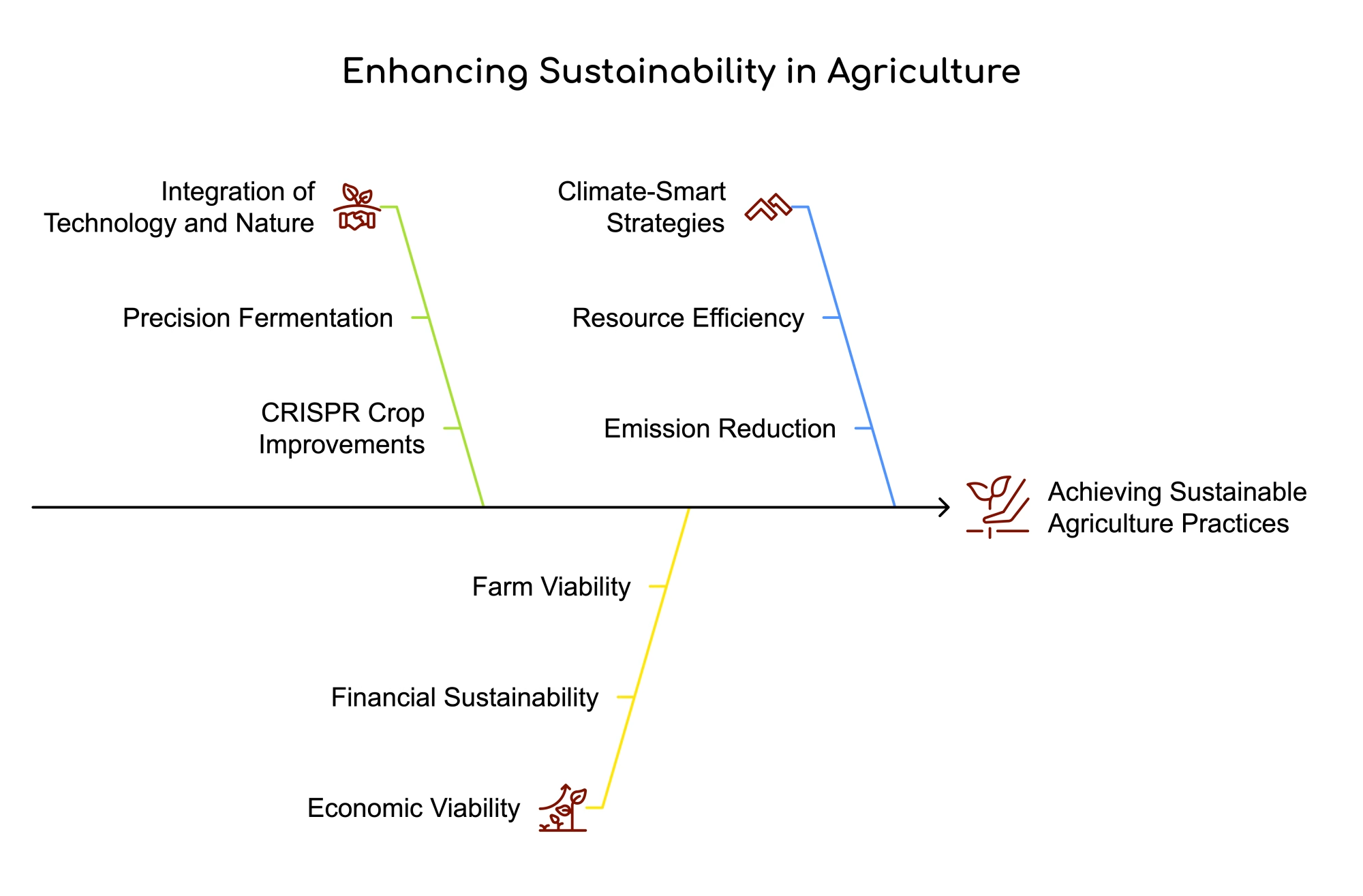

So here’s where the conversation gets interesting. Some operations—and some jurisdictions—are now exploring a fundamentally different model: measuring actual environmental results rather than documenting prescribed practices. Call it outcome-based environmental policy, if you want a name for it.

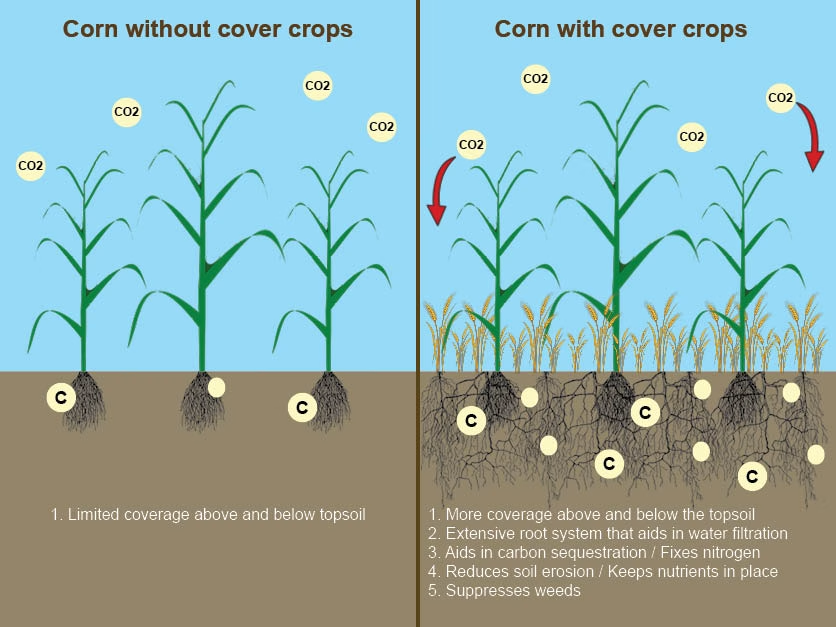

The concept is straightforward enough. Instead of requiring farmers to prove they followed specific practices, you measure what matters—nitrate levels in streams, carbon content in soils, biodiversity indicators on farmland. Then you let farmers figure out how to achieve those outcomes based on their specific land, climate, and management system.

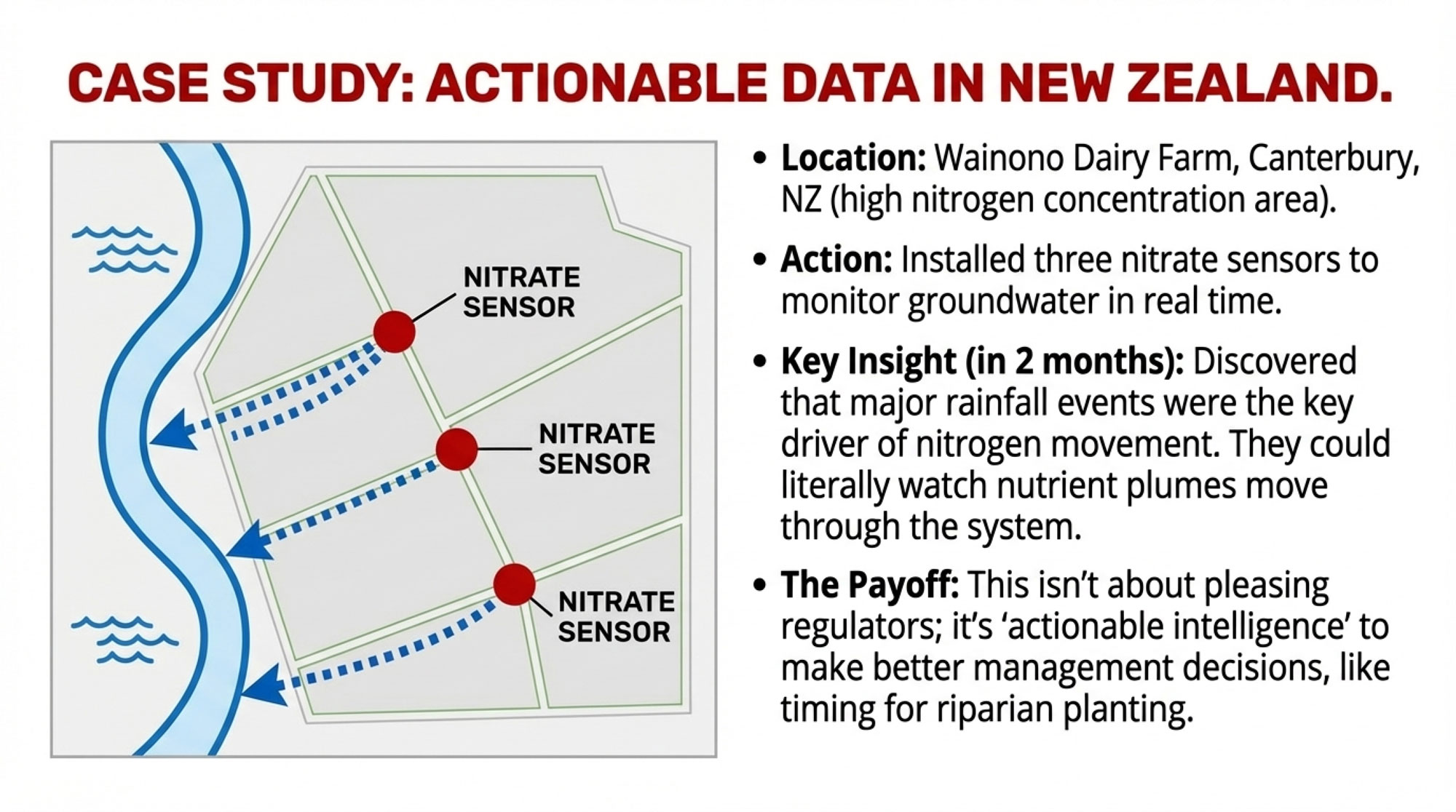

New Zealand offers probably the clearest example of this approach in action. The 672-hectare Wainono Dairy Farm near Fairlie, in Canterbury—it borders the Opihi River in a high nitrogen concentration area—installed three nitrate sensors along groundwater flow paths. Lincoln Agritech has documented the project extensively through their Our Land and Water research program.

John Wright, who manages the operation, explained their reasoning to researchers: “We see this data as a way of informing any environmental measures we take, such as riparian planting.”

What’s encouraging about that perspective is how it shifts the conversation from compliance to actual management improvement. Within two months of installing the sensors, they’d identified something they couldn’t see before—drainage from major rainfall events was the key driver of nitrogen movement on their property. They could actually watch nutrient plumes move through the groundwater system in near real time. That’s actionable intelligence, the kind that helps you make better decisions rather than just documenting what you’ve already done.

When Genetics Becomes Environmental Strategy

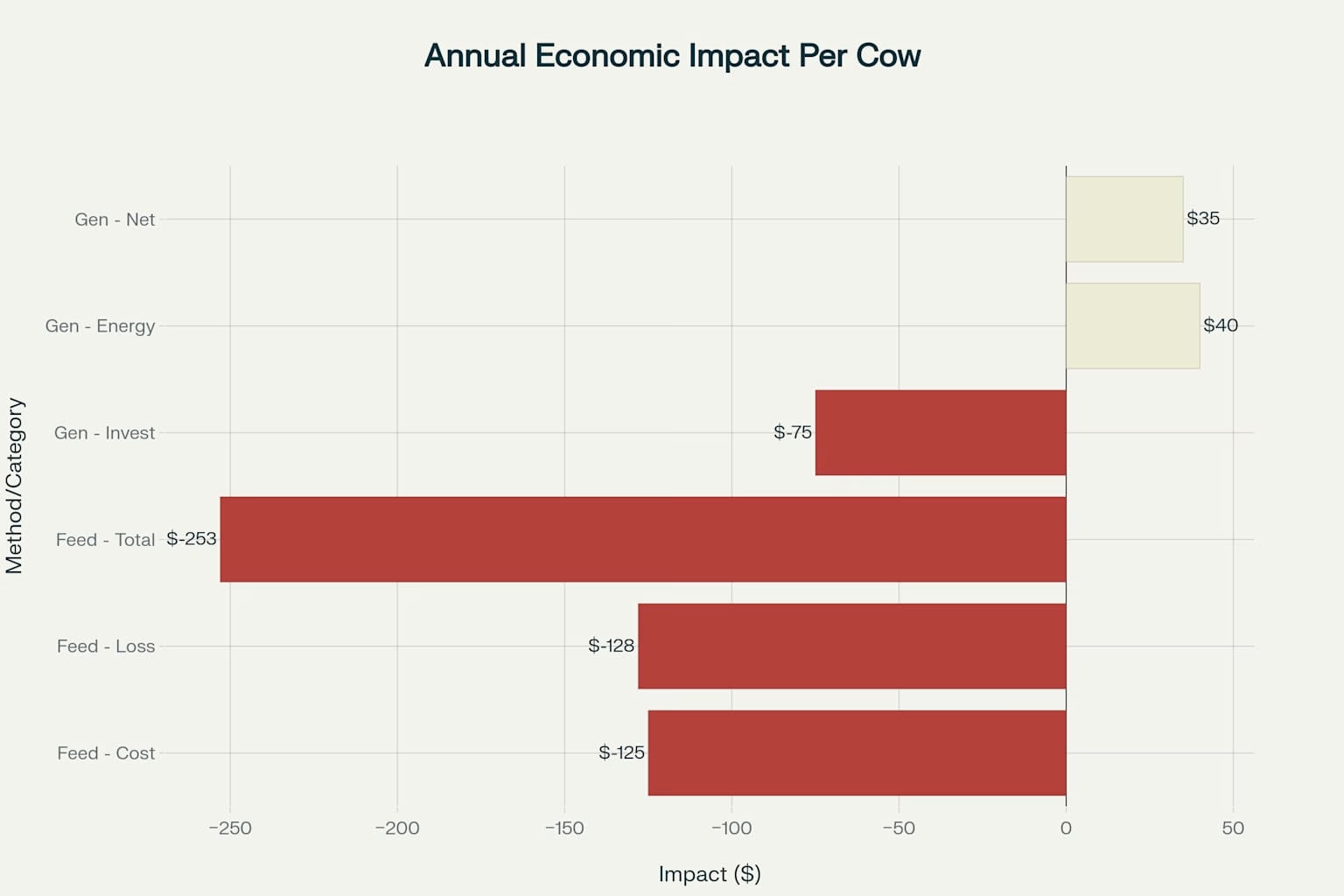

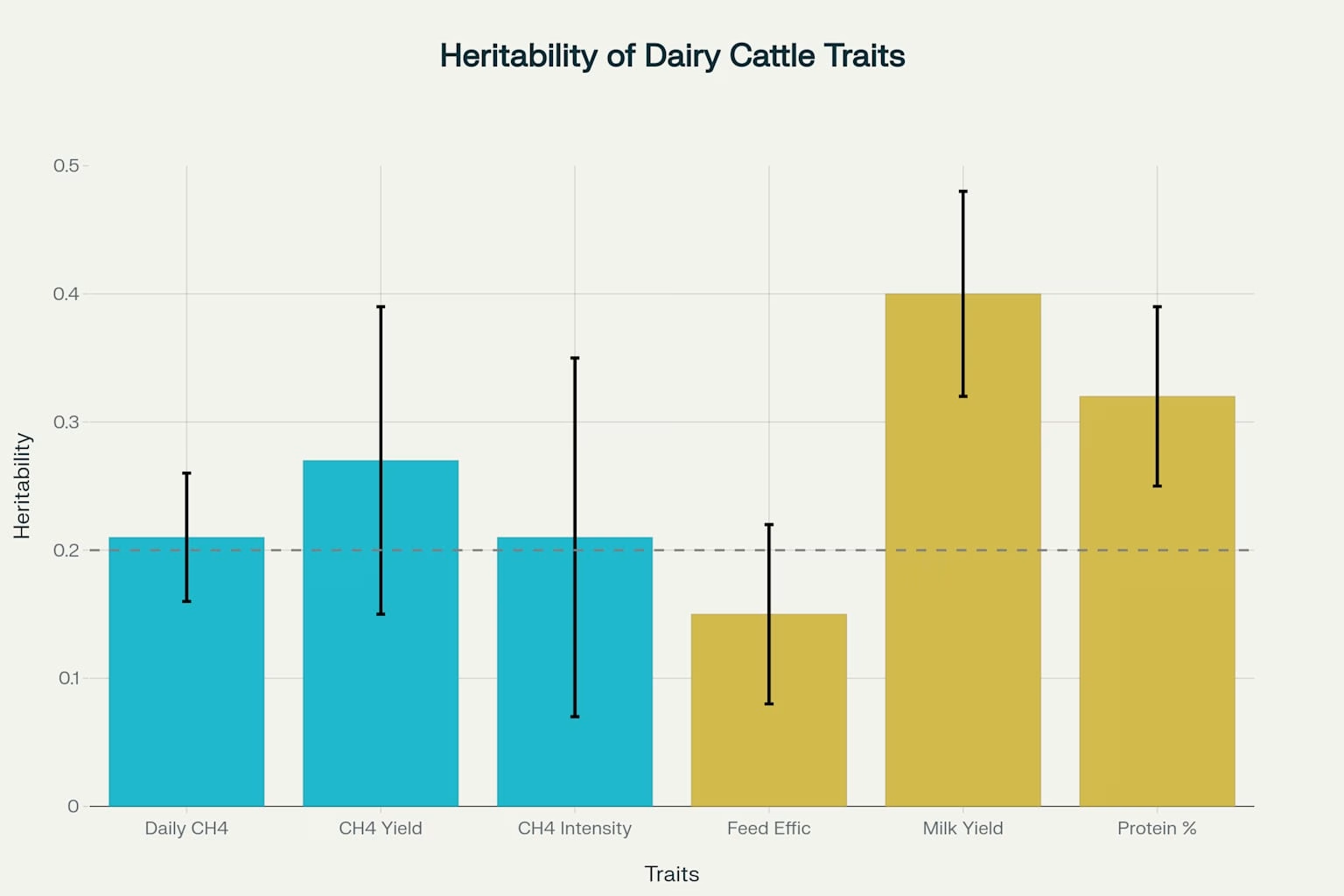

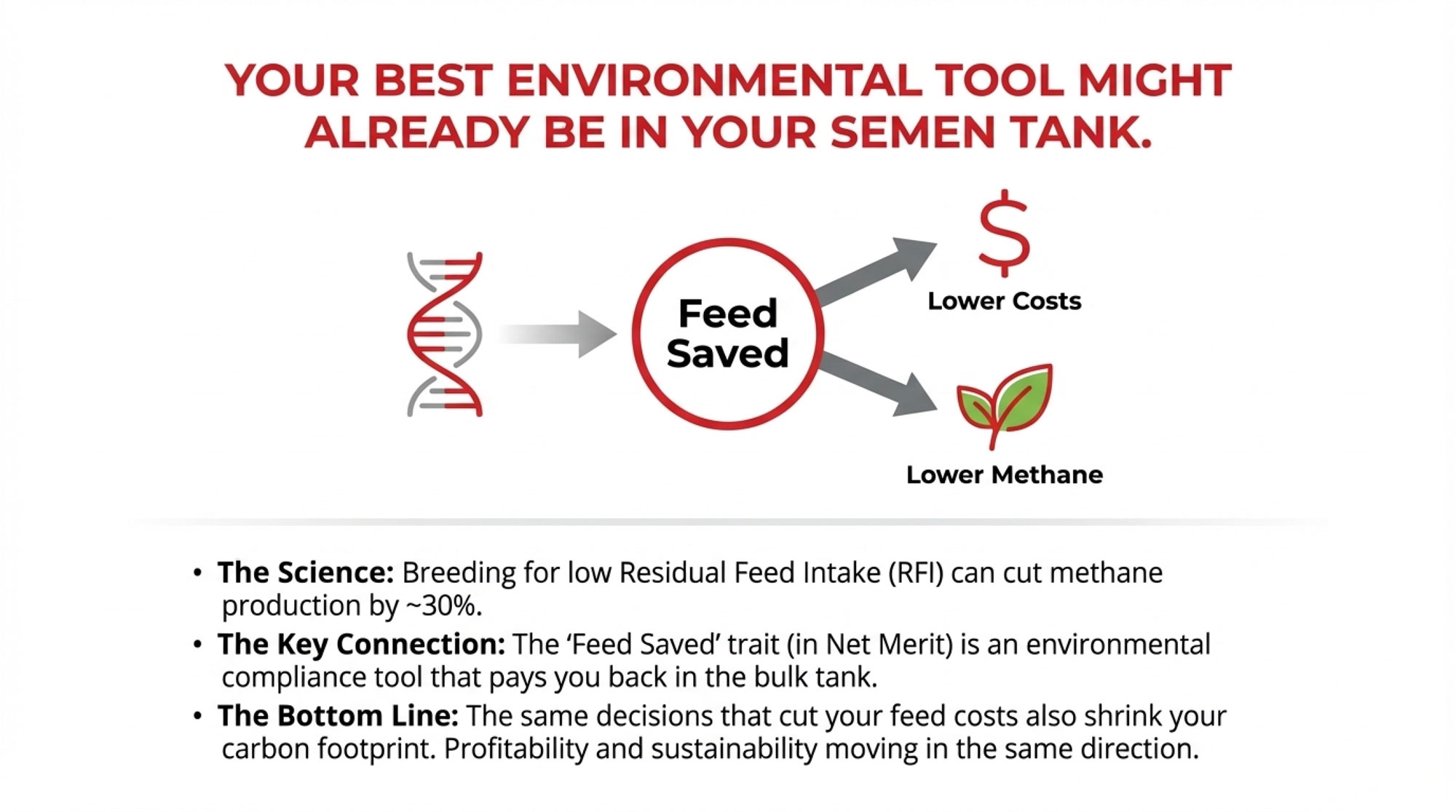

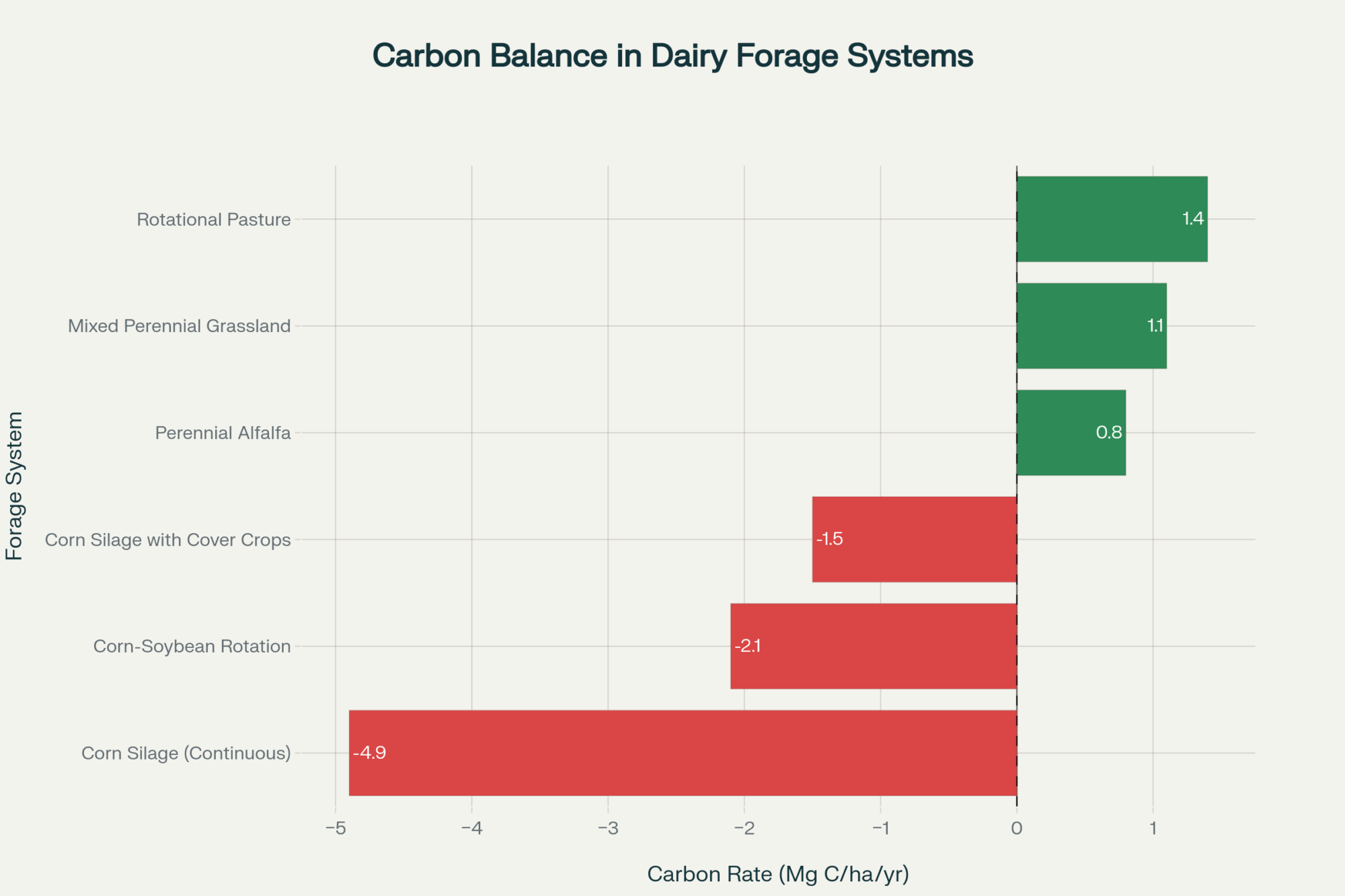

Here’s what’s worth noting for those of us focused on genetics and efficiency: selection for feed efficiency—already a priority for many component-focused operations—delivers environmental benefits as a kind of bonus. The same breeding decisions that reduce your feed costs also reduce your dairy carbon footprint.

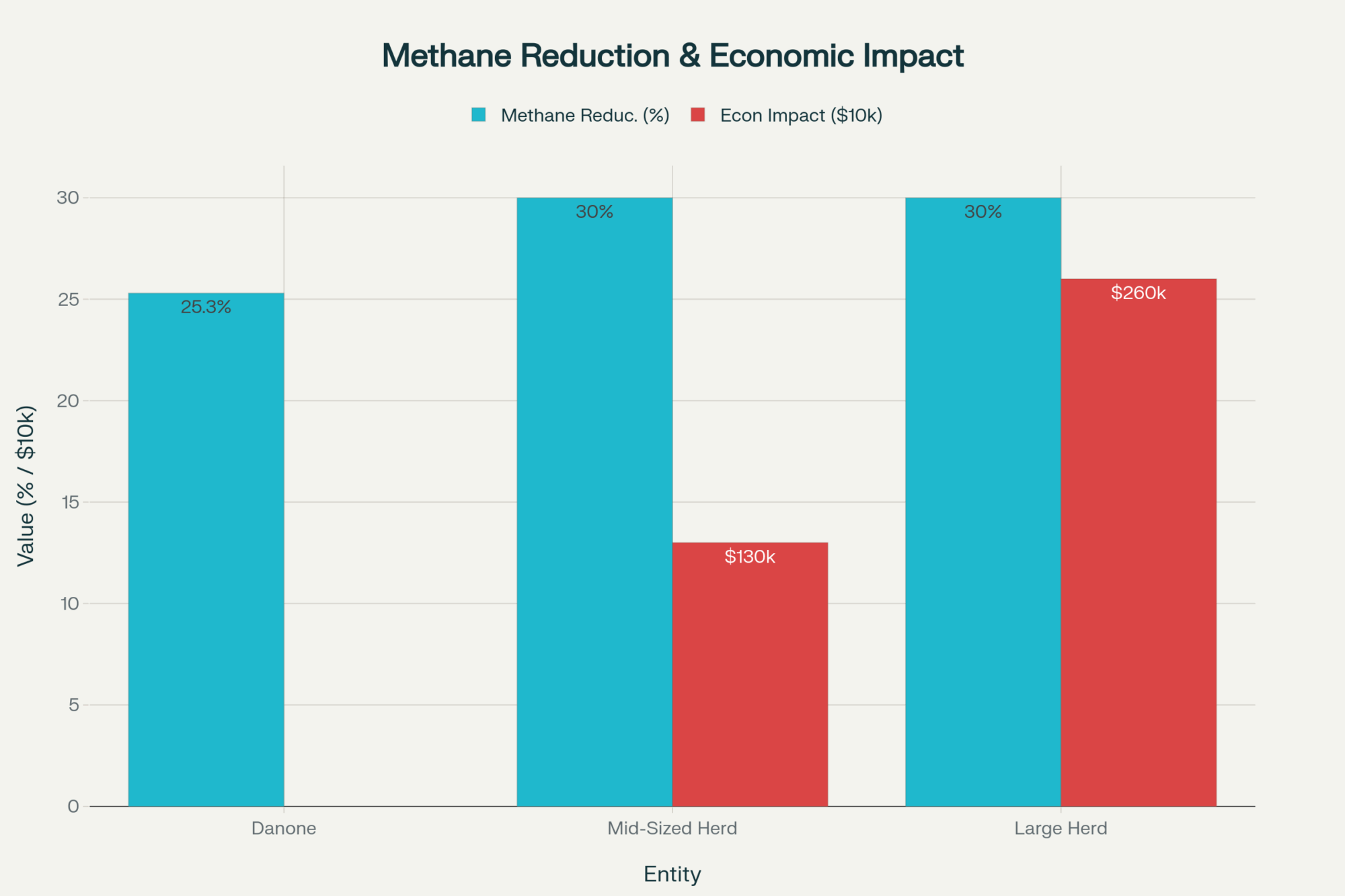

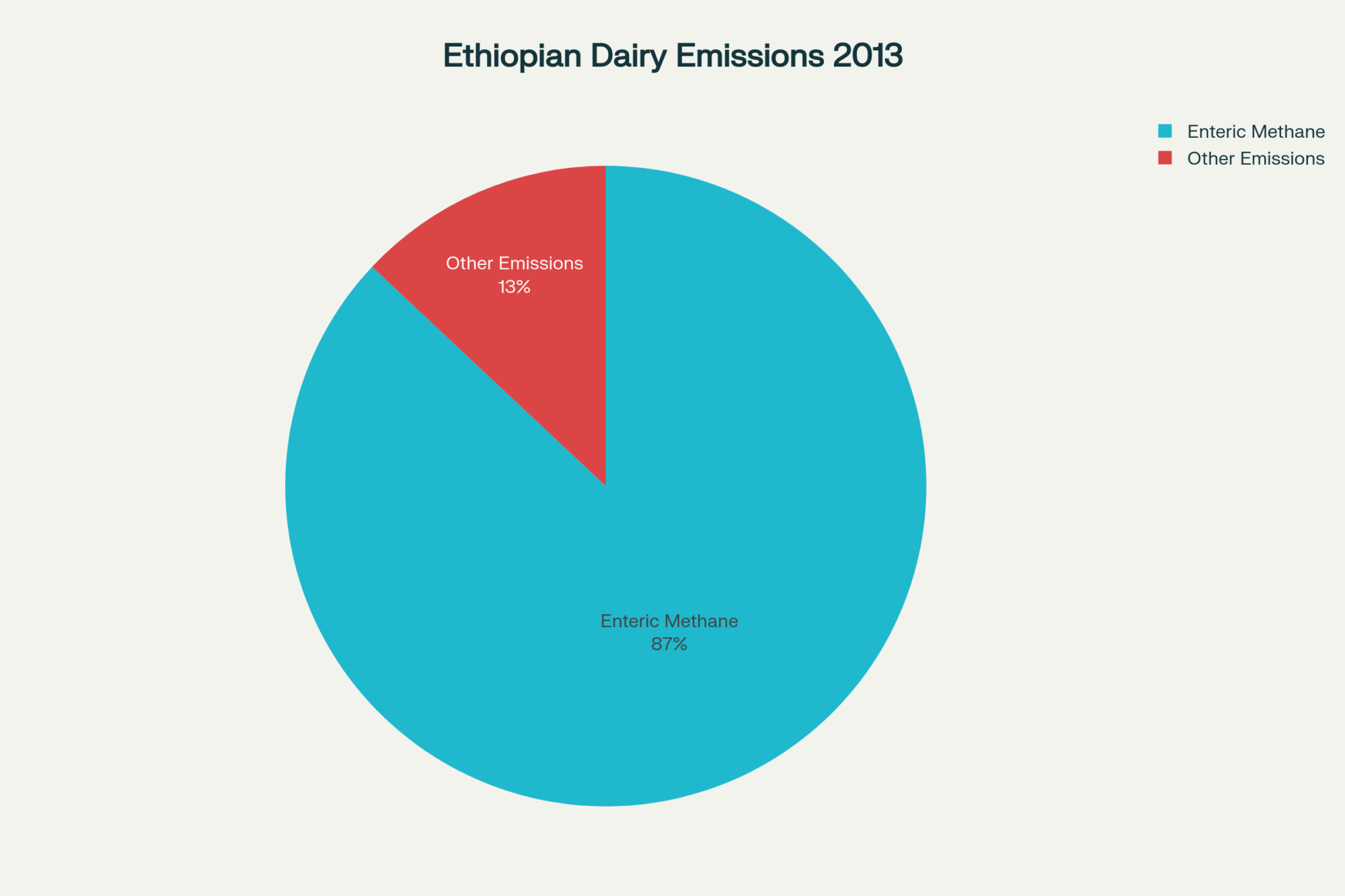

Research published in the Journal of Dairy Science and the Journal of Animal Science shows that selecting for low residual feed intake can reduce methane production by approximately 30% compared to high-RFI animals, while improving overall feed efficiency. So, in a real sense, the Feed Saved trait, now part of Net Merit, is essentially an environmental compliance tool that pays dividends in the bulk tank.

Over in Wisconsin, dairy farmer Joe Loehr demonstrates what this outcome-based approach looks like in American practice. His operation—about 500 cows on roughly 1,000 acres in Fond du Lac County—doesn’t rely solely on forms to demonstrate environmental stewardship.

As documented by The Nature Conservancy, fish species sensitive to nitrogen and phosphorus are thriving in the stream that runs through his property. The Wisconsin Department of Natural Resources surveyed those populations as part of nutrient loss monitoring.

Joe told researchers his heart jumped “just a little” when he learned about those thriving fish. And you can understand why—that’s verification you can’t argue with. Ecosystem health as your compliance metric.

His approach? Precision nutrient management with annual soil testing in grid patterns, careful manure sampling, and matching applications to actual crop needs. He’s been at it for more than 15 years now. The environmental performance is verified by biology, not bureaucracy. And the precision approach has helped reduce input costs along the way.

| Metric | Paperwork Compliance Model | Outcome-Based Verification Model | Winner |

|---|---|---|---|

| Cost | €165/cow annually (Ireland) | €15-75/cow (varies by scale) | Outcome-based |

| Environmental Result | 6% emissions drop in 30 years | Fish species thriving (Wisconsin) | Outcome-based |

| Farmer Time Burden | High – forms, inspections, documentation | Moderate – sensor monitoring, data review | Outcome-based |

| Actual Water Quality | 40% of farms non-compliant on slurry storage | Verified by ecosystem health | Outcome-based |

| Processor Recognition | Minimal differentiation | FrieslandCampina: €245M in premiums | Outcome-based |

Why Some Farmers Are Investing Early

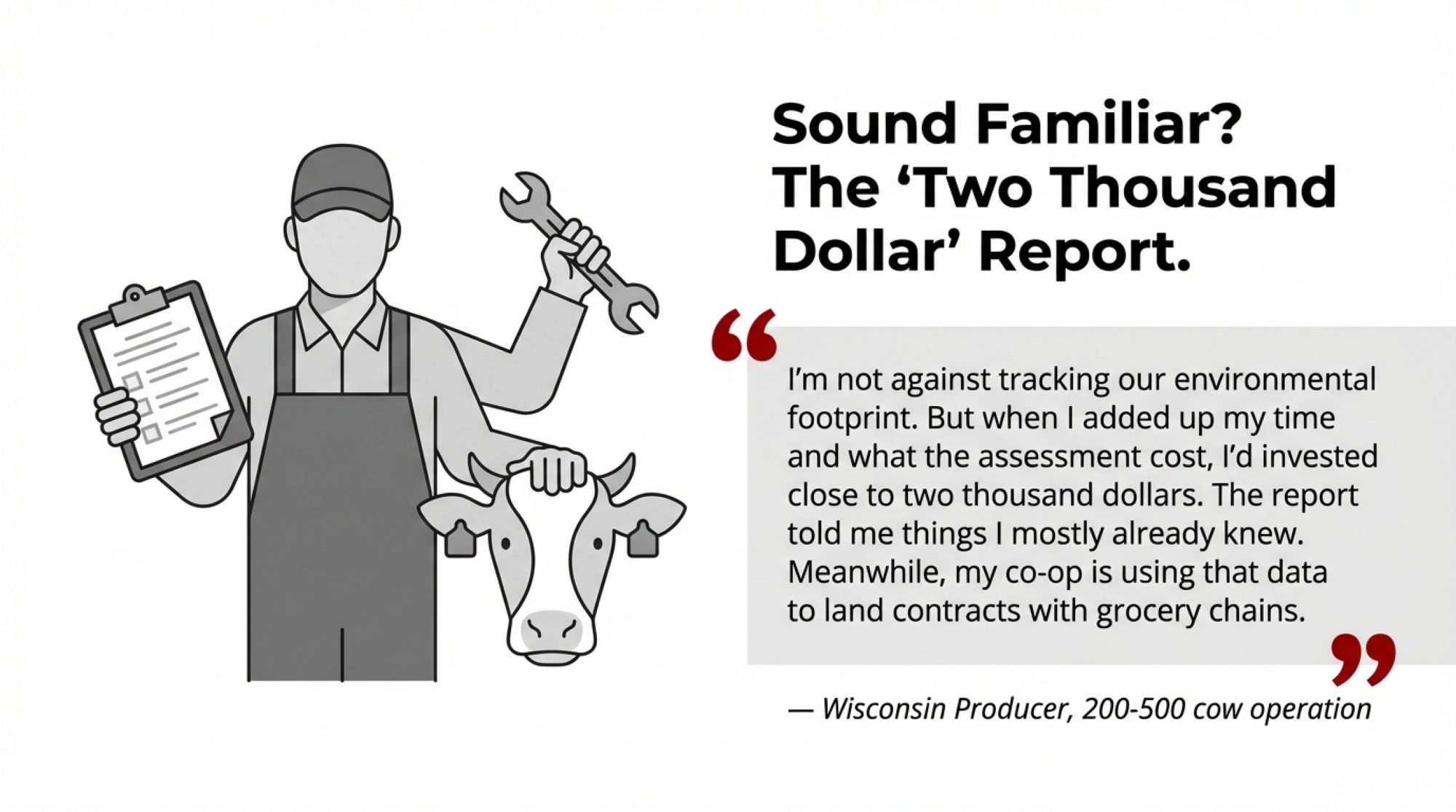

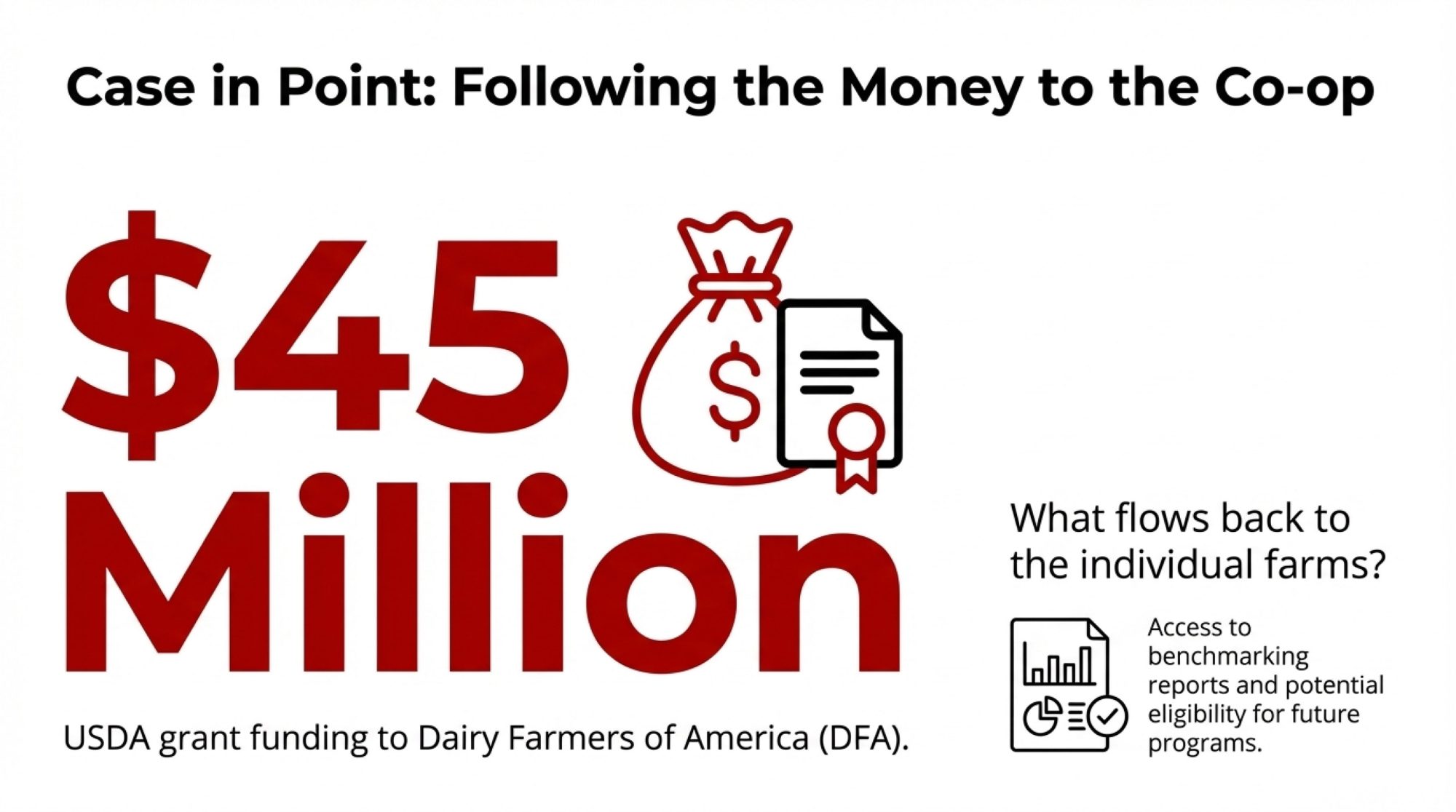

You might wonder—and it’s a fair question—why any farmer would invest in environmental infrastructure before regulations require it. Especially when competitors can stay “compliant” with documentation alone.

I’ve spoken with operations about making that choice, and their motivations tend to fall into a few categories. It’s worth understanding their thinking, even if it doesn’t apply to every situation.

- The efficiency math. For some operations, precision nutrient management simply pays for itself through reduced input costs. When you stop over-applying expensive inputs—whether that’s fertilizer on fields or protein in TMR rations—environmental performance and profitability start moving in the same direction. New Zealand’s dairy sector has among the lowest carbon footprints globally, driven partly by economic necessity in a country without production subsidies. When margins are tight, waste becomes harder to tolerate.

- Market positioning. Processors are increasingly building environmental data collection into producer relationships. The language has shifted from “voluntary sustainability programs” toward “supply chain expectations.” Farms building verification capabilities now may be positioning themselves for requirements that could matter a lot more in five to ten years.

- Risk management. Ireland’s experience illustrates what happens when standards shift toward outcome-based enforcement. Farms that invested early in infrastructure faced less disruption when the rules changed. Those who waited are now navigating herd adjustments alongside infrastructure requirements—a much harder position to be in.

- Succession planning. Younger farmers with 25-30 year horizons are thinking about what their operations—and their land values—might look like when environmental verification becomes more standard. For them, early investment spreads costs over time and builds capabilities while the learning curve is more forgiving.

Who Should NOT Invest Now

Here’s where balance matters, though. Not every operation should be first.

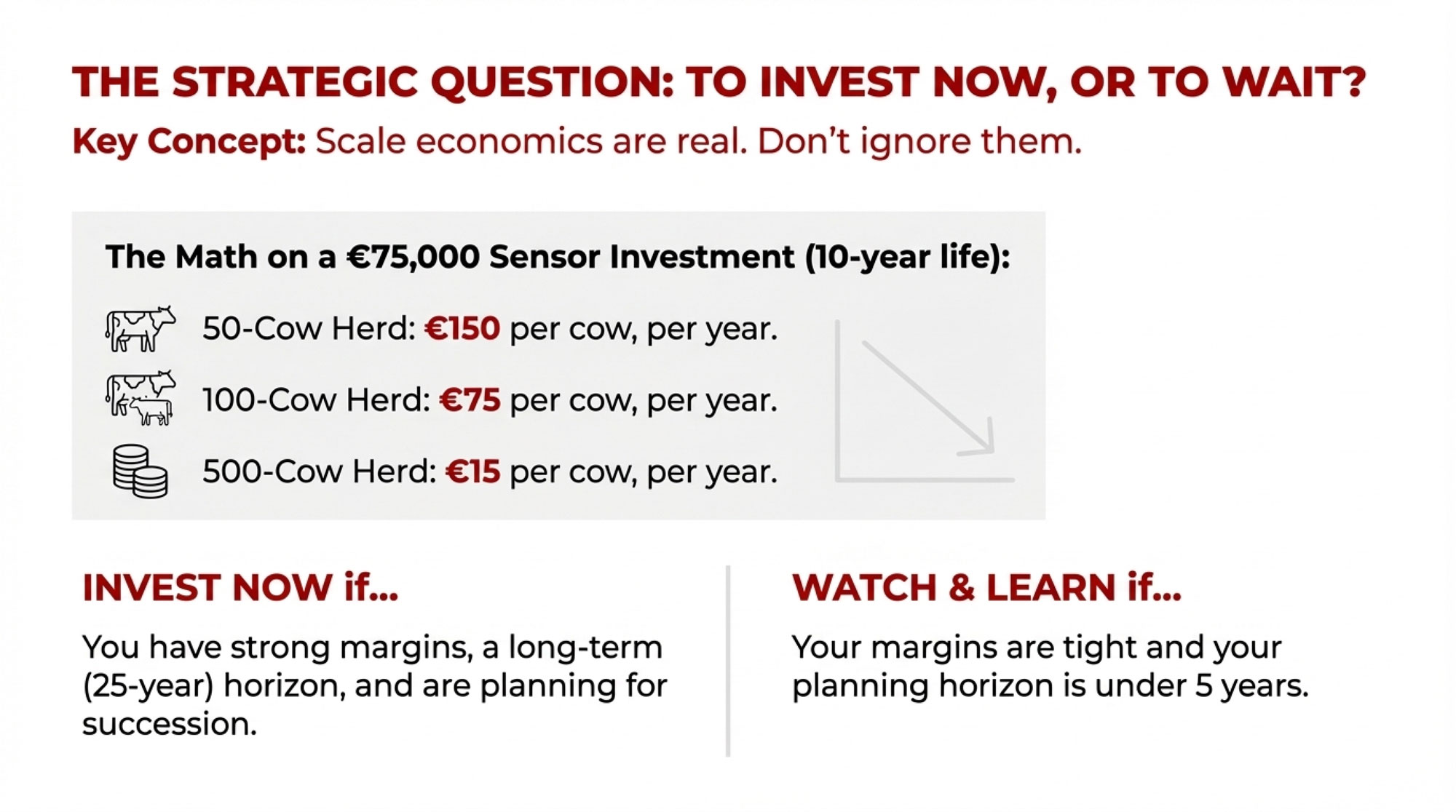

If your margins are tight and your planning horizon is under five years, watching and learning may well be the right call. That’s not a complaint—it’s a spreadsheet. And the spreadsheet doesn’t lie. Anyone who’s survived in dairy this long knows how to read one.

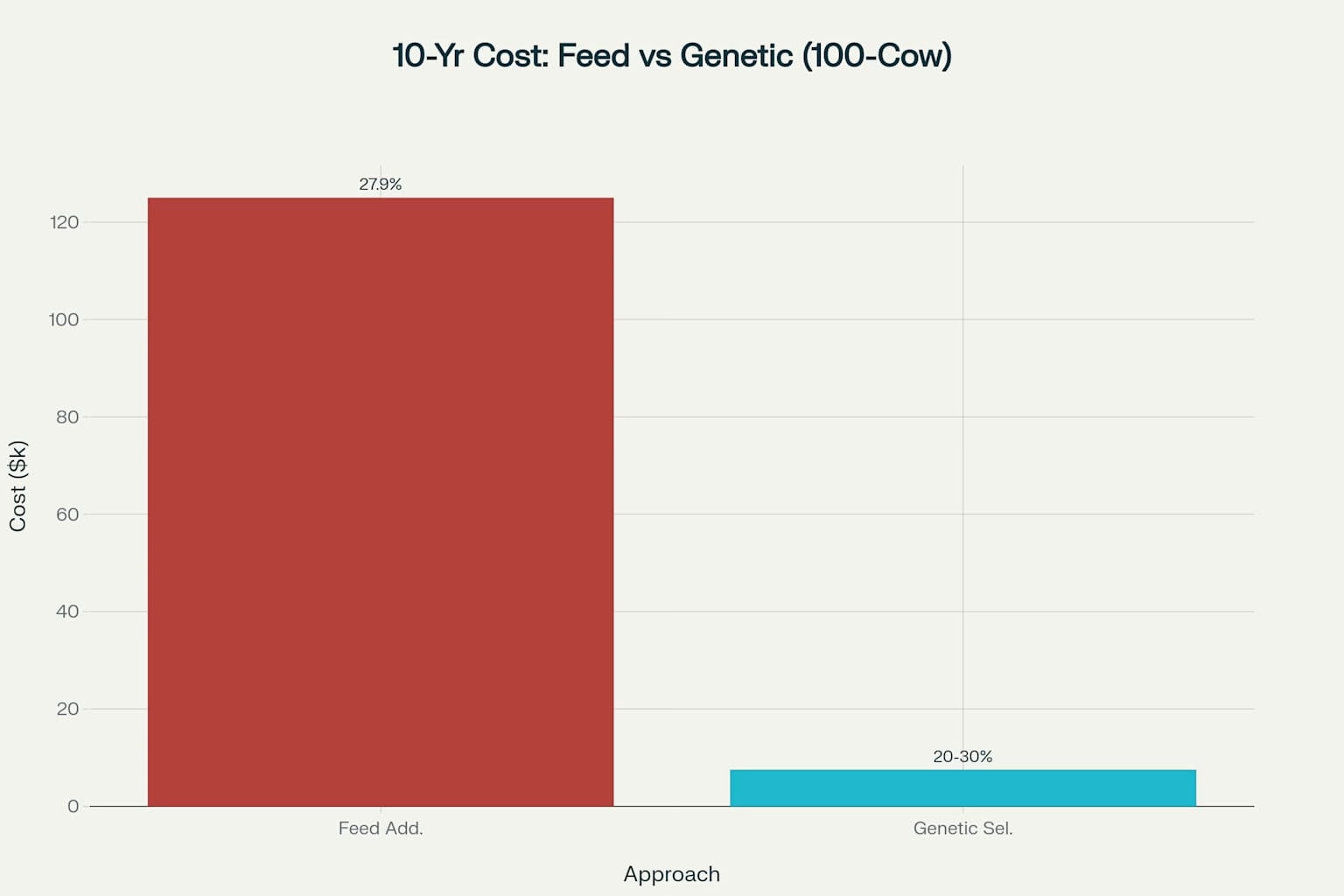

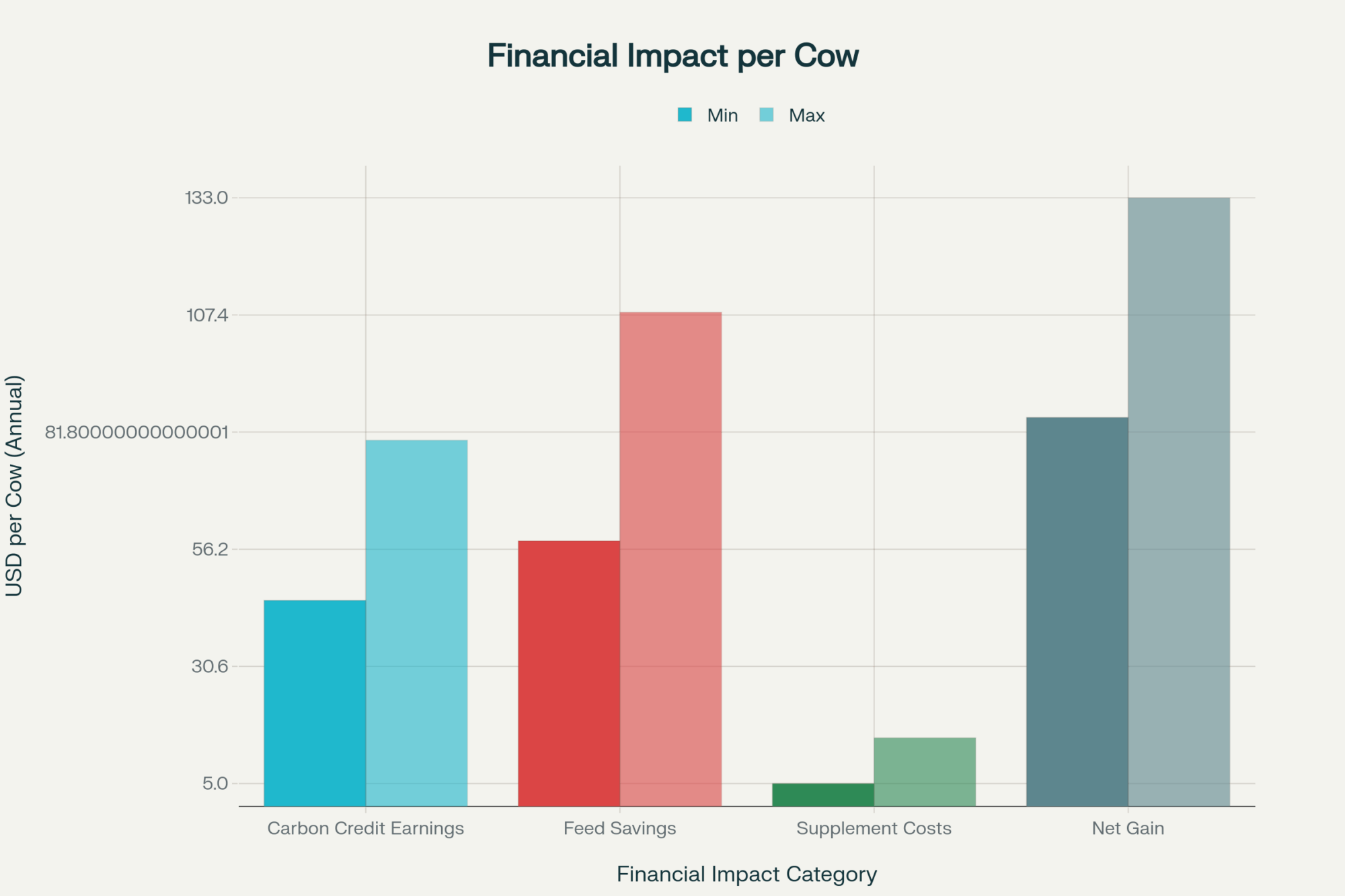

Let me put some numbers on this. At €16,500 in annual compliance costs on a 100-cow operation, you’re already spending €165 per cow just to meet current requirements. If sensor infrastructure costs around €75,000 with a ten-year useful life, that’s €75 per cow per year—but only if it actually reduces your compliance burden or earns you a verifiable premium. On a 50-cow operation, that same €75,000 investment runs €150 per cow annually. On 500 cows? Just €15 per cow. Scale economics are real, and they matter for this decision.

| Herd Size (cows) | Sensor Infrastructure Investment (€) | Annual Cost (10-year amortization) (€) | Cost Per Cow Per Year (€) | Current Compliance Cost Per Cow (€) |

|---|---|---|---|---|

| 50 | €75,000 | €7,500 | €150 | €165 |

| 100 | €75,000 | €7,500 | €75 | €165 |

| 250 | €75,000 | €7,500 | €30 | €165 |

| 500 | €75,000 | €7,500 | €15 | €165 |

Environmental compliance investments interact with the consolidation pressures already reshaping the industry—something worth careful consideration, particularly for mid-sized operations trying to chart a sustainable path forward.

Market premiums for environmental performance remain uncertain. Investing based on expected future market returns involves genuine risk, and nobody has a crystal ball about how quickly buyer preferences will translate into meaningful price signals at the farm gate.

One Irish producer put it to me pretty directly: “Why should I spend €75,000 when the processor is also buying milk from operations that don’t have those costs?”

That’s a legitimate economic question, not stubbornness. The answer depends partly on how markets evolve and whether policy creates more level playing conditions.

What Processors Are Signaling

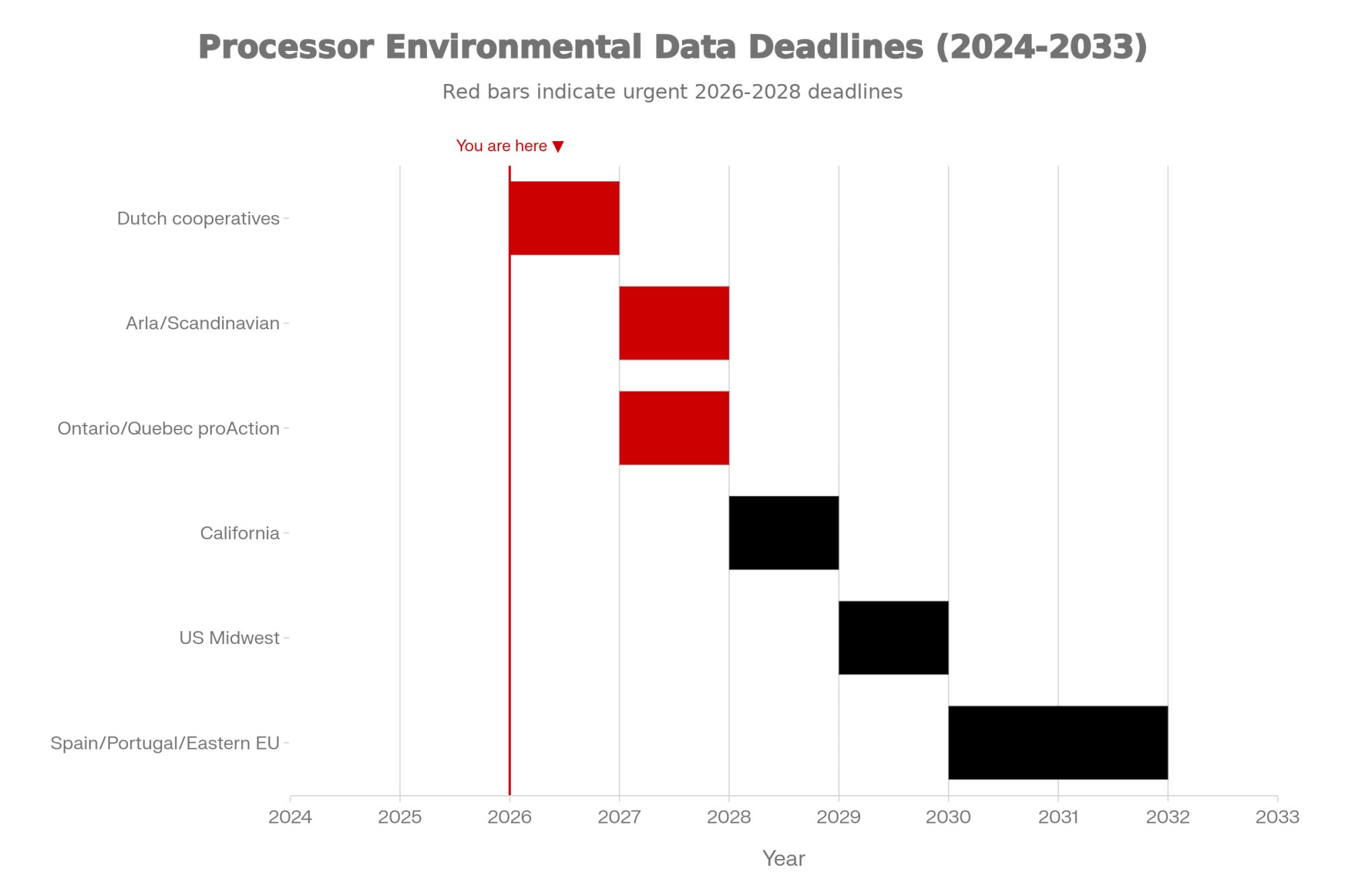

What I’m hearing from processor sustainability teams—and this is worth paying attention to—is that verification expectations are developing faster than some producers realize. But timelines vary significantly by region and processor.

A sustainability director at a major European cooperative reported in late 2024: “We’re moving from asking farmers to check boxes toward asking them to demonstrate outcomes. The suppliers who can show verified environmental data will have advantages when we’re making sourcing decisions.”

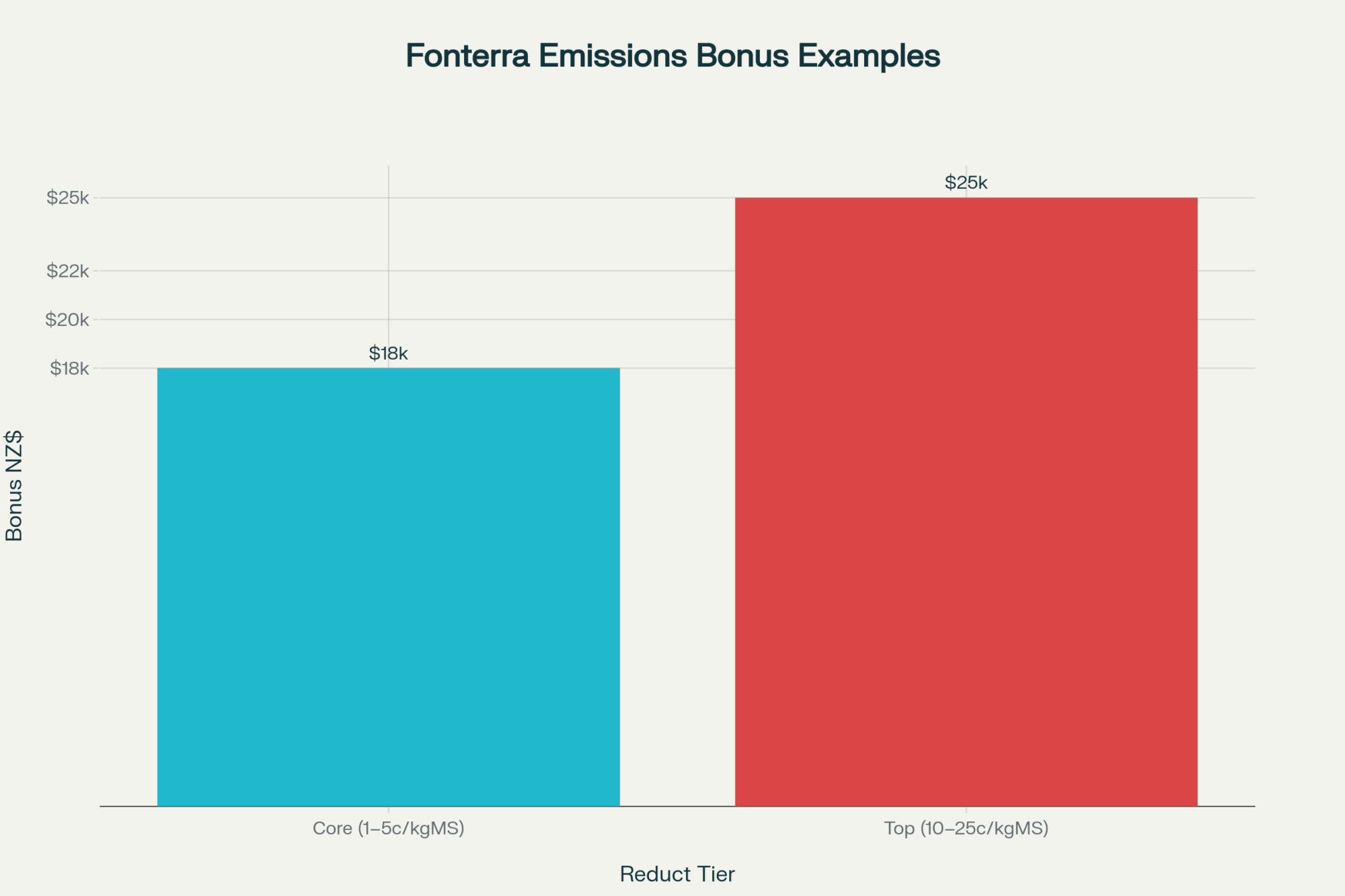

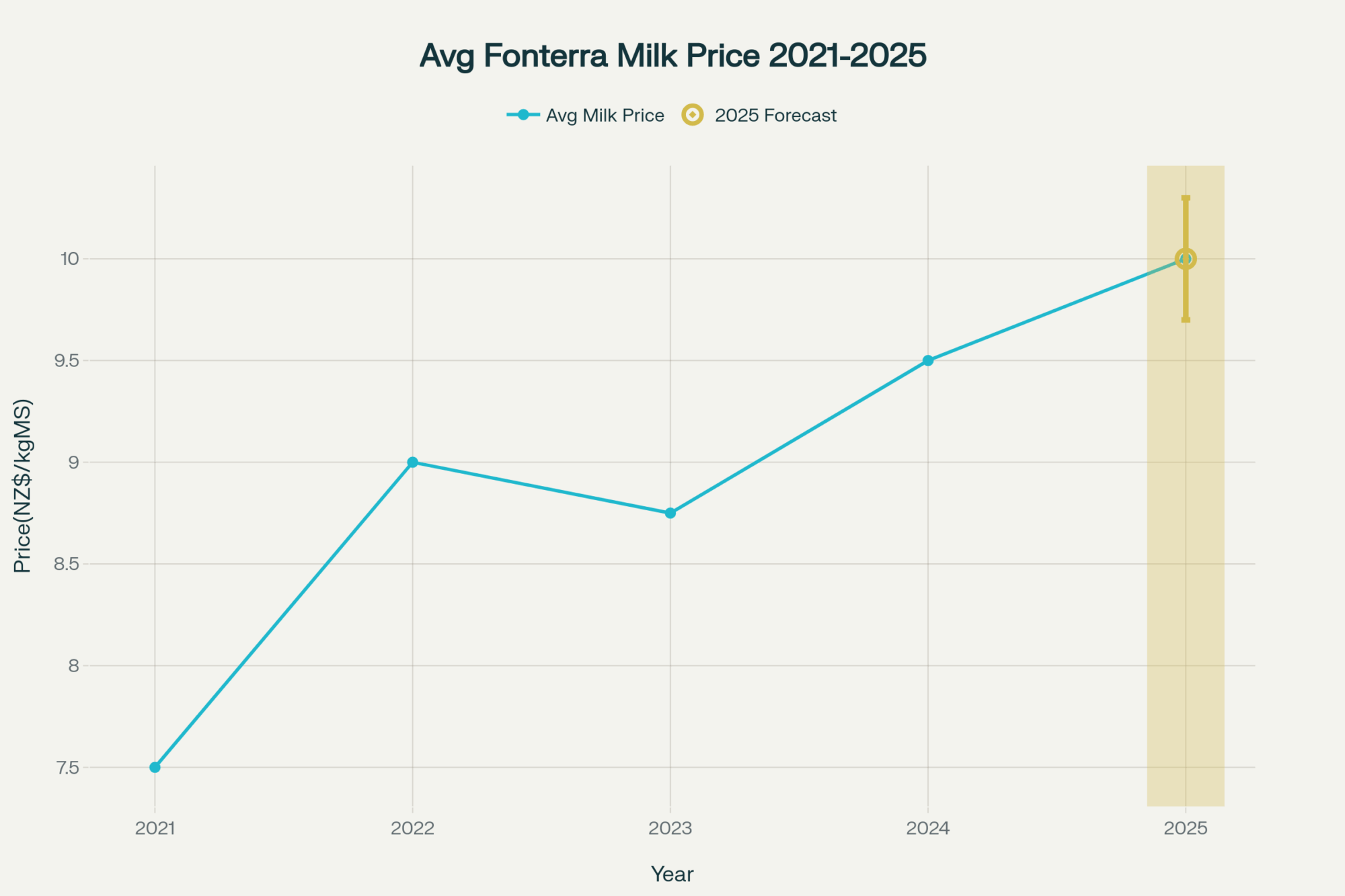

That’s a pretty clear signal about where things are heading. And the numbers backing it up are significant—Arla’s Climate Check program now covers over 8,000 farms across seven European countries, with 95% of their farmers participating and 99% of milk volume enrolled. FrieslandCampina’s Foqus planet Sustainable Development program, launched in 2023, now distributes over €245 million annually to member farmers meeting climate, biodiversity, and animal welfare indicators. These aren’t pilot programs anymore. They’re infrastructure.

Dutch cooperatives operating under stringent national nitrogen regulations are moving fastest. What Scandinavian processors expect by 2027 may not reach Spanish, Portuguese, or Eastern European operations until 2030 or later—though even those timelines are compressing as multinational retailers push sustainability requirements through their supply chains.

In North America, California operations are seeing different signals than Midwest producers. Canadian operations face their own complexity here. Dairy Farmers of Ontario’s proAction Environment module has been mandatory since September 2021, with new enhanced requirements currently being piloted and targeted for implementation in April 2027. In Quebec, similar pressures are building through Les Producteurs de lait du Québec. When your quota represents significant asset value—$24,000 per kg in Ontario under the provincial cap, with prices reaching $40,000 or higher in western provinces like Alberta—anything affecting future transferability or valuation deserves serious attention.

Questions worth asking your processor—maybe at your next field rep visit or annual meeting:

- What environmental verification will be expected for supply relationships by 2028? By 2030?

- Are tiered payments developing based on environmental performance?

- What data collection systems should farms consider implementing?

- Are there cost-sharing programs for monitoring infrastructure?

Farms that wait for mandatory requirements may find themselves building capabilities on compressed timelines. A 15-minute conversation now provides useful planning information—and shows your processor you’re thinking ahead.

Practical Paths for Different Situations

So what should you actually do with all this? It depends on your operation, and there’s really no universal answer.

| Farm Profile | Margin Pressure | Planning Horizon | Strategic Move | Risk Level |

|---|---|---|---|---|

| Large operation (500+ cows) | Strong | 25+ years | Invest in sensors & baseline data now | Low |

| Mid-size operation (100-250 cows) | Moderate | 10-20 years | Phase infrastructure over 3-5 years | Moderate |

| Small operation (50-100 cows) | Tight | 15+ years | Focus on efficiency first, watch & learn on sensors | Moderate-High |

| Any size operation | Tight | Under 5 years | Watch & learn, document current practices | High if invest early |

For operations with strong margins and long-term horizons:

Consider evaluating sensor investments for key environmental metrics—water quality and soil carbon. Companies like Hach and YSI offer agricultural water monitoring systems at various price points. Build baseline data while you have flexibility—you’ll want historical records if verification becomes required, and that data will still have value for your own management decisions.

Engage proactively with processors on their sustainability direction. University extension programs in most regions offer nutrient management planning assistance, often at low or no cost—Wisconsin, Cornell, Penn State, and UC Davis all maintain strong dairy environmental programs.

For operations managing tight margins:

Focus first on efficiency improvements that reduce costs while improving environmental outcomes—precision application, feed optimization, and forage quality work. These often pay for themselves regardless of regulatory considerations.

Document your current practices thoroughly. You may already be meeting emerging standards without realizing it. Plan infrastructure investments over 3-5 years rather than compressed emergency timelines. Phased implementation is usually more manageable both financially and operationally.

For operations approaching succession:

Discuss the environmental trajectory with potential successors—their 25-year horizon likely differs from your five-year view, and their perspective on these investments may differ as well. Consider whether infrastructure investment improves property positioning for sale or transfer. Environmental compliance capability is increasingly becoming part of farm valuations.

Looking Forward

The €1.6 billion simplification reflects something significant: policymakers acknowledging that compliance paperwork wasn’t delivering proportional environmental results. That’s actually encouraging, in a way—it suggests some willingness to adapt when approaches clearly aren’t working.

What replaces the current system remains genuinely uncertain—and that uncertainty is something you’ll need to factor into your planning. The optimistic scenario involves well-designed outcome-based systems that reward farmers for verified environmental performance, with infrastructure investment support and protection against unfair competition. A more challenging scenario involves weakened requirements without effective alternatives, potentially postponing necessary adaptation until crisis forces it.

Most likely? We’ll see varied approaches playing out across different jurisdictions. Some regions are moving toward meaningful, outcome-based systems, while others simply adjust paperwork requirements without developing effective measurement alternatives.

For your operation specifically, the strategic question isn’t primarily about regulatory compliance—it’s about positioning for a future where verified environmental performance may matter considerably more for market access, land values, and operational sustainability.

Your Next 5 Moves

- This week (15 minutes): Call your processor field rep. Ask specifically what environmental verification they’ll expect by 2028. Write down the answer.

- This week (30 minutes): Document your current nutrient management practices in a standardized format. You may already meet emerging standards without realizing it—but you need it written down.

- This month (1-2 hours): Contact your regional extension service (Wisconsin, Cornell, Penn State, UC Davis, or your provincial equivalent) for a free nutrient management assessment. These programs exist specifically to help you identify gaps before they become expensive problems.

- This month: Calculate your current compliance cost per cwt shipped. You need this baseline before you can evaluate whether new investments make economic sense.

- This quarter: Identify one efficiency improvement that reduces both costs and environmental footprint—precision feeding, application timing, or forage quality. Start there. The best environmental investments are the ones that pay for themselves.

The Bottom Line

If your planning horizon is under five years and margins are tight, watching and learning may well be the right call. If you’re building a 25-year operation, the investment clock is already ticking.

In the next decade, the most valuable crop on your farm won’t be corn or alfalfa—it will be the data that proves you’re doing it right.

Key Takeaways

- 6% total emissions reduction since 2005 despite €100 billion investment (European Environment Agency, 2025)

- €1.6 billion annual savings from CAP simplification across 9 million EU farms (European Commission, 2025)

- €165/cow annual compliance cost on 100-cow Irish operations—before any infrastructure investment (Irish Farmers Journal, 2024)

- 40% of Irish dairy farms had slurry storage gaps—showing a disconnect between paperwork and outcomes (Irish Farmers Journal, 2021)

- Feed efficiency genetics can reduce methane by approximately 30% compared to high-RFI animals (Journal of Dairy Science, Journal of Animal Science)

- Scale economics matter: Infrastructure that costs €150/cow on 50 cows drops to €15/cow on 500 cows

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More

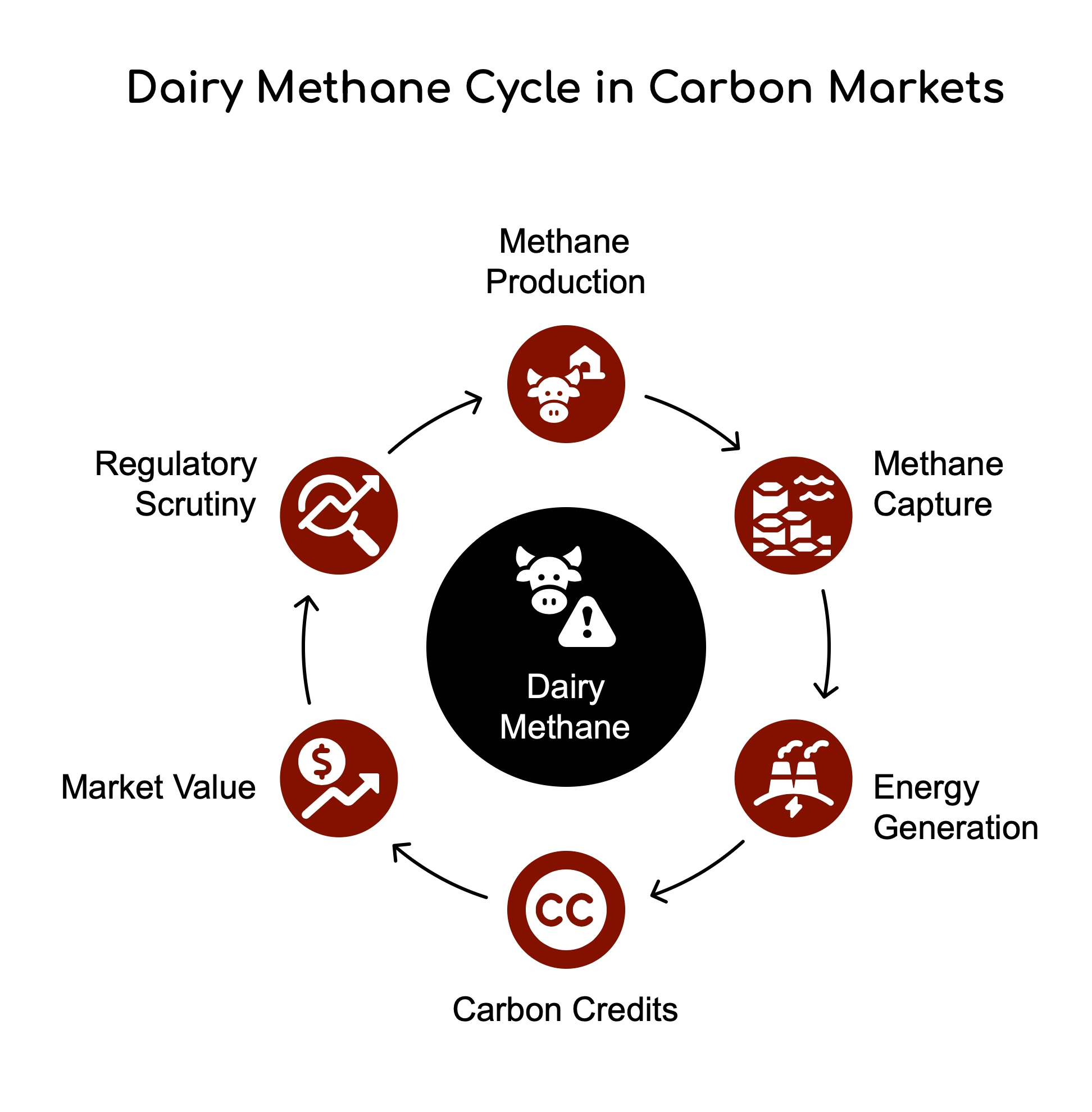

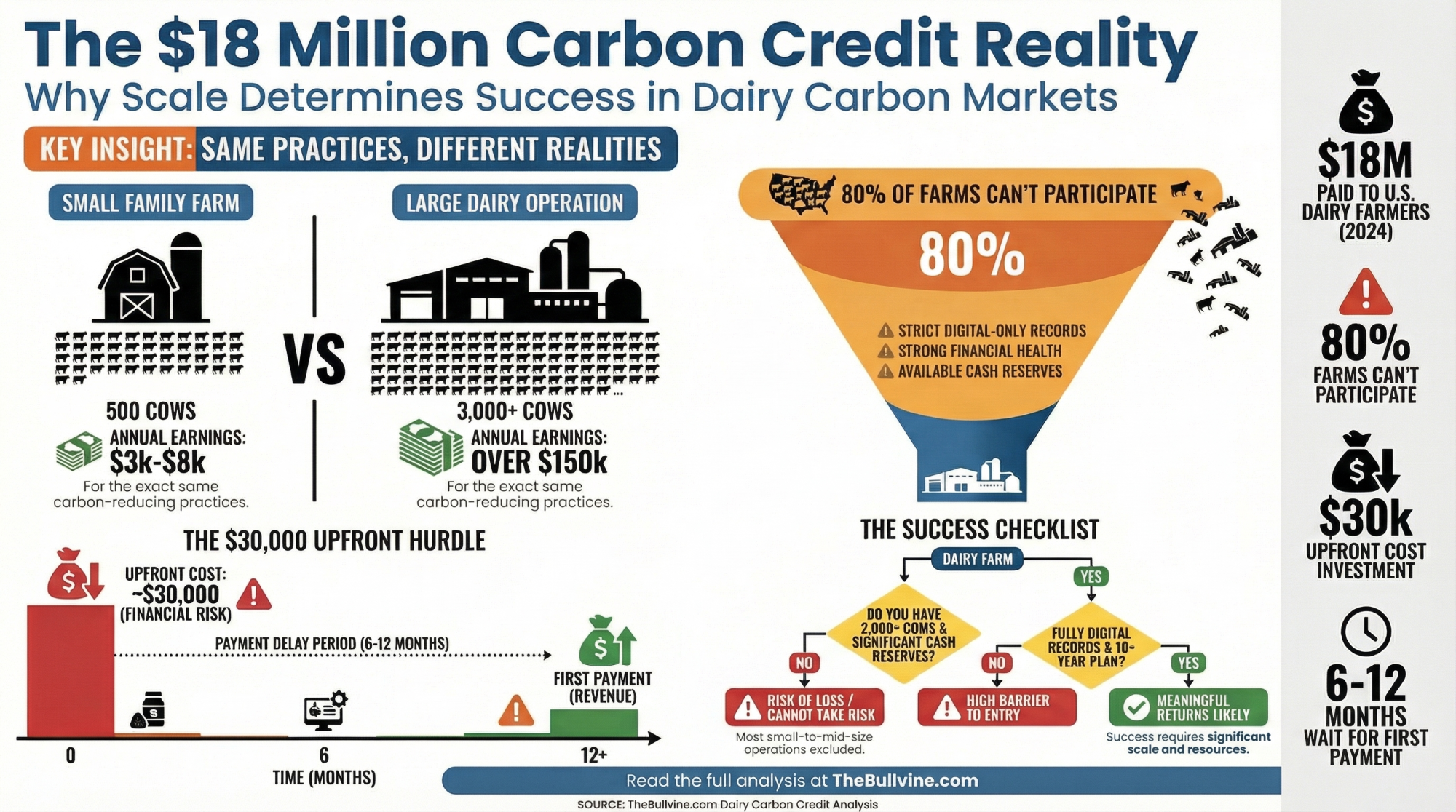

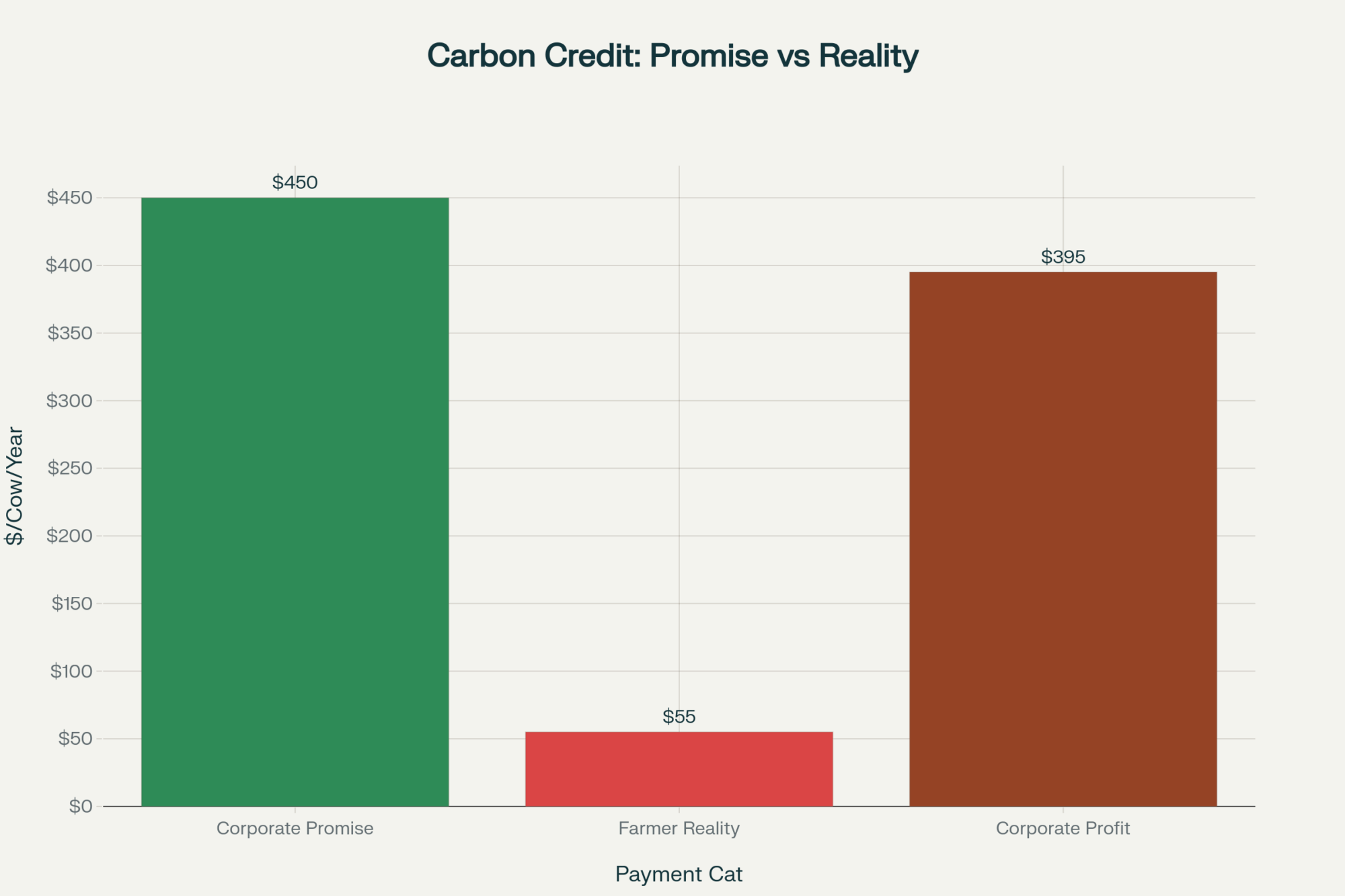

- The Carbon Credit Programs Every Dairy Should Join Before 2026 – Exposes how to turn “environmental compliance” into a profit center by capturing up to $450 per cow in carbon revenue. It arms you with a tiered implementation guide, moving from low-cost feed additives to high-reward digesters.

- 2025 Dairy Market Reality Check: Why Everything You Think You Know About This Year’s Outlook is Wrong– Delivers a strategic roadmap for navigating global supply shifts and processing capacity waves. You’ll gain a decisive advantage by understanding why “volume chasing” is failing while component-based strategies and sustainability positioning are securing the best contracts.

- Your Feed Room’s Hidden $58,400 Leak – And How Smart Dairy Farms Are Plugging It – Reveals how precision tracking technology uncovers 3-8% shrinkage that traditional logs miss. This maverick approach breaks down the ROI on digital monitoring, proving that your best environmental move is often the one that stops expensive waste.

The Sunday Read Dairy Professionals Don’t Skip.

The Sunday Read Dairy Professionals Don’t Skip.

Every week, thousands of producers, breeders, and industry insiders open Bullvine Weekly for genetics insights, market shifts, and profit strategies they won’t find anywhere else. One email. Five minutes. Smarter decisions all week.

The Sunday Read Dairy Professionals Don’t Skip.

The Sunday Read Dairy Professionals Don’t Skip.

![dairy farming, solar leases, milk yield, agrivoltaics, dairy profitability]](https://www.thebullvine.com/wp-content/uploads/2025/06/Whisk_89eec22d14.avif)