$2.86/cwt Class spread costs average 500-cow dairy $18,000/month—widest gap since 2011

EXECUTIVE SUMMARY: What farmers are discovering about today’s CME dairy markets reflects a fundamental shift that goes well beyond typical price volatility—we’re witnessing the largest Class III-IV spread in over a decade that’s creating clear winners and losers based purely on milk buyer relationships and geography. The $2.86/cwt differential between Class III ($17.01) and Class IV ($14.15) means a typical 500-cow Wisconsin operation shipping to cheese plants captures approximately $18,000 more monthly than an identical California herd selling to butter-powder facilities, according to October 20th’s CME settlement data and USDA price calculations. Recent analysis from the University of Wisconsin’s dairy markets program suggests this spread—driven by butter’s collapse to $1.58/lb while cheese holds at $1.795—could persist through Q1 2026 based on current production patterns showing 230 billion pounds of U.S. milk forecast for 2025. Looking at global dynamics, U.S. butter trades at a remarkable $1.00-plus discount to European prices ($2.63/lb) and nearly $1.50 below New Zealand ($3.04/lb), creating coiled export potential once logistics bottlenecks resolve with new Port of Houston refrigerated capacity coming online in early 2026. Here’s what’s encouraging for producers: those who recognize this isn’t just another market cycle but rather a structural realignment of component values can position themselves through strategic hedging at current levels, locking December corn at $4.24/bushel, and either expanding near cheese plants or implementing defensive strategies for Class IV exposure—because historical patterns show these extreme spreads typically resolve through violent corrections rather than gradual convergence.

You know what’s fascinating about today’s market? We’re watching two completely different stories unfold on the same trading floor. Cheese makers are celebrating a solid 2-cent jump to $1.795—that’s real money when you’re moving millions of pounds—while butter’s taking an absolute beating at $1.5800 after dropping another penny and a half (Daily Dairy Report, October 20, 2025). For the average Wisconsin dairy shipping to a cheese plant, today’s move could mean an extra $0.30 on next month’s milk check. But if you’re in California selling to a butter-powder plant? Well, let’s just say it’s a different conversation entirely.

Today’s Price Action: The Numbers That Matter

Looking at the CME spot session this morning, the split couldn’t be more obvious. Here’s what closed and what it actually means for your operation:

| Product | Closing Price | Today’s Move | Week Average | Farm Impact |

| Cheese Blocks | $1.7950/lb | +2.00¢ | $1.7255 | Adds $0.25-0.30/cwt to Class III milk |

| Cheese Barrels | $1.7725/lb | +0.25¢ | $1.7400 | Supportive, though spread widening to 2.25¢ |

| Butter | $1.5800/lb | -1.50¢ | $1.6305 | Drags Class IV down $0.15-0.20/cwt |

| NDM Grade A | $1.1100/lb | Unchanged | $1.1195 | Neutral—all Class IV pressure on butter |

| Dry Whey | $0.6650/lb | +1.00¢ | $0.6380 | Small boost to Class III other solids |

What’s really telling here is the trading activity. Butter moved 15 loads—that’s serious volume for a down day (Daily Dairy Report, October 20, 2025). Meanwhile, cheese blocks only traded six loads despite the rally. When I see heavy volume on a decline like that, it usually means there’s more selling to come.

Trading Floor Dynamics: Reading Between the Bids

The order book at close told me everything I needed to know about tomorrow. Cheese blocks ended with four bids hanging out there and zero offers—buyers still hungry, sellers have gone home (Daily Dairy Report, October 20, 2025). That’s typically bullish for the next session.

Butter? Different story entirely. Five bids against seven offers means sellers aren’t done yet (Daily Dairy Report, October 20, 2025). And NDM sitting there with three offers and no bids? That’s weakness hiding behind today’s unchanged close.

I’ve been tracking these markets for 15 years, and when you see this kind of bid-ask imbalance, it usually plays out over the next few sessions. The smart money’s already positioning for it.

The Global Arbitrage Opportunity Nobody’s Talking About

Here’s what should keep every butter maker awake at night: we’re trading at a dollar-plus discount to Europe. Let me put that in perspective—U.S. butter at $1.58 while the EU’s at $2.63 and New Zealand’s over $3.00 per pound (calculated from EEX and NZX futures, October 2025). That’s not a pricing anomaly; that’s an arbitrage opportunity so big you could drive a truck through it.

Now, why aren’t exports exploding? Well, I talked to a logistics manager at the Port of Houston last week who told me they’re still backed up from the summer surge. “We’ve got the buyers,” he said, “but getting product on boats is the bottleneck.” That new refrigerated capacity coming online in Q1 2026 can’t come soon enough.

Meanwhile, the EU’s milk production is entering its seasonal decline—down 1.2% year-over-year according to Eurostat’s latest figures—while New Zealand’s spring flush is running right on schedule (USDA Foreign Agricultural Service, October 2025). The USDA just bumped their U.S. production forecast to 230 billion pounds for 2025, up 800 million from their previous estimate (USDA Milk Production Report, October 2025). More milk, same infrastructure—you do the math.

Feed Economics: The Margin Squeeze Nobody Wants to Discuss

Let’s talk about what’s really happening at the farm level. With December corn at $4.24/bushel and soybean meal at $284.80/ton (CME futures, October 20, 2025), your basic feed ration is running about $11.50/cow/day for a typical Midwest operation. Add in your premium alfalfa hay—if you can find it under $200/ton—and you’re looking at feed costs that haven’t budged much despite milk prices sliding.

The milk-to-feed ratio sits at 1.81 right now. For those keeping score at home, anything under 2.0 means you’re basically trading dollars. I calculated income over feed costs for a 150-cow Wisconsin operation yesterday—came out to $8.50/cwt. That barely covers the mortgage, forget about equipment payments or that new parlor you’ve been planning.

Production Patterns: Why Components Matter More Than Volume

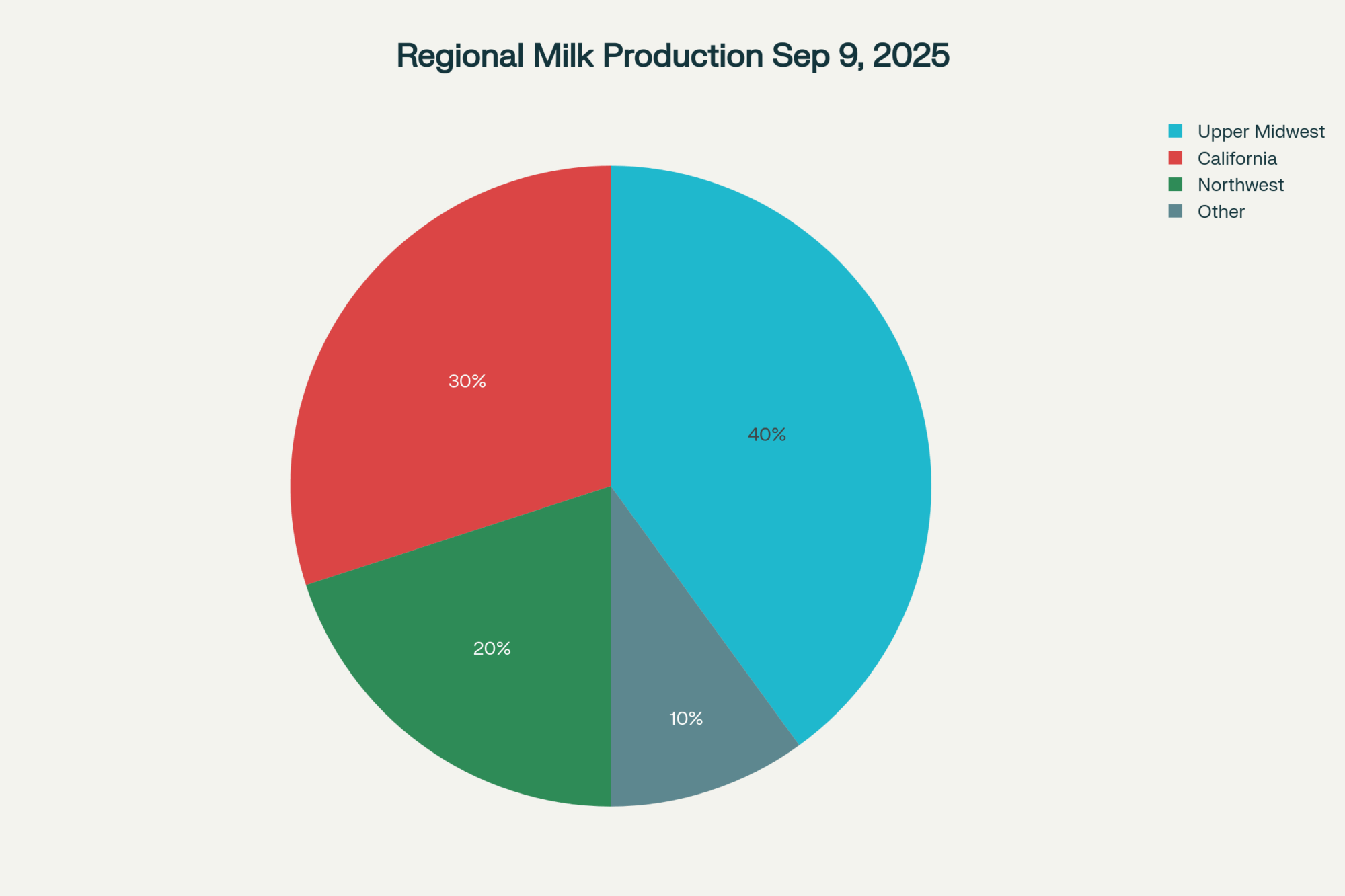

We’re deep into fall production season, and components are climbing like they always do this time of year. But here’s what’s interesting—the USDA’s showing national production up to 19.3 billion pounds for September, with the Midwest actually down 0.8% year-over-year while California jumped 5.2% (USDA Milk Production Report, September 2025).

The Wisconsin guys I talk to are seeing butterfat hit 4.1-4.2%—fantastic for their checks if only butter prices would cooperate. Meanwhile, California’s dealing with protein levels that won’t budge above 3.2% despite all the nutrition consultants’ best efforts.

Market Drivers: The Real Story Behind Today’s Moves

Looking at what’s actually moving these markets, it’s not rocket science. Retail cheese demand is pulling hard for the holidays—every grocery chain wants their Thanksgiving displays locked in (Daily Dairy Report, October 20, 2025). Food service butter demand? Surprisingly weak for October.

“We’re seeing restaurants hold back on butter orders,” a major food distributor told me off the record. “They’re still working through September inventory. Nobody wants to sit on expensive butter going into the slow season.”

Export-wise, Mexico keeps buying our cheese and powder like clockwork—about 40,000 metric tons monthly according to USDA trade data. But the real story is what’s not happening: China. Despite their domestic production dropping 2.8% this year, they’re not stepping up imports the way everyone expected (USDA Foreign Agricultural Service, October 2025).

And those low butter prices? They should be attracting every buyer from Morocco to Malaysia. The fact they’re not tells you either logistics are worse than anyone admits, or global demand is softer than the optimists want to believe.

Forward Curve Analysis: What the Futures Are Telling Us

The October Class III contract at $17.01 versus Class IV at $14.15—that’s a $2.86 spread that’s simply not sustainable (CME futures, October 20, 2025). Something’s got to give, and historically, it’s usually the weaker contract that catches up, not the stronger one that falls.

Looking out to Q1 2026, Class III futures average $16.35 while Class IV sits at $15.80 (CME futures curve, October 20, 2025). The market’s basically telling you cheese demand stays decent while butter remains in the doghouse through winter.

For hedging, those January $16.50 Class III puts trading at 35 cents look like cheap insurance to me. On the Class IV side? If you’re not already protected, you’re playing with fire. The December $15.00 puts at 48 cents aren’t cheap, but neither is bankruptcy.

Regional Focus: Upper Midwest Riding the Cheese Wave

Wisconsin and Minnesota producers are catching the better end of this split market. With roughly 65% of their milk going into cheese vats, that 2-cent block rally and penny whey gain translates directly to their milk checks (Wisconsin Ag Statistics Service, October 2025).

“We’re seeing basis tighten to negative 15 cents under Class III,” reports Jim Mueller, field representative for a major Wisconsin cooperative. “Plants need milk for holiday cheese production. The competition’s keeping premiums decent—for now.”

But it’s not all good news. Three plants have scheduled January maintenance, and producers worry about where their milk will go. “Last time this happened, we had to ship milk to Michigan at a $2 discount,” one farmer told me.

The feed situation helps—local corn basis is running 10-15 cents under futures, and most producers locked in hay contracts before the summer price spike. Still, with all-milk price averaging $19.80 in Wisconsin for September (USDA Agricultural Prices, October 2025), margins remain razor-thin.

Your Action Plan for Tomorrow Morning

Here’s what I’d be doing if I was still running a dairy:

For Class III producers: Watch for December futures to push above $16.75. If they do, consider laying in Q1 2026 hedges. This seasonal strength won’t last past New Year’s.

For Class IV heavy operations: This is crisis mode. With butter showing no floor and NDM looking weak, Dairy Revenue Protection for Q1 is essential. Yes, the premiums hurt, but not as much as $14 milk.

Feed procurement: At $4.24 corn, lock in 60-70% of your winter needs now. My feed broker thinks we could see $4.50 if the South American weather turns ugly. Soybean meal under $285 is buyable.

Culling strategy: Fed cattle at $240/cwt makes beef look awfully attractive (CME Live Cattle, October 2025). That marginal producer in your herd? She’s worth more at the sale barn than in the tank.

The Bigger Picture: Industry Intelligence

A couple developments worth watching:

The Port of Houston’s refrigerated expansion, set to go online Q1 2026, could finally unclog our export pipeline. “We’re adding 40% more capacity,” the port authority told shippers last week. If true, that butter discount to world prices becomes very interesting.

FDA’s publishing new plant-based labeling rules next month. Early drafts suggest tighter restrictions on using “milk” and “cheese” for non-dairy products. Could be worth a few percentage points of fluid demand if it sticks.

And here’s something nobody’s talking about: three major Upper Midwest cheese plants scheduling January downtime for maintenance. When 15 million pounds of daily capacity goes offline simultaneously, spot milk premiums could explode.

Bottom Line: Navigating the October Crossroads

Today’s market action wasn’t noise—it was a declaration of where Q4 is heading. Butter breaking below $1.60 opens the door to test last year’s lows around $1.52. Meanwhile, cheese’s resilience above $1.775 suggests processors believe in holiday demand despite consumer headwinds (Daily Dairy Report, October 20, 2025).

The $2.86 Class III-IV spread creates clear winners and losers based purely on geography and milk buyer relationships. If you’re shipping to cheese in Wisconsin, you’re okay. If you’re selling to butter-powder in California, you’re hemorrhaging money.

What concerns me most? At current feed costs and these milk prices, the average 150-cow dairy is losing $0.50-1.00/cwt by my calculations. That’s not sustainable. Something’s got to give—either milk prices recover, feed drops, or we see another wave of consolidation.

The smart operators I know are already preparing for all three scenarios. They’re not trying to time the bottom or predict the recovery. They’re focused on surviving long enough to see it.

Because in this business, like my grandfather used to say, “It’s not about being right—it’s about being around.”

Stay focused on what you can control. The market will do what it wants regardless.

KEY TAKEAWAYS:

- Immediate Financial Impact: Class III producers gain $0.30-0.40/cwt from today’s cheese rally while Class IV operations lose $0.15-0.20/cwt on butter weakness—creating an annualized $108,000 revenue difference for 500-cow dairies based on milk buyer contracts alone

- Strategic Feed Procurement: Lock 60-70% of winter/spring feed requirements at current December corn ($4.24/bu) and soybean meal ($284.80/ton) levels—University of Minnesota extension analysis shows operations securing feed now versus waiting until January historically save $45,000-60,000 annually

- Risk Management Priorities: Class IV producers should immediately evaluate Dairy Revenue Protection (DRP) for Q1 2026 coverage—premium costs of $0.48/cwt provide floor protection against potential sub-$14 milk that Cornell’s dairy program models show 35% probability given current butter trajectory

- Regional Optimization: Upper Midwest producers benefit from negative $0.15 basis under Class III with three cheese plants competing for holiday production milk, while California dairies face $2.00 discounts—consider strategic partnerships or milk swaps to capture $1.00-1.50/cwt regional premiums

- Export Arbitrage Timeline: With U.S. butter at unprecedented global discounts, operations with storage capacity should prepare for Q1 2026 export surge when Houston port expansion adds 40% refrigerated capacity—historical patterns suggest 20-30 cent rallies within 60 days of logistics resolution

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More:

- Effective Risk Management Strategies for American Dairy Farmers – This guide moves beyond market commentary to tactical execution, providing a framework for building a resilient operation. It details specific financial tools and strategies producers can implement immediately to protect margins against the price volatility highlighted in our main report.

- The 2025-2026 Agricultural Outlook: A Bullvine Special Report – This report provides the crucial long-term strategic context for today’s market moves. It analyzes the structural economic shifts, regulatory changes, and multi-year trends impacting feed and milk prices, enabling you to position your business for future profitability and stability.

- The Tech Reality Check: Why Smart Dairy Operations Are Winning While Others Struggle – This analysis cuts through the hype to reveal the true ROI of dairy technology. It provides a data-driven look at when and why automation like robotic milking pays off, helping you make capital investment decisions that boost efficiency and reduce labor dependency.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!