The T.C. Jacoby Weekly Market Report Week ending June 12, 2020

The bulls came charging out of the gate once again this week. But after a few days romping around LaSalle Street, they left abruptly, presumably in search of greener pastures. Bulls must be fed daily, and by Thursday the market had run out of positive fundamental news with which to fill their troughs.

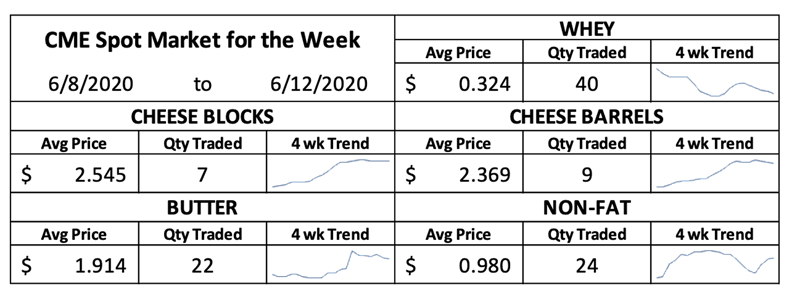

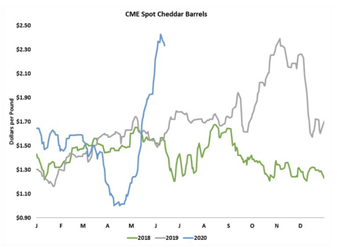

The cheese market has likely climbed high enough, for now. Both blocks and barrels rallied to alltime highs early in the week, but they finished lower. CME spot Cheddar blocks closed today at $2.52 per pound, down 3.25ȼ from last Friday. Barrels reached $2.425 on Tuesday, but they settled at $2.3325, down 2.75ȼ. The invisible hand of the markets and the passage of time are starting to ease the physical shortage that propelled the cheese markets to such unprecedented heights. USDA’s Dairy Market News reports that some end users who were rushing to restock after Covid-19 closures have filled their refrigerators, and buyers are more hesitant at these values. Cheesemakers are still running hard. A high price is the best fertilizer. The markets may have to contend with a bumper crop of cheese later this year.

The cheese market has likely climbed high enough, for now. Both blocks and barrels rallied to alltime highs early in the week, but they finished lower. CME spot Cheddar blocks closed today at $2.52 per pound, down 3.25ȼ from last Friday. Barrels reached $2.425 on Tuesday, but they settled at $2.3325, down 2.75ȼ. The invisible hand of the markets and the passage of time are starting to ease the physical shortage that propelled the cheese markets to such unprecedented heights. USDA’s Dairy Market News reports that some end users who were rushing to restock after Covid-19 closures have filled their refrigerators, and buyers are more hesitant at these values. Cheesemakers are still running hard. A high price is the best fertilizer. The markets may have to contend with a bumper crop of cheese later this year.

With more cheese comes more whey. While whey output climbs, demand appears steady at best. CME spot dry whey dropped 2.75ȼ this week to 31.75ȼ.

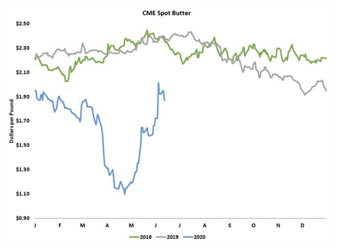

Butter backed off as well. CME spot butter slipped 5.5ȼ this week to $1.87. Although slow demand from foodservice remains a drag, butter is still moving rapidly through retail. Output has slowed as ice cream – and to a lesser extent cream cheese – manufacturers are willing to pay more for cream than most butter makers can afford.

Butter backed off as well. CME spot butter slipped 5.5ȼ this week to $1.87. Although slow demand from foodservice remains a drag, butter is still moving rapidly through retail. Output has slowed as ice cream – and to a lesser extent cream cheese – manufacturers are willing to pay more for cream than most butter makers can afford.

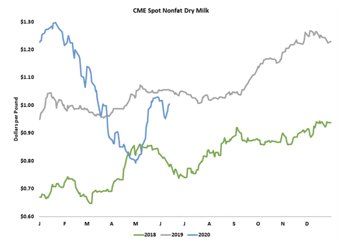

The milk powder market bucked the trend once again and bounced back from last week’s losses. CME spot nonfat dry milk (NDM) advanced 2.75ȼ to $1.005, and most NDM futures finished higher than last Friday, thanks to a strong showing in the middle of the week. Milk production is slowing in some regions, and cheese plants are taking on all the milk they can, leaving less for dryers. Still, there is plenty of milk powder to go around, as manufacturers hold ample stocks.

Milk futures put in a mixed performance this week. June Class III jumped another 54ȼ to $20.42 per cwt. But the other Class III contracts finished lower. Most lost around 30ȼ this week. Most Class IV futures settled a little higher than they did last Friday, but the June contract plummeted 56ȼ to a paltry $13.35.

Milk futures put in a mixed performance this week. June Class III jumped another 54ȼ to $20.42 per cwt. But the other Class III contracts finished lower. Most lost around 30ȼ this week. Most Class IV futures settled a little higher than they did last Friday, but the June contract plummeted 56ȼ to a paltry $13.35.

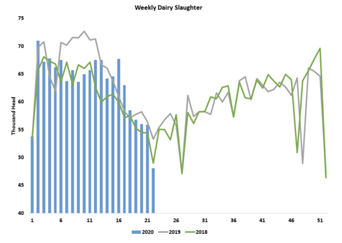

Higher Class III prices are calling for dairy producers to make more milk, a dramatically different message than the one the markets delivered in April and early May. The industry is listening. Milk yields are declining seasonally, but dairy producers are likely undoing all the measures they took to slow output in the spring. They are keeping their barns full, slowing cull rates, and adding high-energy feeds back into the ration. In the week ending May 30, which included Memorial Day, dairy cow slaughter was just 48,120 head. That was down 9.8% from the holiday week in 2019. After exceptionally high volumes in April, dairy slaughter fell short of the prior year four out of five weeks in May.

Higher Class III prices are calling for dairy producers to make more milk, a dramatically different message than the one the markets delivered in April and early May. The industry is listening. Milk yields are declining seasonally, but dairy producers are likely undoing all the measures they took to slow output in the spring. They are keeping their barns full, slowing cull rates, and adding high-energy feeds back into the ration. In the week ending May 30, which included Memorial Day, dairy cow slaughter was just 48,120 head. That was down 9.8% from the holiday week in 2019. After exceptionally high volumes in April, dairy slaughter fell short of the prior year four out of five weeks in May.

More cows will mean more milk, but do we need it? Once restaurants have restocked and food bank donations fade, the industry may find itself awash in dairy products.

The corn market bounced back and forth this week and ultimately settled a little lower. July corn futures closed at $3.30 per bushel, down 1.25ȼ. After resurveying farms in North Dakota, USDA cut its estimate of last year’s corn harvest by 46 million bushels. Still, there is plenty of corn in the world, and U.S. corn stocks are expected to balloon after this year’s harvest. Barring a weather issue, corn is likely to remain cheap. It’s getting uncomfortably dry in the Southern Plains, but in the Corn Belt, the crops are in great shape.

USDA’s monthly supply and demand update showed a surprisingly strong increase in soybean meal demand. The market has also been cheered to see Chinese buyers return to U.S. ports, despite reports that state-owned buyers were told to pause purchases. July soybean futures rallied to 3.5ȼ this week to $8.7125. July soybean meal held steady at $289 per ton.