The T.C. Jacoby Weekly Market Report Week Ending August 5, 2022

The United States sent a record-setting volume of dairy products abroad in May. Then, after adjusting for a shorter month, it bested that record in June.

Slowing global milk output is making room for American dairy. The United States sent a record setting volume of dairy products abroad in May. Then, after adjusting for a shorter month, it bested that record in June. Thanks to lofty dairy product prices, those exports brought home $886.2 million in June, also an all-time high.

Cheese was a significant driver of the strong export performance, with both volume and prices reaching higher than ever before. Exporters shipped 96.8 million pounds of cheese outside our borders in June. In the first half of the year, net exports lapped up more than 4% of U.S. cheese production. U.S. butter and milkfat exports also impressed in June, and dry whey exports climbed back over year-ago levels. Shipments of whey protein concentrates were up 48% from June 2021, marking the highest June volume ever and the third-highest total for any month. However, nonfat dry milk (NDM) exports lagged. They fell 15% from last year’s extremely high mark.

Lively trade is keeping U.S. dairy product inventories in check for now, but the forward-looking futures markets reflect anxiety that U.S. dairy output will overwhelm demand. Amid slowing orders from bottlers and rising components, even modest growth in U.S. milk output can keep processors busy. With just 0.3% more milk in June than the year before, manufacturers made 2.3% more butter, 2.7% more cheese, and 5.6% more whey powder than in June 2021. Combined production of NDM and skim milk powder (SMP) fell 10.4% from the hefty volume dried in June 2021, but it was still the second highest June milk powder output in U.S. history.

Dairy product inventories are not burdensome, at least not yet. But U.S. milk production is not expected to drop back below year-ago levels, and dairy product output is likely to remain high. Meanwhile, uncertainty about the economy and trade continues to simmer in the background. The U.S. dairy industry needs demand to hold firm, or products will start to pile up.

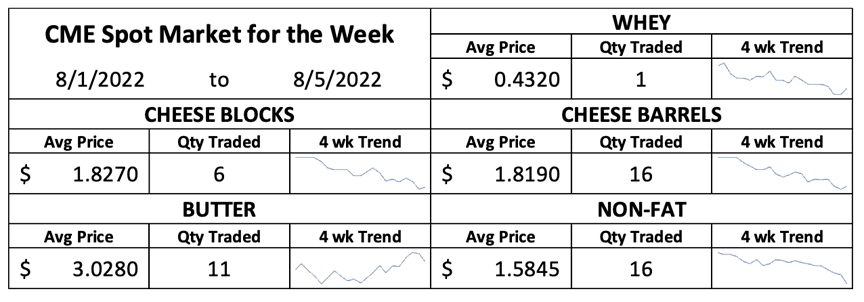

With that in mind, milk and most dairy product prices took a big step back. CME spot Cheddar blocks and barrels both dropped 9.5ȼ this week to their lowest prices since January. That put blocks at $1.785 per pound and barrels at $1.9725. CME spot dry whey slipped another penny to 43.5ȼ, a fresh 20-month low. Class III futures suffered double-digit losses, led by a $1.01 (triple digit) shellacking for the September contract. August, September, and October Class III all spent some time south of $20, but only the September contract finished there, at $19.30 per cwt.

A poor showing at the Global Dairy Trade (GDT) auction and concerns about Chinese demand weighed heavily on milk powder prices. GDT SMP plummeted 5.3% to the rough equivalent of NDM at $1.71. Whole milk powder prices fell 6.1%. In Chicago, CME spot NDM plunged 13.75ȼ to a 10-month low at $1.5025.

But butter held firm. Lower butter output early in the year and resilient demand has pushed retailers to scramble for product ahead of the fall baking season. Butter production is typically low during the summer, and sky-high cream prices have made it clear that this year will be no exception. USDA’s Dairy Market News sums up the issues neatly: “Cream supplies are tight, multiples have risen, and some manufacturers are still trying to find the workers needed to fill up their production schedules.” Those who need butter for later this year are paying up to make sure they have it. On Wednesday, CME spot butter traded at $3.06 per pound, its highest price in nearly seven years. It closed today at $3.01, up 2ȼ from last Friday. But the futures market showed some doubts that prices have staying power. Despite the gains in the spot market, September through November butter futures finished the week lower than where they began.

Spot butter helped to lessen losses in August Class IV futures, but the other contracts moved decisively downward. September Class IV dropped 33ȼ to $23.37 and the October contract fell 95ȼ to $21.60.

On Monday, the bulk carrier Razoni left Odesa, Ukraine, laden with 26,000 metric tons of corn. A tugboat led the Razoni through the heavily-mined waters of the Black Sea. The ship then sailed through the Bosporus Strait, passed inspections from Turkish, Russian, and United Nations officials in Istanbul, traversed the Dardanelles, and is now crossing the Aegean Sea on its way to Tripoli, Lebanon. Since the Razoni’s safe passage through the dangerous Black Sea corridor, two more ships have

departed with some of the 20 million metric tons (~800 million bushels) of grain previously stuck at Ukraine’s ports. More will follow. The resumption of Ukraine’s seaborne exports will provide grain to a hungry world and empty silos needed to store recently harvested wheat and fast-maturing corn and barley crops.

With Ukraine back in the game, U.S. grain prices slipped. December corn closed today at $6.10 per bushel, down a dime from last Friday. Beans fell too, despite pockets of hot, dry weather this month, the most crucial time for soybean development. November soybeans dropped nearly 60ȼ to $14.0875. Soybean meal prices swung violently back and forth but closed a little lower. September soybean meal settled at $437.50, down $2.90 for the week.

Source: Jacoby