64-year low in beef cows. $1,100 dairy-cross calves. 2.5 million replacement heifers. Do the math.

You know how these conversations unfold at producer meetings. Walk into a barn office in Jefferson County, Wisconsin, and somebody’s showing you a $1,100 average on their Angus cross calves. Drive an hour north, and another producer’s working through why he came up short on replacement heifers last spring.

The difference between those two outcomes usually comes down to whether the breeding strategy actually fits the herd’s reproductive performance. That’s precisely what Dr. Victor Cabrera and his team at the University of Wisconsin-Madison have been quantifying—and more recent industry data confirms just how significant this opportunity has become for operations that approach it thoughtfully.

What the Wisconsin Research Reveals

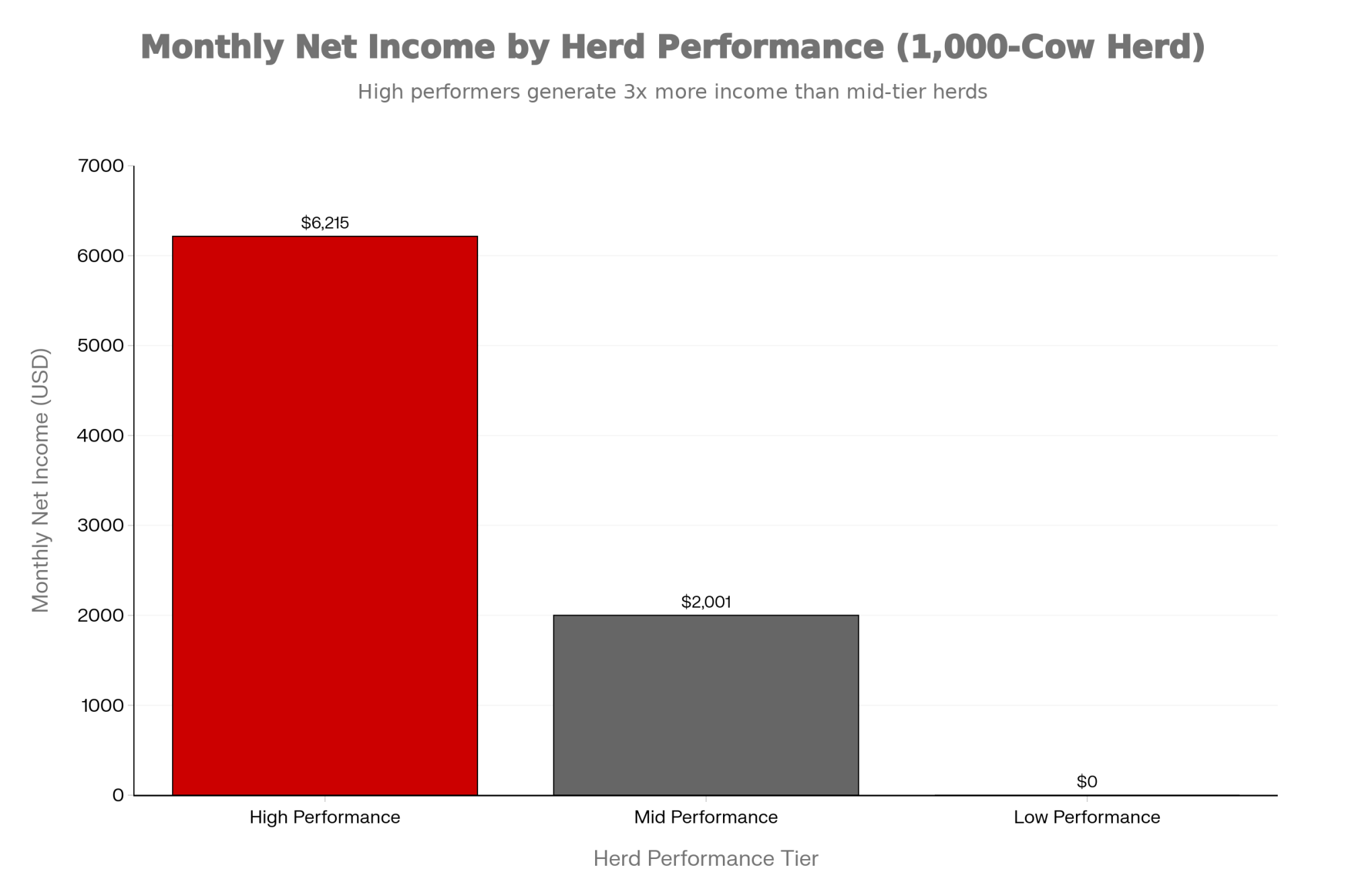

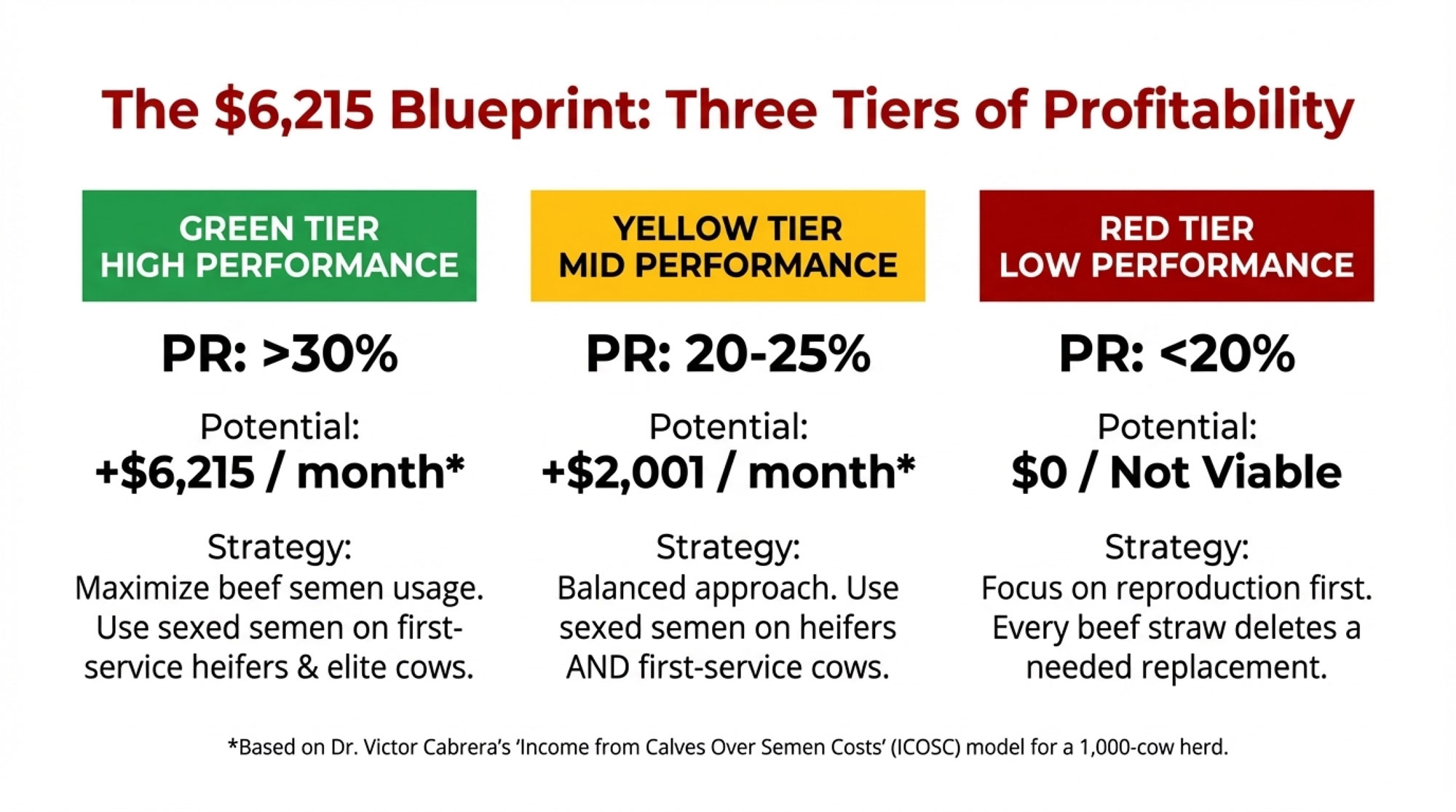

Dr. Cabrera published foundational research in JDS Communications that developed a decision-support model to calculate what he calls “income from calves over semen costs.” His team tested 30 different breeding strategies across three levels of reproductive performance. The results tell you exactly where your herd stands:

- High Performance (~30% pregnancy rate): $6,215/month Using sexed semen on first-service heifers, then beef semen on adult cows. Produces adequate replacements while generating substantial calf income for a 1,000-cow herd.

- Mid Performance (~20% pregnancy rate): $2,001/month. Requires more sexed semen deployment—on heifers and first-service primiparous cows—before safely shifting to beef semen elsewhere. Still meaningful, but the economics shift considerably.

- Low Performance (<20% pregnancy rate): $0 — Not Viable. No economically viable strategy for the use of beef semen exists at this level. These herds struggle to produce enough replacements even under conventional breeding.

That last finding doesn’t get enough attention. It’s not meant to discourage lower-performing herds—it points toward where to focus first. Reproductive fundamentals lay the foundation for beef-on-dairy strategies.

How Widespread Has Adoption Become?

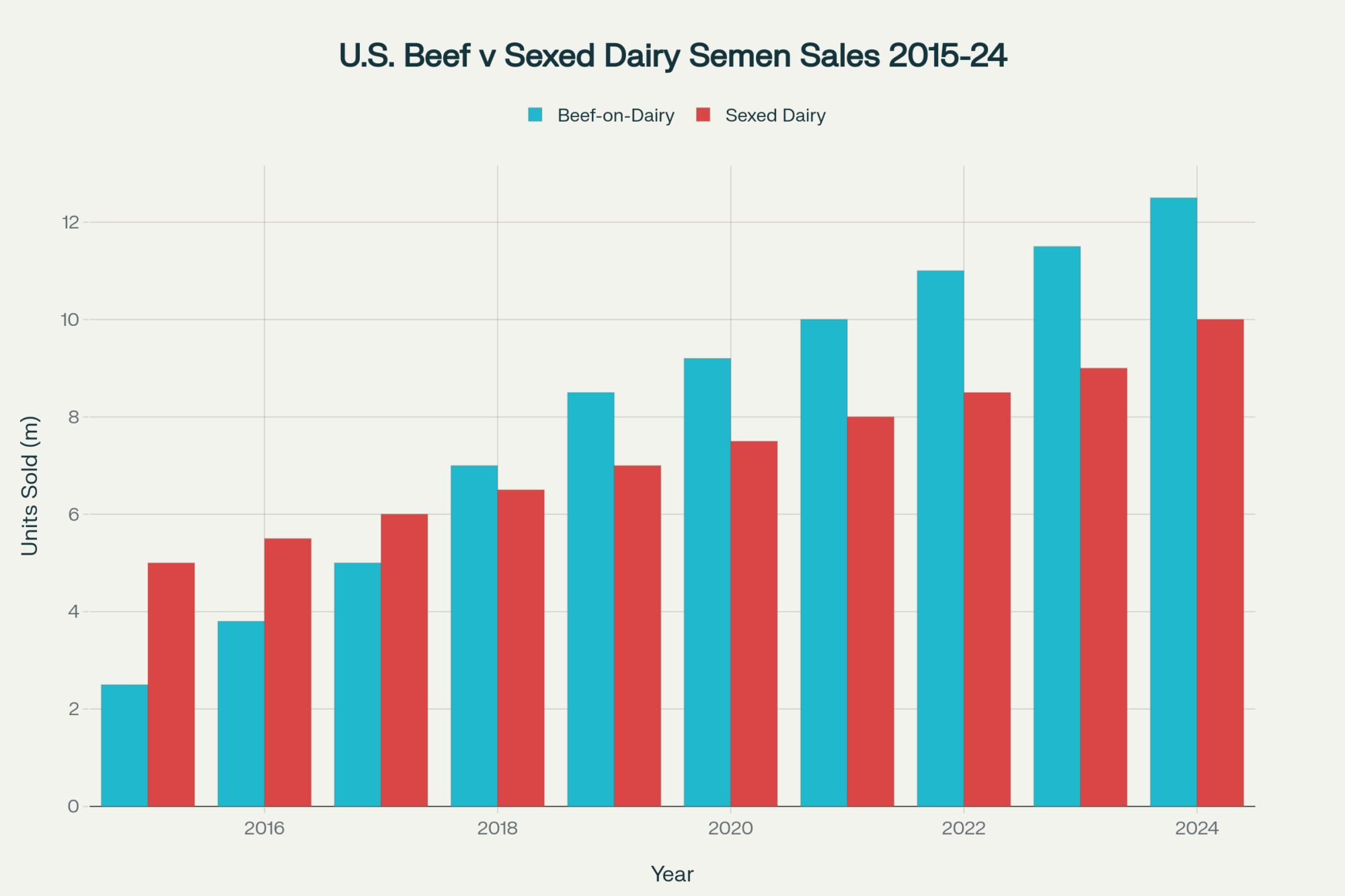

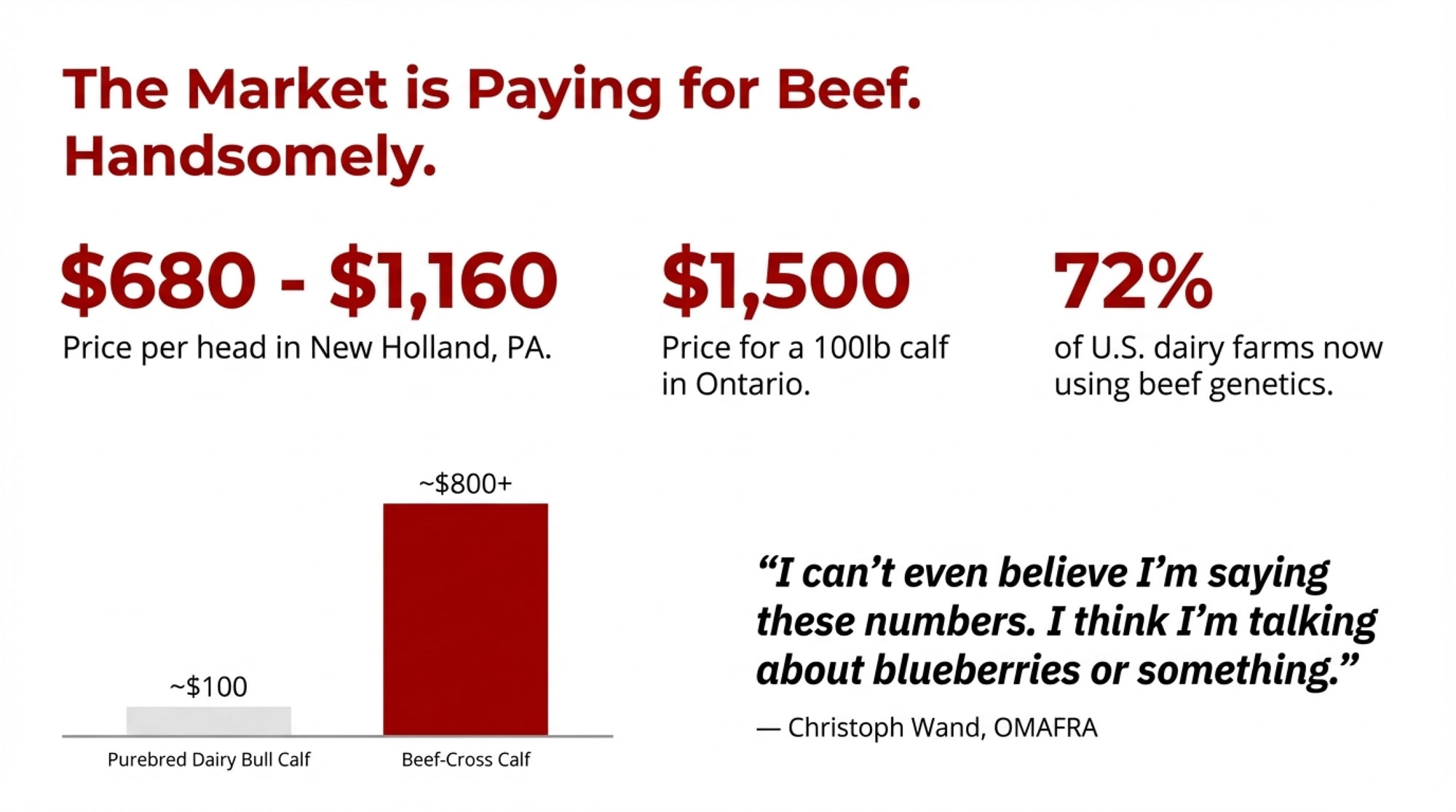

The pace of change since that 2021 research has been remarkable. According to the National Association of Animal Breeders data, domestic beef semen sales to dairy operations reached 7.9 million units in 2023—representing 31% of total semen sales to dairy. A 2024 survey conducted by Purina found that 80% of dairy farmers now receive a premium for beef-on-dairy calves, with reported revenues of $350 to $700 per head above purebred dairy calves.

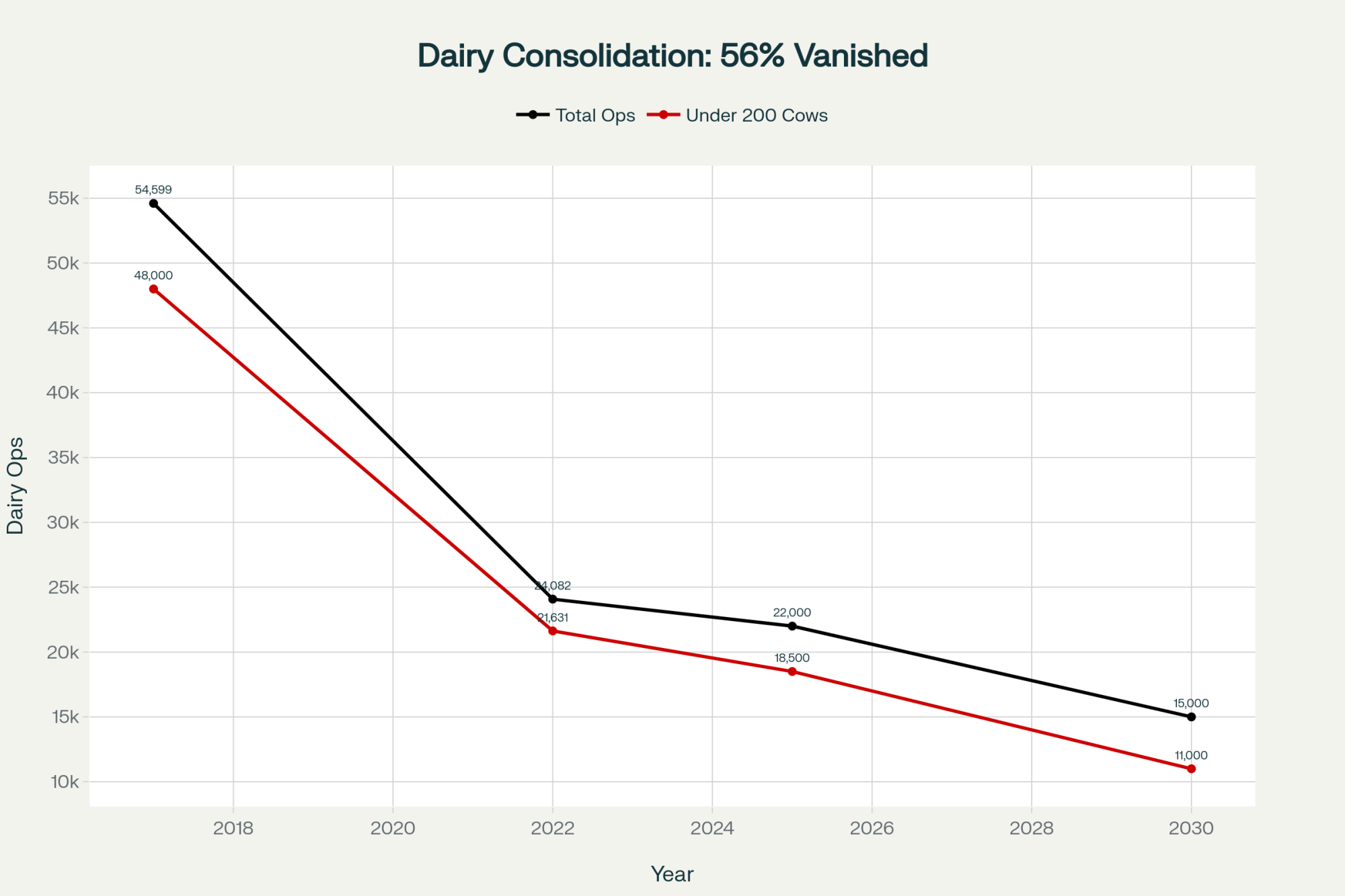

Farm Bureau data indicates that 72% of dairy farms are now using beef genetics on at least part of their herd—a dramatic shift from just a few years ago. Ohio State University economists estimate that beef-on-dairy could account for 15% of total cattle slaughter by 2026, up from essentially zero a decade ago.

What’s interesting is how this has evolved from an experimental strategy into standard practice for many operations. The question isn’t really whether to participate anymore—it’s how to do it without compromising your replacement pipeline.

Current Market Context

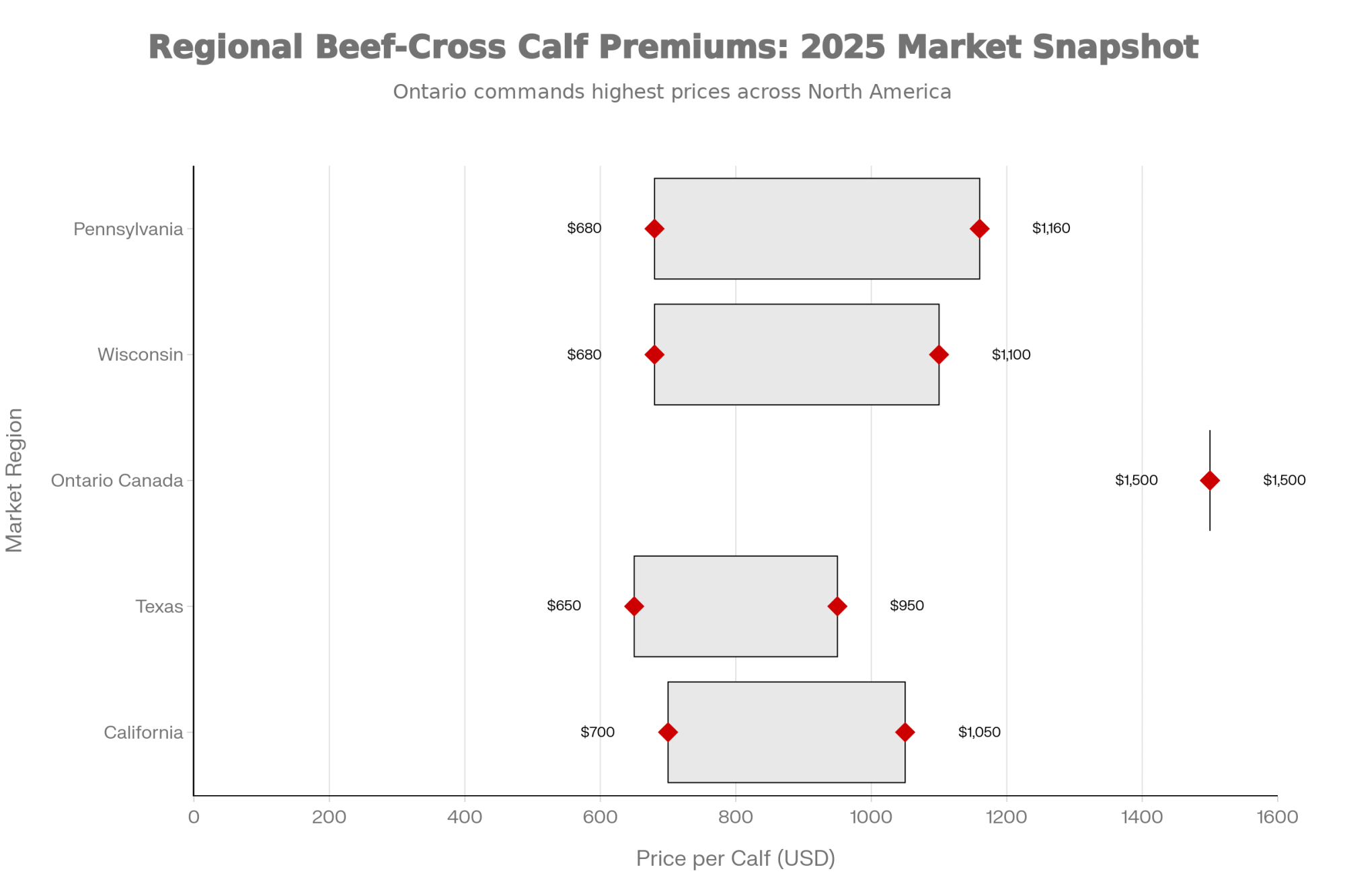

What’s shifted dramatically since the foundational research is the magnitude of the calf price premium. Dr. Cabrera’s original model used a baseline of $225 for beef-cross calves. Current conditions look quite different.

- New Holland (PA): $680 to $1,160 per head for beef-cross calves at 60-100 pounds, according to USDA-verified auction reports.

- Wisconsin markets: $680 to $1,100 per head for comparable calves.

- Ontario: approximately $15 per pound—or $1,500 for a 100-pound calf, as reported by Christoph Wand, OMAFRA’s Livestock Sustainability Specialist, at Ontario Dairy Days earlier this year.

“I can’t even believe I’m saying these numbers,” Wand remarked. “I think I’m talking about blueberries or something.”

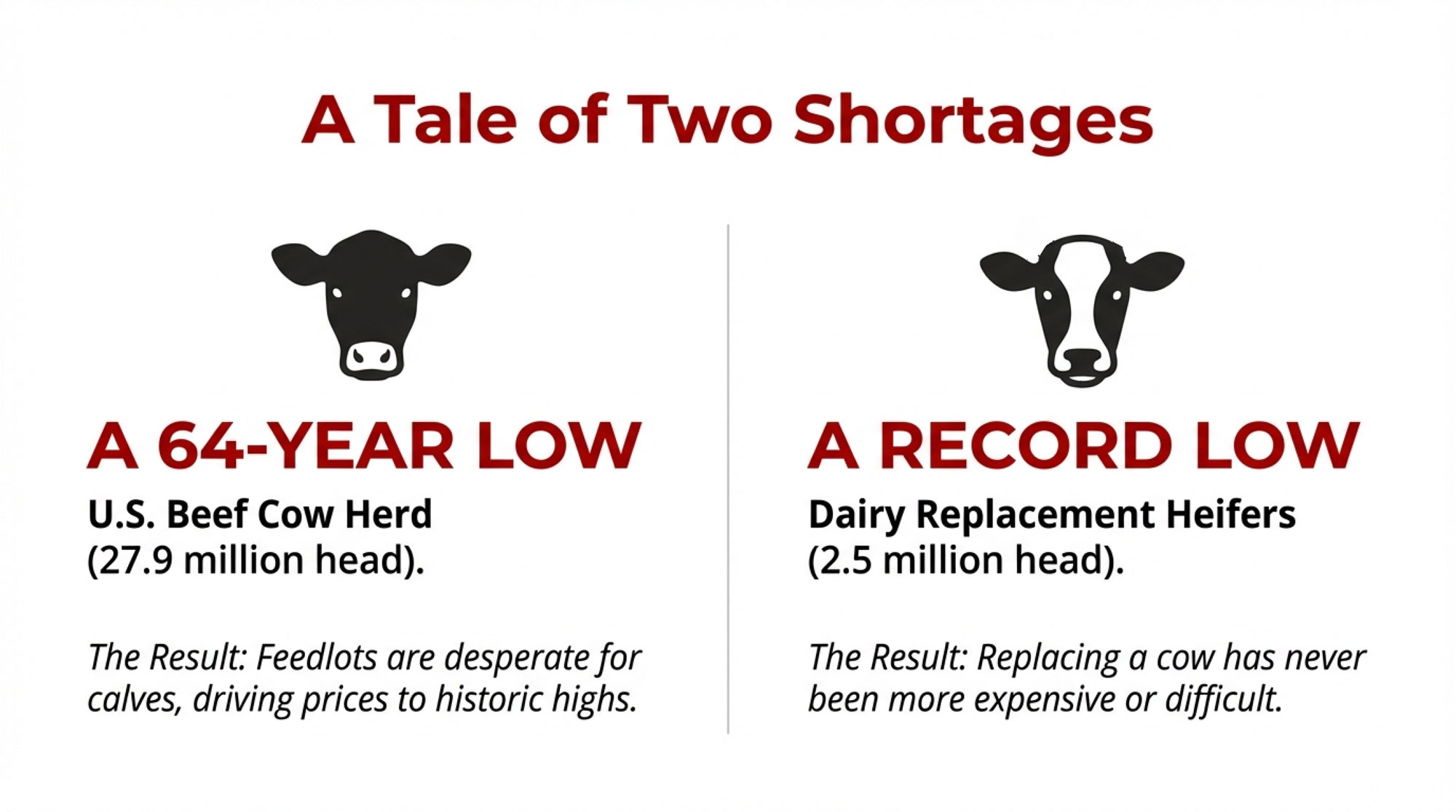

Why such strong premiums? The U.S. beef cow herd hit a 64-year low in early 2025 according to USDA data, and industry analysts don’t expect a meaningful recovery before 2028. Feedlots need calves, and beef-on-dairy crossbreds are filling that supply gap.

A recent analysis in Choices Magazine notes that crossbred calves achieve higher quality grades than traditional dairy steers, increasing profitability at the feedlot level and supporting premium pricing for dairy producers.

Markets cycle. These premiums won’t last forever. But the structural dynamics—a multi-year timeline for beef herd rebuilding—suggest the opportunity window remains open for operations ready to act on it.

The Replacement Question

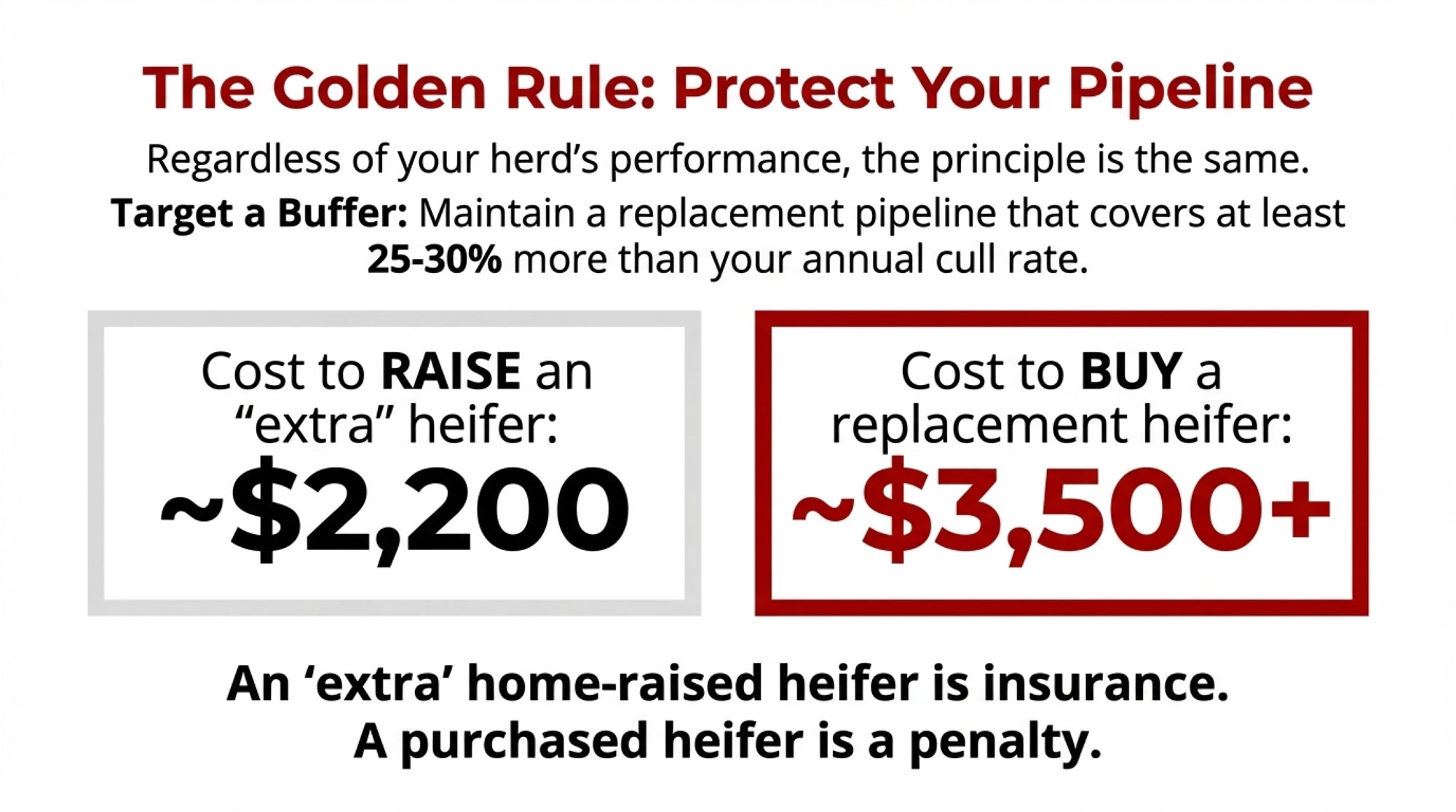

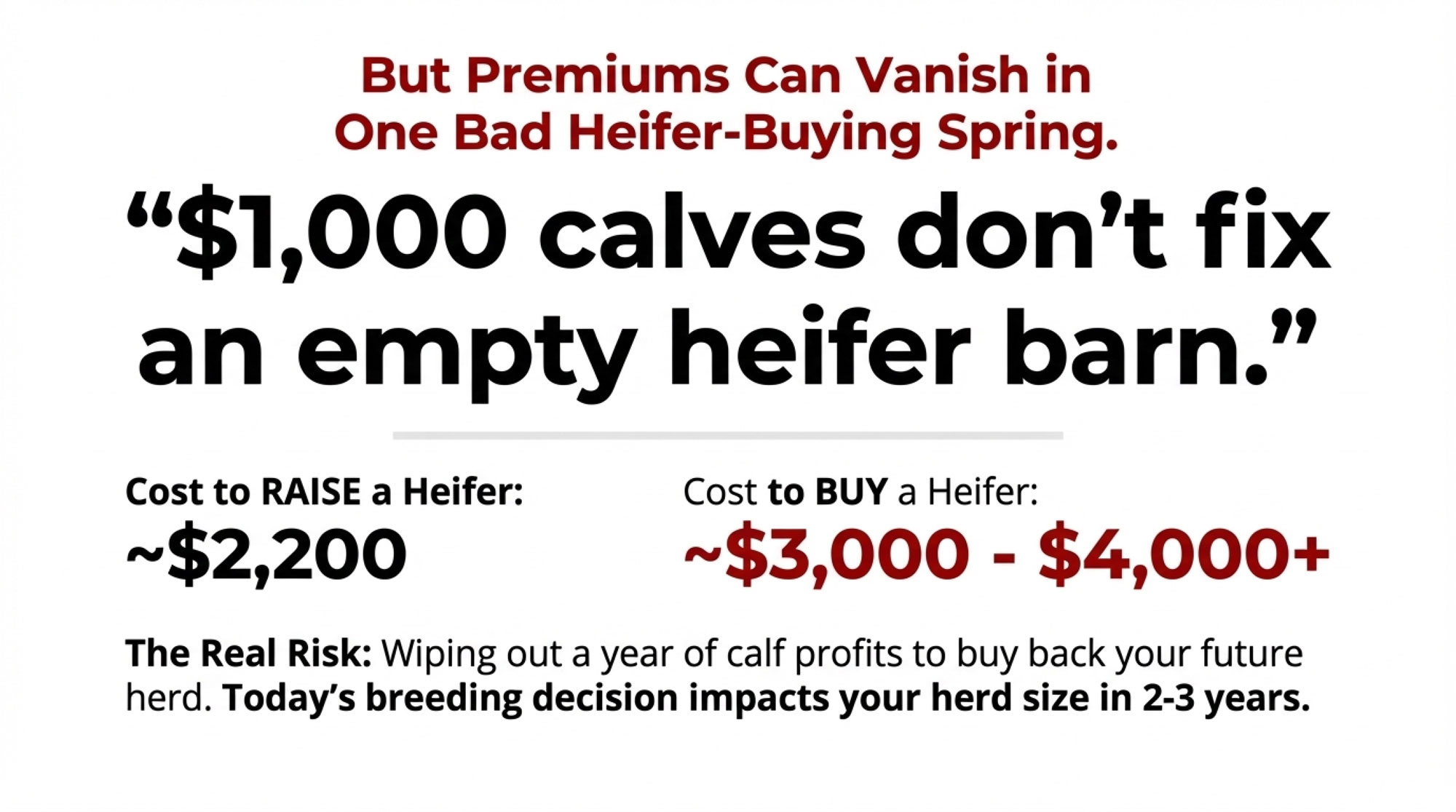

This is where thoughtful planning separates sustainable programs from cautionary tales. A Wisconsin producer who’s been running beef-on-dairy for three years now shared an observation that stuck with me: “The premiums are great, but you can give it all back in one bad heifer-buying spring.”

The Wisconsin model calculated that under optimal conditions (high reproductive performance with strategic sexed-beef deployment), a 1,000-cow herd produces just one extra replacement heifer per month beyond what’s needed to maintain herd size. That’s not much cushion.

Industry consultants generally recommend keeping at least 25-30% of breedings allocated to replacement production. The specific number depends on your culling rate, heifer survival, and how much risk you’re comfortable managing. But the principle holds: protecting your replacement pipeline matters more than maximizing beef-cross production in any single year.

The heifer situation is already critical. USDA data shows dairy heifer inventories expected to calve dropped to 2.5 million head as of January 2025—the lowest level since the agency began tracking this metric. That tightening supply makes the replacement question even more consequential.

One example shared in industry coverage illustrates the risk. A tie-stall operation reportedly shifted too heavily toward beef breedings without accounting for their actual replacement needs. When spring arrived, and heifer prices spiked, the cost to maintain herd size ate significantly into their calf premium gains.

It’s a mistake that’s understandable when you’re looking at $1,000 calves. But the replacement pipeline operates on an 18-24 month lag, and that timeline catches operations who haven’t planned ahead.

Matching Strategy to Your Operation

What makes the Wisconsin research particularly valuable is its recognition that different herds need different approaches. This isn’t one-size-fits-all guidance.

For Higher-Performing Herds (30%+ Pregnancy Rate)

Operations at this level have the most flexibility. The research indicates you can deploy beef semen on most adult cow breedings after using sexed semen on first-service heifers, and you’ll still produce adequate replacements.

Here’s the underlying logic: high reproductive performance typically means you’re already producing surplus dairy heifers under conventional breeding. Many producers in this category know the feeling of watching heifer inventory accumulate or selling springers at less-than-ideal prices. Strategic sexed-beef deployment redirects that surplus into premium beef-cross calves.

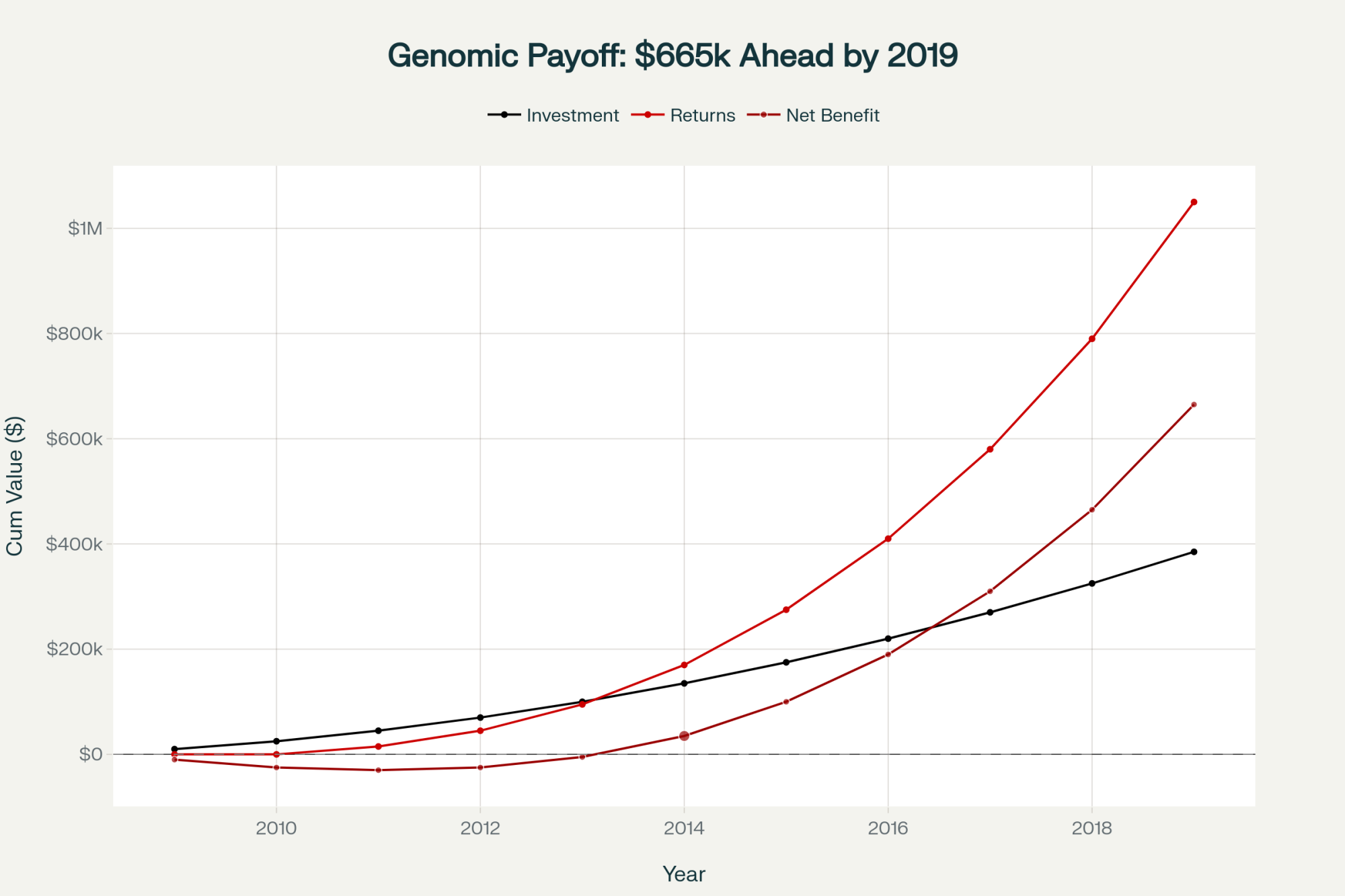

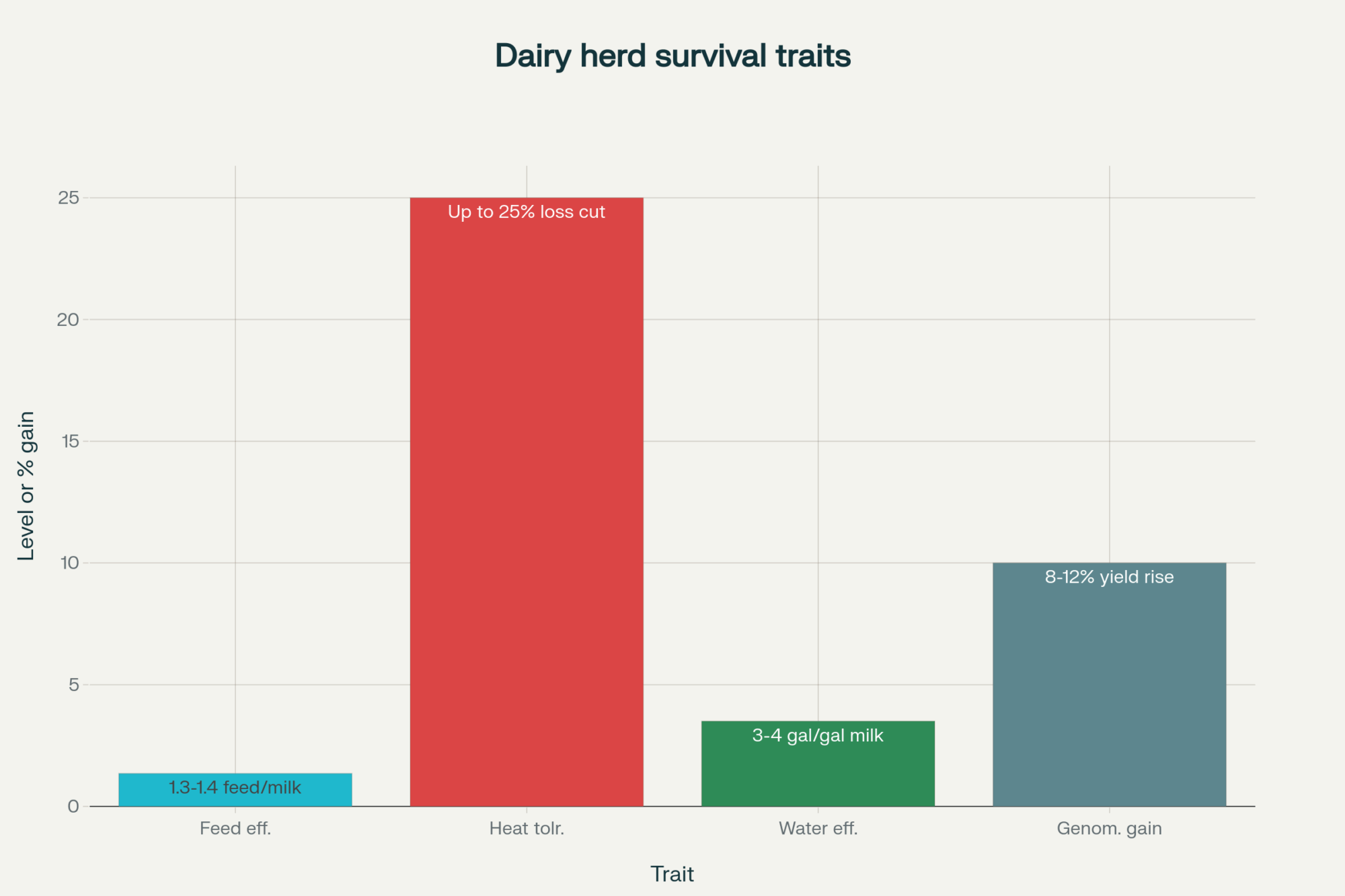

This is also where genomic testing—running about $40-50 per head—starts paying dividends. You can identify lower-genetic-merit animals for beef breedings while keeping your best genetics in the replacement pool. Some operations have built this into their standard protocol, and the ROI makes sense when you’re already managing tight replacement margins.

For Mid-Range Herds (20-25% Pregnancy Rate)

A more measured approach makes sense here. The Wisconsin model suggests you’ll need sexed semen on heifers and first-service primiparous cows before shifting later services to beef.

This is where many solid operations sit—not struggling, but without the reproductive cushion that allows aggressive beef semen deployment. Worth remembering that sexed semen typically achieves about 80% of conventional conception rates, so the fertility trade-off factors into replacement planning.

For Herds Working on Fundamentals (Below 20% Pregnancy Rate)

The research points toward a different priority: improving reproductive efficiency first. Each percentage point of improvement in the pregnancy rate expands future opportunities to capture beef-cross premiums.

This is really about sequencing. Focus on transition cow management, fresh cow protocols, and reproductive fundamentals. The beef-on-dairy opportunity will still be there once the herd performance supports it.

| Strategy Component | High Performance (30%+ PR) | Mid Performance (20-25% PR) | Low Performance (<20% PR) |

|---|---|---|---|

| Sexed semen on heifers (1st service) | Yes | Yes | Focus on reproduction first |

| Sexed semen on primiparous cows | No – can skip | Yes (1st service) | Focus on reproduction first |

| Beef semen on adult cows | Yes – most breedings | Yes – later services only | Not viable |

| Replacement allocation minimum | 25-30% | 30-35% | All breedings |

| Genomic testing ROI | High – target low-merit | Moderate – selective use | Not priority |

| Monthly net calf income (1000-cow herd) | $6,215 | $2,001 | $0 |

What’s Working in Practice

Several patterns keep emerging in conversations with producers successfully implementing these strategies.

Genomic-guided breeding decisions have become increasingly common. At $40-50 per head, genomic testing provides concrete data for targeting beef breedings rather than guessing about genetic merit. One producer described it as “taking the emotion out of breeding decisions”—and there’s something to that.

Protocol consistency matters more than protocol sophistication. Operations that capture full premiums aren’t necessarily complicated—they do the same thing every week. Written protocols, consistent execution, and regular review.

Buyer relationships are evolving. Packers and feedlots increasingly want traceable genetics and documented health records, paying premium prices. Operations that provide vaccination records, colostrum protocols, and weight documentation are building relationships that hold value when markets tighten.

Regional Considerations

Market premiums vary by region, and that variation affects strategy. Pennsylvania’s New Holland market shows some of the strongest beef-cross prices, driven partly by veal demand and feedlot connections. Upper Midwest markets in Wisconsin and Minnesota have been solid but show more week-to-week variability.

California operations have also seen significant adoption, with California Dairy Magazine recently covering emerging data on the value beef-dairy crossbreds bring to the supply chain. The state’s large-scale operations have been early adopters of systematic breeding protocols.

Texas has been particularly notable—according to Texas A&M AgriLife and USDA data, the state recently added 50,000 dairy cows, with complementary beef-on-dairy programs contributing to strong production gains. The Southwest’s integration with regional feedlot infrastructure creates natural marketing channels.

Producers closer to feedlot concentrations in the Central Plains sometimes see slightly lower premiums but more consistent demand. If you’re running a smaller operation, understanding your local market dynamics helps calibrate how aggressively to deploy beef semen.

Putting the Numbers in Perspective

Under 2021 baseline prices ($225 beef-cross calves), the Wisconsin model showed breakeven prices of just $69 per head for high-performing herds and $100 per head for medium-performance herds. Current prices running $700-1,100 sit well above those thresholds.

That margin provides some comfort. Even if beef-cross premiums decline by 50% from current levels, the economics still favor strategic use of beef semen in herds with adequate reproductive performance.

The research team’s sensitivity analysis found that optimal strategies remained consistent across most feasible market scenarios. What changes isn’t whether to use beef semen, but how much and on which animals.

Before Your Next Breeding Cycle

| Critical Decision Point | What 72% Are Doing | What Wisconsin Research Says | The Gap |

|---|---|---|---|

| Pregnancy rate baseline | Guessing or using targets | Actual rolling 12-month 21-day PR | Most overestimate by 5-8% |

| Replacement allocation | 15-20% of breedings | 25-30% minimum to protect pipeline | Leaves zero margin for error |

| Beef semen deployment | “As much as possible” | Strategic by service number & cow type | Burn through replacements |

| Calf pricing strategy | Take spot market price | Build feedlot/packer relationships | Leave $150-$300/head on table |

| Genomic testing | Skip it – too expensive | $40-50/head pays dividends at scale | Miss precision breeding gains |

| Breakeven awareness | Assume current premiums last | Know exact threshold ($69-$100) | Vulnerable to market cycles |

- Review your actual calf sale data. What premium are you actually receiving for beef-cross versus straight dairy? If it’s below $350 per head, it’s worth investigating whether it’s pricing, timing, or buyer relationships.

- Calculate your current pregnancy rate honestly. Use your actual rolling 12-month 21-day pregnancy rate—not your target. This single number largely determines which strategies fit your operation.

- Run your replacement pipeline numbers. Count heifers by age group and compare against your culling rate. Are you producing 25-30% more replacements than you need? If not, be conservative on beef semen deployment.

With 72% of dairy farms now using beef genetics, according to Farm Bureau data, the practice has shifted from innovative to expected. Current premiums reflect a beef supply situation that won’t resolve quickly—the smallest cow herd in 64 years doesn’t rebuild overnight.

The producers succeeding with beef-on-dairy share a common approach: they matched their strategy to their actual reproductive performance, protected their replacement pipeline, and built buyer relationships that hold value beyond the current premium cycle.

The market is paying you to be smart, but it will punish you for being short. Run your numbers through the DairyMGT.info calculator before your next breeding setup—because $1,000 calves don’t fix an empty heifer barn.

Key Takeaways

- Know your tier. Wisconsin research tested 30 strategies: 30%+ pregnancy rate = $6,215/month. 20-25% = $2,001/month. Below 20% = not viable.

- Protect the pipeline. Heifer inventories are at record lows (2.5M head). Keep 25-30% for replacements—$1,000 calves don’t fix an empty heifer barn.

- Margins are historic—for now. Beef-cross calves are selling for $680-$1,160, vs. a breakeven of $69-$100. Even a 50% price drop works for high performers.

- Three numbers determine your strategy: the actual 21-day pregnancy rate. Replacement allocation (25-30%). Genomic cutoff for beef breedings ($40-50/test).

Run the math. Free DairyMGT.info calculator shows which strategy fits your herd before you commit.

EXECUTIVE SUMMARY

Beef-cross calves are selling for $680-$1,160, and 72% of dairy farms have jumped into beef-on-dairy, but University of Wisconsin research reveals most are flying blind. Dr. Victor Cabrera’s team tested 30 breeding strategies and found the economics split sharply: herds at 30%+ pregnancy rate can generate $6,215 monthly in net calf income, while herds below 20% pregnancy rate have no viable beef semen strategy at all. The margin for error is vanishing. The U.S. beef cow herd sits at a 64-year low, dairy heifer inventories hit a record low of 2.5 million head, and one aggressive breeding cycle can erase a year of calf premiums in a single heifer-buying spring. The research points to one approach: know your pregnancy rate, protect your replacement pipeline, and run your numbers through the free DairyMGT.info calculator before your next setup. The market is paying for precision—$1,000 calves don’t fix an empty heifer barn.

The underlying research (Cabrera, 2021) was published in JDS Communications and is available through PubMed Central.

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More:

- The Beef-on-Dairy Wake-Up Call: What Some Farms Are Still Missing – Reveals why holding onto “Holstein purity” is costing herds thousands and details how to implement a genomic testing protocol to accurately identify the bottom 30% of cows for terminal beef breeding.

- The 800,000-Heifer Shortage Reshaping Dairy: Why Some Farms Will Thrive While Others Exit – Analyzes the structural deficit of 800,000 heifers created by aggressive beef breeding and outlines critical strategies to adjust culling and expansion plans to survive the 27-month biological lag in replacement inventory.

- Genetic Revolution: How Record-Breaking Milk Components Are Reshaping Dairy’s Future – Explains how genomic technology is driving record component premiums and details the “2025 Genetic Reset,” helping producers align breeding criteria with the new economic reality of fat and protein valuation.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!