As Milano-Cortina chases medals, Italy’s dairies pull €22.8B from less milk. If your 2026 outlook starts with $18.95, you need to see how they did it.

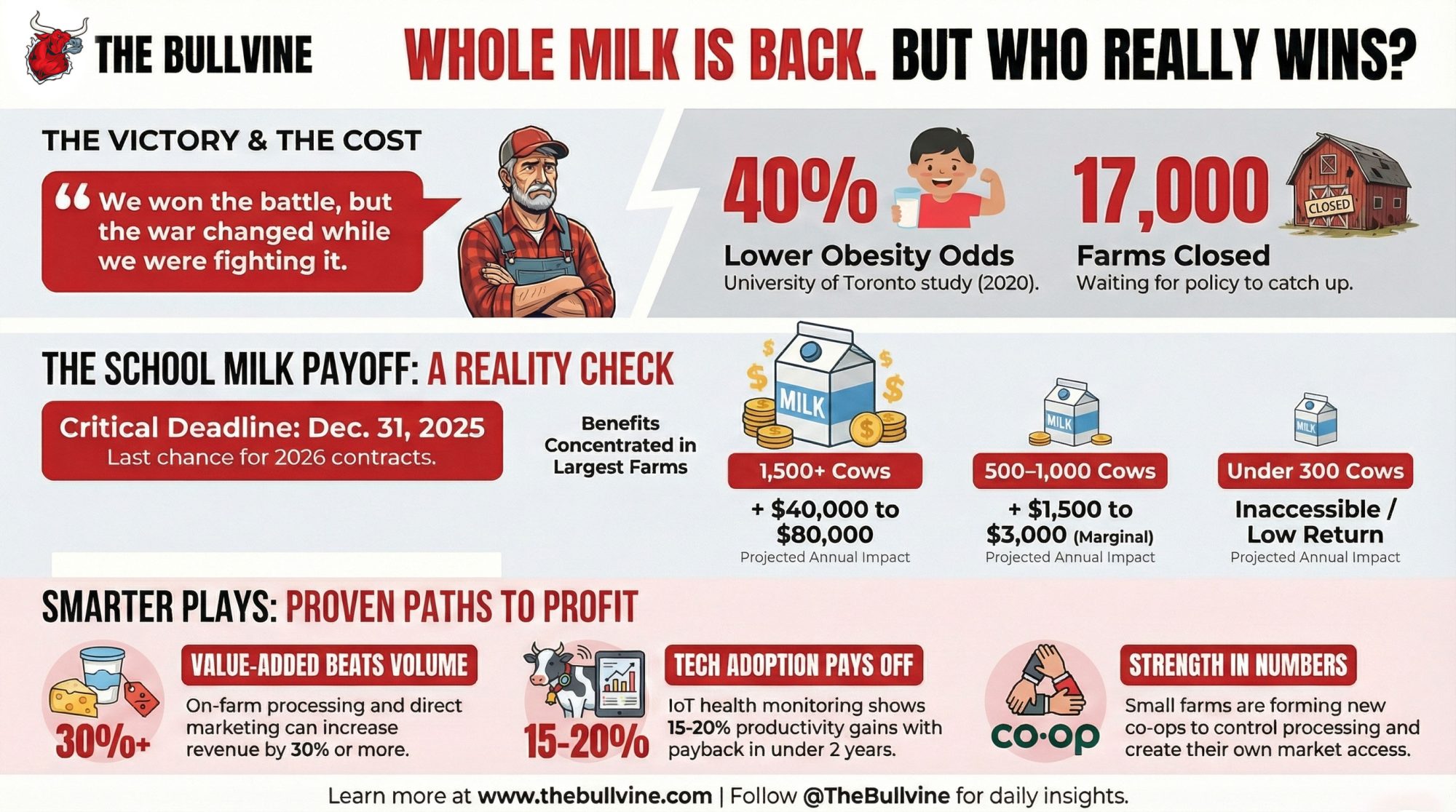

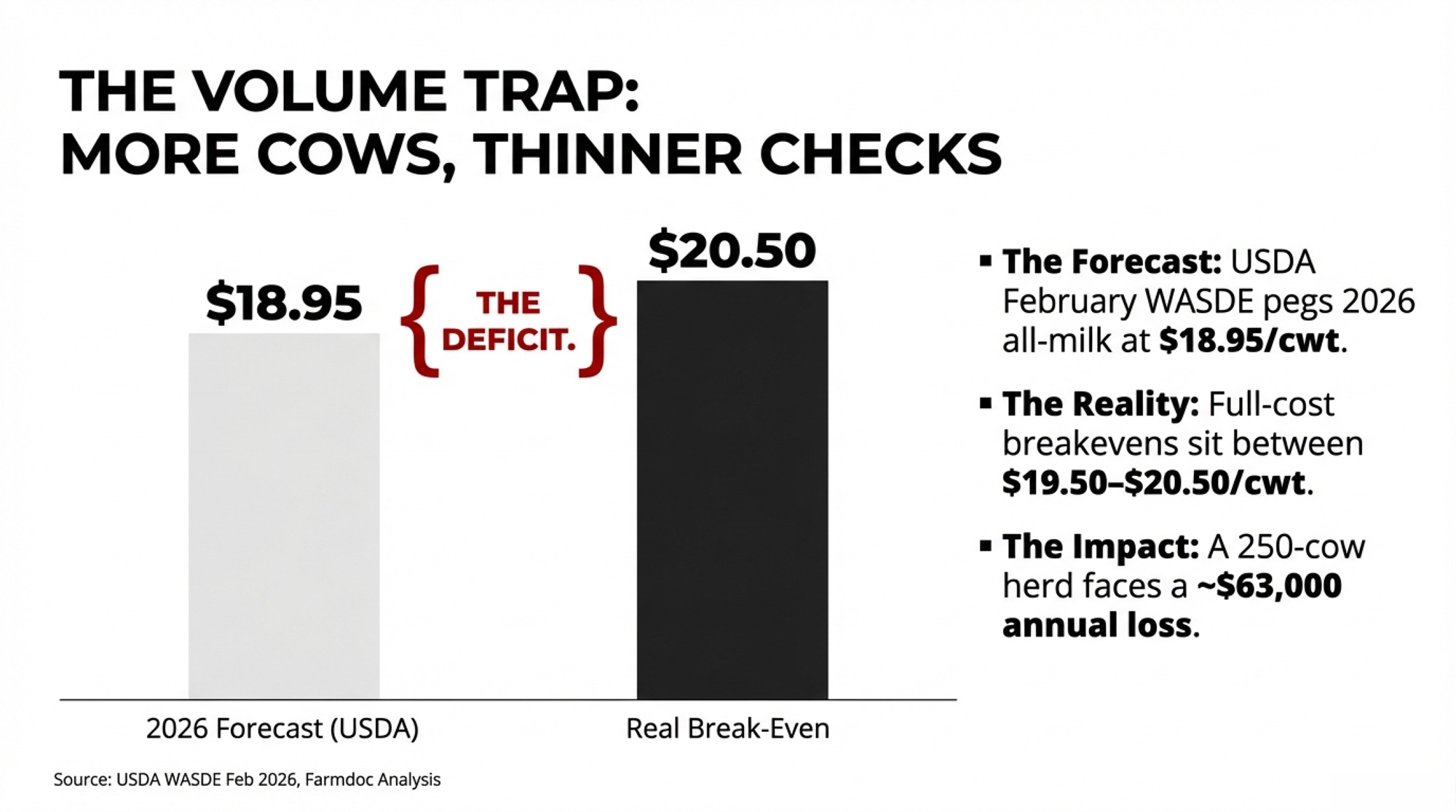

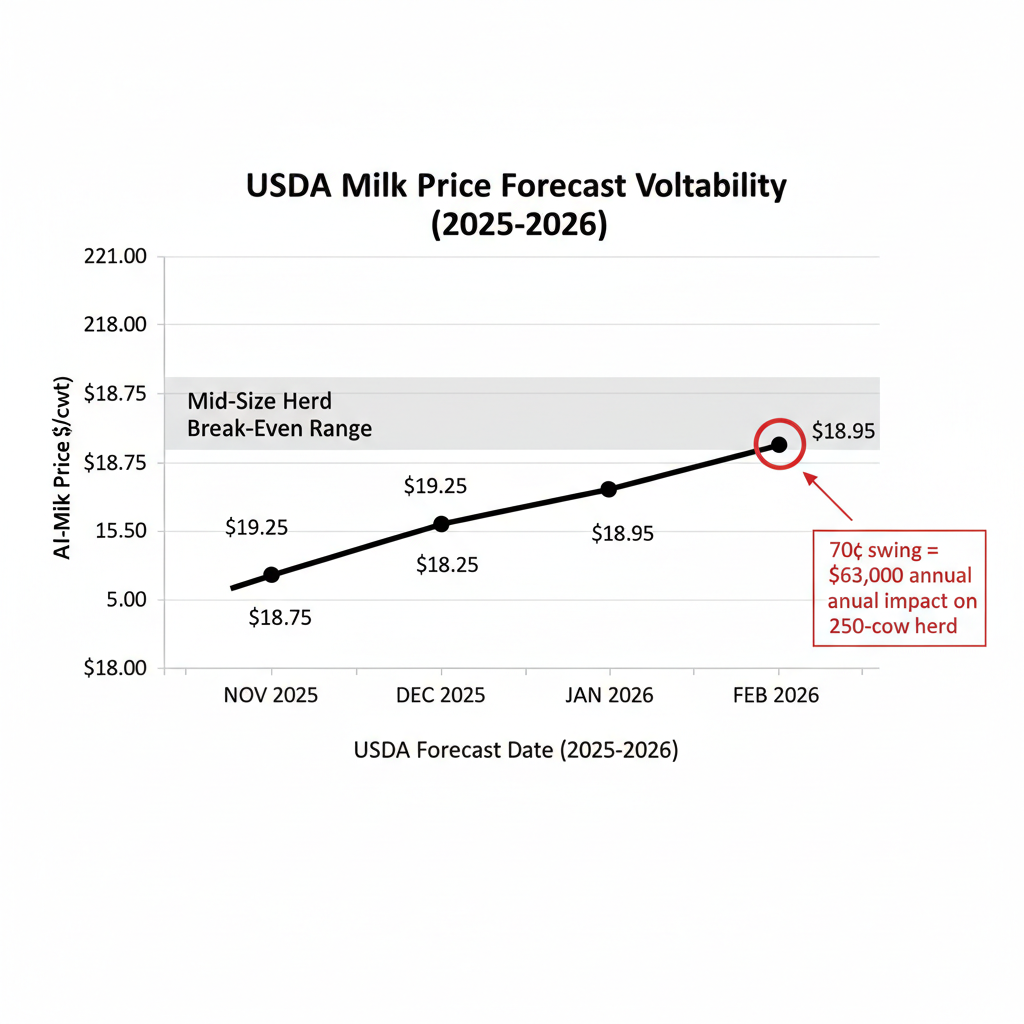

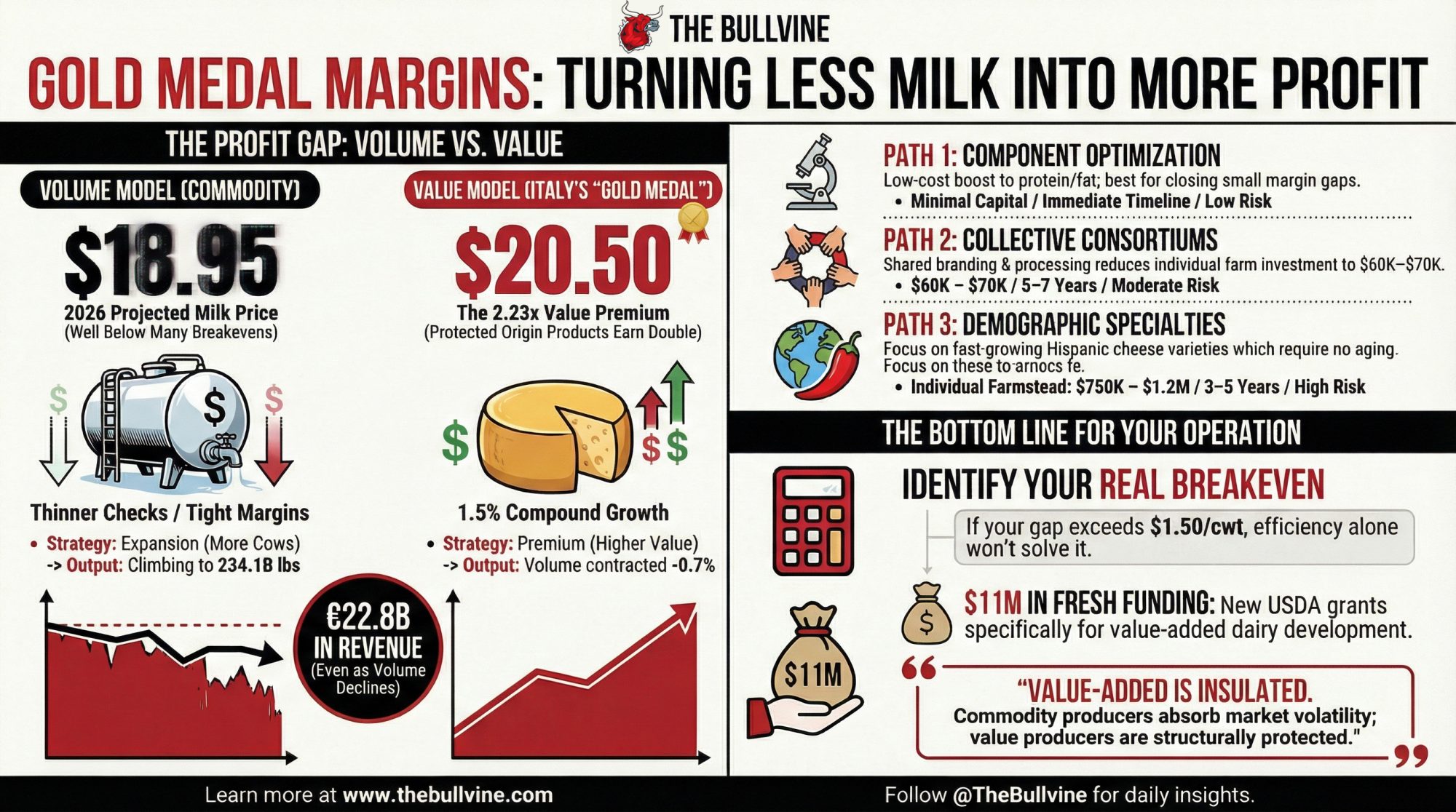

Where does your real break-even sit — family labor honestly valued, principal payments included, living expenses accounted for? Bullvine analysis pegs a mid-size herd’s full-cost break-even in the range of $19.50–$20.50/cwt, depending on region, debt load, and unpaid family labor assumptions — consistent with farmdoc’s 2024 analysis, which places full costs in the low $20s/cwt. USDA’s outlook has been a moving target: the all-milk price for 2026 fell from $19.25 in November to $18.75 in December to $18.25 in January — then bounced to $18.95/cwt in the February 2026 WASDE, released yesterday. Even with the uptick, a 250-cow operation at the midpoint of that break-even range faces a projected annual loss of roughly $63,000. That gap has whipsawed $70,000 in four months of USDA revisions — and the direction isn’t settled.

Now consider the country hosting this month’s Winter Olympics, where dairy producers are doing the opposite: generating €22.8 billion in industry revenue while their milk production declines year over year. The value-added dairy production model behind that number isn’t a European curiosity. It’s a functioning alternative to the volume-first strategy that’s compressing margins across North American herds in 2026 right now.

Two Industries, Two Scorecards: Volume vs. Value in 2026

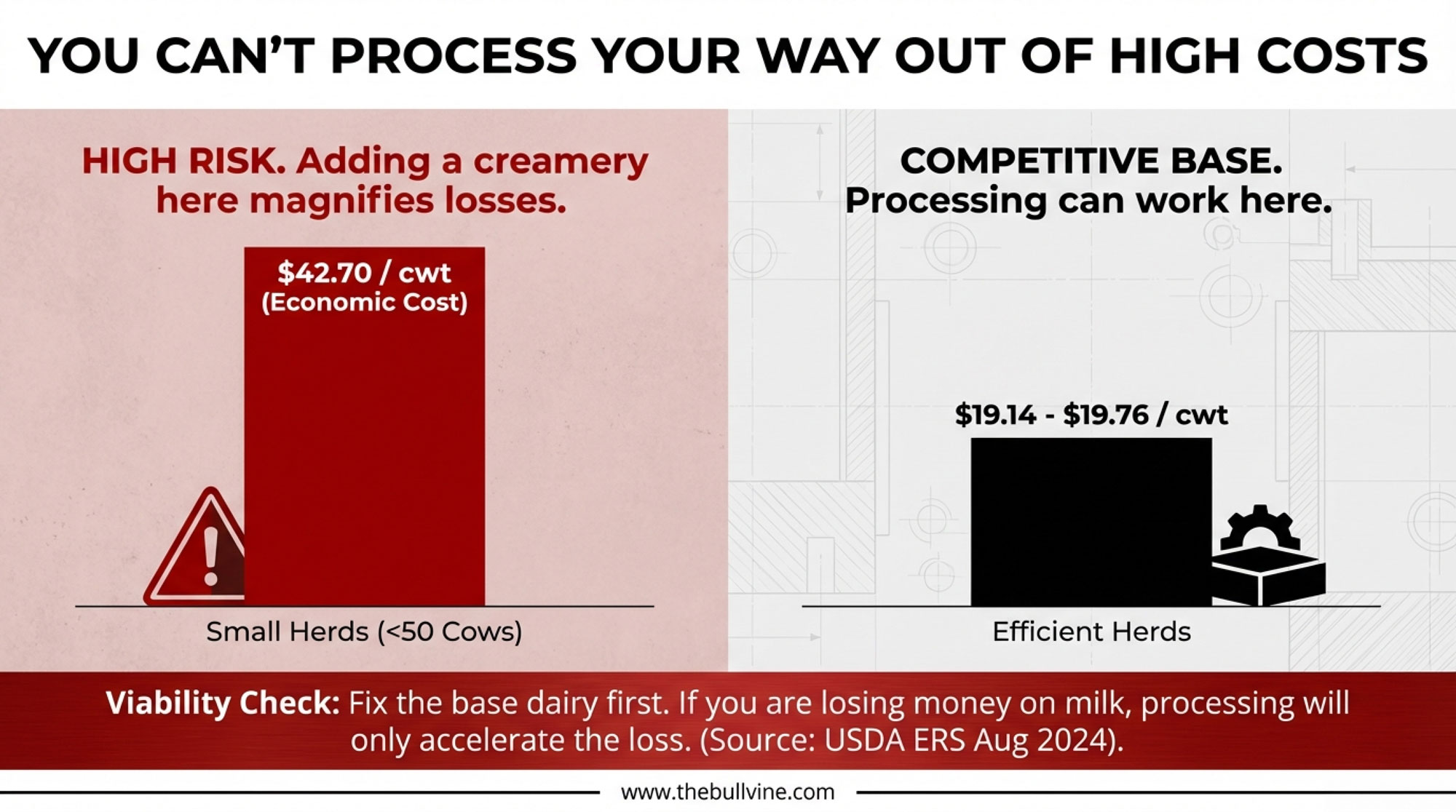

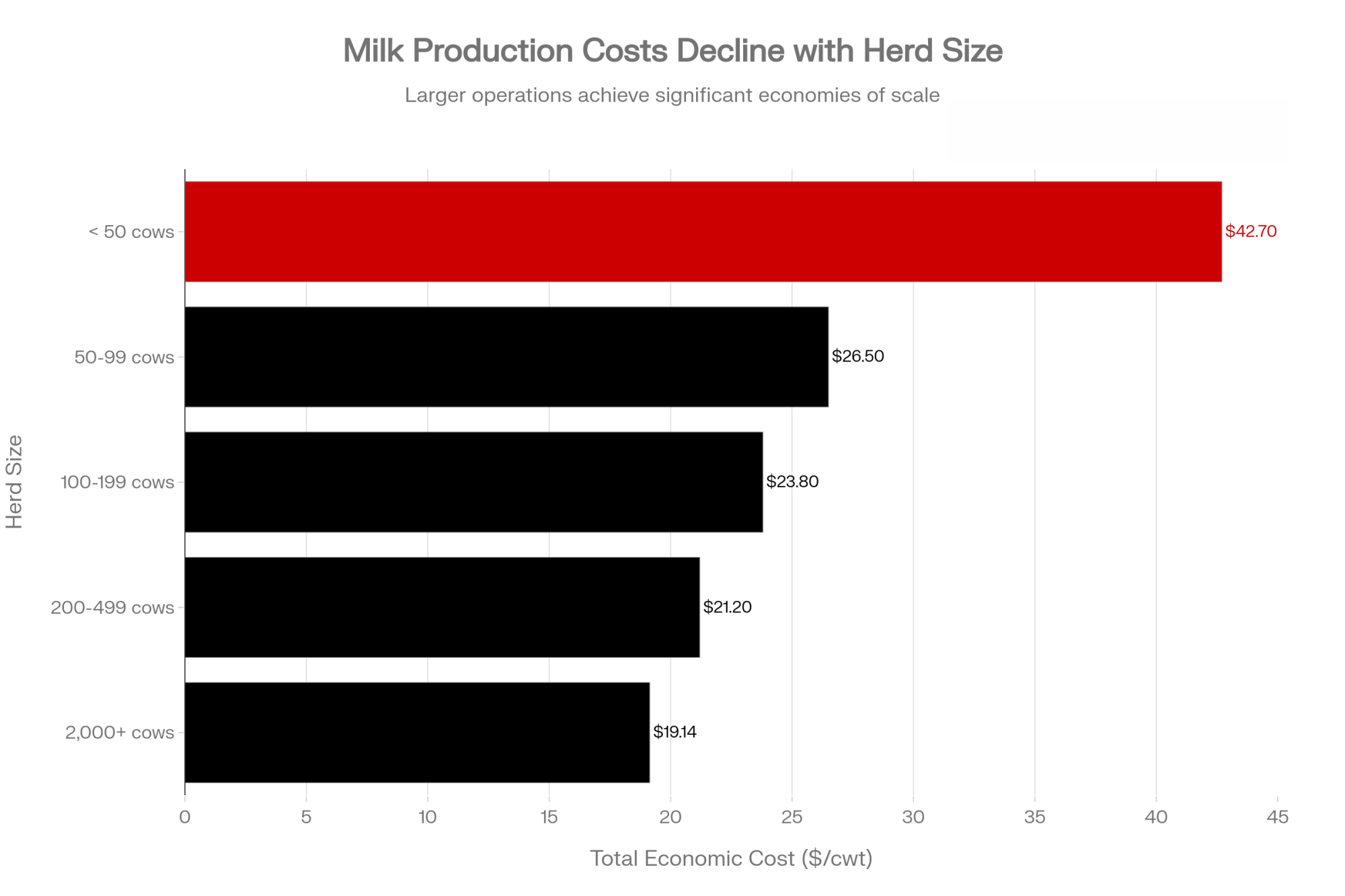

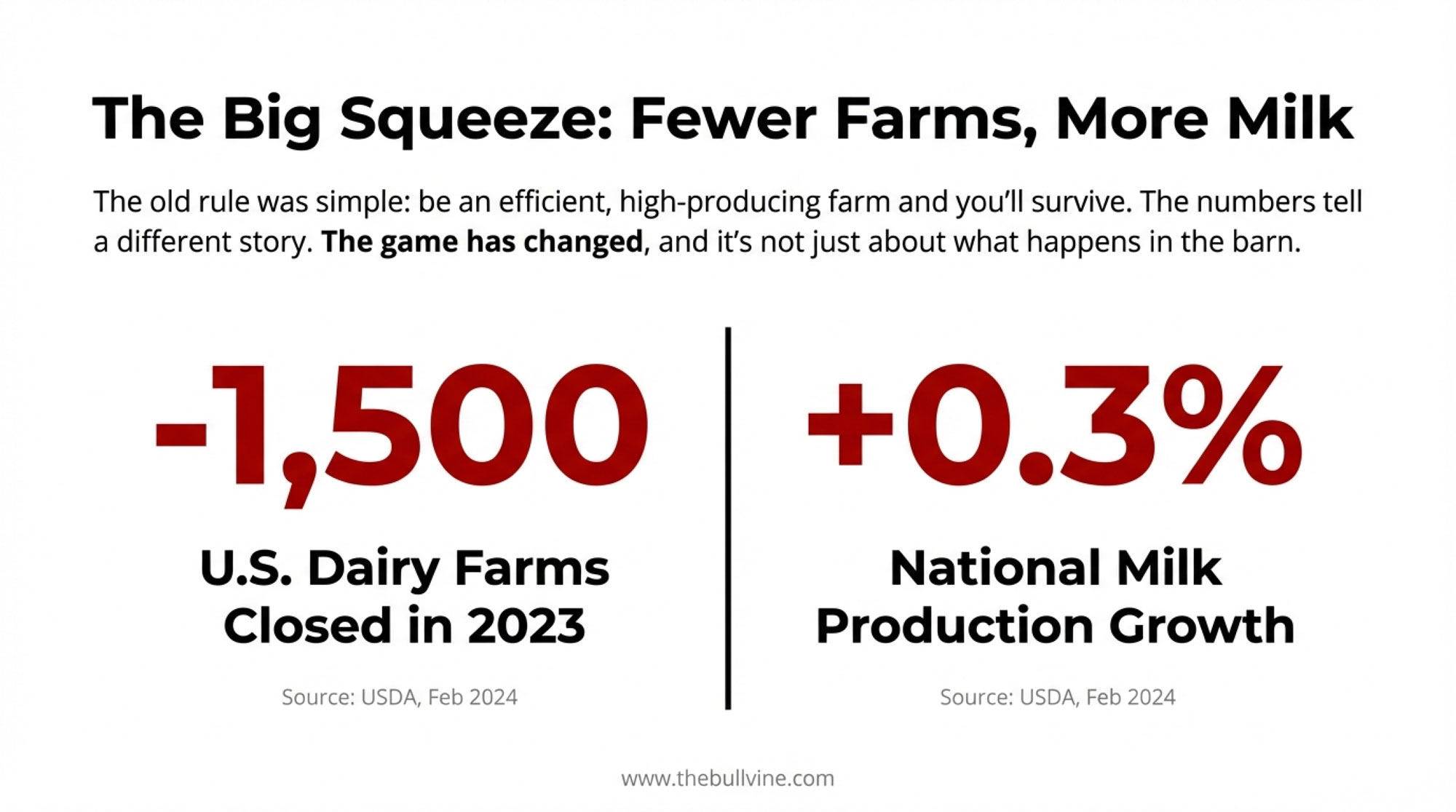

The U.S. dairy herd expanded by an estimated 211,000 cows in 2025 while margins deteriorated. More cows. Thinner checks. USDA projects output climbing to 234.1 billion pounds in 2026, and income-over-feed-cost margins are tightening toward roughly $11.40/cwt. Meanwhile, USDA-ERS cost-of-production data show even the lowest-cost tier — operations with 2,000-plus cows — averages $19.14/cwt on a full economic basis, essentially breakeven at $18.95 milk.

Italy went the other direction. The number of Italian dairy businesses actually increased over the past five years, reaching roughly 4,043 operations (IBISWorld, 2025 data). An industry gaining participants while losing volume only happens when per-unit returns make smaller-scale production pay. Industry revenue grew at a positive 1.5% CAGR over 2020–2025, while milk volume contracted at approximately –0.7% CAGR. Revenue up. Volume down.

EU-wide, the pattern holds. Milk production dropped an estimated 0.2% to 149.4 million metric tons in 2025, while cheese production rose 0.6% to 10.8 million metric tons (USDA FAS data). Germany and France shed 2.3% and 1.8% of milk output, respectively, while Dutch cooperatives lost 14% of members since 2023. The full picture is in our earlier analysis: EU production is declining while cheese output is rising.

The Parmigiano-Reggiano production zone — which extends from Parma north into Lombardy — overlaps with the broader Milano-Cortina Olympic region. The athletes and the cheesemakers are competing in the same territory this month. Only one group has figured out how to turn less into more.

What the Premium Actually Looks Like

Parmigiano-Reggiano, the world’s top-selling PDO (Protected Designation of Origin) cheese, generated €3.2 billion in turnover at consumption in 2024 — a record, up 4.9% from €3.05 billion in 2023 — from approximately 4 million wheels, according to consortium data reported at its April 2025 annual press conference in Milan. Total sales volume rose 9.2%, with domestic sales up 5.2% and exports surging 13.7%. Producer prices for 12-month matured wheels reached €11.0/kg in 2024, up 9% year-over-year. By mid-2025, wholesale hit €13.30/kg. A 21% gain.

The export math is where it gets pointed. Italian cheese exports in the first half of 2025: volume up 2.2%, value up 20.4%. Two percent more product out the door, twenty percent more revenue back. Exports now account for 48.7% of Parmigiano’s total sales volume — closing in on overtaking domestic consumption. As consortium president Nicola Bertinelli put it: “2024 was a challenging year for Parmigiano Reggiano, yet it ended with record results.” The U.S. alone absorbed over 16,000 tons in 2024, up 13.4%.

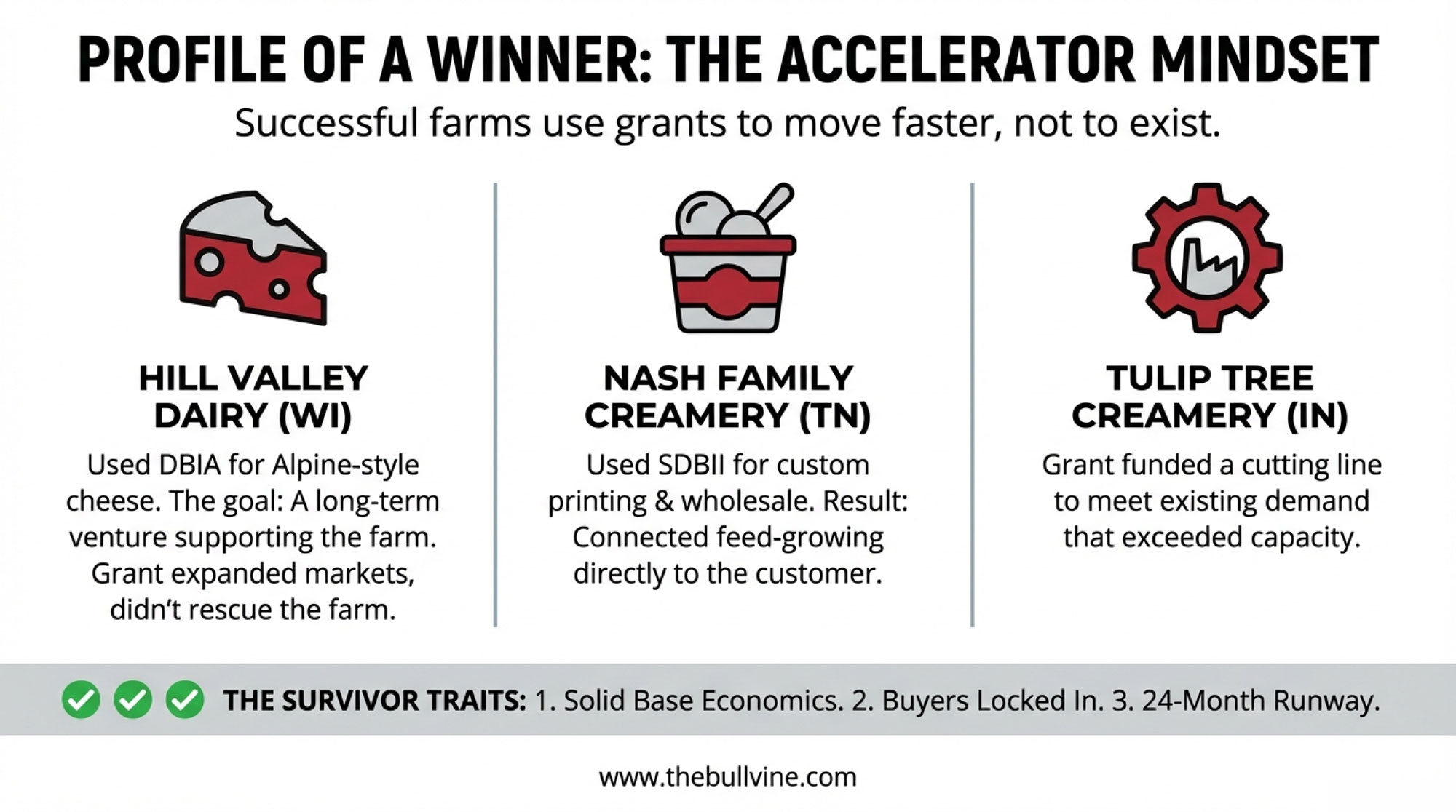

On this side of the Atlantic, Mateo Kehler’s Jasper Hill Farm in Greensboro, Vermont — population roughly 800 — generates multi-million-dollar annual revenue and pays partner farms roughly three times the commodity milk price, according to figures shared with The Bullvine. Kehler has observed that a Vermont family can make a good living with 25 to 30 cows, provided they make high-end cheese. By the operation’s own accounting, the vast majority of profits stay in-state.

But Jasper Hill is entirely debt-financed, took two decades to reach its current scale, and recently watched its Canadian export market collapse after tariff-driven boycotts. Kehler has had to buy 11 properties to house employees in a town with Vermont’s highest second-home ownership rate. Even successful premium transitions create new problems. In Wisconsin, Uplands Cheese Company — two neighboring families in Dodgeville’s Driftless Region — milks roughly 150 cows (Holsteins, Jerseys, and Brown Swiss) and produces just two cheeses: Pleasant Ridge Reserve during summer pasture months and Rush Creek Reserve in fall. At peak production, a day’s run yields up to 78 ten-pound wheels. When the cheese was launched, wholesale pricing was roughly 4 times commodity cheddar — about $10/lb versus $2.50/lb. Multiple Best of Show wins at the American Cheese Society competition. Strategic scarcity is built into the production calendar.

Why the Italian Premium Sticks

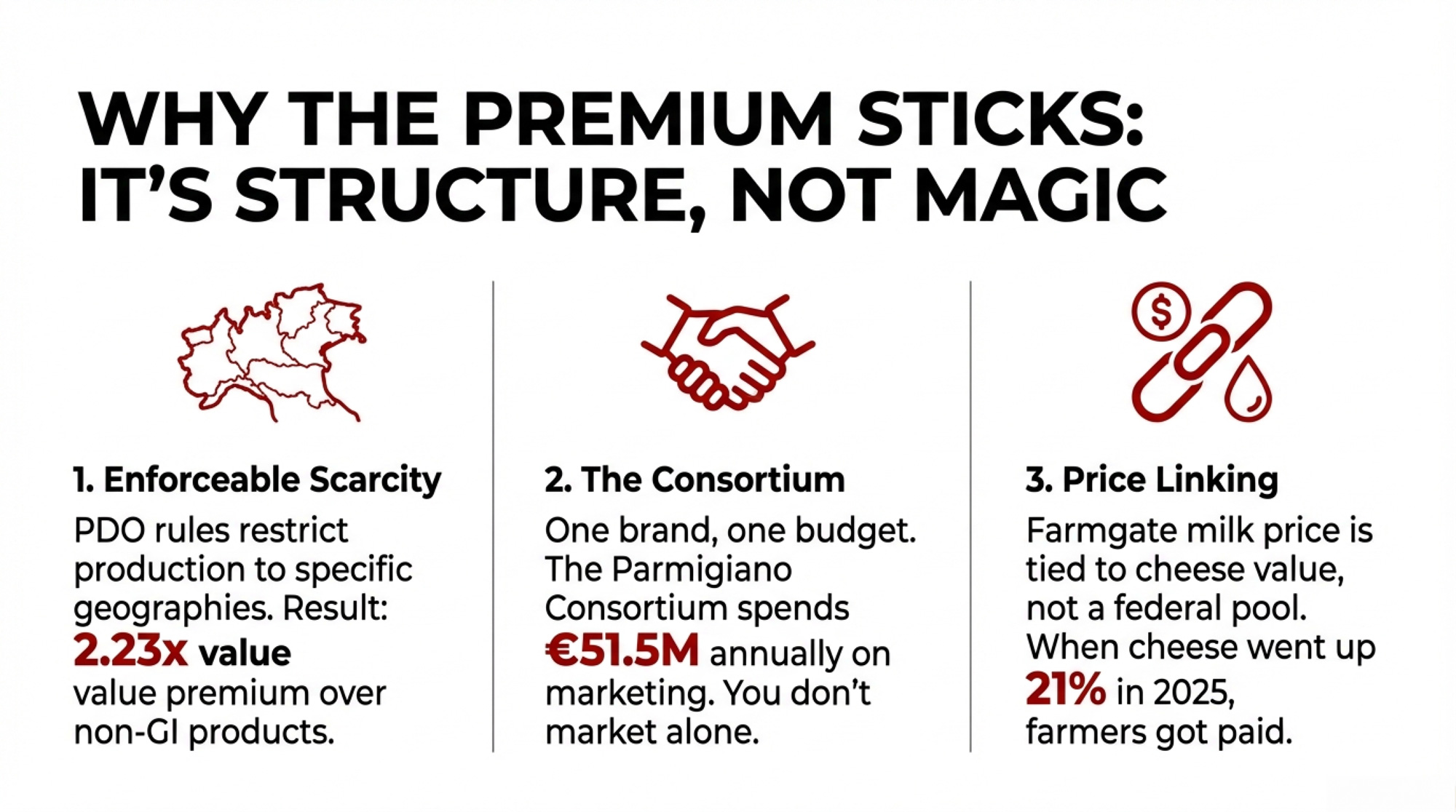

The Italian premium isn’t about Mediterranean mystique or tourist spending. It’s three structural mechanisms—and the first two are replicable.

Geographic designations create enforceable scarcity. PDO rules require all production within a defined region. A 2012 study by AND-International for the European Commission’s DG Agriculture — covering GI products across EU member states — found that the “value premium rate” for PDO/PGI products averaged 2.23 times that of comparable non-GI products. A separate, more detailed 2014 study by Areté srl for the Commission confirmed that PDO/PGI products were generally more profitable than their comparators, though with significant variation across products and regions. Export prices run roughly 11.5% higher even in international markets where consumers have no cultural attachment to the origin.

Consortium structures align producers with collective brand value. The Parmigiano Consortium operates on a projected €51.5 million budget for 2025 — including a €1.5 million crisis fund for price stabilization. Individual farms don’t need their own marketing. The consortium is the marketing.

Farmgate prices link directly to end-product value. When Parmigiano prices rise, supplying farms get paid more — Italian spot milk quotations ran €0.425–€0.4575/kg even during recent downturns. North America’s FMMO system deliberately severs that link through pooling. Under the USDA Final Rule published in January 2025, the FMMO make allowance for cheese increases to $0.2519/lb effective June 1, 2025 — locking in a higher guaranteed margin for processors before your milk check is calculated. Your milk check reflects pool averages, not what your specific milk became.

| Metric | U.S. Commodity Baseline | PDO 2.23× Multiplier | Jasper Hill (VT) | Parmigiano (Italy) |

|---|---|---|---|---|

| Base milk price | $18.95/cwt (Feb 2026 WASDE) | $18.95/cwt | $18.95/cwt | $18.95/cwt (equiv.) |

| Value multiplier | 1.0× | 2.23× (EU study avg.) | ~3.0× (est.) | 2.23× (applied) |

| Premium farmgate equivalent | $18.95/cwt | $42.26/cwt | $56.85/cwt | $42.26/cwt |

| Annual revenue (250-cow herd)¹ | $455,400 | $1,015,548 | $1,365,900 | $1,015,548 |

| Revenue gain vs. commodity | — | +$560,148 | +$910,500 | +$560,148 |

In France, the Comté PDO tells the same story. Data from French agricultural statistics (SCEES), compiled by Origin-GI, show Comté-zone farms achieved a 32% profitability premium over non-PDO dairy farms in the same Franche-Comté region. A February 2022 analysis by the French Ministry of Agriculture’s Centre for Studies and Strategic Foresight confirmed the pattern, finding Franche-Comté PDO farms earned a surplus of approximately €22,000 per agricultural worker unit compared to non-GI farms in surrounding areas. Farmgate milk ran 14% above baseline. Between 1988 and 2000, PDO-area farms lost 36% of their operations — a painful but non-PDO farm loss in the same area was 57%. The designation didn’t prevent consolidation, but it meaningfully slowed it.

These systems aren’t risk-free. Long aging cycles tie up capital for months or years, concentrated brands can suffer when export demand softens, and inventory exposure during downturns is real. But the studies suggest that, over time, farms inside well-run GI systems have had more room to absorb shocks than their commodity neighbors. For more on how geographic indications are reshaping global dairy trade, including the U.S. industry’s pushback, see our earlier analysis.

Four Paths Forward — and What Each One Costs

Not every operation can or should pursue the same route. Your scale, your balance sheet, and how much transition risk your family can absorb determine which path makes sense.

| Path | Upfront Capital | Timeline to Premium | Risk Level | Best Fit |

| 1. Component optimization | Minimal | Immediate | Low | Any herd with protein below 3.4% |

| 2. Individual farmstead cheese | $750K–$1.2M | 3–5 years | High | Operations with strong local market access |

| 3. Collective regional consortium | $60K–$70K per farm | 5–7 years | Moderate | 3+ neighboring herds facing shared margin pressure |

| 4. Demographic-driven specialty | Moderate | 1–3 years | Moderate | Herds near growing Hispanic or urban markets |

Path 1: Component optimization. Under FMMO reforms effective June 1, 2025, moving from 3.1% to 3.4% protein could generate approximately $8,640 annually for a 200-cow herd based on current component pricing — no infrastructure change required. At the February WASDE’s $18.95/cwt outlook, a herd with a $19.50 break-even faces a $0.55/cwt gap — component optimization (including butterfat and quality adjustments) could plausibly close that. At a $20.50 break-even, you’re staring at a $1.55/cwt hole, and $8,640 on 48,000 cwt is only $0.18/cwt in protein gains alone. Path 1 is a margin patch, not a margin strategy. But if your gap is under roughly $1.00/cwt, components might be enough.

| Path | Upfront Capital | Timeline to Premium | Risk Level | Best Fit | Est. $/cwt Gain |

|---|---|---|---|---|---|

| 1. Component Optimization | Minimal (<$10K) | Immediate (0–6 mo) | Low | Any herd with protein <3.4%, gap <$1.00/cwt | $0.15–$0.50/cwt |

| 2. Individual Farmstead Cheese | $750K–$1.2M | 3–5 years | High | Strong local market access, $150K+ working capital | $5–$15/cwt |

| 3. Collective Regional Consortium | $60K–$70K/farm | 5–7 years | Moderate | 3+ neighboring herds, shared margin pressure | $3–$8/cwt |

| 4. Demographic-Driven Specialty | $150K–$400K | 1–3 years | Moderate | Near Hispanic/urban markets, no aging required | $2–$5/cwt |

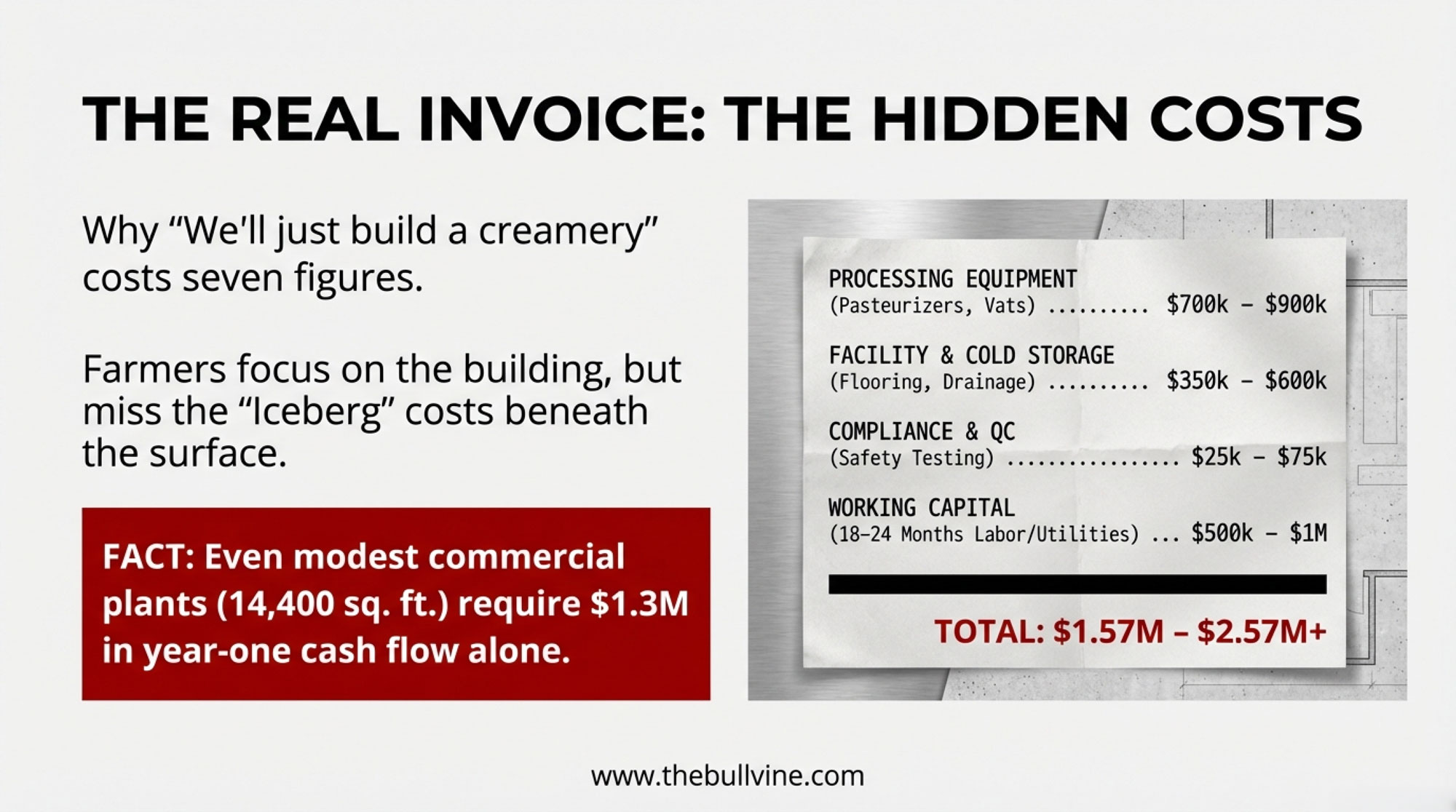

Path 2: Individual farmstead cheese. A 2014 study by Bouma et al., published in the Journal of Dairy Science, found that startup costs for artisan cheese processing and aging facilities ranged from $267,248 to $623,874 for annual production volumes of 7,500 to 60,000 pounds. Bullvine’s own financial modeling — which extrapolates Bouma et al.’s capital benchmarks to current prices and adds working capital, a broader product mix, and aging capacity — puts total investment for a 250-cow operation diverting 40% of milk to artisan cheese at roughly $750,000 to $1.2 million. Annual cheese operating costs add approximately $456,000. The model shows cumulative returns turning positive around Year 4 at $18/lb artisan retail pricing. Kehler’s experience suggests the model works from roughly 25 cows up, but the capital structure looks completely different at 25 versus 250.

Uplands Cheese proves the premium is real — four times commodity cheddar at wholesale — but the operation runs on 150 cows making just two cheeses, and only during months when pasture conditions are ideal. And here’s the sobering counterweight: the American Cheese Society’s 2022 biennial industry survey — funded by the American Cheese Education Foundation, based on responses from more than 200 artisan and specialty cheesemakers (published June 2023) — found 24% of U.S. artisan cheesemakers gross under $50,000 annually. Premium pricing is not automatic. As Paul Scharfman told the Wisconsin Dairy Task Force 2.0, “many specialty cheesemakers are fighting for the same four-foot section in a grocery store.”

Path 3: Collective regional consortium. Twenty farms sharing infrastructure brings individual exposure to roughly $60,000–$70,000 per farm. A consortium modeled on France’s Comté CIGC — shared aging infrastructure, collective branding under a USPTO certification mark, codified production standards that naturally constrain supply — addresses the capital and distribution barriers that kill individual producers. The trade-off is real: Parmigiano producers subordinate their individual farm identity entirely to the regional brand. You gain collective pricing power. You give up the option to differentiate on your own terms. John Umhoefer of the Wisconsin Cheese Makers Association identified “money, licensing, regulations, and liability” as the obstacles when the Wisconsin Dairy Task Force explored exactly this concept. DATCP had $200,000 in total processor grant funding. Parmigiano’s consortium operates on €51.5 million. That funding gap tells you everything about institutional commitment.

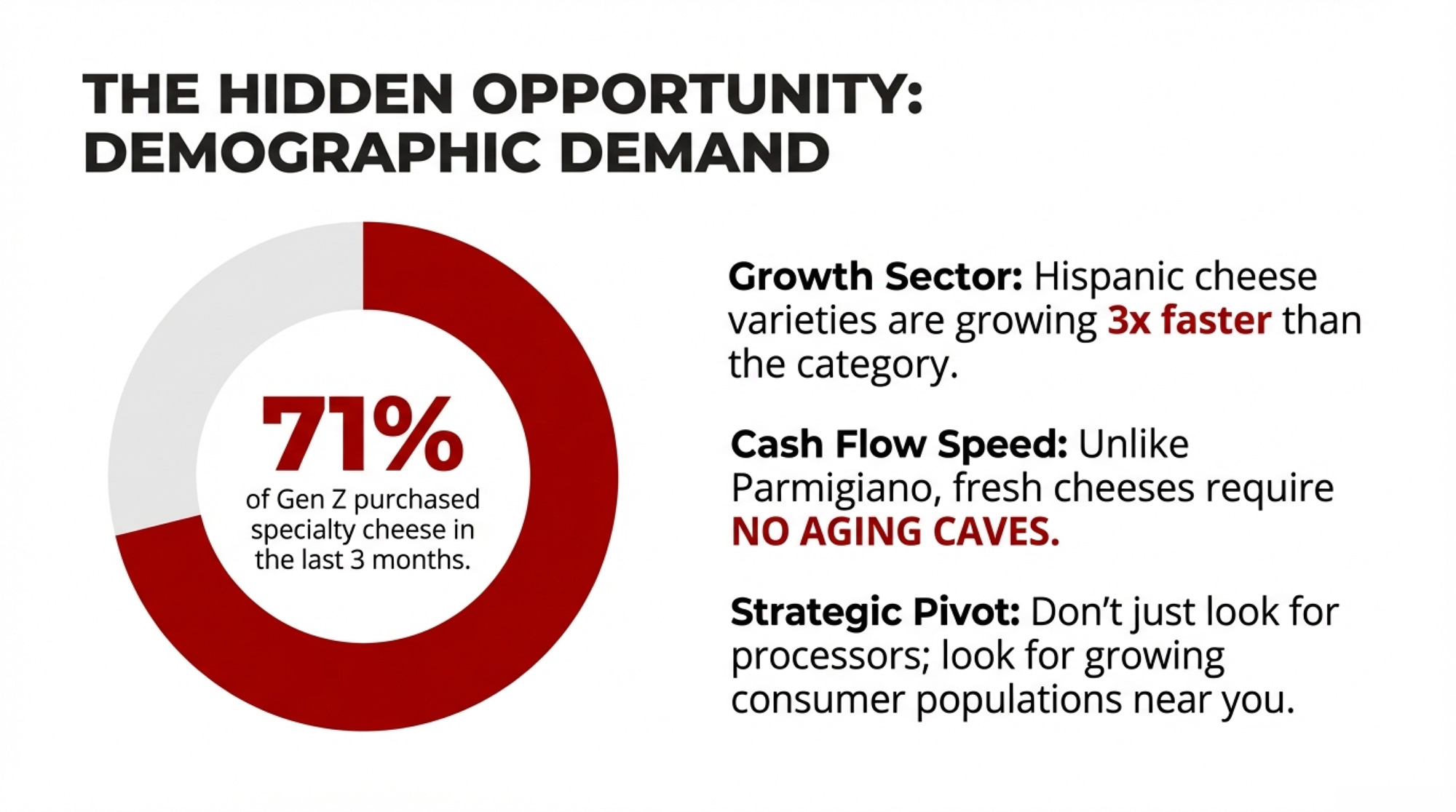

Path 4: Demographic-driven specialty. Hispanic cheese varieties are growing at more than three times the rate of the broader cheese category, according to DFA’s Ken Orf, citing Circana data from early 2024. The latest 52-week MULO+ data (ending December 29, 2024) confirms the acceleration, with Hispanic cheeses growing at 2× to 27× faster than mainstream counterparts in comparable applications. DFA’s acquisition of W&W Dairy in Wisconsin was targeted directly at this segment. No aging caves required, no geographic branding necessary — you need to understand which consumer populations are expanding near you and produce for them.

The Demand Signal Is Already There

A nationally representative survey of 583 U.S. supermarket shoppers — commissioned by Supermarket Perimeter and conducted by Cypress Research (Kansas City, Mo.) with fieldwork in March 2023 — found 64% of Americans purchased specialty cheese in the prior three months. Gen Z led at 71%. And 56% of specialty cheese buyers actively seek seals of authenticity or origin, even though there is no North American GI system.

Market data from Circana supports it. Over the most recent 52-week tracking period in 2025, deli specialty cheese sales rose 8% in both dollars and volume, led by Hispanic and Italian cheese types. American cheese — the commodity benchmark — fell nearly 5% over the same stretch. Rachel Shemirani, senior vice president of Poway, California-based Barons Market, described Gen Z consumers gaining “visual access to different types of specialty cheeses” through TikTok, driving discovery that once took generations to build. The Milano-Cortina Games this month will put Italian food production on a global screen for two weeks, but the domestic demand signals suggest North American consumers don’t need the reminder.

California’s Real California Milk seal — a regional origin certification, not a formal PDO — already delivers a measurable 6.3 percentage point sales spread over non-origin-branded specialty cheese in the same stores (Circana/IRI data, 52 weeks ending May 2023: volume up 3.3% with seal, down 3.0% without). “Domestic origin labeling, and even more so local connotations, carry our customers’ trust in their quality and value,” said the California Milk Advisory Board’s Katelyn Harmon.

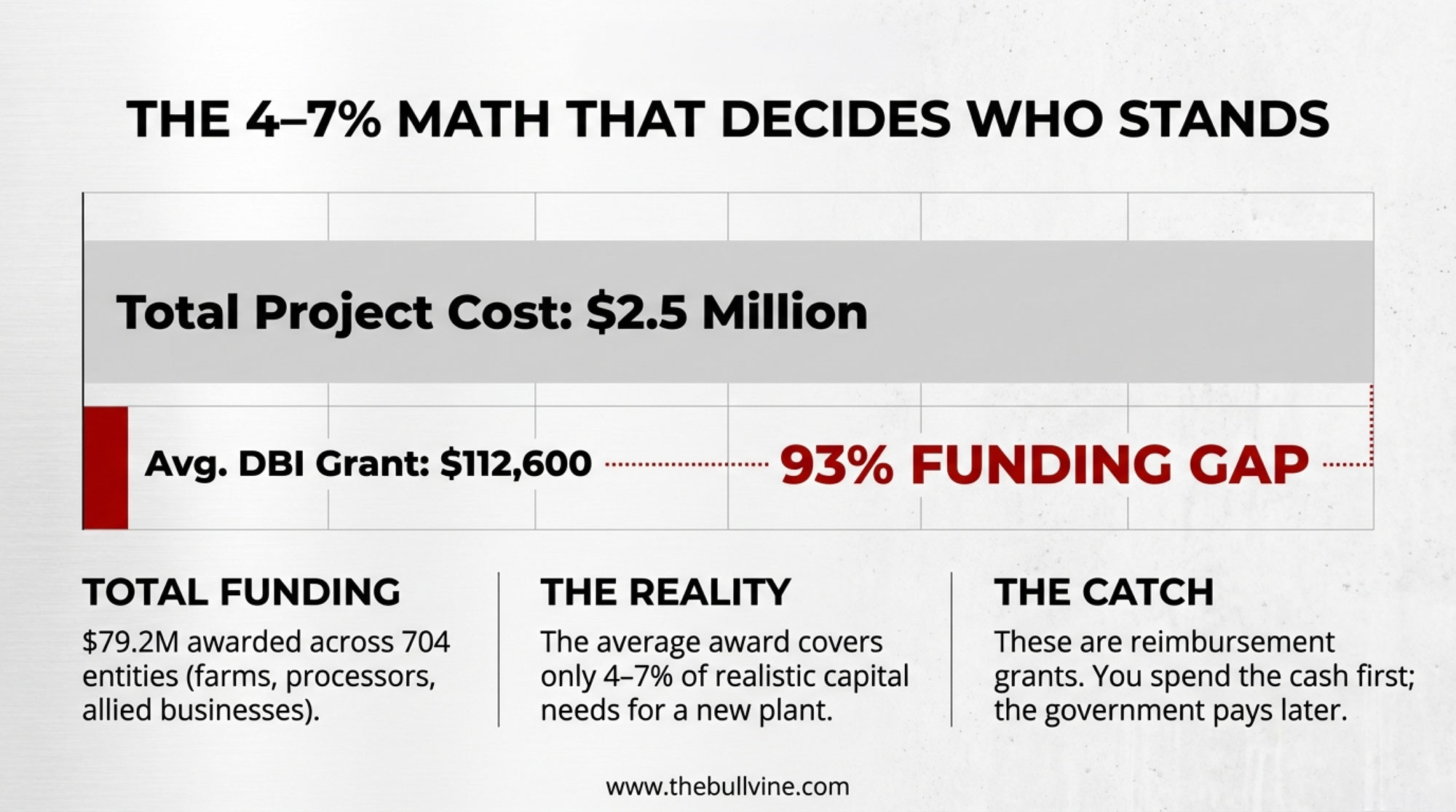

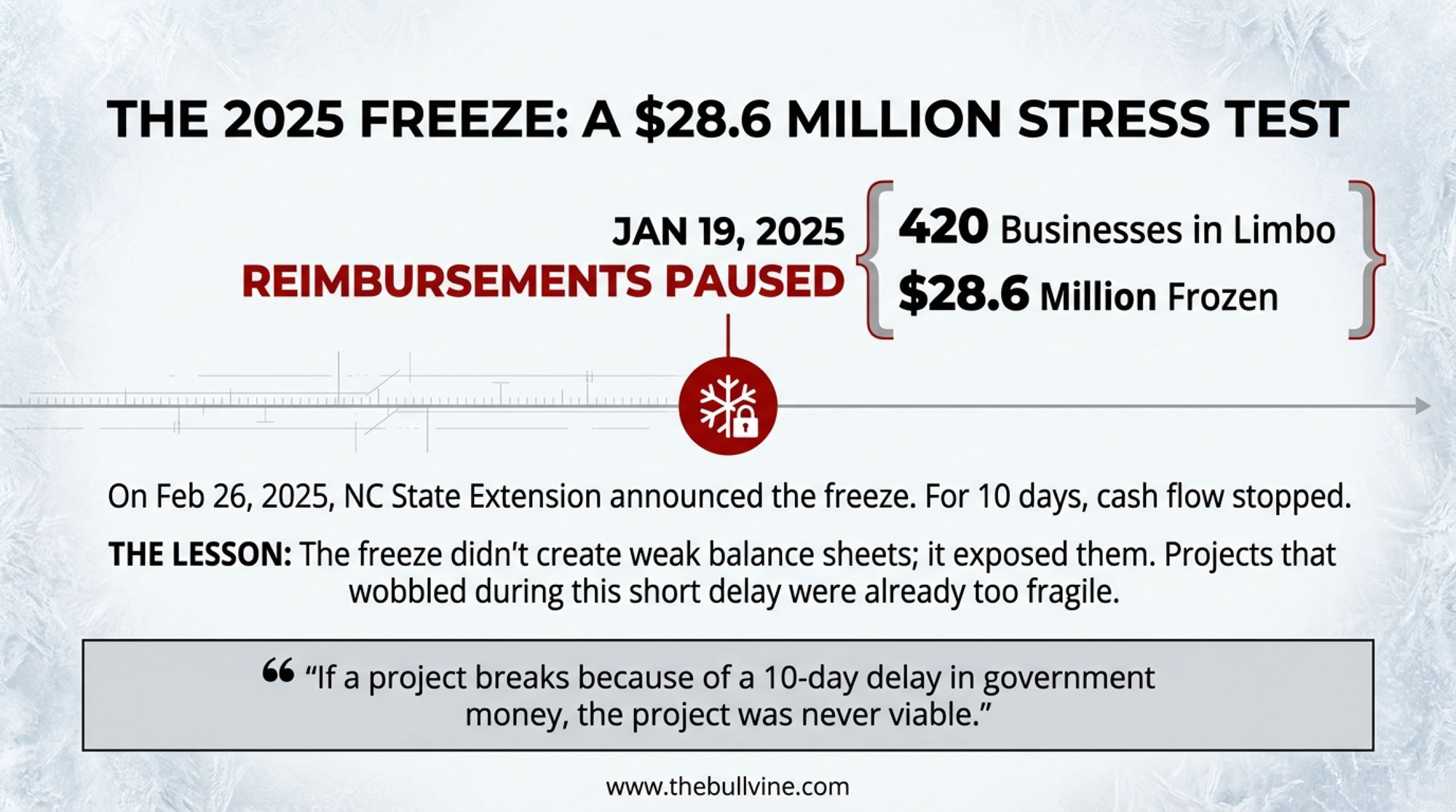

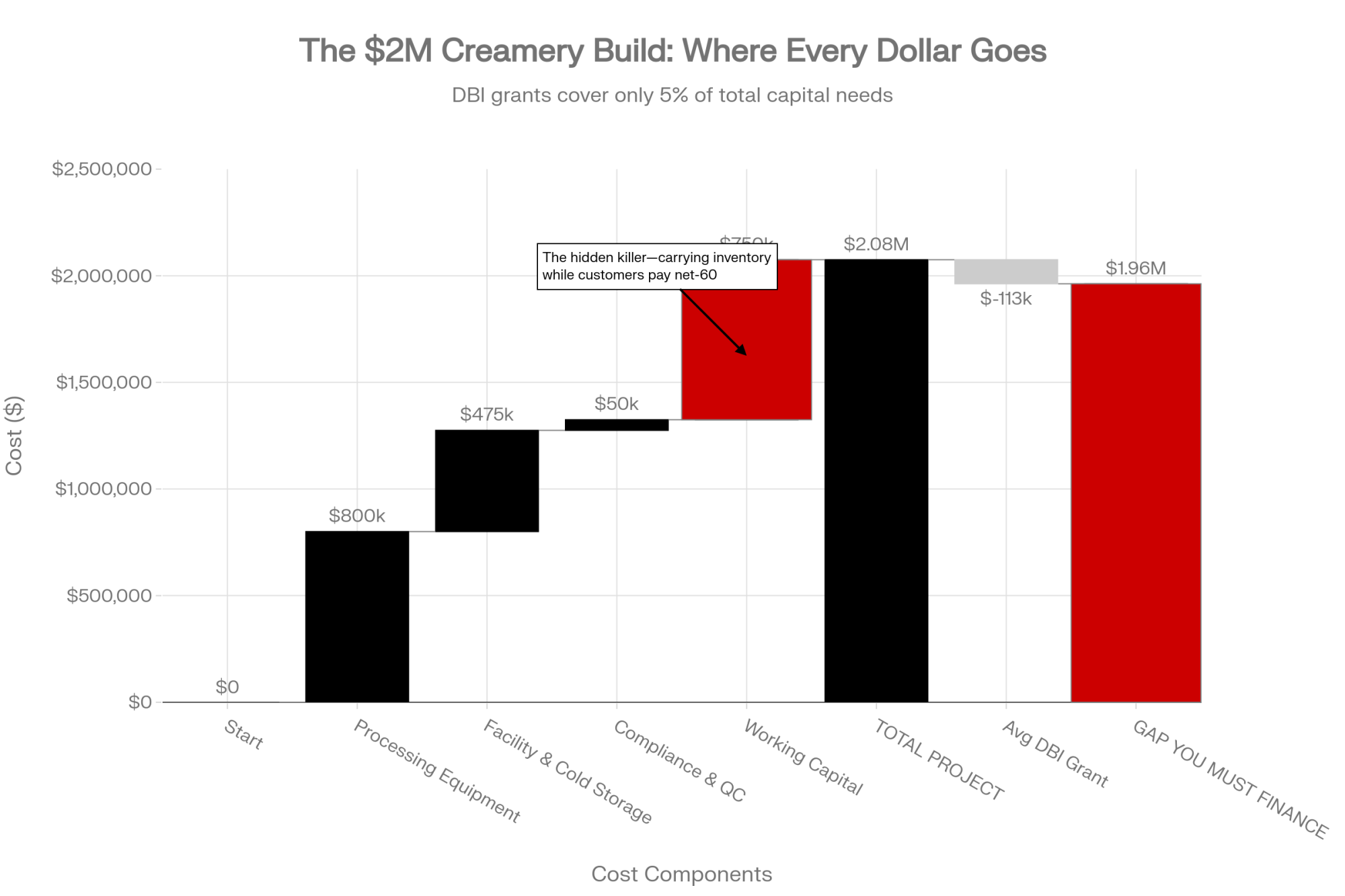

On the institutional side, USDA announced $11 million in new Dairy Business Innovation Initiative grants on January 20, 2026. Wisconsin and Vermont each received $3.45 million — explicitly earmarked for value-added development in small and mid-size dairy operations. That comes on top of the $11 billion in new processing capacity coming online through 2028, almost all of it commodity-oriented. The question is whether any of the new stainless includes specialty or aged-cheese capacity—and whether premium returns would flow back through your milk check.

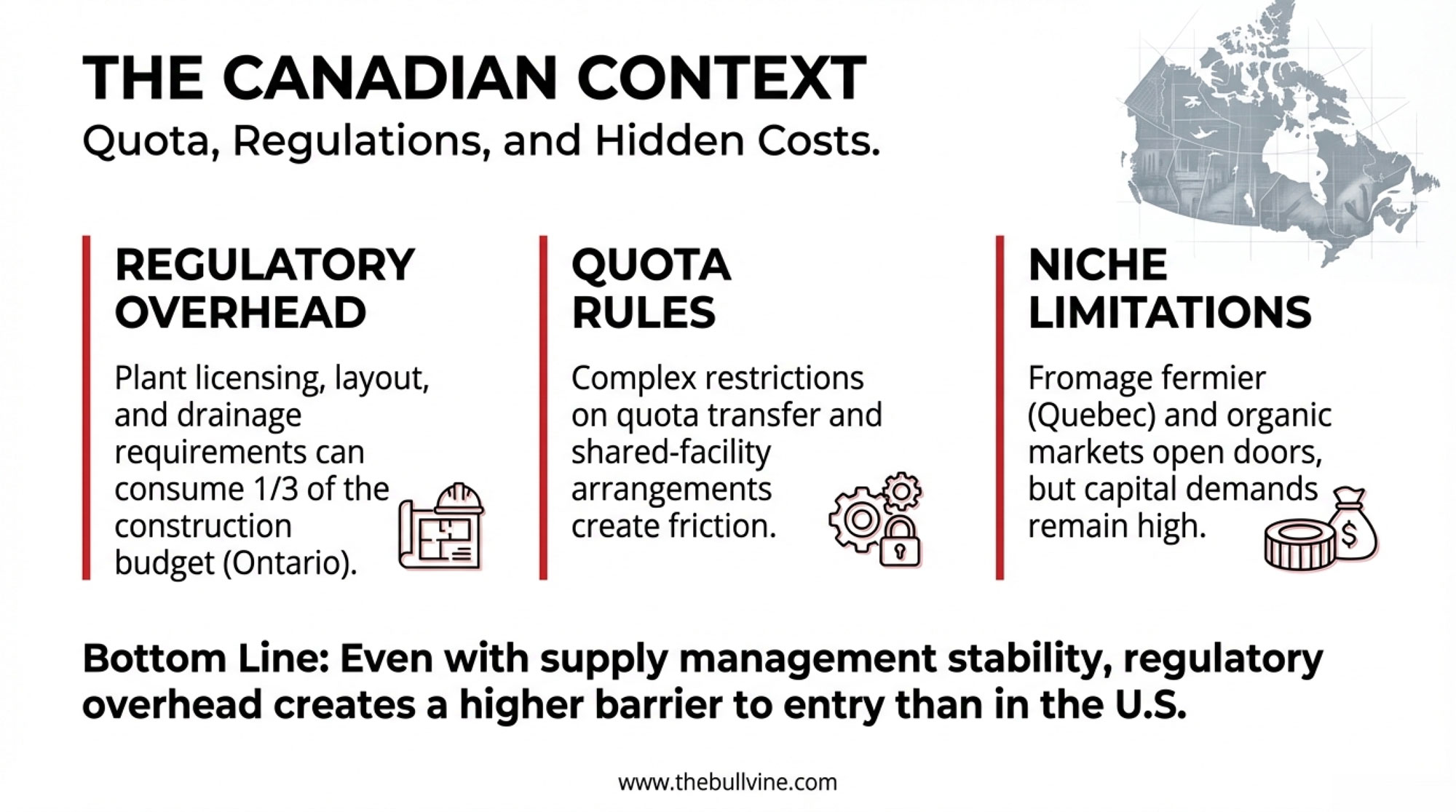

The Canadian Paradox: You Already Have Organized Scarcity — Without the Premium

Here’s the part that should frustrate Canadian producers most: you’re already operating inside a managed-supply system. Quota limits production. Tariffs block imports. The Canadian Dairy Commission sets prices. Supply management has shaped the structure of the Canadian dairy industry since 1972. That’s organized scarcity—the same foundational principle behind every PDO consortium in Europe.

And yet the economic outcomes aren’t even close.

| System Feature | Parmigiano Consortium (Italy) | Canadian Supply Management | Result |

|---|---|---|---|

| Quota system | Yes – tied to brand protection | Yes – tied to domestic demand matching | Both manage scarcity |

| Annual brand investment | €51.5M (2025 budget) | $350M CETA compensation (couldn’t measure impact) | Italy builds value; Canada maintains floor |

| Farmgate price mechanism | Contractually linked to wheel prices | Regulated floor price, pooled | Italy: price rises with product; Canada: static regulation |

| Premium to farmers (vs. commodity) | 2.23× average (EU study) | Minimal to none | Italy captures value; Canada captures stability |

| Producer count trend (recent) | +4,043 operations (growing) | –24% farms (2012–2022) | Italy adds participants; Canada consolidates |

| Export competitiveness | 48.7% of sales, growing 13.7%/yr | Faces 16,000 MT duty-free EU cheese imports | Italy wins globally; Canada defends domestically |

| Price volatility | Low (brand-buffered) | Low (quota-regulated) | Both stable—but only Italy delivers premium |

The Parmigiano Consortium also assigns production quotas directly to farmers, with financial contributions required from anyone who exceeds their allocation—a system the Italian Ministry of Agriculture formally approved for the 2020–2022 cycle and has renewed since. Both countries manage supply. But Italy’s quotas exist to protect the brand value of a €3.2 billion product and flow premium returns back to the farms that produce the milk. Canada’s quotas exist to match domestic supply to domestic demand at a regulated floor price. One system creates scarcity, driving up the value of the end product. The other creates scarcity that maintains stability, which is a different thing entirely. For many Canadian farms, that stability has been the point, and it’s delivered real income predictability that U.S. producers riding the WASDE rollercoaster don’t have. But it hasn’t translated into a structural price premium the way PDO status has in Europe.

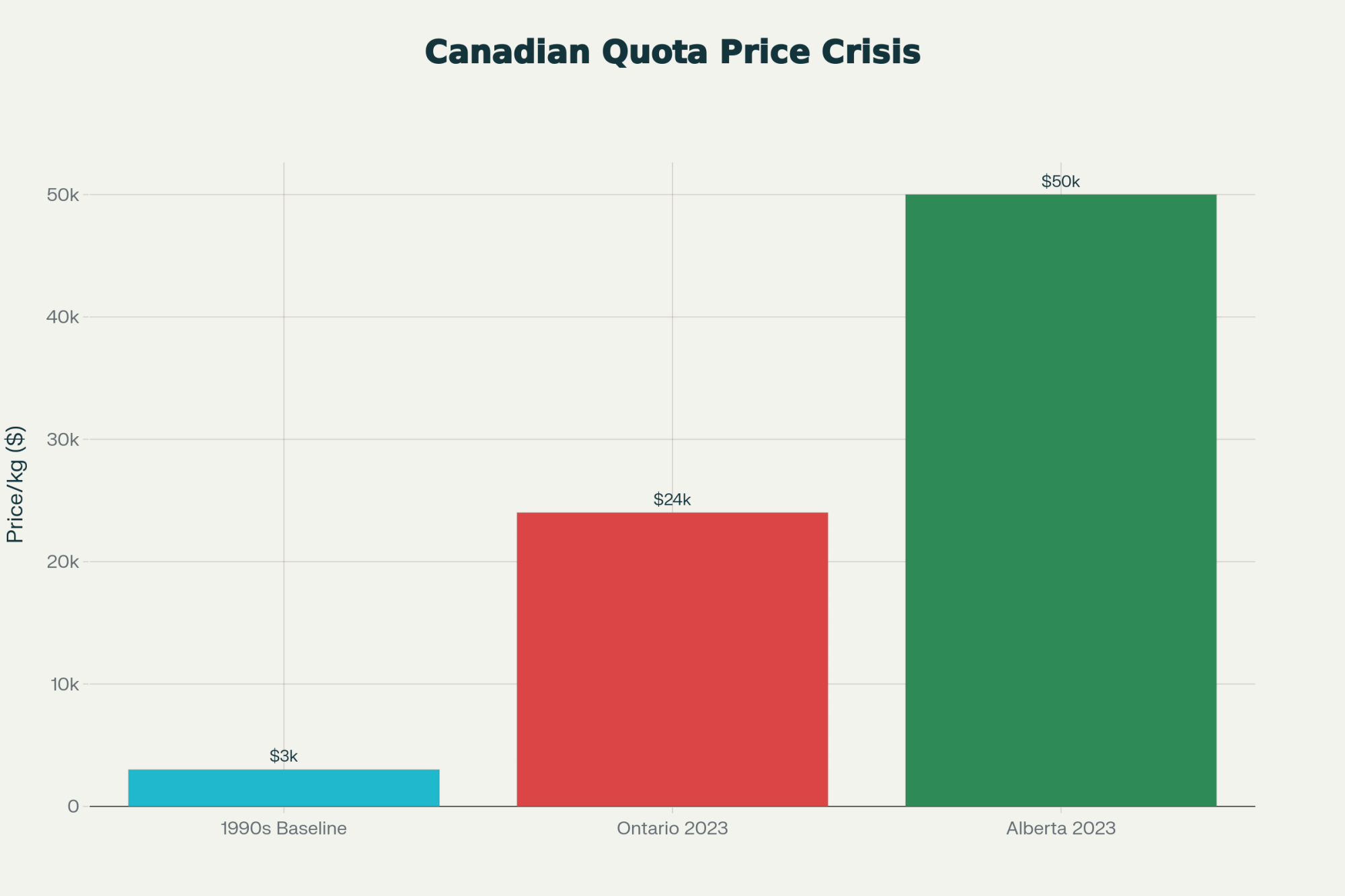

The numbers bear it out. Canadian dairy cash receipts rose from $5.9 billion to $8.2 billion between 2012 and 2022 — a 39% increase (AAFC evaluation, 2024). But the number of farms dropped from 12,762 to 9,739 over the same period, a 24% decline. Production went up 18%. Fewer farms, more milk, higher gross receipts — and yet, as McGill University’s 2023 policy analysis concluded, the system “limits producers’ ability to set the price and quantity of their products” and “prevents farms from achieving economies of scale.” Quota costs in Ontario sit at roughly $24,000 per kilogram of butterfat per day; in other provinces, recent transactions have exceeded $44,000 and even $56,000 per kg/BF/day (Agriculture Canada, 2025 monthly quota trade reports). That capital buys you the right to produce milk at a regulated price. It doesn’t, on its own, create a premium brand.

Agriculture Canada’s own evaluation of the $350 million CETA compensation programs (DFIP and DPIF) was blunt: the department “is unable to determine whether either program mitigated anticipated future growth losses” from increased European cheese imports. Meanwhile, CETA opened the door to 16,000 metric tonnes of duty-free EU cheese annually — about 4% of Canadian consumption. The irony is hard to miss: European PDO cheese is entering the Canadian market because it commands a premium, while Canadian producers inside a managed-supply system have no structural mechanism to build comparable brand value with their own milk.

It’s not impossible to break through. Gunn’s Hill Artisan Cheese in Oxford County, Ontario — Canada’s self-described Dairy Capital — demonstrates at least a partial path. Owner Shep Ysselstein trained in the Swiss Alps, then returned to build a small artisan cheese plant using milk from his family’s neighboring dairy farm, Friesvale Farms. Today, Gunn’s Hill produces Swiss-style artisan cheeses sold in over 300 retail locations across Ontario. And as of this week, dairy farmer organizations across Canada are changing how farmers get paid for milk to meet growing demand for protein — cottage cheese alone grew 32% — which at least signals the system can adapt when market pull is strong enough.

But Gunn’s Hill is small, regional, and essentially operating around the edges of supply management rather than through it. What’s missing isn’t the production discipline — Canadian dairy already has that in spades. What’s missing is the brand architecture, the collective marketing investment, and the legal framework that turns managed scarcity into managed premium. Italy devotes €51.5 million a year to one consortium’s brand. Canada spent $350 million across the sector — and AAFC couldn’t determine whether those investments protected future growth.

What This Means for Your Operation

Before your next capital decision, these are worth working through:

- Where does your real break-even point sit? Not cash break-even — real break-even, with family labor, principal, and living expenses honestly accounted for. Farmdoc’s 2024 analysis pegs full costs in the low $20s/cwt. USDA-ERS data show even the largest herds (2,000+ cows) average $19.14/cwt on a full economic basis. The February WASDE raised the 2026 all-milk outlook to $18.95/cwt — up from $18.25 in January — but a 250-cow herd at a $20.00 break-even still faces a $1.05/cwt structural gap, or roughly $63,000 annually. If your gap exceeds $1.50/cwt, component optimization alone won’t close it. That’s a structural problem, not an efficiency problem.

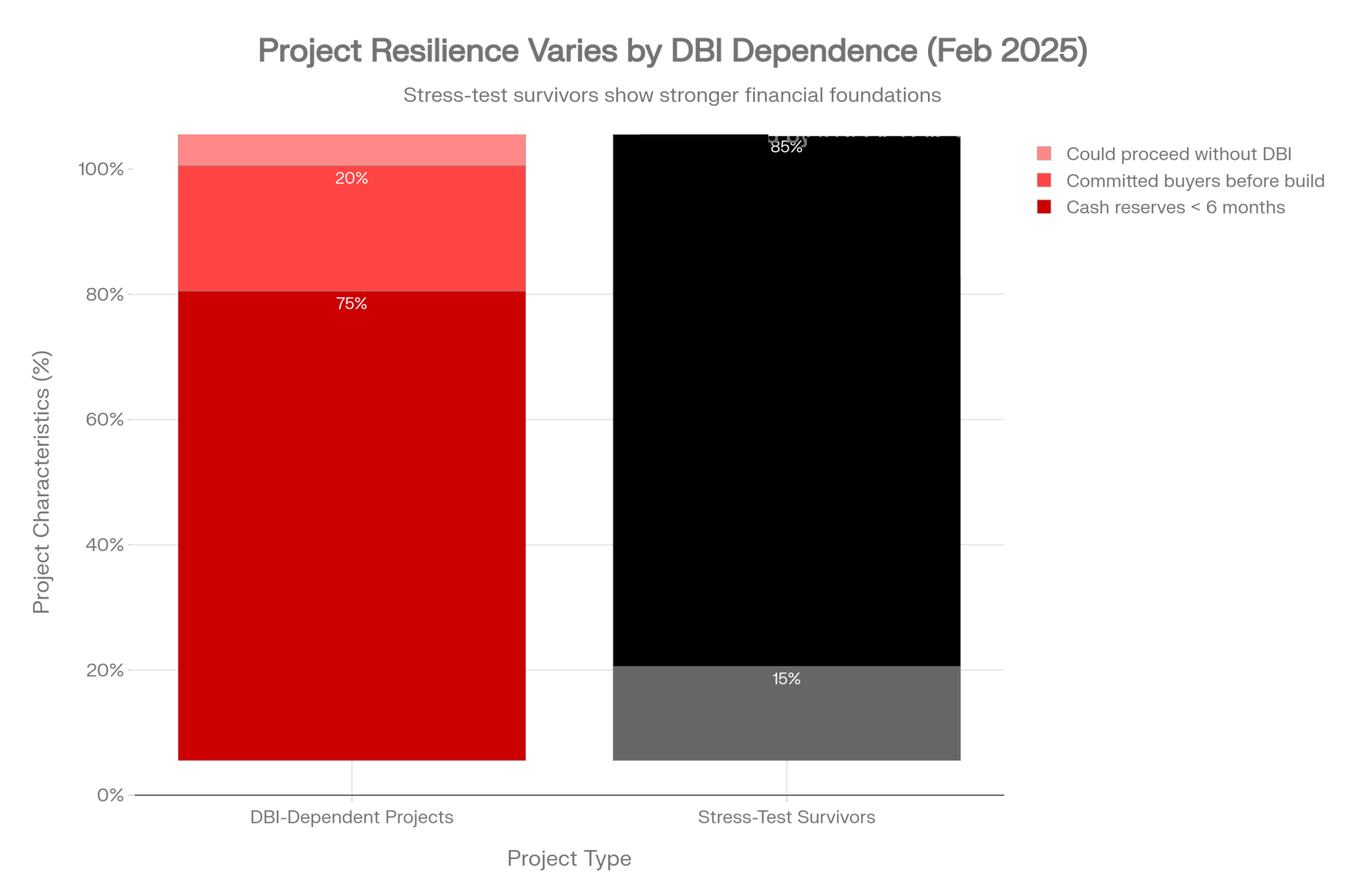

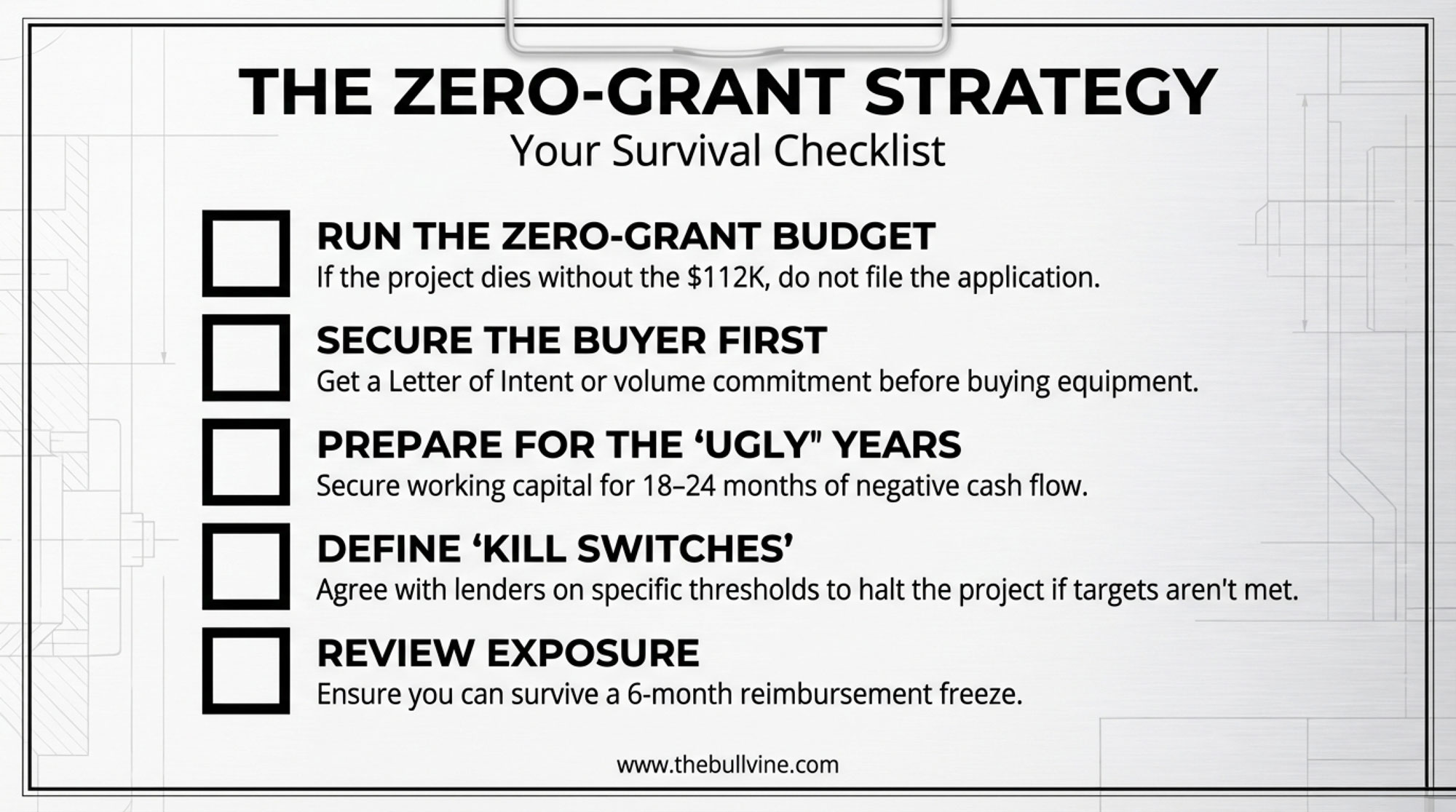

- How many years of operating losses can your balance sheet absorb? The farmstead cheese model shows a 42-month ramp to positive cash flow. If your current debt service doesn’t leave room for three-plus years of additional operating costs, Path 2 isn’t viable without outside capital — whether that’s DBI grants, USDA Rural Development financing, or equity partners.

- Is there a specialty processor within 100 miles who could use your milk at a premium? Jasper Hill pays partner farms at a rate triple the commodity rate. Operations like this cluster across Vermont, Wisconsin, Oregon, and upstate New York. The conversation costs nothing.

- Are three or more neighboring operations facing similar margin pressure? If each operation’s gap exceeds $1.50/cwt, the cost of a collective exploration of shared processing infrastructure is less than one farm’s annual component premium — and the DBI grants specifically fund this kind of feasibility work.

- Has your cooperative discussed value-added returns to producers? The $11 billion in new U.S. processing capacity coming online through 2028 is almost entirely commodity-oriented. Ask whether any of it includes specialty or aged-cheese capacity — and whether premium returns would flow back through your milk check.

- Does your state dairy association have a position on geographic indication development? NMPF and USDEC have identified GI protections as trade barriers in 34 markets, opposing them on stated grounds that GIs function as non-tariff barriers. As USDEC’s Krysta Harden put it in our Global Cheese Wars analysis: “Europe’s misuse of geographical indications is nothing more than a trade barrier dressed up as intellectual property protection.” The organizations representing you nationally may oppose the legal framework that underpins Italy’s pricing power. It’s a question worth raising at your next member meeting.

Key Takeaways

- Italy generates €22.8 billion in dairy revenue while production volume shrinks — driven by PDO-protected cheese commanding 2.23 times the value premium of comparable non-GI products, according to AND-International’s 2012 study for the European Commission.

- North American consumer demand for premium cheese is well established: 64% of U.S. shoppers buy specialty cheese regularly, with Gen Z leading at 71%, and 56% of buyers actively seek origin seals (Cypress Research for Supermarket Perimeter, March 2023).

- A collective consortium approach reduces per-farm investment from $750K–$1.2M to roughly $60K–$70K — and $11 million in fresh USDA DBI funding is available now.

- USDA’s 2026 all-milk outlook has whipsawed from $19.25 (November) to $18.25 (January) to $18.95 (February WASDE). That volatility itself is the point: commodity producers absorb every revision; value-added producers are structurally insulated from it.

- Canada already has organized scarcity through supply management — the same foundational principle Italy uses — but hasn’t built the brand premium layer on top of it. The structure is there. The premium isn’t.

- The realistic timeline is 5–7 years to meaningful premium returns for individual operations, potentially faster for organized collective efforts. Comté’s 32% profitability premium over neighboring farms — confirmed by both Origin-GI analysis and the French Ministry of Agriculture’s 2022 study — took 15–20 years to fully mature, but the divergence from the commodity market began almost immediately.

The Bottom Line

Italy didn’t build a €22.8 billion dairy industry by expanding herds. It organized producers into consortiums that turned commodity milk into protected brands — then enforced the quality and scarcity that hold price. The USDA outlook bounced 70 cents in one month. Next month, it could drop again. Value-added producers don’t spend February wondering which direction the revision goes. Where does your operation sit on that question?

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More

- USDA Says $18, Futures Say $16: The $150k Gap That’s Rewriting 2026 Dairy Budgets – Secure your operation’s survival by mastering the math behind 2026 budgets. This analysis breaks down the gap between USDA forecasts and reality, delivering the ROI benchmarks you need to make immediate, profitable margin adjustments.

- The Global Cheese Wars: How Geographic Indications Are Reshaping Dairy Markets Worldwide – Gain a critical understanding of the legal fight over branding and how its outcome determines your pricing power. It exposes the structural shifts in global trade that will dictate where future premiums flow.

- DFA’s Wisconsin Play: Why This Cheese Move Signals a Major Market Shift – Position your operation for growth by understanding why industry leaders are pivoting toward specialty production. This analysis delivers a roadmap for aligning your herd with expanding consumer segments to capture a measurable advantage.

The Sunday Read Dairy Professionals Don’t Skip.

The Sunday Read Dairy Professionals Don’t Skip.

Every week, thousands of producers, breeders, and industry insiders open Bullvine Weekly for genetics insights, market shifts, and profit strategies they won’t find anywhere else. One email. Five minutes. Smarter decisions all week.

The Sunday Read Dairy Professionals Don’t Skip.

The Sunday Read Dairy Professionals Don’t Skip.