Uses the $48B number, clear conflict, vivid dairy moment. Slightly softer on explicit dollars per event, but very clickable.

Executive Summary: EPA’s February 2 guidance says you can legally override DEF derates during repairs, knocking down the excuse that environmental rules blocked repair tools. Deere points to Operations Center PRO Service as the place that override will live, but dealer docs today still list “Emission Control System Derate Temporary Override” as excluded — you can see diagnostics, not push the button that gets you feeding again. On a 500-cow dairy averaging 80 lbs/day, one missed milking at current 2026 prices strips roughly $2,900–$3,850 in milk revenue before you even see a service invoice . That’s why the math matters: PRO Service runs $195 per machine per year, while a basic dealer call starts around $700 per trip, so if you’re logging more than one or two DEF-related visits a year, the subscription already pencils out on diagnostics alone. The catch is compliance — only dealers can clear the codes and close the Clean Air Act paper trail, and the statutory penalty for tampering violations now sits above $44,000 per engine on paper, even if good-faith repairs are unlikely to see that number. Layer on an FTC antitrust case backed by 17 states and a Deere strategy built around connecting over 1 million machines to its digital platform, and this “right to repair” moment looks less like freedom and more like a new on-ramp into Deere’s ecosystem. Until PRO Service actually ships the DEF override and code

-clearing functions, your smartest move is to treat the guidance as leverage — to renegotiate how much downtime and how many dealer calls your dairy is willing to carry.

The Trump administration says it just saved American farmers $48 billion in repair costs. Your TMR tractor is still hostage to a dealer service call.

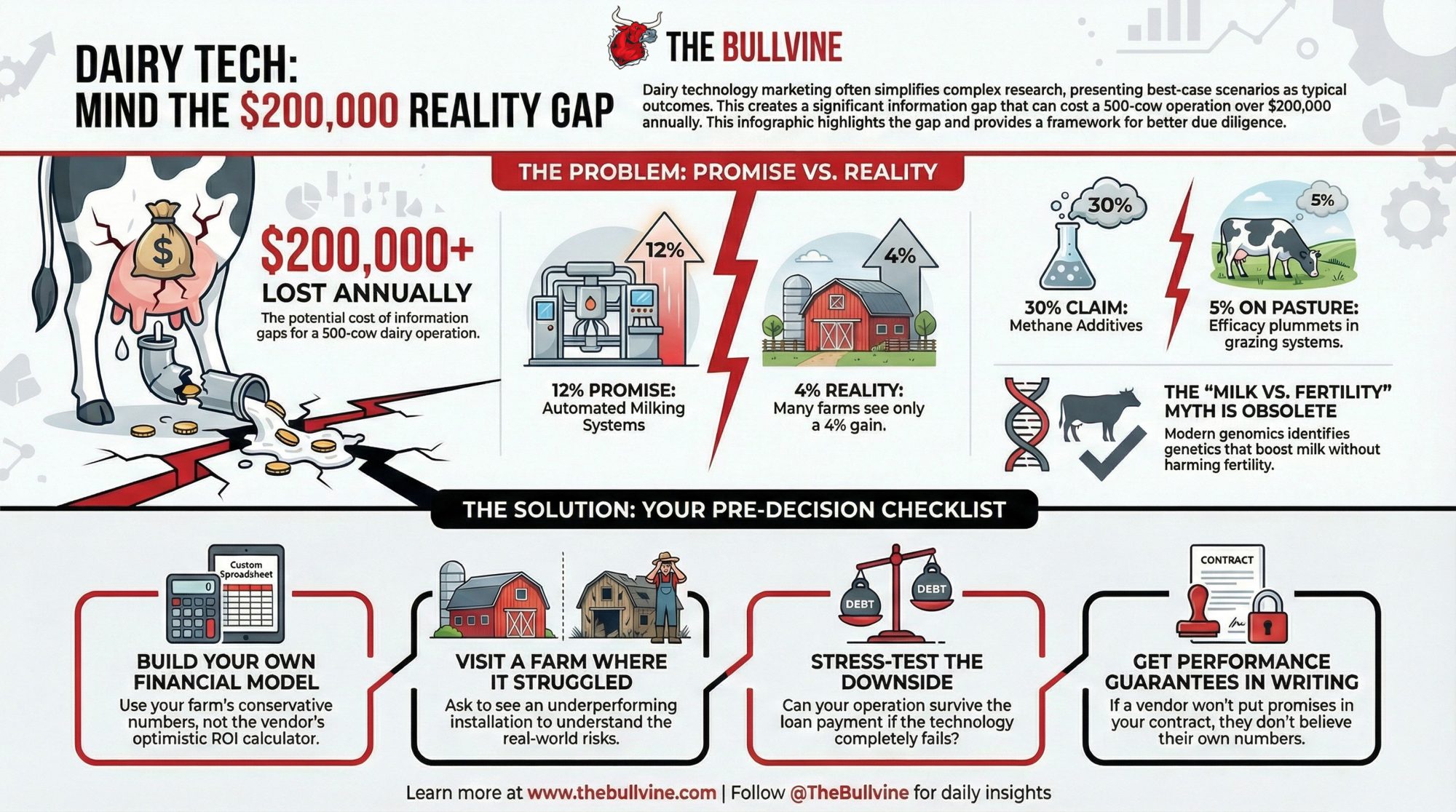

SBA Administrator Kelly Loeffler dropped that number while standing alongside EPA Administrator Lee Zeldin and USDA Secretary Brooke Rollins at a joint right-to-repair press conference on February 2, 2026. She pegged individual savings at $33,000 per repair event and projected 80% annual reductions in repair costs and a roughly 10% cut in operating expenses. Bold claims. But SBA hasn’t published the methodology behind them, and a $33,000 single-event figure sits well above what most producers experience — even on a major DEF/SCR system overhaul. Whether it’s the average repair, the worst case, or a cumulative annual estimate, the administration hasn’t said.

Here’s what they also didn’t mention: the tool Deere says will deliver the override can’t actually perform it yet. And the compliance paper trail still runs straight back to the dealer you’re trying to avoid.

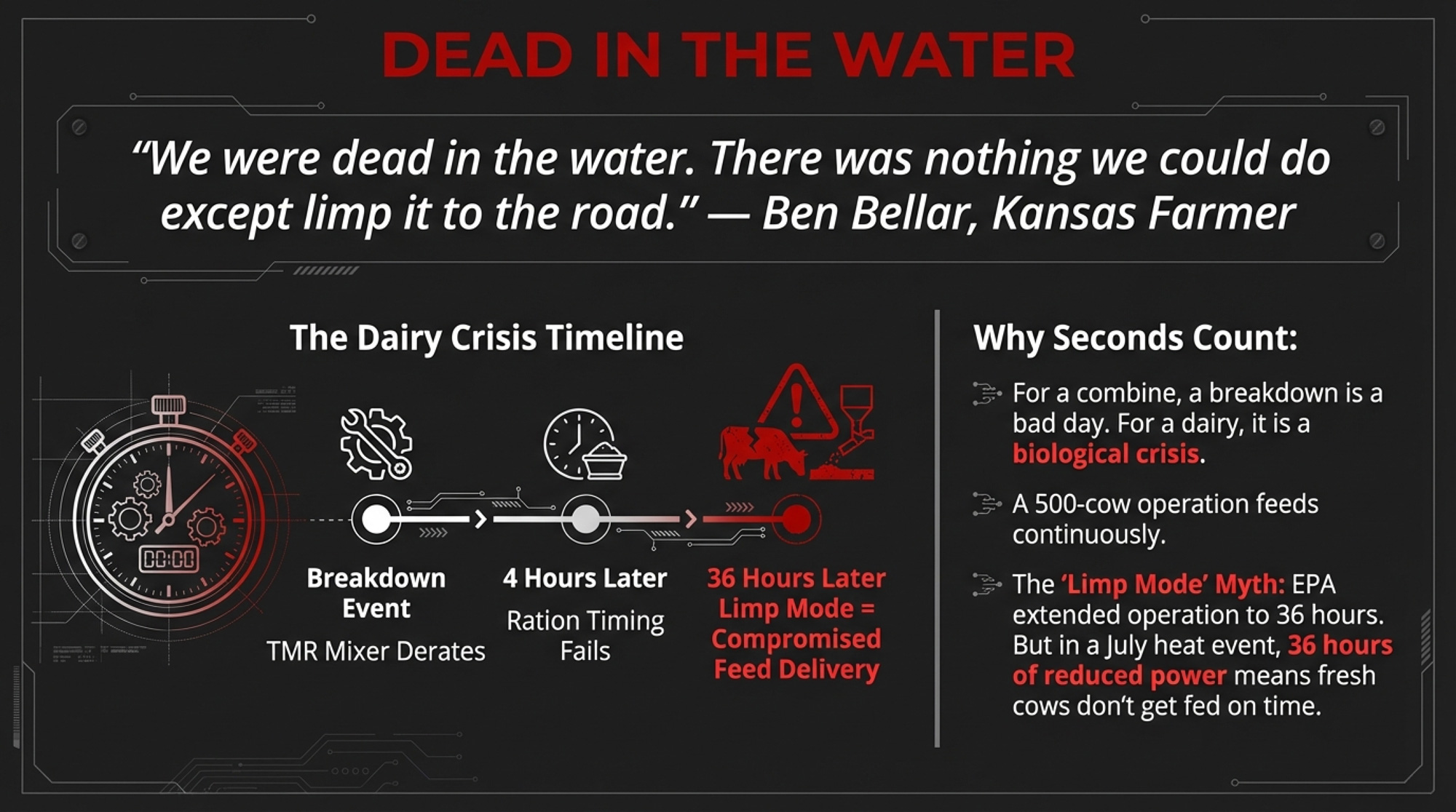

“Dead in the Water” — What a DEF Shutdown Costs a Dairy

Ben Bellar knows exactly what a derate event looks like. The southeast Kansas farmer told Brownfield that his combine went down mid-harvest due to an emissions failure.

“An emissions failure will completely shut you down and de-rate you,” Bellar said. “I had to wait for the local dealer to come out and physically fix this combine. We were dead in the water. There was nothing we could do except limp it to the road, and that was about it”.

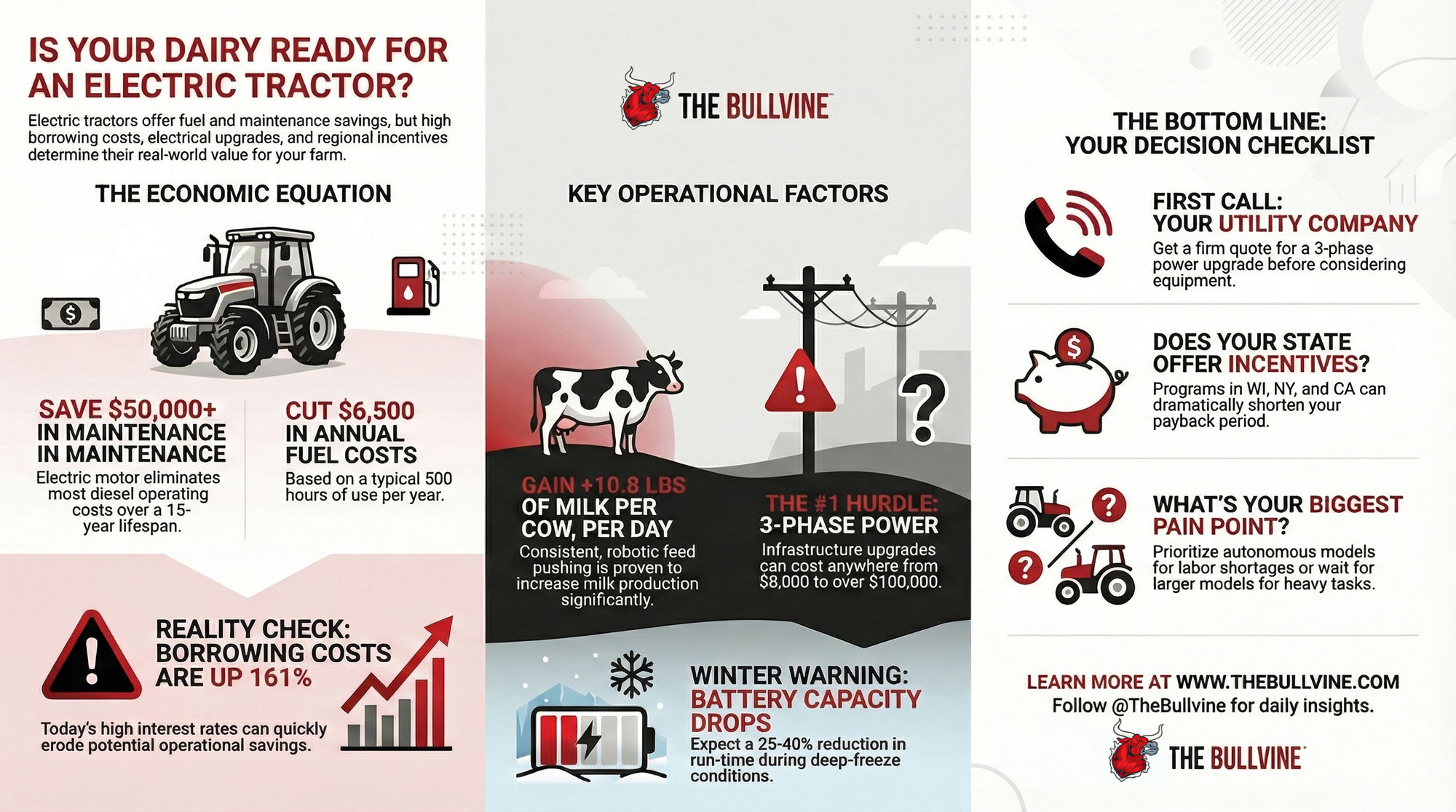

For row crops, that’s a bad day. For dairy, it’s a crisis that compounds by the hour. As we reported in our December analysis of dairy’s structural squeeze, producers across the country have experienced “tractors, TMR mixers, or milk trucks derating or shutting down because of DEF-related faults, even when the engine itself was mechanically sound”. [INTERNAL LINK: “Cheap Milk Is Breaking the Farm: What’s Really Hollowing Out Dairy’s Middle Class” → anchor text: “dairy’s structural squeeze”] When the TMR mixer or manure scraper goes down on a 500-cow operation, cows still need feeding every few hours, milking still happens two or three times daily, and manure doesn’t stop accumulating. Dairy doesn’t get a day off.

Before EPA’s August 2025 guidance, an off-road engine would derate to idle-only mode after just four hours when it ran out of DEF or tripped a sensor failure. The August update extended that window — machines now run 36 hours before a 25% torque reduction, and 100 hours before a 50% cut. Better? Yes. But on a dairy, 36 hours of reduced power on your TMR truck during a July heat event still means compromised feed delivery at exactly the moment fresh cows need consistent ration timing most.

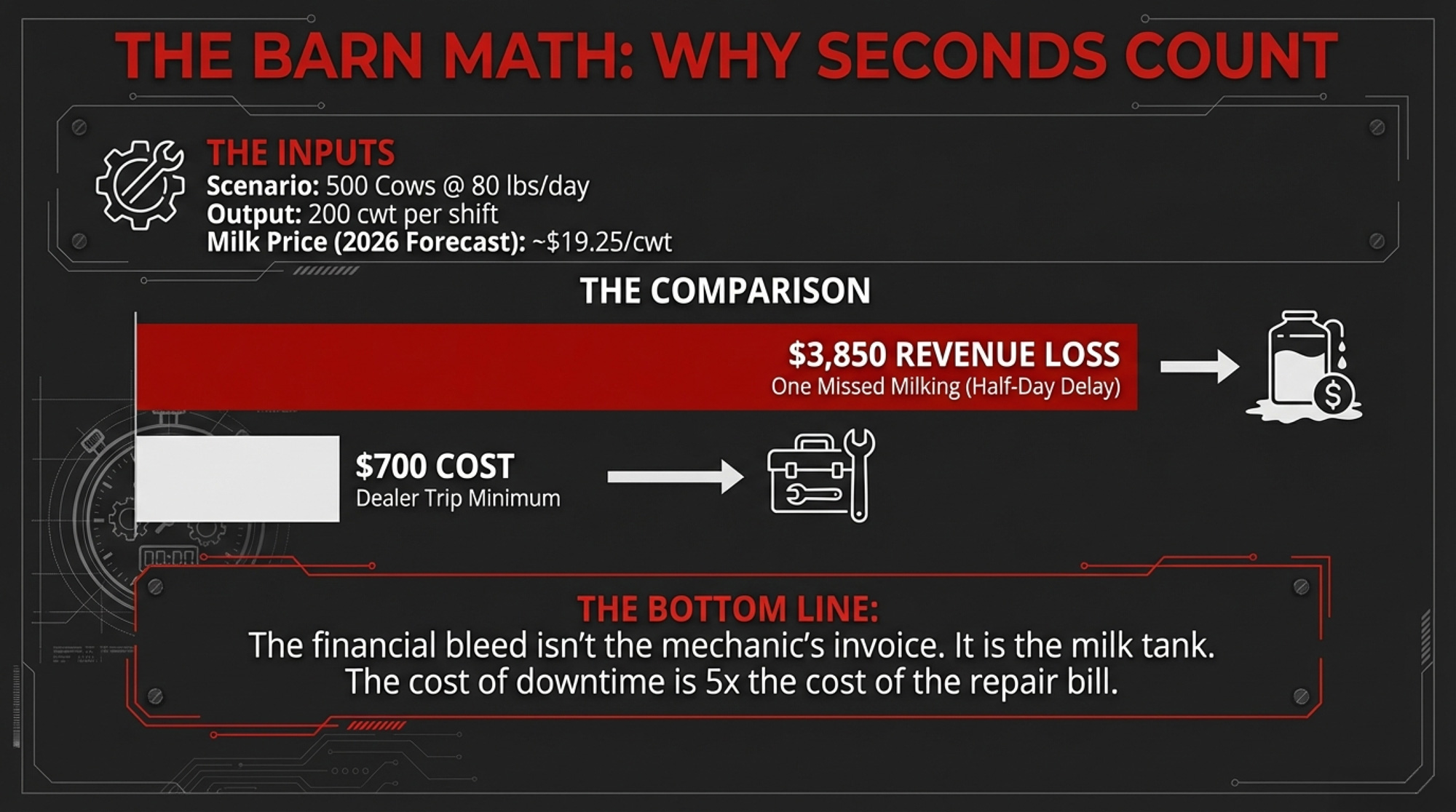

The barn math

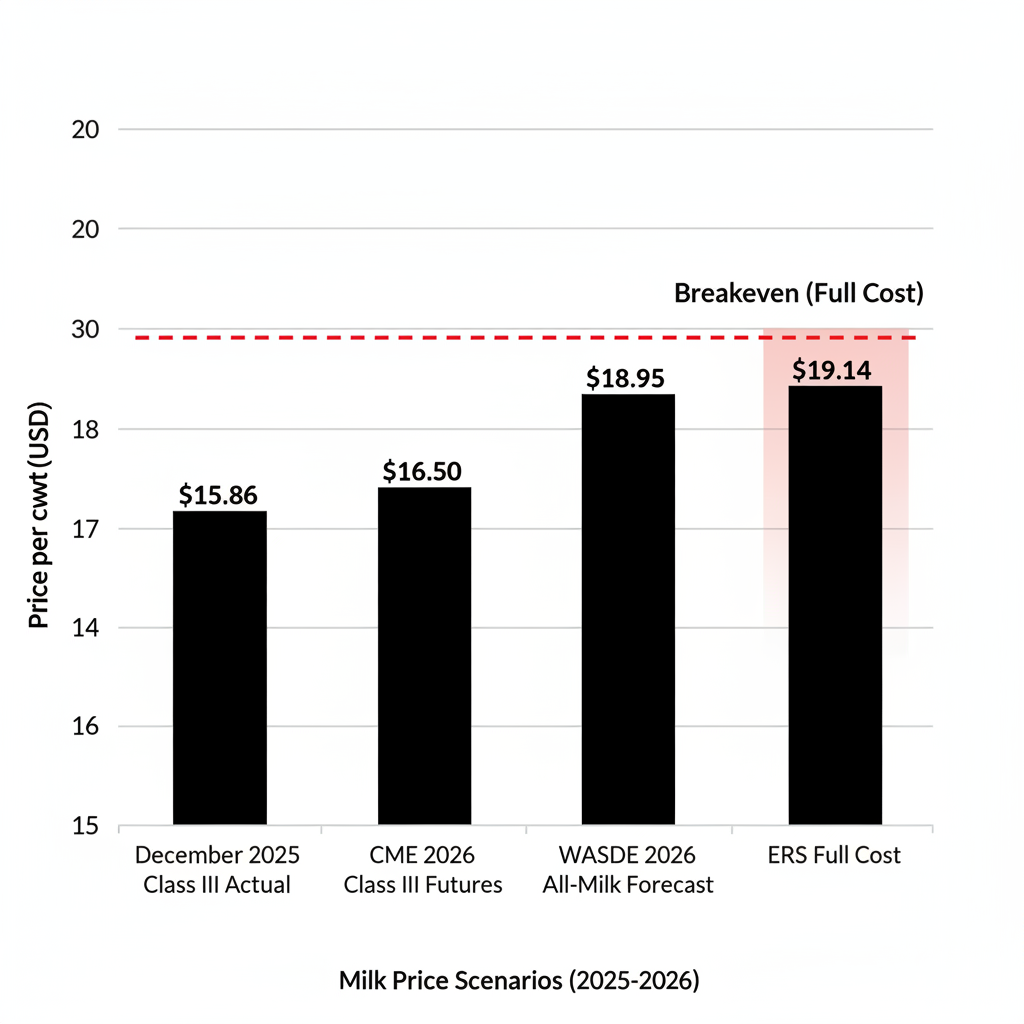

A 500-cow dairy averaging 80 lbs/day — above the U.S. national average of roughly 66.8 lbs/day across all cows, including dry periods (USDA NASS, 2025 annual: 24,392 lbs/cow ), but realistic for a progressive Holstein herd where milking cows produce closer to 78–80 lbs. Miss one milking, call it half a day across the herd, and 20,000 lbs of milk doesn’t ship. That’s 200 cwt.

At USDA’s 2026 all-milk price forecast of roughly $19.25/cwt, that’s $3,850 in gross revenue gone before you pick up the phone. Even at the January 2026 Class III floor of $14.59/cwt, the same half-day costs $2,918. And that’s one machine, one event.

| Herd Size | Avg Production (lbs/day) | One Missed Milking (lbs lost) | Revenue Lost @ $19.25/cwt | Revenue Lost @ $14.59/cwt |

| 250 cows | 80 lbs/day | 10,000 lbs | $1,925 | $1,459 |

| 500 cows | 80 lbs/day | 20,000 lbs | $3,850 | $2,918 |

| 750 cows | 80 lbs/day | 30,000 lbs | $5,775 | $4,377 |

| 1,000 cows | 80 lbs/day | 40,000 lbs | $7,700 | $5,836 |

For context: the U.S. PIRG Education Fund estimated that restrictive repair policies and unplanned breakdowns cost U.S. farmers about $3,348 per year on average across all farm types and equipment, and found dealer mechanics charged $58.90 more per hour than independent shops. Your dairy’s exposure depends on how many DEF-dependent machines sit in your lineup. Plug in your own herd size, your own rolling average production, and your own milk price. That’s your number.

What Does EPA’s Right-to-Repair Guidance Mean for Dairy Equipment?

EPA’s February 2 guidance clarifies that the Clean Air Act doesn’t prevent farmers from temporarily overriding emissions inducements — the forced power reductions that kick in when DEF levels run low, or the system detects a fault — during repairs, so long as the equipment returns to compliance afterward. Zeldin said manufacturers had “misused the Clean Air Act by falsely claiming that environmental laws prevented them from making essential repair tools or software available to all Americans”.

Rollins connected it directly to food security: “When equipment breaks down and remains out of operation, it means crops aren’t planted or harvested, mouths aren’t fed, and America’s economic growth and national security are put at risk”.

This builds on EPA’s August 12, 2025, action that softened DEF inducement requirements to prevent sudden power loss during planting and harvest. Before that, Deere had already asked the EPA to clarify that temporary emissions overrides were allowed. EPA’s February announcement is framed as the answer to that request—not as a unilateral policy shift.

But the National Farmers Union isn’t celebrating. NFU Vice President for Advocacy Mike Stranz told Brownfield the guidance was “much needed” but incomplete, calling for state or federal legislation: “That’s what we need either in state or federal law to be sure that we have the access to the tools and information that we need to fix our own equipment”.

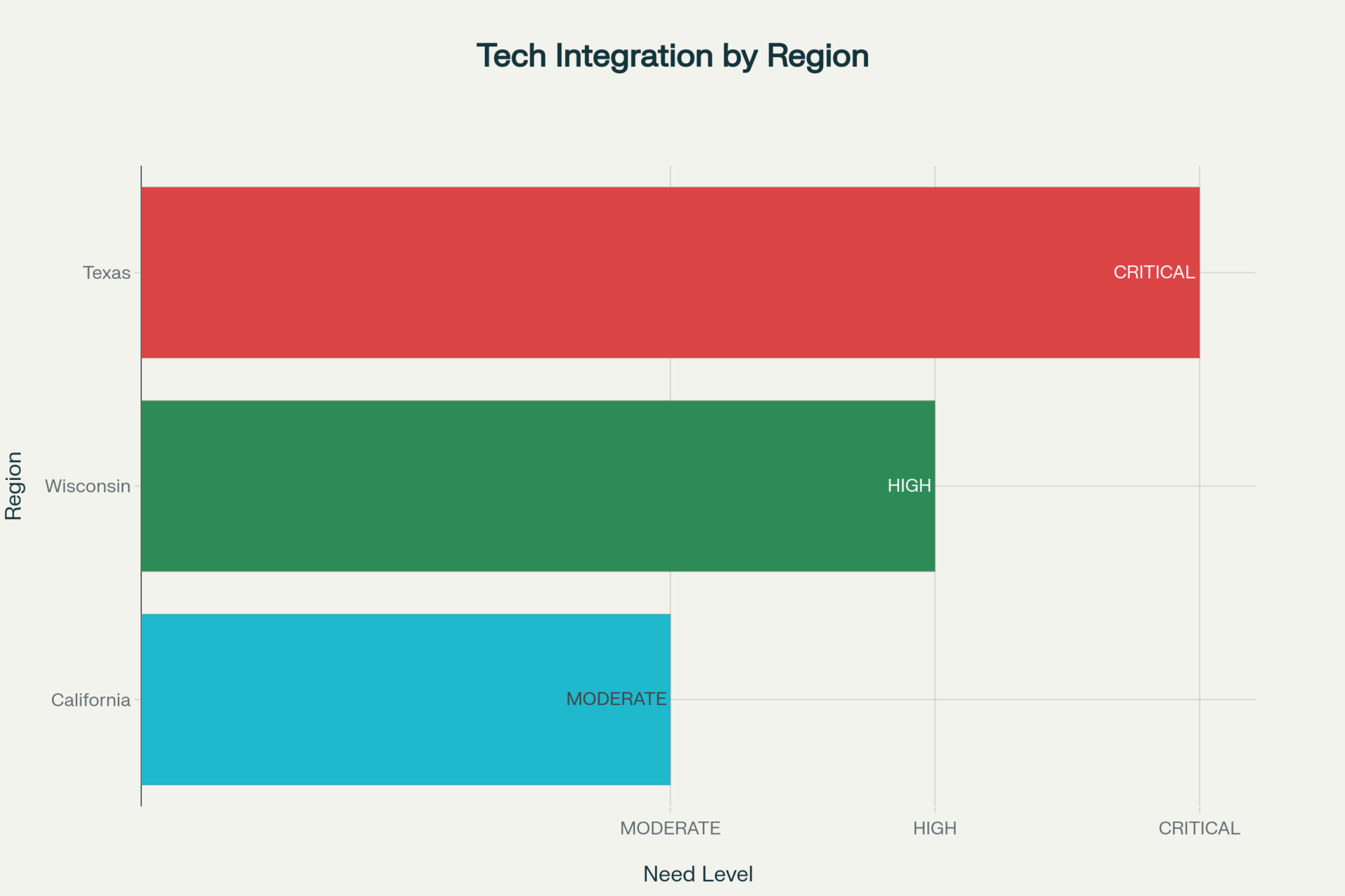

The guidance applies to non-road diesel equipment from every manufacturer, but it hits hardest where DEF issues concentrate: the high-horsepower tractor and 4WD segments, where Deere consistently holds over half the North American market. That’s where a derate stops not just one implement, but your whole feeding or harvesting schedule.

Can PRO Service Actually Perform the Override? Not Yet.

Deere responded by saying, “temporary inducement override capability will soon be made available to John Deere customers through Operations Center™ PRO Service,” an enhanced digital repair tool with diagnostic, repair, and reprogramming capabilities.

Two words matter there. Will soon. Not “is now available.” Not “effective immediately.”

Current PRO Service documentation confirms the gap. LandPro Equipment — an authorized Deere dealer across New York, Ohio, and Pennsylvania — lists functions explicitly excluded from PRO Service. Right there on the page: “Emission Control System Derate Temporary Override”. Deere’s own shop page carries a similar caveat: “Certain emissions-related tests and calibrations are not currently available”. No Deere dealer has publicly commented on a timeline for the override update.

| Compliance Task | Farmer/Owner | Independent Shop | PRO Service | Dealer |

|---|---|---|---|---|

| Perform repair | ✅ Yes | ✅ Yes | ⚠️ Diagnostics only | ✅ Yes |

| Override DEF derate | ❌ No (not yet) | ❌ No | ❌ No (excluded) | ✅ Yes |

| Clear override DTCs | ❌ No | ❌ No | ❌ No | ✅ Dealer only |

| Document compliance return | ❌ No | ❌ No | ❌ No | ✅ Dealer only |

| Verify system to EPA spec | ❌ No | ❌ No | ❌ No | ✅ Dealer only |

The exact capability EPA says you can use isn’t in the tool that Deere says will deliver it.

Independent shops face an even steeper climb. PRO Service access costs $5,995 per year and covers up to 10 local application downloads. For many small-town mechanics, that’s simply out of reach. And even those who pay are locked out of the override function—the same one EPA just told farmers they’re entitled to use.

Farm Action’s Sarah Carden summed up the gap: “They haven’t addressed the fact that farmers don’t have the tools they need”. Right-to-repair advocate Willie Cade called PRO Service a “paywalled limited-access platform”.

Independent technicians can diagnose the problem today. They just can’t clear the code that proves the fix worked.

🐂 The Bullvine Bottom Line: The “Right to Repair” is currently a “Right to Ask for Permission.” Until the override function moves from “soon” to live in your PRO Service dashboard, your 5 AM breakdown still ends with a dealer phone call.

How Much Does a DEF Override Actually Cost at the Dealer?

No major dealer network publishes standardized service pricing. But the floor is clear.

South Dakota Farmers Union President Doug Sombke told Brownfield that a basic dealer service call runs “a minimum of $700 per trip… That’s not counting the repairs and labor.” Stack diagnostics, override work, and a compliance-verification callback on top, and an emergency field call during a critical window pushes well past $1,000. When you’re calling during silage season, you’re not negotiating from a position of strength.

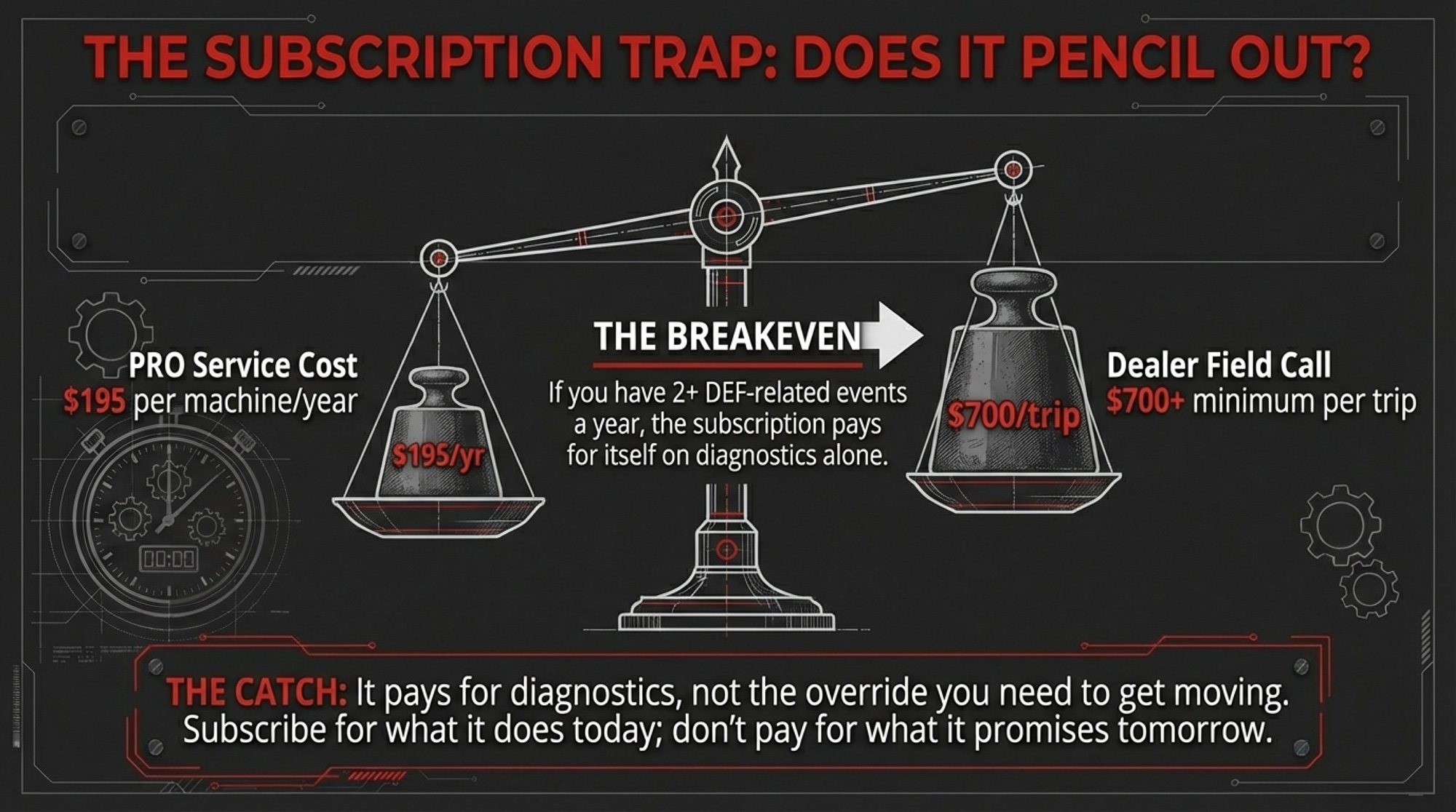

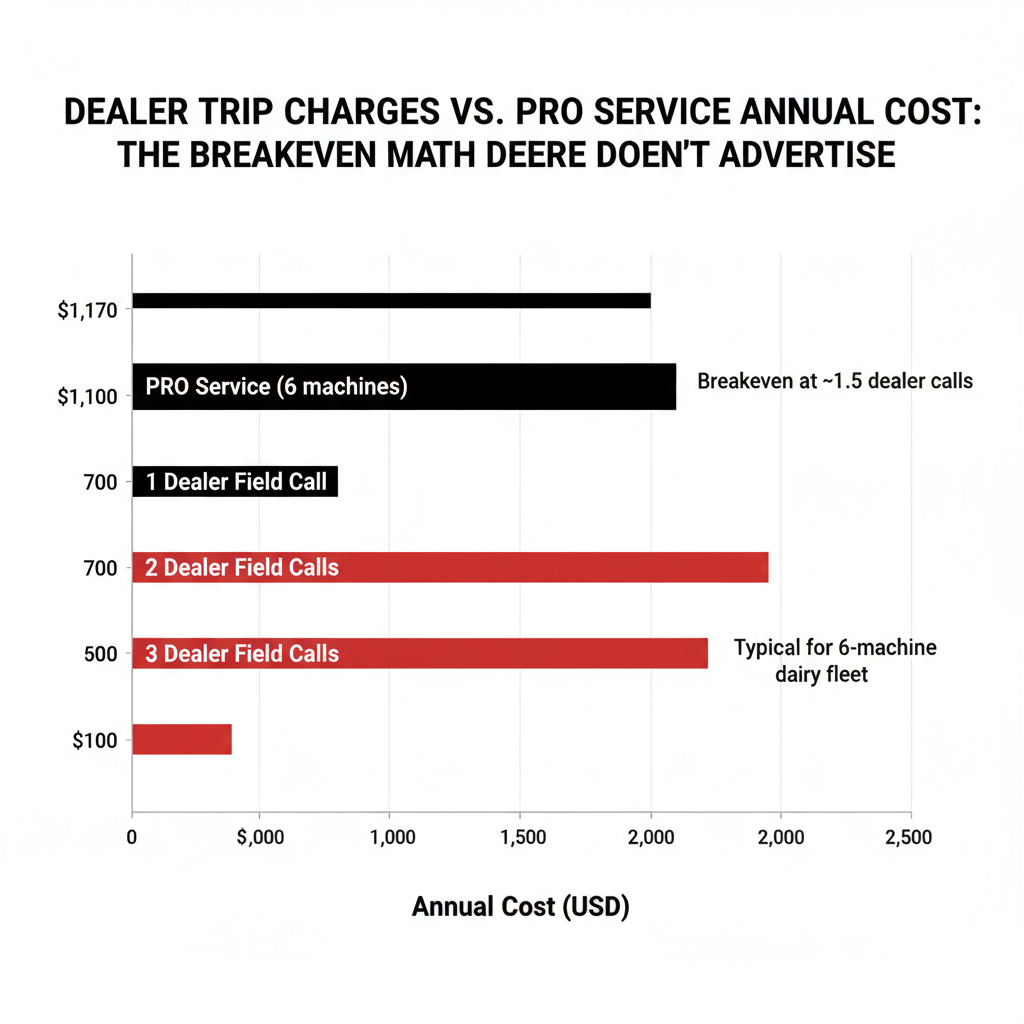

The PRO Service breakeven

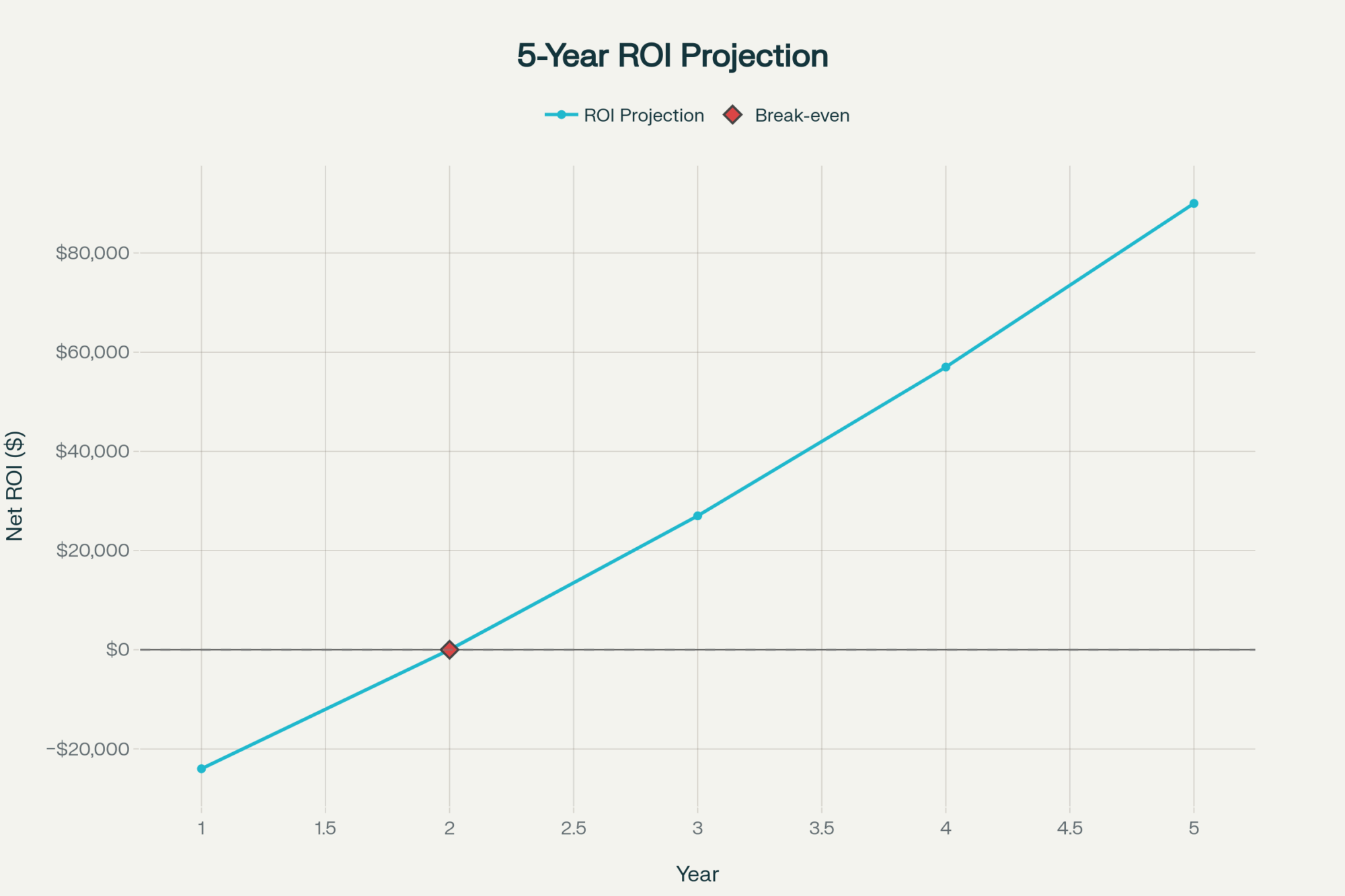

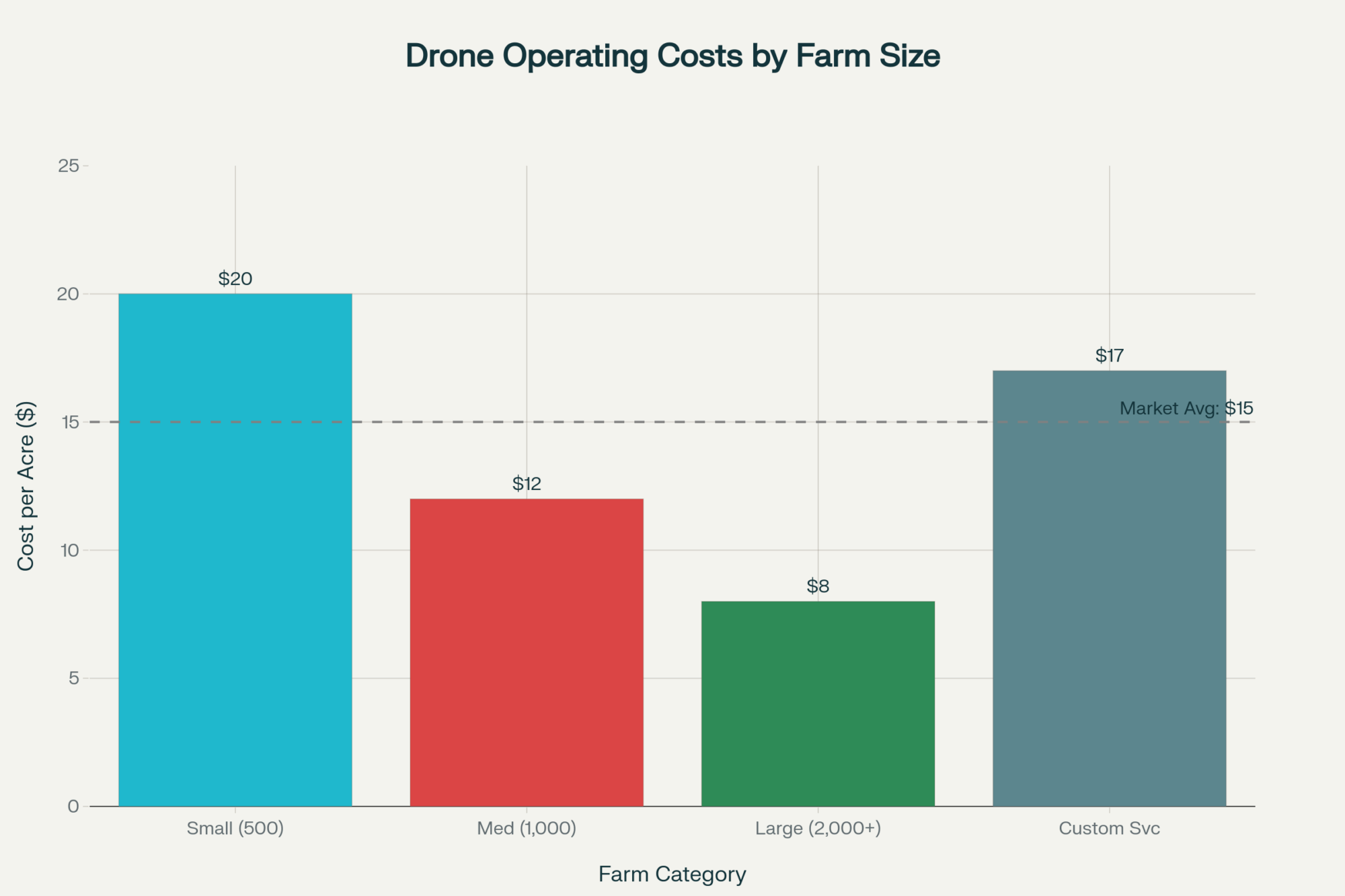

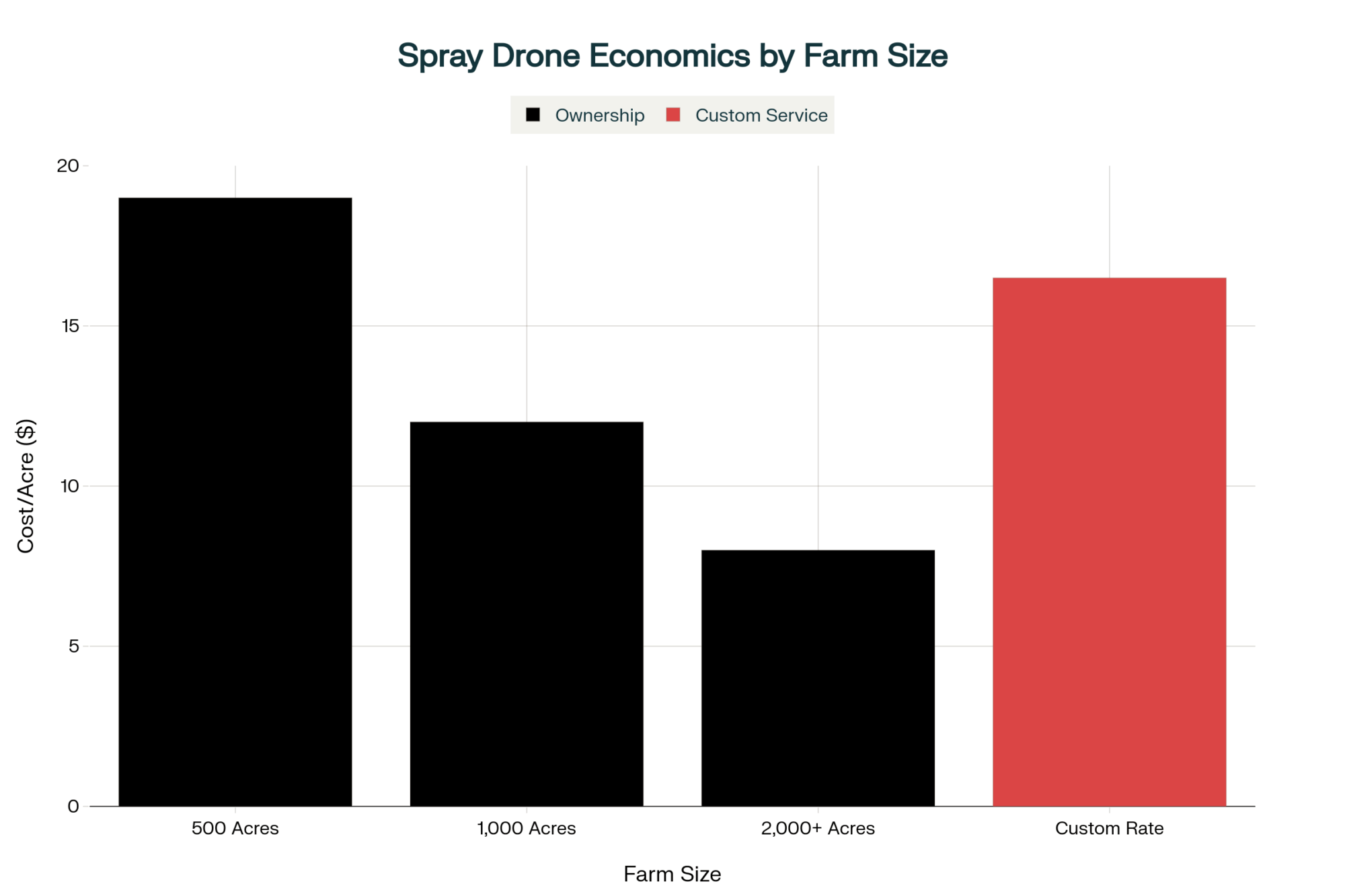

Deere charges $195 per machine per year for PRO Service.

- 6 machines × $195 = $1,170/year for fleet-wide coverage

- 1 emergency dealer field call = $700 minimum (Sombke, Brownfield) before diagnostics and parts

- Breakeven trigger: If you’re averaging more than 1–2 DEF-related dealer calls per year across your fleet, PRO Service pencils out — once the override actually goes live

On a 500-cow dairy with 6 key machines and 3 DEF-related dealer events per year, that’s at least $2,100 in trip charges alone before parts or labor. The same fleet’s PRO Service tab is $1,170. The economic case looks strong on paper. But the one function that changes your downtime risk—the temporary override—sits in the “Excluded” column today.

Pull your fleet’s dealer call history from the last 12 months. Count the DEF-related events. That’s your breakeven test.

Why Would Deere Ask for Guidance That Undercuts Its Own Revenue?

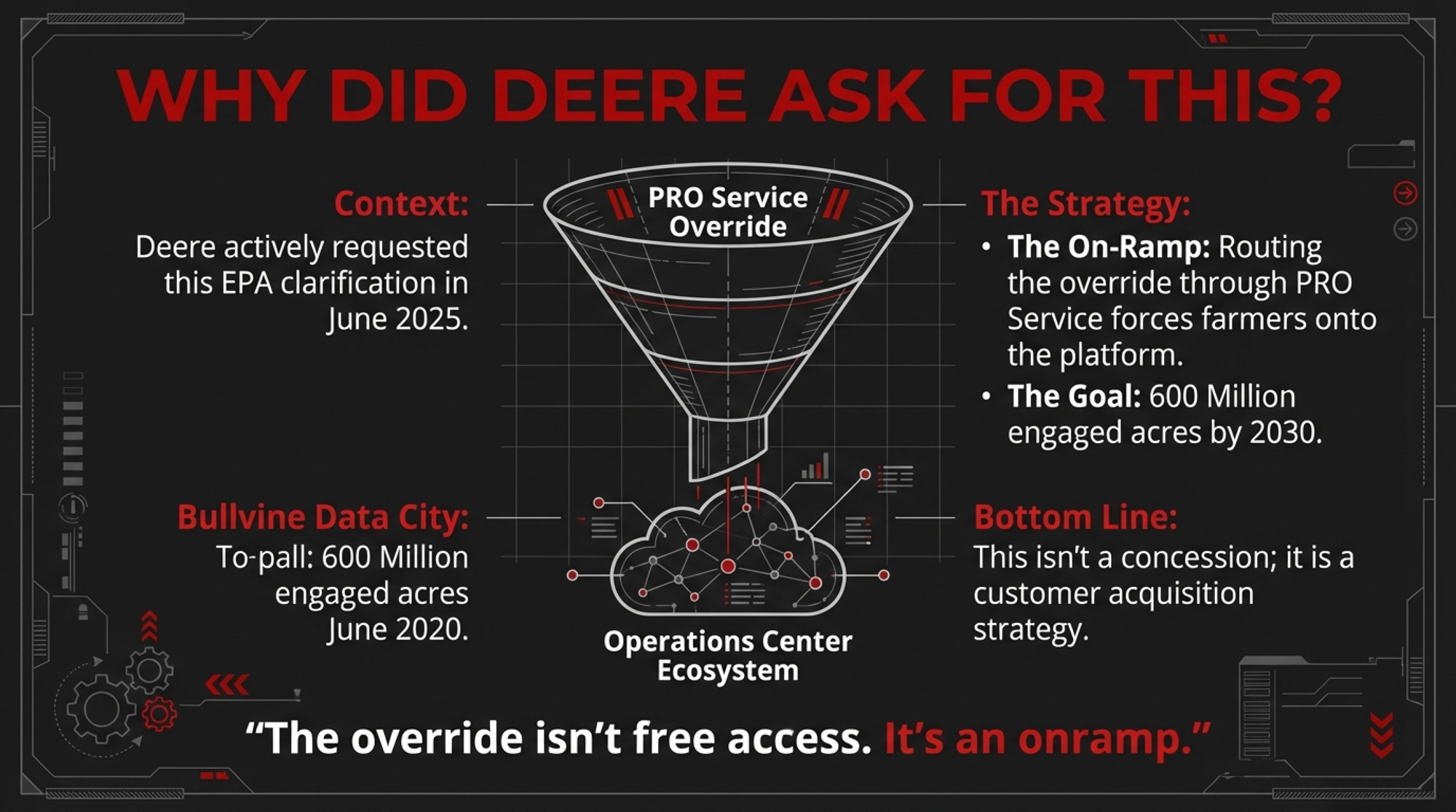

John Deere didn’t react to the EPA’s guidance. They asked for it. On June 3, 2025, the company sent a formal letter to the EPA requesting clarification that temporary emissions overrides are permissible. EPA calls the February 2, 2026 announcement “a direct response” to that letter.

Why invite regulatory clarity that appears to undermine your own service monopoly?

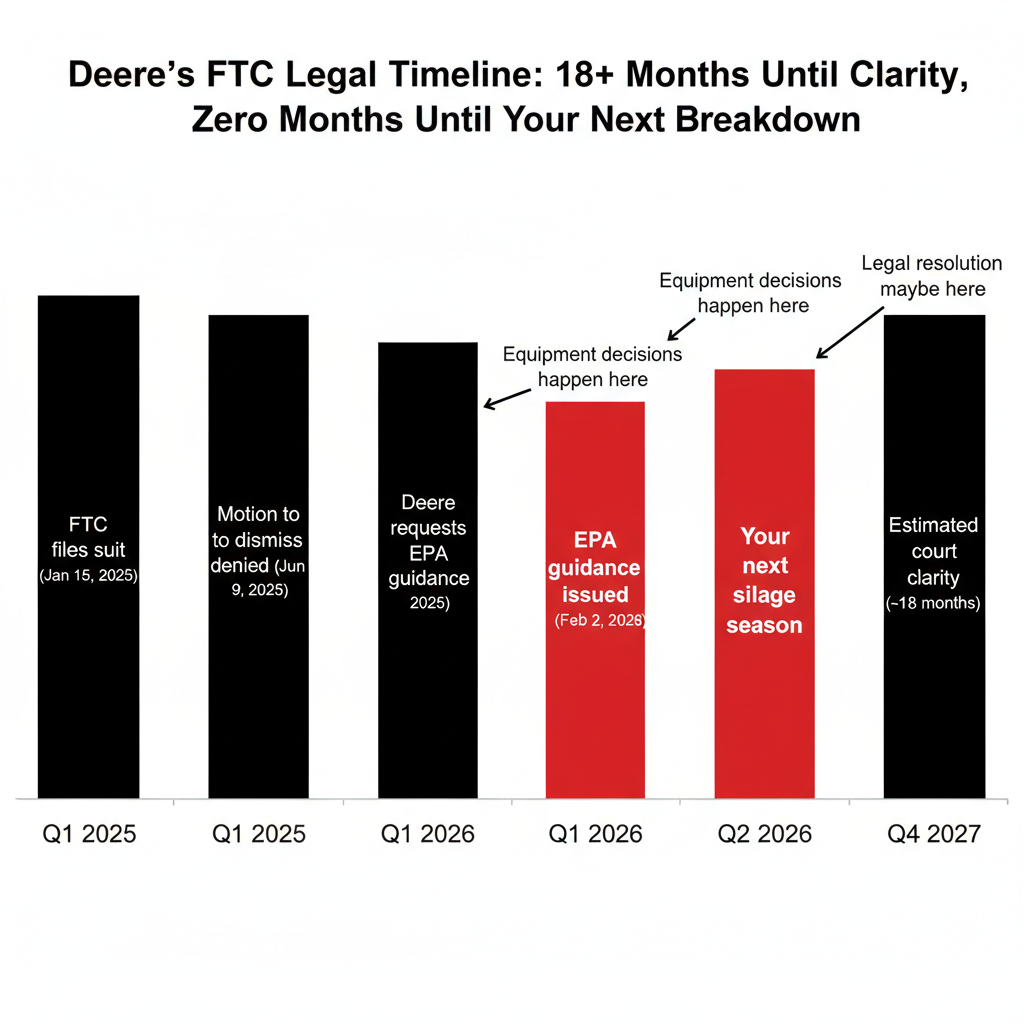

Look at the litigation stack. The FTC filed suit against Deere on January 15, 2025, in the Northern District of Illinois, with Illinois and Minnesota as co-plaintiffs. Michigan, Wisconsin, and Arizona joined in February 2025, and by June 2025, the total had grown to 17 states. On June 9, 2025, U.S. District Judge Iain D. Johnston denied Deere’s motion to dismiss. His language was pointed: “Farmers have no alternatives because of the system created by Deere, which charges suprarcompetitive prices because of the lack of any alternatives”.

Penn State agricultural law director Ross Pifer told Brownfield it could be “another 18 months or so until we get another court ruling that provides any clarity”. The FTC’s own January 2025 complaint said Deere “forces farmers to turn to Deere dealers for critical repairs rather than complete the repairs themselves or choose an IRP that may be cheaper, closer, faster, or more trusted”.

So Deere requested EPA guidance now. Building goodwill with the current administration. Creating a counter-narrative to the FTC’s monopolist framing. And — most importantly — controlling how repair access gets delivered. If the override routes through Operations Center PRO Service, every farmer who uses it enrolls in Deere’s digital ecosystem. At its December 8, 2025, Investor Day, Deere confirmed it already has over 1 million connected machines worldwide, with its Operations Center platform covering 500 million engaged acres — and a target of 600 million engaged acres by 2030. EPA just handed them a reason to accelerate that trajectory.

The override isn’t free access. It’s an onramp.

The Compliance Dead-End Nobody’s Talking About

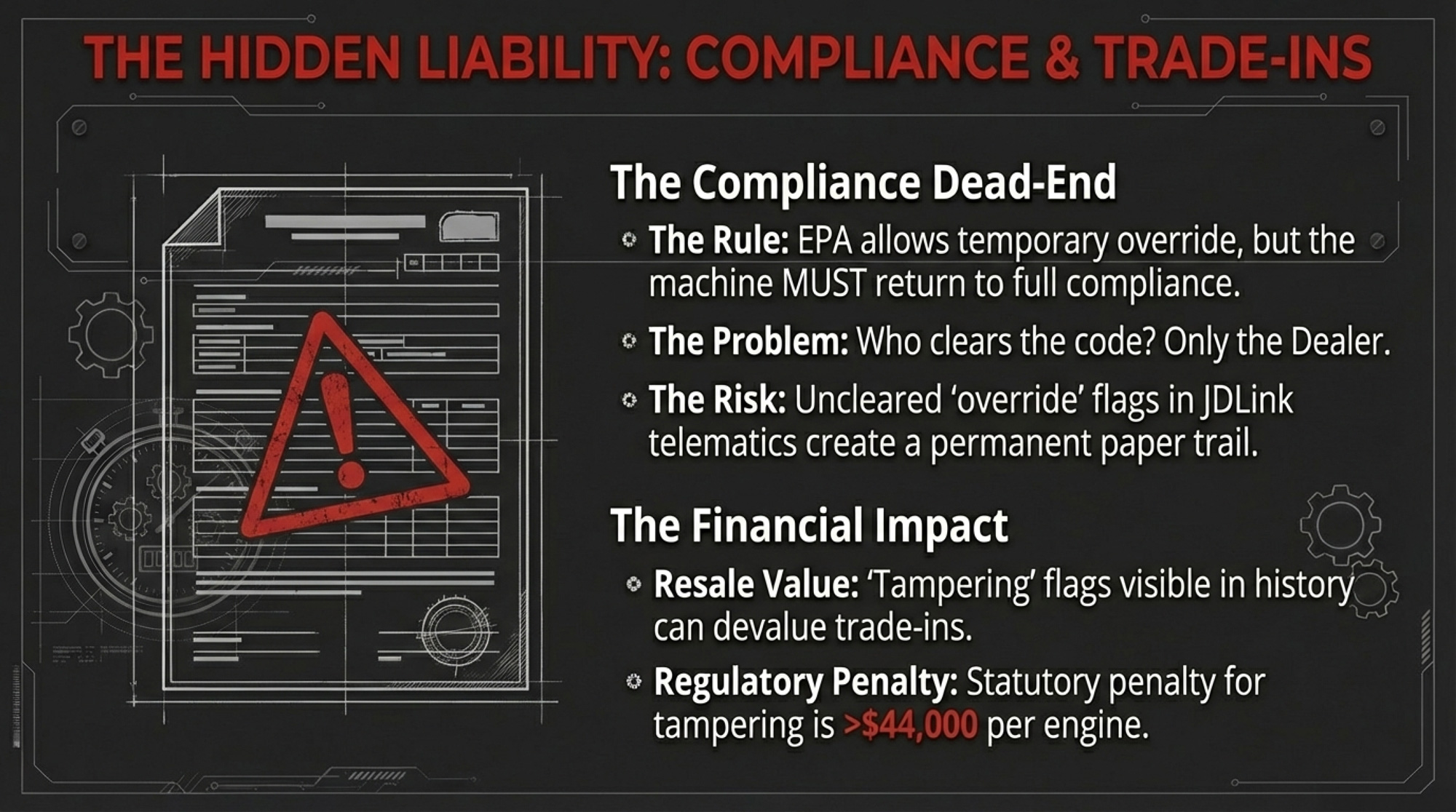

Here’s the part that got almost no coverage. EPA’s guidance says you can override the derate temporarily during a repair. But the equipment has to return to full emissions compliance afterward. That means somebody has to verify the system is working correctly, clear the diagnostic trouble codes, and document that the override was temporary.

Who can do that today? The dealer. Not PRO Service. Not your independent mechanic. The dealer.

Current PRO Service documentation excludes both the override function and the ability to clear the DTCs that prove the fix worked. So even if the override goes live tomorrow, you may still need a dealer visit to close the compliance loop. And an uncleared override sitting in your telematics data creates a paper trail that could become a problem at resale or, in a worst-case scenario, during an EPA audit.

The statutory penalty under 40 CFR § 1068.101 for tampering violations is $44,539 per engine or piece of equipment,according to the current eCFR. EPA’s January 2024 penalty inflation memo confirmed the agency planned another inflation adjustment in January 2026, so the actual 2026 figure may be slightly higher. Nobody’s suggesting a farmer making a good-faith repair faces that number. But without a clean compliance record showing that the override was temporary and that the system returned to spec, you’re relying on enforcement discretion—not documentation.

The Trade-In Trap

And then there’s the resale question. If your override creates a permanent flag in JDLink telematics — and there’s no PRO Service function to clear it — what happens when that tractor hits the auction block or the trade-in lot?

No dealer or auction company has publicly confirmed how an uncleared emissions override flag affects trade-in values. But the risk isn’t theoretical. Any buyer running a JDLink history on a used machine will see it. The data on this is thin, but the direction isn’t complicated: documented compliance problems don’t help resale.

If you’re planning a trade-in within the next 24 months, ask your dealer — in writing — whether an override event, even one EPA says is legal, creates a permanent telematics record. Get the answer before you need it.

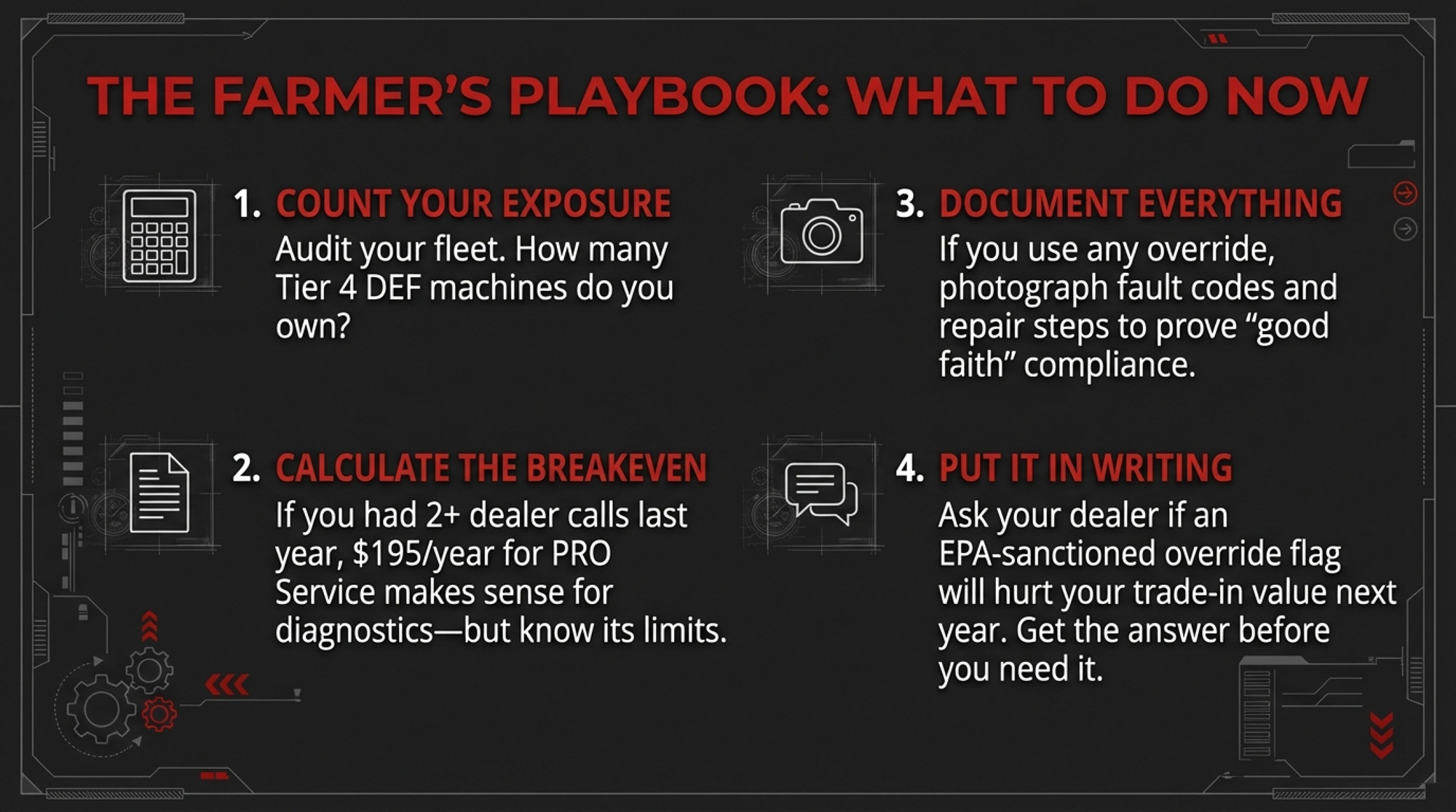

What This Means for Your Operation

- Count your DEF machines. Pull your fleet list. Every Tier 4 diesel with DEF — tractors, TMR mixers, skid steers, loaders — is a potential derate event. More machines means more exposure and a stronger case for PRO Service, once the override goes live.

- Run the breakeven. $195/machine/year for PRO Service vs. $700+ per dealer trip minimum. If your last 12 months show more than 1–2 DEF-related dealer calls across your fleet, the subscription math works even without the override. But know what you’re buying — and what you’re not.

- Document everything now. If you use any override — the Emergency SCR function, a workaround from your independent shop, anything — photograph the original fault code, log the repair steps, and confirm in writing (to your dealer or Deere directly) that the system returned to compliance. The compliance trail matters more than the repair itself.

- Ask the trade-in question in writing. If you’re within 24 months of trading a machine with DEF history, get your dealer’s written answer on how override events affect telematics records and valuations. Before you need it, not after.

- Watch the PRO Service dashboard. The moment Deere switches the override from “excluded” to “active,” the economics change. That update is worth more to your operation than the headline $48 billion number.

- Don’t assume the guidance is the finish line. NFU’s Stranz and multiple state attorneys general say federal or state legislation is still needed to guarantee access to tools, not just permission to use them. Deere’s own FTC case may not produce clarity for another 18 months. The regulatory landscape is still moving.

Key Takeaways

- If you’re averaging 2+ DEF-related dealer calls per year across your fleet, PRO Service at $195/machine already pencils out for diagnostics — but the override function that would actually cut your downtime risk is not yet available. Subscribe for what it does today; don’t pay for what it promises tomorrow.

- If you’re planning a trade-in within 24 months, get written documentation from your dealer on how override events — even those sanctioned by EPA — affect telematics records and resale values. The absence of clear answers is itself a data point.

- If your operation runs 6+ Tier 4 diesel machines, your annual exposure to DEF-related downtime and dealer trip charges likely exceeds $2,000 — before parts or labor. That’s the number to track against, not the $48 billion headline.

- Judge Johnston’s “supracompetitive prices” language and 17 state co-plaintiffs signal that the legal pressure on Deere isn’t going away. But the timeline for resolution is 18+ months. Make equipment decisions based on what’s available today, not on what a court might order in 2027.

The Bottom Line

Ben Bellar’s combine sat in that field, “dead in the water,” because the tool to fix it existed but wasn’t in his hands. EPA now says that the tool should be available. Deere says it will be “soon.” Your next silage season doesn’t wait for “soon.” Pull the invoices, count the DEF events, and ask the hard questions — in writing — before you need the answers.

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More

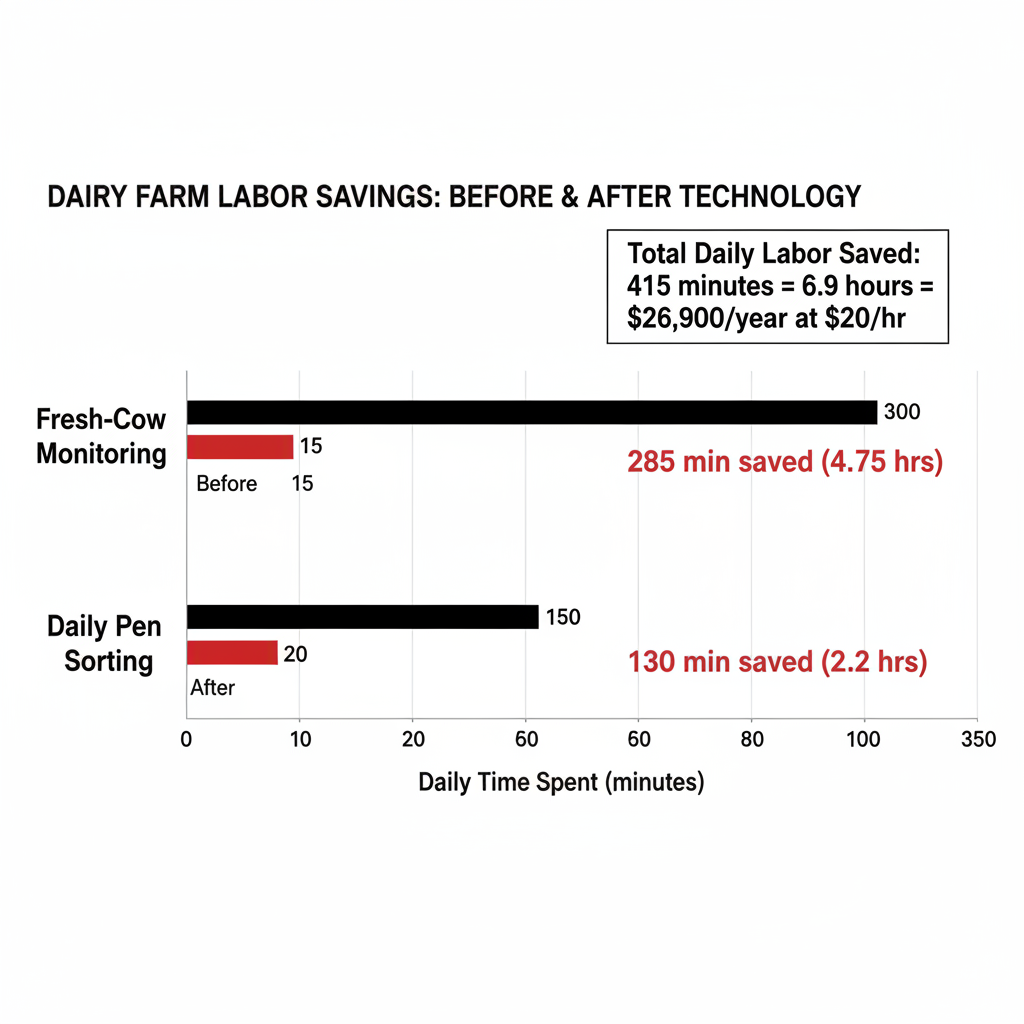

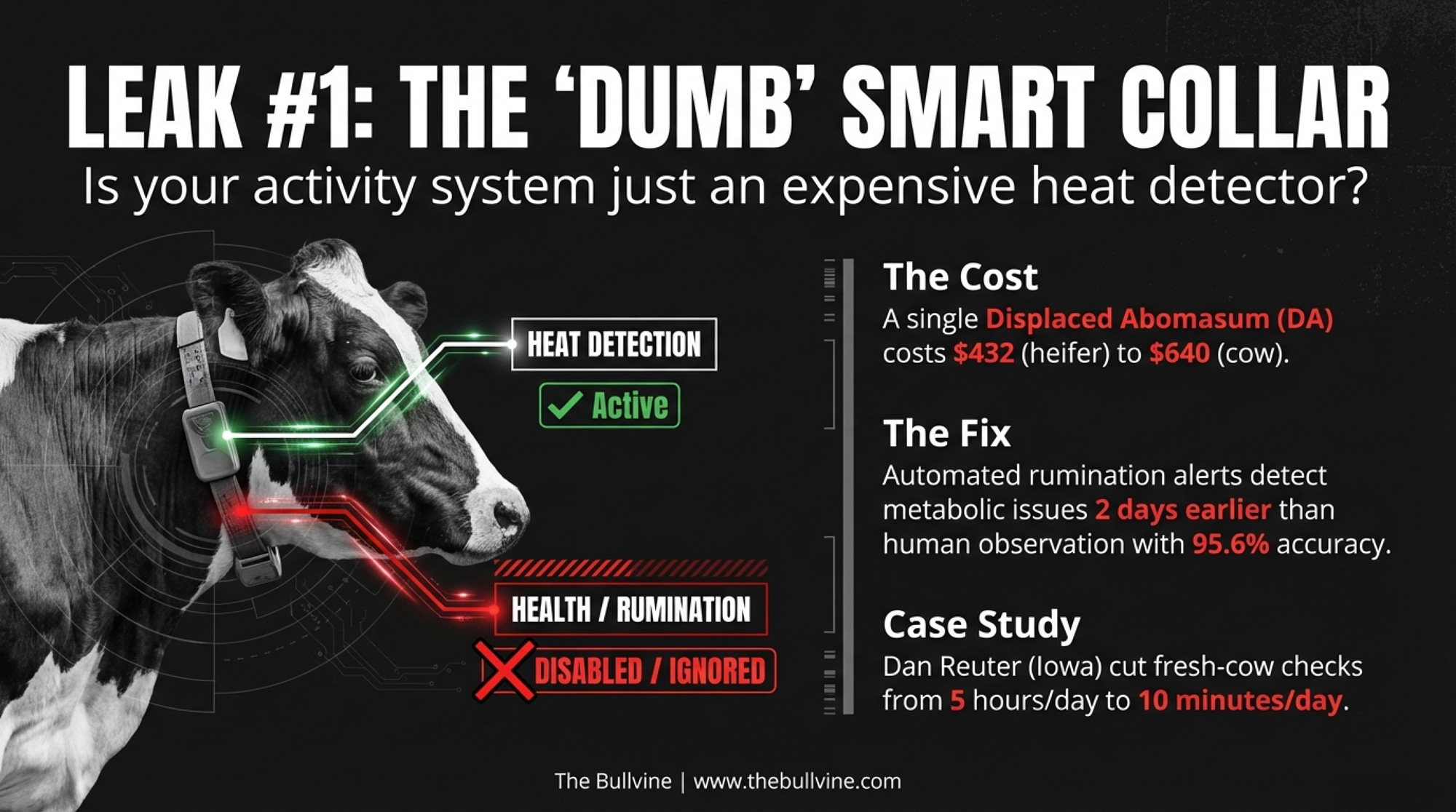

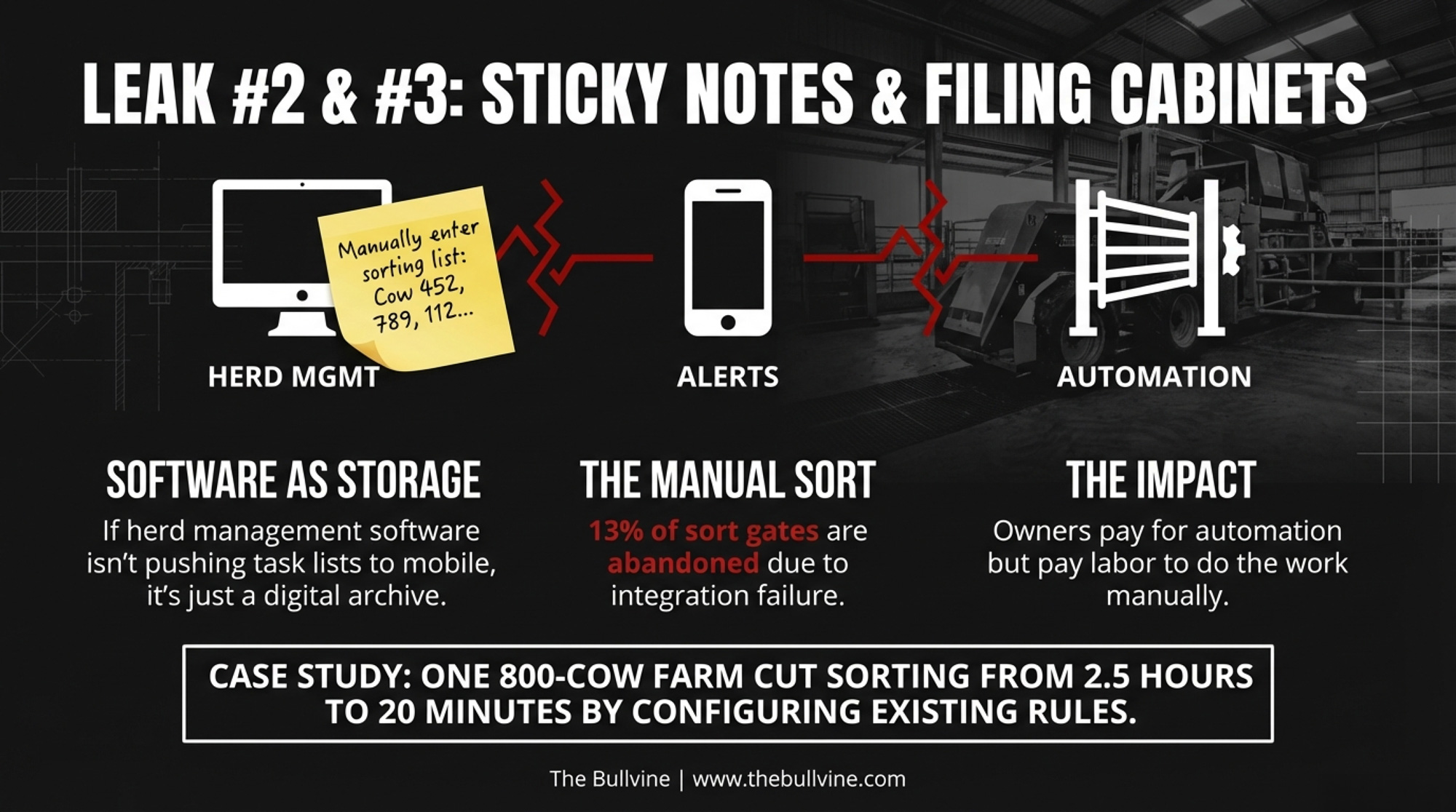

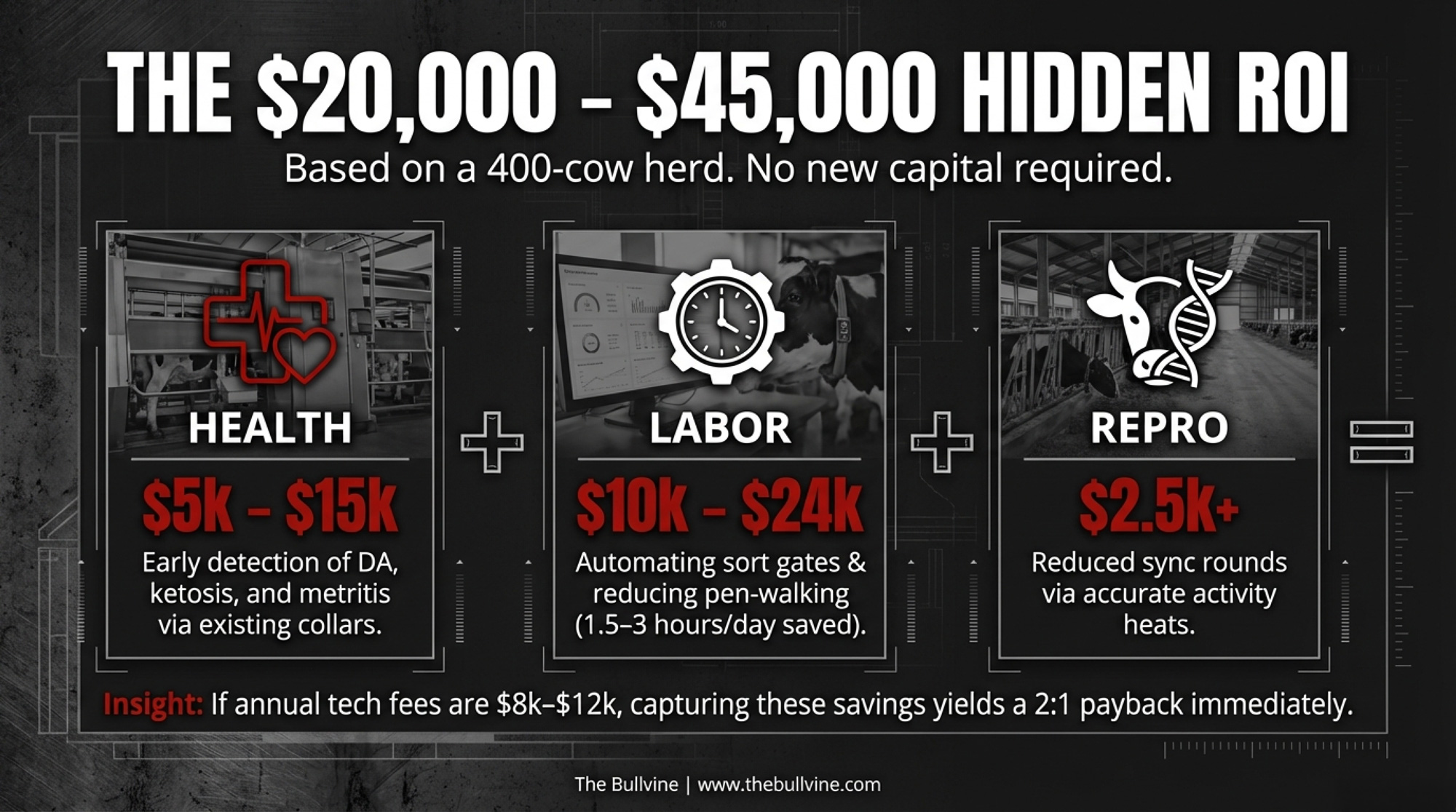

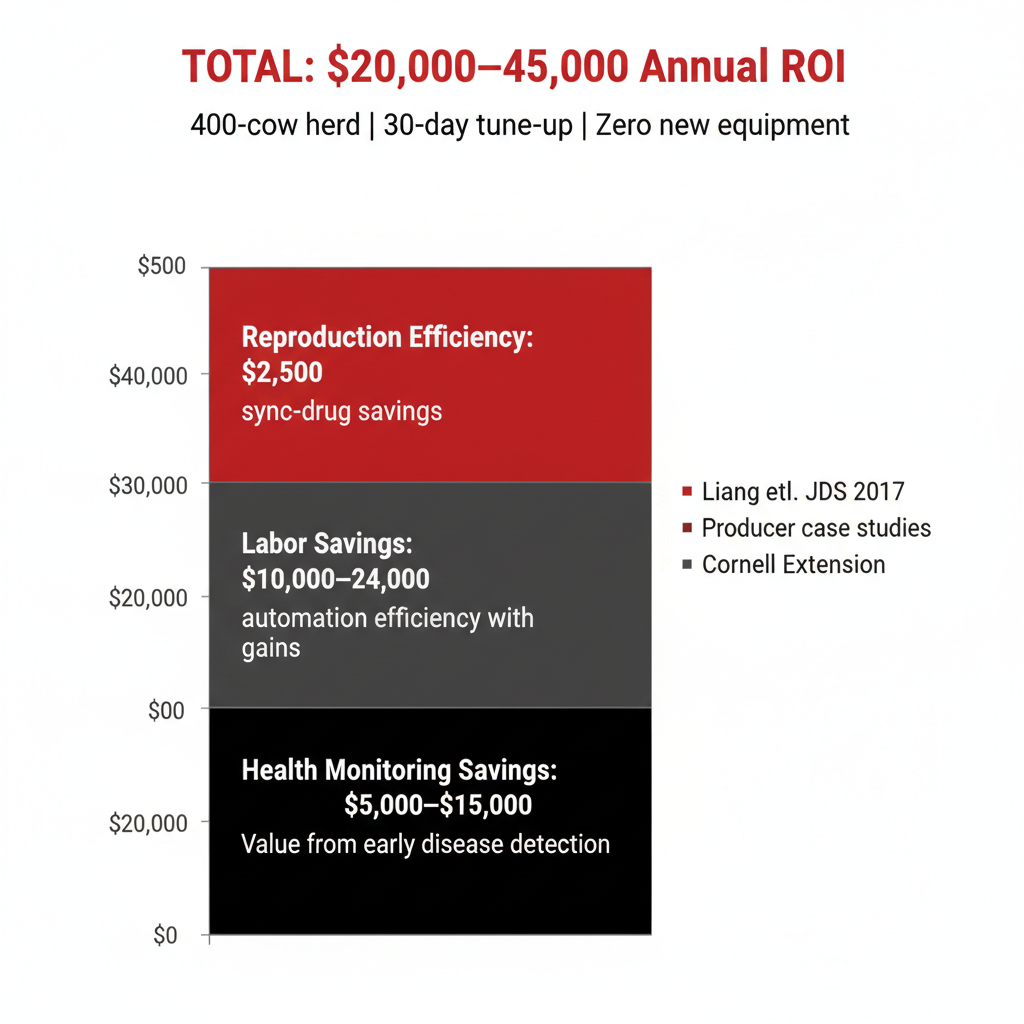

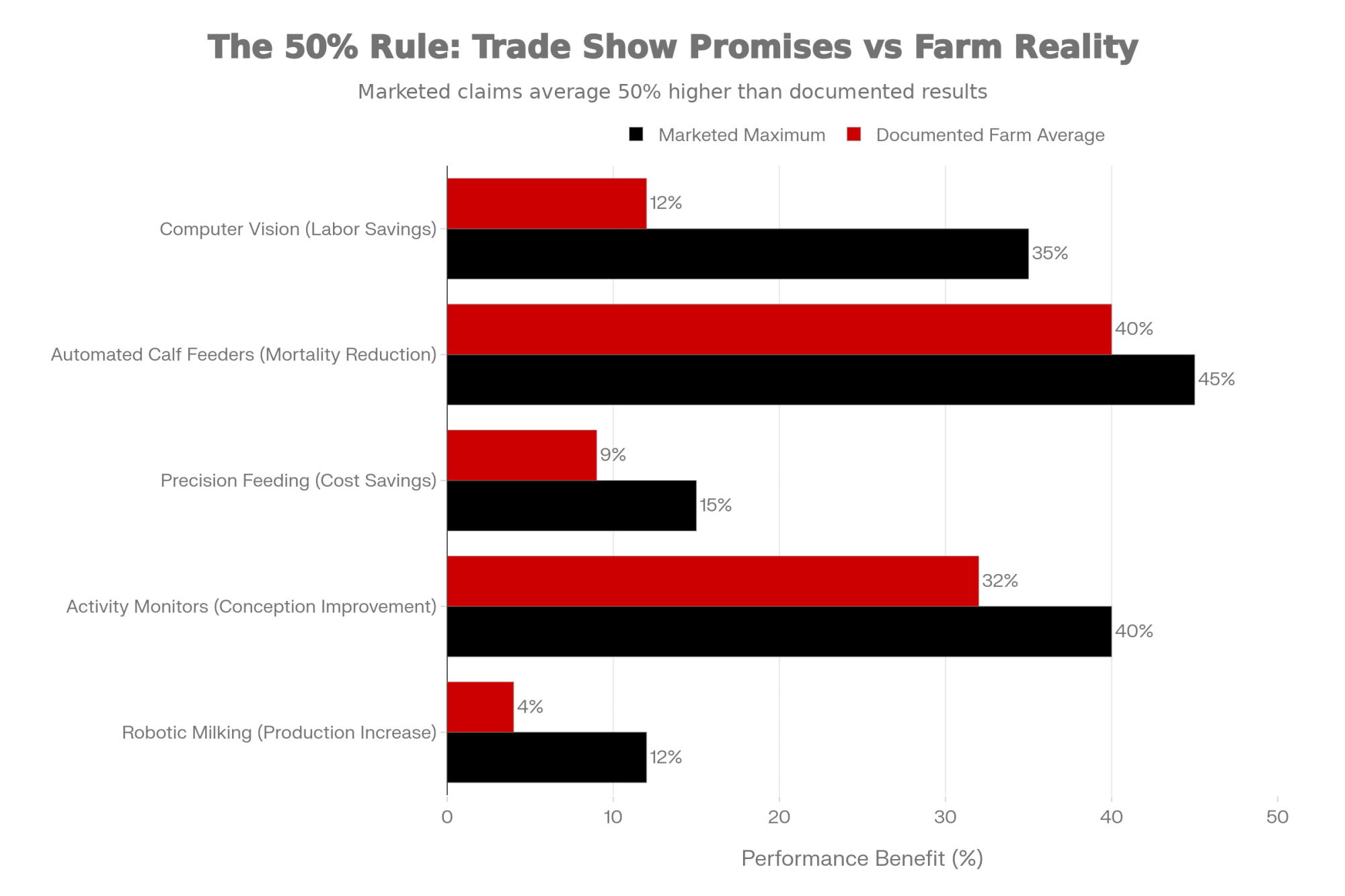

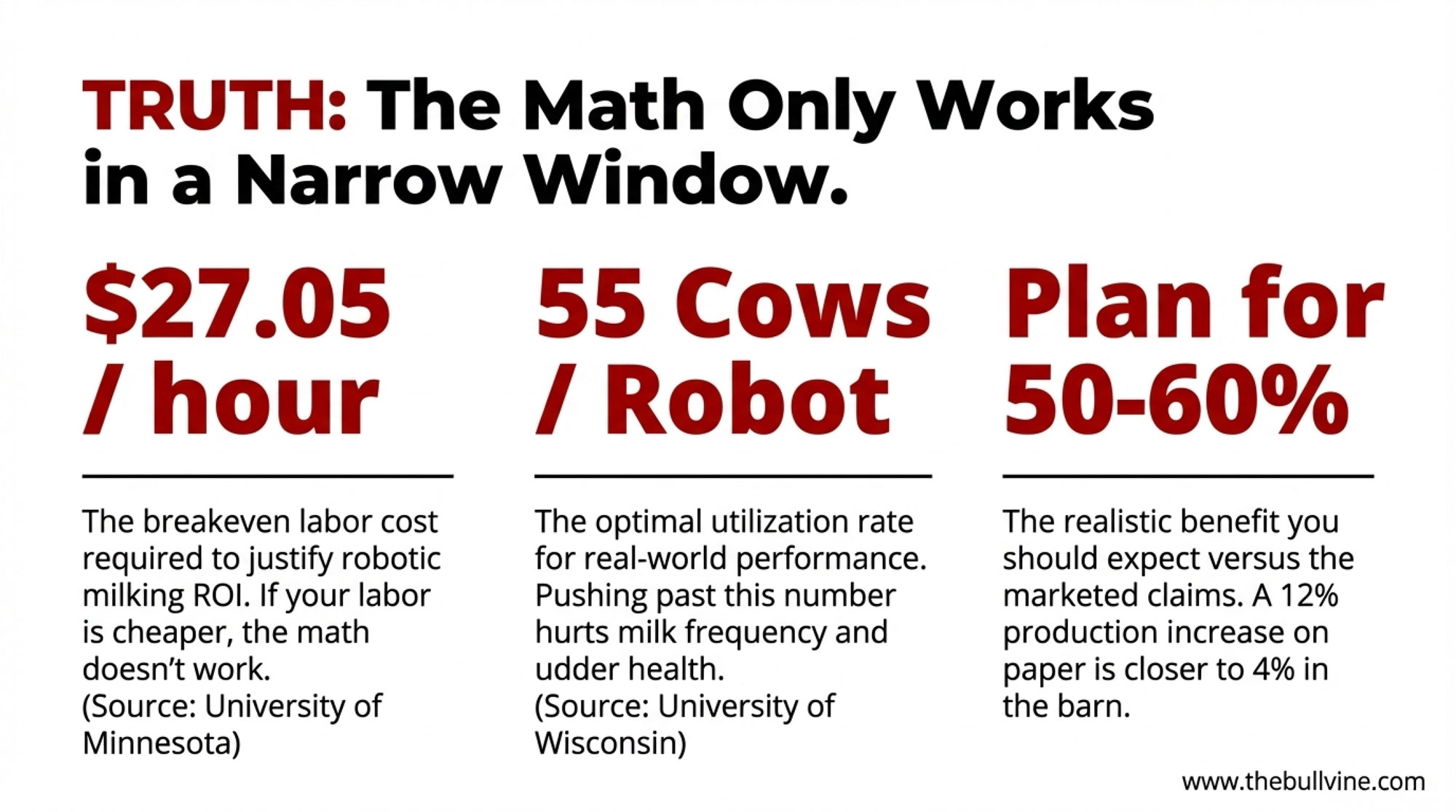

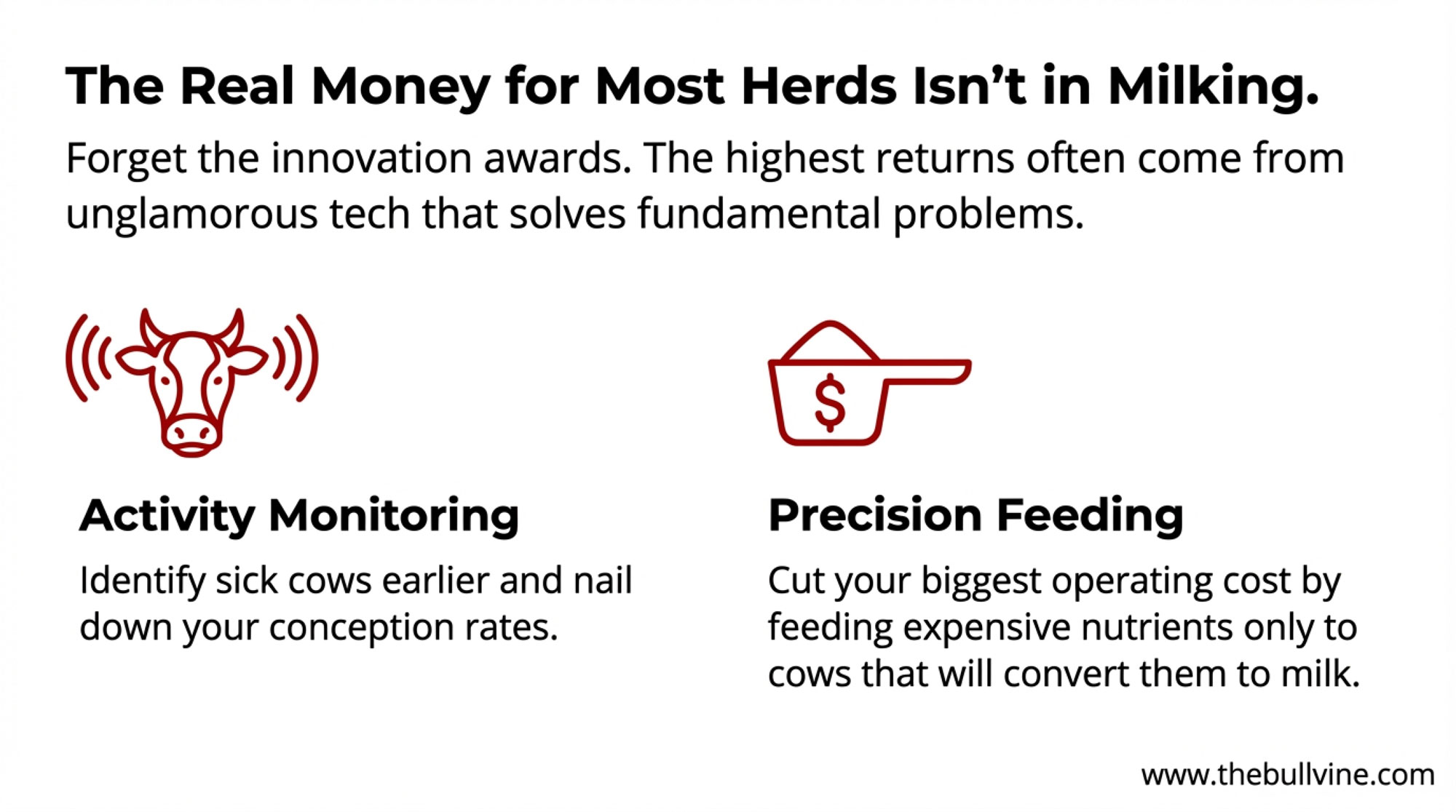

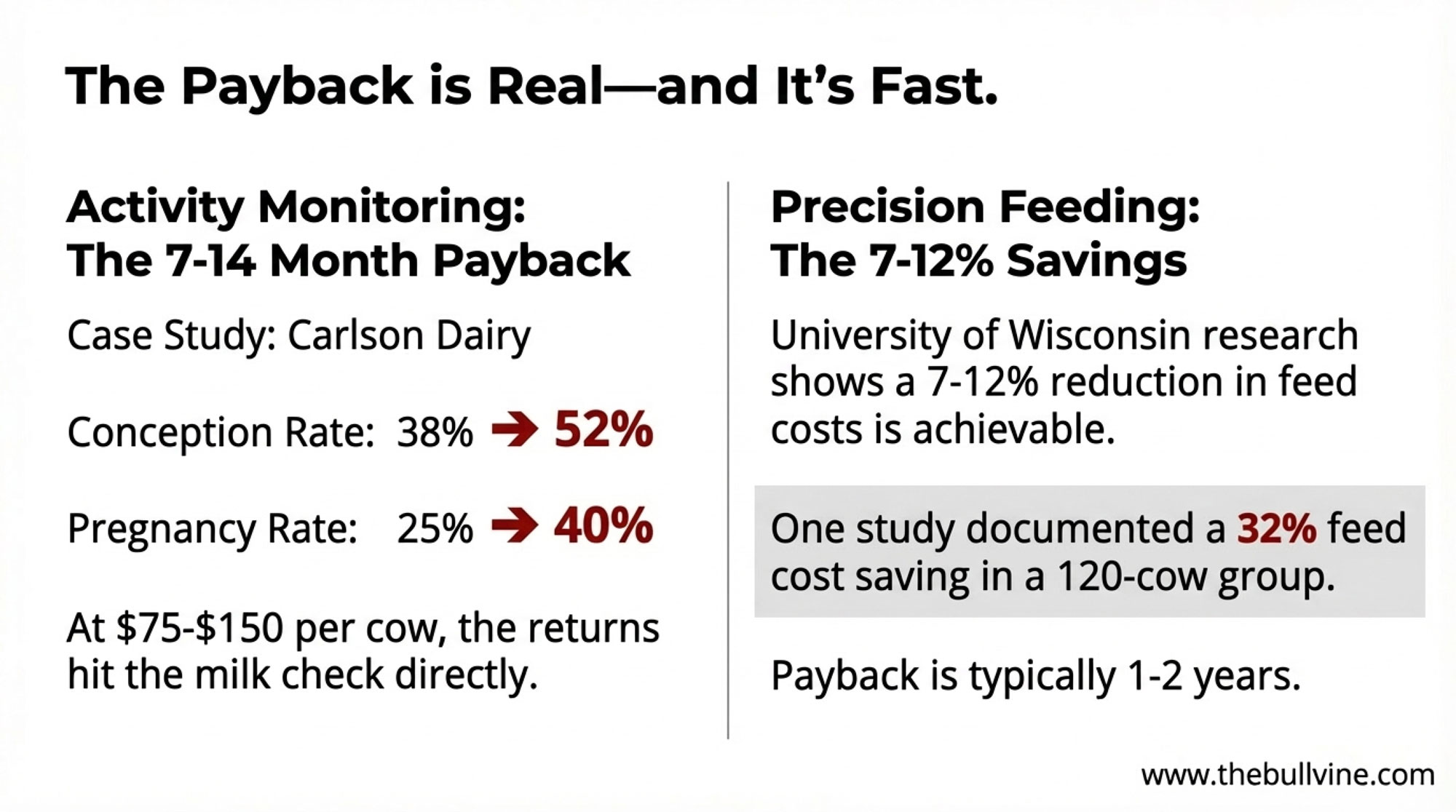

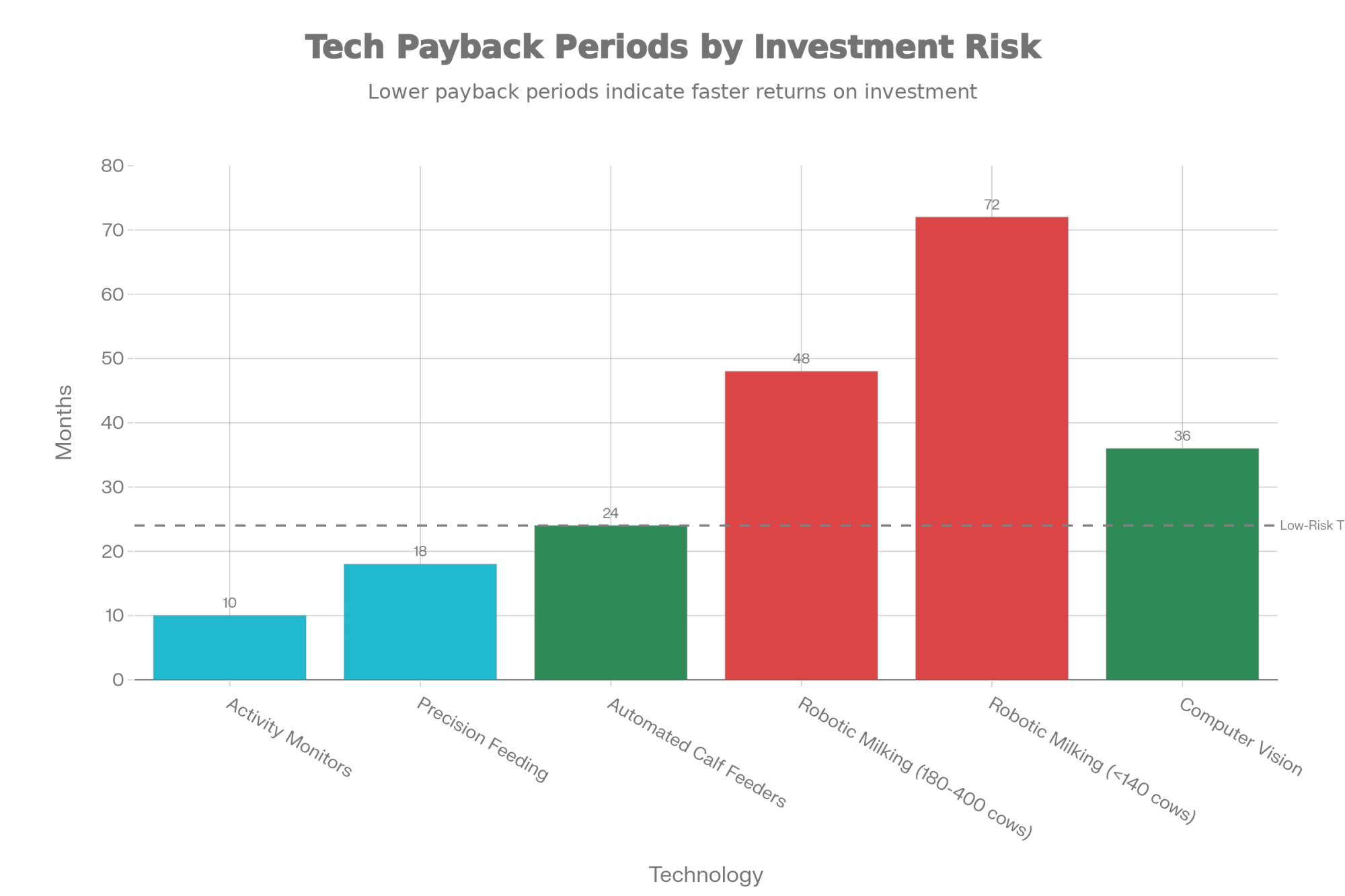

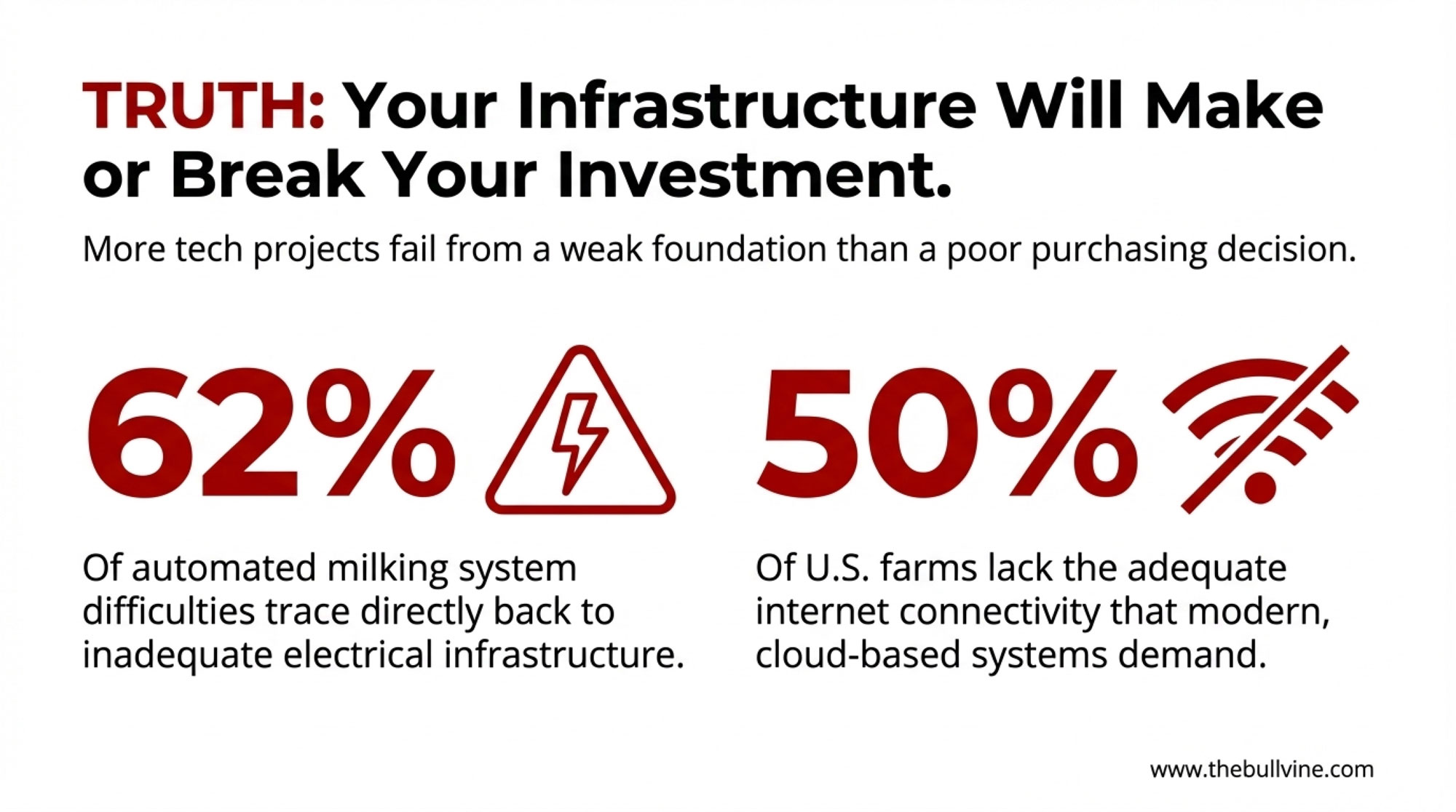

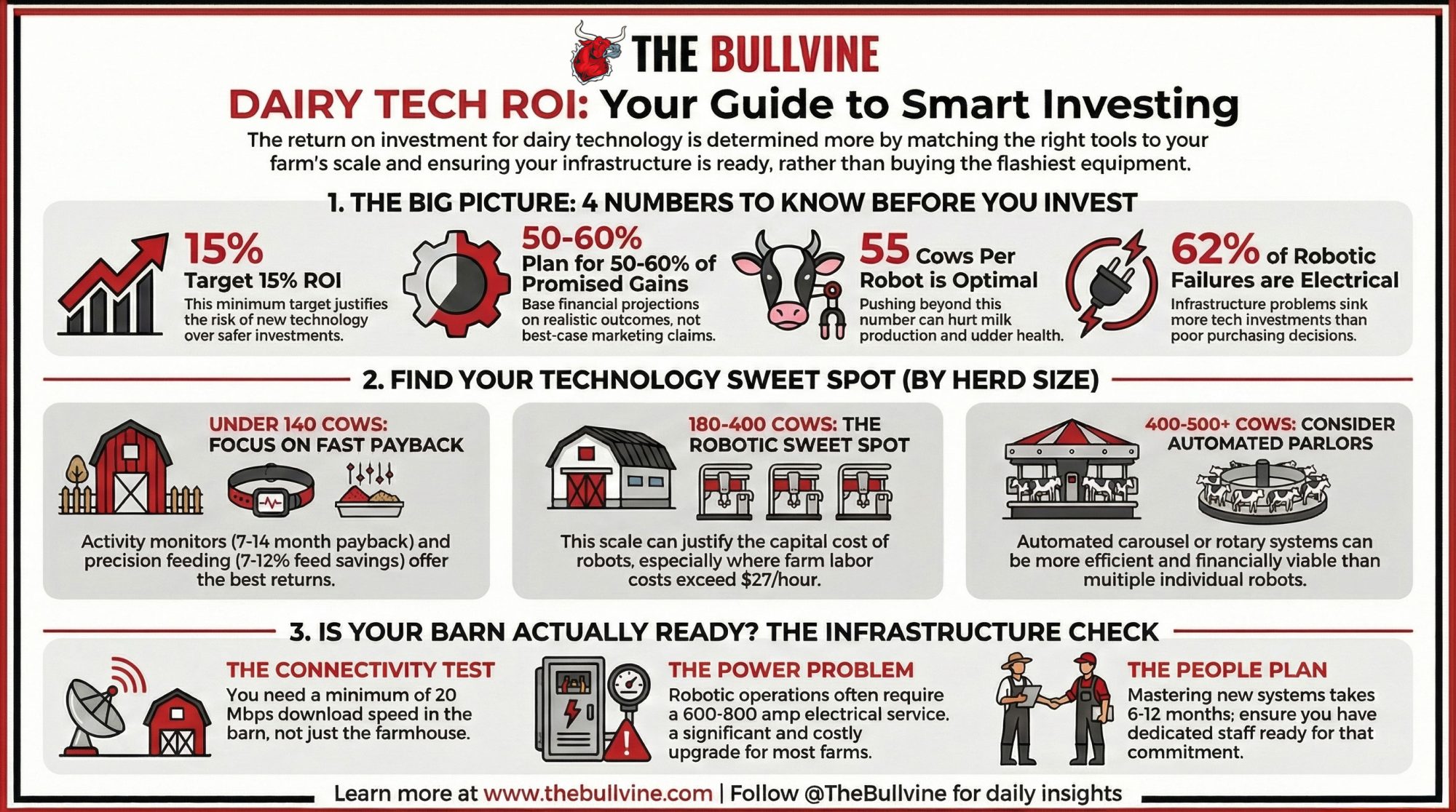

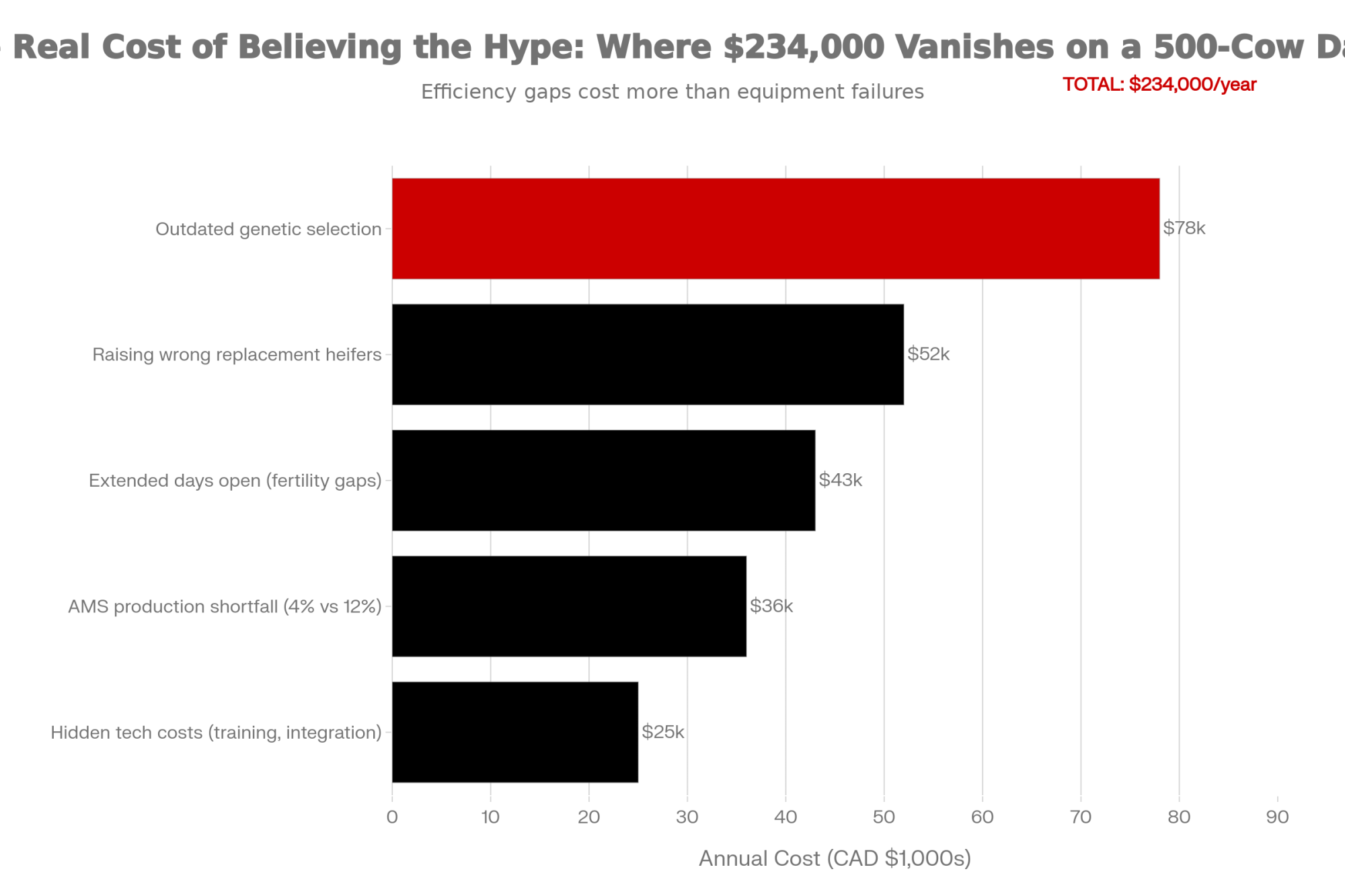

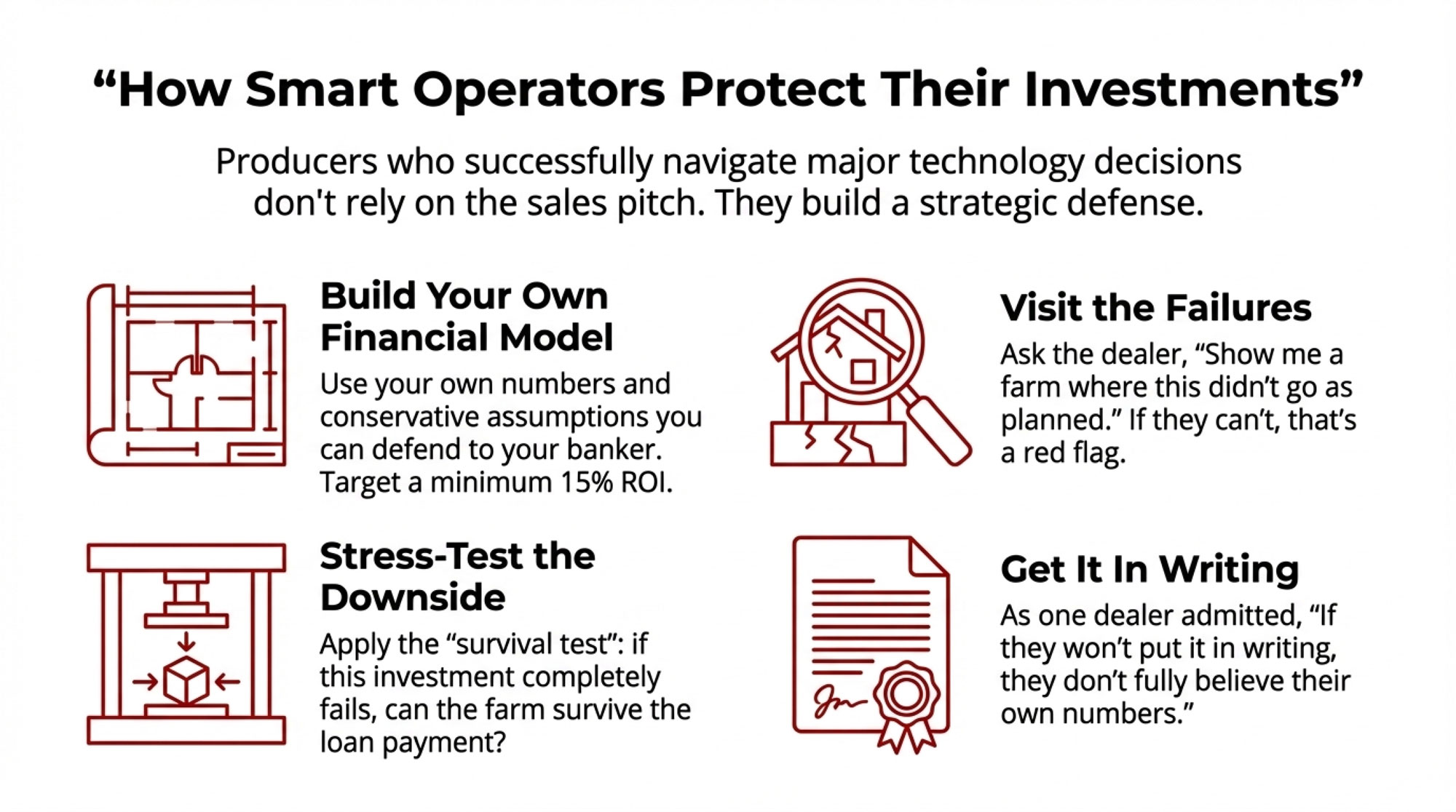

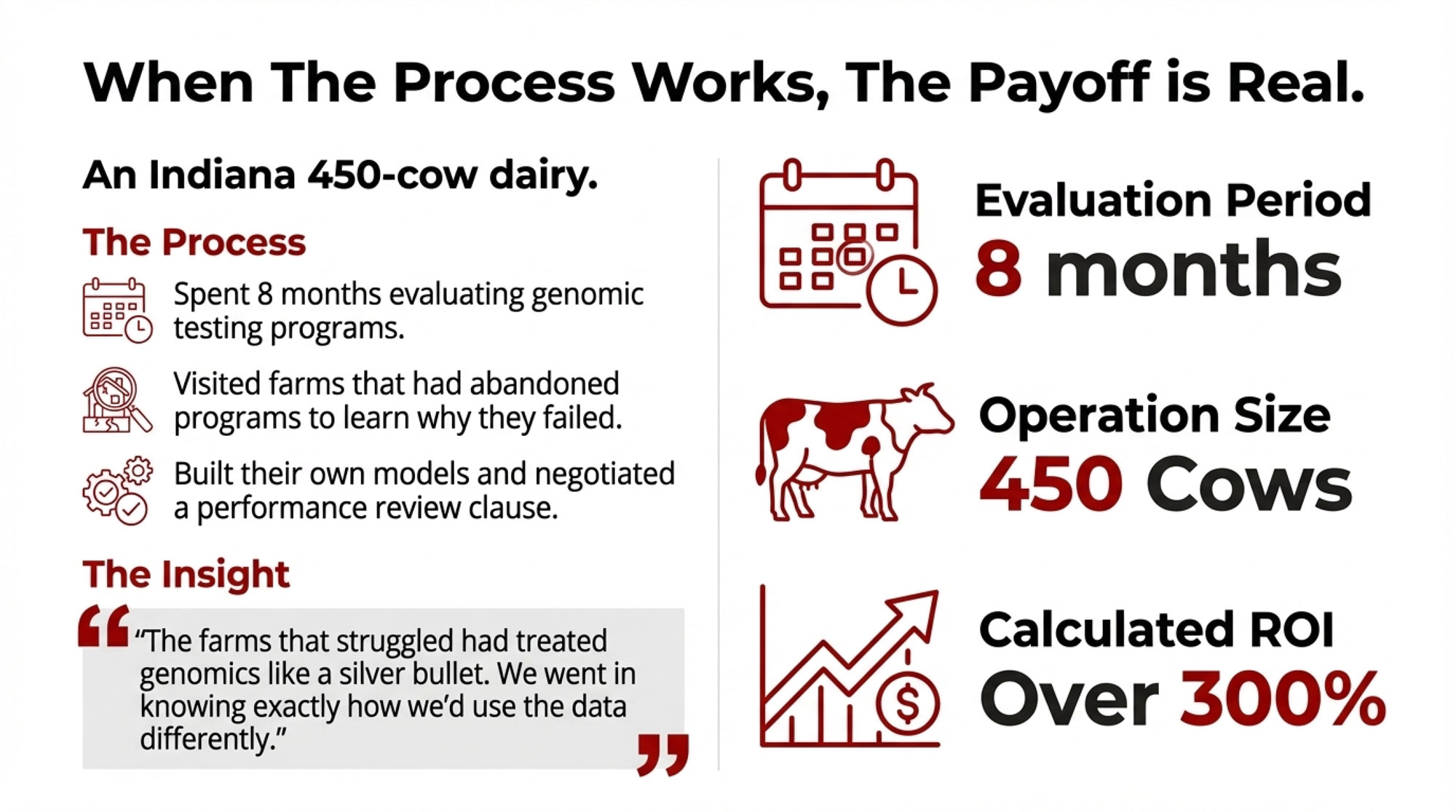

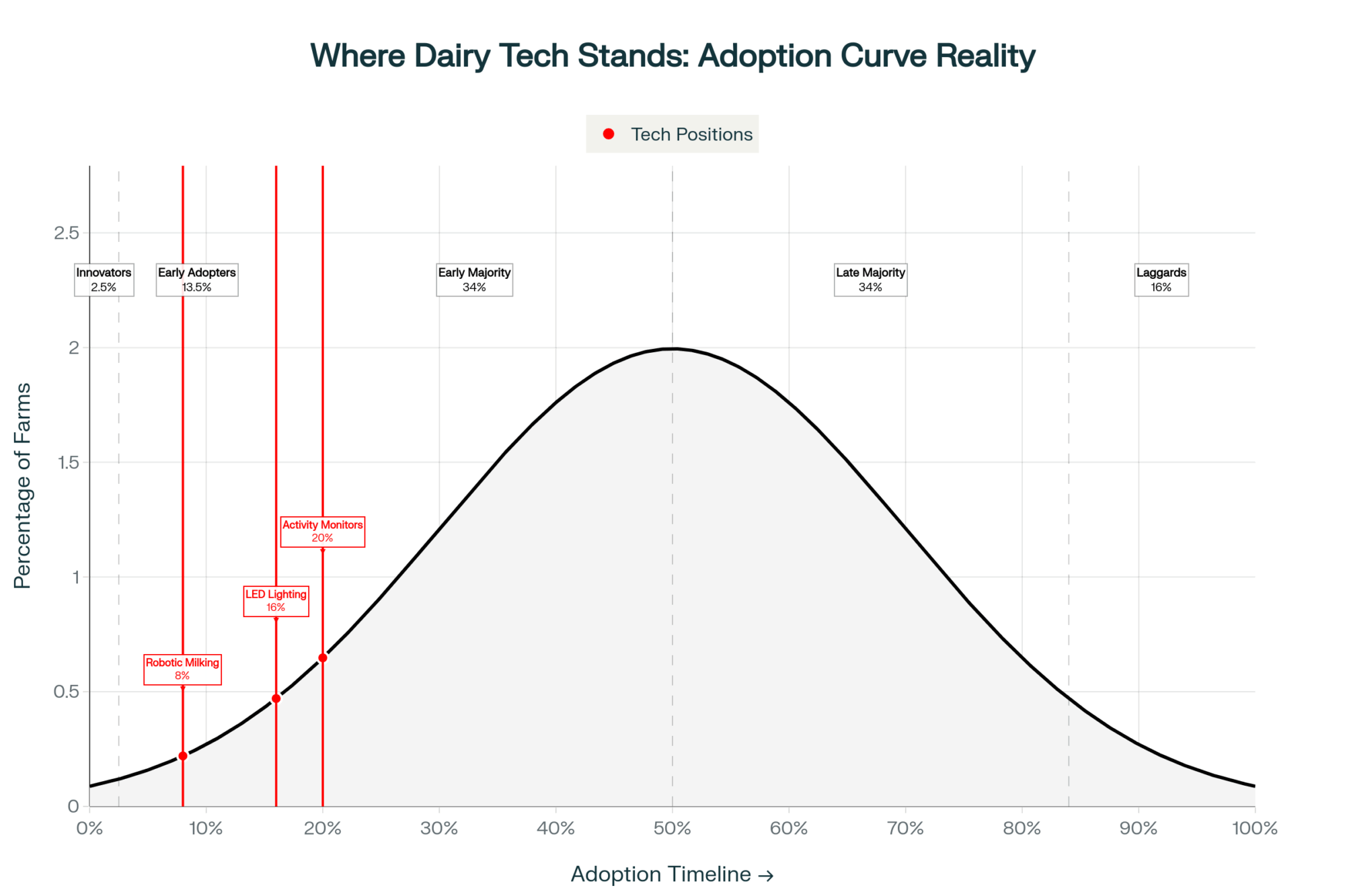

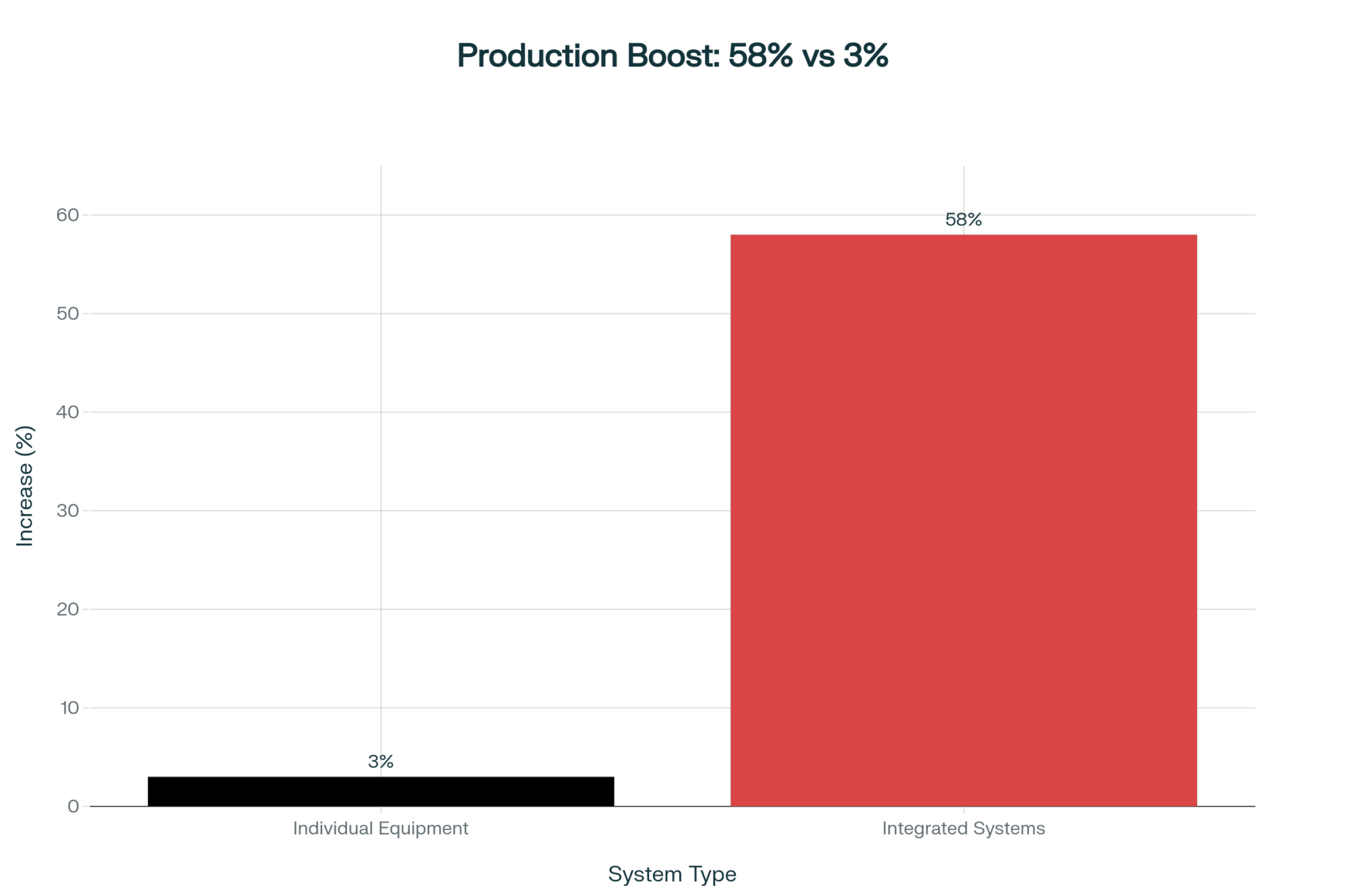

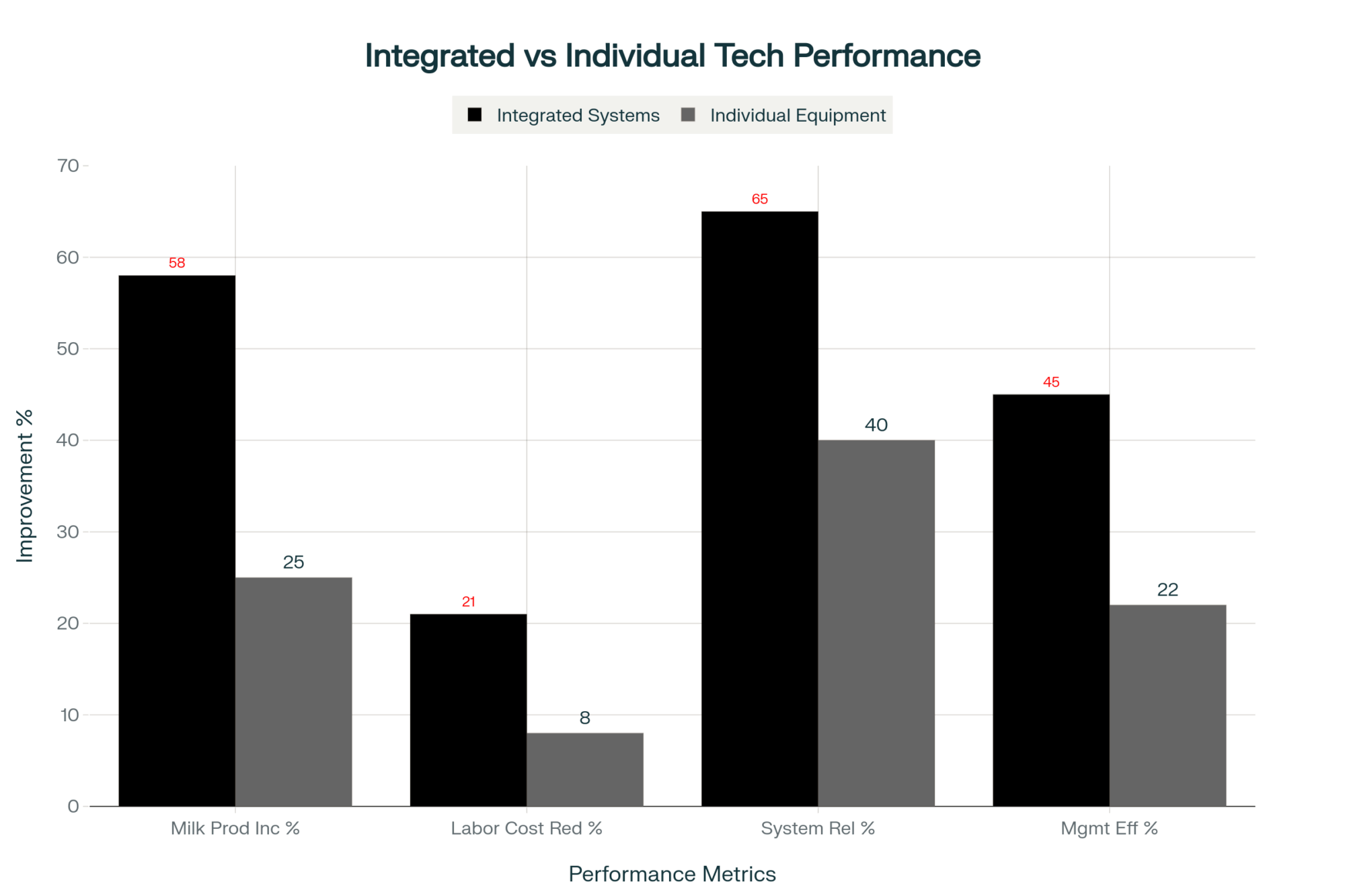

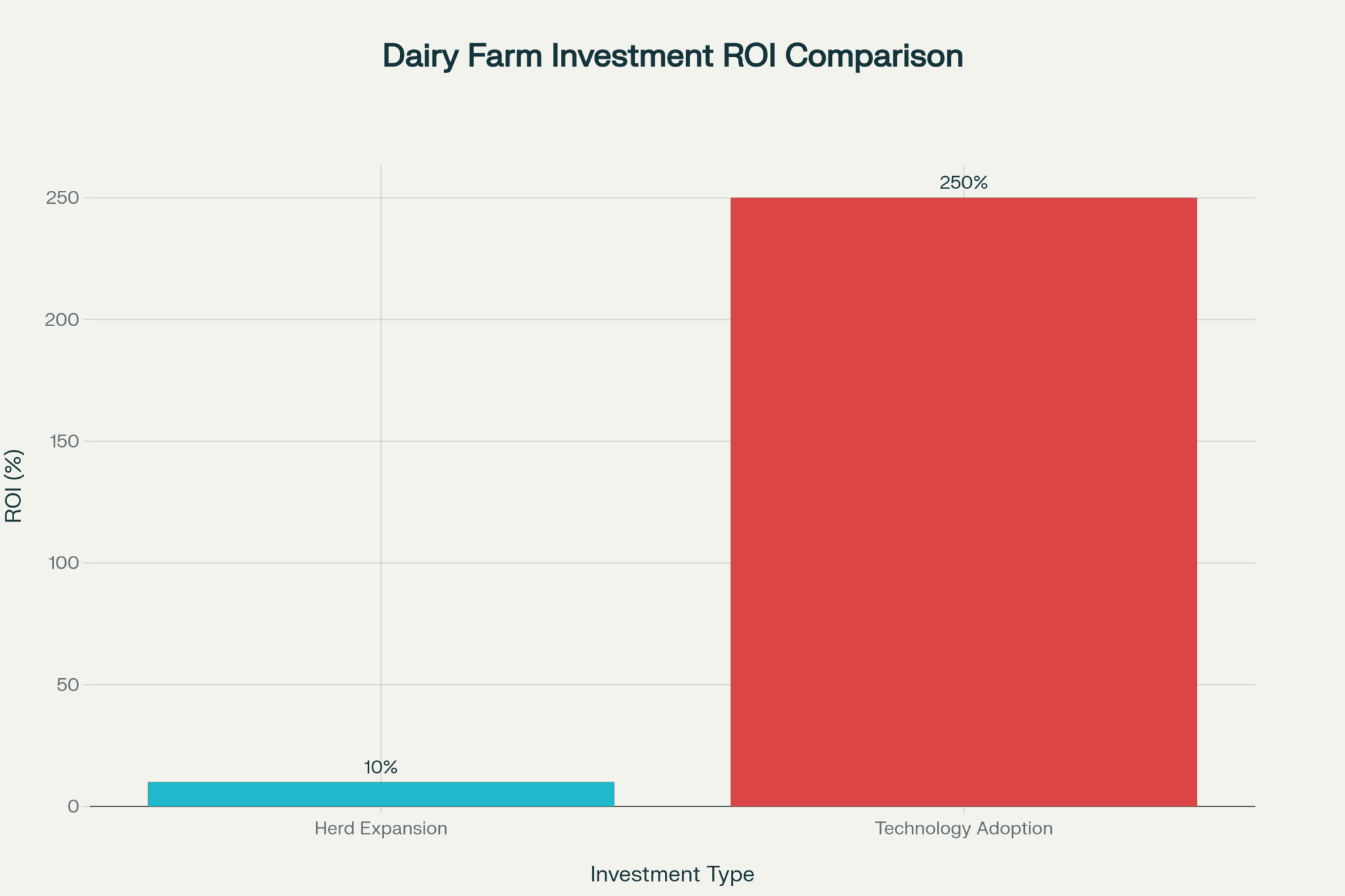

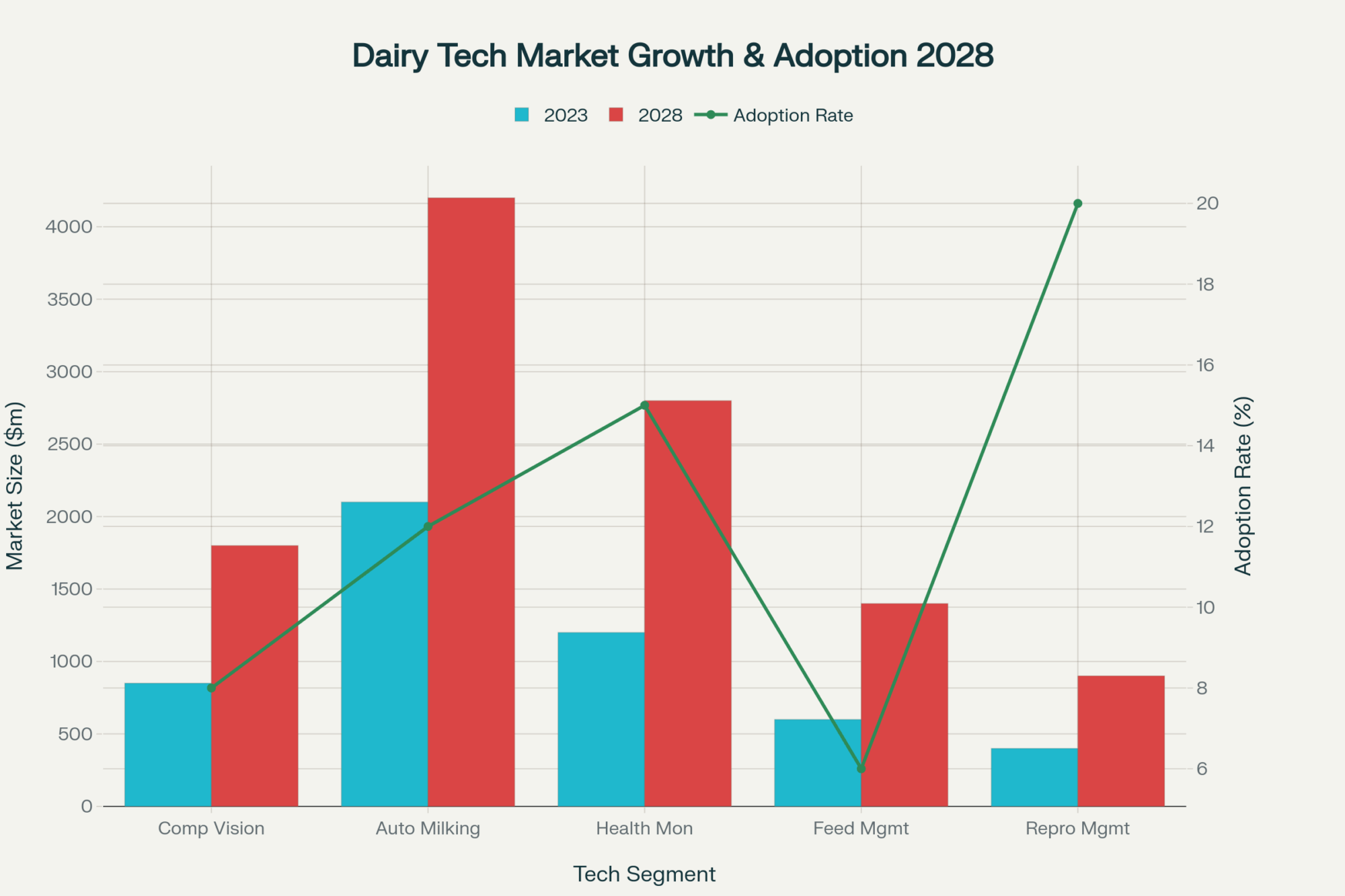

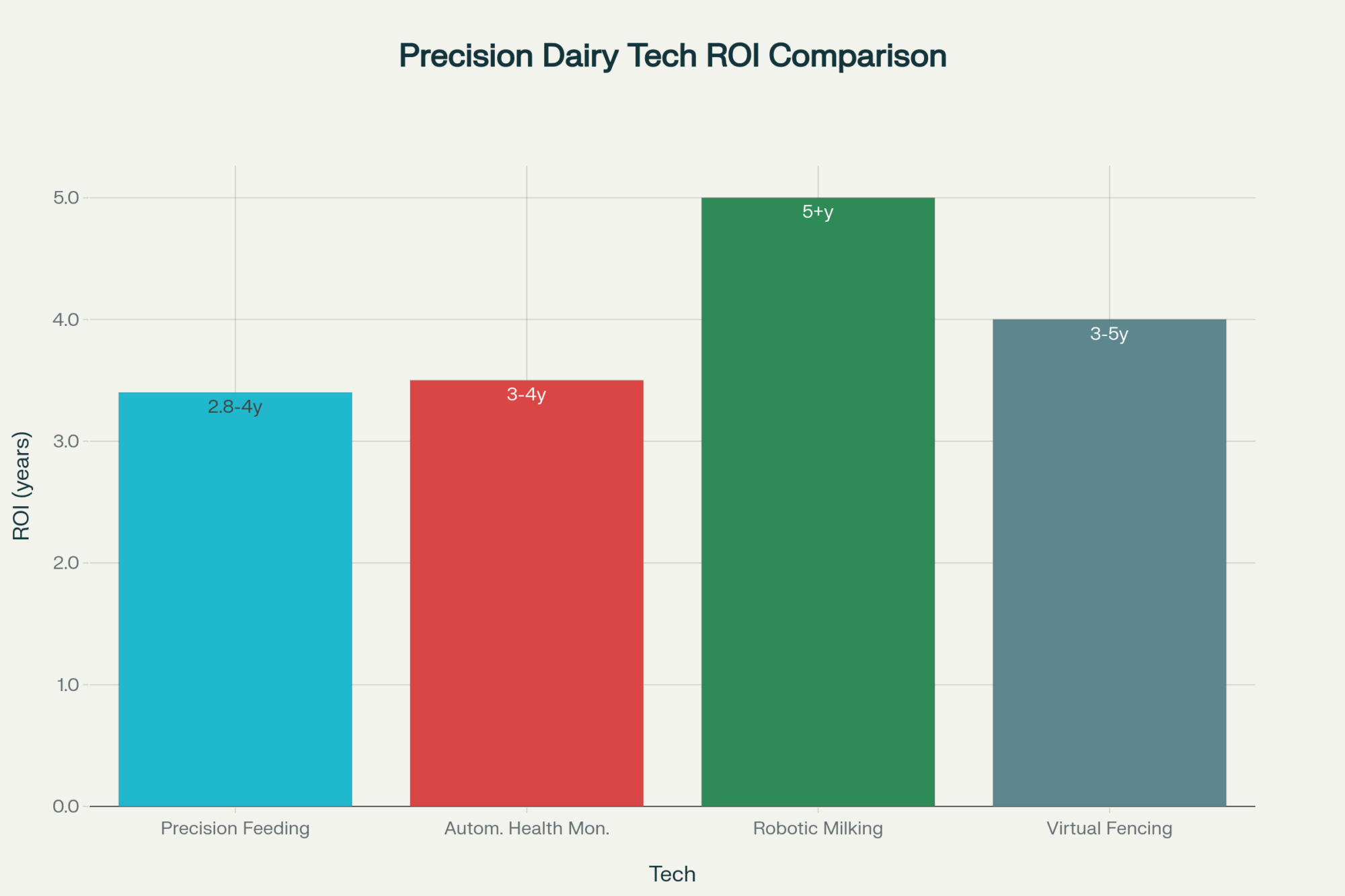

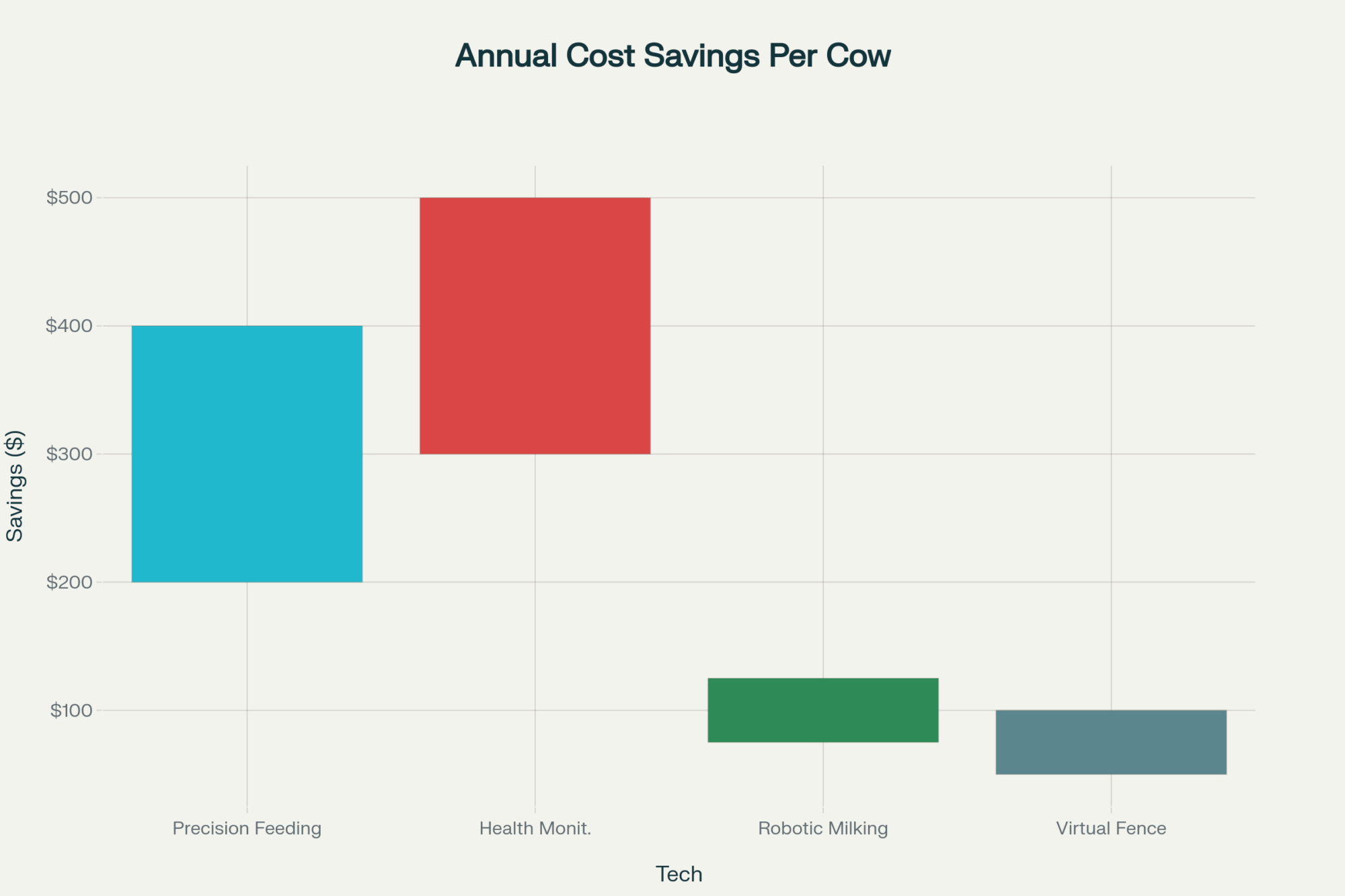

- Dairy Tech ROI: The Questions That Separate $50K Wins from $200K Mistakes – Stop guessing on tech spend and arm yourself with the specific breakeven benchmarks that separate profitable tools from expensive ornaments. This breakdown delivers the “barn-math” on activity monitors and precision feeding—delivering 7–14 month paybacks while Deere’s bigger promises stay stuck in “coming soon” mode.

- Cheap Milk Is Breaking the Farm: What’s Really Hollowing Out Dairy’s Middle Class – Expose the structural squeeze that turns modest input hikes into operation-killing losses for mid-size dairies. This deep dive reveals why absorbing rising repair and compliance costs isn’t just a “bad year” issue—it’s a survival test that requires a total strategic pivot to protect your equity over the next five years.

- The Next Frontier: What’s Really Coming for Dairy Cattle Breeding (2025-2030) – Gain a massive competitive edge by moving beyond mechanical repairs and into the biological disruption of “designer milk.” This reveals how CRISPR and genomic selection for health traits can strip $5,000 in hidden costs per cow annually, proof that the ultimate fix for a broken tractor might actually be a healthier herd.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!