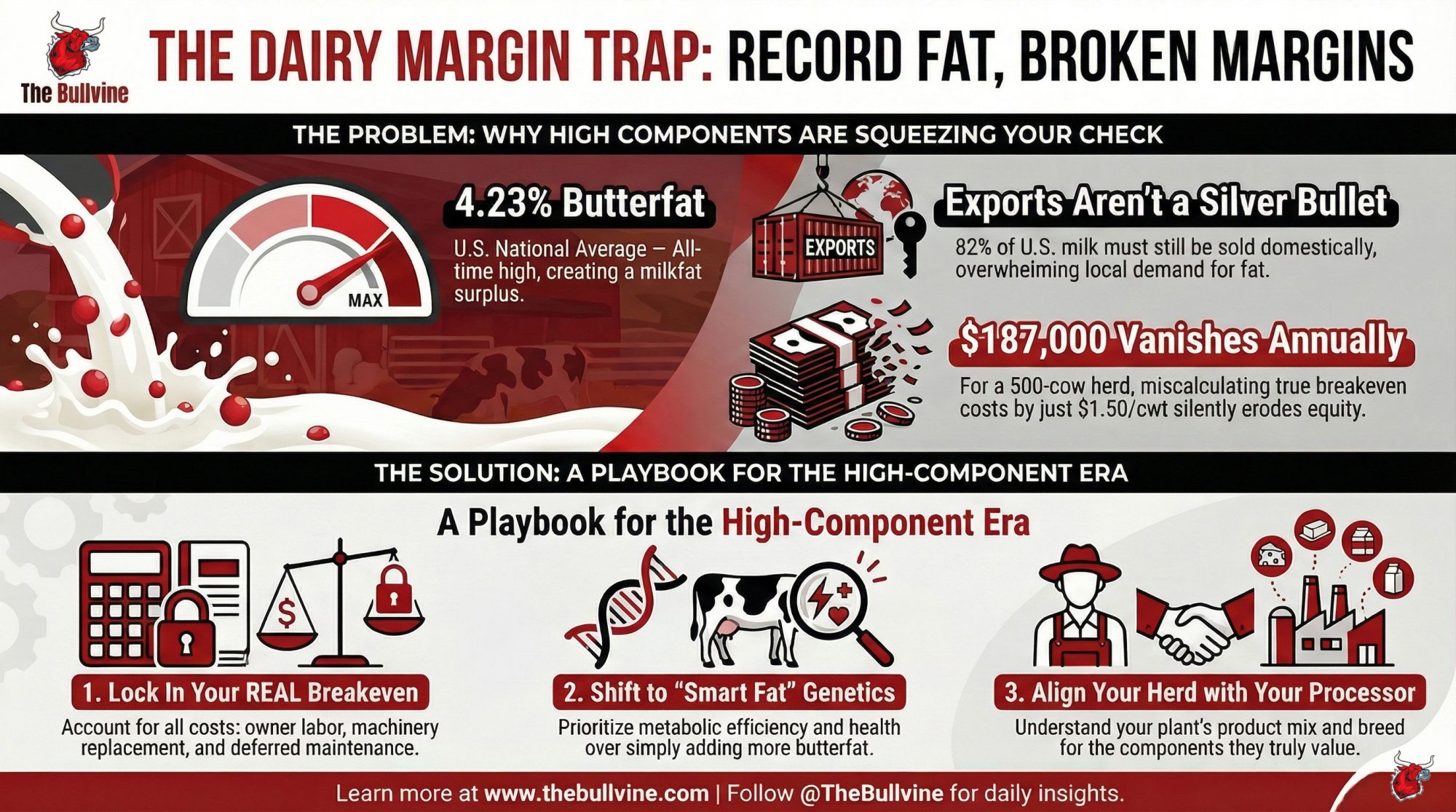

4.23% butterfat—an all-time record. $187,000 gone from a 500-cow herd—silently. That’s not bad luck. It’s the margin math that broke 2025 and shapes who wins by 2028.

Executive Summary: U.S. butterfat hit 4.23% in 2024—an all-time record. Exports topped $8.2 billion. Margins still collapsed. For a 500-cow herd underestimating true breakeven by just $1.50/cwt, that translates to roughly $187,000 in equity vanishing annually—often invisibly, until the lender starts asking hard questions. This isn’t cyclical bad luck; genomic selection has locked the national herd into high-component production through at least 2028, while 82% of U.S. milk still clears domestically, no matter how strong exports run. Regional pain points vary sharply: eroding Class I premiums in the Northeast, punishing cost structures in California, and processor-dependent fortunes across the Southwest. What follows is the margin math that explains 2025’s wreckage—and a 2026-2028 checkpoint framework for aligning genetics, breakeven reality, and processor fit before options narrow further.

You know that feeling when you look at the milk check and think, “This isn’t what the markets promised me a year ago”? A lot of dairy folks were right there in 2025.

What I’ve found, digging through the numbers and talking with economists, lenders, and producers across the country, is that 2025 wasn’t just “one bad year.” It was the point where years of genetic progress in butterfat performance, record-high component tests, and massive processing investments finally collided with the hard limits of demand and pricing. And that’s the math we need to walk through together.

The 2025 Reality: Less About Volume, More About Butterfat

Looking at this trend, one of the first surprises is that the U.S. didn’t suddenly drown in extra milk. Industry analysis based on 2024 and 2025 statistics indicates that total U.S. milk production has been relatively flat compared with earlier decades of growth. So the story isn’t just “too many cows.”

What really changed was what was in the tank.

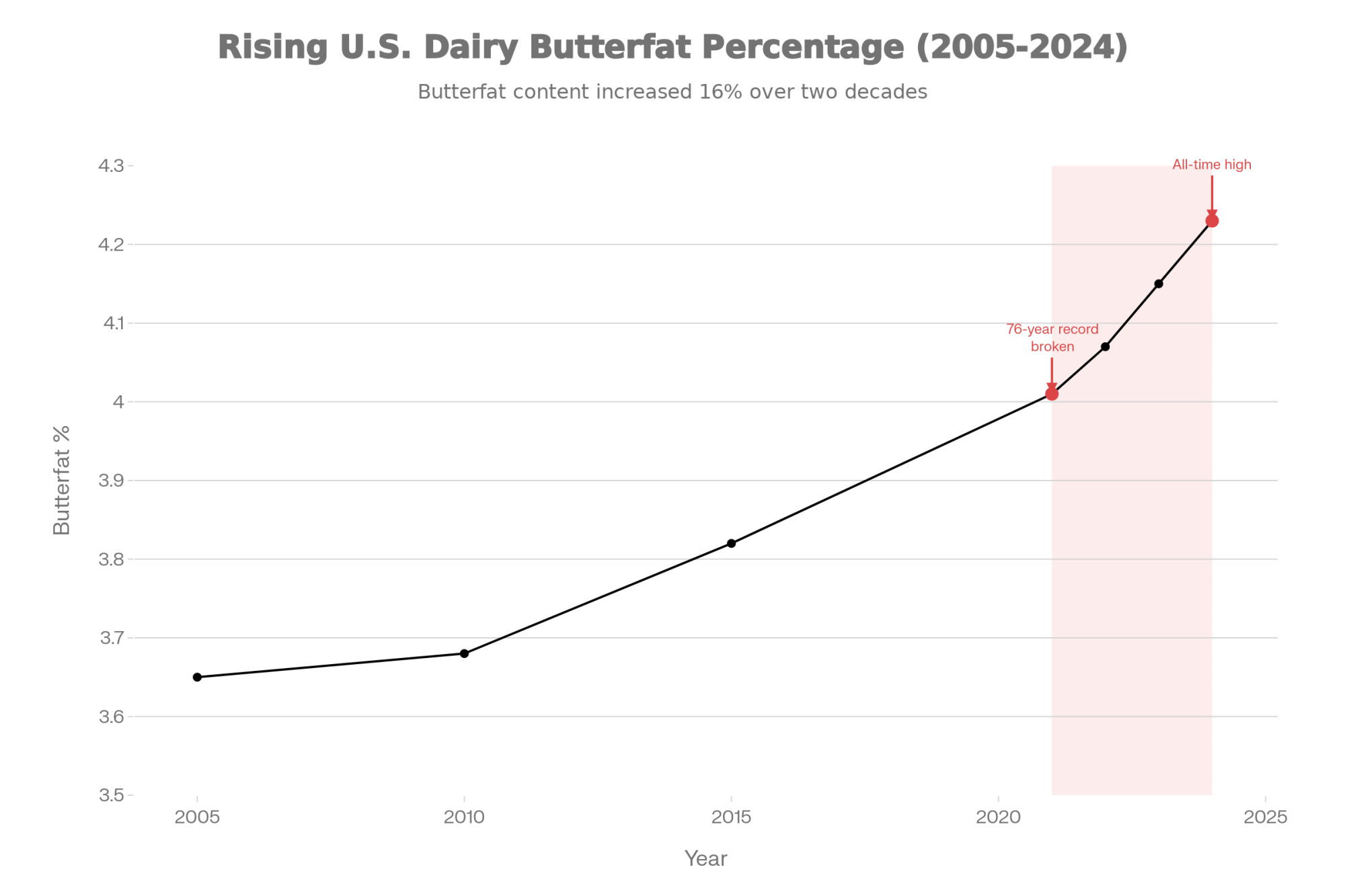

Here’s what’s interesting. Industry reports traced national milkfat trends going back decades, and for a long stretch—from the mid-1960s up to about 2010—average U.S. butterfat hovered in a remarkably tight band, around 3.65–3.69 percent. Then things started to climb. By 2021, we hit a national average of about 4.01 percent milkfat for the first time in recorded history—breaking a record that had stood since 1944 and 1945.

That moved to roughly 4.06–4.08 percent in 2022 and 4.14–4.15 percent in 2023, depending on the calculation method, with each year setting a new record. By 2024, calculated national averages around 4.23 percent butterfat and 3.29 percent protein using monthly USDA National Agricultural Statistics Service data. That lines up with what many of you are probably seeing on DHI sheets—cows that were once 3.6–3.7 percent now sitting comfortably over 4.0.

It’s worth noting that because total milk volume hasn’t grown nearly as fast as butterfat tests, the total pounds of milkfat have jumped faster than the pounds of milk. From 2022 to 2023 alone, U.S. milkfat production increased by about 136.2 million pounds—a 1.5 percent gain—despite modest growth in total milk.

At the same time, price reports and commentary from CME, USDA, and the Farm Bureau, along with our own analysis here at The Bullvine, showed butter and cheese markets under pressure in 2024 and 2025 as stocks built and global competition intensified. So the 2025 reality wasn’t just “more milk.” It was a lot more fat in roughly the same milk pool, with fewer places to sell that fat at the premiums we’d gotten used to.

The Long Component Shift, in One Glance

To put the component story in perspective, here’s a simple snapshot using ranges and figures drawn from USDA statistics and industry analysis.

Table 1. The Component Shift (National Picture)

| Year | Approx. Avg. Milkfat % | Primary Market Focus | Phase |

| 2005 | mid-3.6% range | Fluid milk / volume | Old baseline |

| 2021 | 4.01% | Fat premiums are gaining traction | The “pivot” |

| 2023 | 4.14–4.15% | Fat clearly leading the check | The “boom” |

| 2024 | ~4.23% (estimated) | High-component “new normal.” | The “overload” |

Industry reports confirm that milkfat set a new annual record four years in a row, leading into 2024. And when you combine that with industry genetics coverage and what we’ve been tracking here, the component gains have been fueled by coordinated genetic selection, nutrition programs, and management improvements. Put together, the message is clear: we’re not drifting back to 3.6–3.7 percent as a national norm anytime soon.

Why Exports Didn’t “Save” 2025

What farmers are finding—and you probably know this already if you’ve been watching the trade reports—is that the export story is a bit of a double-edged sword.

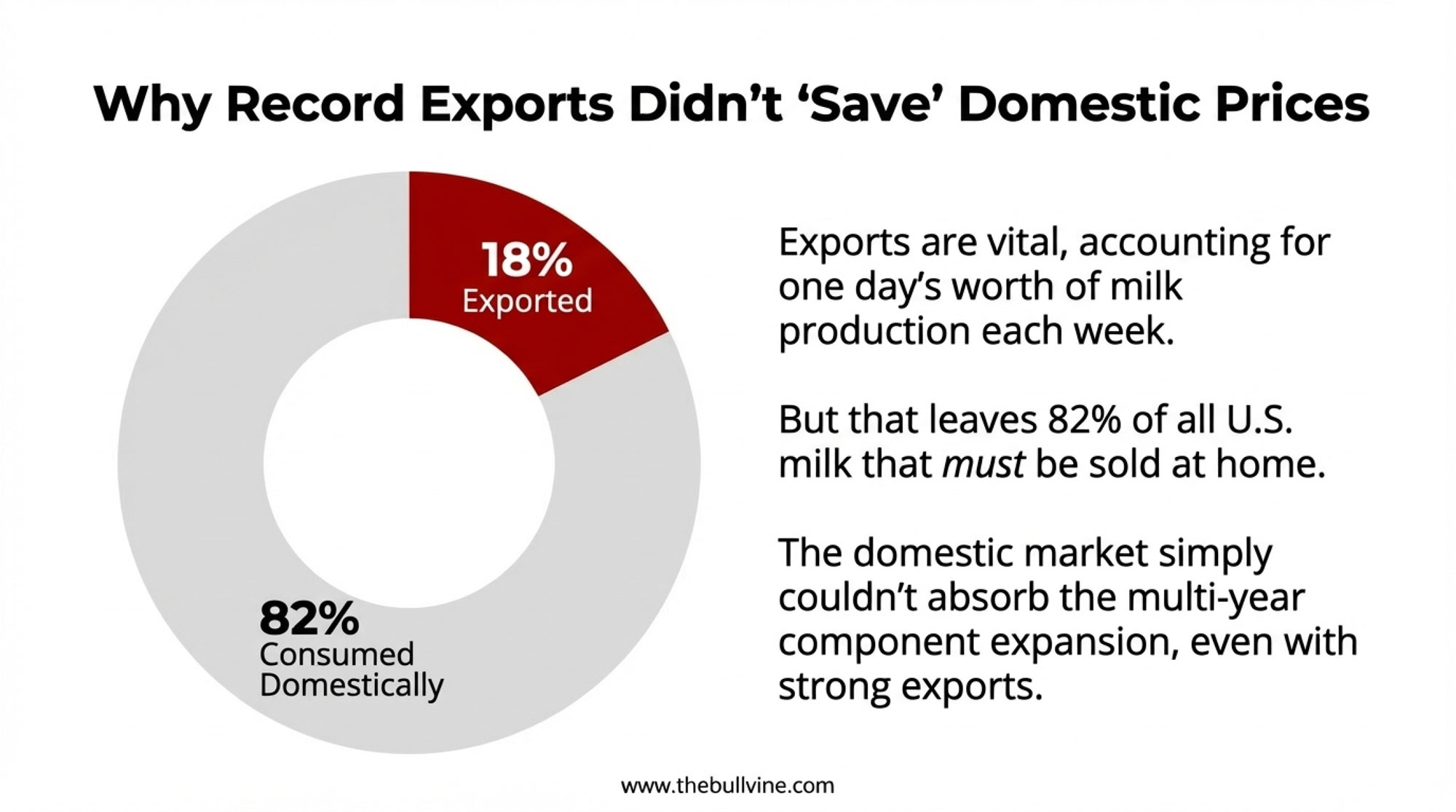

USDA’s Foreign Agricultural Service and industry groups like USDEC and IDFA have all highlighted that U.S. dairy exports hit record or near-record levels in recent years. Dairy Foods reported that U.S. dairy exports topped $8.2 billion in 2024—the second-highest total export value ever—with strong cheese and powder shipments to key buyers such as Mexico and Southeast Asia. And here’s the figure that really matters: according to IDFA, roughly 18 percent of U.S. milk production, on a solids basis, is now exported. That’s about one day’s worth of milk produced on America’s dairy farms each week going overseas. A huge change from 20 years ago.

So it’s fair to ask: if exports were that strong, why did domestic prices still slump?

The scale math is pretty unforgiving. If about 18 percent of U.S. milk production goes out as exports, that still leaves roughly 82 percent that has to be consumed domestically. At the same time, the national butterfat average went from roughly 4.01 to 4.08 to 4.15 to over 4.2 percent in just a few years. So even if total milk volume is nearly flat, the pounds of fat looking for a home are not.

| Market Destination | % of U.S. Milk (Solids Basis) | Key Vulnerability | 2024–2025 Reality |

| Domestic consumption | 82% | Hard ceiling on fat absorption | Butter stocks built despite record components; Class I utilization down to 30% in Northeast |

| Export markets | 18% | Price competition with EU/Oceania | $8.2B record exports in 2024, but often at discounted prices to move volume |

| Processing capacity | 100% | Processor product mix locked in | $11B in new plant investments (2025), but most designed for specific component profiles |

On top of that, USDEC and Farm Bureau’s dairy trade analysis have emphasized that keeping those export channels open often means being competitive on price. In multiple periods, U.S. butter and skim milk powder have had to trade at a discount to European and Oceania products to move volume.

Industry reports have described that dynamic as a mix of record exports and tight margins, as a defining feature of the last couple of years. We covered the implications of this in our piece on 2025’s dairy dilemma.

What’s encouraging is that in some regions, especially in the West and Southwest, export-oriented plants have been a lifeline. Industry coverage of new powder and cheese facilities in Texas, New Mexico, and Kansas shows how those plants have created strong localized demand and a better basis for dairies in those draw areas, many of them large freestall or dry lot systems. In those cases, exports aren’t an abstraction; they’re the reason the local processor can keep taking milk.

But zooming out, the data from USDEC, IDFA, Farm Bureau, and industry analysts suggests exports did about as much as they reasonably could—and still couldn’t completely mop up the extra butterfat coming out of U.S. herds. When 80-plus percent of your product still has to clear domestically, multi-year component expansion will eventually show up in the price.

Genetic Momentum: The Part You Can’t Undo Next Breeding Season

Here’s where the genetics piece comes in, and it’s one of the most important parts of this whole story.

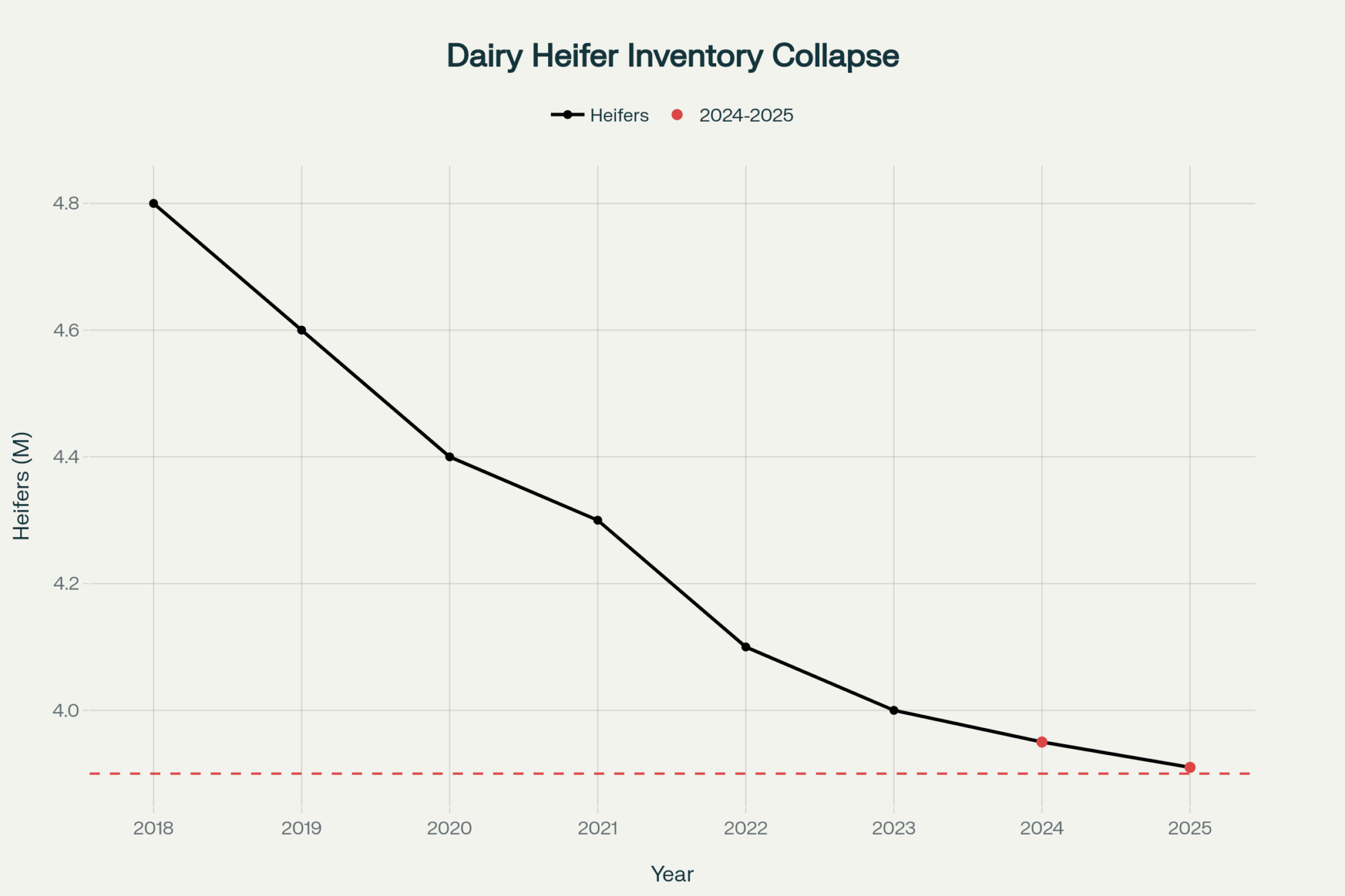

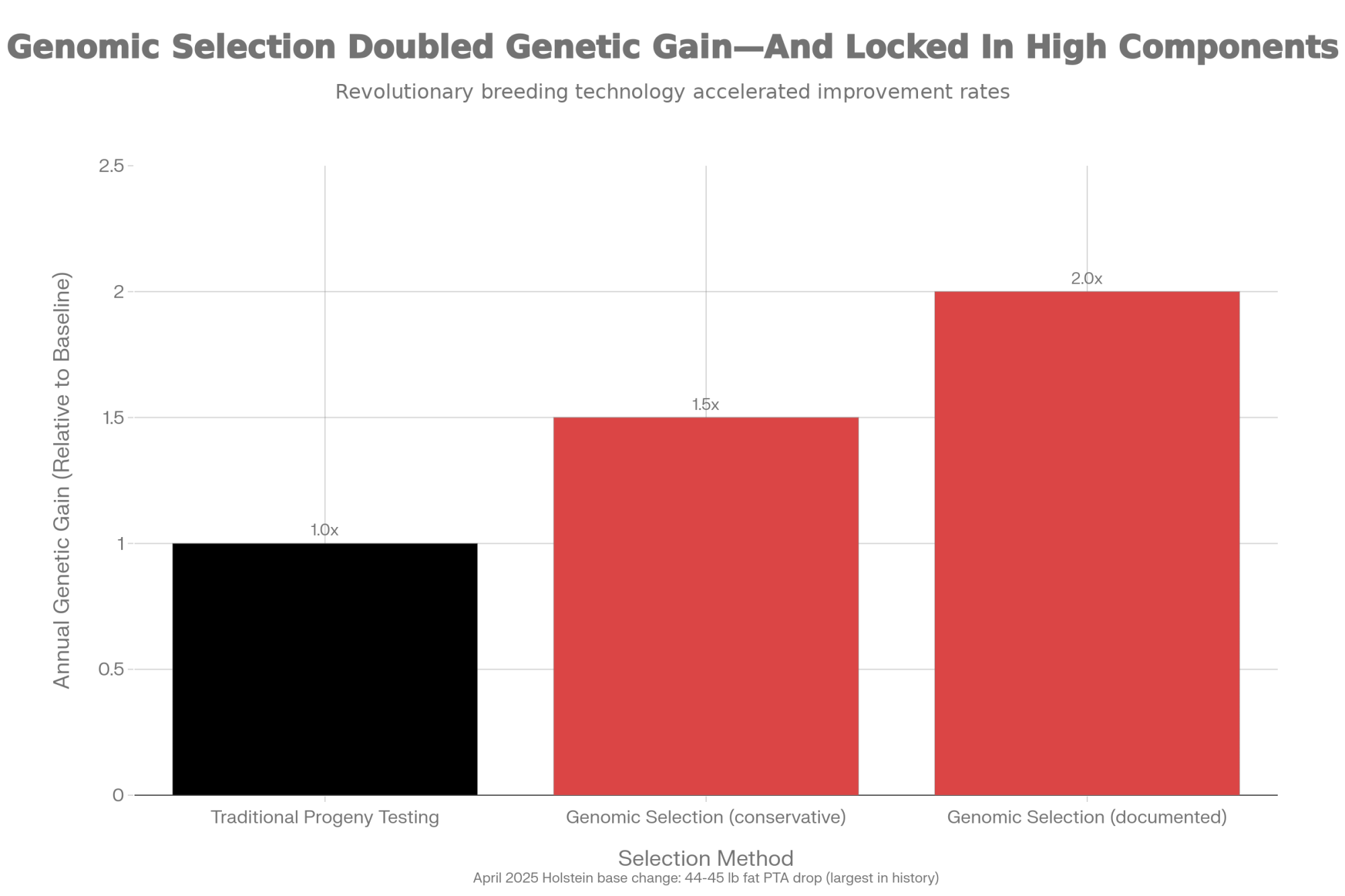

Coverage has spelled out how dairy cattle in the U.S. have essentially entered a “high-component era” thanks to genomics and selection for fat and protein. Genomic selection, shorter generation intervals, and focused breeding goals have stacked more fat and protein into the national herd over the last decade.

And the research backs this up. Peer-reviewed genetics papers published in journals such as Genetics, Selection Evolution, and PNAS have documented that genomic selection has increased genetic gain rates for production and component traits by 50% or more compared with traditional progeny-testing systems. Some studies show even larger gains—the Frontiers in Genetics review on U.S. dairy cattle genomic selection noted that the program has essentially doubled the rate of genetic gain.

The April 2025 Holstein base change really drove this home. According to documentation from NAAB and Select Sires, this was one of the largest base changes in history—resetting values to 2020-born cows with PTAs for fat dropping by about 44-45 pounds in the adjustment. That tells you just how much the genetic level has climbed. We covered the implications in our April 2025 US Holstein Evaluations analysis.

Here’s what that means in the parlor. A heifer you bred in 2021 or 2022 to a high-component genomic bull freshened in 2023 or 2024. Her daughters—already on the grow—will be milking through 2028–2030. So while you can start adjusting your sire lineup today—maybe shifting a bit more emphasis toward protein, feed efficiency, and health—you can’t un-breed the decisions from five years ago.

Land-grant university extension programs have been pretty clear in their 2024–2025 outlook discussions: the industry is genetically “pre-loaded” for high butterfat and strong solids for at least the next several years. The cows in the pipeline and the base-change data both point in that direction.

If current component and utilization trends continue, it’s hard to see a world in the late-2020s where butterfat returns to scarcity. Much more likely is a reality where high butterfat is the baseline, and the true differentiators are metabolic efficiency, health, and how closely your herd’s profile matches your plant’s needs.

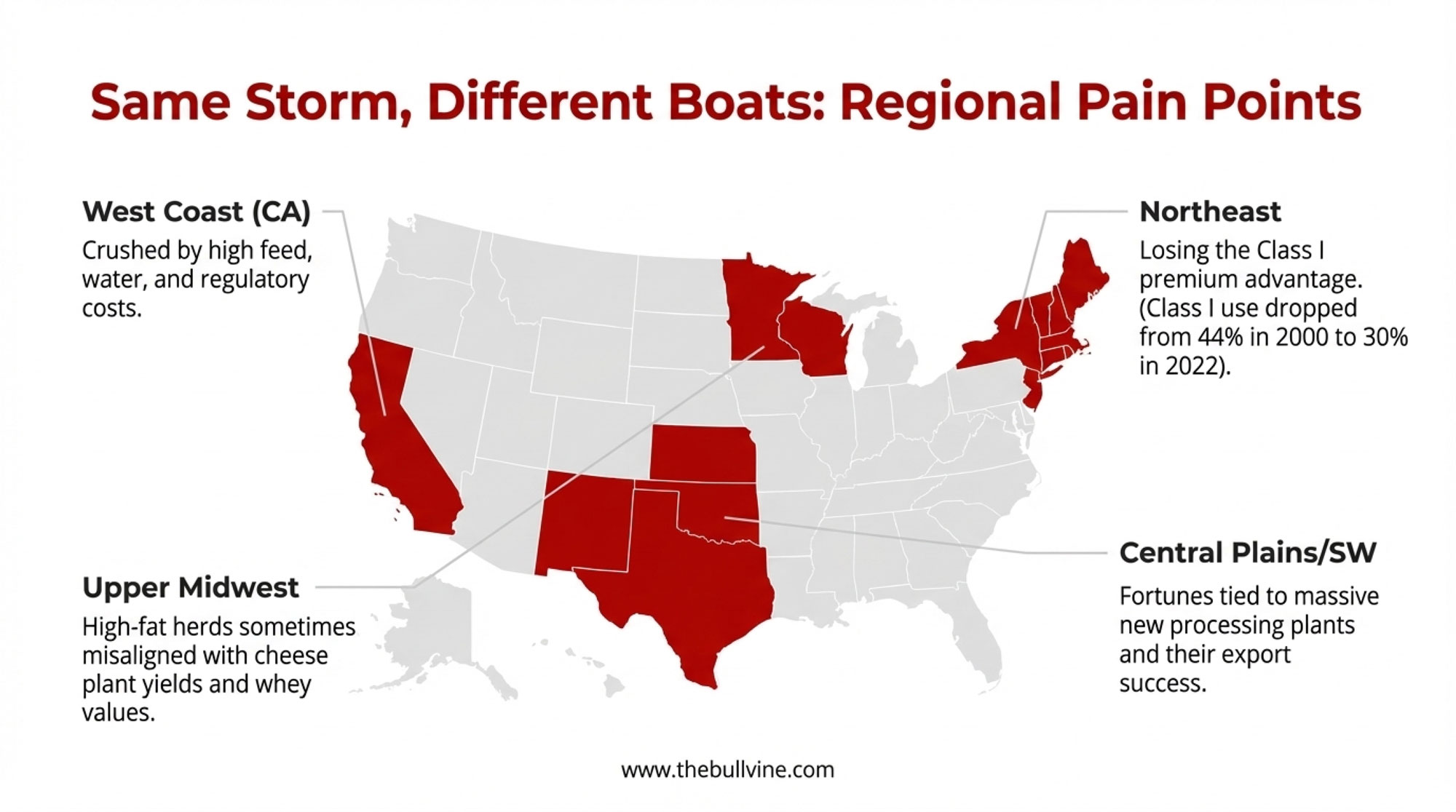

Regional Pain Points: Same Storm, Different Boats

What farmers are finding is that the same national trends play out very differently depending on where you are and who you ship to.

Table 2. Regional Pain Points (2025–2026 Snapshot)

| Region | Primary Market Structure | Biggest Margin Killer (2025) | Est. Breakeven Range ($/cwt) | Strategic Position |

|---|---|---|---|---|

| Northeast (FMMO 1) | Fluid-to-manufacturing shift | Loss of Class I premiums (44% → 30% utilization) | $21–$24 | High-cost structure meets manufacturing pricing; margin squeeze acute |

| California & West Coast | Mixed fluid/manufacturing/export | Feed + regulatory costs + co-op loss pass-throughs | $20–$23 | Punishing input costs; basis often below U.S. average |

| Upper Midwest (WI/MI) | Cheese-focused, high components | Component mismatch with some plants; 4.2%+ fat not always rewarded | $17–$20 | Strong processing diversity, but not all plants optimize ultra-high butterfat |

| Central Plains / Southwest (TX/NM/KS) | New cheese & ingredient plants, export-linked | Processor-dependent; need consistent volume to justify $11B buildout | $16–$19 | Best positioned if tied to new plants; vulnerable if outside draw areas |

In the Northeast, FMMO 1 data and Cornell/Penn State extension work indicate that Class I (fluid) utilization has declined significantly. Analysis has documented that in the Northeast, Class I milk utilization fell from 44 percent in 2000 to 30 percent by 2022. That’s a dramatic shift, and it means more milk is being priced in manufacturing classes. Coverage of FMMO reform and Order 1 discussions has highlighted how that erodes the fluid premium that used to support many smaller and mid-size herds. Producers there are now being judged much more directly on components and the all-in cost structure.

In California and other Western states, the cost picture is especially tight. Feed, water, and regulatory burdens are already higher than in many other regions.

On top of that, reports have documented co-ops passing losses through to members during tough stretches, leaving some producers with net milk prices materially below the national all-milk price. Stack those together, and you have a very narrow margin for error.

In the Central Plains and Southwest, there’s been massive investment in new processing capacity. IDFA reported in October 2025 that more than $11 billion is flowing into 53 new or expanded dairy manufacturing facilities across 19 states, with Texas alone receiving about $1.5 billion. We examined these dynamics in our piece on the $11 billion wave of processor investments. Industry coverage has documented specific projects including Cacique Foods in Amarillo, Great Lakes Cheese in Abilene, H-E-B in San Antonio, and Leprino Foods in Lubbock. Many of those plants are designed around large freestall and drylot systems that supply consistent volume. Producers in those regions often report strong local demand and aggressive base allocations, even in weaker price windows, but they’re also tied tightly to the success of those new plants and their export programs.

In Wisconsin and other Upper Midwest states, statistics and extension data show a mix of strong production, high butterfat, and diversified processing: cheese, butter, whey, specialty products. But even there, when state and national butterfat levels pushed firmly into the 4.0+ range, not every product mix could reward unlimited fat—especially plants focused heavily on cheese yield and whey solids.

A Note for Canadian Producers: The specifics differ north of the border—quota systems buffer volume swings and provide different price dynamics. But the underlying component and cost pressures are real in Canada too, and conversations about efficiency, genetics, and processor fit are just as relevant. The genetic momentum we’re describing is continental, not just American, and many of the strategic questions around breeding emphasis and cost structure apply regardless of which side of the border you’re milking on.

So while the national numbers are the same for everyone, the pain points—and the opportunities—vary a lot by region and processor.

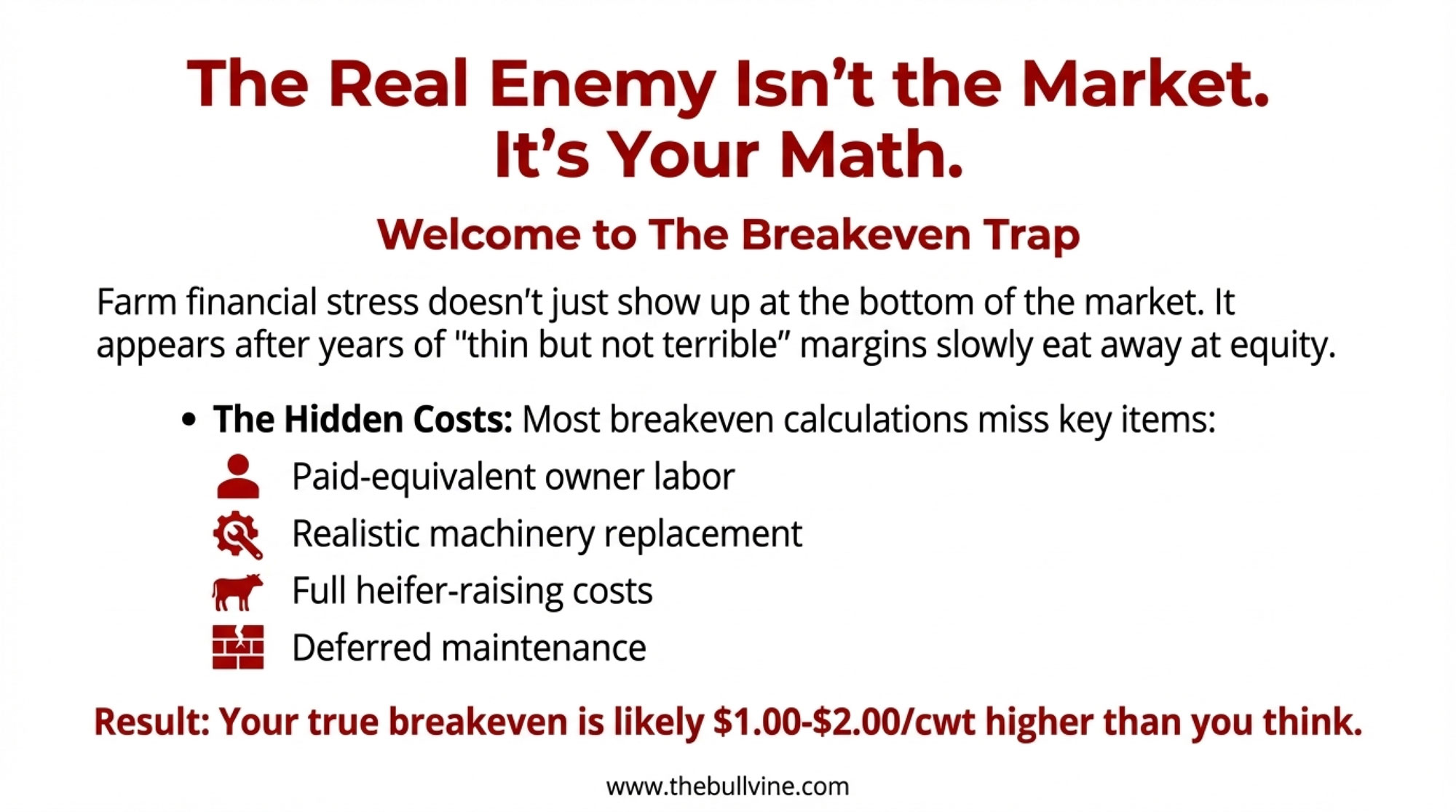

The Breakeven Trap: Where “Almost Okay” Eats Equity

Here’s the part that’s easy to overlook when you’re just trying to get through another month: the breakeven math.

Farm financial analysts, including those at American Farm Bureau and in land-grant university farm management programs, have flagged a significant uptick in Chapter 12 bankruptcies. Chapter 12 filings were up 56 percent in June 2025 compared to the prior year. Farm Policy News documented that family farm bankruptcies increased 55 percent in 2024 compared to 2023. And University of Arkansas Extension noted that Q1 2025 saw 88 Chapter 12 filings compared to just 45 in Q1 2024.

What’s striking is that these filings often don’t coincide with the absolute lowest milk prices we’ve ever seen—they show up after a few years of “thin but not terrible” margins. We explored this pattern in depth in our analysis of the 55% surge in strategic bankruptcies.

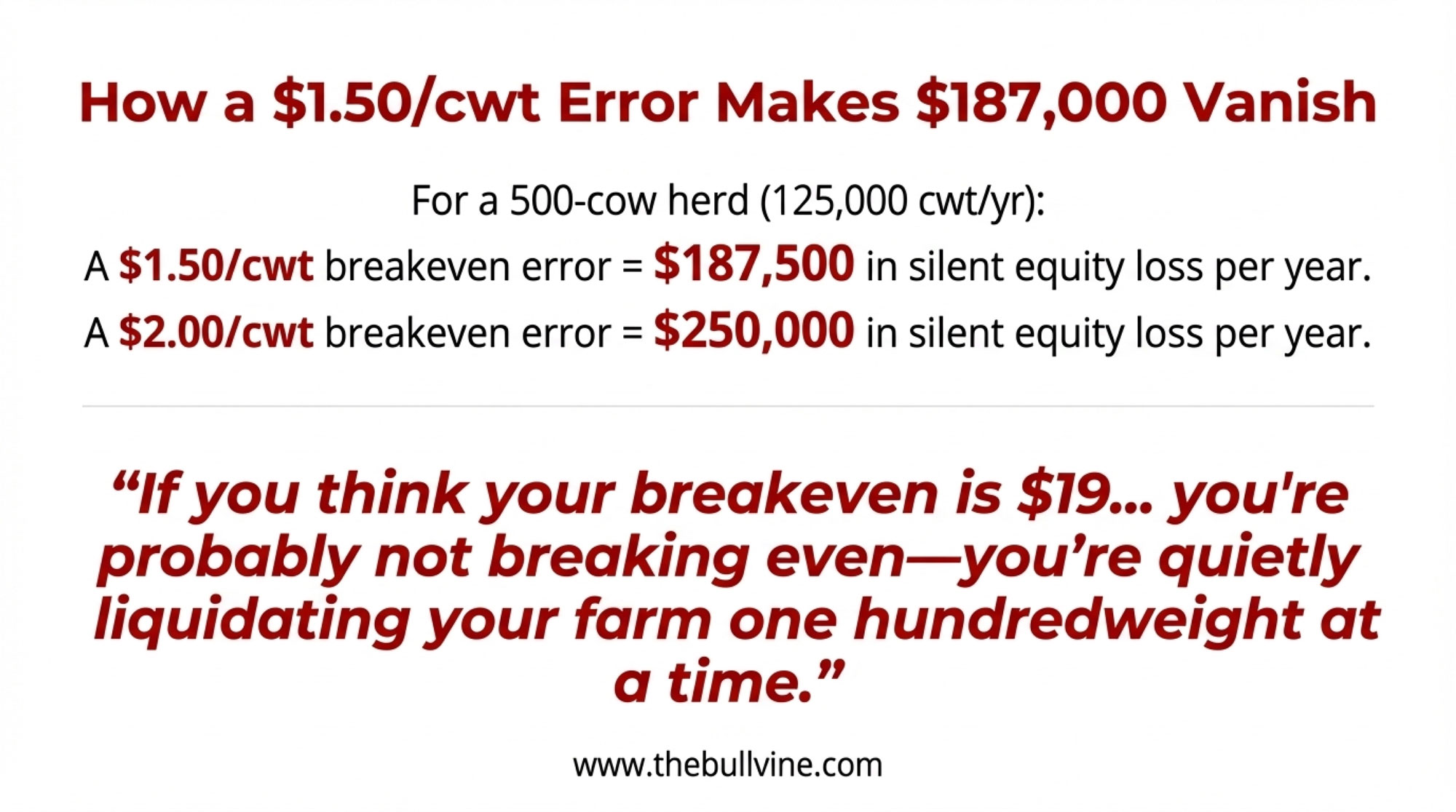

Our own “$200K Dairy Margin Trap” analysis here at The Bullvine walked through an example of how a relatively modest $1.25–$1.75/cwt squeeze between expected and actual margins can quietly drain $150,000–$200,000 a year out of a 500-cow operation. You don’t always feel that in any one month, but the balance sheet sure feels it in three to five years.

Extension bulletins from universities like Wisconsin and Penn State have stressed that many farms underestimate their true cost of production by omitting paid-equivalent owner labor, reasonable machinery replacement, heifer-raising costs, and deferred maintenance. When those are fully accounted for, breakeven often ends up $1–$2 per hundredweight higher than the “mental” number many producers are using.

To put some real numbers on it: a 500-cow herd averaging about 25,000 pounds per cow per year ships roughly 12.5 million pounds—125,000 hundredweight. If your real breakeven is $1.50/cwt higher than you think, that’s around $187,500 a year in unrecognized loss. At $2.00/cwt, it’s roughly $250,000. On a 150-cow herd producing around 37,500 hundredweight, the same $1.50–$2.00 error still adds up to roughly $56,000–$75,000 per year—enough to decide whether you can replace a tractor or re-roof a barn.

“If you think your breakeven is $19 but you haven’t fully counted owner labor, capital replacement, heifer costs, and deferred maintenance, you’re probably not breaking even—you’re quietly liquidating your farm one hundredweight at a time.”

Across three lean years, that’s hundreds of thousands of dollars of equity quietly eroded. It’s no wonder some producers feel blindsided when the bank suddenly looks nervous; the erosion happened slowly, while everyone hoped “next year” would fix it.

That’s why you’re seeing more talk from lenders and extension teams about detailed cost tracking, FINBIN-style benchmarking, and honest breakeven exercises. The goal isn’t to beat anyone up; it’s to make sure the math behind the milk check is as clear as the test sheet for butterfat.

Rethinking “Winning” in a High-Component Era

So, what farmers are finding is that the definition of “winning” has shifted.

Most serious market outlooks—including USDA’s Livestock, Dairy, and Poultry Outlook, CoBank’s Knowledge Exchange dairy briefs, Farm Bureau’s dairy market overviews, and multiple land-grant university outlook meetings—converge on a similar picture: a high-component milk supply, robust processing capacity, strong but not unlimited export growth, and ongoing Class I decline. They don’t pretend to know the exact Class III price in 2027, but they do suggest the structural pressures we’re seeing now aren’t going away.

Against that backdrop, three themes keep emerging in industry coverage and in our analysis here at The Bullvine.

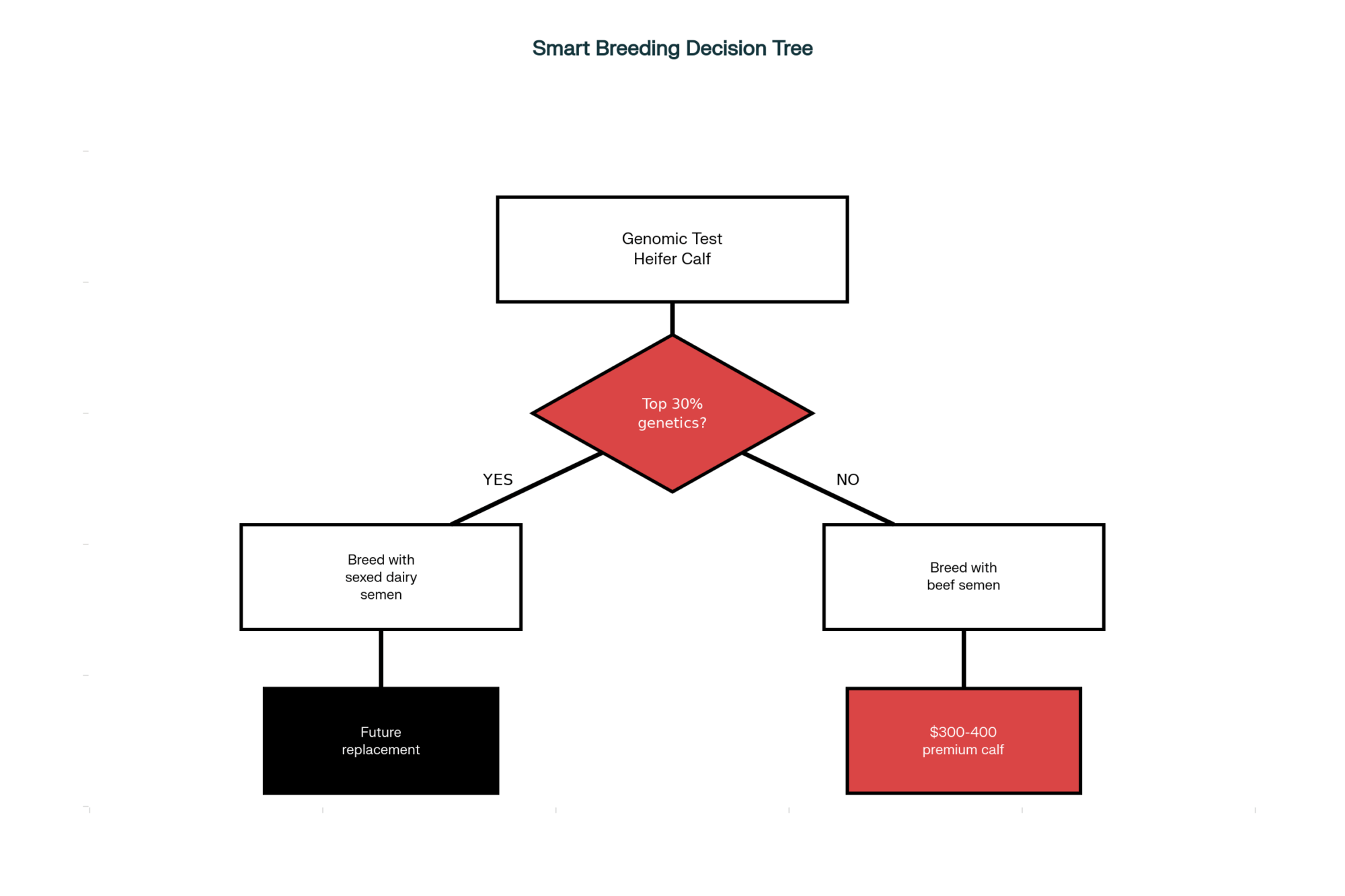

1. Genetics: From “More Fat” to “Smart Fat.”

Industry analysts have shown we can absolutely keep breaking component records with the tools we have. The question isn’t “Can we add more fat?” anymore; it’s “Is more fat the best use of the next unit of genetic progress on this farm, with this processor?”

Reviews on milk quality and economic sustainability in journals such as Animals, and systematic reviews on performance indicators, point to a growing emphasis on metrics such as feed efficiency, health, and fertility. These align with what extension geneticists say: we now have the genomic tools to select for cows that convert feed into milk solids more efficiently, stay healthier through the transition period, and last longer in the herd.

For herds shipping mainly to cheese plants with strong whey and lactose streams, it can make sense to lean a little harder into protein, casein, and efficiency traits, while maintaining solid butterfat performance. For plants more dependent on butter and cream, maintaining high butterfat is still logical—but even there, balancing it with health and feed efficiency can keep production sustainable.

2. Efficiency and Health: Durable Competitive Edge

Our margin analysis and university farm business summaries both highlight that in tight times, the herds that stay profitable are the ones that consistently produce higher income over feed cost per stall, not just more pounds per cow. We explored the feed cost dynamics in our recent piece on why smart dairies are spending more on feed.

Research on seasonal milk composition, transition cow health, and fresh cow management shows that better control of the transition period—reducing displaced abomasum, ketosis, retained placenta, and metritis—pays off in both milk components and lower vet bills. The National Mastitis Council’s “Best of the Best” roundtable and industry coverage of quality award winners show that herds with strong udder health and milking routines capture more premiums and generally have more stable production.

In practical terms, as many of us have seen and extension case studies generally support, herds that clean up transition management and tighten ration consistency often see substantial improvements in income over feed cost—sometimes more than a dollar per cow per day—without adding new technology. That’s the kind of advantage that holds up whether butter is $1.80 or $3.00.

3. Market Alignment: Matching Cows to Plants

Industry coverage and our market pieces here keeps coming back to one simple idea: the same hundredweight of milk can be worth very different amounts, depending on what your plant does with it.

Cheese plants with advanced whey and ingredient streams can usually capture more value from both protein and fat than butter-powder plants with no side-streams. Plants that sell a lot of branded consumer products may be less exposed to global commodity swings than plants that sell mostly unbranded bulk product. Co-ops that spent heavily on certain commodity investments have more riding on specific market segments.

In Wisconsin operations, for example, producers shipping to specialty cheese plants with strong whey programs often report different checks than neighbors shipping to a more traditional commodity mix, even with similar butterfat performance and protein levels. In Texas and Kansas, dairies tied to new cheese/ingredient plants have reported strong demand and competitive pricing, while those just outside certain draw areas don’t see the same benefits.

The farms that seem to be navigating this best aren’t always the biggest, but they usually have a clear grasp of three things:

- How their buyer makes money

- How their butterfat and protein profile fits that product mix

- How their cost of production stacks up against the risk profile of that market

2026–2028: Checkpoints Instead of Crystal Balls

So, where does that leave you when you sit down with your family, your lender, or your advisory team?

Nobody can tell you exactly where prices will be in June 2027. But the combination of USDA data, component trends, USDEC/IDFA trade reports, CoBank outlook briefs, and farm financial analysis provides enough structure to use checkpoints rather than crystal balls.

2026: Get Honest and Get Oriented

- Lock in a real breakeven. Work with a farm business specialist or your lender to build a fully loaded cost of production that includes owner labor, realistic machinery replacement, heifer raising, and deferred maintenance.

- Map your buyer. Identify your processor’s main products—cheese, powder, butter, fluid, ingredients, branded retail—and how they price butterfat and protein. Ask them directly how your component profile helps or hurts their system.

- Audit your herd plan. With your genetic advisor, review whether your current sire choices and culling strategy still make sense for where you expect your milk to go in 2029–2031, not just where it went in 2022.

2027: Test Your Plan Against Reality

- Compare plan vs. actual. Take your 2026 plan and match it against your actual margins, cull rates, heifer inventory, and debt service. Did the quiet equity erosion show up despite your adjustments?

- Reassess market fit. If your plant is clearly long on cream and struggling with butter, but you’re chasing ever-higher butterfat performance, it might be time to rebalance breeding goals and rations slightly toward protein, efficiency, and health.

- Decide whether to fix or pivot. If you’re still below true breakeven after making reasonable operational changes, 2027 is the year to have honest conversations about restructuring, resizing, or exploring different income strategies before equity erosion gets out of hand.

2028: Choose Your Long-Term Role

If current genetic and utilization trends continue, by 2028, we’re likely still in a world of high component prices, strong processing capacity, and export markets that are vital but not omnipotent. At that point, it’s less about hoping for a return to “normal” and more about choosing who you want to be in this system.

- Are you positioned as a lean, efficient, component-savvy herd aligned with a processor that can pay for what you produce?

- Is your breeding program clearly set up for metabolic efficiency, health, and the component balance your market values, not the one it valued five years ago?

- Does your balance sheet give you room to keep investing in fresh cow management, transition cow care, and facilities that support cow comfort, instead of just plugging leaks?

Those aren’t easy questions, but the sooner they’re asked, the more options you tend to have.

Editor’s Note on Data and Methods

The numbers in this article come primarily from USDA National Agricultural Statistics Service milk production and composition data; U.S. dairy statistics; USDEC/IDFA and Dairy Foods export summaries; Farm Bureau, Farm Policy News, and University of Arkansas Extension analysis of dairy financial stress and bankruptcy trends; CoBank Knowledge Exchange dairy briefs; IDFA manufacturing investment data; and The Bullvine’s own breakeven and margin modeling. Genetic trends and efficiency themes reflect published reviews on milk composition and economic sustainability in peer-reviewed journals, including Genetics, Selection, Evolution, PNAS, and Frontiers in Genetics, as well as NAAB/Select Sires base change documentation. These are national or regional averages and may not mirror your exact situation; that’s why we encourage you to run your own numbers and share your experience.

The Bottom Line

What’s interesting is how consistently the data and the on-farm stories line up when you step back. USDA analysis shows a steady march to higher butterfat; industry genetics coverage shows record components driven by genomics; USDEC, IDFA, and Farm Bureau show exports doing well but still capped around that 18-percent share; and farm financial analysis points to slow, quiet equity erosion when breakeven is misjudged.

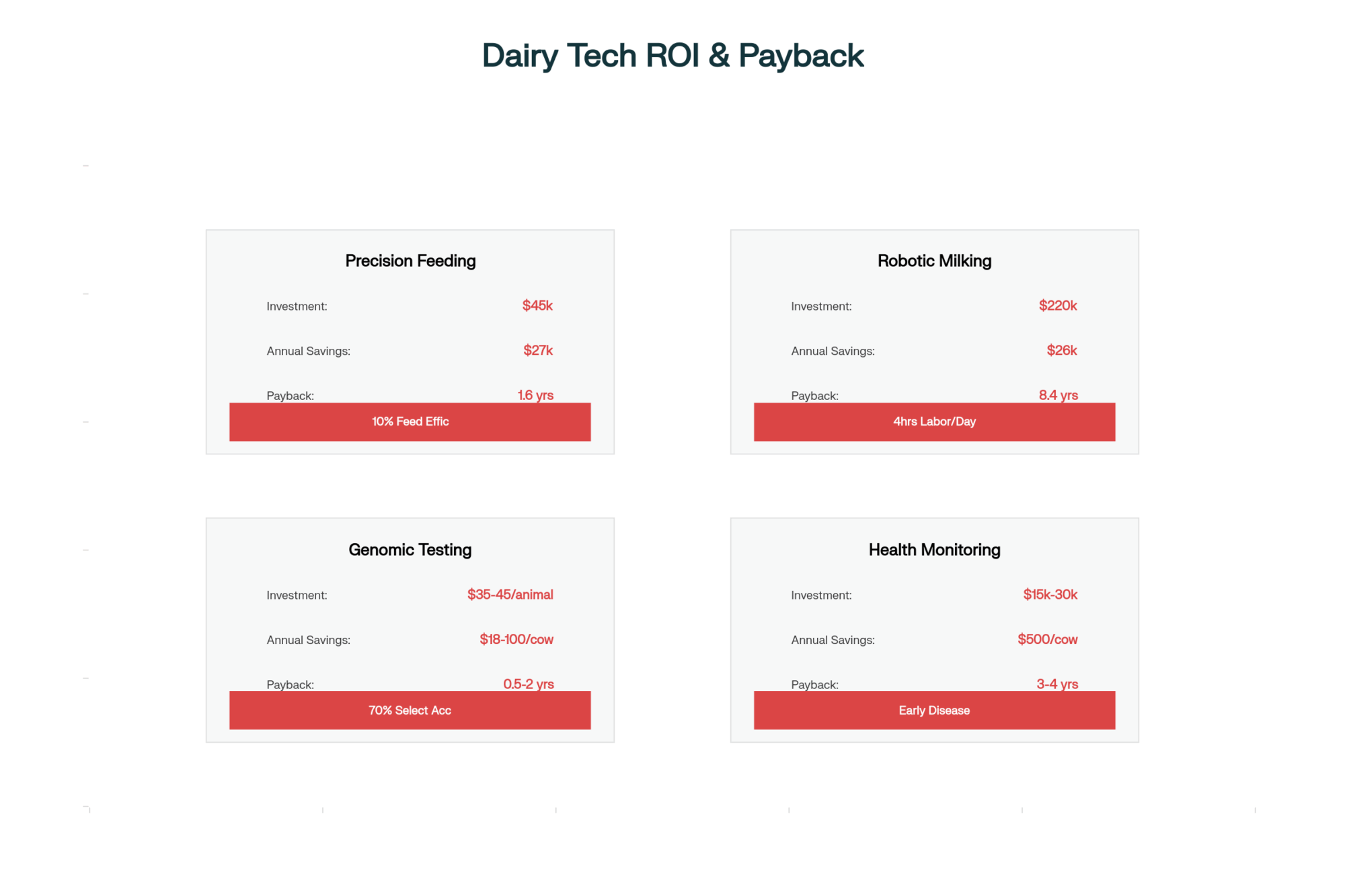

What’s encouraging is that producers have more tools than ever—genomic testing, better transition period nutrition research, fresh cow management protocols, quality benchmarking, and robust financial tools—to respond thoughtfully rather than just react.

If current trends continue, the late-2020s likely won’t be about “getting back” to some old version of the milk check. They’re going to be about thriving in a world where high butterfat is common, where efficiency and health are as valuable as raw output, and where being matched to the right plant matters more than ever.

The 2025 downturn wasn’t a random fluke; it was a feature of a system that finally caught up to its own success in components and capacity. The big question going forward isn’t when the market will fix itself. It’s whether our cows, our costs, and our contracts are lined up with the market we actually have.

So let me leave you with the same question I’ve been asking in winter meetings:

Are you still breeding and budgeting for the 2022 milk check—or are you starting to design your herd and your business for the 2028 reality the data keeps pointing toward?

KEY TAKEAWAYS:

- Record butterfat broke the margin math: 4.23% components and $8.2 billion in exports still left producers struggling—82% of milk clears domestically, and American fat demand has hard limits

- $187,000 vanishes without warning: A 500-cow herd underestimating true breakeven by just $1.50/cwt bleeds that much equity every year—often invisibly, until the lender starts asking hard questions

- Genetics locked this in through 2028: Genomic selection doubled the rate of component gain; the high-fat cows freshening now were bred years ago, and their replacements are already growing out

- Same storm, very different boats: Northeast herds face eroding Class I premiums, California operations fight punishing cost structures, and Southwest dairies have bet heavily on new processing capacity

- Decide by 2027 or drift into trouble: Lock in your real breakeven, understand what your processor actually pays for, and audit your breeding direction—the window for strategic repositioning shrinks every season

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More

- Decide or Decline: 2025 and the Future of Mid-Size Dairies – Eliminate equity leakage and regain operational control with this blueprint for 2025. It delivers the three-point checklist—financial clarity, revenue diversification, and management decisiveness—required to stop the invisible liquidation of your farm’s future.

- Breeding Into a Moving Market: What Butterfat’s Crash Reveals About Dairy’s Genetic Timing Problem – Protect your long-term equity from market volatility by mastering the genetic timing gap. This analysis exposes the mismatch between five-year breeding cycles and six-month market reversals, arming you with a diversified strategy to survive future pivots.

- Genetic Correlations Upended: Why Sticking with Old Breeding Indices Could Cost Your Dairy $486 Per Cow – And What the Data Really Proves – Capture an extra prioritize metabolic efficiency and component value over traditional, profit-killing conformation traits.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!