What if this dairy selloff isn’t temporary? Are you prepared for lower prices through 2026?

EXECUTIVE SUMMARY: We’ve been tracking today’s dairy market massacre, and honestly? It’s worse than most farmers realize. Cheese blocks crashed 5.25¢ and butter dropped 3.75¢ in heavy volume – that’s real money moving, not just market noise. The uncomfortable truth is that this selloff exposed a fundamental supply-demand imbalance that has been building for months. While everyone’s focused on the daily drama, we’re seeing U.S. producers get priced out of key export markets by aggressive EU and New Zealand competition. Your milk-to-feed ratio just took a beating – we estimate most operations dropped from 2.2:1 to barely 2.0:1 overnight. What are the seasonal demand patterns that usually support September pricing? They’re not showing up this year.Here’s what’s really concerning: futures markets are trading at discounts to USDA forecasts, which typically means either the government’s too optimistic or smart money’s positioning for worse. We think it’s time to stop hoping for a bounce and start protecting what margins you still have.

KEY TAKEAWAYS

- Heavy volume selloff signals institutional money is bailing – 11 cheese block trades on a 5.25¢ drop isn’t retail panic, it’s professional money making strategic exits. Consider locking in Q4 and Q1 2026 pricing before this gets worse.

- Export competitiveness is eroding fast – at $1.17/lb, our NDM is pricing 6-14¢ above EU and New Zealand equivalents. That’s why export volumes are struggling and domestic prices are under pressure (CME trade data, September 2025).

- Midwest operations are taking the biggest hit – cheese-heavy regions like Wisconsin are seeing Class III base pricing crater while California’s diversified processing offers some cushion. Regional risk management strategies matter more than ever.

- Feed cost stability won’t save you when milk income drops a dollar – corn at $4.20/bu and stable soybean meal are nice, but margin compression from falling milk prices far outweighs feed savings (USDA commodity reports, 2025).

- December Class III futures around $17.00-17.50 still offer reasonable hedging opportunities – but only if you act before more farmers wake up to this reality. Put options might be your best friend right now.

Look, I’m not going to sugarcoat this – today was brutal. We’re talking about the kind of day that makes you question whether you should’ve gotten into soybeans instead of dealing with these dairy markets.

Your September milk check just took a $0.90 to $1.20/cwt beating, and this isn’t market noise – it’s the sound of fundamentals catching up with wishful thinking.

The thing about market selloffs is you can feel them building. Tuesday and Wednesday, the trading floor had that restless energy… too many people trying too hard to find reasons why cheese should be trading north of .70. Today? Reality stepped in with both boots.

What strikes me most is the volume – 11 trades in blocks alone tells you this wasn’t some algorithm having a bad day. This was real money moving, real decisions being made by people who actually understand this business. Your Class III milk is now tracking toward that uncomfortable .00-16.50 range, and honestly? That might not even be the floor.

Today’s Damage Report (And Why It Matters to Your Bottom Line)

Here’s what the trading floor delivered, and trust me, none of it was pretty:

| Product | Settlement | Daily Move | Weekly Trend | What This Means for Your Operation |

| Cheese Blocks | $1.6200/lb | -5.25¢ | ▼ -4.3% | Class III heading for mid-$16s – your base price just cratered |

| Cheese Barrels | $1.6350/lb | -4.00¢ | ▼ -3.9% | Premium to blocks signals supply chain weirdness |

| Butter | $1.9275/lb | -3.75¢ | ▼ -4.4% | Class IV components are getting hammered |

| NDM | $1.1725/lb | -1.50¢ | ▼ -4.5% | Export pricing is ourselves out of key markets |

| Dry Whey | $0.5850/lb | -0.50¢ | ▲ +3.2% | Only bright spot, but it can’t save the day |

Now, here’s what’s particularly concerning – and this is where my 20 years of watching these markets kicks in. Barrels trading at a 1.5¢ premium to blocks? That’s backwards, folks. Usually, it means either the supply chain’s getting kinked up somewhere or processors are scrambling for specific formats. Neither scenario is particularly encouraging.

The butter collapse… well, that one hurt to watch. Three-point-seven-five cents in a single session, and not a single trade to show for it. When butter traders won’t even engage – when you’ve got three bids sitting out there with four offers and nobody’s willing to make a deal – that’s telling you something about where people think fair value really sits.

What the Trading Floor Was Really Saying

The bid-ask spreads today told the whole story. I’ve been tracking these numbers for years, and when butter spreads blow out to 3×4 (that’s three bids to 4 offers for those keeping score at home), you know confidence just walked out the door.

Here’s something that caught my attention – and this is where experience matters. The 11 block trades on a 5.25¢ decline? That volume pattern screams institutional selling. Not day-traders getting cute, not algorithmic noise… real money making real decisions about where this market’s headed.

NDM’s 10 transactions tell a similar story. Export customers are clearly balking at current pricing, and honestly, can you blame them? At $1.1725/lb, we’re pricing ourselves 6-14¢ above what EU and New Zealand are offering equivalent product for.

The intraday action was textbook bear market stuff – gap down at the open, steady selling through the session, settlement right near the lows. No late-day heroes trying to catch a falling knife. That usually means tomorrow could bring more of the same.

Regional Reality Check: Upper Midwest Taking the Brunt

Let me focus on the Upper Midwest this week because that’s where today’s pain is most acute. Wisconsin and Minnesota producers – you’re feeling this directly in your Class III base pricing. The region’s cheese plants are still running, but they’re clearly not desperate enough to bid up for spot milk.

What’s particularly troubling for Midwest operations is the margin squeeze. Your local feed costs have been relatively stable – corn basis in Wisconsin is running about 15-20¢ under December futures, which isn’t terrible. But when your milk income drops a dollar per hundredweight in a single day? Those feed savings become pretty meaningless.

I’m hearing from contacts in the region that some plants are actually sitting on more inventory than anyone realized. That might explain why the buying interest just wasn’t there when prices started sliding.

California producers are getting some cushion from their more diversified processing base, but not much when the entire complex is under pressure like this.

Feed Costs: The One Bright Spot (Sort Of)

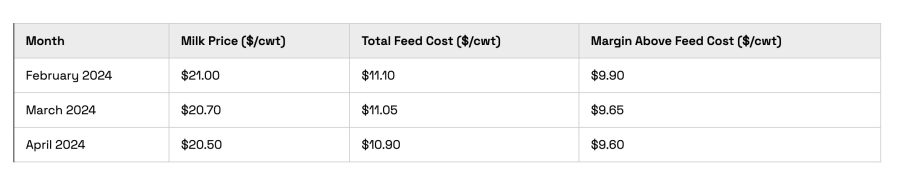

Here’s the cruel irony of today – feed costs are actually behaving themselves. December corn closed at $4.1975, soybeans are holding around $10.34, and soybean meal’s sitting at $287.70 per ton. In regular times, you’d be celebrating this kind of stability.

But when your milk income just took a beating like this? Those stable feed costs don’t help much. Let me give you some quick math that’ll make your stomach turn: if you were running a 2.2:1 milk-to-feed ratio yesterday morning, today’s price action dropped you closer to 2.0:1 or below, depending on your specific situation.

For a typical Wisconsin operation running about 150 head… we’re talking about roughly $450-600 less income per day. That adds up fast, especially when you’re already dealing with higher labor costs and equipment replacement needs.

The Export Picture (And Why It’s Getting Uglier)

This is where things get really concerning for the long-term health of our markets. At current NDM pricing, we’re just not competitive internationally – and that’s before you factor in freight costs and the strong dollar.

Mexico – still our biggest customer by volume – is getting more price-sensitive by the month. They’ve got options now, and they’re using them. Recent industry data indicate that Mexican buyers are increasingly considering EU powder as an alternative.

Southeast Asia is where we’re really losing ground. The pricing gap between our NDM and what New Zealand’s offering has widened to levels that make it hard for even our most loyal customers to justify staying with the U.S. product.

What’s particularly frustrating is that global dairy demand is actually solid. The problem isn’t that people don’t want dairy products – it’s that they don’t want to pay premium prices for them when cheaper alternatives are readily available.

China remains sporadic at best. One week they’re buying, the next week they’re ghost. You can’t build a pricing structure around that kind of inconsistency.

Looking at the Bigger Picture (USDA vs. Market Reality)

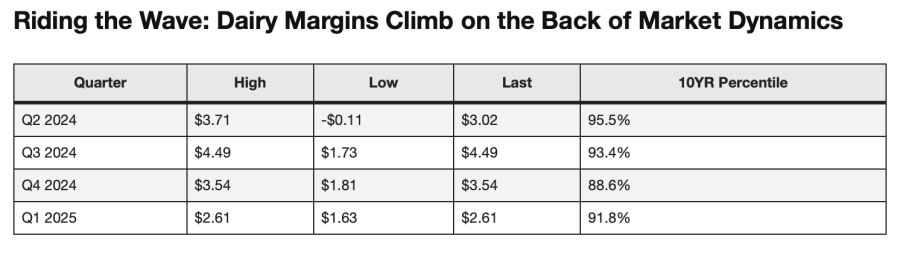

The latest USDA forecasts are still projecting the all-milk price at .00/cwt for 2025. After today’s action, that’s looking pretty optimistic. Class III futures are now trading at a discount to USDA projections, which usually means either the government’s too bullish or the market’s oversold.

My gut says it’s probably a bit of both. USDA tends to be slow to adjust their models when market sentiment shifts this quickly. But the futures market… well, it’s pricing in some pretty bearish assumptions about where demand really sits.

December Class III is trading around $17.00-17.50, and that’s becoming critical support territory. Break through there, and we could be looking at a more significant correction.

What You Need to Do Right Now (Not Tomorrow, Today)

Look, I know nobody likes getting told what to do with their operation, but today’s action demands some immediate attention:

This Week:

- Pull out your budget spreadsheets and recalculate margins based on $16.00-16.50 Class III milk. If those numbers make you uncomfortable, you need a plan.

- Get feed quotes locked for the next 90 days. With milk income dropping, securing your cost side becomes critical.

- Talk to your risk management advisor about December and Q1 2026 futures. They’re still offering reasonable protection around $17.00-17.50.

Strategic Thinking: This isn’t the year for aggressive expansion – I don’t care how good your fresh cow numbers look. Focus on efficiency over volume. Make sure every cow in your herd is pulling her weight.

Cash flow timing becomes crucial when margins get this tight. Know exactly when milk checks arrive and plan accordingly. This business doesn’t forgive timing mistakes when you’re running this close to the edge.

Industry Intelligence (What I’m Hearing)

Processing plant utilization in the Upper Midwest is running high, but plants aren’t bidding aggressively for spot milk. Some major food service buyers are reportedly pushing back on price increases – that could explain the sudden shift in demand dynamics.

One interesting development: the organic sector continues to hold significant premiums over conventional. If you’ve been thinking about transitioning… well, days like today make that premium look pretty attractive.

There are also whispers about some of the larger cooperatives getting more aggressive with their pricing discipline. Could be positioning for what they see as a longer downturn.

Putting Today in Historical Context

Here’s what experience teaches you – today wasn’t just another down day. This was a reality check with serious implications.

Looking at historical patterns, this kind of broad-based selling in September is unusual. September is typically when demand starts building for fall production runs. When you see this kind of rejection of higher prices during what should be a demand-building month… well, that tells you the structural issues in our markets might be more serious than many people assumed.

The last time I saw this kind of price action in September was back in 2019, and that correction lasted longer than most people expected. Not saying we’re heading for the same thing, but the patterns are worth noting.

The Bottom Line: Discipline Over Hope

The thing about dairy markets – and I’ve learned this the hard way over the years – is that fundamentals always win eventually. We spent the last few weeks hoping that demand would catch up with our pricing expectations. Today, the market delivered a clear message: current supply and demand fundamentals don’t support premium pricing.

Does this mean we’re heading for disaster? Not necessarily. We’ve weathered tougher markets before. However, it does mean we need to make decisions based on reality, rather than wishful thinking.

The dairy business rewards preparation and punishes hope. Today’s action was the market’s way of reminding us which camp we need to be in. Stay disciplined, protect your margins where possible, and remember – the farmers who survive these corrections are the ones who adapt quickly to new realities.

This market isn’t going to reward stubbornness or wishful thinking. But for those who adjust their strategies and manage their risks appropriately? There’s still money to be made, even in challenging conditions.

The key is making smart decisions with the information we have, not hoping for a miracle bounce that might not come.

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More:

- Profit and Planning: 5 Key Trends Shaping Dairy Farms in 2025 – This strategic analysis reveals how focusing on feed efficiency and component traits can add thousands to your bottom line. It provides actionable financial and genetic strategies to help your farm capture emerging market opportunities and improve long-term sustainability.

- Your 2025 Dairy Gameplan: Three Critical Areas Separating Profit from Loss – Get tactical with this how-to guide on the everyday decisions that separate winners from losers. It offers practical, research-backed advice on optimizing forage, using methionine, and managing transition cows to boost cow health and cut costs.

- 5 Technologies That Will Make or Break Your Dairy Farm in 2025 – Look beyond market noise and prepare for the future. This article reveals how adopting innovations like smart calf monitoring and advanced health systems can slash mortality rates and increase labor efficiency, securing your competitive edge for the long run.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!