The T.C. Jacoby Weekly Market Report Week Ending September 3, 2021

CME spot butter jumped 9ȼ this week. July butter production fell 0.8% short of the frantic pace of July 2020, but was still historically high. There is plenty of butter socked away to last through the fall and holiday baking season.

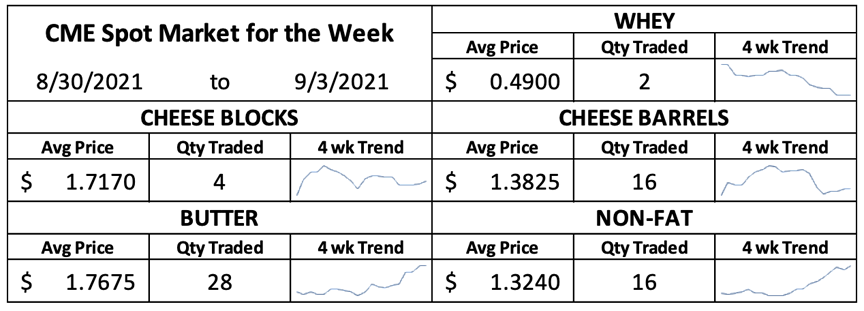

The Class IV market is heating up. CME spot butter jumped 9ȼ this week to $1.7975 per pound. July butter production fell 0.8% short of the frantic pace of July 2020, but was still historically high. There is plenty of butter socked away to last through the fall and holiday baking season.

U.S. milk powder output dropped noticeably in July, and has slowed further in the past five weeks. Combined production of nonfat dry milk (NDM) and skim milk powder (SMP) totaled 208.4 million pounds in July, down 8.4% year over year. On a daily average basis, driers ran 12.5% lighter in July than in June.

Demand for milk powder is running hot. U.S. exports of NDM/SMP in July reached 161 million pounds. That’s a little behind the breakneck pace of last year but still a solid total, especially in the face of all the issues getting milk powder from the warehouse over the border or out to sea. Through July, U.S. NDM/SMP exports are higher than any other year and up 12.4% compared to the first seven months of 2020. More recently, the heat wave and back-to-school rush have completely absorbed the U.S. milk surplus, pushing cheesemakers to use more NDM to fortify their vats. Manufacturers’ stocks of NDM shrunk more than 27 million pounds from June to July, the largest July drawdown since 2009.

Strong demand and falling stocks propelled CME spot NDM up 4.75ȼ this week to $1.34. Aside from two days in early May, that’s the highest spot value since 2014. With both butter and milk powder on the rise, Class IV futures climbed once again. Most contracts added between 20 and 45ȼ. From December onward, Class IV is projected to bring at least $17 per cwt. If they can finish there, dairy producers will reap a better reward for their Class IV milk than they have in any month in the past seven years.

The Class III market was extremely quiet, just marking time ahead of the long weekend. Most contracts regained a little of the ground they lost last week. However, the September contract slipped 12ȼ, eroding some of the premium it held over the spot market. Most Class III contracts are trading north of $17 and not far from their Class IV counterparts. Just two weeks ago, fourth-quarter Class III futures stood $1.15 higher, on average, than Class IV contracts, threatening another few months of depooling and negative producer price

differentials for many struggling dairy producers. But today, the spread has plunged to a healthy 31ȼ, and the menace of depooling has evaporated.

Cheese output was extremely strong in July, but surprisingly, Cheddar production fell a little short of the prior year. Manufacturers focused on other American and Italian cheese varieties. Compared to July 2020, USDA reported a 3.5% increase in total cheese production, driven by a 6.5% increase in output of Italian-style cheeses. Exporters helped to keep product moving. They sent over 81 million pounds of cheese abroad in July, nearly 26% more than in July 2020. CME spot Cheddar blocks slipped 1.5ȼ this week to $1.735. Barrels finished a penny lower at $1.3925.

Spot whey powder also lost 1.5ȼ and closed at 48.5ȼ, a one-month low. Despite formidable cheese output, production of dry whey for human consumption lagged the prior year for the fifth straight month in July. Higher-protein concentrates and whey protein isolates lapped up more of the whey stream than they did last year. Nonetheless, stocks climbed, prompting the recent selloff in the spot market.

USDA announced the August Class III milk price at $15.95 per cwt., down 54ȼ from July and $3.82 lower than August 2020. At $15.92, the August Class IV price was within a hairsbreadth of Class III and just 8ȼ lower than July Class IV. It was also $3.39 better than that of August 2020, when Class IV milk brought just $12.53. Today’s prices are inadequate for many dairy producers, especially in a world where everything costs more than it used to. But after a stormy 18 months, dairy producers whose revenue depends on Class I or Class IV milk can look forward to sunnier skies ahead.

Hurricane Ida slammed into Louisiana on Sunday, damaging export terminals at ports along the Gulf, which account for about 60% of U.S. corn and soybean shipments. More than a million Louisianans are without power, and the major grain facilities remain in the dark. Even after the lights come back on, it will take time to repair the damage and get back to normal operations.

Ida’s winds caused a powerful storm surge which pushed brackish water up the Mississippi River, temporarily reversing the flow of the Big Muddy. Many barges were sunk or grounded. With containers and truck drivers already scarce, the hit to the nation’s barge capacity will severely reduce the flow of grain and oilseeds from the Corn Belt and Delta to the Gulf. In short, it’s a mess.

Meanwhile, combines are getting ready to roll in the southern states. Crops that would normally move quickly from the field to the port will pile up farther inland. Although merchants will shift much of this grain abroad eventually, they’ll likely lose some business to South America. Because the early harvest is staying closer to home, the market will likely transition swiftly from extremely tight old crop supplies to more abundant new crop corn. The storm hammered corn futures this week, and it’s likely to weigh on the basis soon. December corn settled today at $5.24 per bushel, down nearly 30ȼ from last Friday. November soybeans dropped 31.25ȼ to $12.92. December soybean meal slipped another $9.40 per ton to $341.

Source: Jacoby