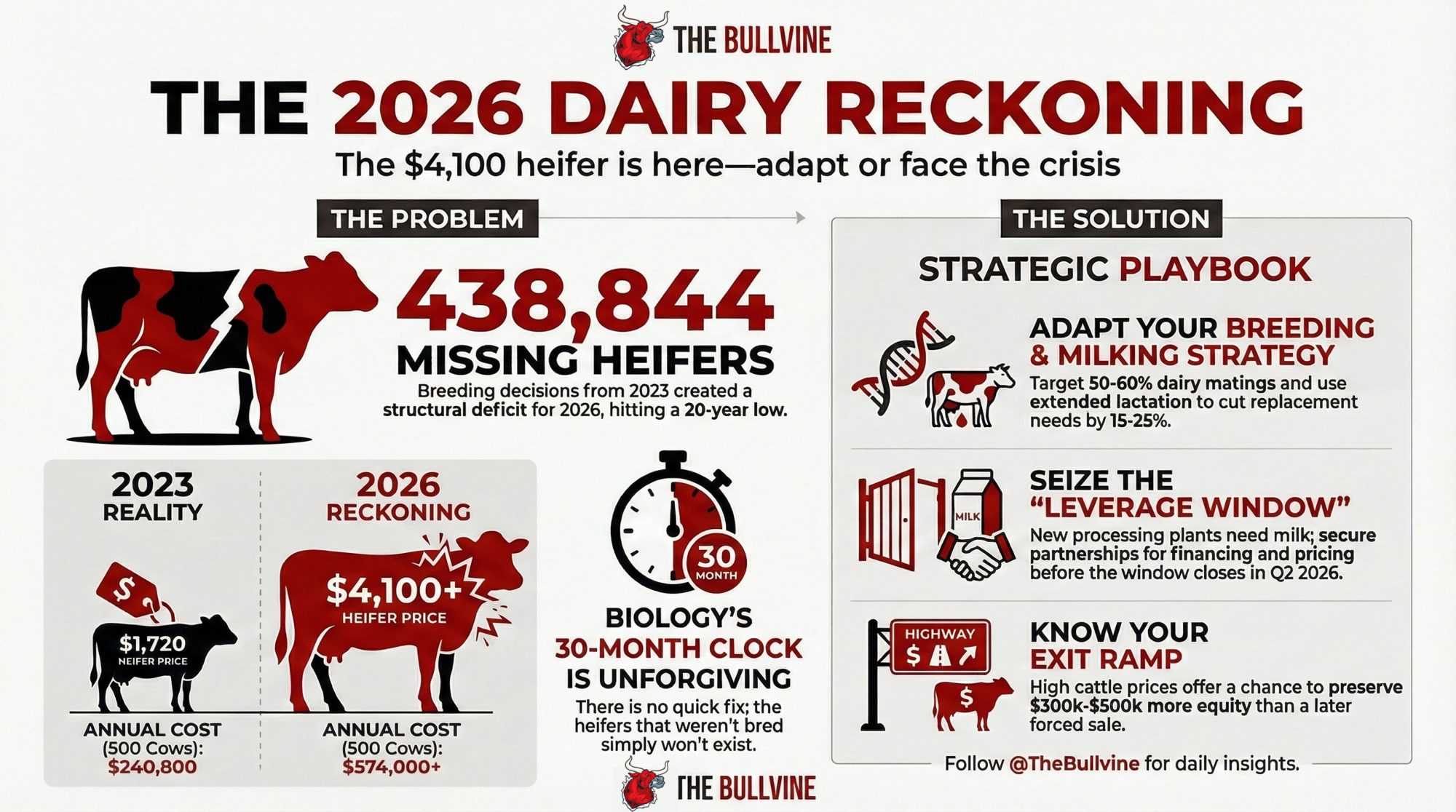

Biology doesn’t negotiate. The heifers you didn’t breed in 2023 can’t freshen in 2026. $4,100 price tags are just the start of this reckoning.

A Wisconsin dairyman running 650 cows near Fond du Lac remembers the exact moment he knew something had shifted. It was September 2025, and he was on the phone with his heifer supplier, trying to secure replacements for his operation. The price quote stopped him cold: $4,100 per head.

“Two years ago, I was paying $1,800,” he shared, asking that his name not be used due to ongoing supplier negotiations. “I actually asked the guy to repeat himself. I thought maybe we had a bad connection.”

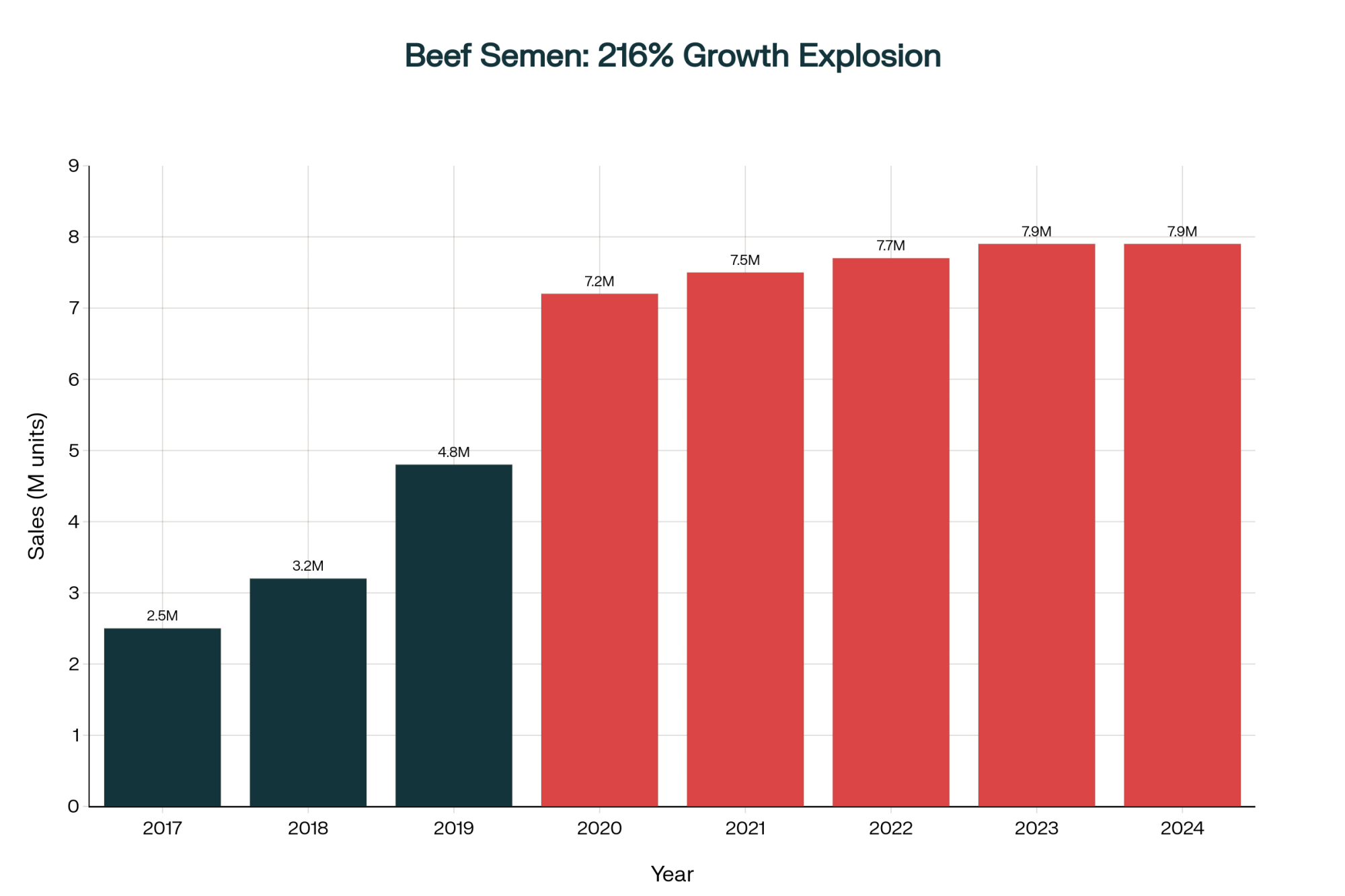

They didn’t. What he was hearing was the sound of breeding decisions made across thousands of farms in 2023 and 2024 finally hitting the replacement market. You probably remember how it played out—when dairy farmers embraced beef-on-dairy genetics, chasing $400-800 beef-cross calves instead of $50-150 dairy bull calves, the math looked irresistible. Premium beef semen ran $8-15 per straw versus $25-40 for sexed dairy genetics. The premiums were real and immediate.

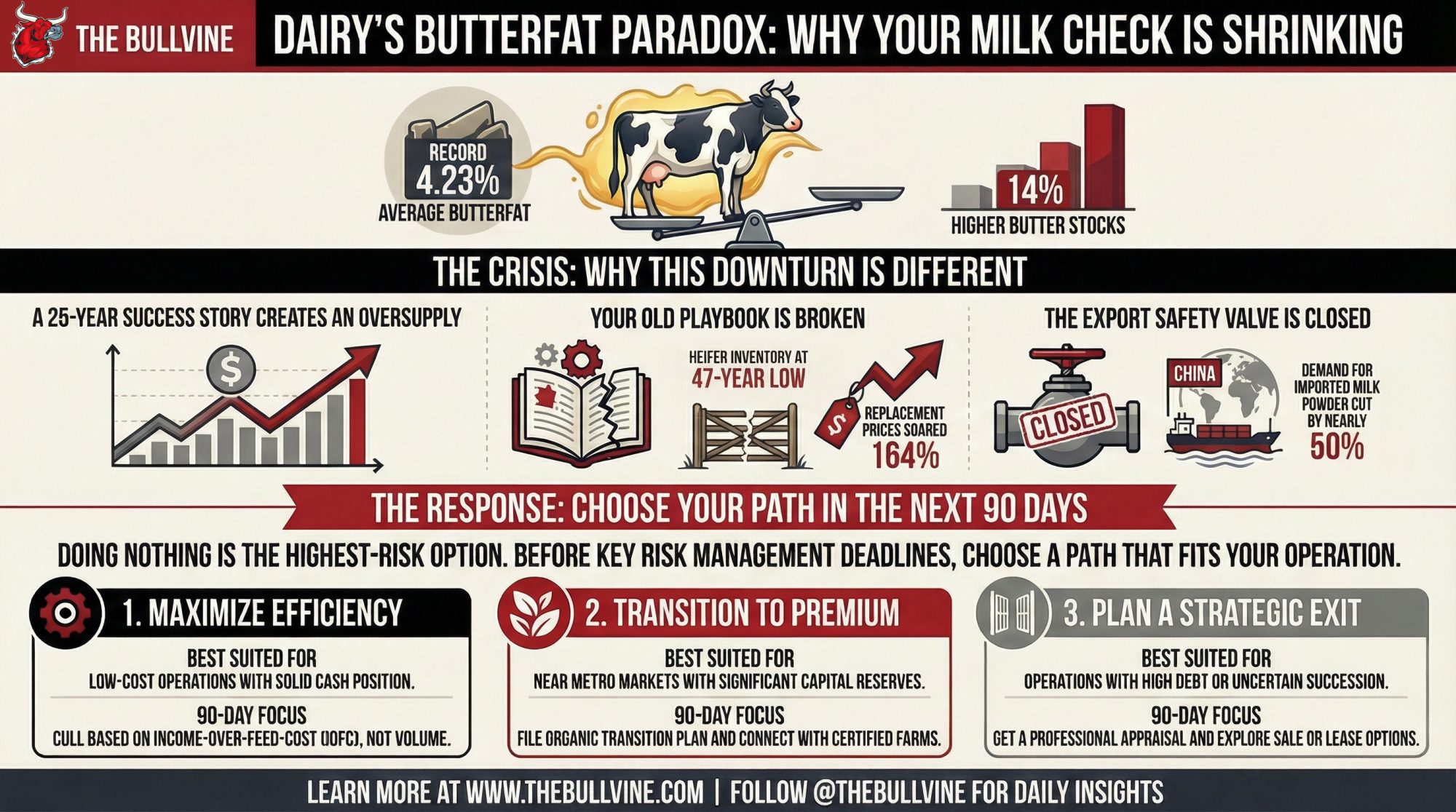

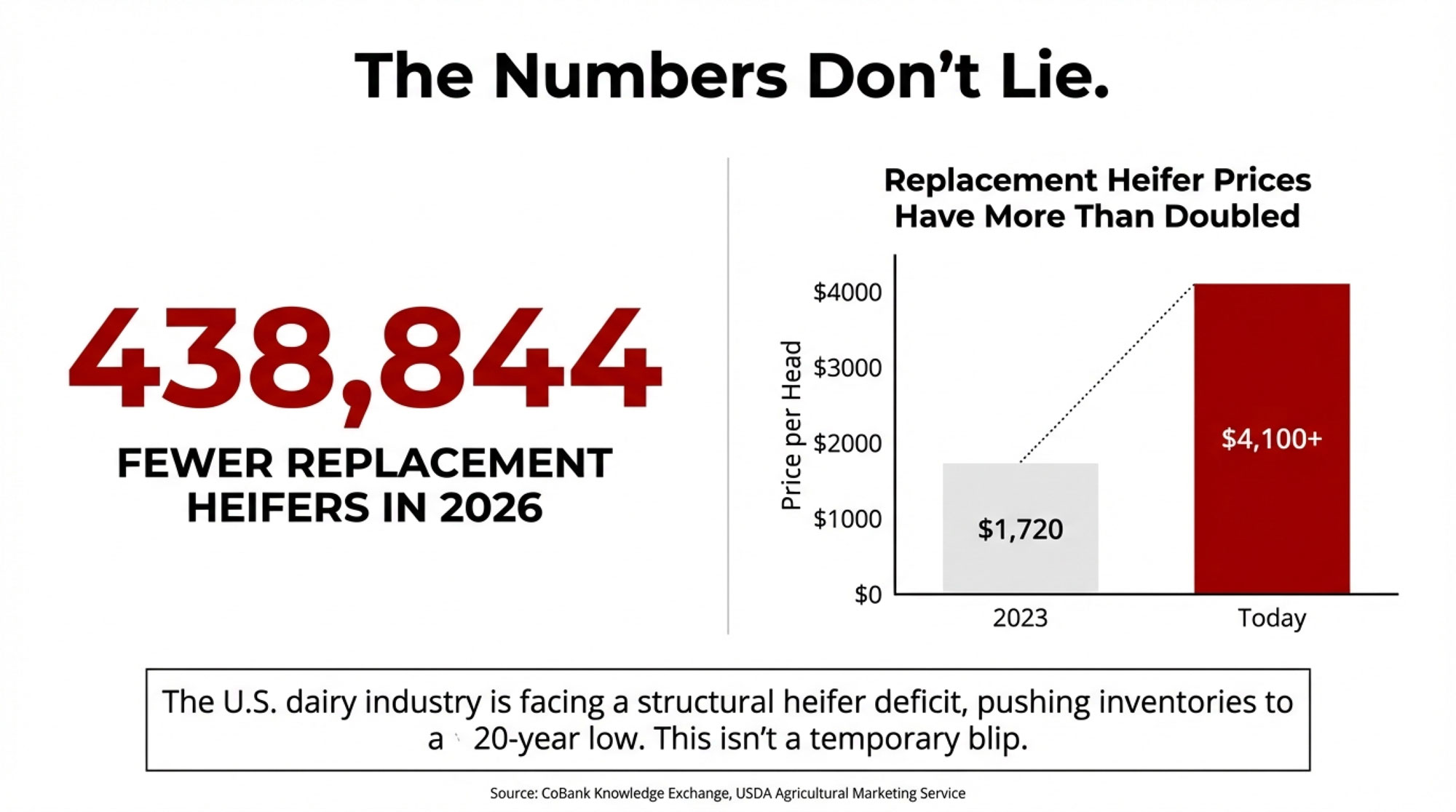

What wasn’t immediately visible was the 30-month lag hidden in those breeding choices. And here’s where it gets sobering. According to CoBank’s Knowledge Exchange report – Dairy Heifer Inventories to Shrink Further Before Rebounding in 2027, published this past August by lead dairy economist Corey Geiger and industry analyst Abbi Prins, the U.S. dairy industry faces 438,844 fewer replacement heifers in 2026 compared to 2025. We’re looking at heifer inventories hitting a 20-year low—territory we haven’t seen since the mid-2000s.

“We’re not talking about a temporary blip,” Geiger says. “The heifer deficit is structural. It reflects breeding decisions that were made two to three years ago, and those decisions can’t be unwound quickly.”

The farms that recognized this timeline early are positioning themselves for the decade ahead. Those that didn’t are facing some difficult choices. And the industry emerging on the other side? It’s going to look fundamentally different.

Biology Doesn’t Care About Your Cash Flow

Here’s what makes this situation so challenging—and you know this as well as anyone: the core constraint isn’t financial or managerial. It’s biological. And biology doesn’t negotiate.

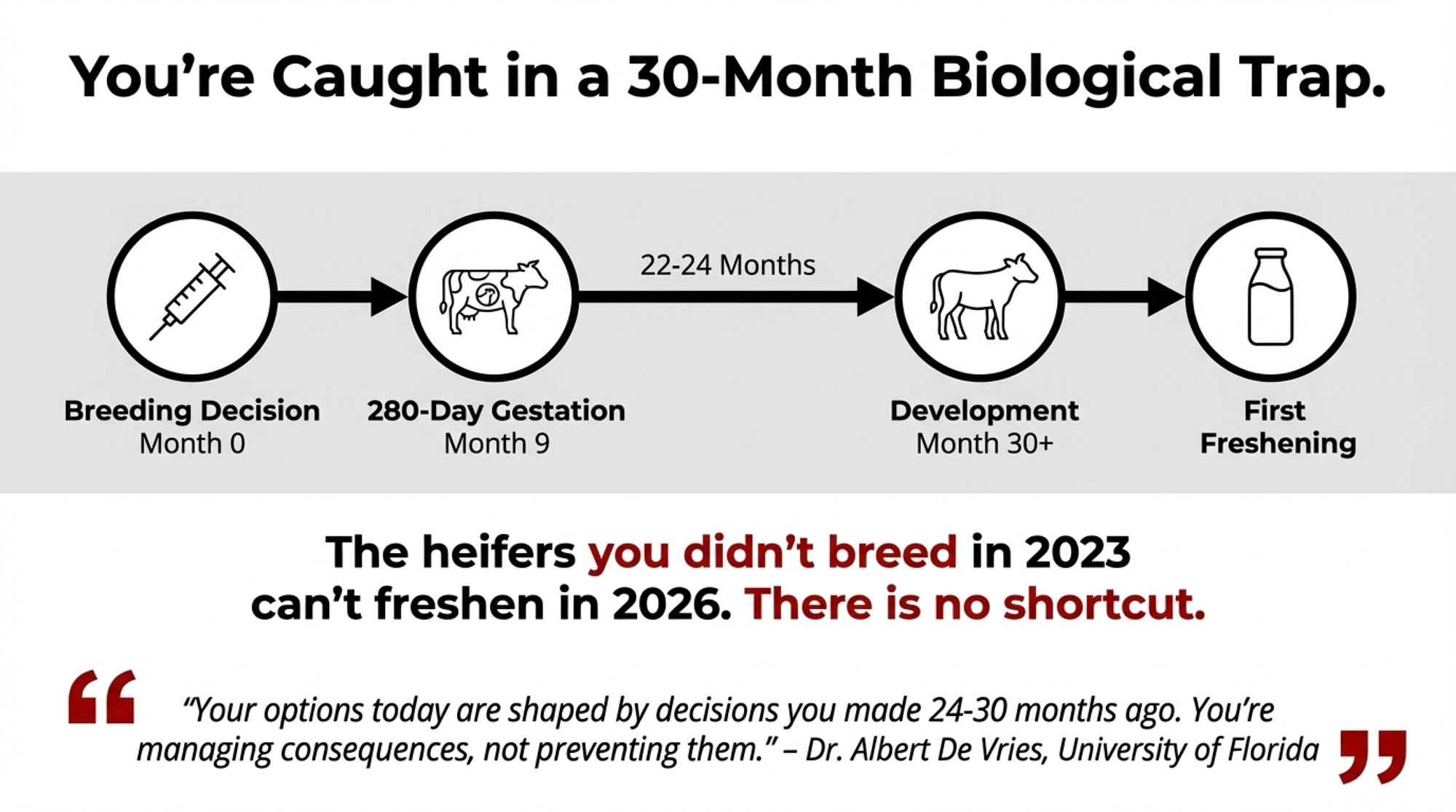

A breeding decision made today takes approximately 30 months to produce a milking cow. You’ve got 280 days of gestation, then 22-24 months of heifer development before that animal freshens and enters your milking string. There’s simply no shortcut through that timeline, regardless of what you’re willing to invest.

What this means, practically, is that the heifer shortage hitting farms in 2026-2027 was locked in by breeding decisions made in 2023-2024. Dr. Albert De Vries, professor of dairy management and economics at the University of Florida, has been modeling replacement dynamics for over two decades. His research on optimal replacement decisions, published in the Journal of Dairy Science, consistently shows that herd composition changes operate on multi-year cycles that can’t be compressed.

“Farmers sometimes ask me, ‘What can I do right now to fix my replacement situation?'” De Vries shared. “The honest answer is that your options today are shaped by decisions you made 24-30 months ago. You’re managing consequences, not preventing them.”

It’s a difficult message, but a necessary one.

The practical impact shows up across the board:

- Replacement heifer prices have climbed from $1,720 in April 2023 to $3,800-4,200 currently—more than doubling in under 30 months, according to USDA Agricultural Marketing Service livestock reports

- A 500-cow dairy requiring 140 annual replacements now faces $532,000-588,000 in heifer costs versus $241,000 two years ago

- Custom heifer rearing operations across the Upper Midwest report being fully booked through the remainder of 2026, with limited capacity for new clients

| Metric | 2023 Reality | 2026 Reckoning | Change |

| Heifer Price (Per Head) | $1,720 | $4,100 | +138% |

| Annual Cost (500-Cow Herd, 140 Replacements) | $240,800 | $574,000 | +$333,200 |

| Breeding Strategy | 60-80% Beef-on-Dairy | 40-50% Beef-on-Dairy | Recalibration |

| Beef Calf Premium | $400-800 vs. $50-150 Dairy | $350-700 vs. $40-120 Dairy | Still Positive |

| Custom Heifer Capacity | Available | Fully Booked Through 2026 | Zero Slack |

| Processor Leverage | Buyer’s Market | Seller’s Market (Q1-Q2 2026 Window) | Historic Shift |

| Primary Strategy Lever | Maximize Beef Premiums | Extended Lactation / Partnerships | Survival Mode |

One custom heifer operator running 400 head outside Lancaster, Pennsylvania, says he’s turned away 11 inquiries in just the past 3 months. “I’ve never seen demand like this,” he shared, asking that his name be withheld due to client confidentiality. “Guys who never called me before are suddenly very interested in long-term contracts. But I’m full. Everyone’s full.”

For operations that went heavily into beef breeding—we’re talking 60-80% of eligible matings, which wasn’t uncommon—the math creates a genuinely challenging scenario. Those heifers that should be entering the milking herd in 2026-2027? They were never conceived in the first place.

The North American Picture

It’s worth noting that this isn’t purely a U.S. phenomenon, though the dynamics differ by market structure. Canadian producers operating under supply management face a different calculus—quota values exceeding $40,000 per kg in many provinces mean heifer prices have always commanded premiums, but the beef-on-dairy trend has been more muted north of the border. The quota system creates built-in incentives to maintain replacement pipelines that open-market systems don’t.

In New Zealand and parts of the EU, seasonal calving patterns and grass-based systems create their own constraints on replacement. But the U.S. situation is unique in scale and severity—the combination of high beef-cross adoption rates and massive processing expansion has created a perfect storm that other markets haven’t experienced to the same degree.

What’s worth watching: The EU’s Green Deal and Farm to Fork Strategy—targeting a 30% reduction in agricultural emissions and 25% organic farmland by 2030—is adding regulatory pressure that’s expected to shrink EU dairy herds further in coming years. EU milk production already declined 0.2% in 2025 to 149.4 million metric tons, with environmental compliance costs straining smaller producers. According to UW-Madison Extension analysis , many EU dairy farmers are concerned these sustainability mandates will hurt their competitiveness in global markets. For U.S. exporters, this creates a potential opening—if domestic supply can keep pace with new processing capacity. The heifer shortage complicates that equation considerably.

Survival of the Smartest: Why Your 2023 Strategy Is Your 2026 Crisis

What’s encouraging is that rather than treating this as an insurmountable crisis, many progressive operations are discovering that the heifer shortage actually creates opportunities—if you adapt quickly enough. The key lies in understanding which strategies work within biological constraints and which ones amount to wishful thinking.

Extended Lactation: The Fastest Lever You Can Pull

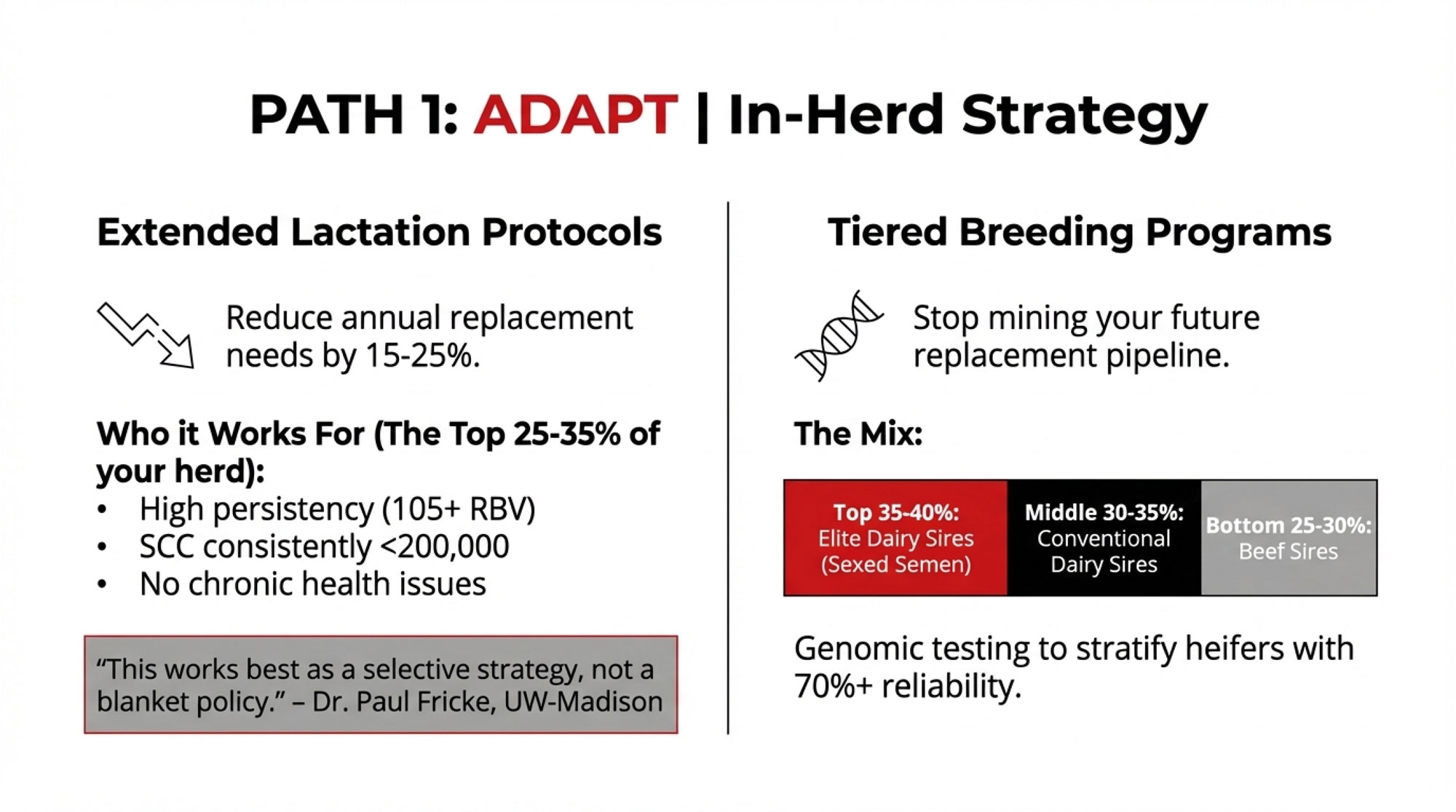

Extended lactation protocols—keeping cows milking 14-18 months instead of the traditional 12-month cycle—offer the quickest path to reducing replacement pressure. This isn’t a new concept, as many of us know, but it’s getting a serious second look given current heifer economics.

Research from the University of Wisconsin-Madison’s Dairy Science Department, led by Dr. Kent Weigel, shows that well-managed extended lactations can reduce replacement needs by 15-25% without sacrificing lifetime production. The key word there is “well-managed.” This isn’t about keeping every cow milking longer—it’s about identifying the right candidates.

Here’s how the economics generally work:

A cow producing 85 pounds daily at month 12 typically drops to 68-72 pounds by month 16. That’s a real decline in daily output, no question. But here’s what the daily production numbers miss: that cow isn’t generating replacement costs, breeding expenses, dry-period feed costs, or fresh cow health risks during transition. When you factor in the full cost of bringing a replacement into the herd—currently running $4,000+ just for the heifer purchase, plus another $800-1,200 in transition period costs—the extended lactation cow often comes out ahead on a total cost basis.

One central Wisconsin producer milking 850 Holsteins started implementing extended lactation protocols in early 2025. “We’re keeping about 130 cows on 16-month cycles now,” she explained, requesting anonymity to avoid drawing competitor attention to her cost structure. “My replacement purchases dropped from 240 last year to around 185 this year. At current prices, that’s real money—probably $220,000 in savings.”

The candidates that work best for extended lactation, based on research and field experience:

- Persistency ratings above 105 RBV (these cows maintain production better through late lactation)

- Somatic cell counts consistently below 200,000, because udder health has to be solid for this to work

- No chronic lameness or recurring health issues

- Body condition scores holding at 2.75-3.25 through mid-lactation

Now, here’s an important caveat that doesn’t always make it into the enthusiastic discussions of extended lactation. Dr. Paul Fricke, professor and extension specialist in dairy cattle reproduction at UW-Madison, notes: “There are real considerations around subsequent fertility and metabolic health. Cows that go significantly longer between calvings can have more difficulty conceiving on subsequent cycles. This works best as a selective strategy, not a blanket policy.”

That’s worth emphasizing. Extended lactation isn’t about keeping your whole herd milking longer. It’s about identifying the 25-35% of your cows that are genuinely good candidates and managing them differently. Your veterinarian can help develop monitoring protocols specific to your operation.

Tiered Breeding: Stop Mining Your Own Future

The operations handling this best are implementing what you might call tiered breeding—a systematic approach that captures beef premiums where it makes sense while ensuring adequate replacement supply.

Here’s where genomic testing has become genuinely transformative. Instead of relying on parent average or waiting for first-lactation data, farms using genomic evaluations can stratify their heifer calves at 2-3 months of age with 70%+ reliability on key traits. That precision matters when you’re deciding which animals get the $40 sexed dairy straw versus the $12 beef straw. The cost of genomic testing—typically $35-50 per head—pays for itself many times over when it prevents you from putting beef genetics on a heifer that should have been a herd-building dam.

Here’s how a typical protocol structures breeding decisions based on genetic merit:

| Herd Segment | % of Herd | Genetic Merit | Breeding Strategy | Cost Per Straw | Strategic Purpose |

| Top Tier | 35-40% | Top 1/3 Net Merit or TPI | Sexed Dairy Semen (Elite Sires) | $35-45 | Herd builders – next generation genetic improvement |

| Middle Tier | 30-35% | Average genetics | Conventional Dairy Semen (Solid Sires) | $15-25 | Replacement pipeline – maintain herd numbers |

| Bottom Tier | 25-30% | Lowest 1/3 production/health | Beef Semen | $8-15 | Terminal value – cull candidates |

| Extended Lactation Candidates | 10-15% | High persistency (>105 RBV), excellent health | Skip Breeding / Delay 4-6 months | $0 initial | Reduce replacement pressure short-term |

- Top 35-40% of herd (highest genetic merit): These are your herd builders. Breed them to elite dairy sires using sexed semen. Yes, it costs more per straw—$35-45 versus $8-15 for conventional beef. But these matings produce your next generation of genetic improvement. They’re investments, not costs. If you’re using genomic testing, these are your animals with Net Merit or TPI in the top third of your herd.

- Middle 30-35% (average genetics): Breed to conventional dairy sires—no sexing premium, solid genetics, predictable outcomes. These animals maintain your replacement numbers without straining the budget.

- Bottom 25-30% (lowest merit): This is where beef genetics make sense. These animals should be transitioning out of your herd anyway based on their production and health profiles. Breeding them to beef sires maximizes their terminal value without compromising your replacement pipeline.

Many progressive operations have recalibrated their breeding mix after going heavy on beef genetics in 2023. The pattern emerging across Wisconsin and the Upper Midwest: farms that had 70% or more of matings going to beef are now pulling back to 40-50%, being much more deliberate about which cows get which service.

The key insight these producers have landed on: not every cow should leave genetic offspring in your herd—but enough of them have to, or you’re mining your own future.

The Processor Partnership Window: Leverage You Won’t See Again

Now, here’s where things get genuinely interesting from a market-dynamics standpoint. Perhaps the most significant—and honestly, underreported—development of late 2025 is the shift in negotiating leverage between farms and processors.

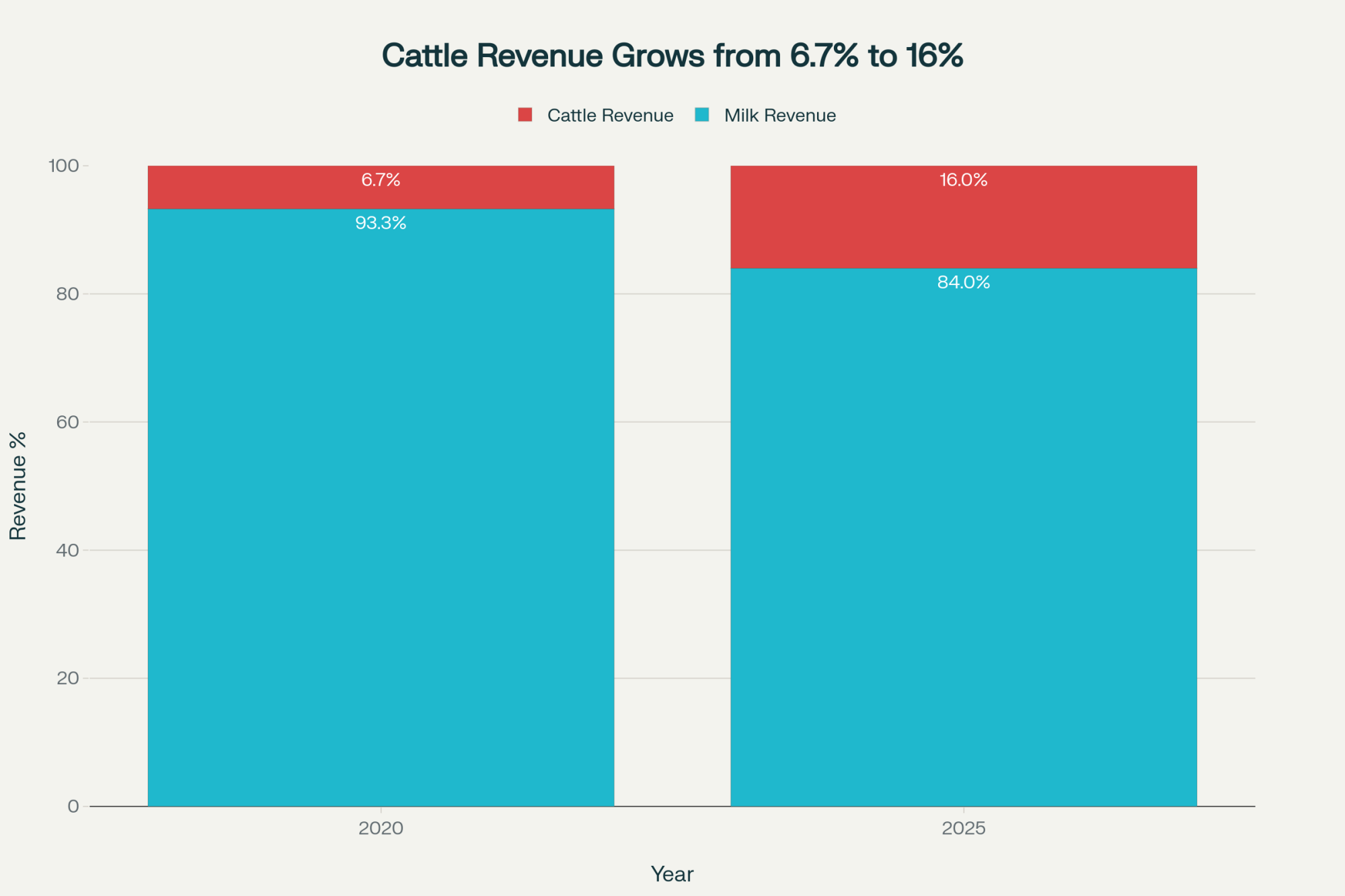

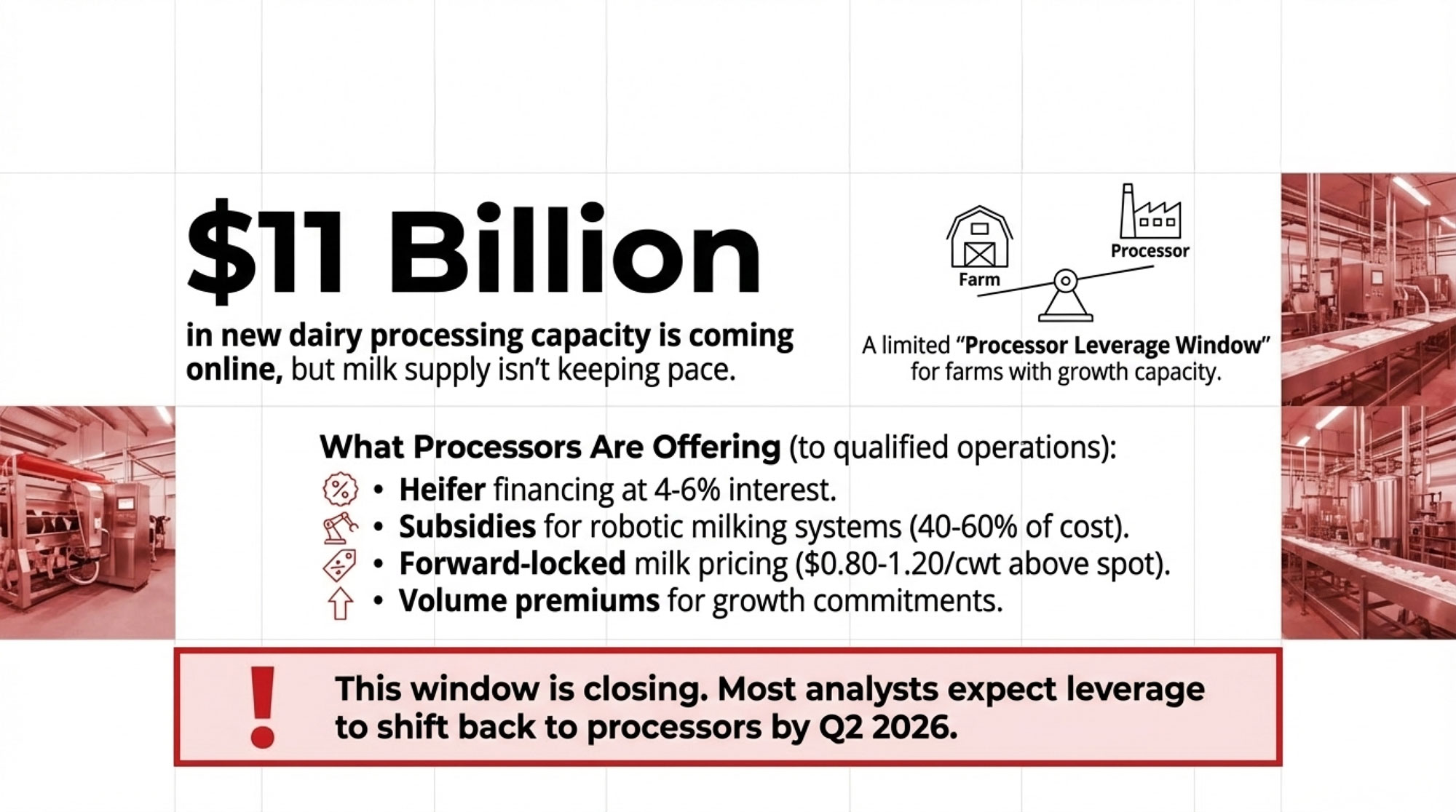

There’s roughly $11 billion in new dairy processing capacity coming online between 2025 and early 2028, according to IDFA data released this past October. These are major investments: Hilmar’s Texas expansion, Leprino’s new Texas facility, Glanbia’s recent Michigan expansion, plus a string of regional cheese and specialty product facilities across the Upper Midwest and Southwest.

Here’s the challenge these processors are facing: plants designed for 85-90% utilization are running at 60-70% because the milk supply growth they projected isn’t materializing. When you breed 60-70% of your herd to beef for two years, you don’t have the replacement heifers to expand production. The connection seems obvious in hindsight, but it caught many in the processing sector off guard.

“We planned capacity based on historical supply growth trends,” one Midwest cooperative procurement manager shared, speaking on background due to ongoing contract negotiations. “Nobody modeled what happens when a significant portion of the national herd stops producing dairy replacements for two years. We’re adjusting our assumptions now, but the capacity is already built.”

This creates what some industry observers are calling a “leverage window”—a period where farms with growth capacity can negotiate terms that would have been unthinkable three years ago.

What some processors are offering qualified operations:

- Heifer financing at 4-6% interest, compared to 7-9% from traditional agricultural lenders

- Equipment subsidies covering 40-60% of robotic milking system costs in exchange for supply commitments

- Forward-locked milk pricing 12-36 months out, often $0.80-1.20/cwt above the current spot market

- Volume premiums for farms that can commit to production growth trajectories

I’ve spoken with several farm operators in Wisconsin and Idaho who’ve signed or are negotiating agreements along these lines, though all requested anonymity given the competitive sensitivity. The common thread: processors are willing to put capital at risk to secure future milk supply because they’re genuinely concerned about where future growth will come from.

“They need us more than they’re used to needing us,” is how one central Wisconsin dairyman put it. “It’s a strange feeling after years of being told to take whatever price they offered.”

The qualification requirements typically include:

- 500+ cows are currently milking

- Component levels approaching 3.2% protein (this aligns with December 2025 FMMO pricing changes that increase protein’s value)

- Debt-to-equity ratios below 50%

- Willingness to sign 5-7 year exclusive supply agreements

- Demonstrated ability to grow production 10-20% over the contract period

For farms meeting these criteria, the partnerships can genuinely reshape their economics. For those who don’t qualify for processor financing, traditional options remain available—FSA guaranteed loans, state dairy assistance programs, and Farm Credit services are all seeing increased demand as farmers look for ways to finance heifer purchases and facility upgrades during this tight market.

But these windows don’t stay open forever. As processor capacity fills and supply concerns ease, the negotiating dynamics will shift back toward buyers.

The realistic window, based on conversations with dairy economists and processor representatives? Probably through Q1 or Q2 of 2026. Maybe a bit longer in regions with less processing competition. But farms considering this path shouldn’t assume the current leverage environment persists indefinitely.

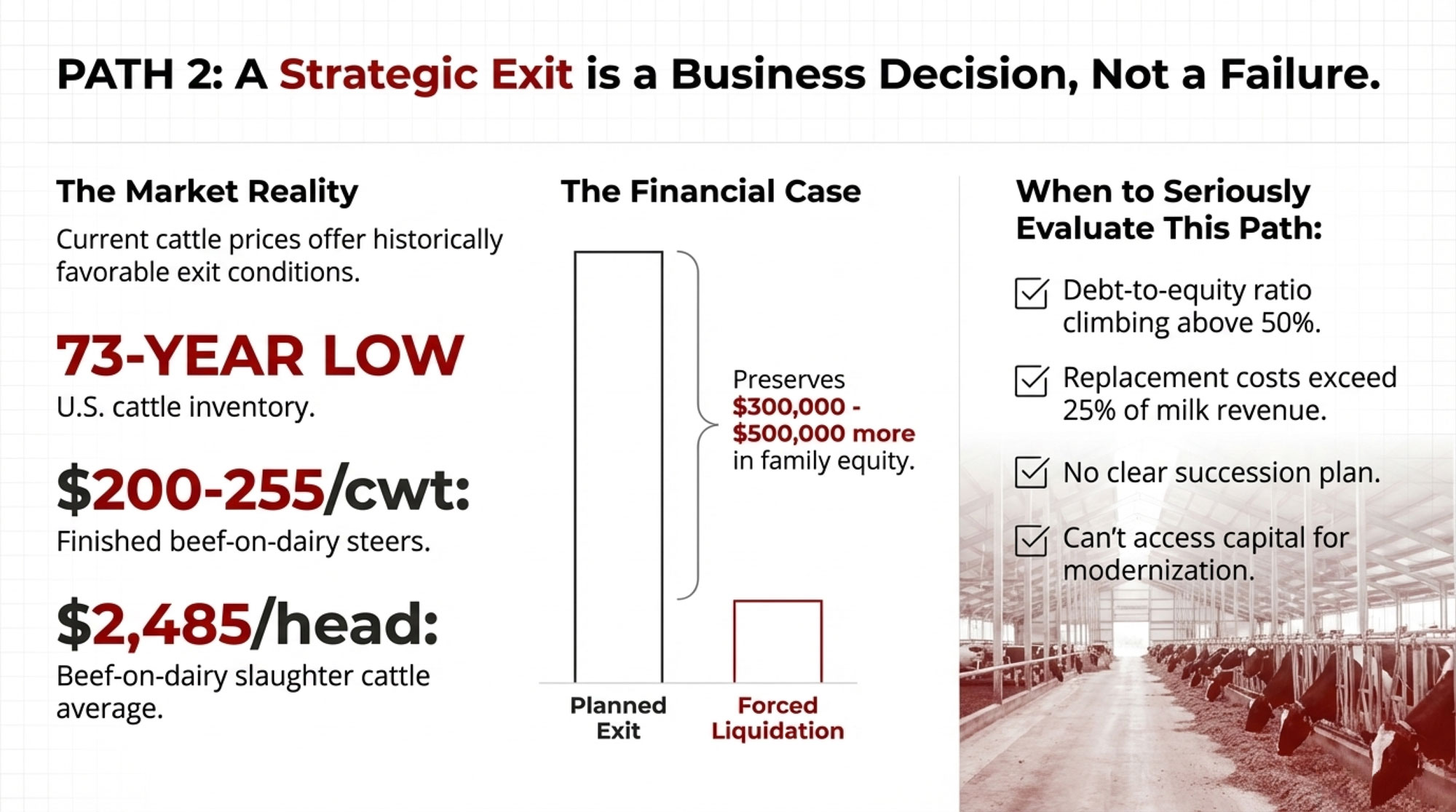

The Exit Ramp: When Walking Away Is the Smartest Play

Processor partnerships aren’t available everywhere, and they’re not the right fit for every operation. For some farms, the current market offers a different kind of opportunity—one that involves making a clear-eyed decision about the future rather than doubling down on growth.

This is the part that’s hardest to write, honestly, but it would be dishonest to leave it out. For farms facing multiple stressors simultaneously, a strategic exit during the current cattle price peak may preserve more family wealth than continued operation.

I want to be clear about framing here: this isn’t a failure narrative. Cattle markets operate in cycles, as we’ve all seen over the years, and the current cycle offers historically favorable exit conditions. Making a clear-eyed decision to capture that value isn’t giving up—it’s recognizing market realities.

Consider the current market context:

- Finished beef-on-dairy steers are bringing $200-255/cwt according to USDA Agricultural Marketing Service reports—near all-time highs

- Beef-on-dairy slaughter cattle are averaging $2,485/head, outperforming native beef by roughly $100/head

- U.S. cattle inventory sits at a 73-year low—the smallest since 1951 according to USDA data—supporting continued strong pricing through at least 2026-2027 per CattleFax projections

What farm transition data suggests—compiled by agricultural lenders, extension economists, and farm management associations—is that the timing difference between strategic exit and forced liquidation can be substantial. Operations that make planned exits in months 8-10 during financial stress typically preserve $300,000-500,000 more in family equity than those forced into distressed sales in months 16-18.

That gap represents college funds, retirement security, or capital to start something new. It’s not trivial.

Indicators that suggest seriously evaluating strategic exit:

- Cash flow negative for 3+ consecutive months with no clear path to reversal

- Debt-to-equity ratio above 50% and still climbing

- No processor contract and fully exposed to spot market volatility

- Replacement heifer costs are consuming more than 25% of milk revenue

- Primary operator is 55-65 with no clear succession plan

- Can’t access capital for necessary modernization

For families recognizing themselves in that list, the current window—Q4 2025 through Q2 2026—offers optimal timing. Cattle prices remain elevated, equipment values haven’t yet been depressed by consolidation-driven sales volume, and agricultural real estate markets in dairy regions remain relatively stable.

One southern Minnesota couple in their early 60s exited their 380-cow dairy this past August after running the numbers on replacement costs. “Our kids aren’t interested in the operation, and the heifer prices were the final straw,” the husband shared, asking that names be withheld to protect family privacy. “Once we did the math on replacing 110 heifers a year at $4,000-plus each, versus what we could get for the herd and equipment right now, the decision got a lot clearer.”

They netted roughly $1.4 million after debt payoff. “Ask me if I’m sad about it? Sure, some days. Ask me if it was the right call? Absolutely.”

A note on taxes: Livestock sale proceeds are taxable income—something that catches some exiting producers off guard. This family worked with an agricultural accountant to structure their sale across two tax years and take advantage of capital gains treatment where applicable. If you’re considering an exit, consult with a tax professional familiar with farm transitions before finalizing timing. The difference between a well-structured exit and an unplanned one can be substantial.

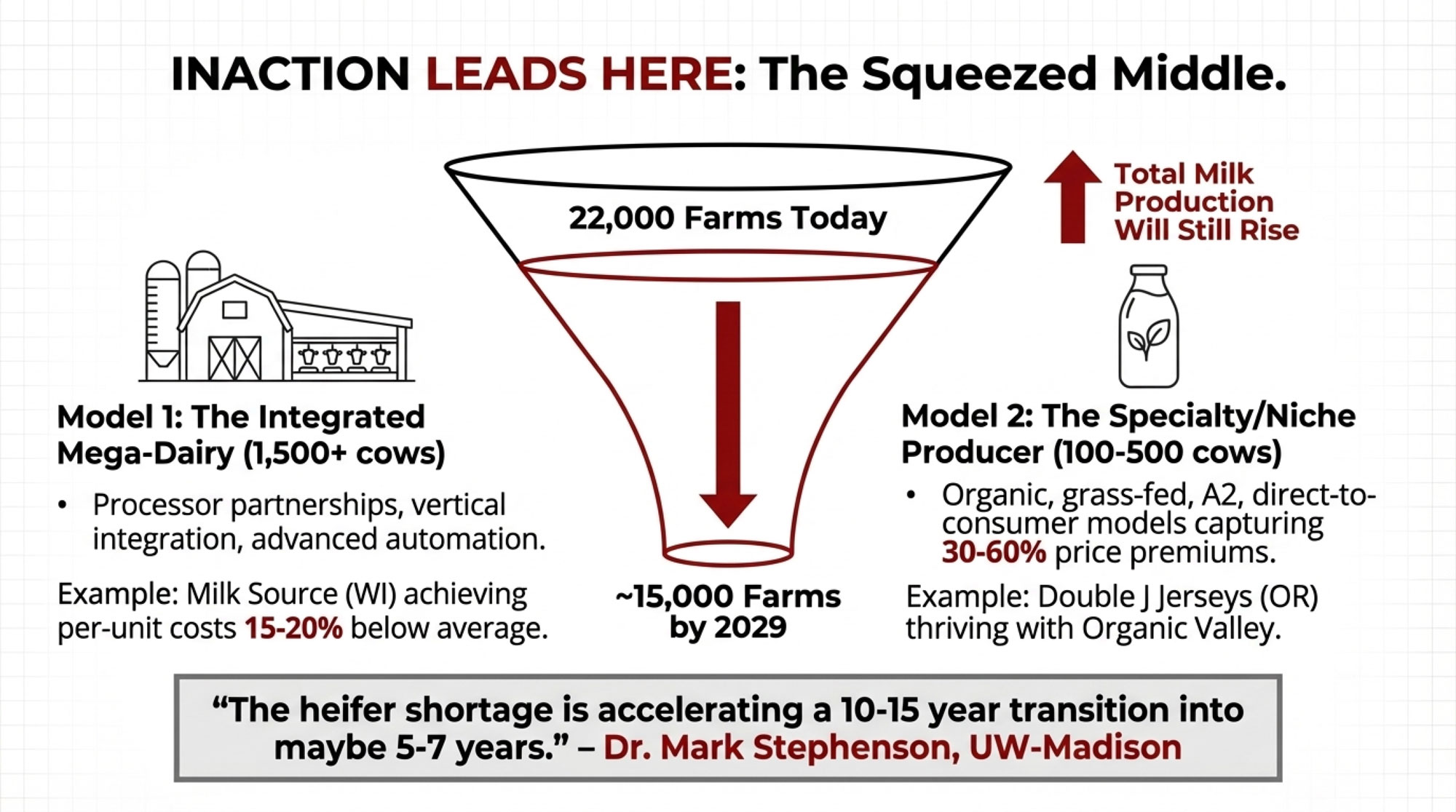

Two Models Will Dominate—Where Does Your Operation Fit?

Looking beyond the immediate heifer crunch, what we’re really watching is a structural transformation that will reshape dairy farming for the next generation. The numbers in various USDA and academic projections tell a consistent story: we’re likely moving from approximately 22,000 dairy farms today to 14,500-17,000 by 2028-2029, while total milk production increases modestly.

That’s not just “fewer farms.” It’s a fundamental restructuring around two viable models, with a shrinking middle ground between them.

Model 1: The Integrated Mega-Dairy

Operations of 1,500+ cows with exclusive processor partnerships, advanced automation, and increasingly vertical supply chains. According to the USDA’s “Consolidation in U.S. Dairy Farming” report, these farms are projected to produce 55-60% of U.S. milk from just 4-5% of total operations by decade’s end.

Large integrated operations, such as Milk Source in Wisconsin, illustrate this model at scale. Co-founded in 1994 by Jim Ostrom, John Vosters, and Todd Willer—all UW-Madison graduates from multi-generational Wisconsin farm families—the operation traces its roots to 1965, when John’s parents started a small 30-cow dairy in Freedom. Today, Milk Source operates multiple facilities across Wisconsin and the Midwest, running their own feed mills, calf ranches, and cropping operations, achieving per-unit costs 15-20% below industry average through vertical integration. That’s the competitive advantage mega-dairies are building: not just size, but system control.

Model 2: The Specialty/Niche Producer

Operations of 100-500 cows focused on organic, grass-fed, A2, or direct-to-consumer markets. These farms capture significant price premiums—often 30-60% above conventional—that offset their smaller scale. Organic Valley, for instance, reports steady demand growth for its farmer-members’ milk, with farmgate prices well above those in conventional markets.

Jon Bansen operates Double J Jerseys, a grass-fed, organic dairy with approximately 150-200 cows near Monmouth, Oregon, that sells through the Organic Valley cooperative. A multi-generational dairy farmer, Bansen has built his operation around intensive rotational grazing and 100% grass-fed practices—even when it means leaving some acres unproductive for conservation. What’s encouraging about operations like Double J Jerseys is that grass-fed premiums and cooperative membership provide price stability that helps absorb cost increases, which might challenge conventional operations of their size.

What’s getting squeezed: The traditional mid-size commodity dairy—500-1,000 cows producing undifferentiated milk for spot markets without processor partnerships or specialty premiums. This segment faces pressure from both directions: too small for mega-dairy efficiencies, too large for niche positioning.

| Characteristic | Model 1: Integrated Mega-Dairy | Model 2: Specialty/Niche Producer | The Disappearing Middle |

| Herd Size | 1,500-10,000+ cows | 100-500 cows | 500-1,000 cows |

| Market Position | Exclusive processor partnerships, vertical integration | Organic, grass-fed, A2, direct-to-consumer | Undifferentiated commodity milk |

| Price Realization | Volume efficiency: $0.40-0.80/cwt below market, profit on scale | Premium pricing: 30-60% above conventional | Spot market exposure: full volatility |

| Competitive Advantage | Per-unit costs 15-20% below average via automation and vertical supply chains | Differentiation premiums and brand loyalty | None sustainable |

| Capital Requirements | $15-40 million (barriers to entry) | $500K-3 million (differentiation investment) | $3-8 million (too big for niche, too small for efficiency) |

| Risk Profile | Contract stability, but massive debt service | Market volatility, but loyal customer base | Maximum exposure: no contracts, no premiums |

| Examples | Milk Source (WI), Riverview Dairy (SD) | Double J Jerseys (OR), Organic Valley members | Most 500-1,000 cow operations without processor partnerships |

| 2028 Projection | 55-60% of U.S. milk from 4-5% of farms | 8-12% of U.S. milk from 15-20% of farms | Declining share, consolidation pressure |

Dr. Mark Stephenson tracked these structural shifts throughout his career as Director of Dairy Policy Analysis at UW-Madison. “The middle hasn’t been comfortable for a while,” he notes. “What the heifer shortage is doing is accelerating a consolidation that was already underway. It’s compressing a 10-15 year transition into maybe 5-7 years.”

Regional Realities: One Size Doesn’t Fit All

The geographic impact isn’t uniform, and it’s worth factoring regional dynamics into your planning.

Upper Midwest (Wisconsin, Minnesota): High processor density creates more partnership options, but also more competition for those deals. Wisconsin’s strong cheese industry values high-component milk, which advantages operations that can hit 3.2%+ protein targets. The state may see farm numbers decline 35-40%, but surviving operations will likely have strong processor relationships.

Northeast (New York, Pennsylvania, Vermont): More fragmented processor landscape with significant organic and specialty opportunity. The decline in fluid milk continues to pressure conventional operations, but proximity to population centers supports direct-market strategies. Farms close to urban markets may find the niche model more viable here than elsewhere.

West/Southwest (California, Idaho, Texas, New Mexico): Where mega-dairy expansion is concentrated. Lower regulatory burden, available land, and new processing capacity are pulling production westward. Texas has seen particularly significant dairy expansion in recent years, according to USDA NASS data, with growth concentrated almost entirely in operations with 2,000 or more head.

Pacific Northwest (Washington, Oregon): Mixed picture—strong organic demand through Tillamook and similar cooperatives, but conventional operations face the same squeeze as elsewhere. Water availability is increasingly a factor in expansion decisions.

What This Means for Your Operation

I want to be careful about projecting too much certainty here. Markets are complicated, and anyone who claims to know exactly what heifer prices will be in 2027 is guessing. That said, there are patterns worth watching and principles that seem reasonably sound.

What seems fairly certain:

- The heifer shortage is structural, not cyclical. It reflects breeding decisions already made and can’t be reversed quickly.

- Replacement costs will remain elevated through at least 2027, with CoBank projecting meaningful recovery only in late 2027 or 2028.

- The farms that position themselves now—whether for growth, for niche markets, or for strategic exit—will have more options than those who wait.

What’s less certain:

- Exactly how high will heifer prices go. The $4,000-$4,500 range seems likely, but market dynamics could push it higher.

- How long does the processor-leverage window stay open? Current estimates suggest Q1-Q2 2026, but this depends on how quickly supply concerns ease.

- Whether export markets absorb the new processing capacity. Trade policy, currency movements, and global demand all factor in.

If You’re Planning to Continue and Grow

Take a serious look at processor partnership opportunities now, while the leverage window remains open. This may be your best chance in a decade to negotiate favorable terms. Think about extended lactation protocols for the right candidates—that 25-35% of your herd with strong persistency, good udder health, and solid body condition. Work with your veterinarian to develop monitoring protocols that fit your operation.

Restructure your breeding program so that at least 50-60% of matings produce dairy replacements. The beef premiums are real, but so is the replacement pipeline you’re building. And budget conservatively—plan for replacement heifer costs of $4,000-5,000 through 2027. Hope for lower, but don’t count on it.

If you’re not already genomic testing your heifer calves, now’s the time to start. The $40-50 investment per head pays for itself when you’re making $4,000 breeding decisions. Knowing which animals have the genetic merit to justify elite dairy genetics versus which should get beef semen isn’t guesswork anymore—it’s data.

If processor financing isn’t available in your area, explore FSA guaranteed loans and state dairy assistance programs. Demand is up, but funds remain available for qualified operations.

If You’re Uncertain About the Future

Start with an honest financial assessment. Debt-to-equity ratio, debt service coverage, cash flow trends, and family situation. These numbers tell you something. Understand that a strategic exit in 2025-2026, at peak cattle valuations, preserves substantially more equity than a forced exit in 2027-2028 when prices may be lower, and more farms are competing for buyers.

Talk to agricultural attorneys and accountants about transition planning. Good advice costs money; poor advice costs more. And consider partial strategies if full continuation isn’t viable—retaining real estate while liquidating livestock and equipment can provide ongoing income while preserving land wealth.

Don’t overlook risk management tools: The Dairy Margin Coverage (DMC) program , extended through 2031 under the recent budget legislation, offers coverage levels from $4.00 to $9.50 per cwt—and Tier 1 coverage has been increased to 6 million pounds of milk. Producers enrolling for multiple years through 2031 can lock in a 25% premium discount. For operations navigating uncertain margins, DMC provides a floor that can help with cash flow planning. LGM-Dairy insurance offers another option, protecting against both feed cost spikes and milk price drops on a rolling 11-month basis. Neither program solves the heifer shortage, but both can help stabilize income while you work through the transition.

For Everyone

Accept that the industry structure of 2028 will look different from today. Not worse, necessarily—but different. Planning for that difference beats hoping it doesn’t happen.

The 30-month biological constraint isn’t going away. Every quarter you wait to adjust breeding protocols is another quarter before those decisions produce results. The farms that feel most confident about their position are those that began adjusting 12-18 months ago. They’re not immune to the heifer shortage, but they’re managing it rather than being managed by it.

The Beef on Dairy Boom that Changed the Game

The beef-on-dairy boom of 2023-2024 revealed something important about dairy economics: optimizing for today can create constraints tomorrow. That’s not a criticism of the farmers who made those breeding decisions—the premiums were real, and the cash flow mattered. But it’s a reminder that agricultural systems operate on biological timelines that don’t align neatly with market cycles.

The farms discovering that lesson now still have time to adapt. The 30-month clock that started with those breeding decisions keeps running. What happens next depends on decisions being made right now.

As that Wisconsin dairyman still processing the $4,100 heifer quote put it: “I can’t go back and change what I bred in 2023. But I can sure change what I’m doing today. That’s gotta count for something.”

It does. The question is whether enough farms figure that out while they still have choices to make.

The Bullvine Bottom Line

If you’re waiting for heifer prices to drop before you change your breeding mix, you’ve already lost. The 438,844-heifer deficit hitting in 2026 was locked in by decisions made in 2023, and the clock started ticking the moment those beef straws went in. Biology doesn’t care about your cash flow projections. The only question left: Are you breeding for 2024’s market or 2028’s reality?

Key Takeaways

- 438,844 Missing Heifers: The 2026 shortage was locked in by 2023 breeding decisions. Biology’s 30-month timeline means there’s no quick fix—only adaptation.

- Replacement Costs Doubled: Heifers jumped from $1,720 to $4,100+. For a 500-cow dairy, that’s $300,000+ more per year in replacement costs alone.

- The Leverage Window Closes Q2 2026: Processor partnerships, heifer financing at 4-6%, and forward pricing are available NOW. This window won’t reopen once capacity fills.

- Restructure Your Breeding Mix: Target 50-60% dairy matings minimum. Extended lactation protocols on your top 25-35% of cows can reduce replacement needs by 15-25%.

- Strategic Exit Beats Forced Liquidation: For operations under financial stress, exiting at peak cattle prices ($200-255/cwt for beef-on-dairy steers) preserves $300K-500K more in family equity.

Executive Summary:

U.S. dairy is staring down a 438,844-heifer deficit in 2026—the unavoidable consequence of 2023’s beef-on-dairy breeding boom. Replacement prices have more than doubled, from $1,720 to over $4,100 per head, adding $300,000+ in annual replacement costs for a typical 500-cow operation. Biology’s 30-month timeline means there’s no quick fix; the heifers that weren’t bred can’t be milked. The farms adapting fastest are implementing extended lactation protocols, restructuring breeding programs to ensure 50-60% dairy matings, and locking in processor partnerships while the leverage window remains open through Q1-Q2 2026. For operations facing compounding stress, current cattle prices—with finished beef-on-dairy steers at $200-255/cwt—offer strategic exit conditions that preserve $300,000-500,000 more in family equity than forced liquidation later. The industry is accelerating toward two dominant models: integrated mega-dairies and specialty niche producers. Mid-size commodity operations without contracts or differentiation are getting squeezed from both directions—and what you decide in the next 6-12 months will determine which side of this reckoning you land on.

About the Data in This Article

Heifer inventory projections and pricing trends cited in this analysis come from CoBank’s August 2025 Knowledge Exchange report by Corey Geiger and Abbi Prins, USDA Agricultural Marketing Service livestock reports, and USDA NASS cattle inventory data. Replacement cost calculations assume 140 annual replacements for a 500-cow dairy (28% replacement rate) at current market pricing of $3,800-4,200 per head. Regional costs and individual farm economics vary significantly based on location, management practices, existing heifer inventory, and market access. Some farmer sources requested anonymity due to ongoing business negotiations or family privacy considerations. We welcome producer feedback and case studies for future reporting—contact editor@thebullvine.com.

For additional resources on replacement heifer management, breeding economics, and dairy transition planning, visit the University of Wisconsin-Madison Division of Extension dairy resources or contact your state extension dairy specialist.

Learn More

- Beef-on-Dairy’s $500,000 Swing: What 72% of Farms Know That’s Costing You $1,000/Cow Every Year – Arms you with a specific 30-day action plan to recapture lost revenue while managing the heifer deficit. This breakdown exposes the $1,000-per-cow swing between traditional and optimized breeding budgets, delivering the math needed for an immediate operational pivot.

- 2025 Dairy Year in Review: Ten Forces That Redefined Who’s Positioned to Thrive Through 2028 – Exposes the ten structural forces redefining dairy profitability through 2028. It reveals why previous “wins” are now irrelevant and delivers a long-term strategic map for navigating culling math flips and redesigned expansion models as replacement inventories tighten.

- Genetic Revolution: How Record-Breaking Milk Components Are Reshaping Dairy’s Future – Breaks down the massive 2025 genetic reset and reveals how component-focused genomics are decoupling from milk volume trends. It delivers a roadmap for leveraging DNA testing to drive a $200 lifetime advantage per cow in the new component economy.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!