The T.C. Jacoby Weekly Market Report Week Ending July 29, 2022

The bulls and bears squared off in Chicago this week, and the dairy markets lurched this way and that as the two sides fought for control.

The bulls and bears squared off in Chicago this week, and the dairy markets lurched this way and that as the two sides fought for control. Class III futures moved higher on Monday and Tuesday, helped by last Friday’s Cold Storage report, which reassured the trade that cheese demand remained healthy through mid-year. But on Wednesday and Thursday, the bears won the upper hand, fueled by news that the U.S. economy contracted in the first half of the year, and that the Federal Reserve hoped to tamp down inflation by raising interest rates yet again. That stoked fears about consumers’ propensity to spend on dairy products going forward. The trade is likely to remain anxious about demand until the economy is on surer footing. But it seems that prices have fallen back far enough for now. When the closing bell rang, the bulls came out on top, and Class III markets bounced back today. August Class III climbed 18ȼ to $20.41 per cwt. and the September contract jumped back over the $20 mark. It closed today at $20.31, up 42ȼ from last Friday. Deferred contracts also finished higher. Fourth-quarter contracts added 30ȼ, on average, and Q1 2023 futures leapt 37ȼ. Nearby Class IV futures posted similar gains, while deferred futures made a smaller advance. August Class IV closed at $24.81.

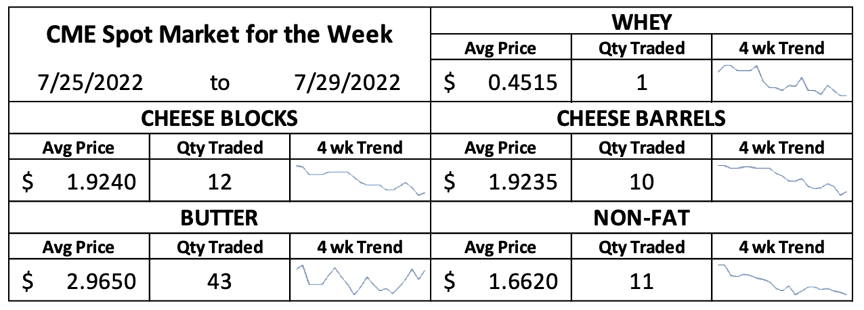

There is still plenty of fresh product to be had, and the spot markets took another step back. CME spot Cheddar blocks slipped 3ȼ to $1.88 per pound, and barrels fell 3.25ȼ to $1.8875. Those mark the lowest spot cheese values since early February. Spot nonfat dry milk (NDM) scored a new low for the year at $1.64, down 4.5ȼ since last Friday. Whey powder dropped a penny to 44.5ȼ, its lowest value since late 2020, when many Americans were at home making sourdough in their sweatpants, rather than pumping iron and pounding protein shakes at the gym. In contrast to its feeble peers, spot butter looked strong. It jumped 8.25ȼ to $2.99, toward the high end of its well-defined trading range.

All year, pricey cream and a lack of carry in butter futures has discouraged processors from churning butter and storing it for use later in the year. Now that fall baking season looms large, butter buyers are scrambling for product. And processors aren’t likely to step up churn rates anytime soon. It’s hot, which means that ice cream makers are running hard, and cows are struggling to make as much milk – let alone cream – as they did in the spring. Cream multiples in the Midwest soared to the highest levels since the weeks leading up to Christmas.

It’s hot in Europe too, which is surely weighing on milk yields. Milk collections in the EU-27 and the United Kingdom dropped 1.6% below year-ago levels in May, tied with April for the worst European deficit since 2016, when the government paid producers to pull back. Anecdotal reports suggest that output was not down quite so hard in June, but the July heat wave pushed production southward once again. Aside from a brief respite in February, European milk output has been negative since September. Given ever tighter environmental regulations, it’s likely to stay in the red for a while.

Throughout 2021 and into this year, European dairy processors prioritized cheese production, allowing them to grow cheese output even as milk production faltered. But EU cheese output fell below year-ago levels in March, and it has remained in the doldrums. Europe is now making less of every category of dairy product, leading to a smaller exportable surplus. If global dairy demand stumbles, a decline in European dairy exports could soften the blow.

The recent selloff in U.S. dairy markets and the setbacks in Europe mean the U.S. is well positioned to keep sending healthy volumes abroad. Meanwhile, there is no sign that U.S. milk or dairy product supplies are likely to become burdensome. Scorching temperatures are keeping output in check in the short term. In the long run, high feed costs, low heifer supplies, processing capacity limitations, and supply management programs will likely cap growth in U.S. milk production. Dairy cow slaughter volumes have been running light since April, but they perked up recently, a hint that producers may be less willing to keep their barns crowded for $20 milk than they were for $24. Milk and dairy product prices likely overreached this summer, but they seem to have found an equilibrium at values that acknowledge tighter global supplies without throttling demand.

Feed futures whipsawed back and forth this week as they assessed the impact of the weather. For corn, it’s a bit of a mixed bag. July rains really helped the crop in the Eastern Corn Belt, but in the South and the Plains, it’s painfully dry. In most areas, the crop will have enough moisture to get through what remains of the crucial pollination season, but yields are likely to average a little below normal. For beans, August weather determines crop yields, and the forecast is hot and dry. That propelled November bean futures up to $14.685 per bushel, up $1.5275 this week. Soybean meal was even stronger. The September contract jumped $11 to $442.40 per ton. December corn futures rallied all the way to $6.365 per bushel today, but when news broke that the Russians and Ukrainians have reached a deal to export grain through the Black Sea, they retreated. They settled at $6.20, still up 56ȼ from last Friday.

Source: Jacoby