Feed as Science: How the Penn State Box Turns TMR Consistency into Butterfat and Profit

I was in a feed room on a Wisconsin dairy not long ago when I noticed something familiar—a brand-new Penn State Particle Separator, still in the box and tucked behind a stack of feed samples. The herd manager laughed when he saw me notice it. “We bought it last winter,” he admitted, “but we’ve been too busy to get into the routine.”

You know, that exchange says a lot about where we are as an industry. We’ve got tools that can unlock thousands of dollars in performance, but in the rush of day-to-day dairy life, the simplest ones often get sidelined. What’s interesting here is that this little plastic box—the Penn State Separator—is turning out to be one of the best pay-per-minute management tools we have.

Why Particle Size Still Deserves Attention

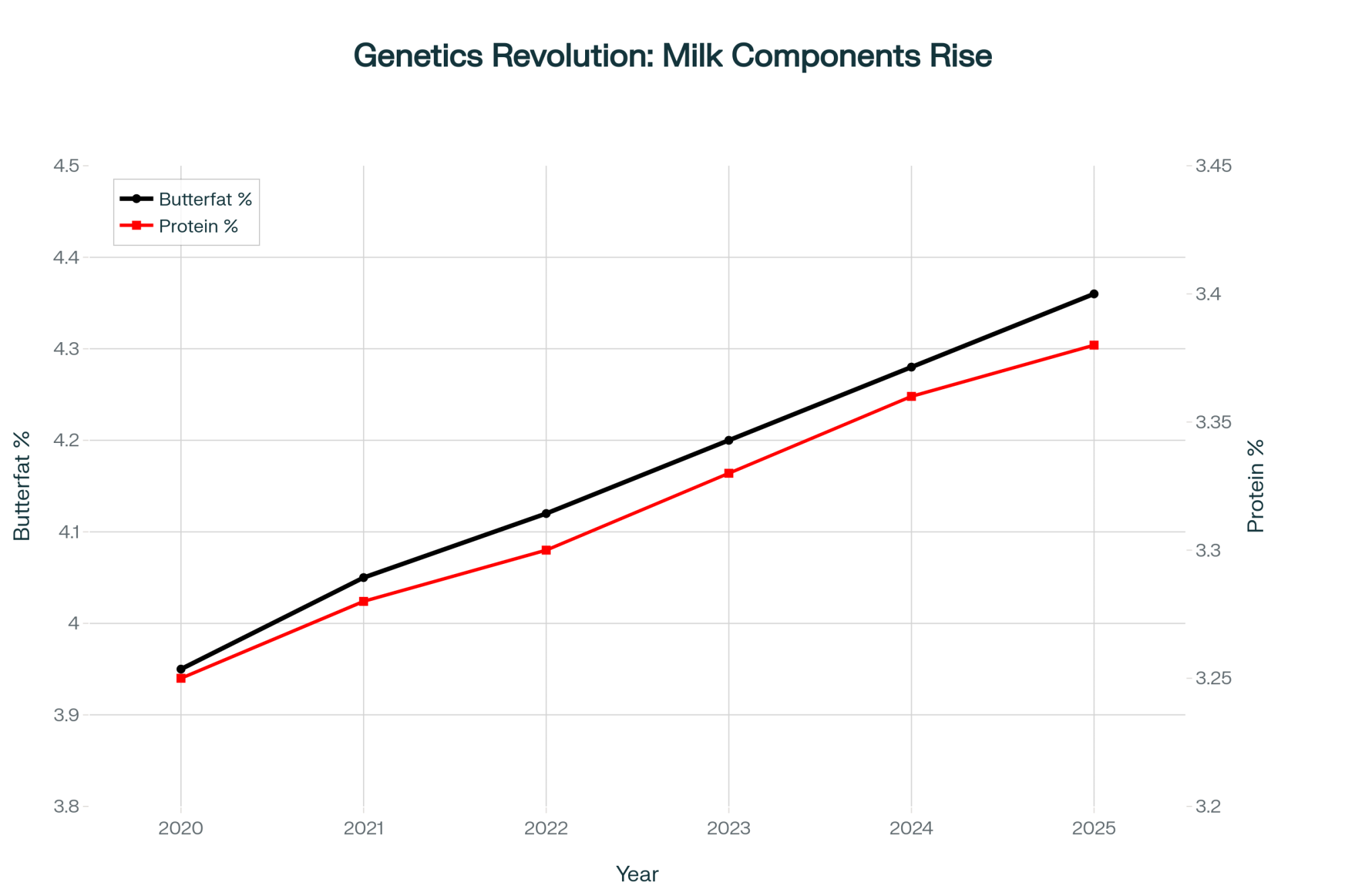

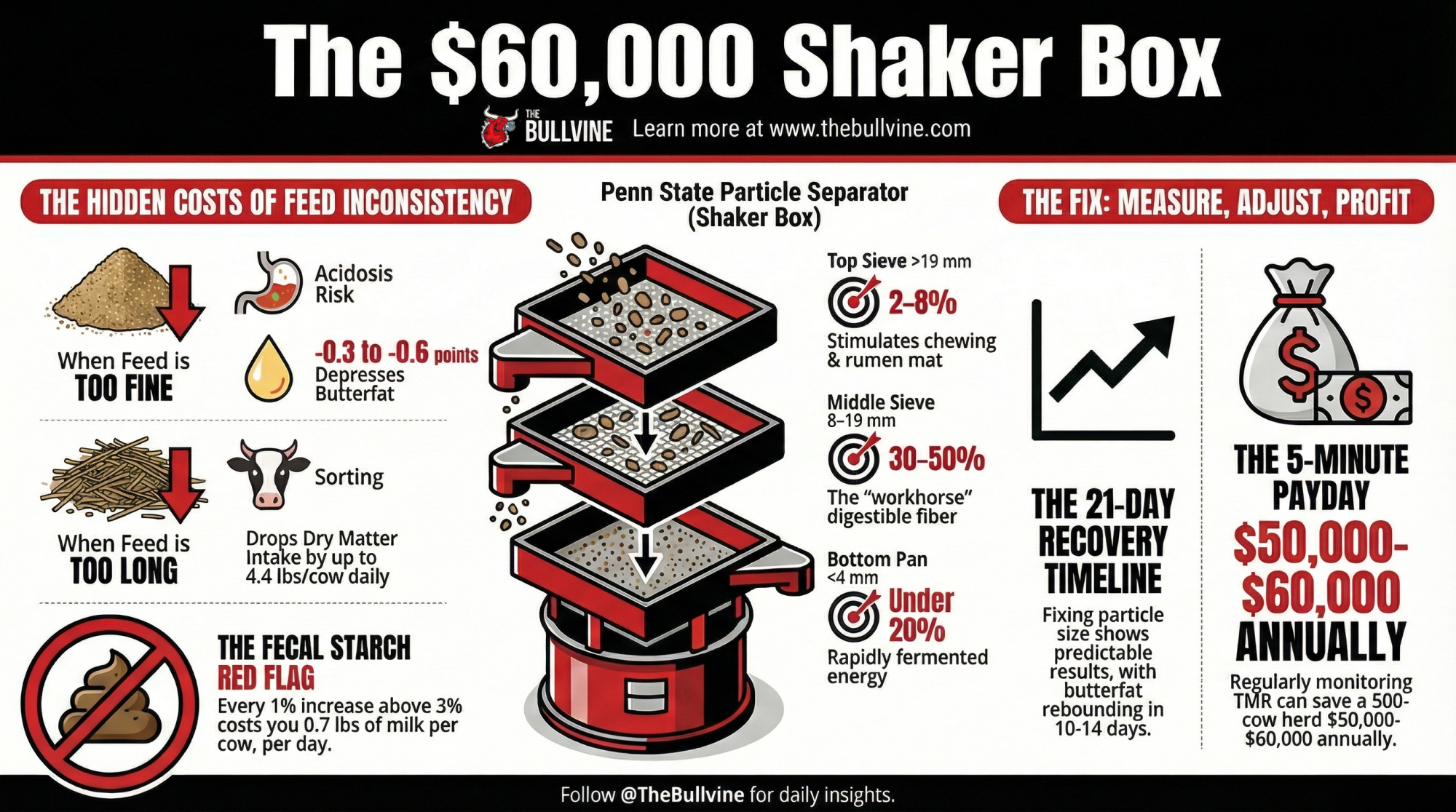

In recent years, research from Penn State Extension and the University of Wisconsin–Madison Department of Dairy Science has made one thing clear: physical feed structure drives both nutrition and profit. When TMR particle size drifts off target—either too fine or too coarse—milk output routinely dips 3–8 pounds (1.4–3.6 kg) per cow per day. Butterfat often falls 0.3–0.6 percentage points, especially when rumen function gets disrupted.

Those numbers add up quickly. For a 600-cow herd, that could easily amount to five figures in monthly component revenue left on the table.

Dr. Mike Hutjens, Professor Emeritus at the University of Illinois, puts it plainly: “Feed uniformity is your daily quality control system. Without it, you’re guessing.” And that’s the truth—consistency isn’t a luxury metric; it’s how high-performing dairies stay profitable year-round.

The Science Inside the Box

If you’ve handled a Penn State Particle Separator, you know it’s simple: four sieve trays stacked by particle size that literally show what cows are eating—not just what’s printed on the ration sheet.

For most lactating cows, Penn State guidelines suggest:

- 2–8% retained on the top (>19 mm) sieve

- 30–50% on the next (8–19 mm)

- 20–30% on the third (4–8 mm)

- Under 20% in the bottom pan (<4 mm)

What’s really fascinating is how this simple distribution tells us everything about the efficiency of rumen function. Too much fine material, and pH typically plummets below 5.8, kicking off subacute ruminal acidosis (SARA) (Krause & Oetzel, J. Dairy Sci., 2006). Too much long material, and cows start sorting, which restricts intake and upsets the delicate microbial balance that drives butterfat production.

Essentially, the Separator is a truth serum for TMR management—turning impressions into data.

When Feed Gets Too Fine – The Hidden Efficiency Leak

Overmixing is easy, especially in winter when forages dry out and mixing times stretch. The problem is subtle: rations start looking “fluffy,” but excessive blending breaks down fiber particles that cows need for natural buffering.

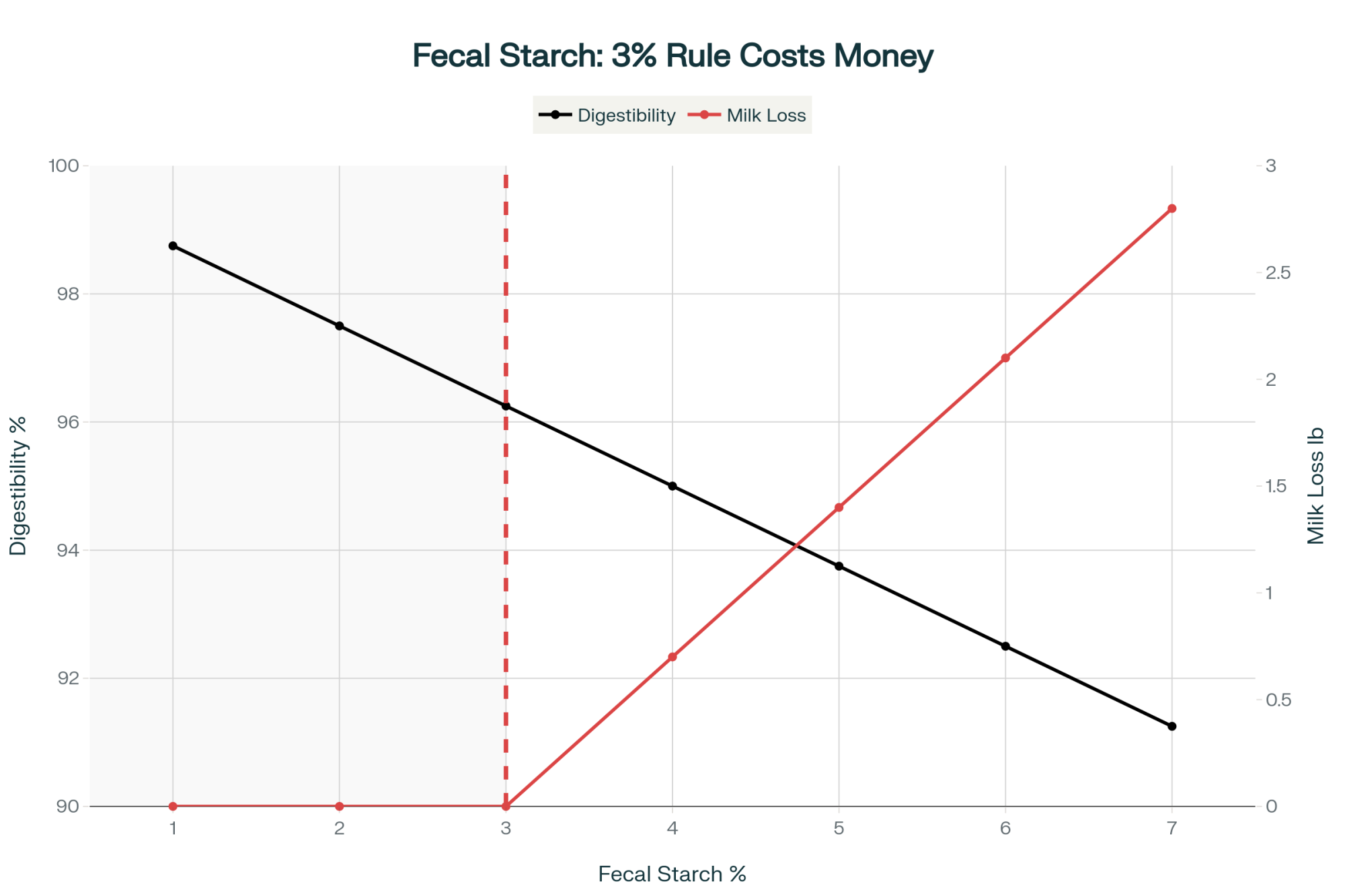

Research from Penn State (2023) and Dairyland Laboratories (2024) shows a consistent relationship—each 1% increase in fecal starch above 3% equals roughly 0.7 pounds (0.3 kg) of lost milk per cow per day. That drop traces directly back to reduced particle size and faster rumen passage.

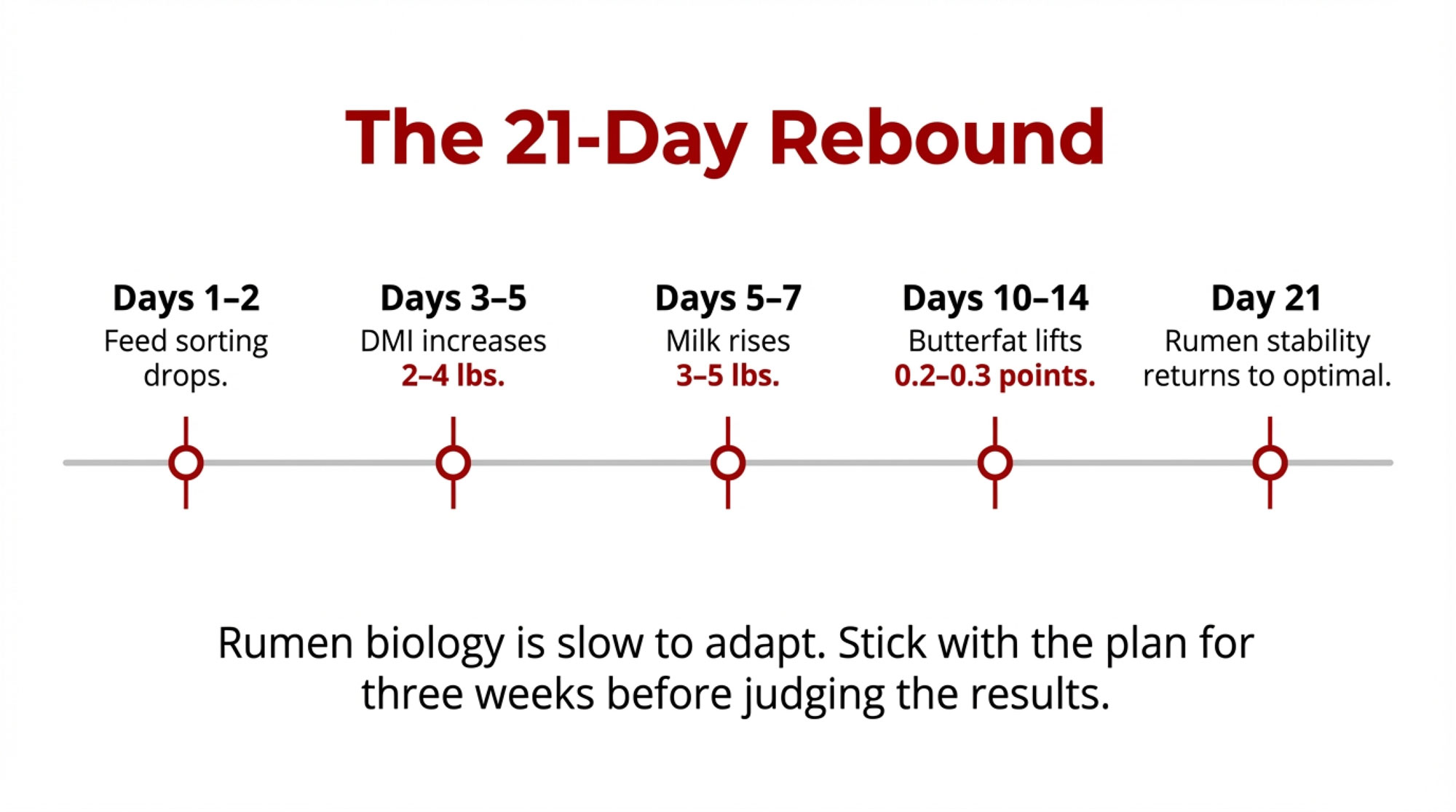

Once the feed texture is corrected, cows respond fast. Intake climbs within a few days, and butterfat tends to normalize within 10–14 days. That’s the rumen re-establishing equilibrium, and it happens predictably if consistency holds.

It’s worth noting that recovery isn’t instant because microbial populations need a full cycle—about three weeks—to rebuild. But when farms stick with the plan, the results speak for themselves.

When Feed Gets Too Long – Why “More Fiber” Can Backfire

Across the Midwest, it’s common to see the opposite: rations that are too coarse. Sometimes it’s due to harvest conditions, sometimes prolonged knife wear, or wet forages. But even 10–15% material on the top sieve can drop dry matter intake by 3.3–4.4 pounds (1.5–2 kg) per cow per day, according to Cornell Cooperative Extension (2023)and Kononoff et al. (J. Dairy Sci., 2003).

It’s easy to spot. Bunks show long refusals, feed sorting increases, and milk solids vary from cow to cow. That imbalance also stresses the fresh cow group, where consistent energy delivery is critical during the transition period.

The fix is often small—a sharper chop or added moisture—but the payoff is large. One Northeast producer told me, “We didn’t change the ration at all, just the chop setting—and our intakes stabilized in a week.”

Connecting Particle Size and Fecal Starch

Here’s where modern precision feeding really shines. When farms combine physical evaluation (via the separator) with digestion analytics (via fecal starch testing), they close the loop on total feed efficiency.

Research at the University of Guelph (2024) found that herds maintaining a balanced TMR structure consistently achieved fecal starch levels below 3%, aligning with about 96% total-tract starch digestibility. Anything over 5% points to feed passing too quickly—often because TMR is too fine, not because kernels are underprocessed.

Or, as Hutjens says in his workshops, “If the rumen can’t hold feed long enough, microbes can’t finish their job.” That line always sticks because it’s a simple truth: the rumen’s efficiency relies on physical structure first, chemistry second.

What Improvement Looks Like – The 21-Day Timeline

Now, many producers ask: once we fix it, how quickly do the cows show results? Based on consistent findings from Penn State, UW–Madison, and the Miner Institute, here’s what usually happens:

- Days 1–2: Feed sorting drops; bunk refusals even out.

- Days 3–5: DMI increases 2–4 pounds (0.9–1.8 kg) per cow.

- Days 5–7: Milk production rises 3–5 pounds (1.4–2.3 kg) per cow.

- Days 10–14: Butterfat lifts 0.2–0.3 points.

- By Day 21: Rumen and microbial stability return to optimal levels.

What’s interesting here is just how predictable the recovery is when particle size and feeding routine stay on target. Results don’t happen overnight—but give it three weeks, and the cows will show you why it’s worth sticking to the plan.

Turning the Separator into a Habit

Producers who’ve made this work treat the Separator as part of weekly herd management, not a special task. I like to call it “Feed Quality Friday”—a fifteen-minute ritual where the feeder runs one test, records the numbers, and shares them with the nutritionist.

The payback for that small amount of time is remarkable. Field results from Penn State Extension (2024) show that farms that regularly monitor particle size reduced component volatility by nearly 30% across seasons, saving $50,000–$60,000 annually on a 500-cow herd.

But more importantly, it changes culture. Feeders begin catching drift before it shows up in milk tests. They start asking better questions about forage moisture, mixing time, and loading sequences. And that’s how farms shift from reactive to proactive management.

Building a Culture of Consistency

What’s encouraging is that this approach works everywhere—from 120-cow tiestalls in Ontario to 2,000-cow dry lot systems in California. The herds that succeed treat feed measurement with the same precision as fresh cow management or breeding records.

Across operations big and small, I’ve noticed that testing isn’t just about data—it builds accountability. Posting results weekly in the feed room, laminating target charts next to the mixer, or even color-coding sieves can transform an abstract concept into a visible, shared goal.

As Hutjens likes to emphasize, “Technology gives you options, but discipline delivers results.” That sentiment captures the heart of this discussion.

The Takeaway

Here’s what it all comes down to: the Penn State Separator isn’t flashy, and it doesn’t plug into an app—but it represents precision in its purest form. Measure, monitor, adjust, repeat. That process costs almost nothing and protects everything that matters: milk yield, butterfat performance, and cow health.

So if your separator is sitting in a corner, unopened, dust it off this week. Shake out one sample. It might just be the five most profitable minutes you’ll spend all month.

This feature draws on research and field data from Penn State Extension, University of Wisconsin–Madison, University of Guelph, Cornell Cooperative Extension, Dairyland Laboratories, and the William H. Miner Agricultural Research Institute, with expert perspective from Dr. Mike Hutjens, University of Illinois Professor Emeritus.

Key Takeaways:

- The Penn State Particle Separator turns feed analysis into a five‑minute habit that can unlock five‑figure profits.

- A simple metric—fecal starch over 3%—signals lost milk and missed feed efficiency worth hundreds daily.

- “Feed Quality Fridays” pay off: just 15 minutes a week can protect up to $60,000 a year in butterfat returns.

- Within 21 days of adjusting the feed structure, rumen health steadies, and milk fat rebounds naturally.

- Across every region and herd size, the best dairies win on one thing: disciplined consistency—not fancy tools.

Executive Summary

Ask any successful dairy manager, and they’ll tell you—precision starts with the basics. This article reveals how the humble Penn State Particle Separator has become one of the most cost-effective tools for improving butterfat and overall feed efficiency. Backed by university and field research, it shows how something as simple as a five-minute TMR check can prevent $50,000 or more in yearly losses from feed inconsistency and poor fiber balance. Each 1% rise in fecal starch above 3% translates directly to milk left on the table, and yet, herds that make testing routine see full recovery in yield and butterfat within just 21 days. What’s interesting here is that the wins don’t come from expensive equipment—they come from habit, focus, and follow-through. It’s proof that on the best dairies, measurement has become a mindset, not just a task.

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More:

- Feed Smart: Cutting Costs Without Compromising Cows in 2025 – Provides strategies for hitting the 1.5–1.8 feed efficiency ratios mentioned in the main article. It reveals specific ration adjustments and alternative ingredients that lower input costs while maintaining the component levels essential for profitability.

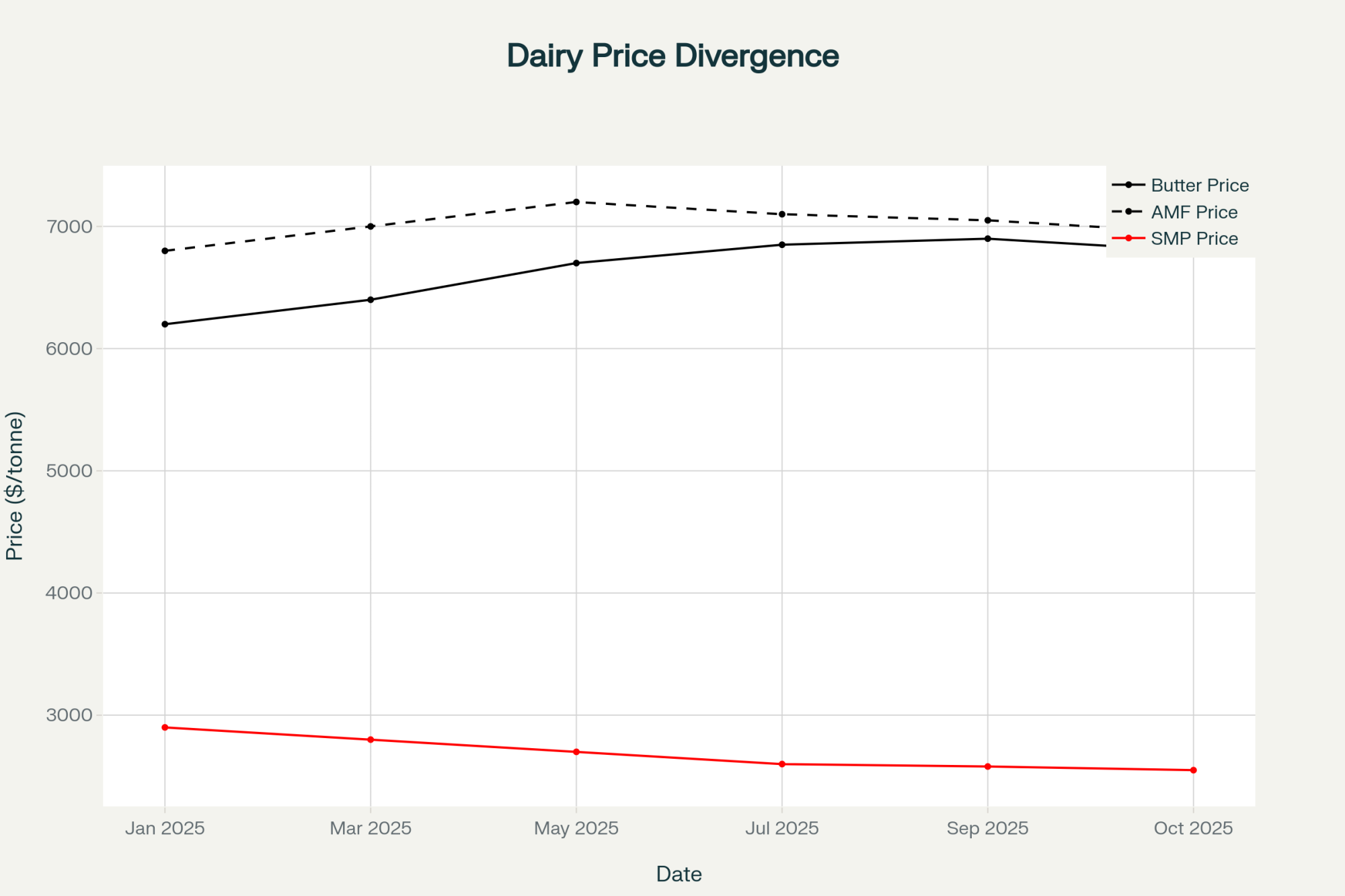

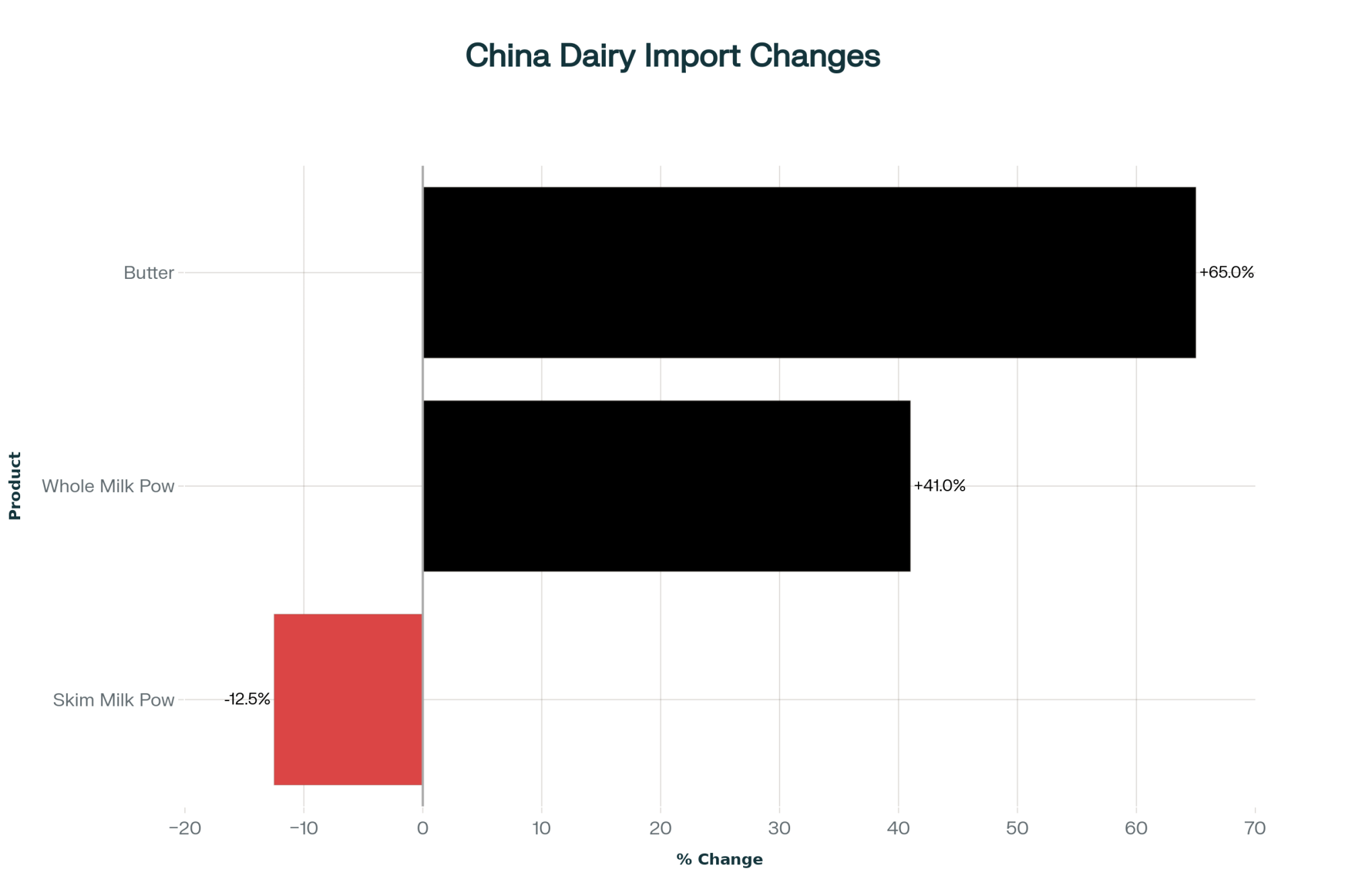

- Why Your Milk Check Makes No Sense Anymore (And How Smart Farms Are Adapting) – Analyzes the current market disconnect where butterfat drives revenue despite volatile milk prices. This strategic breakdown reinforces why the physical TMR adjustments discussed above are financially critical for capturing maximum component premiums right now.

- FEED EFFICIENCY BOMBSHELL: Yeast Additives Expose the Truth About High-Starch Dairy Diets – Demonstrates how combining proper physical TMR structure with biological rumen additives can further stabilize pH and prevent SARA. It details new research showing how this “physical plus biological” approach can unlock an additional 3.5 kg of energy-corrected milk.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!