47% to 83%. No new tech. No new genetics. Just stopped fighting biology.

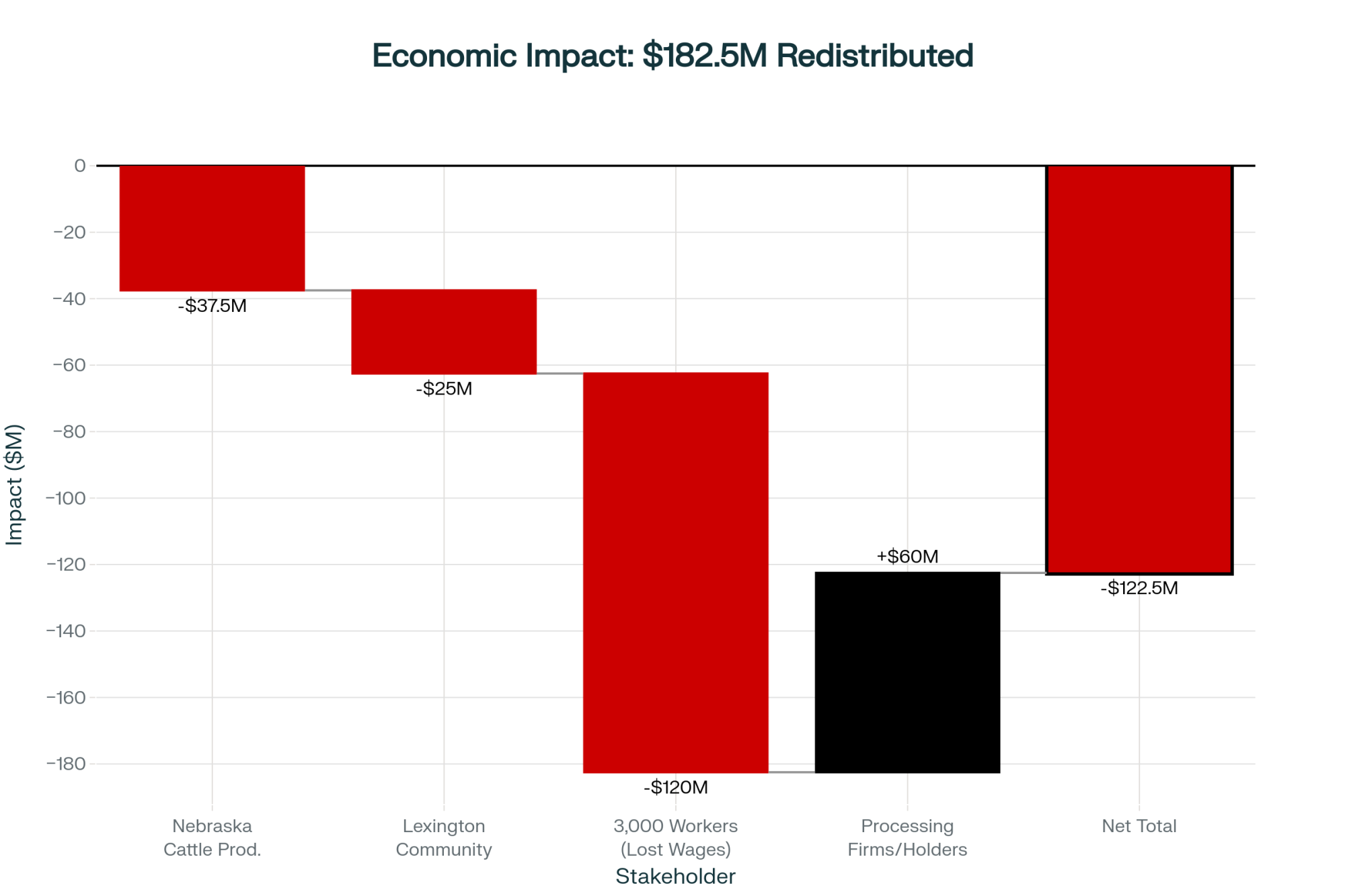

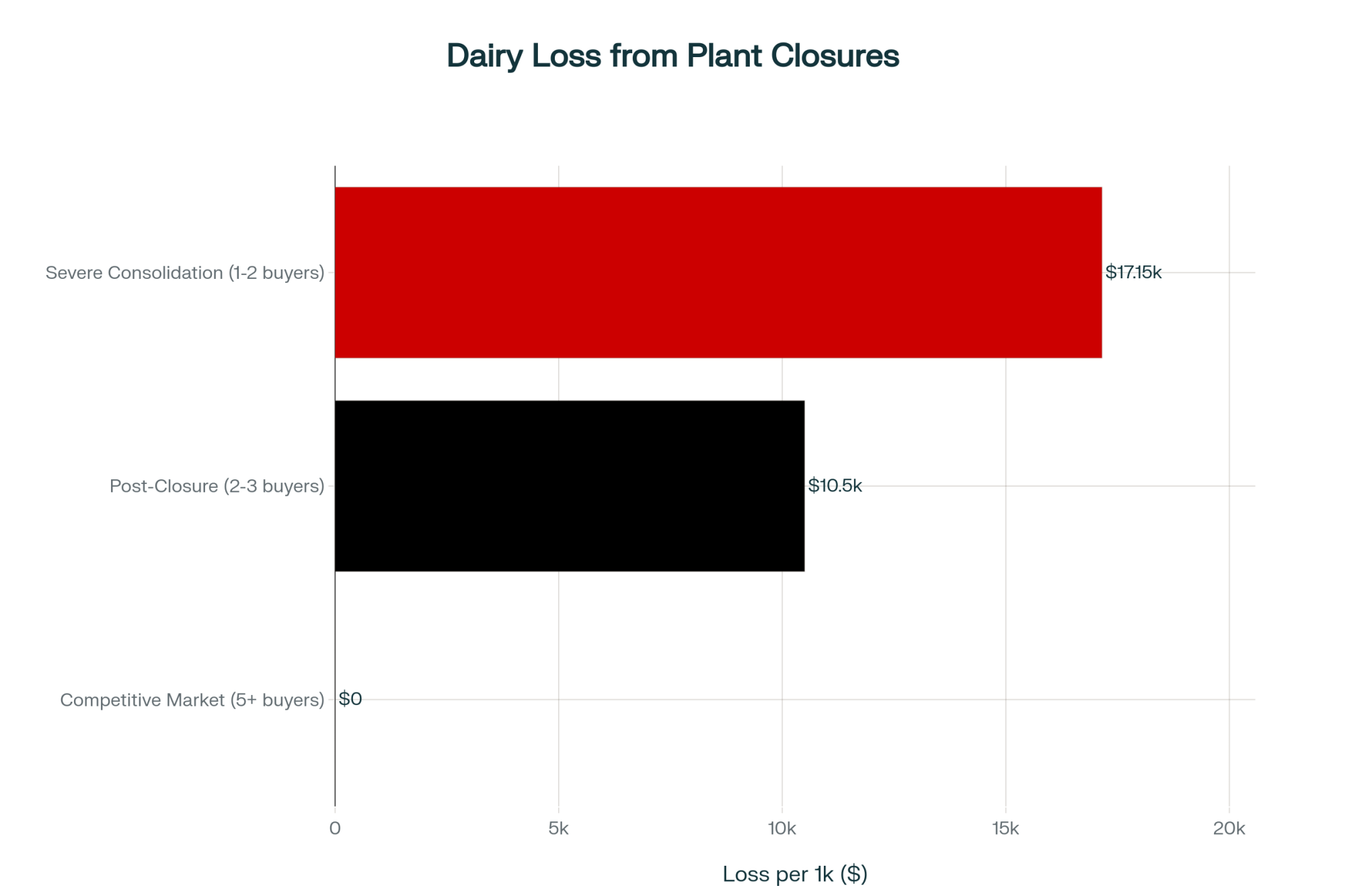

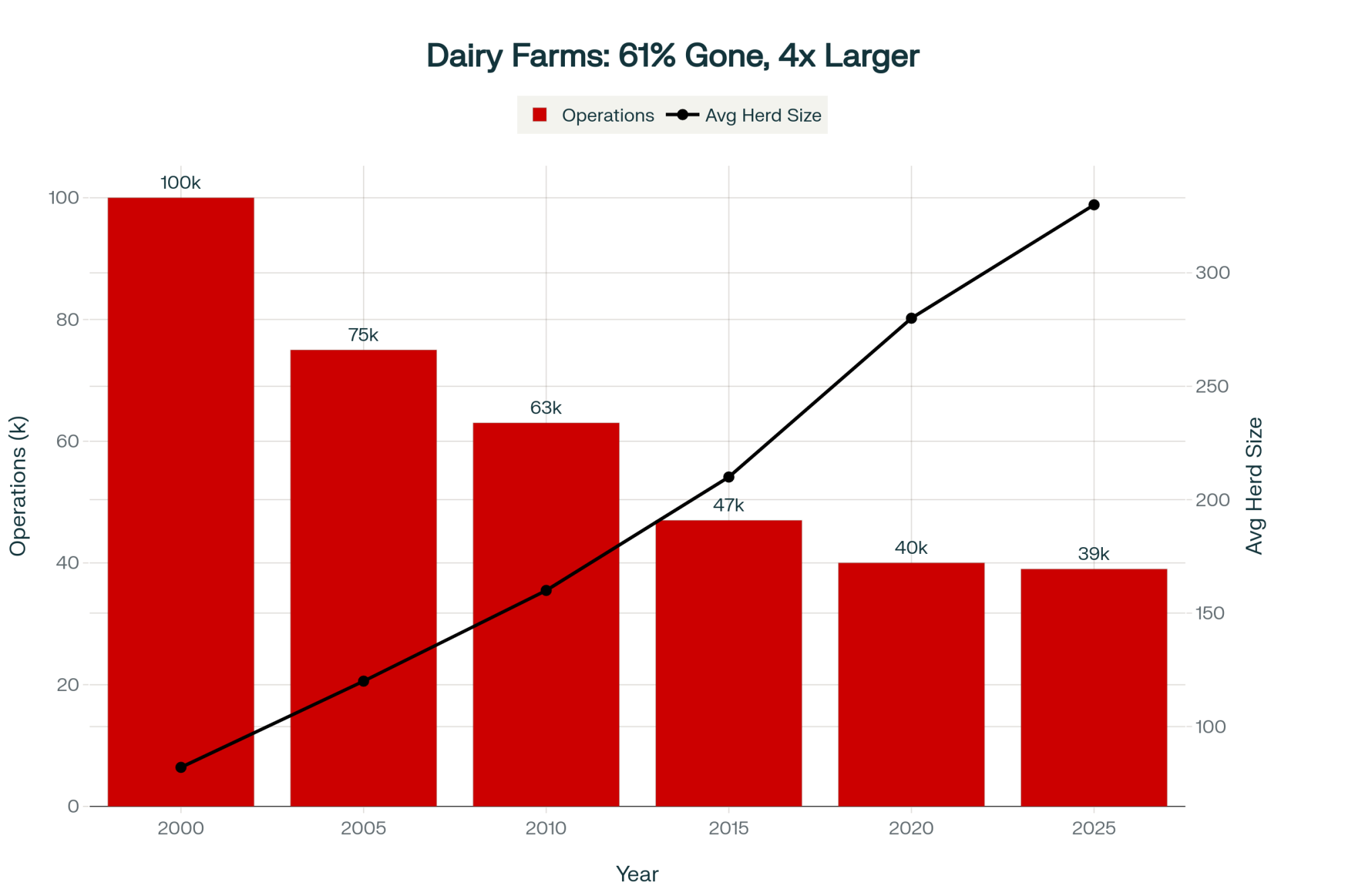

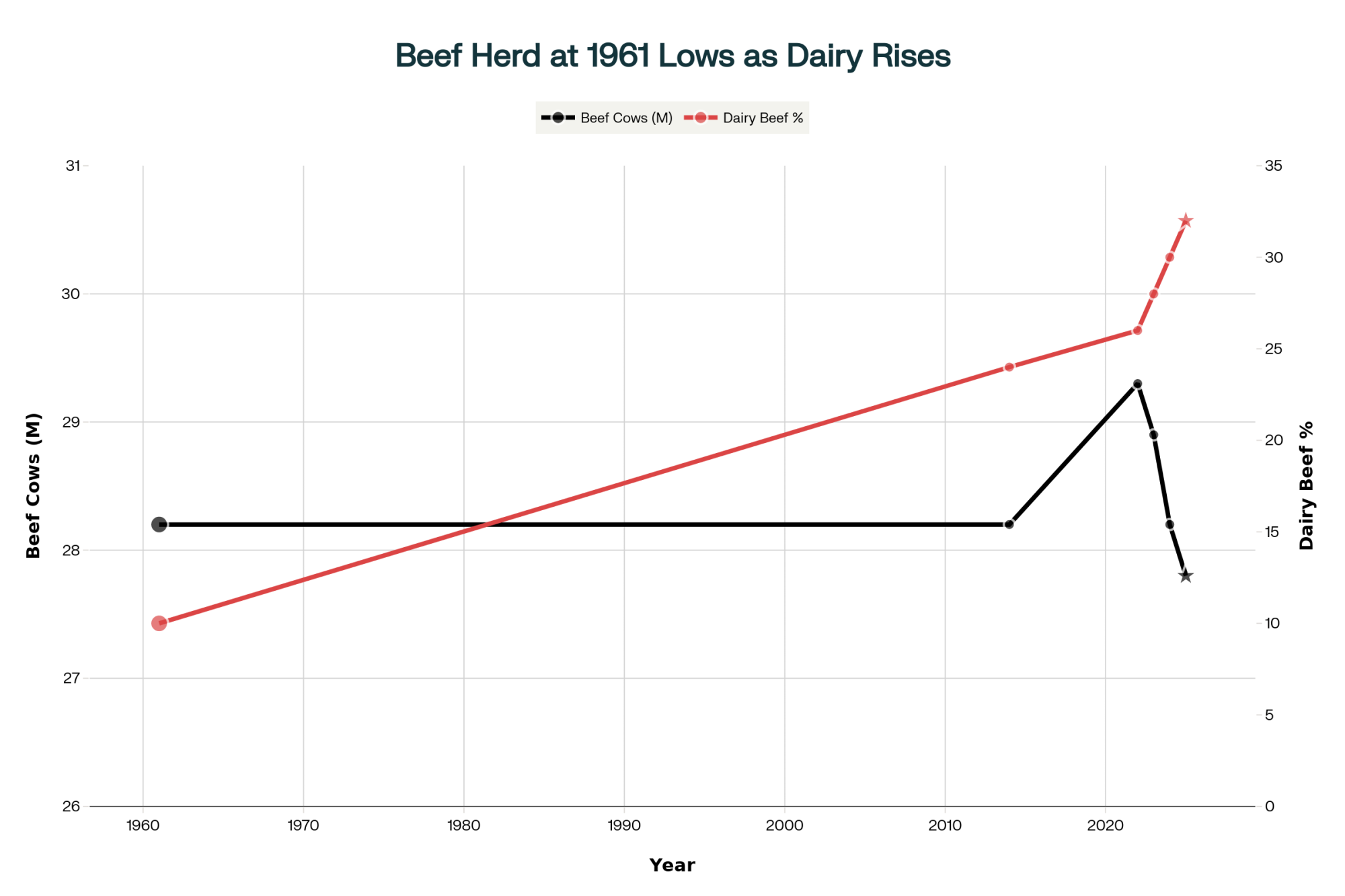

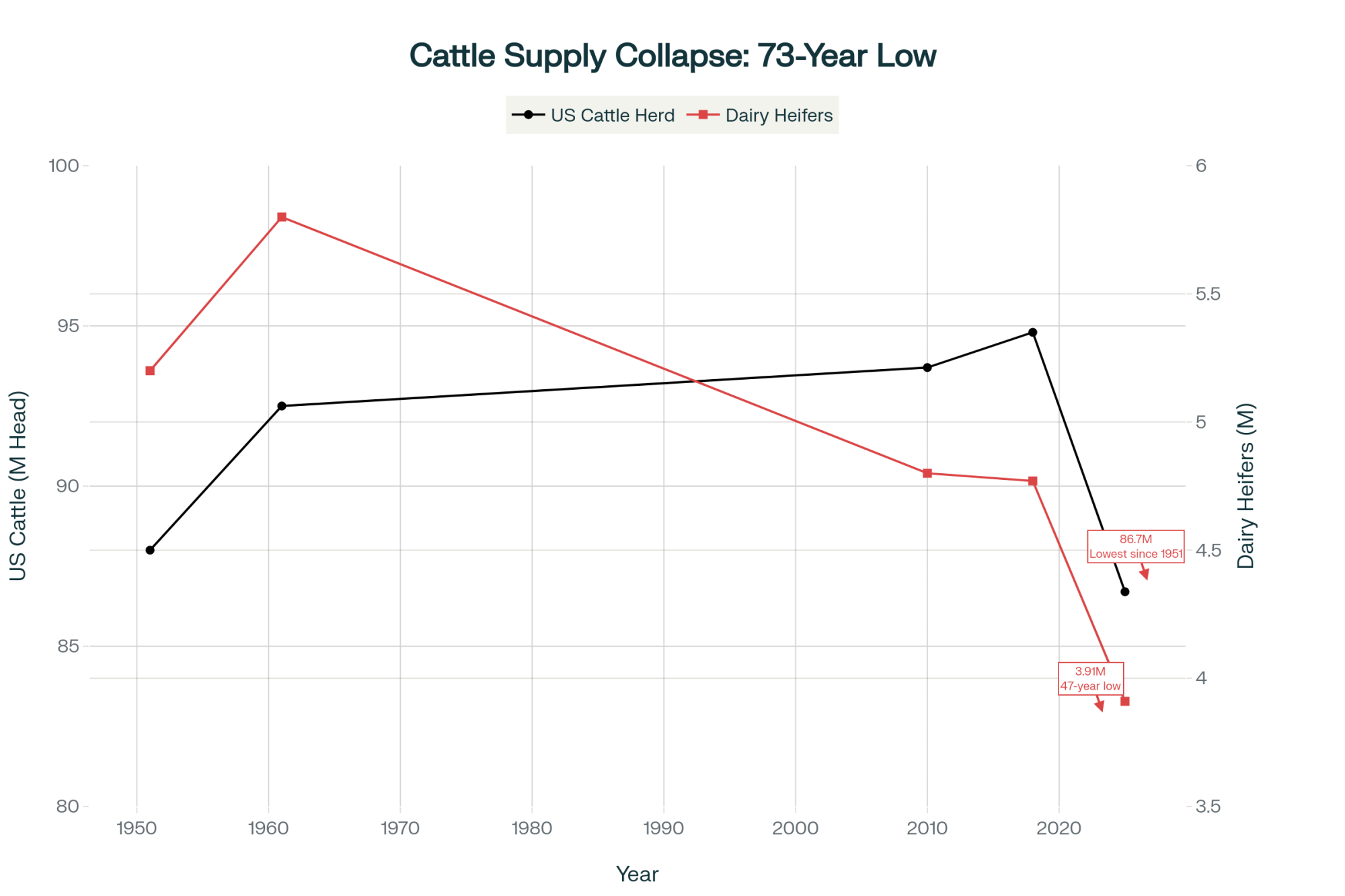

EXECUTIVE SUMMARY: Fighting biology is the most expensive thing you do—it just doesn’t show up as a line item. Australia’s largest cattle operation proved this by boosting weaning from 47% to 83% with zero new genetics and zero new technology. They stopped fighting natural cycles and started profiting from alignment. Sound irrelevant to dairy? Your summer breeding crashes, transition cow disasters, and never-ending replacement costs are the same problem wearing different clothes. Beef-on-dairy just hit $1,400/calf—up from $250 three years ago. Seasonal calving economics are flipping faster than lenders realize. The farms still standing in 2035 won’t be the ones with the most milk. They’ll be the ones that stopped fighting biology and started working with it.

You know, I was at a conference recently when someone brought up Consolidated Pastoral Company—that Australian outfit running 300,000 cattle across 3.2 million hectares. And here’s what’s interesting: they’re dealing with the exact same biological constraints that are probably killing your margins right now.

What I’ve found is they’ve taken their northern Australian beef operations from 47% weaning rates to over 80%, and the Meat & Livestock Australia folks have documented every step. No miracle genetics, mind you. No Silicon Valley nonsense. Just a complete rethink of how they work with biology.

Sound familiar? Because I’ll bet you’re fighting the same battles with lactation cycles, heat stress, and those impossible summer breeding windows. The difference is… well, they stopped fighting and started profiting.

“From 47% to 83% weaning rates through biological alignment—not technology, not genetics, but working with natural cycles instead of against them.”

Infrastructure: Spending Millions to Make Millions

So I was talking to a producer recently who couldn’t wrap his head around CPC dropping $3.5 million on basic infrastructure. We’re talking fences and water points here. Not robots. Not anything fancy.

But here’s what every dairy farmer needs to understand—and this is important—while a TMR mixer is obviously different from a water point in the Outback, the principle is exactly the same. Capital expenditure is worthless unless it unlocks biological potential. Think about it… you’ve probably spent more on that new parlor than CPC spent on their entire fencing project.

Now, northern Australian cattle country is absolutely brutal. The Queensland Department of Agriculture research shows the soil is so phosphorus-deficient that the pasture has maybe a third of what cattle actually need just for maintenance. And during the dry season—we’re talking April through November—lactating cows are literally starving while surrounded by grass. Can you imagine?

The conventional response has always been to just… accept it. Run continuous breeding. Live with those 47% weaning rates. That’s what everyone does, right?

But CPC said no. They put in 200 kilometers of new fencing at about nine grand per kilometer. Thirty water points at sixty thousand each. And here’s the kicker—they’re spending between four hundred thousand and nine hundred thousand annually just on pregnancy testing and moving cattle around.

The payoff, though? For a 20,000-cow operation, that’s 7,200 additional calves every single year. At $650 per weaner—and that’s November 2024 prices, so pretty current—we’re looking at $4.68 million in additional annual revenue. The Northern Territory government’s analysis shows a payback period of less than a year. Less than a year!

So think about your own place for a minute. What biological constraint are you just accepting as “the way it is”? Summer heat stress that everyone complains about, but nobody really fixes? Those transition cow disasters we all pretend are normal? That 60-day voluntary waiting period that, let’s be honest, everyone follows because… well, because everyone follows it?

Turning Red Tape into Premium Pricing

Here’s where it gets really interesting. When Indonesia mandated that 20% of imported cattle be breeding stock in 2017, the whole industry basically panicked. And for good reason—Australia’s export standards couldn’t even certify that an animal could breed. This gap is all documented in the Northern Australia Beef Industry reports, if you want to look it up.

Most exporters, as you’d expect, just shipped whatever they could get away with. Matt Brann from ABC Rural reported in 2018 how Indonesian importers were getting these so-called “breeding cattle” with reproductive problems that went straight to feedlots anyway.

But CPC… they did something clever. They created their own breeding soundness protocols that went beyond what either country required. And now? Indonesian buyers actually pay premiums for that documentation.

This is exactly what’s happening with A2A2 milk, grass-fed certification, all those regenerative agriculture claims we’re seeing. The regulations don’t exist yet, but the producers creating their own verification systems? They’re capturing premiums while everyone else sits around waiting for the government to tell them what to do.

The $500 Calf That Makes Perfect Sense

Okay, this one’s going to sound crazy at first. CPC’s Santori Jabung facility in Indonesia produces calves at a cost of $500 each. Compare that to maybe $60-70 on Australian rangelands. I know, I know—sounds insane.

But Dr. Simon Quigley from the University of Queensland documented what was happening. They had mortality rates exceeding 25-30% when they tried to apply temperate management to tropical conditions. It’s just like your summer pneumonia outbreaks or those heat stress breeding failures we all deal with—wrong system for the environment.

So they made three changes that transformed everything:

First, they set up dedicated colostrum management with round-the-clock monitoring. Any calf that doesn’t nurse within three hours gets bottle-fed in temperature-controlled housing. And get this—mortality dropped from that 25-30% range down to 6-8%.

Second—and the efficiency experts hate this—they concentrated 80% of their calving into just three months. But you know what? Results speak louder than theories.

Third, they got strategic with supplementation. Only during late pregnancy and early lactation. That tiny bump in body condition—from 3.0 to 3.3—cut their days open from 217 to 118. Think about that for a minute.

The result? They’re getting 72% pregnancy rates in absolutely brutal tropical conditions. Your transition barn—that critical period when fresh cows are moving from dry to lactating status—could probably learn something here. Just as those fresh cows need intensive management for a successful transition, these tropical operations need intensive intervention at critical biological moments.

Carbon Credits: The Drought Insurance You’re Missing

Let’s talk carbon for a minute. Australian Carbon Credit Units are trading at $36-42 per tonne according to the Clean Energy Regulator’s latest quarterly report. That works out to about $36-42 per head annually for operations doing regenerative grazing.

Now, it’s not transformative money. But here’s what’s interesting—Garrawin Station’s carbon revenue literally kept them alive during the 2019 drought when their cattle income completely vanished. And for dairy operations, we’re seeing similar opportunities with methane digesters generating credits, cover crop programs building soil carbon, and even manure management improvements qualifying for offset programs in some states.

So let me ask you this: your milk check isn’t guaranteed forever. What’s your backup plan?

“Every dollar spent fighting biology is profit bleeding out. Start asking yourself: what constraints am I accepting that I shouldn’t be?”

Virtual Fencing: Why Silicon Valley Fails on the Farm

You’ve probably heard about virtual fencing. Dr. Richard Rawnsley at the University of Tasmania showed it works great in small paddocks—94-99% containment. Sounds perfect, right?

But then Dr. Dana Campbell at CSIRO found something concerning—9% reduced daily gains under virtual fencing rotations. That’s fifteen bucks per head you’re losing.

That said, I’ve seen it work well for specific dairy applications. There’s a 400-cow grass-based operation in Vermont using virtual fencing just for keeping cows out of wetland areas—it works perfectly for that limited scope. Another Wisconsin farm uses it for temporary paddock divisions during their managed grazing rotation. Small, targeted uses where the technology makes sense.

But at $500-800 per collar for whole-herd implementation? The math just doesn’t work for big operations. It’s like robotic milkers—great technology, but not for everyone.

The Dairy Revolution Hiding in Plain Sight

Alright, here’s where it gets real for us dairy folks.

Your 14-month lactation cycle—you know, calving through milking to dry period and back again—it creates all these problems we just accept as normal. Breeding during negative energy balance. Those heat-stress-related disasters occur every summer. Year-round replacement heifer costs that never end.

Most dairies fight these constraints with more inputs, more technology, more complexity. And let’s be honest… it’s not really working, is it?

I’ve been visiting operations experimenting with seasonal calving—there’s some interesting work happening in Vermont, Ohio, and out in Idaho. Different farms, different approaches, but they’re all aligning their calving with either pasture availability or specific market demands. One Idaho operation I know of is timing fall calving to hit those holiday cheese plant premiums.

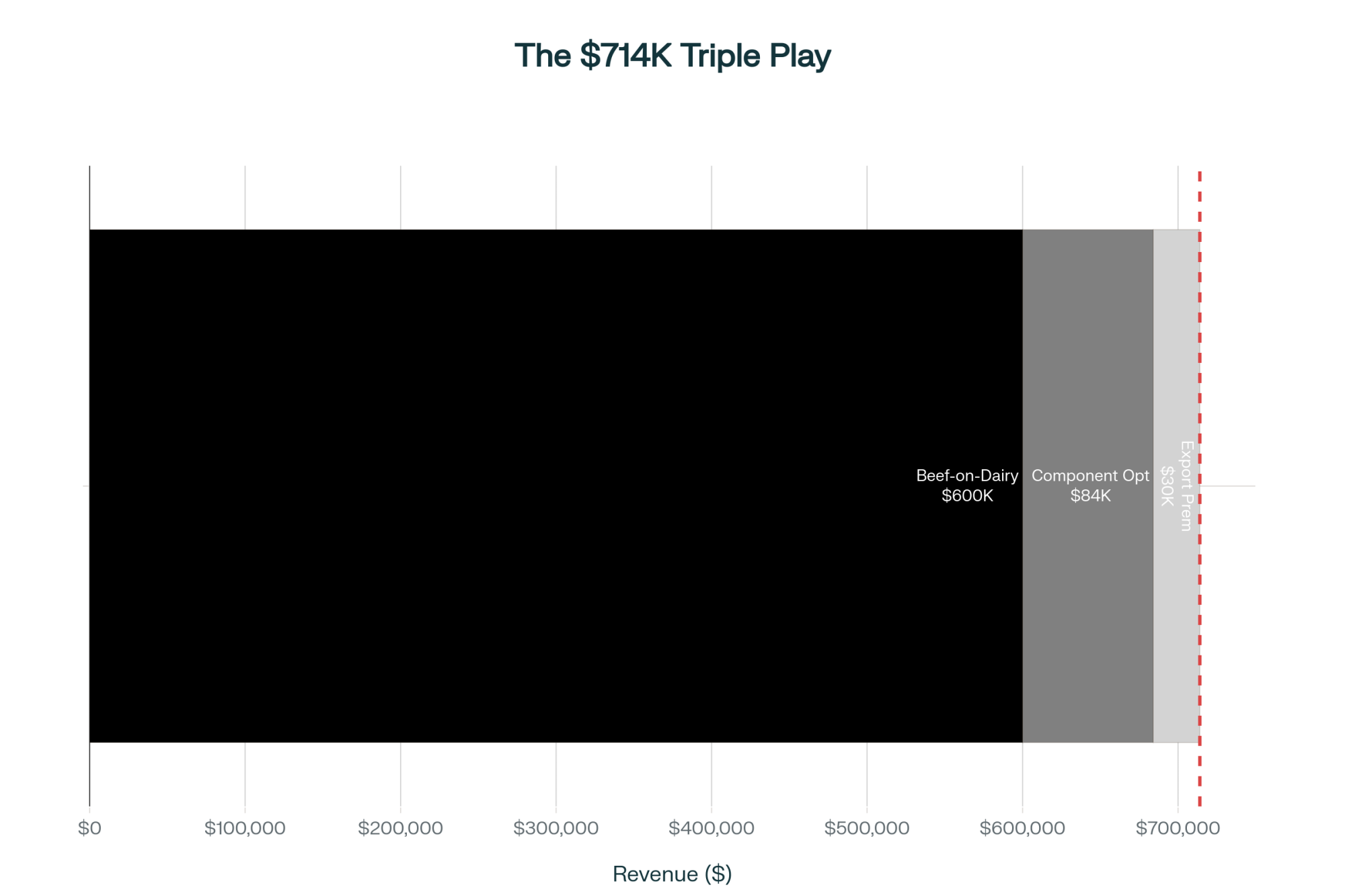

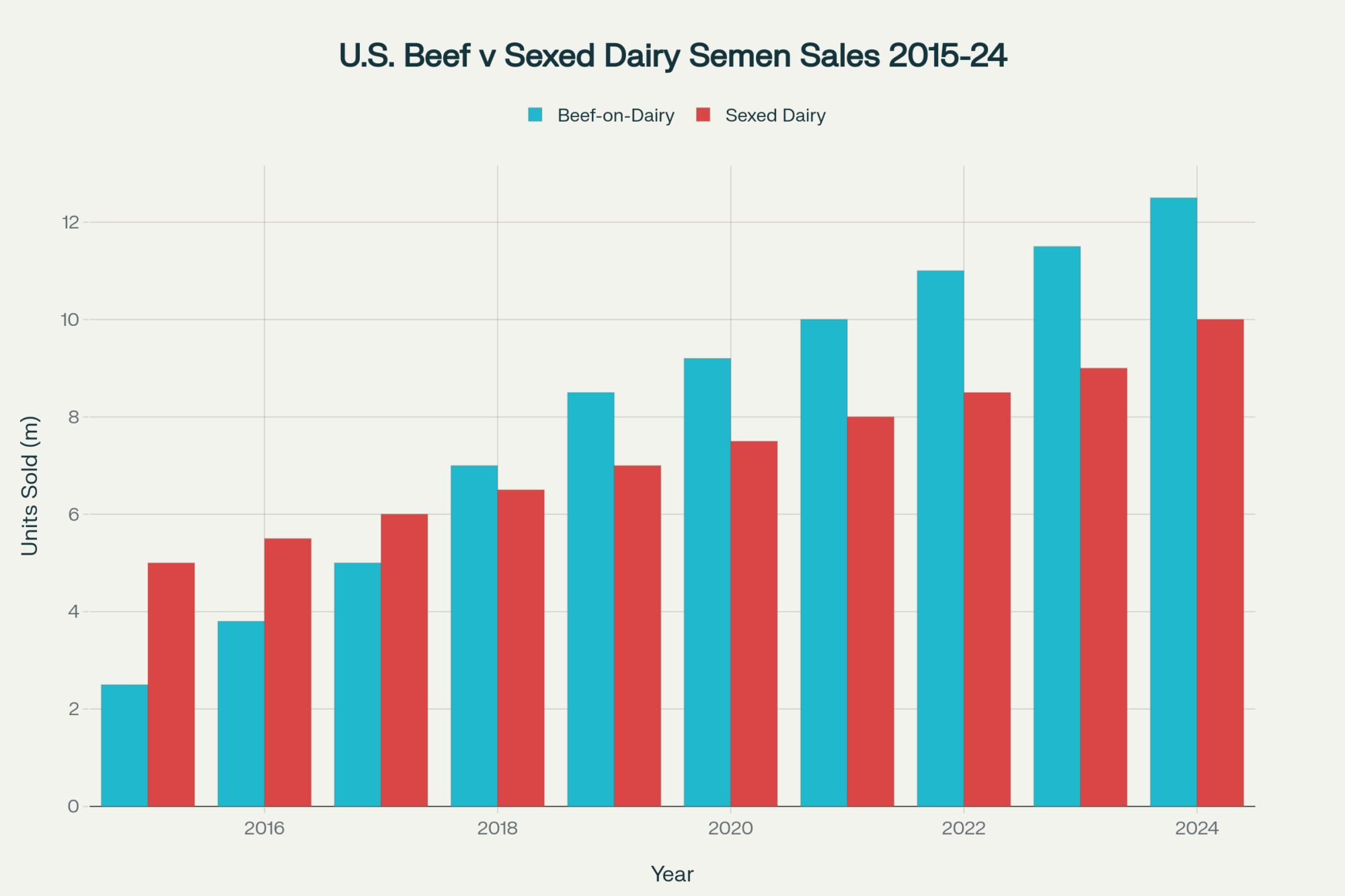

And they’re all riding this beef-on-dairy wave too. You’ve seen the prices—$250 three years ago, $1,400 today, according to USDA market reports. Some markets are seeing even higher premiums this year.

“The operations that survived the 2009 and 2020 milk price crashes weren’t necessarily the most efficient—they were the most adaptable.”

Here’s what concentrated calving can deliver:

- Your peak lactation hits during the highest component periods

- Breeding happens when cows aren’t dying from heat stress

- Replacement heifer management that actually makes economic sense

- Predictable milk composition so you can negotiate premium contracts

- Lower feed costs because you’re not lactating through garbage forage months

Now, the biggest barrier isn’t biology—it’s the banker. Shifting to seasonal calving absolutely terrifies lenders who are used to those monthly milk checks. But here’s the thing… as feed costs keep climbing, that “steady check” might actually be a steady loss.

The folks in New Zealand figured this out decades ago. Sure, their market structure’s different, but the biology? The biology’s the same.

Making It Work at Your Scale

So what does this mean for your operation?

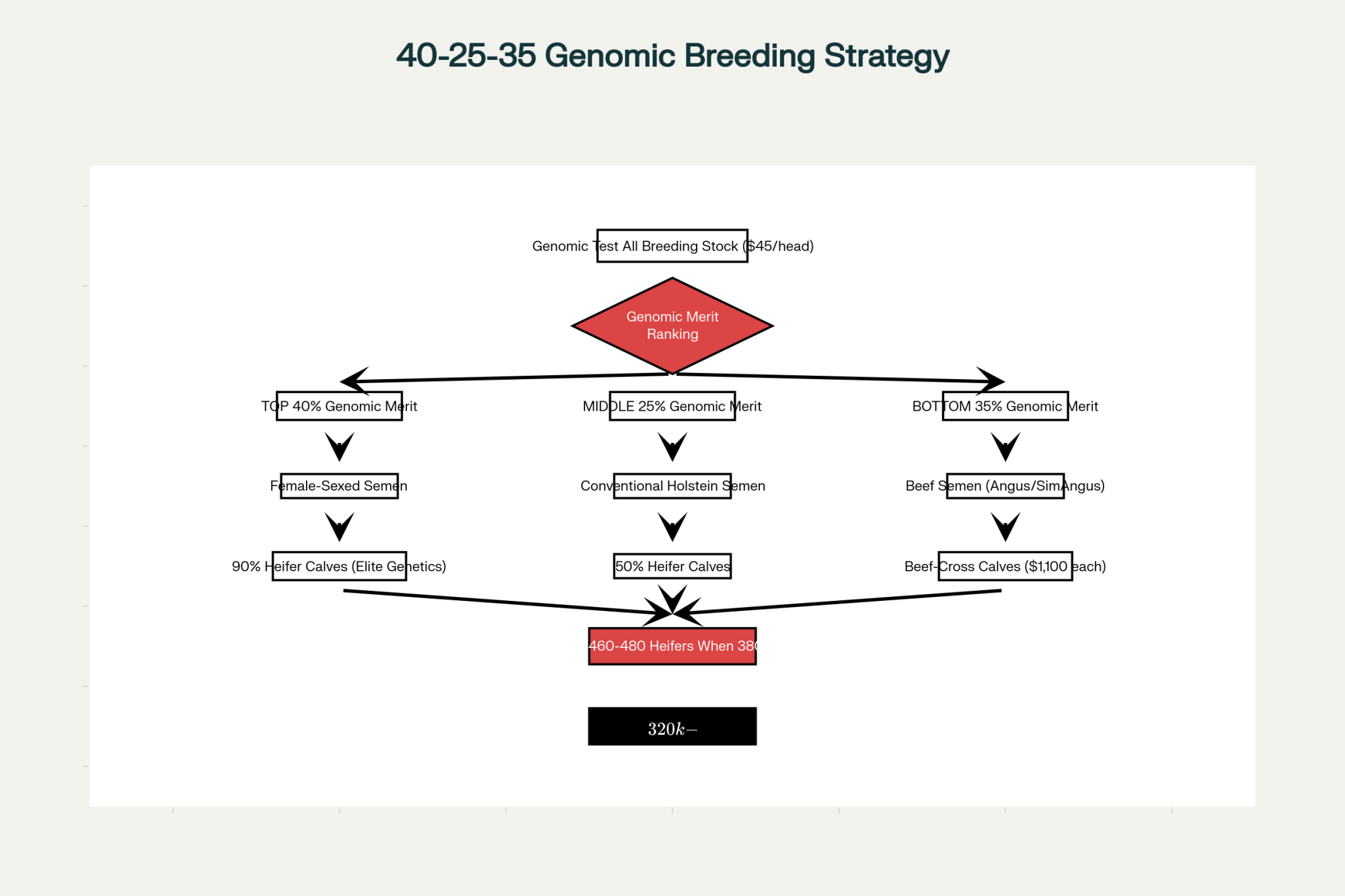

1. If you’re under 500 cows: Start small. Maybe try a 20% seasonal calving pilot—just see what happens. And definitely look at beef-on-dairy for your bottom-tier genetics. Those premiums are real and, according to USDA outlook reports, they’re not going away. Focus on the no-cost changes first, like optimizing breeding timing for your specific climate and conditions.

2. For 500-2,000 cow operations: Any reproduction improvement that pays back in under two years deserves serious consideration. Start building alternative revenue streams now, before you desperately need them. Could be custom heifer raising, beef-on-dairy, or direct marketing. Just… have something. And remember, operations this size in the Upper Midwest are seeing real success with partial seasonal systems—you don’t have to go all-in immediately.

3. Over 2,000 cows: You’ve got the scale to model a full seasonal transition with beef-on-dairy bridging those dry periods. If you own enough land, carbon programs might actually pencil out despite the volatility. But most importantly, document everything. The next generation needs to know what worked and what didn’t. Large operations in California and Idaho are already testing these models—you won’t be the first.

The Hard Truth Nobody Wants to Hear

CPC’s been around since 1879. That’s 146 years of surviving everything the market could throw at them. And here’s their secret: resilience beats efficiency every time.

Their Indonesian feedlots? Currently losing money. Their breeding systems? Modest margins at best. Carbon projects? Who knows what they’ll return.

But together? Together, they survive everything.

Every dollar you’re spending fighting biology—maintaining production through terrible seasons, managing those heat stress breeding disasters, carrying replacement heifers forever—that’s profit just bleeding out.

The question isn’t whether you can afford to change. Given where input costs are going, environmental regulations, market volatility… can you really afford not to?

Start small if you need to. Test things. Learn what works for your specific situation. But start now, before external pressure forces you into bad decisions.

The Bullvine Bottom Line

We’ve spent fifty years breeding cows to ignore the seasons. Maybe it’s time we stopped ignoring the math. You don’t need 3.2 million hectares to realize that fighting biology is the most expensive line item on your P&L. Whether it’s beef-on-dairy, seasonal calving, or aggressive heat abatement, the farms that survive the next decade won’t be the ones with the most milk—they’ll be the ones with the highest margins.

KEY TAKEAWAYS:

- Fighting biology is your priciest line item. Those summer breeding failures and transition cow wrecks aren’t bad luck—they’re the cost of working against natural cycles. Australian operations showed that improvements of 47% to 83% come from alignment, not more inputs.

- Beef-on-dairy hit $1,400/calf. Up from $250 three years ago, per USDA data. For your bottom-third genetics, this isn’t a side gig—it’s a margin strategy.

- Your “steady” milk check may be a steady loss. Seasonal calving terrifies lenders. But as feed costs rise, that monthly revenue is increasingly monthly red ink. Run your own numbers.

- Capital without a biological purpose is waste. New parlor won’t fix heat stress conception crashes. Robots can’t solve the negative-energy-balance breeding problem. Spend where biology says yes.

- Adaptability beats efficiency. The farms standing after 2009 and 2020 weren’t the biggest. They had options when the market didn’t.

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More:

- Component Gold Rush: Are You Still Breeding for Volume While Your Neighbors Cash In? – Reveals the specific genetic selection strategies progressive dairies are using to capture record-breaking butterfat premiums, demonstrating how to shift your breeding focus from outdated volume metrics to maximum component revenue.

- Beyond the Milk Check: How Dairy Operations Are Building $300,000 in New Revenue Today – Provides a strategic roadmap for stacking alternative revenue streams—from optimized beef-on-dairy programs to overlooked government tools—creating a financial fortress that insulates your operation from volatile milk cycles.

- Robot Revolution: Why Smart Dairy Farmers Are Winning with Automated Milking – Analyzes the real-world ROI of automation in 2025, explaining how successful family operations are using robotics not just to replace labor, but to unlock the precise biological data needed to improve per-cow margins.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!