The T.C. Jacoby Weekly Market Report Week Ending June 18, 2021

After a few hot weeks, stress is starting to sap milk yields. Nevertheless, there is more milk than manufacturers can accommodate in the Southwest and mountain states despite supply management programs.

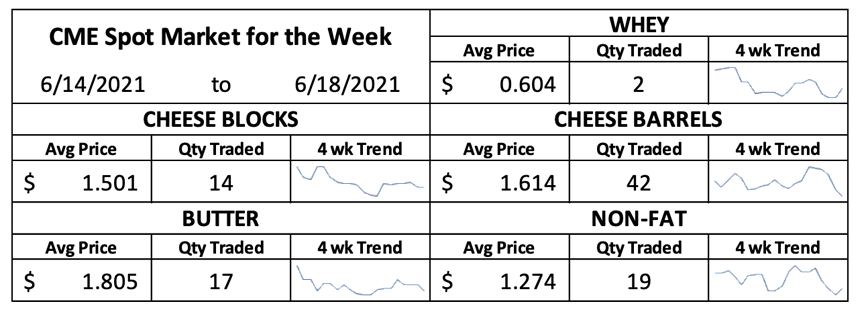

The dairy markets were awash in red ink this week. June Class III milk gained a little ground, but all other Class III and Class IV contracts finished sharply lower. July Class III lost 81ȼ and closed at $16.72 per cwt. The August contract plummeted $1.18. Most Class IV contracts lost between 25 and 45ȼ.

For months, high feed costs have propped up second-half futures, based on the theory that poor margins would reduce milk output eventually. Now, the trade seems to be questioning that theory – and with good reason, given the size of the dairy herd – and concentrating on more immediate supply issues. There is milk in abundance, and it’s weighing on dairy product prices.

After a few hot weeks, stress is starting to sap milk yields. Nevertheless, there is more milk than manufacturers can accommodate in the Southwest and mountain states despite supply management programs. In the Upper Midwest, dairy producers have added cows sufficient to fill up new cheese processing capacity and then some. Excess milk is selling in the region for $4 to $6 under class. In the rest of the nation, there is still no shortage, and cooler weather is on the way nearly everywhere except California.

The cheese markets are looking especially weighed down by overproduction. Traders exchanged 56 loads of fresh Cheddar in Chicago this week, pushing a lot of product through the market of last resort. CME spot Cheddar blocks slipped 0.75ȼ to $1.4925 per pound. Barrels fell 13ȼ to $1.5425. Cheap milk is pushing some Midwest cheese plants to run at “max capacity,” according to USDA’s Dairy Market News. Meanwhile, “demand is mixed.”

Under pressure from abroad, CME spot nonfat dry milk (NDM) fell 3.5ȼ this week to $1.265. Powder values faded at the Global Dairy Trade auction, where skim milk powder (SMP) dropped 1.7% to the equivalent of (NDM) at $1.62 per pound. Big moves in the currency markets also weighed on the most export-dependent of the U.S. dairy commodities. On Wednesday, Federal Reserve officials offered a more optimistic economic outlook and hinted at the possibility of a slightly tougher stance on inflation. That prompted a dramatic turnaround in the dollar, which had been languishing at multi-year lows. Over the past three trading sessions, the U.S. dollar index rallied 1.9% against a basket of foreign currencies, a massive move in the generally stolid forex market. The stronger dollar makes U.S. NDM more expensive when priced in weaker foreign currencies. The snarled supply chain is not helping

matters. The container shortage and port backlogs continue to slow exports, while a lack of truck drivers has delayed domestic shipments.

Ever the contrarian, the whey market softened early in the week but made a strong showing on Friday. Still, CME spot whey finished 1.75ȼ lower than it was last Friday at 61ȼ. Buyers continue to balk when prices top 60ȼ, but stocks are tight, and sellers feel no pressure to lower their sights. High-protein whey products continue to sell at a good clip, mostly to foreign buyers. Although the strong dollar may trim whey exports at the margins, it is less of an issue for whey than for many other products, because China’s yuan is strengthening even more quickly than the greenback.

Butter started strong but faded throughout the week. It closed today at $1.785, down 0.75ȼ. Cream is plentiful and churns are running. Retail orders are starting to fade, but foodservice demand remains strong. European butter prices also softened, especially when adjusting for the currency effect. While benchmark German butter prices fell 1.7% in euro terms this week, they fell 3.7% when converted to dollars.

This week on LaSalle Street was one for the record books. Dragged down by soybean oil, the soy complex spent Monday through Thursday deep underwater. On Thursday, July soybeans capped off a seven-session losing streak by plummeting $1.1875 per bushel, the largest singlesession setback ever. The strong dollar and a Chinese crackdown on inflation weighed on commodities in general. The weather forecast – which promises some relief after a hot, dry stretch – pummeled the already weakened crop markets.

But the majority of the growing season still lies ahead, and there are some real trouble spots. As of last Sunday evening, USDA rated 68% of the corn crop in good or excellent condition, down four points from the previous week. In South Dakota, just 45% of the crop was in good or excellent condition, and ratings are sure to drop again next week after scant rains in the Northern Plains.

Today’s weather maps promised a bit less rain for the Corn Belt than previous iterations, and the crop markets came roaring back. But crop values are still much lower than they were last week after several days of red ink. July corn closed at $6.5525, down 29.25ȼ. New crop December corn was off 43.5ȼ at $5.6625. July soybeans dropped $1.125 to $13.96. July soybean meal fell almost $10 to $373.40 per ton.

Demand for feed remains strong, and the world is hoping for a big crop. It’s going to be a long, volatile summer in the grain pits.

Source: Jacoby