Trembling hands at Expo. A decade of faith. 200 fewer cows. Three families. One truth about what excellence really costs.

Three families. Three different paths. One truth they all discovered: the greatest victories in dairy farming aren’t measured in banners or indexes—they’re measured in the moments that nearly broke you.

The Morning Nobody Saw Coming

October 3, 2025. Michael Lovich sat at World Dairy Expo, his hands shaking so badly he couldn’t hold his phone.

Think about that for a second. This man has been farming his whole life. He’d already bred one World Dairy Expo Grand Champion a decade earlier. If anyone should have nerves of steel watching the Senior Champion selection unfold, it was him.

But there he sat, trembling.

Back home in Saskatchewan—three hours from anywhere most people have heard of—his wife Jessica had given up pretending to eat lunch. Their three daughters huddled around phone screens in the school parking lot, with special permission to skip class.

Some things matter more than algebra.

“Somebody tapped me and said, ‘Are you happy?'” Michael recalls about the first pull. “I said, ‘Nope, not until we’re in the final lineup.’ There’s no sitting down until he does his reasons, and we get the nod for first place.”

That answer tells you everything. It’s the voice of someone who’s been burned before. Someone who knows that hope, unchecked, can shatter you. Someone who’s learned to hold his breath until the very last moment.

When Judge Aaron Eaton finally pointed to Kandy Cane and delivered his reasons—”When she came in the ring, it was game over”—the Lovichs became the first and only breeders in Holstein history to produce two different World Dairy Expo Holstein Grand Champions.

From a 72-cow tie-stall operation in Saskatchewan.

For those who don’t follow the show world closely, World Dairy Expo is the Super Bowl of dairy cattle—the one week each October when the best animals from across North America and beyond gather in Madison, Wisconsin, to compete for the industry’s most prestigious honors. Winning Grand Champion once is a career-defining achievement.

Breeding two? That had never happened before.

The Heifer Nobody Wanted

Here’s what gets me about the Kandy Cane story: she wasn’t supposed to be their keeper.

“She was always that cow,” Jessica laughs, and if you’ve ever raised dairy cattle, you know exactly which cow she means. Born October 20, 2020, headstrong from her first breath. The kind that makes you check the calendar when she’s due to calve because you know she’ll pick the worst possible night. The kind that tests your patience daily and makes you wonder why you bother.

The Lovichs assigned her as a 4-H project calf to a local town kid. Their own daughters picked different heifers—ones that looked more promising, walked better, didn’t fight you every step to the milk house.

And then Jessica’s dad saw something.

Kandy Cane was boarding at his place in Alberta, and he spotted her standing out on the pasture—her deep body already showing, even though she was immature. The way his eyes lit up when he talked about her told Jessica everything.

“He’s like, ‘I really like that heifer. Who is she? What is she? How much do you want for her?'” Jessica remembers.

“She’s not for sale, Dad. She’s got to come home.”

How close did they come to letting her go? Jessica shakes her head when she thinks about it now. The ornery heifer that fought them every day. The one their own daughters passed over. The one that almost ended up someone else’s 4-H project.

When I asked Michael about his breeding philosophy—whether genomics played any role in identifying Kandy Cane’s potential—his answer was characteristically blunt: “Genomics? What are those? Cow families are probably number one. If I don’t like the cow family the bull comes from, we won’t use him. When I see bulls that are out of three unscored dams, I don’t care what the numbers are.”

Sometimes, the cattle that test your patience the most are the ones destined to make history. That’s not a breeding principle you’ll find in any textbook. But the Lovichs have learned it twice now—by trusting what they see in the barn more than what they read on a screen.

Eleven Years Between Victories

If the Lovich story is about lightning striking twice, the Bos story is about the slow grind of thunder. The Bos family in Ontario waited eleven years between their first and second Excellent classifications.

Eleven years.

Let that sink in. Most of us can’t wait eleven days for anything.

They classified their first herd in 1976: 45 Good, 45 Good Plus, and 2 Very Good. Not a single Excellent in sight. Their first EX cow didn’t arrive until November 7, 1980. Most people would’ve celebrated, maybe relaxed a little.

The Bos family got their second Excellent cow on July 23, 1991.

I’m not sure how you keep showing up for a decade without visible progress. How do you keep breeding toward a standard that refuses to appear? How do you walk into that barn every morning and convince yourself it’s worth it when the classification sheets keep coming back the same?

Most people would have quit somewhere in that decade-plus of waiting. Changed their breeding program. Chased different genetics. Wondered if they were doing something wrong. Asked themselves, late at night, whether they were fooling themselves.

Not this family. They didn’t call it perseverance. They just called it Tuesday. And Wednesday. And the decade that followed.

Today, Bosdale Farms has 415 Excellent-classified cows—more than any other operation in Canada. Three Master Breeder shields hang on their walls. When I asked them what drove that patience, the answer was disarmingly simple:

“Life is too short to milk ugly cows.”

Behind the joke lives something deeper. Something about believing in what you’re building even when the evidence hasn’t arrived yet.

Their approach to technology mirrors the Lovichs’ conviction. “Genomic testing can provide a baseline for genetic selection across a herd,” they told me. “However, we believe a much higher degree of reliability can be seen through knowing and understanding individual cows, knowing how cow families and bulls transmit, using bulls with proven numbers, and using that information to pinpoint your sire selection.”

Their advice to younger breeders? “Stay current, always using the best proven bulls. Nothing should override good common cow sense with proven cow families.”

“Farming is hard work,” they added. “But when every new calf has the opportunity to become your next big show cow, your next star brood cow, or lifetime production cow, it makes farming a passion and not just a job.”

For Those Still in the Waiting

I need to pause here and say something to the farmers reading this who haven’t had their Kandy Cane moment yet. Who are in year three of what might be an eleven-year wait. Who wonder, in the quiet of the milk house at 5 a.m., whether any of this is worth it.

I see you. And I want you to know something.

The Bos family didn’t know they’d end up with 415 Excellent cows when they were staring at that single EX classification in 1980. They couldn’t see where they were headed. They just kept showing up.

Michael Lovich didn’t know Kandy Cane would make history when she was fighting him in the halter as a yearling. She was just an ornery heifer who wouldn’t cooperate.

Faith isn’t knowing how the story ends. It’s showing up anyway.

Every elite breeder I’ve ever talked to has a version of this same truth: the breakthrough came after they’d almost stopped believing it would. Not because the universe rewards persistence with some cosmic guarantee—sometimes it doesn’t—but because the people who quit never find out what was waiting on the other side of their doubt.

If you’re in your waiting season right now, these families would tell you the same thing: keep breeding the cows you believe in. Keep trusting what you see. The scoreboard hasn’t finished counting yet.

Your barn holds something worth building. Whether the world ever recognizes it or not, you’ll know what it cost you—and what it’s worth.

The Kitchen Table Where Everything Changed

Three thousand miles west of the Bos family’s Ontario operation, another kind of courage was being tested.

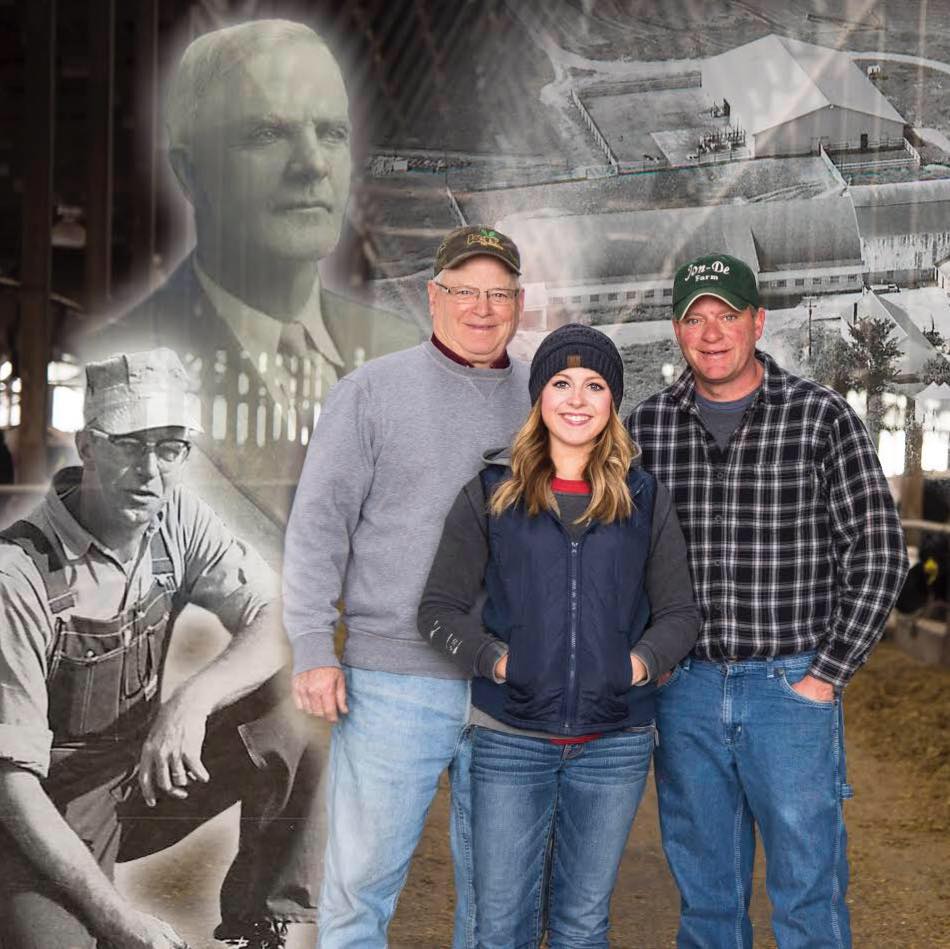

When Mikayla McGee returned to Jon-De Farm in Wisconsin twelve years ago—fresh from River Falls with her dairy science degree—she walked onto a farm that felt foreign. Two herringbone parlors running 24/7. Thirty-plus employees juggling 1,550 cows across endless shifts. The smell of silage and manure mixing with the hum of vacuum pumps that never seemed to stop.

“It didn’t feel like my farm when I first came back,” she told me. “I kind of felt like an outsider a little bit.”

That admission carries more weight than she probably realizes. Here’s someone who grew up on this land, returned with education and passion, and still felt like she didn’t belong. Every farm kid who’s come home will recognize that ache—the strange displacement of standing in a place you know by heart and feeling like a stranger anyway.

But here’s what Mikayla saw that others missed: her family was working harder than they needed to for the results they were getting.

“We had a lot of inputs for really not milking that many cows. A lot of employees for a lot of work for 1,550 cows.”

The conversation that followed—suggesting they milk fewer cows in an industry obsessed with expansion—could have gone sideways fast. I can only imagine the silence at that kitchen table. The raised eyebrows. The unspoken question: You want us to do what?

But Mikayla had something working in her favor: her grandfather’s analytical mind.

“My grandpa is very much… I think he would even like to expand,” she admits with a laugh. “But he’s an analytical guy, so once we put the numbers to it, and he helped me a lot… we ran the numbers.”

They sat at that kitchen table, took their previous year’s financial reports, and made a mock-up of what it would look like with 200 fewer cows. The areas most impacted: labor, milk income, feed cost..

When the math came together, they found their number: 1,350 cows.

And then everything changed.

The Numbers That Rewrote the Rules

Within eighteen months of “right-sizing”—the term their CFO Chris VanSomeren coined—Jon-De Farm was shipping nearly the same milk volume with 200 fewer cows.

Same production. Fewer cows. Dramatically better margins.

Daily milking hours dropped from 144 to 18—an 87.5% reduction. Labor costs fell by $900,000 annually. Between feed savings and labor efficiency, net profit increased by $1.2 million.

But what moves me most about this story isn’t the numbers.

It’s what Mikayla said about her employees:

“I read something… that your boss or your co-workers have, like, an equal influence on a person’s day as their spouse. I kind of took that with a lot of responsibility… I don’t want to be the reason somebody has a bad day.”

She built a kitchen above their new rotary parlor. Not to show off. To cook lunch for her team.

“Maybe cooking is like my love language,” she laughs. “But I just think it’s a nice gesture. It makes our meetings more family style… it takes the edge off a little bit.”

In an industry struggling to find and keep good people, Mikayla discovered that sometimes the boldest move isn’t adding more cows. It’s remembering that the people in your parlor matter as much as the cows.

Her father’s philosophy guides everything: “Be the best, whatever size you are, dairy.”

That sentence has stayed with me.

Read the full Jon-De Farm story →

The Loss That Shaped Everything

The Bos family knows something about loss that most breeding profiles don’t mention.

On May 1, 2020, they lost their son and brother, Timothy. The family doesn’t dwell on it publicly, but when they talk about what drives them, his memory is there in every word:

“This profound loss reinforced for the family how precious life is, that every day is a gift from our heavenly Father and that we must be forever thankful for what he has given us.”

I debated whether to include this. It’s deeply personal. But when I asked how they wanted Bosdale to be remembered, their answer made it clear that this loss—and this faith—shaped everything that followed:

“Hopefully, it would not simply be for achievements but that those achievements would reflect on our commitment to working hard, the importance of family, and our commitment to serving our Lord and Savior Jesus Christ as we attempt to wisely steward the animals, land, and people that we have been given for the time we are here.”

Four hundred fifteen Excellent cows. Three Master Breeder shields. And what matters most to them is whether they were good stewards of what they were given.

One Decision That Changed Generations

Every breeding program has a pivotal decision that echoes through generations. For the Bos family, it came with a cow named Counselor—a really exciting, young two-year-old who, unfortunately, needed to be culled open.

Ed Bos shares the story: “While she was going through her health test, we decided to take a single flush because she had to be culled open. This resulted in the ‘Bosdale Stardust Portrait,’ the second dam of Outside Portrait. Without doing that, the Portrait family would not have been nearly as big a part of Bosdale as they are today.”

One decision. One flush from a cow that was leaving the herd anyway.

Fifty years later, Portrait descendants still fill that barn. A whole family of cows that almost never existed.

That’s not luck. That’s paying attention. That’s seeing opportunity where others see only loss.

Read the full Bosdale Farms story →

The Banners That Hang in Someone Else’s Barn

The morning after Kandy Cane won, Jessica Lovich was back in the barn at 5 a.m. with the girls. Michael was still in Madison, probably running on adrenaline and not much sleep.

Same 72 cows needed milking. Same routine. The familiar rhythm of the tie-stall barn—the clank of stanchions, the hiss of the milking units, the steam rising from fresh milk in the October morning.

“For all the acclaim we have, we still don’t have a grand champion banner hanging anywhere on our farm,” Jessica points out.

No bitterness in her voice. Just a fact.

Both Lovholm champions’ banners hang in other people’s barns. Kandy Cane’s purple and gold went to New York with the Lambs. Katrysha’s from 2015 hangs at MilkSource Genetics.

They bred Holstein history twice, but don’t own the banners. Because sometimes you sell your best to keep the lights on. That’s dairy farming in 2025. That’s the part of the story the industry doesn’t always tell—the economics that force you to let go of what you love most just to keep going.

But breeding great cattle is its own reward. The Lovholm name in those pedigrees? Worth more than any banner.

And besides—the real legacy isn’t hanging on a wall. It’s in the pedigrees that will outlast any of us, and in the barn at 5 a.m., where the cows don’t care about banners.

Three Daughters and What Comes Next

The Lovich girls—Reata, Renelle, and Raelyn—aren’t just farm kids. They’re the next generation of this breeding philosophy.

“It’s a matter of survival around here,” Jessica laughs. “If you’re not in the barn doing chores, you’re in the kitchen cooking supper.”

Reata’s planning to be the farm vet. Renelle will handle the cropping. Raelyn has already declared herself the future farm manager “because she knows all the cows already.” (I love that confidence. The certainty of a kid who’s spent her whole life learning which cow is which, which one needs watching, which one has that look in her eye.)

They’ve got their own cattle—including a Jersey their aunt and uncle sent for Christmas. “Now I’ve got to keep Jersey semen in the tank,” Michael grumbles, but you can see he’s proud.

When Kandy Cane won… “They were crying, they were laughing, they were super excited,” Jessica recalls. “They’ve been coming with me to shows since they were born. They’ve slept on hay bales at shows for 14 to 16 years.”

These kids aren’t learning dairy from textbooks. They’re learning it at 5 a.m. before school, one cow at a time. They’re learning it in the cold, the manure, and the exhaustion. And they’re choosing it anyway.

Someday, they’ll be the ones deciding which ornery heifer gets to stay.

Read the full Lovholm Holsteins story →

What This Really Means

Let me be honest about something: the dairy industry loves stories like these at Expo, standing around at 2 a.m. with a beer, talking about the good old days.

But come Monday morning? Most of us go right back to chasing the newest index. The hottest sire. The genomic flavor of the month.

The Lovichs aren’t just breeding better cows. The Bos family isn’t just patient. Mikayla McGee isn’t just efficient. They’re all proving there’s another way.

Not backwards. Different. Focused on what actually matters when you’re trying to make a living milking cows while keeping your family together and your soul intact.

Michael Lovich’s cows have an average productive life of 8–10 years. Industry average? Four to five, if you’re lucky. Those aren’t just numbers. That’s decades of mornings with the same cows. That’s calves you named becoming cows you mourned.

The Walk We All Take

The longest walk isn’t from barn to show ring. It’s from yesterday’s assumptions to tomorrow’s reality.

Michael and Jessica Lovich have walked it twice. With Saskatchewan stubbornness and the radical belief that good cows, raised right, still matter most.

The Bos family walked it for fifty years. Through eleven years between Excellent classifications. Through the loss of a son. Through industry shifts that should have pushed them to change everything.

Mikayla McGee walked it when she told her banker she wanted to invest in a multimillion-dollar rotary while milking fewer cows—and meant it.

Here’s what these families share: They all discovered that excellence doesn’t come from following someone else’s formula. It comes from understanding what you believe, committing to it completely, and having the patience to see it through even when the evidence hasn’t arrived yet.

Even when you’re shaking so badly you can’t hold your phone.

Even when eleven years pass between victories.

Even when the banners hang in someone else’s barn.

Even when the banker doubts your plans.

What Keeps Them Going

“Is there a third one coming?” I asked Jessica Lovich about another potential World Champion.

She laughed. “We always got to dream bigger, right?”

Then she got serious: “We want to keep breeding functional cows. Cows we enjoy milking. Cows that can maybe have a little bit of fun at shows.”

Not world-beaters. Not genomic wonders. Functional cows.

And that’s exactly why they’ll probably breed another champion.

The Bos family’s hope is simpler still: that their achievements reflect “our commitment to working hard, the importance of family, and our commitment to serving our Lord and Savior Jesus Christ.”

Mikayla McGee keeps her father’s words close: “Be the best, whatever size you are, dairy.”

The Bottom Line

I’ve been writing about this industry for a long time, and I’ll admit something—these stories hit different.

Not because these families achieved more than others—plenty of operations have impressive numbers. But because when you sit with their stories long enough, you realize the victories weren’t really the point. The victories were just proof that the faith was justified.

The point was Michael trusting his eye over the indexes. The point was the Bos family showing up for eleven years without a second Excellent. The point was Mikayla cooking lunch for her team because she didn’t want to be the reason someone had a bad day.

The point was the belief itself. The courage to hold onto it when everyone around you is chasing something shinier.

Three families. Three different paths. One truth they discovered along the way.

For those of you reading this at 5 a.m., wondering if your own commitment will ever pay off: these families would tell you the story isn’t over yet.

Keep breeding the cows you believe in.

Whatever happens next, what you’re building matters—whether anyone else ever sees it or not.

KEY TAKEAWAYS

- Genomics optional, conviction required: Michael Lovich bred two World Champions from 72 cows without touching genomics. “If I don’t like the cow family the bull comes from, we won’t use him.”

- Patience is a breeding program: The Bos family waited eleven years between their first and second Excellent. Today: 415 Excellent cows—most in Canada.

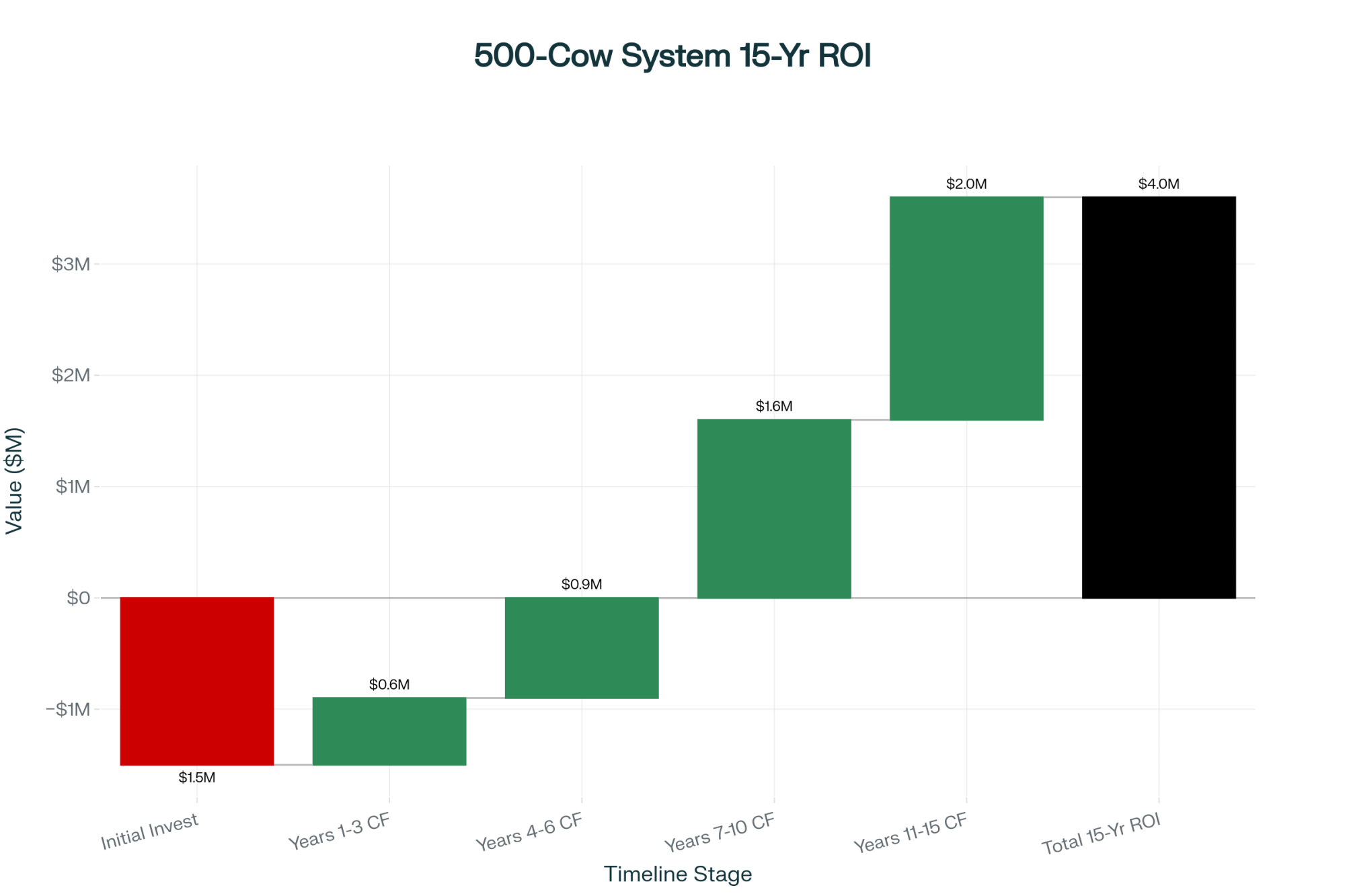

- Optimal beats maximal: Jon-De cut 200 cows, reduced milking hours from 144 to 18 daily, and added $1.2M in annual profit. Same production. Better life.

- Your team is your herd too: Mikayla built a kitchen above the parlor to cook lunch for employees. “I don’t want to be the reason somebody has a bad day.”

- The scoreboard hasn’t finished counting: If you’re in your waiting season, keep breeding the cows you believe in. The breakthrough comes after you’ve almost stopped believing.

EXECUTIVE SUMMARY

His hands trembled so badly he couldn’t hold his phone—and he’d already bred one World Champion. When Michael Lovich’s second Grand Champion was named at World Dairy Expo, the Lovichs became the only breeders in Holstein history to achieve that feat. From 72 cows in a Saskatchewan tie-stall barn. Without touching genomics. The Bos family in Ontario waited eleven years between their first and second Excellent; today, they have 415—the most in Canada. Mikayla McGee convinced her Wisconsin family to cut 200 cows, dropped daily milking hours from 144 to 18, and added $1.2 million in annual profit. Three families, three gambles, one truth: excellence isn’t a formula you follow—it’s a conviction you hold when nobody else understands yet.

Learn More:

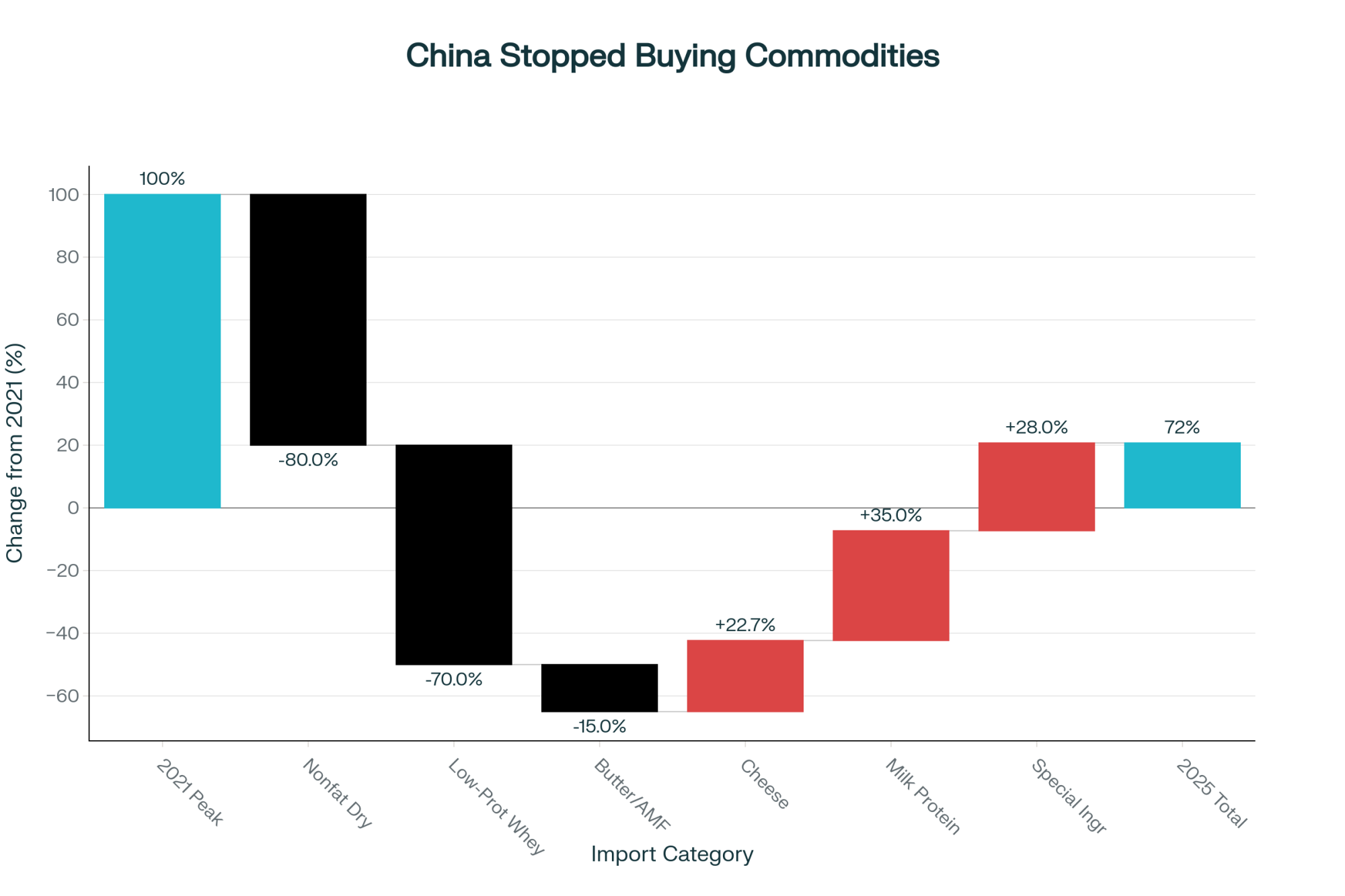

- Breeding Into a Moving Market: What Butterfat’s Crash Reveals About Dairy’s Genetic Timing Problem – Examines the financial risks of chasing short-term genetic fads, providing data-backed evidence on why balanced breeding strategies—similar to the Bos family’s approach—outperform trend-chasing and insulate herds from market volatility.

- The Rules Changed and Nobody Told You: Three Paths Left for the 300-Cow Dairy – Confronts the brutal economic reality facing mid-sized operations, outlining the three distinct survival paths—specialization, scaling, or strategic exit—available to producers who refuse to farm by yesterday’s rules.

- Beyond the Milk Check: How Dairy Operations Are Building $300,000 in New Revenue Today – Details practical, immediate strategies to generate significant new revenue through beef-on-dairy, feed efficiency audits, and carbon programs, proving you don’t need to milk more cows to make more money.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!