Stop chasing milk volume. Smart farmers banking 32¢/lb butter gains while you’re missing the component revolution that’s rewriting profitability.

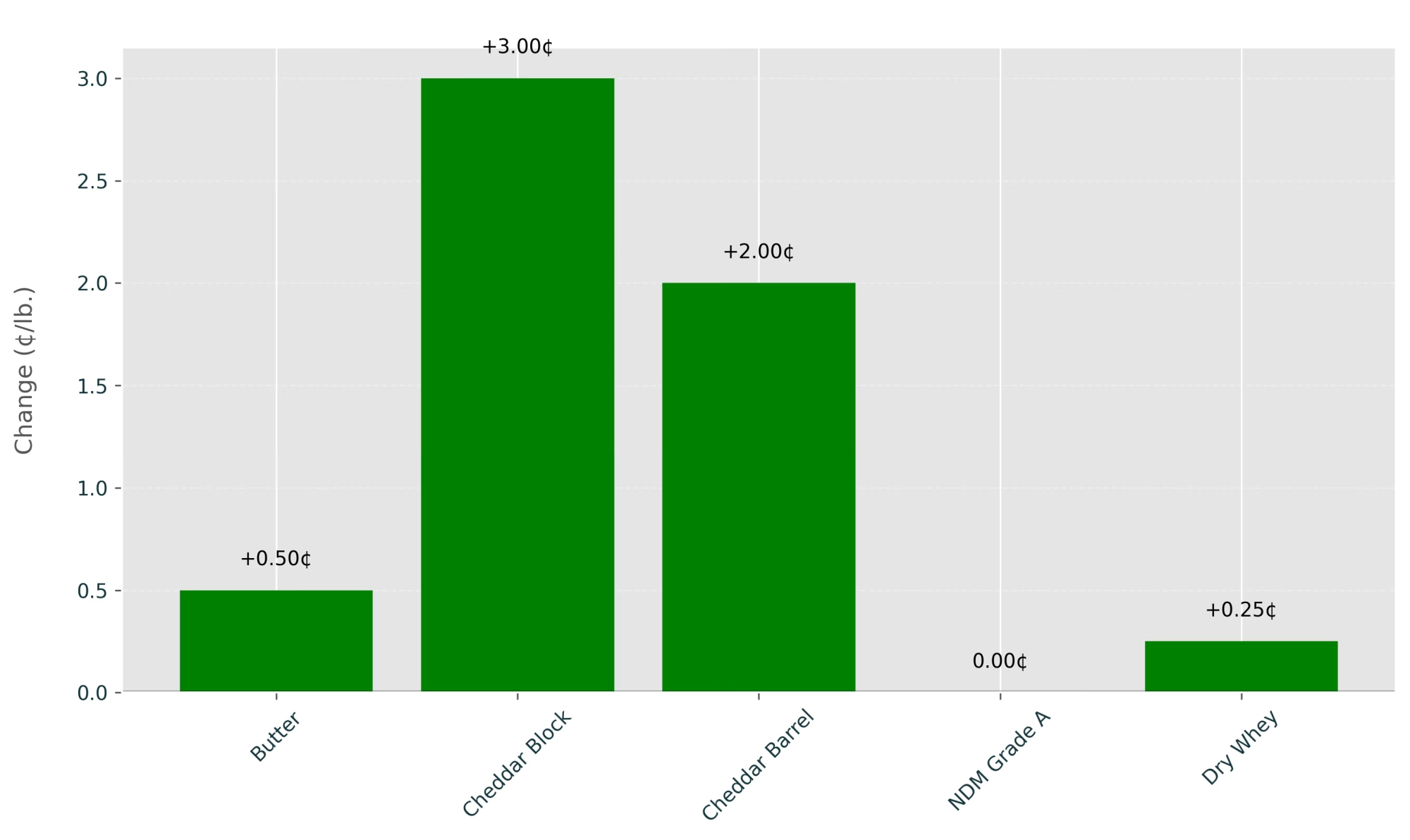

EXECUTIVE SUMMARY: The biggest “I told you so” moment in modern dairy just hit: while everyone obsessed over milk volume, the real money was hiding in plain sight – and butter markets just proved it with a stunning $0.32/lb surge. CME spot butter exploded from $2.24/lb spring lows to $2.56/lb peaks while most farmers focused on the wrong metrics, missing the component revolution that’s fundamentally changed dairy economics. Your Holstein genetics now produce 4.40% butterfat compared to 3.70% two decades ago – that’s nearly 20% more profit per pound of milk, yet most operations still get paid like they’re running 1990s genetics. Americans are consuming butter at 1965 levels despite having 150 million more people, April 2025 consumption hit an all-time record of 200.1 million pounds (up 23%), and U.S. butter trades at a 60% discount to EU prices creating unprecedented export opportunities. Meanwhile, corn at $4.60/bu and favorable feed costs create a golden window for locking contracts while margins remain strong. Stop optimizing for volume and start maximizing component value – the farmers who understand this shift are literally banking the difference.

KEY TAKEAWAYS

- Genetic Goldmine Unlocked: First and second lactation Holstein cows now average 5% butterfat in top herds, with national averages jumping from 4.01% to 4.33% since 2021 – farms optimizing for components over volume can capture $7,430 additional annual profit per 100 cows through strategic feed cost management

- Export Arbitrage Opportunity: U.S. butter’s 60% discount to EU prices ($5,140/MT vs $8,250/MT) creates immediate export competitiveness, with 2025 exports already doubling to 42.6 million pounds through April – position now before this pricing advantage disappears

- Consumer Demand Explosion: Americans consumed 746.8 million pounds of butter through April 2025 (up 8% year-over-year), with March and April setting all-time monthly records – this isn’t seasonal baking, it’s structural market transformation driven by Gen Z’s preference for natural products

- Component Economics Reality Check: Despite milk production growing just 15.9% from 2010-2024, butterfat pounds surged 30.6% – operations still focused on volume metrics are missing the profit revolution happening in their own bulk tanks

- Strategic Risk Management Window: CME futures pricing butter at $2.60-$2.70 for Q3 while current spot prices sit around $2.43 creates optimal hedging opportunities – implement tiered coverage at 60-70% while maintaining upside exposure to capture this unprecedented component premium

The butter market just delivered the biggest “I told you so” moment in modern dairy history. While everyone obsessed over milk volume, the real money was hiding in plain sight – and it’s about to get a whole lot bigger.

The $0.32 Wake-Up Call That Changed Everything

Here’s what happened while you weren’t looking: CME spot butter exploded from December 2021 lows of $2.24/lb to a stunning $2.56/lb peak on June 5 – that’s a 32-cent swing that should have every dairy farmer rethinking their entire operation.

But here’s the kicker – this wasn’t some random market blip. This was the inevitable result of the most significant shift in dairy economics since we started milking cows.

Why Your Holstein Herd Just Became a Goldmine

Let’s cut through the noise and talk numbers that actually matter to your bottom line. U.S. butterfat levels have quietly skyrocketed from 3.70% to 4.40% over the past two decades. That’s not a gradual improvement – that’s a genetic revolution that’s fundamentally changed the math on dairy profitability.

Think about it: your cows produce nearly 20% more butterfat per pound of milk than in 2000. Yet most farmers are still getting paid like they’re running 1990s genetics.

The Component Reality Check:

- First and second lactation Holstein cows now average 5% butterfat in top herds

- Federal Order data shows butterfat jumping from 4.01% in March 2021 to 4.33% by March 2025

- Despite milk production growing just 15.9% from 2010-2024, butterfat pounds surged 30.6%

This isn’t just data – it’s your competitive advantage if you know how to use it.

Americans Are Eating Butter Like It’s 1965 (But There Are 150 Million More of Them)

Here’s where the demand story gets absolutely wild. Americans consumed 6.5 pounds of butter per capita in 2023 – the highest level since 1965. But here’s what most analysts miss: we had 150 million fewer people in 1965.

The spring 2025 consumption numbers are breaking every record in the book:

- April 2025: 200.1 million pounds consumed (all-time April record, up 23% year-over-year)

- March 2025: 209.9 million pounds (new March record, up 3%)

- Year-to-date through April: 746.8 million pounds, representing an 8% jump over 2024

This isn’t seasonal baking demand – this is structural transformation. And it’s happening while plant-based alternatives are supposedly taking over the world.

The Export Opportunity Everyone’s Missing

While domestic demand explodes, U.S. butter exports more than doubled to 42.6 million pounds through April 2025. Why? Because we’re selling at a massive discount to global prices.

The Global Arbitrage Goldmine:

- U.S. butter: $5,140/MT

- EU butter: $8,250/MT

- That’s a 60% discount that won’t last forever

European butter prices were 45% higher than U.S. levels in April 2025. This pricing differential creates unprecedented export opportunities that could vanish overnight if trade dynamics shift.

Why Feed Costs Are Your Secret Weapon Right Now

Here’s your tactical advantage: corn at $4.60/bu, soybean meal at $290/ton, and alfalfa hay at $159/ton are trending lower than 2024. Smart farmers can lock in these costs and save $7,430 annually per 100 cows.

Your Action Plan:

- Audit your milk contract’s component premiums immediately

- Consider culling low-fat cows to maximize per-cow profitability

- Lock in feed contracts while costs remain favorable

- Focus breeding decisions on butterfat genetics, not just volume

The Production Reality That’s Confusing Everyone

Here’s the paradox that’s driving markets crazy: despite reducing the national herd by 557,000 cows in 2024, calculated milk solids production increased by 1.345%.

February 2025 U.S. butter production rose 2.6% year-over-year to 203 million pounds, partly because “weaker cheese, ice cream, and sour cream production freed up some fat for butter.”

This “silent growth” in component output means effective butter supply can continue expanding even if raw milk volume stays flat. That’s why volume-focused farmers are missing the boat while component-focused operations are printing money.

The Class IV Revolution You Need to Understand

Butter now absorbs 18% of the U.S. milk supply on a milkfat basis, up from 16% in 2000. The weighted average retail price has maintained a higher range since April 2022, typically fluctuating between $3.79/lb and $4.68/lb, providing strong support for Class IV milk prices.

CME futures are pricing butter in the $2.60-$2.70 range for Q3, compared to current spot prices around $2.43. If food service cream demand improves and new cheese plants absorb more milk, prices could climb even higher.

What the Smart Money Is Doing Right Now

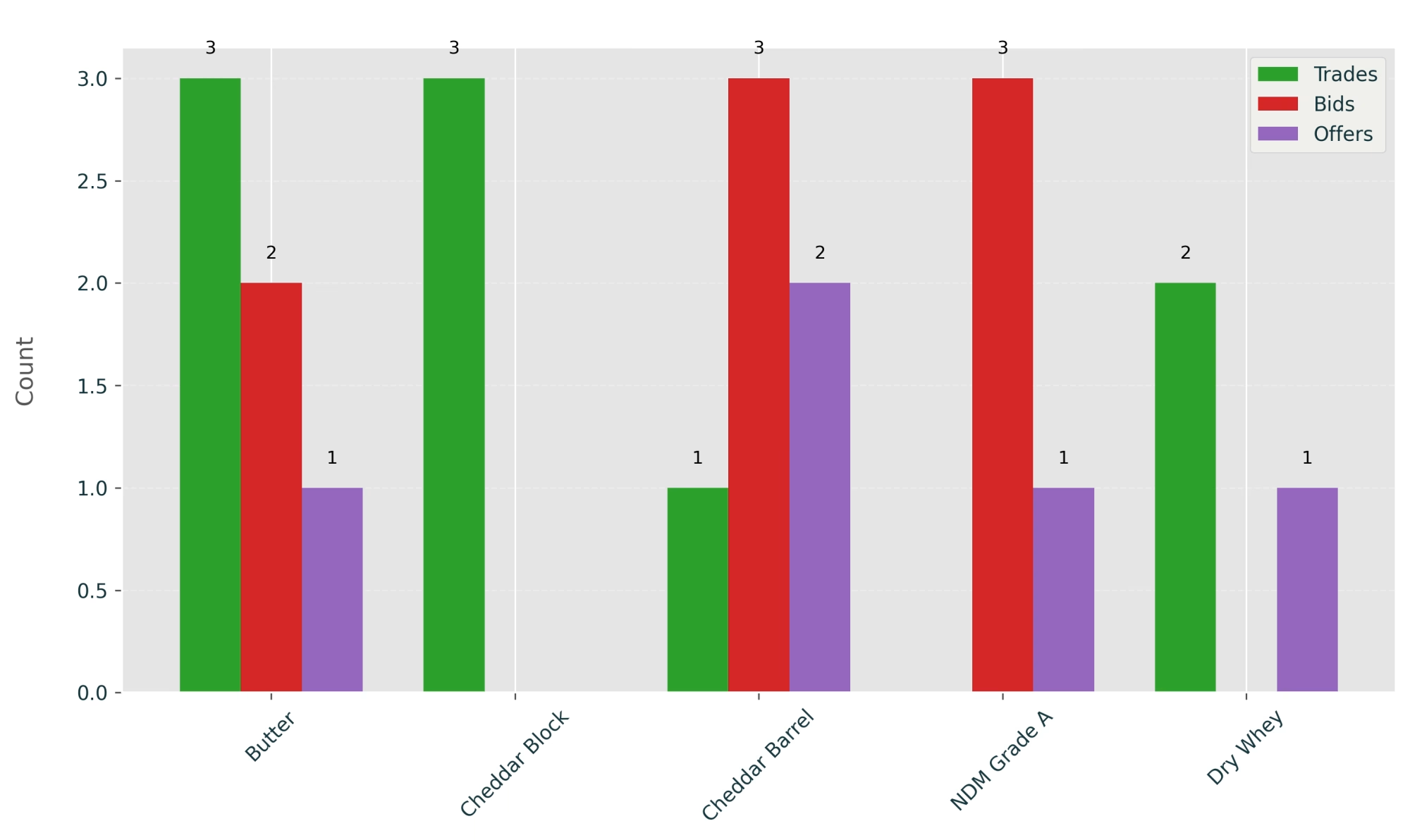

Current market conditions represent what analysts call a “golden window” for 2025, with futures trading at significant premiums to USDA forecasts. Here’s how forward-thinking operations are positioning themselves:

Risk Management Strategy:

- 60-70% coverage at current premium levels

- Maintain upside exposure for potential rallies

- Lock feed costs while margins remain favorable

Genetic Focus:

- Prioritize butterfat content over volume in breeding decisions

- Cull low-component cows that dilute profitability

- Track component premiums in milk pricing

The Global Reality Check

Plant-based alternatives could capture 15-20% of the U.S. market by 2030. But here’s what the doom-and-gloom crowd isn’t telling you: the growth is happening in premium, organic, and grass-fed butter varieties that command higher prices.

Gen Z consumers are leading a charge toward “better-for-you” and natural products. They’re not abandoning butter – they’re upgrading to premium versions and paying more for them.

The Bottom Line: Component Economics Have Permanently Changed

The butter market’s explosive rally isn’t just about supply and demand – it’s validation that dairy economics have permanently shifted toward components over volume. The convergence of genetic advances producing unprecedented butterfat levels, surging consumption among younger demographics, and export opportunities created by favorable U.S. pricing has created a perfect storm of profitability.

Your competitive advantage depends on three critical decisions:

- Optimize for components, not volume – Audit your breeding program and milk contracts

- Lock in favorable input costs – Feed prices won’t stay this friendly forever

- Implement strategic risk management – Use tiered hedging to capture the upside while protecting the downside

The data is crystal clear: butter demand isn’t just lifting markets – it’s rewriting the rules of dairy profitability. The question isn’t whether this trend will continue but whether your operation is positioned to capitalize on the most significant transformation in dairy economics in a generation.

Americans are consuming butter at levels not seen since 1965 despite having 150 million more people today. Your cows produce butterfat levels that would have been impossible two decades ago. Global pricing favors U.S. exports like never before.

The revolution is here. The only question is: are you ready to profit from it?

Learn More:

- Why Boosting Butterfat and Protein Is Key to Higher Profits – Practical strategies for increasing butterfat levels through feeding adjustments and genetic selection, with specific ROI calculations showing how farms can generate an additional $19,920 annually per 100 cows.

- The Export Revolution That’s Starving America’s Butter Supply – Reveals how global buyers are creating unprecedented domestic supply tightness, driving prices to $2.60/lb and creating new marketing opportunities for component-focused operations.

- The Future of Dairy Farming: Embracing Automation, AI and Sustainability in 2025 – Demonstrates how robotic milking and AI-driven precision feeding systems deliver 15-20% productivity gains while optimizing component production for maximum profitability in the evolving butter market.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!