Prices are high and extremely volatile as the trade assesses how long global milk output will remain depressed and whether demand will hold firm despite the rising cost of dairy.

The dairy markets are off to an exciting start in 2022. Class III futures rocketed to life-ofcontract highs Wednesday and then plumbed their lower daily trading limits Thursday. February Class III peaked at $22.45 per cwt., and closed today at a still lofty $21.43. Prices are high and extremely volatile as the trade tries to assess how long global milk output will remain depressed and whether demand will hold firm despite the rising cost of dairy.

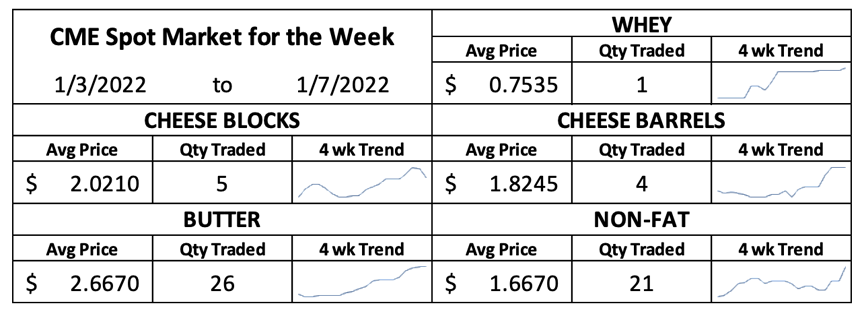

Uncertainty reigns in the cheese markets. Fresh cheese is tight enough to propel spot Cheddar to its highest price since late 2020. CME spot Cheddar blocks pushed well above the $2 mark this week but settled at $1.995 per pound, up 1.5ȼ for the week and up 12.25ȼ since Christmas. Barrels leapt 15.5ȼ over the past five trading sessions and closed today at $1.865. But cheese stocks are heavy and the vats are full. The latest Dairy Products report showed November cheese output at 1.12 billion pounds, up 1.6% from a year ago. However, Cheddar output fell 4.4% short of the very high volumes made in

November 2020, when the government’s food box program boosted demand. This time around, cheesemakers focused on specialty and Italian-style cheeses, which suggests they were making cheese to meet orders rather than to push milk through their plants. Demand is reportedly strong as grocers restock after the holidays. And, despite all the headaches required to move cheese from the warehouses to the ports, U.S. exports are better than ever. We sent 73.9 million pounds of cheese abroad in November, up 39.9% from the prior year. With one month of data yet to be counted, U.S. cheese exports have already set a full-year record.

CME spot whey climbed to a fresh high in its nearly four-year tenure at the spot market. At 75.75ȼ, it is 0.75ȼ higher than it was a week ago. Dry whey production is well above the very low levels of November 2020 but not heavy by historic standards. Processors continue to direct much of the whey stream into concentrates, leaving less to drag down the commodity markets. Dry whey stocks moved higher from October to November but are still somewhat tight, as befits a market at multi-year highs.

With both cheese and whey markets moving higher – albeit erratically – Class III futures gained a lot of ground over the past two weeks. 2022 contracts are up 70ȼ, on average, since the last trading session before Christmas, and the February through April contracts added well over a dollar. The futures promise $20 milk from now until November.

The Class IV markets are even stronger, with an average 2022 price of $21.67 and an average two-week gain of 92ȼ. Both butter and milk powder are in relatively short supply as milk moves to cheese vats and cream is processed into whips and dips. Butter output slumped to 156 million pounds in November, down 9.6% year over year. The spot butter market took off on December 20, and it has been sprinting uphill ever since. It closed today at $2.7425, up 29ȼ this week and up nearly 50ȼ since Christmas. Spot butter hasn’t been this pricey since 2015.

Manufacturers made just 181 million pounds of nonfat dry milk (NDM) and skim milk powder (SMP) in November, 17.8% less than the year before. Exports boomed and stocks waned. The U.S. sent a record-breaking 168.5 million pounds of NDM abroad in November, up 25% from a year ago. Manufacturers’ stocks of NDM have moved from burdensome to scant in just five months. Inventories stood at 196.5 million pounds at the end of November, the lowest November total since 2013 and 21% lower than the prior year.

U.S. exports are likely to remain strong, because foreign milk powder prices just keep climbing. At the Global Dairy Trade auction on Tuesday, SMP advanced another 1% to the equivalent of NDM at $1.83 per pound, after adjusting for protein. In Chicago this week, CME spot NDM climbed 5.5ȼ to $1.71, the highest price – by far – since 2014.

USDA announced the December Class III price at $18.36 per cwt., up 33ȼ from November and up $2.60 from December 2020. At $19.88, December Class IV milk was $1.09 higher than the preceding month and up an astounding $6.46 year over year. It’s been a long time coming, but dairy producers outside the cheese states can expect their best milk check in years, and the futures promise much bigger revenue in the months to come. But costs are high too.

The corn market vacillated but finished close to where it began, at $6.0675 per bushel. Soybeans, on the other hand, moved sharply higher. The March contract closed at $14.1025, up nearly 80ȼ in two weeks. March soybean meal vaulted to $425 per ton, up nearly $19. It’s been hot and dry in southern Brazil and Argentina, and the forecast calls for scorching temperatures for at least another week. After that, rains are expected to bring relief. But until then, the soybean market will be on edge.