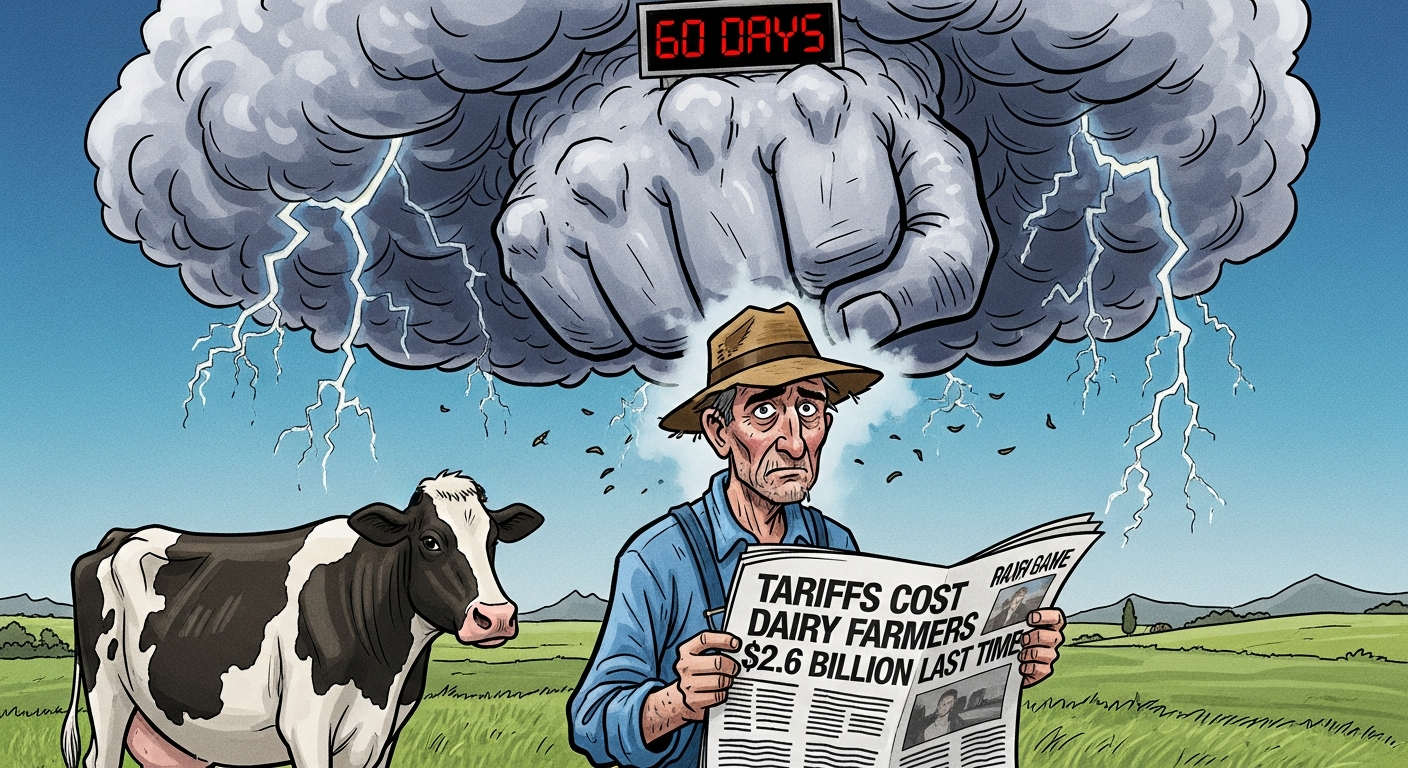

Tariffs stripped $2.6B from dairy farms last time. Use the next 60 days—or your milk check will make the decision for you.

Executive Summary: Tariffs stripped an estimated 2.6 billion dollars from U.S. dairy farms during the last China trade war, and today Mexico alone buys about 29 percent of all U.S. dairy exports while relying on the U.S. for more than 80 percent of its imported dairy. Using current data from USDA‑FAS, USDEC and CoBank, the article shows how that dependence on a few big buyers turns Washington’s tariff tools into direct Class III and milk‑check risk for every herd tied to cheese, powder, and whey markets. China’s experience—export value dropping to 377 million dollars and whey shipments collapsing 69 percent after retaliatory tariffs—illustrates how fast demand can vanish and how slowly it comes back once buyers switch to competitors like the EU. Against that backdrop, the piece lays out a plain‑spoken 60‑day decision window: put two price scenarios on paper, meet once with your co‑op and once with your lender, and use USDA/extension guidance to decide how DMC, LRP‑Dairy, and succession timing fit your risk tolerance. Written in a peer‑to‑peer, “over coffee” voice, it gives progressive dairy producers a clear, credible playbook to manage tariff risk before their milk check makes the decisions for them.

You know, if we were sitting down over coffee at World Dairy Expo or at a winter meeting in Ontario, with producers from Wisconsin freestalls, New York tiestalls, and California dry lot systems all at the table, I’d probably start with this: all the talk about presidential “emergency” tariff powers might sound like it belongs in Washington, but the impact doesn’t stay there. It flows through export channels and, sooner than most of us would like, it shows up in the milk check you’re depositing at home.

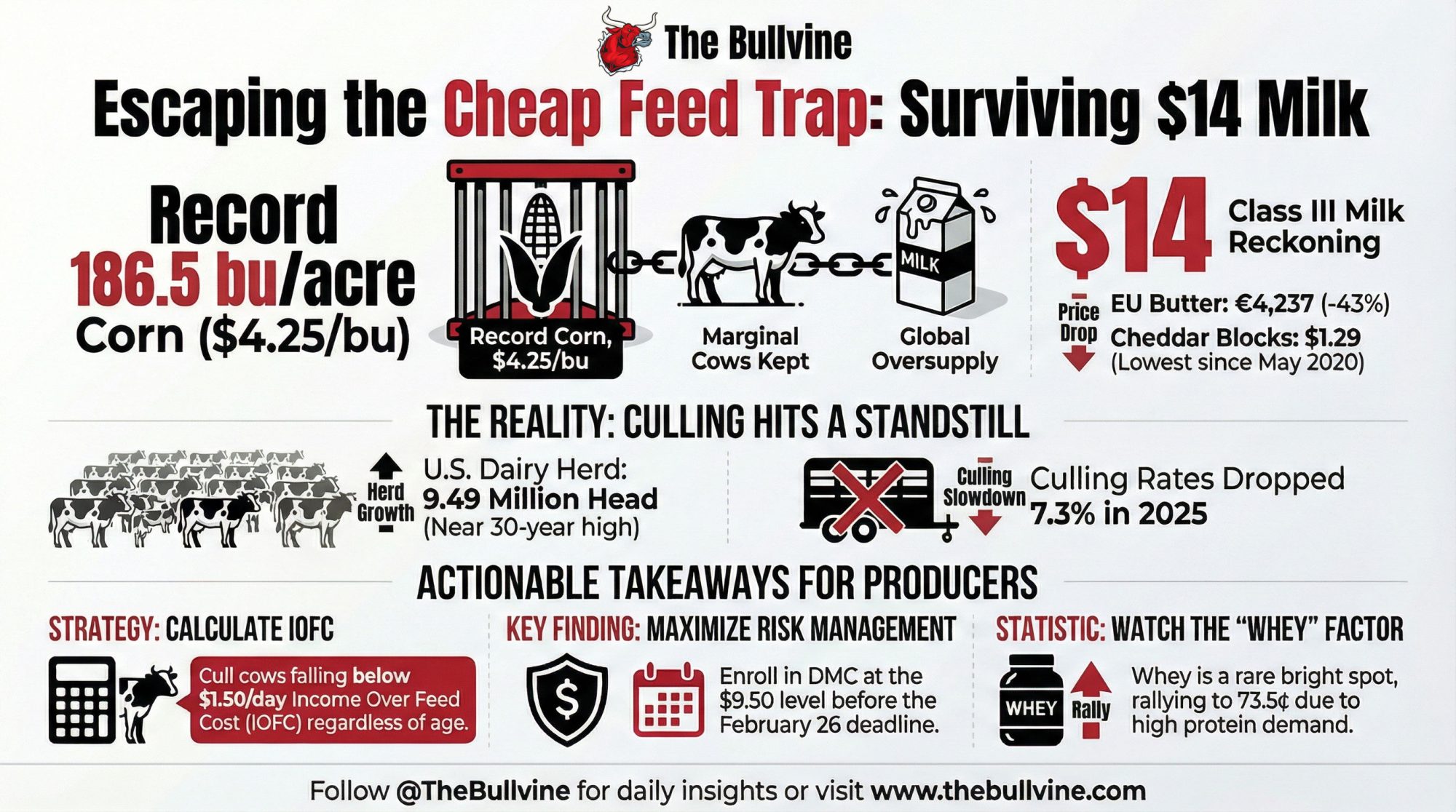

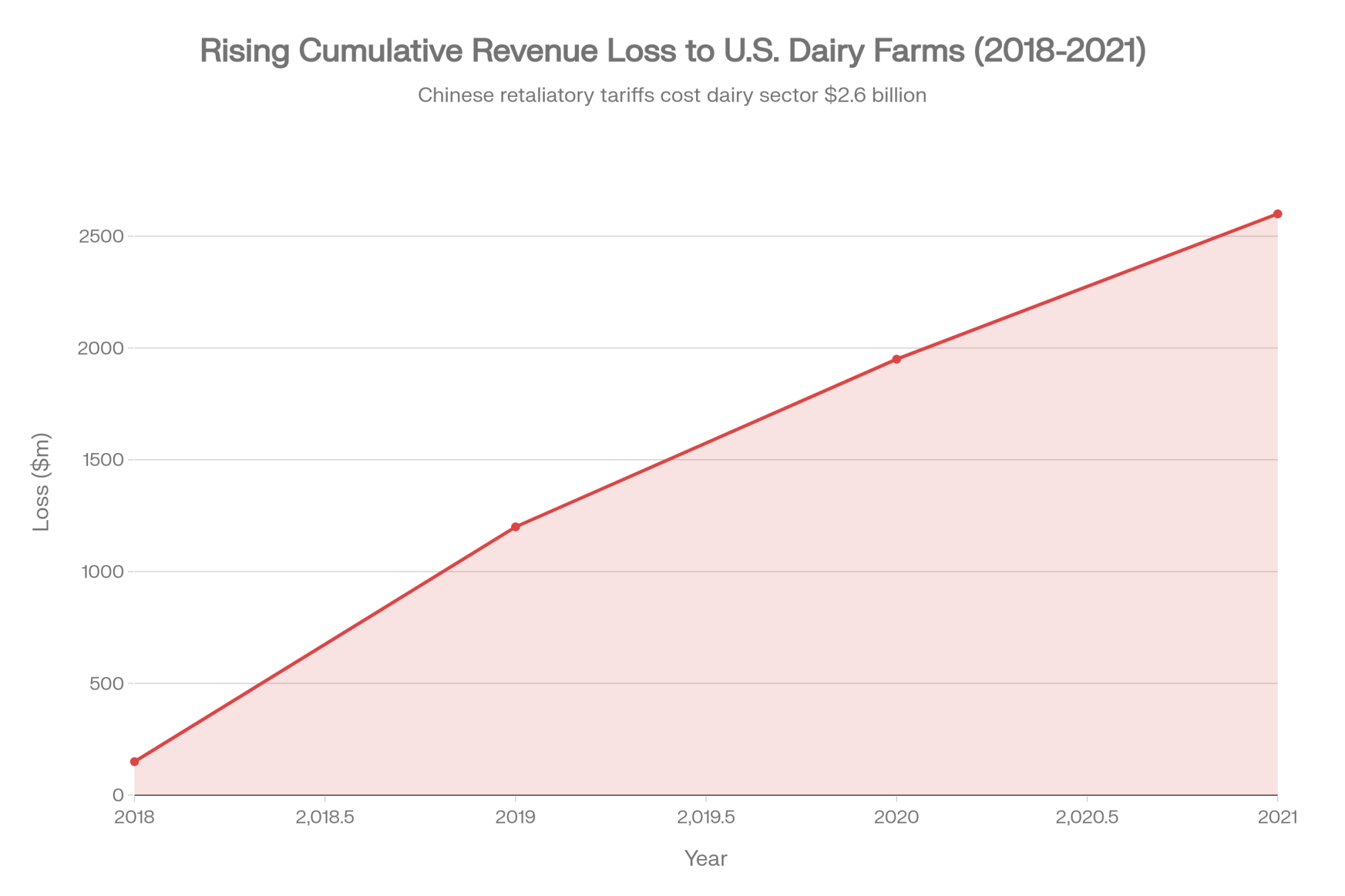

In early 2025, President Donald Trump signed executive orders imposing 25 percent tariffs on most goods from Mexico and Canada and 10 percent on goods from China, creating fresh uncertainty for U.S. dairy exporters and the farms that ultimately depend on those markets. Cornell University’s Charles Nicholson, Ph.D., an adjunct associate professor in the Charles H. Dyson School of Applied Economics and Management, told the Dyson Agricultural and Food Business Outlook conference that “if you pick a trade fight with our major export destinations… that has some substantive negative implications for dairy farms and processors”. What really made people sit up was his estimate that Chinese retaliatory tariffs alone cost U.S. dairy farms about 2.6 billion dollars in lost revenue from 2019 through 2021.

What’s interesting here is that this isn’t just a policy debate. It’s about timing, concentration risk, and how much room you’ve got to maneuver before that next shock hits your milk price.

Let’s walk through what the data actually shows.

Looking Back: What 2018–2019 Really Taught Us

Looking at this trend, the 2018–2019 tariff period remains the clearest case study we’ve got on how quickly things can change.

On the Mexico side, USDA’s Foreign Agricultural Service published a GAIN report in June 2018 showing that Mexico responded to U.S. steel and aluminum tariffs with retaliatory tariffs on a range of U.S. products, including multiple cheese tariff lines. That report laid out how certain U.S. cheese categories were hit with new tariff rates starting June 5, 2018, and then increased again on July 5, with some lines moving into the 20–25 percent range depending on the specific HS code. That shift happened in a matter of weeks, not years.

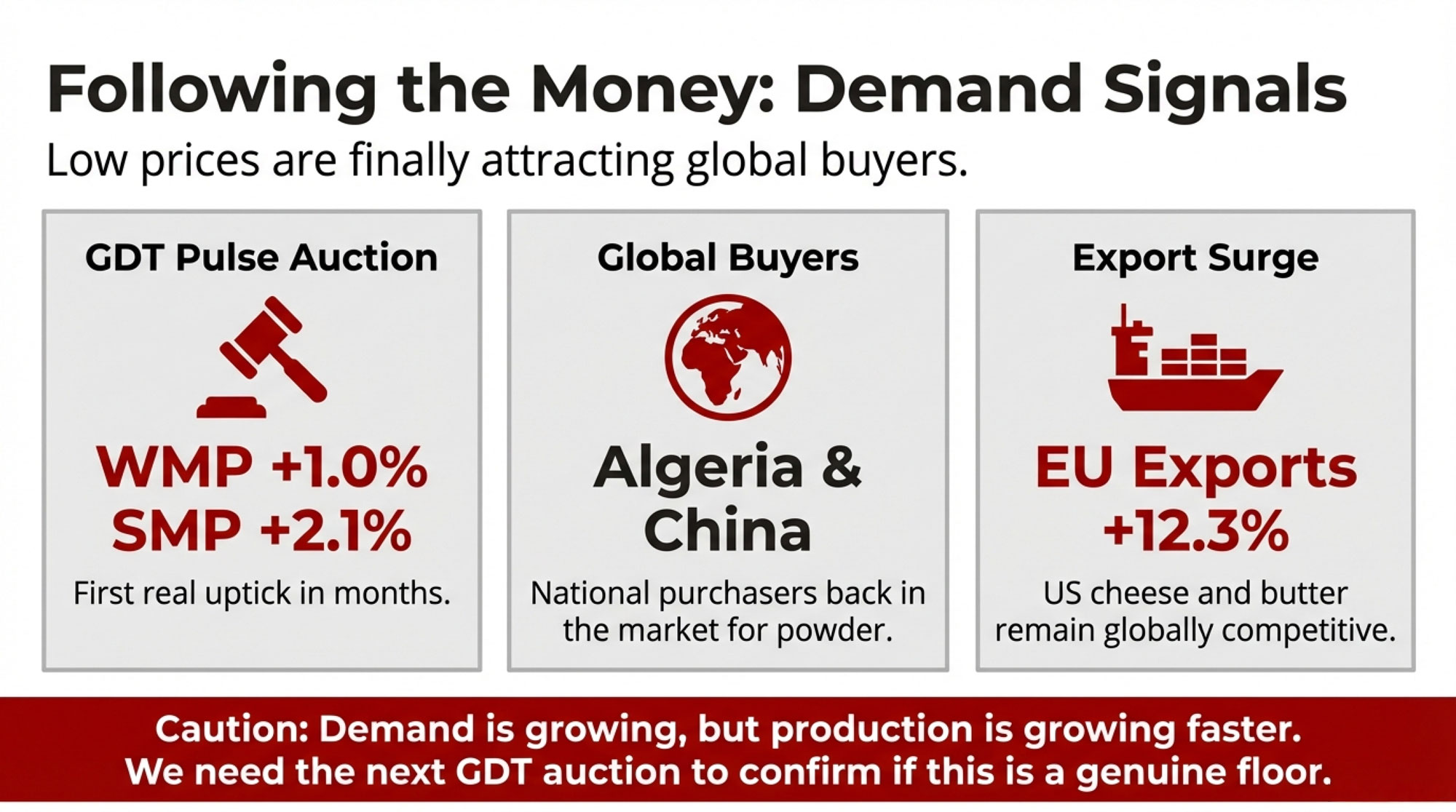

On the China side, the U.S. Dairy Export Council tracked the fallout as Beijing rolled out its own retaliatory measures. Cheese Reporter, summarizing USDEC’s January 2020 export review, noted that for the 12 months from December 2018 through November 2019, the value of U.S. dairy exports to China totaled about 377 million dollars—a roughly 47 percent decline from the prior 12‑month period. That’s a big haircut on a single key market.

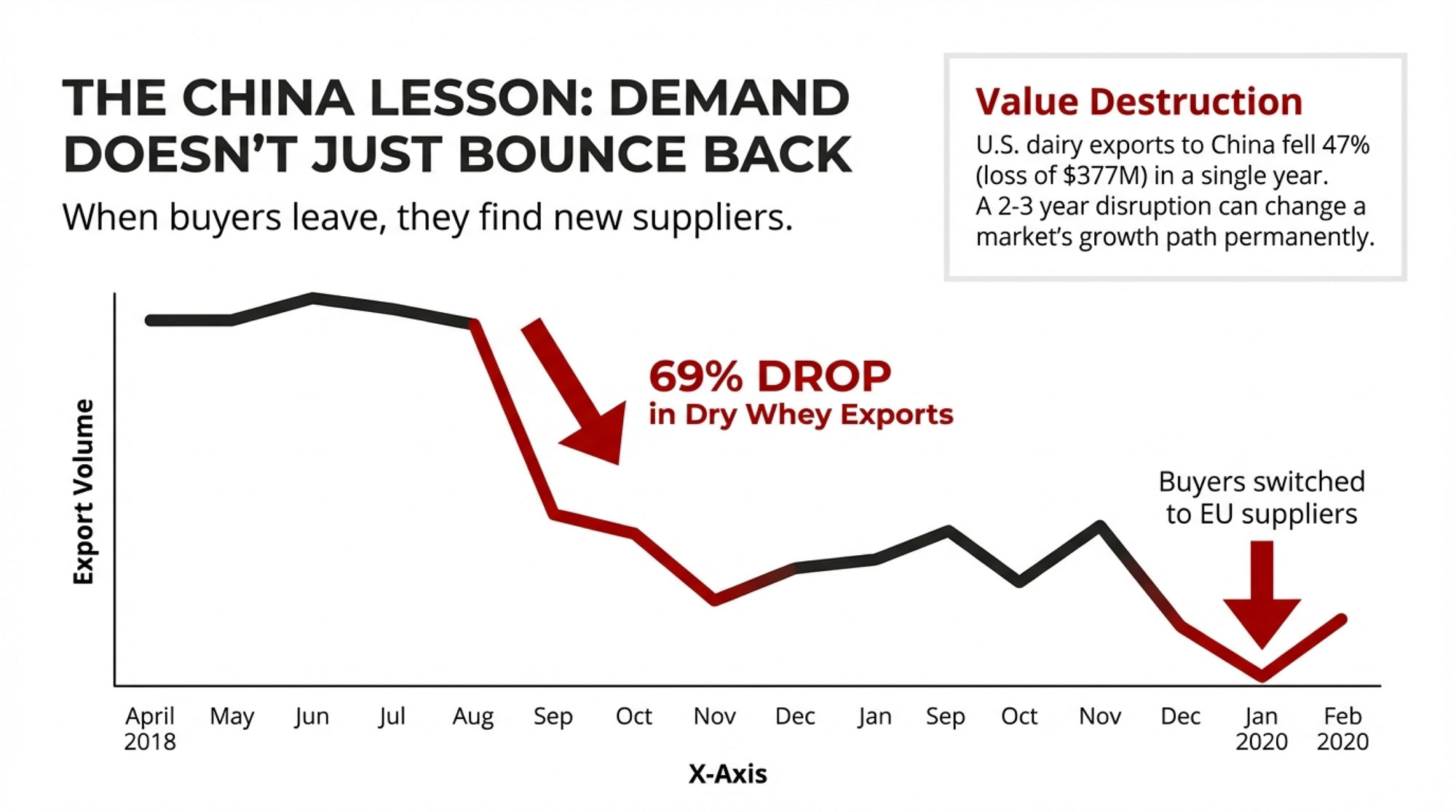

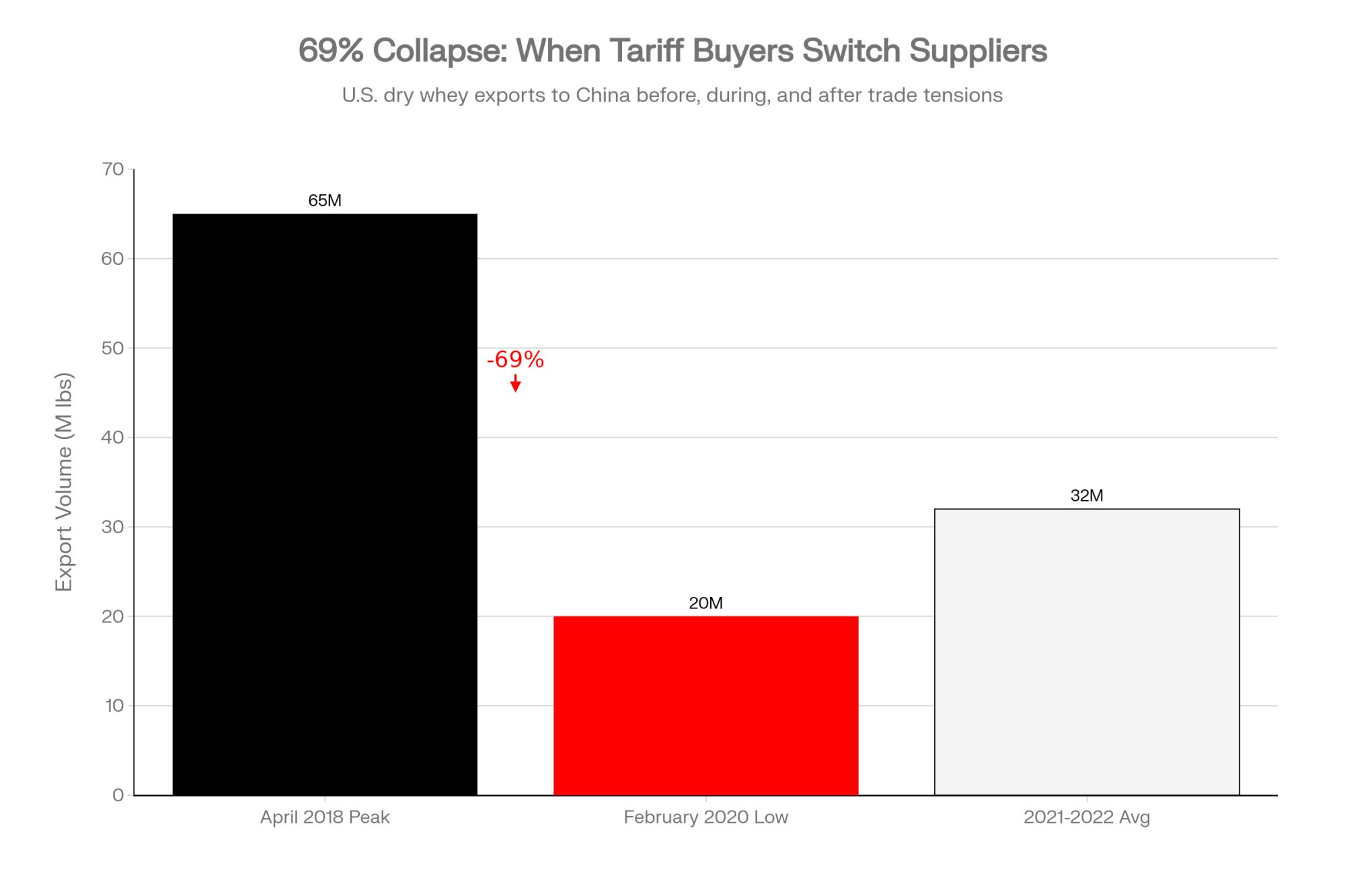

In an April 2025, after China imposed a 20 percent retaliatory tariff on U.S. dry whey in 2018, U.S. dry whey exports to China dropped 69 percent from their April 2018 peak to their February 2020 low, measured on a 12‑month rolling basis. That’s not just noise; that’s a major demand hole for a key by‑product that helps pay the bills in a lot of cheese and whey plants.

As many of us have seen, once those kinds of volumes start moving, they don’t necessarily come back quickly. And if you wait to react until your milk check clearly reflects the problem, you’ve already given up most of your best options.

Mexico: Our Best Customer… and a Big Point of Exposure

You probably know this already, but the more recent numbers really drive home how central Mexico has become to U.S. dairy.

Citing USDA‑FAS data, it was reported that by September 2024, Mexico’s purchases accounted for 29 percent of all U.S. dairy product exports on a value basis. That same piece noted that the United States supplied Mexico with over 80 percent of its imported dairy products in 2024. So from Mexico’s side, the U.S. is the dominant supplier. From the U.S. side, Mexico accounts for close to a third of dairy export value.

CoBank’s December 2024 report, “Mexico Has Become America’s Most Reliable Customer for U.S. Dairy Exports,” put it into milk terms. Their analysts calculated that Mexico purchases the equivalent of about 4.5 percent of total U.S. milk production through imported dairy products and ingredients. Corey Geiger, CoBank’s lead dairy economist, noted that Mexico runs a dairy product deficit of roughly 25–30 percent each year, and that the U.S. supplies over 80 percent of that shortfall.

USDA‑FAS projections reinforce the idea that this isn’t going away overnight. In its May 2025 “Dairy and Products Semi‑annual – Mexico” report, FAS forecast Mexico’s fluid milk production to increase about 1 percent to 13.9 million metric tons in 2025 and projected similar modest growth in consumption. That same report highlighted that processors are expected to increase milk powder imports as they continue to favor lower‑cost raw materials for manufacturing.

What the data suggests is an asymmetric relationship:

- For Mexico, U.S. dairy is the dominant source of imports, but those imports sit on top of a large and growing domestic production base.

- For the U.S., Mexico is the single largest export destination—accounting for around 29 percent of total dairy export value and a major share of cheese, powder, and other products.

So when CoBank calls Mexico “America’s most reliable customer” for U.S. dairy exports, they’re leaning on hard numbers. But Nicholson’s warning comes back into focus too: if trade tools get used aggressively and provoke retaliation in a market that important, the downside for U.S. dairy farms and processors is substantial.

Key Numbers Worth Knowing

Looking at the numbers pulled together by USDA‑FAS, USDEC, and CoBank, a few datapoints really frame the risk:

- Mexico’s share of U.S. dairy exports: about 29 percent by September 2024, based on USDA‑FAS trade data.

- U.S. share of Mexico’s dairy imports: over 80 percent of imported dairy products in 2024, per USDA‑FAS data reported by CoBank.

- Share of U.S. milk exported to Mexico: roughly 4.5 percent of U.S. milk production equivalent, according to CoBank’s 2024 analysis.

- U.S. dairy export value to China (Dec 2018–Nov 2019): about 377 million dollars, a 47 percent decline from the prior 12‑month period, per USDEC numbers reported by Cheese Reporter.

- Dry whey exports to China: a 69 percent drop from the April 2018 peak to the February 2020 low on a 12‑month rolling basis after China imposed a 20 percent retaliatory tariff, as documented by Hoard’s Dairyman.

- Estimated U.S. dairy farm revenue loss from China tariffs (2019–2021): about 2.6 billion dollars, according to Nicholson’s analysis cited by Cornell.

Those numbers alone explain why tariff talk matters to your bottom line, even if all your cows are standing in a barn thousands of miles from the border.

China’s Lesson: When Demand Doesn’t Fully Come Back

Now let’s swing back to China, because what happened there is a warning about long‑term demand, not just short‑term pain.

USDEC’s review, as quoted in Cheese Reporter’s 2018–2019 tariff lessons column, showed that by 2017–2018, China had grown into a key destination for U.S. dairy—especially whey and other ingredients. Then the retaliatory tariffs hit. As mentioned earlier, USDEC’s tally showed the value of U.S. dairy exports to China fell to about $ 377 million in the 12 months from December 2018 through November 2019, a 47 percent drop from the previous year.

2025 whey analysis dug deeper into the ingredient side. With a 20 percent retaliatory tariff on U.S. dry whey, exports to China dropped 69 percent from that April 2018 peak to a February 2020 low, using a rolling 12‑month comparison. During that period, it was noted that Chinese buyers shifted toward more EU dry whey, which wasn’t facing the same tariff penalty.

Nicholson and other trade economists have pointed out that once buyers qualify alternative suppliers and re‑tool supply chains, not all of that business returns when tariffs ease or exemptions appear. A two‑ or three‑year disruption can change the growth path of a market for much longer than that.

For U.S. producers, the key lesson is simple: when tariffs push a major buyer to diversify, some of that lost demand can become permanent.

So, Where Does This Leave Your Farm?

So, with all of that in mind, what does this actually mean when you walk back into your parlor or robot room?

First, it means export exposure is real, whether you’ve ever thought of yourself as an “export farm” or not. If your milk goes to a cooperative or processor that makes cheese, nonfat dry milk, whey, or other export‑oriented products, then pieces of your check are indirectly tied to people buying pizza in Mexico City or feed products in Asia. The concentration numbers—Mexico taking 29 percent of U.S. dairy export value and importing the equivalent of 4.5 percent of U.S. milk output—make that pretty clear.

Second, it means that when tariffs and trade headlines start moving from talk to action, you don’t have unlimited time to react. The 2018–2019 episode showed that retaliatory moves can go from announcement to significantly lower export values in less than a year, and in the case of whey, the effect on shipments was both steep and persistent. That’s why thinking in terms of a “window” makes sense—there’s a period where you can still get ahead of it.

Third, it means that planning and conversations matter as much as any single policy announcement. And that part’s under your control.

Questions to Bring to Your Co‑op or Buyer

Looking at this trend, one of the healthiest shifts in the last few years is that more producers are asking pointed, respectful questions about how their milk buyer is positioned.

For co‑op members in the Upper Midwest, for example, where a lot of milk heads into cheese vats, it’s worth asking your board or management:

- Roughly what share of our milk is going into export‑oriented products like cheese, skim milk powder, and whey, given the national export patterns CoBank and USDEC have outlined?

- During the 2018–2019 tariff period, how did our average pay price compare to other buyers in our federal order—were we generally ahead, behind, or about in the pack?

- What kinds of tools does the co‑op use today—hedging, product diversification, long‑term contracts—to buffer members from sudden export demand shocks?

If you’re shipping to a proprietary plant in Idaho or California that sells into both domestic and export markets, the questions are similar. You’re not trying to tell them how to run the business; you’re trying to understand how your farm fits into their risk picture.

Industry groups like the Wisconsin Cheese Makers Association have recently highlighted how trade tensions and export barriers shape decisions at cheese and whey plants, including product mix and market focus. Those kinds of articles make good conversation starters and show that processors are thinking about this, too.

And I’ve noticed that when producers come to meetings with numbers and questions rather than just frustration, the conversation usually improves for everyone.

Sitting Down With Your Lender Before There’s a Fire

What many lenders have said in interviews with dairy media and farm‑management educators is pretty consistent: the best conversations happen before there’s a cash‑flow emergency.

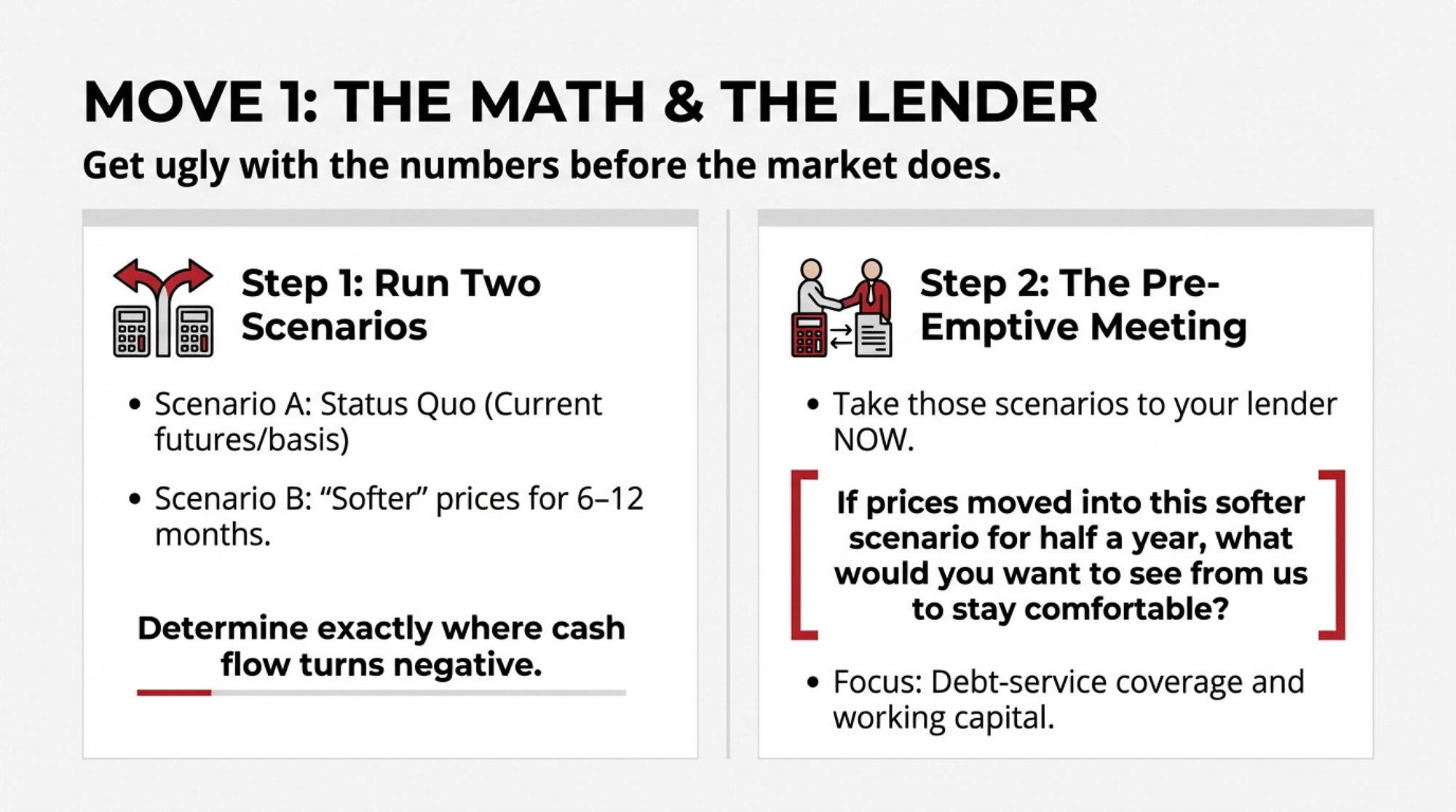

You don’t need perfect forecasts to have a useful meeting. What you do need are a few grounded scenarios you can walk through together:

- One based on today’s outlook, using current futures and your local basis.

- One that assumes a noticeable softening in prices for six to twelve months—something that would squeeze margins but not necessarily be catastrophic.

You might not know all your ratios off the top of your head, but you can bring a simple printout or spreadsheet with you:

- Herd size and average production per cow.

- Your recent butterfat performance and component levels.

- Rough cost per hundredweight from your last farm financial review.

- Current term debt schedule and operating line limits.

Then you can ask very practical questions:

- “If prices moved into this softer scenario for half a year, what would you want to see from us to stay comfortable with our operating line?”

- “Are there any term loans we could look at restructuring in advance to give us more breathing room on cash flow if things get choppy?”

Farm Credit associations and other ag lenders often publish their own dairy outlooks and risk‑management articles, and university extension programs pick them up and discuss them. Skimming one or two of those ahead of time can help you frame what your lender is already worrying about.

What’s encouraging is that lenders generally don’t expect perfection. They expect awareness and a plan.

Thinking About Risk Tools Without the Sales Pitch

Programs like Dairy Margin Coverage and Livestock Risk Protection are designed for exactly the kind of volatility we’re talking about.

USDA’s Farm Service Agency has documented how DMC payments supported participating farms during the margin collapses of 2020, especially for operations that chose higher coverage levels up to the Tier I cap of 5 million pounds per year at 9.50 dollars per hundredweight. USDA’s Risk Management Agency, in its LRP‑Dairy materials, explains how producers can buy coverage on expected milk prices for specific months, with indemnities paid when actual index values fall below the coverage level, allowing smaller‑volume coverage than traditional futures or options.

The data and case examples shared by land‑grant extension programs—like those from UW–Madison, Penn State, and Ohio State—suggest these tools tend to work best when they’re part of a thought‑out risk plan rather than a last‑minute scramble. Extension economists and dairy business management specialists have walked through examples of aligning DMC coverage with the cost of production and using LRP‑Dairy selectively on a portion of milk to cover the riskiest months.

So instead of treating these programs as “nice extras” or something you only look at when prices are already ugly, it’s worth asking yourself:

- “Given my cost structure and butterfat performance, how much downside can I realistically ride out on my own?”

- “Beyond that point, what portion of my milk do I want to insure, and with what mix of tools that I actually understand?”

Your local extension educator, FSA staff, and crop insurance agent can help you look at USDA summaries of past payouts and current premium tables so you’re making decisions based on numbers, not anecdotes.

If Exit Is on the Horizon, Timing Still Matters

This is a tough topic, but it’s part of the real conversation on a lot of farms, especially in regions like the Northeast and Upper Midwest, where farm numbers have been under pressure for years.

In some operations—where the next generation is unsure about taking over or where the main operators are dealing with health issues—the question isn’t just “how do we ride out another tough year?” It’s also “if we’re going to be done sometime in the next five to ten years, when and how do we want that to happen?”

Cull cow and bred heifer prices have gone through stronger periods recently, supported in part by tighter beef supplies and the growing use of beef‑on‑dairy genetics, which can improve the value of crossbred calves and cull animals. Farm‑management articles and extension transition resources from universities in Wisconsin, Pennsylvania, and Ontario have noted that planned dispersals in reasonably firm cattle markets often preserve more equity than forced liquidations after prolonged low‑margin periods and mounting debt, based on farm case studies and lender feedback.

The exact dollars will vary herd by herd. But the pattern is consistent enough that it’s worth a kitchen‑table discussion if you’re in that stage:

- “If we did decide to exit in the next few years, what conditions—milk price, cattle price, debt level—would make that feel like a planned move rather than a last‑ditch sale?”

- “What level of equity do we want to protect for the family, whether that’s land, retirement savings, or off‑farm investments?”

Extension farm‑transition specialists have checklists and meeting templates that can help you structure those conversations and bring everyone into the loop before circumstances force decisions.

It Might Not Be 2018–2019 All Over Again… But It’s Worth Being Ready

It’s worth noting that not every tariff scare becomes a full‑blown crisis.

USDA‑FAS’s 2025 outlook for Mexico shows continued growth in domestic dairy production and ongoing demand for imported powders and cheese, even in the face of broader trade tension. CoBank’s analysis frames Mexico as a structurally reliable customer for U.S. dairy, given its persistent deficit and heavy reliance on the U.S. supply. Trade press coverage has also highlighted that some announced tariff measures end up delayed, modified, or partially offset by exemptions and side deals, which can soften the blow for agriculture.

What’s encouraging is that the U.S. dairy sector has adapted to shocks before. Exporters have shifted product mixes and markets, processors have invested in new capabilities, and producers have improved fresh cow management, feed efficiency, and overall cost control in response to tough years. That doesn’t mean it’s easy; it means it’s possible.

At the same time, the data from the last tariff cycle—and Nicholson’s 2.6‑billion‑dollar loss estimate—are a reminder that when major markets pull back, the financial damage can be both large and long‑lasting. That’s why this isn’t about predicting doom; it’s about deciding how you want to be positioned if the road gets rough.

A Simple 60‑Day Framework You Can Actually Use

| Metric | Current Outlook | Softer Scenario (6–12 mo) | Change |

|---|---|---|---|

| Class III Milk Price ($/cwt) | $18.50 | $16.00 | –$2.50 |

| Butterfat Premium ($/lb) | $2.10 | $1.85 | –$0.25 |

| Feed Cost per Cow/Day | $9.25 | $9.50 | +$0.25 |

| Est. Margin per Cow/Day | $3.20 | $1.15 ⚠️ RED | –$2.05 |

So, over the next couple of months, here’s a straightforward way to put all this into practice without turning it into a full‑time project.

- Put two price scenarios on paper.

Use your own numbers—your butterfat performance, average production per cow, and local basis. Start with something close to today’s outlook based on current futures. Then sketch a second scenario in which prices are meaningfully softer for 6 to 12 months. You don’t need to be perfect; you just need to see roughly where cash flow turns from positive to negative and what that looks like in dollars per month. - Take those scenarios to one meeting with your co‑op or buyer.

At a member meeting in Wisconsin, a one‑on‑one with a field rep in New York, or a call with a plant in the West, use the Mexico and China numbers as a backdrop and ask: “If export markets got choppy like they did in 2018–2019, how would that likely show up in our pay price, and what options would you have beyond just dropping the check?” Co-op and processor leaders have been talking publicly about trade risk and export barriers in venues like the Wisconsin Cheese Makers Association and national dairy policy forums—referencing those discussions shows you’re paying attention. - Take the same scenarios to one meeting with your lender.

Sit down with your banker or Farm Credit officer and say: “Here’s what our cash flow looks like at these two price levels. If the softer scenario showed up for half a year, what would you want to see from us to stay comfortable? Are there things we could adjust now to give both of us more confidence?” Dairy‑focused lenders interviewed by farm media and extension often point to debt‑service coverage, working capital, and equity as the main gauges they watch. Ask them which ones they’re watching on your operation. - Ask good questions about risk tools.

With your extension educator, FSA office, or insurance agent, walk through how DMC and LRP‑Dairy actually performed in 2020 and other recent years for farms your size, using USDA and extension summaries as your guide. You’re not committing on the spot; you’re making sure you understand what they can realistically do for your operation and the costs involved. - If succession or retirement is a live topic, name the “trip wires.”

If the family’s talked about being “done at some point,” put rough thresholds on paper—maybe a certain milk price, debt‑to‑asset ratio, or cattle value—and discuss at what point a planned exit might be better than pushing through at any cost. Extension farm‑transition specialists and case studies from Wisconsin, Pennsylvania, and Ontario can give you examples of how other families have navigated those choices.

None of this requires you to guess which tariff will be announced next or how Mexico or China will respond. It just puts you in a better position to decide, rather than react.

Closing Thoughts: Deciding While You Still Have Room

As many of us have learned, nobody—whether it’s USDA, USDEC, your co‑op, or your lender—has quite the same focus on your farm’s future as you do. They all bring tools and information to the table, but they’re looking across hundreds or thousands of farms, not just yours.

What’s encouraging is that you don’t need to control court decisions, trade negotiations, or election outcomes to tilt the odds a bit more in your favor. You can use this “60‑day window” idea as a reminder: there is a period between policy talk and milk‑check pain where you still have room to adjust your plan.

If things stay relatively calm, you’ll have invested some time in understanding your operation better and strengthening relationships with the people who help finance and market your milk. If tariffs and trade disputes start biting into exports again, you’ll be glad you didn’t wait for your milk statement to tell you there was a problem.

Because once the damage is printed on that check, you’re not really deciding anymore. You’re reacting.

Right now, you still have room to decide.

Key Takeaways

- $2.6 billion lost: Chinese retaliatory tariffs alone cost U.S. dairy farms an estimated $2.6B in revenue from 2019–2021, per Cornell economist Charles Nicholson.

- 29% in one market: Mexico buys about 29% of all U.S. dairy exports and relies on the U.S. for over 80% of its imported dairy—one trade dispute could ripple through the entire sector.

- Demand doesn’t snap back: After China imposed 20% tariffs on U.S. dry whey, exports dropped 69% and buyers shifted to the EU; much of that volume never fully returned.

- You have a 60-day window: From tariff announcement to milk-check impact is roughly 60–90 days—enough time to run price scenarios, schedule one meeting each with your co-op and lender, and review your DMC/LRP position.

- Decide now or your check decides later: Farms that act in the window keep their options open; farms that wait until the damage prints are already reacting instead of choosing.

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More

- The Hidden Contract Clause That Could Cost Your Dairy $55,000 in 2026 – Reveals how to navigate 2026’s new allergen liability clauses that threaten 44% of your net profit. It arms you with a 30-day action plan to audit contracts, benchmark costs, and protect your operation’s financial viability.

- The Bullvine Dairy Curve: 15000 U.S. Farms by 2035 and Under 10000 by 2050 – Who’s Still Milking? – Exposes the structural shifts pushing the industry toward a 15,000-herd reality. It delivers the long-term positioning strategies—scale, specialize, or exit—necessary to ensure your farm remains on the right side of the consolidation curve.

- CDCB’s December ‘Housekeeping’ Is Actually Preparing Dairy Breeding for an AI Revolution – Breaks down the infrastructure shift from traditional evaluations to machine-learning dominance. It exposes how to prepare your farm’s data and breeding strategy now to capitalize on the 300% acceleration in genetic progress promised by AI-driven selection.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!